| | |

| UNITED STATES

SECURITIES AND EXCHANGE COMMISSION |

| | |

| CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

|

| | |

| Investment Company Act file number: | (811–07237) |

| | |

| Exact name of registrant as specified in charter: | Putnam Investment Funds |

| | |

| Address of principal executive offices: | 100 Federal Street, Boston, Massachusetts 02110 |

| | |

| Name and address of agent for service: | Robert T. Burns, Vice President

100 Federal Street

Boston, Massachusetts 02110 |

| | |

| Copy to: | Bryan Chegwidden, Esq.

Ropes & Gray LLP

1211 Avenue of the Americas

New York, New York 10036 |

| | |

| Registrant's telephone number, including area code: | (617) 292–1000 |

| | |

| Date of fiscal year end: | August 31, 2020 |

| | |

| Date of reporting period: | September 1, 2019 — February 29, 2020 |

| | |

|

Item 1. Report to Stockholders: | |

| | |

| The following is a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act of 1940: | |

Putnam PanAgora

Market Neutral

Fund

Semiannual report

2|29|20

IMPORTANT NOTICE: Delivery of paper fund reports

In accordance with regulations adopted by the Securities and Exchange Commission, beginning on January 1, 2021, reports like this one will no longer be sent by mail unless you specifically request it. Instead, they will be on Putnam’s website, and you will be notified by mail whenever a new one is available, and provided with a website link to access the report.

If you wish to stop receiving paper reports sooner, or if you wish to continue to receive paper reports free of charge after January 1, 2021, please see the back cover or insert for instructions. If you invest through a bank or broker, your choice will apply to all funds held in your account. If you invest directly with Putnam, your choice will apply to all Putnam funds in your account.

If you already receive these reports electronically, no action is required.

Message from the Trustees

April 9, 2020

Dear Fellow Shareholder:

After a period of gains and relative tranquility, global financial markets encountered considerable challenges in early 2020. In late February, as COVID-19, the disease caused by the coronavirus, spread into regions beyond China, global stock markets began to experience significant declines and turbulence. By mid-March, major U.S. indexes had fallen into bear market territory, defined as a 20% drop from a previous high. As often happens when stocks decline sharply, bonds generally provided better results. As investors rushed to safe havens, the yield on the benchmark 10-year U.S. Treasury note fell to historic lows. Central banks and governments worldwide have enacted measures to inject liquidity into the markets and restore confidence, including emergency interest-rate cuts.

Markets are working to assess the economic impact of the disease and the public health measures taken in response to it. It is still unclear what the costs will be and how long the effects of the COVID-19 pandemic will last, but history has shown that markets recover from downturns. For investors, we believe the most important course of action is to remain calm, stay focused on your long-term goals, and consult with your financial advisor. At Putnam, our investment professionals remain focused on actively managing fund portfolios with a research-intensive approach that includes risk management strategies.

Thank you for investing with Putnam.

Current performance may be lower or higher than the quoted past performance, which cannot guarantee future results. Share price, principal value, and return will fluctuate, and you may have a gain or a loss when you sell your shares. Performance of class A shares assumes reinvestment of distributions and does not account for taxes. Fund returns in the bar chart do not reflect a sales charge of 5.75%; had they, returns would have been lower. See below and pages 7–8 for additional performance information. For a portion of the periods, the fund had expense limitations, without which returns would have been lower. To obtain the most recent month-end performance, visit putnam.com.

*Returns for the six-month period are not annualized, but cumulative.

This comparison shows your fund’s performance in the context of broad market indexes for the six months ended 2/29/20. See above and pages 7–8 for additional fund performance information. Index descriptions can be found on pages 12–13.

| |

| 2 PanAgora Market Neutral Fund |

George D. Mussalli, CFA

Portfolio Manager

George is Chief Investment Officer and Head of Equity Research at PanAgora Asset Management. He has an M.B.A. from the Sloan School of Business at the Massachusetts Institute of Technology and a B.S. from Tufts University. George joined PanAgora in 2004 and has been in the investment industry since 1995.

Richard Tan, CFA

Portfolio Manager

Richard is a Director in the Equity group at PanAgora Asset Management. He has an M.B.A. from the Carroll Graduate School of Management at Boston College, an M.S. in Computer Science from Rutgers University, and a B.A. from Shanghai Jiao Tong University. Richard joined PanAgora in 2008 and has been in the investment industry since 1997.

Please review global market performance, beginning with equities.

For the six-month reporting period ended February 29, 2020, global equities gained 1.13% as measured by the MSCI All Country World Index [ND] [ACWI]. The asset class finished 2019 strongly due to continued optimism about the U.S.–China trade deal and a series of interest-rate cuts from the U.S. Federal Reserve [Fed]. At the start of 2020, global equities declined. The MSCI ACWI fell by 9.09% in the first two months of 2020. In February, equities reached an all-time high only to sell off later that month. Fears over the potential for a global outbreak of the coronavirus disease [COVID-19] to slow global economic growth further eroded investor confidence.

U.S. large-cap equities finished the six-month period up 1.92% as measured by the S&P 500 Index. Small-cap U.S. equities finished lower, with the Russell 2000 Index declining 0.52% over the same period. Although U.S. equities finished 2019 on a promising note, market turmoil battered the asset class after the amount of coro-navirus cases outside of mainland China surged. The S&P 500 Index notably declined by 11.44% in the last week of February 2020 as worries about the virus shook investor sentiment.

European equities lost 1.12% for the reporting period, as measured by the MSCI Europe Index

|

| PanAgora Market Neutral Fund 3 |

Global composition

The table shows the fund’s long and short exposures in each country or region and the percentage of the fund’s net assets that each represented as of 2/29/20. Allocations will not total 100% because the table reflects the notional value of derivatives (the economic value for purposes of calculating periodic payment obligations), in addition to the market value of securities. Holdings and allocations may vary over time.

[ND]. Similar to U.S. equities, European equities suffered significant losses at the start of 2020. The spread of the coronavirus hit European equities hard after a sizeable outbreak occurred in northern Italy, business slowed in Milan, and fears of contagion rose. Travel and leisure stocks fell the most, given new border restrictions, grounded flights, and lower consumer demand.

Emerging-market equities finished the reporting period up 2.93%, as measured by the MSCI Emerging Markets Index [ND]. Improved U.S.–China trade relations helped boost the asset class. Emerging-market equities had declined at the start of 2020. However, promising reports of the coronavirus containment in China helped to reduce losses compared with developing markets.

How did fixed-income markets perform?

Bonds ended the final months of 2019 on a decline as investors favored riskier assets. As mentioned previously, the market environment changed drastically in the first two months of 2020. Bonds rallied considerably as the coronavirus moved from being a localized epidemic to a global pandemic. Prices for U.S.Treasuries rose as yields dropped to record lows. The yield on the bellwether 10-year U.S. Treasury note declined by approximately 80 basis points from the start of 2020 through the end of the reporting period, closing at a then-all-time low of 1.13%. The spike in volatility and drastic repricing of assets took place over a short period of time. It also followed the results of the January FOMC [Federal Open Market Committee] meeting in which the Fed indicated that the U.S. economy and labor market remained strong.

Across the Atlantic, yields for developed-market government debt moved in step with the United States as prices climbed. The yield on the benchmark 10-year German bund retreated further into negative territory and closed the period at –0.61%. The Bloomberg Barclays U.S. Treasury Index and FTSE World Government Bond Index ex-U.S. [Hedged] finished the period up 3.44% and 0.75%, respectively. Investment-grade credit and inflation-linked bonds also reflected demand for safer haven assets. The Bloomberg Barclays U.S. Credit Index and the Bloomberg Barclays World Government Inflation-Linked Bond Index [Hedged] gained 4.14% and 0.36%, respectively, for the period.

| |

| 4 PanAgora Market Neutral Fund |

How did commodities, the third source of the fund’s asset class diversification, perform?

The risk aversion stemming from coronavirus fears directly affected the prices of commodities. Both the S&P GSCI and the Bloomberg Commodity Index saw their positive gains from the end of 2019 get completely wiped out by the end of February 2020. The more heavily energy-weighted S&P GSCI lost 9.97%, while the more balanced Bloomberg Commodity Index lost 7.06%. The steep decline in prices reflected investor fears that the spread of the corona-virus would disrupt China’s economy and the country’s large demand for certain commodities. The main commodity sectors, with the exception of safe-haven precious metals, posted negative performance for the period, with energy and industrial metals declining the most.

How did the fund perform? Could you discuss some detractors and contributors to results?

Putnam PanAgora Market Neutral Fund posted a return of –5.66% for the six-month reporting period. The long-term portfolio was the largest detractor with most of the underperformance coming from U.S. smaller-capitalization-equity short positions. Intermediate- and short-term strategies contributed to performance for the period.

The long-term portfolio declined due to poor stock selection within the United States. On a sector-basis, U.S. consumer staples and communication services detracted the most. Our alpha model struggled in both sectors. Within staples, growth and quality metrics detracted from results. In communication services, sentiment metrics underperformed. The U.S. health-care sector was the fund’s top contributor. Good performance came from stock selection within the pharmaceuticals, biotechnology, and life sciences industry groups. The alpha model within the health-care sector benefited from the positive performance of the industry-specific model.

International positions slightly detracted from overall results. Positions in the Asia-Pacific region detracted the most. The alpha model did not perform well in the Asia-Pacific region due to poor performance of value and quality metrics. In terms of countries, South Korea and Taiwan detracted the most. Positive stock selection results came from Germany and the United Kingdom, making the European region the largest international fund contributor. The alpha model worked well in Europe, driven by the solid performance of value metrics.

The fund’s intermediate strategies contributed to returns with the majority of positive performance coming from U.S. merger-arbitrage-related trades within the technology sector. The fund’s short-term strategies contributed as well due to performance of the index-reconstitution and company-investors-meeting strategies.

How did the fund use derivatives?

