QuickLinks -- Click here to rapidly navigate through this document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

| Filed by the Registrantý |

| Filed by a Party other than the Registranto |

Check the appropriate box: |

| o | | Preliminary Proxy Statement |

| o | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ý | | Definitive Proxy Statement |

| o | | Definitive Additional Materials |

| o | | Soliciting Material Pursuant to §240.14a-11(c) or §240.14a-12

|

CENTERSPAN COMMUNICATIONS CORPORATION |

(Exact Name of Registrant as Specified In Its Charter) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

| ý | | No fee required |

| o | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 |

| | | (1) | | Title of each class of securities to which transaction applies: |

| | | (2) | | Aggregate number of securities to which transaction applies: |

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | (4) | | Proposed maximum aggregate value of transaction: |

| | | (5) | | Total fee paid: |

| o | | Fee paid previously with preliminary materials. |

| o | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | (1) | | Amount Previously Paid: |

| | | (2) | | Form, Schedule or Registration Statement No.: |

| | | (3) | | Filing Party: |

| | | (4) | | Date Filed:

|

To the Shareholders of CenterSpan Communications Corporation:

NOTICE IS HEREBY GIVEN that the Annual Meeting of Shareholders of CenterSpan Communications Corporation, an Oregon Corporation, will be held at the Embassy Suites, located at 319 SW Pine Street, Portland, Oregon 97204, on Tuesday, May 21, 2002, at 2:00 p.m. local time for the following purposes:

- 1.

- To elect two Class B Directors;

- 2.

- To ratify the appointment of KPMG LLP as our independent accountants for the year ending December 31, 2002;

- 3.

- To approve an amendment to the 1998 Stock Option Plan to increase from 4,100,000 to 4,850,000 the number of shares of our common stock reserved for issuance thereunder; and

- 4.

- To transact any other business as may properly come before the meeting.

Shareholders of record at the close of business on March 29, 2002 are entitled to notice of and to vote at the meeting, and any adjournment thereof.

Information concerning our activities and operating performance during the year ended December 31, 2001 is contained in our Annual Report, which is enclosed.

YOUR VOTE IS IMPORTANT. All shareholders are invited to attend the meeting. Whether or not you plan to attend the meeting, please complete the accompanying proxy and return it promptly in the enclosed return envelope. If you attend the meeting and you are a shareholder of record, you may vote in person even if you have returned your proxy.

| | | By Order of the Board of Directors, |

|

|

Mark B. Conan

Secretary |

Hillsboro, Oregon

April 19, 2002

PROXY STATEMENT FOR 2002 ANNUAL MEETING

OF SHAREHOLDERS

General

This proxy statement and the enclosed form of proxy are being mailed on or about April 19th, 2002 to shareholders of CenterSpan Communications Corporation, an Oregon corporation, in connection with the solicitation of proxies by our Board of Directors for use at our annual meeting of shareholders to be held on Tuesday, May 21, 2002, at 2:00 p.m. local time, at the Embassy Suites, located at 319 SW Pine Street, Portland, Oregon 97204, and any adjournment thereof (the "Annual Meeting").

Revocability of Proxies

A shareholder giving a proxy has the power to revoke that proxy at any time before it is exercised by filing with the Secretary of CenterSpan an instrument of revocation, or a duly executed proxy bearing a later date, or by personally attending and voting at the Annual Meeting.

Record Date and Outstanding Shares

Only shareholders of record at the close of business on March 29, 2002 (the "Record Date") will be entitled to vote at the meeting. At the close of business on the Record Date, there were 10,070,107 shares of our common stock outstanding.

Quorum and Voting

Each share of our common stock entitles the holder thereof to one vote. Under Oregon law, action may be taken on a matter submitted to shareholders only if a quorum exists with respect to such matter. A majority of the outstanding shares of our common stock entitled to vote at the Annual Meeting, present in person or represented by proxy, will constitute a quorum.

If a quorum is present, a nominee for election to the Board of Directors will be elected by a plurality of the votes cast by shares entitled to vote at the Annual Meeting. For all other matters, action will be approved if the votes cast in favor of the action exceed the votes cast opposing the action.

Shares represented by a properly executed proxy will be voted in accordance with the shareholder's instructions, if given. If no instructions are given, shares will be voted "FOR" (i) the election of the nominees for directors named herein, (ii) the ratification of the appointment of KPMG LLP as independent accountants for the year ending December 31, 2002, and (iii) the approval of an amendment to the 1998 Stock Option Plan to increase from 4,100,000 to 4,850,000 the number of shares of our common stock reserved for issuance thereunder, and will be voted in accordance with the best judgment of the persons named in the accompanying form of proxy on any other matters properly brought before the Annual Meeting. The Board of Directors knows of no other matters to be presented for action at the meeting.

Proxies that expressly indicate an abstention as to a particular proposal and broker non-votes will be counted for purposes of determining whether a quorum exists at the Annual Meeting, but will not be counted for any purposes in determining whether a proposal is approved and have no effect on the determination of whether a plurality exists with respect to a given nominee. Proxies will be received and tabulated by Mellon Investor Services (formerly ChaseMellon Shareholder Services), our transfer agent.

1

Solicitation of Proxies

This solicitation is being made on behalf of, and the cost of soliciting proxies will be borne by, CenterSpan. In addition to solicitation by mail, certain of our directors, officers, and regular employees may solicit proxies personally or by telephone or other means without additional compensation. Brokers, nominees and fiduciaries will be reimbursed in accordance with customary practice for expenses incurred in obtaining proxies or authorizations from the beneficial owners of shares of our common stock. Your cooperation in promptly completing, signing, dating and returning the enclosed proxy card will help avoid additional expense.

PROPOSAL 1: ELECTION OF DIRECTORS

The Board of Directors currently consists of five directors and is divided into three classes. The terms of the directors in each class expire at the annual meeting of shareholders in the years listed on the chart below. Under our articles of incorporation and bylaws, Class B Directors are to be elected at the 2002 annual meeting of shareholders.

Class B Directors

2005

| | Class C Director

2003

| | Class A Directors

2004

|

|---|

| Frank G. Hausmann | | Frederick M. Stevens | | David Billstrom |

| Gen. Merrill A. McPeak | | | | G. Gerald Pratt |

The Board of Directors has nominated Messrs. Hausmann and McPeak for re-election as directors in Class B, to serve for three-year terms and until their successors are elected and qualified, unless they shall earlier resign, become disqualified or disabled or shall otherwise be removed.

Although the Board of Directors anticipates that all nominees will be available to serve as directors, if any of them do not accept the nomination, or otherwise are unwilling or unable to serve, the proxies will be voted for the election of a substitute nominee or nominees designated by the Board of Directors.

