- TEO Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

-

Insider

- Institutional

- Shorts

-

6-K Filing

Telecom Argentina (TEO) 6-KCurrent report (foreign)

Filed: 12 May 17, 12:00am

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For the month of May 2017

Commission File Number: 001-13464

Telecom Argentina S.A.

(Translation of registrant’s name into English)

Alicia Moreau de Justo, No. 50, 1107

Buenos Aires, Argentina

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

| Form 20-F | X | Form 40-F |

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

| Yes | No | X |

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

| Yes | No | X |

Indicate by check mark whether by furnishing the information contained in this Form, the Registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934:

| Yes | No | X |

Telecom Argentina S.A.

TABLE OF CONTENTS

Item

Press Release: Telecom Argentina S.A. announces consolidated first quarter results for fiscal year 2017 (‘1Q17’)*

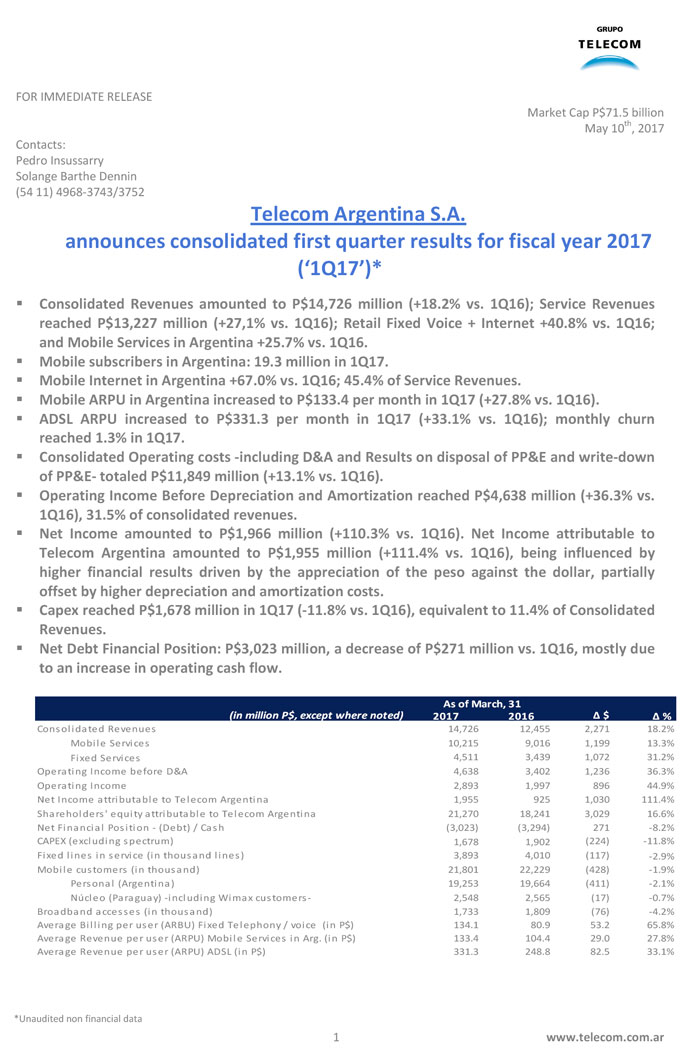

FOR IMMEDIATE RELEASE Market Cap P$71.5 billion May 10th, 2017 Contacts: Pedro Insussarry Solange Barthe Dennin (54 11) 4968-3743/3752Telecom Argentina S.A. announces consolidated first quarter results for fiscal year 2017 (‘1Q17’)* Consolidated Revenues amounted to P$14,726 million (+18.2% vs. 1Q16); Service Revenues reached P$13,227 million (+27,1% vs. 1Q16); Retail Fixed Voice + Internet +40.8% vs. 1Q16; and Mobile Services in Argentina +25.7% vs. 1Q16. Mobile subscribers in Argentina: 19.3 million in 1Q17. Mobile Internet in Argentina +67.0% vs. 1Q16; 45.4% of Service Revenues. Mobile ARPU in Argentina increased to P$133.4 per month in 1Q17 (+27.8% vs. 1Q16). ADSL ARPU increased to P$331.3 per month in 1Q17 (+33.1% vs. 1Q16); monthly churn reached 1.3% in 1Q17. Consolidated Operating costs -including D&A and Results on disposal of PP&E and write-down of PP&E- totaled P$11,849 million (+13.1% vs. 1Q16). Operating Income Before Depreciation and Amortization reached P$4,638 million (+36.3% vs. 1Q16), 31.5% of consolidated revenues. Net Income amounted to P$1,966 million (+110.3% vs. 1Q16). Net Income attributable to Telecom Argentina amounted to P$1,955 million (+111.4% vs. 1Q16), being influenced by higher financial results driven by the appreciation of the peso against the dollar, partially offset by higher depreciation and amortization costs. Capex reached P$1,678 million in 1Q17 (-11.8% vs. 1Q16), equivalent to 11.4% of Consolidated Revenues. Net Debt Financial Position: P$3,023 million, a decrease of P$271 million vs. 1Q16, mostly due to an increase in operating cash flow. As of March, 31(in million P$, except where noted)2017 2016 Δ $ Δ %Consolidated Revenues 14,726 12,455 2,271 18.2% Mobile Services 10,215 9,016 1,199 13.3% Fixed Services 4,511 3,439 1,072 31.2% Operating Income before D&A 4,638 3,402 1,236 36.3% Operating Income 2,893 1,997 896 44.9% Net Income attributable to Telecom Argentina 1,955 925 1,030 111.4% Shareholders' equity attributable to Telecom Argentina 21,270 18,241 3,029 16.6% Net Financial Position - (Debt) / Cash (3,023) (3,294) 271 -8.2% CAPEX (excluding spectrum) 1,678 1,902 (224) -11.8% Fixed lines in service (in thousand lines) 3,893 4,010 (117) -2.9% Mobile customers (in thousand) 21,801 22,229 (428) -1.9% Personal (Argentina) 19,253 19,664 (411) -2.1% Núcleo (Paraguay) -including Wimax customers- 2,548 2,565 (17) -0.7% Broadband accesses (in thousand) 1,733 1,809 (76) -4.2% Average Billing per user (ARBU) Fixed Telephony / voice (in P$) 134.1 80.9 53.2 65.8% Average Revenue per user (ARPU) Mobile Services in Arg. (in P$) 133.4 104.4 29.0 27.8% Average Revenue per user (ARPU) ADSL (in P$) 331.3 248.8 82.5 33.1% *Unaudited non financial data 1www.telecom.com.ar

