| | |

| UNITED STATES

SECURITIES AND EXCHANGE COMMISSION |

| | |

| CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

|

| | |

| Investment Company Act file number: | (811-07237) |

| | |

| Exact name of registrant as specified in charter: | Putnam Investment Funds |

| | |

| Address of principal executive offices: | One Post Office Square, Boston, Massachusetts 02109 |

| | |

| Name and address of agent for service: | Robert T. Burns, Vice President

One Post Office Square

Boston, Massachusetts 02109 |

| | |

| Copy to: | Bryan Chegwidden, Esq.

Ropes & Gray LLP

1211 Avenue of the Americas

New York, New York 10036 |

| | |

| Registrant's telephone number, including area code: | (617) 292-1000 |

| | |

| Date of fiscal year end: | August 31, 2018 |

| | |

| Date of reporting period: | September 1, 2017 — February 28, 2018 |

| | |

|

Item 1. Report to Stockholders: | |

| | |

| The following is a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act of 1940: | |

Putnam PanAgora

Market Neutral

Fund

Semiannual report

2 | 28 | 18

Consider these risks before investing: There can be no assurance that the fund’s strategies will achieve any particular level of return. The fund’s allocation of assets may hurt performance, and efforts to generate returns under different market conditions and over different time horizons may be unsuccessful. Quantitative models or data may be incorrect or incomplete, and reliance on those models or data may not produce the desired results. Stock and bond prices may fall or fail to rise over time for several reasons, including general financial market conditions, changing market perceptions (including, in the case of bonds, perceptions about the risk of default and expectations about monetary policy or interest rates), changes in government intervention in the financial markets, and factors related to a specific issuer or industry. These and other factors may also lead to increased volatility and reduced liquidity in the fund’s portfolio holdings. Investments in small and/or midsize companies increase the risk of greater price fluctuations. Bond investments in which the fund invests (or has exposure to) are subject to interest-rate risk and credit risk. Interest-rate risk is generally greater for longer-term bonds, and credit risk is generally greater for below-investment-grade bonds. Risks associated with derivatives (including “short” derivatives) include losses caused by unexpected market movements (which are potentially unlimited), imperfect correlation between the price of the derivative and the price of the underlying asset, increased investment exposure (which may be considered leverage), the potential inability to terminate or sell derivatives positions, the potential need to sell securities at disadvantageous times to meet margin or segregation requirements, the potential inability to recover margin or other amounts deposited from a counterparty, and the potential failure of the other party to the instrument to meet its obligations. Leveraging can result in volatility in the fund’s performance and losses in excess of the amounts invested. International investing involves certain risks, such as currency fluctuations, economic instability, and political developments. Exposure to REITs subjects the fund to the risks associated with direct ownership in real estate, including economic downturns that have an adverse effect on real estate markets. By investing in open-end or closed-end investment companies and ETFs, the fund is indirectly exposed to the risks associated with direct ownership of the securities held by those investment companies or ETFs. Certain investments are not as readily traded as conventional securities, and the fund may be unable to sell these investments when it considers it desirable to do so. Frequent trading may cause the fund to experience increased brokerage commissions and other transaction costs, and the fund may be more likely to realize capital gains that must be distributed to shareholders as taxable ordinary income. You can lose money by investing in the fund.

Message from the Trustees

April 20, 2018

Dear Fellow Shareholder:

After an extended period of record advances and low volatility, the U.S. stock market encountered some challenges in early 2018. Following several turbulent days, the S&P 500 Index entered correction territory on February 8, 2018, closing more than 10% below its January 2018 peak. Global stock and bond markets have also struggled as concerns grow about rising inflation and interest rates.

While declines like this can be unsettling, seasoned investors recognize that they are natural and ultimately can restore balance in the financial markets. In this changing environment, Putnam’s experienced investment professionals continue to monitor risks and seek opportunities. They take a research-intensive approach to investing that includes risk management strategies designed to serve investors in all types of markets.

As always, we believe investors should maintain a well-diversified portfolio, think about long-term goals, and speak regularly with their financial advisors. In the following pages, you will find an overview of your fund’s performance for the reporting period as well as an outlook for the coming months.

Thank you for investing with Putnam.

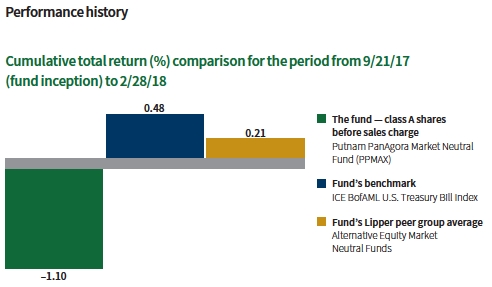

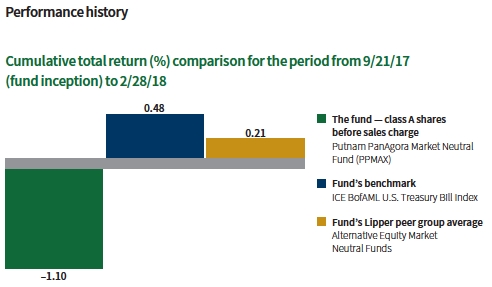

Current performance may be lower or higher than the quoted past performance, which cannot guarantee future results. Share price, principal value, and return will fluctuate, and you may have a gain or a loss when you sell your shares. Performance of class A shares assumes reinvestment of distributions and does not account for taxes. Fund returns in the bar chart do not reflect a sales charge of 5.75%; had they, returns would have been lower. See below and pages 7–8 for additional performance information. For a portion of the period, the fund had an expense limitation, without which the return would have been lower. To obtain the most recent month-end performance, visit putnam.com.

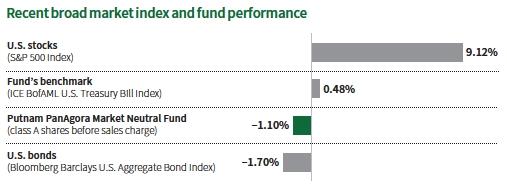

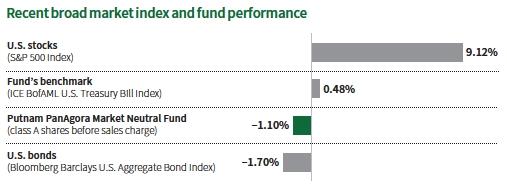

This comparison shows your fund’s performance in the context of broad market indexes for the period from 9/21/17 (commencement of operations) to 2/28/18. See above and pages 7–8 for additional fund performance information. Index descriptions can be found on pages 11–12.

The short-term results of a relatively new fund are not necessarily indicative of its long-term prospects.

|

| 2 PanAgora Market Neutral Fund |

George D. Mussalli, CFA

Portfolio Manager

George is Chief Investment Officer and Head of Equity Research at PanAgora Asset Management. He has an M.B.A. from Sloan School of Business at the Massachusetts Institute of Technology and a B.S. from Tufts University. George joined PanAgora in 2004 and has been in the investment industry since 1995.

Richard Tan, CFA

Portfolio Manager

Richard is a Director in the Equity group at PanAgora Asset Management. He has an M.B.A. from Boston College Carroll School of Management, an M.S. in Computer Science from Rutgers University, and a B.A. from Shanghai Jiao Tong University. Richard joined PanAgora in 2008 and has been in the investment industry since 1997.

How was the investing environment during the reporting period?

Global equities performed strongly between September 2017 and late January 2018, reaching new highs in most markets. However, the upward trend was abruptly halted in February as investors reacted to a more hawkish than expected U.S. Federal Reserve meeting. Expectations quickly moved to price in four anticipated Fed interest-rate hikes for 2018, up from the previous expectation for three. Stocks corrected, with most of the major indexes declining by 5% or more, in early February. Investor expectations shifted toward a tightening of monetary policy in Europe, pushing equities, sovereign bonds, and commodities lower in February.

For the reporting period, several major global regions posted strong equity returns. U.S. equities performed best, with the S&P 500 Index gaining 9.12%. Emerging markets were second, with the MSCI Emerging Markets Index [ND] returning 8.04%, followed by developed non-U.S. markets, which gained 3.69% as measured by the MSCI World ex-U.S. Index [ND]. Within the United States, large-cap stocks outperformed small-caps, with the Russell 2000 Index gaining 5.21% compared with an

|

| PanAgora Market Neutral Fund 3 |

Global composition

| | | |

| | LONG (%) | SHORT (%) | NET (%) |

| North America | 142.5% | –134.0% | 8.5% |

| Emerging Markets | 20.1 | –18.0 | 2.1 |

| Asia Pacific ex-Japan | 15.3 | –13.3 | 2.0 |

| Continental Europe | 48.8 | –47.6 | 1.2 |

| Central America | 0.6 | –0.3 | 0.3 |

| Japan | 15.2 | –15.3 | –0.1 |

| United Kingdom | 8.7 | –9.7 | –1.0 |

| Middle East | 0.0 | –1.2 | –1.2 |

| Total | 251.2 | –239.4 | 11.8 |

The table shows the fund’s long and short exposures in each country or region and the percentage of the fund’s net assets that each represented as of 2/28/18. Allocations will not total 100% because the table reflects the notional value of derivatives (the economic value for purposes of calculating periodic payment obligations), in addition to the market value of securities. Holdings and allocations may vary over time.

_________________________________________________________________________________________________________________________________________________________________________________________________________________________

increase of 8.86% for the Russell 1000 Index for the period.

After posting gains in the second half of 2017, bonds stumbled out of the gate to begin 2018. Several segments of the bond market posted negative returns in January and February. Treasury yields, especially at the longer maturities of the yield curve, rose at the start of 2018 and continued to rally. The jump in yields and selloff in bonds were largely fueled by signs of economic expansion and expectations of additional Fed rate hikes in 2018. Non-U.S. developed market government bond yields took their cues from the United States and rose at the start of the year, albeit at a slower pace. In the eurozone, sovereign bonds fared better as the European economy had not heated up as fast as its U.S. counterpart, and rising inflation had been less pronounced.

