Exhibit 99.2

Second Quarter 2013 Earnings Conference Call May 1, 2013

Jerry Sheridan

CEO of AmeriGas

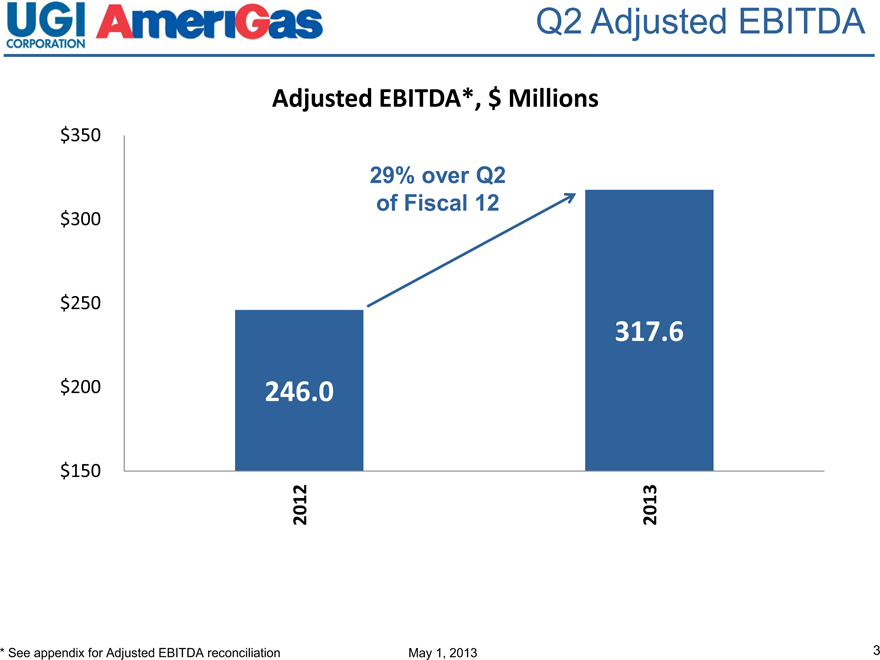

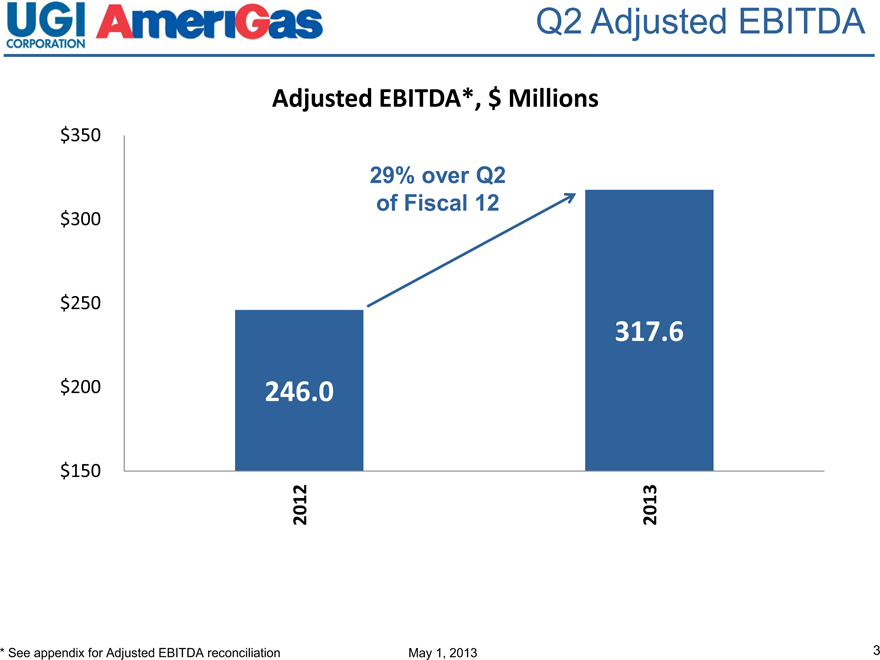

Q2 Adjusted EBITDA

Adjusted EBITDA*, $ Millions

$350

29% over Q2 of Fiscal 12

$300

$250

317.6 $200 246.0

$150

2012 2013

* | | See appendix for Adjusted EBITDA reconciliation |

May 1, 2013

Operational Update

Operations

Weather: Warmer than normal, much colder than LY

Volume up in line with expectations

Lower COGS, Mt. Belvieu prices down 39 cents, or 31%

Growth Initiatives

AmeriGas Cylinder Exchange (ACE): Volume growth of 6% y/y, results muted by a colder March

