Supplement Dated December 8, 2023

To The Prospectus Dated May 15, 2023 For

JACKSON MARKET LINK PRO® II and JACKSON MARKET LINK PRO® ADVISORY II

Issued by

Jackson National Life Insurance Company®

This supplement updates the above-referenced prospectus. Please read and keep it together with your prospectus for future reference. To obtain an additional copy of a prospectus, please contact us at our Customer Care Center, P.O. Box 24068, Lansing, Michigan, 48909-4068; 1-800-644-4565; www.jackson.com.

This supplement updates certain prospectus disclosures to describe the use of guaranteed minimum Index Adjustment Factors in the calculation of Interim Value required by some states. As of the date of this prospectus supplement, the state of New Jersey requires the use of guaranteed minimum Cap Rates, Performance Trigger Rates, Performance Boost Cap Rates, and Buffers in the calculation of Interim Value. To account for this required state variation, the following revisions have been made to the prospectus:

Ø In the section titled “Contract Options”, under the subsection titled "Index Account", the following revisions have been made:

Under the sub-subsection titled "Interim Value", the following disclosure was added:

Use of Guaranteed Minimum Index Adjustment Factors in Certain States. Some states require us to include guaranteed minimum Index Adjustment Factors in your Contract. In those states, when calculating your Interim Value, we will compare the guaranteed minimum Index Adjustment Factor(s) to the (non-guaranteed) prorated Index Adjustment Factor(s). If the guaranteed minimum Index Adjustment Factor(s) are higher than the prorated Index Adjustment Factor(s), then we will use the guaranteed minimum Index Adjustment Factor(s) to calculate your Interim Value. Higher Index Adjustment Factors result in higher Interim Values. Please see Appendix B: State Variations for a current list of the states that require guaranteed minimum Index Adjustment Factors as of the date of this prospectus.

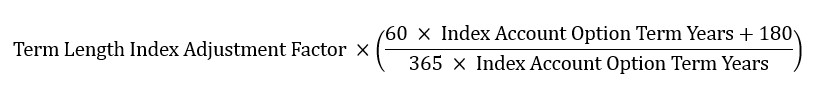

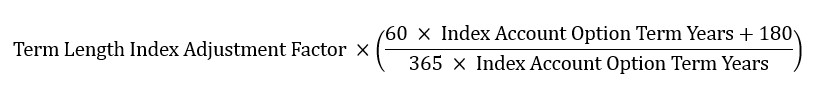

Guaranteed minimum Index Adjustment Factors vary by length of the Index Account Option Term, as shown in the formula and example below. These guaranteed minimum Index Adjustment Factors are not based on the number of days that have elapsed in the term, but on the length of the term. We set them based on the formula below at the start of the Index Account Option Term, and they do not change for the duration of the term. Please note that the Floor and Index Participation Rate are never prorated, even in states that require the use of guaranteed minimum Index Adjustment Factors. In addition, the Performance Boost Rate is never subject to a guaranteed minimum. For the applicable Index Adjustment Factors (e.g. Cap Rate/Performance Trigger Rate/Performance Boost Cap Rate/Buffer), the following formula is used to determine the guaranteed minimum Index Adjustment Factor:

Index Adjustment Factor Proration Example utilizing Guaranteed Minimums: Assume on January 1st you allocate Contract Value to a 1-year Index Account Option with a 15% Performance Boost Cap Rate (PBCR), 10% Performance Boost Rate (PBR) and a 10% Buffer. There are 365 days in your Index Account Option Term. For this term, your guaranteed minimum Index Adjustment Factors are calculated at the start of the term, as follows, and will not change:

•Your guaranteed minimum Buffer for this Index Account Option is equal to 10% * (60 * 1 + 180) / (365 * 1) = 6.5753%

•Your guaranteed minimum PBCR for this Index Account Option is equal to 15% * (60 * 1 + 180) / (365 * 1) = 9.8630%

•There is no guaranteed minimum PBR.

