Schedule 14A Information

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by the Registrant[X]

Filed by a Party other than the Registrant[ ]

Check the appropriate box:[ ]Preliminary Proxy Statement

[ ]Confidential, for Use of the Commission only (as permitted by Rule 14a-6(e)(2))

[ ]Definitive Proxy Statement

[X]Definitive Additional Materials

[ ]Soliciting MaterialunderRule 14a-12

Vanguard Admiral Funds

Vanguard Bond Index Funds

Vanguard CMT Funds

Vanguard California Tax-Free Funds

Vanguard Charlotte Funds

Vanguard Chester Funds

Vanguard Convertible Securities Fund

Vanguard Explorer Fund

Vanguard Fenway Funds

Vanguard Fixed Income Securities Funds

Vanguard Horizon Funds

Vanguard Index Funds

Vanguard Institutional Index Funds

Vanguard International Equity Index Funds

Vanguard Malvern Funds

Vanguard Massachusetts Tax-Exempt Funds

Vanguard Money Market Reserves

Vanguard Montgomery Funds

Vanguard Morgan Growth Fund

Vanguard Municipal Bond Funds

Vanguard New Jersey Tax-Free Funds

Vanguard New York Tax-Free Funds

Vanguard Ohio Tax-Free Funds

Vanguard Pennsylvania Tax-Free Funds

Vanguard Quantitative Funds

Vanguard Scottsdale Funds

Vanguard Specialized Funds

Vanguard STAR Funds

Vanguard Tax-Managed Funds

Vanguard Trustees’ Equity Fund

Vanguard Valley Forge Funds

Vanguard Variable Insurance Funds

Vanguard Wellesley Income Fund

Vanguard Wellington Fund

Vanguard Whitehall Funds

Vanguard Windsor Funds

Vanguard World Funds

(Name of Registrant as Specified in its Declaration of Trust)

|

| (Name of Person(s) Filing Proxy Statement if other than the Registrant) |

| |

| Payment of Filing Fee (Check the appropriate box): |

| |

| [ X ]No fee required. |

| |

| [ ]Fee computed on table below per Exchange Act Rules 14a-6(i) and 0-11. |

| (1) Title of each class of securities to which transaction applies: |

| (2) Aggregate number of securities to which transaction applies: |

| (3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act |

| Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was |

| determined): |

| (4) Proposed maximum aggregate value of transaction: |

| (5) Total Fee Paid: |

| |

| [ ]Fee paid previously with preliminary materials. |

| |

| [ ]Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11 (a)(2) and |

| identify the filing for which the offsetting fee was paid previously. Identify the previous filing |

| by registration statement number, or the form or schedule and the date of its filing. |

| (1) Amount previously paid: |

| (2) Form, schedule or registration statement no.: |

| (3) Filing party; |

| (4) Date filed: |

| |

| Table of contents | |

| |

| General proxy questions | 3 |

| |

| Proposal to elect trustees for each fund | 6 |

| (For all shareholders of U.S.-domiciled funds) | |

| |

| Proposal to approve a manager-of-managers arrangement | |

| with third-party investment advisors | 12 |

| (For all shareholders of certain funds) | |

| |

| Proposal to approve a new manager-of-managers | |

| arrangement with wholly owned subsidiaries of Vanguard | 14 |

| (For all shareholders of U.S.-domiciled funds) | |

| |

| Proposal to change the funds’ investment objective | 16 |

| (For all shareholders of REIT Index Fund and REIT Index Portfolio of the Variable Insurance Fund) | |

| |

| Proposal to reclassify the diversification status to nondiversified | 21 |

| (For shareholders of REIT Index Fund) | |

| |

| Proposal to adopt the Funds’ Service Agreement | 22 |

| (For shareholders of Institutional Index Fund and InstitutionalTotal Stock Market Index Fund) | |

| |

| Shareholder proposal: Genocide-free investing | 24 |

| (For shareholders of certain funds) | |

| |

| Funds and their relevant proposals . | 26 |

Page 2

General proxy questions

What is a proxy?

A proxy is the legal authority or means to permit a shareholder’s vote to be registered without his or her physical presence at an annual or special shareholder meeting. Shareholders may vote their proxy by mail, over the phone, or online.

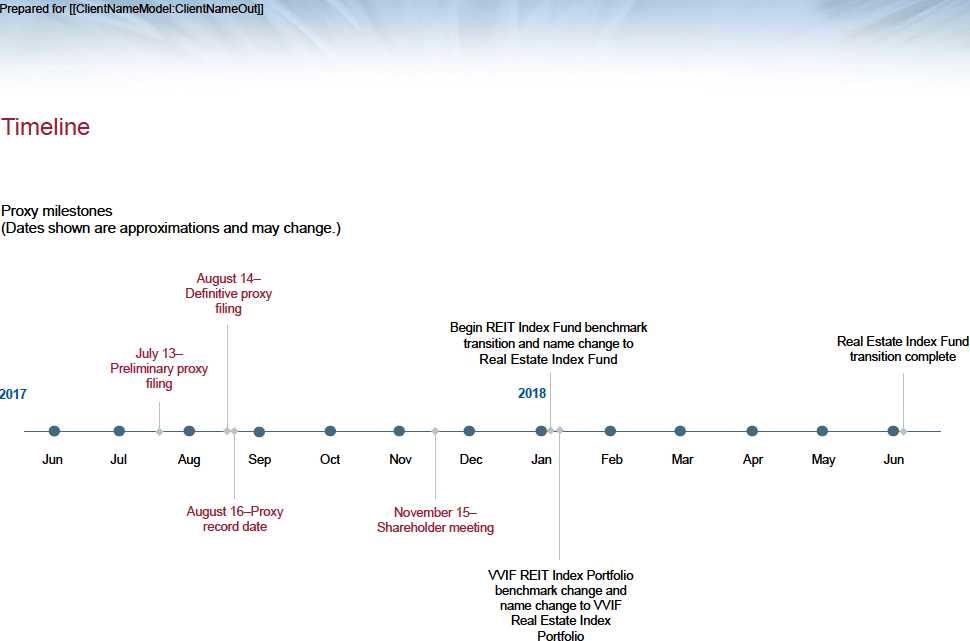

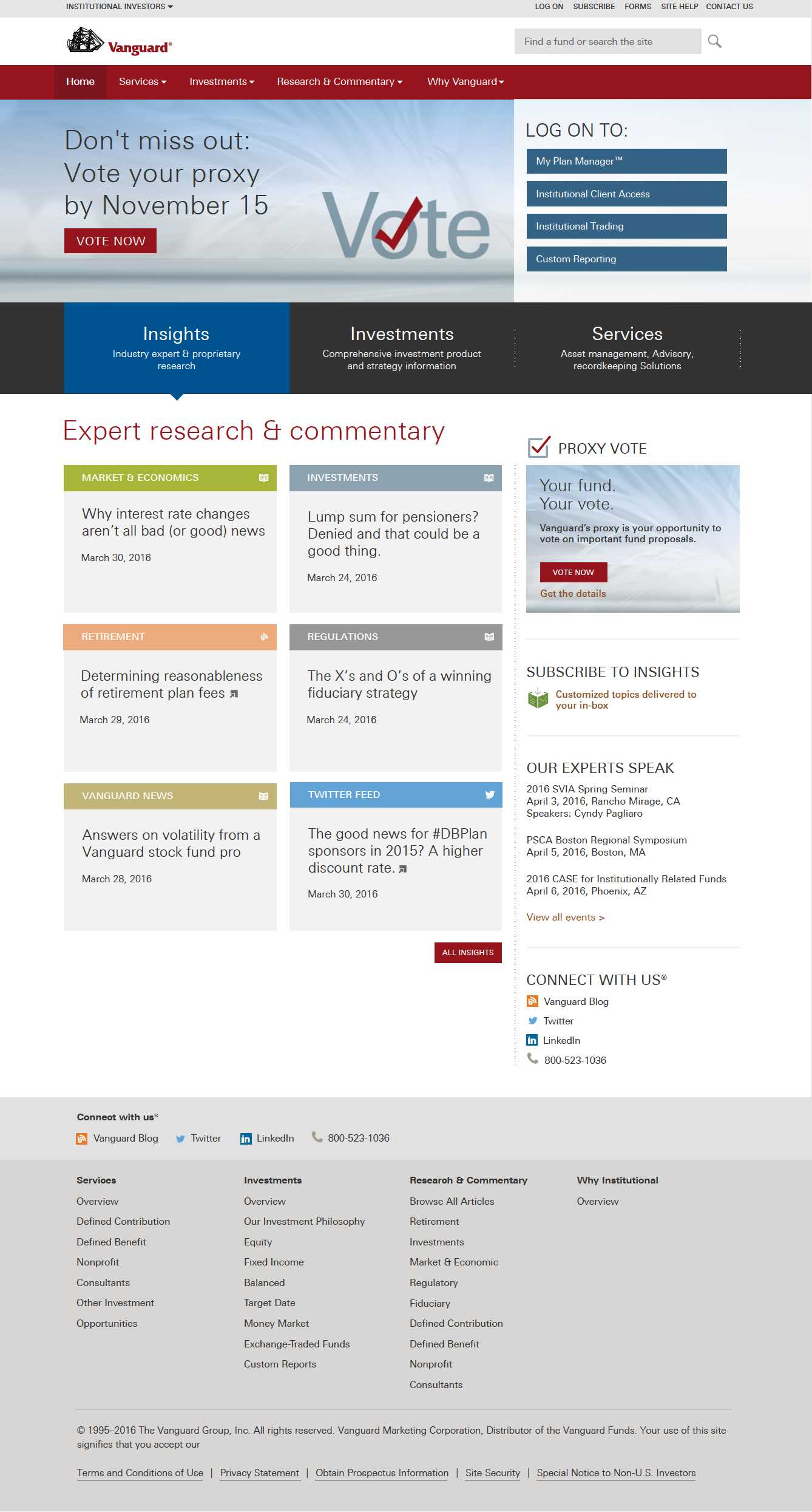

Why is Vanguard conducting a shareholder meeting and proxy?

Most importantly, shareholders are being asked to elect all fund trustees. Trustees oversee the funds to make sure they effectively serve the interests of shareholders. Shareholders are also being asked to vote on several fund policy proposals that will help Vanguard manage the funds more efficiently and effectively. Vanguard’s fund trustees believe that the policy proposals, if approved, will give the funds more operational flexibility and will be in the best interests of their shareholders.

Which Vanguard funds are involved in the proxy?

The 2017 proxy involves all U.S.-domiciled Vanguard funds.Click here for a complete list of funds.

Who can vote?

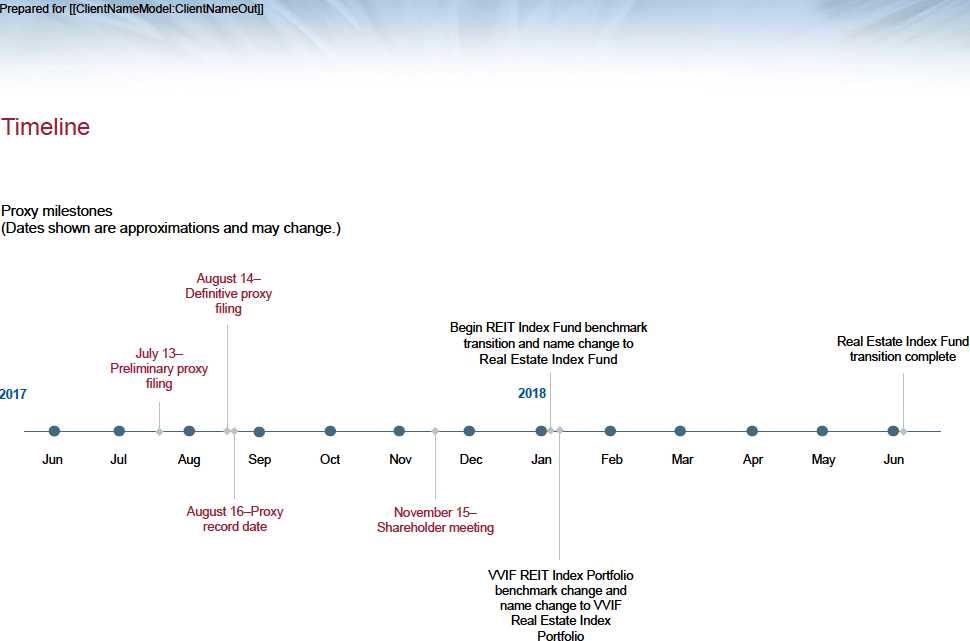

Generally speaking, any person who owns shares of a U.S.-domiciled Vanguard fund on the “record date” of August 16, 2017, can vote, even if that person later sells those shares. This includes investors living outside the United States who are invested in a U.S.-domiciled Vanguard fund. However, there may be instances in which the authority to vote resides with a retirement plan sponsor or financial advisor.

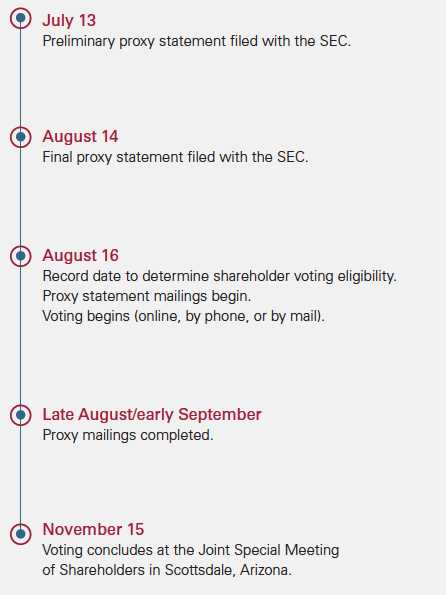

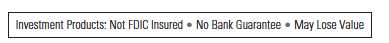

When does voting occur?

Voting by proxy will start on August 16, 2017. Shareholders can vote once they receive their proxy materials after that date. Voting concludes on November 15, 2017, at the Joint Special Meeting of Shareholders in Scottsdale, Arizona.

What is a Special Meeting of Shareholders?

A Special Meeting of Shareholders is a meeting called by a fund’s board of trustees to obtain a shareholder vote on one or more proposals. In this case, a Joint Special Meeting will be held so that shareholders of multiple funds can participate at the same meeting. Vanguard shareholders have the right to vote on important proposals concerning the fund or funds that they own. The vast majority of Vanguard shareholders vote by proxy in advance of the meeting rather than by attending in person.

How often do the Vanguard funds hold shareholder meetings?

The Vanguard funds hold shareholder meetings only when shareholder approval is required to move forward with a particular transaction or policy change or, as in this case, when appropriate to address the composition of the board of trustees and make several fund policy changes. The last time the Vanguard funds held a shareholder meeting to elect trustees was in 2009.