THE BOARD OF DIRECTORS RECOMMENDS THAT THE SHAREHOLDERS VOTE

"FOR"

THE ELECTION OF ALL NOMINEES

BOARD OF DIRECTOR AND NOMINEE BIOGRAPHICAL INFORMATION

Set forth below are the ages, as of the Record Date, and certain biographical information for each nominee and director.

Frank G. Hausmann, 44, became a member of the Board of Directors in October 1998 and was elected Chairman of the Board in March 2000. Mr. Hausmann has been employed by CenterSpan since July 1998, serving as Chairman and Chief Executive Officer since June 2001, President and Chief Executive Officer since October 1998 and Vice President, Finance and Administration and Chief Financial Officer prior to that time. From August 1997 to May 1998, Mr. Hausmann was Vice President, Finance and Chief Financial Officer of Atlas Telecom, Inc., a developer of enhanced facsimile and voice-mail solutions, which was organized in 1985. Mr. Hausmann was recruited by Atlas in an attempt to raise $50 million necessary to effect the turn around of the company. In June 1998, Atlas filed for reorganization under the bankruptcy code. From September 1995 to July 1997, he served as Vice President, Corporate Development and General Counsel of Diamond Multimedia Systems, Inc., a designer and marketer of computer peripherals such as modems and graphics and sound cards. From June 1993 to September 1995, Mr. Hausmann was Executive Vice President and Chief Financial Officer for Supra Corporation, a designer and marketer of modems that was acquired by Diamond Multimedia Systems, Inc. in September 1995. Mr. Hausmann received B.S. degrees in economics and political

2

science from Willamette University and a J.D. degree from the University of Oregon. He is a member of the Oregon State Bar.

General Merrill A. McPeak, 66, became a member of the Board of Directors in March 1996. He has been the President of McPeak and Associates, an international aerospace consulting firm, since January 1995. He is also the President and Chief Operating Officer of Kitcomm Communications, Inc., a Bermuda-based satellite communications startup. General McPeak spent 37 years in the United States Air Force, and was Chief of Staff from October 1990 to October 1994, when he retired. He also serves on the Board of Directors and Compensation Committee of Tektronix, Inc. and TWA, Inc. and on the Board of Directors of ECC International Corp., where he serves as Chairman of the Board. He holds a B.A. degree in economics from San Diego State University and an M.S. degree in international relations from George Washington University.

David Billstrom, 40, became a member of the Board of Directors in November 1999. Mr. Billstrom is Managing Partner at FBR CoMotion Venture Capital. In January 2000, Mr. Billstrom founded FBR CoMotion Venture Capital. From January to August 1999 he was Vice President of Content Services for Infoseek/Go Network, which is now owned by Disney. In 1996, Mr. Billstrom co-founded Quando, Inc. and served as Chief Executive Officer, President and Chairman until the company was acquired by Infoseek in January 1999. Quando built and operated targeted search engines and custom directories for e-commerce, events, venues, and audio clips for such clients as AOL, IBM, Qualcomm and Infoseek. In 1993, Mr. Billstrom co-founded Media Mosaic, a CD-ROM publisher, which was restructured as Quando in January 1996. Prior to 1993, Mr. Billstrom spent seven years at Intel Corporation as a sales/marketing executive. Mr. Billstrom is a member of the board of directors of ThinkShare Corporation, MeasureCast, Inc., Vandaria, Inc. and Radio Central, Inc.

G. Gerald Pratt, 74, has been a director of the Company since its inception in 1990. Since 1980, Mr. Pratt has been a private venture capitalist. Mr. Pratt has been a trustee of the Meyer Memorial Trust, a charitable trust, since 1978.

Frederick M. Stevens, 65, became a member of the Board of Directors in December 1993. From April 1988 until his retirement in January 1991, Mr. Stevens was Chairman of the Board and Chief Executive Officer of Fred Meyer, Inc.

BOARD MEETINGS AND COMMITTEES

During 2001, there were six meetings of the Board of Directors. Each director during 2001 attended more than 75% of the aggregate number of Board of Directors' meetings and meetings of Board committees of which he was a member.

The Board of Directors has a standing Audit Committee, which for the year ended December 31, 2001 consisted of Jerome J. Meyer, Mr. Pratt and General McPeak. The Audit Committee held five meetings during 2001.

The Board of Directors also has a standing Compensation Committee, currently consisting of Messrs. Billstrom and Stevens and General McPeak. The Compensation Committee considers and acts upon management's recommendations to the Board of Directors regarding salaries, bonuses, stock options, and other forms of compensation for our executive officers. Executive officers who are also directors do not participate in decisions affecting their own compensation. The Compensation Committee held one meeting during 2001.

The Board of Directors does not have a Nominating Committee or any other committee that performs a similar function.

3

COMPENSATION OF DIRECTORS

During 2001, each non-employee director received an annual fee of $5,000 and $1,000 for each Board and committee meeting attended (unless the committee meeting was held on the same day as a Board meeting), and $500 for each Board and committee meeting attended via telephone. In 2001, each non-employee director who was a director as of January 2001 and September 2001 received options to purchase 10,000 shares of our common stock with respect to each of those dates (for options to purchase a total of 20,000 shares for a non-employee director who was a director as of both dates) at a price equal to the fair market value of our common stock on the date of grant. No employee director receives additional compensation for his or her service as a director.

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

The members of the Compensation Committee during 2001 were Messrs. Stevens and Billstrom and General McPeak, all of whom are independent, non-employee directors. None of our executive officers serves as a director or member of the Compensation Committee of any entity that has one or more executive officers serving as a member of our Board of Directors or Compensation Committee.

FAMILY RELATIONSHIPS

There are no family relationships between any director, executive officer or person nominated or chosen to be a director or executive officer of CenterSpan, and any other director, executive officer or person nominated or chosen to become a director or executive officer of CenterSpan.

4

PROPOSAL 2: RATIFICATION OF THE APPOINTMENT OF KPMG LLP AS INDEPENDENT ACCOUNTANTS

The Board of Directors has appointed KPMG LLP ("KPMG"), independent accountants, as auditors for the year ending December 31, 2002, subject to ratification by the shareholders.

A representative of KPMG is expected to be present at the Annual Meeting. The representative will be given the opportunity to make a statement on behalf of the firm if such representative so desires, and will be available to respond to appropriate shareholder questions. KPMG was our independent accountant for the year ended December 31, 2001.

Fees Paid to Auditors Related to Fiscal 2001

| Audit Fees | | $ | 70,300 |

| Financial Information Systems Design and Implementation Fees | | | — |

| All Other Fees(A) | | | 51,600 |

| | |

|

| Total | | $ | 121,900 |

| | |

|

- (A)

- All other fees include fees for tax-related services ($7,200) and for services related to CenterSpan's equity offerings ($44,400). The Audit Committee has considered and determined that the provision of these services was compatible with the accountants maintaining their independence.