We used total return swaps to take long or short positions in equity securities.

What is your outlook and portfolio strategy for the coming months?

The fund is designed to generate attractive absolute returns under different market conditions and over different time horizons. The fund uses a diversified set of strategies that have low correlation to one another. The resulting combination is expected to result in more stable returns over time than any individual strategy alone.

At period end, the majority of the fund’s allocation was within the long-term portfolio, which utilizes fundamental-based signals applied across a broad universe of stocks and will provide the majority of the fund’s return, in our

|

| PanAgora Market Neutral Fund 5 |

view. Intermediate- and short-term strategies provide additional alpha based on the number of corporate and market events.

Thank you, George and Richard, for your time and insights today.

Past performance is not a guarantee of future results.

The opinions expressed in this article represent the current, good-faith views of the author(s) at the time of publication, are provided for limited purposes, are not definitive investment advice, and should not be relied on as such. The information presented in this article has been developed internally and/or obtained from sources believed to be reliable; however, PanAgora Asset Management, Inc. (PanAgora) does not guarantee the accuracy, adequacy or completeness of such information. Predictions, opinions, and other information contained in this article are subject to change continually and without notice of any kind and may no longer be true after the date indicated. As with any investment there is a potential for profit as well as the possibility of loss.

Any forward-looking statements speak only as of the date they are made, and PanAgora assumes no duty to and does not undertake to update forward-looking statements. Forward-looking statements are subject to numerous assumptions, risks, and uncertainties, which change over time. Actual results could differ materially from those anticipated in forward-looking statements. Any investments to which this material relates are available only to or will be engaged in only with investment professionals.

ABOUT DERIVATIVES

Derivatives are an increasingly common type of investment instrument, the performance of which isderivedfrom an underlying security, index, currency, or other area of the capital markets. Derivatives employed by the fund’s managers generally serve one purpose: to take long or short positions in equity securities.

For example, the fund’s managers might use derivatives, such as total return swaps, to take long or short positions in equity securities. The fund may also use derivatives as a substitute for a direct investment in the securities of one or more issuers.

Like any other investment, derivatives may not appreciate in value and may lose money. Derivatives may amplify traditional investment risks through the creation of leverage and may be less liquid than traditional securities. And because derivatives typically represent contractual agreements between two financial institutions, derivatives entail “counterparty risk,” which is the risk that the other party is unable or unwilling to pay. PanAgora monitors the counterparty risks we assume. For example, PanAgora often enters into collateral agreements that require the counterparties to post collateral on a regular basis to cover their obligations to the fund. Counterparty risk for exchange-traded futures and centrally cleared swaps is mitigated by the daily exchange of margin and other safeguards against default through their respective clearinghouses.

|

| 6 PanAgora Market Neutral Fund |

Your fund’s performance

This section shows your fund’s performance, price, and distribution information for periods ended February 29, 2020, the end of the first half of its current fiscal year. In accordance with regulatory requirements for mutual funds, we also include performance information as of the most recent calendar quarter-end and expense information taken from the fund’s current prospectus. Performance should always be considered in light of a fund’s investment strategy. Data represent past performance. Past performance does not guarantee future results. More recent returns may be less or more than those shown. Investment return and principal value will fluctuate, and you may have a gain or a loss when you sell your shares. Performance information does not reflect any deduction for taxes a shareholder may owe on fund distributions or on the redemption of fund shares. For the most recent month-end performance, please visit the Individual Investors section at putnam.com or call Putnam at 1-800-225-1581. Class R, R6, and Y shares are not available to all investors. See the Terms and definitions section in this report for definitions of the share classes offered by your fund.

| | | | |

| Fund performanceTotal return for periods ended 2/29/20 | | |

| | Life of fund | Annual average | 1 year | 6 months |

| Class A(9/21/17) | | | | |

| Before sales charge | –18.30% | –7.95% | –10.71% | –5.66% |

| After sales charge | –23.00 | –10.15 | –15.84 | –11.08 |

| Class B(9/21/17) | | | | |

| Before CDSC | –19.70 | –8.60 | –11.37 | –5.86 |

| After CDSC | –22.11 | –9.73 | –15.80 | –10.57 |

| Class C(9/21/17) | | | | |

| Before CDSC | –19.70 | –8.60 | –11.37 | –5.86 |

| After CDSC | –19.70 | –8.60 | –12.25 | –6.80 |

| Class R(9/21/17) | | | | |

| Net asset value | –18.70 | –8.13 | –10.86 | –5.68 |

| Class R6(9/21/17) | | | | |

| Net asset value | –17.80 | –7.72 | –10.55 | –5.52 |

| Class Y(9/21/17) | | | | |

| Net asset value | –17.80 | –7.72 | –10.55 | –5.52 |

Current performance may be lower or higher than the quoted past performance, which cannot guarantee future results. After-sales-charge returns for class A shares reflect the deduction of the maximum 5.75% sales charge levied at the time of purchase. Class B share returns after contingent deferred sales charge (CDSC) reflect the applicable CDSC, which is 5% in the first year, declining over time to 1% in the sixth year, and is eliminated thereafter. Class C share returns after CDSC reflect a 1% CDSC for the first year that is eliminated thereafter. Class R, R6, and Y shares have no initial sales charge or CDSC.

For a portion of the periods, the fund had expense limitations, without which returns would have been lower.

|

| PanAgora Market Neutral Fund 7 |

| | | | |

| Comparative index returnsFor periods ended 2/29/20 | | |

| |

| | Life of fund | Annual average | 1 year | 6 months |

| ICE BofA U.S. | | | | |

| Treasury Bill Index | 4.90% | 1.98% | 2.27% | 0.97% |

| Lipper Alternative | | | | |

| Equity Market | | | | |

| Neutral Funds | –6.57 | –3.05 | –4.99 | –2.87 |

| category average* | | | | |

Index and Lipper results should be compared with fund performance before sales charge, before CDSC, or at net asset value.

*Over the 6-month, 1-year and life-of-fund periods ended 2/29/20, there were 70, 68, and 67 funds, respectively, in this Lipper category.

| | | | | | | |

| Fund price and distribution informationFor the six-month period ended 2/29/20 | |

| | Class A | Class B | Class C | Class R | Class R6 | Class Y |

| | Before | After | Net | Net | Net | Net | Net |

| | sales | sales | asset | asset | asset | asset | asset |

| Share value | charge | charge | value | value | value | value | value |

| 8/31/19 | $8.66 | $9.19 | $8.53 | $8.53 | $8.62 | $8.70 | $8.70 |

| 2/29/20 | 8.17 | 8.67 | 8.03 | 8.03 | 8.13 | 8.22 | 8.22 |

The classification of distributions, if any, is an estimate. Before-sales-charge share value and current dividend rate for class A shares, if applicable, do not take into account any sales charge levied at the time of purchase. After-sales-charge share value, current dividend rate, and current 30-day SEC yield, if applicable, are calculated assuming that the maximum sales charge (5.75% for class A shares) was levied at the time of purchase. Final distribution information will appear on your year-end tax forms.

The fund made no distributions during the period.

| | | | |

| Fund performance as of most recent calendar quarterTotal return for periods ended 3/31/20 |

| | Life of fund | Annual average | 1 year | 6 months |

| Class A(9/21/17) | | | | |

| Before sales charge | –19.10% | –8.04% | –9.91% | –6.58% |

| After sales charge | –23.75 | –10.17 | –15.09 | –11.95 |

| Class B(9/21/17) | | | | |

| Before CDSC | –20.60 | –8.72 | –10.59 | –6.92 |

| After CDSC | –22.98 | –9.81 | –15.06 | –11.57 |

| Class C(9/21/17) | | | | |

| Before CDSC | –20.60 | –8.72 | –10.59 | –6.92 |

| After CDSC | –20.60 | –8.72 | –11.48 | –7.85 |

| Class R(9/21/17) | | | | |

| Net asset value | –19.60�� | –8.26 | –10.17 | –6.73 |

| Class R6(9/21/17) | | | | |

| Net asset value | –18.60 | –7.81 | –9.76 | –6.44 |

| Class Y(9/21/17) | | | | |

| Net asset value | –18.60 | –7.81 | –9.66 | –6.44 |

See the discussion following the fund performance table on page 7 for information about the calculation of fund performance.

|

| 8 PanAgora Market Neutral Fund |

Your fund’s expenses

As a mutual fund investor, you pay ongoing expenses, such as management fees, distribution fees (12b-1 fees), and other expenses. In the most recent six-month period, your fund’s expenses were limited; had expenses not been limited, they would have been higher. Using the following information, you can estimate how these expenses affect your investment and compare them with the expenses of other funds. You may also pay one-time transaction expenses, including sales charges (loads) and redemption fees, which are not shown in this section and would have resulted in higher total expenses. For more information, see your fund’s prospectus or talk to your financial representative.

| | | | | | |

| Expense ratios | | | | | | |

| | Class A | Class B | Class C | Class R | Class R6 | Class Y |

| Net expenses for the fiscal year | | | | | | |

| ended 8/31/19*† | 1.81% | 2.56% | 2.56% | 2.06% | 1.57% | 1.56% |

| Total annual operating expenses for the | | | | | | |

| fiscal year ended 8/31/19* | 3.31% | 4.06% | 4.06% | 3.56% | 3.07% | 3.06% |

| Annualized expense ratio for the | | | | | | |

| six-month period ended 2/29/20 | 1.79% | 2.54% | 2.54% | 2.04% | 1.55% | 1.54% |

Fiscal-year expense information in this table is taken from the most recent prospectus, is subject to change, and may differ from that shown for the annualized expense ratio and in the financial highlights of this report.

Prospectus expense information also includes the impact of acquired fund fees and expenses of 0.02%, which is not included in the financial highlights or annualized expense ratios. Expenses are shown as a percentage of average net assets.

*Other expenses have been restated to reflect current fees.

†Reflects Putnam Management’s contractual obligation to limit certain fund expenses through 12/30/20.

