UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant x |

Filed by a Party other than the Registrant o |

Check the appropriate box: |

o | Preliminary Proxy Statement |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

x | Definitive Proxy Statement |

o | Definitive Additional Materials |

o | Soliciting Material Pursuant to §240.14a-12 |

WESTAFF, INC. |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

|

Payment of Filing Fee (Check the appropriate box): |

x | No fee required. |

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| | N/A |

| (2) | Aggregate number of securities to which transaction applies: |

| | N/A |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | N/A |

| (4) | Proposed maximum aggregate value of transaction: |

| | N/A |

| (5) | Total fee paid: |

| | N/A |

o | Fee paid previously with preliminary materials. |

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| | N/A |

| (2) | Form, Schedule or Registration Statement No.: |

| | N/A |

| (3) | Filing Party: |

| | N/A |

| (4) | Date Filed: |

| | N/A |

| | |

| | Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. |

WESTAFF, INC.

298 North Wiget Lane

Walnut Creek, California 94598

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

to be held on April 19, 2006

TO THE STOCKHOLDERS OF WESTAFF, INC.:

NOTICE IS HEREBY GIVEN that the 2006 Annual Meeting of Stockholders (the “Annual Meeting”) of Westaff, Inc. (the “Company”), a Delaware corporation, will be held on April 19, 2006, at 10:00 a.m., local time, at the Company’s administrative offices located at 298 N. Wiget Lane, Walnut Creek, California, for the following purposes, as more fully described in the Proxy Statement accompanying this Notice:

1. To elect two Class I directors to serve for three-year terms and until their successors are elected;

2. To adopt the Company’s 2006 Stock Incentive Plan (“the Plan”); and

3. To transact such other business as may properly come before the meeting or any adjournment or adjournments thereof.

Only stockholders of record at the close of business on February 23, 2006, are entitled to notice of and to vote at the Annual Meeting. The stock transfer books will not be closed between the record date and the date of the meeting. All stockholders are cordially invited to attend the meeting in person.

This Notice is being mailed on or about March 20, 2006, to all stockholders entitled to vote at the Annual Meeting.

Whether or not you plan to attend, please sign and return the enclosed proxy as promptly as possible in the envelope enclosed for your convenience or follow the instructions for Internet or telephone voting. Should you receive more than one proxy because your shares are registered in different names and addresses, each proxy should be signed and returned to assure that all your shares will be voted. You may revoke your proxy at any time prior to the time it is voted at the Annual Meeting. If you attend the Annual Meeting and vote by ballot, your proxy will be revoked automatically and only your vote at the Annual Meeting will be counted.

| | By Order of the Board of Directors, |

| | /s/ W. ROBERT STOVER |

| | W. Robert Stover |

| | Chairman of the Board of Directors |

Walnut Creek, California | | |

March 10, 2006 | | |

YOUR VOTE IS VERY IMPORTANT, REGARDLESS OF THE NUMBER OF SHARES YOU OWN. PLEASE READ THE ATTACHED PROXY STATEMENT CAREFULLY, COMPLETE, SIGN AND DATE THE ENCLOSED PROXY CARD AS PROMPTLY AS POSSIBLE AND RETURN IT IN THE ENCLOSED ENVELOPE OR FOLLOW THE INSTRUCTIONS FOR INTERNET OR TELEPHONE VOTING ON PAGE 4 OF THE ACCOMPANYING PROXY STATEMENT. |

p

PROXY STATEMENT

TABLE OF CONTENTS

WESTAFF, INC.

298 North Wiget Lane

Walnut Creek, California 94598

PROXY STATEMENT

FOR ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON April 19, 2006

The enclosed proxy (“Proxy”) is solicited on behalf of the Board of Directors of Westaff, Inc. (the “Company”), for use at the Annual Meeting. The Annual Meeting will be held on April 19, 2006, at 10:00 a.m., local time, at the Company’s administrative offices located at 298 N. Wiget Lane, Walnut Creek, California.

These proxy solicitation materials will be mailed on or about March 20, 2006, to all stockholders entitled to vote at the Annual Meeting.

Voting Procedures

The specific proposals to be considered and acted upon at the Annual Meeting are summarized in the accompanying Notice and are described in more detail in this Proxy Statement. On February 23, 2006, 16,395,568 shares of the Company’s common stock, $0.01 par value (“Common Stock”), were issued and outstanding. No shares of the Company’s preferred stock were outstanding.

The presence at the Annual Meeting of a majority of, or approximately 8,197,785 shares of Common Stock, either in person or by Proxy, will constitute a quorum for the transaction of business at the Annual Meeting. Abstentions and broker non-votes are counted as present for the purpose of determining the presence or absence of a quorum for the transaction of business. Each stockholder is entitled to one vote for each share of Common Stock held by such stockholder on February 23, 2006, the record date for determination of stockholders entitled to notice of and to vote at the Annual Meeting. Directors are elected by a plurality of the votes cast. Since votes are cast in favor of or withheld from each nominee, abstentions and broker non-votes therefore will have no effect on the outcome of Proposal One. All votes will be tabulated by the inspector of elections appointed for the meeting, who will separately tabulate affirmative and negative votes, abstentions and broker non-votes.

Voting By Mail

If you are unable to attend the Annual Meeting, you may vote by proxy. The enclosed Proxy is solicited by the Board of Directors, and, when returned properly completed, will be voted as you direct on the Proxy. Please complete, date and sign the Proxy and mail it as soon as possible in the envelope provided. Voting also may be accomplished electronically or by telephone, as described below. In the discretion of the proxy holder, shares represented by such proxies will be voted upon any other business as may properly come before the Annual Meeting. If no specific instructions are given with respect to matters to be acted upon at the Annual Meeting, shares of Common Stock represented by a properly executed proxy will be voted (i) FOR the election of management’s nominees for Directors, (ii) FOR the approval of Westaff, Inc. 2006 Stock Incentive Plan and (iii) as the Board of Directors may recommend for any other matter or matters which may properly come before the meeting. The Board of Directors does not know of any matter that is not referred to herein to be presented for action at the meeting. If any other matters are properly brought before the meeting, the persons named in the Proxy will have discretion to vote on such matters in accordance with their best judgment.

3

Voting Electronically or By Telephone

Instead of submitting your vote by mail on the enclosed Proxy, you can vote electronically by submitting your proxy through the Internet or by telephone. Please note that there are separate arrangements for using the Internet and telephone depending on whether your shares are registered in the Company’s stock records in your name or in the name of a brokerage firm or bank.

The Internet and telephone voting procedures are designed to authenticate your identity as a Westaff, Inc. stockholder, to allow you to vote your shares and to confirm that your instructions have been properly recorded. Stockholders voting by means of the Internet through American Stock Transfer & Trust Company, our transfer agent, should understand that there may be costs associated with electronic access, such as usage charges from Internet access providers and telephone companies, that may be borne by each individual stockholder.

Stockholders with shares registered directly in their name in our stock records maintained by American Stock Transfer & Trust Company may vote their shares as follows:

· By submitting their proxy through the Internet at the following address on the World Wide Web: www.voteproxy.com. Please access the web page and follow the on-screen instructions. Have your control number available when you access the web page.

· By making a toll-free telephone call from the United States and Canada to American Stock Transfer & Trust Company at 1-800-PROXIES and following the instructions. Have your control number and the Proxy available when you call.

· By mailing their signed Proxy. Specific instructions to be followed by registered stockholders are set forth on the enclosed proxy card. Proxies submitted through the Internet or by telephone through American Stock Transfer & Trust Company as described above must be received by 12:59 p.m. Eastern Daylight Savings Time (E.D.T.) on April 19, 2006.

