UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

x QUARTERLY REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended September 30, 2008.

o TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE EXCHANGE ACT

Commission File Number: 000-254888

RG GLOBAL LIFESTYLES, INC.

(Exact Name of issuer as specified in its charter)

| California | | 33-0230641 |

| (State or other jurisdiction of | | (I.R.S. Employer Identification No.) |

| incorporation or organization) | | |

| 1200 N. Van Buren St., Suite A, Anaheim, CA | | 92807 |

| (Address of principal executive offices) | | (Zip Code) |

Issuer’s telephone number: (714) 630-1805

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company.

Large accelerated filer o | Accelerated filer o |

| | |

| Non-accelerated filer o (Do not check if a smaller reporting company) | Smaller reporting company x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

As of September 30, 2008, there were 44,597,792 shares of the Registrant’s common stock issued and outstanding.

INDEX

| | | Page |

| | | |

PART I - FINANCIAL INFORMATION |

| | | |

| Item 1. | Financial Statements | 3 |

| | | |

| | Consolidated Balance Sheets –September 30, 2008 and March 31, 2008 | 3 |

| | | |

| | Consolidated Statements of Operations | |

| | For the Three and Six Months ended September 30, 2008 and 2007 | 4 |

| | | |

| | Consolidated Statements of Cash Flows | |

| | For the Three and Six Months ended September 30, 2008 and 2007 | 5 |

| | | |

| | Notes to Financial Statements | 6 |

| | | |

| Item 2. | Management’s Discussion and Analysis of Financial Condition and | |

| | Results of Operations | 15 |

| | | |

| Item 3. | Quantitative and Qualitative Disclosures About Market Risk | 23 |

| | | |

| Item 4 | Controls and Procedures | 23 |

PART II - OTHER INFORMATION |

| | | |

| Item 1. | Legal Proceedings | 23 |

| Item 2. | Unregistered Sales of Equity Securities and Use of Proceeds | 24 |

| Item 3. | Defaults Upon Senior Securities | 24 |

| Item 4. | Submission of Matters to a Vote of Security Holders | 24 |

| Item 5. | Other Information | 24 |

| Item 6. | Exhibits | 24 |

| | | |

| SIGNATURES | 25 |

PART I — FINANCIAL INFORMATION

Item 1. Financial Statements

Consolidated Balance Sheets

(unaudited)

| | As of September 30, | | As of March 31, | |

| | | 2008 | | 2008 | |

Assets | | | | | | | |

| Current assets: | | | | | | | |

| Cash and cash equivalents | | $ | 18,572 | | $ | 12,319 | |

| Accounts receivable | | | 5,816 | | | 6,087 | |

| Inventory - finished goods | | | 77,596 | | | 86,864 | |

| Federal income tax refund receivable | | | - | | | 143,775 | |

| Prepaids and other current assets | | | 37,063 | | | - | |

| Total current assets | | | 139,047 | | | 249,045 | |

| | | | | | | | |

| Property and equipment, net | | | 2,758,155 | | | 3,060,884 | |

| Intangible assets, net | | | 4,030,041 | | | 4,195,645 | |

| Other assets | | | 270,205 | | | 252,613 | |

| | | | | | | | |

Total Assets | | $ | 7,197,448 | | $ | 7,758,187 | |

| | | | | | | | |

Liabilities and Stockholders' Equity | | | | | | | |

| Current liabilities: | | | | | | | |

| Accounts payable | | $ | 1,224,634 | | $ | 954,500 | |

| Accrued liabilities | | | 998,585 | | | 459,273 | |

| State income taxes payable | | | 97,890 | | | 97,890 | |

| Convertible notes payable | | | 586,296 | | | 864,074 | |

| Notes payable - related party | | | 113,397 | | | 102,700 | |

| Notes payable | | | 410,500 | | | 410,500 | |

| Total current liabilities | | | 3,431,302 | | | 2,888,937 | |

| | | | | | | | |

| Accrued liabilities-Long Term | | | 70,000 | | | 70,000 | |

| Total Liabilities | | | 3,501,302 | | | 2,958,937 | |

| | | | | | | | |

| Stockholders' equity | | | | | | | |

| Preferred stock, $0.001 par value, 10,000,000 shares authorized; none issued and outstanding | | | - | | | - | |

| Common stock, $0.001 par value, 100,000,000 shares authorized 44,597,792 and 36,400,410 issued, 44,415,521 and 34,500,410 outstanding, respectively | | | 44,416 | | | 34,501 | |

| Common stock to be issued | | | 168,000 | | | 2,113,904 | |

| Additional paid-in capital | | | 35,753,003 | | | 32,159,232 | |

| Accumulated deficit | | | (32,269,273 | ) | | (29,508,387 | ) |

| Total stockholders' equity | | | 3,696,146 | | | 4,799,250 | |

| | | | | | | | |

Total Liabilities and Stockholders' Equity | | $ | 7,197,448 | | $ | 7,758,187 | |

The accompanying notes are an integral part of these financial statements.

RG Global Lifestyles, Inc.

Consolidated Statements of Operations

(unaudited)

| | | For the 3 Months Ended | | For the Six Months Ended | |

| | | September 30 | | September 30 | |

| | | 2008 | | 2007 | | 2008 | | 2007 | |

| | | | | | | | | | | | | | |

| Revenue: | | | | | | | | | | | | | |

| Product sales | | $ | 6,851 | | $ | 68,595 | | $ | 36,469 | | $ | 146,643 | |

| Water treatment related | | | - | | | 469,049 | | | 90,419 | | | 678,208 | |

| Total revenues | | | 6,851 | | | 537,644 | | | 126,888 | | | 824,851 | |

| | | | | | | | | | | | | | |

| Cost of revenues: | | | | | | | | | | | | | |

| Product sales | | | 3,653 | | | 55,498 | | | 33,088 | | | 120,854 | |

| Water treatment related | | | 215,227 | | | 436,022 | | | 433,280 | | | 631,401 | |

| Total cost of revenue | | | 218,880 | | | 491,520 | | | 466,368 | | | 752,255 | |

| | | | | | | | | | | | | | |

| Gross profit (loss) | | | (212,029 | ) | | 46,124 | | | (339,480 | ) | | 72,596 | |

| | | | | | | | | | | | | | |

| Expenses: | | | | | | | | | | | | | |

| General and administrative | | | 769,721 | | | 1,244,507 | | | 1,986,430 | | | 2,588,308 | |

| Selling and marketing | | | 13,940 | | | 56,655 | | | 46,860 | | | 91,739 | |

| Project cost | | | 62,364 | | | - | | | 240,534 | | | - | |

| Total expenses | | | 846,025 | | | 1,301,162 | | | 2,273,824 | | | 2,680,047 | |

| | | | | | | | | | | | | | |

| Operating loss | | | (1,058,054 | ) | | (1,255,038 | ) | | (2,613,304 | ) | | (2,607,451 | ) |

| | | | | | | | | | | | | | |

| Other income (expense): | | | | | | | | | | | | | |

| Interest income | | | 64 | | | 591 | | | 64 | | | 3,609 | |

| Interest income (expense) - related party | | | - | | | (22,891 | ) | | - | | | (25,643 | ) |

| Interest expense | | | (104,689 | ) | | (605,467 | ) | | (153,620 | ) | | (2,037,503 | ) |

| Change in fair value of derivative liabilities | | | - | | | 3,588,421 | | | - | | | 4,530,506 | |

| Other income (expense) | | | (995 | ) | | (4,119 | ) | | 5,974 | | | (4,091 | ) |

| Total other income (expense) | | | (105,620 | ) | | 2,956,535 | | | (147,582 | ) | | 2,466,878 | |

| | | | | | | | | | | | | | |

| Net income (loss) before provision for income taxes | | | (1,163,674 | ) | | 1,701,497 | | | (2,760,886 | ) | | (140,573 | ) |

| | | | | | | | | | | | | | |

| Provision for income taxes | | | - | | | - | | | - | | | - | |

| | | | | | | | | | | | | | |

| Net income (loss) before minority interest | | | (1,163,674 | ) | | 1,701,497 | | | (2,760,886 | ) | | (140,573 | ) |

| | | | | | | | | | | | | | |

| Minority interest | | | - | | | 18,585 | | | - | | | 18,585 | |

| | | | | | | | | | | | | | |

| Net income (loss) | | $ | (1,163,674 | ) | $ | 1,720,082 | | $ | (2,760,886 | ) | $ | (121,988 | ) |

| | | | | | | | | | | | | | |

| Weighted average number of common shares: | | | | | | | | | | | | | |

| Basic | | | 44,319,500 | | | 28,769,302 | | | 43,772,751 | | | 27,572,656 | |

| Diluted | | | 44,319,500 | | | 45,461,968 | | | 43,772,751 | | | 27,572,656 | |

| | | | | | | | | | | | | | |

| Net income (loss) per share: | | | | | | | | | | | | | |

| Basic | | $ | (0.03 | ) | $ | 0.06 | | $ | (0.06 | ) | $ | (0.00 | ) |

| Diluted | | $ | (0.03 | ) | $ | 0.04 | | $ | (0.06 | ) | $ | (0.00 | ) |

The accompanying notes are an integral part of these financial statements.