How did the fund perform for the period?

The fund returned –1.10% at net asset value for the period. The long-term portfolio declined 0.24%, with most of the underperformance coming from swap contracts of large-capitalization stocks in developed international markets. This was largely due to weakness in Europe, where companies with low profitability and

unstable earnings outperformed. The model fared much better in the United States, contributing positively to performance for the period. Intermediate-term strategies detracted 0.38%, while short-term strategies contributed 0.51%. Fund performance was primarily driven by stock selection achieved through swap contracts rather than by underlying sectors or industry allocations within the swaps.

What strategies or positions detracted from performance for the period?

Selection of swap contracts with stock exposure in information technology, energy, and consumer staples detracted from returns. Declines in information technology were concentrated in the software and services industry. In the energy sector, rising oil prices caused weaker energy companies to outperform, resulting in losses among the portfolio’s short positions. Examples included Pioneer Natural Resources and Helmerich & Payne. The stocks of these energy companies, which ranked poorly in our proprietary models, rallied during the period. Swap contracts with stocks that were selected in consumer staples was hurt by a short position in Snyder’s-Lance, which was acquired by Campbell Soup Co. We sold our position in Campbell Soup in the period.

|

| 4 PanAgora Market Neutral Fund |

Intermediate strategies detracted due to U.S. merger arbitrage-related trades.

What strategies or positions contributed to performance?

Exposure in financials and materials through swap contracts helped performance during the period. Within financials, our proprietary insurance model contributed positively, particularly long swap positions in Old Mutual and Reinsurance Group of America. We sold our position in Old Mutual during the period. In the materials sector, several long swap positions in metals and mining companies performed well. Short-term strategies contributed 0.51%, due in part to index reconstitution-related trades.

What is your outlook for the coming months?

The fund’s investment strategies are designed to derive uncorrelated returns purely from alpha generation rather than from market risk. The fund is designed to generate attractive absolute returns under different market conditions and, over time, different horizons. The combination of a diversified set of strategies that have low correlation to one another — rather than relying on one individual strategy — is designed to result in more stable returns over time.

The majority of the fund’s allocation is within the long-term portfolio, which utilizes fundamentally based signals applied across a broad universe of stocks, and is designed to provide the majority of return over a market cycle. We believe intermediate- and short-term strategies can provide additional alpha based on the number of corporate and market events.

Thank you, George and Richard, for your time and insights today.

ABOUT DERIVATIVES

Derivatives are an increasingly common type of investment instrument, the performance of which is derived from an underlying security, index, currency, or other area of the capital markets. Derivatives employed by the fund’s managers generally serve one purpose: to take long or short position in equity securities.

For example, the fund’s managers may use derivatives, such as total return swaps, to take long or short positions in equity securities. The fund may also use derivatives as a substitute for a direct investment in the securities of one or more issuers.

Like any other investment, derivatives may not appreciate in value and may lose money. Derivatives may amplify traditional investment risks through the creation of leverage and may be less liquid than traditional securities. And because derivatives typically represent contractual agreements between two financial institutions, derivatives entail “counterparty risk,” which is the risk that the other party is unable or unwilling to pay. PanAgora monitors the counterparty risks we assume. For example, PanAgora often enters into collateral agreements that require the counterparties to post collateral on a regular basis to cover their obligations to the fund. Counterparty risk for exchange-traded futures and centrally cleared swaps is mitigated by the daily exchange of margin and other safeguards against default through their respective clearinghouses.

|

| PanAgora Market Neutral Fund 5 |

The opinions expressed in this article represent the current, good-faith views of the author(s) at the time of publication, are provided for limited purposes, are not definitive investment advice, and should not be relied on as such. The information presented in this article has been developed internally and/or obtained from sources believed to be reliable; however, PanAgora Asset Management, Inc. (PanAgora) does not guar -antee the accuracy, adequacy, or completeness of such information. Predictions, opinions, and other information contained in this article are subject to change continually and without notice of any kind and may no longer be true after the date indicated. As with any investment there is a potential for profit as well as the possibility of loss.

Past performance is not a guarantee of future results. Any forward-looking statements speak only as of the date they are made, and PanAgora assumes no duty to and does not undertake to update forward-looking statements. Forward-looking statements are subject to numerous assumptions, risks, and uncertainties, which change over time. Actual results could differ materially from those anticipated in forward-looking statements. This material is directed exclusively at investment professionals. Any investments to which this material relates are available only to or will be engaged in only with investment professionals.

|

| 6 PanAgora Market Neutral Fund |

Your fund’s performance

This section shows your fund’s performance, price, and distribution information for the reporting period from September 21, 2017 (the fund’s commencement of operations) through February 28, 2018, the end of the first half of its current fiscal year. In accordance with regulatory requirements for mutual funds, we also include performance information as of the most recent calendar quarter-end and expense information taken from the fund’s current prospectus. Performance should always be considered in light of a fund’s investment strategy. Data represent past performance. Past performance does not guarantee future results. More recent returns may be less or more than those shown. Investment return and principal value will fluctuate, and you may have a gain or a loss when you sell your shares. Performance information does not reflect any deduction for taxes a shareholder may owe on fund distributions or on the redemption of fund shares. For the most recent month-end performance, please visit the Individual Investors section at putnam.com or call Putnam at 1-800-225-1581. Class R, R6, and Y shares are not available to all investors. See the Terms and definitions section in this report for definitions of the share classes offered by your fund.

Fund performance Total return for the life-of-fund period ended 2/28/18

| |

| (inception dates) | Life of fund |

| Class A (9/21/17) | |

| Before sales charge | –1.10% |

| After sales charge | –6.79 |

| Class B (9/21/17) | |

| Before CDSC | –1.50 |

| After CDSC | –6.43 |

| Class C (9/21/17) | |

| Before CDSC | –1.50 |

| After CDSC | –2.49 |

| Class M (9/21/17) | |

| Before sales charge | –1.30 |

| After sales charge | –4.75 |

| Class R (9/21/17) | |

| Net asset value | –1.30 |

| Class R6 (9/21/17) | |

| Net asset value | –1.00 |

| Class Y (9/21/17) | |

| Net asset value | –1.00 |

Current performance may be lower or higher than the quoted past performance, which cannot guarantee future results. After-sales-charge returns for class A and M shares reflect the deduction of the maximum 5.75% and 3.50% sales charge, respectively, levied at the time of purchase. Class B share returns after contingent deferred sales charge (CDSC) reflect the applicable CDSC, which is 5% in the first year, declining over time to 1% in the sixth year, and is eliminated thereafter. Class C share returns after CDSC reflect a 1% CDSC for the first year that is eliminated thereafter. Class R, R6, and Y shares have no initial sales charge or CDSC.

For a portion of the period, the fund had an expense limitation, without which returns would have been lower. The short-term results of a relatively new fund are not necessarily indicative of its long-term prospects.

|

| PanAgora Market Neutral Fund 7 |

Comparative index returns For the period ended 2/28/18

| |

| | Life of fund |

| | (since 9/21/17) |

| ICE BofAML U. S. Treasury Bill Index | 0.48% |

| Lipper Alternative Equity Market Neutral Funds | |

| category average* | 0.21 |

Index and Lipper results should be compared with fund performance before sales charge, before CDSC, or at net asset value.

* Over the life-of-fund period ended 2/28/18, there were 109 funds in this Lipper category.

Fund price and distribution information For the life-of-fund period ended 2/28/18

| | | | | | | | | |

| | Class A | Class B | Class C | Class M | Class R | ClassR6 | Class Y |

| | Before | After | Net | Net | Before | After | Net | Net | Net |

| | sales | sales | asset | asset | sales | sales | asset | asset | asset |

| Share value | charge | charge | value | value | charge | charge | value | value | value |

| 9/21/17* | $10.00 | $10.61 | $10.00 | $10.00 | $10.00 | $10.36 | $10.00 | $10.00 | $10.00 |

| 2/28/18 | 9.89 | 10.49 | 9.85 | 9.85 | 9.87 | 10.23 | 9.87 | 9.90 | 9.90 |

The classification of distributions, if any, is an estimate. Before-sales-charge share value and current dividend rate for class A and M shares, if applicable, do not take into account any sales charge levied at the time of purchase. After-sales-charge share value, current dividend rate, and current 30-day SEC yield, if applicable, are calculated assuming that the maximum sales charge (5.75% for class A shares and 3.50% for class M shares) was levied at the time of purchase. Final distribution information will appear on your year-end tax forms.

The fund made no distributions during the period.

* Inception date of the fund.

Fund performance as of most recent calendar quarter Total return for the periods ended 3/31/18

| | |

| (inception dates) | Life of fund | 6 months |

| Class A (9/21/17) | | |

| Before sales charge | –2.80% | –2.31% |

| After sales charge | –8.39 | –7.93 |

| Class B (9/21/17) | | |

| Before CDSC | –3.20 | –2.71 |

| After CDSC | –8.04 | –7.58 |

| Class C (9/21/17) | | |

| Before CDSC | –3.20 | –2.71 |

| After CDSC | –4.17 | –3.69 |

| Class M (9/21/17) | | |

| Before sales charge | –3.10 | –2.61 |

| After sales charge | –6.49 | –6.02 |

| Class R (9/21/17) | | |

| Net asset value | –2.90 | –2.41 |

| Class R6 (9/21/17) | | |

| Net asset value | –2.70 | –2.21 |

| Class Y (9/21/17) | | |

| Net asset value | –2.70 | –2.21 |

See the discussion following the fund performance table on page 7 for information about the calculation of fund performance.

|

| 8 PanAgora Market Neutral Fund |

Your fund’s expenses

As a mutual fund investor, you pay ongoing expenses, such as management fees, distribution fees (12b-1 fees), and other expenses. During the period from 9/21/17 (the fund’s commencement of operations) to 2/28/18, your fund’s expenses were limited; had expenses not been limited, they would have been higher. Using the following information, you can estimate how these expenses affect your investment and compare them with the expenses of other funds. You may also pay one-time transaction expenses, including sales charges (loads) and redemption fees, which are not shown in this section and would have resulted in higher total expenses. For more information, see your fund’s prospectus or talk to your financial representative.

