| | |

| UNITED STATES

SECURITIES AND EXCHANGE COMMISSION |

| | |

| CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

|

| | |

| Investment Company Act file number: | (811-07237) |

| | |

| Exact name of registrant as specified in charter: | Putnam Investment Funds |

| | |

| Address of principal executive offices: | 100 Federal Street, Boston, Massachusetts 02110 |

| | |

| Name and address of agent for service: | Robert T. Burns, Vice President

100 Federal Street

Boston, Massachusetts 02110 |

| | |

| Copy to: | Bryan Chegwidden, Esq.

Ropes & Gray LLP

1211 Avenue of the Americas

New York, New York 10036 |

| | |

| Registrant’s telephone number, including area code: | (617) 292-1000 |

| | |

| Date of fiscal year end: | February 28, 2019 |

| | |

| Date of reporting period: | March 1, 2018 — February 28, 2019 |

| | |

|

Item 1. Report to Stockholders: | |

| | |

| The following is a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act of 1940: | |

Putnam

Small Cap Value

Fund

Annual report

2|28|19

IMPORTANT NOTICE: Delivery of paper fund reports

In accordance with regulations adopted by the Securities and Exchange Commission, beginning on January 1, 2021, reports like this one will no longer be sent by mail unless you specifically request it. Instead, they will be on Putnam’s website, and you will be notified by mail whenever a new one is available, and provided with a website link to access the report.

If you wish to stop receiving paper reports sooner, or if you wish to continue to receive paper reports free of charge after January 1, 2021, please see the back cover or insert for instructions. If you invest through a bank or broker, your choice will apply to all funds held in your account. If you invest directly with Putnam, your choice will apply to all Putnam funds in your account.

If you already receive these reports electronically, no action is required.

Message from the Trustees

April 5, 2019

Dear Fellow Shareholder:

If there is any lesson to be learned from constantly changing financial markets, it is the importance of positioning your investment portfolio for your long-term goals. We believe that one strategy is to diversify across different asset classes and investment approaches.

We also believe your mutual fund investment offers a number of advantages, including constant monitoring by experienced investment professionals who maintain a long-term perspective. Putnam’s portfolio managers and analysts take a research-intensive approach that includes risk management strategies designed to serve you through changing conditions.

Another key strategy, in our view, is seeking the counsel of a financial advisor. For over 80 years, Putnam has recognized the importance of professional investment advice. Your financial advisor can help in many ways, including defining and planning for goals such as retirement, evaluating the level of risk appropriate for you, and reviewing your investments on a regular basis and making adjustments as necessary.

As always, your fund’s Board of Trustees remains committed to protecting the interests of Putnam shareholders like you, and we thank you for investing with Putnam.

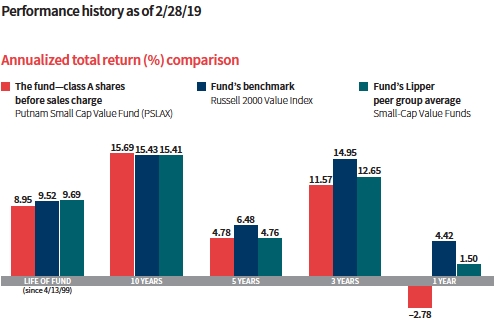

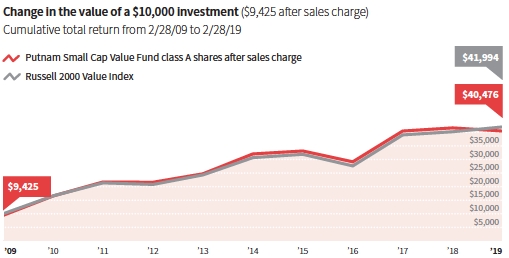

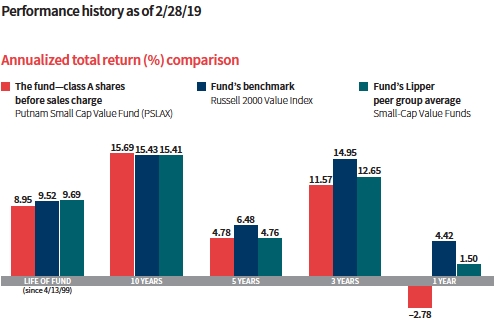

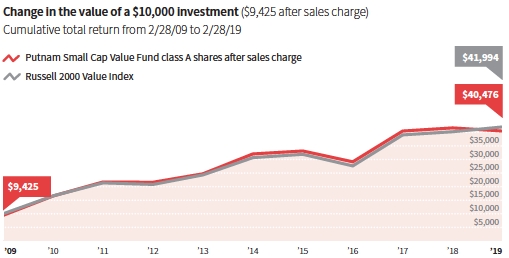

Current performance may be lower or higher than the quoted past performance, which cannot guarantee future results. Share price, principal value, and return will fluctuate, and you may have a gain or a loss when you sell your shares.Performance of class A shares assumes reinvestment of distributions and does not account for taxes. Fund returns in the bar chart do not reflect a sales charge of 5.75%; had they, returns would have been lower. See below and pages 8–11 for additional performance information. For a portion of the periods, the fund had expense limitations, without which returns would have been lower. To obtain the most recent month-end performance, visit putnam.com.

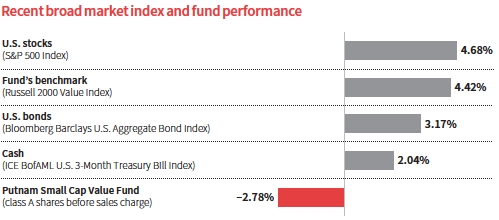

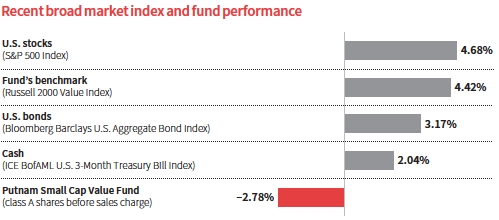

This comparison shows your fund’s performance in the context of broad market indexes for the 12 months ended 2/28/19. See above and pages 8–11 for additional fund performance information. Index descriptions can be found on pages 15–16.

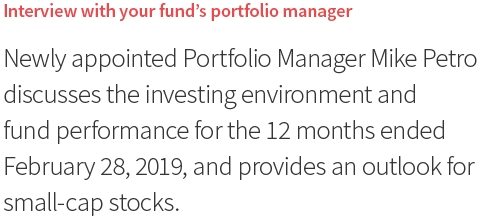

How was the market environment for stocks during the 12 months ended February 28, 2019?

Despite solid U.S. economic data and higher corporate earnings for much of the period, stock markets were quite volatile and marked by historic swings. Faced with a barrage of headlines about U.S.–China trade tensions, rising interest rates, slowing global growth, and geopolitical worries, investors became more cautious and moved into safer investments. The sell-off in equities was especially noteworthy in the fourth quarter of 2018, with December posting the worst monthly performance since 1931.

The Federal Reserve remained committed to a measured approach in its monetary policy. That sentiment led to the third rate increase during the reporting period — and fourth during calendar 2018 — in December. However, with global growth slowing and investor and business confidence waning, the Fed’s comments became more dovish at the December meeting. The change in the Fed’s messaging, which showed a willingness to be “patient,” sparked a strong rebound in the equity markets, which continued for the

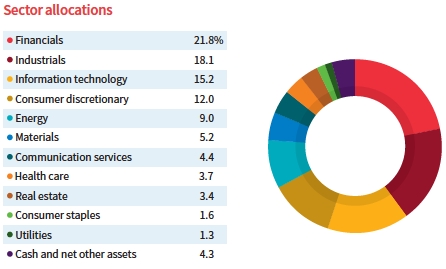

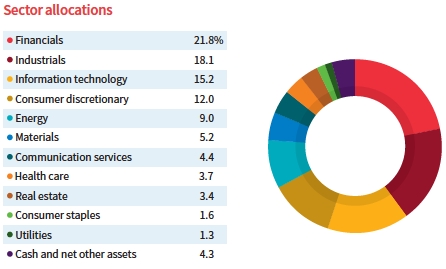

Allocations are shown as a percentage of the fund’s net assets as of 2/28/19. Cash and net other assets, if any, represent the market value weights of cash, derivatives, short-term securities, and other unclassified assets in the portfolio. Summary information may differ from the portfolio schedule included in the financial statements due to the inclusion of derivative securities, any interest accruals, the exclusion of as-of trades, if any, the use of different classifications of securities for presentation purposes, and rounding. Holdings and allocations may vary over time.

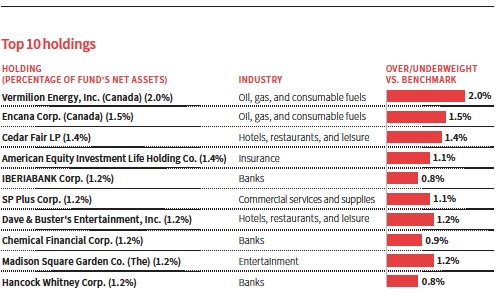

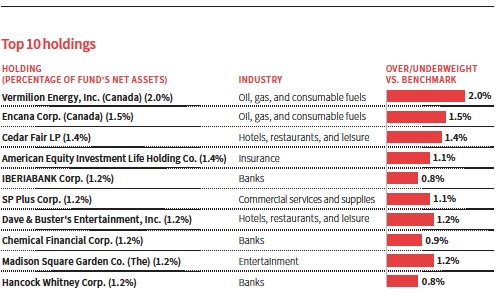

This table shows the fund’s top 10 holdings by percentage of the fund’s net assets as of 2/28/19. Short-term investments and derivatives, if any, are excluded. Holdings may vary over time.

balance of the period. Some further optimism crept into the markets as U.S.–China trade negotiations progressed, with the Trump administration’s decision to delay new tariffs that had been scheduled for March 1, 2019.

How did small-cap value stocks and the fund perform in this environment?

For the 12-month period ended February 28, 2019, the fund underperformed its benchmark, the Russell 2000 Value Index, and the average return for the funds in its Lipper peer group. This was largely due to sector allocation strategies. Overweight positions in the energy and materials industries were major contributors since these sectors were the worst performing in the benchmark during the period. Energy and materials stocks faced several headwinds, including volatile commodity prices, weaker growth in emerging markets, and the sharp stock market sell-off in the fourth quarter. Those factors weighed on companies with weaker balance sheets.

