UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | |

| ¨ | | Preliminary Proxy Statement |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | | Definitive Proxy Statement |

| ¨ | | Definitive Additional Materials |

| ¨ | | Soliciting Material Pursuant to Rule 14a-12 |

Stillwater Mining Company

(Name of Registrant as Specified In Its Charter)

Payment of Filing Fee (Check the appropriate box):

| | | | |

| |

| x | | No fee required. |

| |

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

| | 1. | | Title of each class of securities to which transaction applies: |

| | | | |

| | 2. | | Aggregate number of securities to which transaction applies: |

| | | | |

| | 3. | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | | |

| | 4. | | Proposed maximum aggregate value of transaction: |

| | | | |

| | 5. | | Total fee paid: |

| | |

| | | | |

| | | | |

| |

| ¨ | | Fee paid previously with preliminary materials. |

| |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | 1. | | Amount Previously Paid: |

| | | | |

| | 2. | | Form, Schedule or Registration Statement No.: |

| | | | |

| | 3. | | Filing Party: |

| | | | |

| | 4. | | Date Filed: |

| | | | |

Stillwater Mining Company

March 28, 2014

It is my pleasure to invite you to the Stillwater Mining Company’s 2014 Annual Meeting of Shareholders in Billings, Montana. The attached Notice of Annual Meeting of Shareholders and Proxy Statement will serve as your guide to the business to be conducted.

We have attempted to improve the information provided to you in this year’s proxy statement, which demonstrates our intent to move beyond required disclosures and provide you the information you need, in a format that is easy to follow.

Many of you have told us that ensuring robust corporate governance practices, particularly in the area of executive compensation and corporate transparency, are of high priority. We, therefore, have enhanced the Compensation Discussion & Analysis and corporate governance disclosures in this document, expanding the discussion of our policies and practices.

While we hope you can join us in Billings, whether or not you attend in person, it is important that your shares be represented and voted at the meeting. Please vote your shares by signing and returning your proxy or voting instruction card, using telephone or Internet voting. Instructions on how to vote are found on page 4.

If you are unable to attend the meeting in person, you will be able to listen to a webcast of the meeting at www.stillwatermining.com. We look forward to seeing many of you in Billings on April 30, 2014.

Brian Schweitzer

Chairman of the Board

i

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

| | |

| Time and Date | | 2:00 p.m. (Mountain Daylight Time), on April 30, 2014 |

| |

| Place | | City College at Montana State University Billings

3803 Central Avenue

Billings, Montana 59102 |

| |

| Items of Business | | (1) To elect the seven Board of Director nominees named in the attached proxy. |

| |

| | (2) To ratify the appointment of KPMG LLP as the Company’s independent registered accounting firm for 2014. |

| |

| | (3) To conduct an advisory vote on executive compensation. |

| |

| | (4) To conduct such other business properly presented at the meeting or any adjournments or postponements thereof. |

| |

| Adjournments and Postponements | | Any actions on the items of business described above may be considered at the annual meeting at the time and on the date specified above, or at any time and date to which the annual meeting may be properly adjourned or postponed. |

| |

| Record Date | | You are entitled to vote only if you were a Stillwater Mining Company shareholder as of the close of business on March 3, 2014. |

| |

| Voting | | Your vote is very important. Whether or not you plan to attend the annual meeting, we hope you will vote as soon as possible. If you received a paper copy of a proxy or voting instruction card by mail, you may submit your proxy or voting instruction card for the annual meeting by voting by phone, the internet, or by signing, dating and returning your proxy in the postage-paid envelope provided. |

| |

| | By order of the Board of Directors, |

| |

| |  |

| |

| | Brent R. Wadman |

| | Vice President, Legal Affairs & Corporate Secretary |

ii

This notice of annual meeting and proxy statement and form of proxy are being distributed

and made available on or about March 28, 2014.

Table of Contents

iii

iv

Stillwater Mining Company

PROXY STATEMENT ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON APRIL 30, 2014

This Proxy Statement is being furnished to the shareholders of Stillwater Mining Company (the “Company”) in connection with the solicitation by the Company’s Board of Directors (the “Board”) of proxies to be voted at the Annual Meeting of Shareholders of the Company, and any adjournments or postponements thereof. The meeting will be held on April 30, 2014, at 2:00 p.m. (Mountain Daylight Time) at the City College at Montana State University Billings, 3803 Central Avenue, Billings, Montana.

These proxy solicitation materials were first mailed on or about March 28, 2014, to all shareholders entitled to vote at the meeting. The meeting is being held:

| | 1. | To elect the seven nominees named in this proxy statement to the Company’s Board. |

| | 2. | To ratify the appointment of KPMG LLP as the Company’s independent registered accounting firm for 2014. |

| | 3. | To conduct an advisory vote on executive compensation. |

| | 4. | To conduct such other business properly presented at the meeting or any adjournments or postponements thereof. |

GENERAL INFORMATION

Solicitation

The enclosed proxy is being solicited by the Board on behalf of the Company. The cost of this solicitation will be borne by the Company. In addition to solicitation by mail, the officers, directors and employees of the Company may solicit proxies by telephone, facsimile, email, other electronic means or in person. The Company may also request banks and brokers to solicit their customers who have a beneficial interest in the Common Stock of the Company (the “Common Stock”) registered in the names of nominees. The Company will reimburse such banks and brokers for their reasonable out-of-pocket expenses.

Voting Rights

Holders of shares of Common Stock at the close of business on March 3, 2014 (the “Record Date”) are entitled to notice of and to vote at the meeting. On the Record Date, 119,629,440 shares of Common Stock were issued, outstanding and entitled to vote. The holders of at least 50% of the shares of Common Stock issued, outstanding and entitled to vote at the meeting, present in person or by proxy, constitutes a quorum.

Each share of Common Stock outstanding on the Record Date is entitled to one vote.

Voting

The vote of the holders of (i) a plurality of votes cast by the shares present in person or represented by proxy is required to elect seven nominees standing for the election of directors, (ii) a majority of the shares present in person or represented by proxy is required to approve Proposal 2, regarding the ratification of the selection of KPMG LLP as the Company’s independent registered accounting firm, and Proposal 3, the advisory vote on the compensation of our named executive officers.

1

If a shareholder abstains from voting on any matter, the Company intends to count such shareholder as present for purposes of determining whether a quorum is present at the meeting for the transaction of business. If you sign and return the enclosed proxy card, unless contrary instructions are indicated, the shares of Common Stock represented by such proxy will be voted FOR the election as directors of the nominees named in this proxy statement, FOR ratification of the selection of KPMG LLP as the Company’s independent registered accounting firm, and FOR the advisory vote on executive compensation. Additionally, the Company intends to count broker “non-votes” as present for purposes of determining the presence or absence of a quorum for the transaction of business, but broker non-votes will have no effect on the outcome of any matter. A non-vote occurs when a nominee holding shares for a beneficial owner votes on one proposal, but does not vote on another proposal because the nominee does not have discretionary voting power, and has not received instructions from the beneficial owner. Abstentions will have the effect of a vote against Proposals 2 and 3.

Neither management nor the Board knows of any other matters to be brought before the meeting. If other matters are presented properly to the shareholders for action at the meeting or adjournments or postponements thereof, then the proxy holders named in the proxy have advised they intend to vote in their discretion on all matters in which the shares of Common Stock represented by such proxy are entitled to vote.

Receipt of Multiple Proxy Cards

Many of our shareholders hold their shares in more than one account, and may receive separate proxy cards or voting instructions forms for each of those accounts. To ensure that all of your shares are represented at the annual meeting, we recommend that you vote every proxy card you receive.

Revocability of Proxies

Any proxy may be revoked at any time before it is voted by: (i) written notice to the Company’s Corporate Secretary; (ii) receipt of a proxy properly signed and dated subsequent to an earlier proxy; or (iii) by revoking in person at the meeting or voting in person at the meeting. If not revoked, the shares of Common Stock represented by a proxy will be voted according to the proxy.

Important Notice Regarding the Availability of Proxy Materials for the

Annual Meeting of Shareholders to be held on April 30, 2014

The proxy statement, proxy card, and the Annual Report on Form 10-K for the year ended December 31, 2013, are available on our website at www.stillwatermining.com under the heading “Investor Relations.” You may obtain directions to attend the annual meeting on our website at www.stillwatermining.com under the heading “Investor Relations.”