Why is my vote important?

Vanguard fund shareholders are owners of the funds, so their participation in the voting process is important for the funds to be able to elect trustees and operate more efficiently and effectively. Vanguard is asking shareholders to vote promptly so that the funds can avoid the extra cost of seeking the required level of shareholder participation before voting concludes at the shareholder meeting on November 15, 2017.

Page 3

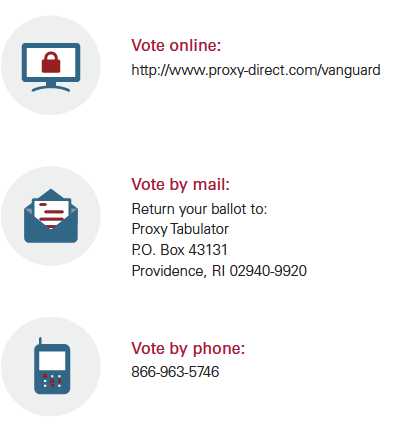

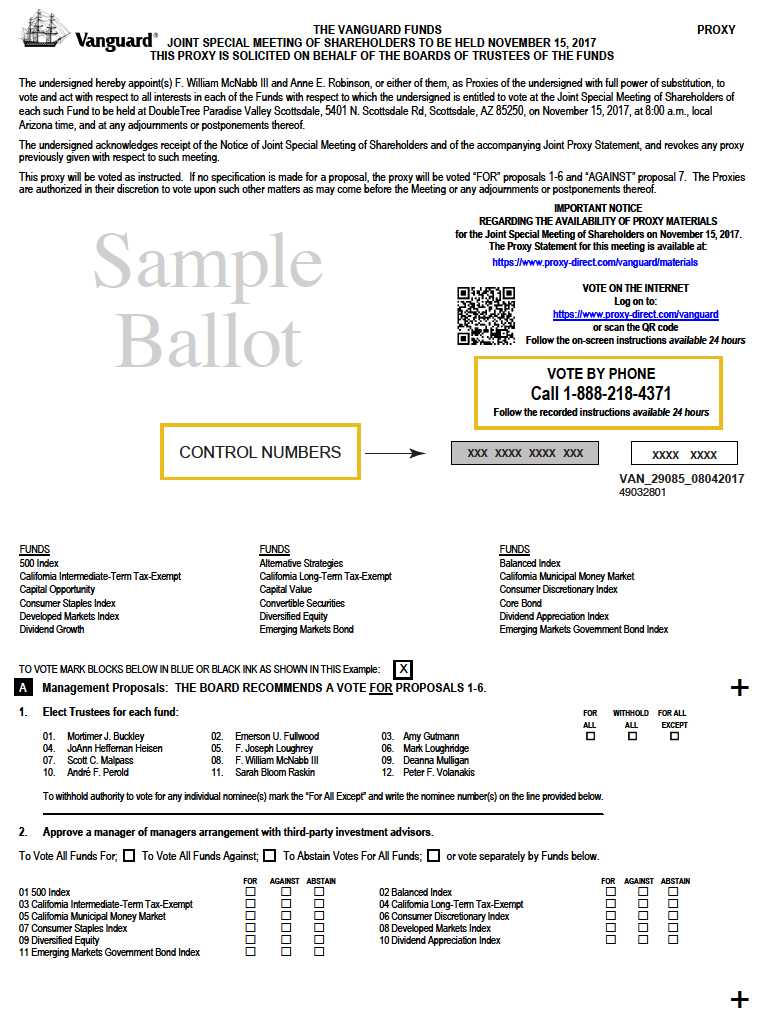

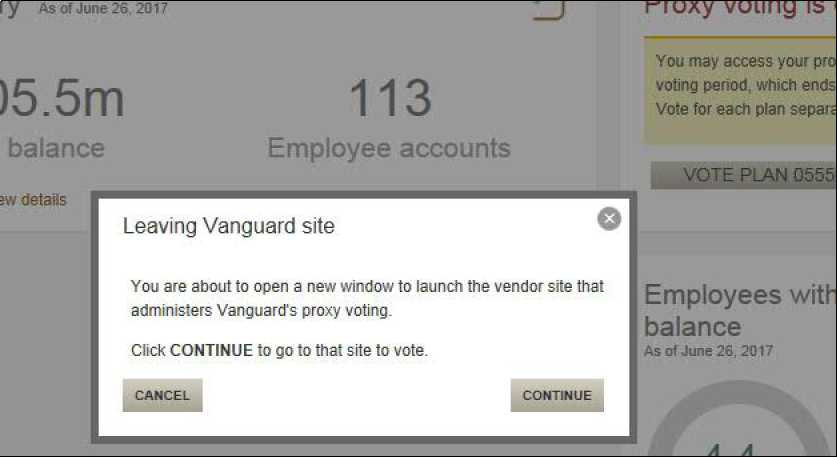

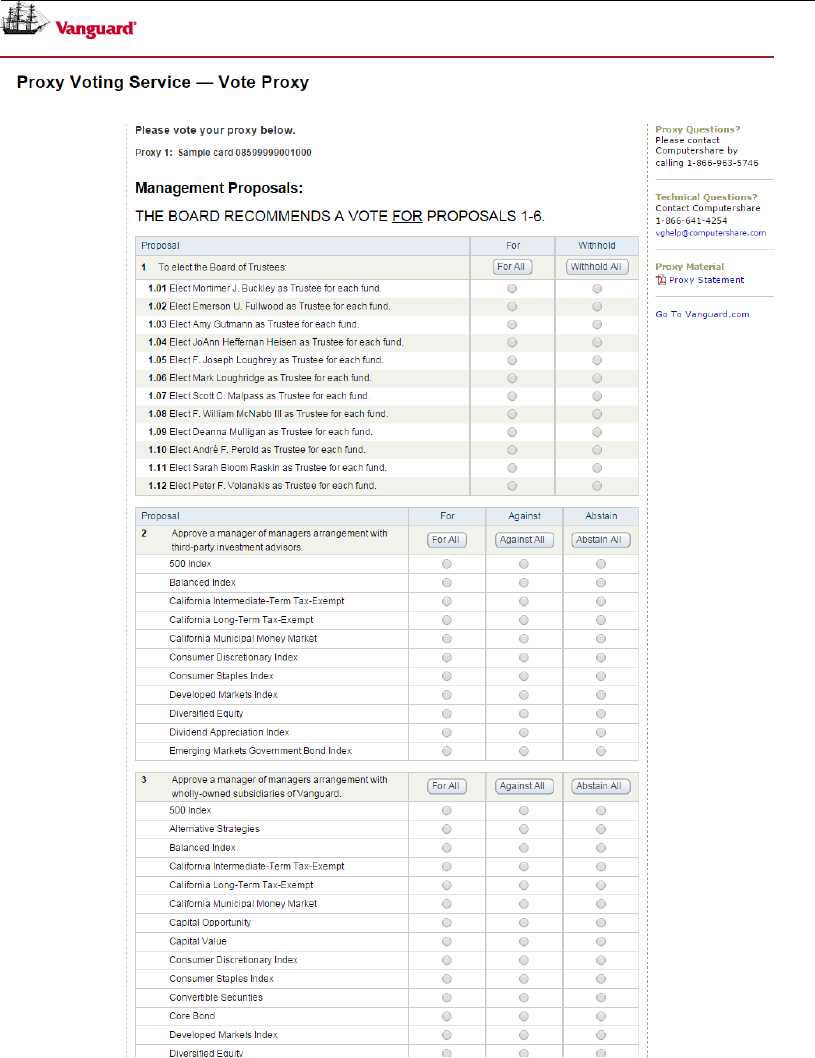

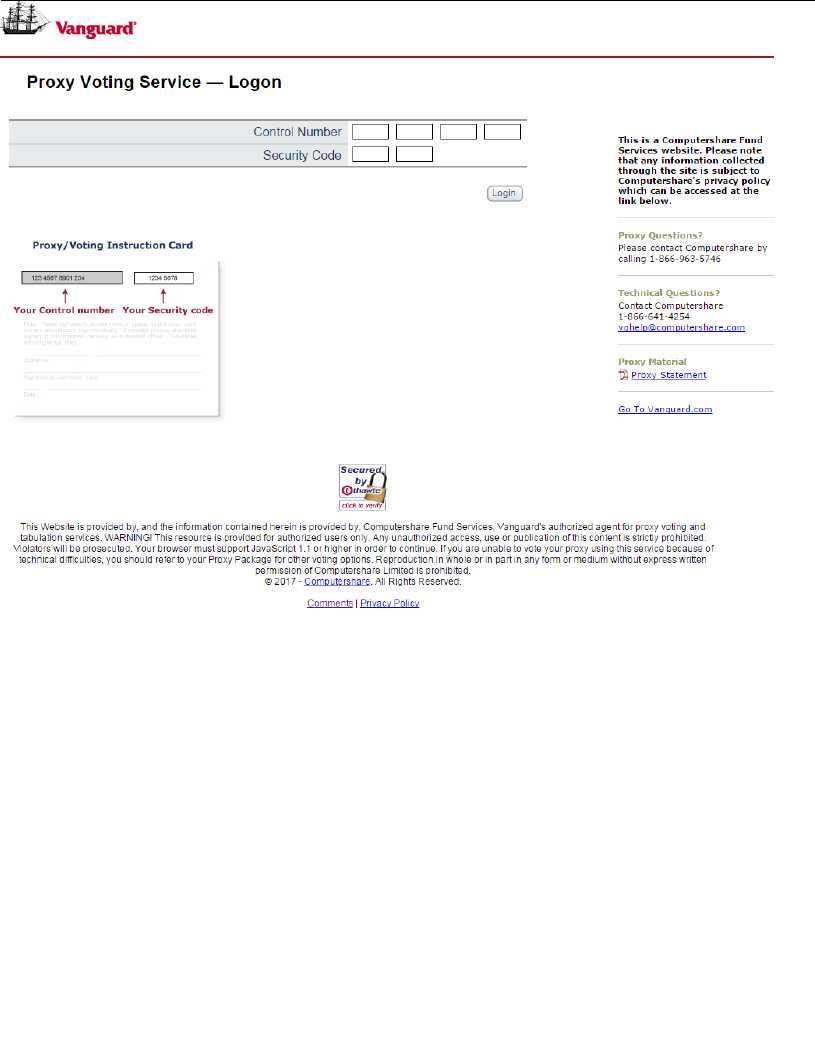

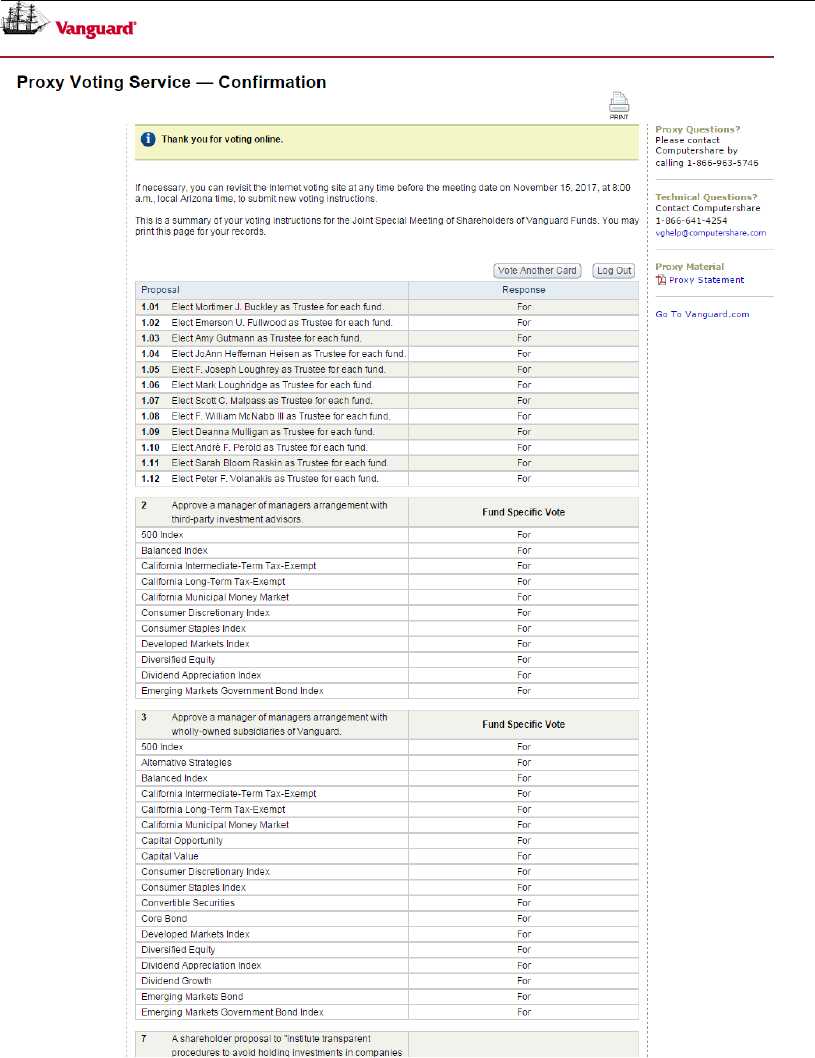

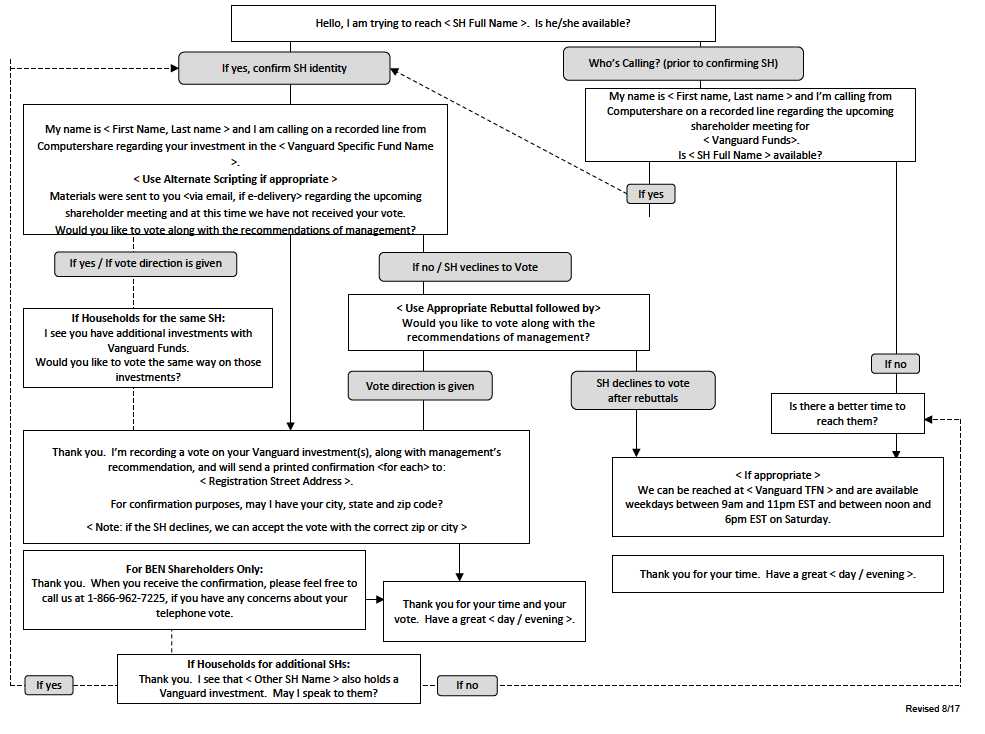

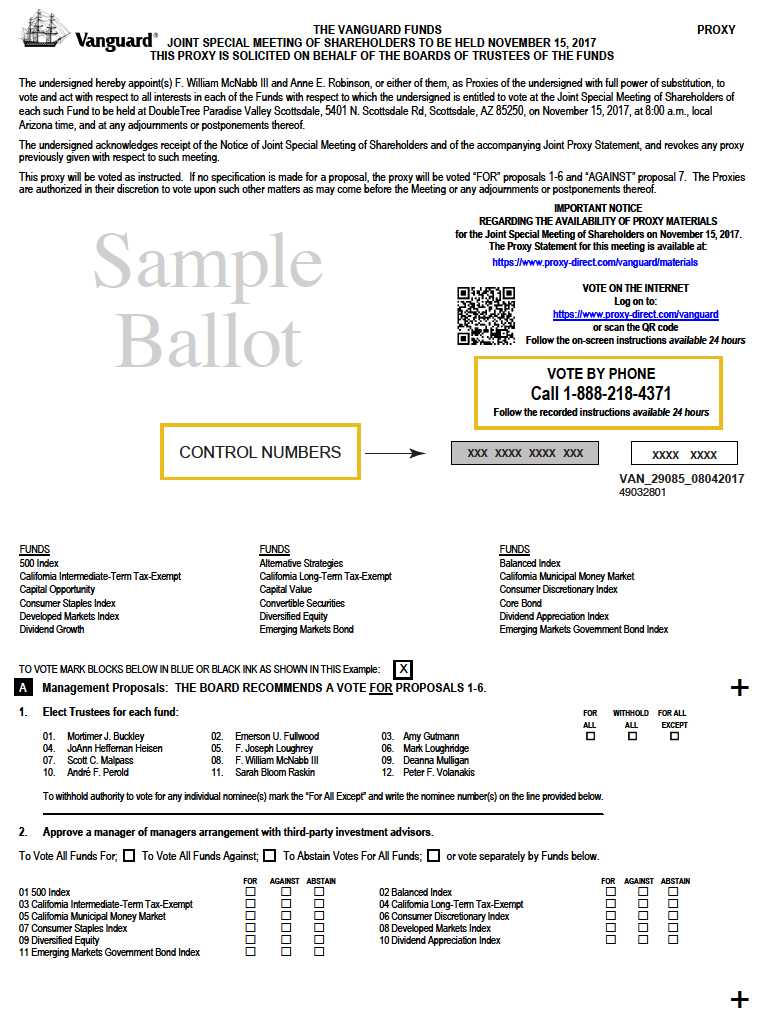

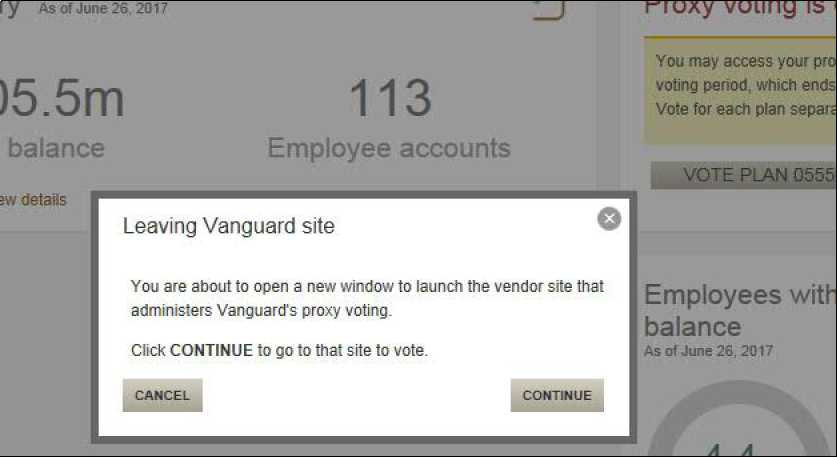

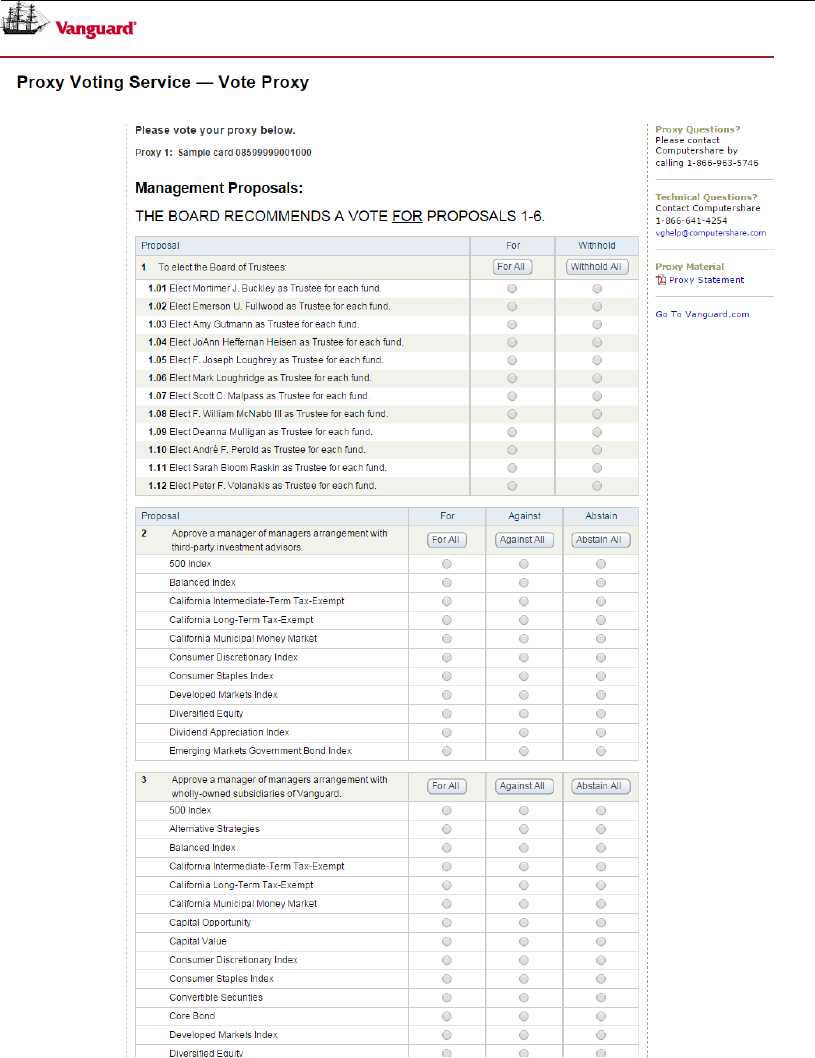

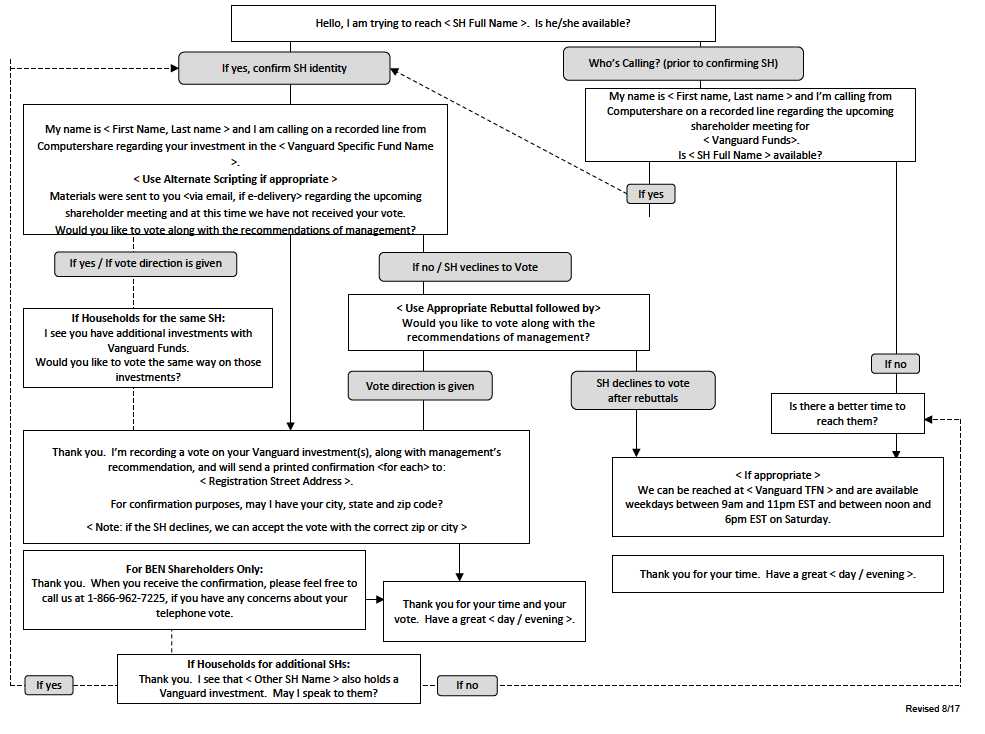

How do I vote?

Shareholders may vote in one of four ways:

