| | |

| UNITED STATES

SECURITIES AND EXCHANGE COMMISSION |

| | |

| CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

|

| | |

| Investment Company Act file number: | (811–07237) |

| | |

| Exact name of registrant as specified in charter: | Putnam Investment Funds |

| | |

| Address of principal executive offices: | 100 Federal Street, Boston, Massachusetts 02110 |

| | |

| Name and address of agent for service: | Robert T. Burns, Vice President

100 Federal Street

Boston, Massachusetts 02110 |

| | |

| Copy to: | Bryan Chegwidden, Esq.

Ropes & Gray LLP

1211 Avenue of the Americas

New York, New York 10036 |

| | |

| Registrant's telephone number, including area code: | (617) 292–1000 |

| | |

| Date of fiscal year end: | August 31, 2019 |

| | |

| Date of reporting period: | September 1, 2018 — August 31, 2019 |

| | |

|

Item 1. Report to Stockholders: | |

| | |

| The following is a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act of 1940: | |

Putnam PanAgora

Market Neutral

Fund

Annual report

8|31|19

IMPORTANT NOTICE: Delivery of paper fund reports

In accordance with regulations adopted by the Securities and Exchange Commission, beginning on January 1, 2021, reports like this one will no longer be sent by mail unless you specifically request it. Instead, they will be on Putnam’s website, and you will be notified by mail whenever a new one is available, and provided with a website link to access the report.

If you wish to stop receiving paper reports sooner, or if you wish to continue to receive paper reports free of charge after January 1, 2021, please see the back cover or insert for instructions. If you invest through a bank or broker, your choice will apply to all funds held in your account. If you invest directly with Putnam, your choice will apply to all Putnam funds in your account.

If you already receive these reports electronically, no action is required.

Message from the Trustees

October 14, 2019

Dear Fellow Shareholder:

We believe your mutual fund investment offers a number of advantages, such as investment diversification and daily liquidity. Putnam funds also include a commitment to active investing. Putnam’s portfolio managers and analysts take a research-intensive approach that incorporates risk management strategies designed to serve you through changing conditions.

To support your overall investment program, we believe that the counsel of a financial advisor is prudent. For over 80 years, Putnam has recognized the importance of professional investment advice. Your financial advisor can help in many ways, including defining and planning for goals, determining your appropriate level of risk, and reviewing your investments on a regular basis.

As always, your fund’s Board of Trustees remains committed to protecting the interests of Putnam shareholders like you. We thank you for investing with Putnam.

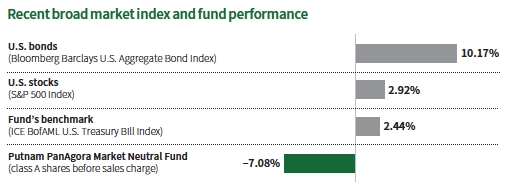

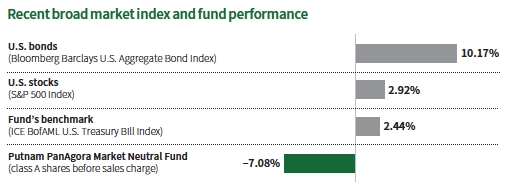

Current performance may be lower or higher than the quoted past performance, which cannot guarantee future results. Share price, principal value, and return will fluctuate, and you may have a gain or a loss when you sell your shares.Performance of class A shares assumes reinvestment of distributions and does not account for taxes. Fund returns in the bar chart do not reflect a sales charge of 5.75%; had they, returns would have been lower. See below and pages 7–9 for additional performance information. For a portion of the periods, the fund had expense limitations, without which returns would have been lower. To obtain the most recent month-end performance, visit putnam.com.

This comparison shows your fund’s performance in the context of broad market indexes for the 12 months ended 8/31/19. See above and pages 7–9 for additional fund performance information. Index descriptions can be found on pages 13–14.

| |

| 2 PanAgora Market Neutral Fund |

Please review global market performance, beginning with equities.

Equity markets experienced the effects of the trade war at the beginning and end of the 12-month reporting period that concluded August 31, 2019. Both developed- and emerging-market equities declined as calendar-year 2018 ended. Equity prices plunged. Concerns about future growth of global GDP [gross domestic product] and the trade conflict between the United States and China contributed to the decline. However, as 2019 began, global equities rebounded and experienced strong performance over the first half of the year, recovering much of the losses of 2018. Performance improved in all regions, reflecting the expectation that the United States and China would reach a favorable trade deal. Dovish signals from the U.S. Federal Reserve also supported the rally.

This tranquility came to an abrupt halt in early August 2019. The U.S.–China trade war escalated, and the U.S. yield curve inverted. Stocks fell after U.S. President Donald Trump suggested an additional 10% tariff on Chinese imports and accused China of manipulating its currency. U.S. equities continued to decline after the 10-year Treasury note traded at a lower yield than the 2-year Treasury note. In

|

| PanAgora Market Neutral Fund 3 |

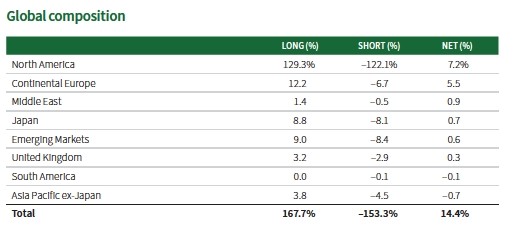

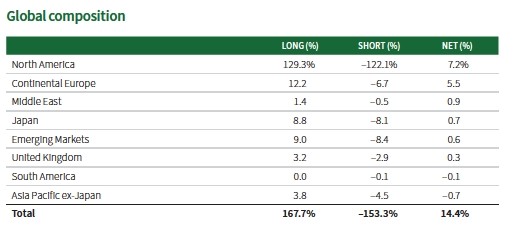

The table shows the fund’s long and short exposures in each country or region and the percentage of the fund’s net assets that each represented as of 8/31/19. Allocations will not total 100% because the table reflects the notional value of derivatives (the economic value for purposes of calculating periodic payment obligations), in addition to the market value of securities. Holdings and allocations may vary over time.

previous economic cycles, such an inversion has been an early indicator of an upcoming economic recession.

International developed- and emerging-market equities also declined toward the end of the 12-month reporting period. Weakening economic data in the European Union and political uncertainties in the United Kingdom and Italy weighed on investor sentiment, in our view. In China, economic indicators reported for July 2019 were worse than expected as monthly retail sales and industrial output growth rates slowed. U.S. large-cap equities managed to finish the period in positive territory, and outperformed U.S. small-cap stocks. The S&P 500 and Russell 2000 indices posted returns of 2.92% and –12.89%, respectively, over the 12-month reporting period. International developed markets fared somewhat better than the emerging markets. The MSCI World ex-U.S. Index [ND] returned –2.90% compared with –4.36% for the MSCI Emerging Markets Index [ND] over the 12-month reporting period.

How did fixed-income markets perform?

Bonds rallied at the end of 2018 as risk aversion returned to the marketplace. Heightened fears of a global economic slowdown, falling crude oilprices, and a partial U.S. government shutdown were contributing factors. The demand for safer assets continued well into 2019 despite the rally in global equities. Fixed income assets rallied even more in the late summer as the re-escalation of the U.S.–China trade war and fears of a weakening global economy helped to drive bond prices higher and yields lower. Volatility also impacted U.S. term structure. The yield spread between the 2-year and 10-year notes turned negative for the first time since December 2005. The yield on the 30-year bond hit an all-time low of 1.94% at the end of August 2019. A 2-year/10-year inversion of the yield curve has preceded the past five recessions going back more than 40 years.

Across the Atlantic, yields for developed-market government debt continued to drop, and even set new all-time lows. In addition to the trade war, geopolitical risks contributed to investor risk aversion, in our view. These risks included a no-deal Brexit and the collapse of Italy’s government. The Bloomberg Barclays U.S. Treasury and FTSE World Government Bond Index ex-U.S. [Hedged] indices both posted double-digit positive performance over the 12-month reporting period. These indices gained 10.38% and 12.86%, respectively.

| |

| 4 PanAgora Market Neutral Fund |

Let’s turn to commodity markets. How did they perform?

Commodity prices plummeted toward the end of 2018. Energy commodities led the decline. However, commodities rebounded at the start of 2019, although the asset class experienced an increase in price volatility during May and August. After reaching a year-to-date peak of $66 per barrel in April 2019, the price of crude oil sank to around $56. Livestock and agricultural commodities also finished the one-year period on the decline. The flight to safer assets toward the end of the period was beneficial for precious metals, including silver, while industrial metals were flat. The S&P GSCI, weighted toward energy, declined 14.52%, while the more balanced Bloomberg Commodity Index declined 5.89% for the reporting period.