Expense ratios

| | | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class R6 | Class Y |

| Estimated net expenses for the fiscal | | | | | | | |

| year ended 8/31/17*† | 1.90% | 2.65% | 2.65% | 2.40% | 2.15% | 1.55% | 1.65% |

| Estimated total annual operating | | | | | | | |

| expenses for the fiscal year | | | | | | | |

| ended 8/31/17* | 2.29% | 3.04% | 3.04% | 2.79% | 2.54% | 1.94% | 2.04% |

| Annualized expense ratio from 9/21/17 | | | | | | | |

| (commencement of operations) | | | | | | | |

| to 2/28/18 | 1.81% | 2.56% | 2.56% | 2.31% | 2.06% | 1.56% | 1.56% |

Fiscal-year expense information in this table is taken from the most recent prospectus, is subject to change, and may differ from that shown for the annualized expense ratio and in the financial highlights of this report.

Expenses are shown as a percentage of average net assets.

* Other expenses are based on estimated amounts for the current fiscal year.

† Reflects Putnam Management’s contractual obligation to limit certain fund expenses through 12/30/18.

Expenses per $1,000

The following table shows the expenses you would have paid on a $1,000 investment in each class of the fund from 9/21/17 (commencement of operations) to 2/28/18. It also shows how much a $1,000 investment would be worth at the close of the period, assuming actual returns and expenses.

| | | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class R6 | Class Y |

| Expenses paid per $1,000 *† | $7.94 | $11.21 | $11.21 | $10.12 | $9.03 | $6.85 | $6.85 |

| Ending value (after expenses) | $989.00 | $985.00 | $985.00 | $987.00 | $987.00 | $990.00 | $990.00 |

* Expenses for each share class are calculated using the fund’s annualized expense ratio for each class, which represents the ongoing expenses as a percentage of average net assets for the period from 9/21/17 (inception date of the class) to 2/28/18. The expense ratio may differ for each share class.

† Expenses are calculated by multiplying the expense ratio by the average account value for the period; then multiplying the result by the number of days in the period; and then dividing that result by the number of days in the year.

|

| PanAgora Market Neutral Fund 9 |

Estimate the expenses you paid

To estimate the ongoing expenses you paid for the period from 9/21/17 (commencement of operations) to 2/28/18, use the following calculation method. To find the value of your investment on 9/21/17, call Putnam at 1-800-225-1581.

Compare expenses using the SEC’s method

The Securities and Exchange Commission (SEC) has established guidelines to help investors assess fund expenses. Per these guidelines, the following table shows your fund’s expenses based on a $1,000 investment, assuming a hypothetical 5% annualized return. You can use this information to compare the ongoing expenses (but not transaction expenses or total costs) of investing in the fund with those of other funds. All mutual fund shareholder reports will provide this information to help you make this comparison. Please note that you cannot use this information to estimate your actual ending account balance and expenses paid during the period.

| | | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class R6 | Class Y |

| Expenses paid per $1,000 *† | $9.05 | $12.77 | $12.77 | $11.53 | $10.29 | $7.80 | $7.80 |

| Ending value (after expenses) | $1,015.82 | $1,012.10 | $1,012.10 | $1,013.34 | $1,014.58 | $1,017.06 | $1,017.06 |

* Expenses for each share class are calculated using the fund’s annualized expense ratio for each class, which represents the ongoing expenses as a percentage of average net assets for the period from 9/21/17 (inception date of the class) to 2/28/18. The expense ratio may differ for each share class.

† Expenses are calculated by multiplying the expense ratio by the average account value for the six-month period; then multiplying the result by the number of days in the six-month period; and then dividing that result by the number of days in the year.

| |

| 10 PanAgora Market Neutral Fund |

Terms and definitions

Important terms

Total return shows how the value of the fund’s shares changed over time, assuming you held the shares through the entire period and reinvested all distributions in the fund.

Before sales charge, or net asset value, is the price, or value, of one share of a mutual fund, without a sales charge. Before-sales-charge figures fluctuate with market conditions, and are calculated by dividing the net assets of each class of shares by the number of outstanding shares in the class.

After sales charge is the price of a mutual fund share plus the maximum sales charge levied at the time of purchase. After-sales-charge performance figures shown here assume the 5.75% maximum sales charge for class A shares and 3.50% for class M shares.

Contingent deferred sales charge (CDSC) is generally a charge applied at the time of the redemption of class B or C shares and assumes redemption at the end of the period. Your fund’s class B CDSC declines over time from a 5% maximum during the first year to 1% during the sixth year. After the sixth year, the CDSC no longer applies. The CDSC for class C shares is 1% for one year after purchase.

Share classes

Class A shares are generally subject to an initial sales charge and no CDSC (except on certain redemptions of shares bought without an initial sales charge).

Class B shares are closed to new investments and are only available by exchange from another Putnam fund or through dividend and/or capital gains reinvestment. They are not subject to an initial sales charge and may be subject to a CDSC.

Class C shares are not subject to an initial sales charge and are subject to a CDSC only if the shares are redeemed during the first year.

Class M shares have a lower initial sales charge and a higher 12b-1 fee than class A shares and no CDSC.

Class R shares are not subject to an initial sales charge or CDSC and are only available to employer-sponsored retirement plans.

Class R6 shares are not subject to an initial sales charge or CDSC, and carry no 12b-1 fee. Effective March 1, 2018, they are generally only available to employer-sponsored retirement plans, corporate and institutional clients, and clients in other approved programs.

Class Y shares are not subject to an initial sales charge or CDSC, and carry no 12b-1 fee. They are generally only available to corporate and institutional clients and clients in other approved programs.

Comparative indexes

Bloomberg Barclays U.S. Aggregate Bond Index is an unmanaged index of U.S. investment-grade fixed-income securities.

ICE BofAML (Intercontinental Exchange Bank of America Merrill Lynch) U.S. Treasury Bill Index is an unmanaged index that tracks the performance of U.S. dollar-denominated U.S. Treasury bills publicly issued in the U.S. domestic market. Qualifying securities must have a remaining term of at least one month to final maturity and a minimum amount outstanding of $1 billion.

MSCI Emerging Markets Index (ND) is a free float-adjusted market capitalization index that is designed to measure equity market performance in the global emerging markets. Calculated with net dividends (ND), this total return index reflects the reinvestment of dividends after the deduction of withholding taxes, using a tax rate applicable to non-resident institutional investors who do not benefit from double taxation treaties.

|

| PanAgora Market Neutral Fund 11 |

MSCI World ex-U.S. Index (ND) is an unmanaged index of equity securities from developed countries, excluding the United States. Calculated with net dividends (ND), this total return index reflects the reinvestment of dividends after the deduction of withholding taxes, using a tax rate applicable to non-resident institutional investors who do not benefit from double taxation treaties.

Russell 1000 Index is an unmanaged index of the 1,000 largest U.S. companies.

Russell 2000 Index is an unmanaged index of 2,000 small companies in the Russell 3000 Index.

S&P 500 Index is an unmanaged index of common stock performance.

ICE Data Indices, LLC (“ICE BofAML”), used with permission. ICE BofAML permits use of the ICE BofAML indices and related data on an “as is” basis; makes no warranties regarding same; does not guarantee the suitability, quality, accuracy, timeliness, and/or completeness of the ICE BofAML indices or any data included in, related to, or derived therefrom; assumes no liability in connection with the use of the foregoing; and does not sponsor, endorse, or recommend Putnam Investments, or any of its products or services.

Indexes assume reinvestment of all distributions and do not account for fees. Securities and performance of a fund and an index will differ. You cannot invest directly in an index.

Frank Russell Company is the source and owner of the trademarks, service marks, and copyrights related to the Russell Indexes. Russell® is a trademark of Frank Russell Company.

Lipper is a third-party industry-ranking entity that ranks mutual funds. Its rankings do not reflect sales charges. Lipper rankings are based on total return at net asset value relative to other funds that have similar current investment styles or objectives as determined by Lipper. Lipper may change a fund’s category assignment at its discretion. Lipper category averages reflect performance trends for funds within a category.

| |

| 12 PanAgora Market Neutral Fund |

Other information for shareholders

Important notice regarding delivery of shareholder documents

In accordance with Securities and Exchange Commission (SEC) regulations, Putnam sends a single copy of annual and semiannual shareholder reports, prospectuses, and proxy statements to Putnam shareholders who share the same address, unless a shareholder requests otherwise. If you prefer to receive your own copy of these documents, please call Putnam at 1-800-225-1581, and Putnam will begin sending individual copies within 30 days.

Proxy voting

Putnam is committed to managing our mutual funds in the best interests of our shareholders. The Putnam funds’ proxy voting guidelines and procedures, as well as information regarding how your fund voted proxies relating to portfolio securities during the 12-month period ended June 30, 2018, will be available in the Individual Investors section of putnam.com, and on the SEC’s website, www.sec.gov. If you have questions about finding forms on the SEC’s website, you may call the SEC at 1-800-SEC-0330. You may also obtain the Putnam funds’ proxy voting guidelines and procedures at no charge by calling Putnam’s Shareholder Services at 1-800-225-1581.

