This management proxy circular and the accompanying materials require your immediate attention. If you are in doubt as to how to deal with these documents or the matters to which they refer, please consult a professional advisor.

ARRANGEMENT INVOLVING

MARATHON PGM CORPORATION

AND

STILLWATER MINING COMPANY

AND

MARATHON GOLD CORPORATION

NOTICE AND MANAGEMENT PROXY CIRCULAR FOR

THE SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD ON NOVEMBER 15, 2010

OCTOBER 15, 2010

| Dear Shareholder: | October 15, 2010 |

The Board of Directors cordially invites you to attend the special meeting of shareholders of Marathon PGM Corporation (“Marathon”) to be held commencing at 9:30 am (Toronto time) on Monday, November 15, 2010 at the Toronto Board of Trade, First Canadian Place, Toronto, Ontario, Canada.

At the special meeting, shareholders of Marathon (“Marathon Shareholders”) will be asked to consider and, if deemed advisable, to pass a special resolution approving a statutory arrangement (the “Arrangement”) pursuant to Section 192 of the Canada Business Corporations Act whereby a wholly owned subsidiary (“AcquireCo”) of Stillwater Mining Company (“Stillwater”) will acquire all of t he outstanding common shares of Marathon, as well as certain related transactions (collectively the “Transaction”). Under the Transaction, shareholders will receive 0.112 of a common share of Stillwater, Cdn. $1.775 in cash, plus 0.5 of a common share of a new public exploration and development company (“Marathon Gold”) in exchange for each common share of Marathon (each a “Marathon Share”), all in accordance with the arrangement agreement dated September 7, 2010 entered into between Stillwater, Marathon and Marathon Gold and amended by an amending agreement dated October 4, 2010.

The Board of Directors of Marathon, based in part on the unanimous recommendation of the special committee of the Board of Directors created to consider the Transaction (the “Special Committee”), has determined that the consideration being offered pursuant to the Transaction is fair to shareholders and that the Transaction is in the best interests of Marathon and recommends that shareholders vote in favour of the special resolution. The recommendation of the Special Committee and the Board of Directors is based on various factors, including the opinion of Haywood Securities Inc., financial advisor to the Special Committee, to the effect that the consideration to b e received by the Marathon Shareholders (other than Stillwater and its affiliates and associates) pursuant to the Arrangement is fair, from a financial point of view.

To be effective, the Transaction must be approved by a resolution passed by two-thirds of the votes cast at the special meeting. The Transaction is also subject to certain conditions and the approval of the Ontario Superior Court of Justice.

The accompanying Notice of Special Meeting and Management Proxy Circular provide a full description of the Transaction and include certain additional information to assist you in considering how to vote on the Transaction. You are encouraged to consider carefully all of the information in the accompanying Management Proxy Circular including the documents incorporated by reference therein. If you require assistance, you should consult your financial, legal or other professional advisors.

Your vote is important regardless of the number of Marathon Shares you own. If you are a registered holder of Marathon Shares, we encourage you to take the time now to complete, sign, date and return the enclosed form of proxy (printed on white paper) by not later than 9:30 am (Toronto time) on November 11, 2010, to ensure that your Marathon Shares will be voted at the meeting in accordance with your instructions, whether or not you are able to attend in person. If you hold your Marathon Shares through a broker or other intermediary, you should follow the instructions provided by your broker or other intermediary to vote your Marathon Shares.

Subject to obtaining court approval and satisfying all other conditions of closing, including obtaining the approval of Marathon’s shareholders, it is anticipated that the Transaction will be completed on or about November 23, 2010.

If you have any questions relating to the Transaction, please contact Kingsdale Shareholder Services Inc. at 1-866-581-1489 or 416-867-2272.

As a founder of Marathon and on behalf of the Board of Directors, I would like to thank all shareholders for their continued support as we prepare for this important event in the history of Marathon.

Yours very truly,

“Phillip C. Walford”

Phillip C. Walford

Director, President and Chief Executive Officer

Please contact Kingsdale Shareholder Services Inc. at 1-866-581-1489 for any questions or assistance completing your Proxy

MARATHON PGM CORPORATION

330 Bay Street

Suite 1505

Toronto, Ontario

M5H 2S8

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

NOTICE IS HEREBY GIVEN that a special meeting (the “Meeting”) of the holders of common shares (the “Marathon Shareholders”) of Marathon PGM Corporation (“Marathon”) will be held at the Toronto Board of Trade, First Canadian Place, Toronto, Ontario, Canada on Monday, November 15, 2010 at 9:30 am (Toronto time) for the following purposes:

| 1. | in accordance with the interim order of the Ontario Superior Court of Justice dated October 15, 2010 (the “Interim Order”), to consider and, if deemed advisable, to pass, with or without variation, a special resolution (the “Special Resolution”) approving an arrangement (the “Arrangement”) under section 192 of the Canada Business Corporations Act (the “CBCA”), the purpose of which is to effect, among other things, the acquisition of all of the common shares of Marathon (“Marathon Shares”) by a wholly owned subsidiary (“AcquireCo”) of Stillwater Mining Company (“Stillwater”) in exchange for Cdn. $1.775 in cash, 0.112 of a common share of Stillwater, plus 0.5 of a common share of Marathon Gold Corporation, a new public exploration and development company, for each Marathon Share held, all as more fully set forth in the accompanying management proxy circular (the “Circular”) of Marathon; and |

| 2. | to transact such further or other business as may properly come before the Meeting and any adjournments or postponements thereof. |

The Board of Directors has fixed October 12, 2010 as the record date for determining Marathon Shareholders who are entitled to receive notice of and to vote at the Meeting. Only registered Marathon Shareholders of record as of October 12, 2010 are entitled to receive notice of the Meeting (“Notice of Meeting”) and to attend and vote at the Meeting. This Notice of Meeting is accompanied by the Circular, a form of proxy (printed on white paper) and a letter of transmittal (printed on yellow paper).

Registered holders of Marathon Shares who are unable to attend the Meeting in person are requested to complete, date, sign and deposit the enclosed form of proxy with Marathon, c/o CIBC Mellon Trust Company, Proxy Department, PO Box 721, Agincourt, Ontario M1S 0A1, prior to 9:30 am (Toronto time) on November 11, 2010, or, if the Meeting is adjourned or postponed, not less than 48 hours (excluding Saturdays, Sundays and holidays) prior to the start of such adjourned or postponed meeting. Non-registered holders of Marathon Shares should complete and return the voting instruction form or other authorization provided to them in accordance with the instructions provided therein. Failure to do so may result in your Marathon Shares not being voted at the Meeting. If you have any questions about the information contained in the Circular or req uire assistance in completing your form of proxy please contact Marathon’s proxy solicitation agent, Kingsdale Shareholder Services Inc., toll-free within North America, at 1-866-581-1489. If you require assistance in completing your letter of transmittal please contact CIBC Mellon Trust Company, toll-free within North America, at 1-800-387-0825.

Registered holders of Marathon Shares who validly dissent from the Arrangement will be entitled to be paid the fair value of their Marathon Shares, subject to strict compliance with section 190 of the CBCA, as modified by the provisions of the Interim Order and the Plan of Arrangement. Failure to comply strictly with the requirements set forth in section 190 of the CBCA, as modified by the provisions of the Interim Order, the Final Order and the Plan of Arrangement may result in the loss or unavailability of any right of dissent.

The Circular provides additional information relating to the matters to be dealt with at the Meeting and is deemed to form part of this Notice of Meeting. Any adjourned or postponed meeting resulting from an adjournment or postponement of the Meeting will be held at a time and place to be specified either by Marathon before the Meeting or by the Chair at the Meeting.

DATED at Toronto, Ontario, this 15th day of October, 2010.