A number of brokerage firms and banks are participating in a program provided through ADP Investor Communication Services that offers telephone and Internet voting options. That program is different from the program provided by American Stock Transfer & Trust Company for shares registered in the name of the stockholder. If your shares are held in an account at a brokerage firm or bank participating in the ADP Program, you may vote those shares by calling the telephone number which appears on your voting form or through the Internet in accordance with the instructions set forth on the voting form. If you have any questions regarding the proposals or how to execute your vote, please contact American Stock Transfer & Trust Company at (800) 937-5449 or visit their web site at www.amstock.com.

Revocability of Proxies

You may revoke or change your Proxy at any time before it is voted at the Annual Meeting by filing, with the Secretary of the Company at our principal executive offices, a notice of revocation or another signed Proxy with a later date. You also may revoke your Proxy by attending the Annual Meeting and voting in person. Please note, however, that if your shares are held of record by a broker, bank or other nominee and you wish to vote at the meeting, you must bring to the meeting a letter from the broker, bank or other nominee confirming your beneficial ownership of the shares. To revoke a proxy previously submitted electronically through the Internet or by telephone, you simply may vote again at a later date, but before 12:59 p.m. E.D.T. on April 19, 2006, by using the same procedures, in which case your later submitted vote will be recorded and your earlier vote revoked.

4

Solicitation

The Company will bear the entire cost of solicitation, including the preparation, assembly, printing and mailing of this Proxy Statement, the Proxy and any additional solicitation materials furnished to stockholders. Copies of solicitation materials will be furnished to brokerage houses, fiduciaries and custodians holding shares in their names that are beneficially owned by others so that they may forward this solicitation material to such beneficial owners. In addition, we may reimburse such persons for their costs in forwarding the solicitation materials to such beneficial owners. The original solicitation of proxies by mail may be supplemented by a solicitation by telephone, telegram, or other means by directors, officers or employees. No additional compensation will be paid to these individuals for any such services. Except as described above, we do not presently intend to solicit proxies other than by mail.

5

MATTERS TO BE CONSIDERED AT THE 2006 ANNUAL MEETING

PROPOSAL ONE—ELECTION OF CLASS I DIRECTORS

General

Our Board of Directors is divided into three classes, designated Class I, Class II and Class III, with each class having a three-year term. The Board of Directors has selected two nominees, who are currently serving as Class I directors of the Company. The nominees for directors are Jack D. Samuelson and Ronald D. Stevens. The nominees have agreed to serve if elected, and management has no reason to believe that they will be unavailable to serve. In the event either nominee is unable or declines to serve as a director at the time of the Annual Meeting, the proxies will be voted for any replacement nominee who may be designated by the present Board of Directors to fill the vacancy.

Unless otherwise instructed, the proxy holders will vote the Proxies received by them FOR the nominees named below. In the event that additional persons are nominated, other than by the Board of Directors, for election as directors, the proxy holders intend to vote all Proxies received by them for the nominees listed below or any replacement Board of Directors’ nominees as described above. The two candidates receiving the highest number of affirmative votes of the shares represented and voting on this particular matter at the Annual Meeting will be elected as Class I directors of the Company, to serve their respective three-year terms and until their successors have been elected and qualified.

Business Experience of Directors

Directors to be Elected at the Annual Meeting

Ronald D. Stevens, age 62, Class I director, was appointed as a director of the Company effective February 24, 2002. He began his business career in 1967 with Arthur Andersen & Co. and became an audit partner in that organization in 1977. He left Arthur Andersen & Co. at the end of 1990 and joined in opening Productivity Consulting Group, Inc. In April 2002, he retired from Robertson-Ceco Corporation where he had been its Executive Vice President and Chief Financial Officer since October 1996. He is a certified public accountant on inactive status.

Jack D. Samuelson, age 81, Class I director, has been a director of the Company since March 1995. Mr. Samuelson co-founded Samuelson Brothers in 1957 to engage in general construction and commercial real estate development. Mr. Samuelson has been its President and Chairman of the Board of Directors from incorporation to the present. Samuelson Brothers sold its construction business in 1979 and since then has continued to develop industrial and commercial real estate. It is now known as Samuelson Partners. Mr. Samuelson is also a director of Nationwide Health Properties, Inc., a New York Stock Exchange-listed real estate investment trust focused on healthcare-related properties.

Directors Whose Terms Extend Beyond the Annual Meeting

Patricia M. Newman, age 54, Class II director, was appointed as our President and Chief Executive Officer effective March 16, 2005. Ms. Newman is a 25 year veteran of the staffing industry and was appointed as Chief Operating Officer of the Company on November 1, 2004. Prior to that, she had been the Company’s U.K. Managing Director since December 1998. In November 2002, she took on the added responsibility of overseeing the Company’s Denmark and Norway Operations. Ms. Newman will continue to serve on the board of Westaff U.K. Limited.

W. Robert Stover, age 84, Class III director, founded the Company in 1948 and has been continuously involved in the management of the Company since that time. Since our incorporation in 1954, Mr. Stover has held the position of Chairman of the Board of Directors. From 1954 to 1985, Mr. Stover served as President, and from 1985 to the end of calendar year 1998, as Chief Executive Officer. He stepped down as

6

Chief Executive Officer effective January 1, 1999, and continued to serve as Chairman of the Board of Directors until May 3, 2000, when he also assumed the position of interim President and Chief Executive Officer following the termination of a management-led buyout transaction. Mr. Stover’s interim service as President and Chief Executive Officer ended upon the hiring of a successor in that office effective May 1, 2001. He continues to serve as Chairman of the Board of Directors.

Janet M. Brady, age 52, Class III director, was appointed as a director of the Company effective September 19, 2002. She was employed by The Clorox Company for almost twenty-seven years having started as Brand Assistant in 1976. After a series of promotions, including as Vice President-Corporate Marketing Services of that company, she was named Vice President-Human Resources in 1993 where she served until her retirement in January 2003. She was a former director of American Protective Services, Inc., a privately held guard service company. She is a director on the Advisory Board of I.P.S.A., a privately held investigative and protective services company.

At the 2005 Annual Meeting, W. Robert Stover and Janet M. Brady were reelected to serve three-year terms in Class III. At the 2004 Annual Meeting, Dwight S. Pedersen was elected to serve a three-year term in Class II. Mr. Pedersen resigned on March 16, 2005. Effective March 16, 2005, prior to the 2005 Annual Meeting of Stockholders, Patricia M. Newman was appointed to serve in Class II to fill the remainder of her predecessor’s term. At the 2003 Annual Meeting, Jack D. Samuelson and Ronald D. Stevens were elected to serve three-year terms in Class I. There are no family relationships among our executive officers or directors.

The Board of Directors Recommends that the Stockholders Vote FOR the

Election of Mr. Stevens and Mr. Samuelson as Class I Directors of the Company.

PROPOSAL TWO—APPROVAL OF THE WESTAFF, INC. 2006 STOCK INCENTIVE PLAN

The Board has unanimously approved for submission to a vote of the stockholders a proposal to adopt the Westaff, Inc. 2006 Stock Incentive Plan (the “2006 Plan”). The purpose of the 2006 Plan is to retain key employees and directors of the Company having experience and ability, to attract new employees and directors whose services are considered valuable, to encourage the sense of proprietorship and to stimulate the active interest of such persons in the development and financial success of the Company and its subsidiaries. The Board believes that grants of options and other forms of equity participation may become an increasingly important means to retain and compensate employees and directors. The Company’s 1996 Stock Option/Stock Issuance Plan (the “1996 Plan”) will terminate on April 30, 2006. In order for the Company to continue to grant equity based awards, it is necessary for the Company to adopt the 2006 Plan to replace the 1996 Plan.

If approved by the stockholders, a total of 1,500,000 shares of Common Stock will be initially reserved for issuance under the 2006 Plan, subject to adjustment in the event of a stock split, stock or other extraordinary dividend, or other similar change in the Common Stock or capital structure of the Company. Capitalized terms used but not defined in this Proposal Two shall have the same meaning as in the 2006 Plan unless otherwise indicated.

