|

| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| WASHINGTON, DC 20549 |

| |

| SCHEDULE 14A |

| (RULE 14A-101) |

| |

| INFORMATION REQUIRED IN PROXY STATEMENT |

| SCHEDULE 14A INFORMATION |

| |

| Proxy Statement Pursuant to Section 14(a) |

| of the Securities Exchange Act of 1934 |

| |

| Filed by the Registrant / X / |

| |

| Filed by a Party other than the Registrant / / |

Check the appropriate box:

| |

| / / | Preliminary Proxy Statement. |

| / / | Confidential, for use of the Commission Only (as permitted by Rule 14a-6(e) (2)). |

| / / | Definitive Proxy Statement. |

| / X / | Definitive Additional Materials. |

| / / | Soliciting Material under § 240.14a-12. |

|

| PUTNAM ASSET ALLOCATION FUNDS |

| PUTNAM CALIFORNIA TAX EXEMPT INCOME FUND |

| PUTNAM CONVERTIBLE SECURITIES FUND |

| PUTNAM DIVERSIFIED INCOME TRUST |

| PUTNAM ETF TRUST |

| PUTNAM FOCUSED INTERNATIONAL EQUITY FUND |

| PUTNAM FUNDS TRUST |

| GEORGE PUTNAM BALANCED FUND |

| PUTNAM GLOBAL HEALTH CARE FUND |

| PUTNAM GLOBAL INCOME TRUST |

| PUTNAM HIGH YIELD FUND |

| PUTNAM INCOME FUND |

| PUTNAM INTERNATIONAL EQUITY FUND |

| PUTNAM INVESTMENT FUNDS |

| PUTNAM LARGE CAP VALUE FUND |

| PUTNAM MASSACHUSETTS TAX EXEMPT INCOME FUND |

| PUTNAM MINNESOTA TAX EXEMPT INCOME FUND |

| PUTNAM MONEY MARKET FUND |

| PUTNAM MORTGAGE SECURITIES FUND |

| PUTNAM NEW JERSEY TAX EXEMPT INCOME FUND |

|

| PUTNAM NEW YORK TAX EXEMPT INCOME FUND |

| PUTNAM OHIO TAX EXEMPT INCOME FUND |

| PUTNAM PENNSYLVANIA TAX EXEMPT INCOME FUND |

| PUTNAM SUSTAINABLE LEADERS FUND |

| PUTNAM TARGET DATE FUNDS |

| PUTNAM TAX EXEMPT INCOME FUND |

| PUTNAM TAX-FREE INCOME TRUST |

| PUTNAM VARIABLE TRUST |

| |

| (Name of Registrant as Specified in its Charter) |

| |

| (Name of Person(s) Filing Proxy Statement, |

| if Other Than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

| |

| / X / | No fee required. |

| |

| / / | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) Title of each class of securities to which transaction applies: |

| | (2) Aggregate number of securities to which transaction applies: |

| | (3) Per unit price or other underlying value of transaction computed pursuant to Exchange |

| | Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how |

| | it was determined): |

| | (4) Proposed maximum aggregate value of transaction: |

| | (5) Total fee paid: |

| |

| / / | Fee paid previously with preliminary materials. |

| |

| / / | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and |

| | identify the filing for which the offsetting fee was paid previously. Identify the previous |

| | filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) Amount Previously Paid: |