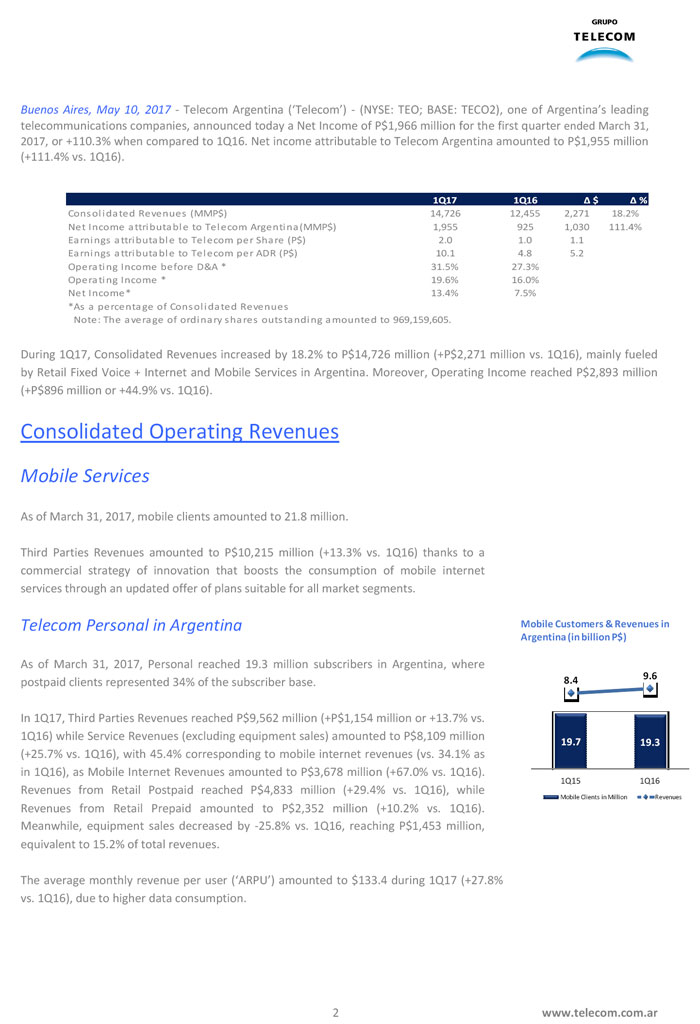

Buenos Aires, May 10, 2017- Telecom Argentina (‘Telecom’) - (NYSE: TEO; BASE: TECO2), one of Argentina's leading telecommunications companies, announced today a Net Income of P$1,966 million for the first quarter ended March 31, 2017, or +110.3% when compared to 1Q16. Net income attributable to Telecom Argentina amounted to P$1,955 million (+111.4% vs. 1Q16).1Q17 1Q16 Δ $ Δ %Consolidated Revenues (MMP$) 14,726 12,455 2,271 18.2% Net Income attributable to Telecom Argentina(MMP$) 1,955 925 1,030 111.4% Earnings attributable to Telecom per Share (P$) 2.0 1.0 1.1 Earnings attributable to Telecom per ADR (P$) 10.1 4.8 5.2 Operating Income before D&A * 31.5% 27.3% Operating Income * 19.6% 16.0% Net Income* 13.4% 7.5% *As a percentage of Consolidated Revenues Note: The average of ordinary shares outstanding amounted to 969,159,605. During 1Q17, Consolidated Revenues increased by 18.2% to P$14,726 million (+P$2,271 million vs. 1Q16), mainly fueled by Retail Fixed Voice + Internet and Mobile Services in Argentina. Moreover, Operating Income reached P$2,893 million (+P$896 million or +44.9% vs. 1Q16). Consolidated Operating RevenuesMobile ServicesAs of March 31, 2017, mobile clients amounted to 21.8 million. Third Parties Revenues amounted to P$10,215 million (+13.3% vs. 1Q16) thanks to a commercial strategy of innovation that boosts the consumption of mobile internet services through an updated offer of plans suitable for all market segments.Telecom Personal in ArgentinaMobile Customers & Revenues in Argentina (in billion P$)As of March 31, 2017, Personal reached 19.3 million subscribers in Argentina, where9.6postpaid clients represented 34% of the subscriber base.8.4In 1Q17, Third Parties Revenues reached P$9,562 million (+P$1,154 million or +13.7% vs. 1Q16) while Service Revenues (excluding equipment sales) amounted to P$8,109 million19.7 19.3(+25.7% vs. 1Q16), with 45.4% corresponding to mobile internet revenues (vs. 34.1% as in 1Q16), as Mobile Internet Revenues amounted to P$3,678 million (+67.0% vs. 1Q16). 1Q15 1Q16 Revenues from Retail Postpaid reached P$4,833 million (+29.4% vs. 1Q16), while Mobile Clients in Million Revenues Revenues from Retail Prepaid amounted to P$2,352 million (+10.2% vs. 1Q16). Meanwhile, equipment sales decreased by -25.8% vs. 1Q16, reaching P$1,453 million, equivalent to 15.2% of total revenues. The average monthly revenue per user (‘ARPU’) amounted to $133.4 during 1Q17 (+27.8% vs. 1Q16), due to higher data consumption. 2www.telecom.com.ar

Commercial InitiativesMobile consumption of Telecom Personal in ArgentinaDuring 1Q17, and in order to continue promoting the evolution towards the 4G service1,420experience, actions were taken to push the update of devices through the launch of new handsets at affordable prices and with financing plans, that complements the offer of794commercial plans that include larger quotas of data.133 104 89 82At the same time, during the summer season, the Company continued with its disruptive offer for the prepaid customers, allowing them to use unlimited whatsapp without 1Q16 1Q17 consuming their data quota during certain days, depending on the amount of the recharge. ARPU (P$/month) MOU (month)* MBOU (month) For those customers who traveled abroad, a differential offer in international service was(*) Includes reestimation of consumption of minutes and SMS per clientpresented: “data passport”, providing an accessible alternative for the control of roaming consumptions. These commercial initiatives were supported, in terms of infrastructure, with the rapid deployment of Personal´s 4G / LTE network, which as of the first quarter reached 826 locations throughout the country from La Quiaca to Ushuaia, with an average population coverage of 93% in capital cities. As part of its entertainment strategy associated to music, Personal organized a new edition of thePersonal Fest Summer, presenting shows in Mar de Plata, Córdoba, Corrientes, Salta and Rosario. The event, with the participation of well known bands and artists, who performed through different locations, reached more than 200,000 attendees in the 5 editions and more than 600,000 live streaming viewers through its website. Finally, as part of the actions that intend to position the brand in association with sports, Personal accompanied as official sponsor, for the second year in a row, the Argentine Rugby Union in the Super Rugby international tournament, where the Jaguars (Argentina’s team) participate. The sponsorship includes associated promotional offers.Telecom Personal in Paraguay (‘Núcleo’)As of March 31, 2017, Núcleo’s subscriber base reached 2.5 million clients. Prepaid and postpaid customers represented 82% and 18%, respectively. Núcleo generated revenues from Third Parties equivalent to P$653 million during 1Q17 (+7.4% vs. 1Q16). Internet revenues amounted to P$285 million (+33.2% vs. 1Q16) representing 45.3% of 1Q17 service revenues (vs. 39.1% in 1Q16).Fixed Services (Voice + Internet and Data)During 1Q17, Revenues generated by Fixed Services amounted to P$4,489 million, +31.8% vs. 1Q16; with Data Revenues growing +18.5% vs. 1Q16, influenced by the variation of the FX rate that underperformed inflation as a significant part of these sales are tied to the evolution of the peso-to-dollar exchange rate, and due to a variation of the exchange rate that was lower than inflation, while Voice + Internet revenues increased by +35.1% vs. 1Q16. 3www.telecom.com.ar