PROPOSAL 1:

ELECTION OF DIRECTORS

The Board is elected by the shareholders to oversee their interest in the long-term viability and the overall success of the Company.

Election Process

The Company’s By-Laws provide for the annual election of Directors. The Company’s By-Laws also provide that the number of Directors shall be determined by the Board, which has set the number at seven (7) effective at the 2014 Annual Meeting of Shareholders.

2

The seven (7) persons set forth below have been nominated to serve as Directors of the Company until the next annual meeting of shareholders, or until their respective successors are elected, and each person has consented to being named as a nominee. All of the nominees are currently Directors of the Company.

The Company’s By-Laws provide that the election of any Director must be by a plurality of the votes cast by shareholders who are present in person or represented by proxy, and entitled to vote at a meeting at which a quorum is present. Brokers and other nominees will not have discretionary authority to vote your shares if you hold your shares in street name, and do not provide instruction as to how your shares should be voted on this proposal.

The Board of Directors unanimously recommends that you vote FOR all of the Board’s nominees.

It is anticipated that proxies will be voted for the nominees listed below, and the Board has no reason to believe any nominee will not continue to be a candidate, or will not be able to serve as a director if elected. In the event that any nominee named below is unable to serve as a Director, the proxy holders named in the proxies have advised that they will vote for the election of such substitute or additional nominees as the Board may propose.

The name and age of each nominee, his or her principal occupation for at least the past five (5) years and certain additional information is set forth below. Such information is as of the date hereof, and is based upon information furnished to the Company by each nominee.

Director Qualifications

Directors are responsible for overseeing the Company’s business consistent with their fiduciary duty to shareholders. This significant responsibility requires highly-skilled individuals with various qualities, attributes and professional experience. The Board believes there are general requirements applicable to all Directors, and other skills and experience that should be represented on the Board as a whole, but not necessarily by each Director. The Board and the Corporate Governance & Nominating Committee consider the qualifications of Directors and Director candidates individually and in the broader context of the Board’s overall composition and the Company’s current and future needs.

Board Tenure

The Company has adopted a Board Tenure Policy which states that a director’s maximum tenure shall be nine (9) years, or seventy-two (72) years of age, at which time the director will not be re-nominated unless the Board determines that specific, exceptional circumstances warrant re-nomination, and which reasons will be publicly disclosed.

3

The following Directors have agreed to stand for election as Directors at this year’s annual meeting, and are proposed by the Nominating Committee of the Board.

Nominees for Election

| | | | |

| | |

| George M. Bee | | | | |

| | |

| | Independent Director since: | | November 24, 2012 |

| | Age: | | 55 |

| | Roles on the Board: | | Health, Safety & Environmental (Chairman), Technical & Ore Reserve |

| | Other Public Company Boards: | | Sandspring Resources Ltd. |

| | Share Ownership: | | 23,794 |

| | Location: | | Toronto, Ontario, Canada |

|

| Specific Qualifications, Attributes, Skills, and Experience: |

| | |

| Industry Knowledge | | | | Environmental, Health, & Safety Oversight |

| | |

| Risk Oversight | | | | International Exposure |

Mr. Bee served as the President and Chief Executive Officer of Andina Minerals Inc. beginning 2009 until January 2013. From 2007 to 2009, he was Chief Operating Officer for Aurelian Resources, Inc. prior to its acquisition by Kinross Gold Corporation. Mr. Bee served in various senior management and operational positions at Barrick Gold Corporation during two terms of service with the company, first from 1989 to 1995, and then from 1998 to 2007. From 1996 to 1998, he was Manager of Planning and Evaluation at Kinross Gold Corporation. He currently serves on the Board of Directors of Sandspring Resources Ltd. Mr. Bee served briefly on the Board of Directors of Peregrine Metals Ltd., which was acquired by Stillwater Mining Company in 2011.

Mr. Bee received a Bachelor of Science degree from the Camborne School of Mines in Cornwall, United Kingdom.

4

| | | | |

| | |

| Charles R. Engles | | | | |

| | |

| | Independent Director since: | | May 2, 2013 |

| | Age: | | 66 |

| | Roles on the Board: | | Compensation (Chairman), Audit, Technical & Ore Reserve |

| | Other Public Company Boards: | | Clean Diesel Technologies, Inc. |

| | Share Ownership: | | 8,715 |

| | Location: | | Portola Valley, California, U.S. |

|

| Specific Qualifications, Attributes, Skills, and Experience: |

| | |

| Industry Knowledge | | | | Executive Leadership |

| | |

| Risk Oversight | | | | PGM Applications Knowledge |

Dr. Engles is currently an independent consultant, and has over 20 years of experience serving as a board member for U.S. public companies, and has also been a board member of seven private companies. Dr. Engles has served as a Director of Clean Diesel Technologies, Inc. (NASDAQ: CDTI) since October 2010, immediately following the business combination of CDTI and Catalytic Solutions, Inc. Dr. Engles served as a Director of Catalytic Solutions, Inc. from January 2000 to October 2010. From April 2008 to October 2008, Dr. Engles served as Interim Chief Executive Officer of ThermoCeramix, Inc., an advanced materials company focused on electrical to thermal energy conversion. From September 1997 to March 2008, Dr. Engles served as Chief Executive Officer of Cutanix Corporation, a biopharmaceutical company focused on dermatological drug discovery, that he co-founded. From September 1994 to March 1997, he served as Chairman and Chief Executive Officer of Stillwater Mining Company and, under his direction, it completed an IPO on the NASDAQ in 1994. In 1992, he organized the spin out from Johns-Manville Corporation (NYSE:BRK.A, BRK.B) and Chevron Corporation (NYSE:CVX) of Stillwater Mining Company. From July 1989 until September 1994, Dr. Engles served as Senior Vice President of Johns- Manville Corporation, responsible for corporate development and worldwide mining and minerals operations. Dr. Engles has served for fourteen years as a board member of catalytic converter companies, the principal users of PGMs.

Dr. Engles holds a Ph.D. from Stanford University in operations research, and attended Oxford University as a Rhodes Scholar.

5

| | | | |

| |

| Michael (Mick) McMullen | | |

| | |

| | Executive Director since: | | December 3, 2013 |

| | Independent Director: | | From May 2, 2013 until December 3, 2013 |

| | Age: | | 43 |

| | Roles on the Board: | | Technical & Ore Reserve Committee |

| | Other Public Company Boards: | | Nevada Iron Ltd. |

| | Share Ownership: | | 31,586 |

| | |

| | Location: | | Billings, Montana, U.S. |

|

| Specific Qualifications, Attributes, Skills, and Experience: |

| | |

| Industry Knowledge | | | | Executive Leadership |

| | |

| Risk Oversight | | | | International Exposure |

Mr. McMullen was appointed President and Chief Executive Officer of Stillwater Mining Company on December 3, 2013. He is also a member of the Board of Directors. Previously, Mr. McMullen served in a variety of senior executive and directorship positions, most recently as a Principal at MRI Advisory AG, a private company focusing on development of metal and minerals projects in the Americas, Europe and Africa. Over the course of his 21-year career, Mr. McMullen has been responsible for development of several large open pit and underground mines in Australia, Europe and Latin America. He has had detailed involvement in all aspects of the mining business, including exploration, permitting, mine development, financing, operations, product sales, and asset acquisition and divestments, as well as debt and equity markets. He has managed multiple operations across several jurisdictions, working with large work forces and unions in culturally diverse and environmentally sensitive areas. His experience covers a range of commodities including copper, gold, iron ore and PGMs.

Mr. McMullen holds a Bachelor of Science degree in Geology from Newcastle University in New South Wales, and pursued graduate studies in Mineral Economics at Western Australian School of Mines.