BY ORDER OF THE BOARD OF DIRECTORS

“Phillip C. Walford”

Phillip C. Walford

Director, President and Chief Executive Officer

Please contact Kingsdale Shareholder Services Inc. at 1-866-581-1489 for any questions or assistance completing your Proxy

| | |

| | Page |

| 1 |

| 3 |

| 5 |

| 5 |

| 5 |

| 6 |

| | |

| 11 |

| 11 |

| 11 |

| 11 |

| 11 |

| 11 |

| 12 |

| 12 |

| 13 |

| 13 |

| | |

| 14 |

| | |

| 15 |

| 16 |

| 17 |

| 17 |

| 18 |

| 21 |

| 22 |

| 22 |

| 24 |

| 24 |

| 24 |

| 25 |

| 27 |

| 27 |

| | |

| 27 |

| | |

| 31 |

| 32 |

| 32 |

| 33 |

| 34 |

| 35 |

| | |

| 36 |

| 42 |

| 52 |

| 55 |

| 55 |

| 57 |

| 66 |

| 67 |

| 67 |

- i -

Please contact Kingsdale Shareholder Services Inc. at 1-866-581-1489 for any questions or assistance completing your Proxy

| 67 |

| 68 |

| 68 |

| 68 |

| 69 |

| 75 |

| 76 |

| 77 |

| A-1 |

| B-1 |

| C-1 |

| D-1 |

| E-1 |

| F-1 |

| G-1 |

| H-1 |

| I-1 |

| J-1 |

| K-1 |

- ii -

Please contact Kingsdale Shareholder Services Inc. at 1-866-581-1489 for any questions or assistance completing your Proxy

THE SECURITIES ISSUABLE IN CONNECTION WITH THE TRANSACTION HAVE NOT BEEN APPROVED OR DISAPPROVED BY THE UNITED STATES SECURITIES AND EXCHANGE COMMISSION OR THE SECURITIES REGULATORY AUTHORITIES IN ANY STATE, NOR HAS THE UNITED STATES SECURITIES AND EXCHANGE COMMISSION OR THE SECURITIES REGULATORY AUTHORITIES IN ANY STATE PASSED ON THE ADEQUACY OR ACCURACY OF THIS MANAGEMENT PROXY CIRCULAR. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENCE.

The Stillwater and Marathon Gold securities to be issued under the Transaction have not been registered under the U.S. Securities Act or applicable state securities laws and are being issued in reliance on the exemption from registration set forth in Section 3(a)(10) thereof on the basis of the approval of the Court as described under “The Transaction – United States Securities Laws Considerations” in this Circular and in reliance on exemptions from registration under applicable state securities laws. The solicitation of proxies is not subject to the requirements of Section 14(a) of the U.S. Exchange Act. Accordingly, this Circular has been prepared in accordance with applicable Canadian disclosure requirements. Residents of the United States shou ld be aware that such requirements differ from those of the United States applicable to proxy statements under the U.S. Exchange Act.

Likewise, information concerning the properties and operations of Marathon (and after the Effective Date, Marathon Gold) has been prepared in accordance with Canadian standards under applicable Canadian securities laws, and may not be comparable to similar information for United States companies. The terms “Mineral Resource”, “Measured Mineral Resource”, “Indicated Mineral Resource” and “Inferred Mineral Resource” used in this Circular or in the documents incorporated by reference herein are Canadian mining terms as defined in accordance with NI 43-101 under guidelines set out in the Canadian Institute of Mining, Metallurgy and Petroleum (the “CIM”) Standards on Mineral Resou rces and Mineral Reserves adopted by the CIM Council on December 11, 2005.

While the terms “Mineral Resource”, “Measured Mineral Resource”, “Indicated Mineral Resource” and “Inferred Mineral Resource” are recognized and required by Canadian securities laws, they are not defined terms under standards of the SEC. As such, certain information contained in this Circular or in the documents incorporated by reference herein concerning descriptions of mineralization and resources under Canadian standards is not comparable to similar information made public by U.S. companies subject to the reporting and disclosure requirements of the SEC. An “Inferred Mineral Resource” has a great amount of uncertainty as to its existence and as to its economic and legal feasibility. It cannot be assumed that all or any part of an “Inferred Mineral Resource” will ever be upgraded to a higher category. Under Canadian securities laws, estimates of Inferred Mineral Resources may not form the basis of feasibility or other economic studies. Investors are cautioned not to assume that all or any part of Measured or Indicated Mineral Resources will ever be converted into Mineral Reserves. Investors are also cautioned not to assume that all or any part of an “Inferred Mineral Resource” exists, or is economically or legally mineable.

In addition, the definitions of “Proven Mineral Reserves” and “Probable Mineral Reserves” under CIM standards differ in certain respects from the SEC standards.

Marathon Shareholders should be aware that the exchange of their Marathon Shares for the Cash Consideration, Stillwater Shares and Marathon Gold Shares as described herein may have tax consequences in both the United States and Canada. Such consequences for Marathon Shareholders who are resident in, or citizens of, the United States may not be described fully herein. See “Certain Canadian Federal Income Tax Considerations” and “Certain United States Federal Income Tax Considerations” in this Circular. Accordingly, Marathon Shareholders who are resident in, or citizens of, the United States are advised to review the summary under “Certain United States Federal Income Tax Considerations” and to consult their own tax advisors to determine the particular United States tax consequences to them of the Arra ngement in light of their particular situation, as well as any tax consequences that may arise under the laws of any other relevant foreign, state, local, or other taxing jurisdiction.

Please contact Kingsdale Shareholder Services Inc. at 1-866-581-1489 for any questions or assistance completing your Proxy

The enforcement by Marathon Shareholders of civil liabilities under the United States federal securities laws may be affected adversely by the fact that Marathon and Marathon Gold are each incorporated or organized under the laws of Canada, that some or all of their officers and directors and the experts named herein may be residents of Canada, and that all or a substantial portion of the assets of Marathon and Marathon Gold and those persons are located outside the United States. As a result, it may be difficult or impossible for U.S. securityholders to effect service of process within the United States upon Marathon or Marathon Gold, their respective officers or directors or the experts named herein, or to realize against them upon judgments of courts of the United States predicated upon civil liabilities under the federal securities laws of the United States or “blue sky” laws of any state within the United States. In addition, U.S. securityholders should not assume that the courts of Canada: (a) would enforce judgments of United States courts obtained in actions against such persons predicated upon civil liabilities under the federal securities laws of the United States or “blue sky” laws of any state within the United States; or (b) would enforce, in original actions, liabilities against such persons predicated upon civil liabilities under the federal securities laws of the United States or “blue sky” laws of any state within the United States.

Marathon’s financial statements incorporated by reference herein have been prepared in accordance with Canadian GAAP, and are subject to auditing and auditor independence standards in Canada, and thus may not be comparable to financial statements of United States companies.

The U.S. Securities Act imposes restrictions on the resale of securities received pursuant to the Arrangement by persons who will be “affiliates” of Stillwater or Marathon Gold, as applicable, after the Effective Time or who have been affiliates of Stillwater or Marathon Gold, as applicable, within 90 days before the Effective Time. See “The Transaction – United States Securities Laws Considerations” in this Circular.

- 2 -

Please contact Kingsdale Shareholder Services Inc. at 1-866-581-1489 for any questions or assistance completing your Proxy

Certain statements, other than statements of historical fact, contained or incorporated by reference in this Circular, including any information as to the future financial or operating performance of Marathon, Stillwater and Marathon Gold, constitute “forward-looking statements” within the meaning of certain securities laws, including the “safe harbour” provisions of the Securities Act (Ontario) and the United States Private Securities Litigation Reform Act of 1995 and are based on expectations, estimates and projections as of the date of this Circular.

Forward-looking statements include, without limitation, statements with respect to the future price of platinum, palladium, copper and other metals, the estimation of mineral reserves and resources, the realization of mineral reserve and resource estimates, the timing and amount of estimated future production, costs of production, expected capital expenditures, costs and timing of the development of new deposits, success of exploration activities, permitting time lines, currency fluctuations, requirements for additional capital, government regulation of mining operations, environmental risks, unanticipated reclamation expenses, title disputes or claims, aboriginal disputes or claims, limitations on insurance coverage and matters related to the completion of the Transaction.

The words “plans,” “expects” or “does not expect,” “is expected,” “budget,” “scheduled,” “estimates,” “forecasts,” “intends,” “anticipates” or “does not anticipate,” or “believes,” or variations of such words and phrases or statements that certain actions, events or results “may,” “could,” “would,” “might,” or “will be taken,” “occur” or “be achieved” and similar expressions identify forward-looking statements. Forward-looking statements are necessarily based upon a number of estimates and assumptions that, while considered reasonable by Marathon and Stillwater as of the date of this Circular, are inherently sub ject to significant business, economic and competitive uncertainties and contingencies.