RG Global Lifestyles, Inc.

Consolidated Statements of Cash Flows

(unaudited)

| | | For the Six Months Ended | |

| | | September 30 | |

| | | 2008 | | 2007 | |

Cash flows from operating activities: | | | | | | | |

| Net loss | | $ | (2,760,886 | ) | $ | (121,988 | ) |

| | | | | | | | |

| Adjustments to reconcile net loss to net cash used in operating activities: | | | | | | | |

| Amortization of debt discounts related to beneficial conversion features and warrants | | | 22,222 | | | 300,822 | |

| Change in fair value of derivative liabilities | | | - | | | (4,530,506 | ) |

| Stock issued for services | | | 110,197 | | | - | |

| Fair value of common stock in excess of notes payable forgiven | | | 94,890 | | | 1,656,152 | |

| Depreciation and amortization | | | 468,333 | | | 162,810 | |

| Stock-based compensation | | | 764,392 | | | 1,499,793 | |

| Minority interest in subsidiary | | | - | | | (18,585 | ) |

| Change is operating assets and liabities: | | | | | | | |

| Accounts receivable | | | 271 | | | (745,478 | ) |

| Inventory | | | 9,268 | | | (32,185 | ) |

| Income tax refund | | | 143,775 | | | | |

| Prepaid expenses | | | (37,063 | ) | | 25,676 | |

| Accounts payable | | | 270,134 | | | 275,492 | |

| Accrued liabilities | | | 539,312 | | | 393,416 | |

| Deferred revenues | | | - | | | 501,792 | |

| Income taxes payable | | | - | | | 1,681 | |

| Net cash used in operating activities | | | (375,155 | ) | | (631,108 | ) |

| | | | | | | | |

Cash flows from investing activities: | | | | | | | |

| Purchase of fixed assets | | | - | | | (31,874 | ) |

| Construction in progress | | | - | | | (41,629 | ) |

| Other assets | | | (17,592 | ) | | 13,568 | |

| Net cash used in investing activities | | | (17,592 | ) | | (59,935 | ) |

| | | | | | | | |

Cash flows from financing activities: | | | | | | | |

| Proceeds from notes payable | | | - | | | 250,000 | |

| Cash received for stock to be issued | | | 168,000 | | | - | |

| Common stock issued for cash | | | 231,000 | | | - | |

| Proceeds from exercise of stock options | | | - | | | 62,500 | |

| Net cash provided by financing activities | | | 399,000 | | | 312,500 | |

| | | | | | | | |

| Net increase (decrease) in cash | | | 6,253 | | | (378,543 | ) |

| Cash - beginning of period | | | 12,319 | | | 502,278 | |

| Cash - ending of period | | $ | 18,572 | | $ | 123,735 | |

| | | | | | | | |

| SUPPLEMENTAL DISCLOSURES OF CASH FLOW INFORMATION | | | | | | | |

| Cash paid during the period for: | | | | | | | |

| Interest | | $ | - | | $ | - | |

| Income taxes | | $ | - | | $ | - | |

| | | | | | | | |

| Non-cash investing and financing activities: | | | | | | | |

| Issuance of common stock in settlement of notes payable and accrued interest | | $ | 300,000 | | $ | 331,095 | |

| | | | | | | | |

| Issuance of common stock for tangible and intangible assets | | $ | | | $ | 474,828 | |

| Issuance of OC Energy, Inc.'s interests for tangible and intangible assets | | $ | | | $ | 43,903 | |

| Construction in progress recorded in accounts payable | | $ | | | $ | 742,502 | |

The accompanying notes are an integral part of these financial statements.

RG GLOBAL LIFESTYLES, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

Note 1 – Basis of Presentation and Significant Accounting Policies

The consolidated financial statements included herein, presented in accordance with United States generally accepted accounting principles and stated in US dollars, have been prepared by the Company, without audit, pursuant to the rules and regulations of the Securities and Exchange Commission. Certain information and footnote disclosures normally included in financial statements prepared in accordance with generally accepted accounting principles have been condensed or omitted pursuant to such rules and regulations, although the Company believes that the disclosures are adequate to make the information presented not misleading.

These statements reflect all adjustments, consisting of normal recurring adjustments, which, in the opinion of management, are necessary for fair presentation of the information contained therein. It is suggested that these consolidated interim financial statements be read in conjunction with the consolidated financial statements and notes thereto of the Company for the year ended March 31, 2008 included in the Company's annual report on Form 10-KSB. The Company follows the same accounting policies in the preparation of interim reports. The financial statements for the three and six months ended September 30, 2008, are not necessarily indicative of the results expected for the full year.

Estimates

The preparation of financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenue and expenses during the reporting period. Significant estimates include the valuation of derivatives, equity instruments such as options and warrants, and the percentage of completion related to construction contracts. Actual results could differ from those estimates.

Concentrations

Customers

During the three and six months ended September 30, 2008, one customer made up zero and 71%, respectively, of all revenues from water treatment royalties. The loss of this customer could have a significant impact on the Company’s financial statements.

Vendors

During the quarter ended September 30, 2008, 50% of the equipment used to generate water treatment revenues was manufactured by one vendor. The loss of this vendor could have a significant impact on the Company’s financial statements.

Inventory

At September 30, 2008, the Company had inventory consisting of chemicals, flavorings, and bottles related to the OC Energy Drink, Inc. segment of the Company. Inventory is valued at cost in the amount of $77,596. Inventory is recorded at lower of cost (first-in, first-out) or net realizable market value.

Net Income (Loss) Per Share

Net loss per share is provided in accordance with SFAS No. 128 “Earnings Per Share” (“SFAS 128”). Basic loss per share is computed by dividing losses available to common stockholders by the weighted average number of common shares outstanding during the period, after giving effect to dilutive common stock equivalents, such as stock options, warrants and convertible debt. The following is a summary of outstanding securities which have been excluded from the calculation of diluted net loss per share because the effect would have been anti-dilutive for the six months ended September 30, 2008 and 2007:

RG GLOBAL LIFESTYLES, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

| | | For the six months ended September 30, 2008 | | For the six months ended September 30, 2007 | |

| | | | | | | | |

| Common stock options | | | 3,520,215 | | | 8,294,430 | |

| Common stock warrants | | | 3,582,433 | | | 11,378,940 | |

| Secured convertible notes | | | - | | | 9,738,046 | |

| Totals | | | 7,102,648 | | | 29,411,416 | |

There were no outstanding securities that would have been considered dilutive for the three months ended September 30, 2008.

The following is a summary of outstanding securities which have been included in the calculation of diluted net income per share for the three months ended September 30, 2007.

| Basic | | | 28,769,302 | |

| Common stock options | | | 2,783,270 | |

| Common stock warrants | | | 4,171,350 | |

| Secured convertible notes | | | 9,738,046 | |

| | | | 16,692,666 | |

| Totals | | | 45,461,968 | |

Note 2 – Going Concern

The accompanying financial statements have been prepared assuming the Company will continue as a going concern. As shown in the accompanying financial statements, the Company during the quarter ended September 30, 2008, has limited revenues, incurred an operating loss before income taxes of $1,163,674 and used cash from operations of $375,155. As of September 30, 2008, the Company had a working capital deficit of $3,292,255. These conditions raise substantial doubt about the Company’s ability to continue as a going concern.