Which fund holdings had a large positive or negative impact on returns?

Putnam PanAgora Market Neutral Fund returned –7.08% for the 12-month reporting period. The fund’s long-term portfolio was the largest detractor. Most of the underperformance came from U.S. large-cap stocks. Intermediate-term strategies contributed positively, while short-term strategies detracted.

The long-term portfolio was down due to weaker stock selection within the United States. On a sector basis, consumer discretionary and financials detracted the most. Within the discretionary sector, the alpha model struggled due to poor performance of value and quality metrics. Within financials, industry-specific models (banks and diversified financials) underperformed due to disappointing returns in the top-quintile alpha names. On the other hand, the information technology sector was the top positive contributor due to strong stock selection within the software and services industry group. The alpha model within the tech sector benefited from performance of growth and momentum metrics.

International positions slightly detracted for the reporting period. Positions in Europe detractedmost. The alpha model did not perform well in Europe due to poor performance of value metrics. The top detracting countries were Germany and France. A highlight for the period was solid stock selection in Japan, which was the largest positive international contributor to fund results. The alpha model worked well in Japan driven by good performance of both momentum and quality metrics.

Intermediate strategies also contributed positively. The majority of the positive performance came from U.S. merger and acquisition-related trades within the technology sector.

Short-term strategies detracted from fund performance. Two strategies — index reconstitution and corporate-event-related strategies — were underperformers.

How did the fund use derivatives?

We used total return swaps to take long or short positions in equity securities.

What is your outlook and strategy as the fund’s next annual period begins?

The fund is designed to generate attractive absolute returns under different market conditions and over different horizons. The fund uses a diversified set of strategies that have low correlation to one another. Their combination is expected to result in more stable returns over time than any individual strategy in and of itself.

The majority of the fund’s assets are within the long-term portfolio. This portion utilizes fundamentally based signals applied across a broad universe of stocks and will provide the majority of return over a market cycle, in our view. We believe intermediate- and short-term strategies

|

| PanAgora Market Neutral Fund 5 |

can provide additional alpha based on the number of corporate and market events.

Thank you, George and Richard, for your time and insights today.

Past performance is not a guarantee of future results.

The opinions expressed in this article represent the current, good-faith views of the author(s) at the time of publication, are provided for limited purposes, are not definitive investment advice, and should not be relied on as such. The information presented in this article has been developed internally and/or obtained from sources believed to be reliable; however, PanAgora Asset Management, Inc. (PanAgora) does not guarantee the accuracy, adequacy or completeness of such information. Predictions, opinions, and other information contained in this article are subject to change continually and without notice of any kind and may no longer be true after the date indicated. As with any investment there is a potential for profit as well as the possibility of loss.

Any forward-looking statements speak only as of the date they are made, and PanAgora assumes no duty to and does not undertake to update forward-looking statements. Forward-looking statements are subject to numerous assumptions, risks, and uncertainties, which change over time. Actual results could differ materially from those anticipated in forward-looking statements. Any investments to which this material relates are available only to or will be engaged in only with investment professionals.

ABOUT DERIVATIVES

Derivatives are an increasingly common type of investment instrument, the performance of which isderivedfrom an underlying security, index, currency, or other area of the capital markets. Derivatives employed by the fund’s managers generally serve one purpose: to take long or short positions in equity securities.

For example, the fund’s managers may use derivatives, such as total return swaps, to take long or short positions in equity securities. The fund may also use derivatives as a substitute for a direct investment in the securities of one or more issuers.

Like any other investment, derivatives may not appreciate in value and may lose money. Derivatives may amplify traditional investment risks through the creation of leverage and may be less liquid than traditional securities. And because derivatives typically represent contractual agreements between two financial institutions, derivatives entail “counterparty risk,” which is the risk that the other party is unable or unwilling to pay. PanAgora monitors the counterparty risks we assume. For example, PanAgora often enters into collateral agreements that require the counterparties to post collateral on a regular basis to cover their obligations to the fund. Counterparty risk for exchange-traded futures and centrally cleared swaps is mitigated by the daily exchange of margin and other safeguards against default through their respective clearinghouses.

|

| 6 PanAgora Market Neutral Fund |

Your fund’s performance

This section shows your fund’s performance, price, and distribution information for periods ended August 31, 2019, the end of its most recent fiscal year. In accordance with regulatory requirements for mutual funds, we also include performance information as of the most recent calendar quarter-end and expense information taken from the fund’s current prospectus. Performance should always be considered in light of a fund’s investment strategy. Data represent past performance. Past performance does not guarantee future results. More recent returns may be less or more than those shown. Investment return and principal value will fluctuate, and you may have a gain or a loss when you sell your shares. Performance information does not reflect any deduction for taxes a shareholder may owe on fund distributions or on the redemption of fund shares. For the most recent month-end performance, please visit the Individual Investors section at putnam.com or call Putnam at 1-800-225-1581. Class R, R6, and Y shares are not available to all investors. See the Terms and definitions section in this report for definitions of the share classes offered by your fund.

| | | |

| Fund performanceTotal return for periods ended 8/31/19 | | |

| | Life of fund | Annual average | 1 year |

| Class A(9/21/17) | | | |

| Before sales charge | –13.40% | –7.13% | –7.08% |

| After sales charge | –18.38 | –9.91 | –12.42 |

| Class B(9/21/17) | | | |

| Before CDSC | –14.70 | –7.84 | –7.78 |

| After CDSC | –18.11 | –9.76 | –12.39 |

| Class C(9/21/17) | | | |

| Before CDSC | –14.70 | –7.84 | –7.78 |

| After CDSC | –14.70 | –7.84 | –8.71 |

| Class M(9/21/17) | | | |

| Before sales charge | –14.30 | –7.62 | –7.55 |

| After sales charge | –17.30 | –9.30 | –10.79 |

| Class R(9/21/17) | | | |

| Net asset value | –13.80 | –7.35 | –7.31 |

| Class R6(9/21/17) | | | |

| Net asset value | –13.00 | –6.91 | –6.85 |

| Class Y(9/21/17) | | | |

| Net asset value | –13.00 | –6.91 | –6.85 |

Current performance may be lower or higher than the quoted past performance, which cannot guarantee future results. After-sales-charge returns for class A and M shares reflect the deduction of the maximum 5.75% and 3.50% sales charge, respectively, levied at the time of purchase. Class B share returns after contingent deferred sales charge (CDSC) reflect the applicable CDSC, which is 5% in the first year, declining over time to 1% in the sixth year, and is eliminated thereafter. Class C share returns after CDSC reflect a 1% CDSC for the first year that is eliminated thereafter.Class R, R6, and Y shares have no initial sales charge or CDSC.

For a portion of the periods, the fund had expense limitations, without which returns would have been lower.

|

| PanAgora Market Neutral Fund 7 |

| | | |

| Comparative index returnsFor periods ended 8/31/19 | | |

| | Life of fund | Annual average | 1 year |

| ICE BofAML U.S. Treasury Bill Index | 3.89% | 1.98% | 2.44% |

| Lipper Alternative Equity Market Neutral Funds | | | |

| category average* | –3.85 | –2.17 | –3.65 |

Index and Lipper results should be compared with fund performance before sales charge, before CDSC, or at net asset value.

*Over the 1-year and life-of-fund periods ended 8/31/19, there were 92 and 91 funds, respectively, in this Lipper category.

Past performance does not indicate future results. At the end of the same time period, a $10,000 investment in the fund’s class B shares would have been valued at $8,530 ($8,189 after contingent deferred sales charge). A $10,000 investment in the fund’s class C shares would be valued at $8,530, and no contingent deferred sales charge would apply. A $10,000 investment in the fund’s class M shares ($9,650 after sales charge) would have been valued at $8,270. A $10,000 investment in the fund’s class R, R6, and Y shares would have been valued at $8,620, $8,700, and $8,700, respectively.

| | | | | | | | | |

| Fund price and distribution informationFor the 12-month period ended 8/31/19 | |

| | Class A | Class B | Class C | Class M | Class R | Class R6 | Class Y |

| | Before | After | Net | Net | Before | After | Net | Net | Net |

| | sales | sales | asset | asset | sales | sales | asset | asset | asset |

| Share value | charge | charge | value | value | charge | charge | value | value | value |

| 8/31/18 | $9.32 | $9.89 | $9.25 | $9.25 | $9.27 | $9.61 | $9.30 | $9.34 | $9.34 |

| 8/31/19 | 8.66 | 9.19 | 8.53 | 8.53 | 8.57 | 8.88 | 8.62 | 8.70 | 8.70 |

The classification of distributions, if any, is an estimate. Before-sales-charge share value and current dividend rate for class A and M shares, if applicable, do not take into account any sales charge levied at the time of purchase. After-sales-charge share value, current dividend rate, and current 30-day SEC yield, if applicable, are calculated assuming that the maximum sales charge (5.75% for class A shares and 3.50% for class M shares) was levied at the time of purchase. Final distribution information will appear on your year-end tax forms.

