SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE TO

(Rule 14d-100)

TENDER OFFER STATEMENT UNDER SECTION 14(d)(1) OR 13(e)(1)

OF THE SECURITIES EXCHANGE ACT OF 1934

APPLIX, INC.

(Name of subject company (Issuer))

COGNOS INCORPORATED

DIMENSION ACQUISITION CORP.

(Names of Filing Persons (Offerors))

Common Stock, $0.0025 par value per share | | 038316105 |

(Title of classes of securities) | | (CUSIP number of common stock) |

Tom Manley

Senior Vice President, Finance & Administration & Chief Financial Officer

Cognos Incorporated

3755 Riverside Drive

P.O. Box 9707, Station T

Ottawa, ON, Canada

K1G 4K9

(613) 738-1440

(Name, address, and telephone number of person authorized to receive notices and communications on behalf of Filing Persons)

Copies to:

Kevin M Barry, Esq.

Bingham McCutchen LLP

150 Federal Street

Boston, Massachusetts 02110-1726

(617) 951-8000

CALCULATION OF FILING FEE

* A filing fee is not required in connection with this filing as it relates solely to preliminary communications made before the commencement of a tender offer.

o Check the box if any part of the fee is offset as provided by Rule 0-11(a)(2) and identify the filing with which the offsetting fee was previously paid. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing.

| Amount Previously Paid: | | N/A | | Filing Party: | | N/A |

| Form of Registration No.: | | N/A | | Date Filed: | | N/A |

x | Check the box if the filing relates solely to preliminary communications made before the commencement of the tender offer. |

Check the appropriate boxes below to designate any transactions to which the statement relates:

| x | third party tender offer subject to Rule 14d-1 |

| o | issuer tender offer subject to Rule 13e-4 |

| o | going private transaction subject to Rule 13e-3 |

| o | amendment to Schedule 13D under Rule 13d-2 |

Check the following box if the filing is a final amendment reporting the results of the tender offer: o

Important Information

THIS FILING IS FOR INFORMATIONAL PURPOSES ONLY AND IS NOT AN OFFER TO BUY OR THE SOLICITATION OF AN OFFER TO SELL ANY SECURITIES. THE SOLICITATION AND THE OFFER TO BUY SHARES OF APPLIX’S COMMON STOCK WILL ONLY BE MADE PURSUANT TO AN OFFER TO PURCHASE AND RELATED MATERIALS THAT COGNOS INTENDS TO FILE WITH THE SEC. ONCE FILED, APPLIX’S STOCKHOLDERS SHOULD READ THESE MATERIALS CAREFULLY PRIOR TO MAKING ANY DECISIONS WITH RESPECT TO THE OFFER BECAUSE THEY CONTAIN IMPORTANT INFORMATION, INCLUDING THE TERMS AND CONDITIONS OF THE OFFER. ONCE FILED, APPLIX’S STOCKHOLDERS WILL BE ABLE TO OBTAIN THE OFFER TO PURCHASE AND RELATED MATERIALS WITH RESPECT TO THE OFFER FREE OF CHARGE AT THE SEC’S WEBSITE AT WWW.SEC.GOV, FROM THE INFORMATION AGENT NAMED IN THE TENDER OFFER MATERIALS OR FROM COGNOS.

Cautionary Statement Regarding Forward-Looking Statements

Certain statements in this press release regarding the proposed transaction between Cognos and Applix, the expected timetable for completing the transaction, future financial and operating results, benefits and synergies of the transaction, future opportunities for the combined company and products and any other statements regarding Cognos’ or Applix’s future expectations, beliefs, goals or prospects constitute forward-looking statements made within the meaning of Section 21E of the Securities Exchange Act of 1934 and Section 138.4(9) of the Ontario Securities Act. Any statements that are not statements of historical fact (including statements containing the words “believes,” “plans,” “anticipates,” “expects,” “estimates” and similar expressions) should also be considered forward-looking statements. A number of important factors could cause actual results or events to differ materially from those indicated by such forward-looking statements, including the parties’ ability to consummate the transaction; the conditions to the completion of the transaction, including a sufficient number of Applix shares being tendered, may not be satisfied, or the regulatory approvals required for the transaction may not be obtained on the terms expected or on the anticipated schedule; and the parties’ ability to meet expectations regarding the timing, completion and accounting and tax treatments of the merger; the possibility that the parties may be unable to achieve expected synergies and operating efficiencies in the merger within the expected time-frames or at all and to successfully integrate Applix’s operations into those of Cognos; such integration may be more difficult, time-consuming or costly than expected; revenues following the transaction may be lower than expected; operating costs, customer loss and business disruption (including, without limitation, difficulties in maintaining relationships with employees, customers, clients or suppliers) may be greater than expected following the transaction; the retention of certain key employees of Applix may be difficult; Cognos and Applix are subject to intense competition and increased competition is expected in the future; the failure to protect either party’s intellectual property rights may weaken its competitive position; Cognos is dependent on large transactions; customer decisions are influenced by general economic conditions; third parties may claim that either party’s products infringe their intellectual property rights; fluctuations in foreign currencies could result in transaction losses and increased expenses; acts of war and terrorism may adversely affect either party’s business; the volatility of the international marketplace; and the other factors described in Cognos’ Annual Report on Form 10-K for the fiscal year ended February 28, 2007 and in its most recent quarterly report filed with the SEC, and Applix’s Annual Report on Form 10-K for the fiscal year ended December 31, 2006 and in its most recent quarterly report filed with the SEC. Cognos and Applix assume no obligation to update the information in this communication, except as otherwise required by law. Readers are cautioned not to place undue reliance on these forward-looking statements that speak only as of the date hereof.

The following is a transcript of a joint conference call with investors conducted by Applix and Cognos on September 5, 2007.

FINAL TRANSCRIPT

Conference Call Transcript

COGN - Cognos Merger & Acquisition Announcement

Event Date/Time: Sep. 05. 2007 / 8:45AM ET

Thomson StreetEvents | www.streetevents.com | Contact Us |

© 2007 Thomson Financial. Republished with permission. No part of this publication may be reproduced or transmitted in any form or by any means without the prior written consent of Thomson Financial.

1

CORPORATE PARTICIPANTS

Tom Manley

Cognos - - CFO

Rob Ashe

Cognos - - President, CEO

Dave Mahoney

Applix - - President and CEO

CONFERENCE CALL PARTICIPANTS

Tom Roderick

Thomas Weisel Partners - Analyst

Abhey Lamba

UBS Asset Management - Analyst

Steven Li

Raymond James - Analyst

Mark Murphy

First Albany - Analyst

Keith Weiss

Morgan Stanley - Analyst

David Wright

BMO Capital Markets - Analyst

Adam Holt

JPMorgan - - Analyst

David Hilal

Friedman, Billings, Ramsey - Analyst

Patrick Walravens

JMP Securities - Analyst

PRESENTATION

Operator

Good morning, ladies and gentlemen. Thank you for standing by. Welcome to the Cognos conference call. At this time, all participants are in a listen-only mode. Following the presentation, we will conduct a question and answer session. Instructions will be provided at that time for you to queue up for questions. (OPERATOR INSTRUCTIONS). As a reminder, we will end today’s call promptly at 9:29 a.m. We ask that you each limit yourself to one question so that everyone has a chance to participate. If we have time left after completing the first round of questions, you may queue up to ask an additional question. I would like to remind everyone that this conference call is being recorded on Wednesday, September 5, 2007, and I will now turn the conference over to Mr. Tom Manley. Please go ahead.

Tom Manley - Cognos - CFO

Thank you, Luke. Welcome to our conference call to discuss Cognos’ execution of a definitive agreement to acquire Applix. Joining me on the call this morning is Cognos’ President and CEO, Rob Ashe and Applix president and CEO, David Mahoney. Given that we are in our quiet period for our first, second quarter and in the pre-close phase of the transition, we’ll have to keep our discussion this morning at a fairly high level, and will not be discussing our recently completed first quarter.

2

Slide 2, please. Before I proceed, I would like to caution you that our remarks will contain forward-looking statements relating to, among other things, our expectations regarding the timing and impact of the proposed acquisition, expected synergies, integration of the businesses, future revenues and earnings on a U.S. GAAP and non-GAAP basis, integration of future products, additional customers and employees, the timing and content of product enhancements or releases and prominent themes and the position of the combined company in the BI market. These forward-looking statements are made pursuant to section 21-E of the Securities and Exchange Act of 1934, and some are considered to provide forward-looking information as defined by the Ontario Securities Act.

