UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant [X]

Filed by a Party other than the Registrant [ ]

Check the appropriate box:

| [ ] | Preliminary Proxy Statement |

| [ ] | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| [X] | Definitive Proxy Statement |

| [ ] | Definitive Additional Materials |

| [ ] | Soliciting Material Pursuant to §240.14a-12 |

SPY INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| [X] | No fee required. |

| [ ] | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | | |

| | (2) | Aggregate number of securities to which transaction applies: |

| | | |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | |

| | (4) | Proposed maximum aggregate value of transaction: |

| | | |

| | (5) | Total fee paid: |

| | | |

| | | |

| [ ] | Fee paid previously with preliminary materials. |

| [ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | | |

| | (2) | Form, Schedule or Registration Statement No.: |

| | | |

| | (3) | Filing Party: |

| | | |

| | (4) | Date Filed: |

| | | |

May 1, 2014

Dear Stockholder:

We invite you to attend the Annual Meeting of Stockholders of SPY Inc. on Wednesday, June 4, 2014, at 9:00 a.m. (local time), at our offices located at 2070 Las Palmas Drive, Carlsbad, California 92011.

This booklet includes the formal notice of the meeting and the proxy statement for the meeting. After reading the proxy statement, please mark, date, sign and return, at your earliest convenience, the enclosed proxy in the enclosed envelope to ensure that your shares will be represented at the meeting. You may also submit your proxy by telephone or online by following the instructions on the enclosed proxy card. YOUR SHARES CANNOT BE VOTED UNLESS YOU SIGN, DATE AND RETURN THE ENCLOSED PROXY, SUBMIT YOUR VOTE BY TELEPHONE OR ONLINE, OR ATTEND THE ANNUAL MEETING AND VOTE IN PERSON. In addition, we have enclosed a copy of our Annual Report on Form 10-K, which includes our financial statements for the year ended December 31, 2013.

Your vote is important, so please return your proxy promptly. Our Board of Directors and management look forward to seeing you at the meeting.

Michael Marckx

President and Chief Executive Officer

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD

JUNE 4, 2014

To the Stockholders of SPY Inc.:

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders of SPY Inc., a Delaware corporation, will be held on Wednesday, June 4, 2014, at 9:00 a.m. (local time), at our offices located at 2070 Las Palmas Drive, Carlsbad, California 92011, for the following purposes:

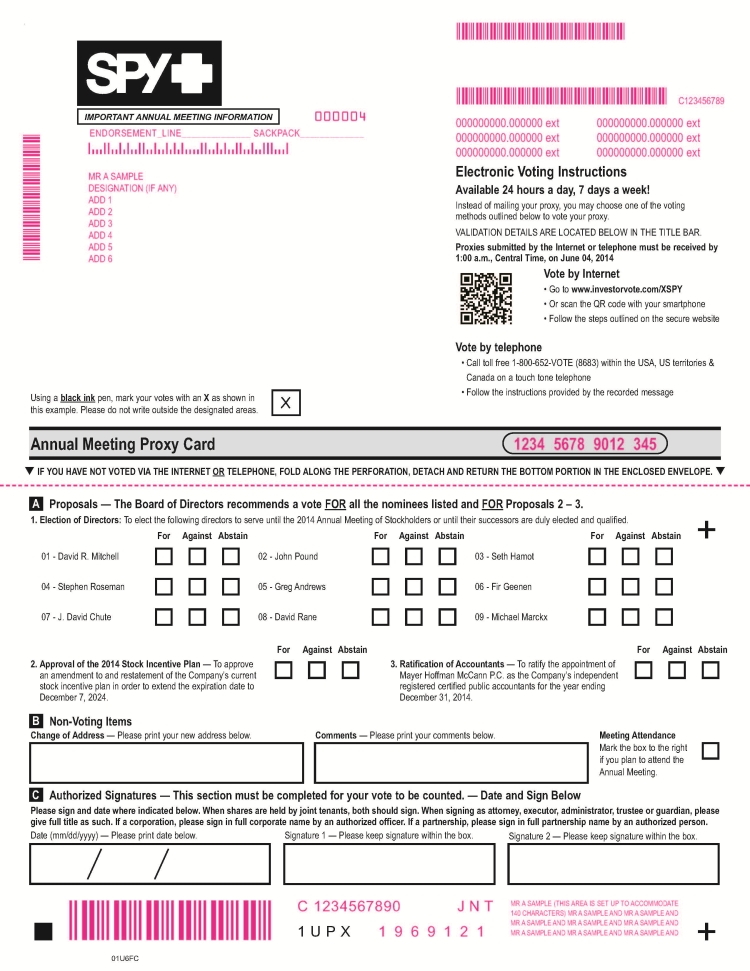

| | 1. | To elect nine directors to serve until the 2015 Annual Meeting of Stockholders or until their successors are duly elected and qualified; |

| | 2. | To approve the Company’s 2014 Stock Incentive Plan, which amends and restates our current stock incentive plan to extend the expiration date to December 7, 2024; |

| | 3. | To ratify the appointment of Mayer Hoffman McCann P.C. as our independent registered certified public accountants for the year ending December 31, 2014; and |

| | 4. | To transact such other business as may properly come before the annual meeting and any adjournment or postponement thereof. |

Stockholders of record as of the close of business on April 11, 2014 are entitled to notice of and to vote at the annual meeting and any adjournment or postponement thereof. A complete list of stockholders entitled to vote at the annual meeting will be available for inspection at our Secretary’s office, located at 2070 Las Palmas Drive, Carlsbad, California 92011, for ten days before the annual meeting.

It is important that your shares are represented at the annual meeting. Even if you plan to attend the meeting, we hope that you will promptly mark, sign, date and return the enclosed proxy, or submit your proxy by telephone or online. This will not limit your right to attend or vote at the meeting.

Sincerely,

James McGinty

Chief Financial Officer, Treasurer and Secretary

Carlsbad, California

May 1, 2014

2070 LAS PALMAS DRIVE

CARLSBAD, CALIFORNIA 92011

PROXY STATEMENT

Important Notice Regarding the Availability of Proxy Materials

for the Annual Meeting of Stockholders to be held on June 4, 2014:

The Notice of Annual Meeting of Stockholders, the Proxy Statement and Annual Report to Stockholders are available at: www.proxyconnect.com/spy

General

This Proxy Statement is furnished in connection with the solicitation by the Board of Directors (the “Board”) of SPY Inc., a Delaware corporation (the “Company,” “we,” “us,” or “our”), of proxies for use at the Annual Meeting of Stockholders of the Company to be held at the Company’s offices located at 2070 Las Palmas Drive, Carlsbad, California 92011, on Wednesday, June 4, 2014, at 9:00 a.m. (local time), and at any adjournment or postponement thereof (the “Annual Meeting”). This Proxy Statement, the enclosed proxy card and the Company’s Annual Report on Form 10-K are first being mailed to stockholders on or about May 1, 2014.

Who Can Vote

Stockholders of record at the close of business on April 11, 2014 (the “Record Date”) are entitled to notice of and to vote at the Annual Meeting. As of the close of business on the Record Date, the Company had 13,337,165 shares of common stock, $0.0001 par value per share, issued and outstanding. Each holder of common stock is entitled to one vote for each share held as of the Record Date.

How You Can Vote

If you are a record holder of our common stock, you may vote your shares at the Annual Meeting either in person or by proxy. You may submit your vote one of four ways: (i) mark, date, sign and mail the enclosed proxy in the prepaid envelope; (ii) via telephone by following the instructions on the enclosed proxy for telephonic voting; (iii) online, by following the instructions on the enclosed proxy for online voting; or (iv) in person at the Annual Meeting. Submitting a proxy will not affect your right to vote your shares if you attend the Annual Meeting and want to vote in person. The shares represented by proxy in response to this solicitation and not properly revoked will be voted at the Annual Meeting in accordance with the instructions therein. On the matters presented at the Annual Meeting for which a choice has been specified by a stockholder on a proxy card, the shares will be voted accordingly. If you return your proxy but do not indicate your voting preference, your shares will be voted: (i) FOR the election of the nominees for directors listed in this Proxy Statement; (ii) FOR the approval of the Company’s 2014 Stock Incentive Plan, which amends and restates our current stock incentive plan to extend the expiration date to December 7, 2024 (the “2014 Plan”); and (iii) FOR the ratification of the appointment of the Company’s independent registered certified public accountants.