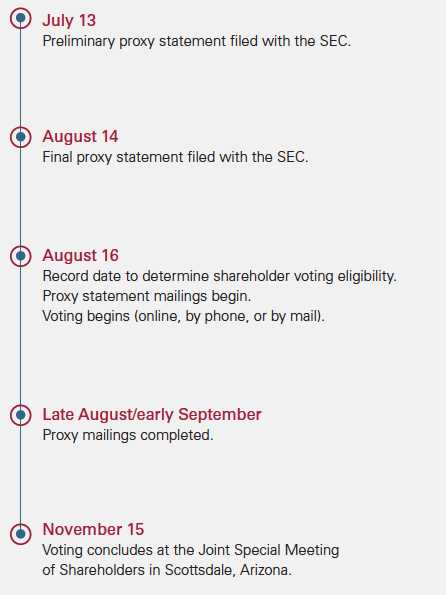

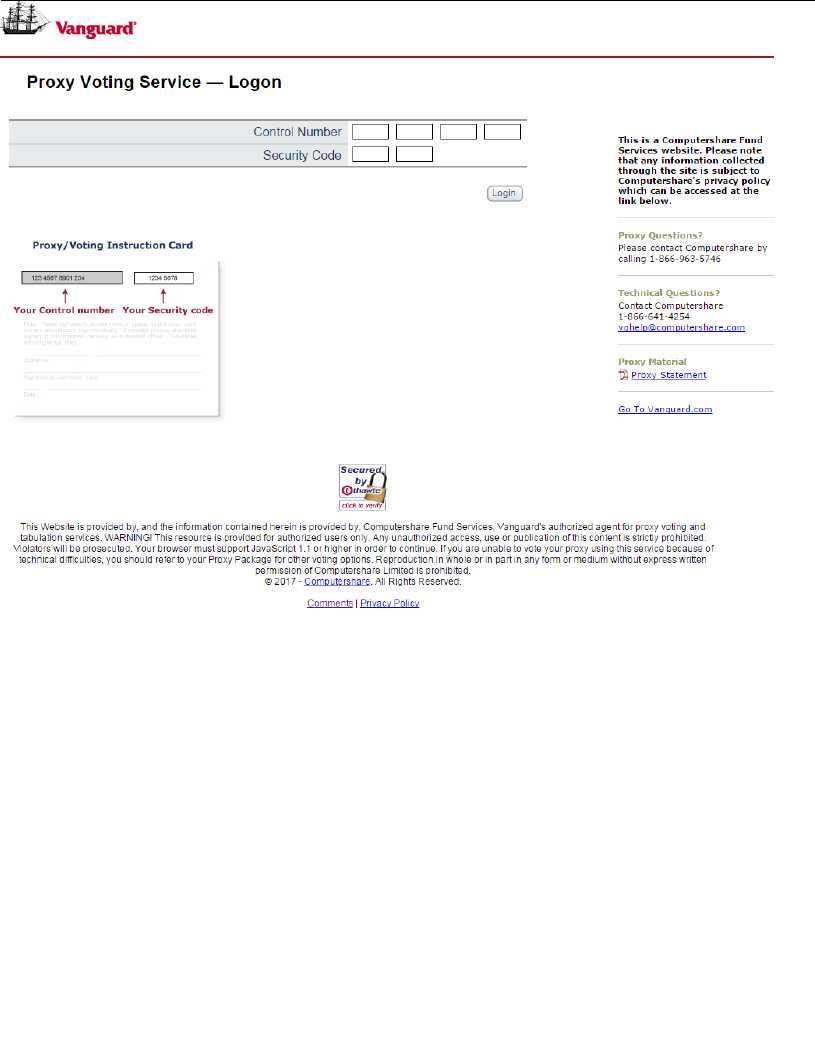

(1) Online, at the website listed on your proxy card or voting instruction card. Follow the on-screen instructions.

(2) By phone, by calling the number listed on your proxy card or voting instruction card. Follow the recorded instructions, available 24 hours a day.

(3) By mail, by signing and dating the proxy card or voting instruction card and returning it using the postage-paid envelope.

(4) In person, at the shareholder meeting on November 15, 2017, at the DoubleTree Paradise

Valley-Scottsdale, 5401 N. Scottsdale Rd., Scottsdale, Arizona 85250.

We encourage shareholders to vote online or by phone, using the voting control number and security code that appear on their proxy card or the voting control number that appears on their voting instruction card. These methods save the Vanguard funds the most money, as they require no return postage.