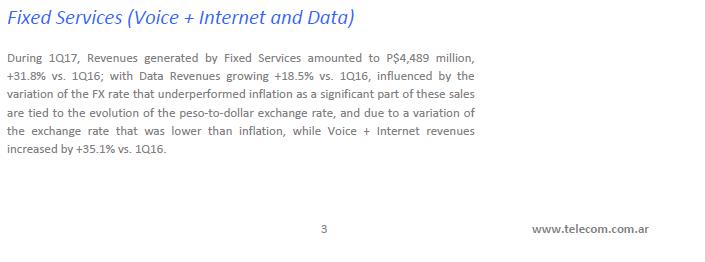

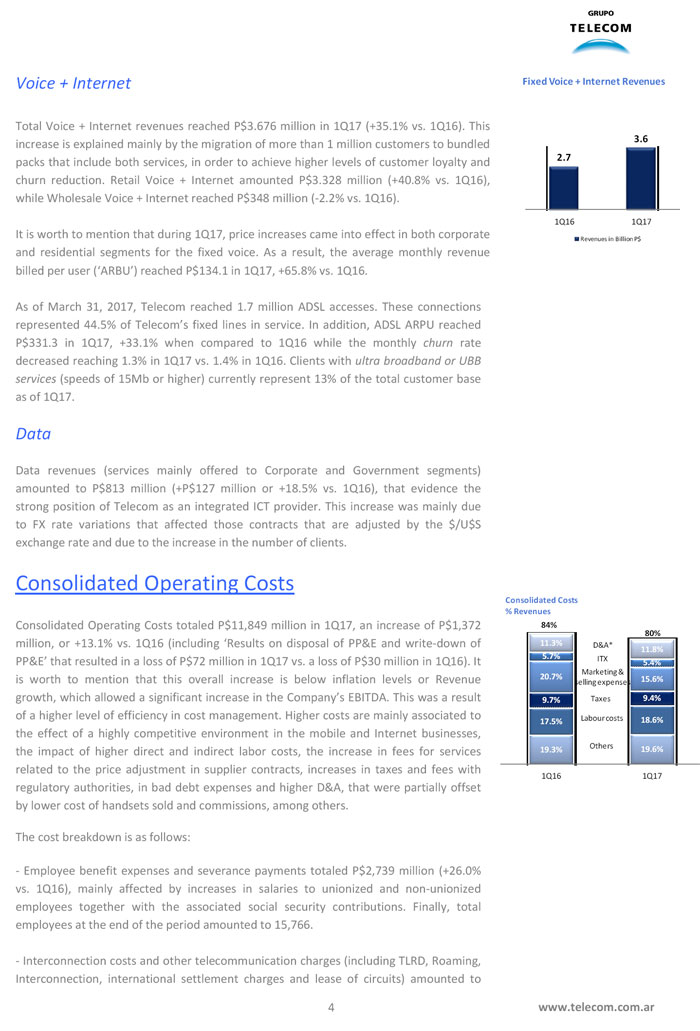

Voice + InternetFixed Voice + Internet RevenuesTotal Voice + Internet revenues reached P$3.676 million in 1Q17 (+35.1% vs. 1Q16). This3.6increase is explained mainly by the migration of more than 1 million customers to bundled packs that include both services, in order to achieve higher levels of customer loyalty and2.7churn reduction. Retail Voice + Internet amounted P$3.328 million (+40.8% vs. 1Q16), while Wholesale Voice + Internet reached P$348 million (-2.2% vs. 1Q16). 1Q16 1Q17 It is worth to mention that during 1Q17, price increases came into effect in both corporate Revenues in Billion P$ and residential segments for the fixed voice. As a result, the average monthly revenue billed per user (‘ARBU’) reached P$134.1 in 1Q17, +65.8% vs. 1Q16. As of March 31, 2017, Telecom reached 1.7 million ADSL accesses. These connections represented 44.5% of Telecom’s fixed lines in service. In addition, ADSL ARPU reached P$331.3 in 1Q17, +33.1% when compared to 1Q16 while the monthlychurn rate decreased reaching 1.3% in 1Q17 vs. 1.4% in 1Q16. Clients withultra broadband or UBB services (speeds of 15Mb or higher) currently represent 13% of the total customer base as of 1Q17.DataData revenues (services mainly offered to Corporate and Government segments) amounted to P$813 million (+P$127 million or +18.5% vs. 1Q16), that evidence the strong position of Telecom as an integrated ICT provider. This increase was mainly due to FX rate variations that affected those contracts that are adjusted by the $/U$S exchange rate and due to the increase in the number of clients. Consolidated Operating CostsConsolidated Costs%RevenuesConsolidated Operating Costs totaled P$11,849 million in 1Q17, an increase of P$1,37284% 80%million, or +13.1% vs. 1Q16 (including ‘Results on disposal of PP&E and write-down of11.3%D&A*11.8%PP&E’ that resulted in a loss of P$72 million in 1Q17 vs. a loss of P$30 million in 1Q16). It5.7%ITX5.4%Marketing & is worth to mention that this overall increase is below inflation levels or Revenue20.7% 15.6%selling expenses growth, which allowed a significant increase in the Company's EBITDA. This was a result9.7%Taxes9.4%of a higher level of efficiency in cost management. Higher costs are mainly associated to Labour costs18.6% 17.5%the effect of a highly competitive environment in the mobile and Internet businesses, Others19.6%the impact of higher direct and indirect labor costs, the increase in fees for services19.3%related to the price adjustment in supplier contracts, increases in taxes and fees with 1Q16 1Q17 regulatory authorities, in bad debt expenses and higher D&A, that were partially offset by lower cost of handsets sold and commissions, among others. The cost breakdown is as follows: - Employee benefit expenses and severance payments totaled P$2,739 million (+26.0% vs. 1Q16), mainly affected by increases in salaries to unionized and non-unionized employees together with the associated social security contributions. Finally, total employees at the end of the period amounted to 15,766. - Interconnection costs and other telecommunication charges (including TLRD, Roaming, Interconnection, international settlement charges and lease of circuits) amounted to 4www.telecom.com.ar