Known and unknown factors could cause actual results to differ materially from those projected in the forward-looking statements. Such factors include, but are not limited to: actual results of exploration activities; actual results of reclamation activities; estimation or realization of mineral reserves and resources; timing and amount of estimated future production; costs of production; capital expenditures; costs and timing of the development of new deposits; requirements for additional capital; future prices of metal; possible variations in ore grade or recovery rates; failure of plant, equipment or processes to operate as anticipated; accidents, labour disputes and other risks of the mining industry; delays in obtaining governmental approvals, permits or financing or in the completion of development or construction activities; hed ging practices; title disputes; claims limitations on insurance coverage; the timing and possible outcome of pending litigation and the possibility of new litigation; risks associated with international operations; risks related to joint venture operations or other material customer or supply agreements; risks related to the integration of acquisitions; fluctuations in the currency markets; fluctuations in the spot and forward price of platinum, palladium, copper or certain other commodities; changes in national and local government legislation, taxation, controls, regulations and political or economic developments in Canada, the United States or other countries in which Marathon, Stillwater or Marathon Gold carries on or may carry on business in the future; operating or technical difficulties in connection with mining or development activities; the speculative nature of mineral exploration and development, including the risks of obtaining necessary licences and permits; diminishing quantities or grades of r eserves; and shortages of required supplies and materials. In addition, there are risks and hazards associated with the business of precious metal exploration, development and mining, including environmental hazards, industrial accidents, unusual or unexpected geologic formations, pressures, cave-ins, flooding (and the risk of inadequate insurance, or inability to obtain insurance, to cover these risks) as well as those factors discussed under the heading “Narrative Description of the Business – Risk Factors” in Marathon’s Annual Information Form for the year ended December 31, 2009 and in this Circular under the heading “Risk Factors” and at Appendix “B” – Information Concerning Stillwater and Appendix “C” – Information Concerning Marathon Gold. There are also certain risks related to the consummation of the Transaction and the business and operations of Marathon including, but not limited to, the risk that the businesses of Marathon and Stillwater may not be integrated successfully or that such integration may be more difficult, time-consuming or costly than expected; the risk that the expected combination benefits may not be fully realized or not realized within the expected time frame; risks associated with realizing the increased earnings and enhanced growth opportunities currently anticipated for Stillwater in the future; risks associated with meeting key production and cost estimates by Stillwater; construction and technological risks related to Stillwater; capital requirements and operating risks associated with the expanded operations of Stillwater; the market price of the shares of Stillwater and Marathon Gold; and other risks discussed in this Circular.

- 3 -

Please contact Kingsdale Shareholder Services Inc. at 1-866-581-1489 for any questions or assistance completing your Proxy

These risk factors are not intended to represent a complete list of the risk factors that could affect Marathon, Stillwater or Marathon Gold. Although Marathon has attempted to identify in this Circular important factors that could cause actual events or results to differ materially from those described in forward-looking statements in this Circular and the documents incorporated by reference herein, there may be other factors that cause events or results not to be as anticipated, estimated or intended. There can be no assurance that the forward-looking statements in this Circular and the documents incorporated by reference herein will prove to be accurate, as actual results and future events could differ materially from those anticipated in such forward-looking statements. Accordingly, readers should not place undue reliance on forwar d-looking statements in this Circular, nor in the documents incorporated by reference herein. All of the forward-looking statements made in this Circular are qualified by these cautionary statements.

Certain of the forward-looking statements and other information contained in this Circular or in the documents incorporated by reference herein concerning the mining industry and Marathon and Stillwater’s general expectations concerning the mining industry are based on estimates prepared by Marathon or Stillwater using data from publicly available industry sources as well as from market research and industry analysis and on assumptions based on data and knowledge of this industry which Marathon or Stillwater believe to be reasonable. However, although generally indicative of relative market positions, market shares and performance characteristics, these data are inherently imprecise. While neither Marathon nor Stillwater is aware of any misstatement regarding any industry data presented herein, the mining indus try involves risks and uncertainties that are subject to change based on various factors.

Each of Marathon, Marathon Gold and Stillwater disclaims any intention or obligation to update or revise any of the forward-looking statements in this Circular or incorporated by reference herein, whether as a result of new information, future events or otherwise, or to explain any material difference between subsequent actual events and such forward-looking statements, except to the extent required by applicable law.

See “Information Concerning Stillwater” and “Information Concerning Marathon Gold”, attached as Appendix “B” and Appendix “C” respectively to this Circular.

- 4 -

Please contact Kingsdale Shareholder Services Inc. at 1-866-581-1489 for any questions or assistance completing your Proxy

Unless otherwise indicated, all references to “U.S.$” or “U.S. dollars” in this Circular refer to United States dollars and all references to “Cdn.$” or “Canadian dollars” in this Circular refer to Canadian dollars. Marathon’s financial statements incorporated by reference herein are reported in Canadian dollars and are prepared in accordance with Canadian GAAP. Stillwater’s financial statements, including those attached hereto at Appendix “E” – Stillwater Financial Statements, are reported in U.S. dollars and prepared in accordance with U.S. GAAP.

On September 3, 2010, the last trading day before the announcement of the Transaction, the exchange rate for one U.S. dollar expressed in Canadian dollars, based on the noon buying rates provided by the Bank of Canada, was Cdn.$1.0411.

On October 14, 2010, the exchange rate for one U.S. dollar expressed in Canadian dollars, based upon the noon buying rates provided by the Bank of Canada, was Cdn.$1.0036.

The information contained in this Circular is given as at October 14, 2010, except where otherwise noted and except that information in documents incorporated by reference is given as of the dates noted therein.

No person has been authorized to give any information or to make any representation in connection with the Transaction and other matters described herein other than those contained in this Circular and, if given or made, any such information or representation should be considered not to have been authorized by Marathon.

This Circular does not constitute the solicitation of an offer to purchase any securities or the solicitation of a proxy by any person in any jurisdiction in which such solicitation is not authorized or in which the person making such solicitation is not qualified to do so or to any person to whom it is unlawful to make such solicitation.

Information contained in this Circular should not be construed as legal, tax or financial advice and Marathon Shareholders are urged to consult their own professional advisors in connection therewith.

Certain information pertaining to Stillwater, including forward-looking statements contained herein, has been provided by Stillwater or is based on publicly available documents and records on file with the SEC and other public sources. Although Marathon does not have any knowledge that would indicate that any such information is untrue or incomplete, Marathon assumes no responsibility for the accuracy or completeness of such information, nor for the failure by such other persons to disclose events which may have occurred or which may affect the completeness or accuracy of such information but which is unknown to Marathon.

- 5 -

Please contact Kingsdale Shareholder Services Inc. at 1-866-581-1489 for any questions or assistance completing your Proxy

The following information is a summary of the contents of this Circular. This summary is provided for convenience only and the information contained in this summary should be read in conjunction with, and is qualified in its entirety by, the more detailed information and financial data and statements contained elsewhere in this Circular or incorporated by reference herein. Capitalized terms in this summary have the meaning set out in the Glossary of Terms or as set out herein. The full text of the Arrangement Agreement is available on SEDAR at www.sedar.com under Marathon’s profile.

| | | |

| Date, Time and Place of Meeting | | The Meeting will be held at the Toronto Board of Trade, 100 King Street West, First Canadian Place, Toronto, Ontario, Canada on Monday, November 15, 2010 at 9:30 am (Toronto time). |

| | | |

| The Record Date | | The Record Date for determining the Marathon Shareholders entitled to receive notice of and to vote at the Meeting is as of the close of business on October 12, 2010. |

| | | |

| Purpose of the Meeting | | At the Meeting, Marathon Shareholders will be asked to consider and, if deemed advisable, to pass, with or without variation, the Special Resolution. The approval of the Special Resolution will require the affirmative vote of two-thirds of the votes cast by Marathon Shareholders present in person or by proxy at the Meeting. |

| | | |

| The Transaction | | The purpose of the Arrangement is to effect the acquisition by AcquireCo of all of the outstanding Marathon Shares. If the Special Resolution is approved by the affirmative vote of two-thirds of the votes cast by Marathon Shareholders present in person or by proxy at the Meeting and all other conditions to the closing of the Arrangement are satisfied or waived, the Arrangement will be implemented by way of a court-approved plan of arrangement under the CBCA. As a result of the Arrangement, each Marathon Shareholder (other than Stillwater and its affiliates and associates and Dissenting Shareholders) will receive the Offered Consideration for each Marathon Share held. Marathon Options will be exchanged for Stillwater Replacement Options. Marathon Warrants will remain outstanding in accordance with their terms. On completion of the Transaction, based on the current outstanding Marathon Shares, Marathon Shareholders will hold approximately 3.8% of the total outstanding Stillwater Shares and Marathon will become a wholly owned subsidiary of AcquireCo. Marathon Shareholders will own 100% of Marathon Gold upon completion of the Transaction. |

| | | |

| | | See “The Transaction – The Arrangement” in this Circular. |

| | | |

| Recommendation of the Special Committee | | The Marathon Board established the Special Committee to, among other things, review and consider the Transaction. On behalf of Marathon, the Special Committee retained Haywood Securities Inc. to act as its financial advisor. Haywood Securities Inc. has given an opinion to the effect that as of the date thereof, and based upon and subject to the scope of the review, analysis undertaken and various assumptions, limitations and qualifications set forth in its opinion, the Offered Consideration to be received by the Marathon Shareholders (other than Stillwater and its affiliates and associates) pursuant to the Arrangement is fair, from a financial point of view. The Special Committee, having taken into account the fairness opinion of Haywood Securities Inc. and such other matters as it considered relevant, has unanimously determined that the offered consideration under the Transaction is fair to Marathon Shareholders and that the Transaction is in the best interests of Marathon. Accordingly, the Special Committee unanimously recommended that the Marathon Board approve the Transaction and recommend that the Marathon Shareholders vote FOR the Special Resolution. |