The future of the Company is dependent upon its ability to obtain equity and/or debt financing and ultimately achieving profitable operations from the development of its new business opportunities. During the quarter ended September 30, 2008, the Company funded operations through equity offerings. The Company does not have any commitments or assurances for additional capital. In addition, during the second quarter the Company announced it intention to sell the OC Energy subsidiary. However, the Company is no longer actively looking for a buyer due to the testing of the product with a potential customer. Thus, the assets and liabilities of OC Energy have been included in continuing operations. Subsequent to September 30, 2008, the Company commenced discussions to potentially sell its only existing water treatment plant to generate cash to continue operations. All discussions are preliminary, an offer has not been received, nor has the Company made a formal determination that the water treatment plant will be held for sale. There can be no assurance that the revenue from the sale of the plant will be sufficient for the Company to achieve profitability in its operations, and it is possible that additional equity or debt financing may be required to continue as a going concern. Without such additional capital, there is some doubt as to whether the Company will continue as a going concern. The Company estimates the current cash reserves are expected to fund operations through Q3 of fiscal 2009.

RG GLOBAL LIFESTYLES, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

The financial statements do not include any adjustments relating to the recoverability and classification of recorded assets, or the amounts of and classification of liabilities, which might be necessary in the event the Company cannot continue in existence.

Note 3 – Property and Equipment

Property and equipment as of September 30, 2008 and March 31, 2008 consisted of the following:

| | | September 30, 2008 | | March 31, 2008 | |

| Water treatment plant | | $ | 3,016,261 | | $ | 3,016,261 | |

| Office equipment, computer software, and furniture and fixtures | | | 64,175 | | | 57,974 | |

| Accumulated depreciation | | | (322,281 | ) | | (13,351 | ) |

| Total | | $ | 2,758,155 | | $ | 3,060,884 | |

During the six months ended September 30, 2008 and 2007, the Company recorded depreciation expense of $308,930 and $2,004, respectively.

During the three months ended September 30, 2008, the Company’s water treatment plant was semi operational due to the outflow pond needing repairs from a wash out from a burst pipe and the required ongoing draining. The Company is currently addressing the issue. Due to the delays in production and current market conditions, management believes it should evaluate the carrying value of its water treatment plant and Catalyx technology to determine if an impairment is necessary. Management expects to complete the analysis during the third quarter of fiscal 2009.

Asset Retirement Obligations

The Company recognizes asset retirement costs under SFAS 143 in the period in which they are incurred. Under a water treatment contract with a customer, the Company’s owns the building and equipment but does not own the land. At the term of the contract, the Company is required to return the land to its original condition. At September 30, 2008, the balance of the Company’s asset retirement obligation was $70,000.

Note 4 – Catalyx Technology

The Company entered into a series of agreements with Catalyx Fluid Solutions, Inc. (“Catalyx”) pursuant to which the Company acquired certain technology, know-how, and patent rights related to water treatment for use in the oil and gas industry. In addition, per the terms of the acquisition agreement the initial $200,000 paid will be offset against future royalties of $0.01 per barrel of water treated and 5% of equipment sold based on the Catalyx technology. Royalties earned by Catalyx during the three and six months ended September 30, 2008 were $4,566 and were offset against the prepaid.

RG GLOBAL LIFESTYLES, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

During the six month period ended September 30, 2008 and 2007, the Company recorded amortization expense of $165,604 and $160,806, respectively.

Note 5 – Certain Balance Sheet Elements

Other Assets

At September 30, 2008 and March 31, 2008, the Company had deposits with various vendors comprised of the following:

| | | September, 30, 2008 | | March 31, 2008 | |

| Rental deposits | | $ | 32,056 | | $ | 32,557 | |

| Deposit future Catalyx royalty | | | 195,434 | | | 200,000 | |

| Other | | | 42,715 | | | 20,056 | |

| Total: | | $ | 270,205 | | $ | 252,613 | |

Accrued Liabilies

At September 30, 2008 and March 31, 2008, the Company had accrued expenses as follows:

| | | September, 30, 2008 | | March 31, 2008 | |

| Salaries and wages | | $ | 570,780 | | $ | 239,384 | |

| Deposits for preferred stock subscriptions | | | 217,483 | | | - | |

| Accrued interest | | | 42,338 | | | 44,663 | |

| Other | | | 167,984 | | | 175,226 | |

| Total: | | $ | 998,585 | | $ | 459,273 | |

During the six months ended September 30, 2008, the Company received proceeds of $217,483 for the purchase of 1,499,888 shares of preferred stock. As of September 30, 2008, the Company has recorded the proceeds received as a liability as the proper preferred stock designations have not been filed with the State of California. The Company intends to issue this stock once the State of California authorizes the designations.

Note 6 – Notes Payable

2007 Notes Payable

On January 12, 2007, the Company entered into a note agreement with an accredited investor for proceeds totaling $350,000. This note matured on January 12, 2008 and is currently in default as the holder had demanded payment. In connection with the default, the interest rate increased to 11% per annum. As of September 30 2008, accrued interest recorded in accrued liabilities related to this note was $5,367. See Note 9 for discussion of a lawsuit filed by holder of the note against the Company and the payment of accrued interest by Company.

$600,000 Promissory Note

In connection with the settlement of the $2,000,000 secured convertible notes in fiscal 2008, the Company issued a $600,000 promissory note with an interest rate of 10%, with payments due in 12 equal $50,000 monthly payments commencing on March 3, 2008. In addition, the Company issued 2,000,000 shares of common stock to an escrow account in which secures the promissory note. The promissory note can be paid in cash or the Company’s common stock at the election of the Company. If paid in common stock, the common stock will be issued at a equal to $55,000 divided by the lesser of the weighted average price (“VWAP”) over the five days preceding the due date of payment or the day on which the note is transmitted to the escrow agent. If the VWAP is lower than $0.10 or the there are insufficient shares in escrow the Company cannot settle the monthly obligation in common shares.

RG GLOBAL LIFESTYLES, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Since the $600,000 promissory note does not incur interest the Company recorded a discount of $44,444 to the promissory notes. During the three and six months ended September 30, 2008, the Company amortized $11,111 and $22,222 respectively, of the discount to interest expense. As of September 30, 2008, the remaining discount was $13,704.

During the six months ended September 30, 2008, the Company issued 1,717,729 of common stock from the escrow account to satisfy payments for the six months ending September 30, 2008 totaling $300,000. As of September 30, 2008, 182,271 shares of common stock are held in escrow.

Note Payable to Vendor

On January 29, 2008, the Company the issued a promissory note to a vendor in settlement of $780,500 in accounts payable. The vendor manufactured and installed the Company’s water treatment facility. The note bears interest at 10% per annum and is secured by the Company’s contract with Yates Petroleum Corporation and the equipment that was manufactured by the vendor. The note calls for an initial payment of $270,000 due on February 1, 2008 with monthly principal payments of $100,000 due each month until paid off. The balance due on this note at September 30, 2008 was $410,500 with accrued interest of $29,650. The Company did not make its July, August or September 2008 payment and is technically in default on this note.

Note 7 – Stockholders’ Deficit

During the six months ended September 30, 2008, the Company sold 770,000 shares of common stock to accredited investors at a price of $0.30 per share for total net cash proceeds of $231,000. As of September 30, 2008, the Company has not issued 560,000 shares of common stock related to subscriptions of $168,000. Thus, the proceeds received are recorded as “common stock to be issued” on the accompanying balance sheet. In addition, for each dollar invested the investor received a warrant to purchase one share of the Company’s common stock at an exercise price of $0.40 per share. The warrants vest immediately and expire in five years. The warrants were valued at $164,628 based upon the Black Scholes valuation model using the following weighted average estimates: 3.34% risk free rate, 303% volatility, an expected life of five years and no dividends.