Fund portfolio holdings

The fund will file a complete schedule of its portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Shareholders may obtain the fund’s Form N-Q on the SEC’s website at www.sec.gov. In addition, the fund’s Form N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. You may call the SEC at 1-800-SEC-0330 for information about the SEC’s website or the operation of the Public Reference Room.

Trustee and employee fund ownership

Putnam employees and members of the Board of Trustees place their faith, confidence, and, most importantly, investment dollars in Putnam mutual funds. As of February 28, 2018, Putnam employees had approximately $528,000,000 and the Trustees had approximately $81,000,000 invested in Putnam mutual funds. These amounts include investments by the Trustees’ and employees’ immediate family members as well as investments through retirement and deferred compensation plans.

|

| PanAgora Market Neutral Fund 13 |

Trustee approval of management contract

General conclusions

In June 2017, the Putnam Funds’ Board of Trustees, which oversees the management of each Putnam fund, approved your fund’s management contract with Putnam Investment Management, LLC (“Putnam Management”) and the sub-advisory contract with respect to your fund between Putnam Management and its affiliate, PanAgora Asset Management, Inc. (“PanAgora”).

The Board, with the assistance of its Contract Committee, which consists solely of Trustees who are not “interested persons” (as this term is defined in the Investment Company Act of 1940, as amended) of The Putnam Funds (“Independent Trustees”), requested and evaluated all information it deemed reasonably necessary under the circumstances in connection with its approval of your fund’s management contract and sub-advisory contract. Over the course of the several months ending in June 2017, the Contract Committee and other committees of the Board met with representatives of Putnam Management and PanAgora, and separately in executive session, to consider the information that Putnam Management and PanAgora provided and other information developed with the assistance of the Board’s independent counsel and independent staff. The Independent Trustees also took into consideration the Contract Committee’s review and consideration of the other Putnam funds’ management, sub-management, and sub-advisory contracts and related information over the course of several months leading up to their June 2017 meeting.

On June 22, 2017, the Contract Committee recommended, and on June 23, 2017, the Independent Trustees approved, the initial execution and continuance of your fund’s management and sub-advisory contracts.

The Independent Trustees’ approval was based on the following conclusions:

• That the proposed fee schedule for your fund would represent reasonable compensation in light of the nature and quality of the services to be provided to the fund and the fees paid by competitive funds; and

• That the proposed fee schedule would represent an appropriate sharing between fund shareholders, Putnam Management and PanAgora of such economies of scale as may exist in the management of the fund at anticipated future asset levels.

These conclusions were based on a comprehensive consideration of all information provided to the Trustees and were not the result of any single factor. Some of the factors that figured particularly in the Trustees’ deliberations and how the Trustees considered these factors are described below, although individual Trustees may have evaluated the information presented differently, giving different weights to various factors.

Management fee schedules and total expenses

The Trustees considered the proposed management fee schedule for your fund, including fee levels and breakpoints, in light of the fund’s proposed investment program. The Trustees also focused on the competitiveness of your fund’s fee schedule in comparison to other Putnam funds and to market competitors.

Your fund has the benefit of breakpoints in its management fee that provide shareholders with economies of scale in the form of reduced fee rates as assets under management of all open-end funds sponsored by Putnam Management for which PanAgora acts as sub-adviser launched on or after the date of your fund’s management contract.

The Trustees also focused on the competitiveness of your fund’s projected total expense ratio. In order to support the effort to have fund expenses of the Putnam funds continue to meet evolving competitive standards, the Trustees and Putnam Management have implemented certain expense limitations. These expense limitations attempt to maintain competitive expense levels for the funds. The expense limitations were: (i) a contractual expense limitation applicable to specified retail open-end funds of 25 basis points on investor servicing fees and expenses and (ii) a contractual expense limitation applicable to specified open-end funds of 20 basis points on so-called “other expenses” (i.e., all expenses exclusive of management fees, distribution fees, investor servicing fees, investment-related expenses, interest, taxes, brokerage commissions, acquired fund fees and expenses and extraordinary expenses). Putnam Management has agreed to maintain these expense limitations until at least December 30, 2018. Putnam Management’s

| |

| 14 PanAgora Market Neutral Fund |

support for these expense limitation arrangements was an important factor in the Trustees’ decision to approve your fund’s management and sub-advisory contracts.

The information examined by the Trustees in connection with their contract review for your fund included information regarding fees charged by Putnam Management and by PanAgora to certain of their other clients. The Trustees did not rely on these comparisons to any significant extent in concluding that the management fees paid by your fund are reasonable.

Investment performance

Because your fund was not yet operational, the Trustees were not able to consider your fund’s performance before their initial approval of your fund’s management and sub-advisory contracts.

Brokerage and soft-dollar allocations; investor servicing

The Trustees considered various potential benefits that PanAgora may receive in connection with the services it provides under the sub-advisory contract with your fund. These include benefits related to brokerage allocation and the use of soft dollars, whereby a portion of the commissions paid by the fund for brokerage may be used to acquire research services that are expected to be useful to PanAgora in managing the assets of the fund and of other clients.

Putnam Management may also receive benefits from payments that the fund makes to Putnam Management’s affiliates for investor or distribution services. In conjunction with the June 2017 initial review and continuance of your fund’s management and sub-advisory contracts, the Trustees reviewed your fund’s proposed investor servicing agreement with Putnam Investor Services, Inc. (“PSERV”) and its proposed distributor’s contracts and distribution plans with Putnam Retail Management Limited Partnership (“PRM”), both of which are affiliates of Putnam Management. The Trustees concluded that the proposed fees to be paid by your fund to PSERV and PRM, as applicable, for such services are fair and reasonable in relation to the expected nature and quality of such services, the fees paid by competitive funds, and the expected costs incurred by PSERV and PRM, as applicable, in providing such services. Furthermore, the Trustees were of the view that the services provided were required for the operation of the funds, and that they were of a quality at least equal to those provided by other providers.

|

| PanAgora Market Neutral Fund 15 |

Financial statements

These sections of the report, as well as the accompanying Notes, constitute the fund’s financial statements.

The fund’s portfolio lists all the fund’s investments and their values as of the last day of the reporting period. Holdings are organized by asset type and industry sector, country, or state to show areas of concentration and diversification.

Statement of assets and liabilities shows how the fund’s net assets and share price are determined. All investment and non-investment assets are added together. Any unpaid expenses and other liabilities are subtracted from this total. The result is divided by the number of shares to determine the net asset value per share, which is calculated separately for each class of shares. (For funds with preferred shares, the amount subtracted from total assets includes the liquidation preference of preferred shares.)

Statement of operations shows the fund’s net investment gain or loss. This is done by first adding up all the fund’s earnings — from dividends and interest income — and subtracting its operating expenses to determine net investment income (or loss). Then, any net gain or loss the fund realized on the sales of its holdings — as well as any unrealized gains or losses over the period — is added to or subtracted from the net investment result to determine the fund’s net gain or loss for the fiscal period.

Statement of changes in net assets shows how the fund’s net assets were affected by the fund’s net investment gain or loss, by distributions to shareholders, and by changes in the number of the fund’s shares. It lists distributions and their sources (net investment income or realized capital gains) over the current reporting period and the most recent fiscal year-end. The distributions listed here may not match the sources listed in the Statement of operations because the distributions are determined on a tax basis and may be paid in a different period from the one in which they were earned. Dividend sources are estimated at the time of declaration. Actual results may vary. Any non-taxable return of capital cannot be determined until final tax calculations are completed after the end of the fund’s fiscal year.

Financial highlights provide an overview of the fund’s investment results, per-share distributions, expense ratios, net investment income ratios, and portfolio turnover in one summary table, reflecting the five most recent reporting periods. In a semiannual report, the highlights table also includes the current reporting period.

| |

| 16 PanAgora Market Neutral Fund |

The fund’s portfolio 2/28/18 (Unaudited)

| | |

| INVESTMENT COMPANIES (13.5%)* | Shares | Value |

| State Street Institutional US Government Money Market Fund | 1,533,642 | $1,533,642 |

| Total investment companies (cost $1,533,709) | | $1,533,642 |

| |

| SHORT-TERM INVESTMENTS (88.2%)* | Principal amount | Value |

| U. S. Treasury Bills with effective yields ranging from 1.251% | | |

| to 1.742%, 9/13/18 ∆ | $10,100,000 | $10,001,697 |

| Total short-term investments (cost $10,027,475) | | $10,001,697 |

| |

| TOTAL INVESTMENTS | | |

| Total investments (cost $11,561,184) | | $11,535,339 |

| |

| Key to holding’s abbreviations |

| |

| ADR/Adr | American Depository Receipts: represents ownership of foreign securities on deposit with a |

| | custodian bank |

| ETF/Etf | Exchange Traded Fund |

| GDR/Gdr | Global Depository Receipts: represents ownership of foreign securities on deposit with a |

| | custodian bank |

| NVDR/Nvdr | Non-voting Depository Receipts |

| OTC | Over-the-counter |

| PJSC/Pjsc | Public Joint Stock Company |

| REGS/Regs | Securities sold under Regulation S may not be offered, sold or delivered within the United |

| | States except pursuant to an exemption from, or in a transaction not subject to, the registration |

| | requirements of the Securities Act of 1933. |

| SPDR/Spdr | S&P Depository Receipts |

Notes to the fund’s portfolio

Unless noted otherwise, the notes to the fund’s portfolio are for the close of the fund’s reporting period, which ran from September 21, 2017 (commencement of operations) through February 28, 2018 (the reporting period). Within the following notes to the portfolio, references to “Putnam Management” represent Putnam Investment Management, LLC, the fund’s manager, an indirect wholly-owned subsidiary of Putnam Investments, LLC and references to “ASC 820” represent Accounting Standards Codification 820 Fair Value Measurements and Disclosures.