They are neither promises nor guarantees, but are subject to risk factors that may cause actual results to differ materially from expected results and any conclusions, forecasts, projections, in the forward-looking statement. Discussions of those risks as contained in our filings with the Securities and Exchange Commission in the Canadian securities administrators, including our most recent annual report on Form 10-K, and quarterly reports on Form 10-Q and in our press release of today’s date, as well as other periodic reports filed with the SEC.

For the purposes of the Ontario Securities Act, certain material factors and assumptions were implied in drawing a conclusion or making a forecast projection as reflected in certain of the forward-looking statements and additional information with respect to those material factors and assumptions is provided during this call. Investors should not place undue reliance on such statements, which are current only as of the day they are made, and we disclaim any obligation to update them.

On this conference call, we will also discuss non-GAAP financial measures as defined by SEC Regulation G to provide greater transparency regarding expectations resulting from the proposed acquisition. In particular, we will provide our expectations regarding the impact on earnings per share on non-GAAP basis of the combined company. Any non-GAAP financial measures discussed should not be considered as alternative to measures required by U.S. GAAP and are unlikely to be comparable to non-GAAP information provided by other issuers. Any non-GAAP financial measures disclosed or reconciled to the extent reasonably practicable to the most directly comparable GAAP net financial measure in a table provided on our investor relations page on our website at www.Cognos.com.

Finally, this call is for informational purposes only and is not an offer to buy or the solicitation of an offer to sell any securities. The solicitation and the offer to buy share of Applix’ common stock will only be made pursuant to an offer to purchase and related materials that Cognos intends to file with the Securities and Exchange Commission. Applix will file a solicitation or recommendation statement with respect to the offer. Once filed, Applix stockholders should read its materials carefully prior to making any decisions with respect to the offer because they contain important information, including the terms and conditions of the offer. Once filed, Applix stockholders will be able to obtain the offer to purchase, the solicitation or recommendation statement and related materials with respect to the offer, free of charge at the SEC’s website at www.SEC.gov, from the information agent named in the tender offer materials from Applix or from Cognos.

Slide 3, please. Today’s announcement is a major new milestone for both Cognos and Applix and great news for our customers and shareholders. Applix is a world leader in analytics, well known for its innovative technology and strong solutions for financial performance management. Publicly held and headquartered in Westborough, Massachusetts, the company serves more than 3000 customers and employs over 200 people and offices around the world. Through this acquisition, Cognos and Applix will bring together a strong focus and financial performance management, complimentary solution capabilities and a deep passion for innovation. Together, we will offer a powerful combination in the marketplace, committed to the success of our customers, our shareholders, and our people.

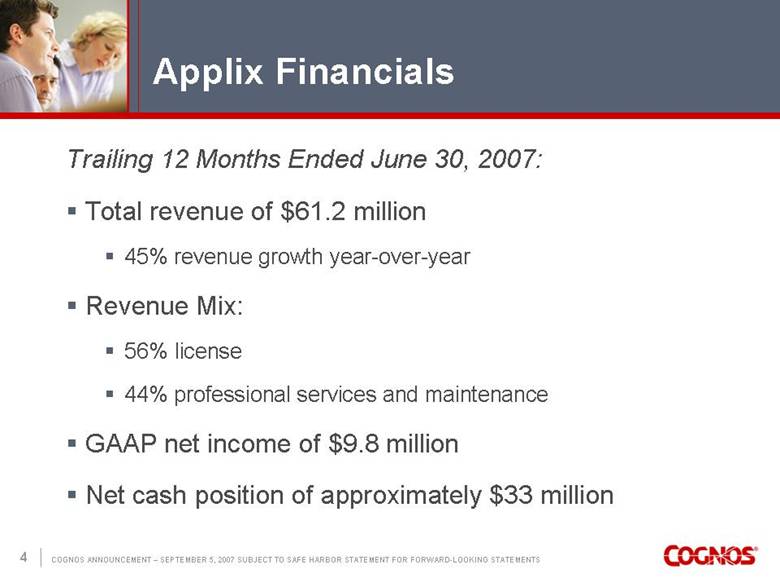

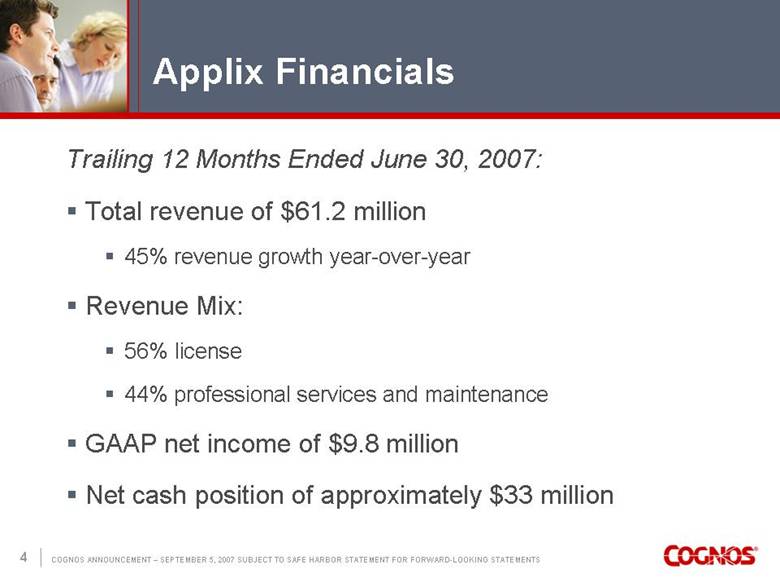

Slide 4, please. For the trailing 12 months ended June 30, 2007, Applix’ total revenues were $61.2 million, an increase of 45% over the prior 12-month period. U.S. GAAP net income for the period was $9.8 million. Revenue mix for the trailing 12-month period was 56% license and 44% professional services and maintenance. As of June 30, 2007, Applix had a net cash position of $33 million. Additional details of Applix’ financial performance are available on its website.

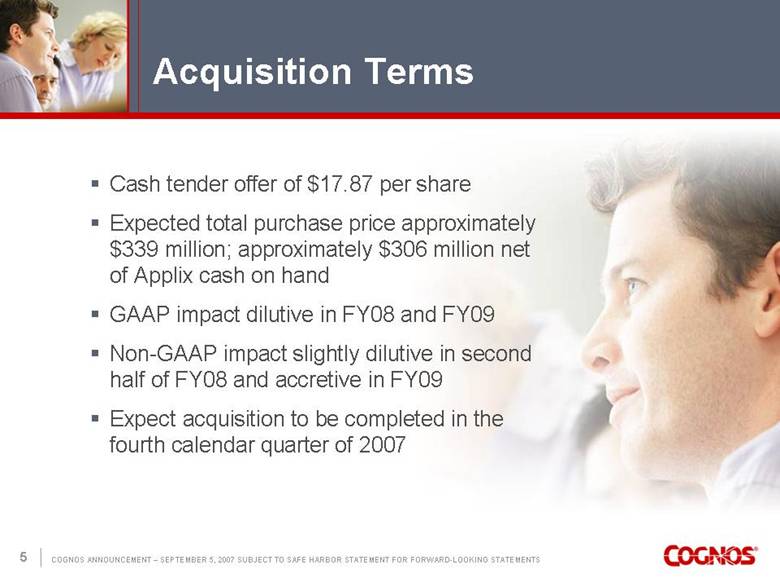

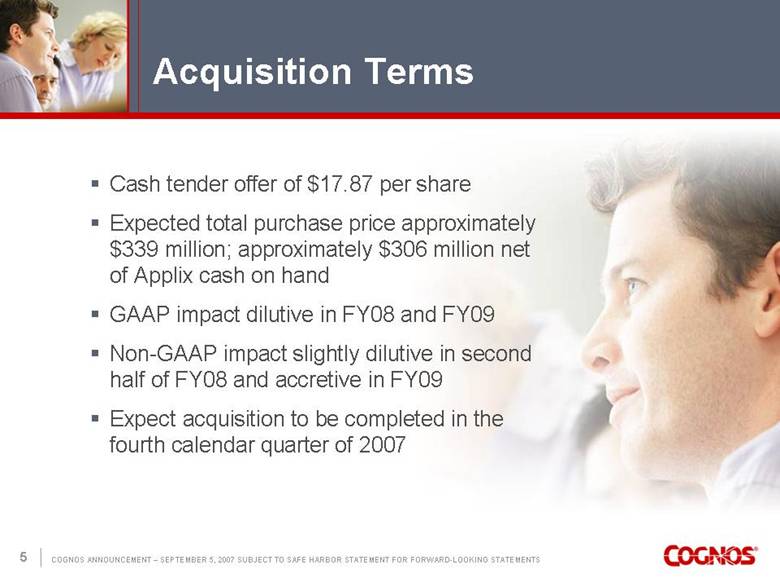

Slide 5, please. GAAP position is structured as a cash tender offer to be followed by a merger. Under the terms of the tender offer, Cognos has offered to pay holders of Applix shares $17.87 per share. Expected total purchase price is approximately $339 million, or approximately $306 million net of Applix’ cash on hand. Closing of the tender offer and the completion of the merger as subject to customary closing conditions, including the minimum tender of 50% of Applix’ outstanding shares on a fully diluted basis, the expiration of the waiting period under the Hart-Scott-Rodino antitrust improvement sap and the receipt of any other antitrust or merger control approval.