- 6 -

Please contact Kingsdale Shareholder Services Inc. at 1-866-581-1489 for any questions or assistance completing your Proxy

| Recommendation of the Marathon Board | | After careful consideration, the Marathon Board has unanimously determined that the Offered Consideration for each Marathon Share held is fair to Marathon Shareholders and that the Transaction is in the best interests of Marathon. Accordingly, the Marathon Board unanimously recommends that Marathon Shareholders vote FOR the Special Resolution. |

| | | | |

| Reasons for the Transaction | | In the course of their evaluation of the Transaction, the Special Committee and the Marathon Board consulted with senior management, legal counsel, and Haywood Securities Inc., performed extensive financial, technical and legal due diligence with the help of its advisors, and considered a number of factors including, among others, the following: |

| | | | |

| | | ● | Significant Premium to Marathon Shareholders. The total consideration payable by Stillwater represents an 89% premium to Marathon Shareholders over the closing price of Marathon Shares on September 3, 2010, the last trading day prior to the public announcement of the Agreement, without taking into account the value of the Marathon Gold shares. |

| | | | |

| | | ● | Continued Participation by Marathon Shareholders in the Marathon PGM- Copper Project through Stillwater and continued participation in Marathon’s exploration projects through Marathon Gold. Marathon Shareholders, through their ownership of Stillwater Shares, will continue to participate in any value increases associated with the development and operation of the Marathon PGM Copper Project. In addition, through their equity holding in Marathon Gold resulting from the Arrangement, Marathon Shareholders will continue to participate in the exploration upside associated with the Marathon Gold Properties, including the Valentine Lake Project. |

| | | | |

| | | ● | State of Debt and Equity Markets. The Special Committee and the Marathon Board considered the state of debt and equity markets, the difficulty of being able to raise the debt and equity needed to continue the development of the Marathon PGM- Copper Project, and the likelihood and effect of having to scale back and/or delay the development of the Marathon PGM Copper Project absent the Transaction. |

| | | | |

| | | ● | Fairness Opinion. The Special Committee and the Marathon Board considered the Fairness Opinion to the effect that, as of the date thereof, and subject to the analyses, assumptions, qualifications and limitations set forth in the Fairness Opinion, the consideration to be received pursuant to the Arrangement by Marathon Shareholders, other than Stillwater and its affiliates and associates, is fair from a financial point of view. |

| | | | |

| | | ● | The Terms of the Arrangement Agreement. Under the Arrangement Agreement, the Marathon Board remains able to respond, in accordance with its fiduciary duties, to unsolicited proposals that are more favourable to Marathon Shareholders than the Arrangement. |

| | | | |

| | | ● | Private Placement Financing. Stillwater subscribed for 974,026 Marathon Shares at a subscription price of Cdn.$3.08 per share for aggregate gross proceeds to Marathon of Cdn.$3 million which was not conditional upon completion of the Arrangement. |

| | | | |

| | | ● | Support Agreements. The directors and officers of Marathon, who in total held approximately 3.5% of the outstanding Marathon Shares (on a non-diluted basis) as at September 7, 2010, have entered into support agreements with Stillwater pursuant to which they will vote in favour of the Arrangement. |

| | | | |

| | | ● | Dissent Rights. Registered Marathon Shareholders who oppose the Arrangement may, upon compliance with certain conditions, exercise their Dissent Rights and receive the fair value of their Marathon Shares in accordance with the Plan of Arrangement. |

- 7 -

Please contact Kingsdale Shareholder Services Inc. at 1-866-581-1489 for any questions or assistance completing your Proxy

| | | ● | Approval Thresholds. The Marathon Board considered the fact that the Special Resolution must be approved by two-thirds of the votes cast in person or by proxy at the Meeting to be protective of the rights of Marathon Shareholders. The Arrangement must also be approved by the Court, which will consider the fairness of the Arrangement to all Marathon securityholders. |

| | | | |

| | | See “The Transaction – Reasons for the Transaction”. |

| | | |

| Support Agreements | | The directors and executive officers have entered into Support Agreements with Stillwater pursuant to which they have agreed, on and subject to the terms thereof, among other things, to vote in favour of the Special Resolution. As of October 14, 2010, these directors and officers held 1,861,200 Marathon Shares, representing approximately 5.4% of the issued Marathon Shares on such date. |

| | | |

| Fairness Opinion of Haywood Securities Inc. | | As at the date of the Fairness Opinion and subject to the scope of the review, analysis undertaken and various assumptions, limitations and qualifications set forth in the Fairness Opinion, Haywood Securities Inc. has delivered its opinion that the consideration to be received pursuant to the Arrangement by Marathon Shareholders, other than Stillwater and its affiliates and associates, is fair from a financial point of view. |

| | | |

| | | See “The Transaction – Fairness Opinion of Haywood Securities Inc.” in this Circular and the full text of the Fairness Opinion describing the assumptions made, procedures followed, information reviewed, matters considered and limitations on the review undertaken by Haywood Securities Inc. which is attached as Appendix “G” to this Circular. Marathon Shareholders are encouraged to read the Fairness Opinion carefully in its entirety. |

| | | |

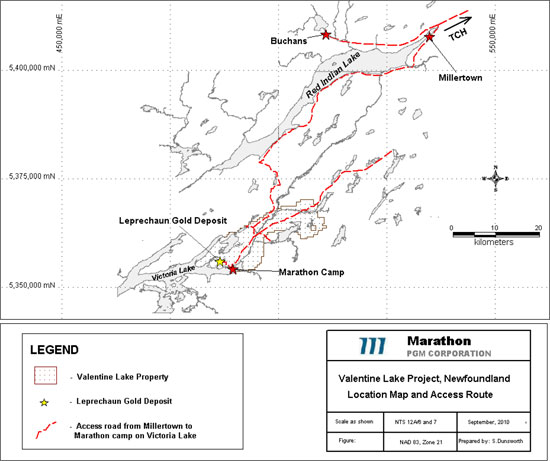

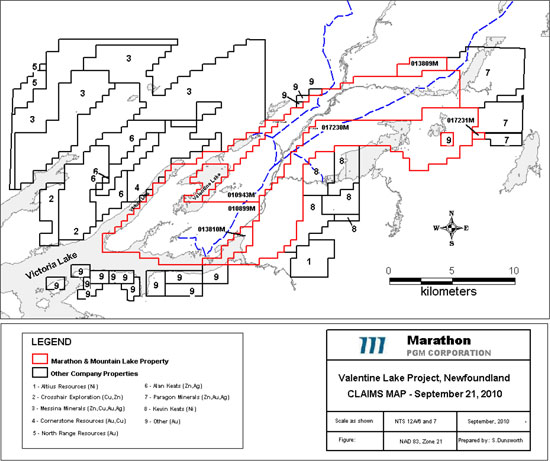

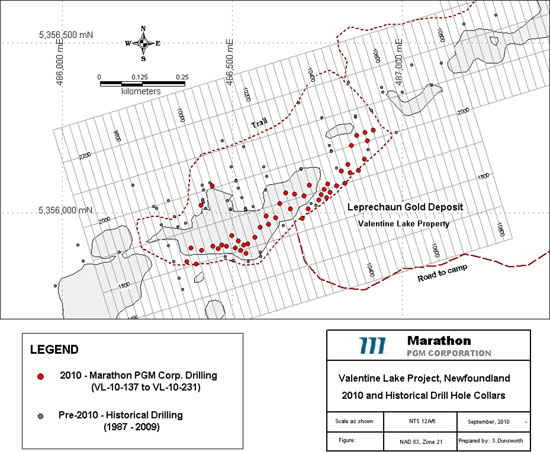

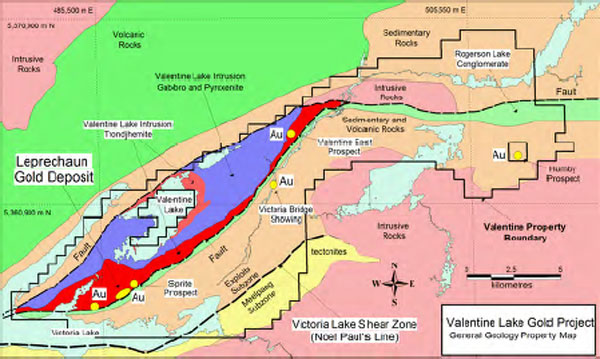

| Marathon Gold | | Marathon Gold’s principal business, subsequent to the completion of the Transaction, will be the investigation, acquisition, exploration, development and ultimately operation of resource properties, primarily precious metals. Marathon Gold’s principal exploration activities after the Transaction will be focused on the Valentine Lake Project located in the Province of Newfoundland and Labrador in eastern Canada. |