National Accounts: Volume increased 14 MM gallons y/y, 22 MM gallons ytd

Acquisitions: No acquisitions closed during the quarter

May 1, 2013

Guidance & Heritage Update

FY13 Guidance remains $620MM—$645MM, trending toward the midpoint

Final stages of Heritage integration: Planning to consolidate over 200 stores

Increased estimated transition expenses for the year by $5 MM reflecting additional severance costs

On track to realize at least $60MM in total net synergies

May 1, 2013

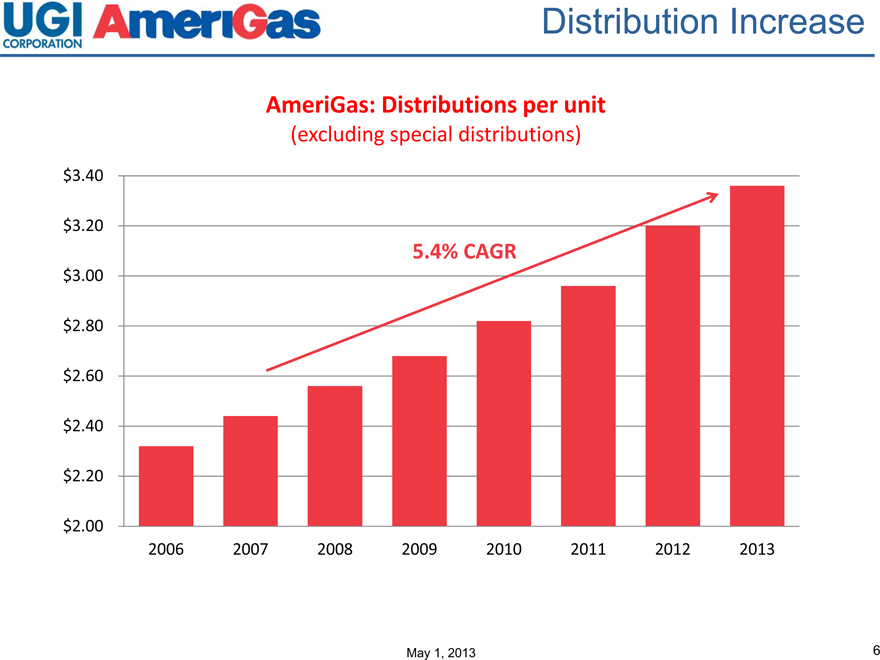

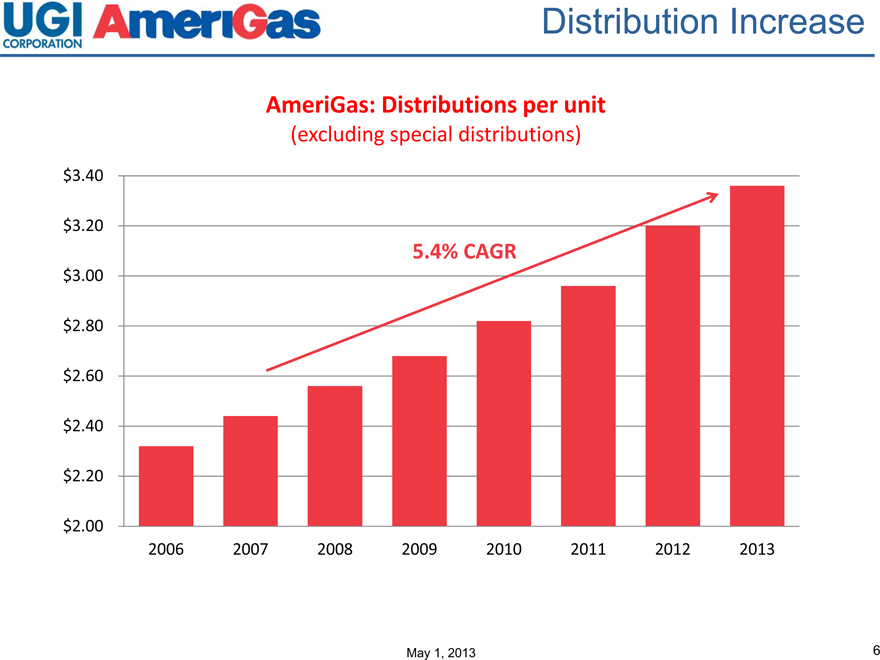

Distribution Increase

AmeriGas: Distributions per unit

(excluding special distributions)