If a bank holds your shares, broker or other institution, you will receive instructions from the holder of record that you must follow for your shares to be voted.

Broker Non-Votes

A “broker non-vote” occurs when a nominee (typically a broker or bank) holding shares for a beneficial owner (typically referred to as shares being held in “street name”) submits a proxy for the Annual Meeting, but does not vote on a particular proposal because the nominee has not received voting instructions from the beneficial owner and does not have discretionary authority to vote the shares with respect to that proposal.

Brokers and other nominees may vote on “routine” proposals on behalf of beneficial owners who have not furnished voting instructions, subject to the rules applicable to broker nominees concerning transmission of proxy materials to beneficial owners, and subject to any proxy voting policies and procedures of those firms. The ratification of the independent registered public accountants, for example, is a routine proposal. Brokers and other nominees may not vote on “non-routine” proposals, unless they have received voting instructions from the beneficial owner. The election of directors and the approval of the 2014 Plan are “non-routine” proposals. This means that brokers and other firms must obtain voting instructions from the beneficial owner to vote on the election of directors and approval of the 2014 Plan; otherwise they will not be able to cast a vote for these “non-routine” proposals. If your shares are held in the name of a broker, bank or other nominee, please follow their voting instructions so you can instruct your broker on how to vote your shares.

Revocation of Proxies

Stockholders of record can revoke their proxies at any time before they are exercised in any one of three ways:

| | • | | by voting in person at the Annual Meeting; |

| | • | | by submitting written notice of revocation to the Secretary of the Company prior to the Annual Meeting; or |

| | • | | by submitting another proxy bearing a later date that is properly executed prior to or at the Annual Meeting. |

Quorum

In order for any business to be conducted at the Annual Meeting, there must be a quorum, meaning a majority of the shares of our common stock issued and outstanding and entitled to vote at the Annual Meeting must be present, either in person or by proxy. If you submit a properly executed proxy, regardless of whether you abstain from voting on one or more matters, your shares will be counted as present at the Annual Meeting for the purpose of establishing a quorum. Shares that constitute broker non-votes will also be counted as present at the Annual Meeting for the purpose of establishing a quorum. If a quorum is not present at the scheduled time of the Annual Meeting, the stockholders who are present may adjourn the Annual Meeting until a quorum is present. The time and place of the adjourned Annual Meeting will be announced at the time the adjournment is taken, and no other notice will be given. An adjournment will have no effect on the business that may be conducted at the Annual Meeting.

Vote Required for Approval

Proposal One: Election of Directors. Directors are elected by a plurality vote. This means the director nominees who receive the highest number of affirmative votes cast at the Annual Meeting, up to the number of directors to be elected, will be elected as directors. Abstentions and broker non-votes will have no effect on the outcome of the election of the directors.

Proposal Two: Approval of the 2014 Plan. The affirmative “FOR” vote of a majority of the shares present in person or by proxy and entitled to vote is necessary for approval of the 2014 Plan. A properly executed proxy marked “ABSTAIN” will not be voted, although it will be counted as present and entitled to vote for purposes of the Proposal. Accordingly, an abstention will have the same effect as a vote against this Proposal. Broker “non-votes” will have no effect on the outcome of this Proposal.

Proposal Three: Ratification of Appointment of Auditors: The affirmative “FOR” vote of a majority of the shares present in person or by proxy and entitled to vote is necessary to approve this proposal. A properly executed proxy marked “ABSTAIN” will not be voted, although it will be counted as present and entitled to vote for purposes of the Proposal. Accordingly, an abstention will have the effect of a vote against this Proposal. A broker or other nominee will generally have discretionary authority to vote on this Proposal because it is considered a routine matter, and therefore we do not expect broker non-votes with respect to this Proposal. However, any broker non-votes received will have no effect on the outcome of this Proposal.

IMPORTANT

Please mark, sign and date the enclosed proxy and return it at your earliest convenience in the enclosed postage-prepaid return envelope, or place your vote by telephone or online, so that, whether you intend to be present at the Annual Meeting or not, your shares can be voted. This will not limit your rights to attend or vote at the Annual Meeting.

PROPOSAL ONE

ELECTION OF DIRECTORS

General

The Board currently consists of ten members. At the Annual Meeting, one of our directors, Harry Casari, will not stand for re-election. As a result, following the Annual Meeting, the size of the Board will be reduced to nine members. Accordingly, nine director candidates will be elected to serve until the 2015 Annual Meeting of Stockholders or until their successors are duly elected and qualified. If any nominee is unable or declines to serve as a director at the time of the Annual Meeting, an event not currently anticipated, votes pursuant to the proxy will be cast for a substitute candidate as may be designated by the Nominating and Corporate Governance Committee of the Board or in the absence of such designation, in a manner as the proxy holders determine in their discretion. Alternately, in any such situation, the directors may, subject to the terms of our certificate of incorporation, take action to fix the number of directors for the ensuing year at the number of nominees and incumbent directors who are then able to serve. Proxies will then be voted for the election of such nominees as specified in the proxies.

Required Vote

Directors are elected by a plurality vote. This means that the nominees for directors who receive the highest number of affirmative votes cast at the Annual Meeting, up to the number of directors to be elected, will be elected as directors. Abstentions and broker non-votes will have no effect on the outcome of the election of the directors.

The Board recommends a vote “FOR” the election of each nominee set forth below.

Biographical information concerning the nominees for director is set forth below.

| Name | | Served as | | Age | | Principal Business Experience |

| Director |

| Since |

| | | | | | | |

| David R. Mitchell | | 2003 | | 47 | | David Mitchell has served on the Board since April 2003. Mr. Mitchell currently serves as a managing director with Transportation Resource Partners, a private equity business affiliated with the Penske Corporation, and has assisted in the firm’s investment activities since its formation in 2003. From May 2002 to July 2003, Mr. Mitchell served as a Vice President of Penske Corporation. From January 1999 to April 2002, Mr. Mitchell served as a partner in R.J. Peters and Company, a private equity investment and financial advisory company. From July 1994 to January 1999, Mr. Mitchell was a Senior Manager with Deloitte Consulting. Mr. Mitchell also currently serves as a director on the boards of directors of various private companies. Mr. Mitchell received an M.B.A. from Stanford University’s Graduate School of Business and holds a B.S. in Chemical Engineering from the University of Notre Dame. |

| | | | | | |

| | | | | | In considering Mr. Mitchell as a director of the Company, the Nominating and Corporate Governance Committee reviewed his extensive senior management expertise and the leadership he has shown in his positions. In addition, Mr. Mitchell's investment and financial expertise were considered important factors in the determination of the Nominating and Corporate Governance Committee. |

| John Pound | | 2006 | | 59 | | John Pound has served on the Board since October 2006, previously serving as Co-Chairman of the Board from October 2006 to August 2008. Most notably, Mr. Pound has served as President and a director of Integrity Brands, Inc., a firm that originates and oversees investments in specialty retail and branded consumer products companies, since July 1997. He also served as a director of RedEnvelope, Inc., a specialty gift retailer, from August 2005 to March 2008, and as the Executive Chairman of its Board from March 2007 to March 2008. Mr. Pound also served as RedEnvelope, Inc.’s Chief Executive Officer from November 2007 to March 2008. Mr. Pound has also served as a director of The Gymboree Corporation (NASDAQ:GYMB), a branded specialty retailer of children’s apparel, from September 2000 until its sale in November 2010, and Cost Plus World Market (NASDAQ:CPWM) from June 2010 until its sale in June 2012. Mr. Pound currently sits on the board of directors of several private companies. |

| | | | | | |

| | | | | | In considering Mr. Pound as a director of the Company, the Nominating and Corporate Governance Committee reviewed his extensive retail, brand and consumer products expertise and experience. In addition, Mr. Pound's public company senior management and board experience, and the leadership he has shown in his positions with prior companies, were considered important factors in the determination of the Nominating and Corporate Governance Committee. |