The fund’s relatively large underweight exposure to utilities detracted from results. Utilities were the best-performing industry within the benchmark due to investors’ preference for lower-risk strategies and the decline in long-term interest rates following the Fed’s forecast of two rate hikes in 2019 instead of three. While we increased the fund’s utility holdings during the period, the portfolio still remained underweight at period-end given our view that the industry was overvalued.

What stocks proved most disappointing during the period?

The fund’s investments in the oil and natural gas producer Chaparral Energy was the leading detractor. While Chaparral made strides strengthening its cash flow, in our view, the decline in oil prices was a major setback for the company. We still hold the stock but trimmed back the position as part of our effort to reduce the fund’s overweight in energy.

Evoqua Water Technologies, which provides water and wastewater treatment systems for municipalities and industrial customers, also detracted. The company’s results for the fourth quarter of 2018 and full-year results for fiscal 2018 fell short of market expectations due to troubled product launches, acquisition system-integration issues, and supply chain disruptions as a result of tariffs. We sold the holding at a loss as part of our broader strategy to trim the fund’s exposure to high-volatility stocks.

The stock of Lions Gate Entertainment, the producer of television and movie content, fell due to weak box office performance and declining revenue. One bright spot for the company was the success of shows on its proprietary Starz channel, includingOutlanderandAmerican Gods, which have attracted increasing numbers of subscribers. With a slate of upcoming shows on Starz and international expansion plans, we are holding on to Lions Gate as a value play and, in our view, a potential acquisition target in a consolidating industry.

What were some holdings that contributed to performance results?

The fund’s top-performing holding was Clean Harbors, a provider of environmental, energy, and industrial services, including hazardous waste cleanup and disposal. The company benefited from strong pricing that offset cost pressures during the period. We added to the position during the market correction in the fourth quarter of 2018, which was timely and beneficial given the stock’s strong appreciation during the market rebound in the closing months of the period. Before period-end, we

had reduced the position, selling shares to lock in profits.

Clarus, which specializes in outdoor equipment and lifestyle products focused on skiing and climbing and in skin care products, also helped results. In our view, the company has a strong culture of innovation and has been opportunistic in acquiring “super-fan brands” to augment its product line. Clarus was a relatively undiscovered company with low Wall Street coverage when we purchased the stock. We remain upbeat about the company’s ability to grow earnings and generate attractive shareholder returns.

DMC Global was another highlight and represents an energy-related company that performed well despite falling oil prices. DMC operates in industrial infrastructure, providing explosive metalworking, and in oilfield products and services where it produces advanced explosive components and systems used to perforate oil and gas wells in a process called fracking. As a result of the success of its technology, DMC has been gaining market share and growing revenue and profits, all of which was reflected in its rising stock price during the period.

You assumed management of the fund on January 31, 2019. How would you describe your investment approach?

Our small-cap value team searches the market for companies that we believe are priced at a discount to their intrinsic value and that have a catalyst to unlock value that has not yet been fully realized by investors. Our bottom-up investment process relies on stock selection rather than overarching themes, such as predictions about the direction of the economy, market volatility, or acquisition targets, that might tilt the portfolio too narrowly in a single direction. Rather, we seek to add value in each sector of the benchmark while attempting to limit overall risk and risk relative to the benchmark.

What is your outlook in the coming months?

Large-cap growth stocks led gains in 2017 and 2018. Therefore, we believe that investing in small-cap value stocks represents a timely opportunity to find overlooked or less well-known stocks with attractive return potential. Some small companies are at the beginning of their corporate life cycle and have the potential

This chart shows the fund’s largest allocation shifts, by percentage, over the past six months. Allocations are shown as a percentage of the fund’s net assets. Current period summary information may differ from the portfolio schedule included in the financial statements due to the inclusion of derivative securities, any interest accruals, the exclusion of as-of trades, if any, the use of different classifications of securities for presentation purposes, and rounding. Holdings and allocations may vary over time.

Data in the chart reflect a new calculation methodology put into effect on 10/1/18.

to grow at high rates for a longer period compared with large companies, in our view.

At the beginning of the period, the fund was overweight cyclical stocks, which are dependent on economic growth, and underweight defensive stocks, which are more resilient in a market downturn. In the final months of the period, we began to move the fund to a more balanced profile. As the new fiscal year begins, we will continue to reduce most of the sector over/underweights relative to the benchmark with the objective of ensuring that stock selection continues as the primary driving force for performance. As always, we look to minimize the impact of marketfluctuations by investing in companies that, in our view, offer attractive long-term growth potential, a competitive edge, and fundamental business strength.

Thank you, Mike, for your time and insights today.

The views expressed in this report are exclusively those of Putnam Management and are subject to change. They are not meant as investment advice.

Please note that the holdings discussed in this report may not have been held by the fund for the entire period. Portfolio composition is subject to review in accordance with the fund’s investment strategy and may vary in the future. Current and future portfolio holdings are subject to risk.

Your fund’s performance

This section shows your fund’s performance, price, and distribution information for periods ended February 28, 2019, the end of its most recent fiscal year. In accordance with regulatory requirements for mutual funds, we also include performance information as of the most recent calendar quarter-end and expense information taken from the fund’s current prospectus. Performance should always be considered in light of a fund’s investment strategy. Data represent past performance. Past performance does not guarantee future results. More recent returns may be less or more than those shown. Investment return and principal value will fluctuate, and you may have a gain or a loss when you sell your shares. Performance information does not reflect any deduction for taxes a shareholder may owe on fund distributions or on the redemption of fund shares. For the most recent month-end performance, please visit the Individual Investors section at putnam.com or call Putnam at 1-800-225-1581. Class R, R5, R6, and Y shares are not available to all investors.See the Terms and definitions section in this report for definitions of the share classes offered by your fund.

Fund performanceTotal return for periods ended 2/28/19

| | | | | | | | |

| | Annual | | | | | | | |

| | average | | Annual | | Annual | | Annual | |

| | (life of fund) | 10 years | average | 5 years | average | 3 years | average | 1 year |

| Class A(4/13/99) | | | | | | | | |

| Before sales charge | 8.95% | 329.46% | 15.69% | 26.30% | 4.78% | 38.88% | 11.57% | –2.78% |

| After sales charge | 8.62 | 304.76 | 15.01 | 19.04 | 3.55 | 30.89 | 9.39 | –8.37 |

| Class B(5/3/99) | | | | | | | | |

| Before CDSC | 8.70 | 310.30 | 15.16 | 21.69 | 4.00 | 35.82 | 10.75 | –3.57 |

| After CDSC | 8.70 | 310.30 | 15.16 | 20.50 | 3.80 | 33.65 | 10.15 | –7.42 |

| Class C(7/26/99) | | | | | | | | |

| Before CDSC | 8.53 | 298.58 | 14.83 | 21.67 | 4.00 | 35.85 | 10.75 | –3.60 |

| After CDSC | 8.53 | 298.58 | 14.83 | 21.67 | 4.00 | 35.85 | 10.75 | –4.37 |

| Class M(3/29/00) | | | | | | | | |

| Before sales charge | 8.41 | 308.71 | 15.12 | 23.22 | 4.27 | 36.93 | 11.05 | –3.27 |

| After sales charge | 8.22 | 294.41 | 14.71 | 18.91 | 3.52 | 32.14 | 9.73 | –6.66 |

| Class R(3/30/07) | | | | | | | | |

| Net asset value | 8.67 | 318.71 | 15.40 | 24.71 | 4.52 | 37.84 | 11.29 | –3.07 |

| Class R5(11/1/13) | | | | | | | | |

| Net asset value | 9.22 | 341.95 | 16.02 | 28.53 | 5.15 | 40.34 | 11.96 | –2.50 |

| Class R6(11/1/13) | | | | | | | | |

| Net asset value | 9.25 | 343.86 | 16.07 | 28.99 | 5.22 | 40.74 | 12.07 | –2.39 |

| Class Y(1/3/01) | | | | | | | | |

| Net asset value | 9.20 | 339.84 | 15.97 | 27.89 | 5.04 | 39.94 | 11.85 | –2.66 |

Current performance may be lower or higher than the quoted past performance, which cannot guarantee future results. After-sales-charge returns for class A and M shares reflect the deduction of the maximum 5.75% and 3.50% sales charge, respectively, levied at the time of purchase. Class B share returns after contingent deferred sales charge (CDSC) reflect the applicable CDSC, which is 5% in the first year, declining over time to 1% in the sixth year, and is eliminated thereafter. Class C share returns after CDSC reflect a 1% CDSC for the first year that is eliminated thereafter.Class R, R5, R6, and Y shares have no initial sales charge or CDSC. Performance for class B, C, M, R, and Y shares before their inception is derived from the historical performance of class A shares, adjusted for the applicable sales charge (or CDSC) and the higher operating expenses for such shares, except for class Y shares, for which 12b-1 fees are not applicable. Performance for class R5 and R6 shares prior to their inception is derived from the historical performance

of class Y shares and has not been adjusted for the lower investor servicing fees applicable to class R5 and R6 shares; had it, returns would have been higher.

For a portion of the periods, the fund had expense limitations, without which returns would have been lower.

Class B share performance reflects conversion to class A shares after six years.

Class C share performance reflects conversion to class A shares after 10 years.

Comparative index returnsFor periods ended 2/28/19

| | | | | | | | |

| | Annual | | | | | | | |

| | average | | Annual | | Annual | | Annual | |

| | (life of fund) | 10 years | average | 5 years | average | 3 years | average | 1 year |

| Russell 2000 Value Index | 9.52% | 319.94% | 15.43% | 36.85% | 6.48% | 51.91% | 14.95% | 4.42% |

| Lipper Small-Cap Value | | | | | | | | |

| Funds category average* | 9.69 | 324.75 | 15.41 | 26.85 | 4.76 | 43.19 | 12.65 | 1.50 |

Index and Lipper results should be compared with fund performance before sales charge, before CDSC, or at net asset value.

*Over the 1-year, 3-year, 5-year, 10-year, and life-of-fund periods ended 2/28/19, there were 294, 265, 236, 159, and 51 funds, respectively, in this Lipper category.