6

| | | | |

| | |

| Patrice E. Merrin | | | | |

| | |

| | Independent Director since: | | May 2, 2013 |

| | Age: | | 65 |

| | Roles on the Board: | | Corporate Governance & Nominating (Chairman), Compensation |

| | Other Public Company Boards: | | None |

| | Share Ownership: | | 17,586 |

| | Location: | | Toronto, Ontario, Canada |

|

| Specific Qualifications, Attributes, Skills, and Experience: |

| | |

| Industry Knowledge | | | | Executive Leadership |

| | |

| Risk Oversight | | | | Government Affairs and Public Policy |

Ms. Merrin was elected to the Board on May 2, 2013. She was Chairman of the Board of Directors of CML HealthCare Inc., a leading provider of private laboratory testing services, from 2011 until 2013, prior to which she had been a director since 2008, and served as Interim President and Chief Executive Officer from May 2011 to February 2012. Since January 2012, she has served as a Director of Ornge, Ontario’s air ambulance service. She is a Director of Climate Change and Emissions Management Corporation, which was created in 2009 to support Alberta’s initiatives on climate change and the reduction of emissions. From October 2009 to June 2011, Ms. Merrin served as a Director of Enssolutions Group Inc., which provides engineered environmental applications for mine tailings control, process dust and stockpile sealing. She also served as a Director of the NB Power Group, a company that generates and distributes electricity from nuclear, hydro, wind and oil, from 2007 to 2009, and as Chairman of the Environment, Health and Safety Committee from 2008 to 2009. From 2005 to 2006, Ms. Merrin served as President, Chief Executive Officer and a Director of Luscar Ltd., Canada’s largest producer of thermal coal, and as Executive Vice President from 2004 to 2005. During her tenure, Luscar was owned equally by Sherritt International and Ontario Teachers Pension Plan Board. Before joining Luscar, from 1999 to 2004, Ms. Merrin was Executive Vice President and Chief Operating Officer of Sherritt International, a diversified international natural resources company with assets in base metals mining and refining, thermal coal, oil, gas and power generation. In addition, Ms. Merrin was a member of the National Advisory Panel on Sustainable Energy Science & Technology from 2005 to 2006, and from 2003 to 2006, was a member of Canada’s National Round Table on the Environment and the Economy.

Ms. Merrin holds a Bachelor of Arts degree from Queen’s University, and completed the Advanced Management Programme at INSEAD. She is a Director and former Chairman of the Council on Canadian American Relations, New York, NY.

7

| | | | |

| | |

| Michael S. Parrett | | | | |

| | |

| | Independent Director since: | | May 7, 2009 |

| | Age: | | 62 |

| | Other Roles on the Board: | | Audit (Chairman), Corporate Governance & Nominating |

| | Other Public Company Boards: | | Pengrowth Energy Corporation |

| | Share Ownership: | | 29,053 |

| | Location: | | Richmond Hill, Ontario, Canada |

|

| Specific Qualifications, Attributes, Skills, and Experience: |

| | |

| Financial Expertise | | | | Executive Leadership |

| | |

| Industry Knowledge | | | | International Exposure |

Mr. Parrett has been an independent consultant and corporate director since 2002. During 2002, 2003 and the first quarter of 2004, Mr. Parrett served as a financial consultant to Stillwater Mining Company. From 1990 to 2001, he was Chief Financial Officer, President of Rio Algom and Chief Executive of Billiton Base Metals. From 1983 to 1989, Mr. Parrett performed various financial functions, including Controller, Chief Financial Officer, Treasurer, Controller Marketing and Director of Internal Audit at Falconbridge Limited. He has been on the Board of Directors of Pengrowth Energy Corporation since 2004. Since 2010, he has been a member of the Board of Directors (Chairman 2010-2013) of Mongolia Minerals Corporation (a private corporation), and a member of the Board of Directors of Sunshine Silver Mines Corporation (a private corporation). Mr. Parrett was on the Board of Directors of Gabriel Resources Ltd. from 2003 to 2010, and was Chairman since December 2005. He was also a Trustee and on the Board of Directors of Fording Canadian Coal Trust from 2003-2008.

Mr. Parrett is a Chartered Accountant, and received his Bachelor of Arts degree in Economics from York University.

8

| | | | |

| Brian Schweitzer | | | | |

| | Independent Director since: | | May 2, 2013 |

| | Age: | | 58 |

| | Roles on the Board: | | Chairman; Corporate Governance & Nominating, Health Safety & Environment |

| | Other Public Company Boards: | | None |

| | Share Ownership: | | 39,703 |

| | Location: | | Anaconda, Montana, U.S. |

|

| Specific Qualifications, Attributes, Skills, and Experience: |

| Executive Leadership | | | | Geopolitical Expertise |

| International Exposure | | | | Risk Oversight |

Mr. Schweitzer became the Chairman of the Board on May 17, 2013. Mr. Schweitzer most recently served as Governor of Montana, from January 5, 2005 to January 7, 2013. As Governor, he was the chief regulator of water and air quality, fisheries and wildlife. As Governor, he served as Chair of the Western Governors’ Association, during 2009, and the Democratic Governors’ Association, during 2008. Mr. Schweitzer also served as the 2011 President of the Council of State Governments, during his tenure as Governor. Prior to his role as Governor of Montana, Mr. Schweitzer was a successful rancher and entrepreneur. He began his career as an international agricultural consultant, and worked as an irrigation developer on projects in Africa, Asia, Europe and South America. He spent several years working in Libya and Saudi Arabia.

Mr. Schweitzer earned his Bachelor of Science degree in international agronomy from Colorado State University, and a Master of Science in soil science from Montana State University, Bozeman.

| | | | |

| Gary A. Sugar | | | | |

| | Independent Director since: | | August 29, 2012 |

| | Age: | | 65 |

| | Other Roles on the Board: | | Audit, Compensation, Technical & Ore Reserve (Chairman) |

| | Other Public Company Boards: | | Osisko Mining Corporation, Romarco Minerals Inc. |

| | Share Ownership: | | 11,703 |

| | Location: | | Toronto, Ontario, Canada |

|

| Specific Qualifications, Attributes, Skills, and Experience: |

| Industry Knowledge | | | | Capital Markets Expertise |

| Risk Oversight | | | | International Exposure |

Mr. Sugar retired in 2011 from RBC Capital Markets after a distinguished 32-year career. He initially worked in the mining industry in exploration and corporate development for companies including Inco, Cominco, Rio Algom, and Imperial Oil (Exxon). Mr. Sugar joined a predecessor company to RBC Capital Markets in 1979. He specialized in the mining sector, particularly in equity and debt financings, mergers and acquisitions, and other advisory services for a wide range of Canadian and international mining companies. He was appointed managing director in 1987, and led the mining practice for many years. He is currently on the Boards of Directors of Osisko Mining Corporation and Romarco Minerals Inc.

Mr. Sugar holds a Bachelor of Science degree in Geology and an M.B.A. from the University of Toronto.

9

BOARD OF DIRECTORS AND COMMITTEES

The Board met twenty-seven (27) times during 2013. Each Director attended 100% or more of the total number of meetings of the Board and each committee on which he or she served in 2013. The independent Directors regularly met in executive session without management. Seven out of nine of the then-elected Directors attended the 2013 Annual Meeting.

Director Independence

The Board follows the standards set forth in the Company’s Corporate Governance Principles when determining director independence, which standards meet or exceed the listing standards of the New York Stock Exchange (“NYSE”) with respect to director independence. These guidelines can be found on the Company’s corporate website atwww.stillwatermining.com, under the heading “Corporate Governance/Independence Criteria for Directors.” A copy may also be obtained upon request from the Company’s Corporate Secretary at Stillwater Mining Company, 1321 Discovery Drive, Billings, Montana 59102.

These guidelines provide objective, as well as subjective, criteria that the Board utilizes in determining whether each Director meets the independence standards of the Securities and Exchange Commission (the “SEC”) and the NYSE applicable to the Company. Additionally, the Company complies with guidelines adopted pursuant to the 2010 Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”).

The Board undertook its annual review of Director transactions and relationships between each Director or any member of his or her immediate family and the Company and its subsidiaries and affiliates. The Board also examined transactions and relationships between Directors or their affiliates and members of the Company’s senior management or their affiliates.

The Board affirmatively determined that all of the Directors being nominated for election at the annual meeting are independent of the Company and the Company’s management under the standards set forth in the Corporate Governance Principles, with the exception of Michael (Mick) McMullen. Mr. McMullen is considered not independent because he serves as the Company’s Chief Executive Officer.

Committees

Audit Committee: The Company has a standing Audit Committee as defined in Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The Audit Committee held seven (7) meetings during 2013. The members of the Audit Committee in 2013 were Michael S. Parrett (Chairman), Gary A. Sugar, Michael McMullen, and Charles Engles. On December 3, 2013, Mr. McMullen resigned from his position on the Audit Committee, and Dr. Charles Engles was appointed as his replacement. Each of the Audit Committee members was “independent,” and satisfied the additional independence requirements of Section 303A.02 of the NYSE’s listing standards and Rule 10A-3 of the Exchange Act and the NYSE requirements for audit committee members.