On a U.S. GAAP basis, we expect the impact of the acquisition to be dilutive on Cognos’ earnings per share in fiscal years 2008 and 2009. Excluding the effects of stock-based compensation, amortization of intangible assets and the write-down of deferred revenue, we expect the impact of this acquisition on non-GAAP basis to be very slightly dilutive in the second half of fiscal year 2008 and slightly accretive in fiscal year 2009. We expect the acquisition to be completed in the fourth calendar quarter of 2007.

3

I would now like to turn the call over to Rob.

Rob Ashe - Cognos - President, CEO

Thanks, Tom. Before proceeding further, I would just like to welcome Applix’ President and CEO, Dave Mahoney on today’s call. Dave, thanks for your participation this morning with us here.

Slide 6, please. I’m very pleased with our announcement today. The acquisition of Applix will be a terrific strategic fit for Cognos. It will broaden their solution offerings for this market with an extensive set of financial analytic capabilities. It will enhance our leadership position and financial performance management and will once again advance our position as the technology and innovation leader by bringing into Cognos an innovative, 64-bit in-memory capability to power those analytics. In addition, we’ll be welcoming to Cognos a very strong team of employees from Applix and adding a broad customer base with a shared commitment to financial performance management through high end back analytics.

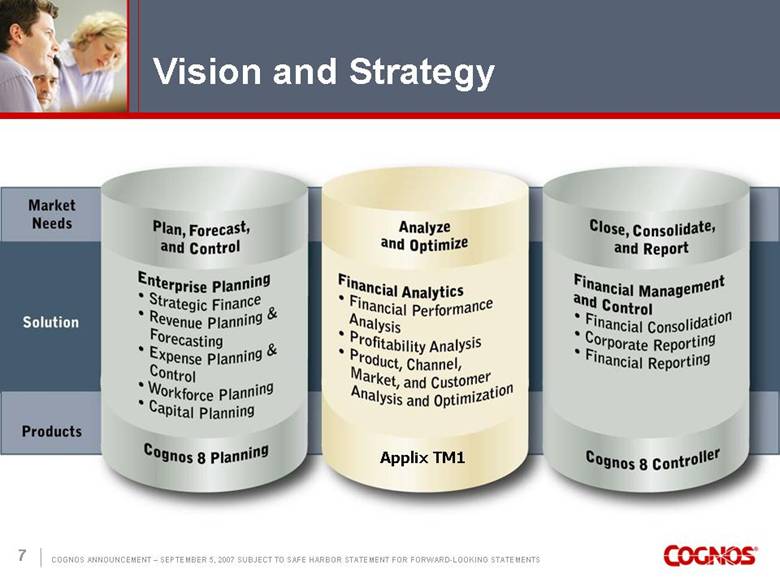

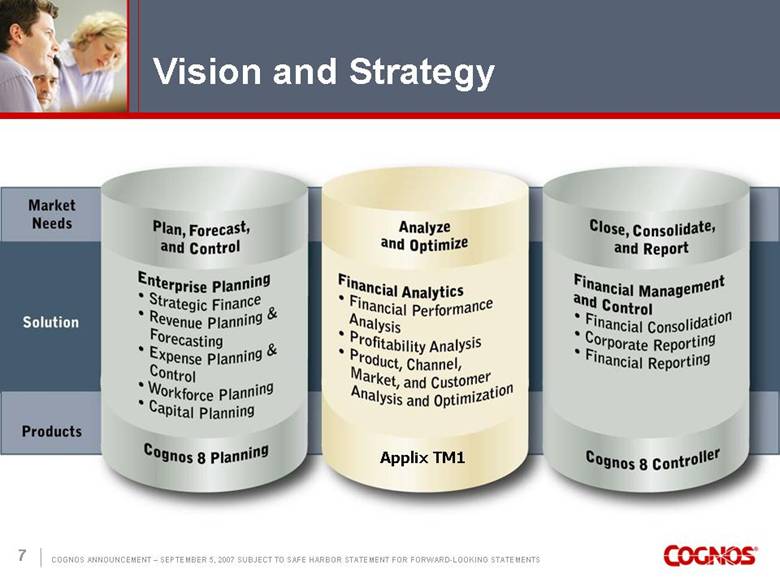

Slide 7, please. Let me put this acquisition into the context of our overall strategy. Cognos is committed to being the leading independent provider of solutions for performance management for both large and mid-size enterprises. While many Cognos solutions, blueprints and applications support this vision, at the very heart of our solution, our performance management leadership and vision are based on comprehensive demand coverage in two key areas.

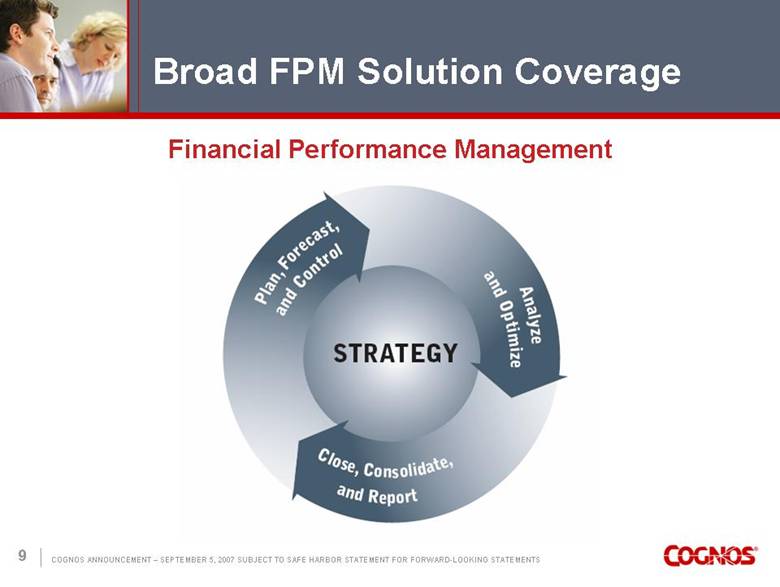

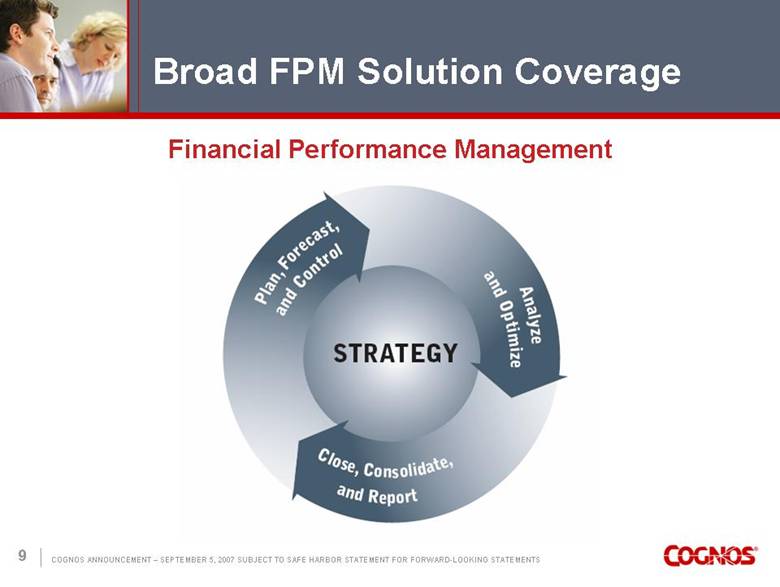

First, in IT and line of business where business intelligence drives performance management value, and second, in the office of finance, where financial performance management solutions allow finance to drive the key processes that enable performance management. Going forward, we will refer to our solutions in finance, as Financial Performance Management, or FPM. Collectively, these solutions will provide the best coverage for large and mid-size enterprises to address their broad performance management needs. With the addition of Applix, will provide incremental value in business intelligence that will most substantially support our solutions for Financial Performance Management.