Past performance does not indicate future results. At the end of the same time period, a $10,000 investment in the fund’s class B and C shares would have been valued at $41,030 and $39,858, respectively, and no contingent deferred sales charges would apply. A $10,000 investment in the fund’s class M shares ($9,650 after sales charge) would have been valued at $39,441. A $10,000 investment in the fund’s class R, R5, R6, and Y shares would have been valued at $41,871, $44,195, $44,386 and $43,984, respectively.

Fund price and distribution informationFor the 12-month period ended 2/28/19

| | | | | | | | | | |

| Distributions | Class A | Class B | Class C | Class M | Class R | Class R5 | Class R6 | Class Y |

| Number | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 |

| Income | $0.094609 | $0.045872 | $0.038740 | $0.061919 | $0.073212 | $0.120760 | $0.129081 | $0.111250 |

| Capital gains | | | | | | | | | | |

| Long-term | | | | | | | | | | |

| gains | 0.278679 | 0.278679 | 0.278679 | 0.278679 | 0.278679 | 0.278679 | 0.278679 | 0.278679 |

| Short-term | | | | | | | | | | |

| gains | 1.512141 | 1.512141 | 1.512141 | 1.512141 | 1.512141 | 1.512141 | 1.512141 | 1.512141 |

| Return | | | | | | | | | | |

| of capital* | 0.064571 | 0.031308 | 0.026440 | 0.042261 | 0.049968 | 0.082420 | 0.088099 | 0.075930 |

| Total | $1.950000 | $1.868000 | $1.856000 | $1.895000 | $1.914000 | $1.994000 | $2.008000 | $1.978000 |

| | Before | After | Net | Net | Before | After | Net | Net | Net | Net |

| | sales | sales | asset | asset | sales | sales | asset | asset | asset | asset |

| Share value | charge | charge | value | value | charge | charge | value | value | value | value |

| 2/28/18 | $13.06 | $13.86 | $10.21 | $10.16 | $11.44 | $11.85 | $12.76 | $13.79 | $13.78 | $13.74 |

| 2/28/19 | 10.63 | 11.28 | 7.87 | 7.83 | 9.06 | 9.39 | 10.34 | 11.33 | 11.32 | 11.28 |

The classification of distributions, if any, is an estimate. Before-sales-charge share value and current dividend rate for class A and M shares, if applicable, do not take into account any sales charge levied at the time of purchase. After-sales-charge share value, current dividend rate, and current 30-day SEC yield, if applicable, are calculated assuming that the maximum sales charge (5.75% for class A shares and 3.50% for class M shares) was levied at the time of purchase. Final distribution information will appear on your year-end tax forms.

Most recent distribution, including any return of capital and excluding capital gains, annualized and divided by NAV or market price at end of period.

*See page 47.

Fund performance as of most recent calendar quarterTotal return for periods ended 3/31/19

| | | | | | | | |

| | Annual | | | | | | | |

| | average | | Annual | | Annual | | Annual | |

| | (life of fund) | 10 years | average | 5 years | average | 3 years | average | 1 year |

| Class A(4/13/99) | | | | | | | | |

| Before sales charge | 8.73% | 282.67% | 14.36% | 20.13% | 3.74% | 25.74% | 7.93% | –5.29% |

| After sales charge | 8.41 | 260.67 | 13.69 | 13.22 | 2.51 | 18.51 | 5.82 | –10.74 |

| Class B(5/3/99) | | | | | | | | |

| Before CDSC | 8.49 | 265.58 | 13.84 | 15.73 | 2.96 | 23.01 | 7.15 | –5.98 |

| After CDSC | 8.49 | 265.58 | 13.84 | 14.60 | 2.76 | 21.04 | 6.57 | –9.74 |

| Class C(7/26/99) | | | | | | | | |

| Before CDSC | 8.32 | 254.20 | 13.48 | 15.61 | 2.94 | 22.88 | 7.11 | –6.03 |

| After CDSC | 8.32 | 254.20 | 13.48 | 15.61 | 2.94 | 22.88 | 7.11 | –6.79 |

| Class M(3/29/00) | | | | | | | | |

| Before sales charge | 8.19 | 263.28 | 13.77 | 17.14 | 3.21 | 23.87 | 7.40 | –5.79 |

| After sales charge | 8.00 | 250.57 | 13.36 | 13.04 | 2.48 | 19.53 | 6.13 | –9.09 |

| Class R(3/30/07) | | | | | | | | |

| Net asset value | 8.46 | 272.94 | 14.07 | 18.60 | 3.47 | 24.87 | 7.68 | –5.48 |

| Class R5(11/1/13) | | | | | | | | |

| Net asset value | 9.01 | 294.10 | 14.70 | 22.12 | 4.08 | 27.04 | 8.30 | –4.96 |

| Class R6(11/1/13) | | | | | | | | |

| Net asset value | 9.03 | 295.79 | 14.75 | 22.62 | 4.16 | 27.39 | 8.40 | –4.86 |

| Class Y(1/3/01) | | | | | | | | |

| Net asset value | 8.99 | 292.52 | 14.65 | 21.67 | 4.00 | 26.75 | 8.22 | –4.97 |

See the discussion following the fund performance table on page 8 for information about the calculation of fund performance.

Your fund’s expenses

As a mutual fund investor, you pay ongoing expenses, such as management fees, distribution fees (12b-1 fees), and other expenses. Using the following information, you can estimate how these expenses affect your investment and compare them with the expenses of other funds. You may also pay one-time transaction expenses, including sales charges (loads) and redemption fees, which are not shown in this section and would have resulted in higher total expenses. For more information, see your fund’s prospectus or talk to your financial representative.

Expense ratios

| | | | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class R5 | Class R6 | Class Y |

| Total annual operating | | | | | | | | |

| expenses for the fiscal year | | | | | | | | |

| ended 2/28/18 | 1.48% | 2.23% | 2.23% | 1.98% | 1.73% | 1.16% | 1.06% | 1.23% |

| Annualized expense ratio | | | | | | | | |

| for the six-month period | | | | | | | | |

| ended 2/28/19* | 1.23% | 1.98% | 1.98% | 1.73% | 1.48% | 0.90% | 0.80% | 0.98% |

Fiscal-year expense information in this table is taken from the most recent prospectus, is subject to change, and may differ from that shown for the annualized expense ratio and in the financial highlights of this report.

Prospectus expense information also includes the impact of acquired fund fees and expenses of 0.27%, which is not included in the financial highlights or annualized expense ratios. Expenses are shown as a percentage of average net assets.

*Expense ratios for each class are for the fund’s most recent fiscal half year. As a result of this, ratios may differ from expense ratios based on one-year data in the financial highlights.

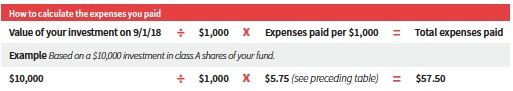

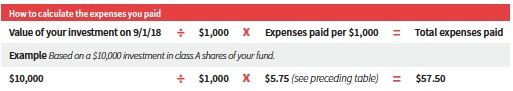

Expenses per $1,000

The following table shows the expenses you would have paid on a $1,000 investment in each class of the fund from 9/1/18 to 2/28/19. It also shows how much a $1,000 investment would be worth at the close of the period, assumingactual returnsand expenses.

| | | | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class R5 | Class R6 | Class Y |

| Expenses paid per $1,000*† | $5.75 | $9.24 | $9.24 | $8.08 | $6.92 | $4.21 | $3.75 | $4.59 |

| Ending value (after expenses) | $886.60 | $883.00 | $883.10 | $884.50 | $885.30 | $888.10 | $888.40 | $887.50 |

*Expenses for each share class are calculated using the fund’s annualized expense ratio for each class, which represents the ongoing expenses as a percentage of average net assets for the six months ended 2/28/19. The expense ratio may differ for each share class.

†Expenses are calculated by multiplying the expense ratio by the average account value for the period; then multiplying the result by the number of days in the period; and then dividing that result by the number of days in the year.

Estimate the expenses you paid

To estimate the ongoing expenses you paid for the six months ended 2/28/19, use the following calculation method. To find the value of your investment on 9/1/18, call Putnam at 1-800-225-1581.

Compare expenses using the SEC’s method

The Securities and Exchange Commission (SEC) has established guidelines to help investors assess fund expenses. Per these guidelines, the following table shows your fund’s expenses based on a $1,000 investment, assuming ahypothetical 5% annualized return. You can use this information to compare the ongoing expenses (but not transaction expenses or total costs) of investing in the fund with those of other funds. All mutual fund shareholder reports will provide this information to help you make this comparison. Please note that you cannot use this information to estimate your actual ending account balance and expenses paid during the period.

| | | | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class R5 | Class R6 | Class Y |

| Expenses paid per $1,000*† | $6.16 | $9.89 | $9.89 | $8.65 | $7.40 | $4.51 | $4.01 | $4.91 |

| Ending value (after expenses) | $1,018.70 | $1,014.98 | $1,014.98 | $1,016.22 | $1,017.46 | $1,020.33 | $1,020.83 | $1,019.93 |

*Expenses for each share class are calculated using the fund’s annualized expense ratio for each class, which represents the ongoing expenses as a percentage of average net assets for the six months ended 2/28/19. The expense ratio may differ for each share class.

†Expenses are calculated by multiplying the expense ratio by the average account value for the six-month period; then multiplying the result by the number of days in the six-month period; and then dividing that result by the number of days in the year.

Consider these risks before investing

Investments in small and/or midsize companies increase the risk of greater price fluctuations. Value stocks may fail to rebound, and the market may not favor value-style investing. Stock prices may fall or fail to rise over time for several reasons, including general financial market conditions, changing market perceptions, changes in government intervention in the financial markets, and factors related to a specific issuer or industry. These and other factors may lead to increased volatility and reduced liquidity in the fund’s portfolio holdings. These risks are generally greater for small and midsize companies. You can lose money by investing in the fund.

Terms and definitions

Important terms

Total returnshows how the value of the fund’s shares changed over time, assuming you held the shares through the entire period and reinvested all distributions in the fund.

Before sales charge, or net asset value, is the price, or value, of one share of a mutual fund, without a sales charge. Before-sales-charge figures fluctuate with market conditions, and are calculated by dividing the net assets of each class of shares by the number of outstanding shares in the class.