| | | |

| | | See “Information Concerning Marathon Gold” attached as Appendix “C” to this Circular. |

| | | |

| Conditions to Completion of the Transaction | | The implementation of the Transaction is subject to a number of conditions being satisfied or waived by one or more of Marathon, Stillwater or Marathon Gold at or prior to the Effective Time, including the following: |

| | | |

| | | ● | the approval of the Special Resolution by the affirmative vote of two-thirds of the votes cast by Marathon Shareholders present in person or by proxy at the Meeting; |

| | | | |

| | | ● | receipt of the Final Order; |

| | | | |

| | | ● | compliance in all material respects by Marathon, Stillwater and Marathon Gold with all covenants required to be performed under the Arrangement Agreement; |

| | | | |

| | | ● | the representations and warranties of Marathon, Stillwater and Marathon Gold contained in the Arrangement Agreement being true and correct as of the Effective Time; |

| | | | |

| | | ● | Dissent Rights not having been exercised in respect of more than 5% of the Marathon Shares; |

| | | | |

| | | ● | the Pre-Acquisition Reorganization transactions having been completed; |

- 8 -

Please contact Kingsdale Shareholder Services Inc. at 1-866-581-1489 for any questions or assistance completing your Proxy

| | | ● | the TSX having conditionally approved the listing of Marathon Gold effective upon completion of the Transaction; and |

| | | | |

| | | ● | the NYSE having approved, subject to official notice of issuance, the listing thereon of the Stillwater Shares to be issued pursuant to the Arrangement. |

| | | | |

| | | See “The Arrangement Agreement – Conditions Precedent to the Arrangement” in this Circular. |

| | | | |

| No Solicitation/Superior Proposal | | In the Arrangement Agreement, Marathon and Marathon Gold have agreed that they will not, directly or indirectly, solicit or participate in any discussions or negotiations regarding an Acquisition Proposal or potential Acquisition Proposal except under certain conditions. Stillwater is entitled to a five Business Day period within which to exercise a right to offer to amend the terms of the Arrangement Agreement. Stillwater will be entitled to the Termination Fee if Marathon terminates the Arrangement Agreement in order to enter into a definitive written agreement with respect to a Superior Proposal. |

| | | |

| | | See “The Arrangement Agreement – No Solicitation”, “The Arrangement Agreement – Superior Proposals” and “The Arrangement Agreement – Termination Fee” in this Circular. |

| | | | |

| Termination of Arrangement Agreement | | Marathon, Marathon Gold and Stillwater may agree in writing to terminate the Arrangement Agreement and abandon the Transaction at any time prior to the Effective Time. In addition, Marathon, Marathon Gold or Stillwater may terminate the Arrangement Agreement and abandon the Transaction at any time prior to the Effective Date if certain specific events occur. |

| | | |

| | | See “The Arrangement Agreement – Termination of the Arrangement Agreement” in this Circular. |

| | | |

| Termination Fee | | The Arrangement Agreement provides that Marathon will pay to Stillwater a Termination Fee of Cdn.$3 million if the Arrangement Agreement is terminated in certain circumstances. |

| | | |

| | | See “The Arrangement Agreement – Termination Fee” in this Circular. |

| | | |

| Stillwater Subscription for Marathon Shares; Retained Interest in Marathon Gold | | In accordance with the Arrangement Agreement, on September 15, 2010 Stillwater subscribed for 974,026 Marathon Shares at a subscription price of Cdn.$3.08 per share for aggregate gross proceeds to Marathon of Cdn.$3 million. These funds provide additional liquidity to Marathon to fund its ongoing operations and will be used for general working capital purposes prior to closing of the Transaction. |

| | | |

| | | Upon completion of the Transaction, Stillwater will hold an equity interest in Marathon Gold as a result of the initial distribution of Marathon Gold Shares to Marathon Shareholders. In addition, Stillwater has been granted an option, exercisable concurrent with an initial equity offering by Marathon Gold undertaken following the Effective Date, to purchase from Marathon Gold (at the offering price per Marathon Gold Share under such equity offering) that number of Marathon Gold Shares as will provide Stillwater with a 15% ownership interest in Marathon Gold following the completion of such offering. |

| | | | |

| Exchange of Marathon Share Certificates and Treatment of Fractional Consideration | | A letter of transmittal is enclosed with this Circular for use by Marathon Shareholders for the purpose of the surrender of Marathon share certificates. The details for the surrender of share certificates to the Depositary and the addresses of the Depositary are set out in the letter of transmittal. Provided that a Registered Shareholder has delivered and surrendered to the Depositary all share certificates, together with a letter of transmittal properly completed and executed in accordance with the instructions of such letter of transmittal, and any additional documents as the Depositary may reasonably require, the Marathon Shareholder will be entitled to receive, and Stillwater, AcquireCo and Marathon Gold will cause the Depositary to deliver, to the Maratho n Shareholder a cheque representing the Cash Consideration payable, and certificates representing the number of Stillwater Shares and Marathon Gold Shares, respectively, issuable or deliverable, to such holder pursuant to the Arrangement in respect of the exchange of Marathon Shares. |

- 9 -

Please contact Kingsdale Shareholder Services Inc. at 1-866-581-1489 for any questions or assistance completing your Proxy

| | | No fractional Stillwater Shares or Marathon Gold Shares will be issued to Marathon Shareholders. If a Marathon Shareholder is entitled to a fractional share of either Stillwater or Marathon Gold, the number of Stillwater Shares or Marathon Gold Shares to be issued to that Marathon Shareholder will be rounded down to the nearest whole share and no compensation will be paid in respect of such fractional share. If the aggregate Cash Consideration payable to a Marathon Shareholder results in a fraction of a cent, it will be rounded up to the next whole cent. |

| | | |

| | | See “The Transaction – The Arrangement” in this Circular. |

| | | |

| Rights of Dissent | | Registered Shareholders are entitled to dissent from the Special Resolution in the manner provided in section 190 of the CBCA, as modified by the Interim Order and the Plan of Arrangement. A Registered Shareholder who wishes to dissent must ensure that a Dissent Notice is received by Marathon, Attention: President, at its registered office located at 330 Bay Street, Suite 1505, Toronto, Ontario, M5H 2S8 at or prior to than 5:00 p.m. (Toronto Time) on the business day prior to the date of the Meeting (or any adjournment or postponement of the Meeting). |

| | | |

| | | See “The Transaction – Dissenting Holders’ Rights” in this Circular. |

| | | |

| Income Tax Considerations | | Marathon Shareholders should carefully review the tax considerations described in this Circular and are urged to consult their own tax advisors in regard to their particular circumstances. See “Certain Canadian Federal Income Tax Considerations” and “Certain United States Federal Income Tax Considerations” in this Circular, for discussions of certain Canadian federal income tax considerations and certain United States income tax considerations. |

| | | |

| Risk Factors | | There are risks associated with the completion of the Transaction. |

| | | |

| | | Some of these risks include: (i) the Arrangement Agreement may be terminated by Marathon or Stillwater in certain circumstances, in which case the market price for Marathon Shares may be adversely affected; (ii) as Marathon Shareholders will receive Stillwater Shares based on a fixed exchange ratio, Stillwater Shares received by Marathon Shareholders under the Transaction may have a lower market value than expected; (iii) the closing of the Transaction is conditional on, among other things, the receipt of consents and approvals from regulatory authorities that could delay or impede completion of the Transaction; and (iv) the issue of Stillwater Shares under the Transaction and their subsequent sale may cause the market price of Stillwater Shares to decline. |

| | | |

| | | See “Risk Factors” in this Circular. |

- 10 -

Please contact Kingsdale Shareholder Services Inc. at 1-866-581-1489 for any questions or assistance completing your Proxy

MARATHON PGM CORPORATION

330 Bay Street

Suite 1505

Toronto, Ontario

M5H 2S8

INFORMATION CONCERNING THE MEETING

At the Meeting, Marathon Shareholders will be asked to consider and, if deemed advisable, to pass, with or without variation, the Special Resolution. The approval of the Special Resolution will require the affirmative vote of two-thirds of the votes cast by Marathon Shareholders present in person or by proxy at the Meeting.