The Audit Committee reviews the accounting principles and procedures of the Company and its annual financial reports and statements, recommends to the Board the engagement of the Company’s independent auditors, reviews with the independent auditors the plans and results of the auditing engagement and considers the independence of the Company’s auditors. The Audit Committee is also responsible for reviewing the Company’s finance matters.

The Audit Committee is governed by a written charter which is available on the Company’s corporate website at www.stillwatermining.com, under the heading “Corporate Governance/Committee Charters/Audit Committee.” Copies of the charter are also available in print to shareholders upon request, addressed to the Corporate Secretary at Stillwater Mining Company, 1321 Discovery Drive, Billings, Montana 59102.

10

The Audit Committee also follows a written Audit and Non-Audit Services Pre-Approval Policy for services to be performed by the independent auditor. Proposed services may be either (i) pre-approved without consideration of specific case-by-case services by the Audit Committee (“General Pre-Approval”), or (ii) require the specific pre-approval of the Audit Committee (“Specific Pre-Approval”). The Audit Committee believes that the combination of these two approaches results in an effective and efficient procedure to pre-approve services performed by the independent auditor to ensure the auditor’s independence is not impaired. Unless a type of service has received General Pre-Approval, it requires Specific Pre-Approval by the Audit Committee if it is to be provided by the independent auditor. Any proposed specific individual project to provide an otherwise generally approved service whose expected fees exceed $25,000 requires an overriding Specific Pre-Approval by the Audit Committee.

The Audit Committee considers whether such services are consistent with the rules of the SEC on auditor independence, whether the independent auditor is best positioned to provide the most effective and efficient service, and whether the service might enhance the Company’s ability to manage or control risk or improve audit quality.

This policy is available on the Company’s corporate website atwww.stillwatermining.com, under the heading “Governance/Governance Documents/Audit and Non-Audit Policy.” Copies of this policy are also available in print to shareholders upon request, addressed to the Corporate Secretary at Stillwater Mining Company, 1321 Discovery Drive, Billings, Montana 59102.

SEC rules and NYSE listing standards require the Board to determine whether a member of its audit committee is an “audit committee financial expert,” and disclose its determination. According to these requirements, an audit committee member can be designated an audit committee financial expert only when the audit committee member satisfies specified qualification requirements, such as experience (or “experience actively supervising” others engaged in) preparing, auditing, analyzing, or evaluating financial statements presenting a level of accounting complexity comparable to what is encountered in connection with the Company’s financial statements. SEC rules further require such qualifications to have been acquired through specified means of experience or education. The Board has determined that Michael S. Parrett qualifies as an audit committee financial expert under SEC rules. The Board believes that the current members of the Audit Committee are qualified to carry out the duties and responsibilities of the Audit Committee.

Compensation Committee: The Company has a separate Compensation Committee as required under the NYSE’s listing standards. The Compensation Committee held eighteen (18) meetings during 2013. During 2013, the members of the Compensation Committee were Charles Engles (Chairman), Patrice E. Merrin and Gary A. Sugar. The Board has determined that all members of the Compensation Committee are “independent” under the applicable NYSE listing standards.

Under the oversight of our Chief Executive Officer, management provides recommendations to the Compensation Committee on matters of compensation philosophy and incentive compensation and equity-based compensation. Our Chief Executive Officer provides recommendations for pay levels for executives other than himself based on a variety of factors including market data, internal fairness, past performance, and future potential. Our Human Resources department supports management and the Compensation Committee by providing information on historical compensation levels, employee evaluations and its analysis of comparative industry data, and by interfacing with our compensation consultant. While members of the management team attend Compensation Committee meetings, they are not generally present during executive sessions, and individual members of the management team are never present during discussions of their respective compensation. The Compensation Committee and the Board, as required under the Compensation Committee’s charter, make all final decisions with respect to compensation of our executive officers.

The principal responsibilities of the Compensation Committee are to establish policies and determine matters involving executive compensation, recommend changes in employee benefit programs, approve the grant of

11

stock options and stock awards under the Company’s stock plans and provide assistance to management regarding key personnel selection. The Compensation Committee’s written charter is available on the Company’s corporate website atwww.stillwatermining.com, under the heading “Governance/Committee Charters/Compensation Committee.” Copies of the charter are also available in print to shareholders upon request, addressed to the Corporate Secretary at Stillwater Mining Company, 1321 Discovery Drive, Billings, Montana 59102.

Corporate Governance and Nominating Committee: The Company has a Corporate Governance and Nominating Committee as required pursuant to Section 303A.04 of the NYSE’s listing standards. The Corporate Governance and Nominating Committee held seven (7) meetings during 2013. The Corporate Governance and Nominating Committee is composed of Patrice E. Merrin (Chairman), Michael S. Parrett, and Brian Schweitzer. The Board has determined that all of the members of the Corporate Governance and Nominating Committee are independent directors under the applicable NYSE listing standards. The Company complies with the requirement of the NYSE to have a Corporate Governance and Nominating Committee comprised entirely of independent directors.

The principal responsibilities of the Corporate Governance and Nominating Committee are: (i) identifying and recommending to the Board individuals qualified to serve as directors of the Company and on committees of the Board; (ii) advising the Board as to the appropriate size, function and procedures of the committees of the Board; (iii) developing and recommending to the Board corporate governance principles; and (iv) overseeing evaluation of the Board and the Company’s executive officers.

The Corporate Governance and Nominating Committee is governed by a written charter. The Board also follows written corporate governance guidelines for the Company, and a written policy for shareholder nomination of directors. These documents set forth the criteria and methodology the Board uses when considering individuals as nominees to the Board. Current copies of these documents are available on the Company’s corporate website atwww.stillwatermining.com, under the headings “Governance/Committee Charters/Corporate Governance & Nominating Committee,” “Governance/ Governance Principles” and “Governance/Governance Documents/Stockholder Nomination of Directors,” respectively. Copies of these documents are also available in print to shareholders upon request, addressed to the Corporate Secretary at Stillwater Mining Company, 1321 Discovery Drive, Billings, Montana 59102.

The Company has a Business Ethics and Code of Conduct policy applicable to its officers, directors, employees and agents, including the Chief Executive Officer and all senior financial officers, including our principal financial officer and corporate controller. A current copy of this policy is available on the Company’s corporate website atwww.stillwatermining.com, under the heading “Governance/Governance Documents/Code of Conduct.” The purpose of this policy is to provide legal, ethical and moral standards for the conduct of the Company’s officers, directors, employees and agents. In addition, waivers from and amendments to our Code of Business Conduct and Ethics that apply to our directors and executive officers, including our principal executive officer, principal financial officer, principal accounting officer, or persons performing similar functions, will be timely posted in the governance section of our website atwww.stillwatermining.com. The Board has also adopted a written Code of Ethics for its Chief Executive and Senior Financial Officers which is available on the Company’s corporate website atwww.stillwatermining.com, under the heading “Governance/ Governance Documents/Code of Ethics for Senior Financial Officers.” This document sets forth specific policies to guide the Chief Executive Officer, Chief Financial Officer and Corporate Controller in the performance of their duties. Copies of these documents are also available in print to shareholders upon request, addressed to the Corporate Secretary at Stillwater Mining Company, 1321 Discovery Drive, Billings, Montana 59102.

Health, Safety and Environmental Committee: The Company has a Health, Safety and Environmental Committee with the principal responsibilities of: (i) reviewing the Company’s environmental and occupational health and safety policies and programs; (ii) overseeing the Company’s environmental and occupational health and safety performance; and (iii) monitoring current and future regulatory issues. During 2013, the Health, Safety and Environmental Committee consisted of George M. Bee (Chairman), Brian Schweitzer, and Mick McMullen. This committee held two (2) meetings, in 2013.

12

Technical & Ore Reserve Committee: The Company has a Technical & Ore Reserve Committee with principal responsibilities of: (i) advising the Board on the appropriateness, accuracy and completeness of the Company’s ore reserves; (ii) ensuring that management appropriately presents the Company’s ore reserves to regulatory agencies; and (iii) overseeing the Company’s technical and strategic position. During 2013, the Technical and Ore Reserves Committee was composed of Mick McMullen (Chairman), Gary A. Sugar, George M. Bee and Charles Engles. On December 17, 2013, Mr. Sugar replaced Mr. McMullen as Chairman of the Committee. This committee held six (6) meetings in 2013.