A general description of the principal terms of the 2006 Plan as proposed is set forth below. This description is qualified in its entirety by the terms of the 2006 Plan, a copy of which is attached to this Proxy Statement as Appendix A and is incorporated herein by reference.

General Description

Purpose. The purpose of the 2006 Plan is to provide the Company’s employees and directors, whose present and potential contributions are important to the success of the Company, an incentive, through

7

ownership of the Company’s Common Stock, to continue in service to the Company, and to help the Company compete effectively with other enterprises for the services of qualified individuals.

Shares Reserved for Issuance under the 2006 Plan. If approved by the stockholders, a total of 1,500,000 shares of Common Stock will be reserved initially for issuance under the 2006 Plan, subject to adjustment in the event of a stock split, stock or other extraordinary dividend, or other similar change in the Common Stock or capital structure of the Company. The maximum number of shares with respect to which options and stock appreciation rights may be granted to a participant during a calendar year is 1,000,000 shares. In addition, in connection with a participant’s commencement of continuous service, a participant may be granted options and stock appreciation rights for up to an additional 500,000 shares which shall not count against the limit set forth in the previous sentence. The foregoing limitations shall be adjusted proportionately by the Administrator in connection with any change in the Company’s capitalization due to a stock split, stock dividend or similar event affecting the Common Stock of the Company and its determination shall be final, binding and conclusive. For awards of restricted stock and restricted stock units that are intended to be performance-based compensation under Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”), the maximum number of shares subject to such awards that may be granted to a participant during a calendar year is 1,000,000 shares.

Administration. The 2006 Plan will be administered by the plan administrator (the “Administrator”), defined as the Board. The Board must act unanimously with respect to all actions taken as the Administrator.

Terms and Conditions of Awards. The 2006 Plan provides for the grant of stock options, restricted stock, restricted stock units, stock appreciation rights and dividend equivalent rights (collectively referred to as “awards”). Stock options granted under the 2006 Plan may be either incentive stock options under the provisions of Section 422 of the Code, or nonqualified stock options. Incentive stock options may be granted only to employees. Awards other than incentive stock options may be granted to employees and directors. To the extent that the aggregate fair market value of shares of the Company’s Common Stock subject to options designated as incentive stock options which become exercisable for the first time by a participant during any calendar year exceeds $100,000, such excess options shall be treated as nonqualified stock options. Under the 2006 Plan, awards may be granted to such employees and directors who are residing in non-U.S. jurisdictions as the Administrator may determine from time to time. Each award granted under the 2006 Plan shall be designated in an award agreement.

The Administrator may issue awards under the 2006 Plan in settlement, assumption or substitution for, outstanding awards or obligations to grant future awards in connection with the Company or a related entity acquiring another entity, an interest in another entity or an additional interest in a related entity whether by merger, stock purchase, asset purchase or other form of transaction. Subject to applicable laws, the Administrator has the authority, in its discretion, to select employees and directors to whom awards may be granted from time to time, to determine whether and to what extent awards are granted, to determine the number of shares of the Company’s Common Stock or the amount of other consideration to be covered by each award (subject to the limitations set forth under the above sub-section of this Proposal Two “—Shares Reserved for Issuance under the 2006 Plan”), to approve award agreements for use under the 2006 Plan, to determine the terms and conditions of any award (including the vesting schedule applicable to the award), to amend the terms of any outstanding award granted under the Plan, to construe and interpret the terms of the 2006 Plan and awards granted, to establish additional terms, conditions, rules or procedures to accommodate the rules or laws of applicable non-U.S. jurisdictions and to take such other action not inconsistent with the terms of the 2006 Plan, as the Administrator deems appropriate.

The term of any award granted under the 2006 Plan may not be for more than ten years (or five years in the case of an incentive stock option granted to any participant who owns stock representing more than 10% of the combined voting power of the Company or any parent or subsidiary of the Company),

8

excluding any period for which the participant has elected to defer the receipt of the shares or cash issuable pursuant to the award.

The 2006 Plan authorizes the Administrator to grant incentive stock options and non-qualified stock options at an exercise price not less than 100% of the fair market value of the Common Stock on the date the option is granted (or 110%, in the case of an incentive stock option granted to any employee who owns stock representing more than 10% of the combined voting power of the Company or any parent or subsidiary of the Company). In the case of stock appreciation rights, the base appreciation amount shall not be less than 100% of the fair market value of the Common Stock on the date of grant. In the case of awards intended to qualify as performance-based compensation, the exercise or purchase price, if any, shall be not less than 100% of the fair market value per share on the date of grant. In the case of all other awards granted under the 2006 Plan, the exercise or purchase price shall be determined by the Administrator. The exercise or purchase price is generally payable in cash, check, shares of Common Stock or with respect to options, payment through a broker-dealer sale and remittance procedure or a “net exercise” procedure.

The 2006 Plan provides that any amendment that would adversely affect the grantee’s rights under an outstanding awards shall not be made without the grantee’s written consent, provided, however, that an amendment or modification that may cause an incentive stock option to become a non-qualified stock option shall not be treated as adversely affecting the rights of the grantee. The 2006 Plan also provides that stockholder approval is required in order to (i) reduce the exercise price of any option and the base appreciation amount of any stock appreciation awarded under the 2006 Plan or (ii) cancel any option or stock appreciation right awarded under the 2006 Plan in exchange for another award at a time when exercise price or base appreciation amount (as applicable) exceeds the fair market value of the underlying shares unless the cancellation and exchange occurs in connection with a Corporate Transaction.

Under the 2006 Plan, the Administrator may establish one or more programs under the 2006 Plan to permit selected grantees the opportunity to elect to defer receipt of consideration payable under an award. The Administrator also may establish under the 2006 Plan separate programs for the grant of particular forms of awards to one or more classes of grantees.

Termination of Service. An award may not be exercised after the termination date of such award as set forth in the award agreement. In the event a participant in the 2006 Plan terminates continuous service with the Company, an award may be exercised only to the extent provided in the award agreement. Where an award agreement permits a participant to exercise an award following termination of service, the award shall terminate to the extent not exercised on the last day of the specified period or the last day of the original term of the award, whichever comes first. Any award designated as an incentive stock option, to the extent not exercised within the time permitted by law for the exercise of incentive stock options following the termination of employment, shall convert automatically to a nonqualified stock option and thereafter shall be exercisable as such to the extent exercisable by its terms for the period specified in the award agreement.

Transferability of Awards. Under the 2006 Plan, incentive stock options may not be sold, pledged, assigned, hypothecated, transferred or disposed of in any manner other than by will or by the laws of descent or distribution and may be exercised during the lifetime of the participant only by the participant. Other awards shall be transferable only by will or by the laws of descent or distribution and to the extent provided in the award agreement. The 2006 Plan permits the designation of beneficiaries by holders of awards, including incentive stock options.

Section 162(m) of the Code. The maximum number of shares with respect to which options and stock appreciation rights may be granted to a participant during a calendar year is 1,000,000 shares. In addition, in connection with a participant’s commencement of continuous service, a participant may be granted options and stock appreciation rights for up to an additional 500,000 shares which shall not count against

9

the limit set forth in the previous sentence. Under Code Section 162(m) no deduction is allowed in any taxable year of the Company for compensation in excess of $1 million paid to the Company’s chief executive officer and the four other most highly compensated officers of the Company.

