QuickLinks -- Click here to rapidly navigate through this documentSCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant /x/

|

| Filed by a Party other than the Registrant / / |

Check the appropriate box: |

| / / | | Preliminary Proxy Statement |

| / / | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| /x/ | | Definitive Proxy Statement |

| / / | | Definitive Additional Materials |

| / / | | Soliciting Material Pursuant to §240.14a-12

|

OSTEX INTERNATIONAL, INC. |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

| /x/ | | No fee required |

| / / | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

| / / | | Fee paid previously with preliminary materials. |

| / / | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | (1) | | Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

OSTEX INTERNATIONAL, INC.

2203 Airport Way South, Suite 400

Seattle, Washington 98134

March 28, 2002

Dear Shareholder:

You are cordially invited to attend the Annual Meeting of Shareholders of Ostex International, Inc. to be held on Wednesday, May 22, 2002, at 9:00 a.m. at the Renaissance Madison Hotel, located at 515 Madison Street, Seattle, Washington.

The matters to be acted upon are described in the accompanying Notice of Annual Meeting of Shareholders and Proxy Statement. At the Annual Meeting, we will also report on Ostex' operations and respond to any questions you may have.

Whether or not you plan to attend the Annual Meeting, it is important that your shares be represented and voted.Therefore, please complete, sign, date and mail the enclosed proxy card as soon as possible in the enclosed postage-prepaid envelope. Returning the enclosed proxy will not affect your right to revoke it later or to vote your shares in person if you attend the Annual Meeting.

OSTEX INTERNATIONAL, INC.

2203 Airport Way South, Suite 400

Seattle, Washington 98134

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD MAY 22, 2002

To the Shareholders of Ostex International, Inc.:

The Annual Meeting of the Shareholders of Ostex International, Inc. (the "Company") will be held at the Renaissance Madison Hotel, located at 515 Madison Street, in Seattle, Washington, on May 22, 2002, at 9:00 a.m. If you would like directions, please call the Company at (206) 292-8082. The Annual Meeting is held for the following purposes:

- 1.

- To elect two directors to the Company's Board of Directors;

- 2.

- To approve an increase in the number of shares authorized under the Company's 1994 Stock Option Plan;

- 3.

- To ratify the selection of Arthur Andersen LLP as the Company's independent auditors for the fiscal year ending December 31, 2002; and

- 4.

- To transact such other business as may properly come before the Annual Meeting or any adjournment or postponement thereof.

The foregoing items of business are more fully described in the Proxy Statement accompanying this Notice.

The record date for the Annual Meeting is March 14, 2002. Only shareholders of record at the close of business on that date are entitled to notice of, and to vote at, the Annual Meeting or any adjournment or postponement thereof.

Seattle, Washington

March 28, 2002

ALL SHAREHOLDERS ARE CORDIALLY INVITED TO ATTEND THE ANNUAL MEETING. WHETHER OR NOT YOU EXPECT TO ATTEND THE ANNUAL MEETING, PLEASE COMPLETE, SIGN AND DATE THE ENCLOSED PROXY CARD AND RETURN IT AS SOON AS POSSIBLE IN THE ENCLOSED POSTAGE-PREPAID ENVELOPE IN ORDER TO ENSURE YOUR REPRESENTATION AT THE MEETING. THE GIVING OF SUCH PROXY DOES NOT AFFECT YOUR RIGHT TO REVOKE IT LATER OR VOTE YOUR SHARES IN PERSON IN THE EVENT THAT YOU SHOULD ATTEND THE ANNUAL MEETING.

OSTEX INTERNATIONAL, INC.

PROXY STATEMENT

For The

Annual Meeting Of Shareholders

To Be Held May 22, 2002

INFORMATION CONCERNING SOLICITATION AND VOTING

General

This enclosed proxy is solicited on behalf of the Board of Directors of Ostex International, Inc., a Washington corporation (the "Company"), to be voted at the Company's 2002 Annual Meeting of Shareholders (the "Annual Meeting"), to be held at 9:00 a.m. on Wednesday, May 22, 2002, at the Renaissance Madison Hotel, located at 515 Madison Street, in Seattle, Washington, or at any adjournment or postponement thereof, for the purposes set forth in the accompanying Notice of Annual Meeting of Shareholders. Any shareholder requiring directions to the Renaissance Madison Hotel should call the Company at (206) 292-8082.

This Proxy Statement and accompanying proxy card are first being mailed to shareholders on or about March 28, 2002.