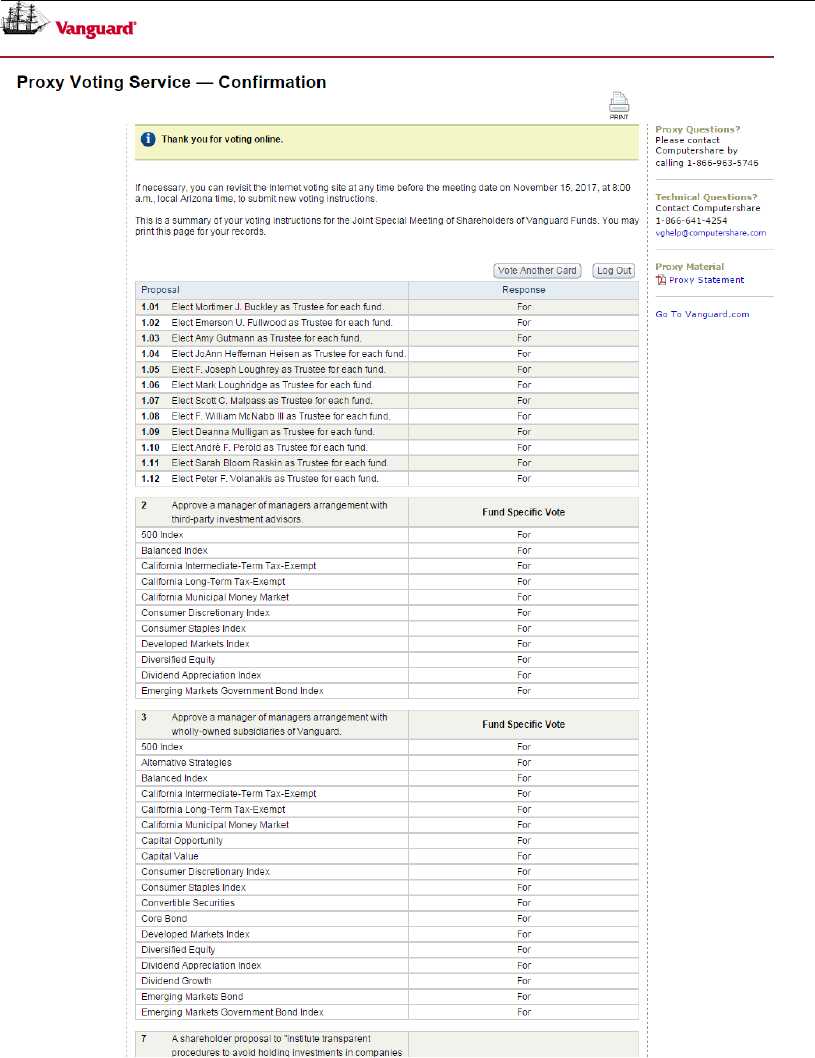

What if I want to change my vote?

If you would like to change your previous vote, you may vote again using any of the methods described above. The last vote that the shareholder casts is the one that counts.

What is a proxy card?

A proxy card is a ballot used to vote by mail.

What is a voting instruction card?

A voting instruction card is another kind of ballot used to vote by mail. Voting instruction cards are provided to fund shareholders who invest through certain intermediaries including Vanguard Brokerage Services. In these cases, shareholders are instructing their intermediaries as to how they want their shares voted. The intermediaries then place the votes pursuant to the shareholder’s instructions.

Why didn’t I get a proxy statement and proxy card or voting instruction card?

A shareholder must hold one or more U.S.-domiciled Vanguard funds as of the record date of August 16, 2017. Also, you should verify the following:

• Do you own shares through a broker-dealer or bank?

ê If so, check with your broker or bank.

• If you are signed up for e-delivery of proxy statements, confirm that your email address is correct on vanguard.com.

• If you are not signed up for e-delivery, confirm your mailing address at vanguard.com.

• Are you invested only in an institutional or 529 plan held directly with Vanguard?

ê If yes, then it is possible that the plan sponsor or State plan sponsor has the voting authority. If that is the case, you would not have received proxy materials.

• If you’re still unable to locate voting materials, call 866-963-5746 to speak with a Computershare representative.

What should I do if my security code and/or control number is not working?

For all technical difficulties, shareholders should call Computershare at 866-963-5746 to speak with a representative.

Page 4

During what hours is the Computershare voting call center open?

The touch-tone voting service is available 24 hours a day. Computershare representatives are available to take votes and answer questions Monday through Friday from 9 a.m. to 11 p.m. Eastern time and Saturdays from noon to 6 p.m. Eastern time.

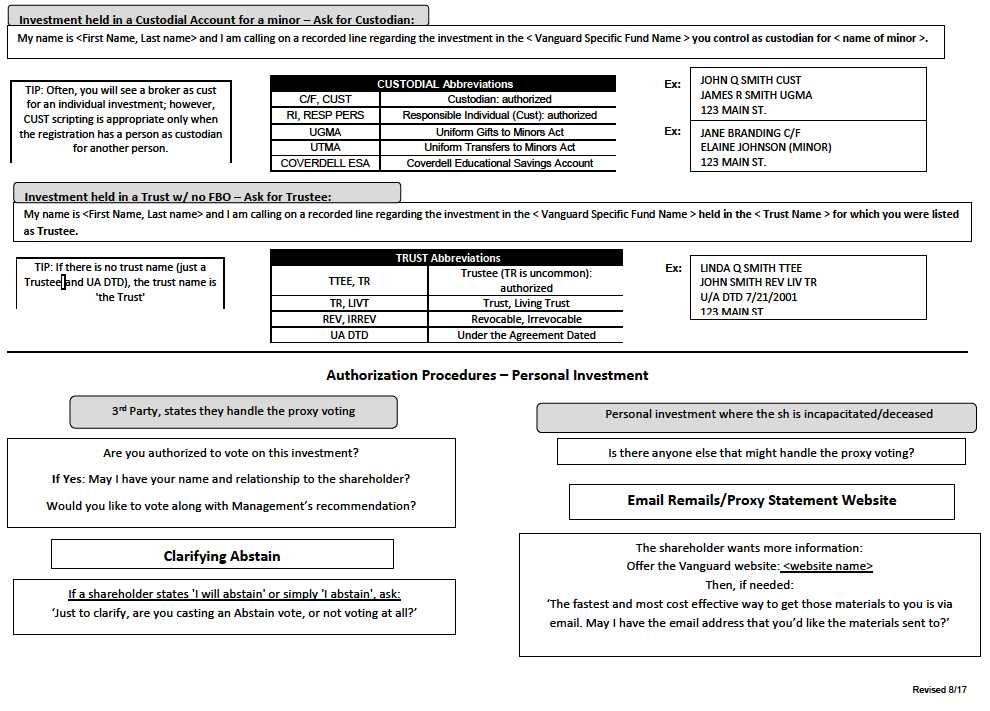

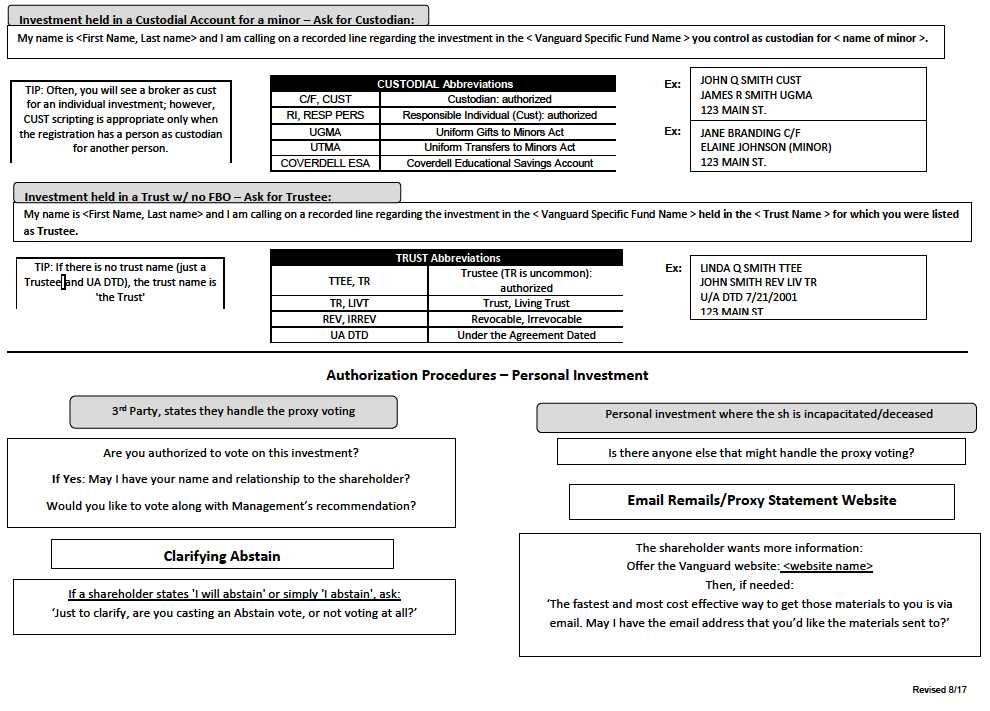

If voting by mail, how should I sign the proxy card or voting instruction card?

Shareholders should sign their name exactly as it appears on the proxy card or voting instruction card they received along with their proxy statement. For a joint account, either owner of the account may sign the card, but one of the joint owners must sign the name exactly as it appears on the card. The proxy card or voting instruction card for other types of accounts should be signed in a way that indicates the signer’s authority—for example, “John Brown, Custodian.”

If I lose my return envelope, where should I mail my proxy card to vote?

Shareholders are not required to mail their proxy cards, and they may vote by phone or online using the information on their proxy card or voting instruction card. However, if you wish to mail your vote, send your completed proxy card or voting instruction card to: PROXY TABULATOR, PO Box 43131, Providence, RI 02940-9920.

Page 5

Proposal to elect trustees for each fund

(For all shareholders of U.S.-domiciled funds)

Each fund’s board of trustees recommends a vote FOR this proposal.

What is the current composition of the board for each fund?

There are currently ten trustees on the board for each fund. Nine are independent, meaning they have no affiliation with Vanguard or the funds apart from any investments they may choose to make as private individuals.

Vanguard’s chief executive officer, F. William McNabb III, serves as chairman of the board and Mark Loughridge serves as lead independent trustee.

Why are fund shareholders being asked to elect trustees?

Obtaining shareholder approval of the full slate of trustee nominees will enable the new nominees (who were not previously elected by shareholders)—Mortimer J. Buckley, Deanna Mulligan, and Sarah Bloom Raskin—to join each fund’s board of trustees. Each fund’s board will then (i) be 100% elected by shareholders and (ii) will have flexibility for future appointments as circumstances warrant.

Shareholders must elect at least one-half of a fund’s board of trustees. In addition, a fund’s board can fill any board vacancies by appointment only if, immediately after the board fills the vacancy, at least two-thirds of the trustees are ones whom shareholders had elected. The ability to appoint is important, because without it the funds would have to hold expensive shareholder meetings for each new trustee each time a vacancy needed to be filled. Given the current composition of the funds’ boards, however, the funds are not able to add new trustees through appointment.

Importantly, a long-serving elected trustee, Rajiv L. Gupta, plans to retire from each fund’s board at the end of December 2017.

| | |

| Who are the nominees? | | |

| |

| Nominees | Principal Occupation(s) and Outside Directorships | |

| Interested Trustees | | |

| |

| Mortimer J. Buckley2 | | |

| Born 1969 | Mr. Buckley has served as President and Director of The Vanguard Group, Inc., | |

| Nominee | since July 2017. Prior to this, Mr. Buckley served as Chief Investment Officer of | |

| | Vanguard from 2013 to 2017, head of the Retail Investor Group from 2006 to 2012, | |

| | and Chief Information Officer of Vanguard from 2001 to 2006. He also served as | |

| | Chairman of the Board of The Children’s Hospital of Philadelphia from 2011 | |

| | to 2017 | . |

2 If elected as trustee of the Vanguard funds, Mr. Buckley will be considered an “interested person,” as defined in the Investment Company Act of 1940, of each Vanguard fund because he also holds the position of president of Vanguard.

Page 6

| |

| Nominees | Principal Occupation(s) and Outside Directorships |

| Interested Trustees (continued) | |

| |

| F. William McNabb III3 | |

| Born 1957 | Mr. McNabb has served as Chairman of the Board of The Vanguard Group, Inc., |

| Chairman of the | and of each of the investment companies served by Vanguard, since January 2010; |

| Board of Trustees | Trustee of each of the investment companies served by Vanguard, since 2009; |

| | Director of Vanguard, since 2008; Chief Executive Officer of Vanguard and Chief |

| | Executive Officer and President of each of the investment companies served by |

| | Vanguard, since 2008; and President of Vanguard from 2008 to 2017. Mr. McNabb |

| | also serves as a Director of Vanguard Marketing Corporation. Mr. McNabb served as |

| | a Managing Director of Vanguard from 1995 to 2008 and has been a Vanguard funds |

| | trustee since July 2009. |

| Independent Trustees | |

| |

| Emerson U. Fullwood | |

| Born 1948 | Mr. Fullwood is the former Executive Chief Staff and Marketing Officer for North |

| Trustee | America and Corporate Vice President (retired 2008) of Xerox Corporation |

| | (document management products and services). Previous positions held by Mr. |

| | Fullwood at Xerox include President of the Worldwide Channels Group, President of |

| | Latin America, Executive Chief Staff Officer of Developing Markets, and President |

| | of Worldwide Customer Services. Mr. Fullwood is the Executive in Residence and |

| | 2009–2010 Distinguished Minett Professor at the Rochester Institute of Technology. |

| | Mr. Fullwood serves as Lead Director of SPX FLOW, Inc. (multi-industry |

| | manufacturing); as a Director of the University of Rochester Medical Center, |

| | Monroe Community College Foundation, the United Way of Rochester, North |

| | Carolina A&T University, and Roberts Wesleyan College; and as a Trustee of the |

| | University of Rochester. Mr. Fullwood has been a Vanguard funds trustee since |

| | January 2008. |

| Amy Gutmann | |

| Born 1949 | Dr. Gutmann has served as President of the University of Pennsylvania since 2004. |

| Trustee | She is the Christopher H. Browne Distinguished Professor of Political Science, |

| | School of Arts and Sciences, and Professor of Communication, Annenberg School |

| | for Communication, with secondary faculty appointments in the Department of |

| | Philosophy, School of Arts and Sciences, and at the Graduate School of Education, |

| | University of Pennsylvania. Dr. Gutmann also serves as a Trustee of the National |

| | Constitution Center. Dr. Gutmann has been a Vanguard funds trustee since |

| | June 2006. |

| JoAnn Heffernan Heisen | |

| Born 1950 | Ms. Heisen is the former Corporate Vice President of Johnson & Johnson |

| Trustee | (pharmaceuticals/medical devices/consumer products) and a former member of the |

| | Executive Committee (1997–2008). During her tenure at Johnson & Johnson, Ms. |

| | Heisen held multiple roles, including: Chief Global Diversity Officer (retired 2008), |

| | Vice President and Chief Information Officer (1997–2006), Controller (1995–1997), |

| | Treasurer (1991–1995), and Assistant Treasurer (1989–1991). Ms. Heisen serves as |

| | a Director of Skytop Lodge Corporation (hotels) and the Robert Wood Johnson |

| | Foundation and as a member of the Advisory Board of the Institute for Women’s |

| | Leadership at Rutgers University. Ms. Heisen has been a Vanguard funds trustee |

| | since July 1998. |

3 Mr. McNabb is considered an “interested person,” as defined in the Investment Company Act of 1940, because he is an officer of the Vanguard funds and because of his position at Vanguard.