The fund made no distributions during the period.

|

| 8 PanAgora Market Neutral Fund |

| | | |

| Fund performance as of most recent calendar quarterTotal return for periods ended 9/30/19 |

| | Life of fund | Annual average | 1 year |

| Class A(9/21/17) | | | |

| Before sales charge | –13.40% | –6.85% | –6.98% |

| After sales charge | –18.38 | –9.53 | –12.33 |

| Class B(9/21/17) | | | |

| Before CDSC | –14.70 | –7.54 | –7.68 |

| After CDSC | –17.26 | –8.92 | –12.30 |

| Class C(9/21/17) | | | |

| Before CDSC | –14.70 | –7.54 | –7.68 |

| After CDSC | –14.70 | –7.54 | –8.61 |

| Class M(9/21/17) | | | |

| Before sales charge | –14.30 | –7.33 | –7.45 |

| After sales charge | –17.30 | –8.95 | –10.69 |

| Class R(9/21/17) | | | |

| Net asset value | –13.80 | –7.06 | –7.11 |

| Class R6(9/21/17) | | | |

| Net asset value | –13.00 | –6.64 | –6.75 |

| Class Y(9/21/17) | | | |

| Net asset value | –13.00 | –6.64 | –6.75 |

See the discussion following the fund performance table on page 7 for information about the calculation of fund performance.

|

| PanAgora Market Neutral Fund 9 |

Your fund’s expenses

As a mutual fund investor, you pay ongoing expenses, such as management fees, distribution fees (12b-1 fees), and other expenses. In the most recent six-month period, your fund’s expenses were limited; had expenses not been limited, they would have been higher. Using the following information, you can estimate how these expenses affect your investment and compare them with the expenses of other funds. You may also pay one-time transaction expenses, including sales charges (loads) and redemption fees, which are not shown in this section and would have resulted in higher total expenses. For more information, see your fund’s prospectus or talk to your financial representative.

| | | | | | | |

| Expense ratios | | | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class R6 | Class Y |

| Net expenses for the fiscal year | | | | | | | |

| ended 8/31/18*† | 1.82% | 2.57% | 2.57% | 2.32% | 2.07% | 1.58% | 1.57% |

| Total annual operating expenses for the | | | | | | | |

| fiscal year ended 8/31/18* | 3.42% | 4.17% | 4.17% | 3.92% | 3.67% | 3.18% | 3.17% |

| Annualized expense ratio for the | | | | | | | |

| six-month period ended 8/31/19‡ | 1.79% | 2.54% | 2.54% | 2.29% | 2.04% | 1.55% | 1.54% |

Fiscal-year expense information in this table is taken from the most recent prospectus, is subject to change, and may differ from that shown for the annualized expense ratio and in the financial highlights of this report.

Prospectus expense information also includes the impact of acquired fund fees and expenses of 0.03%, which is not included in the financial highlights or annualized expense ratios. Expenses are shown as a percentage of average net assets.

*Other expenses have been annualized.

†Reflects Putnam Management’s contractual obligation to limit certain fund expenses through 12/30/19.

‡Expense ratios for each class are for the fund’s most recent fiscal half year. As a result of this, ratios may differ from expense ratios based on one-year data in the financial highlights.

Expenses per $1,000

The following table shows the expenses you would have paid on a $1,000 investment in each class of the fund from 3/1/19 to 8/31/19. It also shows how much a $1,000 investment would be worth at the close of the period, assumingactual returnsand expenses.

| | | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class R6 | Class Y |

| Expenses paid per $1,000*† | $8.78 | $12.43 | $12.43 | $11.21 | $10.00 | $7.61 | $7.56 |

| Ending value (after expenses) | $946.40 | $941.50 | $941.50 | $942.80 | $945.20 | $946.70 | $946.70 |

*Expenses for each share class are calculated using the fund’s annualized expense ratio for each class, which represents the ongoing expenses as a percentage of average net assets for the six months ended 8/31/19. The expense ratio may differ for each share class.

†Expenses are calculated by multiplying the expense ratio by the average account value for the period; then multiplying the result by the number of days in the period; and then dividing that result by the number of days in the year.

| |

| 10 PanAgora Market Neutral Fund |

Estimate the expenses you paid

To estimate the ongoing expenses you paid for the six months ended 8/31/19, use the following calculation method. To find the value of your investment on 3/1/19, call Putnam at 1-800-225-1581.

Compare expenses using the SEC’s method

The Securities and Exchange Commission (SEC) has established guidelines to help investors assess fund expenses. Per these guidelines, the following table shows your fund’s expenses based on a $1,000 investment, assuming ahypothetical 5% annualized return. You can use this information to compare the ongoing expenses (but not transaction expenses or total costs) of investing in the fund with those of other funds. All mutual fund shareholder reports will provide this information to help you make this comparison. Please note that you cannot use this information to estimate your actual ending account balance and expenses paid during the period.

| | | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class R6 | Class Y |

| Expenses paid per $1,000*† | $9.10 | $12.88 | $12.88 | $11.62 | $10.36 | $7.88 | $7.83 |

| Ending value (after expenses) | $1,016.18 | $1,012.40 | $1,012.40 | $1,013.66 | $1,014.92 | $1,017.39 | $1,017.44 |

*Expenses for each share class are calculated using the fund’s annualized expense ratio for each class, which represents the ongoing expenses as a percentage of average net assets for the six months ended 8/31/19. The expense ratio may differ for each share class.

†Expenses are calculated by multiplying the expense ratio by the average account value for the six-month period; then multiplying the result by the number of days in the six-month period; and then dividing that result by the number of days in the year.

|

| PanAgora Market Neutral Fund 11 |

Consider these risks before investing

There can be no assurance that the fund’s strategies will achieve any particular level of return. The fund’s allocation of assets may hurt performance, and efforts to generate returns under different market conditions and over different time horizons may be unsuccessful. Quantitative models or data may be incorrect or incomplete, and reliance on those models or data may not produce the desired results. The value of investments in the fund’s portfolio may fall or fail to rise over extended periods of time for a variety of reasons, including general economic, political, or financial market conditions, investor sentiment and market perceptions, government actions, geopolitical events, or changes and factors related to a specific issuer, asset class, geography, industry, or sector. These and other factors may lead to increased volatility and reduced liquidity in the fund’s portfolio holdings. Investments in small and/or midsize companies increase the risk of greater price fluctuations. Bond investments in which the fund invests (or has exposure to) are subject to interest-rate risk and credit risk. Interest-rate risk is generally greater for longer-term bonds, and credit risk is generally greater for below-investment-grade bonds. Risks associated with derivatives (including “short” derivatives) include losses caused by unexpected market movements (which are potentially unlimited), imperfect correlation between the price of the derivative and the price of the underlying asset, increased investment exposure (which may be considered leverage), the potential inability to terminate or sell derivatives positions, the potential need to sell securities at disadvantageous times to meet margin or segregation requirements, the potential inability to recover margin or other amounts deposited from a counterparty, and the potential failure of the other party to the instrument to meet its obligations. Leveraging can result in volatility in the fund’s performance and losses in excess of the amounts invested. International investing involves certain risks, such as currency fluctuations, economic instability, and political developments. Exposure to REITs subjects the fund to the risks associated with direct ownership in real estate, including economic downturns that have an adverse effect on real estate markets. By investing in open-end or closed-end investment companies and ETFs, the fund is indirectly exposed to the risks associated with direct ownership of the securities held by those investment companies or ETFs. Certain investments are not as readily traded as conventional securities, and the fund may be unable to sell these investments when it considers it desirable to do so. Frequent trading may cause the fund to experience increased brokerage commissions and other transaction costs, and the fund may be more likely to realize capital gains that must be distributed to shareholders as taxable ordinary income. You can lose money by investing in the fund.

| |

| 12 PanAgora Market Neutral Fund |

Terms and definitions

Important terms

Total returnshows how the value of the fund’s shares changed over time, assuming you held the shares through the entire period and reinvested all distributions in the fund.