An exception to this rule applies to compensation that is paid pursuant to a stock incentive plan approved by stockholders and that specifies, among other things, the maximum number of shares with respect to which options and stock appreciation rights may be granted to eligible participants under such plan during a specified period. Compensation paid pursuant to options or stock appreciation rights granted under such a plan and with an exercise price equal to the fair market value of the Company’s Common Stock on the date of grant is deemed to be inherently performance-based, since such awards provide value to participants only if the stock price appreciates. However, the options and stock appreciation rights must be approved by a committee of the Board composed solely of “outside directors” within the meaning of Section 162(m). Because the terms of the 2006 Plan require that the Board act unanimously with respect to all actions taken in connection with the Plan, options and stock appreciation rights will not be eligible for the exception to the $1 million deduction limitation under Section 162(m) of the Code. To the extent required by Section 162(m) of the Code or the regulations thereunder, in applying the limitation contained in the 2006 Plan, if any option or stock appreciation right is canceled, the cancelled award shall continue to count against the maximum number of shares of Common Stock with respect to which an award may be granted to a participant.

For awards of restricted stock and restricted stock units that are intended to be performance-based compensation under Section 162(m) of the Code, the maximum number of shares subject to such awards that may be granted to a participant during a calendar year is 1,000,000 shares. In addition, in order for restricted stock and restricted stock units to qualify as performance-based compensation under Section 162(m), the Administrator must establish a performance goal with respect to such award in writing not later than 90 days after the commencement of the services to which the award relates and while the achievement of the performance goal is still substantially uncertain. Furthermore, the performance goal must be stated in terms of an objective formula or standard. In addition, the restricted stock and restricted stock units (as well as the performance goals) must be approved by a committee of the Board composed solely of “outside directors” within the meaning of Section 162(m). Because the terms of the 2006 Plan require that the Board act unanimously with respect to all actions taken in connection with the Plan, restricted stock and restricted stock units will not be eligible for the exception to the $1 million deduction limitation under Section 162(m) of the Code.

The 2006 Plan includes the following performance criteria that may be considered by the Administrator when granting performance-based awards: (i) increase in share price, (ii) earnings per share, (iii) total stockholder return, (iv) operating margin, (v) gross margin, (vi) return on equity, (vii) return on assets, (viii) return on investment, (ix) operating income, (x) net operating income, (xi) pre-tax profit, (xii) cash flow, (xiii) revenue, (xiv) expenses, (xv) earnings before interest, taxes and depreciation, (xvi) economic value added, (xvii) market share, (xviii) gross profit, (xix) growth in sales and (xx) sales targets.

10

Change in Capitalization. Subject to any required action by the stockholders of the Company, the number of shares of Common Stock covered by outstanding awards, the number of shares of Common Stock that have been authorized for issuance under the 2006 Plan, the exercise or purchase price of each outstanding award, the maximum number of shares of Common Stock that may be granted subject to awards to any participant in a calendar year, and the like, shall be proportionally adjusted by the Administrator in the event of (i) any increase or decrease in the number of issued shares of Common Stock resulting from a stock split, stock dividend, combination or reclassification or similar event affecting the Common Stock of the Company, (ii) any other increase or decrease in the number of issued shares of Common Stock effected without receipt of consideration by the Company or (iii) as the Administrator may determine in its discretion, any other transaction with respect to Common Stock including a corporate merger, consolidation, acquisition of property or stock, separation (including a spin-off or other distribution of stock or property), reorganization, liquidation (whether partial or complete), distribution of cash or other assets to stockholders other than a normal cash dividend, or any similar transaction; provided, however, that conversion of any convertible securities of the Company shall not be deemed to have been “effected without receipt of consideration.” Such adjustment shall be made by the Administrator and its determination shall be final, binding and conclusive.

Corporate Transaction. The Administrator has the authority to provide for the full or partial automatic vesting and exercisability for all of the shares at the time represented by the awards and the release from restrictions on transfer and repurchase or forfeiture rights of such awards, before or at the time of a Corporate Transaction (as defined in the 2006 Plan). Effective upon the consummation of a Corporate Transaction, all outstanding awards shall terminate. However, all such awards shall not terminate to the extent the contractual obligations represented by the awards are assumed by the successor entity. To the extent the contractual obligations represented by the awards are not assumed by the successor entity, the awards shall become fully vested immediately prior to the consummation of a Corporate Transaction.

Change in Control. The Administrator has the authority to provide for the full or partial automatic vesting and exercisability for all of the shares at the time represented by the awards and the release from restrictions on transfer and repurchase or forfeiture rights of such awards, before or at the time of a Change in Control (as defined in the 2006 Plan).

Amendment, Suspension or Termination of the 2006 Plan. The Board may at any time amend, suspend or terminate the 2006 Plan. The 2006 Plan will terminate ten years from the date of its approval by our stockholders, unless terminated earlier by the Board. To the extent necessary to comply with applicable provisions of federal securities laws, state corporate and securities laws, the Code, the rules of any applicable stock exchange or national market system, and the rules of any non-U.S. jurisdiction applicable to awards granted to residents therein, we shall obtain stockholder approval of any such amendment to the 2006 Plan in such a manner and to such a degree as is required.

Certain Federal Tax Consequences

The following summary of the federal income tax consequences of the 2006 Plan and the awards granted thereunder is based upon federal income tax laws in effect on the date of this proxy statement. This summary does not purport to be complete, and does not discuss non-U.S., state or local tax consequences or guidance that may be issued by the Treasury Department under Section 409A of the Internal Revenue Code.

Nonqualified Stock Options. The grant of a nonqualified stock option under the 2006 Plan will not result in any federal income tax consequences to the optionholder or to the Company. Upon exercise of a nonqualified stock option, the optionholder is subject to income taxes at the rate applicable to ordinary compensation income on the difference between the option exercise price and the fair market value of the

11

shares on the date of exercise. This income is subject to withholding for federal income and employment tax purposes. The Company is entitled to an income tax deduction in the amount of the income recognized by the optionholder, subject to possible limitations imposed by Section 162(m) of the Code and so long as the Company withholds the appropriate taxes with respect to such income (if required) and the optionholder’s total compensation is deemed reasonable in amount. Any gain or loss on the optionholder’s subsequent disposition of the shares of Common Stock will receive long or short-term capital gain or loss treatment, depending on whether the shares are held for more than one year following exercise. The Company does not receive a tax deduction for any such gain.

In the event a nonqualified stock option is amended, such option may be considered deferred compensation and subject to the rules of new Section 409A of the Code, which provide rules regarding the timing of payment of deferred compensation. An option subject to Section 409A of the Code which fails to comply with the rules of Section 409A, can result in an additional 20% tax obligation, plus penalties and interest. Currently how the additional tax and penalties and interest will be applied is unclear.

Incentive Stock Options. The grant of an incentive stock option under the 2006 Plan will not result in any federal income tax consequences to the optionholder or to the Company. An optionholder recognizes no federal taxable income upon exercising an incentive stock option (subject to the alternative minimum tax rules discussed below), and the Company receives no deduction at the time of exercise. In the event of a disposition of stock acquired upon exercise of an incentive stock option, the tax consequences depend upon how long the optionholder has held the shares of Common Stock. If the optionholder does not dispose of the shares within two years after the incentive stock option was granted, nor within one year after the incentive stock option was exercised, the optionholder will recognize a long-term capital gain (or loss) equal to the difference between the sale price of the shares and the exercise price. The Company is not entitled to any deduction under these circumstances.

If the optionholder fails to satisfy either of the foregoing holding periods, he or she must recognize ordinary income in the year of the disposition (referred to as a “disqualifying disposition”). The amount of such ordinary income generally is the lesser of (i) the difference between the amount realized on the disposition and the exercise price or (ii) the difference between the fair market value of the stock on the exercise date and the exercise price. Any gain in excess of the amount taxed as ordinary income will be treated as a long or short-term capital gain, depending on whether the stock was held for more than one year. The Company, in the year of the disqualifying disposition, is entitled to a deduction equal to the amount of ordinary income recognized by the optionholder, subject to possible limitations imposed by Section 162(m) of the Code and so long as the optionholder’s total compensation is deemed reasonable in amount.