P$791 million, +11.9% vs. 1Q16. This increase resulted mainly from higher costs related to TLRD. - Fees for services, maintenance, materials and supplies amounted to P$1,359 million (+24.3% vs. 1Q16), mainly due to costs’ increases in software maintenance in the fixed segment and systems’ licenses in the mobile segment, higher costs related to the deployment of sites in the mobile network and higher storage costs. Higher costs recognized to suppliers in both mobile and fixed segments also explain the increase. - Taxes and fees with regulatory authorities reached P$1,390 million (+15.1% vs. 1Q16), impacted mainly by higher revenues, by higher municipal taxes, as well as higher bank debit and credit taxes related to collection flows and payments to suppliers. - Commissions (Commissions paid to agents, prepaid card commissions and others) totaled P$912 million (+2.5% vs. 1Q16). Decrease in commissions (considered before SAC, P$1,151 million in 1Q17 vs. P$1,231 million in 1Q16) is mainly due to a reduction in commissions paid to commercial channels, associated with lower levels of additions as well as lower handset sales. Agent commissions capitalized as SAC amounted to P$239 million (-29.9% vs. 1Q16). - Cost of handsets sold totaled P$1,160 million (-22.6% vs. 1Q16), this decrease was mainly due to a reduction in quantities of handsets sold partially offset by higher cost per device. Deferred costs from SAC amounted to P$13 million (-62.9% vs. 1Q16). Lower deferred costs were derived from lower equipment sales during the quarter.D&A (in billion P$)- Advertising amounted to P$223 million (+16.1% vs. 1Q16), due to new advertising1.67campaigns launched by the Group.0.01 1.38 0.08 0.01- Depreciation and Amortization reached P$1,673 million (+21.7% vs. 1Q16). PP&E0.10depreciation amounted to P$1,190 million (+27.5% vs. 1Q16) resulting from the1.19 0.93incorporation of assets related to the investment plan that the Group has been executing; the amortization of SAC and service connection costs that totaled P$3910.34 0.39million (+15.7% vs. 1Q16); the amortization of 3G/4G licenses that amounted to P$85 million (-13.3% vs. 1Q16), due to the extension in the duration of the license as the 1Q16 1Q17 Amortization of other intangible assets 700MHz band remains partially unavailable, and the amortization of other intangible 3G/4G Spectrum Amortization PP&E Depreciations assets that reached P$7 million (+16.7% vs. 1Q16). Amortization of SAC and service connection costs - Other Costs totaled P$1,530 million (+16.9% vs. 1Q16), of which Bad debt expenses reached P$342 million (+34.1% vs. 1Q16), mainly influenced by the financing plans for the sale of handsets in the mobile business, representing 2.9% of consolidated costs and 2.3% of consolidated revenues, increase that was partially offset by a decrease on VAS costs that totaled P$283 million (-27.4% vs. 1Q16), due new controls implemented in the platform that manages these contents so as to assure the customers’ acceptance of the service. 5www.telecom.com.ar

Consolidated Financial Results Net Financial Results totaled a gain of P$124 million, an improvement of P$681 millionin million of P$ 1Q16 1Q17Net Interests -$ 310 -$ 216 vs. 1Q16. This was mainly due to lower financial costs generated by a lower loss in net Gains on Mutual Funds & $ 196 $ 67 financial interests of P$216 million in 1Q17 (+P$94 million vs. 1Q16) and positive results other inv. on losses of FX results net of NDF instruments for P$290 million in 1Q17 (vs. a loss of FX results net of NDF -$ 420 $ 290 instruments P$420 million in 1Q16) mainly due to the peso appreciation that occurred since Others -$ 23 -$ 17 December 2016. Meanwhile, gains on mutual funds and other investments amounted toTotal -$ 557 $ 124P$67 million (-P$129 million vs. 1Q16). Consolidated Net Financial PositionNet Financial Debt (in billion P$)As of March 31, 2017, Net Debt Financial Position (Cash, Cash Equivalents and financial Investments minus Loans) totaled P$3,023 million, a decrease of P$271 million when compared to the Net Financial Position as of March 31, 2016, mostly due to an increase in operating cash flow during 1Q17; highlighting this improvement that occurred both by an increase in EBITDA and by a greater efficiency in working capital management.3.3 3.0Capital Expenditures 1Q16 1Q17 During 1Q17, the Company invested P$1,678 million (-11.8% vs. 1Q16). Of this amount, P$643 million were allocated to Fixed Services and P$1,035 million to Mobile services, focusing on projects that maximize network capacity and on the development of products and services that contribute to address the customers needs that today demand for connectivity and data availability. In relative terms, Capex reached 11.4% of consolidated revenues vs. 15.3% in 1Q16. In February, the Telecom Group put into commercial service the core of its mobile network with NFV (Network Function Virtualization) infrastructure. The CompanyCapex (In billion P$)became one of the pioneers in Latin America to enter the world of convergent virtualized networks.1.90 1.68This qualitative leap from the technological point of view, along with the modernization1.32 1.04that is being performed in the overall network infrastructure, will allow innovation in products and services, and to improve the user experience so as to support a high quality service to the customers.0.58 0.641Q16 1Q17 Moreover, in April 2017, the Company's new charging system was implemented, a tool Fixed Mobile that allows us to quickly adapt to market needs in a flexible and less time-consuming manner, as well as to innovate with new product schemes. This milestone implies a modernization of Personal’s network, which increases its capacity and security, generating substantial improvements in the customer experience. 6www.telecom.com.ar

Relevant Matters Corporate Reorganization On March 17, 2017, the Company received notice from its indirect controlling shareholder Sofora Telecomunicaciones S.A. (“Sofora”), who informed that its shareholders had expressed their wish that the Board of Directors of Sofora as well as the ones of its subsidiaries Nortel Inversora S.A. (“Nortel”), Telecom Argentina S.A. (“Telecom Argentina”) and Telecom Personal S.A. (“Telecom Personal”) evaluate a corporate reorganization at the head of Telecom Argentina S.A. as the surviving company, aiming to conclude this reorganization during the current year. This project seeks to simplify the shareholding structure of Telecom Argentina in line with international standards and market practices. In this context, it has been agreed that Sofora amortizes, in the terms of Article 223 of the General Corporate Law No. 19,550, the shares owned by W de Argentina Inversiones S.A. ("WAI") as follows: (i) 17% of the capital stock of Sofora in the first place and (ii) once the corresponding regulatory requirements have been met, the remaining 15% of WAI's stake in Sofora. Once both amortizations are realized, Fintech Telecom LLC will control 100% of the share capital of Sofora consolidating all the economic and corporate rights of the Company. Moreover, on March 31, 2017, the Board of Directors of Telecom Argentina S.A., Sofora Telecomunicaciones S.A., Nortel Inversora S.A. and Telecom Personal S.A. approved the Preliminary Merger Agreement by which they agree that Telecom Argentina will absorb by merger Nortel, Sofora and Telecom Personal, in accordance with the terms of Sections 82 and 83 of the General Corporate Law, and ad referendum of the corporate and regulatory approvals established in said Commitment. Resulting from the Reorganization and effective as of the Reorganization Effectiveness Date: (i) all the assets and liabilities of the Absorbed Companies shall be transferred to the Surviving Company at the values included in the respective Special-Purpose Unconsolidated Financial Statements, causing Telecom Argentina to acquire ownership of all rights and to assume all obligations and liabilities of any nature of Telecom Personal, Sofora and Nortel including (ii) Telecom Argentina shall be the successor of all activities of Telecom Personal, Sofora and Nortel. Regarding the aforementioned corporate reorganization and in order to facilitate the merger process by concentrating the entire capital stock of the Absorbed Company (Telecom Personal) under the ownership of the Surviving Company (Telecom Argentina), The Board of Directors of Nortel and Telecom Argentina approved on March 31, 2017 the sale of 120,000 shares of Telecom Personal, held by Nortel, to Telecom Argentina, for the amount of P$ 4,000,000, -. As a consequence of this transaction, as of March 31, 2017, Telecom Argentina owns 100% of Telecom Personal. Finally, The Board of Directors of the Company, resolved to summon a General Ordinary and Extraordinary Shareholders’ Meeting of Telecom Argentina to be held on May 23, 2017 on the first call, in order to consider the corporate reorganization described herein and the documentation approved by the Board of Directors. 7www.telecom.com.ar