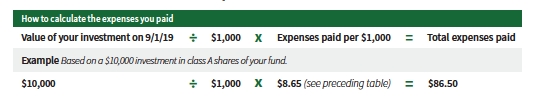

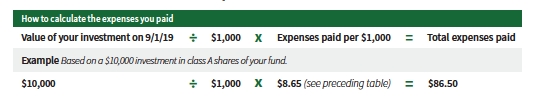

Expenses per $1,000

The following table shows the expenses you would have paid on a $1,000 investment in each class of the fund from 9/1/19 to 2/29/20. It also shows how much a $1,000 investment would be worth at the close of the period, assumingactual returnsand expenses.

| | | | | | |

| | Class A | Class B | Class C | Class R | Class R6 | Class Y |

| Expenses paid per $1,000*† | $8.65 | $12.26 | $12.26 | $9.86 | $7.49 | $7.45 |

| Ending value (after expenses) | $943.40 | $941.40 | $941.40 | $943.20 | $944.80 | $944.80 |

*Expenses for each share class are calculated using the fund’s annualized expense ratio for each class, which represents the ongoing expenses as a percentage of average net assets for the six months ended 2/29/20. The expense ratio may differ for each share class.

†Expenses are calculated by multiplying the expense ratio by the average account value for the period; then multiplying the result by the number of days in the period; and then dividing that result by the number of days in the year.

|

| PanAgora Market Neutral Fund 9 |

Estimate the expenses you paid

To estimate the ongoing expenses you paid for the six months ended 2/29/20, use the following calculation method. To find the value of your investment on 9/1/19, call Putnam at 1-800-225-1581.

Compare expenses using the SEC’s method

The Securities and Exchange Commission (SEC) has established guidelines to help investors assess fund expenses. Per these guidelines, the following table shows your fund’s expenses based on a $1,000 investment, assuming ahypothetical 5% annualized return. You can use this information to compare the ongoing expenses (but not transaction expenses or total costs) of investing in the fund with those of other funds. All mutual fund shareholder reports will provide this information to help you make this comparison. Please note that you cannot use this information to estimate your actual ending account balance and expenses paid during the period.

| | | | | | |

| | Class A | Class B | Class C | Class R | Class R6 | Class Y |

| Expenses paid per $1,000*† | $8.97 | $12.71 | $12.71 | $10.22 | $7.77 | $7.72 |

| Ending value (after expenses) | $1,015.96 | $1,012.23 | $1,012.23 | $1,014.72 | $1,017.16 | $1,017.21 |

*Expenses for each share class are calculated using the fund’s annualized expense ratio for each class, which represents the ongoing expenses as a percentage of average net assets for the six months ended 2/29/20. The expense ratio may differ for each share class.

†Expenses are calculated by multiplying the expense ratio by the average account value for the six-month period; then multiplying the result by the number of days in the six-month period; and then dividing that result by the number of days in the year.

| |

| 10 PanAgora Market Neutral Fund |

Consider these risks before investing

There can be no assurance that the fund’s strategies will achieve any particular level of return. The fund’s allocation of assets may hurt performance, and efforts to generate returns under different market conditions and over different time horizons may be unsuccessful. Quantitative models or data may be incorrect or incomplete, and reliance on those models or data may not produce the desired results. The value of investments in the fund’s portfolio may fall or fail to rise over extended periods of time for a variety of reasons, including general economic, political, or financial market conditions; investor sentiment and market perceptions; government actions; geopolitical events or changes; and factors related to a specific issuer, asset class, geography, industry, or sector. These and other factors may lead to increased volatility and reduced liquidity in the fund’s portfolio holdings. Investments in small and/or midsize companies increase the risk of greater price fluctuations. Bond investments in which the fund invests (or has exposure to) are subject to interest-rate risk and credit risk. Interest-rate risk is generally greater for longer-term bonds, and credit risk is generally greater for below-investment-grade bonds. Risks associated with derivatives (including “short” derivatives) include losses caused by unexpected market movements (which are potentially unlimited), imperfect correlation between the price of the derivative and the price of the underlying asset, increased investment exposure (which may be considered leverage), the potential inability to terminate or sell derivatives positions, the potential need to sell securities at disadvantageous times to meet margin or segregation requirements, the potential inability to recover margin or other amounts deposited from a counterparty, and the potential failure of the other party to the instrument to meet its obligations. Leveraging can result in volatility in the fund’s performance and losses in excess of the amounts invested. International investing involves certain risks, such as currency fluctuations, economic instability, and political developments. Exposure to REITs subjects the fund to the risks associated with direct ownership in real estate, including economic downturns that have an adverse effect on real estate markets. By investing in open-end or closed-end investment companies and ETFs, the fund is indirectly exposed to the risks associated with direct ownership of the securities held by those investment companies or ETFs. Certain investments are not as readily traded as conventional securities, and the fund may be unable to sell these investments when it considers it desirable to do so. Frequent trading may cause the fund to experience increased brokerage commissions and other transaction costs, and the fund may be more likely to realize capital gains that must be distributed to shareholders as taxable ordinary income. You can lose money by investing in the fund.

|

| PanAgora Market Neutral Fund 11 |

Terms and definitions

Important terms

Total returnshows how the value of the fund’s shares changed over time, assuming you held the shares through the entire period and reinvested all distributions in the fund.

Before sales charge, or net asset value, is the price, or value, of one share of a mutual fund, without a sales charge. Before-sales-charge figures fluctuate with market conditions, and are calculated by dividing the net assets of each class of shares by the number of outstanding shares in the class.

After sales chargeis the price of a mutual fund share plus the maximum sales charge levied at the time of purchase. After-sales-charge performance figures shown here assume the 5.75% maximum sales charge for class A shares.

Contingent deferred sales charge (CDSC)is generally a charge applied at the time of the redemption of class B or C shares and assumes redemption at the end of the period. Your fund’s class B CDSC declines over time from a 5% maximum during the first year to 1% during the sixth year. After the sixth year, the CDSC no longer applies. The CDSC for class C shares is 1% for one year after purchase.

Share classes

Class A sharesare generally subject to an initial sales charge and no CDSC (except on certain redemptions of shares bought without an initial sales charge).

Class B sharesare closed to new investments and are only available by exchange from another Putnam fund or through dividend and/ or capital gains reinvestment. They are not subject to an initial sales charge and may be subject to a CDSC.

Class C sharesare not subject to an initial sales charge and are subject to a CDSC only if the shares are redeemed during the first year.

Class R sharesare not subject to an initial sales charge or CDSC and are only available to employer-sponsored retirement plans.

Class R6 sharesare not subject to an initial sales charge or CDSC and carry no 12b-1 fee. They are generally only available to employer-sponsored retirement plans, corporate and institutional clients, and clients in other approved programs.

Class Y sharesare not subject to an initial sales charge or CDSC and carry no 12b-1 fee. They are generally only available to corporate and institutional clients and clients in other approved programs.

Comparative indexes

Bloomberg Barclays U.S. Aggregate Bond Indexis an unmanaged index of U.S. dollar-denominated, investment-grade fixed-income securities.

Bloomberg Barclays U.S. Credit Indexis an unmanaged index of U.S. dollar-denominated, investment-grade, fixed-rate, taxable corporate and government-related bonds.

Bloomberg Barclays U.S. Treasury Indexis an unmanaged index of U.S.-dollar-denominated, fixed-rate, nominal debt issued by the U.S. Treasury.

Bloomberg Barclays World Government Inflation-Linked Bond (ILB) Index (Hedged)is an unmanaged index that tracks the performance of government inflation-protected securities.

Bloomberg Commodity Indexis a broadly diversified index that measures the prices of commodities.

FTSE World Government Bond Index (WGBI) ex-U.S. (Hedged)is an unmanaged index that represents the world bond market, excluding the United States.

|

| 12 PanAgora Market Neutral Fund |

ICE BofA (Intercontinental Exchange Bank of America) U.S. Treasury Bill Indexis an unmanaged index that tracks the performance of U.S. dollar-denominated U.S. Treasury bills publicly issued in the U.S. domestic market. Qualifying securities must have a remaining term of at least one month to final maturity and a minimum amount outstanding of $1 billion.

MSCI ACWI (All Country World Index) (ND)is a free float-adjusted market capitalization index that is designed measure equity market performance in the global developed and emerging markets. Calculated with net dividends, this total return index reflects the reinvestment of dividends after the deduction of withholding taxes, using a tax rate applicable to non-resident institutional investors who do not benefit from double taxation treaties.

MSCI Emerging Markets Index (ND)is a free float-adjusted market capitalization index that is designed to measure equity market performance in global emerging markets. Calculated with net dividends (ND), this total return index reflects the reinvestment of dividends after the deduction of withholding taxes, using a tax rate applicable to non-resident institutional investors who do not benefit from double taxation treaties.

MSCI Europe Index (ND)is an unmanaged index of Western European equity securities. Calculated with net dividends (ND), this total return index reflects the reinvestment of dividends after the deduction of withholding taxes, using a tax rate applicable to non-resident institutional investors who do not benefit from double taxation treaties.

Russell 2000 Indexis an unmanaged index of 2,000 small companies in the Russell 3000 Index.

S&P 500 Indexis an unmanaged index of common stock performance.

S&P GSCIis a composite index of commodity sector returns that represents a broadly diversified, unleveraged, long-only position in commodity futures.

Indexes assume reinvestment of all distributions and do not account for fees. Securities and performance of a fund and an index will differ. You cannot invest directly in an index.

ICE Data Indices, LLC (“ICE BofA”), used with permission. ICE BofA permits use of the ICE BofA indices and related data on an “as is” basis; makes no warranties regarding same; does not guarantee the suitability, quality, accuracy, timeliness, and/or completeness of the ICE BofA indices or any data included in, related to, or derived therefrom; assumes no liability in connection with the use of the foregoing; and does not sponsor, endorse, or recommend Putnam Investments, or any of its products or services.