The “spread” under an incentive stock option—i.e., the difference between the fair market value of the shares at exercise and the exercise price—is classified as an item of adjustment in the year of exercise for purposes of the alternative minimum tax. If an optionholder’s alternative minimum tax liability exceeds such optionholder’s regular income tax liability, the optionholder will owe the larger amount of taxes. In order to avoid the application of alternative minimum tax with respect to incentive stock options, the optionholder must sell the shares within the same calendar year in which the incentive stock options are exercised. However, such a sale of shares within the same year of exercise will constitute a disqualifying disposition, as described above.

In the event an incentive stock option is amended, such option may be considered deferred compensation and subject to the rules of new Section 409A of the Code. An option subject to Section 409A of the Code which fails to comply with the rules of Section 409A, can result in an additional 20% tax obligation, plus penalties and interest. Currently how the additional tax and penalties and interest will be applied is unclear. In addition, the amendment of an incentive stock option may convert the option from an incentive stock option to a nonqualified stock option.

12

Restricted Stock. The grant of restricted stock will subject the recipient to ordinary compensation income on the difference between the amount paid for such stock and the fair market value of the shares on the date that the restrictions lapse. This income is subject to withholding for federal income and employment tax purposes. The Company is entitled to an income tax deduction in the amount of the ordinary income recognized by the recipient, subject to possible limitations imposed by Section 162(m) of the Code and so long as the Company withholds the appropriate taxes with respect to such income (if required) and the recipient’s total compensation is deemed reasonable in amount. Any gain or loss on the recipient’s subsequent disposition of the shares will receive long or short-term capital gain or loss treatment depending on how long the stock has been held since the restrictions lapsed. The Company does not receive a tax deduction for any such gain.

Recipients of restricted stock may make an election under Section 83(b) of the Code (“Section 83(b) Election”) to recognize as ordinary compensation income in the year that such restricted stock is granted, the amount equal to the spread between the amount paid for such stock and the fair market value on the date of the issuance of the stock. If such an election is made, the recipient recognizes no further amounts of compensation income upon the lapse of any restrictions and any gain or loss on subsequent disposition will be long or short-term capital gain to the recipient. The Section 83(b) Election must be made within thirty days from the time the restricted stock is issued.

Stock Appreciation Rights. Recipients of stock appreciation rights (“SARs”) generally should not recognize income until the SAR is exercised (assuming there is no ceiling on the value of the right). Upon exercise, the recipient will normally recognize taxable ordinary income for federal income tax purposes equal to the amount of cash and fair market value of the shares, if any, received upon such exercise. Recipients who are employees will be subject to withholding for federal income and employment tax purposes with respect to income recognized upon exercise of a SAR. Recipients will recognize gain upon the disposition of any shares received on exercise of a SAR equal to the excess of (i) the amount realized on such disposition over (ii) the ordinary income recognized with respect to such shares under the principles set forth above. That gain will be taxable as long or short-term capital gain depending on whether the shares were held for more than one year. The Company will be entitled to a tax deduction to the extent and in the year that ordinary income is recognized by the recipient, subject to possible limitations imposed by Section 162(m) of the Code and so long as the Company withholds the appropriate taxes with respect to such income (if required) and the recipient’s total compensation is deemed reasonable in amount.

A SAR can be considered non-qualified deferred compensation and subject to the new Section 409A of the Code. A SAR that does not meet the requirements of Code Section 409A will result in an additional 20% tax obligation, plus penalties and interest to such recipient. Currently, how the additional tax, penalties and interest will be applied is unclear.

Restricted Stock Units. Recipients of restricted stock units generally should not recognize income until such units are converted into cash or shares of stock. Upon conversion, the recipient will normally recognize taxable ordinary income for federal income tax purposes equal to the amount of cash and fair market value of the shares, if any, received upon such conversion. Recipients who are employees will be subject to withholding for federal income and employment tax purposes with respect to income recognized upon conversion of the restricted stock units. Participants will recognize gain upon the disposition of any shares received upon conversion of the restricted stock units equal to the excess of (i) the amount realized on such disposition over (ii) the ordinary income recognized with respect to such shares under the principles set forth above. That gain will be taxable as long or short-term capital gain depending on whether the shares were held for more than one year. The Company will be entitled to a tax deduction to the extent and in the year that ordinary income is recognized by the recipient, subject to possible limitations imposed by Section 162(m) of the Code and so long as the Company withholds the appropriate

13

taxes with respect to such income (if required) and the recipient’s total compensation is deemed reasonable in amount.

Restricted stock units also can be considered non-qualified deferred compensation and subject to the new Section 409A of the Code. A grant of restricted stock units that does not meet the requirements of Code Section 409A will result in an additional 20% tax obligation, plus penalties and interest to such recipient. Currently, how the additional tax, penalties and interest will be applied is unclear.

Dividends and Dividend Equivalents. Recipients of stock-based awards that earn dividends or dividend equivalents will recognize taxable ordinary income on any dividend payments received with respect to unvested and/or unexercised shares subject to such awards, which income is subject to withholding for federal income and employment tax purposes. The Company is entitled to an income tax deduction in the amount of the income recognized by a recipient, subject to possible limitations imposed by Section 162(m) of the Code and so long as the Company withholds the appropriate taxes with respect to such income (if required) and the individual’s total compensation is deemed reasonable in amount.

New Plan Benefits

As of the date of this Proxy Statement, no executive officer, employee or director, and no associate of any executive officer or director, has been granted any options under the 2006 Plan. The benefits to be received by the Company’s directors, executive officers and employees pursuant to the 2006 Plan are not determinable at this time.

Equity Compensation Plan Information

The following table sets forth securities authorized for issuance under equity compensation plans as of October 29, 2005. The Company maintains only the 1996 Stock Option/Stock Issuance Plan, as amended and restated, pursuant to which it may grant equity awards to eligible persons. This equity compensation plan was previously approved by security holders.

14

EQUITY COMPENSATION PLAN INFORMATION

Plan Category | | | | Number of securities to

be issued upon exercise of

outstanding options,

warrants and rights | | Weighted-average

exercise price of

outstanding options,

warrants and rights | | Number of securities

remaining available for

future issuance under

equity compensation

plans (excluding

securities reflected in

column (a)) | |

| | (a) | | (b) | | (c) | |

Equity compensation plans approved by securities holders | | | 640,000 | | | | $ | 3.69 | | | | 1,482,000 | | |

Equity compensation plans not approved by security holders | | | — | | | | — | | | | — | | |

Total | | | 640,000 | | | | $ | 3.69 | | | | 1,482,000 | | |

Vote Required

The affirmative vote of holders of a majority of the voting power of the shares of Common Stock, present in person or represented by proxy and entitled to vote at the Annual Meeting is required to approve the 2006 Plan.

The Board of Directors Recommends that the Stockholders Vote FOR the

approval of the 2006 Stock Incentive Plan.

15

OTHER MATTERS TO COME BEFORE THE 2006 ANNUAL MEETING

We know of no other matters that will be presented for consideration at the Annual Meeting. If any other matters properly come before the Annual Meeting, it is the intention of the persons named in the enclosed form of Proxy to vote the shares they represent as the Board of Directors may recommend. Discretionary authority with respect to such other matters is granted by the execution of the enclosed Proxy.

BOARD MEETINGS AND COMMITTEES

The standing Committees of the Board of Directors of the Company consist of the following: the Audit Committee, the Compensation Committee (which includes a Primary Committee and a Secondary Committee), the Strategic Planning Committee, and the Nominating and Governance Committee. The membership and functions of these committees are described below.