REPORT OF AUDIT COMMITTEE

The Audit Committee of the Board of Directors reports to the Board and is responsible for overseeing CenterSpan's annual audit and quarterly financial reviews, the system of internal controls established by management, and the processes to assure compliance with applicable laws, regulations and internal policies. The Audit Committee is comprised of three directors, each of whom meet independence requirements under current National Association of Securities Dealers corporate governance standards. The Audit Committee's activities are governed by a written charter, which was adopted by the Board in June 2000 and a copy of which was filed with the proxy statement for our 2001 annual meeting of shareholders.

Management is responsible for CenterSpan's internal controls and the financial reporting process. The independent accountants are responsible for performing an independent audit of CenterSpan's consolidated financial statements in accordance with auditing standards generally accepted in the United States and to issue a report thereon. The Audit Committee's responsibility is to monitor and oversee these processes.

In discharging its responsibilities, the Audit Committee and its individual members have met with management and CenterSpan's independent auditors, KPMG LLP, to review the accounting functions, the audited financial statements for the year ended December 31, 2001, and the audit process. The Audit Committee discussed and reviewed with the independent auditors all matters that the independent auditors were required to communicate and discuss with the Audit Committee under applicable auditing standards, including those described in Statement on Auditing Standards No. 61, as amended, regarding communications with audit committees. Audit Committee members also discussed and reviewed the results of the independent auditors' examination of the financial statements, the quality and adequacy of CenterSpan's internal controls, and issues relating to auditor independence. The Audit Committee has obtained a formal written statement relating to independence consistent with Independence Standards Board Standard No. 1, "Independence Discussions with Audit Committee," and discussed with the auditors any relationships that may impact their objectivity and independence.

5

Based on its review and discussions with management and the independent auditors, the Audit Committee recommended to the Board that the audited financial statements be included in CenterSpan's Annual Report on Form 10-K for the fiscal year ended December 31, 2001, for filing with the United States Securities and Exchange Commission.

Submitted by the Audit Committee of the Board of Directors:

Jerome J. Meyer

Merrill A. McPeak

G. Gerald Pratt

THE BOARD OF DIRECTORS RECOMMENDS THAT THE SHAREHOLDERS VOTE

"FOR"

THE RATIFICATION OF THE APPOINTMENT OF KPMG LLP AS INDEPENDENT

ACCOUNTANTS

PROPOSAL 3: APPROVAL OF AN AMENDMENT TO THE 1998 STOCK OPTION PLAN

In order for us to continue to attract and retain key personnel, the Board of Directors has approved an amendment to the 1998 Stock Option Plan to increase the number of shares of common stock authorized thereunder by an additional 750,000 shares, increasing the total number of shares reserved for issuance thereunder from 4,100,000 to 4,850,000 shares. As of March 29, 2002, 249,242 shares remained available for grant under the 1998 Stock Option Plan. If this amendment is approved, 999,242 shares will be available for grant.

See Exhibit A for a summary of the 1998 Stock Option Plan as amended by this Proposal 3.

THE BOARD OF DIRECTORS RECOMMENDS THAT THE SHAREHOLDERS VOTE

"FOR"

THE APPROVAL OF THE AMENDMENT TO THE 1998 STOCK OPTION PLAN

6

EXECUTIVE OFFICERS

Set forth below are the ages, as of the Record Date, and certain biographical information for our executive officers.

Name

| | Age

| | Position

|

|---|

| Frank G. Hausmann(1) | | 44 | | Chairman and Chief Executive Officer |

| Mark B. Conan | | 41 | | Vice President of Finance, Administration, Chief Financial Officer and Secretary |

| Steven G. Frison | | 49 | | President and Chief Operating Officer |

| Alfred M. Lee | | 46 | | Vice President of Engineering |

| Andrew Mallinger | | 43 | | Vice President of Marketing |

- (1)

- For information regarding Mr. Hausmann, see "Board of Director and Nominee Biographical Information."

Mark B. Conan has been employed by CenterSpan since November 1999 as Vice President of Finance, Administration, Chief Financial Officer and Secretary. Prior to joining CenterSpan, he served as Vice President of Finance, Controller and Treasurer and Tax Director and Assistant Treasurer for Crown Pacific Partners, L.P. (NYSE: CRO) from 1993 to November 1999. Mr. Conan spent 10 years with Price Waterhouse LLP, as an accountant, prior to joining Crown Pacific. He earned a Bachelor of Science degree in Business Administration/Accounting from Oregon State University and is a C.P.A.

Steven G. Frison joined CenterSpan in February 2000 as Vice President, Engineering and was promoted in August 2000 to Senior Vice President, Product Development and Chief Technology Officer. In June 2001, Mr. Frison was promoted to President and Chief Operating Officer. Prior to joining CenterSpan, he served as Vice President of Product Development for nCUBE Corporation, the world's leading developer of interactive streaming media servers, where he was instrumental in developing nCUBE's next generation MediaCube 4 Video Server. From January 1996 until June 1999, Mr. Frison was Chief Technology Officer of Complete Business Solutions, Inc. (Nasdaq: CBSI) where he led the development of a Java framework for web-enabled business applications. From January 1995 through January 1996 he was the Vice President of Product Development for Now Software, Inc. From December 1993 through January 1995, he was an Engineering Manager in Intel Corporation's Personal Conferencing Division. He received his B.S. in Mathematics/Computer Science from Portland State University.

Alfred M. Lee joined CenterSpan in July 2001 as Vice President of Engineering. From September 1999 until joining CenterSpan, he was Vice President, Engineering for Supertracks, Inc., a developer of software solutions for the delivery of cached digital media and entertainment content over the Internet. From June 1995 to September 1999, Mr. Lee held various positions at ADP Dealer Services. Prior to ADP, Mr. Lee held software development and engineering management positions at E-Systems. Mr. Lee received his B.S. in Electrical Engineering from the University of Washington.

Andrew Mallinger joined CenterSpan in January 2001 as Vice President of Marketing. Prior to joining CenterSpan, he was a General Manager at InstallShield Software Corporation, where he oversaw a product team including product marketing, channel marketing, strategic alliances and product development. He also acted as InstallShield's Director of Product Management, overseeing the marketing team responsible for all InstallShield authoring products. From June 1994 to July 1998, Mr. Mallinger was Director of Product Management at CCC Information Services ("CCC"), the leading software provider to the insurance claims industry. At both InstallShield and CCC, he led teams that successfully launched new products to the market. From March 1991 to May 1994, Mr. Mallinger managed his own consulting practice, with Kraft U.S.A. being one of his clients. He holds an M.B.A.

7

from Northwestern University's J. L. Kellogg Graduate School of Management and a B.A. in Computer Science and Economics from Denison University.