After sales chargeis the price of a mutual fund share plus the maximum sales charge levied at the time of purchase. After-sales-charge performance figures shown here assume the 5.75% maximum sales charge for class A shares and 3.50% for class M shares.

Contingent deferred sales charge (CDSC)is generally a charge applied at the time of the redemption of class B or C shares and assumes redemption at the end of the period. Your fund’s class B CDSC declines over time from a 5% maximum during the first year to 1% during the sixth year. After the sixth year, the CDSC no longer applies. The CDSC for class C shares is 1% for one year after purchase.

Share classes

Class A sharesare generally subject to an initial sales charge and no CDSC (except on certain redemptions of shares bought without an initial sales charge).

Class B sharesare closed to new investments and are only available by exchange from another Putnam fund or through dividend and/or capital gains reinvestment. They are not subject to an initial sales charge and may be subject to a CDSC.

Class C sharesare not subject to an initial sales charge and are subject to a CDSC only if the shares are redeemed during the first year.

Class M shareshave a lower initial sales charge and a higher 12b-1 fee than class A shares and no CDSC.

Class R sharesare not subject to an initial sales charge or CDSC and are only available to employer-sponsored retirement plans.

Class R5 sharesare not subject to an initial sales charge or CDSC and carry no 12b-1 fee. They are only available to employer-sponsored retirement plans.

Class R6 sharesare not subject to an initial sales charge or CDSC and carry no 12b-1 fee. They are generally only available to employer-sponsored retirement plans, corporate and institutional clients, and clients in other approved programs.

Class Y sharesare not subject to an initial sales charge or CDSC and carry no 12b-1 fee. They are generally only available to corporate and institutional clients and clients in other approved programs.

Comparative indexes

Bloomberg Barclays U.S. Aggregate Bond Indexis an unmanaged index of U.S. investment-grade fixed-income securities.

ICE BofAML (Intercontinental Exchange Bank of America Merrill Lynch) U.S. 3-Month Treasury Bill Indexis an unmanaged index that seeks to measure the performance of U.S.Treasury bills available in the marketplace.

Russell 2000 Value Indexis an unmanaged index of those companies in the small-cap Russell 2000 Index chosen for their value orientation.

S&P 500 Indexis an unmanaged index of common stock performance.

ICE Data Indices, LLC (“ICE BofAML”), used with permission. ICE BofAML permits use of the ICE BofAML indices and related data on an “as is” basis; makes no warranties regarding same; does not guarantee the suitability, quality, accuracy, timeliness, and/or completeness of the ICE BofAML indices or any data included in, related

to, or derived therefrom; assumes no liability in connection with the use of the foregoing; and does not sponsor, endorse, or recommend Putnam Investments, or any of its products or services.

Indexes assume reinvestment of all distributions and do not account for fees. Securities and performance of a fund and an index will differ. You cannot invest directly in an index.

Frank Russell Company is the source and owner of the trademarks, service marks, and copyrights related to the Russell Indexes. Russell® is a trademark of Frank Russell Company.

Lipperis a third-party industry-ranking entity that ranks mutual funds. Its rankings do not reflect sales charges. Lipper rankings are based on total return at net asset value relative to other funds that have similar current investment styles or objectives as determined by Lipper. Lipper may change a fund’s category assignment at its discretion. Lipper category averages reflect performance trends for funds within a category.

Other information for shareholders

Proxy voting

Putnam is committed to managing our mutual funds in the best interests of our shareholders. The Putnam funds’ proxy voting guidelines and procedures, as well as information regarding how your fund voted proxies relating to portfolio securities during the 12-month period ended June 30, 2018, are available in the Individual Investors section of putnam.com and on the Securities and Exchange Commission (SEC) website, www.sec.gov. If you have questions about finding forms on the SEC’s website, you may call the SEC at 1-800-SEC-0330. You may also obtain the Putnam funds’ proxy voting guidelines and procedures at no charge by calling Putnam’s Shareholder Services at 1-800-225-1581.

Fund portfolio holdings

The fund will file a complete schedule of its portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Shareholders may obtain the fund’s Form N-Q on the SEC’s website at www.sec.gov.

Trustee and employee fund ownership

Putnam employees and members of the Board of Trustees place their faith, confidence, and, most importantly, investment dollars in Putnam mutual funds. As of February 28, 2019, Putnam employees had approximately $493,000,000 and the Trustees had approximately $68,000,000 invested in Putnam mutual funds. These amounts include investments by the Trustees’ and employees’ immediate family members as well as investments through retirement and deferred compensation plans.

Important notice regarding Putnam’s privacy policy

In order to conduct business with our shareholders, we must obtain certain personal information such as account holders’ names, addresses, Social Security numbers, and dates of birth. Using this information, we are able to maintain accurate records of accounts and transactions.

It is our policy to protect the confidentiality of our shareholder information, whether or not a shareholder currently owns shares of our funds. In particular, it is our policy not to sell information about you or your accounts to outside marketing firms. We have safeguards in place designed to prevent unauthorized accessto our computer systems and procedures to protect personal information from unauthorized use.

Under certain circumstances, we must share account information with outside vendors who provide services to us, such as mailings and proxy solicitations. In these cases, the service providers enter into confidentiality agreements with us, and we provide only the information necessary to process transactions and perform other services related to your account. Finally, it is our policy to share account information with your financial representative, if you’ve listed one on your Putnam account.

Financial statements

These sections of the report, as well as the accompanying Notes, preceded by the Report of Independent Registered Public Accounting Firm, constitute the fund’s financial statements.

The fund’s portfoliolists all the fund’s investments and their values as of the last day of the reporting period. Holdings are organized by asset type and industry sector, country, or state to show areas of concentration and diversification.

Statement of assets and liabilitiesshows how the fund’s net assets and share price are determined. All investment and non-investment assets are added together. Any unpaid expenses and other liabilities are subtracted from this total. The result is divided by the number of shares to determine the net asset value per share, which is calculated separately for each class of shares. (For funds with preferred shares, the amount subtracted from total assets includes the liquidation preference of preferred shares.)

Statement of operationsshows the fund’s net investment gain or loss. This is done by first adding up all the fund’s earnings — from dividends and interest income — and subtracting its operating expenses to determine net investment income (orloss). Then, any net gain or loss the fund realized on the sales of its holdings — as well as any unrealized gains or losses over the period — is added to or subtracted from the net investment result to determine the fund’s net gain or loss for the fiscal year.

Statement of changes in net assetsshows how the fund’s net assets were affected by the fund’s net investment gain or loss, by distributions to shareholders, and by changes in the number of the fund’s shares. It lists distributions and their sources (net investment income or realized capital gains) over the current reporting period and the most recent fiscal year-end. The distributions listed here may not match the sources listed in the Statement of operations because the distributions are determined on a tax basis and may be paid in a different period from the one in which they were earned.

Financial highlightsprovide an overview of the fund’s investment results, per-share distributions, expense ratios, net investment income ratios, and portfolio turnover in one summary table, reflecting the five most recent reporting periods. In a semiannual report, the highlights table also includes the current reporting period.

Report of Independent Registered Public Accounting Firm

The Board of Trustees and Shareholders

Putnam Investment Funds:

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities of Putnam Small Cap Value Fund (the “fund”), a series of the Putnam Investments Funds, including the fund’s portfolio, as of February 28, 2019, and the related statement of operations for the year then ended, the statements of changes in net assets for each of the years in the two-year period then ended, and the related notes (collectively, the “financial statements”) and the financial highlights for each of the years in the five-year period then ended. In our opinion, the financial statements and financial highlights present fairly, in all material respects, the financial position of the fund as of February 28, 2019, and the results of its operations for the year then ended, the changes in its net assets for each of the years in the two-year period then ended, and the financial highlights for each of the years in the five-year period then ended, in conformity with U.S. generally accepted accounting principles.

Basis for Opinion

These financial statements and financial highlights are the responsibility of the fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement, whether due to error or fraud. Our audits included performing procedures to assess the risks of material misstatement of the financial statements and financial highlights, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements and financial highlights. Such procedures included confirmation of securities owned as of February 28, 2019, by correspondence with the custodian and brokers or by other appropriate auditing procedures. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements and financial highlights. We believe that our audits provide a reasonable basis for our opinion.

We have served as the auditor of one or more Putnam investment companies since 1999.

