MERGER PROPOSAL—YOUR VOTE IS VERY IMPORTANT

July 12, 2019

Dear Common Unitholders of AmeriGas Partners, L.P.:

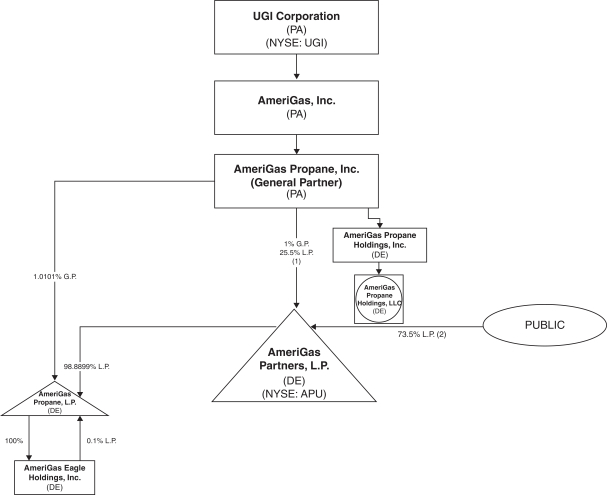

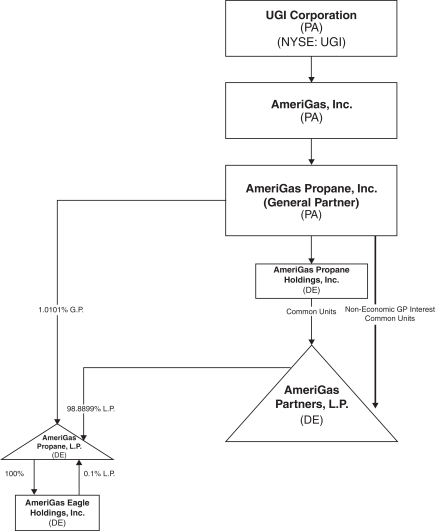

On April 1, 2019, UGI Corporation (“UGI”), AmeriGas Partners, L.P. (“AmeriGas”) and certain of their affiliates entered into a merger agreement (as may be amended from time to time, the “merger agreement”), pursuant to which AmeriGas Propane Holdings, LLC, an indirect, wholly owned subsidiary of UGI, will merge with and into AmeriGas, with AmeriGas continuing as the surviving entity and an indirect, wholly owned subsidiary of UGI (the “merger”). The board of directors (the “GP Board”) of AmeriGas Propane, Inc. (the “General Partner”), the general partner of AmeriGas and an indirect, wholly owned subsidiary of UGI, approved and agreed to submit the merger agreement and the merger to a vote of AmeriGas common unitholders (“AmeriGas Unitholders”) following the recommendation of the audit committee of the GP Board (the “GP Audit Committee”). The GP Audit Committee has determined that the merger agreement and the merger are fair and reasonable to, and in the best interests of, AmeriGas and the AmeriGas Unitholders who are unaffiliated with UGI or the General Partner (the “Unaffiliated AmeriGas Unitholders,” which term, as used herein, excludes directors and executive officers of UGI and the General Partner), approved the merger agreement and the merger, and recommended that the GP Board approve the merger agreement and the merger. Based on a number of factors, including the recommendation of the GP Audit Committee, the GP Board has determined that the merger agreement and the transactions contemplated thereby, including the merger, are fair and reasonable to, and in the best interests of, AmeriGas and the Unaffiliated AmeriGas Unitholders, and has approved the merger agreement and the merger. Under the terms of the merger agreement, subject to certain adjustments, each of the common units representing limited partner interests in AmeriGas (“AmeriGas common units”) (other than AmeriGas common units held by UGI or its subsidiaries, including the General Partner) will be automatically converted into the right to receive, at the election of each AmeriGas Unitholder, but subject to any applicable withholding tax and proration as described in the accompanying proxy statement/prospectus, one of the following forms of consideration (collectively, the “merger consideration”): (i) 0.6378 shares of common stock, with no par value, of UGI (“UGI Shares”; such election, a “Share Election”); (ii)(A) $7.63 in cash, without interest, and (B) 0.500 UGI Shares (such election, a “Mixed Election”); or (iii) $35.325 in cash, without interest (such election, a “Cash Election”).

The merger consideration to be received by AmeriGas Unitholders (other than UGI and its subsidiaries, including the General Partner) is valued at approximately $35.325 per AmeriGas common unit based on the closing price of UGI’s common stock as of April 1, 2019, the last trading day before the public announcement of the merger, representing an approximate 13.5% premium to the closing price of AmeriGas common units of $31.13 on April 1, 2019 and a 21.9% premium to the volume-weighted average price of AmeriGas common units for the 30 trading days ended April 1, 2019. The Mixed Election merger consideration is valued at approximately $34.24 per unit based on the closing price of UGI common stock as of July 8, 2019, representing a 2.2% discount to the closing price of AmeriGas common units of $35.00 on July 8, 2019, and a 2.0% discount to the volume-weighted average price of AmeriGas common units for the five trading days ended July 8, 2019.

UGI’s common stock and AmeriGas’ common units are traded on the New York Stock Exchange (“NYSE”) under the symbols “UGI” and “APU,” respectively.

AmeriGas is holding a special meeting of its common unitholders at the Sheraton Valley Forge Hotel at 480 North Gulph Road, King of Prussia, PA 19406, on August 21, 2019 at 10:00 a.m., local time, to obtain the vote of the AmeriGas Unitholders to approve the merger agreement and the transactions contemplated thereby, including the merger (the “special meeting”).Your vote is very important regardless of the number of AmeriGas common units you own. The merger cannot be completed unless the holders of at least a majority of the outstanding AmeriGas common units vote to approve the merger agreement and the transactions contemplated thereby, including the merger, at the special meeting.The GP Board recommendsthat AmeriGas Unitholders vote“FOR” the approval of the merger agreement and the transactions contemplated thereby, including the merger,“FOR” the proposal to approve the adjournment of the special meeting, if necessary, to solicit additional proxies if there are not sufficient votes to approve the merger agreement and the transactions contemplated thereby, including the merger, at the time of the special meeting and“FOR” the approval of the advisory compensation proposal. Pursuant to a support agreement, the General Partner, which owns the general partner interest in AmeriGas, including the incentive distribution rights, as well as 23,756,882 AmeriGas common units representing approximately 25.5% of the AmeriGas common units outstanding as of July 1, 2019, has agreed to vote all of the AmeriGas common units owned beneficially or of record by it in favor of the approval of the merger agreement and the transactions contemplated thereby, including the merger, and the approval of any actions necessary or desirable in furtherance thereof. Whether or not you expect to attend the special meeting in person, we urge you to submit your proxy as promptly as possible through one of the delivery methods described in the accompanying proxy statement/prospectus.

In addition, we urge you to read carefully the accompanying proxy statement/prospectus (and the documents incorporated by reference into the accompanying proxy statement/prospectus), which includes important information about the merger agreement, the merger and the special meeting. Please pay particular attention to the section titled “Risk Factors,” beginning on page 107 of the accompanying proxy statement/prospectus.

On behalf of the GP Board, we thank you for your continued support.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the securities to be issued under the accompanying proxy statement/prospectus or determined that the accompanying proxy statement/prospectus is accurate or complete. Any representation to the contrary is a criminal offense.

The accompanying proxy statement/prospectus is dated July 12, 2019 and is first being mailed to the AmeriGas Unitholders on or about July 15, 2019.

Sincerely,

John L. Walsh

Chairman of the Board of AmeriGas

Propane, Inc., on behalf of AmeriGas

Partners, L.P.