EMPLOYMENT CONTRACTS AND TERMINATION OF EMPLOYMENT AND

CHANGE-IN-CONTROL ARRANGEMENTS

We have entered into arrangements with all of the executive officers listed in the table above providing for a severance payment equal to six months base salary if they are terminated without cause. We have also entered into change-in-control agreements with all the executive officers listed in the table above providing for a severance payment equal to 12 months (18 months in the case of Mr. Hausmann) base salary in the event of termination as the result of a change-in-control.

EXECUTIVE COMPENSATION

The following table sets forth the compensation paid to our Chief Executive Officer and the three other executive officers who earned more than $100,000 during 2001 (collectively, the "Named Executive Officers").

Summary Compensation Table

| |

| | Annual Compensation

| | Long-Term

Compensation

Awards

| |

|

|---|

Name and Principal Position

| | Year

| | Salary

| | Bonus

| | Other

Annual

Compensation(1)

| | Securities

Underlying

Options (#)

| | All Other

Compensation

|

|---|

Frank G. Hausmann

Chairman and CEO | | 2001

2000

1999 | | $

| 275,000

230,000

199,500 | | $

| 100,000

115,000

140,000 | | $

| 1,891

1,869

1,680 | | 265,000

85,000

100,000 | | $

| —

—

— |

Steven G. Frison(2)

President and Chief Operating Officer |

|

2001

2000

1999 |

|

|

250,000

186,667

— |

|

|

75,000

100,000

— |

|

|

2,438

2,350

— |

|

260,000

345,000

— |

|

|

—

—

— |

Mark B. Conan(3)

Vice President of Finance, Administration and CFO |

|

2001

2000

1999 |

|

|

175,000

150,000

22,500 |

|

|

15,000

45,000

12,500 |

|

|

2,297

2,250

— |

|

80,000

50,000

100,000 |

|

|

—

—

— |

Andrew Mallinger(4)

Vice President of Marketing |

|

2001

2000

1999 |

|

|

141,710

—

— |

|

|

15,000

—

— |

|

|

2,352

—

— |

|

155,000

—

— |

|

|

32,698

—

— |

- (1)

- Other annual compensation represents company matching contributions under our 401(k) plan.

- (2)

- Mr. Frison's 2000 salary represents amounts earned since joining CenterSpan in February 2000 through December 2000.

- (3)

- Mr. Conan's 1999 salary represents amounts earned since joining CenterSpan in November 1999 through December 1999.

- (4)

- Mr. Mallinger joined CenterSpan in January 2001. All other compensation for Mr. Mallinger consists of relocation assistance.

8

Option Grants

The following table sets forth information with respect to grants of stock options to the Named Executive Officers during 2001.

Option Grants In Last Fiscal Year

| | Individual Grants

| |

| |

|

|---|

| | Potential Realizable Value At

Assumed Annual Rates of

Stock Price Appreciation for

Option Term(3)

|

|---|

| | Number of

Securities

Underlying

Options

Granted(1)

| | % of Total

Options

Granted to

Employees in

Fiscal Year

| |

| |

|

|---|

Name

| | Exercise

Price ($/Sh.)(2)

| | Expiration

Date

|

|---|

| | 5%

| | 10%

|

|---|

| Frank G. Hausmann | | 100,000

65,000

100,000 | | 5.0

3.3

5.0 | %

| $

| 17.00

10.69

5.15 | | 01/11/11

04/04/11

09/21/11 | | $

| 1,069,121

436,906

323,881 | | $

| 2,709,362

1,107,205

820,777 |

Steve G. Frison |

|

100,000

40,000

120,000 |

|

5.0

2.0

6.0 |

|

|

17.00

10.69

5.15 |

|

01/11/11

04/04/11

09/21/11 |

|

|

1,069,121

268,865

388,657 |

|

|

2,709,362

681,357

984,933 |

Mark B. Conan |

|

35,000

45,000 |

|

1.8

2.3 |

|

|

17.00

5.15 |

|

01/11/11

09/21/11 |

|

|

374,192

145,746 |

|

|

948,277

369,350 |

Andrew Mallinger |

|

125,000

30,000 |

|

6.3

1.5 |

|

|

13.44

5.15 |

|

02/23/11

09/21/11 |

|

|

1,056,386

97,164 |

|

|

2,677,089

246,233 |

- (1)

- Options granted during 2001 vest as to 25% of the total amount granted on the first anniversary of the grant date with an additional 1/48th of the total vesting each month thereafter.

- (2)

- Based on the closing prices of our common stock as reported on The Nasdaq National Market on the respective grant dates.

- (3)

- This column shows the hypothetical gains or option spreads of the options granted based on assumed annual compound stock appreciation rates of 5% and 10% over the full 10-year term of the options. The assumed rates of appreciation are mandated by the rules of the Securities and Exchange Commission and do not represent our estimate or projection of our future common stock prices.

9

Option Exercises and Holdings

The following table provides information concerning unexercised options held at December 31, 2001 by the Named Executive Officers. There were no options exercised by the Named Executive Officers during 2001.

Fiscal Year-End Option Values

Name

| | Number of

Securities Underlying

Unexercised

Options

At FY-End (#)

Exercisable/

Unexercisable

| | Value of Unexercised

In-The-Money Options

At FY-End ($)(1)

Exercisable/

Unexercisable

|

|---|

| Frank G. Hausmann | | 291,667/348,333 | | $1,248,219/$486,436 |

| Steve G. Frison | | 96,250/508,750 | | 47,480/616,960 |

| Mark B. Conan | | 66,667/163,333 | | 19,784/235,316 |

| Andrew Mallinger | | —/155,000 | | —/130,500 |

- (1)

- Calculated based on the difference between the market value of the underlying securities at December 31, 2001, $9.50 per share based on the closing price of our common stock reported on the Nasdaq National Market for the date, and the exercise price of the unexercised options. The potential values have not been, and may never be, realized. The underlying options have not been, and may never be, exercised. Actual gains, if any, on exercise will depend on the value of our common stock on the date of exercise.

COMPENSATION COMMITTEE REPORT ON EXECUTIVE COMPENSATION*

It is the duty of the Compensation Committee to evaluate the performance of management, review levels of compensation, and consider related matters.

CenterSpan's compensation policy, which is endorsed by the Compensation Committee, is that a substantial portion of the annual cash compensation of executive officers should be contingent upon the performance of CenterSpan and the individual executive officer as well. As a result, a substantial portion of an executive officer's compensation is "at risk," with annual bonus compensation constituting a significant portion of total compensation.

CenterSpan's compensation programs are designed to align the executive officers' compensation with the strategic goals and performance of CenterSpan and the underlying interests of our shareholders. Accordingly, executive officers are generally granted options to purchase shares of our common stock under our stock option plans tied to their level of compensation and contribution.

The base compensation for Frank G. Hausmann, our Chairman and Chief Executive Officer, was determined by the Compensation Committee to be $275,000 for 2001 based upon prevailing market conditions. Mr. Hausmann was also awarded a bonus of $100,000 related to 2001 performance and options exercisable for 265,000 shares of our common stock.