During the six months ended September 30, 2008, the Company issued 380,800 shares of common stock for services rendered by consultants and employees. The services related to general corporate duties and equipment purchased for the Yates plant. The Company valued the shares on the date of issuance as there were no future performance conditions. The shares were valued at $127,179 based on the closing market price of the Company’s common stock on the date of issuance.

During the six months ended September 30, 2008, the Company issued 1,717,729 shares of common stock for payment on notes payable due to the NIR Group. The shares were valued at $384,193 based on the closing market price of the Company’s common stock on the date of issuance which resulted in additional interest expense of $84,193.

See Notes 6 and 8 for discussion of common stock issuances and other items impacting stockholders’ deficit during the six month period ending September 30, 2008 and 2007.

RG GLOBAL LIFESTYLES, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Note 8 – Options and Warrants

Options

On May 3, 2006 and December 26, 2006, the Company’s Board of Directors adopted the 2006 and 2007 Incentive and Non-statutory Stock Option Plan (“2006 Plan”) for issuance of stock options to employees and others. Compensation expense for these plans recorded during the three and six months ended September 30, 2008 was $313,684 and $747,392, respectively. Compensation expense for these plans recorded during the three and six months ended September 30, 2007 was $655,042 and $1,431,072, respectively.

The following is a summary of activity of outstanding stock option activity for the six months ended September 30, 2008:

| | | Number | |

| | | of Shares | |

| Balance, March 31, 2008 | | | 7,903,579 | |

| Options granted | | | 300,000 | |

| Options exercised | | | - | |

| Options cancelled or forfeited | | | (300,000 | ) |

| | | | | |

| Balance, September 30, 2008 | | | 7,903,579 | |

Although management believes its estimate regarding the fair value of the services to be reasonable, there can be no assurance that all of the subjective assumptions will remain constant, and therefore the valuation of the services may not be a reliable measure of the fair value of stock compensation or stock based payments for consulting services.

Warrants

Along every dollar received from an investor for the purchase of its common stock, the Company grants the investor a warrant to purchase additional shares of the Company’s common stock. The warrants, which have an exercise price of $0.40 per share and a vesting period of two to three years, have an expiration date of five years after the date of issuance. The following is a summary of activity of outstanding common stock warrants for the six months ended September 30, 2008:

| | | Number | |

| | | Of Shares | |

| | | | |

| Balance, March 31, 2008 | | | 17,163,344 | |

| Warrants granted | | | 399,000 | |

| Warrants exercised | | | (1,606,904 | ) |

| Balance, September 30, 2008 | | | 15,955,440 | |

Note 9 – Commitments and Contingencies

Legal Proceedings

On June 11, 2008, the Company and Grant King was served a lawsuit from one of its note holders claiming that the Company defaulted on repayment on a note payable in the amount of $350,000 plus interest at 8%. The complaint asks for payment of these amounts plus damages. On August 12, 2008, the parties agreed to stipulated order whereby Grant King was dismissed from the lawsuit and the Company was granted a 90-day extension to respond to the complaint (until November 10, 2008) in exchange the Company paid $49,530 which represents the interest due on the note through July 18, 2008. No amounts for damages have been accrued in the accompanying consolidated financial statement other than the note payable and accrued interest.

RG GLOBAL LIFESTYLES, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

On July 11, 2008, the Company received notice that one of the Company’s vendors used in the construction of the Company’s water treatment facility filed a lien against the project for past due amounts. As of September 30, 2008, the vendor is due $136,691, which is included in accounts payable.

Water Treatment Contracts

On June 25, 2007, the Company entered into contract with Yates Petroleum Corporation (“YPC”) to engineer, design, and install a water treatment system (“System”) of Coal Bed Methane (“CBM”) produced water provided by YPC. The Company will own and operate the System and regeneration waste pond. The Company will receive a base rate under the contract of $0.125 (12.50 cents) per barrel (42 US gallons) of water discharged by the System. The term of the contract is for 60 months from the start of the first billing cycle.

YPC is responsible for constructing the inflow pond and will receive a credit from the Company of $50,000 each month for the first three months of operation. In addition, YPC will receive credits on current billings for future repairs and maintenance to the inflow pond of which there were none during the three and six month periods ended September 30, 2008 due to the limited production.

Note 10 – Segment Reporting and Concentrations

The Company’s segments consist of the sale of energy drinks and the licensing of water treatment technology. Currently, the Company operates in a single geographical segment.

The following is a summary of revenues generated by segment for the three months and six months ended September 30, 2008:

| | | Three Months Ended September 30, 2008 | | Six Months Ended September 30, 2008 | |

| | | | | | | | |

| Water treatment revenues | | $ | - | | $ | $36,469 | |

| Energy drink sales | | | 6,851 | | | 90,419 | |

| Total | | $ | 6,851 | | $ | 126,888 | |

During the three and six months ended September 30, 2008 and 2007, one customer accounted for 100% of water treatment revenues.

RG GLOBAL LIFESTYLES, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

A summary of operating loss by segment for the three and six months ended September 30, 2008 is as follows:

| | | Three Months Ended September 30, 2008 | | Six Months Ended September 30, 2008 | |

| | | | | | | | |

| Water treatment segment | | $ | (277,592 | ) | $ | (583,394 | ) |

| OC energy drink segment | | | (97,059 | ) | | (253,605 | ) |

| Corporate segment | | | (683,403 | ) | | (1,776,305 | ) |

| Total | | $ | (1,058,054 | ) | $ | (2,613,304 | ) |

A summary of the net assets as of September 30, 2008 related to the Company’s segments, after eliminating all inter-company assets, are as follows:

| Water treatment segment | | $ | 6,687,411 | |

| OC energy drink segment | | | 363,543 | |

| Corporate segment | | | 146,494 | |

| Total | | $ | 7,197,448 | |

A summary of revenues generated by segment for the three and six months ended September 30, 2007, is as follows:

| | | Three Months Ended September 30, 2007 | | Six Months Ended September 30, 2007 | |

| | | | | | |

| Water treatment segment | | $ | 469,049 | | $ | 678,208 | |

| OC energy drink segment | | | 68,595 | | | 146,643 | |

| Total | | $ | 537,644 | | $ | 824,851 | |

A summary of operating loss by segment for the three and six months ended September 30, 2007, is as follows:

| | | Three Months Ended September 30, 2007 | | Six Months Ended September 30, 2007 | |

| Water treatment segment | | $ | 24,750 | | $ | (136,369 | ) |

| OC energy drink segment | | | (92,929 | ) | | (184,996 | ) |

| Corporate segment | | | (1,186,859 | ) | | (2,286,086 | ) |

| Total | | $ | (1,255,038 | ) | $ | (2,607,451 | ) |

During the quarter ended September 30, 2007, sales to a single customer were 100% and 58.1% of total sales for revenues related to water-treatment technology and revenues related to OC energy drink product sales, respectively.

Note 11 – Related Party Transactions

On February 11, 2008, Grant King, Chief Executive Officer, made a payment of $100,000 towards a note from a vendor and recorded it as a loan payable to a related party. On March 4, 2008, the Company repaid Grant King $30,000 against the loan. On March 14, 2008, the Company received an additional $32,700 from Grant King for operating purposes. The loan accrues interest at 11% and is due upon demand. Interest expense accrued on this loan for the six months ended September 30, 2008 was $7,320. The total loan outstanding from Grant King as of September 30, 2008 is $113,397 and accrued interest of $7,320.

RG GLOBAL LIFESTYLES, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

During the fiscal year ended March 31, 2008, the Company issued a purchase order to Catalyx Fluid Solutions, Inc. (“Catalyx”), for the purchase of resin, at the approximate cost of $756,000, needed for the operation of the Company’s wastewater treatment plant in Wyoming. Catalyx is partially owned by Juzer Jangbarwala, a Company Director and its Chief Technology Officer. In addition, from time to time Catalyx has paid for various costs related to the wastewater treatment plant on behalf of the Company, for which the Company has reimbursed Catalyx. As of September 30, 2008, amounts due to Catalyx included in accounts payable were $280,000.