Candidate Selection Process

The minimum qualifications for serving as a director of the Company are that a nominee demonstrate, by significant accomplishment in his or her field, an ability to make a meaningful contribution to the Board’s oversight of the business and affairs of the Company. In addition, the Corporate Governance and Nominating Committee examines a candidate’s specific experiences and skills, time availability in light of other commitments, potential conflicts of interest and independence from management and the Company. While the Corporate Governance and Nominating Committee has not adopted a formal diversity policy with respect to the selection of director nominees, the committee seeks to have the Board represent a diversity of backgrounds and experiences. As part of this process, the committee evaluates how a particular candidate would strengthen and increase the diversity of the Board, and contribute to the Board’s overall balance of perspectives, backgrounds, knowledge, experience and expertise in areas relevant to the Company’s business. The committee assesses its achievement of diversity through review of Board composition as part of the Board’s annual self-assessment process.

Under the Company’s Corporate Governance Principles, the Corporate Governance and Nominating Committee will present a list of candidates to the Board for nomination. The Chief Executive Officer will be included in the process on a non-voting basis. Taking into account the factors outlined above, the Corporate Governance and Nominating Committee will make a recommendation to the Board, and the Board will determine which of the recommended candidates to approve for nomination.

Nomination Process

Nominations of persons for election as directors of the Company may be made at a meeting of shareholders, (a) by or at the direction of the Board, (b) by the Corporate Governance and Nominating Committee or persons appointed by the Board, or (c) by any shareholder of the Company entitled to vote for the election of directors at the meeting who complies with the notice procedures set forth in Section 3.3 of the Company’s By-Laws. Such nominations, other than those made by or at the direction of the Board, shall be made pursuant to timely notice in writing to the Company’s Corporate Secretary. To be timely, a shareholder’s notice shall be delivered to or mailed and received at the principal executive office of the Company not less than fifty (50) days, nor more than seventy- five (75) days prior to the meeting; provided, however, that in the event that less than sixty (60) days’ notice or prior public disclosure of the date of the meeting is given or made to shareholders, notice by the shareholder to be timely must be so received not later than the close of business on the tenth day following the day on which such notice of the date of the meeting was mailed or such public disclosure was made, whichever first occurs. Such shareholder’s notice to the Company’s Corporate Secretary shall set forth: (a) as to each person whom the shareholder proposes to nominate for election or reelection as a director, (i) the name, age, business address and residence address of the person, (ii) the principal occupation or employment of the person, (iii) the class and number of shares of capital stock of the Company which are beneficially owned by the person, and (iv) any other information relating to the person that is required to be disclosed in solicitations for proxies for election of directors pursuant to the Exchange Act, as now or hereafter amended; and (b) as to the shareholder giving the notice, (i) the name and record address of such shareholder, and (ii) the class and number of shares of capital stock of the Company which are beneficially owned by such shareholder. The Company may require any proposed nominee to furnish such other information as may reasonably be required by the Company to determine

13

the eligibility of such proposed nominee to serve as a director of the Company. No person shall be eligible for election by the shareholders as a director of the Company unless nominated in accordance with the procedures set forth herein.

Board Oversight of Risk

The Board has responsibility for risk oversight, and its committees help oversee risk in areas over which they have responsibility. The Board receives regular updates related to various risks for both our Company and our industry. The Audit Committee receives and discusses reports regularly from members of management who are involved in the risk assessment and risk management functions on a daily basis. In addition, the Compensation Committee annually reviews, with the assistance of management, the overall structure of the Company’s compensation program and policies for all employees as they relate to the Company’s risk management practices.

The Board oversees the management of risks inherent in the Company’s businesses, and the implementation of its strategic plan. The Board performs this oversight role by implementing multiple levels of review. In connection with reviews of the operations of the Company’s business units and corporate functions, the Board addresses the primary risks associated with those units and functions. In addition, the Board reviews the risks associated with the Company’s strategic plan at an annual strategic planning session and periodically throughout the year as part of its consideration of the strategic direction of the Company. The Board also considers other risk topics at its meetings, including risks associated with capital structure, strategic plan, business climate, industry changes, and development activities. Further, the Board is routinely informed by management of developments that could affect the Company’s risk profile. The Board’s current role in risk oversight is complemented by our leadership structure.

Each of the Board’s Committees also manages Company risks that fall within the Committee’s areas of responsibility. In performing this function, each Committee has full access to management, as well as the authority to engage advisors.

Review of Compensation Risk

As part of its oversight of the Company’s executive compensation program, the Compensation Committee annually assesses the Company’s compensation programs, and has concluded that these compensation policies and practices do not create risks reasonably likely to have a material adverse effect on the Company. The Compensation Committee and Management spent considerable time and effort assessing the Company’s executive compensation and benefits programs over the past year to determine whether the programs’ provisions and operations create material, undesired or unintentional, risk to the Company. This risk assessment process included a review of policies and procedures; analysis of risk identification and controls; and determination of the balance of potential risk to potential reward.

The review of the programs and policies that apply to our named executive officers includes:

| | • | | analysis of how different elements of compensation may increase or mitigate risk-taking; |

| | • | | analysis of performance metrics used for short-term and long-term incentive programs, and the relation of such incentives to the objectives of a particular position or business unit; |

| | • | | analysis of whether the performance measurement periods for short-term and long-term incentive compensation are appropriate; |

| | • | | analysis of the overall structure of compensation programs as related to business risks; and |

| | • | | an annual review of the Company’s share ownership guidelines, including share ownership levels and retention practices. |

14

Based on the foregoing, we believe our compensation policies and practices do not create inappropriate or unintended significant risk to the Company as a whole. We also believe our incentive compensation programs provide incentives that do not encourage risk-taking beyond the organization’s ability to effectively identify and manage significant risks; are compatible with effective internal controls and the risk-management practices of the Company; and are supported by the oversight and administration of the Compensation Committee with regard to executive compensation programs.

Compensation Committee Interlocks and Insider Participation

The members of the Compensation Committee are identified under “Committees” above. No member of the Compensation Committee was, at any time during 2013, an officer or employee, or a former officer, of the Company.

Charles Engles served as Chairman and Chief Executive Officer of the Company from September 1994 until March 1997.

Shareholder Communication with Directors

The Board has a written policy on shareholder and interested party communications with directors, a copy of which is available on the Company’s corporate website atwww.stillwatermining.com, under the heading “Governance/ Communication with Directors.”

Under the policy, shareholders and other interested parties may contact any member (or all members) of the Board (including, without limitation, the Chairman, Brian Schweitzer, or the independent directors as a group), any Board committee or any chair of any such committee by mail or email. To communicate with the Board, any individual director or any group or committee of directors, correspondence should be addressed to the Board or any such individual director or group or committee of directors by either name or title. All such correspondence should be sent to the Corporate Secretary, Stillwater Mining Company, 1321 Discovery Drive, Billings, Montana 59102. To communicate with any of the Company’s directors via email, shareholders should go to the Company’s corporate website atwww.stillwatermining.com. Under the heading “Governance/Communication with Directors,” you will find an on-line form that may be used for writing an electronic message to the Board, any individual director, or any group or committee of directors. Please follow the instructions on the Company’s website to send your message.

Director Compensation

Commencing on May 16, 2013, non-employee director retainers and meeting fees were reduced by 15% to the following amounts: each non-employee director receives an annual retainer of $55,250, which may be paid in cash or may be deferred in cash or Common Stock. In addition, the Company pays each non-employee director and committee member $2,125 per meeting of the Board attended and $1,275 per telephonic meeting in which he or she participated. The Chairman of the Board receives an additional annual retainer of $60,000; the Audit Committee chair receives an additional annual retainer of $17,000; the Compensation Committee chair receives an additional $12,750 annual retainer; and the other Committee chairs each receive additional annual retainers of $8,500. The Company reimburses all directors for reasonable travel expenses. The Company’s Stock Ownership Guidelines state that independent directors should own Common Stock having a value of at least two times their annual retainer. Pursuant to these guidelines, each Director is asked to comply with this new guideline by the fifth anniversary of his or her election to the Board. All Directors are in compliance with this guideline, and no Director has over five (5) years of service with the Company.