The Meeting will be held at the Toronto Board of Trade, First Canadian Place, Toronto, Ontario, Canada on November 15, 2010 at 9:30 am (Toronto time).

The record date for determining persons entitled to receive notice of and vote at the Meeting is October 12, 2010. Shareholders of record as at the close of business on October 12, 2010 will be entitled to attend and vote at the Meeting, or any adjournment or postponement thereof, in the manner and subject to the procedures described in this Circular.

This Circular is being furnished in connection with the solicitation of proxies by or on behalf of management of Marathon for use at the Meeting (or any adjournment or postponement thereof) to be held at the time and place and for the purposes set out in the accompanying Notice of Meeting. While it is expected that the solicitation will be primarily by mail, proxies may be solicited personally, by telephone or other electronic means by officers and directors of Marathon (for no additional compensation). All costs incurred in connection with the preparation and mailing of this Circular and the accompanying form of proxy and letter of transmittal, as well as the costs of solicitation of proxies, will be borne by Marathon. In accordance with the Arrangement Agreement, Marathon has retained Kingsdale Shareholder Services Inc. (“Kingsdale”) to solicit proxies from Marathon Shareholders. Kingsdale will receive a proxy solicitation program management fee of approximately Cdn.$40,000 and reimbursement of disbursements related to the solicitation.

The persons named in the accompanying form of proxy are Phillip C. Walford and James Kirke, each of whom is a member of management of Marathon. Each Marathon Shareholder has the right to appoint a person or company, other than the persons named in the enclosed form of proxy, who need not be a Marathon Shareholder, to attend and act for and on behalf of the Marathon Shareholder at the Meeting. This right may be exercised by inserting such person’s name in the blank space provided in the accompanying form of proxy or by completing another proper form of proxy. A proxy that is in writing, must be dated the date on which it is executed, must be executed by the Marathon Shareholder or his or her attorney authorized in writing or, if the Marathon Shareholder is a corporation, by a duly authorized officer or attorney of that corporation and, if the proxy is to apply to less than all the Marathon Shares registered in the name of the Marathon Shareholder, must specify the number of Marathon Shares to which it is to apply.

The Marathon Shares represented by a properly executed proxy will be voted for or against all matters to be voted on at the Meeting in accordance with the instructions of the Registered Shareholder on any vote that may be called for.

- 11 -

Please contact Kingsdale Shareholder Services Inc. at 1-866-581-1489 for any questions or assistance completing your Proxy

In the absence of any instructions to the contrary, the Marathon Shares represented by proxies received by management will be voted FOR the approval of the Special Resolution.

The enclosed form of proxy confers discretionary authority upon the persons named therein with respect to amendments or variations to the matters identified in the Notice of Meeting and with respect to other matters which may properly come before the Meeting. At the date of this Circular, management of Marathon knows of no such amendments, variations or other matters to come before the Meeting other than the matters referred to in the Notice of Meeting. If any other matters do properly come before the Meeting, it is intended that the person appointed as proxy shall vote on such other business in such manner as that person then considers to be proper.

Registered Shareholders may wish to vote by proxy whether or not they attend the Meeting in person. Registered Shareholders who choose to submit a proxy may do so by completing, dating and signing the enclosed proxy and returning it to the Transfer Agent by fax from within North America at 1-866-781-3111, or from outside North America at 1-416-368-2502, by hand to CIBC Mellon Trust Company at 320 Bay Street, Banking Hall Level, Toronto, Ontario, M6H 4A6, or by mail to CIBC Mellon Trust Company, Proxy Department, PO box 721, Agincourt, Ontario, M1S 0A1, in all cases ensuring that the proxy is received by 9:30 a.m. (Toronto time) on November 11, 2010 or at least 48 hours (excluding Saturdays, Sundays and holidays) before the time to which the Meeting is adjourned or postponed. Failure to complete or deposit a proxy properly may result i n its invalidation. The time limit for the deposit of proxies may be waived by the Marathon Board at its discretion.

Only Registered Shareholders or the persons they appoint as their proxies are permitted to vote at the Meeting. However, in many cases, Marathon Shares beneficially owned by a person (a “Non-Registered Holder”) are registered either (a) in the name of an Intermediary that the Non-Registered Holder deals with in respect of the shares (Intermediaries include, among others, banks, trust companies, securities dealers or brokers and trustees or administrators of self-administered registered retirement savings plans, registered retirement income funds, registered education savings plans and similar plans), or (b) in the name of a clearing agency (such as The Canadian Depository for Securities Limited) of which the Intermediary is a participant. In accordance with the requirements of National Instrument 54-101 – Communication with Beneficial Owners of Securities of a Reporting Issuer, Marathon will be distributing copies of the Notice of Meeting, this Circular, the form of proxy (or voting information form) and the letter of transmittal (collectively, the “Meeting Materials”) to the clearing agencies and Intermediaries for onward distribution to Non-Registered Holders.

Intermediaries are required to forward the Meeting Materials to Non-Registered Holders unless a Non-Registered Holder has waived the right to receive them. Very often, Intermediaries will use service companies to forward the Meeting Materials to Non-Registered Holders. Generally, Non-Registered Holders who have not waived the right to receive the Meeting Materials will either:

| | (a) | be given a form of proxy which has already been signed by the Intermediary (typically by a facsimile, stamped signature), which is restricted as to the number of shares beneficially owned by the Non-Registered Holder but which is otherwise not completed. Because the Intermediary has already signed the form of proxy, this form of proxy is not required to be signed by the Non-Registered Holder when submitting the proxy. In this case, the Non-Registered Holder who wishes to submit a proxy should otherwise properly complete the form of proxy and deliver it to the Transfer Agent as set out above; or |

| | (b) | more typically, be given a form which, when properly completed and signed by the Non-Registered Holder and returned to the Intermediary or its service company, will constitute voting instructions (often called a “voting information form”) which the Intermediary must follow. |

In either case, the purpose of this procedure is to permit Non-Registered Holders to direct the voting of the shares which they beneficially own. Should a Non-Registered Holder who receives either form of proxy wish to vote at the Meeting in person, the Non-Registered Holder should strike out the persons named in the form of proxy and insert the Non-Registered Holder’s name in the blank space provided. In either case, Non-Registered Holders should carefully follow the instructions of their Intermediary, including those regarding when and where the form of proxy or proxy authorization form is to be delivered.

- 12 -

Please contact Kingsdale Shareholder Services Inc. at 1-866-581-1489 for any questions or assistance completing your Proxy

A Registered Shareholder executing a proxy has the power to revoke it as to any matter on which a vote shall not already have been cast:

| | (a) | by depositing an instrument in writing executed by such Marathon Shareholder or by such Marathon Shareholder’s attorney authorized in writing, or, if the Marathon Shareholder is a corporation, by an officer or attorney thereof duly authorized indicating the capacity under which such officer or attorney is signing: |

| | (i) | at the registered office of Marathon located at 330 Bay Street, Suite 1505, Toronto, Ontario M5H 2S8, Attention: President, until 2:00 pm (Toronto time) on the last business day preceding the day of the Meeting, or any adjournments or postponements thereof, or |

| | (ii) | with the Chairman of the Meeting on the day of the Meeting, or any adjournment or postponement thereof; or |

| | (b) | in any other manner permitted by law. |

A Non-Registered Holder should contact his or her Intermediary and carefully follow the instructions provided by the Intermediary in order to revoke a voting information form (or a proxy).

As of the Record Date, 34,621,206 Marathon Shares were issued and outstanding. Each Marathon Shareholder is entitled to one vote per Marathon Share held on all matters to come before the Meeting, including the Special Resolution. Marathon Shares are the only securities of Marathon which have voting rights at the Meeting.