Voting and Outstanding Shares

Only holders of record of the Company's common stock, $0.01 par value (the "Common Stock"), at the close of business on March 14, 2002, are entitled to notice of, and to vote at, the Annual Meeting. At the close of business on March 14, 2002, there were outstanding and entitled to vote 12,558,174 shares of Common Stock. Shareholders of record on such date are entitled to one vote for each share of Common Stock held on all matters to be voted upon at the Annual Meeting. All votes will be tabulated by the inspector of election appointed for the Annual Meeting, who will separately tabulate affirmative and negative votes, abstentions and broker nonvotes.

The presence in person or by proxy of holders of record of a majority of the outstanding shares of Common Stock is required to constitute a quorum at the Annual Meeting. Under Washington law and the Company's Articles of Incorporation (the "Articles"), assuming the presence of a quorum, the election of the Company's directors, the approval of the amendment to the Company's Amended and Restated 1994 Stock Option Plan (the "1994 Plan") and ratification of the Company's selection of independent auditors require the affirmative vote of a majority of the shares represented at the meeting and entitled to vote.

Abstentions and "broker nonvotes" (shares held by a broker or nominee as to which a broker or nominee indicates on the proxy that it does not have the authority, either express or discretionary, to vote on a particular matter) are counted for purposes of determining the presence of a quorum. Abstentions and broker nonvotes do not count either as votes for or as votes against the proposals. Therefore, they have no effect on the proposals to be voted on at the Annual Meeting other than to reduce the number of favorable votes that may be necessary to approve the proposals. There will be no broker nonvotes on the election of directors since brokers who hold shares for the accounts of their clients have authority to vote such shares with respect to these matters.

Revocability of Proxies

Any person giving a proxy pursuant to this solicitation has the power to revoke it at any time before it is voted. It may be revoked by filing with the Secretary of the Company at the Company's

1

principal executive office, 2203 Airport Way South, Suite 400, Seattle, Washington 98134, a written notice of revocation or a duly executed proxy bearing a later date, or it may be revoked by attending the Annual Meeting and voting in person. Attendance at the Annual Meeting will not, by itself, revoke a proxy.

Solicitation

The Company will bear the entire cost of solicitation of proxies, including preparing, printing and mailing this Proxy Statement, the proxy card and any additional information furnished to shareholders. The Company will also request brokerage firms, banks, nominees, custodians and fiduciaries to forward proxy materials to the beneficial owners of shares of Common Stock as of the record date. The Company will provide reimbursement for the cost of forwarding the proxy materials in accordance with customary practice. In addition to mailing this Proxy Statement and the accompanying proxy card, proxies may be solicited by directors, officers and other employees of the Company, without additional compensation, in person or by telephone, telegraph or facsimile transmission.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information regarding the beneficial ownership of the Common Stock as of March 14, 2002, by (i) each person who is known by the Company to own beneficially more than 5% of the Common Stock; (ii) each director and nominee for director; (iii) our Chief Executive Officer and each of our four most highly compensated executive officers (other than our Chief Executive Officer) who earned more than $100,000 in 2001 (the "Named Executive Officers"); and (iv) all directors and executive officers of the Company as a group.

The term "beneficial ownership" includes shares over which the indicated beneficial owner exercises voting and/or investment power. The rules of the Securities and Exchange Commission ("SEC") also deem common stock subject to options or warrants currently exercisable, or exercisable within 60 days, to be outstanding for the purposes of computing the percentage of ownership of the person holding the options or warrants, but they do not deem that stock to be outstanding for the purposes of computing the percentage ownership of any other person.

Unless otherwise indicated, the address for each of the individuals listed below is c/o Ostex International, Inc., 2203 Airport Way South, Suite 400, Seattle, Washington 98134.

Name and Address of

Beneficial Owner

| | Amount and Nature of

Beneficial Ownership(1)

| | Percent of Class(2)

| |

|---|

CH Partners IV Limited Partnership

1615 72nd Ave. SE

Mercer Island, WA 98040 | | 991,070 | | 7.89 | % |

Wisconsin Investment Board(3)

P.O. Box 7842

Madison, WI 53707 |

|

789,000 |

|

6.28 |

% |

Mochida Pharmaceutical, Co., Ltd.

