|

| Schedule 14A Information |

| Proxy Statement Pursuant to Section 14(a) |

| of the Securities Exchange Act of 1934 |

| |

| |

| Filed by the Registrant[X] |

| Filed by a Party other than the Registrant[ ] |

| |

| Check the appropriate box: |

| [ ] Preliminary Proxy Statement |

| |

| [ ] Confidential, for Use of the Commission only (as permitted by Rule 14a-6(e)(2)) |

| |

| [ ] Definitive Proxy Statement |

| |

| [X] Definitive Additional Materials |

| |

| [ ] Soliciting Material under Rule 14a-12 |

| |

| Vanguard Admiral Funds |

| Vanguard Bond Index Funds |

| Vanguard CMT Funds |

| Vanguard California Tax-Free Funds |

| Vanguard Charlotte Funds |

| Vanguard Chester Funds |

| Vanguard Convertible Securities Fund |

| Vanguard Explorer Fund |

| Vanguard Fenway Funds |

| Vanguard Fixed Income Securities Funds |

| Vanguard Horizon Funds |

| Vanguard Index Funds |

| Vanguard Institutional Index Funds |

| Vanguard International Equity Index Funds |

| Vanguard Malvern Funds |

| Vanguard Massachusetts Tax-Exempt Funds |

| Vanguard Money Market Reserves |

| Vanguard Montgomery Funds |

| Vanguard Morgan Growth Fund |

| Vanguard Municipal Bond Funds |

| Vanguard New Jersey Tax-Free Funds |

| Vanguard New York Tax-Free Funds |

| Vanguard Ohio Tax-Free Funds |

| Vanguard Pennsylvania Tax-Free Funds |

| Vanguard Quantitative Funds |

| Vanguard Scottsdale Funds |

| Vanguard Specialized Funds |

| Vanguard STAR Funds |

|

| Vanguard Tax-Managed Funds |

| Vanguard Trustees’ Equity Fund |

| Vanguard Valley Forge Funds |

| Vanguard Variable Insurance Funds |

| Vanguard Wellesley Income Fund |

| Vanguard Wellington Fund |

| Vanguard Whitehall Funds |

| Vanguard Windsor Funds |

| Vanguard World Funds |

| |

| (Name of Registrant as Specified in its Declaration of Trust) |

| |

| |

| (Name of Person(s) Filing Proxy Statement if other than the Registrant) |

| |

| Payment of Filing Fee (Check the appropriate box): |

| |

| [ X ]No fee required. |

| |

| [ ]Fee computed on table below per Exchange Act Rules 14a-6(i) and 0-11. |

| (1) Title of each class of securities to which transaction applies: |

| (2) Aggregate number of securities to which transaction applies: |

| (3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act |

| Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was |

| determined): |

| (4) Proposed maximum aggregate value of transaction: |

| (5) Total Fee Paid: |

| |

| [ ]Fee paid previously with preliminary materials. |

| |

| [ ]Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11 (a)(2) and |

| identify the filing for which the offsetting fee was paid previously. Identify the previous filing |

| by registration statement number, or the form or schedule and the date of its filing. |

| (1) Amount previously paid: |

| (2) Form, schedule or registration statement no.: |

| (3) Filing party; |

| (4) Date filed: |

October 2017

P.O. Box 2600

Valley Forge, PA 19482-2600

vanguard.com

Separate proxy ballots provided for your mutual fund and brokerage accounts

Dear Vanguard Client,

Thank you for choosing Vanguard for your investments. We hope you’re enjoying the flexibility of your accounts and the convenience of one integrated platform.

Vanguard opened an important three-month proxy voting campaign on August 16, 2017. Shareholders are being asked to help elect their fund trustees and vote on several policy changes across Vanguard’s U.S.-domiciled fund lineup.

Since you recently upgraded to a brokerage account, a ballot for your new brokerage account is included in this mailing. Ballots for any mutual fund accounts and brokerage accounts opened before July 13, 2017, were delivered in August. Please vote all ballots.

We’re requesting your vote because you owned shares of at least one Vanguard fund as of August 16, 2017, which was the record date for the proxy. We encourage you to vote even if you sold any of your shares after that date. No matter how many shares or units you owned, your vote is important.

For more information, go to https://about.vanguard.com/proxy/

All investing is subject to risk, including the possible loss of the money you invest.

© 2017 The Vanguard Group, Inc. All rights reserved.