Before sales charge, or net asset value, is the price, or value, of one share of a mutual fund, without a sales charge. Before-sales-charge figures fluctuate with market conditions, and are calculated by dividing the net assets of each class of shares by the number of outstanding shares in the class.

After sales chargeis the price of a mutual fund share plus the maximum sales charge levied at the time of purchase. After-sales-charge performance figures shown here assume the 5.75% maximum sales charge for class A shares and 3.50% for class M shares.

Contingent deferred sales charge (CDSC)is generally a charge applied at the time of the redemption of class B or C shares and assumes redemption at the end of the period. Your fund’s class B CDSC declines over time from a 5% maximum during the first year to 1% during the sixth year. After the sixth year, the CDSC no longer applies. The CDSC for class C shares is 1% for one year after purchase.

Share classes

Class A sharesare generally subject to an initial sales charge and no CDSC (except on certain redemptions of shares bought without an initial sales charge).

Class B sharesare closed to new investments and are only available by exchange from another Putnam fund or through dividend and/ or capital gains reinvestment. They are not subject to an initial sales charge and may be subject to a CDSC.

Class C sharesare not subject to an initial sales charge and are subject to a CDSC only if the shares are redeemed during the first year.

Class M shareshave a lower initial sales charge and a higher 12b-1 fee than class A shares and no CDSC.

Class R sharesare not subject to an initial sales charge or CDSC and are only available to employer-sponsored retirement plans.

Class R6 sharesare not subject to an initial sales charge or CDSC and carry no 12b-1 fee. They are generally only available to employer-sponsored retirement plans, corporate and institutional clients, and clients in other approved programs.

Class Y sharesare not subject to an initial sales charge or CDSC and carry no 12b-1 fee. They are generally only available to corporate and institutional clients and clients in other approved programs.

Comparative indexes

Bloomberg Barclays U.S. Aggregate Bond Indexis an unmanaged index of U.S. investment-grade fixed-income securities.

Bloomberg Barclays U.S. Treasury Indexis an unmanaged index of U.S.-dollar-denominated, fixed-rate, nominal debt issued by the U.S. Treasury.

Bloomberg Commodity Indexis a broadly diversified index that measures the prices of commodities.

FTSE World Government Bond Index (WGBI) ex-U.S. (Hedged)is an unmanaged index that represents the world bond market, excluding the United States.

ICE BofAML (Intercontinental Exchange Bank of America Merrill Lynch) U.S. Treasury Bill Indexis an unmanaged index that tracks the performance of U.S. dollar-denominated U.S. Treasury bills publicly issued in the U.S. domestic market. Qualifying securities must have a remaining term of at least one month to final maturity and a minimum amount outstanding of $1 billion.

|

| PanAgora Market Neutral Fund 13 |

MSCI Emerging Markets Index (ND)is a free float-adjusted market capitalization index that is designed to measure equity market performance in the global emerging markets. Calculated with net dividends (ND), this total return index reflects the reinvestment of dividends after the deduction of withholding taxes, using a tax rate applicable to non-resident institutional investors who do not benefit from double taxation treaties.

MSCI World ex-U.S. Index (ND)is an unmanaged index of equity securities from developed countries, excluding the United States. Calculated with net dividends (ND), this total return index reflects the reinvestment of dividends after the deduction of withholding taxes, using a tax rate applicable to non-resident institutional investors who do not benefit from double taxation treaties.

Russell 2000 Indexis an unmanaged index of 2,000 small companies in the Russell 3000 Index.

S&P 500 Indexis an unmanaged index of common stock performance.

S&P GSCIis a composite index of commodity sector returns that represents a broadlydiversified, unleveraged, long-only position in commodity futures.

Indexes assume reinvestment of all distributions and do not account for fees. Securities and performance of a fund and an index will differ. You cannot invest directly in an index.

ICE Data Indices, LLC (“ICE BofAML”), used with permission. ICE BofAML permits use of the ICE BofAML indices and related data on an “as is” basis; makes no warranties regarding same; does not guarantee the suitability, quality, accuracy, timeliness, and/or completeness of the ICE BofAML indices or any data included in, related to, or derived therefrom; assumes no liability in connection with the use of the foregoing; and does not sponsor, endorse, or recommend Putnam Investments, or any of its products or services.

Frank Russell Company is the source and owner of the trademarks, service marks, and copyrights related to the Russell Indexes. Russell® is a trademark of Frank Russell Company.

Lipperis a third-party industry-ranking entity that ranks mutual funds. Its rankings do not reflect sales charges. Lipper rankings are based on total return at net asset value relative to other funds that have similar current investment styles or objectives as determined by Lipper. Lipper may change a fund’s category assignment at its discretion. Lipper category averages reflect performance trends for funds within a category.

| |

| 14 PanAgora Market Neutral Fund |

Other information for shareholders

Proxy voting

Putnam is committed to managing our mutual funds in the best interests of our shareholders. The Putnam funds’ proxy voting guidelines and procedures, as well as information regarding how your fund voted proxies relating to portfolio securities during the 12-month period ended June 30, 2019, are available in the Individual Investors section of putnam.com and on the Securities and Exchange Commission (SEC) website, www.sec.gov. If you have questions about finding forms on the SEC’s website, you may call the SEC at 1-800-SEC-0330. You may also obtain the Putnam funds’ proxy voting guidelines and procedures at no charge by calling Putnam’s Shareholder Services at 1-800-225-1581.

Fund portfolio holdings

The fund will file a complete schedule of its portfolio holdings with the SEC for the firstand third quarters of each fiscal year on Form N-PORT within 60 days of the end of such fiscal quarter. Shareholders may obtain the fund’s Form N-PORT on the SEC’s website at www.sec.gov.

Prior to its use of Form N-PORT, the fund filed its complete schedule of its portfolio holdings with the SEC on Form N-Q, which is available online at www.sec.gov.

Trustee and employee fund ownership

Putnam employees and members of the Board of Trustees place their faith, confidence, and, most importantly, investment dollars in Putnam mutual funds. As of August 31, 2019, Putnam employees had approximately $470,000,000 and the Trustees had approximately $72,000,000 invested in Putnam mutual funds. These amounts include investments by the Trustees’ and employees’ immediate family members as well as investments through retirement and deferred compensation plans.

|

| PanAgora Market Neutral Fund 15 |

Important notice regarding Putnam’s privacy policy

In order to conduct business with our shareholders, we must obtain certain personal information such as account holders’ names, addresses, Social Security numbers, and dates of birth. Using this information, we are able to maintain accurate records of accounts and transactions.

It is our policy to protect the confidentiality of our shareholder information, whether or not a shareholder currently owns shares of our funds. In particular, it is our policy not to sell information about you or your accounts to outside marketing firms. We have safeguards in place designed to prevent unauthorized accessto our computer systems and procedures to protect personal information from unauthorized use.

Under certain circumstances, we must share account information with outside vendors who provide services to us, such as mailings and proxy solicitations. In these cases, the service providers enter into confidentiality agreements with us, and we provide only the information necessary to process transactions and perform other services related to your account. Finally, it is our policy to share account information with your financial representative, if you’ve listed one on your Putnam account.

| |

| 16 PanAgora Market Neutral Fund |

Trustee approval of management contract

General conclusions

The Board of Trustees of The Putnam Funds oversees the management of each fund and, as required by law, determines annually whether to approve the continuance of your fund’s management contract with Putnam Investment Management, LLC (“Putnam Management”) and the sub-advisory contract with respect to your fund between Putnam Management and its affiliate, PanAgora Asset Management, Inc. (“PanAgora”). The Board, with the assistance of its Contract Committee, requests and evaluates all information it deems reasonably necessary under the circumstances in connection with its annual contract review. The Contract Committee consists solely of Trustees who are not “interested persons” (as this term is defined in the Investment Company Act of 1940, as amended (the “1940 Act”)) of The Putnam Funds (“Independent Trustees”).