| | | | | | |

| Seth Hamot | | 2009 | | 52 | Seth Hamot has served on the Board since February 2009 and as its Chairman since February 2010. Mr. Hamot has served as Managing Member of Roark, Rearden & Hamot Capital Management, LLC (“RRHCM”) since 1997 and was the owner of its corporate predecessor, Roark, Rearden & Hamot, Inc. RRHCM is the investment manager to Costa Brava Partnership III L.P. (“Costa Brava”), an investment fund, whose principal business is to make investments in, buy, sell, hold, pledge and assign securities. Mr. Hamot is also President of Roark, Rearden & Hamot LLC, the general partner of Costa Brava. Prior to 1997, Mr. Hamot was one of the partners of the Actionvest entities. Mr. Hamot served as the Chairman of the board of directors of TechTeam Global Inc., until that company was sold in December 2010. Additionally, Mr. Hamot served as Chairman of the board of directors of Bradley Pharmaceuticals, Inc., until that company was sold in February of 2008. Mr. Hamot is currently a member of the board of directors of Telos Corporation (OTC:TLSRP), a networking and security products and services provider. Mr. Hamot graduated from Princeton University in 1983 with a degree in economics. |

| | | | | | |

| | | | | | In considering Mr. Hamot as a director of the Company, the Nominating and Corporate Governance Committee considered his extensive business, investment and merger and acquisition experience, as well as the fact that Mr. Hamot indirectly is the Company’s largest shareholder. In addition, Mr. Hamot’s extensive experience serving on a number of public company board of directors was considered an important factor in the determination of the Nominating and Corporate Governance Committee. |

| Stephen Roseman | | 2009 | | 43 | | Stephen Roseman has served on the Board since July 2009 and brings extensive public company board experience and business development skills to the Company. Mr. Roseman is Senior Vice President and Consumer Sector Head at Calamos Advisors. Until May 2013, Mr. Roseman was the managing member of Thesis Capital Group, a firm he founded in 2005. Mr. Roseman served as a member of the board of directors of Celebrate Express, Inc. (NASDAQ:BDAY) starting in August 2006, and as Chairman from November 2007 until August 2008 when the company was acquired by Liberty Media Corporation (NASDAQ:LINTA). From 2003 to 2005, Mr. Roseman was a portfolio manager at Kern Capital Management, where he managed the consumer discretionary, consumer staples and business services portfolio. His previous professional experience includes serving as a senior equity analyst with OppenheimerFunds, Inc. from 2000 to 2003 where he was responsible for public and private investments in all of the consumer, financials, energy and industrial sectors for its Discovery Fund. Prior to OppenheimerFunds, he was employed by PaineWebber Group and Sperry Van Ness. Mr. Roseman also serves on the advisory boards of various private companies. He is a C.F.A. and received an M.B.A. from Fordham University Graduate School of Business Administration and a B.A. in French Literature from Arizona State University. |

| | | | | | |

| | | | | | In considering Mr. Roseman as a director of the Company, the Nominating and Corporate Governance Committee reviewed his extensive public company board and investment experience. In addition, Mr. Roseman possesses valuable business development skills, which was considered an important factor in the determination of the Nominating and Corporate Governance Committee. |

| | | | | | |

| Greg Andrews | | 2010 | | 52 | Greg Andrews has served on the Board since October 2010. Mr. Andrews is currently the Chief Financial Officer of Ramco-Gershenson Properties Trust (NYSE: RPT), a publicly traded real estate investment trust listed on the New York Stock Exchange. Prior to joining Ramco-Gershenson in 2010, Mr. Andrews served as Chief Financial Officer of Equity One, Inc. from 2006 to 2009. From 1997 to 2006, Mr. Andrews was a Principal at Green Street Advisors, Inc., an investment research and advisory firm. Mr. Andrews also previously served as Vice President in the corporate (Hong Kong) and commercial real estate (U.S.) divisions of Bank of America, and as an analyst at First Interstate Bank of California. Mr. Andrews received an M.B.A. from the UCLA Anderson School of Business and holds a B.A. in Architecture from Princeton University. |

| | | | | | |

| | | | | | In considering Mr. Andrews as a director of the Company, the Nominating and Corporate Governance Committee reviewed his extensive expertise and knowledge regarding finance and public company matters. Mr. Andrews qualifies as an "audit committee expert" under the applicable SEC rules and accordingly contributes his expertise and substantial experience as a principal accounting and financial officer to the deliberations of the Board. |

| Fir Geenen | | 2011 | | 59 | | Fir Geenen has served on the Board since June 2011. Since October 2008, and from 1993 to October 2007, Mr. Geenen has been a principal of Harlingwood Partners, an investment firm of which Mr. Geenen was a founding principal. From October 2007 to October 2008, Mr. Geenen was a principal at the investment firm Relational Investors, where he served as a portfolio manager. Prior to founding Harlingwood Partners, Mr. Geenen served in investment banking, consulting and executive management roles including at Laidlaw Inc. (Executive Vice President, 1992 to 1996), Shepherd Products (Chairman, 1988 to 1989), Nesbitt Burns (Managing Director, 1982 to 1987) and RBC Dominion Securities (Vice President, 1979 to 1982). Mr. Geenen graduated from Brock University in Ontario, Canada in 1977 with a degree in chemistry and biology. |

| | | | | | |

| | | | | | In considering Mr. Geenen as a director of the Company, the Nominating and Corporate Governance Committee reviewed his extensive executive business experience and the leadership he has shown in his positions with prior companies. In addition, Mr. Geenen’s investment and merger and acquisition experience, and experience serving on a number of board of directors were considered important factors in the determination of the Nominating and Corporate Governance Committee. |

| | | | | | |

| J. David Chute | | 2012 | | 57 | J. David Chute has served on the Board since April 2012. Mr. Chute is President of i2C Ventures, LLC, a company he founded in 2003 that consults with, commercializes and invests in early state proprietary consumer products. Mr. Chute is also co-founder of SunBird, LLC, which he co-founded in 2004 and which licenses certain rights to clip-on sunglasses technology. From 2008 until its acquisition in 2010, Mr. Chute was President and CEO of Switch Vision, a company he co-founded that sells sunglasses with magnetic interchangeable lenses. Switch Vision was acquired in 2010. From 1990 until 2002, Mr. Chute served as Global Managing Director of the Nike, Flexon and Trade Divisions and Executive Vice President of Marchon Eyewear, where his responsibilities included brand and product development, sourcing, marketing, management and strategy. Mr. Chute also founded Flex Eyewear in 1988, a company that was acquired by Marchon Eyewear in 1990. From 1986 until 1989, Mr. Chute was a partner in the Beta Group, which founded or acquired, and managed several businesses. From 1983 until 1986, Mr. Chute was a consultant at the Boston Consulting Group. Mr. Chute received an M.B.A. from Stanford University’s Graduate School of Business, holds an M.S. in Economics from the London School of Economics, and earned a B.A. in Economics at the University of California, Davis. |

| | | | | | | |

| | | | | | | The Nominating and Corporate Governance Committee considered Mr. Chute’s experience founding and managing companies specializing in sunglasses and eyewear, as well as his extensive senior executive experience, in considering him as a director of the Company. |

| David Rane | | 2013 | | 60 | | David Rane has served on the Board since August 2013. Mr. Rane works as a consultant. He also serves on the board of Linksoul, Inc, a private golf apparel company since 2013. Mr. Rane served as Chief Financial Officer and a director of Spectrum Sports, Inc., a non-profit organization focused on serving the special needs community until April 2013. He served as a director and Chairman of the Audit Committee of Telanetix, Inc., a publicly traded, broadband audio communications company until the company was sold in September 2013. Mr. Rane has also served as Chief Financial Officer of several companies, including Callaway Golf Company, a publicly traded company that manufactures golf equipment, NextImage Medical, Inc., a healthcare management and technology company, World Waste Technologies, Inc., a company focused on renewable energy, and SureBeam Corporation, a development stage company focused on food safety that filed for bankruptcy in 2004. Prior to these positions, Mr. Rane was employed by PricewaterhouseCoopers, where he was responsible for resolving complex accounting and reporting issues, including serving for two years in its national SEC and Accounting Services Group. Mr. Rane received his undergraduate degree from Brigham Young University in 1978, and is a certified public accountant. |