Y.S. Building

9 San-Eicho, Shinjuku-ku

Tokyo 160, Japan |

|

736,842 |

|

5.87 |

% |

Thomas A. Bologna(4) |

|

1,134,708 |

|

8.30 |

% |

Thomas J. Cable(5) |

|

1,092,570 |

|

8.64 |

% |

Elisabeth L. Evans, M.D.(6) |

|

48,083 |

|

* |

|

|

|

|

|

|

|

2

David R. Eyre, Ph.D.(7) |

|

1,497,500 |

|

11.87 |

% |

Fredric J. Feldman, Ph.D.(6) |

|

45,000 |

|

* |

|

John H. Trimmer(6) |

|

45,000 |

|

* |

|

Cory J. Smith(8) |

|

101,527 |

|

* |

|

J. Daniel Clemens(10) |

|

113,552 |

|

* |

|

Thomas F. Broderick(9) |

|

272,021 |

|

2.13 |

% |

Michael C. Perry(8) |

|

31,188 |

|

* |

|

All directors and executive officers as a group (eleven people)(11) |

|

4,396,028 |

|

30.57 |

% |

- *

- Less than 1%

- (1)

- Unless otherwise indicated in the footnotes to this table, each of the shareholders named in this table has sole voting and investment power with respect to the, shares of Common Stock shown as beneficially owned.

- (2)

- Percentage beneficially owned is based on 12,558,174 shares of Common Stock outstanding as of March 14, 2002, together with any applicable options and warrants for each shareholder.

- (3)

- Based on publicly available information filed with the SEC on Form 13G on February 14, 2002.

- (4)

- Includes 6,000 shares held in trust for the benefit of Mr. Bologna's children. In addition, the number of shares includes 1,108,708 shares subject to stock options that are exercisable within 60 days of March 14, 2002.

- (5)

- Includes 991,070 shares held by CH Partners IV Limited Partnership ("CH IV"), a venture capital fund of which Mr. Cable is a general partner. Under federal securities laws, Mr. Cable may be deemed to own beneficially all the shares held by CH IV. In addition, the number of shares includes 80,000 shares subject to stock options that are exercisable within 60 days of March 14, 2002.

- (6)

- Includes 45,000 shares subject to stock options that are exercisable within 60 days of March 14, 2002.

- (7)

- Includes 560,000 shares held in trust for the benefit of Dr. Eyre's children and 55,000 shares subject to stock options that are exercisable within 60 days of March 14, 2002.

- (8)

- Represents shares subject to stock options that are exercisable within 60 days of March 14, 2002.

- (9)

- Includes 208,021 shares subject to stock options that are exercisable within 60 days of March 14, 2002.

- (10)

- Includes 88,552 shares subject to stock options that are exercisable within 60 days of March 14, 2002.

- (11)

- Includes 1,822,874 shares subject to stock options that are exercisable within 60 days of March 14, 2002.

3

PROPOSAL 1:

ELECTION OF DIRECTORS AND DIRECTOR INFORMATION

The Company's Articles divide the Board of Directors into three classes, each class consisting, as nearly as possible, of one-third of the total number of directors. The members of each class are elected to serve for a three-year term and until the election and qualification of their successors. At each annual meeting of shareholders, one class of the Board of Directors is elected and directors in the other classes remain in office until their respective three-year terms expire. Under the Company's Amended Bylaws, the Board of Directors is to be comprised of no more than ten members and no fewer than three members, the exact number of which shall be set by the Board of Directors from time to time. The Board of Directors currently consists of six directors and will consist of six directors after the Annual Meeting.

At the Annual Meeting, shareholders will be asked to elect two directors to the class whose term of office will expire at the year 2005 annual meeting of shareholders (the "Class 2 Directors"). The nominees for election are Thomas J. Cable and John H. Trimmer. Unless otherwise directed, the persons named in the proxy intend to cast all proxies in favor of Messrs. Cable and Trimmer to serve as Class 2 Directors. Both nominees have agreed to serve if elected and management has no reason to believe that they will be unable to serve, but if either of them is not able to serve, it is intended that the proxies will be voted for the election of such nominee as designated by the Board of Directors to fill any such vacancy.

The names of the Class 2 nominees for director and certain information about them are set forth in the table below. The names of, and certain information about, the current Class 1 and Class 3 directors with unexpired terms are also set forth below.

Name

| | Age

| | Principal Occupation

|

|---|

| NOMINEES FOR CLASS 2 DIRECTORS | | | | |

| | |

Thomas J. Cable |

|

62 |

|

Retired |

| | |

John H. Trimmer |

|

49 |

|

President and CEO, CallTower, Inc. |

CONTINUING CLASS 1 DIRECTORS |

|

|

|

|

| | |

David R. Eyre, Ph.D. |

|

57 |

|

Burgess Professor of Orthopaedics, University of Washington |

| | |

Fredric J. Feldman, Ph.D. |

|

62 |

|

President, FJF Associates |

CONTINUING CLASS 3 DIRECTORS |

|

|

|

|

| | |

Thomas A. Bologna |

|

53 |

|

Chairman of the Board, President and CEO, Ostex International, Inc. |

| | |

Elisabeth L. Evans |

|

54 |

|

Physician, Obstetrics and Gynecology, Overlake Obstetricians and Gynecologists |

Except as indicated below, each nominee or incumbent director has been engaged in the principal occupation set forth above during the last five years. There are no family relationships between any of the directors or executive officers of the Company.