David Billstrom

Merrill A. McPeak

Frederick M. Stevens

- *

- Neither the Compensation Committee Report nor the graph set forth below shall be deemed to be incorporated by reference into any filing by CenterSpan under either the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, except to the extent that we specifically incorporate the same by reference.

10

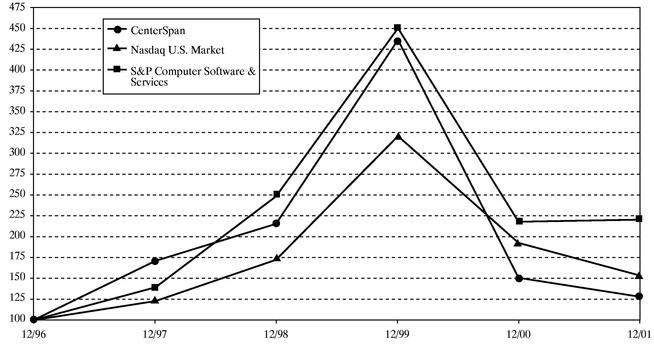

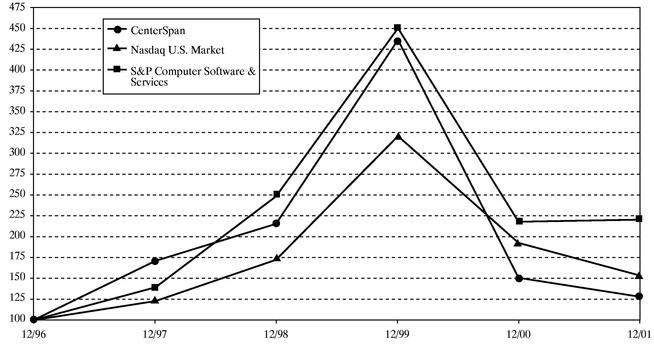

COMPARISON OF TOTAL CUMULATIVE SHAREHOLDER RETURN*

The following graph and table set forth our total cumulative shareholder return as compared to that of The Nasdaq U.S. Stock Market and of the S&P Computer Software and Services Index. The total shareholder return assumes that $100 was invested at the beginning of the period our common stock, The Nasdaq U.S. Stock Market Index and the S&P Computer Software and Services Index, with all cash dividends reinvested on the date paid. Historical stock price performance is not necessarily indicative of future stock price performance.

Company/Index

| | Base

Period

12/31/96

| | Indexed Returns

Year Ended

12/31/97

| | 12/31/98

| | 12/31/99

| | 12/31/00

| | 12/31/01

|

|---|

| CenterSpan | | $ | 100.00 | | $ | 171.39 | | $ | 216.13 | | $ | 437.33 | | $ | 151.13 | | $ | 128.33 |

| Nasdaq U.S. Market | | | 100.00 | | | 122.71 | | | 172.59 | | | 320.80 | | | 193.06 | | | 153.15 |

| S&P Computer Software & Services | | | 100.00 | | | 138.88 | | | 249.02 | | | 451.37 | | | 217.95 | | | 220.68 |

11

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information regarding beneficial ownership as of March 29, 2002 of our common stock by (i) each shareholder known by us to be the beneficial owner of more than 5% of the outstanding common stock, (ii) each director, (iii) each of the Named Executive Officers and (iv) all directors and executive officers as a group. Except as otherwise indicated, we believe that the beneficial owners of our common stock listed below, based on information furnished by such owners, have sole investment and voting power with respect to such shares.

| | Common Stock(2)

| |

|---|

Shareholder(1)

| | Number of

Shares(3)

| | Percent of Shares

Outstanding

| |

|---|

| Peter R. Kellogg(4) | | 2,380,072 | | 23.1 | % |

| Sawtooth Capital Management, L.P.(5) | | 1,060,004 | | 10.4 | % |

| G. Gerald Pratt | | 463,881 | | 4.6 | % |

| Frank G. Hausmann | | 366,632 | | 3.5 | % |

| Steven G. Frison | | 188,333 | | 1.8 | % |

| Mark B. Conan | | 85,278 | | * | |

| Frederick M. Stevens | | 65,208 | | * | |

| General Merrill A. McPeak | | 57,058 | | * | |

| David J. Billstrom | | 47,500 | | * | |

| Andrew F. Mallinger | | 39,063 | | * | |

All current executive officers and directors as a group

(9 persons) | | 1,312,953 | | 12.0 | % |

- *

- Less than 1%

- (1)

- Unless otherwise indicated, the address of each beneficial owner identified is CenterSpan Communications Corporation, 7175 NW Evergreen Parkway #400, Hillsboro, Oregon 97124.

- (2)

- Beneficial ownership is based on 10,070,107 shares outstanding as of March 29, 2002 and is determined in accordance with the rules of the Securities and Exchange Commission. For purposes of this table, a person is deemed to be the beneficial owner of securities that (i) can be acquired by such person within 60 days upon the exercise of options or warrants and (ii) are held by such person's spouse or other immediate family member sharing such person's household. Each beneficial owner's percentage ownership is determined by assuming that options and warrants held by such person, but not those held by any other person, that are exercisable within 60 days after March 29, 2002, have been exercised.

12

- (3)

- Includes/excludes options and warrants currently exercisable or exercisable within 60 days/beyond 60 days after March 29, 2002 for shares of our common stock as follows:

Name

| | Includes Shares

Subject to Options and/or

Warrants

Exercisable within 60 days

| | Excludes Shares

Subject to Options and/or

Warrants Not

Exercisable within 60 days

|

|---|

| Peter R. Kellogg | | 240,050 | | — |

| Sawtooth Capital Management, L.P. | | 89,207 | | — |

| G. Gerald Pratt | | 60,470 | | 45,250 |

| Frank G. Hausmann | | 361,632 | | 318,368 |

| Steve G. Frison | | 188,333 | | 416,667 |

| Mark B. Conan | | 85,278 | | 144,722 |

| Frederick M. Stevens | | 60,470 | | 45,250 |

| General Merrill A. McPeak | | 57,058 | | 46,042 |

| David J. Billstrom | | 47,500 | | 62,500 |

| Andrew F. Mallinger | | 39,063 | | 115,937 |

| All executive officers and directors as a group (9 persons) | | 899,804 | | 1,339,736 |

- (4)

- Mr. Kellogg's address is c/o Spear, Leeds & Kellogg, 120 Broadway, New York, NY 10271.