Slide 8, please. This acquisition will bring 3000 Applix customers together with 3500 Cognos customers in finance departments around the world, creating a substantial global base of 6500 customers for our FPN solution. In addition, we will have a strong new team of performance management experts and a growing network of partners. We feel very confident about our team and our strong position in the market.

Slide 9, please. Our vision is to provide integrated solutions for the core processes that finance engages in to drive performance, and to extend those solutions to the use of Cognos 8 and it’s broad user reach. We will provide complete coverage of virtually all of the finance activity that aligns company performance. First, we will enable finance to begin its performance management journey directly around the consolidate and close process, bringing actual data from diverse entities and divisions into a single statutory based core performance for accountability compliance and performance management. Cognos controllers are a leading solution for this agenda.

Second, many finance organizations operate the performance management process outside of that consolidated closed process, leveraging its data, but not its process. These organizations drive performance management from the planning and forecasting process, importing historical data into this process, but really focusing on a forward view with high participation and high frequency planning. Cognos planning is the industry’s most innovative solution for this agenda.

The third key finance process is the activity around analyzing and optimizing performance. This activity is heavily centered on three components, a captive multidimensional data source, rapid updating, change and processing to handle the complex analytics associated with applications like customer churn, product optimization and possibility analysis, and reporting performance management constituents. With Applix, we’ll add these important capabilities to our overall offering, filling out the industry’s broadest and strongest solution for financial performance management. In addition, this comprehensive solution will be a strong offering for the midmarket complimenting our current portfolio of products.

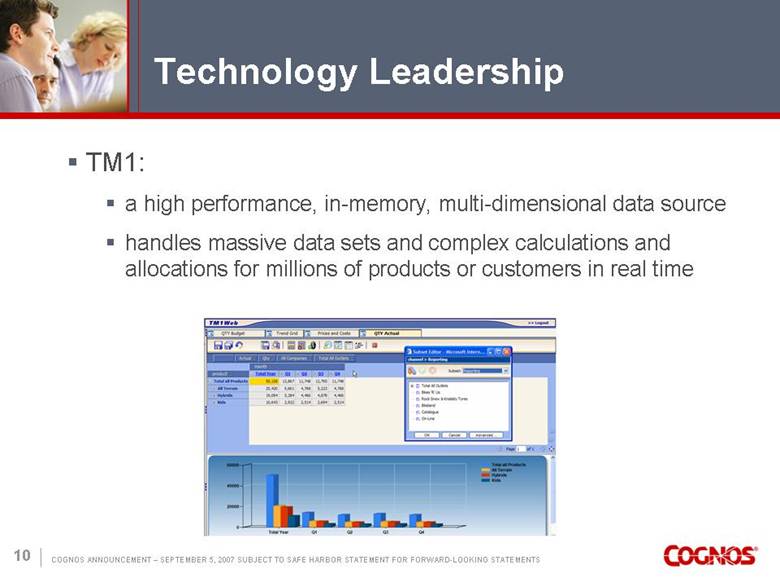

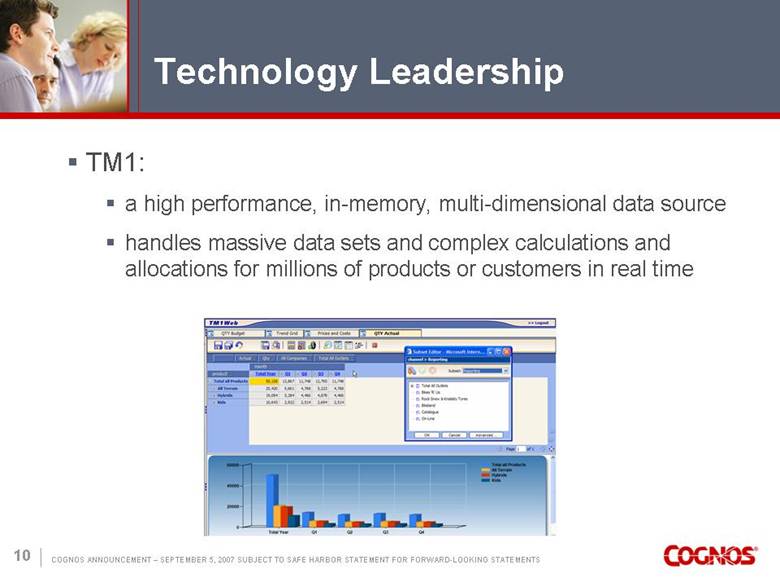

Slide 10, please. We’ll also bring into our innovative platform the Tier 1 engine, the high performance in-memory multidimensional data source to position us as the center of finance. We believe the growth and in-memory capability will drive take up of better, faster analytics, eliminating the need for cost and time consuming data warehouse restructuring to enable those analytics with every change in the business. Finance can make changes on the fly, rapidly see outcomes and further perform sensitivity of whatever scenario. For example, Applix customers routinely overcome limitations spreadsheet based analytics models and create a single multidimensional view of customers, products and geography. TM1 handles massive data sets and complex calculations and allocations, for millions of products or customers in realtime. Keeping this data readily available for analysis ensures vital questions about pricing, customer attrition, product trends, and profitability are answered in detail every day. Applix sets itself apart in the market with its innovative capability.

4

We have developed a strong shared vision with the Applix team around these basic principles and we anticipate that we will build a very strong combined team. There will be areas of modest product overlap to manage, but in the few cases where this occurs, there will also be an opportunity for us to position a very strong joint solution. Overall, we anticipate a relatively smooth integration, given our shared vision and the familiarity between the two companies in addition to many shared customers. I would now like to invite Applix president and CEO, Dave Mahoney, to say a few words.

Dave Mahoney - Applix - President and CEO

Thank you, Rob, and good morning, everyone. It’s my pleasure to be a part of this very exciting announcement this morning. As Rob’s comments indicate, the combination of Applix and Cognos has the potential to create a powerful force in the financial performance management market space.

For those of you less familiar with Applix, in early 2003, the Applix board and management team decided to reinvent the company as a contender in the analytics software arena. At the time, we were a little known software company and virtually invisible in the business intelligence and business performance management market. However, what we had going for us with us a loyal base of customers and partners, who are convinced that TM1 was an industry-leading [reef bright] OLAP product and that in turn convinced us that we had a great opportunity ahead of us, if we could turn the company around and start executing effectively.

Over the past four and a half years, we have made enormous progress in establishing Applix as a leading innovator in the business analytics market. Once we rededicated to leveraging TM1’s inherent strengths of in-memory architecture coupled with 64-bit technology, we were able to set new standards for performance and scalability. We added new applications, features and administration functions that have enabled us to be among the best in customer satisfaction, ease of use, and rapid return on investment. And as a result, the strong worldwide field organization that Michael Morrison built over the past three years, we achieved consistent industry-leading license and revenue growth since 2004.

As we look forward to the future, we saw excellent opportunity to build on our successes. However, we also recognize that we are a relatively small player and we still needed to make significant investments in product, marketing and sales in order to maintain our technological advantage and growth trajectory. Cognos recently approached us with a compelling offer for both the Cognos and Applix share holders to combine our strengths and after a thorough evaluation and review by our financial advisors, our board determined that this acquisition is an excellent outcome for our shareholders, customers, employees and partners.

It gives our customers and partners increased confidence that TM1 legacy will carry forward as a part of a much larger company. Our employees who have worked extremely hard to build the value of it is being recognized today. It brings the opportunity to continue to work with one of the strongest technologies and markets and opens up new career options. On behalf of the board and management team, I want to say that we are very excited about this combination and that we will work diligently to bring the acquisition to a successful closure. With that, I’ll turn the call back to Rob.