Other Relevant Matters General Ordinary and Extraordinary Shareholders’ Meeting of Telecom Argentina The General Ordinary and Extraordinary Shareholders’ Meeting held on April 27, 2017 has adopted the following resolutions, among others: a. to approve the Annual Report and the financial statements of Telecom Argentina as of December 31, 2016; b. to allocate the total amount of Retained Earnings as of December 31, 2016 (P$3,975 million) to the constitution of a ‘Reserve for Future Cash Dividends’; c. to partially withdraw P$2,730 million from the ‘Voluntary Reserve for Capital Investments’ and to allocate that amount to increase the ‘Reserve for Future Cash Dividends’; d. to totally withdraw P$2,904 million from the ‘Voluntary Reserve for Future Investments’ and to allocate that amount to increase the ‘Reserve for Future Cash Dividends’. Tuves’ shares purchase option for Núcleo On October 4, 2016, Núcleo’s Board of Directors authorized the execution of the shares purchase option that TU VES S.A (Chile) granted to Núcleo in order to acquire the controlling interest in TUVES Paraguay (‘Tuves’). TUVES Paraguay is a DTH provider in Paraguay. On October 6, 2016 Tuves’ shareholders accepted Núcleo’s proposal for executing the shares purchase option (70% Tuves’ total capital), being subject to the CONATEL’s previous approval. On April 11, 2017, by Resolution No. 460/2017, the Board of Directors of CONATEL authorized TU VES S.A. (Chile) to transfer in favor of Núcleo 350 shares of Tuves that represent 70% of its capital. With this authorization given by CONATEL, Núcleo will proceed to close the transaction in the terms agreed with the sellers during the second quarter of 2017. Inter-American Investment Corporation (IIC) Loan On April 7, 2017, Personal and the Inter-American Investment Corporation (“IIC”), a member of the Inter-American Development Bank ( “IDB”) Group, signed a loan agreement (“IIC Loan”) for an amount of US$100 million and for a six year period, payable in 8 equal half-yearly installments starting the first on the 24th month, with a 6 month LIBO rate + 400bp. The funds of this loan will be allocated to deploy the 4G network and for financing working capital and other financial needs.*********8www.telecom.com.ar

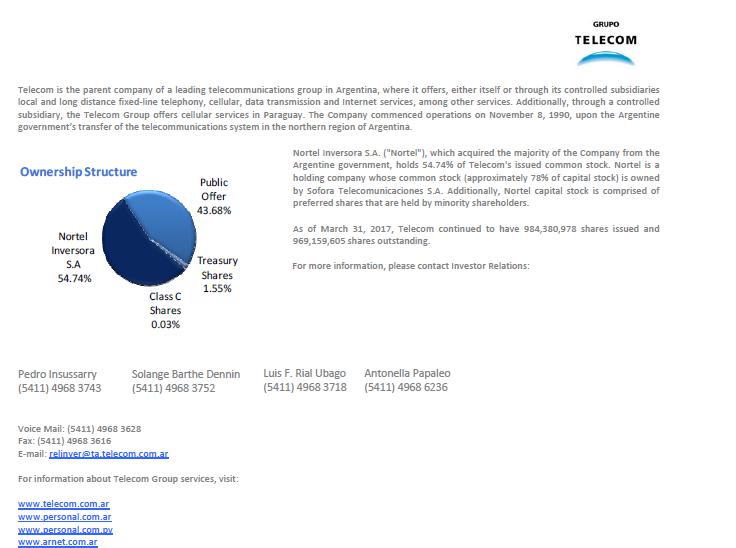

Telecom is the parent company of a leading telecommunications group in Argentina, where it offers, either itself or through its controlled subsidiaries local and long distance fixed-line telephony, cellular, data transmission and Internet services, among other services. Additionally, through a controlled subsidiary, the Telecom Group offers cellular services in Paraguay. The Company commenced operations on November 8, 1990, upon the Argentine government’s transfer of the telecommunications system in the northern region of Argentina. Nortel Inversora S.A. ("Nortel"), which acquired the majority of the Company from the Argentine government, holds 54.74% of Telecom's issued common stock. Nortel is aOwnership StructurePublic holding company whose common stock (approximately 78% of capital stock) is owned by Sofora Telecomunicaciones S.A. Additionally, Nortel capital stock is comprised of Offer preferred shares that are held by minority shareholders. 43.68% As of March 31, 2017, Telecom continued to have 984,380,978 shares issued and Nortel 969,159,605 shares outstanding. Inversora S.A Treasury For more information, please contact Investor Relations: 54.74% Shares 1.55% Class C Shares 0.03% Pedro Insussarry Solange Barthe Dennin Luis F. Rial Ubago Antonella Papaleo (5411) 4968 3743 (5411) 4968 3752 (5411) 4968 3718 (5411) 4968 6236 Voice Mail: (5411) 4968 3628 Fax: (5411) 4968 3616 E-mail: relinver@ta.telecom.com.ar For information about Telecom Group services, visit: www.telecom.com.ar www.personal.com.ar www.personal.com.py www.arnet.com.ar Disclaimer This document may contain statements that could constitute forward-looking statements, including, but not limited to, the Company’s expectations for its future performance, revenues, income, earnings per share, capital expenditures, dividends, liquidity and capital structure; the effects of its debt restructuring process; the impact of emergency laws enacted by the Argentine Government; and the impact of rate changes and competition on the Company’s future financial performance. Forward-looking statements may be identified by words such as “believes,” “expects,” “anticipates,” “projects,” “intends,” “should,” “seeks,” “estimates,” “future” or other similar expressions. Forward-looking statements involve risks and uncertainties that could significantly affect the Company’s expected results. The risks and uncertainties include, but are not limited to, the impact of emergency laws enacted by the Argentine government that have resulted in the repeal of Argentina’s Convertibility law, devaluation of the peso, various changes in restrictions on the ability to exchange pesos into foreign currencies, and currency transfer policy generally, the “pesification” of tariffs charged for public services, the elimination of indexes to adjust rates charged for public services and the Executive branch announcement to renegotiate the terms of the concessions granted to public service providers, including Telecom. Due to extensive changes in laws and economic and business conditions in Argentina, it is difficult to predict the impact of these changes on the Company’s financial condition. Other factors may include, but are not limited to, the evolution of the economy in Argentina, growing inflationary pressure and evolution in consumer spending and the outcome of certain legal proceedings. Readers are cautioned not to place undue reliance on forward-looking statements, which speak only as the date of this document. The Company undertakes no obligation to release publicly the results of any revisions to forward-looking statements which may be made to reflect events and circumstances after the date of this press release, including, without limitation, changes in the Company’s business or to reflect the occurrence of unanticipated events. Readers are encouraged to consult the Company’s Annual Report on Form 20-F, as well as periodic filings made on Form 6-K, which are filed with or furnished to the United States Securities and Exchange Commission for further information concerning risks and uncertainties faced by Telecom. (Financial tables follow)*******Mariano Marcelo Ibáñez Chairman 9www.telecom.com.ar