At the outset of the review process, members of the Board’s independent staff and independent legal counsel discussed with representatives of Putnam Management the annual contract review materials furnished to the Contract Committee during the course of the previous year’s review, identifying possible changes in these materials that might be necessary or desirable for the coming year. Following these discussions and in consultation with the Contract Committee, the Independent Trustees’ independent legal counsel requested that Putnam Management and PanAgora furnish specified information, together with any additional information that Putnam Management and PanAgora considered relevant, to the Contract Committee. Over the course of several months ending in June 2019, the Contract Committee met on a number of occasions with representatives of Putnam Management, and separately in executive session, to consider the information that Putnam Management and PanAgora provided. Throughout this process, the Contract Committee was assisted by the members of the Board’s independent staff and by independent legal counsel for The Putnam Funds and the Independent Trustees.

In May 2019, the Contract Committee met in executive session to discuss and consider its recommendations with respect to the continuance of the contracts. At the Trustees’ June 2019 meeting, the Contract Committee met inexecutive session with the other Independent Trustees to review a summary of the key financial, performance and other data that the Contract Committee considered in the course of its review. The Contract Committee then presented its written report, which summarized the key factors that the Committee had considered and set forth its recommendations. The Contract Committee recommended, and the Independent Trustees approved, the continuance of your fund’s management contract (as well as the management and sub-advisory contracts of its wholly-owned subsidiary) and the approval of an amended and restated sub-advisory contract with respect to your fund between Putnam Management and PanAgora, effective July 1, 2019. In considering whether to approve the amended and restated sub-advisory contract, the Trustees noted that the amended and restated sub-advisory contract differed in substance from the existing sub-advisory contract only in that the amended and restated sub-advisory contract provided that PanAgora may voluntarily waive all or a portion of its sub-advisory fees on written notice to Putnam Management.

The Independent Trustees’ approval was based on the following conclusions:

• That the fee schedule in effect for your fund represented reasonable compensation in light of the nature and quality of the services being provided to the fund, the fees paid by competitive funds, the costs incurred by Putnam Management and PanAgora in providing services to the fund, and the application of certain reductions and waivers noted below; and

• That the fee schedule in effect for your fund represented an appropriate sharing between fund shareholders and Putnam Management and PanAgora of such economies of scale as may exist in the management of the fund at current asset levels.

These conclusions were based on a comprehensive consideration of all information provided to the Trustees and were not the result of any single factor. Some of the factors that figured particularly in the Trustees’ deliberations and how the Trustees considered these factors are described below, although individual Trustees may have evaluated the information presented differently, giving different weights to various factors.

|

| PanAgora Market Neutral Fund 17 |

Management fee schedules and total expenses

The Trustees reviewed the management fee schedules in effect for all Putnam funds, including fee levels and breakpoints. The Trustees also reviewed the total expenses of each Putnam fund, recognizing that in most cases management fees represented the major, but not the sole, determinant of total costs to fund shareholders. (Two funds have implemented so-called “all-in” management fees covering substantially all routine fund operating costs.)

In reviewing fees and expenses, the Trustees generally focus their attention on material changes in circumstances — for example, changes in assets under management, changes in a fund’s investment strategy, changes in Putnam Management’s operating costs or profitability, or changes in competitive practices in the mutual fund industry — that suggest that consideration of fee changes might be warranted. The Trustees concluded that the circumstances did not indicate that changes to the management fee structure for your fund would be appropriate at this time.

Under its management contract, your fund has the benefit of breakpoints in its management fee schedule that provide shareholders with economies of scale in the form of reduced fee rates as assets under management of all open-end funds sponsored by Putnam Management for which PanAgora acts as sub-adviser increase. The Trustees concluded that the fee schedule in effect for your fund represented an appropriate sharing of economies of scale between fund shareholders, Putnam Management and PanAgora.

As in the past, the Trustees also focused on the competitiveness of each fund’s total expense ratio. In order to support the effort to have fund expenses meet competitive standards, the Trustees and Putnam Management and the funds’ investor servicing agent, Putnam Investor Services, Inc. (“PSERV”), have implemented expense limitations that were in effect during your fund’s fiscal year ending in 2018. These expense limitations were: (i) a contractual expense limitation applicable to all open-end funds of 25 basis points on investor servicing fees and expenses and (ii) a contractual expense limitation applicable to specified open-end funds, including your fund, of 20 basis points on so-called “other expenses” (i.e., all expenses exclusive of management fees, distribution fees, investor servicing fees, investment-related expenses, interest, taxes,brokerage commissions, acquired fund fees and expenses and extraordinary expenses). These expense limitations attempt to maintain competitive expense levels for the funds. Most funds had sufficiently low expenses that these expense limitations were not operative during their fiscal years ending in 2018. However, in the case of your fund, the second of the expense limitations was operative during its fiscal year ending in 2018. Putnam Management and PSERV have agreed to maintain these expense limitations until at least December 30, 2020. The support of Putnam Management and PSERV for these expense limitation arrangements was an important factor in the Trustees’ decision to approve the continuance of your fund’s management contract and the approval of your fund’s amended and restated sub-advisory contract.

The Trustees reviewed comparative fee and expense information for a custom group of competitive funds selected by Broadridge Financial Solutions, Inc. (“Broadridge”). This comparative information included your fund’s percentile ranking for effective management fees and total expenses (excluding any applicable 12b-1 fees), which provides a general indication of your fund’s relative standing. In the custom peer group, your fund ranked in the third quintile in effective management fees (determined for your fund and the other funds in the custom peer group based on fund asset size and the applicable contractual management fee schedule) and in the fourth quintile in total expenses (excluding any applicable 12b-1 fees) as of December 31, 2018. The first quintile represents the least expensive funds and the fifth quintile the most expensive funds. The fee and expense data reported by Broadridge as of December 31, 2018 reflected the most recent fiscal year-end data available in Broadridge’s database at that time.

In connection with their review of fund management fees and total expenses, the Trustees also reviewed the costs of the services provided and the profits realized by Putnam Management and PanAgora from their contractual relationships with the funds. This information included trends in revenues, expenses and profitability of Putnam Management and its affiliates relating to the investment management, investor servicing and distribution services provided to the funds. In this regard, the Trustees also reviewed an analysis of Putnam Management’s revenues, expenses and profitability, allocated on a fund-by-fund basis, with respect to the funds’ management,

| |

| 18 PanAgora Market Neutral Fund |

distribution, and investor servicing contracts. For each fund, the analysis presented information about revenues, expenses and profitability for each of the agreements separately and for the agreements taken together on a combined basis. The Trustees also reviewed the costs incurred by PanAgora in providing its services under the sub-advisory contract and the resulting profitability to it in respect of your fund. The Trustees concluded that, at current asset levels, the fee schedules in place represented reasonable compensation for the services being provided and represented an appropriate sharing between fund shareholders, Putnam Management and PanAgora of such economies of scale as may exist in the management of the fund at that time.

The information examined by the Trustees in connection with their annual contract review for the Putnam funds included information regarding fees charged by Putnam Management and its affiliates (including PanAgora) to institutional clients, including defined benefit pension and profit-sharing plans and sub-advised mutual funds. This information included, in cases where an institutional product’s investment strategy corresponds with a fund’s strategy, comparisons of those fees with fees charged to the Putnam funds, as well as an assessment of the differences in the services provided to these different types of clients as compared to the services provided to the Putnam funds. The Trustees observed that the differences in fee rates between these clients and the Putnam funds are by no means uniform when examined by individual asset sectors, suggesting that differences in the pricing of investment management services to these types of clients may reflect, among other things, historical competitive forces operating in separate markets. The Trustees considered the fact that in many cases fee rates across different asset classes are higher on average for mutual funds than for institutional clients, and the Trustees also considered differences between the services that Putnam Management and PanAgora provide to the Putnam funds and those that they provide to their other clients. The Trustees did not rely on these comparisons to any significant extent in concluding that the management fees paid by your fund are reasonable.

Investment performance

The quality of the investment process provided by Putnam Management, and the quality of services provided by Putnam Management with respectto your fund, represented major factors in the Trustees’ evaluation of the quality of services provided by Putnam Management under your fund’s management contract. The Trustees were assisted in their review of the Putnam funds’ investment process and performance by the work of the investment oversight committees of the Trustees and the full Board of Trustees, which meet on a regular basis with the funds’ portfolio teams and with the Chief Investment Officers and other senior members of Putnam Management’s Investment Division throughout the year. The Trustees concluded that Putnam Management generally provides a high-quality investment process — based on the experience and skills of the individuals assigned to the management of fund portfolios, the resources made available to them, and in general Putnam Management’s ability to attract and retain high-quality personnel — but also recognized that this does not guarantee favorable investment results for every fund in every time period. With respect to its review of PanAgora’s investment process and your fund’s investment performance, the Contract Committee, along with other members of the Board, met with a portfolio manager of your fund to review, among other items, the fund’s investment strategy, performance attribution, risks and outlook.