Rob Ashe - Cognos - President, CEO

Thanks, Dave. In closing, this announcement of our intended acquisition of Applix is the next major step forward in our strategy to lead this market. It will expand our position as a leader in finance, will enable a broad solution for financial performance management and it will add to our position as the innovator in our industry. This is an important day for our two companies, our people and our shareholders and I look forward to the opportunity ahead for Cognos and Applix. We’ll now be happy to take some of your questions.

QUESTION AND ANSWER

Operator

Your first question comes from Tom Roderick from Thomas Weisel Partners. Please go ahead.

5

Tom Roderick - Thomas Weisel Partners - Analyst

Hi, good morning. Thank you very much. Just in looking at this stated numbers in the press release, without having the benefit of a lot of historical detail, we’re looking at a company that’s growing 45%. Can you give us a little sense for how much of that is organic versus, versus acquired growth from Applix? And then if you could just give us a brief history of the continued versus discontinued operations that the company has had, that would be helpful background to start. Thanks.

Dave Mahoney - Applix - President and CEO

I will answer the first part of the question. We are generating — this is Dave Mahoney, by the way. We are generating about 60% of our business from new accounts, mid-market enterprise accounts 40% from the install base. That’s been in and around a little above, a little below 50/50 for the past several years. The second part of the question—

Rob Ashe - Cognos - President, CEO

What was the second part of the question?

Tom Roderick - Thomas Weisel Partners - Analyst

Discontinued, the old, the old tier business.

Dave Mahoney - Applix - President and CEO

Going so far back, we’ve forgotten. We haven’t — the CRM business hasn’t been part of our financials since 2003, so nowhere in our financials is there stated any CRM revenue.

Tom Roderick - Thomas Weisel Partners - Analyst

Just in terms of any acquisitions that Applix has made within the course of the last year and a half, two years.

Dave Mahoney - Applix - President and CEO

We made a small acquisition in June of 2006, which was a small company in the Netherlands by the name of [Temtech], which brought a front end technology a non-Excel front end technology to the company, about 300 customers and about $7 million total in revenue.

Tom Roderick - Thomas Weisel Partners - Analyst

Okay, and, Rob, just a quick question for you, just in terms of the strategy for Cognos going forward. We’ve seen the company really focused on operating margin expansion and buying back stock over the last year or so here, really cleaning up the corporate structure. Does this sort of shift the focus going forward to be more acquisitive and more growth-minded, as you look into the future?

Rob Ashe - Cognos - President, CEO

I think we’ve always been growth-minded and always been acquisitive, with I guess peaks and valleys in that, as you see with most M&A activity. We remain committed to programs to drive the operating margin effective execution here at the company and we can’t say anything about our most recent quarter, obviously. We’ll talk about that on September 27, with our earnings call. But one of the things we liked about Applix, the job that David and Michael Morrison have done in terms of driving this company has been its margin. It operates at a high level of margin. We’re very pleased with that, so we think that fits into our overall goals of growth and margin. So we like it on all fronts.

6

Tom Roderick - Thomas Weisel Partners - Analyst

Thank you, again.

Operator

Your next question comes from Abhey Lamba of UBS Asset Management. Please go ahead.

Abhey Lamba - UBS Asset Management - Analyst

Thanks. Tom, can you talk a little bit about what this acquisition does to your buyback plans and how do you feel about your cash balance after you have paid for this acquisition?

Tom Manley - Cognos - CFO

Well, certainly we continue to manage our business based on the opportunities that are out there, whether it be acquisition, continued stock buyback. As you know, both us and Applix generate very healthy margins and we’ll continue to drive a lot of cash. So we’ll continue to evaluate our plans for both stock buyback and further acquisitions as we go forward. Certainly we do expect, or we are paying cash for this acquisition and we’ll manage our business appropriately.

Abhey Lamba - UBS Asset Management - Analyst

Thank you.

Operator

Your next question comes from Steven Li of Raymond James. Please go ahead.

Steven Li - Raymond James - Analyst

Yes, hi, guys. Is there a breakup fee, and also how much does Applix management own?

Dave Mahoney - Applix - President and CEO

Well, we’re not disclosing any terms of the actual arrangement. There is a normal market, market breakup fee, I guess is the answer to that question, and a very small proportion of the ownership is management.

Steven Li - Raymond James - Analyst

Okay. So the other $61 million of revenues last 12 months trailing, how much is actually the OLAP server and how much is performance management? Do you break it down that way?

Dave Mahoney - Applix - President and CEO

No, we haven’t broken it down that way. Our revenue, we break it down between license and then maintenance and the small amount of services, all of our licenses derive from selling a combination of technologies, our engine, our applications, and solutions built around that, that product set.

7

Rob Ashe - Cognos - President, CEO

And, Steven, virtually all of the applications are performance management, whether it’s the, you know, the old solution-based front end, every single thing Applix does and what we like about the company is they live and breathe performance management. They are all about optimizing results, so it’s a nice combination. We could talk about this either way. I could give you all the nice jargon and buzzwords on the technology, 64 bit, in-memory, highly scalable, high performance.

You could talk about the technology or you could talk about the application of the technology, which it enables, fast, updates fast, change on the fly, people seeing, client periods and geographies and product sets updated very quickly. So all of those solutions. So the application of this OLAP server is all about performance management. Performance management is about multidimensional capability. It’s this sort of fast-change capability and that’s what Applix uniquely brings to Cognos, so we like it because it’s all about performance management. There’s not a split of this revenue and that revenue.

Steven Li - Raymond James - Analyst

Rob, was the TM1 competing at all against Power Play?

Rob Ashe - Cognos - President, CEO

Not really much against Power Play. I would think over time when we both have thousands of customers and there’s millions of Power Play cubes out there, so I’m sure at some point in time it competed a little bit, but where we have competed is just the more in finance, not around power play. But this area of where the line crosses between, distributed contribution-based planning and centralized analytics, which has a planning element, on the edges of that, you know, that part of finance we have contributed.

Steven Li - Raymond James - Analyst

Okay, thanks.

Dave Mahoney - Applix - President and CEO

I would add one comment. This is Dave Mahoney. For all of you who have also followed Applix, you know that we have said for some time that a big part of our strength in the market is the fact that we can easily be viewed by customers to be complimentary to investments that are made in many historical PI technologies from a variety of different vendors so we would find ourselves often in situations where we were being looked at as complementary to Cognos as opposed to competing on a head to head sale.

Operator

Your next question comes from Mark Murphy of First Albany. Please go ahead.

Mark Murphy - First Albany - Analyst

Thank you, congratulations. It’s a highly intuitive acquisition. Rob, I wanted to ask, was the bidding for Applix highly competitive?

Rob Ashe - Cognos - President, CEO

That’s a comment I can’t make. We won’t comment on that.

Mark Murphy - First Albany - Analyst

In terms of the retention of the key employees on the Applix side, is there anything being done in terms of earn-outs or any other kind of potential structure?

8

Rob Ashe - Cognos - President, CEO

Well, without going into too much detail, let me just first of all say that we have a high regard for all the Applix employees. Some of them are former Cognos employees and some of them are going to — with the completion of this acquisition, become Cognos employees for the first time. So there is a level of familiarity between the two companies. We, you know, in the process of working with Dave and his team over the last couple weeks and making sure we had the most effective combination here, we made sure that some of the key employees that we’re aware of could be locked up, locked up is the wrong word, but signed up prior to the announcement. From a practical basis, we couldn’t sign up everybody because we just needed to get a deal closed and so, you know, some of the key employees are now committed to an ongoing participation with Cognos and are appropriately incented to do that, you know, starting at the top with Michael Morrison, and a number of the key employees that, you know, I think you know, are at Applix.

Dave Mahoney - Applix - President and CEO

This is Dave. Speaking to the employees that I have spoken to that have learned about this and been a part of these discussions, I think everybody to a person is very excited about this. They see the logic to the fit, as you say, intuitive, and I think they also believe that their strength and knowledge of what TM1 can be in the future is very exciting in the sense that they can now take that knowledge into a much bigger company and do many, many more things that they couldn’t afford to do in an Applix environment.

Mark Murphy - First Albany - Analyst

One last one. As you look at the marketplace today, currently do you — does it feel to you as though Power Play and TM1 are coexisting in a large number of accounts and how is this going to look moving forward in terms of how do you steer customers that might go either way there? Would you push TM1 as a midmarket solution and Power Play as more of an enterprise solution, or is there a different way of looking at this?