| | | | | | | |

| | | | | | | The Nominating and Corporate Governance Committee considered Mr. Rane’s extensive formal expertise, training and knowledge regarding accounting and finance, and his public company board experience. Mr. Rane qualifies as an “audit committee financial expert” under the applicable rules and accordingly contributes to the Board of Directors his understanding of corporate finance and his skills in analyzing and evaluating financial statements. |

| | | | | | | |

| Michael Marckx | | 2013 | | 49 | | Michael Marckx has served as Chief Executive Officer of the Company since December 15, 2011 and as a member of the Board since December 2013. He joined the Company in February 2011 as its Vice President of Marketing and was promoted to President on April 12, 2011. Since 2001, Mr. Marckx has served on the board of directors of Surfrider Foundation, a non-profit foundation, serving as Chairman since 2009. From 2004 until 2011, Mr. Marckx was the Vice President of Global Marketing/Entertainment of Globe International, which manufactures and markets apparel, footwear and boardsports hardgoods. From 2001 until 2004, Mr. Marckx was the Vice President, International Marketing/Creative Director at Ocean Pacific, which manufacturers and markets beach apparel. From 2000 until 2001, Mr. Marckx was the Vice President, Marketing/Entertainment at Broadband Interactive Group. Mr. Marckx holds a B.S. in economics from the University of California, Irvine. |

| | | | | | | |

| | | | | | | The Nominating and Corporate Governance Committee considered Mr. Marckx’s executive marketing background, the leadership he has demonstrated at SPY and in his positions with prior companies and his extensive knowledge of the action sports industry. |

Arrangements Related to Mr. Geenen’s Nomination

Mr. Geenen was selected as a nominee to the Board in accordance with the terms of the stock purchase agreement between the Company and Harlingwood (Alpha), LLC, an affiliate of Harlingwood Partners (“Harlingwood”), dated February 28, 2011. See “Certain Relationships and Related Party Transactions” below for further information.

Board Meetings and Committees

The Board held four meetings during the year ended December 31, 2013 and all incumbent directors attended at least 75% of the aggregate number of meetings of the Board and of the committees on which such directors served. The Board encourages the directors to attend our annual meetings of stockholders when stockholder participation is expected.

Independent Directors

The Board believes that a majority of its members should be independent directors. The Board has determined that, other than Messrs. Hamot, Geenen and Marckx, all of its current directors are independent directors as defined by the rules and regulations of the Nasdaq Stock Market.

The members of the Audit Committee and Compensation Committee of the Board each meet the independence standards established by the Nasdaq Stock Market and the U.S. Securities and Exchange Commission (the “SEC”) for audit committees and compensation committees. In addition, the Board has determined that Messrs. Rane, Andrews and Casari each satisfy the definition of an “audit committee financial expert” under SEC rules and regulations. These designations do not impose any duties, obligations or liabilities on Messrs. Rane, Andrews and Casari that are greater than those generally imposed on them as members of the Audit Committee and the Board, and their designations as audit committee financial experts does not affect the duties, obligations or liability of any other member of the Audit Committee or the Board.

Board Committees and Charters

The Board has a standing Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee. The Board appoints the members and chairpersons of these committees. The majority of the members of these committees have been determined by the Board to be independent. In addition, each member of these committees, except for Mr. Hamot (Nominating and Governance Committee), has been determined by the Board to be independent. Each committee has a written charter approved by the Board. Copies of each committee charter are available on the Company’s website at investor.spyoptic.com and by clicking on the “Corporate Governance” tab.

Audit Committee

| | |

| Mr. Rane (Chairman) Mr. Casari Mr. Andrews Mr. Roseman |

Number of Meetings in 2013: | This committee held four meetings during 2013. |

| This committee assists the Board in fulfilling its legal and fiduciary obligations in matters involving the Company’s accounting, auditing, financial reporting, internal control and legal compliance functions by approving the services performed by the Company’s independent accountants and reviewing their reports regarding the Company’s accounting practices and systems of internal accounting controls. This committee is responsible for the appointment, compensation, retention and oversight of the independent accountants and for ensuring that the accountants are independent of management. |

Compensation Committee

| | | |

| Mr. Mitchell (Chairman) Mr. Casari Mr. Pound | |

Number of Meetings in 2013: | This committee held one meeting during 2013. |

| This committee determines the Company’s general compensation policies and practices. This committee also reviews and approves compensation packages for the Company’s officers and, based upon such review, recommends overall compensation packages for the officers to the Board. This committee also reviews and determines equity-based compensation for the Company’s directors, officers, employees and consultants and administers the Company’s stock option plans. |

Nominating and Corporate Governance Committee

| | |

| Mr. Hamot (Chairman) Mr. Pound Mr. Geenen |

Number of Meetings in 2013: | This committee held two meetings during 2013. |

| This committee is responsible for making recommendations to the Board regarding candidates for directorships and the size and composition of the Board and for overseeing the Company’s corporate governance guidelines and reporting and making recommendations to the Board concerning corporate governance matters. |

Director Nominations

The Board nominates directors for election at each annual meeting of stockholders and appoints new directors to fill vacancies when they arise. The Nominating and Corporate Governance Committee has the responsibility to identify, evaluate, recruit and recommend qualified candidates to the Board for such nomination or appointment.

The Board seeks membership composed of experienced and dedicated individuals with diverse backgrounds, perspectives and skills. The Nominating and Corporate Governance Committee will select candidates for director based on their character, judgment, diversity of experience, business acumen and ability to act on behalf of all stockholders. The Nominating and Corporate Governance Committee believes that nominees for director should have experience, such as experience in management or accounting and finance, or industry and technology knowledge, that may be useful to the Company and the Board, high personal and professional ethics, and the willingness and ability to devote sufficient time to effectively carry out his or her duties as a director. The Board and Nominating and Corporate Governance Committee do not have a specific policy with regard to the consideration of diversity in the identification of director nominees. However, the Board and Nominating and Corporate Governance Committee consider diversity to be a valuable factor when evaluating director candidates’ qualifications and potential for making meaningful contributions to the operation of the Board and the Company. The Nominating and Corporate Governance Committee also believes it to be appropriate for at least one member of the Board to meet the criteria for an “audit committee financial expert” as defined by SEC rules, and for a majority of the members of the Board to meet the definition of “independent director” under the applicable SEC rules and regulations.

Prior to each annual meeting of stockholders, the Board or Nominating and Corporate Governance Committee identifies nominees first by evaluating the current directors whose term will expire at the annual meeting and who are willing to continue in service. These candidates are evaluated based on the criteria described above, including as demonstrated by the candidate’s prior service as a director, and the needs of the Board with respect to the particular talents and experience of its directors. In the event that a director does not wish to continue in service, the Board or Nominating and Corporate Governance Committee determines not to re-nominate a director, or a vacancy is created on the Board as a result of a resignation, an increase in the size of the Board or other event, the Nominating and Corporate Governance Committee will consider various candidates for Board membership, including those suggested by the Nominating and Corporate Governance Committee members, by other Board members, by any executive search firm engaged by the Nominating and Corporate Governance Committee and by stockholders. The Company’s policy is to consider nominees for the Board from stockholders. A stockholder who wishes to suggest a prospective nominee for the Board should notify the Secretary of the Company or any member of the Nominating and Corporate Governance Committee in writing with any supporting material the stockholder considers appropriate. Nominees suggested by stockholders are considered in the same way as nominees suggested from other sources. Once the Nominating and Corporate Governance Committee chooses a slate of candidates, the Nominating and Corporate Governance Committee recommends the candidates to the entire Board, and the Board then determines whether to recommend the slate to the stockholders.

In addition, the Company’s Bylaws contain provisions that address the process by which a stockholder may nominate an individual to stand for election to the Board at the Company’s annual meeting of stockholders. In order to nominate a candidate for director, a stockholder must give timely notice in writing to the Secretary of the Company and otherwise comply with the provisions of the Company’s Bylaws. Information required by the Company’s Bylaws to be in the notice include: the name, contact information and share ownership information for the candidate and the person making the nomination and other information about the nominee that must be disclosed in proxy solicitations under Section 14 of the Securities Exchange Act of 1934 and its related rules and regulations. The Nominating and Corporate Governance Committee may also require any proposed nominee to furnish such other information as may reasonably be required by the Nominating and Corporate Governance Committee to determine the eligibility of such proposed nominee to serve as director of the Company. The recommendation should be sent to: Secretary, SPY Inc., 2070 Las Palmas Drive, Carlsbad, California 92011. You can obtain a copy of the Company’s Bylaws by writing to the Secretary at this address.