$3.40

$3.20

5.4% CAGR

$3.00

$2.80

$2.60

$2.40

$2.20

$2.00

2006 2007 2008 2009 2010 2011 2012 2013

May 1, 2013

Q&A

Appendix

AmeriGas Supplemental Information: Footnotes

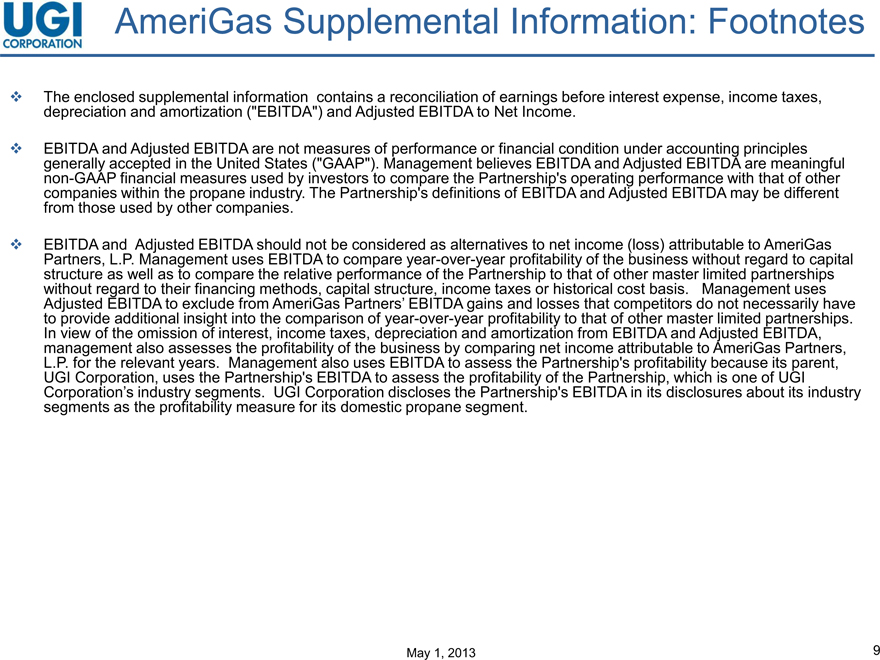

The enclosed supplemental information contains a reconciliation of earnings before interest expense, income taxes, depreciation and amortization (“EBITDA”) and Adjusted EBITDA to Net Income.

EBITDA and Adjusted EBITDA are not measures of performance or financial condition under accounting principles generally accepted in the United States (“GAAP”). Management believes EBITDA and Adjusted EBITDA are meaningful non-GAAP financial measures used by investors to compare the Partnership’s operating performance with that of other companies within the propane industry. The Partnership’s definitions of EBITDA and Adjusted EBITDA may be different from those used by other companies.

EBITDA and Adjusted EBITDA should not be considered as alternatives to net income (loss) attributable to AmeriGas Partners, L.P. Management uses EBITDA to compare year-over-year profitability of the business without regard to capital structure as well as to compare the relative performance of the Partnership to that of other master limited partnerships without regard to their financing methods, capital structure, income taxes or historical cost basis. Management uses Adjusted EBITDA to exclude from AmeriGas Partners’ EBITDA gains and losses that competitors do not necessarily have to provide additional insight into the comparison of year-over-year profitability to that of other master limited partnerships.

In view of the omission of interest, income taxes, depreciation and amortization from EBITDA and Adjusted EBITDA, management also assesses the profitability of the business by comparing net income attributable to AmeriGas Partners, L.P. for the relevant years. Management also uses EBITDA to assess the Partnership’s profitability because its parent, UGI Corporation, uses the Partnership’s EBITDA to assess the profitability of the Partnership, which is one of UGI

Corporation’s industry segments. UGI Corporation discloses the Partnership’s EBITDA in its disclosures about its industry segments as the profitability measure for its domestic propane segment.