Frank Russell Company is the source and owner of the trademarks, service marks, and copyrights related to the Russell Indexes. Russell® is a trademark of Frank Russell Company.

Lipperis a third-party industry-ranking entity that ranks mutual funds. Its rankings do not reflect sales charges. Lipper rankings are based on total return at net asset value relative to other funds that have similar current investment styles or objectives as determined by Lipper. Lipper may change a fund’s category assignment at its discretion. Lipper category averages reflect performance trends for funds within a category.

|

| PanAgora Market Neutral Fund 13 |

Other information for shareholders

Important notice regarding delivery of shareholder documents

In accordance with Securities and Exchange Commission (SEC) regulations, Putnam sends a single copy of annual and semiannual shareholder reports, prospectuses, and proxy statements to Putnam shareholders who share the same address, unless a shareholder requests otherwise. If you prefer to receive your own copy of these documents, please call Putnam at 1-800-225-1581, and Putnam will begin sending individual copies within 30 days.

Proxy voting

Putnam is committed to managing our mutual funds in the best interests of our shareholders. The Putnam funds’ proxy voting guidelines and procedures, as well as information regarding how your fund voted proxies relating to portfolio securities during the 12-month period ended June 30, 2019, are available in the Individual Investors section of putnam.com and on the SEC’s website, www.sec.gov. If you have questions about finding forms on the SEC’s website, you may call the SEC at 1-800-SEC-0330. You may also obtain the Putnam funds’ proxy voting guidelines andprocedures at no charge by calling Putnam’s Shareholder Services at 1-800-225-1581.

Fund portfolio holdings

The fund will file a complete schedule of its portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-PORT within 60 days of the end of such fiscal quarter. Shareholders may obtain the fund’s Form N-PORT on the SEC’s website at www.sec.gov.

Prior to its use of Form N-PORT, the fund filed its complete schedule of its portfolio holdings with the SEC on Form N-Q, which is available online at www.sec.gov.

Trustee and employee fund ownership

Putnam employees and members of the Board of Trustees place their faith, confidence, and, most importantly, investment dollars in Putnam mutual funds. As of February 29, 2020, Putnam employees had approximately $449,000,000 and the Trustees had approximately $74,000,000 invested in Putnam mutual funds. These amounts include investments by the Trustees’ and employees’ immediate family members as well as investments through retirement and deferred compensation plans.

| |

| 14 PanAgora Market Neutral Fund |

Financial statements

These sections of the report, as well as the accompanying Notes, constitute the fund’s financial statements.

The fund’s portfoliolists all the fund’s investments and their values as of the last day of the reporting period. Holdings are organized by asset type and industry sector, country, or state to show areas of concentration and diversification.

Statement of assets and liabilitiesshows how the fund’s net assets and share price are determined. All investment and non-investment assets are added together. Any unpaid expenses and other liabilities are subtracted from this total. The result is divided by the number of shares to determine the net asset value per share, which is calculated separately for each class of shares. (For funds with preferred shares, the amount subtracted from total assets includes the liquidation preference of preferred shares.)

Statement of operationsshows the fund’s net investment gain or loss. This is done by first adding up all the fund’s earnings — from dividends and interest income — and subtracting its operating expenses to determine net investment income (or loss). Then, any net gain or loss the fund realized on the sales of its holdings — as well as any unrealized gains or losses over the period — is added toor subtracted from the net investment result to determine the fund’s net gain or loss for the fiscal period.

Statement of changes in net assetsshows how the fund’s net assets were affected by the fund’s net investment gain or loss, by distributions to shareholders, and by changes in the number of the fund’s shares. It lists distributions and their sources (net investment income or realized capital gains) over the current reporting period and the most recent fiscal year-end. The distributions listed here may not match the sources listed in the Statement of operations because the distributions are determined on a tax basis and may be paid in a different period from the one in which they were earned. Dividend sources are estimated at the time of declaration. Actual results may vary. Any non-taxable return of capital cannot be determined until final tax calculations are completed after the end of the fund’s fiscal year.

Financial highlightsprovide an overview of the fund’s investment results, per-share distributions, expense ratios, net investment income ratios, and portfolio turnover in one summary table, reflecting the five most recent reporting periods. In a semiannual report, the highlights table also includes the current reporting period.

|

| PanAgora Market Neutral Fund 15 |

| | |

| The fund’s portfolio2/29/20 (Unaudited) | | |

| |

| UNITS (2.5%)* | Units | Value |

| Amplitude Healthcare Acquisition Corp. † | 2,947 | $30,590 |

| CHP Merger Corp. † | 1,898 | 19,796 |

| Churchill Capital Corp. III † | 374 | 3,908 |

| CIIG Merger Corp. † | 2,780 | 28,773 |

| East Stone Acquisition Corp. † | 2,904 | 28,982 |

| Greenrose Acquisition Corp. † | 2,903 | 29,030 |

| InterPrivate Acquisition Corp. † | 2,918 | 29,764 |

| LIV Capital Acquisition Corp. (Mexico) † | 2,822 | 28,502 |

| PropTech Acquisition Corp. † | 1,896 | 20,098 |

| SCVX Corp. † | 1,124 | 11,566 |

| Total units (cost $226,752) | | $231,009 |

| |

| INVESTMENT COMPANIES (0.7%)* | Shares | Value |

| Morgan Stanley Emerging Markets Domestic Debt Fund, Inc. † | 640 | $4,096 |

| State Street Institutional U.S. Government Money Market Fund | 59,360 | 59,360 |

| Total investment companies (cost $63,854) | | $63,456 |

| |

| SHORT-TERM INVESTMENTS (99.9%)* | Principal amount | Value |

| U.S. Treasury Bills with an effective yield of 1.533%, 5/7/20 ∆ | $4,850,000 | $4,838,439 |

| U.S. Treasury Bills with an effective yield of 1.526%, 8/6/20 | 4,550,000 | 4,527,180 |

| Total short-term investments (cost $9,356,004) | | $9,365,619 |

| |

| TOTAL INVESTMENTS | | |

| Total investments (cost $9,646,610) | | $9,660,084 |

| |

| Key to holding’s abbreviations |

| | |

| ETF/Etf | Exchange Traded Fund |

| JSC/Jsc | Joint Stock Company |

| OTC | Over-the-counter |

| PJSC/Pjsc | Public Joint Stock Company |

| SPDR/Spdr | S&P Depository Receipts |

Notes to the fund’s portfolio

Unless noted otherwise, the notes to the fund’s portfolio are for the close of the fund’s reporting period, which ran from September 1, 2019 through February 29, 2020 (the reporting period). Within the following notes to the portfolio, references to “Putnam Management” represent Putnam Investment Management, LLC, the fund’s manager, an indirect wholly-owned subsidiary of Putnam Investments, LLC and references to “ASC 820” represent Accounting Standards Codification 820Fair Value Measurements and Disclosures.

*Percentages indicated are based on net assets of $9,379,553.

†This security is non-income-producing.

∆This security, in part or in entirety, was pledged and segregated with the custodian for collateral on certain derivative contracts at the close of the reporting period. Collateral at period end totaled $4,218,788 and is included in Investments in securities on the Statement of assets and liabilities (Notes 1 and 7).

At the close of the reporting period, the fund maintained liquid assets totaling $27,128 to cover certain derivative contracts.

The dates shown on debt obligations are the original maturity dates.

| |

| 16 PanAgora Market Neutral Fund |

| | | | | | |

| OTC TOTAL RETURN SWAP CONTRACTS OUTSTANDING at 2/29/20 (Unaudited) | |

| | | Upfront | | | | |

| | | premium | Termina- | Payments | Total return | Unrealized |

| Swap counterparty/ | | received | tion | received (paid) | received by | appreciation/ |

| Notional amount | Value | (paid) | date | by fund | or paid by fund | (depreciation) |

| Morgan Stanley & Co. International PLC | | | | |

| $46,614 | $47,698 | $— | 1/28/25 | (Federal Funds | 1–800-Flowers.com | $1,028 |

| | | | | Effective Rate US | Inc — Monthly | |

| | | | | plus 0.25%) — | | |

| | | | | Monthly | | |

| 12,909 | 13,213 | — | 1/28/25 | (Federal Funds | 2U Inc — Monthly | 302 |

| | | | | Effective Rate US | | |

| | | | | plus 0.25%) — | | |

| | | | | Monthly | | |

| 23,209 | 22,840 | — | 1/28/25 | (Federal Funds | 58.com Inc — | (396) |

| | | | | Effective Rate US | Monthly | |

| | | | | plus 0.25%) — | | |

| | | | | Monthly | | |

| 7,087 | 6,764 | — | 1/28/25 | (Federal Funds | Aberdeen Income | (260) |

| | | | | Effective Rate US | Credit Strategies | |

| | | | | plus 0.25%) — | Fund — Monthly | |

| | | | | Monthly | | |

| 7,859 | 6,630 | — | 1/28/25 | (Federal Funds | Abivax Sa — Monthly | (1,242) |

| | | | | Effective Rate US | | |

| | | | | plus 0.25%) — | | |

| | | | | Monthly | | |

| 42,240 | 42,339 | — | 1/28/25 | (Federal Funds | Acacia | 39 |

| | | | | Effective Rate US | Communications | |

| | | | | plus 0.25%) — | Inc — Monthly | |

| | | | | Monthly | | |

| — | — | — | 1/28/25 | (Federal Funds | Achillion | — |

| | | | | Effective Rate US | Pharmaceutical — | |

| | | | | plus 0.25%) — | Monthly | |

| | | | | Monthly | | |

| 13,475 | 13,309 | — | 1/28/25 | (Federal Funds | Acs Actividades | (188) |

| | | | | Effective Rate US | Construccion Y | |

| | | | | plus 0.25%) — | Servicios Sa — | |

| | | | | Monthly | Monthly | |

| 50,631 | 52,176 | — | 1/28/25 | (Federal Funds | Adamas | 1,460 |

| | | | | Effective Rate US | Pharmaceuticals | |

| | | | | plus 0.25%) — | Inc — Monthly | |

| | | | | Monthly | | |

| 31,706 | 32,699 | — | 1/28/25 | (Federal Funds | Adaptimmune | 942 |

| | | | | Effective Rate US | Therapeutics Plc — | |

| | | | | plus 0.25%) — | Monthly | |

| | | | | Monthly | | |

| 37,941 | 38,006 | — | 1/28/25 | (Federal Funds | Adesto | 65 |

| | | | | Effective Rate US | Technologies | |

| | | | | plus 0.25%) — | Corp — Monthly | |

| | | | | Monthly | | |

| 24,408 | 22,855 | — | 1/28/25 | (Federal Funds | Admiral Group Plc — | (1,580) |