Stockholder Communications

If you wish to communicate with the Board, you may send your communication in writing to: Secretary, SPY Inc., 2070 Las Palmas Drive, Carlsbad, California 92011. You must include your name and address in the written communication and indicate whether you are a stockholder of the Company. The Secretary will review any communication received from a stockholder, and all material and appropriate communications from stockholders will be forwarded to the appropriate director or directors or committee of the Board based on the subject matter.

Board Leadership Structure

The Board currently separates the roles of Chief Executive Officer and Chairman of the Board in recognition of the differences between the two roles. The Chief Executive Officer is responsible for setting the strategic direction of the Company and the day-to-day leadership and performance of the Company, while the Chairman of the Board provides guidance to the Chief Executive Officer and sets the agenda for the Board meetings and presides over meetings of the Board. However, the Board believes it should be able to freely select the Chairman of the Board based on criteria that it deems to be in the best interest of the Company and its stockholders, and therefore one person may, in the future, serve as both the Chief Executive Officer and Chairman of the Board.

Board Role in Risk Assessment

Management, in consultation with outside professionals, as applicable, identifies risks associated with the Company’s operations, strategies and financial statements. Risk assessment is also performed through periodic reports received by the Audit Committee from management, counsel and the Company’s independent registered public accountants relating to risk assessment and management. Audit Committee members meet privately in executive sessions with representatives of the Company’s independent registered public accountants. The Board also provides risk oversight through its periodic reviews of the financial and operational performance of the Company.

PROPOSAL TWO

APPROVAL OF THE 2014 STOCK INCENTIVE PLAN

General and Purpose of Restatement

We are asking our stockholders to approve the SPY Inc. 2014 Stock Incentive Plan (the “2014 Plan”), which amends and restates our 2004 Stock Incentive Plan (the “2004 Plan”) in order to extend the expiration date to December 7, 2024. No other changes to the 2004 Plan are proposed in the 2014 Plan. The 2004 Plan was originally adopted by the Board and approved by our stockholders in December 2004 and is currently set to expire on December 7, 2014. The 2014 Plan was approved by our Board in April 2014.

Set forth below is a summary of the material terms of the 2014 Plan, which summary is qualified in its entirety by the specific language of the 2014 Plan, a copy of which is included at the end of this Proxy Statement as Annex A and which stockholders are urged to read.

Shares Subject to the 2014 Plan. The 2014 Plan currently reserves for issuance up to 6,425,000 shares of the Company’s common stock, and provides that this maximum share limit shall be increased annually, on January 1st, in an amount equal to the lesser of (i) 700,000 shares, (ii) 10% of the outstanding shares on the last day of the immediately preceding year, or (iii) an amount determined by the Board.

Administration of the 2014 Plan. The 2014 Plan will be administered by the Compensation Committee of the Board, acting as the 2014 Plan Committee (as such term is defined in the 2014 Plan). With respect to certain awards issued under the 2014 Plan, the members of the 2014 Plan Committee also must be “non-employee directors” under Rule 16b-3 of the Securities Exchange Act of 1934, and/or “outside directors” under Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”). Subject to the terms of the 2014 Plan, the 2014 Plan Committee has the sole discretion, among other things, to:

| | • | | select the individuals who will receive awards; |

| | • | | determine the terms and conditions of awards (for example, the exercise price of stock options, performance conditions and vesting schedule); |

| | • | | correct any defect, supply any omission, or reconcile any inconsistency in the 2014 Plan or any award agreement; |

| | • | | amend the terms of outstanding awards; |

| | • | | delegate certain elements of its responsibilities to prescribed persons; |

| | • | | offer to buyout outstanding stock options on terms and conditions that it establishes; and |

| | • | | interpret and apply the provisions of the 2014 Plan. |

Eligible Participants. Awards may be granted under the 2014 Plan to employees and directors of, and to consultants and advisors to, the Company or one of its subsidiaries. As of March 31, 2014, approximately 86 employees and nine directors may be eligible to be considered for the grant of awards under the 2014 Plan.

Incentive stock options (as defined under Section 422 of the Code) may be granted only to employees. The other awards that may be granted under the 2014 Plan (nonstatutory stock options, stock appreciation rights, restricted shares and stock units), may be granted to employees, directors who are not employees of or paid consultants to the Company or one of its subsidiaries (“Outside Directors”), advisors and consultants.

No single participant can be granted stock options or stock appreciation rights that relate to more than an aggregate of 500,000 shares of the Company’s common stock in any calendar year.

In addition, to the extent permitted by the Board, outside directors have the ability to receive equity awards under the 2014 Plan in lieu of their annual cash retainer and/or meeting fees.

Awards Issuable Under the 2014 Plan. The 2014 Plan provides for various awards, which are described below:

Stock Options and Stock Appreciation Rights. A stock option is the right to purchase a certain number of shares of stock, at a certain exercise price, in the future. A stock appreciation right, or SAR, is the right to receive the net of the market price of a share of stock over the exercise price of the right, either in cash or in stock, in the future. Stock options and SARs may be conditioned upon continued employment, the achievement of performance objectives or the satisfaction of any other condition as specified in the applicable award agreement.

The per share exercise price for incentive stock options may not be less than 100% of the fair market value of a Company common shares on the date of grant (110% of the fair market value if the grant is to an employee who owns more than 10% of the total combined voting power of all classes of the Company’s capital stock). The Code currently limits to $100,000 the aggregate value of common stock for which incentive stock options may first become exercisable in any calendar year under the 2014 Plan or any other option plan adopted by the Company. The exercise prices for nonstatutory stock option and SARs are also set by the Compensation Committee.

Subject to the terms of the 2014 Plan, the Compensation Committee has the discretion to establish the terms of any specific award granted under the 2014 Plan, including any vesting arrangement and exercise period. In no event may options granted under the 2014 Plan be exercised more than 10 years after the date of grant (five years after the date of grant if the grant is an incentive stock option to an employee who owns more than 10% of the total combined voting power of all classes of the Company’s capital stock).

Restricted Stock Awards and Restricted Stock Units. Restricted stock is a share award that may be conditioned upon continued employment, the achievement of performance objectives or the satisfaction of any other condition as specified in a restricted stock agreement. Subject to the terms of the 2014 Plan, the Compensation Committee will determine the terms and conditions of any restricted stock award, which will be set forth in a restricted stock agreement to be entered into between the Company and each grantee. Shares may be awarded under the 2014 Plan for such consideration as the Compensation Committee may determine, including without limitation cash, cash equivalents, full-recourse promissory notes, future services, or services rendered prior to the award, without a cash payment by the grantee.

Under the 2014 Plan, the Compensation Committee may also grant restricted stock units that give recipients the right to acquire a specified number of shares of stock, or the equivalent value in cash, at a future date upon the satisfaction of certain conditions established by the Compensation Committee and as set forth in a stock unit agreement. Subject to the terms of the 2014 Plan, the Compensation Committee will determine the terms and conditions of any stock unit award, which will be set forth in a stock unit agreement to be entered into between the Company and each grantee. Restricted stock units may be granted in consideration of a reduction in the recipient’s other compensation, but no cash consideration is required of the recipient. Recipients of restricted stock units do not have voting or dividend rights, but may be credited with dividend equivalent compensation.

Nondiscretionary, Automatic Option Grants to Outside Directors. Each outside director, who was not previously an employee, will automatically be granted a nonstatutory stock option to purchase 15,000 shares of the Company’s common stock on the date of his or her initial election to the Board. This award will vest on the first anniversary of the grant date. Additionally, on the first business day following each of the Company’s regularly scheduled annual meetings of stockholders, each outside director who was not elected to the Board for the first time at such meeting and who will continue serving as a member of the Board thereafter, so long as he or she has served on the Board for at least six months as of that date, will be granted a nonstatutory stock option to purchase 15,000 shares of the Company’s common stock. This award will vest on the first anniversary of the date of grant or, if earlier, immediately prior to the Company’s next Annual Meeting of Stockholders following the date of grant. Both the initial election to the Board award and annual award will vest in full if a change in control during the director’s service.