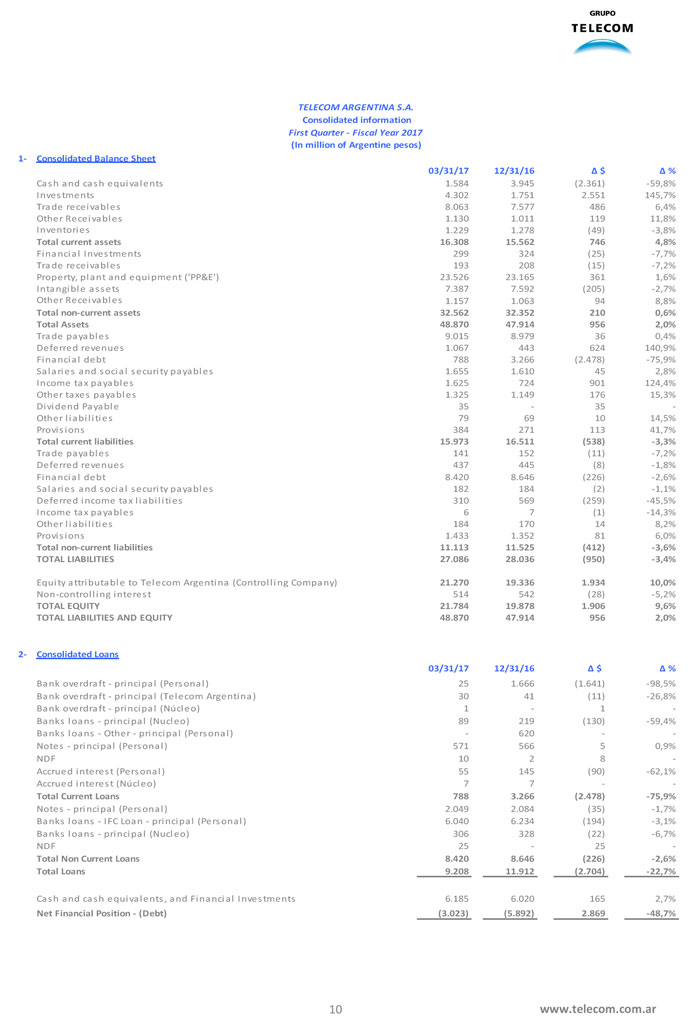

TELECOM ARGENTINA S.A.Consolidated informationFirst Quarter - Fiscal Year 2017(In million of Argentine pesos) 1- Consolidated Balance Sheet 03/31/17 12/31/16 Δ $ Δ %Cash and cash equivalents 1.584 3.945 (2.361) -59,8% Investments 4.302 1.751 2.551 145,7% Trade receivables 8.063 7.577 486 6,4% Other Receivables 1.130 1.011 119 11,8% Inventories 1.229 1.278 (49) -3,8%Total current assets 16.308 15.562 746 4,8%Financial Investments 299 324 (25) -7,7% Trade receivables 193 208 (15) -7,2% Property, plant and equipment ('PP&E') 23.526 23.165 361 1,6% Intangible assets 7.387 7.592 (205) -2,7% Other Receivables 1.157 1.063 94 8,8%Total non-current assets 32.562 32.352 210 0,6% Total Assets 48.870 47.914 956 2,0%Trade payables 9.015 8.979 36 0,4% Deferred revenues 1.067 443 624 140,9% Financial debt 788 3.266 (2.478) -75,9% Salaries and social security payables 1.655 1.610 45 2,8% Income tax payables 1.625 724 901 124,4% Other taxes payables 1.325 1.149 176 15,3% Dividend Payable 35 - 35 -Other liabilities 79 69 10 14,5% Provisions 384 271 113 41,7%Total current liabilities 15.973 16.511 (538) -3,3%Trade payables 141 152 (11) -7,2% Deferred revenues 437 445 (8) -1,8% Financial debt 8.420 8.646 (226) -2,6% Salaries and social security payables 182 184 (2) -1,1% Deferred income tax liabilities 310 569 (259) -45,5% Income tax payables 6 7 (1) -14,3% Other liabilities 184 170 14 8,2% Provisions 1.433 1.352 81 6,0%Total non-current liabilities 11.113 11.525 (412) -3,6% TOTAL LIABILITIES 27.086 28.036 (950) -3,4%Equity attributable to Telecom Argentina (Controlling Company)21.270 19.336 1.934 10,0%Non-controlling interest 514 542 (28) -5,2%TOTAL EQUITY 21.784 19.878 1.906 9,6% TOTAL LIABILITIES AND EQUITY 48.870 47.914 956 2,0% 2- Consolidated Loans 03/31/17 12/31/16 Δ $ Δ %Bank overdraft - principal (Personal) 25 1.666 (1.641) -98,5% Bank overdraft - principal (Telecom Argentina) 30 41 (11) -26,8% Bank overdraft - principal (Núcleo) 1 - 1 - Banks loans - principal (Nucleo) 89 219 (130) -59,4% Banks loans - Other - principal (Personal) - 620 - - Notes - principal (Personal) 571 566 5 0,9% NDF 10 2 8 - Accrued interest (Personal) 55 145 (90) -62,1% Accrued interest (Núcleo) 7 7 - -Total Current Loans 788 3.266 (2.478) -75,9%Notes - principal (Personal) 2.049 2.084 (35) -1,7% Banks loans - IFC Loan - principal (Personal) 6.040 6.234 (194) -3,1% Banks loans - principal (Nucleo) 306 328 (22) -6,7% NDF 25 - 25 -Total Non Current Loans 8.420 8.646 (226) -2,6% Total Loans 9.208 11.912 (2.704) -22,7%Cash and cash equivalents, and Financial Investments 6.185 6.020 165 2,7%Net Financial Position - (Debt) (3.023) (5.892) 2.869 -48,7%10www.telecom.com.ar