Boston, Massachusetts

April 5, 2019

The fund’s portfolio2/28/19

| | |

| COMMON STOCKS (93.9%)* | Shares | Value |

| Aerospace and defense (0.3%) | | |

| Vectrus, Inc. † | 33,620 | $906,395 |

| | | 906,395 |

| Airlines (1.5%) | | |

| JetBlue Airways Corp. † | 123,835 | 2,068,045 |

| Mesa Air Group, Inc. † | 199,200 | 2,005,944 |

| | | 4,073,989 |

| Auto components (1.0%) | | |

| Cooper Tire & Rubber Co. | 60,577 | 1,936,041 |

| VOXX International Corp. † | 121,633 | 608,165 |

| | | 2,544,206 |

| Banks (14.5%) | | |

| Ameris Bancorp | 62,900 | 2,564,433 |

| Berkshire Hills Bancorp, Inc. | 32,700 | 1,024,164 |

| Brookline Bancorp, Inc. | 57,800 | 923,644 |

| Cadence BanCorporation | 59,713 | 1,193,663 |

| Camden National Corp. | 10,637 | 477,069 |

| Chemical Financial Corp. | 72,400 | 3,318,092 |

| Coastal Financial Corp. (WA) † | 26,974 | 441,025 |

| First Horizon National Crop. | 109,669 | 1,714,126 |

| First Merchants Corp. | 52,608 | 2,124,837 |

| Franklin Financial Network, Inc. | 19,000 | 623,200 |

| Hancock Whitney Corp. | 74,690 | 3,262,459 |

| IBERIABANK Corp. | 42,900 | 3,356,067 |

| Independent Bank Group, Inc. | 26,221 | 1,519,769 |

| Investors Bancorp, Inc. | 128,465 | 1,614,805 |

| Pacific Premier Bancorp, Inc. † | 33,000 | 985,050 |

| Pinnacle Financial Partners, Inc. | 50,690 | 2,974,996 |

| Sterling Bancorp | 148,127 | 3,011,422 |

| Synovus Financial Corp. | 36,585 | 1,451,693 |

| Umpqua Holdings Corp. | 34,900 | 634,482 |

| Union Bankshares Corp. | 38,900 | 1,383,673 |

| Univest Corp of Pennsylvania | 71,041 | 1,883,297 |

| Western Alliance Bancorp † | 54,700 | 2,530,969 |

| | | 39,012,935 |

| Beverages (0.6%) | | |

| Craft Brew Alliance, Inc. † | 101,341 | 1,727,864 |

| | | 1,727,864 |

| Building products (1.3%) | | |

| Apogee Enterprises, Inc. | 79,400 | 2,833,786 |

| Quanex Building Products Corp. | 45,434 | 781,010 |

| | | 3,614,796 |

| Capital markets (0.7%) | | |

| Donnelley Financial Solutions, Inc. † | 121,650 | 1,728,647 |

| | | 1,728,647 |

| Chemicals (3.1%) | | |

| AdvanSix, Inc. † | 29,300 | 959,575 |

| Minerals Technologies, Inc. | 4,315 | 255,448 |

| Olin Corp. | 74,600 | 1,929,156 |

| | |

| COMMON STOCKS (93.9%)*cont. | Shares | Value |

| Chemicalscont. | | |

| Orion Engineered Carbons SA (Luxembourg) | 85,200 | $2,374,524 |

| Tronox, Ltd. Class A | 236,300 | 2,795,429 |

| | | 8,314,132 |

| Commercial services and supplies (3.9%) | | |

| CECO Environmental Corp. † | 128,746 | 981,045 |

| Charah Solutions, Inc. † | 43,322 | 262,531 |

| Clean Harbors, Inc. † | 29,345 | 1,995,460 |

| Matthews International Corp. Class A | 38,600 | 1,535,122 |

| Quad/Graphics, Inc. | 164,200 | 2,395,678 |

| SP Plus Corp. † | 97,300 | 3,347,120 |

| | | 10,516,956 |

| Communications equipment (3.1%) | | |

| CommScope Holding Co., Inc. † | 82,282 | 1,917,993 |

| Digi International, Inc. † | 31,000 | 409,200 |

| EXFO, Inc. (Canada) † | 44,915 | 162,143 |

| Lumentum Holdings, Inc. † | 41,100 | 2,044,725 |

| Plantronics, Inc. | 57,700 | 2,898,848 |

| Tessco Technologies, Inc. | 55,518 | 916,047 |

| | | 8,348,956 |

| Construction and engineering (3.0%) | | |

| Construction Partners, Inc. Class A † | 61,616 | 761,574 |

| Granite Construction, Inc. | 29,290 | 1,363,742 |

| MYR Group, Inc./DE † | 59,786 | 2,005,222 |

| Sterling Construction Co., Inc. † | 67,500 | 986,175 |

| Valmont Industries, Inc. | 5,800 | 792,222 |

| Williams Scotsman Corp. † | 227,900 | 2,322,301 |

| | | 8,231,236 |

| Construction materials (1.0%) | | |

| Eagle Materials, Inc. | 34,640 | 2,647,882 |

| | | 2,647,882 |

| Containers and packaging (0.4%) | | |

| Berry Plastics Group, Inc. † | 20,189 | 1,059,317 |

| | | 1,059,317 |

| Diversified consumer services (0.2%) | | |

| frontdoor, Inc. † | 17,466 | 558,912 |

| | | 558,912 |

| Diversified financial services (0.1%) | | |

| FGL Holdings (Bermuda) † | 47,300 | 392,590 |

| | | 392,590 |

| Diversified telecommunication services (0.7%) | | |

| Zayo Group Holdings, Inc. † | 73,600 | 1,825,280 |

| | | 1,825,280 |

| Electric utilities (1.3%) | | |

| ALLETE, Inc. | 10,300 | 834,815 |

| El Paso Electric Co. | 16,345 | 879,361 |

| Portland General Electric Co. | 38,100 | 1,910,334 |

| | | 3,624,510 |

| | |

| COMMON STOCKS (93.9%)*cont. | Shares | Value |

| Electrical equipment (1.1%) | | |

| Acuity Brands, Inc. | 9,780 | $1,272,574 |

| nVent Electric PLC (United Kingdom) | 30,900 | 849,132 |

| Powell Industries, Inc. | 25,401 | 815,118 |

| | | 2,936,824 |

| Electronic equipment, instruments, and components (4.3%) | | |

| Anixter International, Inc. † | 13,100 | 768,708 |

| Bel Fuse, Inc. Class A | 1,887 | 38,853 |

| Bel Fuse, Inc. Class B | 23,483 | 574,159 |

| Evertz Technologies, Ltd. (Canada) | 43,401 | 542,533 |

| II-VI, Inc. † | 59,441 | 2,525,054 |

| Jabil, Inc. | 87,500 | 2,485,000 |

| Knowles Corp. † | 118,190 | 1,924,133 |

| SYNNEX Corp. | 28,851 | 2,830,860 |

| | | 11,689,300 |

| Energy equipment and services (1.0%) | | |

| Natural Gas Services Group, Inc. † | 38,946 | 719,722 |

| Patterson-UTI Energy, Inc. | 39,222 | 520,084 |

| Select Energy Services, Inc. Class A † | 132,255 | 1,333,130 |

| | | 2,572,936 |

| Entertainment (2.5%) | | |

| IMAX Corp. (Canada) † S | 85,403 | 1,956,583 |

| Lions Gate Entertainment Corp. Class A S | 101,631 | 1,570,199 |

| Madison Square Garden Co. (The) Class A † | 11,402 | 3,285,372 |

| | | 6,812,154 |

| Equity real estate investment trusts (REITs) (3.0%) | | |

| Columbia Property Trust, Inc. R | 78,200 | 1,691,466 |

| Gaming and Leisure Properties, Inc. R | 43,140 | 1,569,433 |

| QTS Realty Trust, Inc. Class A R | 48,855 | 2,038,719 |

| RLJ Lodging Trust R | 56,784 | 1,054,479 |

| Tier REIT, Inc. R | 71,200 | 1,726,600 |

| | | 8,080,697 |

| Food and staples retail (0.3%) | | |

| United Natural Foods, Inc. † | 60,100 | 902,101 |

| | | 902,101 |

| Food products (0.1%) | | |

| Limoneira Co. | 14,419 | 337,405 |

| | | 337,405 |

| Health-care equipment and supplies (0.5%) | | |

| Accuray, Inc. † | 300,530 | 1,448,555 |

| | | 1,448,555 |

| Health-care providers and services (2.7%) | | |

| Acadia Healthcare Co., Inc. † | 36,900 | 970,101 |

| Brookdale Senior Living, Inc. † | 210,654 | 1,424,021 |

| Cross Country Healthcare, Inc. † | 184,850 | 1,615,589 |

| Magellan Health, Inc. † | 33,500 | 2,281,685 |

| Select Medical Holdings Corp. † | 67,900 | 1,006,278 |

| | | 7,297,674 |

| | |

| COMMON STOCKS (93.9%)*cont. | Shares | Value |

| Hotels, restaurants, and leisure (6.3%) | | |

| Bloomin’ Brands, Inc. | 64,964 | $1,343,456 |

| Carrols Restaurant Group, Inc. † | 188,584 | 2,015,963 |

| Cedar Fair LP | 73,638 | 3,902,814 |

| Cheesecake Factory, Inc. (The) | 45,042 | 2,130,487 |

| Dave & Buster’s Entertainment, Inc. | 64,832 | 3,327,827 |

| Del Taco Restaurants, Inc. † | 50,176 | 518,820 |

| Papa John’s International, Inc. | 37,900 | 1,656,609 |

| Penn National Gaming, Inc. † | 32,507 | 807,799 |

| Scientific Games Corp. Class A † S | 47,300 | 1,374,538 |

| | | 17,078,313 |

| Household durables (0.5%) | | |

| William Lyon Homes Class A † | 93,200 | 1,318,780 |

| | | 1,318,780 |

| Insurance (2.2%) | | |

| American Equity Investment Life Holding Co. | 122,830 | 3,887,570 |

| Heritage Insurance Holdings, Inc. | 139,000 | 2,073,880 |

| | | 5,961,450 |

| Interactive media and services (0.6%) | | |

| Cars.com, Inc. † S | 65,230 | 1,535,514 |

| | | 1,535,514 |

| IT Services (2.2%) | | |

| Information Services Group, Inc. † | 125,896 | 542,612 |

| Perficient, Inc. † | 102,900 | 2,943,969 |

| Perspecta, Inc. | 119,000 | 2,510,900 |

| | | 5,997,481 |

| Leisure products (1.5%) | | |

| Brunswick Corp. | 14,611 | 770,584 |

| Clarus Corp. | 161,707 | 1,969,591 |

| MasterCraft Boat Holdings, Inc. † | 50,500 | 1,245,835 |

| | | 3,986,010 |

| Machinery (4.6%) | | |

| Alamo Group, Inc. | 10,100 | 970,004 |

| ATS Automation Tooling Systems, Inc. (Canada) † | 48,750 | 686,453 |

| Columbus McKinnon Corp./NY | 35,600 | 1,333,220 |

| Deutz AG (Germany) | 222,978 | 1,614,331 |

| DMC Global, Inc. | 36,422 | 1,711,106 |

| Federal Signal Corp. | 101,900 | 2,504,702 |

| Manitex International, Inc. † S | 184,715 | 1,411,223 |

| Rexnord Corp. † | 80,100 | 2,136,267 |

| | | 12,367,306 |

| Marine (0.1%) | | |

| Stolt-Nielsen, Ltd. (United Kingdom) | 25,744 | 346,597 |

| | | 346,597 |

| Media (0.6%) | | |

| Beasley Broadcast Group, Inc. Class A | 43,145 | 177,326 |

| Tribune Publishing Co. † | 115,050 | 1,387,503 |

| | | 1,564,829 |

| | |

| COMMON STOCKS (93.9%)*cont. | Shares | Value |

| Metals and mining (1.0%) | | |

| Allegheny Technologies, Inc. † S | 72,390 | $2,072,526 |

| Carpenter Technology Corp. | 7,584 | 355,993 |

| Ferroglobe Representation & Warranty Insurance Trust † | 270,395 | — |

| Major Drilling Group International, Inc. (Canada) † | 49,982 | 178,134 |

| | | 2,606,653 |

| Mortgage real estate investment trusts (REITs) (0.7%) | | |

| Granite Point Mortgage Trust, Inc. R | 99,500 | 1,892,490 |

| | | 1,892,490 |

| Oil, gas, and consumable fuels (8.0%) | | |

| Andeavor Logistics LP (Units) | 60,300 | 2,121,354 |

| Berry Petroleum Corp. | 88,500 | 1,126,605 |

| Callon Petroleum Co. † | 159,523 | 1,220,351 |

| Chaparral Energy, Inc. Class A † S | 81,139 | 438,151 |

| Encana Corp. (Canada) | 540,625 | 3,919,531 |

| Magnolia Oil & Gas Corp. † | 86,300 | 1,061,490 |

| Matador Resources Co. † S | 78,400 | 1,458,240 |

| Parsley Energy, Inc. Class A † | 38,100 | 691,134 |

| Riviera Resources, Inc./Linn † | 37,048 | 550,904 |

| Roan Resources, Inc. † | 104,001 | 808,088 |

| Scorpio Tankers, Inc. | 121,600 | 2,238,656 |

| Seven Generations Energy, Ltd. Class A (Canada) † | 66,900 | 489,060 |

| Vermilion Energy, Inc. (Canada) | 213,880 | 5,470,720 |

| | | 21,594,284 |

| Pharmaceuticals (0.5%) | | |

| China Traditional Chinese Medicine Holdings Co., Ltd. (China) | 1,894,000 | 1,249,839 |