Rob Ashe - Cognos - President, CEO

Well, as Dave said in his earlier comments, we have many, many joint customers, and I would say the preponderance of joint customers are in the area of finance, where they combine our planning solution which is really good at decentralized contribution-based planning, where users in remote departments will do some modeling themselves then update a centralized data store. Often times customers will leverage that process with Applix for heavy analytics and reporting of that capability out to a number of users. And the difference is the planning capability might be thousands of users and the heavy analytics might be numbered in the hundreds up to a thousand. So you see a lot of joint customer usage on the finance side. On the power play side, there is very modest overlap really if you think about it.

What you’ve got here is a read/write, high performance OLAP store optimized for writing, for quick update, et cetera, for what-if scenarios, for things like that. Power Play is really broad distribution of very quick reporting, really, is what it is, or analysis. It’s at a level of just drilling down and changing periods. There’s no updating. There never has been, so the two solutions are really complementary and should not be viewed as this is some kind of replacement for Power Play or it’s going to compete or really very complementary on the Power Play side, and on the finance side, very complementary. Again, as I said in my comments, modest overlap in the area where planning might overlap from the centralized to decentralized model, but I think very easy to manage in our customer base and especially from the point of the joint customers that are already using the solution.

Mark Murphy - First Albany - Analyst

Okay, thank you.

Operator

Your next question comes from Keith Weiss of Morgan Stanley. Please go ahead.

9

Keith Weiss - Morgan Stanley - Analyst

Hi, guys. Thanks for taking my question. Maybe just to go a little bit further go the discussion about joint customers, when you talk about 3000 Applix customers versus 3500 Cognos FPM customers. Will you guys be able to quantify at all how many customers do overlap today, and then maybe if you could just go through a little bit more about Applix 3000 customer base, a little bit more of where do they tend to be in terms of verticals, in terms of size compared to the Cognos customer base?

Rob Ashe - Cognos - President, CEO

Perhaps Dave could comment on the last question first and then I’ll—

Dave Mahoney - Applix - President and CEO

Well, our customers are pretty well spread between various market segments, financial management, financial services, excuse me, healthcare, manufacturing, consumer goods, telecommunications. Combination of companies that are looking for good, basic financial performance management are also companies, telecommunications would be a good example, where they are looking to build out a highly specialized application that need to deal with massive amounts of data that’s changing constantly.

As far as company size, once again, we cover quite a spectrum. We have a good solid portion of our customers that are mid-market customers — they do all of their reporting, planning, budgeting on our product and it’s a one-stop shop for them. Then we have a spectrum of customers that are using our product for much more complex financial and operational applications. Those customers tend to be large Oracle and SAP users. We have actually quite large portion of our customer base, probably a quarter to a third of our customers are among some of the biggest SAP users in the world. So quite a spectrum and the customers — the company’s been around quite sometime, so we’ve built up a fairly strong worldwide presence, even though we’re small. We have quite a geographical spread to our business.

Rob Ashe - Cognos - President, CEO

On the customer overlap, hard to quantify at this stage how much customer overlap there is. Reasonable for our ability to go into those customers and I guess leverage those joint solutions as they exist. I will tell you a couple of data points. We have seen in our customer base quite a significant increase in demand for us to support the TM1 engine. As you know, with Cognos 8, we support diverse data sources through a single platform. Adding TM1 is going to be a very reasonable path for us to drive up some synergies here, so we’ve seen that from big customers, big names in the industry, big financial institution, big healthcare institution, big credit card company, so we’ve seen a very significant uptick in the basic support of Cognos 8 on top of TM1.

Secondly, as we see customers in finance looking to leverage the complete solution more, kind of, feedback from customers to provide some view of common metadata across these capabilities, just to ease the process, having them work together, so we see good solution areas for leverage and synergies going forward from these joint customers, a reasonable number of joint customers, I wouldn’t say more than 25 or 30%, but a reasonable number for us to work on and other areas where we can look to penetrate competitive opportunity.

Keith Weiss - Morgan Stanley - Analyst

Got it, and then if I could just sneak one more in, for — it sounds like Applix was used as a complete planning application solution for mid-market customers. Tom, do you expect to retain that kind of positioning as perhaps a separate mid-market offering for planning and budgeting outside Cognos planning?

Rob Ashe - Cognos - President, CEO

Why don’t I take that. One of the strengths in the mid-market, one of the reasons we like this acquisition for the medium-size enterprise is for those customers looking for that all in one solution. Our reps and solution providers and partners will be able to position that, if that’s what the customer wants. I think we are going to have the luxury of a very broad solution portfolio and we think we’re going to get something out of all the assets. We think — we don’t think any one asset suddenly becomes less important. They are all available because customers have different demands.

10

For one customer it might be an all in one plan, and for another customer it might be all in one financial system. For another customer it might be really a planning based solution. So we really intend to make the most out of that. We intend to drive that capability through our mid-market channel. I know our teams are going to be very excited about having this capability.

Keith Weiss - Morgan Stanley - Analyst

Thanks again.

Operator

Your next question comes from David Wright of BMO Capital Markets. Please go ahead.

David Wright - BMO Capital Markets - Analyst

Thank you. I wondered if you would tell us who you commonly compete against Applix when you’re — what are the common applications?

Dave Mahoney - Applix - President and CEO

Sorry, David. Was that a question, who does Applix compete with?

David Wright - BMO Capital Markets - Analyst

Yes.

Dave Mahoney - Applix - President and CEO

Usual suspects. The companies that are in and around the space, Hyperions, the BusinessObjects, to a minor degree, portions of SAP’s business, [Eklisoft] used to be a fairly common competitor, some elements of Oracle’s business and now continue to be I think more of a competitor with Hyperion’s acquisition. But generally speaking, that’s — there are a few smaller companies out there that aren’t on too many deals, but pop up every now and then.

David Wright - BMO Capital Markets - Analyst

Care to comment on your win rate against Cognos?

Dave Mahoney - Applix - President and CEO

Huge win we’ve announced today.

David Wright - BMO Capital Markets - Analyst

Yes, and don’t know if you could comment, Tom, on potential cost savings that you might see in the coming year?

Tom Manley - Cognos - CFO

Well, we’re not prepared to talk about specifics of synergies. We’ll have more to talk about following the closing on that.

11

David Wright - BMO Capital Markets - Analyst

Could we assume some real estate synergies? Is that likely or planned?

Tom Manley - Cognos - CFO

Very nominal, if any.

David Wright - BMO Capital Markets - Analyst

Okay. Thank you.

Rob Ashe - Cognos - President, CEO

Dave, I’m just going to put a little bit more color on that win rate between our two companies, but the most common thing we’ve discovered over the last, I’ll say since Applix has done such a good job increasing the distribution capability and getting more deals, is the number of times, reps on either side of the table, this was borne out in our due diligence, but certainly reiterated by Dave to me a number of times, their team would say boy, if we could use Cognos here, this could be a good joint situation, and the number of times our guys would say this would be a good joint situation, why does the customer have to choose. I think that speaks to why we both won our share of deals. I think it speaks ultimately to the synergy that both our solutions provide.

Dave Mahoney - Applix - President and CEO

I was just going to say that we’re gentlemanly and we let you guys win every once in a while.

Operator

Your next question comes from Adam Holt of JPMorgan. Please go ahead.

Adam Holt - JPMorgan - Analyst

Good morning and congratulations on the deal. Maybe just a follow-up on the commentary around some of the synergies you are just referring to, Rob. It would look like the — and I understand, Tom, you said you’re not going to comment on detail about the financial synergies, but it would look like the deal should be accretive to fiscal ‘09 based on sort of the current run rate of the business and I wanted to make sure at a high level, that’s sort of the right operating assumption for the model. Then secondarily, maybe a little bit more detail on the go-to-market strategy, how you plan on bringing the Applix products into the Cognos sales force, et cetera.

Tom Manley - Cognos - CFO

Well, certainly on the financials, depending on the timing of the close, you know, we expect it to be very slightly dilutive in this fiscal year, might be two or three months of integration going on then, but we would expect the synergies on the revenues and costs to kick in certainly early in ‘09 and we would expect it to be accretive in ‘09 for sure. We’ve very, very high expectations on the success of the merger.