4

Information About the Director Nominees

Thomas J. Cable has been a director of the Company since 1989 and currently serves on the Compensation Committee of the Board of Directors. Mr. Cable was co-founder and partner of Cable & Howse Ventures, Inc., a venture management company founded in 1979. Mr. Cable was also co-founder and, from 1982 to 1985, a partner in Cable Howse & Ragen, a Seattle investment banking and brokerage firm now known as Ragen MacKenzie Group Incorporated. Mr. Cable is a founder and current Chairman of the Washington Research Foundation and serves on the Board of Directors of Therus Corporation, Omeros Medical Systems, Inc., and Stellar One Corporation. Mr.��Cable received an M.B.A. from Stanford University and a B.A. from Harvard College.

John H. Trimmer has been a director of the Company since June 1997 and currently serves on the Audit and Compensation Committees of the Board of Directors. Mr. Trimmer presently serves as President and Chief Executive Officer of CallTower, Inc., a telecommunications company. From 1992 to 1994, Mr. Trimmer served as Chairman, President and Chief Executive Officer of National Diagnostic Systems, Inc., a managed care company focused on the management of clinically appropriate diagnostic imaging services; from 1985 to 1989 as President and Chief Operating Officer of American Biodyne, Inc., a managed care company focused on the delivery and management of clinically appropriate mental health services; and from 1984 to 1985 as President of TMS, Inc., a private management consulting firm providing services to health care venture businesses. Mr. Trimmer also held positions with American Medical Systems, Inc., Hospital Business, and Booz, Allen & Hamilton. Mr. Trimmer received an M.B.A. from the University of Chicago and an B.A. from Harvard University.

THE BOARD OF DIRECTORS RECOMMENDS A VOTEFOR THE ELECTION OF EACH OF THE DIRECTOR NOMINEES.

Information About Directors Whose Terms of Office Continue After the Annual Meeting

Directors Whose Terms Expire in 2003

David R. Eyre, Ph.D. is a founder of the Company and has been a director since the Company's formation in May 1989. His major research interests include collagen biochemistry, inborn skeletal diseases, cartilage pathology, biochemistry of the intervertebral disc, bone metabolism and osteoporosis. Since 1985, Dr. Eyre has served as the Burgess Professor of Orthopaedics at the University of Washington, where he is also an Adjunct Professor of Biochemistry and Oral Biology and a director of the Orthopaedic Research Laboratories. Dr. Eyre has previously served as a research scientist at Children's Hospital Medical Center in Boston, Massachusetts, and as a faculty member in the department of biological chemistry at Harvard Medical School. In addition, from 1973 to 1976, Dr. Eyre served on the permanent scientific staff of the Kennedy Institute of Rheumatology in London, England, and as a Research Fellow at Massachusetts General Hospital and Harvard Medical School. Dr. Eyre has published numerous articles on the biochemistry of connective tissue. Dr. Eyre earned his Ph.D. and B.S. in biochemistry from the University of Leeds, England.

Fredric J. Feldman, Ph.D. has been a director with the Company since April 1997 and currently serves on the Audit Committee of the Board of Directors. Dr. Feldman has served as the President of FJF Associates since 1992, a firm providing management and investment consulting services to venture capital and emerging growth companies in the health care industry. From 1995 to 1996 and from 1999 to 2000, Dr. Feldman has served and is serving as Chief Executive Officer of Biex, Inc., a biotechnology company; from 1992 to 1995, Dr. Feldman served as the Chairman of the Board of Directors and Chief Executive Officer of Oncogenetics, Inc., a genetic cancer diagnostic company; and from 1988 to 1992, he was President and Chief Executive Officer of Microgenic Corporation, a biotechnology diagnostic company.