Page 7

| |

| Nominees | Principal Occupation(s) and Outside Directorships |

| Independent Trustees (continued) |

| |

| F. Joseph Loughrey | |

| Born 1949 | Mr. Loughrey is the former President and Chief Operating Officer (retired 2009) and |

| Trustee | Vice Chairman of the Board (2008–2009) of Cummins Inc. (industrial machinery). |

| | Mr. Loughrey serves as Chairman of the Board of Hillenbrand, Inc. (specialized |

| | consumer services), Oxfam America, and the Lumina Foundation for Education; as a |

| | Director of the V Foundation for Cancer Research; and as a member of the Advisory |

| | Council for the College of Arts and Letters and Chair of the Advisory Board to the |

| | Kellogg Institute for International Studies, both at the University of Notre Dame. |

| | Mr. Loughrey has been a Vanguard funds trustee since October 2009. |

| Mark Loughridge | |

| Born 1953 | Mr. Loughridge is the former Senior Vice President and Chief Financial Officer |

| Trustee | (retired 2013) at IBM (information technology services). Mr. Loughridge also served |

| | as a fiduciary member of IBM’s Retirement Plan Committee (2004–2013). Previous |

| | positions held by Mr. Loughridge at IBM include Senior Vice President and General |

| | Manager of Global Financing (2002–2004), Vice President and Controller (1998– |

| | 2002), and a variety of management roles. Mr. Loughridge serves as a Director of |

| | The Dow Chemical Company and as a member of the Council on Chicago Booth. |

| | Mr. Loughridge has been a Vanguard funds trustee since March 2012. |

| Scott C. Malpass | |

| Born 1962 | Mr. Malpass has served as Chief Investment Officer since 1989 and Vice President |

| Trustee | since 1996 at the University of Notre Dame. Mr. Malpass serves as an Assistant |

| | Professor of Finance at the Mendoza College of Business at the University of Notre |

| | Dame and is a member of the Notre Dame 403(b) Investment Committee. |

| | Mr. Malpass also serves as Chairman of the Board of TIFF Advisory Services, Inc., |

| | and on the board of Catholic Investment Services, Inc. (investment advisors); as a |

| | member of the board of advisors for Spruceview Capital Partners; and as a member |

| | of the Board of Superintendence of the Institute for the Works of Religion. |

| | Mr. Malpass has been a Vanguard funds trustee since March 2012. |

| Deanna Mulligan | |

| Born 1963 | Ms. Mulligan has served as Chief Executive Officer since 2011 and President since |

| Nominee | 2010 of The Guardian Life Insurance Company of America.4Previous positions held |

| | by Ms. Mulligan since joining The Guardian Life Insurance Company of America in |

| | 2008 include Chief Operating Officer (2010–2011) and Executive Vice President |

| | of Individual Life and Disability (2008–2010). Ms. Mulligan serves as a Board |

| | Member of The Guardian Life Insurance Company of America, the American Council |

| | of Life Insurers, the Partnership for New York City (business leadership), and the |

| | Committee Encouraging Corporate Philanthropy; as a Trustee of the Economic Club |

| | of New York and the Bruce Museum (arts and science); and as a member of the |

| | Advisory Council for the Stanford Graduate School of Business. |

4 Guardian Life provides group insurance and administrative services for employee benefits such as group life, dental, vision, and disability coverage to two advisors, each of which manages one or more of the Vanguard funds. Amounts paid by these advisors to Guardian Life for such insurance and services were less than 0.006% of Guardian Life’s premium revenues in each of 2015 and 2016. Park Avenue Securities (PAS) is an indirect, wholly owned subsidiary of Guardian Life and a dually registered broker-dealer and investment adviser. From time to time, PAS receives payments related to the sale of certain non-Vanguard mutual funds advised by firms that also advise certain Vanguard funds. In 2016, these payments amounted to less than 0.15% of PAS’ revenues and PAS’ earnings comprised less than 1% of Guardian Life’s pre-tax earnings. Deanna Mulligan is not an officer or director of PAS.

Page 8

| |

| Nominees | Principal Occupation(s) and Outside Directorships |

| Independent Trustees (continued) |

| |

| André F. Perold | |

| Born 1952 | Dr. Perold is the George Gund Professor of Finance and Banking, Emeritus at the |

| Trustee | Harvard Business School (retired 2011). Dr. Perold serves as Chief Investment |

| | Officer and Co-Managing Partner of HighVista Strategies LLC (private investment |

| | firm). Dr. Perold also serves as an Overseer of the Museum of Fine Arts Boston. |

| | Dr. Perold has been a Vanguard funds trustee since December 2004. |

| Sarah Bloom Raskin | |

| Born 1961 | Ms. Raskin served as Deputy Secretary of the United States Department of the |

| Nominee | Treasury (2014–2017), as Governor of the Federal Reserve Board (2010–2014), and |

| | as Commissioner of Financial Regulation of the State of Maryland (2007–2010). Ms. |

| | Raskin also served as a member of the Neighborhood Reinvestment Corporation |

| | Board from 2012 to 2014. |

| Peter F. Volanakis | |

| Born 1955 | Mr. Volanakis is the retired President and Chief Operating Officer (retired 2010) of |

| Trustee | Corning Incorporated (communications equipment) and a former Director of Corning |

| | Incorporated (2000–2010) and of Dow Corning (2001–2010). Mr. Volanakis served |

| | as a Director of SPX Corporation (multi-industry manufacturing) in 2012 and as an |

| | Overseer of the Amos Tuck School of Business Administration at Dartmouth |

| | College from 2001 to 2013. Mr. Volanakis serves as Chairman of the Board of |

| | Trustees of Colby-Sawyer College and is a Member of the Board of Hypertherm Inc. |

| | (industrial cutting systems, software, and consumables). Mr. Volanakis has been a |

| | Vanguard funds trustee since July 2009. |

How many of the nominees will be independent trustees if elected?

Ten of the twelve nominees—all but Mr. McNabb and Mr. Buckley—will be independent trustees if elected by shareholders.

How many of the trustee nominees have ownership shares in Vanguard funds?

All the nominees allocate personal assets among the Vanguard funds according to their own investment needs. Each nominee owns more than $100,000 worth of shares of Vanguard funds. As a group, each fund’s nominees own less than 1% of the outstanding shares of that fund.

How are the boards of each Vanguard fund structured?

The Vanguard funds are grouped into 37 separate trusts. Each trust is made up of one or more Vanguard funds (which are sometimes called “series” of the trust). Funds that are part of the same trust elect their trustees jointly.

The same individuals currently serve as trustees for all the Vanguard funds. There are important benefits in having the board of each fund include trustees who serve on the boards of the other Vanguard funds. Service on multiple fund boards gives the trustees greater familiarity with operations that are common to all Vanguard funds. Such service also permits the trustees to address common issues knowledgeably and consistently. It also avoids the substantial additional costs, administrative complexities, and redundancies that would result from having a different board of trustees for every Vanguard fund.

Although there are many areas of common interest among the funds, the trustees recognize that they are responsible for exercising their responsibilities at all times on a fund-by-fund basis.

Page 9

How long will each trustee serve if elected?

If elected, each trustee will serve until he or she resigns, retires, or is removed from the board as provided in the fund’s governing documents. The trustees believe that, as a general matter, each trustee should retire from the board no later than the end of the year in which the trustee attains age 72. However, the trustees believe that a majority of the independent trustees should be permitted to allow any independent trustee who attains age 72 to continue to serve on the board for a temporary period (not to exceed one year) if exceptional circumstances are present and if a temporary extension of service is determined to be in the best interests of the Vanguard funds.

A trustee may be removed from the board by a shareholder vote representing two-thirds of the total combined net asset value of all fund shares under the same trust. If a nominee is unable to accept election, or subsequently leaves the board before the next election, the board of trustees may, in its discretion, select another person to fill the vacancy.

What are the responsibilities of the board of each fund?

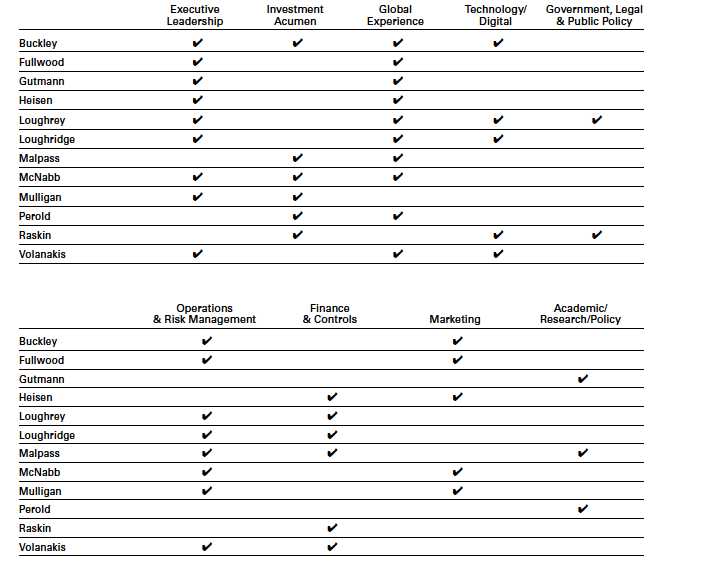

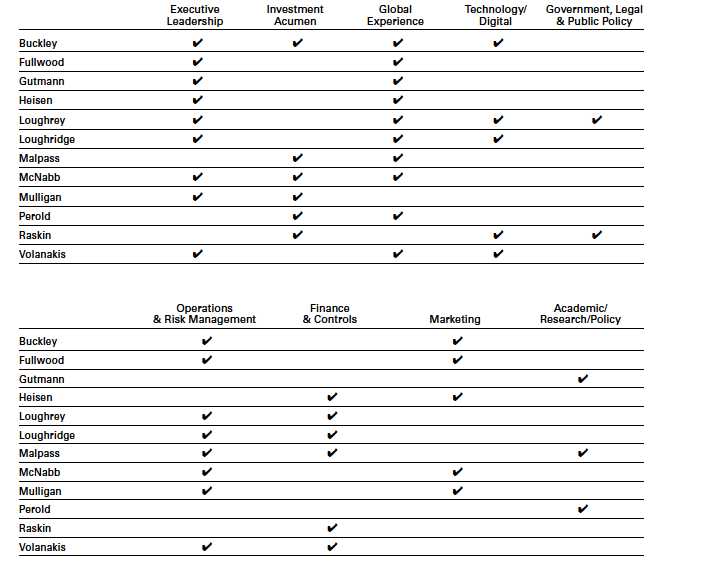

The primary responsibility of the board of trustees of each fund is to oversee the management of the fund for the benefit of shareholders. Each board has a supermajority of independent trustees who are not “interested persons” of the funds. Mr. McNabb and Mr. Buckley would be the only interested trustees on the funds’ boards. The independent trustees bring a broad range of relevant backgrounds, experience, and skills to the boards, particularly in those domains critical to the funds and their shareholders.

In exercising their oversight responsibilities, the trustees focus on matters they determine to be vitally important to fund shareholders. This includes not only the management, performance, and risk management of the funds, but also the approval of arrangements with material service providers (e.g., fund custodians).

The investment acumen, experience, and objective thinking of the independent trustees are invaluable assets for the funds’ shareholders and Vanguard management. Holding management accountable to a group of independent, highly experienced, and qualified individuals who act solely on behalf of shareholders makes management more effective in the long run.

Each fund’s board of trustees met seven times during its last fiscal year. No trustee attended fewer than 75% of the total meetings of the board and 75% of the total meetings of the board committees on which he or she serves.

How are trustees selected?

The independent trustees’ nominating committee nominates candidates for election to the board of trustees of each fund. Oversight of the funds and their management by a group of highly qualified trustees is critical to the long-term investment outcomes of our fund investors. To that end, the board has identified a range of capabilities relevant to the funds’ operations that the trustees—in aggregate—must bring to bear as fiduciaries for fund shareholders. The board expects that all trustees will be of the highest integrity, committed to acting solely in fund investors’ best interests, and have a track record of substantial professional accomplishment.

Page 10

The following table reflects the board’s assessment of each trustee’s background and its relevance to oversight of the funds:

Although each trustee and nominee may not be equally skilled in each area the board deems important, the board

believes that a variety of skills and experience—as well as diversity along dimensions such as age, tenure, gender,

and ethnicity—will result in a board uniquely suited to serve investors’ long-term interests.

Page 11

Proposal to approve a manager-of-managers arrangement with third-party investment advisors

(For all shareholders of funds listedhere)

Each fund’s board of trustees recommend a vote FOR this proposal.

What are shareholders being asked to approve?

If approved, this proposal would allow 147 U.S.-domiciled Vanguard funds, including all Vanguard-managed index funds and 18 Vanguard-managed active funds, to enter into or materially amend investment advisory agreements with third-party investment advisors without first obtaining additional approval.

(Click here for a list of the affected funds.)

How will the funds and fund shareholders benefit from passage of this proposal?

If approved, this proposal would give the funds flexibility to enter into and materially amend investment advisory contracts without prior shareholder approval, potentially saving shareholders from additional fund expenses and delays associated with obtaining shareholder approval.

Vanguard has over 20 years of experience in identifying, evaluating, and monitoring investment advisors; selecting and refining investment objectives; and evaluating and negotiating low-cost advisory fees. Approval of this proposal would allow the funds to benefit from Vanguard’s expertise in recommending and monitoring the most suitable third-party investment advisors for the funds and negotiating competitive fees with those advisors.

In addition, approval of this proposal would bring consistency to the Vanguard fund complex by allowing all funds to benefit from the existing manager-of-managers arrangement when structuring their advisory arrangements, as several funds currently have this flexibility. Approval of this proposal would also give the Vanguard funds many of the same benefits enjoyed by a wide range of competitors that rely on similar permission to structure their advisory arrangements.