In July 2007, the Company entered into a lease agreement with Catalyx Engineering, Inc. (“CEI”), a company that is owned in part by Juzer Jangbarwala, a Company Director and its Chief Technology Officer, to sub-lease approximately 7,000 square feet to serve as its new corporate office in Anaheim, California. The term of the lease is 18 months at a base monthly rent of $7,200. During the six months ended September 30, 2008, payments to CEI for rent were $36,000.

The Company utilized CEI for engineering services related to the design and construction of its water treatment plant in Wyoming. The agreement is verbal and provides engineering services at $75 per hour, which represents a 37.5% discount off of normal CEI rates. Total expenses incurred by the Company with CEI during the six months ended September 30, 2008 were $2,944. As of September 30, 2008, amounts due to CEI included in accounts payable were $23,368.

In previous periods, the Company utilized Fusion Solutions (“Fusion”) for manufacturing of product and promotional items for it OC Energy drink products. Fusion is partially owned by Mariano Fusco, a former owner and former CEO of the Company’s subsidiary, OC Energy and Albert Guerra, a partial owner of OC Energy. As of September 30, 2008, amounts due to Fusion included in accounts payable were $99,807.

During the three months ended September 30, 2008, the Company utilized Glaser Corporation (“Glaser”) for the rental of office space and equipment, as well as for accounting and administrative services for it OC Energy subsidiary. Glaser is owned by Robert Glaser, a partial owner and President of OC Energy. For the six months ended September 30, 2008, amounts expensed under this arrangement were $12,378. As of September 30, 2008, amounts due to Glaser included in accounts payable were $32,201.

Note 12 – Subsequent Events

Subsequent to September 30, 2008, the Company generated $252,500 of additional cash from the sales of 1,683,333 shares of preferred stock to 9 accredited investors.

FORWARD-LOOKING STATEMENTS

This document contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical fact are “forward-looking statements” for purposes of federal and state securities laws, including, but not limited to, any projections of earnings, revenue or other financial items; any statements of the plans, strategies and objections of management for future operations; any statements concerning proposed new services or developments; any statements regarding future economic conditions or performance; any statements or belief; and any statements of assumptions underlying any of the foregoing.

Forward-looking statements may include the words "may," "could," "estimate," "intend," "continue," "believe," "optimistic," "plan," "aim," "will," "likely," "expect" or "anticipate" or other similar words. These forward-looking statements present our estimates and assumptions only as of the date of this report. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date on which they are made. Except for our ongoing securities laws, we do not intend, and undertake no obligation, to update any forward-looking statement.

Although we believe that the expectations reflected in any of our forward-looking statements are reasonable, actual results could differ materially from those projected or assumed in any of our forward-looking statements. Our future financial condition and results of operations, as well as any forward-looking statements, are subject to change and inherent risks and uncertainties. The factors impacting these risks and uncertainties include, but are not limited to:

| | | Increased competitive pressures from existing competitors and new entrants; |

| | | Deterioration in general or regional economic conditions; |

| | | Adverse state or federal legislation or regulation that increases the costs of compliance, or adverse findings by a regulator with respect to existing operations; |

| | | Ability to grow business in OC Energy Drink product lines and CFS wastewater treatment technology, and meet or exceed its return on shareholders’ equity target, which will depend on the Company’s ability to manage its capital needs and the effect of business and/or acquisitions; |

| | | If acquisitions are made, the costs and successful integration of acquisitions; |

| | | Barriers in trade with foreign countries or tariff regulations and other United States and foreign laws; |

| | | Loss of customers or sales weakness; |

| | | Effect of environmental regulations in the field of wastewater treatment associated with coal bed methane mining; |

| | | Inability to achieve future sales levels or other operating results; |

| | | Ability to locate suitable new products for distribution within our business sector, and retain licensing rights to such new products on acceptable terms; |

| | | The continuation of favorable trends, including the drop in affordable potable water globally; |

| | | Outcomes and costs associated with litigation and potential compliance matters; |

| | | Inadequacies in the Company’s internal control over financial reporting, which could result in inaccurate or incomplete financial reporting; |

| | | Dilution to Shareholders from convertible debt or equity financings; |

| | | Loss of key management or other unanticipated personnel changes; |

| | | The unavailability of funds for capital expenditures; and |

| | | Operational inefficiencies in distribution or other systems. |

The following discussion should be read in conjunction with the historical financial statements and related notes thereto of R.G. Global Lifestyles, Inc., including Form 10-KSB as of March 31, 2008.

Item 2. Management's Discussion and Analysis of Financial Condition and Results of Operations

You should read the following discussion and analysis of our financial condition and results of operations together with "Selected Financial Data" and our financial statements and related notes appearing elsewhere in this quarterly report. This discussion and analysis contains forward-looking statements that involve risks, uncertainties, and assumptions. The actual results may differ materially from those anticipated in these forward-looking statements as a result of certain factors, including, but not limited to, those presented under "Risk Factors" in our prior SEC filings and elsewhere in this quarterly report.

OVERVIEW

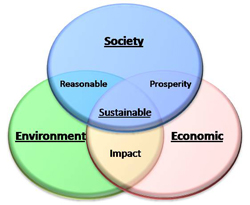

During the past year RG Global Lifestyles management has prepared the company for a transition that would generate revenue without the heavy cash requirements that have currently inhibited the growth of the company. In transitioning from a build/own/operate (B/O/O) business model, for their CBM water treatment process, to that of strategic licensing, RG Global Lifestyles will be able to move from competing in the CBM water treatment business, to a supporting partner of new technology; to some of the largest names in the industry. This move has allowed management to refocus the company’s direction through advanced research and development for strategic acquisitions of both technology and synergistic partners. This enhanced business model will benefit the company and its shareholders through diversification as well as an ability to compete globally through responsible principles of Sustainable Development.

RG Global Lifestyles

RG Global Lifestyles is a company dedicated to responsible resource utilization through the strategic balance of Environmental, Societal and Economic growth. We will achieve this through advanced research and development for strategic acquisitions of both technology and synergistic partners. The benefit will be to our shareholders, the longevity of our planet and future generations through the protection and refinement of our most valuable resources.

With strategic partnerships, through prominent global manufacturers and distributors, we have access to a worldwide distribution network. We have assembled a successful management team with a marketing history and expertise to develop and bring our cutting edge technology to market.

Catalyx Fluid Solutions (CFS) Technology:

RG Global Lifestyles Inc., through its wholly-owned division Catalyx Fluid Solutions, has patented technology developed for use in reclamation of Coal Bed Methane (CBM) discharge water. Our technology allows us to reduce the environmental impact of CBM mining and process the discharged water directly into local streams and rivers; at a significant savings compared to other technologies currently being utilized in this industry. The end result is a technology that solves a major environmental issue while providing a tremendous economic advantage in the CBM industry.

CBM is the fastest growing alternative energy sector. CBM gas is processed though the removal of trapped gas located between the coal and water table. The gas is pumped out at very low operating cost, with a very high purity level. The only restricting factor has been the disposal or processing of the discharge water that is perpetually produced as a byproduct of the CBM gas extraction. By 2010 experts expect there to be more than 50,000 wells in Wyoming alone. Each well produces an average of 6.2 million gallons of discharge water per year.

OC Energy

OC Energy receives global brand recognition through “The Real Housewives of Orange County,” a syndicated TV show on the Bravo Network, which airs in over 114 countries around the world. Even with this benefit, OC Energy has still been unable to compete with the endless marketing budgets of the Energy Drink leaders. These budgets combined with the growth of the energy shot industry have resulted in OC Energy redirecting its focus on the energy shot market. This refinement of the product line will minimize the future financial and resource impacts on RG Global lifestyles while increasing the possibility for the sale of OC Energy.