| | | | | Effective Rate US | Monthly | |

| | | | | plus 0.25%) — | | |

| | | | | Monthly | | |

|

| PanAgora Market Neutral Fund 17 |

| | | | | | |

| OTC TOTAL RETURN SWAP CONTRACTS OUTSTANDING at 2/29/20 (Unaudited)cont. | |

| | | Upfront | | | | |

| | | premium | Termina- | Payments | Total return | Unrealized |

| Swap counterparty/ | | received | tion | received (paid) | received by | appreciation/ |

| Notional amount | Value | (paid) | date | by fund | or paid by fund | (depreciation) |

| Morgan Stanley & Co. International PLCcont. | | | | |

| $43,950 | $44,003 | $— | 1/28/25 | (Federal Funds | Advanced Disposal | $(8) |

| | | | | Effective Rate US | Services Inc — | |

| | | | | plus 0.25%) — | Monthly | |

| | | | | Monthly | | |

| 36,947 | 35,383 | — | 1/27/20 | (Federal Funds | Advanced Micro | (1,605) |

| | | | | Effective Rate US | Devices — Monthly | |

| | | | | plus 0.25%) — | | |

| | | | | Monthly | | |

| 22,028 | 22,033 | — | 1/28/25 | (Federal Funds | Advanced | (45) |

| | | | | Effective Rate US | Petrochemicals | |

| | | | | plus 1.20%) — | Co — Monthly | |

| | | | | Monthly | | |

| 6,728 | 6,439 | — | 1/28/25 | (Federal Funds | Advent Convertible | (256) |

| | | | | Effective Rate US | & Income — Monthly | |

| | | | | plus 0.25%) — | | |

| | | | | Monthly | | |

| 66,986 | 57,449 | — | 1/28/25 | (Federal Funds | Agenus Inc — | (9,677) |

| | | | | Effective Rate US | Monthly | |

| | | | | plus 0.25%) — | | |

| | | | | Monthly | | |

| 18,512 | 18,266 | — | 1/28/25 | (Federal Funds | Agilent | (275) |

| | | | | Effective Rate US | Technologies Inc — | |

| | | | | plus 0.25%) — | Monthly | |

| | | | | Monthly | | |

| 23,424 | 23,447 | — | 1/28/25 | (Federal Funds | Agility Public | (31) |

| | | | | Effective Rate US | Warehousing Co | |

| | | | | plus 1.20%) — | Kscp — Monthly | |

| | | | | Monthly | | |

| 11,531 | 11,181 | — | 1/28/25 | (Federal Funds | Aida Engineering | (367) |

| | | | | Effective Rate US | Ltd — Monthly | |

| | | | | plus 0.25%) — | | |

| | | | | Monthly | | |

| 37,729 | 34,574 | — | 1/28/25 | (Federal Funds | Airgain Inc — | (3,214) |

| | | | | Effective Rate US | Monthly | |

| | | | | plus 0.25%) — | | |

| | | | | Monthly | | |

| 10,384 | 9,923 | — | 1/30/20 | (Federal Funds | Airtac International | (462) |

| | | | | Effective Rate US | Group — Monthly | |

| | | | | plus 0.35%) — | | |

| | | | | Monthly | | |

| 10,402 | 9,638 | — | 1/28/25 | (Federal Funds | Akzo Nobel Nv — | (781) |

| | | | | Effective Rate US | Monthly | |

| | | | | plus 0.25%) — | | |

| | | | | Monthly | | |

| 43,463 | 40,044 | — | 1/28/25 | (Federal Funds | Albany International | (3,483) |

| | | | | Effective Rate US | Corp — Monthly | |

| | | | | plus 0.25%) — | | |

| | | | | Monthly | | |

| |

| 18 PanAgora Market Neutral Fund |

| | | | | | |

| OTC TOTAL RETURN SWAP CONTRACTS OUTSTANDING at 2/29/20 (Unaudited)cont. | |

| | | Upfront | | | | |

| | | premium | Termina- | Payments | Total return | Unrealized |

| Swap counterparty/ | | received | tion | received (paid) | received by | appreciation/ |

| Notional amount | Value | (paid) | date | by fund | or paid by fund | (depreciation) |

| Morgan Stanley & Co. International PLCcont. | | | | |

| $20,716 | $19,061 | $— | 1/28/25 | (Federal Funds | Aldeyra | $(1,705) |

| | | | | Effective Rate US | Therapeutics Inc — | |

| | | | | plus 0.25%) — | Monthly | |

| | | | | Monthly | | |

| 47,277 | 41,379 | — | 1/28/25 | (Federal Funds | Alexander & Baldwin | (5,966) |

| | | | | Effective Rate US | Inc — Monthly | |

| | | | | plus 0.25%) — | | |

| | | | | Monthly | | |

| 6,196 | 5,906 | — | 1/28/25 | (Federal Funds | Alfresa Holdings | (299) |

| | | | | Effective Rate US | Corp — Monthly | |

| | | | | plus 0.25%) — | | |

| | | | | Monthly | | |

| 19,622 | 19,552 | — | 1/28/25 | (Federal Funds | Alibaba Group | (97) |

| | | | | Effective Rate US | Holding Ltd — | |

| | | | | plus 0.25%) — | Monthly | |

| | | | | Monthly | | |

| 7,964 | 7,642 | — | 1/27/20 | (Federal Funds | Align Technology | (334) |

| | | | | Effective Rate US | Inc — Monthly | |

| | | | | plus 0.25%) — | | |

| | | | | Monthly | | |

| 78,242 | 77,221 | — | 1/28/25 | (Federal Funds | Allergan Plc — | (911) |

| | | | | Effective Rate US | Monthly | |

| | | | | plus 0.25%) — | | |

| | | | | Monthly | | |

| 9,718 | 9,566 | — | 1/28/25 | (Federal Funds | Alliance Global | (171) |

| | | | | Effective Rate US | Group Inc — Monthly | |

| | | | | plus 0.75%) — | | |

| | | | | Monthly | | |

| 10,764 | 9,665 | — | 1/28/25 | (Federal Funds | Allianzgi Convertible | (1,063) |

| | | | | Effective Rate US | & Income Fund — | |

| | | | | plus 0.25%) — | Monthly | |

| | | | | Monthly | | |

| 5,538 | 4,999 | — | 1/28/25 | (Federal Funds | Allianzgi Convertible | (516) |

| | | | | Effective Rate US | & Income Fund Ii — | |

| | | | | plus 0.25%) — | Monthly | |

| | | | | Monthly | | |

| 3,406 | 3,019 | — | 1/28/25 | (Federal Funds | Allianzgi Diversified | (380) |

| | | | | Effective Rate US | Income — Monthly | |

| | | | | plus 0.25%) — | | |

| | | | | Monthly | | |

| 21,443 | 20,787 | — | 1/28/25 | (Federal Funds | Allison Transmission | (683) |

| | | | | Effective Rate US | Holdings Inc — | |

| | | | | plus 0.25%) — | Monthly | |

| | | | | Monthly | | |

| 18,170 | 16,524 | — | 1/28/25 | (Federal Funds | Allstate Corp — | (1,587) |

| | | | | Effective Rate US | Monthly | |

| | | | | plus 0.25%) — | | |

| | | | | Monthly | | |

|

| PanAgora Market Neutral Fund 19 |

| | | | | | |

| OTC TOTAL RETURN SWAP CONTRACTS OUTSTANDING at 2/29/20 (Unaudited)cont. | |

| | | Upfront | | | | |

| | | premium | Termina- | Payments | Total return | Unrealized |

| Swap counterparty/ | | received | tion | received (paid) | received by | appreciation/ |

| Notional amount | Value | (paid) | date | by fund | or paid by fund | (depreciation) |

| Morgan Stanley & Co. International PLCcont. | | | | |

| $6,352 | $5,919 | $— | 1/28/25 | (Federal Funds | Alpen Co Ltd — | $(442) |

| | | | | Effective Rate US | Monthly | |

| | | | | plus 0.25%) — | | |

| | | | | Monthly | | |

| 43,499 | 44,737 | — | 1/28/25 | (Federal Funds | Alpha & Omega | 1,162 |

| | | | | Effective Rate US | Semiconductor | |

| | | | | plus 0.25%) — | Ltd — Monthly | |

| | | | | Monthly | | |

| 30,590 | 29,464 | — | 1/28/25 | (Federal Funds | Alphabet Inc — | (1,172) |

| | | | | Effective Rate US | Monthly | |

| | | | | plus 0.25%) — | | |

| | | | | Monthly | | |

| 27,690 | 26,626 | — | 1/28/25 | (Federal Funds | Altium Ltd — | (942) |

| | | | | Effective Rate US | Monthly | |

| | | | | plus 0.25%) — | | |

| | | | | Monthly | | |

| 14,933 | 14,953 | — | 1/28/25 | (Federal Funds | Amada Holdings Co | (4) |

| | | | | Effective Rate US | Ltd — Monthly | |

| | | | | plus 0.25%) — | | |

| | | | | Monthly | | |

| 10,047 | 9,757 | — | 1/28/25 | (Federal Funds | Amag | (307) |

| | | | | Effective Rate US | Pharmaceuticals | |

| | | | | plus 0.25%) — | Inc — Monthly | |

| | | | | Monthly | | |

| 5,077 | 4,914 | — | 1/28/25 | (Federal Funds | Amano Corp — | (172) |

| | | | | Effective Rate US | Monthly | |

| | | | | plus 0.25%) — | | |

| | | | | Monthly | | |

| 25,735 | 24,489 | — | 1/28/25 | (Federal Funds | Amazon.com Inc — | (1,280) |

| | | | | Effective Rate US | Monthly | |

| | | | | plus 0.25%) — | | |

| | | | | Monthly | | |

| 33,417 | 31,000 | — | 1/28/25 | (Federal Funds | American Express | (2,432) |

| | | | | Effective Rate US | Co — Monthly | |

| | | | | plus 0.25%) — | | |

| | | | | Monthly | | |

| 15,444 | 13,989 | — | 1/28/25 | (Federal Funds | Ameriprise Financial | (1,382) |