To the knowledge of the directors and senior officers of Marathon, no person or company beneficially owns, or controls, or directs, directly or indirectly, 10% or more of any class of voting securities of Marathon, except as described below.

On January 18, 2008 The Dromore Investment Company, Limited, 117902 Canada Inc., W. A. Investments Ltd., Smith Vincent & Co. Ltd., Forfuture Limited, Martha Vincent, G. Mark Curry and The Murphy Foundation Incorporation (collectively, the “Vincent/Curry Shareholders”) filed a press release and early warning report indicating that they were related holding companies, individuals and trusts that are all related to the Vincent and/or Curry families of Toronto who may be considered to act “jointly or in concert” for purposes of Canadian securities legislation, and that they then owned an aggregate of 4,329,380 Marathon Shares. Smith Vincent & Co. Ltd. has recently advised Marathon that the Vincent/Curry Shareholders now own an aggregate of 3,966,880 Marathon Shares rep resenting approximately 11.46% of the issued and outstanding Marathon Shares.

As of the Record Date, the directors and senior officers of Marathon, as a group, owned beneficially, directly or indirectly, or exercised control or direction over, 2,161,200 Marathon Shares, representing approximately 6.2% of the outstanding Marathon Shares, including the voting rights attributable to 300,000 Marathon Shares owned by Benton Resources Ltd.

A quorum will be present at the Meeting if there are at least two persons present, each of whom is either a registered Marathon Shareholder entitled to attend and vote at the Meeting or the proxyholder of a registered Marathon Shareholder appointed by means of a valid proxy.

- 13 -

Please contact Kingsdale Shareholder Services Inc. at 1-866-581-1489 for any questions or assistance completing your Proxy

If approved by the Court, the Transaction will be carried out pursuant to the Arrangement Agreement, the Plan of Arrangement and related documents. A summary of the principal terms of the Arrangement Agreement and the Plan of Arrangement is provided in this section. This summary does not purport to be complete and is qualified in its entirety by reference to the Arrangement Agreement which is available on SEDAR at www.sedar.com and the Plan of Arrangement, which is attached as Appendix “D” to this Circular. Capitalized terms have the meaning set out in the Glossary of Terms, or are otherwise defined herein.

Approval of Special Resolution

At the Meeting, Marathon Shareholders will be asked to approve the Special Resolution, in the form set out in Appendix “A” attached to this Circular. The approval of the Special Resolution will require the affirmative vote of two-thirds of the votes cast by Marathon Shareholders present in person or by proxy at the Meeting.

Background to the Transaction

Between April 2008 and August 2010, the Marathon Board explored a variety of financing, joint venture and other strategic alternatives aimed principally at securing funding for the further advancement of the Marathon PGM-Copper Project. During this time, financial advisors were periodically engaged by the Marathon Board to solicit interest from and liaise with third parties, assist in structuring and valuing potential transactions, and perform due diligence.

On April 16, 2008, a confidentiality agreement between Marathon and Stillwater was first entered into, however the parties did not pursue a transaction at that time. In May 2010, representatives of Stillwater and Marathon commenced discussions again concerning a potential business combination transaction. A confidentiality agreement was entered into as of May 6, 2010. Discussions ensued and the parties, with the assistance of their respective advisors, commenced negotiations regarding the proposed structure, value and other essential terms of a potential merger transaction and performed extensive financial, legal and technical due diligence.

On August 14, 2010, Stillwater provided Marathon with a preliminary draft letter of intent contemplating, among other things, (i) the spin-out by Marathon to Marathon Gold of Cdn.$6 million in cash, the Valentine Lake Project, and certain other mineral property interests, and (ii) the subsequent acquisition by Stillwater of all of the outstanding Marathon Shares by way of a plan of arrangement. The proposed consideration was not specified by Stillwater at this point.

On August 16, 2010, a revised draft letter of intent was presented to Marathon by Stillwater and included some additional terms and conditions, but did not include the proposed consideration.

A conference call was held on August 17, 2010 among representatives of Stillwater and Marathon and their respective legal counsel during which the proposed deal terms were discussed in detail.

The Marathon Board met on August 19, 2010 to discuss the Stillwater proposal and received a legal memorandum and presentation from Fogler, Rubinoff LLP with respect to directors’ duties in the context of a potential change of control transaction. The Marathon Board determined it was appropriate to appoint a Special Committee comprised of the three independent directors. The Special Committee recommended that Marathon continue discussing a potential business combination with Stillwater based on the proposed terms, noting that the offered consideration and corresponding exchange ratios were key unsettled points. The Special Committee was authorized to retain a financial advisor to assist it in determining the fairness of the transaction, from a financial point of view, to the Marathon Shareholders.

On August 20, 2010, Stillwater provided Marathon with a preliminary draft of a definitive arrangement agreement which specified the proposed structure and terms and conditions as had previously been discussed.

On August 21, 2010, Marathon decided to suspend negotiations in light of their inability to reach consensus on the offered consideration and corresponding exchange ratios. On August 24, 2010, the parties agreed to resume discussions.

A conference call was held on August 25, 2010 among representatives of Stillwater and Marathon and their respective legal counsel during which the proposed deal structure was discussed.

- 14 -

Please contact Kingsdale Shareholder Services Inc. at 1-866-581-1489 for any questions or assistance completing your Proxy

On August 31, 2010 a revised draft definitive agreement was circulated reflecting mutually acceptable consideration.

A conference call was held on September 2, 2010 among representatives of Stillwater and Marathon and their respective legal counsel during which the remaining outstanding issues were discussed. Later that day, a revised draft definitive arrangement agreement, in substantially final form, was circulated.

On September 1, 2010, the Special Committee, on behalf of the Marathon Board, retained Haywood Securities Inc. to deliver a fairness opinion and provide financial advisory services to Marathon with respect to the Transaction. On September 3, 2010, Haywood Securities Inc. provided its written opinion to the effect that the consideration to be received pursuant to the Arrangement by Marathon Shareholders, other than Stillwater and its affiliates and associates, was fair from a financial point of view.

On September 5, 2010, the Special Committee convened to consider the draft form of the Arrangement Agreement and related documents. Haywood Securities Inc. made its presentation as to the fairness of the consideration to be received pursuant to the Arrangement. The rest of the members of the Board were present during such presentation. The Special Committee determined that it would wait to receive what was expected to be the final form of the Arrangement Agreement and reconvene the next day.

On September 6, 2010, the Special Committee reconvened to consider the final form of the Arrangement Agreement. Based in part on the Fairness Opinion which was amended and updated on September 6, 2010, the Special Committee resolved to recommend to the Marathon Board that it approve the Arrangement, the Arrangement Agreement, and related documents. The Marathon Board met later on the same day when they approved the Arrangement and the Arrangement Agreement, and resolved to recommend that Marathon Shareholders vote in favour of the Arrangement.

Between August 19, 2010 and September 6, 2010, the Special Committee met on five separate occasions to receive periodic updates on discussions with Stillwater. The Special Committee also received periodic progress reports from management of Marathon. The Special Committee continued to review and receive information in regards to the Stillwater proposal until a final decision was made to enter into the Arrangement Agreement on September 6, 2010.

The Arrangement Agreement was executed on the morning of September 7, 2010, at which time a press release was issued announcing the Transaction.

In the course of evaluating the Transaction, the Special Committee and the Marathon Board consulted with senior management, legal counsel, and Haywood Securities Inc., performed extensive financial, legal and technical due diligence with the assistance of its advisors, and considered a number of factors including, among others, the following:

| ● | Significant Premium to Marathon Shareholders. The total consideration payable by Stillwater represents an 89% premium to Marathon Shareholders over the closing price of Marathon Shares on September 3, 2010, the last trading day prior to the public announcement of the Agreement, without taking into account the value of the Marathon Gold shares. |

| ● | Continued Participation by Marathon Shareholders in the Marathon PGM-Copper Project through Stillwater and continued participation in Marathon’s exploration projects through Marathon Gold. Marathon Shareholders, through their ownership of Stillwater Shares, will continue to participate in any value increases associated with the development and operation of the Marathon PGM-Copper Project. In addition, through their equity holding in Marathon Gold resulting from the Arrangement, Marathon Shareholders will continue to participate in the exploration upside associated with the Marathon Gold Properties, including the Valentine Lake Project. |

| ● | State of Debt and Equity Markets. The Special Committee and the Marathon Board considered the state of debt and equity markets, the difficulty of being able to raise the debt and equity needed to continue the development of the Marathon PGM-Copper Project, and the likelihood and effect of having to scale back and/or delay the development of the Marathon PGM-Copper Project absent the Transaction. |