Vanguard Marketing Corporation, Distributor.

MOBYVBA 092017

Subject:REIT II Index Fund makes its debut

#FirstName#,

I'm writing to let you know that Vanguard® REIT II Index Fund was launched on September 26, 2017. This new fund is a passively managed U.S. equity REIT portfolio whose principal investor will be the existing Vanguard REIT Index Fund.

After the REIT Index Fund's initial investment, the REIT II Index Fund will be made available only to select institutional investors, separately managed accounts, and other Vanguard funds. The REIT II Index Fund is offered with Institutional Plus Shares (Ticker: VRTPX; CUSIP: 922031695), which have a minimum initial investment of $100 million.

The new fund will provide increased investment capacity for the REIT Index Fund. The two funds have identical investment objectives and investment strategies and seek to track the same benchmark,theMSCI US REIT Index.

Vanguard does not expect the launch of and the initial investment in the REIT II Index Fund to affect the tracking error or performance of the REIT Index Fund. There are no changes in how shareholders of the REIT Index Fund interact with that fund.

The REIT II Index Fund is managed by Vanguard Equity Index Group.

Related proxy matter

As part of Vanguard’s 2017 proxy campaign, shareholders of the REIT Index Fund and Vanguard Variable Insurance Fund REIT Index Portfolio are being asked to approve a change to the investment objectives of the funds, which would involve a corresponding change to each fund’s benchmark index and name.

If the change to the REIT Index Fund’s investment objective is approved by its shareholders, then the investment objective, benchmark index, and fund name for the REIT II Index Fund would change as well.

Details on the proposals and voting methods are available at Vanguard’sproxy resource center.

If you have any questions or would like more information, please don't hesitate to contact me.

#VGI_Name#

#VGI_Title#

Phone:#VGI_Phone#, Ext.#VGI_EXT#

_____________________________________________________________

**For more information about Vanguard funds, visit advisors.vanguard.com or call 800-997-2798 to obtain a prospectus or, if available, a summary prospectus. Investment objectives, risks, charges, expenses, and other important information about a fund are contained in the prospectus; read and consider it carefully before investing.**

**CGS identifiers have been provided by CUSIP Global Services, managed on behalf of the American Bankers Association by Standard & Poor's Financial Services, LLC, and are not for use or dissemination in a manner that would serve as a substitute for any CUSIP service. The CUSIP Database, © 2017 American Bankers Association. "CUSIP" is a registered trademark of the American Bankers Association.**

All investing is subject to risk, including the possible loss of the money you invest. Funds that concentrate on a relatively narrow market sector face the risk of higher share-price volatility.

For financial advisors only. Not for public distribution.

© 2017 The Vanguard Group, Inc. All rights reserved. Vanguard Marketing Corporation, Distributor. | Privacy statement:http://www.vanguard.com/finadvprivacystmt

455 Devon Park Drive | Wayne, PA 19087-1815 | advisors.vanguard.com

Subject:REIT II Index Fund makes its debut

#FirstName#,

I’m writing to let you know that Vanguard® REIT II Index Fund was launched on September 26, 2017. This new fund is a passively managed U.S. equity REIT portfolio whose principal investor will be the existing Vanguard REIT Index Fund.

After the REIT Index Fund’s initial investment, the REIT II Index Fund will be made available only to select institutional investors, separately managed accounts, and other Vanguard funds. The REIT II Index Fund is offered with Institutional Plus Shares (Ticker: VRTPX), which have a minimum initial investment of $100 million.

The new fund will provide increased investment capacity for the REIT Index Fund. The two funds have identical investment objectives and investment strategies and seek to track the same benchmark, the MSCI US REIT Index.

Vanguard does not expect the launch of and the initial investment in the REIT II Index Fund to affect the tracking error or performance of the REIT Index Fund. There are no changes in how shareholders of the REIT Index Fund interact with that fund.

The REIT II Index Fund is managed by Vanguard Equity Index Group.

Related proxy matter

As part of Vanguard’s 2017 proxy campaign, shareholders of the REIT Index Fund and the Vanguard Variable Insurance Fund REIT Index Portfolio are being asked to approve a change to the investment objectives of the funds, which would involve a corresponding change to each fund’s benchmark index and name.

If the change to the REIT Index Fund’s investment objective is approved by its shareholders, then the investment objective, benchmark index, and fund name for the REIT II Index Fund would change as well.