On the date of each annual meeting of shareholders, each non-employee director will receive a grant of Restricted Stock Units valued at $70,000, with restrictions that lapse (vest) upon the earlier of six months following the date of grant or the Director’s death, disability, retirement or a change in control of the Company.

15

A non-employee director may elect to defer all, or a portion, of their vested Restricted Stock Unit grant into the 2005 Non-Employee Directors’ Deferral Plan, in which case, upon receiving deferred shares, the non-employee director is credited additional “matching” deferred shares in the amount of 20% of the non-employee director’s deferred shares. Matching shares are fully vested, and non- forfeitable. Any Restricted Stock Units which have not vested will result in forfeiture, unless otherwise provided under the terms of the Restricted Stock Unit Agreement. The minimum deferral period is two (2) years.

Additionally, the 2005 Non-Employee Directors’ Deferral Plan allows independent directors to defer cash compensation for service as a director of the Company, and later receive such compensation in the form of cash or shares of Common Stock. If a Director elects to defer compensation and receive such compensation in the form of deferred shares of Common Stock, the number of shares such Director will be entitled to receive will be determined by dividing the amount of compensation deferred during such quarter by the fair market value of one share of Common Stock on the last day the stock traded before the end of such quarter. Upon receiving deferred shares of Common Stock, such Director’s account will be credited additional “matching” deferred shares in an amount equal to 20% of the number of deferred shares to which he or she is entitled pursuant to the calculation described above.

2013 DIRECTOR COMPENSATION

| | | | | | | | | | | | | | | | | | | | |

Name | | Fees

Earned or

Paid in

Cash

(1)($) | | | Stock

Awards

(2)($) | | | Option

Awards

(3)($) | | | All Other

Compensation

(4)($) | | | Total

($) | |

Brian Schweitzer (5) | | | 104,343 | | | | 69,993 | | | | — | | | | 13,862 | | | | 188,197 | |

Michael McMullen (5) | | | 70,827 | | | | 69,993 | | | | — | | | | | | | | 140,820 | |

Patrice E. Merrin (5,6) | | | 100,732 | | | | 69,993 | | | | — | | | | | | | | 170,724 | |

Michael S. Parrett | | | 152,586 | | | | 69,993 | | | | — | | | | 13,862 | | | | 236,440 | |

Charles R. Engles (5) | | | 100,192 | | | | 69,993 | | | | — | | | | 13,862 | | | | 184,047 | |

Gary A. Sugar (6) | | | 159,714 | | | | 69,993 | | | | — | | | | 13,862 | | | | 243,568 | |

George M. Bee | | | 118,568 | | | | 69,993 | | | | — | | | | 16,862 | | | | 205,423 | |

| (1) | Amounts include fees deferred in the form of Common Stock in the 2005 Non-Employee Directors’ Deferral Plan in the amount of $15,000 for George M. Bee. |

| (2) | Value is based on the grant date fair value in accordance with FASB ASC Topic 718 for Restricted Stock Units issued in 2013. These awards were granted with a six month vesting period, and vested pursuant to change in control requirements triggered by the retirement of Francis R. McAllister. |

| (3) | As of December 31, 2013 there were no option awards outstanding for any non-employee director. |

| (4) | Amounts include a 20% Company match, in the form of Company stock, on fees and stock awards deferred in the form of stock into the 2005 Non-Employee Directors’ Deferral Plan. The Company match is also deferred into the 2005 Non-Employee Directors’ Deferral Plan. |

| (5) | Elected to the Company’s board of directors, effective May 2, 2013. As of December 3, 2013, Mr.McMullen ceased receiving director fees. |

| (6) | Includes fees for adhoc Search Committee meetings. |

16

COMPENSATION DISCUSSION AND ANALYSIS

Introduction and Organization

This compensation discussion and analysis describes the analysis and decisions made and implemented in 2013 and 2014 to align our compensation practices with stated corporate goals. It further describes 2013 executive compensation for named executive officers (“NEOs”), who were:

| | • | | Francis R. McAllister, Former Chairman/Chief Executive Officer (Through June 7, 2013) |

| | • | | Michael J. McMullen, President and Chief Executive Officer (Effective December 3, 2013) |

| | • | | Gregory A. Wing, Vice President and Chief Financial Officer |

| | • | | Terrell I. Ackerman, Vice President, Corporate Development (And Interim Chief Executive Officer from June 7, 2013 until December 3, 2013) |

| | • | | Kevin G. Shiell, Vice President, Montana Mining Operations |

| | • | | Brent R. Wadman, Vice President, Legal Affairs and Corporate Secretary |

| | • | | Kristen K. Koss, Vice President, Human Resources and Safety & Health |

The compensation discussion and analysis is divided into the following sections:

Part 1: Response to May 2013 Say on Pay Vote and Summary of Executive Compensation Program Changes

Part 2: Changes to the 2014 Compensation Program

Part 3: 2013 Compensation Program, Philosophy, Elements and Decisions

Part 4: Other Compensation Related Items

PART 1:

RESPONSE TO MAY 2013 SAY ON PAY VOTE AND SUMMARY

OF EXECUTIVE COMPENSATION PROGRAM CHANGES

At the May 2013 annual meeting, Company shareholders did not provide majority support for NEO compensation, and elected four new directors and four incumbent directors. Subsequently, the Compensation Committee undertook a comprehensive review of executive compensation programs with the assistance of a new compensation consultant, Farient Advisors, LLC (Farient), engaged by the Compensation Committee in July 2013. During the fourth quarter of 2013, the Compensation Committee, Farient and management re-assessed the executive pay program, analyzed its linkages to business strategy and shareholder value creation, and considered feedback from proxy advisors.

The Compensation Committee examined:

| | • | | Criteria for peer group selection |

| | • | | Competitive assessment of compensation levels among peer companies, a survey of mining companies (all executives) and a survey of general industrial companies (non-operational executives) |

| | • | | Competitive assessment of executive compensation program design, including structure, pay mix, and performance measures |

| | • | | Pay and performance alignment |

| | • | | Governance considerations, including stock ownership guidelines, clawback policy, andchange-in-control arrangements |

| | • | | Feedback from proxy advisor firms and shareholder concerns |

17

Based on the Compensation Committee’s review of executive pay programs, the Company made material changes to its executive pay program for 2014. These changes were carefully considered after significant data collection, and careful study and analysis, with adoption completed in March 2014. As a result, the Summary Compensation Table will continue to show the results of the awards made prior to the 2014 changes, with the exception of pay for the new chief executive officer hired in December 2013, and a few other items introduced during the first half of 2013. These changes are summarized in the table below.

Summary of Changes to the Executive Compensation Program 2013 vs. 2014

| | | | |

Pay Design | | 2013 Compensation Program | | 2014 Compensation Program |

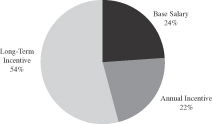

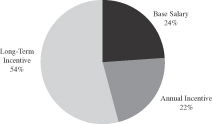

| Pay Positioning | | * Salary/annual incentive at 50th percentile * LTI between 50th and 75th percentile | | * Total direct compensation (salary + annual incentive + LTI) at 50th percentile * No increases to salary or annual incentive targets for NEOs |

| | |

| Peer Groups and Survey Sources | | * Median peer size of» $1.5 billion revenue, or» 2x our annual revenue at time of peer group review * Survey data from TowersWatson Top Management Compensation Survey Report and two Pearl Meyer proprietary general industry surveys | | * For pay purposes: Compensation Peer Group selection criteria revised Compensation Peer Group median at» $700 million revenue, close to our annual revenue of» $1 billion (as of most recent fiscal year end at time of analysis 12/31/12) Survey data adjusted to our approximate annual revenue (mining and general industry surveys) * For stock price/total shareholder return performance purposes: Performance Peer Group established to be a better fit with Stillwater’s business ( PGM producer with smelting/recycling) Performance Peer Group is subset of Compensation Peer Group, reducing proportion of gold producers and adding PGM and recycling producers * PGM and recycling companies were too large and/or non-U.S.Canada domiciled; therefore not appropriate as Compensation/Peer Group |

| | |

| Long-Term Incentive Mix | | * 100% Performance restricted stock units (RSUs) based on prior 1-year performance | | * Two LTI measures: Performance RSUs based on prospective 3-year performance Time-vesting RSUs (provides tangible value in volatile industry) * Weighting: CEO, CFO, VP of Mining Operations, VP of Business Development = 70% Performance RSUs, 30% time-vesting RSUs Other NEOs/Officers = 60% Performance RSUs, 40% time-vesting RSUs |