May 1, 2013

9

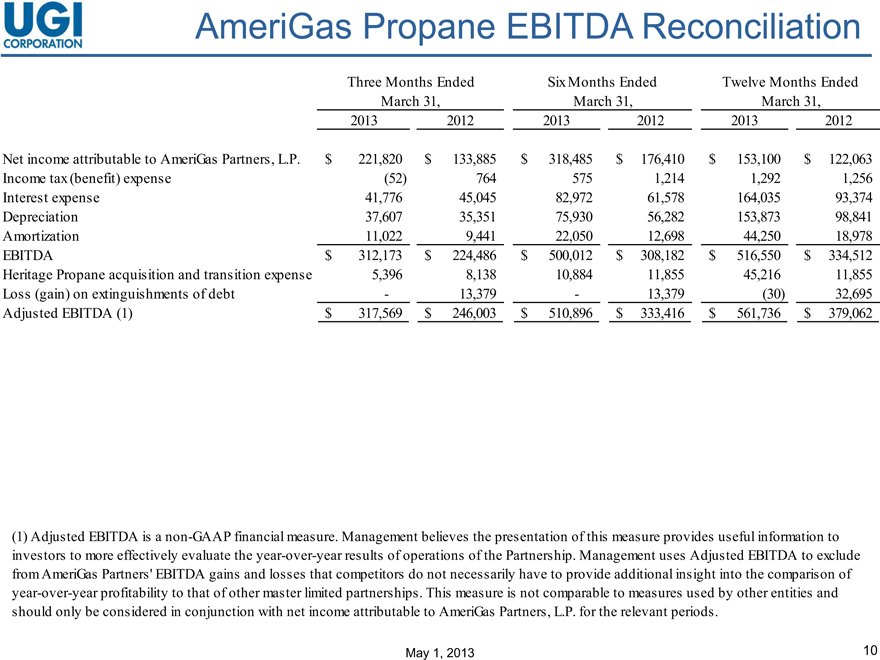

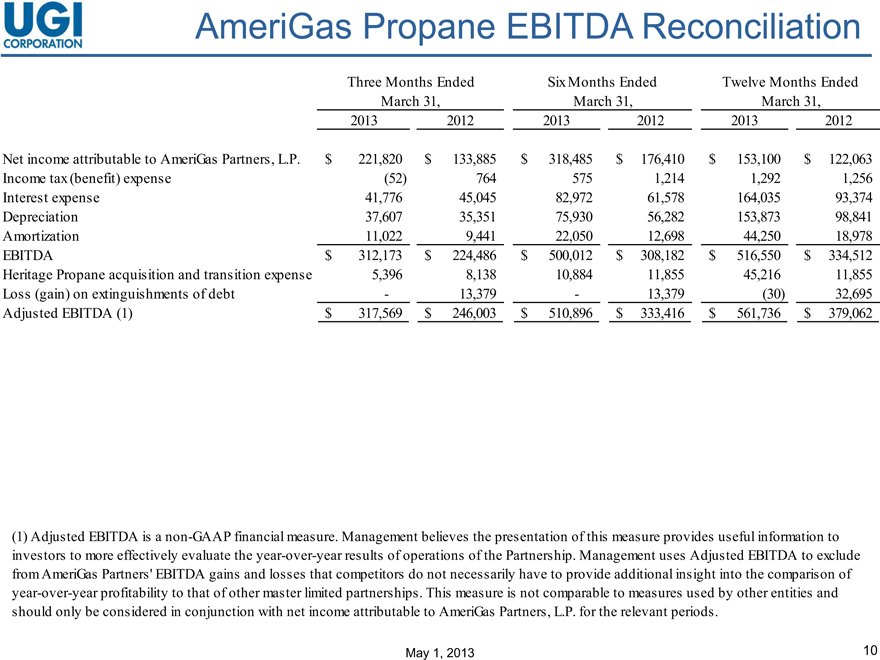

AmeriGas Propane EBITDA Reconciliation

Three Months Ended Six Months Ended Twelve Months Ended

March 31, March 31, March 31,

2013 2012 2013 2012 2013 2012

Net income attributable to AmeriGas Partners, L.P. $ 221,820 $ 133,885 $ 318,485 $ 176,410 $ 153,100 $ 122,063

Income tax (benefit) expense (52) 764 575 1,214 1,292 1,256

Interest expense 41,776 45,045 82,972 61,578 164,035 93,374

Depreciation 37,607 35,351 75,930 56,282 153,873 98,841

Amortization 11,022 9,441 22,050 12,698 44,250 18,978

EBITDA $ 312,173 $ 224,486 $ 500,012 $ 308,182 $ 516,550 $ 334,512

Heritage Propane acquisition and transition expense 5,396 8,138 10,884 11,855 45,216 11,855

Loss (gain) on extinguishments of debt — 13,379 — 13,379 (30) 32,695

Adjusted EBITDA (1) $ 317,569 $ 246,003 $ 510,896 $ 333,416 $ 561,736 $ 379,062

(1) Adjusted EBITDA is a non-GAAP financial measure. Management believes the presentation of this measure provides useful information to investors to more effectively evaluate the year-over-year results of operations of the Partnership. Management uses Adjusted EBITDA to exclude from AmeriGas Partners’ EBITDA gains and losses that competitors do not necessarily have to provide additional insight into the comparison of year-over-year profitability to that of other master limited partnerships. This measure is not comparable to measures used by other entities and should only be considered in conjunction with net income attributable to AmeriGas Partners, L.P. for the relevant periods.

May 1, 2013

10

Investor Relations:

610-337-1000

Hugh Gallagher (x1029) gallagherh@ugicorp.com

Simon Bowman (x3645) bowmans@ugicorp.com