| | | 1,249,839 |

| Professional services (0.6%) | | |

| BancTec, Inc. 144A CVR F | 160,833 | — |

| Franklin Covey, Co. † | 28,725 | 747,425 |

| Willdan Group, Inc. † | 20,959 | 793,927 |

| | | 1,541,352 |

| Real estate management and development (0.4%) | | |

| Newmark Group, Inc. Class A | 116,400 | 1,077,864 |

| | | 1,077,864 |

| Road and rail (0.9%) | | |

| Saia, Inc. † | 10,600 | 701,296 |

| Schneider National, Inc. Class B | 52,700 | 1,153,603 |

| US Xpress Enterprises, Inc. Class A † | 67,147 | 587,536 |

| | | 2,442,435 |

| Semiconductors and semiconductor equipment (2.4%) | | |

| Brooks Automation, Inc. | 41,589 | 1,335,423 |

| Cohu, Inc. | 80,300 | 1,436,567 |

| Mellanox Technologies, Ltd. (Israel) † | 13,835 | 1,486,432 |

| Photronics, Inc. † | 217,000 | 2,128,770 |

| | | 6,387,192 |

| Software (2.4%) | | |

| Avaya Holdings Corp. † | 87,900 | 1,361,571 |

| j2 Global, Inc. | 29,500 | 2,507,795 |

| Nuance Communications, Inc. † | 88,300 | 1,480,791 |

| | |

| COMMON STOCKS (93.9%)*cont. | Shares | Value |

| Softwarecont. | | |

| TiVo Corp. | 97,100 | $973,913 |

| Upland Software, Inc. † | 1,596 | 56,020 |

| | | 6,380,090 |

| Specialty retail (2.4%) | | |

| American Eagle Outfitters, Inc. | 46,384 | 946,234 |

| Citi Trends, Inc. | 29,400 | 636,216 |

| MarineMax, Inc. † | 129,074 | 2,533,723 |

| RTW RetailWinds, Inc. † | 156,130 | 474,635 |

| Sportsman’s Warehouse Holdings, Inc. † S | 286,034 | 1,799,154 |

| | | 6,389,962 |

| Technology hardware, storage, and peripherals (0.9%) | | |

| Electronics For Imaging, Inc. † | 89,712 | 2,425,812 |

| | | 2,425,812 |

| Textiles, apparel, and luxury goods (0.3%) | | |

| Delta Apparel, Inc. † | 33,540 | 792,886 |

| | | 792,886 |

| Thrifts and mortgage finance (1.4%) | | |

| First Defiance Financial Corp. | 31,937 | 988,131 |

| OceanFirst Financial Corp. | 32,474 | 818,345 |

| Territorial Bancorp, Inc. | 15,198 | 427,064 |

| Washington Federal, Inc. | 53,100 | 1,629,108 |

| | | 3,862,648 |

| Tobacco (0.4%) | | |

| Turning Point Brands, Inc. | 27,200 | 1,112,208 |

| | | 1,112,208 |

| Trading companies and distributors (0.3%) | | |

| Herc Holdings, Inc. † | 12,891 | 567,204 |

| Houston Wire & Cable Co. † | 65,514 | 370,154 |

| | | 937,358 |

| Transportation infrastructure (0.5%) | | |

| Macquarie Infrastructure Co., LLC | 35,000 | 1,431,150 |

| | | 1,431,150 |

| Total common stocks (cost $248,315,583) | | $253,486,752 |

| | |

| INVESTMENT COMPANIES (2.5%)* | Shares | Value |

| Ares Capital Corp. | 108,800 | $1,884,416 |

| Bain Capital Specialty Finance, Inc. | 57,070 | 1,152,243 |

| Golub Capital BDC, Inc. | 89,049 | 1,642,954 |

| PennantPark Investment Corp. | 186,861 | 1,332,319 |

| TriplePoint Venture Growth BDC Corp. | 62,081 | 789,670 |

| Total investment companies (cost $6,484,179) | | $6,801,602 |

| | | | |

| PURCHASED OPTIONS | Expiration | | | |

| OUTSTANDING (0.2%)* | date/strike | Notional | Contract | |

| Counterparty | price | amount | amount | Value |

| Bank of America N.A. | | | | |

| Dril-Quip, Inc. (Call) | Mar-19/$35.00 | $358,222 | $8,407 | $64,408 |

| Barclays Bank PLC | | | | |

| Callon Petroleum Co. (Call) | Jul-19/7.00 | 136,782 | 17,880 | 25,208 |

| | | | |

| PURCHASED OPTIONS | Expiration | | | |

| OUTSTANDING (0.2%)* | date/strike | Notional | Contract | |

| Counterpartycont. | price | amount | amount | Value |

| Citibank, N.A. | | | | |

| Cross Country Healthcare, Inc. (Call) | Mar-19/$7.50 | $284,784 | $32,584 | $43,203 |

| Donnelley Financial Solution (Call) | Apr-19/12.50 | 559,931 | 39,404 | 79,226 |

| Eagle Materials, Inc. (Call) | Apr-19/65.00 | 589,429 | 7,711 | 93,189 |

| UBS AG | | | | |

| Clean Harbors, Inc. (Call) | Apr-19/40.00 | 804,236 | 11,827 | 332,847 |

| Total purchased options outstanding (cost $579,278) | | | $638,081 |

| | |

| | Principal | |

| U.S. TREASURY OBLIGATIONS (—%)* | amount | Value |

| U.S. Treasury Inflation Index Notes 2.125%, 2/15/41 i | $95,242 | $115,312 |

| Total U.S. treasury obligations (cost $115,312) | | $115,312 |

| | | |

| | Principal amount/ | |

| SHORT-TERM INVESTMENTS (8.6%)* | | shares | Value |

| Putnam Cash Collateral Pool, LLC 2.67% d | Shares | 9,613,695 | $9,613,695 |

| Putnam Short Term Investment Fund 2.58% L | Shares | 12,287,820 | 12,287,820 |

| State Street Institutional U.S. Government Money Market Fund, | | | |

| Premier Class 2.35% P | Shares | 500,000 | 500,000 |

| U.S. Treasury Bills 2.481%, 4/18/19 | | $158,000 | 157,498 |

| U.S. Treasury Bills 2.473%, 7/25/19 | | 209,000 | 206,959 |

| U.S. Treasury Bills 2.462%, 7/18/19 | | 354,000 | 350,702 |

| Total short-term investments (cost $23,116,674) | | | $23,116,674 |

| |

| TOTAL INVESTMENTS | |

| Total investments (cost $278,611,026) | $284,158,421 |

Key to holding’s abbreviations

| |

| CVR | Contingent Value Rights |

Notes to the fund’s portfolio

Unless noted otherwise, the notes to the fund’s portfolio are for the close of the fund’s reporting period, which ran from March 1, 2018 through February 28, 2019 (the reporting period). Within the following notes to the portfolio, references to “Putnam Management” represent Putnam Investment Management, LLC, the fund’s manager, an indirect wholly-owned subsidiary of Putnam Investments, LLC and references to “ASC 820” represent Accounting Standards Codification 820Fair Value Measurements and Disclosures.

*Percentages indicated are based on net assets of $270,093,812.

†This security is non-income-producing.

dAffiliated company. See Notes 1 and 5 to the financial statements regarding securities lending. The rate quoted in the security description is the annualized 7-day yield of the fund at the close of the reporting period.

FThis security is valued by Putnam Management at fair value following procedures approved by the Trustees. Securities are classified as Level 3 for ASC 820 based on the securities’ valuation inputs.

iThis security was pledged, or purchased with cash that was pledged, to the fund for collateral on certain derivative contracts (Note 1).

LAffiliated company (Note 5). The rate quoted in the security description is the annualized 7-day yield of the fund at the close of the reporting period.

PThis security was pledged, or purchased with cash that was pledged, to the fund for collateral on certain derivative contracts. The rate quoted in the security description is the annualized 7-day yield of the fund at the close of the reporting period.

RReal Estate Investment Trust.

SSecurity on loan, in part or in entirety, at the close of the reporting period (Note 1).

Unless otherwise noted, the rates quoted in Short-term investments security descriptions represent the weighted average yield to maturity.

144A after the name of an issuer represents securities exempt from registration under Rule 144A of the Securities Act of 1933, as amended. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers.

ASC 820 establishes a three-level hierarchy for disclosure of fair value measurements. The valuation hierarchy is based upon the transparency of inputs to the valuation of the fund’s investments. The three levels are defined as follows:

Level 1: Valuations based on quoted prices for identical securities in active markets.

Level 2: Valuations based on quoted prices in markets that are not active or for which all significant inputs are observable, either directly or indirectly.

Level 3: Valuations based on inputs that are unobservable and significant to the fair value measurement.