Details on the proposals and voting methods are available at Vanguard’sproxy resource center.

If you have any questions or would like more information, please don't hesitate to contact me.

#VGI_Name# #VGI_Title#

Phone:#VGI_Phone#, Ext.#VGI_EXT#_____________________________________________________________

**For more information about Vanguard funds, visit institutional.vanguard.com or call 800-523-1036 to obtain a prospectus or, if available, a summary prospectus. Investment objectives, risks, charges, expenses, and other important information about a fund are contained in the prospectus; read and consider it carefully before investing.**

All investing is subject to risk, including the possible loss of the money you invest. Funds that concentrate on a relatively narrow market sector face the risk of higher share-price volatility.

For institutional use only. Not for distribution to retail investors.

© 2017 The Vanguard Group, Inc. All rights reserved. Vanguard Marketing Corporation, Distributor. |

Privacy statement:http://www.vanguard.com/instlprivacystmt

455 Devon Park Drive | Wayne, PA 19087-1815 | institutional.vanguard.com

Prepared for

Vanguard REIT II Index Fund

and REIT-related updates

For institutional use only. Not for distribution to retail investors.

Prepared for [[ClientNameModel:ClientNameOut]]

What is a REIT?

| A real estate investment trust or REIT is a company that owns or manages real estate. |

| Rather than directly owning properties—which can be costly and difficult to convert into cashneeded—some investors buy shares of REIT securities or mutual funds. |

|

| REITs are unique in that, unlike other corporations, REITs do not generally have to payincome taxes if they meet certain tax code requirements. |

|

| To qualify as a REIT, such a company must, among other requirements, distribute at leastof its taxable income to its shareholders and receive at least 75% of that income frommortgages, and sales of property. |

|

|

| REITs are separated into three types: |

| | - | An equity REIT* generally owns properties directly. Equity REITs typically generate income from rental and lease payments and offer the potential for growth through property appreciation as well as the occasional capital gain through the sale of property. |

| | - | A mortgage REIT makes loans to commercial real estate developers. |

| | - | A hybrid REIT holds both properties and mortgages. |

| | |

| * | Vanguard REIT Index Fund and Vanguard REIT II Index Fund invest in equity REITs only, not in mortgage or hybrid REITS. |

| | | | |

| Slide ID #: | Tracking #: CONINS-2017-09-14-0371 | DOLU: 9/26/2018 | For institutional use only. Not for distribution to retail investors. | 2 |

| | [[ContentInventoryWithContentID:Row.Le | [[ContentInventoryWithContentID:Row.D | | |

| | galTracking]] | OLU]] | | |

Prepared for [[ClientNameModel:ClientNameOut]]

Launch of Vanguard REIT II Index Fund

Vanguard REIT II Index Fund was launched September 26, 2017. Its investment objective, investment strategies, and benchmark are identical to those of Vanguard REIT Index Fund:

Investment objective

The fund seeks to provide a high level of income and moderate long-term capital appreciation by tracking the performance of a benchmark index that measures the performance of publicly traded equity REITs.

Principal investment strategies

The fund employs an indexing investment approach designed to track the performance of the MSCI US REIT Index. The index is composed of stocks of publicly traded equity REITs. Thefund attempts to replicate the index by investing all, or substantially all, of its assets in thestocks that make up the index. The fund seeks to hold each stock in approximately the same proportion as its weighting in the index.

Note:Two proposals affecting the REIT Index Fund are part of Vanguard's 2017 proxy campaign. If approved, one of these proposals would affect the REIT II Index Fund's investment objective and investment strategies as outlined later in this presentation.

| | | | |

| Slide ID #: | Tracking #: CONINS-2017-09-14-0371 | DOLU: 9/26/2018 | For institutional use only. Not for distribution to retail investors. | 3 |

| | [[ContentInventoryWithContentID:Row.Le | [[ContentInventoryWithContentID:Row.D | | |

| | galTracking]] | OLU]] | | |

Prepared for [[ClientNameModel:ClientNameOut]]

Key characteristics

Vanguard REIT II Index Fund—Key characteristics

- Share class: Institutional Plus (VRTPX)