Rob Ashe - Cognos - President, CEO

From a go-to-market perspective, it’s important to maybe layout the market landscape and Cognos’ thinking over the last several months. First of all, we had a number of consolidation activities that took place earlier in the year, Oracle buys Hyperion and SAP buys Eklisoft, Cognos sees this huge opportunity as the independent player with the broad solution covering finance. Finance, often times wants to choose an independent solution, independent of the broader infrastructure, one because of the diversity of the infrastructure and the need to cover up many different bases.

12

Two, they want the focus. They want the focus on performance management. They, they sign off on the books, drive performance, want the focus, exclusively on performance management and management in many cases and they want the innovation. So with that as a backdrop, Cognos began to take steps months ago to further specialize a go-to-market model around the finance business with increased incentives and our regional management structure, increased specialization, hiring of people in specialized roles to increase our ability to take advantage of that opportunity.

So a part of that thinking was the acquisition of ultimately the early discussions in the acquisition of Applix and a go-to-market model that would emerge as a more specialized model than we’ve had before. That would be obviously in key geographies where we’ve had critical mass, but you will see, we believe we’re acquiring a great group of people. We believe we’re adding that to a great group of specialists we already have in the company, so we will have more specialization coming out of this acquisition, a broad group of financial performance management experts on the go-to-market side that will drive both solutions for the customer. So we really, really see a go-to-market opportunity here with lots of synergies, with the 30 to 35 sales reps that Dave’s team brings to the table, compared with our last quarterly report, I think it was close to 400, 390 sales reps at Cognos that we’re going to get good leverage across the whole team as we pursue this more specialized model.

Adam Holt - JPMorgan - Analyst

Great. If I could ask just one follow-up. If you look at the 3000 Applix customers, what would be rough split between the midmarket customers and enterprise customers?

��

Dave Mahoney - Applix - President and CEO

It’s about 50/50.

Adam Holt - JPMorgan - Analyst

Great, thank you very much.

Rob Ashe - Cognos - President, CEO

If I could just add to Dave’s comment as one of the observations I’ve made, you’ll see a heck of a lot of big departments of large enterprises that some people call mid-market. Is that mid-market, is that — what is that? Very, very large companies, key departmental areas, strategically using Applix, and we think that’s opportunity for expansion of those accounts.

Operator

Your next question comes from David Hilal of FBR. Please go ahead.

David Hilal - Friedman, Billings, Ramsey - Analyst

Great, thank you. Hey, Rob, can you drill down a little bit more on the integration plans and I was hoping to go down two fronts, one from a product standpoint, the level of effort needed, and then on the people front, kind of follow up to the last question, particularly within sales. Is there a lot of sales integration needed and also maybe a comment on R&D, personnel integration. Thanks.

Rob Ashe - Cognos - President, CEO

First of all, David, it is early. We obviously have begun our own internal PMI process. That’s kind of part of the diligence as we start ours, but we can’t work with Dave’s team to effect that until we get further along in this process. So with that as kind of an overarching statement, on the product side, first of all, we think the effort to integrate TM1 with Cognos 8 is modest. We think that Dave’s team has done a good job in exposing an API that we can write to. We’ve already got a lot of experience with analysis services with Hyperion, where their own controlling and planning cubes to access, true Cognos 8 multidimensional data sources. So we think we’ll be demonstrable in a reasonably short period of

13

time and we think we’ll be in the market certainly not longer than the first quarter, depending on when this thing, when the whole thing closes. So from that perspective, it’s, I would call it modest.

Further strategically, as we look down the road, getting more out of the Applix TM1 engine, making it more and more the center of our financial solution at the core will evolve over a number of releases. We’ll probably start with trying to innovate the metadata and trying to provide master data management capability across the product. That’s probably a little bit longer than the core access true Cognos 8. So I think it’s all very reasonable amount of work and given that we already have customers already using the solutions, I think from day one we have the ability to leverage the complimentary nature of the solutions right out of the gate. So feel pretty good on that front.

On the people side, our diligence suggests that the integration on the people side, is going to be quite easy, we’re in the market together, we share a vision which I view is always kind of a real determining factor in how easy these things are to integrate, we share a vision around performance management, so in creating this specialized team, I think it’s a very doable task. I think it’s very low level of risk and I think once we get this closed, we’ll see that integration happen pretty quickly.

David Hilal - Friedman, Billings, Ramsey - Analyst

Rob, if I could ask a quick follow-up on that, on the people side, how many sales reps does Applix have, and are they going to be cross-trained on the Cognos product, or are they going to solely sell TM1? Thanks.

Rob Ashe - Cognos - President, CEO

There’s currently 38 sales reps in the Applix sales organization. They will — we will combine — we will have some form of specialization, probably more in the presale side in terms of the Applix engine and its capability. On the sales side, we will want everybody to have the most leverage possible, so all of our financial performance management sales teams at the end of the day is going to sell all the products that we have, and there’s been some movement of people back and forth between the companies. We hire the same kind of people, training people across these solution sets is not going to be a big challenge. It’s going to be a real, I think a real smooth process.

David Hilal - Friedman, Billings, Ramsey - Analyst

Okay, thank you.

Operator

We have time for one more question. Your final question comes from Patrick Walravens of JMP Securities. Please go ahead.

Patrick Walravens - JMP Securities - Analyst

Thanks very much. I guess, and you addressed this earlier in the call, but I want to be specific. What are the areas that have the product overlap? I mean does Applix have its own planning product?

Rob Ashe - Cognos - President, CEO

Applix can be used for planning, so if you talk about the modest overlap that I talked about, it’s this area Pat, kind of planning, where you look at what Applix does through the TM1 store, centralized, high performance read/write store. The writing side says people will write to it and they are going to do that in context of looking at future performance. You peel back the layers of the onion and look at what we’re both good at, the Applix capability when it comes to planning is really good at centralized planning, highly analytic base, rapid update, scenario-based, so I would call that centralized planning.

We’re really good at is what we call distributed planning, which is an architecture built for thousands of users in remote locations to work in their own models to update a centralized plan, driver-base, high participation, high frequency kind of planning. So in fact, while on the edges, there is some overlap on the planning side, what we really have is two very complementary solutions to position for that heavy analytic centralized base

14

capability as well as that high-contribution-based planning that interacts with the ability to position the solution that’s appropriate for the job and therefore combined with our specialized go-to-market model, I think be very highly competitive in the market. Again, go back to my earlier thoughts, we want to be the leading independent provider, we think we have the broadest solution coverage and this modest area of overlap is really greatly overshadowed by the complementary nature of these products as our folks get to understand them.

Patrick Walravens - JMP Securities - Analyst

Presumably, you guys have known about Applix for sometime, why now?

Rob Ashe - Cognos - President, CEO

Well, I guess to Dave’s credit and Steve’s credit, popping up more and more in our customers and demands from our customers to work jointly with it, whatnot. I think his team has done a great job over the last couple of years focusing the business in performance management. Prior to that, it was I think a little bit more, and excuse me for this expression, Dave, a little all over the map with CRM and the TM1 datasource.

Dave Mahoney - Applix - President and CEO

I would agree with you.

Rob Ashe - Cognos - President, CEO

Focused on the performance management, which is right in our wheel house. They have really done a good job of getting the most out of the TM1 engine, enhancing it, improving it, so first of all, it’s popped up more and more. Second of all, as we’ve gone through our development of this business and we look at the core processes and finance the one process that we see more and more in this very competitive environment is this idea of analyzing and optimizing performance, closing and consolidating the books is one thing. Connected the planning of forecasting the business is another thing. Analyzing and optimizing the business to get the most out of, SKU combinations in retail and customer options in finances really become important to management, driving performance management. So we just see it as a steady progression of our business to be a broader and broader solution. The opportunity that’s presented the market by the consolidation above us, and Applix’ success at getting onto the radar and getting onto our radar.

Patrick Walravens - JMP Securities - Analyst

Okay. Thanks a lot.

Rob Ashe - Cognos - President, CEO

Okay. Well, I’m going to close the call now. I appreciate everybody joining us. I appreciate Dave Mahoney here from Applix joining us. We’re very excited about our joint opportunity here, and we look forward to talking to you on the 27th of September.

15

DISCLAIMER

Thomson Financial reserves the right to make changes to documents, content, or other information on this web site without obligation to notify any person of such changes.