The Trustees considered that, after a strong start to the year, 2018 was a mixed year for The Putnam Funds, with the Putnam open-end Funds’ performance, on an asset-weighted basis, ranking in the 54th percentile of their Lipper Inc. (“Lipper”) peers (excluding those Putnam funds that are evaluated based on their total returns versus selected investment benchmarks). The Trustees also noted that The Putnam Funds were ranked by the Barron’s/Lipper Fund Families survey as the 41st-best performing mutual fund complex out of 57 complexes for the one-year period ended December 31, 2018 and the 29th-best performing mutual fund complex out of 55 complexes for the five-year period ended December 31, 2018. The Trustees observed that The Putnam Funds’ performance over the longer-term continued to be strong, ranking 6th out of 49 mutual fund complexes in the survey over the ten-year period ended 2018. In addition, the Trustees noted that 22 of the funds were four- or five-star rated by Morningstar Inc. at the end of 2018. They also noted, however, the disappointing investment performance of some funds for periods ended December 31, 2018 and considered information

|

| PanAgora Market Neutral Fund 19 |

provided by Putnam Management regarding the factors contributing to the underperformance and actions being taken to improve the performance of these particular funds. The Trustees indicated their intention to continue to monitor closely the performance of those funds, including the effectiveness of any efforts Putnam Management has undertaken to address underperformance and whether additional actions to address areas of underperformance are warranted.

For purposes of the Trustees’ evaluation of the Putnam Funds’ investment performance, the Trustees generally focus on a competitive industry ranking of each fund’s total net return over a one-year, three-year and five-year period. For a number of Putnam funds with relatively unique investment mandates for which Putnam Management informed the Trustees that meaningful competitive performance rankings are not considered to be available, the Trustees evaluated performance based on their total gross and net returns and comparisons of those returns with the returns of selected investment benchmarks. In the case of your fund, the Trustees considered that its class A share cumulative total return performance at net asset value was in the fourth quartile of its Lipper peer group (Lipper Alternative Equity Market Neutral Funds) for the one-year period ended December 31, 2018 (the first quartile representing the best-performing funds and the fourth quartile the worst-performing funds). Over the one-year period ended December 31, 2018, there were 97 funds in your fund’s Lipper peer group. (When considering performance information, shareholders should be mindful that past performance is not a guarantee of future results.) The Trustees expressed concern about your fund’s fourth quartile performance over the one-year period ended December 31, 2018 and considered the circumstances that may have contributed to this disappointing performance. The Trustees noted Putnam Management’s observation that the fund’s diversified, quantitative strategy, which is based on the view that companies with strong fundamentals will outperform over time, performed less favorably in the recent later stage market, in which strong returns were concentrated in fewer securities and driven to a lesser extent by a company’s fundamentals.

The Trustees considered that Putnam Management remained confident in the fund’s portfolio managers. The Trustees also noted that the fund was launched in September 2017, that itsperformance track record was somewhat limited, and that the portfolio managers sought to deliver strong performance over a full economic cycle. The Trustees considered Putnam Management’s continued efforts to support fund performance through initiatives including structuring compensation for portfolio managers and research analysts to enhance accountability for fund performance, emphasizing accountability in the portfolio management process, and affirming its commitment to a fundamental-driven approach to investing. The Trustees noted further that Putnam Management had made selective hires in 2018 to strengthen its investment team. The Trustees will continue to closely monitor your fund and its investment performance in the coming year.

As a general matter, the Trustees believe that cooperative efforts between the Trustees and Putnam Management represent the most effective way to address investment performance concerns that may arise from time to time. The Trustees noted that investors in the Putnam funds have, in effect, placed their trust in the Putnam organization, under the oversight of the funds’ Trustees, to make appropriate decisions regarding the management of the funds. Based on Putnam Management’s willingness to take appropriate measures to address fund performance issues and Putnam Management’s responsiveness to Trustee concerns about investment performance, the Trustees concluded that it continued to be advisable to seek change within Putnam Management to address performance shortcomings. In the Trustees’ view, the alternative of engaging a new investment adviser for an underperforming fund, with all the attendant risks and disruptions, would not likely provide any greater assurance of improved investment performance.

Brokerage and soft-dollar allocations; investor servicing

The Trustees considered various potential benefits that Putnam Management and PanAgora may receive in connection with the services they provide under the management and sub-advisory contracts with your fund. These include benefits related to brokerage allocation and the use of soft dollars, whereby a portion of the commissions paid by a fund for brokerage may be used to acquire research services that are expected to be useful to PanAgora in managing the assets of the fund and of other clients. Subject to policies approved by the Trustees, soft dollars generated by these means are used predominantly to

| |

| 20 PanAgora Market Neutral Fund |

acquire brokerage and research services (including third-party research and market data) that enhance PanAgora’s investment capabilities and supplement PanAgora’s internal research efforts. The Trustees indicated their continued intent to monitor regulatory and industry developments in this area with the assistance of their Brokerage Committee. The Trustees also indicated their continued intent to monitor the allocation of the Putnam funds’ brokerage in order to ensure that the principle of seeking best price and execution remains paramount in the portfolio trading process.

Putnam Management may also receive benefits from payments that the funds make to Putnam Management’s affiliates for investor or distribution services. In conjunction with the annual reviewof your fund’s management and sub-advisory contracts, the Trustees reviewed your fund’s investor servicing agreement with PSERV and its distributor’s contracts and distribution plans with Putnam Retail Management Limited Partnership (“PRM”), both of which are affiliates of Putnam Management. The Trustees concluded that the fees payable by the funds to PSERV and PRM, as applicable, for such services are fair and reasonable in relation to the nature and quality of such services, the fees paid by competitive funds, and the costs incurred by PSERV and PRM, as applicable, in providing such services. Furthermore, the Trustees were of the view that the services provided were required for the operation of the funds, and that they were of a quality at least equal to those provided by other providers.

|

| PanAgora Market Neutral Fund 21 |

Audited financial statements

These sections of the report, as well as the accompanying Notes, preceded by the Report of Independent Registered Public Accounting Firm, constitute the fund’s audited financial statements.

The fund’s portfoliolists all the fund’s investments and their values as of the last day of the reporting period. Holdings are organized by asset type and industry sector, country, or state to show areas of concentration and diversification.

Statement of assets and liabilitiesshows how the fund’s net assets and share price are determined. All investment and non-investment assets are added together. Any unpaid expenses and other liabilities are subtracted from this total. The result is divided by the number of shares to determine the net asset value per share, which is calculated separately for each class of shares. (For funds with preferred shares, the amount subtracted from total assets includes the liquidation preference of preferred shares.)

Statement of operationsshows the fund’s net investment gain or loss. This is done by first adding up all the fund’s earnings — from dividends and interest income — and subtracting its operatingexpenses to determine net investment income (or loss). Then, any net gain or loss the fund realized on the sales of its holdings — as well as any unrealized gains or losses over the period — is added to or subtracted from the net investment result to determine the fund’s net gain or loss for the fiscal year.

Statement of changes in net assetsshows how the fund’s net assets were affected by the fund’s net investment gain or loss, by distributions to shareholders, and by changes in the number of the fund’s shares. It lists distributions and their sources (net investment income or realized capital gains) over the current reporting period and the most recent fiscal year-end. The distributions listed here may not match the sources listed in the Statement of operations because the distributions are determined on a tax basis and may be paid in a different period from the one in which they were earned.

Financial highlightsprovide an overview of the fund’s investment results, per-share distributions, expense ratios, net investment income ratios, and portfolio turnover in one summary table, reflecting the five most recent reporting periods. In a semiannual report, the highlights table also includes the current reporting period.

| |

| 22 PanAgora Market Neutral Fund |

Report of Independent Registered Public Accounting Firm

To the Trustees of Putnam Investment Funds and Shareholders

of Putnam PanAgora Market Neutral Fund

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities, including the fund’s portfolio, of Putnam PanAgora Market Neutral Fund (one of the funds constituting Putnam Investment Funds, referred to hereafter as the “Fund”) as of August 31, 2019, the related statement of operations for the year ended August 31, 2019, and the statement of changes in net assets and the financial highlights for the year ended August 31, 2019 and for the period September 21, 2017 (commencement of operations) through August 31, 2018 including the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of August 31, 2019, the results of its operations for the year ended August 31, 2019, and the changes in its net assets and the financial highlights for the year ended August 31, 2019 and for the period September 21, 2017 (commencement of operations) through August 31, 2018 in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits of these financial statements in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. Our procedures included confirmation of securities owned as of August 31, 2019 by correspondence with the custodian and the broker; when replies were not received from the broker, we performed other auditing procedures. We believe that our audits provide a reasonable basis for our opinion.