Lastly, having this flexibility would enhance the funds’ business continuity plans by providing an additional option for the funds to continue operating should an event, such as a natural disaster, significantly disrupt Vanguard’s operations.

If approved, what changes will the funds be able to make without prior shareholder approval?

If this proposal is approved, each fund’s board of trustees would be required to approve any new or amended advisory agreements and would continue to provide oversight of the investment advisor selection and engagement process. The trustees would periodically review and consider for renewal all investment advisory agreements with any third-party investment advisors.

Each fund will have the flexibility to enter into and materially amend an investment advisory agreement with a third-party advisor if the fund’s trustees approve the agreement or amendments. Once approved, a fund would be able to make the following changes without prior shareholder approval:

• A fund may reallocate its assets among existing advisors;

• A fund may allocate a portion of its assets to one or more advisors;

• A fund may replace existing advisors with a different advisor;

• A fund may continue an advisory agreement where a change of management control of the advisor would otherwise require shareholder approval.

Page 12

Will shareholders be notified in the event that a fund enters into or materially changes an investment advisory agreement with a new third-party advisor?

Within 90 days of hiring a new third-party advisor, Vanguard would provide a statement to shareholders containing certain information about the new advisor and the related advisory agreement.

Are there currently any plans to change a fund’s advisory arrangements based on this proposal?

No. Vanguard has not recommended, and no fund’s board of trustees has approved, any changes to a fund’s advisory arrangements in anticipation of receiving approval of this proposal.

What happens if shareholders do not approve this proposal?

If shareholders of a fund do not approve this proposal, then the fund will not be permitted to rely on the existing manager-of-managers arrangement and would be required to obtain shareholder approval before entering into or materially amending an investment advisory agreement with a third-party advisor.

Page 13

Proposal to approve a new manager-of-managers arrangement with wholly owned subsidiaries of Vanguard

(For all shareholders of U.S.-domiciled funds)

Each fund’s board of trustees recommends a vote FOR this proposal.

What are shareholders being asked to approve?

If approved, and pending approval of a U.S. Securities and Exchange Commission (SEC) exemptive application, this proposal would enable all U.S.-domiciled Vanguard funds to enter into or materially amend investment advisory agreements with wholly owned subsidiaries of Vanguard.

How will the funds and fund shareholders benefit from the passing of this proposal?

If approved, this proposal would give the funds flexibility to enter into and materially amend investment advisory contracts with third-party investment advisors and wholly owned subsidiaries of Vanguard without first obtaining additional shareholder approval. This flexibility could potentially save shareholders additional fund expenses and delays associated with obtaining shareholder approval.

Approving this proposal would also allow the funds to leverage certain capabilities of Vanguard’s non-U.S. subsidiaries, which would be particularly valuable for funds that transact in non-U.S. markets. More specifically, funds would benefit from the ability to participate in the new-issue market outside of normal U.S. business hours, leverage relationships with brokers in local markets, and gain access to local issuers through investor calls and in-person meetings.

Lastly, having this flexibility would enhance the funds’ business continuity plans by providing an additional option for the funds to continue operating should an event, such as a natural disaster, significantly disrupt Vanguard’s operations.

How is this proposal different from the proposal seeking approval of the existing manager-of-managers arrangement with third-party investment advisors?

The proposal to approve an existing manager-of-managers arrangement with third-party investment advisors seeks shareholder approval to rely on existing SEC permission that was granted in 1993. It permits funds to enter into and materially amend investment advisory agreements with third-party investment advisors, but it does not extend to agreements with wholly owned subsidiaries of Vanguard. The proposal to approve a new manager-of-managers arrangement with wholly owned subsidiaries of Vanguard would allow the funds to enter into or materially amend investment advisor agreements with both third-party investment advisors and wholly owned subsidiaries of Vanguard, provided that the SEC grants the funds’ application for permission.

Why are shareholders being asked to vote on both manager-of-managers proposals?

Although the SEC has issued a large number of similar manager-of-managers orders, there is no guarantee it will grant the funds’ requested permission. If the SEC denies the funds’ request for a new managers-of-managers arrangement, the funds would not be able to enact the new arrangement even if shareholders approve the manager-of-managers proposal involving wholly owned subsidiaries.

How does the proposal support the best interests of fund shareholders?

If the SEC grants the funds’ requested permission and shareholders approve this proposal, then under the new manager-of-managers arrangement, each fund’s board of trustees would be required to approve any new or amended advisory agreements and would continue to provide oversight of the investment advisor selection and engagement process.

Page 14

In addition, whenever Vanguard recommends an investment advisory change for a fund involving one of Vanguard’s wholly owned subsidiaries, the board of trustees of the fund must find that such change is in the best interests of the fund and its subsidiaries and does not involve a conflict of interest from which Vanguard or its wholly owned subsidiary derives an inappropriate advantage. Each year, a fund’s board of trustees would review and consider for renewal all investment advisory agreements with any third-party investment advisors.

If approved, what changes will the funds be able to make without prior shareholder approval?

In addition to shareholder approval, the SEC would need to grant Vanguard’s request for permission before the funds could proceed. Assuming both conditions are met, a fund would be able to make the following changes without prior shareholder approval:

• A fund may reallocate its assets among existing advisors, including Vanguard;

• A fund may allocate a portion of its assets to one or more additional advisors, including a wholly owned subsidiary of Vanguard;

• A fund may replace an existing advisor with a different advisor, including a wholly owned subsidiary of Vanguard;

• A fund may continue an advisory agreement when a change of control of the advisor would otherwise require shareholder approval.

Will shareholders be notified in the event that a fund enters into or materially changes an investment advisory agreement?

Within 90 days of hiring a new advisor, the fund must provide to shareholders an information statement, and/or notice of availability of such an information statement on a website, that contains certain information about the new advisor and the related advisory agreement.

Are there currently any plans to change a fund’s advisory arrangements based on this proposal?

No. Vanguard has not recommended, and no fund’s board of trustees has approved, any changes to a fund’s advisory arrangements in anticipation of receiving approval of this proposal.

What happens if shareholders do not approve this proposal?

If shareholders of a fund do not approve the proposal, then the fund will not be permitted to rely on the new manager-of-managers arrangement and would be required to obtain shareholder approval before entering into or materially amending an investment advisory agreement with a wholly owned subsidiary of Vanguard.

Page 15

Proposal to change the funds’ investment objective

(For shareholders of Vanguard REIT Index Fund and the REIT Index Portfolio of Vanguard Variable Insurance Fund)

Each fund’s board of trustees recommends a vote FOR this proposal.

What are shareholders being asked to approve?

This proposal solicits shareholder approval to change the investment objective of Vanguard REIT Index Fund and Vanguard Variable Insurance Fund REIT Index Portfolio, as shown here:

| |

| Current investment objective | Proposed investment objective |

| |

| The Fund/Portfolio seeks to provide a high | The Fund/Portfolio seeks to provide a high level of |

| level of income and moderate long-term capital | income and moderate long-term capital appreciation |

| appreciation by tracking the performance of a | by tracking the performance of a benchmark index that |

| benchmark index that measures the performance | measures the performance of publicly traded equity |

| of publicly traded equity REITs. | REITs and other real estate-related investments. |

This change in the objective will allow for a change to the benchmark index of the two funds from the MSCI US REIT Index to the MSCI US Investable Market Real Estate 25/50 Index. This will result in a corresponding name change for the funds, as shown below.

| | | |

| Fund | Current MSCI | Proposed MSCI | Proposed MSCI |

| | benchmark | transition benchmark | destination benchmark |

| |

| Vanguard REIT Index | MSCI US REIT Index | MSCI US Investable | MSCI US Investable |

| Fund | | Market Real Estate | Market Real Estate 25/50 |

| | | 25/50 Transition Index | Index |

| |

| Vanguard Variable | MSCI US REIT Index | Not applicable | MSCI US Investable |

| Insurance Fund REIT | | | Market Real Estate 25/50 |

| Index Portfolio | | | Index |

Why are these changes being proposed?

In September 2016, several changes were made to the Global Industry Classification Standard (GICS) methodology, an industry-recognized approach to classifying global market sectors, that resulted in the addition of real estate as an 11th GICS sector. This sector now encompasses equity real estate investment trusts (REITs), including certain additional specialized REITs, along with real estate management and development companies.

The changes to the investment objective of the funds are being proposed because they will:

• Align the funds with the updated GICS methodology.

• Broaden the Vanguard funds’ sector lineup for the equities market by allowing the funds to invest not just in equity REITs but also in all real estate-related securities in the sector, which is not currently in our lineup.

• Provide additional investment capacity.

Overall, these changes will align the funds with the newly constituted real estate sector and enable investors in Vanguard’s sector equity index funds to have broader market exposure, effectively increasing the market capitalization of the two funds by approximately 20%. The change will also provide additional investment capacity for the funds, which helps mitigate the impact of limits on how much of any one REIT an investor can own.

Page 16

If this proposal is approved, the funds will change their benchmark from the MSCI US REIT Index to the MSCI US

Investable Market Real Estate 25/50 Index.

Why is a shareholder vote required to change the investment objective?

To change the benchmark index of the funds and align them with the new real estate sector, shareholders must approve the change to the investment objective to encompass equity REITs and real estate-related securities. This is required because the investment objective of Vanguard REIT Index Fund and Vanguard Variable Insurance Fund REIT Index Portfolio was established as a fundamental investment policy, so it can be changed only with shareholder approval.

Although the funds seek to provide exposure to publicly traded equity REITs, their investment objective does not currently allow for investment in certain specialized REITs and real estate management and development companies.

What are some of the key characteristics of the existing and proposed new benchmark indexes?

Here is a comparison of the two benchmark indexes:

| | | | | | | | | |

| Comparison of the current and proposed benchmarks |

| (As of June 30, 2017) |

| | | MSCI US Investable Market |

| MSCI US REIT Index | | | Real Estate 25/50 Index | | | |

| | | (Current) | | | (Proposed) | | | Difference |

| Characteristics | | | |

| Index Market Capitalization (in Billions) | $844.3 | | $1,034.9 | | $190.6 |

| Number of Constituents | | | 155 | | | 181 | | | 26 |

| Dividend Yield | | | 4.02 | % | | 3.74 | % | | -0.28 |

| Price/Earnings Ratio | | | 36.3 | | | 37.8 | | | 1.5 |

| Performance (%) | | | |

| Year to Date | | | 2.6 | | | 5.1 | | | 2.5 |

| 1 Year | | | -1.8 | | | 1.1 | | | 2.9 |

| 3 Year | | | 8.2 | | | 7.9 | | | -0.3 |

| 5 Year | | | 9.4 | | | 9.5 | | | 0.1 |

| Volatility (%) | | | |

| 1 Year | | | 11.1 | | | 10.5 | | | -0.6 |

| 3 Year | | | 15.0 | | | 13.8 | | | -1.2 |

| 5 Year | | | 13.8 | | | 12.7 | | | -1.1 |

| Sharpe Ratio | | | |

| 1 Year | | | -0.17 | | | 0.09 | | | 0.26 |

| 3 Year | | | 0.57 | | | 0.60 | | | 0.03 |

| 5 Year | | | 0.70 | | | 0.76 | | | 0.06 |

| Number of Companies | | | |

| Large-Cap | | | 12 | | | 15 | | | 3 |

| Mid-Cap | | | 21 | | | 24 | | | 3 |

| Small-Cap | | | 122 | | | 144 | | | 22 |

| Total | | | 155 | | | 181 | | | 26 |

| Market Cap (%) | | | |

| Large-Cap (%) | | | 37.3 | | | 41.8 | | | 4.5 |

Page 17

| | | | | | | | | | | | |

| Mid-Cap (%) | | | 24.7 | | | | | 23.4 | | | -1.3 | |

| Small-Cap (%) | | | 38.0 | | | | | 34.8 | | | -3.2 | |

| Total | | | 100.0 | % | | | | 100.0 | % | | | |

| Median Market Cap (in Billions) | $3.06 | | | | $3.04 | | -$ | 0.02 | |

| Turnover (%) | | | 4.32 | | | | | 5.42 | | | 1.1 | |

| |

| | | | | MSCI US Investable Market | |

| | | MSCI US REIT Index | | | Real Estate 25/50 Index | |

| | | (Current) | | | | | (Proposed) | | | | |

| |

| | Index | | | Index | |

| Industry Breakdown | | | Holdings | | Weight | | | Holdings | | | Weight | |

| Specialized REITs | | | 17 | | 17.3 | % | | 29 | | | 29.1 | % |

| Retail REITs | | | 30 | | 19.0 | % | | 30 | | | 15.5 | % |

| Residential REITs | | | 18 | | 16.6 | % | | 17 | | | 13.7 | % |

| Office REITs | | | 23 | | 13.3 | % | | 23 | | | 10.8 | % |

| Health Care REITs | | | 17 | | 13.0 | % | | 18 | | | 10.6 | % |

| Diversified REITs | | | 22 | | 7.5 | % | | 21 | | | 6.1 | % |

| Industrial REITs | | | 9 | | 7.0 | % | | 9 | | | 5.7 | % |

| Hotel & Resort REITs | | | 19 | | 6.3 | % | | 19 | | | 5.2 | % |

| Real Estate Services | | | 0 | | 0.0 | % | | 7 | | | 2.3 | % |

| Real Estate Development | | | 0 | | 0.0 | % | | 2 | | | 0.5 | % |

| Diversified Real Estate Activities | | 0 | | 0.0 | % | | 4 | | | 0.3 | % |

| Real Estate Operating Companies | | 0 | | 0.0 | % | | 2 | | | 0.2 | % |

| Total | | | 155 | | 100.0 | % | | 181 | | | 100.0 | % |

| |

| | Index | | | Index | |

| Top 20 Holdings | | | Security | | Weight | | | Security | | | Weight | |

| Simon Property Group | | 6.1 | % | | American Tower | | | 5.5 | % |

| | | Equinix | | 3.9 | % | | Simon Property Group | | | 5.0 | % |

| | | Public Storage | | 3.9 | % | | Crown Castle Intl. Corp. | | | 3.5 | % |

| | | Prologis | | 3.7 | % | | Equinix | | | 3.2 | % |

| | | Welltower Inc. | | 3.2 | % | | Public Storage | | | 3.1 | % |

| Avalonbay Communities | | 3.1 | % | | Prologis | | | 3.0 | % |

| | | Ventas | | 2.9 | % | | Welltower Inc. | | | 2.6 | % |

| | | Equity Residential | | 2.9 | % | | Avalonbay Communities | | | 2.6 | % |

| | | Boston Properties | | 2.2 | % | | Weyerhaeuser Co. | | | 2.4 | % |

| | | Digital Realty | | 2.1 | % | | Ventas | | | 2.4 | % |

| | | Essex Property Trust | | 2.0 | % | | Equity Residential | | | 2.3 | % |

| | | Vornado Realty Trust | | 1.9 | % | | Boston Properties | | | 1.8 | % |

| | | HCP | | 1.8 | % | | Digital Realty Trust | | | 1.7 | % |

| | | GGP | | 1.7 | % | | Essex Property Trust | | | 1.6 | % |

| | | Realty Income Corp | | 1.7 | % | | SBA Communications A | | | 1.6 | % |

| Host Hotels & Resorts | | 1.6 | % | | Vornado Realty Trust | | | 1.5 | % |

| Mid-America Apratment | | 1.4 | % | | HCP | | | 1.4 | % |

| Alexandria Real Estate | | 1.3 | % | | GGP | | | 1.4 | % |

| SL Green Realty Corp. | | 1.3 | % | | Realty Income Corp. | | | 1.4 | % |

| | | UDR | | 1.2 | % | | Host Hotels & Resorts | | | 1.3 | % |

| |

| Source: MSCI. | | | | | | | | | | | | |

Page 18

Will changing the benchmark index require the funds to change their names?