Directors | | | | Audit

Committee | | Compensation

Primary

Committee | | Compensation

Secondary

Committee | | Strategic

Planning

Committee | | Nominating and

Governance Committee |

Janet M. Brady | | X | | Chairman | | Chairman | | | | X |

Patricia M. Newman | | | | | | | | Chairman | | |

Jack D. Samuelson | | X | | | | | | X | | X |

Ronald d. Stevens | | Chairman | | X | | X | | | | Chairman |

W. Robert Stover | | | | | | X | | X | | |

Meetings of Directors. During fiscal 2005, the Board of Directors held ten meetings, the Audit Committee held four meetings, and the Compensation Committee held four meetings. The Special Committee held three meetings. The Strategic Planning Committee did not meet. The Board acted by unanimous written consent on two occasions. The active committees of the Board of Directors in fiscal 2005 were the Audit Committee, the Compensation Committee and the Special Committee. The Nominating and Governance Committee was established in fiscal 2006 and therefore had no meetings in fiscal 2005. In fiscal 2005, each of the directors attended at least 75% of the aggregate of (i) all Board meetings and (ii) all meetings held by committees of the Board on which such director served.

Audit Committee. The Audit Committee’s duties include reviewing internal financial information, reviewing our internal controls, reviewing our internal audit plans and programs, reviewing with our independent accountants the results of all audits upon their completion, overseeing the quarterly unaudited reporting process and taking such other action as may be necessary to assure the adequacy and integrity of all financial information distributed by us. The Audit Committee is also directly responsible for the appointment, compensation, retention and oversight of the work of the Company’s independent auditors, including the resolution of disagreements between management and the auditors regarding financial reporting. Additionally, the Audit Committee must review and approve all related party transactions that are required to be disclosed pursuant to Item 404 of Regulation S-K.

The current members of the Audit Committee are Messrs. Stevens and Samuelson, and Ms. Brady, and Mr. Stevens is the Chairman. The Audit Committee is required to have at least three members, all of whom must be “independent directors” as defined in the NASDAQ listing standards. The Board of Directors has determined that it has an “audit committee financial expert,” as defined in Item 401(h)(2) of Regulation S-K serving on the Audit Committee, Ronald D. Stevens, and that Mr. Stevens and each of the other Audit Committee members is an “independent director” as defined in Rule 4200(a)(15) of the NASDAQ listing standards. The Board has adopted a written charter for the Audit Committee, which was amended and restated after the end of fiscal 2003. A copy of the amended and restated Audit Committee charter is available on the Company’s website at http://www.westaff.com.

16

Compensation Committee. The Compensation Committee adopted a Compensation Committee Charter on February 27, 2006, a copy of which is attached to this year’s Proxy Statement as Appendix B. The Compensation Committee charter is also available on the Company’s website at http://www.westaff.com. The Compensation Committee currently consists of three directors, Janet M. Brady, Ronald D. Stevens and W. Robert Stover. Ms. Brady is its Chairman. The Primary Committee of the Compensation Committee consists of two directors, Ms. Brady and Mr. Stevens, both of whom are independent. The Secondary Committee of the Compensation Committee consists of the members of the Primary Committee and Mr. Stover. The Compensation Committee has the authority to administer the Company’s 1996 Stock Option/Stock Issuance Plan, the Employee Stock Purchase Plan and the International Employee Stock Purchase Plan. The Primary Committee of the Compensation Committee administers the Discretionary Option Grant, the Automatic Option Grant and Stock Issuance Programs with respect to Section 16 insiders. The Secondary Committee of the Compensation Committee administers the Discretionary Option Grant and Stock Issuance Programs with respect to eligible persons other than Section 16 insiders. In addition, the Primary Committee of the Compensation Committee is responsible for providing recommendations to the Board of Directors concerning compensation levels for the Company’s executive officers. The Secondary Committee of the Compensation Committee works with senior executive officers on benefit and compensation programs for employees, including matters related to participation in profit sharing, bonus plans and stock option plans and preparing reports to the extent necessary to comply with applicable disclosure requirements established by the Securities and Exchange Commission or other regulatory bodies. Our Chief Executive Officer is not present and does not participate in the deliberation or voting of the Primary Committee of the Compensation Committee for her compensation.

Strategic Planning Committee. The Strategic Planning Committee currently consists of three directors, Patricia M. Newman, Jack D. Samuelson and W. Robert Stover. Ms. Newman is its Chairman. The Committee is responsible for evaluating the Company’s business plans and future business including, but not limited to, the evaluation of potential acquisitions and new business opportunities. The Strategic Planning Committee did not meet in fiscal 2005.

Nominating and Governance Committee. The Board of Directors has adopted a standing Nominating and Governance Committee (the “Nominating Committee”) which currently consists of three directors, Janet M. Brady, Ronald D. Stevens and Jack D. Samuelson. Mr. Stevens is its Chairman. All of its members are “independent.” The Nominating Committee adopted a charter of the Nominating Committee of the Board of Directors by unanimous consent on February 22, 2006, a copy of which is attached to this year’s Proxy Statement as Appendix C. The Nominating Committee charter is also available on the Company’s website at http://www.westaff.com. The Nominating Committee identifies, screens and reviews individuals qualified to serve as directors; reviews each current director and recommends to the Board whether such director should stand for re-election; and recommends to the Board the nominees for election or re-election at the next annual meeting of stockholders and for filling vacancies that may occur at other times, subject to limitations set forth in the corporate governance guidelines of the Company.

Director Nominations. The Board of Directors did not have a standing nominating committee or committee performing similar functions or any related committee charter prior to September 12, 2005 because of the relatively small size of the Board of Directors, and the entire Board of Directors (which includes members that do not meet the NASDAQ definition of “independent director”) functioned in the same capacity as a nominating committee. After September 12, 2005, no directors were nominated for election to the Board until the Nominating Committee recommended the current slate of directors, Mr. Stevens and Mr. Samuelson on February 27, 2006, to the Board as nominee for re-election at the 2006 Annual Meeting.

17

The Company has a policy regarding the consideration of any director candidates recommended by security holders. Nominations of directors by stockholders must be made pursuant to timely notice in writing to the Secretary of the Company for bringing business before a meeting of stockholders. To be timely, a stockholder’s notice must be delivered to or mailed and received at the principal executive offices of the Company (a) in the case of an annual meeting, not less than 60 days nor more than 90 days prior to the first anniversary of the preceding year’s annual meeting, and (b) in the case of a special meeting at which directors are to be elected, not later than the close of business on the 10th day following the earlier of the day on which notice of the date of the meeting was mailed or public disclosure was made. Such stockholder’s notice shall set forth (a) as to each person whom the stockholder proposes to nominate for election or reelection as a director, all information relating to such person that is required to be disclosed in solicitations of proxies for election of directors, or is otherwise required, in each case pursuant to Regulation 14A under the Exchange Act, (including such person’s written consent to being named in the proxy statement as a nominee and to serving as a director if elected); (b) as to the stockholder giving the notice (i) the name and address, as they appear on the Company’s books, of such stockholder and (ii) the class and number of shares of Common Stock which are beneficially owned by such stockholder and also which are owned of record by such stockholder; and (c) as to the beneficial owner, if any, on whose behalf the nomination is made, (i) the name and address of such person and (ii) the class and number of shares of Common Stock which are beneficially owned by such person. In addition, the Nominating Committee remains open to candidates for Directors. The Nominating Committee considers multiple sources for identifying and evaluating nominees for Directors, including referrals from current Directors and stockholders.

The Nominating Committee determines the required selection criteria and qualifications of director nominees based upon the Company’s needs at the time nominees are considered. In general directors should possess personal and professional ethics, integrity and values, and be committed to representing the long-term interests of Westaff’s shareholders. Directors should also have an inquisitive and objective perspective, practical wisdom and mature judgment, and be willing and able to challenge management in a constructive manner. Westaff endeavors to have its Board represent diverse skills and experience at policymaking levels in finance, human resources, marketing, technology and other aspects of business relevant to Westaff’s activities. Directors should be willing to devote sufficient time to carrying out their duties and responsibilities effectively, and should be committed to serving on the Board for an extended period of time. The number of Boards of publicly traded companies or Audit Committees thereof on which outside directors sit should not exceed three (in addition to the Company) without the concurrence of the Nominating Committee and may not, in any event, constitute a conflict of interest. The Nominating Committee will consider these same criteria for candidates regardless of whether the candidate was identified by the Nominating Committee, by stockholders, or any other source. See below for the Report of the Nominating Committee regarding executive compensation.