- Estimated expense ratio: 0.08%

- Investment minimum: $100 million

- Launch date: September 26, 2017

- Benchmark: MSCI US REIT Index

- Benchmark holdings: 155 (as of August 31, 2017)

| | | | |

| Slide ID #: | Tracking #: CONINS-2017-09-14-0371 | DOLU: 9/26/2018 | For institutional use only. Not for distribution to retail investors. | 4 |

| | [[ContentInventoryWithContentID:Row.Le | [[ContentInventoryWithContentID:Row.D | | |

| | galTracking]] | OLU]] | | |

Prepared for [[ClientNameModel:ClientNameOut]]

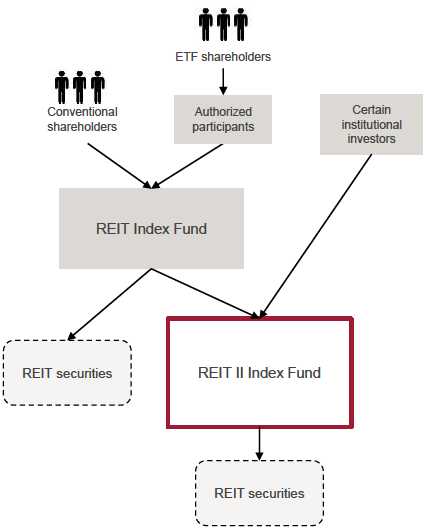

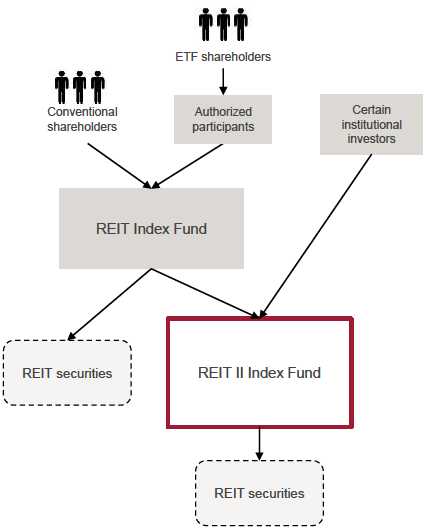

Relationship with the REIT Index Fund

- Vanguard REIT Index Fund is and will remain the principalinvestor in Vanguard REIT II Index Fund.

- After the REIT Index Fund’s initial investment, the REIT II Index

Fund will be made available only to certain institutional investors,separately managed accounts, and other Vanguard funds.

| | | | |

| Slide ID #: | Tracking #: CONINS-2017-09-14-0371 | DOLU: 9/26/2018 | For institutional use only. Not for distribution to retail investors. | 5 |

| | [[ContentInventoryWithContentID:Row.Le | [[ContentInventoryWithContentID:Row.D | | |

| | galTracking]] | OLU]] | | |

Prepared for [[ClientNameModel:ClientNameOut]]

Impact on the REIT Index Fund

- The REIT Index Fund is expected to experience minimal impact resulting from itsinvestment in the REIT II Index Fund.

- No increase is expected in the expense ratio.

- No changes are expected in performance and benchmark tracking.

- The investment in the REIT II Index Fund is not expected to have material taxconsequences for shareholders of the REIT Index Fund.

- Other investment companies investing in the REIT Index Fund may be limited in how muchthey can invest because of restrictions on multiple tiered-fund structures under theInvestment Company Act of 1940.

| | | | |

| Slide ID #: | Tracking #: CONINS-2017-09-14-0371 | DOLU: 9/26/2018 | For institutional use only. Not for distribution to retail investors. | 6 |

| | [[ContentInventoryWithContentID:Row.Le | [[ContentInventoryWithContentID:Row.D | | |

| | galTracking]] | OLU]] | | |

Prepared for [[ClientNameModel:ClientNameOut]]

Who can invest in the REIT II Index Fund?

- The Vanguard REIT Index Fund will be the initial and principal investor in the REIT Index Fund,owning approximately 95% of the investable capacity in the REIT II Index Fund.

- The remaining investment capacity will be available only to certain institutional investors,separately managed accounts, and other Vanguard funds.

- Vanguard approval will be required for all new accounts and additional purchases into the fund.