- (5)

- Sawtooth Capital Management, L.P. is a registered investment advisor. One client, Sawtooth Partners, L.P. owns 711,835 of such shares. Sawtooth Capital Management, L.P. has shared voting and dispositive power with respect to all shares held. Sawtooth Capital Management, L.P. is the sole general partner of Sawtooth Partners, L.P. Sawtooth Capital Management, Inc. is the sole general partner of Sawtooth Capital Management, L.P., and Bartley B. Blout is the controlling shareholder of Sawtooth Capital Management, Inc. The address for all of these persons is 360 East Avenue North, Suite 400, Ketchum, ID, 83340.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), requires any person who is a director or executive officer at any time during the fiscal year and any person who beneficially owns more than 10 percent of our common stock to report their initial ownership and any subsequent changes in that ownership to the Securities and Exchange Commission (the "SEC"). Specific due dates for such reports have been established. Persons subject to the Section 16(a) reporting requirements are required to furnish us copies of all Section 16(a) reports they file with the SEC. To our knowledge, based solely on a review of copies of such reports furnished to us and representations that no other reports are required, all Section 16(a) filing requirements applicable to such reporting persons were complied with during the year ended December 31, 2001, except as follows:

- •

- Messrs. Andrew Mallinger and Alfred Lee, both executive officers, failed to timely file a report on Form 3, Initial Statement of Beneficial Ownership of Securities;

- •

- Mr. Mark Conan, an executive officer, failed to timely file one report on Form 5, Annual Statement of Beneficial Ownership of Securities, and failed to timely report one transaction;

- •

- Mr. Steve Frison, an executive officer, failed to timely file one report on Form 5, Annual Statement of Beneficial Ownership of Securities, and failed to timely report three transactions;

- •

- Mr. Frank Hausmann, an executive officer and director failed to timely file two reports on Form 5, Annual Statement of Beneficial Ownership of Securities, and failed to timely report four transactions;

13

- •

- Messrs. Jerome Meyer, David Billstrom and Lee Mikles, each a director, each failed to timely file one report on Form 5, Annual Statement of Beneficial Ownership of Securities, and failed to timely report two transactions; and

- •

- General Merrill McPeak and Mr. Frederick Stevens, both directors, each failed to timely file three reports on Form 5, Annual Statement of Beneficial Ownership of Securities, and failed to timely report six transactions; and

- •

- Mr. Gerald Pratt, a director, failed to timely file three reports on Form 5, Annual Statement of Beneficial Ownership of Securities, and failed to timely report seven transactions.

All of the transactions not reported on a timely basis related to the grant or cancellation of stock options.

SHAREHOLDER PROPOSALS FOR 2003 ANNUAL MEETING

Shareholder proposals to be presented at the 2003 Annual Meeting of Shareholders must be received at our principal executive offices no later than December 20, 2002 in order to be included in our proxy statement and form of proxy relating to that meeting.

According to our Bylaws, for business to be properly brought before the 2003 Annual Meeting by a shareholder, the shareholder must have given timely notice thereof in writing to the Secretary. To be timely, a shareholder's notice must be delivered to or mailed and received at our principal executive offices not less than 60 days nor more than 90 days prior to the date of the 2003 Annual Meeting; provided, that in the event that less than 70 days' notice of the date of the 2003 Annual Meeting is given to the shareholders, notice by the shareholder, to be timely, must be so received not later than the close of business on the seventh day following the day on which such notice of the date of the meeting was mailed.

If we receive proper notice of a shareholder proposal pursuant to our Bylaws, but such notice is not received within a reasonable time prior to the mailing of our proxy materials for our 2003 Annual Meeting of Shareholders, our proxy holders will use the discretionary authority granted by the proxy card to vote against the proposal at the meeting without including any disclosure of the proposal in the proxy statement relating to such meeting.

OUR 2001 ANNUAL REPORT TO SHAREHOLDERS ACCOMPANIES THESE MATERIALS. COPIES OF OUR ANNUAL REPORT ON FORM 10-K FOR THE FISCAL YEAR ENDED DECEMBER 31, 2001 MAY BE OBTAINED WITHOUT CHARGE UPON WRITTEN REQUEST. REQUESTS SHOULD BE DIRECTED TO THE SECRETARY, CENTERSPAN COMMUNICATIONS CORPORATION, 7175 N.W. EVERGREEN PARKWAY #400, HILLSBORO, OREGON 97124.

|

|

Mark B. Conan

Secretary |

| April 19, 2002 | | CenterSpan Communications Corporation |

14

EXHIBIT A

1998 STOCK OPTION PLAN SUMMARY,

AS AMENDED BY PROPOSAL 3

General

In 1998, our shareholders approved the 1998 Stock Option Plan (the "1998 Plan"). The purpose of the 1998 Plan is to enhance our long-term shareholder value by offering opportunities to employees (and persons offered employment), directors, officers, consultants, agents, advisors and independent contractors to participate in our growth and success, and to encourage them to remain in our service and to acquire and maintain stock ownership. The 1998 Plan is administered by the Compensation Committee of the Board of Directors.

Eligibility

As of March 29, 2002, the persons eligible to participate in the 1998 Plan included five officers, four non-employee directors and approximately 71 other employees. As of March 29, 2002, options to purchase 2,501,555 shares of our common stock were outstanding at an average exercise price of $11.63 per share, 1,349,203 shares of common stock had been issued upon exercise of options and, assuming approval of the proposed amendment, 999,242 shares of common stock were available for future grants under the 1998 Plan. If our shareholders do not approve the proposed amendment at this annual meeting, the number of shares available for future grants will remain at 249,242 shares.

Stock Subject to the 1998 Plan

Subject to adjustment from time to time as provided in the 1998 Plan, the maximum number of shares of Common Stock available for issuance under the 1998 Plan, assuming the approval of the proposed amendment, is equal to the sum of: (a) 3,250,000 shares of common stock; (b) any shares of common stock available for future awards under (i) our 1994 Stock Incentive Plan and (ii) our Directors' Stock Incentive Plan; and (c) any shares of common stock that are represented by awards granted under our 1994 Stock Incentive Plan or our Directors' Stock Incentive Plan that are forfeited, expire or are canceled without delivery of shares of common stock or which result in the forfeiture of shares of common stock back to us. Assuming shareholder approval of the proposed amendment, at March 29, 2002, the sum of (a), (b) and (c) totaled 4,850,000. If our shareholders do not approve this proposed amendment at this annual meeting, the total number of shares authorized for issuance under the 1998 Plan would remain at 4,100,000.

Subject to adjustment from time to time as provided in the 1998 Plan, no more than 200,000 shares of common stock may be subject to aggregate awards under the 1998 Plan to any participant in any one year, except that we may make additional one-time grants of up to 250,000 shares to newly hired individuals, such limitation to be applied consistently with the requirements of, and only to the extent required for compliance with, certain provisions of Section 162(m) of the Internal Revenue Code of 1986, as amended, which precludes us from taking a tax deduction for compensation payments to executives in excess of $1.0 million, unless such payments qualify for the "performance-based" exemption from the $1.0 million limitation.