| | | | | Effective Rate US | Inc — Monthly | |

| | | | | plus 0.25%) — | | |

| | | | | Monthly | | |

| 27,457 | 24,706 | — | 1/28/25 | (Federal Funds | Amerisourcebergen | (2,665) |

| | | | | Effective Rate US | Corp — Monthly | |

| | | | | plus 0.25%) — | | |

| | | | | Monthly | | |

| 33,027 | 32,004 | — | 1/28/25 | (Federal Funds | Amicus | (1,066) |

| | | | | Effective Rate US | Therapeutics Inc — | |

| | | | | plus 0.25%) — | Monthly | |

| | | | | Monthly | | |

| |

| 20 PanAgora Market Neutral Fund |

| | | | | | |

| OTC TOTAL RETURN SWAP CONTRACTS OUTSTANDING at 2/29/20 (Unaudited)cont. | |

| | | Upfront | | | | |

| | | premium | Termina- | Payments | Total return | Unrealized |

| Swap counterparty/ | | received | tion | received (paid) | received by | appreciation/ |

| Notional amount | Value | (paid) | date | by fund | or paid by fund | (depreciation) |

| Morgan Stanley & Co. International PLCcont. | | | | |

| $36,547 | $36,564 | $— | 1/28/25 | (Federal Funds | Amkor Technology | $(41) |

| | | | | Effective Rate US | Inc — Monthly | |

| | | | | plus 0.25%) — | | |

| | | | | Monthly | | |

| 4,272 | 4,170 | — | 1/28/25 | (Federal Funds | Amuse Inc — | (109) |

| | | | | Effective Rate US | Monthly | |

| | | | | plus 0.25%) — | | |

| | | | | Monthly | | |

| 1,722 | 1,630 | — | 1/28/25 | (Federal Funds | Anaptysbio Inc — | (95) |

| | | | | Effective Rate US | Monthly | |

| | | | | plus 0.25%) — | | |

| | | | | Monthly | | |

| 24,220 | 23,623 | — | 1/28/25 | (Federal Funds | Angiodynamics | (637) |

| | | | | Effective Rate US | Inc — Monthly | |

| | | | | plus 0.25%) — | | |

| | | | | Monthly | | |

| 3,670 | 3,519 | — | 1/28/25 | (Federal Funds | Apollo Senior | (134) |

| | | | | Effective Rate US | Floating Rate Fund | |

| | | | | plus 0.25%) — | Inc — Monthly | |

| | | | | Monthly | | |

| 10,535 | 9,841 | — | 8/31/20 | (Federal Funds | Apple Inc — Monthly | (683) |

| | | | | Effective Rate US | | |

| | | | | plus 0.25%) — | | |

| | | | | Monthly | | |

| 43,762 | 42,413 | — | 1/28/25 | (Federal Funds | Arcbest Corp — | (1,253) |

| | | | | Effective Rate US | Monthly | |

| | | | | plus 0.25%) — | | |

| | | | | Monthly | | |

| 30,601 | 29,168 | — | 1/28/25 | (Federal Funds | Arena | (1,473) |

| | | | | Effective Rate US | Pharmaceuticals | |

| | | | | plus 0.25%) — | Inc — Monthly | |

| | | | | Monthly | | |

| 9,292 | 8,900 | — | 1/28/25 | (Federal Funds | Argo Graphics Inc — | (405) |

| | | | | Effective Rate US | Monthly | |

| | | | | plus 0.25%) — | | |

| | | | | Monthly | | |

| 51,274 | 47,271 | — | 1/28/25 | (Federal Funds | Artisan Partners | (3,088) |

| | | | | Effective Rate US | Asset Management | |

| | | | | plus 0.25%) — | Inc — Monthly | |

| | | | | Monthly | | |

| 11,774 | 10,974 | — | 1/28/25 | (Federal Funds | Ascom Holding Ag — | (817) |

| | | | | Effective Rate US | Monthly | |

| | | | | plus 0.25%) — | | |

| | | | | Monthly | | |

| 27,813 | 25,515 | — | 1/28/25 | (Federal Funds | Ashtead Group | (2,259) |

| | | | | Effective Rate US | Plc — Monthly | |

| | | | | plus 0.25%) — | | |

| | | | | Monthly | | |

|

| PanAgora Market Neutral Fund 21 |

| | | | | | |

| OTC TOTAL RETURN SWAP CONTRACTS OUTSTANDING at 2/29/20 (Unaudited)cont. | |

| | | Upfront | | | | |

| | | premium | Termina- | Payments | Total return | Unrealized |

| Swap counterparty/ | | received | tion | received (paid) | received by | appreciation/ |

| Notional amount | Value | (paid) | date | by fund | or paid by fund | (depreciation) |

| Morgan Stanley & Co. International PLCcont. | | | | |

| $20,691 | $20,506 | $— | 1/28/25 | (Federal Funds | Asia Cement Corp — | $(186) |

| | | | | Effective Rate US | Monthly | |

| | | | | plus 0.35%) — | | |

| | | | | Monthly | | |

| 36,891 | 33,252 | — | 1/28/25 | (Federal Funds | Asm International | (3,691) |

| | | | | Effective Rate US | Nv — Monthly | |

| | | | | plus 0.25%) — | | |

| | | | | Monthly | | |

| 6,520 | 6,301 | — | 1/28/25 | (Federal Funds | Astellas Pharma | (229) |

| | | | | Effective Rate US | Inc — Monthly | |

| | | | | plus 0.25%) — | | |

| | | | | Monthly | | |

| 12,418 | 12,151 | — | 1/28/25 | (Federal Funds | Asustek Computer | (268) |

| | | | | Effective Rate US | Inc — Monthly | |

| | | | | plus 0.35%) — | | |

| | | | | Monthly | | |

| 8,569 | 9,629 | — | 1/28/25 | (Federal Funds | Atresmedia | 1,046 |

| | | | | Effective Rate US | Corporacion | |

| | | | | plus 0.25%) — | de Medios de | |

| | | | | Monthly | Comunicacion Sa — | |

| | | | | | Monthly | |

| 4,455 | 4,968 | — | 1/28/25 | (Federal Funds | Audi Ag — Monthly | 507 |

| | | | | Effective Rate US | | |

| | | | | plus 0.25%) — | | |

| | | | | Monthly | | |

| 14,490 | 13,804 | — | 1/28/25 | (Federal Funds | Aurizon Holdings | (431) |

| | | | | Effective Rate US | Ltd — Monthly | |

| | | | | plus 0.25%) — | | |

| | | | | Monthly | | |

| 7,675 | 7,598 | — | 1/28/25 | (Federal Funds | Australian Pharma | (89) |

| | | | | Effective Rate US | Indus Ltd — Monthly | |

| | | | | plus 0.25%) — | | |

| | | | | Monthly | | |

| 6,061 | 5,641 | — | 1/28/25 | (Federal Funds | Avex Inc — Monthly | (430) |

| | | | | Effective Rate US | | |

| | | | | plus 0.25%) — | | |

| | | | | Monthly | | |

| 11,095 | 10,169 | — | 1/28/25 | (Federal Funds | Aviva Plc — Monthly | (926) |

| | | | | Effective Rate US | | |

| | | | | plus 0.25%) — | | |

| | | | | Monthly | | |

| 4,645 | 4,387 | — | 1/27/20 | (Federal Funds | Avnet Inc — Monthly | (266) |

| | | | | Effective Rate US | | |

| | | | | plus 0.25%) — | | |

| | | | | Monthly | | |

| 22,268 | 22,072 | — | 1/28/25 | (Federal Funds | B&M European | (222) |

| | | | | Effective Rate US | Value Retail Sa — | |

| | | | | plus 0.25%) — | Monthly | |

| | | | | Monthly | | |

| |

| 22 PanAgora Market Neutral Fund |

| | | | | | |

| OTC TOTAL RETURN SWAP CONTRACTS OUTSTANDING at 2/29/20 (Unaudited)cont. | |

| | | Upfront | | | | |

| | | premium | Termina- | Payments | Total return | Unrealized |

| Swap counterparty/ | | received | tion | received (paid) | received by | appreciation/ |

| Notional amount | Value | (paid) | date | by fund | or paid by fund | (depreciation) |

| Morgan Stanley & Co. International PLCcont. | | | | |

| $10,520 | $9,801 | $— | 1/28/25 | (Federal Funds | Baic Motor Corp | $(733) |

| | | | | Effective Rate US | Ltd — Monthly | |

| | | | | plus 0.25%) — | | |

| | | | | Monthly | | |

| 18,892 | 17,475 | — | 1/28/25 | (Federal Funds | Balfour Beatty Plc — | (1,442) |