PricewaterhouseCoopers LLP

Boston, Massachusetts

October 14, 2019

We have served as the auditor of one or more investment companies in the Putnam Investments family of mutual funds since at least 1957. We have not been able to determine the specific year we began serving as auditor.

|

| PanAgora Market Neutral Fund 23 |

| | |

| The fund’s portfolio8/31/19 | | |

| |

| INVESTMENT COMPANIES (1.7%)* | Shares | Value |

| State Street Institutional U.S. Government Money Market Fund | 172,790 | $172,790 |

| Total investment companies (cost $172,790) | | $172,790 |

| |

| SHORT-TERM INVESTMENTS (97.6%)* | Principal amount | Value |

| U.S. Treasury Bills with effective yields ranging from 2.474% | | |

| to 2.577%, 9/12/19 Δ | $4,850,000 | $4,847,727 |

| U.S. Treasury Bills with an effective yield of 2.358%, 11/21/19 | 4,850,000 | 4,829,370 |

| Total short-term investments (cost $9,670,910) | | $9,677,097 |

| |

| TOTAL INVESTMENTS | | |

| Total investments (cost $9,843,700) | | $9,849,887 |

| |

| Key to holding’s abbreviations |

| ADR/Adr | American Depository Receipts: represents ownership of foreign securities on deposit with a |

| | custodian bank |

| ETF/Etf | Exchange Traded Fund |

| GDR/Gdr | Global Depository Receipts: represents ownership of foreign securities on deposit with a |

| | custodian bank |

| NVDR/Nvdr | Non-voting Depository Receipts |

| OTC | Over-the-counter |

| PJSC/Pjsc | Public Joint Stock Company |

| SPDR/Spdr | S&P Depository Receipts |

Notes to the fund’s portfolio

Unless noted otherwise, the notes to the fund’s portfolio are for the close of the fund’s reporting period, which ran from September 1, 2018 through August 31, 2019 (the reporting period). Within the following notes to the portfolio, references to “Putnam Management” represent Putnam Investment Management, LLC, the fund’s manager, an indirect wholly-owned subsidiary of Putnam Investments, LLC and references to “ASC 820” represent Accounting Standards Codification 820Fair Value Measurements and Disclosures.

*Percentages indicated are based on net assets of $9,911,284.

ΔThis security, in part or in entirety, was pledged and segregated with the custodian for collateral on certain derivative contracts at the close of the reporting period. Collateral at period end totaled $3,789,194 and is included in Investments in securities on the Statement of assets and liabilities (Notes 1 and 8).

The dates shown on debt obligations are the original maturity dates.

| | | | | | |

| OTC TOTAL RETURN SWAP CONTRACTS OUTSTANDING at 8/31/19 | | |

| | | Upfront | | | | |

| | | premium | Termina- | Payments | Total return | Unrealized |

| Swap counterparty/ | | received | tion | received (paid) | received by | appreciation/ |

| Notional amount | Value | (paid) | date | by fund | or paid by fund | (depreciation) |

| Morgan Stanley & Co. International PLC | | | | |

| $81,002 | $80,597 | $— | 1/29/20 | (Federal Funds | Abbvie Inc — | $(420) |

| | | | | Effective Rate US | Monthly | |

| | | | | plus 0.25%) — | | |

| | | | | Monthly | | |

| 38,909 | 38,965 | — | 1/29/20 | (Federal Funds | Acacia | 48 |

| | | | | Effective Rate US | Communications | |

| | | | | plus 0.25%) — | Inc — Monthly | |

| | | | | Monthly | | |

| |

| 24 PanAgora Market Neutral Fund |

| | | | | | |

| OTC TOTAL RETURN SWAP CONTRACTS OUTSTANDING at 8/31/19cont. | | |

| | | Upfront | | | | |

| | | premium | Termina- | Payments | Total return | Unrealized |

| Swap counterparty/ | | received | tion | received (paid) | received by | appreciation/ |

| Notional amount | Value | (paid) | date | by fund | or paid by fund | (depreciation) |

| Morgan Stanley & Co. International PLCcont. | | | | |

| $34,869 | $35,465 | $— | 1/29/20 | (Federal Funds | Acs Actividades | $589 |

| | | | | Effective Rate US | De Construccion | |

| | | | | plus 0.25%) — | Y Servicios Sa — | |

| | | | | Monthly | Monthly | |

| 52,292 | 52,867 | — | 1/29/20 | (Federal Funds | Adidas Ag — | 565 |

| | | | | Effective Rate US | Monthly | |

| | | | | plus 0.25%) — | | |

| | | | | Monthly | | |

| 64,140 | 64,699 | — | 1/29/20 | (Federal Funds | Advance Auto Parts | 545 |

| | | | | Effective Rate US | Inc — Monthly | |

| | | | | plus 0.25%) — | | |

| | | | | Monthly | | |

| 86,521 | 86,334 | — | 1/29/20 | (Federal Funds | Advanced Disposal | (203) |

| | | | | Effective Rate US | Services Inc — | |

| | | | | plus 0.25%) — | Monthly | |

| | | | | Monthly | | |

| 8,240 | 8,339 | — | 1/27/20 | (Federal Funds | Advanced Info | 96 |

| | | | | Effective Rate US | Service Pcl Nvdr — | |

| | | | | plus 0.75%) — | Monthly | |

| | | | | Monthly | | |

| 39,492 | 40,345 | — | 1/29/20 | (Federal Funds | Aflac Inc — Monthly | 845 |

| | | | | Effective Rate US | | |

| | | | | plus 0.25%) — | | |

| | | | | Monthly | | |

| 82,210 | 84,534 | — | 1/29/20 | (Federal Funds | Agco Corp — | 2,307 |

| | | | | Effective Rate US | Monthly | |

| | | | | plus 0.25%) — | | |

| | | | | Monthly | | |

| 161,631 | 164,335 | — | 1/29/20 | (Federal Funds | Agilent | 2,672 |

| | | | | Effective Rate US | Technologies Inc — | |

| | | | | plus 0.25%) — | Monthly | |

| | | | | Monthly | | |

| 13,341 | 12,537 | — | 8/01/24 | (Federal Funds | Agility Public | (826) |

| | | | | Effective Rate US | Warehousing Co | |

| | | | | plus 1.20%) — | Kscp — Monthly | |

| | | | | Monthly | | |

| 6,119 | 6,415 | — | 1/29/20 | (Federal Funds | Aguas Andinas Sa — | 295 |

| | | | | Effective Rate US | Monthly | |

| | | | | plus 1.25%) — | | |

| | | | | Monthly | | |

| 112,001 | 113,195 | — | 1/29/20 | (Federal Funds | Akamai | 1,172 |

| | | | | Effective Rate US | Technologies Inc — | |

| | | | | plus 0.25%) — | Monthly | |

| | | | | Monthly | | |

| 4,936 | 4,936 | — | 7/09/24 | (Federal Funds | Al Rajhi Bank — | (1) |

| | | | | Effective Rate US | Monthly | |

| | | | | plus 1.20%) — | | |

| | | | | Monthly | | |

|

| PanAgora Market Neutral Fund 25 |

| | | | | | |

| OTC TOTAL RETURN SWAP CONTRACTS OUTSTANDING at 8/31/19cont. | | |

| | | Upfront | | | | |

| | | premium | Termina- | Payments | Total return | Unrealized |

| Swap counterparty/ | | received | tion | received (paid) | received by | appreciation/ |

| Notional amount | Value | (paid) | date | by fund | or paid by fund | (depreciation) |

| Morgan Stanley & Co. International PLCcont. | | | | |

| $12,550 | $13,309 | $— | 1/29/20 | (Federal Funds | Alfa Sab De Cv — | $756 |

| | | | | Effective Rate US | Monthly | |

| | | | | plus 0.90%) — | | |

| | | | | Monthly | | |

| 27,961 | 28,005 | — | 1/27/20 | (Federal Funds | Alfresa Holdings | 37 |

| | | | | Effective Rate US | Corp — Monthly | |

| | | | | plus 0.25%) — | | |

| | | | | Monthly | | |

| 41,595 | 41,527 | — | 1/29/20 | (Federal Funds | Allergan Plc — | (76) |

| | | | | Effective Rate US | Monthly | |

| | | | | plus 0.25%) — | | |

| | | | | Monthly | | |

| 159,425 | 164,880 | — | 1/29/20 | (Federal Funds | Allison Transmission | 5,423 |