18

| | | | |

Pay Design | | 2013 Compensation Program | | 2014 Compensation Program |

| Incentive Plan Payout Leverage | | * Annual incentive payouts: Threshold at 50% of target payout Maximum at 200% of target payout * Performance RSUs payouts: Threshold at 50% of target payout Maximum at 150% of target payout | | * Annual incentive payouts: Same threshold and maximum For CEO only, amount >120% of target payout delivered in time-vesting RSUs with additional 3-year ratable vesting * Performance RSUs payouts: Threshold at 25% of target payout Maximum at 175% of target payout |

| | |

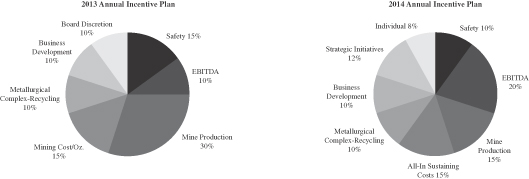

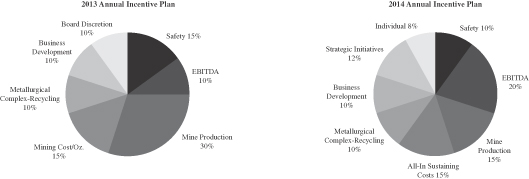

| Annual Incentive Performance Measures | | Annual scorecard: * 15% Safety * 10% EBITDA * 30% Mine Production * 15% Mining Costs per Ounce * 10% Metallurgical Complex-Recycling (Production, Furnace re-build, Slag recovery improvement * 10% Business Development * 10% Board Discretion | | Key annual scorecard changes noted in italics: * 10% Safety * 20% EBITDAearnings weighting increase * 15% Mine Production * 15% All-In Sustaining Costs per Ounce total Company cost per ounce * 10% Metallurgical Complex-Recycling (EBTDA, Production, Costs)add earnings and cost measures * 10% Business Development * 12% Strategic Initiatives replaces Board Discretion measure * 8% Individual Performanceadditional measure |

| | |

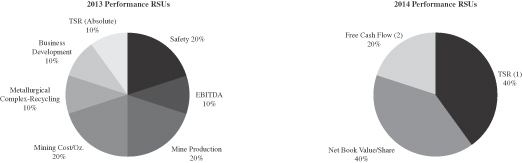

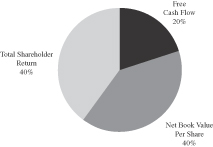

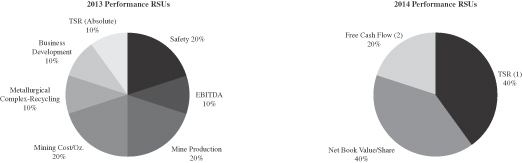

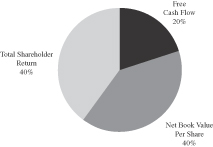

LTI Performance Measures for Performance RSUs | | Performance RSUs scorecard, measures largely same as annual scorecard: * 20% Safety * 10% EBITDA * 20% Mine Production * 20% Mining Costs * 10% Metallurgical Complex-Recycling * 10% Business Development * 10% Total Shareholder Return (absolute goal) | | New Performance RSUs scorecard measures focus on ties to shareholder outcomes, financial measures, and long-term strategic measures: * 40% Total Shareholder Return (peer relative, absolute, PGM price change relative) Measure starting and ending stock price using a60-trading-day average stock price Measure starting and ending PGM price using a60-trading-day average price * 40% Net Book Value Per Share * 20% Free Cash Flow |

| | |

Determining # of Shares to Grant | | * 90-trading day closing stock price average to convert LTI value to number of shares to grant | | * 60-trading-day average stock price to convert LTI value to number of shares to grant |

| | |

| Risk Mitigators | | * Ownership guidelines added in early 2013 * Clawback policy introduced in early 2013 * Anti-hedging policy | | * Ownership guidelines revised to reflect peer practices * Clawback policy generally consistent with Dodd-Frank guidelines * No change to anti-hedging policy |

19

| | | | |

Pay Design | | 2013 Compensation Program | | 2014 Compensation Program |

| Change-in- Control | | * Reasonable change-in-control severance multiples of salary and annual incentive: Former CEO at 3x CFO and VP Business Development at 1.5x * No 280G tax gross-ups for new officers * Cash double trigger, equity single trigger | | * New CEO has severance multiple of 2x salary and annual incentive with or without a change-in-control (1) * No change to change-in-control severance multiples for CFO and VP Corporate Development * New CEO hired without 280G tax gross-ups, per policy * Double triggers now required on equity grants as well as cash |

| (1) | Per New CEO employment agreement entered into upon hiring in December 2013. |

PART 2:

CHANGES TO THE 2014 COMPENSATION PROGRAM

For 2014, the Company redesigned its compensation programs to better align compensation practices with the Company’s short-term and long-term goals and taking into account industry characteristics (e.g., commodity-priced mining product, capital intensive, long-term assets), current operational situation, and strategic alternatives as determined by our new CEO and the management team. Accordingly, for 2014 incentive programs, focus on financial performance measures and total shareholder return was increased, while maintaining a strong emphasis on key operational drivers of shareholder value (e.g., production and cost), and providing for specific strategic measures in the annual incentive that are key to driving the long-term success of the Company.

2014 Pay Positioning Philosophy, Peer Group and Market Data

For 2014 pay decisions, the Compensation Committee adopted an approach to positioning overall target pay generally at the 50th percentile of competitive levels, with individual variation reflecting incumbent experience and responsibilities in the role. Competitive pay levels were benchmarked in comparison to the revised Compensation Peer Group established in the fourth quarter of 2013 and market surveys of executive compensation. The revised Compensation Peer Group reflects as closely as possible our relevant industry, business model and size, and data from the compensation surveys is selected to be representative of our size of approximately $1.04 billion in revenue.

To determine appropriate competitive benchmarks, the Compensation Committee considered the following criteria for peer selection:

| | • | | GICS sub-industry classification of “Diversified Metals,” “Gold,” or “Precious Metals and Minerals,” revenue approximately between $300 million and $3 billion (roughly 0.3x to 3.0x Stillwater’s projected 2013 revenue) |

| | • | | Consideration of market cap (qualitative assessment) |

| | • | | U.S or Canadian domiciled company |

| | • | | As similar a business model as possible, given the scarcity of PGM producing companies outside of South Africa and Russia |

| | • | | Currently operating at least one mine |

| | • | | Underground mining operations, where possible |

| | • | | Harvesting metals for industrial end users |

20

This assessment resulted in a revised Compensation Peer Group with revenue ranging from $215 million to $2.3 billion, with median revenue of approximately $700 million (based on latest available fiscal year end revenue through June 30, 2013). The revised peer group included the following companies:

2013 Compensation Peer Group Used for 2014 Pay Decisions

| | |

| Agnico Eagle Mines Ltd * | | Hecla Mining Co |

| Allied Nevada Gold Corp * | | Horsehead Holding Corp * |

| B2Gold Corp * | | HudBay Minerals, Inc * |

| Capstone Mining Corp * | | IAMGOLD Corp |

| Coeur Mining, Inc | | New Gold, Inc * |

| Compass Minerals Intl * | | Osisko Mining Corp * |

| Eldorado Gold Corp * | | Pan American Silver Corp * |

| First Majestic Silver Corp * | | Thompson Creek Metals Co * |

| Golden Star Resources, Ltd | | Yamana Gold, Inc. * |

| * | New additions to 2013 Compensation Peer Group. |

Six (6) companies from the 2012 peer group were eliminated from the 2013 Compensation Peer Group because they did not meet the screening criteria, as follows:

| | |

Companies | | Reasons for Elimination |

Cliffs Natural Resources, Inc. Gold Fields Limited Goldcorp, Inc. Kinross Gold Corporation | | Too large, revenue for each greater than the $3 billion upper revenue screen |

| |

| North American Palladium Ltd | | Too small, revenue significantly less than the $300 million lower revenue screen Concerns about some of its performance issues at time of peer group review |

| |

| Randgold Resource Limited | | Domiciled outside the U.S or Canada, in the Channel Islands |

In addition to the 2013 Compensation Peer Group, two surveys were used to set pay for 2014. Data from the 2013 Equilar Mining Survey was used as part of benchmarking for all NEO positions. Data from the 2012 Mercer U.S. Executive Benchmark Database was used for non-operational positions only.