Special Committee. In addition to the standing committees, the Board of Directors periodically delegated various items to a Special Committee consisting of the directors of the Company who are non-members of, and independent from management, Janet M. Brady, Ronald D. Stevens and Jack D. Samuelson, to consider strategic alternatives for the Company, including, but not limited to, mergers, acquisitions and the evaluation of potential sales of the company.

Directors’ Compensation

Non-employee members of the Board of Directors each received an annual fee of $15,000 for service on the Board of Directors in fiscal 2005. They received an additional fee of $1,000 for each meeting attended in person. In the event a Board meeting and a committee meeting was held on the same day, the total meeting fee was not more than $1,000 per day. They also received a fee of $500 for each telephonic meeting attended, if called by the Chairman of the Board of Directors or an employee member of the

18

Board of Directors. The Chairman of the Compensation Committee and the Chairman of the Audit Committee received an additional fee of $1,500 per quarter.

Non-employee members of the Board of Directors also were reimbursed for their reasonable expenses incurred in connection with attending Board of Directors meetings.

We anticipate no increase in our directors’ compensation during fiscal 2006. No additional compensation was paid to any of the directors during fiscal 2005 for their committee service.

In addition, non-employee Board of Directors members are eligible to receive periodic option grants under the Automatic Option Grant Program in effect under our 1996 Stock Option/Stock Issuance Plan (the “Stock Option Plan”). Under the Automatic Option Grant Program, each individual who subsequently joins the Board of Directors as a non-employee director will receive at that time an option grant, provided such individual has not previously been in our employ. In addition, at each annual stockholders’ meeting each individual who continues to serve as a non-employee Board of Directors member presently is entitled to an option grant for 3,000 shares with an exercise price equal to the fair market value of the option shares on the grant date, provided such individual has served as a Board of Directors member for at least six months.

Each automatic option grant will have a maximum term of ten years measured from the grant date, subject to earlier termination following the optionee’s cessation of Board of Directors service. The option will become exercisable for all the option shares upon the optionee’s completion of one year of Board of Directors service measured from the grant date. However, the option will become immediately exercisable for all the option shares should the optionee cease Board of Directors service by reason of death or disability or should the Company be acquired by merger or asset sale or change of control during the period of the optionee’s service on the Board of Directors. The Stock Option Plan will expire in 2006 in accordance with its terms and we expect that this Automatic Option Grant Program will be maintained under the 2006 Stock Incentive Plan described in Proposal 2 above.

Pursuant to the terms of the Automatic Option Grant Program, Messrs. Samuelson and Stevens, and Ms. Brady each received an option grant to purchase 3,000 shares of Common Stock during fiscal 2005.

19

OWNERSHIP OF SECURITIES

The following table sets forth as of January 31, 2006 certain information regarding the beneficial ownership of our Common Stock for (i) all persons who are known to us to be beneficial owners of five percent or more of the outstanding shares of our Common Stock, (ii) each of our directors and nominees, (iii) our current Chief Executive Officer and the four other executive officers who were serving as executive officers at the end of fiscal 2005, and (iv) all of our executive officers and directors as a group. Unless otherwise indicated, each of the stockholders has sole voting and investment power with respect to the shares beneficially owned, subject to community property laws, where applicable. Unless otherwise noted, the address of each person identified below is c/o Westaff, Inc., 298 N. Wiget Lane, Walnut Creek, California 94598. The share information set forth in the table below is as of January 31, 2006.

Name | | | | Number of Shares(#)(1) | | Percent(%)(2) | |

Ironwood Capital Management LLC(3) 21 Custom House Street Suite 240 Boston, MA 02019 | | | 894,466 | | | | 5.49 | % | |

W. Robert Stover(4) | | | 6,666,797 | | | | 40.66 | % | |

Jack D. Samuelson(5) | | | 47,250 | | | | * | | |

Ronald D. Stevens(6) | | | 9,000 | | | | * | | |

Janet M. Brady(7) | | | 9,000 | | | | * | | |

Patricia M. Newman(8) | | | 33,103 | | | | * | | |

Dirk A. Sodestrom(9) | | | 114,602 | | | | * | | |

Stephen J. Russo(10) | | | 10,937 | | | | * | | |

David P. Wilson(11) | | | 24,813 | | | | * | | |

Christa C. Leonard(12) | | | 23,437 | | | | * | | |

All current executive officers and directors as a group

(9 persons)(13) | | | 6,938,939 | | | | 42.30 | % | |

* Less than one percent

(1) To the Company’s knowledge, except as indicated in the footnotes to this table and subject to applicable community property laws, each of the persons named in this table has sole voting and investment power with respect to all shares of Common Stock indicated opposite such person’s name.

(2) Based on 16,395,568 shares of Common Stock outstanding at January 31, 2006. Shares of Common Stock subject to options, warrants and convertible notes and other purchase rights currently exercisable or convertible, or exercisable or convertible within 60 days of January 31, 2006, are deemed outstanding for computing the percentage of the person or entity holding such securities but are not deemed outstanding for computing the percentage of any other person or entity.

(3) Security ownership information for the beneficial ownership is taken from the Form SC13G filed with the SEC on February 21, 2006.

(4) Includes 2,607,018 shares of Common Stock held by W. Robert Stover and Joan C. Stover as Co-Trustees of the Stover Revocable Trust dated 11/16/88, as amended, the beneficial ownership of which may be attributable to each of Mr. Stover and Mrs. Stover. Includes 3,783,164 shares of Common Stock contributed to the Stover 1999 Charitable Remainder Unitrust dated 4/21/99 of which Mr. Stover is Co-Trustee. Includes 276,615 shares of Common Stock owned by the Stover Foundation, a California nonprofit religious corporation (the “Foundation”).

(5) Includes unexercised options to purchase 26,250 shares of Common Stock beneficially owned by Mr. Samuelson under the 1996 Stock Option/Stock Issuance Plan.

20

(6) Includes unexercised options to purchase 9,000 shares of Common Stock beneficially owned by Mr. Stevens under the 1996 Stock Option/Stock Issuance Plan.

(7) Includes unexercised options to purchase 9,000 shares of Common Stock beneficially owned by Ms. Brady under the 1996 Stock Option/Stock Issuance Plan.

(8) Includes unexercised options to purchase 27,395 shares of Common Stock beneficially owned by Ms. Newman under the 1996 Stock Option/Stock Issuance Plan.

(9) Includes unexercised options to purchase 90,541 shares of Common Stock beneficially owned by Mr. Sodestrom under the 1996 Stock Option/Stock Issuance Plan.

(10) Includes unexercised options to purchase 10,937 shares of Common Stock beneficially owned by Mr. Russo under the 1996 Stock Option/Stock Issuance Plan. Effective March 7, 2006, Westaff and Mr. Russo mutually agreed to end his employment with Westaff. The terms of his departure are currently being negotiated. Westaff has commenced a search for a replacement for Mr. Russo and intends to appoint a successor as soon as practicable.

(11) Includes unexercised options to purchase 20,750 shares of Common Stock beneficially owned by Mr. Wilson under the 1996 Stock Option/Stock Issuance Plan.

(12) Includes unexercised options to purchase 23,437 shares of Common Stock beneficially owned by Ms. Leonard under the 1996 Stock Option/Stock Issuance Plan.

(13) Includes unexercised options to purchase 217,310 shares of Common Stock under the 1996 Stock Option/Stock Issuance Plan.