Recently the “OC Energy Shot+” was launched in a major Drug Store Chain. Energy Shots have several key advantages over traditional energy drinks. With a 2oz. shot, you get the same amount of energy as an entire 8oz. can. This increased potency means less liquid that needs to be ingested, which has an appeal to a variety of professionals. Truck drivers can travel longer without restroom breaks, doctors can pound a quick shot between patients, and the busy office professional can get help through their afternoon slump. Energy shots have nightlife appeal as well. Shots can be used straight or easily added to a drink, providing just the right boost to keep the night going. Their convenient size allow them to be transported easily in a purse or pocket, something not possible with regular energy drinks. It is clear that energy shots are the next big player in the beverage industry.

Because the Company has a controlling interest in OC Energy Drink, Inc., its results of operations are included in the Company's consolidated financial statements. The percentage of equity interest that is not owned by the Company is shown as "Minority interest in subsidiary" in the consolidated balance sheets and consolidated statements of operations. The change in value of the minority interest in subsidiary is reflected as other income in the attached consolidated statements of operations.

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

RESULTS OF OPERATIONS FOR THE THREE-MONTH PERIOD ENDED SEPTEMBER 30, 2008 AND 2007.

The following table summarizes the results of continuing operations and balance sheet amounts of the Company for the periods and dates shown:

| | | Three Months Ended September 30, | |

| | | 2008 | | 2007 | |

INCOME STATEMENT DATA | | | | | | | |

| Revenue | | $ | 6,851 | | $ | 537,644 | |

| Gross profit (loss) | | $ | (212,029 | ) | $ | 46,124 | |

| Loss from operations | | $ | (1, 058,054 | ) | $ | (1,255,038 | ) |

| Net income/loss | | $ | (1, 163,674 | ) | $ | 1,720,082 | |

| Net income/loss per weighted average common share | | $ | (0.03 | ) | $ | 0.06 | |

REVENUES

| | | For the quarter ended September 30, | | Increase/(Decrease) | |

| | | 2008 | | 2007 | | $ | | % | |

| Revenues | | $ | 6,851 | | $ | 537,644 | | $ | (530,793 | ) | | (99 | )% |

During the quarter ended September 30, 2008, revenue associated with the Company's energy drink sales accounted for 100% of its total revenues. During the quarter ended September 30, 2007, the Company’s primary source of revenues was sales of its water treatment technology, which accounting for $469,049 of total revenue. The decrease in water treatment sales as compared to the same period in 2007 was resulted from the Company shutting down the Yates plant after its first initial operation to make adjustments and modifications deemed necessary to reduce unexpected amounts of residual waste produced in the outflow pond during the filtration of the waste water. The decrease in energy drink revenues was due to redirecting the company focus from energy drinks to energy shot market. This refinement resulted in an increase to the inventory costs that were required to re-launch the product into a major drug chain.

GROSS PROFIT (LOSS)

| | | For the quarter ended September 30, | | Increase/(Decrease) | |

| | | 2008 | | 2007 | | $ | | % | |

| Gross profit (loss) | | $ | (212,029 | ) | $ | 46,124 | | $ | (258,153 | ) | | (560) | % |

During the quarter ended September 30, 2008, gross profit (loss) associated with the Company's water treatment technology was $(215,227) and the gross profit from OC Energy Drink products was $3,198. The resulting loss During the quarter ended September 30, 2008, the Company was due primarily to its inability to operate the plant at full capacity because of the excessive amounts of waste water produced by the plant in the outflow pond. Included in its cost of sales were labor costs and depreciation expense of approximately $215,227. The lower profit level from the OC Energy drink line was the result of costs associated with eliminating the existing line, its related inventory, and re-launching the reformulated energy shot. The gross profit from the Company’s results for the quarter ended September 30, 2007 resulted primarily from deferred revenue recorded on the Black Diamond project and profitable sales of its OC Energy Drink products.

TOTAL OPERATING EXPENSES

| | | For the quarter ended September 30, | | Increase/(Decrease) | |

| | | 2008 | | 2007 | | $ | | % | |

| Total Operating Expenses | | $ | 846,025 | | $ | 1,301,162 | | $ | (455,137 | ) | | (35) | % |

Total operating expenses include management and administrative personnel costs (including non-cash stock-based compensation), corporate office costs, accounting fees, legal expense, information systems expense, and product marketing and sales expense. The decrease in total operating expenses in the quarter ended September 30, 2008 as compared to the quarter ended September 30, 2007 was primarily the result of a decrease in stock-based compensation.

OTHER INCOME (EXPENSE)

| | | For the quarter ended September 30, | | Increase/(Decrease) | |

| | | | | 2007 | | $ | | % | |

| Other Income (Expense) | | $ | (105,620 | ) | $ | 2,956,535 | | $ | (3,062,155 | ) | | (103.6) | % |

The decrease in other income during the quarter ended September 30, 2008 as compared to the quarter ended September 30, 2007 resulted primarily from reduced interest expense for notes converted to stock in 2007, a reduction in the change in the fair value of common stock issued in connection with convertible notes in 2007 and a reduction in the change in fair value of derivative liabilities in 2007.

RESULTS OF OPERATIONS FOR THE SIX-MONTH PERIOD ENDED SEPTEMBER 30, 2008 AND 2007.

The following table summarizes the results of continuing operations and balance sheet amounts of the Company for the periods and dates shown:

| | | Six Months Ended September 30 | |

| | | 2008 | | 2007 | |

INCOME STATEMENT DATA | | | | | | | |

| Revenue | | $ | 126,888 | | $ | 824,851 | |

| Gross profit (loss) | | $ | (339,480 | ) | $ | 72,596 | |

| Loss from operations | | $ | (2,613,304 | ) | $ | (2,607,451 | ) |

| Net loss | | $ | (2,760,886 | ) | $ | (121,988 | ) |

| Net loss per weighted average common share | | $ | (0.06 | ) | $ | (0.00 | ) |

| | | As of September 30 | |

| | | 2008 | | 2007 | |

BALANCE SHEET DATA | | | | | | | |

| Total assets | | $ | 7,197,448 | | $ | 7,021,428 | |

| Total liabilities | | $ | 3,501,302 | | $ | 12,274,786 | |

| Stockholders' equity (deficit) | | $ | 3,696,146 | | $ | (5,253,358 | ) |

REVENUES

| | | For the six months ended September 30, | | Increase/(Decrease) | |

| | | 2008 | | 2007 | | $ | | % | |

| Revenues | | $ | 126,888 | | $ | 824,851 | | $ | (697,963 | ) | | (84.6 | )% |

During the six months ended September 30, 2008, royalty revenue associated with the Company's water treatment technology accounted for 71% of its total revenues. This revenues related solely to the treatment and purification of approximately 450,000 barrels of waste water at the Yates plant. The Company recorded $36,469 in sales of OC Energy Drink products during the six months presented. During the six months ended September 30, 2007, the Company’s primary source of revenues was sales of its water treatment technology, which accounting for $678,208 of total revenue. The decrease in water treatment sales was due to one of the Company’s current customers (Black Diamond Energy) request that the construction of its plant be delayed until it could obtain additional funding. In addition, the Company shut down the Yates plant after its first initial operation to make adjustments and modifications deemed necessary to reduce unexpected amounts of residual waste produced in the outflow pond during the filtration of the waste water. The decrease in energy drink revenues was due to a lack of sales at OC Energy resulting from its inability to market the product or obtain any contracts to place its products with retailers.

GROSS PROFIT (LOSS)

| | | For the six months ended September 30, | | Increase/(Decrease) | |

| | | 2008 | | 2007 | | $ | | % | |

| Gross profit (loss) | | $ | (339,480 | ) | $ | 72,596 | | $ | (412,076 | ) | | (568) | % |

During the quarter ended September 30, 2008, gross profit (loss) associated with the Company's water treatment technology was $(342,861) and the gross profit from OC Energy Drink products was $3,381. During the quarter ended September 30, 2008, the Company was unable to operate the plant at full capacity. Included in its cost of sales were labor costs and depreciation expense of approximately $433,280. The lower profit level from the OC Energy drink line was the result of costs associated with eliminating the existing line, its related inventory, and re-launching the reformulated energy shot. The gross profit from the Company’s results for the six months ended September 30, 2007 was primarily the result from deferred revenue recorded on the Black Diamond project and profitable sales of its OC Energy Drink products.