| | (2) Form, Schedule or Registration Statement No.: |

| | (3) Filing Party: |

| | (4) Date Filed: |

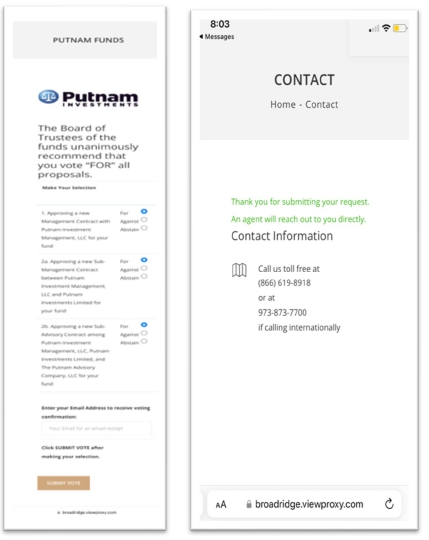

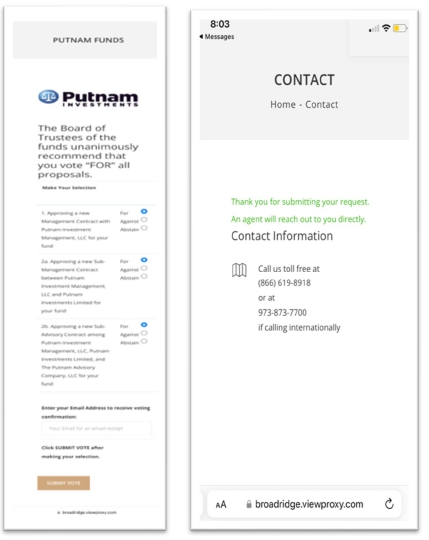

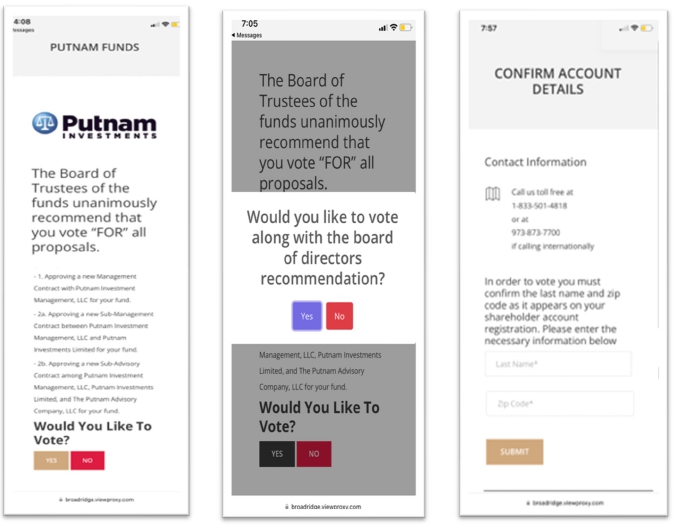

BROADRDIGE TEXT MESSAGE SAMPLE – 09/2023

BROADRDIGE TEXT MESSAGE SAMPLE – 09/2023

“YES” to Voting> “YES” to Vote with Recommendation

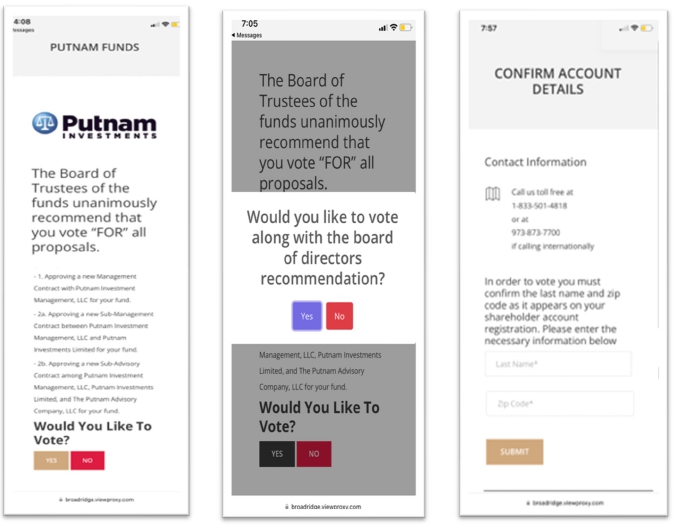

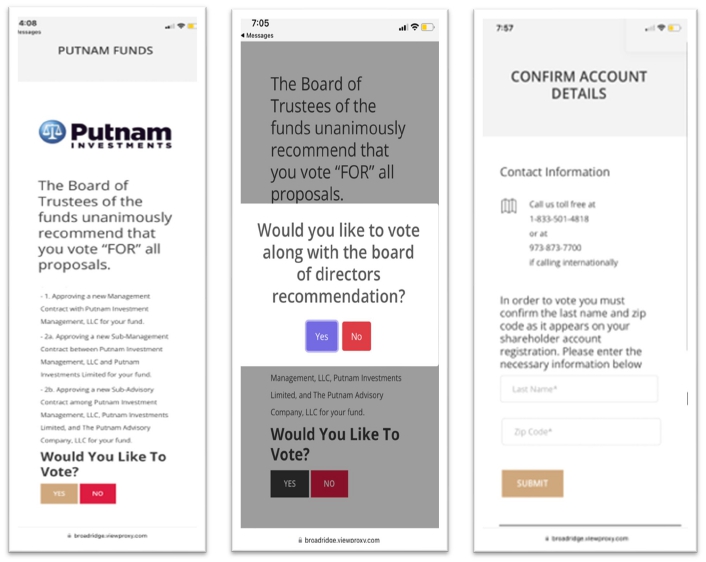

BROADRDIGE TEXT MESSAGE SAMPLE – 09/2023

“YES” to Voting> “YES” to Vote with Recommendation (continued)

BROADRDIGE TEXT MESSAGE SAMPLE – 09/2023

“NO” to Voting

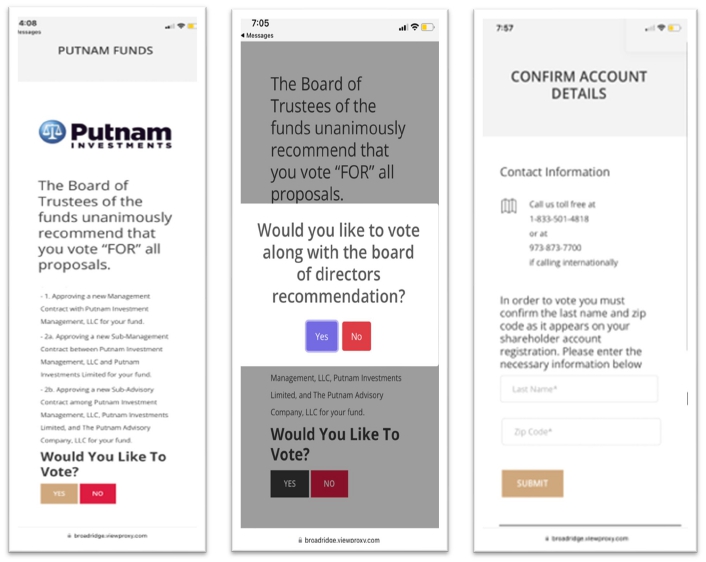

BROADRDIGE TEXT MESSAGE SAMPLE – 09/2023

“YES” to Voting> “NO” to Vote with Recommendation

BROADRDIGE TEXT MESSAGE SAMPLE – 09/2023

“YES” to Voting> “NO” to Vote with Recommendation (continued)