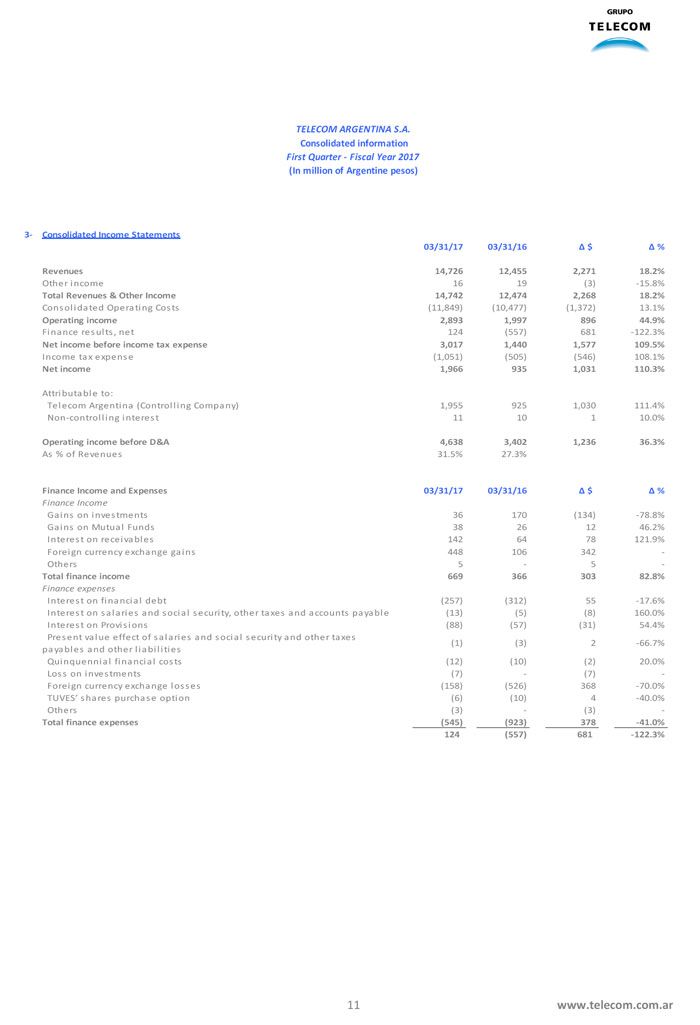

TELECOM ARGENTINA S.A.Consolidated informationFirst Quarter - Fiscal Year 2017(In million of Argentine pesos) 3- Consolidated Income Statements 03/31/17 03/31/16 Δ $ Δ % Revenues 14,726 12,455 2,271 18.2%Other income 16 19 (3) -15.8%Total Revenues & Other Income 14,742 12,474 2,268 18.2%Consolidated Operating Costs (11,849) (10,477) (1,372) 13.1%Operating income 2,893 1,997 896 44.9%Finance results, net 124 (557) 681 -122.3%Net income before income tax expense 3,017 1,440 1,577 109.5%Income tax expense (1,051) (505) (546) 108.1%Net income 1,966 935 1,031 110.3%Attributable to: Telecom Argentina (Controlling Company) 1,955 925 1,030 111.4% Non-controlling interest 11 10 1 10.0%Operating income before D&A 4,638 3,402 1,236 36.3%As % of Revenues 31.5% 27.3%Finance Income and Expenses 03/31/17 03/31/16 Δ $ Δ %Finance IncomeGains on investments 36 170 (134) -78.8% Gains on Mutual Funds 38 26 12 46.2% Interest on receivables 142 64 78 121.9% Foreign currency exchange gains 448 106 342 - Others 5 - 5 -Total finance income 669 366 303 82.8%Finance expensesInterest on financial debt (257) (312) 55 -17.6% Interest on salaries and social security, other taxes and accounts payable (13) (5) (8) 160.0% Interest on Provisions (88) (57) (31) 54.4% Present value effect of salaries and social security and other taxes (1) (3) 2 -66.7% payables and other liabilities Quinquennial financial costs (12) (10) (2) 20.0% Loss on investments (7) - (7) - Foreign currency exchange losses (158) (526) 368 -70.0% TUVES’ shares purchase option (6) (10) 4 -40.0% Others (3) - (3) -Total finance expenses (545) (923) 378 -41.0% 124 (557) 681 -122.3% 11www.telecom.com.ar