TOTAL OPERATING EXPENSES

| | | For the six months ended September 30, | | Increase/(Decrease) | |

| | | 2008 | | 2007 | | $ | | % | |

| Total Operating Expenses | | $ | 2,273,824 | | $ | 2,680,047 | | $ | (406,223 | ) | | (15 | )% |

Total operating expenses include management and administrative personnel costs (including non-cash stock-based compensation), corporate office costs, accounting fees, legal expense, information systems expense, and product marketing and sales expense. The decrease in total operating expenses in the six months ended September 30, 2008 as compared to the six months ended September 30, 2007 was primarily the result of a decrease in stock-based compensation..

OTHER INCOME (EXPENSE)

| | | For the six months ended September 30, | | Increase/(Decrease) | |

| | | 2008 | | 2007 | | $ | | % | |

| Other Income (Expense) | | $ | (147,582 | ) | $ | 2,466,878 | | $ | (2,614,460 | ) | | (106) | % |

The decrease in other income during the six months ended September 30, 2008 as compared to the six months ended September 30, 2007 resulted primarily from reduced interest expense for notes converted to stock in 2007, a reduction in the change in the fair value of common stock issued in connection with convertible notes in 2007and a reduction in the change in fair value of derivative liabilities in 2007.

LIQUIDITY AND CAPITAL RESOURCES

The accompanying consolidated financial statements have been prepared on a going-concern basis, which contemplates the realization of assets and satisfaction of liabilities and other commitments in the normal course of business. The report of our independent auditors contains an explanatory paragraph expressing substantial doubt about the Company’s ability to continue as a going concern as a result of recurring losses and negative cash flows. The financial statements do not include any adjustments relating to the recoverability and classification of recorded asset amounts or the amounts and classification of liabilities that may be necessary if we are unable to continue as a going concern.

The Company’s principal sources of liquidity consist of cash and cash equivalents, cash generated from product sales and construction contracts, and the issuance of equity and/or debt securities. In addition to funding operations, the Company’s principal short-term and long-term liquidity needs have been, and are expected to be, the debt service requirements of its notes payable, capital expenditures and general corporate expense expenses. In addition, as its sales and operations continue to increase, the Company anticipates significant increases in purchases of equipment for the construction of plants utilizing the CFS Technology. As of September 30, 2008, the Company had cash and cash equivalents of $18,572, accounts payable of $1,224,634, accrued liabilities of $998,585 and notes payable outstanding of $1,110,193.

The Company believes that cash expected to be generated from the issuance of debt and equity securities will be sufficient to fund its operations, anticipated capital expenditures, working capital and other financing requirements through December 31, 2008. The Company will need to continue a focused program of capital expenditures to effectuate its CFS Technology project constructions and OC Energy drink production capacity expansion. In order to fund capital expenditures or increase working capital above the current plan, or complete any acquisitions, the Company may seek to obtain additional debt or equity financing. It may also need to obtain additional debt or equity financing if it experiences downturns or cyclical fluctuations in its business that are more severe or longer than anticipated, or if the Company fails to achieve anticipated revenue, experiences significant increases in the costs associated with products sales, or if it engages in additional strategic transactions. The Company cannot provide assurance that such financing will be available to it on favorable terms, or at all. If, after utilizing the existing sources of capital available to the Company, further capital needs are identified and the Company is not successful in obtaining the financing, it may be forced to curtail its existing or planned future operations.

In addition, if needed the Company would potentially sell it’s only existing water treatment plant and move to a more royalty based revenue stream to generate cash to continue operations. There can be no assurance that the revenue from the sale of the plant will be sufficient for the Company to achieve profitability in its operations.

For the six month period ended September 30, 2008, the Company funded operations primarily through sales of its common stock to investors in the amount of $399,000.

OPERATING ACTIVITIES

Operating cash flows used during the six months ended September 30, 2008, amounted to $375,155. The primary use of operating cash was to pay consultants and salaries and wages. This was the result of a net loss of $2,760,886 offset by non-cash and non-operating items (depreciation, amortization of intangible assets, stock-based compensation and interest expense from the amortization of debt discounts) totaling $1,460,034 and net changes in current assets and liabilities of $925,697.

INVESTING ACTIVITIES

Investing cash flows used during the six months ended September 30, 2008, amounted to ($17,592) used primarily for minor capitalized costs and deposits.

FINANCING ACTIVITIES

Financing cash flows during the six months ended September 30, 2008, amounted to $399,000 and consisted entirely of, sales of its common stock to investors.

CRITICAL ACCOUNTING POLICIES

We prepare our consolidated financial statements in accordance with accounting principles generally accepted in the United States of America (US GAAP). The preparation of these financial statements requires the use of estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements and the reported amount of revenues and expenses during the reporting period. Our management periodically evaluates the estimates and judgments made. Management bases its estimates and judgments on historical experience and on various factors that are believed to be reasonable under the circumstances. Actual results may differ from these estimates as a result of different assumptions or conditions.

The methods, estimates, and judgment we use in applying our most critical accounting policies have significant impact on the results we report in our financial statements. The SEC has defined "critical accounting policies" as those accounting policies that are most important to the portrayal of our financial condition and results, and require us to make our most difficult and subjective judgments, often as a result of the need to make estimates of matters that are inherently uncertain. Based upon this definition, our most critical estimates are described below under the heading "Revenue Recognition." We also have other key accounting estimates and policies, but we believe that these other policies either do not generally require us to make estimates and judgments that are as difficult or as subjective, or it is less likely that they would have a material impact on our reported results of operations for a given period. For additional information see Note 1, "Summary of Organization and Significant Accounting Policies" in the notes to our audited financial statements appearing in our annual report on Form 10-KSB. Although we believe that our estimates and assumptions are reasonable, they are based upon information presently available, and actual results may differ significantly from these estimates.

IMPAIRMENT OF LONG-LIVED AND INTANGIBLE ASSETS

The Company has adopted Statement of Financial Accounting Standards ("SFAS") No. 144 ("SFAS 144"). The Statement requires that long-lived assets and certain identifiable intangibles held and used by the Company be reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. Events relating to recoverability may include significant unfavorable changes in business conditions, recurring losses, or a forecasted inability to achieve break-even operating results over an extended period. The Company evaluates the recoverability of long-lived assets based upon forecasted undercounted cash flows. Should impairment in value be indicated, the carrying value of intangible assets will be adjusted, based on estimates of future discounted cash flows resulting from the use and ultimate disposition of the asset. SFAS No. 144 also requires assets to be disposed of be reported at the lower of the carrying amount or the fair value less costs to sell.

REVENUE RECOGNITION

Product sales - For revenue from product sales, the Company recognizes revenue in accordance with Staff Accounting Bulletin No. 104, Revenue Recognition ("SAB104"), which superseded Staff Accounting Bulletin No. 101, Revenue Recognition in Financial Statements ("SAB101"). SAB 101 requires that four basic criteria must be met before revenue can be recognized: (1) persuasive evidence of an arrangement exists; (2) delivery has occurred; (3) the selling price is fixed and determinable; and (4) collectability is reasonably assured. Determination of criteria (3) and (4) are based on management's judgments regarding the fixed nature of the selling prices of the products delivered and the collectability of those amounts. Provisions for discounts and rebates to customers, estimated returns and allowances, and other adjustments are provided for in the same period the related sales are recorded.

Construction contracts - In accordance with Statement of Position 81-1"Accounting for Performance of Construction-Type and Certain Production-Type Contracts", the Company uses the percentage completion method for the recognition of revenue received in connection with it's engineering, equipment sale and installation contracts. In making the estimate of the percentage of revenue to recognize, the Company compares costs to the total projected cost of the contract. Accordingly, the Company recognizes that portion of the revenue and record the balance of the cash received as deferred revenues, which is included within accrued liabilities on the accompanying balance sheet.

STOCK-BASED COMPENSATION

On June 16, 2004, the FASB published Statement of Financial Accounting Standards No. 123 (Revised 2004), "Share-Based Payment" ("SFAS 123R"). SFAS 123R requires that compensation cost related to share-based payment transactions be recognized in the financial statements. Share-based payment transactions within the scope of SFAS 123R include stock options, restricted stock plans, performance-based awards, stock appreciation rights, and employee share purchase plans. The provisions of SFAS 123R were effective as of the first interim period that begins after June 15, 2005.