Any shares of Common Stock that cease to be subject to an option will be available for issuance in connection with future grants under the 1998 Plan. Options also may be granted in replacement of, or as alternatives to, grants or rights under any other employee or compensation plan or in substitution for, or by the assumption of, awards issued under plans of an acquired entity.

A-1

Eligibility to Receive Options

Options may be granted under the 1998 Plan to those officers, directors and employees as the plan administrator from time to time selects. Options may also be granted to consultants, agents, advisors and independent contractors who provide services to us and our subsidiaries.

Terms and Conditions of Stock Option Grants

Options granted under the 1998 Plan may be Incentive Stock Options ("ISOs") or Non-Statutory Stock Options ("NSOs"). The per share exercise price for each option granted under the 1998 Plan will be determined by the plan administrator, but will be not less than 100% of the fair market value of a share of common stock on the date of grant with respect to ISOs. For purposes of the 1998 Plan, "fair market value" means the closing price for a share of common stock as reported by the Nasdaq National Market for a single trading day.

The exercise price for shares purchased under options may be paid in cash or by check or, unless the plan administrator at any time determines otherwise, a combination of cash, check, shares of common stock which have been held for at least six months, delivery of a properly executed exercise notice together with certain irrevocable instructions to a broker, or such other consideration as the plan administrator may permit. We may require the optionee to pay to us any applicable withholding taxes that we are required to withhold with respect to the grant or exercise of any award. The withholding tax may be paid in cash or, subject to applicable law, the plan administrator may permit the optionee to satisfy such obligations by the withholding or delivery of shares of common stock. We may withhold from any shares of common stock issuable pursuant to an option or from any cash amounts otherwise due from us to the recipient of the award an amount equal to such taxes. We may also deduct from any option any other amounts due from the recipient to us or any of our subsidiaries.

The option term is fixed by the plan administrator, and each option is exercisable pursuant to a vesting schedule determined by the plan administrator. If the vesting schedule is not set forth in the instrument evidencing the option, the option will become exercisable in four equal annual installments beginning one year after the date of grant. The plan administrator also determines the circumstances under which an option will be exercisable in the event the optionee ceases to be employed by, or to provide services to, us or one of our subsidiaries. If not so established, options generally will be exercisable for one year after termination of services as a result of retirement, early retirement at our request, disability or death and for three months after all other terminations. An option automatically terminates if the optionee's services are terminated for cause, as defined in the 1998 Plan.

Transferability

No option is assignable or otherwise transferable by the holder other than by will or the laws of descent and distribution and, during the holder's lifetime, may be exercised only by the holder, unless the plan administrator determines otherwise in its sole discretion, and except to the extent permitted by Section 422 of the Code.

Federal Tax Effects of ISOs

We intend that ISOs granted under the 1998 Plan will qualify as ISOs under Section 422 of the Code. An optionee acquiring stock pursuant to an ISO receives favorable tax treatment in that the optionee does not recognize any taxable income at the time of the grant of the ISO or upon exercise. The tax treatment of the disposition of ISO stock depends upon whether the stock is disposed of within the holding period, which is the later of two years from the date the ISO is granted or one year from the date the ISO is exercised. If the optionee disposes of ISO stock after completion of the holding period, the optionee will recognize as capital gains income the difference between the amount received in such disposition and the basis in the ISO stock, i.e. the option's exercise price. If the optionee

A-2

disposes of ISO stock before the holding period expires, it is considered a disqualifying disposition and the optionee must recognize the gain on the disposition as ordinary income in the year of the disqualifying disposition. Generally, the gain is equal to the difference between the option's exercise price and the stock's fair market value at the time the related stock is sold. While the exercise of an ISO does not result in taxable income, there are implications with regard to the alternative minimum tax ("AMT"). When calculating income for AMT purposes, the favorable tax treatment granted ISOs is disregarded and the difference between the option exercise price and the fair market value of the related common stock on the date of exercise (the "bargain purchase element") will be considered as part of AMT income. Just as the optionee does not recognize any taxable income on the grant or exercise of an ISO, we are not entitled to a deduction on the grant or exercise of an ISO. Upon a disqualifying disposition of ISO stock, we may deduct from taxable income in the year of the disqualifying disposition an amount generally equal to the amount that the optionee recognizes as ordinary income due to the disqualifying disposition.

Federal Tax Effects of NSOs

If an option does not meet the statutory requirements of Section 422 of the Code and therefore does not qualify as an ISO, the difference, if any, between the option's exercise price and the fair market value of the stock on the date the option is exercised is considered compensation and is taxable as ordinary income to the optionee in the year the option is exercised, and is deductible by us for federal income tax purposes in such year.

The foregoing summary of federal income tax consequences of stock options does not purport to be complete, nor does it discuss the provisions of the income tax laws of any state or foreign country in which the optionee resides.

Corporate Transactions

In the event of certain mergers, consolidations, sales or transfers of substantially all of our assets or a liquidation of CenterSpan, each option, that is at the time outstanding, will automatically accelerate so that each such option becomes, immediately prior to such corporate transaction, 100% vested, except that such option will not so accelerate if and to the extent such option is, in connection with the corporate transaction, either to be assumed by the successor corporation or parent thereof or to be replaced with a comparable award for the purchase of shares of the capital stock of the successor corporation. Any such options granted to an "executive officer" (as defined for purposes of Section 16 of the Exchange Act) that are assumed or replaced in the corporate transaction and do not otherwise accelerate at that time shall be accelerated in the event such holder's employment or services shall subsequently terminate within two years following such corporate transaction, unless such employment or services are terminated by the successor corporation or parent thereof for cause or by the holder voluntarily without good reason.

Further Adjustment of Options

The plan administrator shall have the discretion, exercisable at any time before a sale, merger, consolidation, reorganization, liquidation or change in control of CenterSpan, as defined by the plan administrator, to take such further action as it determines to be necessary or advisable, and fair and equitable to holders, with respect to options. Such authorized action may include (but is not limited to) establishing, amending or waiving the type, terms, conditions or duration of, or restrictions on, options so as to provide for earlier, later, extended or additional time for exercise or settlement and other modifications, and the plan administrator may take such actions with respect to all holders, to certain categories of holders or only to individual holders. The plan administrator may take such actions before or after granting options to which the action relates and before or after any public announcement with

A-3

respect to such sale, merger, consolidation, reorganization, liquidation or change in control that is the reason for such action.

Amendment and Termination

The 1998 Plan may be suspended or terminated by the Board of Directors at any time. The Board may amend the 1998 Plan, as it deems advisable, subject to shareholder approval in certain instances, as set forth in the 1998 Plan. If not earlier terminated, the 1998 Plan terminates ten years after the date the 1998 Plan was adopted by the Board of Directors.