Yes, because the funds currently invest exclusively in U.S. publicly traded equity REITs. The proposed benchmark index includes additional specialized REITs (a type of equity REIT) and real estate management and development companies. Therefore, changing each fund’s name more accurately reflects the securities in which each one seeks to invest.

| |

| Current names | Future names |

| Vanguard REIT Index Fund | Vanguard Real Estate Index Fund |

| Vanguard Variable Insurance Fund | Vanguard Variable Insurance Fund |

| REIT Index Portfolio | Real Estate Index Portfolio |

Why will the REIT Index Fund be using a transition index?

The use of a transition index is expected to reduce the transaction costs associated with trading large amounts of securities in a short period. Accordingly, the REIT Index Fund’s board of trustees has determined the use of a transition index to be in the best interests of shareholders.

During the six-month transition, the REIT Index Fund will sell positions in its current holdings while proportionally adding exposure to additional specialized REITs and real estate management and development companies based on each security’s weight in the index. To reduce transaction costs, the REIT Index Fund will seek to track a transition index, the MSCI US Investable Market Real Estate 25/50 Transition Index, for the duration of the transition. The transaction costs for the REIT Index Fund’s transition are expected to be moderate. SEC filings will be made when the REIT Index Fund begins tracking the transition index and again at the conclusion of the transition, at which time the fund will begin to track the MSCI US Investable Market Real Estate 25/50 Index.

When do you expect the REIT Index Fund’s transition to the new index to start?

The REIT Index Fund’s transition to the new benchmark index is contingent upon obtaining shareholder approval of the new investment objective. If shareholders approve the change, then the transition is expected to begin in early 2018. To protect the REIT Index Fund and its investors and to diminish the ability of other investors to trade “in front” of the REIT Index Fund, more specific information regarding the timing of the transition will not be publicly provided.

When do you expect the REIT Index Fund’s transition to the new index to be completed?

Because of the REIT Index Fund’s size and the degree of trading required, the transition is expected to occur over a six-month period. The transition index will be used to minimize transaction costs.

Will a transition index be used for Vanguard Variable Insurance Fund REIT Index Portfolio?

No, the REIT Index Portfolio will not require a transition index because the portfolio is small enough to allow for a transition to the new benchmark index in a shorter time. Because the portfolio is smaller, the transition to the new index will not result in the same level of costs that are associated with transitioning a larger fund, like the REIT Index Fund, to a new index.

Will the benchmark index change result in expense ratio changes for the funds?

No, the benchmark index change is not expected to result in a change to the expense ratio for Vanguard REIT Index Fund or Vanguard Variable Insurance Fund REIT Index Portfolio.

Page 19

Will the benchmark index changes trigger capital gains distributions for the funds?

Capital gains distributions are not expected to occur as a result of the benchmark changes. However, actual costs depend on multiple variables, most importantly market conditions at the time of each transition.

Will tracking the broader benchmark indexes lead to better performance for the funds?

This change is not intended to improve or “chase” returns. The new benchmark index will provide broader real estate exposure for investors in the funds. We are continually focused on the long term, and we believe that over time, investors will benefit from broader real estate exposure. In addition, the new benchmark index will provide broader real estate exposure for investors who use our sector lineup for portfolio construction.

Do you expect the benchmark index change to result in higher tracking error for the REIT Index Fund?

During the six-month trading/transition period, the REIT Index Fund will sample and replicate the transition benchmark. As a result, the fund is expected to temporarily incur a slightly higher tracking error. After the transition, the tracking error is expected to narrow.

Page 20

Proposal to reclassify the diversification status to nondiversified

(For shareholders of Vanguard REIT Index Fund)

The fund’s board of trustees recommends a vote FOR this proposal.

Why is the REIT Index Fund proposing to change its diversification status?

Changing the diversification status of the REIT Index Fund from diversified to nondiversified, as defined by the Investment Company Act of 1940 (the “1940 Act”), is being proposed to provide additional flexibility to the fund to track its benchmark index, as such tracking can be more challenging for a diversified fund investing in a specific industry sector. By moving to a nondiversified status, the REIT Index Fund will be able to own securities in its index in the appropriate weight as the fund continues to grow. Changing the diversification status of the REIT Index Fund will also align the fund with the diversification status of Vanguard’s other sector equity index funds.

What does “diversified” mean, as defined by the 1940 Act?

Under the 1940 Act, a mutual fund is designated as diversified or nondiversified, depending in part on its ownership of the issuers in which the fund invests. A “diversified” mutual fund must abide by certain rules that limit aggregate ownership of securities in the fund’s investment portfolio. For example, diversified funds are limited in their ability to own more than 10% of the voting stock of single issuers. Some industry sectors, such as the REIT market, are more concentrated than others and therefore can present challenges for large diversified funds seeking to invest in securities in such sectors.

If the proposal is approved, additional disclosure related to nondiversification risk will be required in the prospectus, but the day-to-day management of the REIT Index Fund will remain the same.

The REIT Index Fund must continue to comply with Internal Revenue Code asset diversification requirements.

Shareholders of the REIT Index Fund approved changing the fund’s diversification status to nondiversified in 2002. Why is shareholder approval required again?

The REIT Index Fund operated as a diversified fund for three consecutive years after the 2002 shareholder approval, meaning it did not hold more than 10% of the voting stock of a single issuer or otherwise operate as nondiversified. Under the 1940 Act, the REIT Index Fund was then automatically reclassified as diversified; that change did not require shareholder approval. However, the 1940 Act does require that shareholder approval must be obtained for the REIT Index Fund to change its status from diversified to nondiversified.

Will the REIT Index Fund’s principal risks change if the fund becomes nondiversified?

The REIT Index Fund will continue to invest in securities represented in its benchmark index and will operate as a nondiversified fund only as necessary to track its benchmark index. In such a case, the REIT Index Fund’s risk profile may increase, because a nondiversified fund may invest a greater percentage of its assets in a particular issuer or a group of issuers or may own more of an issuer’s voting stock than a diversified fund.

Are other Vanguard funds nondiversified?

Yes, currently 27 Vanguard funds have a nondiversified status, including all Vanguard sector equity index funds.

Page 21

Proposal to adopt the Funds’ Service Agreement

(For shareholders of Vanguard Institutional Index Fund and Vanguard Institutional Total Stock Market Index Fund)

Each fund’s board of trustees recommends a vote FOR this proposal.

What is the Funds’ Service Agreement (FSA)?

All publicly available Vanguard funds, except for Vanguard Institutional Index Fund and Vanguard Institutional Total Stock Market Index Fund, operate under an “internalized” management structure in accordance with exemptive orders issued by the SEC and with a service agreement among all the other funds and Vanguard. The FSA sets the terms under which the Vanguard funds capitalize, operate, and share the expenses of Vanguard. Under the FSA, Vanguard and its affiliates provide corporate management, administrative, transfer agency, distribution, and investment advisory services to the funds based on Vanguard’s cost of operations.

Why has the board decided to approve the adoption of the FSA by the two institutional funds?

The board’s decision was based on the best interests of shareholders of both funds and the benefits that shareholders are expected to derive from each of the funds’ becoming a party to the FSA. Vanguard Institutional Index Fund and Vanguard Institutional Total Stock Market Index Fund are the only publicly offered Vanguard mutual funds that are not parties to the FSA. Harmonizing the funds’ advisory and distribution arrangements offers the potential for lower costs, broader access to lower-cost share classes, and operational effectiveness for institutional fund shareholders.

In addition, each Vanguard fund that is currently a party to the FSA might benefit from long-term shared economies of scale by bringing in the assets of the institutional funds and spreading Vanguard’s cost allocation methodology over those funds along with the existing member funds.

What is the impact on the institutional funds if shareholders approve adopting the FSA?

If shareholders approve the institutional funds’ adoption of the FSA, Institutional class shareholders of both funds are expected to see immediate expense ratio reductions as outlined below:

Institutional Index Fund and Institutional Total Stock Market Index Fund

| | | | |

| Share class | Current expense ratio | | Proposed expense ratio | |

| Institutional | 0.040 | % | 0.035 | % |

| Institutional Plus | 0.020 | % | 0.020 | % |

In addition, by combining the assets of the institutional funds along with those of all other publicly available Vanguard mutual funds and by sharing in the economies of scale that derive from the growth of the Vanguard fund complex, the institutional funds could potentially see additional expense ratio reductions in the future.

Page 22

Will the institutional funds’ minimum initial investments change if shareholders approve the funds’ adoption of the FSA?

Yes. If shareholders approve the institutional funds’ adoption of the FSA, shareholders of the institutional funds could see immediate broader access to lower-cost share classes through the proposed reduction of minimum initial investments as outlined below:

| | |

| Institutional Index Fund | | |

| Share class | Current minimum | Proposed minimum |

| Institutional | $5 million | $5 million |

| Institutional Plus | $200 million | $100 million |

| | |

| Institutional Total Stock Market Index Fund | |

| Share class | Current minimum | Proposed minimum |

| Institutional | $100 million | $5 million |

| Institutional Plus | $200 million | $100 million |

What are the differences between the institutional funds’ advisory/distribution arrangements and those in the FSA?

The FSA describes the terms under which almost all of Vanguard’s U.S.-domiciled funds capitalize, operate, and share the expenses of Vanguard. Under the FSA, Vanguard and Vanguard Marketing Corporation provide investment advisory and distribution services based on Vanguard’s cost of operations.

The institutional funds are the only publicly available U.S.-domiciled Vanguard funds that are not a party to the FSA. Rather, they receive services pursuant to two separate agreements in which they pay a set fee for those services.

If shareholders agree to authorizing the institutional funds to adopt the FSA as outlined above, the institutional funds’ shareholders will be agreeing to their funds operating under the terms in which all other publicly available Vanguard funds capitalize, operate, and share the expenses of Vanguard as set forth by the FSA. Under the FSA, the institutional funds would become owners of Vanguard by making a capital contribution to Vanguard, which may be adjusted from time to time, and they may be called upon to invest up to 0.40% of their net assets in Vanguard. Based on net assets as of May 31, 2017, each institutional fund’s investment in Vanguard would be less than 0.01% of its net assets. The institutional funds’ expenses will be based on their respective allocated portions of Vanguard’s expenses, similar to the other Vanguard funds.

Are the institutional funds similar to Vanguard 500 Index Fund and Vanguard Total Stock Market Index Fund?

Yes, the institutional funds are similar to these funds in that they track the same market segments and indexes. When Vanguard Institutional Index Fund was launched in 1990 and Vanguard Institutional Total Stock Market Index Fund in 2001, they were launched outside of the FSA’s internalized management structure, because doing so was necessary at that time to provide competitive pricing for institutional investors.

Upon adoption of the FSA, will historical performance of the institutional funds still be available?

Yes, historical performance of the institutional funds will be unaffected by adoption of the FSA.

Page 23

Shareholder proposal: Genocide-free investing

(For shareholders of certain funds listedhere)

Each fund’s board of trustees recommends a vote AGAINST this proposal.

Why are we including this shareholder proposal?

A shareholder can submit a proposal for inclusion in a fund’s proxy statement, as long as the shareholder meets certain eligibility and procedural requirements outlined by federal securities laws. Certain Vanguard fund shareholders have complied with these requirements, so we are including their proposal.

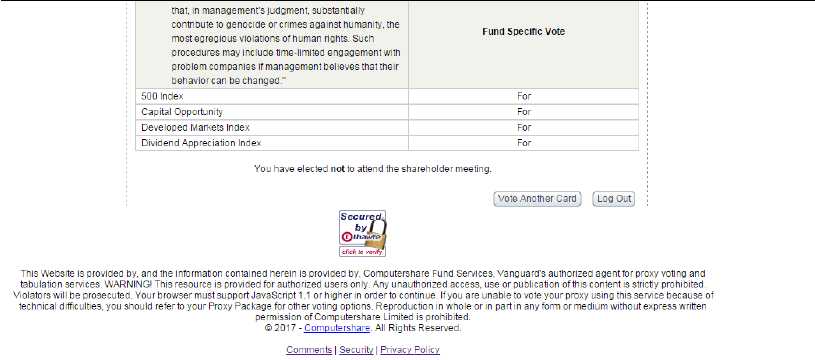

What is the shareholder proposal?

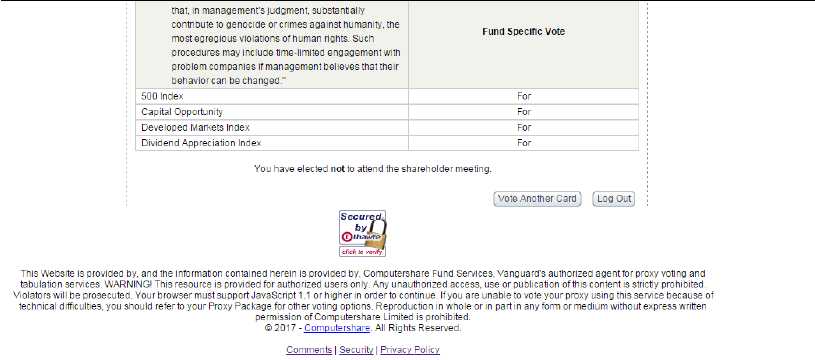

As submitted by shareholders of certain funds, without modification, the proposal requested that the board of trustees of the Vanguard funds listedhereinstitute transparent procedures to avoid holding investments in companies that, in management’s judgment, substantially contribute to genocide or crimes against humanity, the most egregious violations of human rights. Such procedures may include time-limited engagement with problem companies if management believes that their behavior can be changed.

What is Vanguard’s position on this issue?