In the conference calls upon which Event Transcripts are based, companies may make projections or other forward-looking statements regarding a variety of items. Such forward-looking statements are based upon current expectations and involve risks and uncertainties. Actual results may differ materially from those stated in any forward-looking statement based on a number of important factors and risks, which are more specifically identified in the companies’ most recent SEC filings. Although the companies may indicate and believe that the assumptions underlying the forward-looking statements are reasonable, any of the assumptions could prove inaccurate or incorrect and, therefore, there can be no assurance that the results contemplated in the forward-looking statements will be realized.

THE INFORMATION CONTAINED IN EVENT TRANSCRIPTS IS A TEXTUAL REPRESENTATION OF THE APPLICABLE COMPANY’S CONFERENCE CALL AND WHILE EFFORTS ARE MADE TO PROVIDE AN ACCURATE TRANSCRIPTION, THERE MAY BE MATERIAL ERRORS, OMISSIONS, OR INACCURACIES IN THE REPORTING OF THE SUBSTANCE OF THE CONFERENCE CALLS. IN NO WAY DOES THOMSON FINANCIAL OR THE APPLICABLE COMPANY OR THE APPLICABLE COMPANY ASSUME ANY RESPONSIBILITY FOR ANY INVESTMENT OR OTHER DECISIONS MADE BASED UPON THE INFORMATION PROVIDED ON THIS WEB SITE OR IN ANY EVENT TRANSCRIPT. USERS ARE ADVISED TO REVIEW THE APPLICABLE COMPANY’S CONFERENCE CALL ITSELF AND THE APPLICABLE COMPANY’S SEC FILINGS BEFORE MAKING ANY INVESTMENT OR OTHER DECISIONS.

© 2005, Thomson StreetEvents All Rights Reserved.

16

| Cognos Announces Offer to Acquire Applix |

| Important Information THIS PRESENTATION IS FOR INFORMATIONAL PURPOSES ONLY AND IS NOT AN OFFER TO BUY OR THE SOLICITATION OF AN OFFER TO SELL ANY SECURITIES. THE SOLICITATION AND THE OFFER TO BUY SHARES OF APPLIX’S COMMON STOCK WILL ONLY BE MADE PURSUANT TO AN OFFER TO PURCHASE AND RELATED MATERIALS THAT COGNOS INTENDS TO FILE WITH THE SECURITIES AND EXCHANGE COMMISSION. APPLIX WILL FILE A SOLICITATION/RECOMMENDATION STATEMENT WITH RESPECT TO THE OFFER. ONCE FILED, APPLIX STOCKHOLDERS SHOULD READ THESE MATERIALS CAREFULLY PRIOR TO MAKING ANY DECISIONS WITH RESPECT TO THE OFFER BECAUSE THEY CONTAIN IMPORTANT INFORMATION, INCLUDING THE TERMS AND CONDITIONS OF THE OFFER. ONCE FILED, APPLIX STOCKHOLDERS WILL BE ABLE TO OBTAIN THE OFFER TO PURCHASE, THE SOLICITATION/RECOMMENDATION STATEMENT AND RELATED MATERIALS WITH RESPECT TO THE OFFER FREE OF CHARGE AT THE SEC’S WEBSITE AT WWW.SEC.GOV, FROM THE INFORMATION AGENT NAMED IN THE TENDER OFFER MATERIALS, FROM APPLIX OR FROM COGNOS. Cautionary Statement Regarding Forward-Looking Statements Certain statements in this presentation regarding the proposed transaction between Cognos and Applix, the expected timetable for completing the transaction, future financial and operating results, benefits and synergies of the transaction, future opportunities for the combined company and products and any other statements regarding Cognos’ or Applix’s future expectations, beliefs, goals or prospects constitute forward-looking statements made within the meaning of Section 21E of the Securities Exchange Act of 1934 and Section 138.4(9) of the Ontario Securities Act. Any statements that are not statements of historical fact (including statements containing the words “believes,” “plans,” “anticipates,” “expects,” “estimates” and similar expressions) should also be considered forward-looking statements. A number of important factors could cause actual results or events to differ materially from those indicated by such forward-looking statements, including the parties’ ability to consummate the transaction; the conditions to the completion of the transaction, including a sufficient number of Applix shares being tendered, may not be satisfied, or the regulatory approvals required for the transaction may not be obtained on the terms expected or on the anticipated schedule; and the parties’ ability to meet expectations regarding the timing, completion and accounting and tax treatments of the merger; the possibility that the parties may be unable to achieve expected synergies and operating efficiencies in the merger within the expected time-frames or at all and to successfully integrate Applix’s operations into those Cognos; such integration may be more difficult, time-consuming or costly than expected; revenues following the transaction may be lower than expected; operating costs, customer loss and business disruption (including, without limitation, difficulties in maintaining relationships with employees, customers, clients or suppliers) may be greater than expected following the transaction; the retention of certain key employees of Applix may be difficult; Cognos and Applix are subject to intense competition and increased competition is expected in the future; the failure to protect either party’s intellectual property rights may weaken its competitive position; Cognos is dependent on large transactions; customer decisions are influenced by general economic conditions; third parties may claim that either party’s products infringe their intellectual property rights; fluctuations in foreign currencies could result in transaction losses and increased expenses; acts of war and terrorism may adversely affect either party’s business; the volatility of the international marketplace; and the other factors described in Cognos’ Annual Report on Form 10-K for the fiscal year ended February 28, 2007 and in its most recent quarterly report filed with the SEC, and Applix’s Annual Report on Form 10-K for the fiscal year ended December 31, 2006 and in its most recent quarterly report filed with the SEC. Cognos and Applix assume no obligation to update the information in this communication, except as otherwise required by law. Readers are cautioned not to place undue reliance on these forward-looking statements that speak only as of the date hereof. Non-GAAP Information On the conference call and in this presentation, we will also present non-GAAP financial measures, as defined by SEC Regulation G, to provide greater transparency regarding expectations resulting from the proposed acquisition. In particular, we will provide our expectations regarding the impact on earnings per share on a non-GAAP basis of the combined company and historical net income for Applix. Any non-GAAP financial measures discussed should not be considered an alternative to measures required by US GAAP, and are unlikely to be comparable to non-GAAP information provided by other issuers. Any non-GAAP measures disclosed are reconciled to the extent reasonably practicable to the most directly comparable GAAP financial measure in a table provided on the investor relations page on our website at http://www.cognos.com. |

| Headquartered in Westborough, MA. NASDAQ: APLX Industry leader in analytics 3,000+ customers 200+ employees Applix |

| Trailing 12 Months Ended June 30, 2007: Total revenue of $61.2 million 45% revenue growth year-over-year Revenue Mix: 56% license 44% professional services and maintenance GAAP net income of $9.8 million Net cash position of approximately $33 million Applix Financials |

| Acquisition Terms Cash tender offer of $17.87 per share Expected total purchase price approximately $339 million; approximately $306 million net of Applix cash on hand GAAP impact dilutive in FY08 and FY09 Non-GAAP impact slightly dilutive in second half of FY08 and accretive in FY09 Expect acquisition to be completed in the fourth calendar quarter of 2007 |

| Broadest solution coverage for Financial Performance Management A market leader in Financial Performance Management Technology and innovation leadership Strong Strategic Fit |

| Vision and Strategy Applix TM1 Market Needs Solution Products Plan, Forecast and Control Enterprise Planning Strategic Finance Revenue Planning & Forecasting Expense Planning & Control Workforce Planning Capital Planning Cognos 8 Planning Analyze and Optimize Financial Analytics Financial Performance Analysis Profitability Analysis Product, Channel, Market, and Customer Analysis and Optimization Close, Consolidate and Report Financial Management and Control Financial Consolidation Corporate Reporting Financial Reporting Cognos 8 Controller |

| A Market Leader in Financial Performance Management Strong global Financial Performance Management (FPM) client base 3,500+ Cognos FPM customers 3,000+ Applix FPM customers Strong and growing partner network |

| Broad FPM Solution Coverage Financial Performance Management |

| Technology Leadership TM1: a high performance, in-memory, multi-dimensional data source handles massive data sets and complex calculations and allocations for millions of products or customers in real time |

| Loyal base of customers and partners A leading innovator in the analytics market Set new standards in the market for performance and scalability Cognos + Applix = Powerful force in the Financial Performance Management market space David Mahoney President and CEO, Applix |

| Summary Next major step forward for Performance Management Extends position as a leader in Finance Broadest solution for Financial Performance Management Technology and innovation leadership |

| Q&A |