* Percentages indicated are based on net assets of $11,337,047.

∆ This security, in part or in entirety, was pledged and segregated with the custodian for collateral on certain derivative contracts at the close of the reporting period. Collateral at period end totaled $6,897,300 and is included in Investments in securities on the Statement of assets and liabilities (Notes 1 and 8).

The dates shown on debt obligations are the original maturity dates.

| | | | | | |

| OTC TOTAL RETURN SWAP CONTRACTS OUTSTANDING at 2/28/18 (Unaudited) | |

| | | Upfront | | | | |

| | | premium | Termina- | Payments | Total return | Unrealized |

| Swap counterparty/ | | received | tion | received (paid) | received by | appreciation/ |

| Notional amount | Value | (paid) | date | by fund | or paid by fund | (depreciation) |

| Morgan Stanley & Co. International PLC | | | | |

| $3,325 | $3,173 | $— | 9/25/19 | (Federal Funds | 1&1 Drillisch Ag— | $(152) |

| | | | | Effective Rate | Monthly | |

| | | | | US plus 0.25%) — | | |

| | | | | Monthly | | |

| 30,609 | 30,268 | — | 9/25/19 | (Federal Funds | 3I Group Plc— | (342) |

| | | | | Effective Rate | Monthly | |

| | | | | US plus 0.25%) — | | |

| | | | | Monthly | | |

|

| PanAgora Market Neutral Fund 17 |

| | | | | | |

| OTC TOTAL RETURN SWAP CONTRACTS OUTSTANDING at 2/28/18 (Unaudited) cont. | |

| | | Upfront | | | | |

| | | premium | Termina- | Payments | Total return | Unrealized |

| Swap counterparty/ | | received | tion | received (paid) | received by | appreciation/ |

| Notional amount | Value | (paid) | date | by fund | or paid by fund | (depreciation) |

| Morgan Stanley & Co. International PLC cont. | | | | |

| $46,740 | $45,800 | $— | 9/25/19 | (Federal Funds | Abb Ltd-Reg— | $(941) |

| | | | | Effective Rate | Monthly | |

| | | | | US plus 0.25%) — | | |

| | | | | Monthly | | |

| 45,621 | 44,786 | — | 9/25/19 | (Federal Funds | Abiomed Inc— | (837) |

| | | | | Effective Rate | Monthly | |

| | | | | US plus 0.25%) — | | |

| | | | | Monthly | | |

| 114,720 | 113,298 | — | 9/25/19 | (Federal Funds | Acs Actividades | (1,428) |

| | | | | Effective Rate | Cons Y Serv— | |

| | | | | US plus 0.25%) — | Monthly | |

| | | | | Monthly | | |

| 16,548 | 15,589 | — | 9/27/19 | (Federal Funds | Adaro Energy Tbk | (961) |

| | | | | Effective Rate | Pt—Monthly | |

| | | | | US plus 0.75%) — | | |

| | | | | Monthly | | |

| 17,638 | 17,700 | — | 9/25/19 | (Federal Funds | Advanced | 61 |

| | | | | Effective Rate US | Semiconductor | |

| | | | | plus 0.35%) — | Engineering Inc— | |

| | | | | Monthly | Monthly | |

| 34,619 | 33,450 | — | 9/25/19 | (Federal Funds | Aecom—Monthly | (1,170) |

| | | | | Effective Rate | | |

| | | | | US plus 0.25%) — | | |

| | | | | Monthly | | |

| 37,378 | 37,736 | — | 9/26/19 | (Federal Funds | Aeon Mall Co Ltd— | 626 |

| | | | | Effective Rate | Monthly | |

| | | | | US plus 0.25%) — | | |

| | | | | Monthly | | |

| 41,653 | 41,963 | — | 9/25/19 | (Federal Funds | Aetna Inc—Monthly | 309 |

| | | | | Effective Rate | | |

| | | | | US plus 0.25%) — | | |

| | | | | Monthly | | |

| 21,015 | 20,702 | — | 9/25/19 | (Federal Funds | Agile Group | (314) |

| | | | | Effective Rate | Holdings Ltd— | |

| | | | | US plus 0.25%) — | Monthly | |

| | | | | Monthly | | |

| 78,061 | 75,861 | — | 9/25/19 | (Federal Funds | Agilent | (2,205) |

| | | | | Effective Rate | Technologies Inc— | |

| | | | | US plus 0.25%) — | Monthly | |

| | | | | Monthly | | |

| 21,031 | 20,012 | — | 9/25/19 | (Federal Funds | Agricultural Bank Of | (1,020) |

| | | | | Effective Rate | China Ltd—Monthly | |

| | | | | US plus 0.25%) — | | |

| | | | | Monthly | | |

| 38,360 | 40,842 | — | 9/25/19 | (Federal Funds | Air New Zealand | 2,480 |

| | | | | Effective Rate | Ltd—Monthly | |

| | | | | US plus 0.25%) — | | |

| | | | | Monthly | | |

| |

| 18 PanAgora Market Neutral Fund |

| | | | | | |

| OTC TOTAL RETURN SWAP CONTRACTS OUTSTANDING at 2/28/18 (Unaudited) cont. | |

| | | Upfront | | | | |

| | | premium | Termina- | Payments | Total return | Unrealized |

| Swap counterparty/ | | received | tion | received (paid) | received by | appreciation/ |

| Notional amount | Value | (paid) | date | by fund | or paid by fund | (depreciation) |

| Morgan Stanley & Co. International PLC cont. | | | | |

| $40,968 | $41,132 | $— | 9/26/19 | (Federal Funds | Aisin Seiki Co Ltd— | $163 |

| | | | | Effective Rate | Monthly | |

| | | | | US plus 0.25%) — | | |

| | | | | Monthly | | |

| 16,401 | 16,506 | — | 9/26/19 | (Federal Funds | Ajinomoto Co Inc— | 104 |

| | | | | Effective Rate | Monthly | |

| | | | | US plus 0.25%) — | | |

| | | | | Monthly | | |

| 49,118 | 48,301 | — | 9/25/19 | (Federal Funds | Akamai | (819) |

| | | | | Effective Rate | Technologies Inc— | |

| | | | | US plus 0.25%) — | Monthly | |

| | | | | Monthly | | |

| 37,557 | 36,678 | — | 9/25/19 | (Federal Funds | Aker Bp Asa— | (880) |

| | | | | Effective Rate | Monthly | |

| | | | | US plus 0.25%) — | | |

| | | | | Monthly | | |

| 28,827 | 16,127 | — | 9/25/19 | (Federal Funds | Akorn Inc—Monthly | (12,699) |

| | | | | Effective Rate | | |

| | | | | US plus 0.25%) — | | |

| | | | | Monthly | | |

| 37,326 | 38,380 | — | 9/26/19 | (Federal Funds | Alfresa Holdings | 1,052 |

| | | | | Effective Rate | Corp—Monthly | |

| | | | | US plus 0.25%) — | | |

| | | | | Monthly | | |

| 72,769 | 72,367 | — | 9/25/19 | (Federal Funds | Allianz Se-Reg— | (405) |

| | | | | Effective Rate | Monthly | |

| | | | | US plus 0.25%) — | | |

| | | | | Monthly | | |

| 108,417 | 109,022 | — | 9/25/19 | (Federal Funds | Allison Transmission | 600 |

| | | | | Effective Rate | Holding—Monthly | |

| | | | | US plus 0.25%) — | | |

| | | | | Monthly | | |

| 33,130 | 31,922 | — | 9/25/19 | (Federal Funds | Allstate Corp— | (1,210) |

| | | | | Effective Rate | Monthly | |

| | | | | US plus 0.25%) — | | |

| | | | | Monthly | | |

| 52,613 | 50,818 | — | 9/25/19 | (Federal Funds | Alphabet Inc-Cl C— | (1,797) |

| | | | | Effective Rate | Monthly | |

| | | | | US plus 0.25%) — | | |

| | | | | Monthly | | |

| 116,808 | 111,976 | — | 9/25/19 | (Federal Funds | Altaba Inc—Monthly | (4,838) |

| | | | | Effective Rate US | | |

| | | | | plus 0.30%) — | | |

| | | | | Monthly | | |

| 29,771 | 28,642 | — | 9/25/19 | (Federal Funds | Altria Group Inc— | (1,130) |

| | | | | Effective Rate | Monthly | |

| | | | | US plus 0.25%) — | | |

| | | | | Monthly | | |

|

| PanAgora Market Neutral Fund 19 |

| | | | | | |

| OTC TOTAL RETURN SWAP CONTRACTS OUTSTANDING at 2/28/18 (Unaudited) cont. | |

| | | Upfront | | | | |

| | | premium | Termina- | Payments | Total return | Unrealized |

| Swap counterparty/ | | received | tion | received (paid) | received by | appreciation/ |

| Notional amount | Value | (paid) | date | by fund | or paid by fund | (depreciation) |

| Morgan Stanley & Co. International PLC cont. | | | | |

| $182,634 | $181,494 | $— | 9/25/19 | (Federal Funds | Amazon.Com Inc— | $(1,149) |

| | | | | Effective Rate | Monthly | |

| | | | | US plus 0.25%) — | | |

| | | | | Monthly | | |

| 17,657 | 17,266 | — | 9/25/19 | (Federal Funds | Amcor Limited— | (65) |

| | | | | Effective Rate | Monthly | |

| | | | | US plus 0.25%) — | | |

| | | | | Monthly | | |

| 31,453 | 29,890 | — | 9/25/19 | (Federal Funds | America Movil-Spn | (1,565) |

| | | | | Effective Rate | Adr Cl L—Monthly | |

| | | | | US plus 0.25%) — | | |

| | | | | Monthly | | |

| 38,013 | 36,469 | — | 9/25/19 | (Federal Funds | American Express | (1,546) |

| | | | | Effective Rate US | Co—Monthly | |

| | | | | plus 0.30%) — | | |

| | | | | Monthly | | |

| 124,662 | 120,146 | — | 9/25/19 | (Federal Funds | Ameriprise Financial | (4,521) |