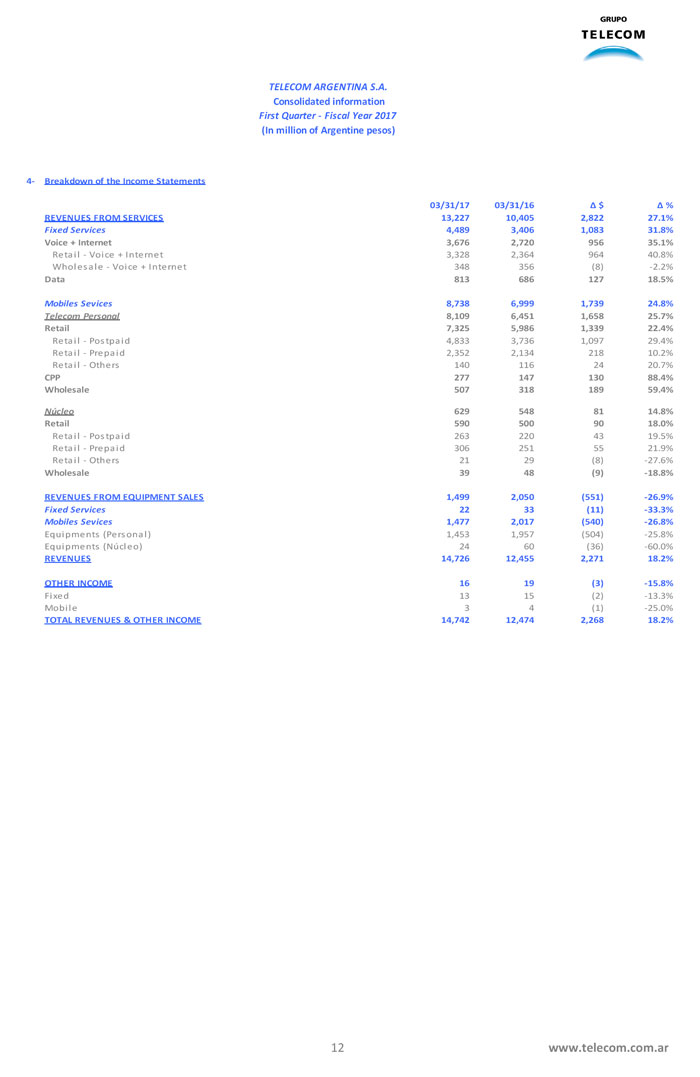

TELECOM ARGENTINA S.A.Consolidated informationFirst Quarter - Fiscal Year 2017(In million of Argentine pesos) 4- Breakdown of the Income Statements 03/31/17 03/31/16 Δ $ Δ % REVENUES FROM SERVICES 13,227 10,405 2,822 27.1%Fixed Services4,489 3,406 1,083 31.8% Voice + Internet 3,676 2,720 956 35.1%Retail - Voice + Internet 3,328 2,364 964 40.8% Wholesale - Voice + Internet 348 356 (8) -2.2%Data 813 686 127 18.5%Mobiles Sevices8,738 6,999 1,739 24.8%Telecom Personal8,109 6,451 1,658 25.7% Retail 7,325 5,986 1,339 22.4%Retail - Postpaid 4,833 3,736 1,097 29.4% Retail - Prepaid 2,352 2,134 218 10.2% Retail - Others 140 116 24 20.7%CPP 277 147 130 88.4% Wholesale 507 318 189 59.4%Núcleo629 548 81 14.8% Retail 590 500 90 18.0%Retail - Postpaid 263 220 43 19.5% Retail - Prepaid 306 251 55 21.9% Retail - Others 21 29 (8) -27.6%Wholesale 39 48 (9) -18.8% REVENUES FROM EQUIPMENT SALES 1,499 2,050 (551) -26.9%Fixed Services22 33 (11) -33.3%Mobiles Sevices1,477 2,017 (540) -26.8%Equipments (Personal) 1,453 1,957 (504) -25.8% Equipments (Núcleo) 24 60 (36) -60.0%REVENUES 14,726 12,455 2,271 18.2% OTHER INCOME 16 19 (3) -15.8%Fixed 13 15 (2) -13.3% Mobile 3 4 (1) -25.0%TOTAL REVENUES & OTHER INCOME 14,742 12,474 2,268 18.2%12www.telecom.com.ar

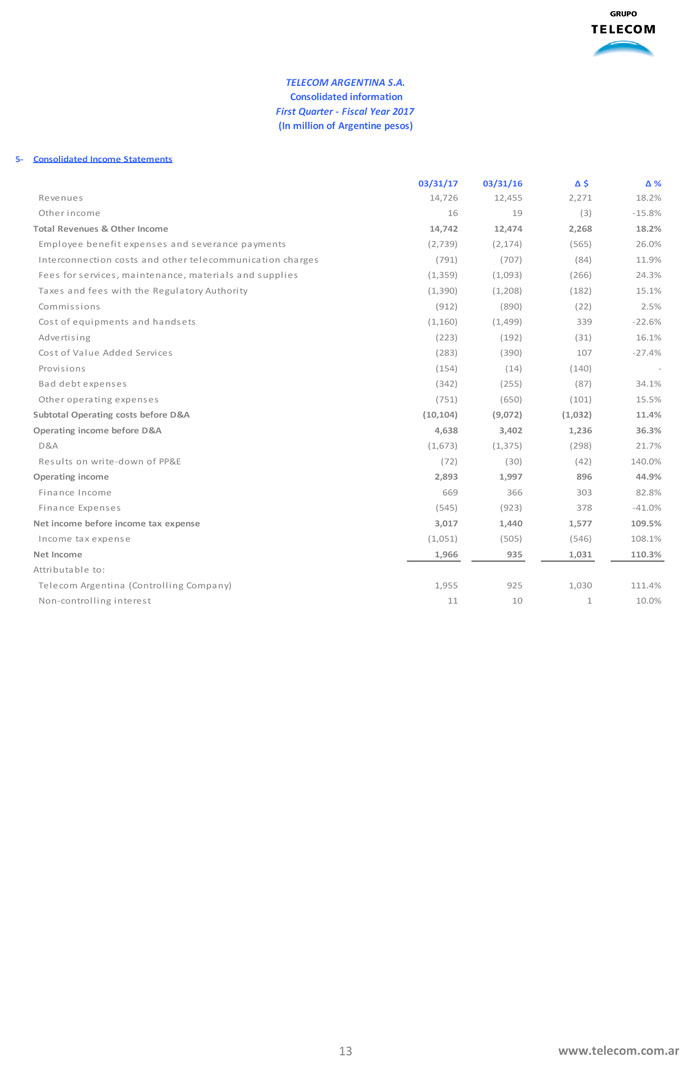

TELECOM ARGENTINA S.A.Consolidated informationFirst Quarter - Fiscal Year 2017(In million of Argentine pesos) 5- Consolidated Income Statements 03/31/17 03/31/16 Δ $ Δ %Revenues 14,726 12,455 2,271 18.2% Other income 16 19 (3) -15.8%Total Revenues & Other Income 14,742 12,474 2,268 18.2%Employee benefit expenses and severance payments (2,739) (2,174) (565) 26.0% Interconnection costs and other telecommunication charges (791) (707) (84) 11.9% Fees for services, maintenance, materials and supplies (1,359) (1,093) (266) 24.3% Taxes and fees with the Regulatory Authority (1,390) (1,208) (182) 15.1% Commissions (912) (890) (22) 2.5% Cost of equipments and handsets (1,160) (1,499) 339 -22.6% Advertising (223) (192) (31) 16.1% Cost of Value Added Services (283) (390) 107 -27.4% Provisions (154) (14) (140) - Bad debt expenses (342) (255) (87) 34.1% Other operating expenses (751) (650) (101) 15.5%Subtotal Operating costs before D&A (10,104) (9,072) (1,032) 11.4% Operating income before D&A 4,638 3,402 1,236 36.3%D&A (1,673) (1,375) (298) 21.7% Results on write-down of PP&E (72) (30) (42) 140.0%Operating income 2,893 1,997 896 44.9%Finance Income 669 366 303 82.8% Finance Expenses (545) (923) 378 -41.0%Net income before income tax expense 3,017 1,440 1,577 109.5%Income tax expense (1,051) (505) (546) 108.1%Net Income 1,966 935 1,031 110.3%Attributable to: Telecom Argentina (Controlling Company) 1,955 925 1,030 111.4% Non-controlling interest 11 10 1 10.0% 13www.telecom.com.ar

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Telecom Argentina S.A. | |||||

| Date: | May 11, 2017 | By: | /s/ Pedro G. Insussarry | ||

| Name: | Pedro G. Insussarry | ||||

| Title: | Responsible for Market Relations | ||||