The 2013 Compensation Peer Group was used along with survey data to benchmark 2014 pay for our chief executive officer, chief financial officer, vice president of corporate development, and the vice president of mining operations. Peer data was weighted more heavily, at 75%, than survey data, at 25%, because the Compensation Peer Group’s composition was based on the Compensation Committee’s approved selection criteria, and there was greater control over analysis considerations for the Compensation Peer Group data than for the survey data. Survey data alone was used for the other NEOs whose positions were not well represented among the NEOs of the Compensation Peer Group. For the pay level analysis, the Compensation Peer Group companies’ pay data and the survey pay data were size-adjusted, where necessary, to reflect a similar level of revenue as that for Stillwater.

21

Competitive Data Sources and Weighting to Benchmark 2014 Pay

| | | | | | | | | | | | |

Position | | Compensation

Peer Group | | | Equilar

Survey | | | Mercer

Survey | |

Chief Executive Officer Vice President, Corporate Development

Vice President, Montana Mining Operations | | | 75 | % | | | 25 | % | | | 0 | % |

| | | |

| Chief Financial Officer | | | 75 | % | | | 12.5 | % | | | 12.5 | % |

| | | |

| Vice President Legal Affairs and Corporate Secretary Vice President, Human Resources and Safety & Health | | | 0 | % | | | 50 | % | | | 50 | % |

As a result of this benchmarking and the general mining industry economic environment, base salaries and target annual incentives for our NEOs did not increase for 2014. Further, since our new chief executive officer was hired in December 2013, his salary and target annual incentive were determined at that time based on the 2013 Compensation Peer Group and the above-referenced surveys, and were intended as the pay level for 2014 as well.

To assess competitive practices with respect to executive compensation program design, data from the above peer group was analyzed. This information was augmented by data from five “general reference” mining companies that were too large to be included in the Compensation Peer Group for purposes of determining compensation levels. Freeport McMoRan Copper & Gold and Newmont Mining Corporation have been used in this capacity in the past, and the other three companies were added as general references for 2014 after their removal from the revised peer group due to size.

2013 General Reference Mining Companies for Program Design

| | |

| Cliffs Natural Resources Inc. | | Kinross Gold Corp |

| |

| Freeport McMoRan Copper & Gold | | Newmont Mining Corporation |

| |

| Goldcorp Ind. | | |

2014 Performance Peer Group

For purposes of assessing Total Shareholder Return (TSR) performance in comparison to peers, the Company established a Performance Peer Group to be a better fit with Stillwater’s business characteristics (a PGM producer with smelting and recycling operations). The Performance Peer Group has eleven of the same companies as the Compensation Peer Group, plus three other companies that are PGM producers and/or have recycling operations. These three other companies were too large and/or non-U.S./Canada domiciled to be an appropriate fit as members of the Compensation Peer Group. The reason for removing the other seven companies was to reduce the proportion of gold producers. This is important because PGM prices can move quite differently from gold prices, and thus distort relative TSR performance. The resulting composition of the Performance Peer Group reflects a more balanced exposure to various metals. The Performance Peer Group is shown below.

Performance Peer Group to be Used for the Performance RSUs Going Forward

| | |

| Allied Nevada Gold Corp | | IAMGOLD Corp |

| Capstone Mining Corp | | Impala Platinum Holdings Ltd * |

| Coeur Mining, Inc | | Johnson Matthey PLC * |

| Compass Minerals Intl | | Pan American Silver Corp |

| First Majestic Silver Corp | | Thompson Creek Metals Co |

| Hecla Mining Co | | Umicore S.A. * |

| HudBay Minerals, Inc | | Yamana Gold, Inc. |

| * | The three peers added for the Performance Peer Group only. |

22

2014 Incentive Program Design

For 2014, we are strengthening the link between pay and performance by modifications to the incentive program design. First, we changed the mix of our long-term incentive vehicles to have two vehicles instead of one, continuing with the performance RSUs that now vest based on achievement of prospective three-year performance goals instead of one-year goals and adding a lesser proportion of time-vesting RSUs. Second, we modified the CEO’s annual incentive above- target payout to require that part of it be paid out in time-vesting RSUs, and adjusted the performance RSUs’ threshold and maximum payouts for all NEOs and officers to increase the tie to shareholder value changes. Third, we altered the weightings for some of our performance measures, and changed some of the others to emphasize direct links to shareholder outcomes.

Long-Term Incentive Mix

We are improving the structure of our long-term incentives for 2014 with the modification of the performance RSUs to vest based on prospective three-year performance. This eliminates the historic approach that reflected only one year of performance and performance RSU pay based largely on the same measures as for the annual incentive.

The performance RSUs for 2014 are intended to be annual grants, generally granted in the first quarter of our fiscal year. The performance period for the performance RSUs will be three years, and a new performance cycle will start each year. Performance measures and goals will be set at the beginning of the performance period, and the number of units vesting will be based on achievement of those performance goals.

We are also providing a time-vesting RSU component as part of the total LTI mix for 2014 that is proportionally smaller than the performance RSU component. Like the performance RSUs, the time-vesting RSUs are intended to be annual grants, generally granted in the first quarter of our fiscal year. The time-vesting RSUs will vest ratably over three years.

The performance RSUs going forward are intended to create a direct link to shareholder value outcomes and to reward management for long-term value creation. The time-vesting RSUs have a less direct link to shareholder value outcomes, and are intended to provide a smaller portion of tangible value in a volatile industry where management has little control over the pricing of its commodity product.

The 2014 LTI mix and vesting time horizon are consistent with typical peer practices, as most peers use a “portfolio approach” to LTI vehicles. The proportion of performance RSUs is aligned with the overall responsibility and ability to influence performance outcomes, with the largest proportion for the CEO.

The following table summarizes the overall changes made to the LTI mix:

Long-Term Incentive Mix

2013 vs. 2014

| | | | | | | | | | | | | | |

| | | | | 2013 | | | 2014 | |

Long-Term Incentive Vehicle | | Time Horizon | | All

Participants | | | CEO, CFO,

VP Mining

Operations,

VP Corporate

Development | | | Other

NEOs/

Officers | |

Performance RSUs— Prospective 3-Year Performance | | 3-year prospective performance period, cliff vesting | | | NA | | | | 70 | % | | | 60 | % |

| Time-Vesting RSUs | | 3-year ratable vesting | | | NA | | | | 30 | % | | | 40 | % |

Performance RSUs— Prior 1-Year Performance | | Prior 1-year performance period, 3-year ratable vesting | | | 100 | % | | | NA | | | | NA | |

23

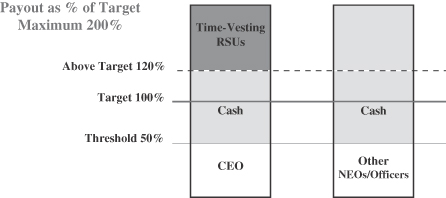

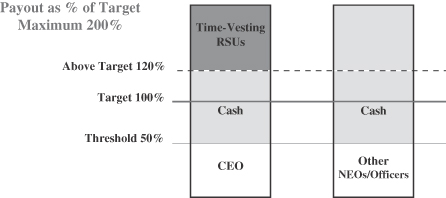

Incentive Plan Payout Leverage

The 2014 annual incentive threshold and maximum payouts, at 50% and 200% of target payouts, respectively, are unchanged from 2013, whereas the 2014 performance RSUs threshold and maximum payouts have more downside and upside leverage than those for 2013. For the 2014 performance RSUs, the decrease in the threshold payout to 25% and the increase in the maximum payout to 175% are intended to further align pay and performance. The 2014 annual incentive payout leverage and the new 2014 payout leverage for the performance RSUs are consistent with typical peer practices.

Annual Incentive and Performance RSUs Plan Payout Leverage

2013 vs. 2014

| | | | | | | | | | | | |

Performance Achievement | | Annual Incentive Payouts

As a % of Target Payout | | | Performance RSUs Payouts

As a % of Target Payout | |

| | | 2013 & 2014 | | | 2013 | | | 2014 | |

Maximum | | | 200 | % | | | 150 | % | | | 175 | % |

Target | | | 100 | % | | | 100 | % | | | 100 | % |