| | | | | Effective Rate | Inc—Monthly | |

| | | | | US plus 0.25%) — | | |

| | | | | Monthly | | |

| 18,264 | 18,332 | — | 9/25/19 | (Federal Funds | Amp Ltd—Monthly | 66 |

| | | | | Effective Rate | | |

| | | | | US plus 0.25%) — | | |

| | | | | Monthly | | |

| 34,307 | 34,937 | — | 9/25/19 | (Federal Funds | Amplifon Spa— | 630 |

| | | | | Effective Rate | Monthly | |

| | | | | US plus 0.25%) — | | |

| | | | | Monthly | | |

| 10,094 | 9,993 | — | 9/25/19 | (Federal Funds | Amundi Sa— | (101) |

| | | | | Effective Rate | Monthly | |

| | | | | US plus 0.25%) — | | |

| | | | | Monthly | | |

| 21,731 | 21,443 | — | 9/25/19 | (Federal Funds | Anhui Conch | (289) |

| | | | | Effective Rate | Cement Co Ltd-H— | |

| | | | | US plus 0.25%) — | Monthly | |

| | | | | Monthly | | |

| 34,588 | 34,446 | — | 9/25/19 | (Federal Funds | Apartment | (142) |

| | | | | Effective Rate US | Investment & | |

| | | | | plus 0.30%) — | Management Co— | |

| | | | | Monthly | Monthly | |

| 11,551 | 11,460 | — | 9/25/19 | (Federal Funds | Applied Materials | (90) |

| | | | | Effective Rate | Inc—Monthly | |

| | | | | US plus 0.25%) — | | |

| | | | | Monthly | | |

| 42,529 | 41,007 | — | 9/25/19 | (Federal Funds | Aptiv Plc—Monthly | (1,524) |

| | | | | Effective Rate | | |

| | | | | US plus 0.25%) — | | |

| | | | | Monthly | | |

| |

| 20 PanAgora Market Neutral Fund |

| | | | | | |

| OTC TOTAL RETURN SWAP CONTRACTS OUTSTANDING at 2/28/18 (Unaudited) cont. | |

| | | Upfront | | | | |

| | | premium | Termina- | Payments | Total return | Unrealized |

| Swap counterparty/ | | received | tion | received (paid) | received by | appreciation/ |

| Notional amount | Value | (paid) | date | by fund | or paid by fund | (depreciation) |

| Morgan Stanley & Co. International PLC cont. | | | | |

| $18,095 | $17,676 | $— | 9/25/19 | (Federal Funds | Aqua America Inc— | $(420) |

| | | | | Effective Rate | Monthly | |

| | | | | US plus 0.25%) — | | |

| | | | | Monthly | | |

| 11,816 | 11,869 | — | 9/25/19 | (Federal Funds | Arista Networks | 53 |

| | | | | Effective Rate US | Inc—Monthly | |

| | | | | plus 0.30%) — | | |

| | | | | Monthly | | |

| 36,005 | 34,910 | — | 9/25/19 | (Federal Funds | Arris International | (1,097) |

| | | | | Effective Rate US | Plc—Monthly | |

| | | | | plus 0.30%) — | | |

| | | | | Monthly | | |

| 9,222 | 9,219 | — | 9/25/19 | (Federal Funds | Assa Abloy Ab-B— | (3) |

| | | | | Effective Rate | Monthly | |

| | | | | US plus 0.25%) — | | |

| | | | | Monthly | | |

| 18,631 | 19,255 | — | 9/26/19 | (Federal Funds | Astellas Pharma | 624 |

| | | | | Effective Rate | Inc—Monthly | |

| | | | | US plus 0.25%) — | | |

| | | | | Monthly | | |

| 14,989 | 14,457 | — | 9/27/19 | (Federal Funds | Astro Malaysia | (533) |

| | | | | Effective Rate | Holdings Bhd— | |

| | | | | US plus 0.75%) — | Monthly | |

| | | | | Monthly | | |

| 19,090 | 19,110 | — | 9/25/19 | (Federal Funds | Asx Ltd—Monthly | 20 |

| | | | | Effective Rate | | |

| | | | | US plus 0.25%) — | | |

| | | | | Monthly | | |

| 5,769 | 5,590 | — | 9/25/19 | (Federal Funds | At&T Inc—Monthly | (179) |

| | | | | Effective Rate | | |

| | | | | US plus 0.25%) — | | |

| | | | | Monthly | | |

| 132,000 | 129,450 | — | 9/25/19 | (Federal Funds | Athene Holding Ltd- | (2,557) |

| | | | | Effective Rate | Class A—Monthly | |

| | | | | US plus 0.25%) — | | |

| | | | | Monthly | | |

| 4,807 | 4,737 | — | 9/25/19 | (Federal Funds | Attendo Ab— | (70) |

| | | | | Effective Rate | Monthly | |

| | | | | US plus 0.25%) — | | |

| | | | | Monthly | | |

| 53,721 | 48,525 | — | 9/25/19 | (Federal Funds | Autozone Inc— | (5,197) |

| | | | | Effective Rate | Monthly | |

| | | | | US plus 0.25%) — | | |

| | | | | Monthly | | |

| 132,842 | 130,674 | — | 9/25/19 | (Federal Funds | Avery Dennison | (2,174) |

| | | | | Effective Rate | Corp—Monthly | |

| | | | | US plus 0.25%) — | | |

| | | | | Monthly | | |

|

| PanAgora Market Neutral Fund 21 |

| | | | | | |

| OTC TOTAL RETURN SWAP CONTRACTS OUTSTANDING at 2/28/18 (Unaudited) cont. | |

| | | Upfront | | | | |

| | | premium | Termina- | Payments | Total return | Unrealized |

| Swap counterparty/ | | received | tion | received (paid) | received by | appreciation/ |

| Notional amount | Value | (paid) | date | by fund | or paid by fund | (depreciation) |

| Morgan Stanley & Co. International PLC cont. | | | | |

| $64,379 | $62,944 | $— | 9/25/19 | (Federal Funds | Avista Corp— | $(1,437) |

| | | | | Effective Rate | Monthly | |

| | | | | US plus 0.25%) — | | |

| | | | | Monthly | | |

| 42,144 | 41,959 | — | 9/25/19 | (Federal Funds | Aviva Plc—Monthly | (187) |

| | | | | Effective Rate | | |

| | | | | US plus 0.25%) — | | |

| | | | | Monthly | | |

| 34,442 | 33,233 | — | 9/25/19 | (Federal Funds | Axalta Coating | (1,210) |

| | | | | Effective Rate US | Systems Ltd— | |

| | | | | plus 0.30%) — | Monthly | |

| | | | | Monthly | | |

| 125,319 | 124,953 | — | 9/25/19 | (Federal Funds | Axfood Ab— | (373) |

| | | | | Effective Rate | Monthly | |

| | | | | US plus 0.25%) — | | |

| | | | | Monthly | | |

| 10,742 | 10,022 | — | 9/26/19 | (Federal Funds | Ayala Land Inc— | (721) |

| | | | | Effective Rate | Monthly | |

| | | | | US plus 0.75%) — | | |

| | | | | Monthly | | |

| 26,145 | 25,733 | — | 9/26/19 | (Federal Funds | Banco Do Brasil | (414) |

| | | | | Effective Rate | S. A.—Monthly | |

| | | | | US plus 0.65%) — | | |

| | | | | Monthly | | |

| 1,932 | 1,920 | — | 9/27/19 | (Federal Funds | Bank Danamon | (12) |

| | | | | Effective Rate | Indonesia Tbk— | |

| | | | | US plus 0.75%) — | Monthly | |

| | | | | Monthly | | |

| 102,350 | 101,340 | — | 9/25/19 | (Federal Funds | Bank Of America | (1,013) |

| | | | | Effective Rate | Corp—Monthly | |

| | | | | US plus 0.25%) — | | |

| | | | | Monthly | | |

| 14,724 | 14,187 | — | 9/25/19 | (Federal Funds | Bank Of China Ltd— | (537) |

| | | | | Effective Rate | Monthly | |

| | | | | US plus 0.25%) — | | |

| | | | | Monthly | | |

| 10,538 | 10,566 | — | 9/25/19 | (Federal Funds | Bank Of East Asia | 27 |

| | | | | Effective Rate | Ltd/The—Monthly | |

| | | | | US plus 0.25%) — | | |

| | | | | Monthly | | |

| 35,606 | 34,902 | — | 9/25/19 | (Federal Funds | Bank Of New York | (706) |

| | | | | Effective Rate US | Mellon Corp/The— | |

| | | | | plus 0.30%) — | Monthly | |

| | | | | Monthly | | |

| 83,084 | 83,139 | — | 9/25/19 | (Federal Funds | Bank Of Nova | 52 |

| | | | | Effective Rate | Scotia—Monthly | |

| | | | | US plus 0.25%) — | | |

| | | | | Monthly | | |

| |

| 22 PanAgora Market Neutral Fund |

| | | | | | |

| OTC TOTAL RETURN SWAP CONTRACTS OUTSTANDING at 2/28/18 (Unaudited) cont. | |

| | | Upfront | | | | |

| | | premium | Termina- | Payments | Total return | Unrealized |

| Swap counterparty/ | | received | tion | received (paid) | received by | appreciation/ |

| Notional amount | Value | (paid) | date | by fund | or paid by fund | (depreciation) |