Unlike your guaranteed minimum Index Adjustment Factors, your (non-guaranteed) prorated Index Adjustment Factor(s) change each day based on how many days have elapsed in the Index Account Option Term. When we calculate your Interim Value, we will first calculate the prorated Index Adjustment Factor(s), and we will apply whichever is greater, as follows:

•On February 1st, 31 days have elapsed in your Index Account Option Term. Your prorated Buffer, prior to any application of the guaranteed minimum, is calculated using the following formula: 10% * 31 / 365 = 0.8493%. Since this is less than your guaranteed minimum Buffer (shown above), your Buffer on February 1st is your guaranteed minimum Buffer of 6.5753%. Your prorated PBCR, prior to any application of the guaranteed minimum, is calculated using the following formula: 15% * 31 / 365 = 1.2740%. Since this is less than your guaranteed minimum PBCR (shown above), your PBCR on February 1st is your guaranteed minimum PBCR of 9.8630%. Your prorated PBR is determined by the following formula: 10% * 31 / 365 = 0.8493%. There is no guaranteed minimum PBR, so your PBR on February 1st is the prorated PBR of 0.8493%.

•On July 3rd, 183 days have elapsed in your Index Account Option Term. Your prorated Buffer, prior to the application of any guaranteed minimum, is calculated using the following formula: 10% * 183 / 365 = 5.0137%. Since this is less than your guaranteed minimum Buffer (shown above), your Buffer on July 3rd is your guaranteed minimum Buffer of 6.5753%. Your prorated PBCR, prior to the application of any guaranteed minimum, is calculated using the following formula: 15% * 183 / 365 = 7.5205%. Since this is less than your guaranteed minimum PBCR (shown above), your PBCR on July 3rd is your guaranteed minimum PBCR of 9.8630%. Your prorated PBR is determined by the following formula: 10% * 183 / 365 = 5.0137%. There is no guaranteed minimum PBR, so your PBR on July 3rd is the prorated PBR of 5.0137%.

•On October 20th, 292 days have elapsed in your Index Account Option Term. Your prorated Buffer, prior to any application of the guaranteed minimum, is calculated using the following formula: 10% * 292 / 365 = 8%. Since this is greater than your guaranteed minimum Buffer (shown above), your Buffer on October 20th is the prorated Buffer of 8%. Your prorated PBCR, prior to the application of any guaranteed minimum, is calculated using the following formula: 15% * 292 / 365 = 12%. Since this is greater than your guaranteed minimum PBCR (shown above), your PBCR on October 20th is the prorated PBCR of 12%. Your prorated PBR is determined by the following formula: 10% * 292 / 365 = 8%. There is no guaranteed minimum PBR, so your PBR on October 20th is the prorated PBR of 8%.

Ø In Appendix A: Calculation Examples, the following disclosure has been added to the second introductory paragraph:

Certain states require us to provide guaranteed minimum Index Adjustment Factors (identified in Appendix B: State Variations). In these states, when we calculate your Interim Value, we compare the applicable guaranteed minimum Index Adjustment Factor(s) to the (non-guaranteed) prorated Index Adjustment Factor(s). If the guaranteed minimum Index Adjustment Factor(s) are higher than the prorated Index Adjustment Factor(s), then we will use the guaranteed minimum Index Adjustment Factor(s) to calculate your Interim Value. Higher Index Adjustment Factors result in a higher Interim Values.

Ø In Appendix B: State Variations, the following disclosure has been added to the row identifying variations in the state of New Jersey:

Guaranteed minimum Cap Rates, Performance Trigger Rates, Performance Boost Cap Rates, and Buffers may be used in the calculation of Interim Value. We compare the applicable guaranteed minimum Index Adjustment Factor(s) to the (non-guaranteed) prorated Index Adjustment Factors. If the guaranteed minimum Index Adjustment Factor(s) are higher than the prorated Index Adjustment Factor(s), then we will use the guaranteed minimum Index Adjustment Factor(s) to calculate your Interim Value.. Higher Index Adjustment Factors result in higher Interim Values.

Ø Throughout the prospectus, where disclosures reference the use of prorated Index Adjustment Factors in the calculation of Interim Value, the following disclosure has been added:

Please note: certain states require the use of guaranteed minimum Index Adjustment Factors, if greater, in calculating Interim Value. Please see "Use of Guaranteed Minimum Index Adjustment Factors in Certain States" for more information.

(To be used with RPR00001 05/23 and RPR00002 05/23)

Page 3 of 3

RPS00051 12/23