- 15 -

Please contact Kingsdale Shareholder Services Inc. at 1-866-581-1489 for any questions or assistance completing your Proxy

| ● | Fairness Opinion. The Special Committee and the Marathon Board considered the Fairness Opinion to the effect that, as of the date thereof, and subject to the analyses, assumptions, qualifications and limitations set forth in the Fairness Opinion, the consideration to be received pursuant to the Arrangement by Marathon Shareholders, other than Stillwater and its affiliates and associates, was fair from a financial point of view. |

| ● | The Terms of the Arrangement Agreement. Under the Arrangement Agreement, the Marathon Board remains able to respond, in accordance with its fiduciary duties, to unsolicited proposals that are more favourable to Marathon Shareholders than the Arrangement. |

| ● | Private Placement Financing. Stillwater subscribed for 974,026 Marathon Shares at a subscription price of Cdn.$3.08 per share for aggregate gross proceeds to Marathon of Cdn.$3 million which was not conditional upon completion of the Arrangement. |

| ● | Support Agreements. The directors and officers of Marathon, who in total held approximately 3.5% of the outstanding Marathon Shares (on a non-diluted basis) as at September 7, 2010, have entered into Support Agreements with Stillwater pursuant to which they will vote in favour of the Arrangement. |

| ● | Dissent Rights. Registered Marathon Shareholders who oppose the Arrangement may, upon compliance with certain conditions, exercise their Dissent Rights and receive the fair value of their Marathon Shares in accordance with the Plan of Arrangement. |

| ● | Approval Thresholds. The Marathon Board considered the fact that the Special Resolution must be approved by two-thirds of the votes cast in person or by proxy at the Meeting to be protective of the rights of Marathon Shareholders. The Arrangement must also be approved by the Court, which will consider the fairness of the Arrangement to all Marathon securityholders. |

In the course of their deliberations, the Special Committee and the Marathon Board also identified and considered a variety of risks, including, but not limited to:

| ● | as Marathon Shareholders will receive Stillwater Shares based on the fixed Exchange Ratio, Stillwater Shares received by Marathon Shareholders under the Arrangement may have a market value lower than expected; and |

| ● | the risks to Marathon if the Arrangement is not completed, including the costs to Marathon in pursuing the Arrangement and the diversion of management’s attention away from the conduct of Marathon’s business, and in particular the financing and development of the Marathon PGM-Copper Project. |

The foregoing summary of the information and factors considered by the Special Committee and the Marathon Board is not, and is not intended to be, exhaustive. In view of the variety of factors and the amount of information considered in connection with its evaluation of the Arrangement, the Special Committee and the Marathon Board did not find it practical to, and did not, quantify or otherwise attempt to assign any relative weight to each specific factor considered in reaching its conclusion and recommendation. The Special Committee’s and the Marathon Board’s recommendations were made after consideration of all of the above-noted factors and in light of the Special Committee’s and the Marathon Board’s collective knowledge of the business, financial condition and prospects of Marathon, and were also based upon the advice of financial advisors and legal advisors to the Special Committee and the Marathon Board. In addition, individual members of the Special Committee and the Marathon Board may have assigned different weights to different factors.

The Marathon Board established the Special Committee to, among other things, review and consider the Transaction. On behalf of Marathon, the Special Committee retained Haywood Securities Inc. to act as its financial advisor. Haywood Securities Inc. has given an opinion that, as at September 6, 2010, the consideration to be received pursuant to the Arrangement by the Marathon Shareholders, other than Stillwater and its affiliates or associates, is fair from a financial point of view. The Special Committee, having taken into account the Fairness Opinion and such other matters as it considered relevant, has unanimously determined that the offered consideration under the Transaction is fair to Marathon Shareholders and that the Transaction is in the best interests of Marathon. Accordingly, the Special Committee unanimously recommended tha t the Marathon Board approve the Transaction and recommend that the Marathon Shareholders vote FOR the Special Resolution.

- 16 -

Please contact Kingsdale Shareholder Services Inc. at 1-866-581-1489 for any questions or assistance completing your Proxy

After careful consideration, the Marathon Board has unanimously determined that the offered consideration of Cdn.$1.775 in cash, 0.112 of a Stillwater Share and 0.5 of a Marathon Gold Share for each Marathon Share under the Transaction is fair to Marathon Shareholders and that the Transaction is in the best interests of Marathon. Accordingly, the Marathon Board unanimously recommends that Marathon Shareholders vote FOR the Special Resolution.

On September 1, 2010, the Special Committee, on behalf of the Marathon Board, retained Haywood Securities Inc. to deliver a fairness opinion and provide financial advisory services to Marathon with respect to the Transaction.

On September 3, 2010, Haywood Securities Inc. delivered a written Fairness Opinion which was amended and updated on September 6, 2010, to the effect that, as of that date, and based upon and subject to the scope of the review, analysis undertaken and various assumptions, limitations and qualifications set forth in its opinion, the Consideration to be received pursuant to the Arrangement by the Marathon Shareholders, other than Stillwater and its affiliates and associates, is fair from a financial point of view. The full text of the Fairness Opinion describing the assumptions made, procedures followed, information reviewed, matters considered and limitations on the review undertaken by Haywood Securities Inc. is attached as Appendix “G” hereto and forms part of this Circular. Marathon Shareholders are encouraged to read the Fairness Opinion carefully in its entirety.

The Fairness Opinion addresses the fairness, from a financial point of view, of the consideration offered pursuant to the Arrangement to Marathon Shareholders and does not address any other aspect of the Arrangement or any related transaction, including any tax consequences of the Arrangement to Marathon or the Marathon Shareholders. The Fairness Opinion was provided for the exclusive use of the Marathon Board and may not be relied upon by any other person. The Fairness Opinion does not address the relative merits of the Arrangement or any related transaction as compared to other business strategies or transactions that might be available to Marathon or the underlying business decision of Marathon to effect the Arrangement or any related transaction. The Fairness Opinion does not constitute a recommendation to any Marathon Shareholder as to how such Marathon Shareholder should vote on the Special Resolution, or how to act with respect to any matters relating to the Arrangement.

The Fairness Opinion was rendered on the basis of the securities market, economic and general business and financial conditions prevailing as at September 6, 2010 and on information relating to the subject matter thereof as represented to Haywood Securities Inc. As set forth in the Fairness Opinion, Haywood Securities Inc. has relied upon, and assumed the completeness, accuracy and fair presentation of all financial information, business plans, forecasts, and other information, data, advice, opinions, and representations obtained by Haywood Securities Inc. from public sources or provided by or on behalf of Marathon. Haywood Securities Inc. was not asked to prepare, and has not prepared, a formal valuation of Marathon.

The Fairness Opinion and the financial analyses of Haywood Securities Inc. were only one of many factors considered by the Special Committee and the Marathon Board in their evaluation of the Arrangement and should not be viewed as determinative of the views of the Marathon Board or the Special Committee with respect to the Arrangement or the consideration provided for in the Arrangement.

Under the terms of Haywood Securities Inc.’s engagement, Marathon has agreed to pay Haywood Securities Inc. a fee for delivery of the Fairness Opinion. In addition, Marathon has agreed to reimburse Haywood Securities Inc. for its reasonable out-of-pocket expenses, and to indemnify Haywood Securities Inc. and related parties against liabilities relating to, or arising out of, its engagement.

Haywood Securities Inc. was retained as financial advisor of the Special Committee because it is one of Canada’s leading independent investment banking firms with expertise in corporate finance, equity sales and trading, and investment research. Haywood Securities has participated in a significant number of transactions involving mining and exploration companies and its investment banking professionals have extensive experience in preparing valuations.

- 17 -

Please contact Kingsdale Shareholder Services Inc. at 1-866-581-1489 for any questions or assistance completing your Proxy

Each of the directors and officers of Marathon have entered into a Support Agreement with Stillwater pursuant to which they have agreed, on and subject to the terms thereof, among other things, (i) to vote any Marathon Shares held as of the Record Date in favour of the Special Resolution, (ii) subject to certain exceptions, not to sell or transfer any of their Marathon Shares or other Marathon securities prior to the Effective Date, and (iii) not to exercise Dissent Rights in respect of the Transaction.

The Support Agreement may be terminated or extended by mutual agreement of the applicable Marathon Shareholder and Stillwater. Absent a mutual agreement to extend, the Support Agreement will automatically terminate on the Termination Deadline or in the event that the Arrangement Agreement is terminated by any party thereto in accordance with its terms.

The Arrangement