- Please discuss the availability of the fund with your relationship or sales manager.

| | | | |

| Slide ID #: | Tracking #: CONINS-2017-09-14-0371 | DOLU: 9/26/2018 | For institutional use only. Not for distribution to retail investors. | 7 |

| | [[ContentInventoryWithContentID:Row.Le | [[ContentInventoryWithContentID:Row.D | | |

| | galTracking]] | OLU]] | | |

Prepared for [[ClientNameModel:ClientNameOut]]

Proposed changes to the REIT Index Fund

Vanguard’s 2017 proxy campaign includes two proposals affecting the REIT IndexFund. Here are the proposals and whether their passage would have implications for the REIT II Index Fund:

To change the investment objective of the REIT Index Fund.

- The change would broaden the mandate to include real estate management and developmentcompanies.

- It would allow the fund to change its benchmark and result in a name change for the fund.

- As a result, the REIT II Index Fund would change its benchmark and name to remain aligned with theREIT Index Fund.

To reclassify the diversification status of the REIT Index Fund to “nondiversified” under theInvestment Company Act of 1940.

- The change would enable the REIT Index Fund to track its benchmark more closely andalign its diversification status with that of Vanguard’s other sector equity index funds.

- The change would not affect the REIT II Index Fund. As of of its launch, the REIT II IndexFund is already classified as nondiversified.

Note: Shareholders of record as of August 16, 2017, are eligible to vote during Vanguard’s2017 proxy campaign. A special shareholder meeting is scheduled for November 15, 2017.

For details visit: http://about.vanguard.com/proxy/

| | | | |

| Slide ID #: | Tracking #: CONINS-2017-09-14-0371 | DOLU: 9/26/2018 | For institutional use only. Not for distribution to retail investors. | 8 |

| | [[ContentInventoryWithContentID:Row.Le | [[ContentInventoryWithContentID:Row.D | | |

| | galTracking]] | OLU]] | | |

Prepared for [[ClientNameModel:ClientNameOut]]

Proposed investment objective change for the REIT Index Fund

| | |

| | From | To |

| Proposed investment | The fund seeks to provide a high level of income and moderate | The fund seeks to provide a high level of income and moderate |

| objective change | long-term capital appreciation by tracking the performance of a | long-term capital appreciation by tracking the performance of a |

| | benchmark index that measures the performance of publicly traded | benchmark index that measures the performance of publicly traded |

| | equity REITs. | equity REITsand other real estate-related investments. |

| Benchmark change** | MSCI US REIT Index | MSCI US Investable Market Real Estate 25/50 Index* |

| Name change** | Vanguard REIT Index Fund | Vanguard Real Estate Index Fund |

| | Vanguard REIT II Index Fund | Vanguard Real Estate II Index Fund |

| * | If the investment objective change is approved, the REIT Index Fund will track a transition index for approximately 6 months in order to sell securities and invest proceeds in select specialized REITs and real estate management and development companies. (Note: The REIT II Index Fund would follow the same transition strategy.) |

| ** | Shareholders of the REIT Index Fund are not being asked to vote on the name change or the benchmark change. However, changing the benchmark would necessitate a name change. |

| | | | |

| Slide ID #: | Tracking #: CONINS-2017-09-14-0371 | DOLU: 9/26/2018 | For institutional use only. Not for distribution to retail investors. | 9 |

| | [[ContentInventoryWithContentID:Row.Le | [[ContentInventoryWithContentID:Row.D | | |

| | galTracking]] | OLU]] | | |

Prepared for [[ClientNameModel:ClientNameOut]]

Important information

For more information about Vanguard funds, visit institutional.vanguard.com or call 800-523-1036 to obtain a prospectus or, if available, a summary prospectus. Investment objectives, risks, charges, expenses, and other important information about a fund are contained in the prospectus; read and consider it carefully before investing.

All investing is subject to risk, including the possible loss of the money you invest. Funds that concentrate on a relatively narrow market sector face the risk of higher share-price volatility.

The funds or securities referred to herein are not sponsored, endorsed, or promoted by MSCI, and MSCI bears no liability with respect to any such funds or securities. The prospectus or theStatement of Additional Information contains a more detailed description of the limited relationship MSCI has with Vanguard and any related funds.

© 2017 The Vanguard Group, Inc. All rights reserved. Vanguard Marketing Corporation, Distributor.

NECP 092017

| | | | |

| Slide ID #: | Tracking #: CONINS-2017-09-14-0371 | DOLU: 9/26/2018 | For institutional use only. Not for distribution to retail investors. | 10 |

| | [[ContentInventoryWithContentID:Row.Le | [[ContentInventoryWithContentID:Row.D | | |

| | galTracking]] | OLU]] | | |