21

WESTAFF, INC.

COMPENSATION COMMITTEE

OF THE BOARD OF DIRECTORS

EXECUTIVE COMPENSATION REPORT

Notwithstanding anything to the contrary set forth in any of our previous filings under the Securities Act of 1933, as amended (the “Securities Act”), or the Securities Exchange Act of 1934, as amended (the “Exchange Act”), that might incorporate future filings, including this Proxy Statement, in whole or in part, the following report shall not be deemed to be “soliciting material” or to be “filed” with the Securities and Exchange Commission, nor shall such report be incorporated by reference into any such filings, nor be deemed to be incorporated by reference into any future filings under the Securities Act or the Exchange Act.

The Compensation Committee currently consists of three directors, Janet M. Brady, Ronald D. Stevens and W. Robert Stover. Ms. Brady is its current Chairman. It is the duty of the Compensation Committee to review and establish the compensation of executive officers of the Company, including base salary, participation in profit sharing, bonus and other cash incentive plans, subject to ratification by the Board of Directors. During fiscal 2005, the Compensation Committee also had the authority to administer the Company’s 1996 Stock Option/Stock Issuance Plan (the “Plan”) under which grants may be made to such officers. With respect to administration of the Plan, the Compensation Committee has a Primary Committee and a Secondary Committee.

The Primary Committee consists of two or more non-employee members of the Board of Directors who have authority to administer the Discretionary Option Grant, the Automatic Option Grant and Stock Issuance Programs with respect to Section 16 insiders. Section 16 insiders are officers or directors of the Company subject to the short-swing profit recapture provisions of Section 16 of the Exchange Act. The Primary Committee is constituted in such a manner as to satisfy all applicable laws and to permit such grants and related transactions under the Plan to be exempt from Section 16(b) of the Exchange Act in accordance with Rule 16b-3. In fiscal 2005, the Primary Committee members were Janet M. Brady and Ronald D. Stevens.

The Secondary Committee consists of two or more members of the Board of Directors who administer the Discretionary Option Grant and Stock Issuance Programs with respect to eligible persons other than Section 16 insiders. In fiscal 2005, the Secondary Committee members were Janet M. Brady, Ronald D. Stevens and W. Robert Stover.

Members of the Primary Committee or any Secondary Committee serve for such period of time as the Board of Directors may determine and may be removed by the Board of Directors at any time. The Board of Directors may also at any time terminate the functions of the Primary Committee and any Secondary Committee and reassume all powers and authority previously delegated to such committee.

General Compensation Policy

The fundamental policy of the Compensation Committee is to offer the Company’s executive officers competitive compensation opportunities based upon their personal performance and their contribution to the financial success of the Company. Generally, each executive officer’s compensation package comprises three elements: (i) base salary which is designed primarily to be competitive with base salary levels in effect both at companies within the temporary staffing industry that are of comparable size to the Company and at companies outside of such industry with which the Company competes for executive talent; (ii) annual bonuses payable in cash and tied to the Company’s attainment of financial milestones based on criteria established by the Compensation Committee; and (iii) long-term stock-based incentive awards which strengthen the mutuality of interests between the executive officers and the Company’s stockholders. As an employee’s level of responsibility and accountability within the Company increases over time, a greater

22

portion of his or her total compensation is intended to be dependent upon the Company’s performance and stock price appreciation rather than upon base salary.

Factors. The principal factor considered by the Compensation Committee in establishing the components of each executive officer’s compensation package for fiscal 2005 is external salary data of both temporary staffing service companies and other companies within a similar geographical area and with small to medium market capitalization.

Base Salary. The base salary for each executive officer is determined on the basis of internal comparability and on external salary data of temporary staffing service companies and other companies within a similar geographic area and with small to medium market capitalization. Salaries are reviewed on an annual basis, and discretionary adjustments to each executive officer’s base salary are based upon individual performance and salary increases paid by the Company’s competitors and other companies of similar size and scope. The Primary Committee of the Compensation Committee sets the base salaries of the Chairman of the Board of Directors and makes a recommendation to the Board regarding the base salary of the President and Chief Executive Officer, and the committee reviews the salaries of the other corporate officers who are members of the senior management team and makes recommendations to the Board.

Annual Incentive Compensation. There was a discretionary executive bonus plan for fiscal 2005 designed to provide financial rewards to the participants based on company performance for fiscal 2005. No bonuses were awarded under the plan since the Company did not meet its minimum financial goals other than a minimum guaranteed bonus paid to Ms. Newman as part of her contractual agreement.

Long-Term Incentive Compensation. Option grants are intended to align the interests of each executive officer with those of the Company’s stockholders and to provide each individual with an incentive to manage the Company from the perspective of an owner with an equity stake in the business. The Compensation Committee has the discretion to set the option exercise price (not less than 100% of the fair market value of the stock on the grant date for an Incentive Option and not less than 85% of such fair market value for a Non-Statutory Option) and the vesting schedule for option grants. The Compensation Committee determines the amount of the option grant according to each executive’s position within the Company and sets a level it considers appropriate to create a meaningful opportunity for stock ownership. In addition, the Compensation Committee takes into account an individual’s level of responsibility and opportunity to influence the Company’s financial results, comparable awards made to individuals in similar positions within the industry, and the number of unvested options held by each individual at the time of the new grant. The relative weight given to each of these factors varies among individuals and is at the Compensation Committee’s discretion.

Each option grant allows the officer to acquire shares of the Company’s Common Stock at a fixed price per share (typically the closing market price on the date of grant) over a specified period of time (up to ten years). The options generally vest in installments over a four-year period, contingent upon the executive officer’s continued employment with the Company. The options generally become exercisable with respect to 25% of the option shares upon the optionee’s completion of one year of service measured from the vesting commencement date and the balance in 36 successive monthly installments upon the optionee’s completion of each month of service over the 36-month period measured from the first anniversary of the vesting commencement date. Accordingly, the option will provide a return to the executive officer only if the executive officer remains employed by the Company for one or more years during which the option vests, and then only if the market price of the underlying shares appreciates over the option term.

Tax Limitation. As a result of federal tax legislation enacted in 1993, a publicly-held company such as Westaff, Inc. will not be allowed a federal income tax deduction for compensation paid to the executive officers named in the Summary Compensation Table to the extent that compensation exceeds $1,000,000

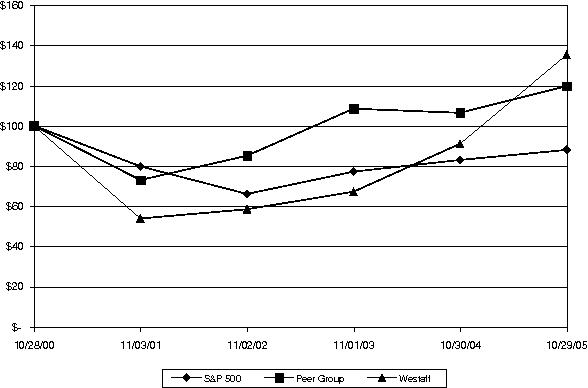

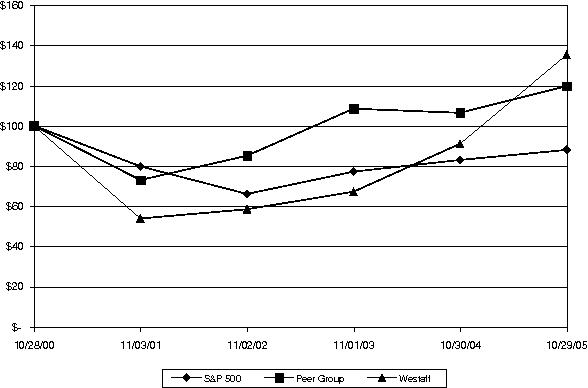

23