| Morgan Stanley & Co. International PLC cont. | | | | |

| $19,328 | $19,163 | $— | 9/27/19 | (Federal Funds | Bank Rakyat | $(166) |

| | | | | Effective Rate | Indonesia Perser— | |

| | | | | US plus 0.75%) — | Monthly | |

| | | | | Monthly | | |

| 54,838 | 54,304 | — | 9/25/19 | (Federal Funds | Bankinter Sa— | (537) |

| | | | | Effective Rate | Monthly | |

| | | | | US plus 0.25%) — | | |

| | | | | Monthly | | |

| 12,088 | 11,818 | — | 9/25/19 | (Federal Funds | Beijing Capital Intl | (271) |

| | | | | Effective Rate | Airpo-H—Monthly | |

| | | | | US plus 0.25%) — | | |

| | | | | Monthly | | |

| 11,198 | 11,131 | — | 9/25/19 | (Federal Funds | Beijing Enterprises | (68) |

| | | | | Effective Rate | Holdings—Monthly | |

| | | | | US plus 0.25%) — | | |

| | | | | Monthly | | |

| 92,688 | 91,229 | — | 9/25/19 | (Federal Funds | Berry Global Group | (1,462) |

| | | | | Effective Rate | Inc—Monthly | |

| | | | | US plus 0.25%) — | | |

| | | | | Monthly | | |

| 131,134 | 130,899 | — | 9/25/19 | (Federal Funds | Best Buy Co Inc— | (241) |

| | | | | Effective Rate | Monthly | |

| | | | | US plus 0.25%) — | | |

| | | | | Monthly | | |

| 17,881 | 17,707 | — | 9/25/19 | (Federal Funds | Bhp Billiton Ltd— | (175) |

| | | | | Effective Rate | Monthly | |

| | | | | US plus 0.25%) — | | |

| | | | | Monthly | | |

| 17,560 | 16,953 | — | 9/25/19 | (Federal Funds | Bhp Billiton Plc— | (607) |

| | | | | Effective Rate | Monthly | |

| | | | | US plus 0.25%) — | | |

| | | | | Monthly | | |

| 74,382 | 74,304 | — | 9/25/19 | (Federal Funds | Billerudkorsnas | (81) |

| | | | | Effective Rate | Ab—Monthly | |

| | | | | US plus 0.25%) — | | |

| | | | | Monthly | | |

| 159,772 | 159,742 | — | 9/25/19 | (Federal Funds | Bioverativ Inc— | (38) |

| | | | | Effective Rate | Monthly | |

| | | | | US plus 0.25%) — | | |

| | | | | Monthly | | |

| 106,253 | 105,259 | — | 9/25/19 | (Federal Funds | Black Knight Inc— | (1,000) |

| | | | | Effective Rate | Monthly | |

| | | | | US plus 0.25%) — | | |

| | | | | Monthly | | |

| 44,795 | 44,795 | — | 9/25/19 | (Federal Funds | Blackhawk Network | (2) |

| | | | | Effective Rate US | Holdings Inc— | |

| | | | | plus 0.30%) — | Monthly | |

| | | | | Monthly | | |

|

| PanAgora Market Neutral Fund 23 |

| | | | | | |

| OTC TOTAL RETURN SWAP CONTRACTS OUTSTANDING at 2/28/18 (Unaudited) cont. | |

| | | Upfront | | | | |

| | | premium | Termina- | Payments | Total return | Unrealized |

| Swap counterparty/ | | received | tion | received (paid) | received by | appreciation/ |

| Notional amount | Value | (paid) | date | by fund | or paid by fund | (depreciation) |

| Morgan Stanley & Co. International PLC cont. | | | | |

| $33,838 | $32,966 | $— | 9/25/19 | (Federal Funds | Blackrock Inc— | $(874) |

| | | | | Effective Rate | Monthly | |

| | | | | US plus 0.25%) — | | |

| | | | | Monthly | | |

| 118,494 | 118,080 | — | 9/25/19 | (Federal Funds | Boeing Co/The— | (419) |

| | | | | Effective Rate | Monthly | |

| | | | | US plus 0.25%) — | | |

| | | | | Monthly | | |

| 1,048 | 1,010 | — | 9/25/19 | (Federal Funds | Bonava Ab-B | (38) |

| | | | | Effective Rate | Shares—Monthly | |

| | | | | US plus 0.25%) — | | |

| | | | | Monthly | | |

| 50,405 | 47,657 | — | 9/25/19 | (Federal Funds | Borgwarner Inc— | (2,585) |

| | | | | Effective Rate | Monthly | |

| | | | | US plus 0.25%) — | | |

| | | | | Monthly | | |

| 63,997 | 62,031 | — | 9/25/19 | (Federal Funds | Brighthouse | (1,968) |

| | | | | Effective Rate | Financial Inc— | |

| | | | | US plus 0.25%) — | Monthly | |

| | | | | Monthly | | |

| 15,094 | 14,372 | — | 9/25/19 | (Federal Funds | British Land Co Plc— | (722) |

| | | | | Effective Rate | Monthly | |

| | | | | US plus 0.25%) — | | |

| | | | | Monthly | | |

| 105,480 | 102,774 | — | 9/25/19 | (Federal Funds | Broadcom Ltd— | (2,713) |

| | | | | Effective Rate | Monthly | |

| | | | | US plus 0.25%) — | | |

| | | | | Monthly | | |

| 35,541 | 35,334 | — | 9/25/19 | (Federal Funds | Broadridge | (209) |

| | | | | Effective Rate | Financial Solutio— | |

| | | | | US plus 0.25%) — | Monthly | |

| | | | | Monthly | | |

| 34,311 | 35,241 | — | 9/26/19 | (Federal Funds | Brother Industries | 928 |

| | | | | Effective Rate | Ltd—Monthly | |

| | | | | US plus 0.25%) — | | |

| | | | | Monthly | | |

| 63,532 | 61,719 | — | 9/25/19 | (Federal Funds | Brunswick Corp/ | (1,815) |

| | | | | Effective Rate | De—Monthly | |

| | | | | US plus 0.25%) — | | |

| | | | | Monthly | | |

| 116,080 | 112,821 | — | 9/25/19 | (Federal Funds | Cadence Design Sys | (3,265) |

| | | | | Effective Rate | Inc—Monthly | |

| | | | | US plus 0.25%) — | | |

| | | | | Monthly | | |

| 91,275 | 90,866 | — | 9/25/19 | (Federal Funds | Cae Inc—Monthly | (413) |

| | | | | Effective Rate | | |

| | | | | US plus 0.25%) — | | |

| | | | | Monthly | | |

| |

| 24 PanAgora Market Neutral Fund |

| | | | | | |

| OTC TOTAL RETURN SWAP CONTRACTS OUTSTANDING at 2/28/18 (Unaudited) cont. | |

| | | Upfront | | | | |

| | | premium | Termina- | Payments | Total return | Unrealized |

| Swap counterparty/ | | received | tion | received (paid) | received by | appreciation/ |

| Notional amount | Value | (paid) | date | by fund | or paid by fund | (depreciation) |

| Morgan Stanley & Co. International PLC cont. | | | | |

| $45,162 | $45,162 | $— | 9/25/19 | (Federal Funds | Callidus Software | $(2) |

| | | | | Effective Rate US | Inc—Monthly | |

| | | | | plus 0.30%) — | | |

| | | | | Monthly | | |

| 103,481 | 103,481 | — | 9/25/19 | (Federal Funds | Calpine Corp— | (4) |

| | | | | Effective Rate | Monthly | |

| | | | | US plus 0.25%) — | | |

| | | | | Monthly | | |

| 95,143 | 96,333 | — | 9/25/19 | (Federal Funds | Caltex Australia | 1,186 |

| | | | | Effective Rate | Ltd—Monthly | |

| | | | | US plus 0.25%) — | | |

| | | | | Monthly | | |

| 3,592 | 3,539 | — | 9/25/19 | (Federal Funds | Canadian Tire Corp- | (54) |

| | | | | Effective Rate | Class A—Monthly | |

| | | | | US plus 0.25%) — | | |

| | | | | Monthly | | |

| 22,319 | 23,032 | — | 9/26/19 | (Federal Funds | Canon Inc.— | 712 |

| | | | | Effective Rate | Monthly | |

| | | | | US plus 0.25%) — | | |

| | | | | Monthly | | |

| 16,474 | 15,749 | — | 9/25/19 | (Federal Funds | Capita Plc—Monthly | (725) |

| | | | | Effective Rate | | |

| | | | | US plus 0.25%) — | | |

| | | | | Monthly | | |

| 43,029 | 42,451 | — | 9/25/19 | (Federal Funds | Carnival Plc— | (580) |

| | | | | Effective Rate | Monthly | |

| | | | | US plus 0.25%) — | | |

| | | | | Monthly | | |

| 25,960 | 24,459 | — | 9/25/19 | (Federal Funds | Cars. Com Inc— | (1,503) |

| | | | | Effective Rate | Monthly | |

| | | | | US plus 0.25%) — | | |

| | | | | Monthly | | |

| 17,167 | 17,460 | — | 9/25/19 | (Federal Funds | Catcher Technology | 291 |

| | | | | Effective Rate US | Co Ltd—Monthly | |

| | | | | plus 0.35%) — | | |

| | | | | Monthly | | |

| 108,690 | 102,674 | — | 9/25/19 | (Federal Funds | Caterpillar Inc— | (6,021) |