Amendment. The Board can amend or modify the terms of the 2014 Plan at any time, subject to stockholder approval only to the extent required under applicable laws, rules and regulations.

Governing Law. The 2014 Plan, and (unless otherwise provided in the award agreement) all awards, will be construed in accordance with and governed by the laws of the State of Delaware, but without regard to its conflict of law provisions. The Compensation Committee may provide that any dispute as to any award shall be presented and determined in such forum as the Compensation Committee may specify, including through binding arbitration. Unless otherwise provided in the award agreement, recipients of an award are deemed to submit to the exclusive jurisdiction and venue of the federal or state courts of California to resolve any and all issues that may arise out of or relate to the 2014 Plan or any related award agreement.

Term. The 2014 Plan terminates on December 7, 2024, unless earlier terminated by the Board.

Options and Restricted Stock Awards Granted

Because grants under the 2014 Plan are subject to the discretion of the Compensation Committee, awards under the 2014 Plan that may be made in the future, including in the upcoming year, are not determinable, except with respect to the automatic grant of nonstatutory stock options to outside directors which are described under, “Summary of the 2014 Plan – Nondiscretionary, Automatic Option Grants to Outside directors,” above. Future exercise prices for options granted under the 2014 Plan are also not determinable because they will be based upon the fair market value of the common stock on the date of grant.

The following table discloses the awards granted to the persons or groups specified below under the current version of the Company’s stock incentive plan, the 2004 Plan, during the year ended December 31, 2013:

| | Number of Options | | Number of Shares of Restricted Stock | | Dollar Value ($) |

| Michael Marckx | | | 100,000 | | — | | $ | 88,790 |

| Chief Executive Officer and President | | | | | | | | | |

| | | | | | | | | | |

| James McGinty | | | 400,000 | | — | | $ | 308,120 |

| Chief Financial Officer, Treasurer and Secretary | | | | | | | | | |

| | | | | | | | | | |

| Jim Sepanek | | | | | | | | | |

| Executive Vice President | | | — | | — | | $ | — |

| | | | | | | | | | |

| All current executive officers as a group (3 persons) | | | 500,000 | | — | | $ | 396,910 |

| | | | | | | | | | |

| All current directors who are not executive officers as a group (9 persons) | | | 150,000 | | 76,502 | | $ | 229,277 |

| | | | | | | | | | |

| All employees, including all current officers who are not executive officers, as a group | | | 90,000 | | — | | $ | 73,239 |

Securities Authorized for Issuance under Compensation Plans

Set forth in the table below is certain information regarding the number of shares of our common stock that were subject to outstanding stock options or other compensation plan grants (including individual compensation arrangements) and awards as of December 31, 2013. We did not have any equity compensation plans not approved by security holders at December 31, 2013:

| | Number of Securities to be Issued Upon Exercise of Outstanding Options, Warrants and Rights | | | Weighted- Average Exercise Price of Outstanding Options, Warrants and Rights | | | Number of Securities Remaining Available for Future Issuance Under Equity Compensation Plans (Excluding Securities Reflected in Column (a)) |

| | | (a) | | | (b) | | | (c) |

| Equity compensation plans approved by security holders | | | 3,090,801 | | | $ | 1.76 | | | | 1,849,654 |

| Total | | | | | | | | | | | | |

Certain Federal Income Tax Consequences

The following is a general summary, as of April 11, 2014, of the federal income tax consequences to the Company and to U.S. participants for awards granted under the 2014 Plan. The federal tax laws may change and the federal, state and local tax consequences for any participant will depend upon his or her individual circumstances. Tax consequences for any particular individual may be different. This summary is not intended to be exhaustive and does not discuss the tax consequences of a participant’s death or provisions of income tax laws of any municipality, state or other country. The Company advises participants to consult with a tax advisor regarding the tax implications of their awards under the 2014 Plan.

Incentive Stock Options (“ISO”). For federal income tax purposes, the holder of an ISO has no taxable income at the time of the grant or exercise of the ISO. If such person retains the common stock acquired under the ISO for a period of at least two years after the stock option is granted and one year after the stock option is exercised, any gain upon the subsequent sale of the common stock will be taxed as a long-term capital gain. A participant who disposes of shares acquired by exercise of an ISO prior to the expiration of two years after the stock option is granted or before one year after the stock option is exercised will realize ordinary income as of the date of exercise equal to the difference between the exercise price and fair market value of the stock. Any additional gain or loss recognized upon any later disposition of the shares would be a short- or long-term capital gain or loss, depending on whether the shares have been held by the participant for more than one year. The difference between the option exercise price and the fair market value of the shares on the exercise date of an ISO is an adjustment in computing the holder’s alternative minimum taxable income and may be subject to an alternative minimum tax which is paid if such tax exceeds the participant’s regular income tax for the year.

Nonstatutory Stock Options (“NSO”). A participant who receives an NSO generally will not realize taxable income on the grant of such option, but will realize ordinary income at the time of exercise of the stock option equal to the difference between the option exercise price and the fair market value of the stock on the date of exercise. Any additional gain or loss recognized upon any later disposition of the shares would be short- or long-term capital gain or loss, depending on whether the shares had been held by the participant for more than one year.

Stock Appreciation Rights. No taxable income is generally reportable when a stock appreciation right is granted to a participant. Upon exercise, the participant will recognize ordinary income in an amount equal to the amount of cash received plus the fair market value of any shares received. Any additional gain or loss recognized upon any later disposition of any shares received would be a short- or long-term capital gain or loss, depending on whether the shares had been held by the participant for one year or more.

Restricted Stock. A participant will generally not have taxable income upon grant of unvested restricted shares unless he or she elects to be taxed at that time pursuant to an election under Code Section 83(b). Instead, he or she will recognize ordinary income at the time(s) of vesting equal to the fair market value (on each vesting date) of the shares or cash received minus any amount paid for the shares.

Restricted Stock Units. No taxable income is generally reportable when unvested restricted stock units are granted to a participant. Upon settlement of the vested restricted stock units, the participant will recognize ordinary income in an amount equal to the value of the payment received pursuant to the vested restricted stock units.

Income Tax Effects for the Company. The Company generally will be entitled to a tax deduction in connection with an award under the 2014 Plan in an amount equal to the ordinary income realized by a participant at the time the participant recognizes such income (for example, upon the exercise of an NSO).

Internal Revenue Code Section 162(m) Limits. Section 162(m) of the Code places a limit of $1.0 million on the amount of compensation that the Company may deduct in any one fiscal year with respect to certain executive officers (“Covered Employees”). The 2014 Plan is intended to enable options and SARs to constitute performance-based compensation not subject to the annual deduction limitations of Section 162(m) of the Code. However, to maintain flexibility in compensating executive officers in a manner designed to promote varying corporate goals, the Board has not adopted a policy that all compensation must be tax deductible.

Internal Revenue Code Section 409A. Section 409A of the Code governs the federal income taxation of certain types of nonqualified deferred compensation arrangements. A violation of Section 409A of the Code generally results in an acceleration of the recognition of income of amounts intended to be deferred and the imposition of a federal excise tax of 20% on the employee over and above the income tax owed, plus possible penalties and interest. The types of arrangements covered by Section 409A of the Code are broad and may apply to certain awards available under the 2014 Plan (such as restricted stock units). The intent is for the 2014 Plan, including any awards available thereunder, to comply with the requirements of Section 409A of the Code to the extent applicable. As required by Code Section 409A, certain nonqualified deferred compensation payments to specified employees may be delayed to the seventh month after such employee’s separation from service.

The affirmative “FOR” vote of at least a majority of the votes cast at the Annual Meeting is required to approve the 2014 Plan, which amends and restates our current stock incentive plan to extend the expiration date to December 7, 2024.

The Board unanimously recommends a vote “FOR” approval of the 2014 Stock Incentive Plan.