The following is a summary of the inputs used to value the fund’s net assets as of the close of the reporting period:

| | | |

| | | | Valuation inputs | |

| Investments in securities: | Level 1 | Level 2 | Level 3 |

| Common stocks*: | | | |

| Communication services | $11,737,777 | $— | $— |

| Consumer discretionary | 32,669,069 | — | — |

| Consumer staples | 4,079,578 | — | — |

| Energy | 24,167,220 | — | — |

| Financials | 52,850,760 | — | — |

| Health care | 9,996,068 | — | — |

| Industrials | 49,346,394 | — | —** |

| Information technology | 41,228,831 | — | — |

| Materials | 14,627,984 | — | — |

| Real estate | 9,158,561 | — | — |

| Utilities | 3,624,510 | — | — |

| Total common stocks | 253,486,752 | — | — |

| | | | |

| Investment companies | 6,801,602 | — | — |

| Purchased options outstanding | — | 638,081 | — |

| U.S. treasury obligations | — | 115,312 | — |

| Short-term investments | 12,787,820 | 10,328,854 | — |

| Totals by level | $273,076,174 | $11,082,247 | $— |

*Common stock classifications are presented at the sector level, which may differ from the fund’s portfolio presentation.

**Value of Level 3 security is $—.

At the start and close of the reporting period, Level 3 investments in securities represented less than 1% of the fund’s net assets and were not considered a significant portion of the fund’s portfolio.

The accompanying notes are an integral part of these financial statements.

Statement of assets and liabilities2/28/19

| |

| ASSETS | |

| Investment in securities, at value, including $9,139,249 of securities on loan (Notes 1 and 8): | |

| Unaffiliated issuers (identified cost $256,709,511) | $262,256,906 |

| Affiliated issuers (identified cost $21,901,515 (Notes 1 and 5) | 21,901,515 |

| Cash | 269,921 |

| Dividends, interest and other receivables | 333,632 |

| Receivable for shares of the fund sold | 202,441 |

| Receivable for investments sold | 5,690,042 |

| Receivable for investor servicing fees (Note 2) | 159,312 |

| Prepaid assets | 42,809 |

| Total assets | 290,856,578 |

| |

| LIABILITIES | |

| Payable for investments purchased | 9,665,320 |

| Payable for shares of the fund repurchased | 399,489 |

| Payable for compensation of Manager (Note 2) | 127,075 |

| Payable for custodian fees (Note 2) | 74,969 |

| Payable for Trustee compensation and expenses (Note 2) | 113,725 |

| Payable for administrative services (Note 2) | 1,107 |

| Payable for distribution fees (Note 2) | 64,510 |

| Collateral on securities loaned, at value (Note 1) | 9,613,695 |

| Collateral on certain derivative contracts, at value (Notes 1 and 8) | 615,312 |

| Other accrued expenses | 87,564 |

| Total liabilities | 20,762,766 |

| | |

| Net assets | $270,093,812 |

| |

| REPRESENTED BY | |

| Paid-in capital (Unlimited shares authorized) (Notes 1 and 4) | $307,372,571 |

| Total distributable earnings (Note 1) | (37,278,759) |

| Total — Representing net assets applicable to capital shares outstanding | $270,093,812 |

(Continued on next page)

Statement of assets and liabilitiescont.

| |

| COMPUTATION OF NET ASSET VALUE AND OFFERING PRICE | |

| Net asset value and redemption price per class A share | |

| ($138,636,391 divided by 13,042,862 shares) | $10.63 |

| Offering price per class A share(100/94.25 of $10.63)* | $11.28 |

| Net asset value and offering price per class B share($1,773,851 divided by 225,507 shares)** | $7.87 |

| Net asset value and offering price per class C share($9,845,061 divided by 1,257,358 shares)** | $7.83 |

| Net asset value and redemption price per class M share($1,888,216 divided by 208,491 shares) | $9.06 |

| Offering price per class M share(100/96.50 of $9.06)* | $9.39 |

| Net asset value, offering price and redemption price per class R share | |

| ($1,050,485 divided by 101,593 shares) | $10.34 |

| Net asset value, offering price and redemption price per class R5 share | |

| ($445,618 divided by 39,348 shares) | $11.33 |

| Net asset value, offering price and redemption price per class R6 share | |

| ($36,573,518 divided by 3,231,921 shares) | $11.32 |

| Net asset value, offering price and redemption price per class Y share | |

| ($79,880,672 divided by 7,079,594 shares) | $11.28 |

*On single retail sales of less than $50,000. On sales of $50,000 or more the offering price is reduced.

**Redemption price per share is equal to net asset value less any applicable contingent deferred sales charge.

The accompanying notes are an integral part of these financial statements.

Statement of operationsYear ended 2/28/19

| |

| INVESTMENT INCOME | |

| Dividends (net of foreign tax of $80,955) | $4,510,627 |

| Interest (including interest income of $471,427 from investments in affiliated issuers) (Note 5) | 502,812 |

| Securities lending (net of expenses) (Notes 1 and 5) | 359,219 |

| Total investment income | 5,372,658 |

| |

| EXPENSES | |

| Compensation of Manager (Note 2) | 1,992,609 |

| Investor servicing fees (Note 2) | 633,107 |

| Custodian fees (Note 2) | 109,704 |

| Trustee compensation and expenses (Note 2) | 16,176 |

| Distribution fees (Note 2) | 549,754 |

| Administrative services (Note 2) | 8,818 |

| Other | 264,013 |

| Total expenses | 3,574,181 |

| Expense reduction (Note 2) | (534,996) |

| Net expenses | 3,039,185 |

| | |

| Net investment income | 2,333,473 |

| |

| REALIZED AND UNREALIZED GAIN (LOSS) | |

| Net realized gain (loss) on: | |

| Securities from unaffiliated issuers (Notes 1 and 3) | (22,503,482) |

| Foreign currency transactions (Note 1) | (11,594) |

| Futures contracts (Note 1) | (1,120,456) |

| Written options (Note 1) | 4,325,127 |

| Total net realized loss | (19,310,405) |

| Change in net unrealized appreciation (depreciation) on: | |

| Securities from unaffiliated issuers | 8,611,717 |

| Assets and liabilities in foreign currencies | (921) |

| Written options | 506,696 |

| Total change in net unrealized appreciation | 9,117,492 |

| | |

| Net loss on investments | (10,192,913) |

| |

| Net decrease in net assets resulting from operations | $(7,859,440) |

The accompanying notes are an integral part of these financial statements.

Statement of changes in net assets

| | |

| INCREASE (DECREASE) IN NET ASSETS | Year ended 2/28/19 | Year ended 2/28/18 |

| Operations | | |

| Net investment income | $2,333,473 | $1,332,165 |

| Net realized gain (loss) on investments | | |

| and foreign currency transactions | (19,310,405) | 111,426,373 |

| Change in net unrealized appreciation (depreciation) | | |

| of investments and assets and liabilities | | |

| in foreign currencies | 9,117,492 | (100,608,932) |

| Net increase (decrease) in net assets resulting | | |

| from operations | (7,859,440) | 12,149,606 |

| Distributions to shareholders (Note 1): | | |

| From ordinary income | | |

| Net investment income | | |

| Class A | (1,081,577) | (734,076) |

| Class B | (9,146) | — |

| Class C | (43,376) | — |

| Class M | (6,961) | (1,580) |

| Class R | (5,795) | (2,598) |

| Class R5 | (4,245) | (3,851) |

| Class R6 | (396,349) | (448,698) |

| Class Y | (730,421) | (873,027) |

| Net realized short-term gain on investments | | |

| Class A | (17,287,847) | (10,893,320) |

| Class B | (301,500) | (216,480) |

| Class C | (1,692,614) | (1,540,987) |

| Class M | (169,976) | (111,734) |

| Class R | (119,663) | (65,056) |

| Class R5 | (53,153) | (32,372) |

| Class R6 | (4,643,057) | (3,329,232) |

| Class Y | (9,954,825) | (9,046,357) |

| From net realized long-term gain on investments | | |

| Class A | (3,186,052) | (35,181,255) |

| Class B | (55,564) | (699,147) |

| Class C | (311,939) | (4,976,799) |

| Class M | (31,325) | (360,858) |

| Class R | (22,053) | (210,104) |

| Class R5 | (9,795) | (104,551) |

| Class R6 | (855,688) | (10,752,144) |

| Class Y | (1,834,720) | (29,216,269) |

| From return of capital | | |

| Class A | (738,192) | — |

| Class B | (6,242) | — |

| Class C | (29,604) | — |

| Class M | (4,751) | — |

| Class R | (3,955) | — |

| Class R5 | (2,897) | — |

| Class R6 | (270,514) | — |

| Class Y | (498,522) | — |

| Decrease from capital share transactions (Note 4) | (39,718,625) | (25,460,431) |

| Total decrease in net assets | (91,940,383) | (122,111,320) |

| |

| NET ASSETS | | |

| Beginning of year | 362,034,195 | 484,145,515 |

| End of year(Note 1) | $270,093,812 | $362,034,195 |

The accompanying notes are an integral part of these financial statements.