| | | | | Effective Rate US | Monthly | |

| | | | | plus 0.25%) — | | |

| | | | | Monthly | | |

| 13,805 | 12,774 | — | 1/28/25 | (Federal Funds | Bancfirst Corp — | (1,048) |

| | | | | Effective Rate US | Monthly | |

| | | | | plus 0.25%) — | | |

| | | | | Monthly | | |

| 24,075 | 22,401 | — | 1/28/25 | (Federal Funds | Bank Of America | (1,711) |

| | | | | Effective Rate US | Corp — Monthly | |

| | | | | plus 0.25%) — | | |

| | | | | Monthly | | |

| 11,968 | 11,501 | — | 1/28/25 | (Federal Funds | Bank Of Commerce | (484) |

| | | | | Effective Rate US | Holdings — Monthly | |

| | | | | plus 0.25%) — | | |

| | | | | Monthly | | |

| 43,367 | 40,342 | — | 1/28/25 | (Federal Funds | Bank Of Marin | (2,849) |

| | | | | Effective Rate US | Bancorp — Monthly | |

| | | | | plus 0.25%) — | | |

| | | | | Monthly | | |

| 59,748 | 54,768 | — | 1/28/25 | (Federal Funds | Banner Corp — | (5,067) |

| | | | | Effective Rate US | Monthly | |

| | | | | plus 0.25%) — | | |

| | | | | Monthly | | |

| 50,870 | 46,542 | — | 1/28/25 | (Federal Funds | Barrett Business | (4,420) |

| | | | | Effective Rate US | Services Inc — | |

| | | | | plus 0.25%) — | Monthly | |

| | | | | Monthly | | |

| 20,865 | 20,061 | — | 1/28/25 | (Federal Funds | Baudax Bio Inc — | (840) |

| | | | | Effective Rate US | Monthly | |

| | | | | plus 0.25%) — | | |

| | | | | Monthly | | |

| 17,426 | 17,048 | — | 1/28/25 | (Federal Funds | Bavarian Nordic | (401) |

| | | | | Effective Rate US | As — Monthly | |

| | | | | plus 0.25%) — | | |

| | | | | Monthly | | |

| 40,727 | 39,700 | — | 1/28/25 | (Federal Funds | Bbx Capital Corp — | (1,090) |

| | | | | Effective Rate US | Monthly | |

| | | | | plus 0.25%) — | | |

| | | | | Monthly | | |

| 5,084 | 4,514 | — | 1/28/25 | (Federal Funds | Beauty Garage Inc — | (579) |

| | | | | Effective Rate US | Monthly | |

| | | | | plus 0.25%) — | | |

| | | | | Monthly | | |

|

| PanAgora Market Neutral Fund 23 |

| | | | | | |

| OTC TOTAL RETURN SWAP CONTRACTS OUTSTANDING at 2/29/20 (Unaudited)cont. | |

| | | Upfront | | | | |

| | | premium | Termina- | Payments | Total return | Unrealized |

| Swap counterparty/ | | received | tion | received (paid) | received by | appreciation/ |

| Notional amount | Value | (paid) | date | by fund | or paid by fund | (depreciation) |

| Morgan Stanley & Co. International PLCcont. | | | | |

| $8,774 | $8,094 | $— | 1/28/25 | (Federal Funds | Beenos Inc — | $(694) |

| | | | | Effective Rate US | Monthly | |

| | | | | plus 0.25%) — | | |

| | | | | Monthly | | |

| 22,600 | 22,644 | — | 6/19/20 | (Federal Funds | Beigene Ltd — | 13 |

| | | | | Effective Rate US | Monthly | |

| | | | | plus 0.25%) — | | |

| | | | | Monthly | | |

| 14,620 | 14,040 | — | 1/28/25 | (Federal Funds | Beijing Capital | (600) |

| | | | | Effective Rate US | International Airport | |

| | | | | plus 0.25%) — | Co Ltd — Monthly | |

| | | | | Monthly | | |

| 20,051 | 18,774 | — | 1/28/25 | (Federal Funds | Berkeley Group | (1,306) |

| | | | | Effective Rate US | Holdings/The — | |

| | | | | plus 0.25%) — | Monthly | |

| | | | | Monthly | | |

| 27,284 | 25,116 | — | 1/28/25 | (Federal Funds | Best Buy Co Inc — | (2,209) |

| | | | | Effective Rate US | Monthly | |

| | | | | plus 0.25%) — | | |

| | | | | Monthly | | |

| 18,573 | 16,741 | — | 1/28/25 | (Federal Funds | Bid Corp Ltd — | (1,868) |

| | | | | Effective Rate US | Monthly | |

| | | | | plus 0.60%) — | | |

| | | | | Monthly | | |

| 11,324 | 10,581 | — | 1/28/25 | (Federal Funds | Bilia Ab — Monthly | (760) |

| | | | | Effective Rate US | | |

| | | | | plus 0.25%) — | | |

| | | | | Monthly | | |

| 19,040 | 18,769 | — | 1/28/25 | (Federal Funds | Biodelivery | (309) |

| | | | | Effective Rate US | Sciences | |

| | | | | plus 0.25%) — | International Inc — | |

| | | | | Monthly | Monthly | |

| 39,453 | 39,037 | — | 1/28/25 | (Federal Funds | Biohaven | (477) |

| | | | | Effective Rate US | Pharmaceutical | |

| | | | | plus 0.25%) — | Holding Co Ltd — | |

| | | | | Monthly | Monthly | |

| 9,391 | 8,740 | — | 1/28/25 | (Federal Funds | Biotage Ab — | (664) |

| | | | | Effective Rate US | Monthly | |

| | | | | plus 0.25%) — | | |

| | | | | Monthly | | |

| 43,148 | 40,529 | — | 1/28/25 | (Federal Funds | Bj’s Restaurants | (2,691) |

| | | | | Effective Rate US | Inc — Monthly | |

| | | | | plus 0.25%) — | | |

| | | | | Monthly | | |

| 4,373 | 4,339 | — | 1/28/25 | (Federal Funds | Blackrock California | (29) |

| | | | | Effective Rate US | Municipal Income | |

| | | | | plus 0.25%) — | Trust — Monthly | |

| | | | | Monthly | | |

| |

| 24 PanAgora Market Neutral Fund |

| | | | | | |

| OTC TOTAL RETURN SWAP CONTRACTS OUTSTANDING at 2/29/20 (Unaudited)cont. | |

| | | Upfront | | | | |

| | | premium | Termina- | Payments | Total return | Unrealized |

| Swap counterparty/ | | received | tion | received (paid) | received by | appreciation/ |

| Notional amount | Value | (paid) | date | by fund | or paid by fund | (depreciation) |

| Morgan Stanley & Co. International PLCcont. | | | | |

| $24,948 | $23,870 | $— | 1/28/25 | (Federal Funds | Blackrock | $(935) |

| | | | | Effective Rate US | Corporate High | |

| | | | | plus 0.25%) — | Yield Fund Inc — | |

| | | | | Monthly | Monthly | |

| 7,515 | 7,124 | — | 1/28/25 | (Federal Funds | Blackrock Debt | (354) |

| | | | | Effective Rate US | Strategies Fund | |

| | | | | plus 0.25%) — | Inc — Monthly | |

| | | | | Monthly | | |

| 13,637 | 13,023 | — | 1/28/25 | (Federal Funds | Blackrock Floating | (552) |

| | | | | Effective Rate US | Rate Income | |

| | | | | plus 0.25%) — | Strategies Fund | |

| | | | | Monthly | Inc — Monthly | |

| 3,953 | 3,754 | — | 1/28/25 | (Federal Funds | Blackrock Floating | (180) |

| | | | | Effective Rate US | Rate Income Trust — | |

| | | | | plus 0.25%) — | Monthly | |

| | | | | Monthly | | |

| 4,076 | 3,808 | — | 1/28/25 | (Federal Funds | Blackrock Municipal | (260) |

| | | | | Effective Rate US | Income Trust — | |

| | | | | plus 0.25%) — | Monthly | |

| | | | | Monthly | | |

| 2,108 | 2,072 | — | 1/28/25 | (Federal Funds | Blackrock Municipal | (30) |

| | | | | Effective Rate US | Income Quality | |

| | | | | plus 0.25%) — | Trust — Monthly | |

| | | | | Monthly | | |

| 2,750 | 2,700 | — | 1/28/25 | (Federal Funds | Blackrock | (49) |

| | | | | Effective Rate US | Munienhanced Fund | |

| | | | | plus 0.25%) — | Inc — Monthly | |

| | | | | Monthly | | |

| 2,865 | 2,824 | — | 1/28/25 | (Federal Funds | Blackrock | (40) |

| | | | | Effective Rate US | Muniholdings New | |

| | | | | plus 0.25%) — | Jersey Quality Fund | |

| | | | | Monthly | Inc — Monthly | |

| 2,635 | 2,609 | — | 1/28/25 | (Federal Funds | Blackrock | (21) |

| | | | | Effective Rate US | Muniholdings | |

| | | | | plus 0.25%) — | Quality Fund Ii — | |

| | | | | Monthly | Monthly | |

| 6,524 | 6,421 | — | 1/28/25 | (Federal Funds | Blackrock | (101) |

| | | | | Effective Rate US | Muniholdings | |

| | | | | plus 0.25%) — | Quality Fund — | |

| | | | | Monthly | Monthly | |

| 1,988 | 1,947 | — | 1/28/25 | (Federal Funds | Blackrock | (37) |

| | | | | Effective Rate US | Muniholdings | |

| | | | | plus 0.25%) — | Quality Fund — | |

| | | | | Monthly | Monthly | |

| 4,917 | 4,768 | — | 1/28/25 | (Federal Funds | Blackrock Munivest | (143) |

| | | | | Effective Rate US | Fund Inc — Monthly | |

| | | | | plus 0.25%) — | | |

| | | | | Monthly | | |

|

| PanAgora Market Neutral Fund 25 |

| | | | | | |

| OTC TOTAL RETURN SWAP CONTRACTS OUTSTANDING at 2/29/20 (Unaudited)cont. | |

| | | Upfront | | | | |

| | | premium | Termina- | Payments | Total return | Unrealized |

| Swap counterparty/ | | received | tion | received (paid) | received by | appreciation/ |