PROPOSAL THREE

RATIFICATION OF INDEPENDENT REGISTERED CERTIFIED PUBLIC ACCOUNTANTS

Upon the recommendation of the Audit Committee, the Board has selected the firm of Mayer Hoffman McCann P.C. as the Company’s independent registered certified public accountants for the year ending December 31, 2014. Mayer Hoffman McCann P.C. leases substantially all its personnel, who work under the control of Mayer Hoffman McCann P.C. shareholders, from wholly-owned subsidiaries of CBIZ, Inc., in an alternative practice structure Representatives of Mayer Hoffman McCann P.C. are expected to be present at the Annual Meeting. They will have an opportunity to make a statement, if they desire to do so, and will be available to respond to appropriate questions. Although stockholder ratification of the Company’s independent registered certified public accountants is not required by the Company’s Bylaws or otherwise, the Company is submitting the selection of Mayer Hoffman McCann P.C. to its stockholders for ratification as a matter of good corporate practice. If our stockholders do not ratify the appointment of Mayer Hoffman McCann P.C., the Audit Committee will reconsider this appointment. Even if the appointment is ratified, the Audit Committee, in its discretion, may appoint a different independent registered public accounting firm at any time during the year if the Audit Committee determines that such a change would be in the best interests of the Company and its stockholders.

Principal Accountant Fees and Services

The following table presents fees for professional audit services rendered by Mayer Hoffman McCann P.C. for the audit of the Company’s financial statements for 2013 and 2012, and fees billed for other services rendered by Mayer Hoffman McCann P.C.

| | | Year Ended December 31, |

| | | 2013 | | | 2012 |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | | |

| | | | | | | |

| (1) | Audit Fees include all services that are performed to comply with Generally Accepted Auditing Standards (“GAAS”). In addition, this category includes fees for services that normally would be provided by the accountant in connection with statutory and regulatory filings or engagements, such as audits, quarterly reviews, attest services, statutory audits, comfort letters, consents, reports on an issuer’s internal controls, and review of documents to be filed with the SEC. Certain services, such as tax services and accounting consultations, may not be billed as audit services. To the extent that such services are necessary to comply with GAAS (i.e., tax accrual work), an appropriate allocation of those fees is in this category. |

| (2) | Audit-Related Fees include assurance and related services that are traditionally performed by an independent accountant such as employee benefit plan audits, due diligence related to mergers and acquisitions, accounting assistance and audits in connection with proposed or consummated acquisitions, and special assignments related to internal control reviews. |

| (3) | Tax Fees include all services performed by an accounting firm’s tax division except those related to the audit. Typical services include tax compliance, tax planning and tax advice. |

| (4) | All Other Fees include fees for any service not addressed in the other three categories above. |

Determination of Independence

The Audit Committee has determined that the fees received by Mayer Hoffman McCann P.C. for the non-audit related services listed above are compatible with maintaining the independence of Mayer Hoffman McCann P.C.

Pre-Approval Policy and Procedures

It is the Company’s policy that all audit and non-audit services to be performed by the Company’s independent registered certified public accountants be approved in advance by the Audit Committee. The Audit Committee will not approve the engagement of the independent registered certified public accountants to perform any service that the independent registered certified public accountants would be prohibited from providing under applicable securities laws. In assessing whether to approve the use of the independent registered certified public accountants for permitted non-audit services, the Audit Committee tries to minimize relationships that could appear to impair the objectivity of the independent registered certified public accountants. The Audit Committee will approve permitted non-audit services by the independent registered certified public accountants only when it will be more effective or economical to have such services provided by the independent registered certified public accountants. During the year ended December 31, 2013, all audit and non-audit services performed by the Company’s independent registered certified public accountants were approved in advance by the Audit Committee.

Required Vote

The affirmative vote of the holders of a majority of the shares present in person or represented by proxy at the Annual Meeting and entitled to vote on this Proposal is required to ratify the appointment of the Company’s independent registered certified public accountants. Abstentions will have the same effect as a vote “AGAINST” this Proposal. A broker or other nominee will generally have discretionary authority to vote on this Proposal because it is considered a routine matter, and therefore we do not expect broker non-votes with respect to this Proposal. However, any broker non-vote received will not effect the outcome of this Proposal.

The Board recommends a vote “FOR” ratification of the appointment of Mayer Hoffman McCann P.C. as the Company’s independent registered certified public accountants.

EXECUTIVE OFFICERS

The Company’s executive officers are appointed by the Board on an annual basis and serve at the discretion of the Board, subject to the terms of any employment agreements they may have with the Company. The following is a brief description of the present and past business experience of each of the Company’s current executive officers.

| Name | | Age | | Position |

| | | | Chief Executive Officer and President |

| | | | Chief Financial Officer, Treasurer and Secretary |

| | | | |

Michael Marckx serves as the Company’s President and Chief Executive Officer, and is also a member of the Company’s Board of Directors. He has served as Chief Executive Officer since December 15, 2011. He joined the Company in February 2011 as its Vice President of Marketing and was promoted to President on April 12, 2011. Since 2001, Mr. Marckx has served on the board of directors of Surfrider Foundation, a non-profit foundation, serving as Chairman since 2009. From 2004 until 2011, Mr. Marckx was the Vice President of Global Marketing/Entertainment of Globe International, which manufactures and markets apparel, footwear and boardsports hardgoods. From 2001 until 2004, Mr. Marckx was the Vice President, International Marketing/Creative Director at Ocean Pacific, which manufacturers and markets beach apparel. From 2000 until 2001, Mr. Marckx was the Vice President, Marketing/Entertainment at Broadband Interactive Group. Mr. Marckx holds a B.S. in economics from the University of California, Irvine.

James McGinty joined the Company in August 2013 and serves as the Company’s Chief Financial Officer, Treasurer and Secretary. From 2000 to 2013, Mr. McGinty was a member of the management team of Hot Topic, Inc., serving as Chief Financial Officer from February 2001 to March of 2013. Prior to Hot Topic, Mr. McGinty was Vice President-Controller at Victoria's Secret Stores, a division of The Limited, Inc., from July 1996 to July 2000, and held various financial and accounting positions within other divisions of The Limited, Inc. from 1984 to 1996. Mr. McGinty holds a B.S. degree in Accounting from Miami University in Oxford, Ohio.

Jim Sepanek joined the Company in May 2011, and was promoted to Executive Vice President in December 2013. From 2008 to 2011, Mr. Sepanek served as vice president of Business Development at Signature Eyewear, which designs and distributes branded eyewear under global licenses, where he was responsible for brand management, key account sales and product design and development. Prior to that, he held executive positions at Rem Eyewear and Revo, Inc., respectively. Mr. Sepanek holds a B.A. degree in Business from Michigan State University and a M.B.A from California State University, San Jose.

EXECUTIVE COMPENSATION

The following table discloses the compensation paid to or earned during the years ended December 31, 2013 and 2012 by the Company’s principal executive officer, the Company’s two most highly compensated executive officers (other than the Company’s principal executive officer) who were serving as executive officers at the end of 2013 and two executive officers who would have been the Company’s most highly compensated executive officers during 2013, but resigned from the Company before the end of 2013 (collectively the “Named Executive Officers”):

2013 Summary Compensation Table

| Name and Principal Position | | Year | | Salary Earned ($) | | | Bonus ($) (5) | | Option Award(s) ($) (6) | | Non-Equity Incentive Plan Compensation ($) | | | All Other Compensation ($) (7) | | Total Compensation ($) |

| | | | $ | | | | | | | $ | | | | | | | | | | | |

Chief Executive Officer, President and Director | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | $ | | | | | | | | | | | | | | | | | | |

Chief Financial Officer, Treasurer and Secretary | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | — | | | | | | | |

| | | | | | | | | | | | | | | — | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | — | | | | | | | |

Former Chief Financial Officer, Treasurer and Secretary | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