New Plan Benefits

The following options have been granted under the 1998 Plan from January 1, 2002 through March 29, 2002:

Name and Position

| | Number of Options(A)

|

|---|

| Frank G. Hausmann, Chairman and Chief Executive Officer | | 35,000 |

| Mark B. Conan, Vice President, Finance and Administration | | — |

| Steven G. Frison, President and Chief Operating Officer | | — |

| Andrew F. Mallinger, Vice President, Product Marketing | | — |

| David J. Billstrom, Director | | — |

| General Merrill A. McPeak, Director | | — |

| G. Gerald Pratt, Director | | — |

| Frederick M. Stevens, Director | | — |

| All Current Executive Officers as a Group (5 people) | | 35,000 |

| All Current Non-Executive Officer Directors as a Group (4 people) | | — |

| All Non-Executive Officer Employees as a Group (71 people) | | 143,875 |

- (A)

- The options granted to Mr. Hausmann are non-qualified and were granted at an exercise price per share of $5.15, which was at a discount from the fair market value of our common stock on the date of grant. All other options were granted at an exercise price per share that was equal to the fair market value of our common stock on the date of grant. The average per share exercise price of all option grants included in the above table is $7.58. The options granted shall become exercisable over a four-year period and expire ten years from the date of grant. Option grants under the 1998 Stock Option Plan are made at the discretion of the Plan Administrator and, therefore, grants for the remainder of 2002 or thereafter are not currently determinable.

A-4

CENTERSPAN COMMUNICATIONS CORPORATION

7175 N.W. Evergreen Parkway #400

Hillsboro, OR 97124-5839

PROXY FOR THE MAY 21, 2002 ANNUAL MEETING OF SHAREHOLDERS

This Proxy is Solicited By the Board of Directors of CenterSpan Communications Corporation (the "Company").

The undersigned shareholder(s) of the Company hereby appoint Frank G. Hausmann and Mark B. Conan and each of them, as proxies, each with the power of substitution to represent and to vote, as designated in this Proxy, all the shares of common stock of the Company held of record by the undersigned as of March 29, 2002, at the Annual Meeting of Shareholders to be held at 2:00 p.m., May 21, 2002 at the Embassy Suites, located at 319 SW Pine Street, Portland, Oregon 97204 and at any and all adjournments thereof.

| 1. | | PROPOSAL 1—Election of Class B Directors for terms expiring in 2005 |

|

|

|

|

o FOR all nominees listed below |

|

|

|

|

o WITHHOLD AUTHORITY to vote for all nominees listed below |

|

|

To withhold authority to vote for any individual nominee, strike a line through the nominee's name in the list below: |

|

|

Frank G. Hausmann |

|

General Merrill A. McPeak |

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTEFOR EACH OF

THE NOMINEES NAMED ABOVE. |

|

|

Although the Board of Directors anticipates that all nominees will be available to serve as Directors of the Company, if any nominee is unable, or for good cause is unwilling to serve, this Proxy will be voted for the election of a substitute nominee or nominees designated by the Board of Directors. |

2. |

|

PROPOSAL 2—To ratify the appointment of KPMG LLP as the Company's independent accountants for the year ending December 31, 2002. |

|

|

FOR PROPOSAL 2o |

|

AGAINST PROPOSAL 2o |

|

ABSTAIN ON PROPOSAL 2o |

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTEFOR THE

APPROVAL OF PROPOSAL 2 |

3. |

|

PROPOSAL 3—To approve an amendment to the 1998 Stock Option Plan to increase from 4,100,000 to 4,850,000 the number of shares available thereunder. |

|

|

FOR PROPOSAL 3o |

|

AGAINST PROPOSAL 3o |

|

ABSTAIN ON PROPOSAL 3o |

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTEFOR THE

APPROVAL OF PROPOSAL 3 |

4. |

|

Upon such other matters as may properly come before, or incident to the conduct of the Annual Meeting, the Proxy holders shall vote in such manner as they determine to be in the best interests of the Company. The Board of Directors is not presently aware of any such matters to be presented for action at the meeting. |

IF NO SPECIFIC DIRECTION IS GIVEN AS TO ANY OF THE ABOVE ITEMS, THIS PROXY WILL BE VOTEDFOR EACH OF THE NOMINEES NAMED IN PROPOSAL 1 ANDFOR PROPOSALS 2 AND 3. |

| Signature(s) |

| Dated | ,

| | 2002 |

NOTE: |

Please sign as name appears hereon. Joint owners should each sign. When signing as attorney, executor, administrator, trustee or guardian, please give full title as such. |

I do ( ) do not ( ) plan to attend the meeting. (Please check)

The shareholder signed above reserves the right to revoke this Proxy at any time prior to its exercise by written notice delivered to the Company's Secretary at the Company's corporate offices at 7175 NW Evergreen Parkway #400, Hillsboro, Oregon 97124, prior to the Annual Meeting. The power of the Proxy holders shall also be suspended if the shareholder signed above appears at the Annual Meeting and elects in writing to vote in person.

QuickLinks

PROXY STATEMENT FOR 2002 ANNUAL MEETING OF SHAREHOLDERSPROPOSAL 1: ELECTION OF DIRECTORSTHE BOARD OF DIRECTORS RECOMMENDS THAT THE SHAREHOLDERS VOTE "FOR" THE ELECTION OF ALL NOMINEESBOARD MEETINGS AND COMMITTEESCOMPENSATION OF DIRECTORSCOMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATIONFAMILY RELATIONSHIPSPROPOSAL 2: RATIFICATION OF THE APPOINTMENT OF KPMG LLP AS INDEPENDENT ACCOUNTANTSREPORT OF AUDIT COMMITTEETHE BOARD OF DIRECTORS RECOMMENDS THAT THE SHAREHOLDERS VOTE "FOR" THE RATIFICATION OF THE APPOINTMENT OF KPMG LLP AS INDEPENDENT ACCOUNTANTSPROPOSAL 3: APPROVAL OF AN AMENDMENT TO THE 1998 STOCK OPTION PLANTHE BOARD OF DIRECTORS RECOMMENDS THAT THE SHAREHOLDERS VOTE "FOR" THE APPROVAL OF THE AMENDMENT TO THE 1998 STOCK OPTION PLANEXECUTIVE OFFICERSEMPLOYMENT CONTRACTS AND TERMINATION OF EMPLOYMENT AND CHANGE-IN-CONTROL ARRANGEMENTSEXECUTIVE COMPENSATIONSummary Compensation TableOption Grants In Last Fiscal YearFiscal Year-End Option ValuesCOMPENSATION COMMITTEE REPORT ON EXECUTIVE COMPENSATIONCOMPARISON OF TOTAL CUMULATIVE SHAREHOLDER RETURNSECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENTSECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCESHAREHOLDER PROPOSALS FOR 2003 ANNUAL MEETING1998 STOCK OPTION PLAN SUMMARY, AS AMENDED BY PROPOSAL 3PROXY FOR THE MAY 21, 2002 ANNUAL MEETING OF SHAREHOLDERS