| Notional amount | Value | (paid) | date | by fund | or paid by fund | (depreciation) |

| Morgan Stanley & Co. International PLCcont. | | | | |

| $2,235 | $2,164 | $— | 1/28/25 | (Federal Funds | Blackrock Munivest | $(67) |

| | | | | Effective Rate US | Fund Ii Inc — | |

| | | | | plus 0.25%) — | Monthly | |

| | | | | Monthly | | |

| 3,719 | 3,663 | — | 1/28/25 | (Federal Funds | Blackrock Muniyield | (52) |

| | | | | Effective Rate US | California Quality | |

| | | | | plus 0.25%) — | Fund Inc — Monthly | |

| | | | | Monthly | | |

| 4,569 | 4,445 | — | 1/28/25 | (Federal Funds | Blackrock Muniyield | (117) |

| | | | | Effective Rate US | Fund Inc — Monthly | |

| | | | | plus 0.25%) — | | |

| | | | | Monthly | | |

| 1,990 | 1,968 | — | 1/28/25 | (Federal Funds | Blackrock Muniyield | (20) |

| | | | | Effective Rate US | Michigan Quality | |

| | | | | plus 0.25%) — | Fund Inc — Monthly | |

| | | | | Monthly | | |

| 2,357 | 2,310 | — | 1/28/25 | (Federal Funds | Blackrock Muniyield | (41) |

| | | | | Effective Rate US | New Jersey Fund | |

| | | | | plus 0.25%) — | Inc — Monthly | |

| | | | | Monthly | | |

| 2,744 | 2,702 | — | 1/28/25 | (Federal Funds | Blackrock Muniyield | (37) |

| | | | | Effective Rate US | Quality Fund Inc — | |

| | | | | plus 0.25%) — | Monthly | |

| | | | | Monthly | | |

| 5,382 | 5,344 | — | 1/28/25 | (Federal Funds | Blackrock Muniyield | (22) |

| | | | | Effective Rate US | Quality Fund Inc — | |

| | | | | plus 0.25%) — | Monthly | |

| | | | | Monthly | | |

| 15,953 | 15,068 | — | 1/28/25 | (Federal Funds | Blackrock Taxable | (839) |

| | | | | Effective Rate US | Municipal Bond | |

| | | | | plus 0.25%) — | Trust — Monthly | |

| | | | | Monthly | | |

| 11,068 | 10,488 | — | 1/28/25 | (Federal Funds | Blackstone/Gso | (515) |

| | | | | Effective Rate US | Strategic Credit | |

| | | | | plus 0.25%) — | Fund — Monthly | |

| | | | | Monthly | | |

| 5,544 | 5,394 | — | 1/28/25 | (Federal Funds | Bml Inc — Monthly | (158) |

| | | | | Effective Rate US | | |

| | | | | plus 0.25%) — | | |

| | | | | Monthly | | |

| 3,695 | 3,498 | — | 1/28/25 | (Federal Funds | Bny Mellon Strategic | (185) |

| | | | | Effective Rate US | Municipals Inc — | |

| | | | | plus 0.25%) — | Monthly | |

| | | | | Monthly | | |

| 4,089 | 3,935 | — | 1/28/25 | (Federal Funds | Bny Mellon Strategic | (144) |

| | | | | Effective Rate US | Municpal Bond | |

| | | | | plus 0.25%) — | Fund — Monthly | |

| | | | | Monthly | | |

| |

| 26 PanAgora Market Neutral Fund |

| | | | | | |

| OTC TOTAL RETURN SWAP CONTRACTS OUTSTANDING at 2/29/20 (Unaudited)cont. | |

| | | Upfront | | | | |

| | | premium | Termina- | Payments | Total return | Unrealized |

| Swap counterparty/ | | received | tion | received (paid) | received by | appreciation/ |

| Notional amount | Value | (paid) | date | by fund | or paid by fund | (depreciation) |

| Morgan Stanley & Co. International PLCcont. | | | | |

| $10,132 | $9,833 | $— | 1/28/25 | (Federal Funds | Bogota Financial | $(314) |

| | | | | Effective Rate US | Corp — Monthly | |

| | | | | plus 0.25%) — | | |

| | | | | Monthly | | |

| 9,879 | 9,447 | — | 1/28/25 | (Federal Funds | Bollore — Monthly | (448) |

| | | | | Effective Rate US | | |

| | | | | plus 0.25%) — | | |

| | | | | Monthly | | |

| 7,692 | 6,202 | — | 1/28/25 | (Federal Funds | Bombardier Inc — | (1,502) |

| | | | | Effective Rate US | Monthly | |

| | | | | plus 0.25%) — | | |

| | | | | Monthly | | |

| 22,597 | 23,637 | — | 1/28/25 | (Federal Funds | Borgwarner Inc — | 1,130 |

| | | | | Effective Rate US | Monthly | |

| | | | | plus 0.25%) — | | |

| | | | | Monthly | | |

| 22,531 | 22,553 | — | 1/28/25 | (Federal Funds | Boubyan Bank | (28) |

| | | | | Effective Rate US | Kscp — Monthly | |

| | | | | plus 1.20%) — | | |

| | | | | Monthly | | |

| 15,543 | 15,558 | — | 1/28/25 | (Federal Funds | Boubyan | (21) |

| | | | | Effective Rate US | Petrochemicals Co | |

| | | | | plus 1.20%) — | Kscp — Monthly | |

| | | | | Monthly | | |

| 60,115 | 67,218 | — | 1/28/25 | (Federal Funds | Box Inc — Monthly | 7,023 |

| | | | | Effective Rate US | | |

| | | | | plus 0.25%) — | | |

| | | | | Monthly | | |

| 24,354 | 23,612 | — | 1/28/25 | (Federal Funds | Boyd Gaming | (809) |

| | | | | Effective Rate US | Corp — Monthly | |

| | | | | plus 0.25%) — | | |

| | | | | Monthly | | |

| 7,677 | 7,328 | — | 1/28/25 | (Federal Funds | Bpost Sa — Monthly | (363) |

| | | | | Effective Rate US | | |

| | | | | plus 0.25%) — | | |

| | | | | Monthly | | |

| 18,242 | 17,539 | — | 1/28/25 | (Federal Funds | Br Malls | (733) |

| | | | | Effective Rate US | Participacoes Sa — | |

| | | | | plus 0.65%) — | Monthly | |

| | | | | Monthly | | |

| 2,913 | 2,816 | — | 1/28/25 | (Federal Funds | Brandywineglobal | (85) |

| | | | | Effective Rate US | Global Income | |

| | | | | plus 0.25%) — | Opportunities Fund | |

| | | | | Monthly | Inc — Monthly | |

| 10,245 | 10,030 | — | 1/28/25 | (Federal Funds | Bridgestone Corp — | (33) |

| | | | | Effective Rate US | Monthly | |

| | | | | plus 0.25%) — | | |

| | | | | Monthly | | |

|

| PanAgora Market Neutral Fund 27 |

| | | | | | |

| OTC TOTAL RETURN SWAP CONTRACTS OUTSTANDING at 2/29/20 (Unaudited)cont. | |

| | | Upfront | | | | |

| | | premium | Termina- | Payments | Total return | Unrealized |

| Swap counterparty/ | | received | tion | received (paid) | received by | appreciation/ |

| Notional amount | Value | (paid) | date | by fund | or paid by fund | (depreciation) |

| Morgan Stanley & Co. International PLCcont. | | | | |

| $1,567 | $1,504 | $— | 1/28/25 | (Federal Funds | Bristol-Myers | $(65) |

| | | | | Effective Rate US | Squibb Co — | |

| | | | | plus 0.25%) — | Monthly | |

| | | | | Monthly | | |

| 17,930 | 17,068 | — | 1/28/25 | (Federal Funds | Bristol-Myers | (619) |

| | | | | Effective Rate US | Squibb Co — | |

| | | | | plus 0.25%) — | Monthly | |

| | | | | Monthly | | |

| 22,342 | 21,026 | — | 1/28/25 | (Federal Funds | Brookfield Real | (1,140) |

| | | | | Effective Rate US | Assets Income Fund | |

| | | | | plus 0.25%) — | Inc — Monthly | |

| | | | | Monthly | | |

| 17,265 | 15,800 | — | 8/31/20 | (Federal Funds | Brunswick Corp — | (1,403) |

| | | | | Effective Rate US | Monthly | |

| | | | | plus 0.25%) — | | |

| | | | | Monthly | | |

| 18,068 | 18,086 | — | 1/28/25 | (Federal Funds | Burgan Bank Sak — | (23) |

| | | | | Effective Rate US | Monthly | |

| | | | | plus 1.20%) — | | |

| | | | | Monthly | | |

| 8,363 | 7,692 | — | 1/28/25 | (Federal Funds | C&C Group Plc — | (683) |

| | | | | Effective Rate US | Monthly | |

| | | | | plus 0.25%) — | | |

| | | | | Monthly | | |

| 7,711 | 6,996 | — | 1/28/25 | (Federal Funds | Cac Holdings | (584) |

| | | | | Effective Rate US | Corp — Monthly | |

| | | | | plus 0.25%) — | | |

| | | | | Monthly | | |

| 11,365 | 10,781 | — | 1/28/25 | (Federal Funds | Caci International | (601) |

| | | | | Effective Rate US | Inc — Monthly | |

| | | | | plus 0.25%) — | | |

| | | | | Monthly | | |

| 27,552 | 26,456 | — | 1/28/25 | (Federal Funds | Cadence Design | (1,137) |

| | | | | Effective Rate US | Systems Inc — | |

| | | | | plus 0.25%) — | Monthly | |

| | | | | Monthly | | |

| 47,099 | 46,226 | — | 1/28/25 | (Federal Funds | Caesars | (943) |

| | | | | Effective Rate US | Entertainment | |