Former Vice President, Sales | | | | | | | | | | | | | | | | | | | | | | |

| (1) | Mr. McGinty began serving as the Company’s Chief Financial Officer, Treasurer and Secretary on August 19, 2013 with an annual base salary of $265,000. |

| (2) | Prior to his promotion to Executive Vice President on December 21, 2013, Mr. Sepanek served as the Company’s Vice President of Optical. On October 1, 2012, Mr. Sepanek’s compensation was restructured to lower his base salary to $100,000. On December 21, 2013, Mr. Sepanek’s compensation was restructured to increase his base salary to $250,000. |

| (3) | Mr. Angel resigned as the Company’s Chief Financial Officer, Treasurer and Secretary on May 31, 2013, and served as the Company’s interim Chief Financial Officer until Mr. McGinty’s appointment on August 19, 2013. |

| (4) | Mr. Darby resigned from the Company on December 20, 2013. |

| (5) | With respect to 2013, the bonus amount in this column represent $180,157 and $29,286, earned by Mr. Sepanek and Mr. Darby, respectively, for bonus and commissions earned for achieving certain quarterly sales levels. With respect to 2012, the bonus amount in this column represent $22,153 and $62,924 earned by Mr. Sepanek and Mr. Darby, respectively, for bonus and commissions earned for achieving certain quarterly sales levels. |

| (6) | The amounts in this column represent the grant date fair value of stock option awards computed in accordance with FASB guidance, excluding the effect of estimated forfeitures under which the Named Executive Officer has the right to purchase, subject to vesting, shares of the Company’s common stock. For the assumptions made in determining the grant date fair values of the stock option awards see Note 10 “Share-Based Compensation” to the Company’s audited consolidated financial statements for the year ended December 31, 2013 included in its Annual Report on Form 10-K, filed with the SEC on March 20, 2014. |

| (7) | With respect to 2013, the amounts in this column represent: (a) $10,837 paid to Mr. Marckx for his employee portion of his health benefits and $6,000 paid as an automobile allowance, (b) $3,692 paid to Mr. McGinty for his employee portion of his health benefits and $3,314 paid for a housing and transportation allowance, (c) $10,905 paid to Mr. Sepanek for his employee portion of his health benefits and $6,000 paid as an automobile allowance, (d) $21,923 paid to Mr. Darby for vacation payout upon termination $10,905 paid for his employee portion of his health benefits and (e) Mr. Angel was paid $147,727 in severance payments during 2013 and will receive $102,273 in severance payments during 2014, $15,682 paid to Mr. Angel for vacation payout upon termination, $13,188 paid for his employee portion of his health benefits and $7,500 paid for a housing and transportation allowance. With respect to 2012, the amounts in this column represent: (a) $11,106 paid to Mr. Marckx for his employee portion of his health benefits and $6,000 paid as an automobile allowance, (b) $11,174 paid to Mr. Sepanek for his employee portion of his health benefits and $6,000 paid as an automobile allowance (c) $10,321 paid to Mr. Angel for his employee portion of his health benefits and $18,000 paid for a housing and transportation allowance and (d) $11,174 paid to Mr. Darby for his employee portion of his health benefits. |

Management Transition in Fiscal 2013

On May 31, 2013, Michael Angel resigned from his positions as the Company’s Chief Financial Officer, Treasurer and Secretary. Mr. Angel continued to serve as the Company’s interim Chief Financial Officer until the appointment of James McGinty on August 19, 2013.

On December 20, 2013, Erik Darby resigned from his position as the Company’s Vice President, Sales.

Employment Agreements and Change-in-Control Arrangements for Current Named Executive Officers

Michael Marckx

Employment Agreement. Mr. Marckx currently serves as the Company’s Chief Executive Officer and President under the terms of an Employment Agreement, by and between Mr. Marckx and the Company, originally dated October 31, 2011, and amended and restated on December 15, 2011 and October 16, 2012 (the “Marckx Employment Agreement”). The Marckx Employment Agreement will expire on December 14, 2015. Under the terms of the Marckx Employment Agreement, Mr. Marckx received an annual base salary of $300,000 during the year ended December 31, 2013 and 2012, and may receive, at the discretion of the Compensation Committee, an annual cash bonus of up to 100% of his annual base salary. However, on October 16, 2012, Mr. Marckx agreed to waive his right to receive a cash bonus he might have otherwise been entitled to during the years ending December 31, 2012 and 2013. Effective January 1, 2014, Mr. Marckx’s annual salary was increased to $360,000.

The Marckx Employment Agreement also provides that if the Company terminates his employment without “cause” (as such term is defined in the Marckx Employment Agreement), and such termination takes place either before a change in control transaction or more than 12 months following a change in control transaction, then the vesting of 50% of any outstanding unvested stock options held by Mr. Marckx will be accelerated, provided that he signs a general release of claims.

Change in Control Severance Agreement. In connection with his appointment as the Company’s Chief Executive Officer, the Company and Mr. Marckx entered into an amended and restated change in control severance agreement, effective December 15, 2011 and amended on October 16, 2012 (the “Marckx Severance Agreement”), under which, if Mr. Marckx’s employment as an executive is terminated by the Company without “cause” (as such term is defined in the Marckx Severance Agreement) within 12 months following a change of control transaction, or if Mr. Marckx voluntary terminated his employment for “good reason” (as such term is defined in the Marckx Severance Agreement) within 12 months following a change of control transaction, after providing the Company with written notice of such “good reason” and allowing the Company 30 days to cure or remedy the “good reason”. In either event, Mr. Marckx is entitled to (i) continuation of his base salary for a period of 24 months, payable in regular payroll installments; (ii) continuation of payments for group health plan continuation coverage under COBRA for 18 months, or until Mr. Marckx became eligible for group insurance benefits from another employer; (iii) payment of an amount equal to any unpaid “annual performance bonus” for the year in which his employment terminates; and (iv) the acceleration of all outstanding, unvested stock options or other equity compensation held by Mr. Marckx at the time of termination. The payment of these severance benefits is conditioned upon Mr. Marckx timely providing a release of claims against the Company, the Company’s affiliates and related parties. Further, in the event of a change of control which involves a transaction which represents an “enterprise value” (as such term is defined in the Marckx Severance Agreement) of the Company less than or equal to $50,000,000, the Company shall pay Mr. Marckx a bonus amount equal to $150,000. In the event of a change of control transaction, which involves a transaction that represents an “enterprise value” of the Company over $50,000,000, the Company shall pay Mr. Marckx an amount equal to $300,000. Any of the above bonuses shall be paid in a lump sum payment on the 60th day after Mr. Marckx’s termination date.

James McGinty

Employment Agreement. Mr. McGinty currently serves as the Company’s Chief Financial Officer, Treasurer and Secretary pursuant to a three year employment agreement entered into by the Company and Mr. McGinty on August 19, 2013 (the “McGinty Employment Agreement”). The McGinty Employment Agreement will expire on August 18, 2016. Under the term and conditions of the McGinty Employment Agreement, Mr. McGinty receives an annual base salary of $265,000, and is eligible to receive, at the discretion of the Compensation Committee, an annual cash bonus of up to 50% of Mr. McGinty’s annual base salary. However, any bonus for the 2013 calendar year will be determined and awarded at the discretion of the Board of Directors. Mr. McGinty also received a nonstatutory stock option on August 19, 2013 under the McGinty Employment Agreement to purchase up to 400,000 shares of the Company’s common stock, vesting annually in one-third increments over a period of three years, pursuant to the Company’s Amended and Restated 2004 Stock Incentive Plan. The Company may terminate the Employment Agreement at any time, with or without “cause” (as such term is defined in the McGinty Employment Agreement). If the Company terminates the McGinty Employment Agreement without “cause”, Mr. McGinty will be entitled to (i) 12 months base salary and (ii) vesting of 50% of the unvested portion of the stock option issued pursuant to the McGinty Employment Agreement.

Change in Control Severance Agreement. Pursuant to the change in control severance agreement by and between Mr. McGinty and the Company (the “Severance Agreement”), in the event Mr. McGinty’s employment is involuntarily terminated by the Company without “cause” (as such term is defined in the McGinty Severance Agreement) within 12 months following a change of control transaction (as such term is defined in the McGinty Severance Agreement), or if Mr. McGinty voluntarily terminates his employment within 14 months following a change of control transaction, Mr. McGinty will be entitled to: (i) continuation of his base salary for a period of 18 months, (ii) continuation of payments for group health plan continuation coverage under COBRA for 18 months, or until Mr. McGinty becomes eligible for group insurance benefits from another employer, (iii) payment of a bonus equal to 50% of Mr. McGinty’s potential annual bonus, and (iv) acceleration of the vesting of unvested portions of the Stock Option.

Jim Sepanek