Financial highlights(For a common share outstanding throughout the period)

| | | | | | | | | | | | | | |

| | INVESTMENT OPERATIONS | | | LESS DISTRIBUTIONS | | | | | RATIOS AND SUPPLEMENTAL DATA | |

| | | | | | | | | | | | | Ratio of | Ratio of net | |

| | Net asset | | Net realized | | | From | | | | | | expenses | investment | |

| | value, | | and unrealized | Total from | From | net realized | From | | Net asset | Total return | Net assets, | to average | income (loss) | Portfolio |

| | beginning | Net investment | gain (loss) on | investment | net investment | gain on | return of | Total | value, end | at net asset | end of period | net assets | to average | turnover |

| Period ended | of period | income (loss)a | investments | operations | income | investments | capital | distributions | of period | value (%)b | (in thousands) | (%)c | net assets (%) | (%) |

| Class A | | | | | | | | | | | | | | |

| February 28, 2019 | $13.06 | .07 | (.56) | (.49) | (.09) | (1.79) | (.06) | (1.94) | $10.63 | (2.78) | $138,636 | 1.22 | .58 | 534 |

| February 28, 2018 | 17.69 | .03 | .50 | .53 | (.08) | (5.08) | — | (5.16) | 13.06 | 2.85 | 159,252 | 1.21 | .18 | 469 |

| February 28, 2017 | 12.82 | .08 | 4.91 | 4.99 | (.12) | — | — | (.12) | 17.69 | 38.90 | 187,839 | 1.18d | .53d | 63 |

| February 29, 2016 | 15.34 | .10 | (1.87) | (1.77) | (.13) | (.58) | (.04) | (.75) | 12.82 | (12.04) | 142,656 | 1.15 | .70 | 62 |

| February 28, 2015 | 15.45 | .09 | .42 | .51 | (.12) | (.50) | — | (.62) | 15.34 | 3.40 | 172,363 | 1.18 | .60 | 54 |

| Class B | | | | | | | | | | | | | | |

| February 28, 2019 | $10.21 | (.01) | (.46) | (.47) | (.05) | (1.79) | (.03) | (1.87) | $7.87 | (3.57) | $1,774 | 1.97 | (.10) | 534 |

| February 28, 2018 | 14.93 | (.08) | .44 | .36 | — | (5.08) | — | (5.08) | 10.21 | 2.21 | 2,594 | 1.96 | (.56) | 469 |

| February 28, 2017 | 10.86 | (.03) | 4.14 | 4.11 | (.04) | — | — | (.04) | 14.93 | 37.80 | 3,424 | 1.93d | (.25)d | 63 |

| February 29, 2016 | 13.10 | —e | (1.59) | (1.59) | (.05) | (.58) | (.02) | (.65) | 10.86 | (12.68) | 2,398 | 1.90 | (.03) | 62 |

| February 28, 2015 | 13.28 | (.02) | .35 | .33 | (.01) | (.50) | — | (.51) | 13.10 | 2.60 | 3,398 | 1.93 | (.16) | 54 |

| Class C | | | | | | | | | | | | | | |

| February 28, 2019 | $10.16 | (.01) | (.46) | (.47) | (.04) | (1.79) | (.03) | (1.86) | $7.83 | (3.60) | $9,845 | 1.97 | (.08) | 534 |

| February 28, 2018 | 14.88 | (.08) | .44 | .36 | — | (5.08) | — | (5.08) | 10.16 | 2.21 | 18,306 | 1.96 | (.57) | 469 |

| February 28, 2017 | 10.82 | (.03) | 4.13 | 4.10 | (.04) | — | — | (.04) | 14.88 | 37.88 | 22,025 | 1.93d | (.23)d | 63 |

| February 29, 2016 | 13.09 | (.01) | (1.60) | (1.61) | (.06) | (.58) | (.02) | (.66) | 10.82 | (12.78) | 15,527 | 1.90 | (.05) | 62 |

| February 28, 2015 | 13.29 | (.02) | .36 | .34 | (.04) | (.50) | — | (.54) | 13.09 | 2.68 | 17,701 | 1.93 | (.15) | 54 |

| Class M | | | | | | | | | | | | | | |

| February 28, 2019 | $11.44 | (.04)f | (.45) | (.49) | (.06) | (1.79) | (.04) | (1.89) | $9.06 | (3.27) | $1,888 | 1.72 | (.34)f | 534 |

| February 28, 2018 | 16.12 | (.05) | .47 | .42 | (.02) | (5.08) | — | (5.10) | 11.44 | 2.39 | 1,368 | 1.71 | (.32) | 469 |

| February 28, 2017 | 11.70 | —e | 4.48 | 4.48 | (.06) | — | — | (.06) | 16.12 | 38.26 | 1,482 | 1.68d | .03d | 63 |

| February 29, 2016 | 14.06 | .03 | (1.72) | (1.69) | (.07) | (.58) | (.02) | (.67) | 11.70 | (12.51) | 1,097 | 1.65 | .21 | 62 |

| February 28, 2015 | 14.22 | .01 | .38 | .39 | (.05) | (.50) | — | (.55) | 14.06 | 2.85 | 1,524 | 1.68 | .10 | 54 |

| Class R | | | | | | | | | | | | | | |

| February 28, 2019 | $12.76 | .04 | (.55) | (.51) | (.07) | (1.79) | (.05) | (1.91) | $10.34 | (3.07) | $1,050 | 1.47 | .28 | 534 |

| February 28, 2018 | 17.40 | (.02) | .51 | .49 | (.05) | (5.08) | — | (5.13) | 12.76 | 2.64 | 1,146 | 1.46 | (.10) | 469 |

| February 28, 2017 | 12.62 | .04 | 4.82 | 4.86 | (.08) | — | — | (.08) | 17.40 | 38.55 | 977 | 1.43d | .29d | 63 |

| February 29, 2016 | 15.12 | .06 | (1.85) | (1.79) | (.10) | (.58) | (.03) | (.71) | 12.62 | (12.28) | 743 | 1.40 | .39 | 62 |

| February 28, 2015 | 15.25 | .05 | .41 | .46 | (.09) | (.50) | — | (.59) | 15.12 | 3.14 | 772 | 1.43 | .35 | 54 |

| Class R5 | | | | | | | | | | | | | | |

| February 28, 2019 | $13.79 | .12 | (.59) | (.47) | (.12) | (1.79) | (.08) | (1.99) | $11.33 | (2.50) | $446 | .89 | .91 | 534 |

| February 28, 2018 | 18.39 | .08 | .54 | .62 | (.14) | (5.08) | — | (5.22) | 13.79 | 3.29 | 555 | .89 | .48 | 469 |

| February 28, 2017 | 13.32 | .13 | 5.11 | 5.24 | (.17) | — | — | (.17) | 18.39 | 39.36 | 469 | .87d | .80d | 63 |

| February 29, 2016 | 15.90 | .15 | (1.94) | (1.79) | (.16) | (.58) | (.05) | (.79) | 13.32 | (11.73) | 14 | .86 | .96 | 62 |

| February 28, 2015 | 15.98 | .15 | .43 | .58 | (.16) | (.50) | — | (.66) | 15.90 | 3.76 | 12 | .88 | .90 | 54 |

See notes to financial highlights at the end of this section.

The accompanying notes are an integral part of these financial statements.

| |

| 32 Small Cap Value Fund | Small Cap Value Fund 33 |

Financial highlightscont.

| | | | | | | | | | | | | | |

| | INVESTMENT OPERATIONS | | | LESS DISTRIBUTIONS | | | | | RATIOS AND SUPPLEMENTAL DATA | |

| | | | | | | | | | | | | Ratio of | Ratio of net | |

| | Net asset | | Net realized | | | From | | | | | | expenses | investment | |

| | value, | | and unrealized | Total from | From | net realized | From | | Net asset | Total return | Net assets, | to average | income (loss) | Portfolio |

| | beginning | Net investment | gain (loss) on | investment | net investment | gain on | return of | Total | value, end | at net asset | end of period | net assets | to average | turnover |

| Period ended | of period | income (loss)a | investments | operations | income | investments | capital | distributions | of period | value (%)b | (in thousands) | (%)c | net assets (%) | (%) |

| Class R6 | | | | | | | | | | | | | | |

| February 28, 2019 | $13.78 | .14 | (.59) | (.45) | (.13) | (1.79) | (.09) | (2.01) | $11.32 | (2.39) | $36,574 | .79 | 1.07 | 534 |

| February 28, 2018 | 18.39 | .10 | .53 | .63 | (.16) | (5.08) | — | (5.24) | 13.78 | 3.33 | 52,510 | .79 | .59 | 469 |

| February 28, 2017 | 13.31 | .14 | 5.12 | 5.26 | (.18) | — | — | (.18) | 18.39 | 39.54 | 56,106 | .77d | .85d | 63 |

| February 29, 2016 | 15.90 | .15 | (1.94) | (1.79) | (.17) | (.58) | (.05) | (.80) | 13.31 | (11.71) | 21,860 | .76 | .97 | 62 |

| February 28, 2015 | 15.99 | .16 | .43 | .59 | (.18) | (.50) | — | (.68) | 15.90 | 3.81 | 13,129 | .78 | 1.00 | 54 |

| Class Y | | | | | | | | | | | | | | |

| February 28, 2019 | $13.74 | .12 | (.60) | (.48) | (.11) | (1.79) | (.08) | (1.98) | $11.28 | (2.66) | $79,881 | .97 | .93 | 534 |

| February 28, 2018 | 18.33 | .08 | .53 | .61 | (.12) | (5.08) | — | (5.20) | 13.74 | 3.20 | 126,302 | .96 | .45 | 469 |

| February 28, 2017 | 13.27 | .12 | 5.09 | 5.21 | (.15) | — | — | (.15) | 18.33 | 39.30 | 211,823 | .93d | .76d | 63 |

| February 29, 2016 | 15.86 | .14 | (1.94) | (1.80) | (.16) | (.58) | (.05) | (.79) | 13.27 | (11.86) | 146,979 | .90 | .94 | 62 |

| February 28, 2015 | 15.95 | .14 | .43 | .57 | (.16) | (.50) | — | (.66) | 15.86 | 3.68 | 148,321 | .93 | .86 | 54 |

aPer share net investment income (loss) has been determined on the basis of the weighted average number of shares outstanding during the period.

bTotal return assumes dividend reinvestment and does not reflect the effect of sales charges.

cIncludes amounts paid through expense offset and brokerage/service arrangements, if any (Note 2). Also excludes acquired fund fees, if any.

dReflects a voluntary waiver of certain fund expenses in effect during the period. As a result of such waiver, the expenses of each class reflect a reduction of less than 0.01% as a percentage of average net assets.

eAmount represents less than $0.01 per share.

fThe net investment income ratio and per share amount shown for the period ending February 28, 2019 may not correspond with the expected class specific differences for the period due to the timing of redemptions out of the class.

The accompanying notes are an integral part of these financial statements.

| |

| 34 Small Cap Value Fund | Small Cap Value Fund 35 |

Notes to financial statements2/28/19

Within the following Notes to financial statements, references to “State Street” represent State Street Bank and Trust Company, references to “the SEC” represent the Securities and Exchange Commission, references to “Putnam Management” represent Putnam Investment Management, LLC, the fund’s manager, an indirect wholly-owned subsidiary of Putnam Investments, LLC and references to “OTC”, if any, represent over-the-counter. Unless otherwise noted, the “reporting period” represents the period from March 1, 2018 through February 28, 2019.