The Company has adopted SFAS 123R, which requires disclosure of the fair value and other characteristics of stock options, and SFAS 148 "Accounting for Stock-Based Compensation -- Transition and Disclosure," which requires more prominent disclosure about the effects of an entity's accounting policy decisions with respect to stock-based compensation on reported net loss. The Company has reflected the expense of such stock based compensation based on the fair value at the grant date for awards consistent with the provisions of SFAS No. 123R. All other options and warrants had been accounted for at fair value using the Black Scholes valuation model. Thus, the impact of adopting SFAS 123R was immaterial to the Company's financial statements.

In connection with the adoption of SFAS 123R, we estimate the fair value of our share-based compensation utilizing the Black-Scholes pricing model. The fair value of the options granted is amortized as compensation expense on a straight line basis over the requisite service period of the award, which is generally the vesting period. The fair value calculations involve significant judgments, assumptions, estimates and complexities that impact the amount of compensation expense to be recorded in current and future periods. The factors include: (1) the time period our stock-based compensation awards are expected to remain outstanding based upon the average of the original award period and the remaining vesting period in accordance with SEC Staff Accounting Bulletin 107 simplified method. Our Company's stock trading history has been relatively short (since January 2005). Our expected term assumption for awards issued was five years. As additional evidence develops from our stock's trading history, the expected term assumption will be refined to capture the relevant trends. (2) The future volatility of our stock has been estimated based upon our entire trading history from inception to the reporting date. (3) A dividend yield of zero has been assumed for awards issued during the quarter ended September 30, 2008 based upon our actual past experience and the fact that we do not anticipate paying a dividend on our shares in the near future. (4) We have based our risk-free interest rate assumption for awards issued during the quarter September 30, 2008 based upon the weighted-average yield of 5.25% available on US Treasury debt instruments with an equivalent expected term. (5) Forfeiture rates for awards issued during these periods have not yet been estimated as the Company has only recently issued share based awards and no forfeiture data has been available to the Company as a result.

The Company's accounting policy for equity instruments issued to consultants and vendors in exchange for goods and services follows the provisions of Emerging Issues Task Force ("EITF") 96-18, "Accounting for Equity Instruments That are Issued to Other Than Employees for Acquiring, or in Conjunction with Selling, Goods or Services". The measurement date for the fair value of the equity instruments issued is determined at the earlier of (i) the date at which a commitment for performance by the consultant or vendor is reached or (ii) the date at which the consultant or vendor's performance is complete. In the case of equity instruments issued to consultants, the fair value of the equity instrument is recognized over the term of the consulting agreement.

RECENT ACCOUNTING PRONOUNCEMENTS

In September 2007, the FASB issued SFAS No. 157, "Fair Value Measurements" ("SFAS 157"). SFAS 157 provides accounting guidance on the definition of fair value and establishes a framework for measuring fair value and requires expanded disclosures about fair value measurements. SFAS 157 is effective for financial statements issued for fiscal years beginning after November 15, 2008. We plan to adopt the provisions of SFAS 157 on April 1, 2009 and are currently assessing the impact of the adoption of SFAS 157 on our results of operations and financial condition.

In February 2008, the FASB issued SFAS No. 159, "The Fair Value Option for Financial Assets and Financial Liabilities--Including an amendment of FASB Statement No. 115" ("SFAS 159"). SFAS 159 permits entities to choose to measure financial instruments and certain other items at fair value. The objective is to improve financial reporting by providing entities with the opportunity to mitigate volatility in reported earnings caused by measuring related assets and liabilities differently without having to apply complex hedge accounting provisions. SFAS 159 is effective for financial statements issued for fiscal year beginning after November 15, 2008. We are currently assessing the impact of adopting SFAS 159 on our results of operations and financial condition.

In December 2007, the FASB issued SFAS No. 141(R), Business Combinations ("SFAS 141(R)"), which replaces FAS 141. SFAS 141(R) establishes principles and requirements for how an acquirer in a business combination recognizes and measures in its financial statements the identifiable assets acquired, the liabilities assumed, and any controlling interest; recognizes and measures the goodwill acquired in the business combination or a gain from a bargain purchase; and determines what information to disclose to enable users of the financial statements to evaluate the nature and financial effects of the business combination. FAS 141(R) is to be applied prospectively to business combinations.

In December 2007, the FASB issued SFAS No. 160, "Noncontrolling Interests in Consolidated Financial Statements", which is an amendment of Accounting Research Bulletin ("ARB") No. 51. This statement clarifies that a noncontrolling interest in a subsidiary is an ownership interest in the consolidated entity that should be reported as equity in the consolidated financial statements. This statement changes the way the consolidated income statement is presented, thus requiring consolidated net income to be reported at amounts that include the amounts attributable to both parent and the noncontrolling interest. This statement is effective for the fiscal years, and interim periods within those fiscal years, beginning on or after December 15, 2008. Based on current conditions, the Company does not expect the adoption of SFAS 160 to have a significant impact on its results of operations or financial position. OFF-BALANCE SHEET ARRANGEMENTS

The Company does not have any off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on the Company's financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that are material to investors.

Item 3. Quantitative and Qualitative Disclosures About Market Risk – Not Applicable

Item 4. Controls and Procedures

During its year end procedures, the Company noted several weaknesses in its internal controls. No steps have been taken to address these control weaknesses.

As required by SEC Rule 13a-15 or Rule 15d-15, our Chief Executive and Principal Accounting Officers carried out an evaluation under the supervision and with the participation of our management, of the effectiveness of the design and operation of our disclosure controls and procedures as of the end of the period covered by this report. In the course of the previous fiscal quarter ended September 30, 2008, our chief executive officer and principal accounting officer concluded that our disclosure controls and procedures were not effective in ensuring that material information relating to the Company required to be disclosed by the Company in reports that it files or submits under the Exchange Act is recorded, processed, summarized and reported within the time periods specified in the SEC's rules and forms and that such information is accumulated and communicated to management, including the chief executive officer and the Principal Accounting officer, as appropriate, to allow timely decisions regarding required disclosure.

Our management does not expect that our disclosure controls and procedures or our internal control over financial reporting will necessarily prevent all fraud and material error. Our disclosure controls and procedures are designed to provide reasonable assurance of achieving our objectives and our Chief Executive Officer and Principal Accounting Officer concluded that our disclosure controls and procedures are effective at that reasonable assurance level. Further, the design of a control system must reflect the fact that there are resource constraints, and the benefits of controls must be considered relative to their costs. Because of the inherent limitations in all control systems, no evaluation of controls can provide absolute assurance that all control issues and instances of fraud, if any, within the Company have been detected. These inherent limitations include the realities that judgments in decision-making can be faulty, and that breakdowns can occur because of simple error or mistake. Additionally, controls can be circumvented by the individual acts of some persons, by collusion of two or more people, or by management override of the internal control. The design of any system of controls also is based in part upon certain assumptions about the likelihood of future events, and there can be no assurance that any design will succeed in achieving its stated goals under all potential future conditions. Over time, control may become inadequate because of changes in conditions, or the degree of compliance with the policies or procedures may deteriorate.

Internal Control Over Financial Reporting

Pursuant to Rule 13a-15(d) or Rule 15d-15(d) of the Exchange Act, our management, with participation with the Company’s Chief Executive and Principal Accounting Officers, is responsible for evaluating any change in the company's internal control over financial reporting (as defined in Rule 13a-15(f) or Rule 15d-15(f) under the Exchange Act), that occurred during each of the issuer's fiscal quarters that has materially affected, or is reasonably likely to materially affect, the company's internal control over financial reporting.

Based on the foregoing evaluation, the Company has concluded that there was no change in our internal control over financial reporting that occurred during the fiscal quarter ended September 30, 2008, that has materially affected, or is reasonably likely to materially affect, our internal control over financial reporting.

PART II — OTHER INFORMATION

Item 1. Legal Proceedings