| | | | | Effective Rate US | Holdings Inc — | |

| | | | | plus 0.25%) — | Monthly | |

| | | | | Monthly | | |

| 110,333 | 111,910 | — | 1/29/20 | (Federal Funds | Alphabet Inc — | 1,555 |

| | | | | Effective Rate US | Monthly | |

| | | | | plus 0.25%) — | | |

| | | | | Monthly | | |

| 122,777 | 124,502 | — | 1/29/20 | (Federal Funds | Altice Usa Inc — | 1,701 |

| | | | | Effective Rate US | Monthly | |

| | | | | plus 0.25%) — | | |

| | | | | Monthly | | |

| 50,937 | 52,146 | — | 1/27/20 | (Federal Funds | Amada Holdings Co | 1,196 |

| | | | | Effective Rate US | Ltd — Monthly | |

| | | | | plus 0.25%) — | | |

| | | | | Monthly | | |

| 165,840 | 166,971 | — | 1/29/20 | (Federal Funds | Amazon.Com Inc — | 1,099 |

| | | | | Effective Rate US | Monthly | |

| | | | | plus 0.25%) — | | |

| | | | | Monthly | | |

| 141,959 | 145,489 | — | 1/29/20 | (Federal Funds | Ameriprise Financial | 3,502 |

| | | | | Effective Rate US | Inc — Monthly | |

| | | | | plus 0.25%) — | | |

| | | | | Monthly | | |

| 82,848 | 84,641 | — | 1/29/20 | (Federal Funds | Ametek Inc — | 1,776 |

| | | | | Effective Rate US | Monthly | |

| | | | | plus 0.25%) — | | |

| | | | | Monthly | | |

| 17,704 | 18,676 | — | 1/28/20 | (Federal Funds | Ammb Holdings | 966 |

| | | | | Effective Rate US | Bhd — Monthly | |

| | | | | plus 0.75%) — | | |

| | | | | Monthly | | |

| 64,645 | 65,685 | — | 1/29/20 | (Federal Funds | Anaplan Inc — | 1,027 |

| | | | | Effective Rate US | Monthly | |

| | | | | plus 0.25%) — | | |

| | | | | Monthly | | |

|

| 26 PanAgora Market Neutral Fund |

| | | | | | |

| OTC TOTAL RETURN SWAP CONTRACTS OUTSTANDING at 8/31/19cont. | | |

| | | Upfront | | | | |

| | | premium | Termina- | Payments | Total return | Unrealized |

| Swap counterparty/ | | received | tion | received (paid) | received by | appreciation/ |

| Notional amount | Value | (paid) | date | by fund | or paid by fund | (depreciation) |

| Morgan Stanley & Co. International PLCcont. | | | | |

| $5,653 | $5,635 | $— | 1/29/20 | (Federal Funds | Anhui Conch | $(20) |

| | | | | Effective Rate US | Cement Co Ltd — | |

| | | | | plus 0.25%) — | Monthly | |

| | | | | Monthly | | |

| 38,378 | 38,833 | — | 1/29/20 | (Federal Funds | Ansys Inc — Monthly | 447 |

| | | | | Effective Rate US | | |

| | | | | plus 0.25%) — | | |

| | | | | Monthly | | |

| 16,179 | 16,190 | — | 1/27/20 | (Federal Funds | Aozora Bank Ltd — | 7 |

| | | | | Effective Rate US | Monthly | |

| | | | | plus 0.25%) — | | |

| | | | | Monthly | | |

| 39,726 | 39,844 | — | 1/29/20 | (Federal Funds | Aptargroup Inc — | 110 |

| | | | | Effective Rate US | Monthly | |

| | | | | plus 0.25%) — | | |

| | | | | Monthly | | |

| 44,160 | 44,127 | — | 1/29/20 | (Federal Funds | Aquantia Corp — | (42) |

| | | | | Effective Rate US | Monthly | |

| | | | | plus 0.25%) — | | |

| | | | | Monthly | | |

| 8,265 | 8,373 | — | 1/29/20 | (Federal Funds | Arca Continental Sa | 106 |

| | | | | Effective Rate US | De Cv — Monthly | |

| | | | | plus 0.90%) — | | |

| | | | | Monthly | | |

| 18,673 | 18,942 | — | 1/29/20 | (Federal Funds | Aristocrat Leisure | 265 |

| | | | | Effective Rate US | Ltd — Monthly | |

| | | | | plus 0.25%) — | | |

| | | | | Monthly | | |

| 41,705 | 42,022 | — | 1/27/20 | (Federal Funds | Asahi Group | 306 |

| | | | | Effective Rate US | Holdings Ltd — | |

| | | | | plus 0.25%) — | Monthly | |

| | | | | Monthly | | |

| 59,118 | 62,727 | — | 1/29/20 | (Federal Funds | Ashtead Group | 3,597 |

| | | | | Effective Rate US | Plc — Monthly | |

| | | | | plus 0.25%) — | | |

| | | | | Monthly | | |

| 47,967 | 48,740 | — | 1/29/20 | (Federal Funds | Asm International | 763 |

| | | | | Effective Rate US | Nv — Monthly | |

| | | | | plus 0.25%) — | | |

| | | | | Monthly | | |

| 7,808 | 8,095 | — | 1/27/20 | (Federal Funds | Atacadao Sa — | 284 |

| | | | | Effective Rate US | Monthly | |

| | | | | plus 0.65%) — | | |

| | | | | Monthly | | |

| 39,517 | 39,661 | — | 1/29/20 | (Federal Funds | Autozone Inc — | 136 |

| | | | | Effective Rate US | Monthly | |

| | | | | plus 0.25%) — | | |

| | | | | Monthly | | |

|

| PanAgora Market Neutral Fund 27 |

| | | | | | |

| OTC TOTAL RETURN SWAP CONTRACTS OUTSTANDING at 8/31/19cont. | | |

| | | Upfront | | | | |

| | | premium | Termina- | Payments | Total return | Unrealized |

| Swap counterparty/ | | received | tion | received (paid) | received by | appreciation/ |

| Notional amount | Value | (paid) | date | by fund | or paid by fund | (depreciation) |

| Morgan Stanley & Co. International PLCcont. | | | | |

| $30,590 | $30,860 | $— | 1/29/20 | (Federal Funds | Avista Corp — | $264 |

| | | | | Effective Rate US | Monthly | |

| | | | | plus 0.25%) — | | |

| | | | | Monthly | | |

| 17,617 | 17,586 | — | 1/29/20 | (Federal Funds | Aviva Plc — Monthly | (34) |

| | | | | Effective Rate US | | |

| | | | | plus 0.25%) — | | |

| | | | | Monthly | | |

| 51,401 | 52,487 | — | 1/29/20 | (Federal Funds | Avon Products Inc —�� | 1,076 |

| | | | | Effective Rate US | Monthly | |

| | | | | plus 0.25%) — | | |

| | | | | Monthly | | |

| 32,717 | 35,441 | — | 1/27/20 | (Federal Funds | Banco Btg Pactual | 2,714 |

| | | | | Effective Rate US | Sa — Monthly | |

| | | | | plus 0.65%) — | | |

| | | | | Monthly | | |

| 4,260 | 4,476 | — | 1/27/20 | (Federal Funds | Banco Do Brasil | 214 |

| | | | | Effective Rate US | Sa — Monthly | |

| | | | | plus 0.65%) — | | |

| | | | | Monthly | | |

| 4,651 | 4,849 | — | 1/29/20 | (Federal Funds | Bank Millennium | 197 |

| | | | | Effective Rate US | Sa — Monthly | |

| | | | | plus 0.70%) — | | |

| | | | | Monthly | | |

| 51,042 | 52,297 | — | 1/29/20 | (Federal Funds | Bank Of America | 1,245 |

| | | | | Effective Rate US | Corp — Monthly | |

| | | | | plus 0.25%) — | | |

| | | | | Monthly | | |

| 20,112 | 20,296 | — | 1/29/20 | (Federal Funds | Bank Of | 181 |

| | | | | Effective Rate US | Communications Co | |

| | | | | plus 0.25%) — | Ltd — Monthly | |

| | | | | Monthly | | |

| 55,535 | 55,999 | — | 1/29/20 | (Federal Funds | Barratt | 454 |