| | | | | Effective Rate | Monthly | |

| | | | | US plus 0.25%) — | | |

| | | | | Monthly | | |

| 14,812 | 14,934 | — | 9/25/19 | (Federal Funds | Cathay Financial | 121 |

| | | | | Effective Rate US | Holding Co— | |

| | | | | plus 0.35%) — | Monthly | |

| | | | | Monthly | | |

| 90,479 | 90,287 | — | 9/25/19 | (Federal Funds | Cavium Inc— | (196) |

| | | | | Effective Rate | Monthly | |

| | | | | US plus 0.25%) — | | |

| | | | | Monthly | | |

|

| PanAgora Market Neutral Fund 25 |

| | | | | | |

| OTC TOTAL RETURN SWAP CONTRACTS OUTSTANDING at 2/28/18 (Unaudited) cont. | |

| | | Upfront | | | | |

| | | premium | Termina- | Payments | Total return | Unrealized |

| Swap counterparty/ | | received | tion | received (paid) | received by | appreciation/ |

| Notional amount | Value | (paid) | date | by fund | or paid by fund | (depreciation) |

| Morgan Stanley & Co. International PLC cont. | | | | |

| $94,959 | $95,183 | $— | 9/25/19 | (Federal Funds | Cbre Group Inc— | $219 |

| | | | | Effective Rate | Monthly | |

| | | | | US plus 0.25%) — | | |

| | | | | Monthly | | |

| 8,947 | 7,818 | — | 9/26/19 | (Federal Funds | Ccr Sa—Monthly | (1,129) |

| | | | | Effective Rate | | |

| | | | | US plus 0.65%) — | | |

| | | | | Monthly | | |

| 14,707 | 14,267 | — | 9/25/19 | (Federal Funds | Celltrion Pharm | (441) |

| | | | | Effective Rate US | Inc—Monthly | |

| | | | | plus 0.35%) — | | |

| | | | | Monthly | | |

| 102,269 | 101,014 | — | 9/25/19 | (Federal Funds | Centene Corp— | (1,259) |

| | | | | Effective Rate | Monthly | |

| | | | | US plus 0.25%) — | | |

| | | | | Monthly | | |

| 46,742 | 45,727 | — | 9/25/19 | (Federal Funds | Centrica Plc— | (1,017) |

| | | | | Effective Rate | Monthly | |

| | | | | US plus 0.25%) — | | |

| | | | | Monthly | | |

| 33,654 | 32,141 | — | 9/25/19 | (Federal Funds | Charter | (1,514) |

| | | | | Effective Rate | Communications | |

| | | | | US plus 0.25%) — | Inc-A—Monthly | |

| | | | | Monthly | | |

| 8,881 | 8,777 | — | 9/25/19 | (Federal Funds | Cheil Worldwide | (105) |

| | | | | Effective Rate US | Inc—Monthly | |

| | | | | plus 0.35%) — | | |

| | | | | Monthly | | |

| 49,212 | 45,800 | — | 9/25/19 | (Federal Funds | Chemours Co/The— | (3,417) |

| | | | | Effective Rate | Monthly | |

| | | | | US plus 0.25%) — | | |

| | | | | Monthly | | |

| 67,156 | 65,585 | — | 9/25/19 | (Federal Funds | Chevron Corp— | (1,572) |

| | | | | Effective Rate | Monthly | |

| | | | | US plus 0.25%) — | | |

| | | | | Monthly | | |

| 11,194 | 11,423 | — | 9/25/19 | (Federal Funds | China Airlines Ltd— | 228 |

| | | | | Effective Rate US | Monthly | |

| | | | | plus 0.35%) — | | |

| | | | | Monthly | | |

| 13,512 | 13,150 | — | 9/25/19 | (Federal Funds | China Cinda Asset | (363) |

| | | | | Effective Rate | Management Co | |

| | | | | US plus 0.25%) — | Ltd—Monthly | |

| | | | | Monthly | | |

| 10,791 | 10,719 | — | 9/25/19 | (Federal Funds | China | (73) |

| | | | | Effective Rate | Communications | |

| | | | | US plus 0.25%) — | Servi-H—Monthly | |

| | | | | Monthly | | |

| |

| 26 PanAgora Market Neutral Fund |

| | | | | | |

| OTC TOTAL RETURN SWAP CONTRACTS OUTSTANDING at 2/28/18 (Unaudited) cont. | |

| | | Upfront | | | | |

| | | premium | Termina- | Payments | Total return | Unrealized |

| Swap counterparty/ | | received | tion | received (paid) | received by | appreciation/ |

| Notional amount | Value | (paid) | date | by fund | or paid by fund | (depreciation) |

| Morgan Stanley & Co. International PLC cont. | | | | |

| $14,084 | $14,062 | $— | 9/25/19 | (Federal Funds | China Medical | $(23) |

| | | | | Effective Rate | System Holding— | |

| | | | | US plus 0.25%) — | Monthly | |

| | | | | Monthly | | |

| 20,351 | 19,859 | — | 9/25/19 | (Federal Funds | China National | (493) |

| | | | | Effective Rate | Building Material Co | |

| | | | | US plus 0.25%) — | Ltd—Monthly | |

| | | | | Monthly | | |

| 8,159 | 8,051 | — | 9/25/19 | (Federal Funds | China Railway | (108) |

| | | | | Effective Rate | Construction-H— | |

| | | | | US plus 0.25%) — | Monthly | |

| | | | | Monthly | | |

| 14,013 | 13,916 | — | 9/25/19 | (Federal Funds | China Resources | (97) |

| | | | | Effective Rate | Cement—Monthly | |

| | | | | US plus 0.25%) — | | |

| | | | | Monthly | | |

| 27,458 | 26,989 | — | 9/25/19 | (Federal Funds | China Resources | (469) |

| | | | | Effective Rate | Gas Group Lt— | |

| | | | | US plus 0.25%) — | Monthly | |

| | | | | Monthly | | |

| 35,371 | 34,351 | — | 9/25/19 | (Federal Funds | Choice Hotels Intl | (1,022) |

| | | | | Effective Rate | Inc—Monthly | |

| | | | | US plus 0.25%) — | | |

| | | | | Monthly | | |

| 30,471 | 30,220 | — | 9/25/19 | (Federal Funds | Christian Dior Se— | (251) |

| | | | | Effective Rate | Monthly | |

| | | | | US plus 0.25%) — | | |

| | | | | Monthly | | |

| 45,108 | 44,346 | — | 9/25/19 | (Federal Funds | Ci Financial Corp— | (579) |

| | | | | Effective Rate | Monthly | |

| | | | | US plus 0.25%) — | | |

| | | | | Monthly | | |

| 93,591 | 94,600 | — | 9/25/19 | (Federal Funds | Cimic Group Ltd— | 1,006 |

| | | | | Effective Rate | Monthly | |

| | | | | US plus 0.25%) — | | |

| | | | | Monthly | | |

| 64,939 | 63,408 | — | 9/25/19 | (Federal Funds | Citizens Financial | (1,534) |

| | | | | Effective Rate | Group—Monthly | |

| | | | | US plus 0.25%) — | | |

| | | | | Monthly | | |

| 132,175 | 130,824 | — | 9/25/19 | (Federal Funds | Citrix Systems Inc— | (1,356) |

| | | | | Effective Rate | Monthly | |

| | | | | US plus 0.25%) — | | |

| | | | | Monthly | | |

| 17,270 | 17,303 | — | 9/25/19 | (Federal Funds | Ck Asset Holdings | 32 |

| | | | | Effective Rate | Ltd—Monthly | |

| | | | | US plus 0.25%) — | | |

| | | | | Monthly | | |

|

| PanAgora Market Neutral Fund 27 |

| | | | | | |

| OTC TOTAL RETURN SWAP CONTRACTS OUTSTANDING at 2/28/18 (Unaudited) cont. | |

| | | Upfront | | | | |

| | | premium | Termina- | Payments | Total return | Unrealized |

| Swap counterparty/ | | received | tion | received (paid) | received by | appreciation/ |

| Notional amount | Value | (paid) | date | by fund | or paid by fund | (depreciation) |

| Morgan Stanley & Co. International PLC cont. | | | | |

| $10,072 | $10,031 | $— | 9/25/19 | (Federal Funds | Clariant Ag-Reg— | $(41) |

| | | | | Effective Rate | Monthly | |

| | | | | US plus 0.25%) — | | |

| | | | | Monthly | | |

| 24,751 | 25,271 | — | 9/25/19 | (Federal Funds | Clp Holdings Ltd— | 518 |

| | | | | Effective Rate | Monthly | |

| | | | | US plus 0.25%) — | | |

| | | | | Monthly | | |

| 72,133 | 69,958 | — | 9/25/19 | (Federal Funds | Cms Energy Corp— | (2,178) |

| | | | | Effective Rate | Monthly | |

| | | | | US plus 0.25%) — | | |

| | | | | Monthly | | |

| 77,151 | 76,594 | — | 9/25/19 | (Federal Funds | Cnp Assurances— | (560) |

| | | | | Effective Rate | Monthly | |

| | | | | US plus 0.25%) — | | |

| | | | | Monthly | | |

| 39,472 | 42,344 | — | 9/25/19 | (Federal Funds | Cnx Resources | 2,870 |

| | | | | Effective Rate US | Corp—Monthly | |

| | | | | plus 0.30%) — | | |

| | | | | Monthly | | |

| 60,143 | 57,592 | — | 9/25/19 | (Federal Funds | Coca-Cola Amatil | (824) |

| | | | | Effective Rate | Ltd—Monthly | |

| | | | | US plus 0.25%) — | | |

| | | | | Monthly | | |

| 44,181 | 43,436 | — | 9/25/19 | (Federal Funds | Com Hem Holding | (747) |

| | | | | Effective Rate | Ab—Monthly | |

| | | | | US plus 0.25%) — | | |

| | | | | Monthly | | |

| 98,474 | 96,053 | — | 9/25/19 | (Federal Funds | Comerica Inc— | (2,426) |

| | | | | Effective Rate | Monthly | |

| | | | | US plus 0.25%) — | | |

| | | | | Monthly | | |