The board’s statement of opposition is as follows:

The trustees of the funds recommend that you vote against this proposal. While the humanitarian issues on which this proposal is ultimately focused are of consequence and deep concern, meaningful, long-term solutions to these issues require diplomatic and political resources to come together to implement change. Importantly, your funds are compliant with all applicable U.S. laws on this matter. In addition, the proposal would interfere with the advisors’ fiduciary duty to manage your funds in line with their investment objectives and strategies. Finally, we believe that the divestment contemplated by the proposal would be an ineffective means to implement the social change it seeks.

Vanguard is fully compliant with all applicable U.S. laws and regulations.

The United States government, through its policymakers, has established a clear legal framework wherein investments in companies that are owned or controlled by the government of Sudan, among other countries, are prohibited. The proposal does not take into account that the funds are compliant with these laws.

As an investment firm with a very large client base, Vanguard is periodically asked by clients to modify our investments for a variety of reasons—from environmental and social issues to humanitarian and political concerns. We simply cannot manage the funds in an effective manner that would address all of these issues as well as, or better than, policymakers while fulfilling our fiduciary obligation to shareholders.

The addition of further investment constraints is not in fund shareholders’ best interests.

Placing additional and specifically prescriptive constraints on a portfolio manager’s investable universe, based on factors unrelated to a fund’s stated investment objective and/or investment strategies, could interfere with the fund’s obligation to its investors. Each of the Vanguard funds is required to invest shareholders’ assets pursuant to a given fund’s stated objective. In the case of actively managed funds, which seek to provide varying degrees of current income and/or long-term capital appreciation, they are managed in adherence to tightly prescribed parameters related to the geography, size, sector and/or style (for example, growth versus value) of the companies in which they invest. Constraints imposed by third parties could impair the ability of portfolio managers to provide fund shareholders investment returns that are competitive with similar funds. Index funds typically seek to track the performance of a benchmark index that represents either the broad market or a subset of the market based on geography, size, sector and/or style. As such, limiting a fund’s ability to invest in all of the constituent companies in its benchmark index could introduce deviation (that is, tracking error) between the fund’s performance and that of its benchmark index, which would be detrimental to the fund’s shareholders.

Page 24

Divestment is an ineffective means to implement social change.

The trustees believe that divestment—especially in cases where a company bears no direct relation to the issue at hand—is a particularly ineffective remedy. Selling a company’s shares into the secondary market (that is, not back to the subject company itself) has no direct impact on the company’s capitalization, and it simply puts the shares into the hands of another owner (one perhaps with less concern for the underlying issues). Additionally, as investors in publicly traded companies, the funds are not well poised to influence matters that extend well beyond the operations of their portfolio companies. While we understand the concerns of shareholders who have submitted the proposal, we believe that ending genocide requires diplomatic and political solutions.

Page 25

Funds and their relevant proposals

Proposal key

| | |

| 1 | . | Elect trustees |

| 2 | . | Approve a manager-of-managers arrangement with third-party investment advisors |

| 3 | . | Approve a manager-of-managers arrangement with wholly owned subsidiaries of Vanguard |

| 4 | . | Change the investment objective of Vanguard REIT Index Fund and the REIT Index Portfolio of the Vanguard |

Variable Insurance Fund

Reclassify the diversification status of the REIT Index Fund to nondiversified

Adopt the Funds’ Service Agreement for Vanguard Institutional Index Fund and Vanguard Institutional Total

Stock Market Index Fund

Shareholder proposal: Genocide-free investing

| | | | | | | | | |

| Vanguard Fund Name | 1 | 2 | | 3 | 4 | 5 | 6 | | 7 |

| 500 Index Fund | X | X | | X | | | | | X |

| Alternative Strategies Fund | X | | | X | | |

| Balanced Index Fund | X | X | | X | | |

| California Intermediate-Term Tax-Exempt Fund | X | X | | X | | |

| California Long-Term Tax-Exempt Fund | X | X | | X | | | | | |

| California Municipal Money Market Fund | X | X | | X | | | | | |

| Capital Opportunity Fund | X | | | X | | | | | X |

| Capital Value Fund | X | | | X | | |

| Consumer Discretionary Index Fund | X | X | | X | | |

| Consumer Staples Index Fund | X | X | | X | | |

| Convertible Securities Fund | X | | | X | | |

| Core Bond Fund | X | | | X | | |

| Developed Markets Index Fund | X | X | | X | | | X |

| Diversified Equity Fund | X | X | | X | | |

| Dividend Appreciation Index Fund | X | X | | X | | | X |

| Dividend Growth Fund | X | | | X | | |

| Emerging Markets Bond Fund | X | | | X | | |

| Emerging Markets Government Bond Index Fund | X | X | | X | | |

| Emerging Markets Select Stock Fund | X | | | X | | |

| Emerging Markets Stock Index Fund | X | X | | X | | | X |

| Energy Fund | X | | | X | | | X |

| Energy Index Fund | X | X | | X | | | X |

| Equity Income Fund | X | | | X | | | X |

| European Stock Index Fund | X | X | | X | | | X |

| Explorer FundTM | X | | | X | | |

| Explorer Value Fund | X | | | X | | |

| Extended Duration Treasury Index Fund | X | X | | X | | |

| Extended Market Index Fund | X | X | | X | | | X |

| Federal Money Market Fund | X | X | | X | | |

| Financials Index Fund | X | X | | X | | |

| FTSE All-World ex-US Index Fund | X | X | | X | | | X |

| FTSE All-World ex-US Small-Cap Index Fund | X | X | | X | | |

| FTSE Social Index Fund | X | X | | X | | | X |

| Global Equity Fund | X | | | X | | |

| Global ex-U.S. Real Estate Index Fund | X | X | | X | | |

| Global Minimum Volatility Fund | X | | | X | | |

| GNMA Fund | X | | | X | | | X |

Page 26

| | | | | | | | | |

| Vanguard Fund Name | 1 | 2 | | 3 | 4 | 5 | 6 | | 7 |

| Growth and Income Fund | X | | | X |

| Growth Index Fund | X | X | | X | | | X |

| Health Care Fund | X | | | X | | | X |

| Health Care Index Fund | X | X | | X |

| High Dividend Yield Index Fund | X | X | | X |

| High-Yield Corporate Fund | X | | | X |

| High-Yield Tax-Exempt Fund | X | X | | X |

| Industrials Index Fund | X | X | | X |

| Inflation-Protected Securities Fund | X | X | | X | | | X |

| Information Technology Index Fund | X | X | | X |

| Institutional Index Fund | X | X | | X | | X | | X |

| Institutional Intermediate-Term Bond Fund | X | X | | X |

| Institutional Short-Term Bond Fund | X | X | | X |

| Institutional Target Retirement 2015 Fund | X | X | | X |

| Institutional Target Retirement 2020 Fund | X | X | | X |

| Institutional Target Retirement 2025 Fund | X | X | | X |

| Institutional Target Retirement 2030 Fund | X | X | | X |

| Institutional Target Retirement 2035 Fund | X | X | | X |

| Institutional Target Retirement 2040 Fund | X | X | | X |

| Institutional Target Retirement 2045 Fund | X | X | | X |

| Institutional Target Retirement 2050 Fund | X | X | | X |

| Institutional Target Retirement 2055 Fund | X | X | | X |

| Institutional Target Retirement 2060 Fund | X | X | | X |

| Institutional Target Retirement 2065 Fund | X | | | X |

| Institutional Target Retirement Income Fund | X | X | | X |

| Institutional Total Stock Market Index Fund | X | X | | X | | X | | |

| Intermediate-Term Bond Index Fund | X | X | | X | | | X |

| Intermediate-Term Corporate Bond Index Fund | X | X | | X |

| Intermediate-Term Government Bond Index Fund | X | X | | X |

| Intermediate-Term Investment-Grade Fund | X | X | | X |

| Intermediate-Term Tax-Exempt Fund | X | X | | X |

| Intermediate-Term Treasury Fund | X | X | | X | | | X |

| International Dividend Appreciation Index Fund | X | X | | X |

| International Explorer Fund | X | | | X | | | X |

| International Growth Fund | X | | | X | | | X |

| International High Dividend Yield Index Fund | X | X | | X |

| International Value Fund | X | | | X | | | X |

| Large-Cap Index Fund | X | X | | X |

| LifeStrategy Conservative Growth Fund | X | X | | X |

| LifeStrategy Growth Fund | X | X | | X |

| LifeStrategy Income Fund | X | X | | X |

| LifeStrategy Moderate Growth Fund | X | X | | X | | | X |

| Limited-Term Tax-Exempt Fund | X | X | | X |

| Long-Term Bond Index Fund | X | X | | X |

| Long-Term Corporate Bond Index Fund | X | X | | X |

| Long-Term Government Bond Index Fund | X | X | | X |

| Long-Term Investment-Grade Fund | X | | | X |

| Long-Term Tax-Exempt Fund | X | X | | X |

| Long-Term Treasury Fund | X | X | | X | | | X |

| Managed Payout Fund | X | X | | X |

| Market Liquidity Fund | X | | | X |

| Market Neutral Fund | X | | | X |

| Massachusetts Tax-Exempt Fund | X | X | | X |

Page 27

| | | | | | |

| Vanguard Fund Name | 1 | 2 | 3 | 4 | 5 | 6 | | 7 |

| Materials Index Fund | X | X | X | | |

| Mega Cap Growth Index Fund | X | X | X | | |

| Mega Cap Index Fund | X | X | X | | |

| Mega Cap Value Index Fund | X | X | X | | |

| Mid-Cap Growth Fund | X | | X | | |

| Mid-Cap Growth Index Fund | X | X | X | | |

| Mid-Cap Index Fund | X | X | X | | | X |

| Mid-Cap Value Index Fund | X | X | X | | | X |

| Morgan Growth FundTM | X | | X | | | X |

| Mortgage-Backed Securities Index Fund | X | X | X | | |

| Municipal Cash Management Fund | X | | X | | |

| Municipal Money Market Fund | X | X | X | | | X |

| New Jersey Long-Term Tax-Exempt Fund | X | X | X | | |

| New Jersey Municipal Money Market Fund | X | X | X | | |

| New York Long-Term Tax-Exempt Fund | X | X | X | | |

| New York Municipal Money Market Fund | X | X | X | | |

| Ohio Long-Term Tax-Exempt Fund | X | X | X | | |

| Pacific Stock Index Fund | X | X | X | | | X |

| Pennsylvania Long-Term Tax-Exempt Fund | X | X | X | | |

| Pennsylvania Municipal Money Market Fund | X | X | X | | |

| Precious Metals and Mining Fund | X | | X | | | X |

| Prime Money Market Fund | X | X | X | | | X |

| PRIMECAP Core Fund | X | | X | | |

| PRIMECAP Fund | X | | X | | |

| REIT Index Fund | X | X | X | X | X | | | X |

| Russell 1000 Growth Index Fund | X | X | X | | |

| Russell 1000 Index Fund | X | X | X | | |

| Russell 1000 Value Index Fund | X | X | X | | |

| Russell 2000 Growth Index Fund | X | X | X | | |

| Russell 2000 Index Fund | X | X | X | | |

| Russell 2000 Value Index Fund | X | X | X | | |

| Russell 3000 Index Fund | X | X | X | | |

| S&P 500 Growth Index Fund | X | X | X | | |

| S&P 500 Value Index Fund | X | X | X | | |

| S&P Mid-Cap 400 Growth Index Fund | X | X | X | | |

| S&P Mid-Cap 400 Index Fund | X | X | X | | |

| S&P Mid-Cap 400 Value Index Fund | X | X | X | | |

| S&P Small-Cap 600 Growth Index Fund | X | X | X | | |

| S&P Small-Cap 600 Index Fund | X | X | X | | |

| S&P Small-Cap 600 Value Index Fund | X | X | X | | |

| Selected Value Fund | X | | X | | |

| Short-Term Bond Index Fund | X | X | X | | | X |

| Short-Term Corporate Bond Index Fund | X | X | X | | |

| Short-Term Federal Fund | X | X | X | | |

| Short-Term Government Bond Index Fund | X | X | X | | |

| Short-Term Inflation-Protected Securities Index Fund | X | X | X | | |

| Short-Term Investment-Grade Fund | X | X | X | | |

| Short-Term Tax-Exempt Fund | X | X | X | | | X |

| Short-Term Treasury Fund | X | X | X | | | X |

| Small-Cap Growth Index Fund | X | X | X | | | X |

| Small-Cap Index Fund | X | X | X | | | X |

| Small-Cap Value Index Fund | X | X | X | | | X |

| STAR Fund® | X | X | X | | | X |

Page 28

| | | | | | | |

| Vanguard Fund Name | 1 | 2 | | 3 | 4 | 5 | 6 | 7 |

| Strategic Equity Fund | X | X | | X | |

| Strategic Small-Cap Equity Fund | X | X | | X | |

| Target Retirement 2015 Fund | X | X | | X | |

| Target Retirement 2020 Fund | X | X | | X | |

| Target Retirement 2025 Fund | X | X | | X | |

| Target Retirement 2030 Fund | X | X | | X | |

| Target Retirement 2035 Fund | X | X | | X | |

| Target Retirement 2040 Fund | X | X | | X | |

| Target Retirement 2045 Fund | X | X | | X | |

| Target Retirement 2050 Fund | X | X | | X | |

| Target Retirement 2055 Fund | X | X | | X | |

| Target Retirement 2060 Fund | X | X | | X | |

| Target Retirement 2065 Fund | X | | | X | |

| Target Retirement Income Fund | X | X | | X | |

| Tax-Exempt Bond Index Fund | X | X | | X | |

| Tax-Managed Balanced Fund | X | X | | X | |

| Tax-Managed Capital Appreciation Fund | X | X | | X | |

| Tax-Managed Small-Cap Fund | X | X | | X | | X |

| Telecommunication Services Index Fund | X | X | | X | |

| Total Bond Market Index Fund | X | X | | X | | X |

| Total Bond Market II Index Fund | X | X | | X | |

| Total International Bond Index Fund | X | X | | X | |

| Total International Stock Index Fund | X | X | | X | | X |

| Total Stock Market Index Fund | X | X | | X | | X |

| Total World Stock Index Fund | X | X | | X | |

| Treasury Money Market Fund | X | X | | X | |

| U.S. Growth Fund | X | | | X | |

| U.S. Value Fund | X | | | X | |

| Ultra-Short-Term Bond Fund | X | | | X | |

| Utilities Index Fund | X | X | | X | |

| Value Index Fund | X | X | | X | | X |

| Variable Insurance Fund - Balanced Portfolio | X | | | X | | X |

| Variable Insurance Fund - Capital Growth Portfolio | X | | | X | |