5

Directors Whose Terms Expire in 2004

Thomas A. Bologna has been a director, President and Chief Executive Officer of the Company since July 1997 and, in April 1999, he was appointed Chairman of the Board of Directors. From January 1996 to July 1997, Mr. Bologna was a principal in Healthcare Venture Associates, a consulting firm. From January 1994 to January 1996, Mr. Bologna was President and Chief Executive Officer for Scriptgen Pharmaceuticals, Inc., a biotechnology company with proprietary drug screening technology that is developing orally active drugs to regulate gene expression, and from July 1987 to January 1994, Mr. Bologna was Chairman of the Board of Directors, President and Chief Executive Officer of Gen-Probe Incorporated, a biotechnology company commercializing genetic-probe-based technology for diagnostic and therapeutic applications. Prior to Gen-Probe, Mr. Bologna held several senior level positions with Becton, Dickinson and Company and Warner-Lambert Company. At Becton, Dickinson and Company, he served as President of the Diagnostic Instrument Systems Division, President of the Johnston Laboratories Division, and Vice President and General Manager of the Hynson, Wescott & Dunning biotechnology unit. At Warner-Lambert Company, he served as a Vice President responsible for the marketing, sales and R&D functions, as well as the Asia/Pacific profit center for the Scientific Instrument Division. Mr. Bologna serves on the Board of Directors for Leonardo MD Corporation. Mr. Bologna received an M.B.A. and a B.S. from New York University.

Elisabeth L. Evans, M.D. has been a director of Ostex since June 1997 and currently serves on the Audit Committee of the Board of Directors. Since 1987, Dr. Evans has been in private practice in obstetrics and gynecology at Overlake Obstetricians and Gynecologists, and from 1997 to 2000 served as Chief of Medical Staff at Overlake Hospital Medical Center. Dr. Evans previously served as Section Chief, Department of Obstetrics and Gynecology at Overlake Hospital Medical Center, a Staff Physician, Department of Obstetrics and Gynecology, Kaiser Permanente, Portland, Oregon; as the Senior Staff and Division Head, Department of Gynecology and Obstetrics, Henry Ford Hospital, Detroit, Michigan; and as a Clinical Instructor at the University of Michigan Medical Center, Ann Arbor, Michigan. Dr. Evans received an M.D. from the University of Washington School of Medicine and a B.A. from Wellesley College.

Compensation of Directors

The Company pays a retainer of $1,875 to each director on a quarterly basis and an additional $1,000 for each Board of Directors meeting attended and $500 for each committee meeting attended. Each director is also reimbursed actual travel expenses for attendance at regular Board of Directors and committee meetings. Additionally, the Company's nonemployee directors participate in the Company's Nonqualified Stock Option Plan (the "Directors Plan"). Upon election or appointment to the Board of Directors, each nonemployee director receives a one-time stock option grant to purchase 25,000 shares of Common Stock under the Directors Plan. In addition, each nonemployee director who is in office the day following an annual meeting of shareholders of the Company (at which meeting such director was re-elected or continued in office) and who has been in office for at least five months prior to such annual meeting, receives an option to purchase 10,000 shares of Common Stock.

Options granted under the Directors Plan vest in equal annual installments over a three-year period with the first vesting event occurring on the one-year anniversary of the grant date. Options will be accelerated and vest immediately if a director is terminated by reason of death or disability. Options granted under the Directors Plan have a term of ten years from the date of grant. Vested options may be exercised for 90 days after a director's termination as a director of the Company for any reason other than death or disability, and one year after termination upon death or disability unless the option expires according to its terms prior to the end of the 90 day or one year post-termination exercise period, as the case may be. The exercise price of options granted under the Directors Plan is the fair market value of the Common Stock on the date of grant. Upon exercise, the exercise price may be paid immediately in cash, by delivering to the Company shares of Common Stock previously held by such

6

director, by having shares withheld from the amount of shares of Common Stock to be received by the director, or by delivering an irrevocable subscription agreement obligating the director to take and pay for the shares of Common Stock to be purchased within one year of the date of exercise.

Consulting Agreement with Director

The Company has entered into a consulting agreement with Dr. Eyre for assistance with the urinary test for measuring bone resorption and osteoclast colony stimulating factor technologies. The agreement provides for the payment of $6,000 per month by the Company to Dr. Eyre, plus expenses. During the year ended December 31, 2001, the Company paid Dr. Eyre $72,000 pursuant to the agreement.

Committees of the Board Directors and Meeting Attendance

During 2001, there were five meetings of the Board of Directors and each director attended at least 80% of the aggregate number of Board meetings and meetings of committees on which he or she served. The Company's Board of Directors has an Audit Committee, composed of three members, and Compensation Committee composed of two members.

The Compensation Committee currently consists of Messrs. Cable and Trimmer. The Compensation Committee administers the Company's employee stock option plans and is responsible for determining the compensation of the executive officers. The Compensation Committee met eight times in 2001.

The Audit Committee currently consists of Messrs. Feldman and Trimmer and Dr. Evans, all of whom are independent directors, as defined in Nasdaq's Marketplace Rule 4200(a)(14), and are able to read and understand fundamental financial statements. The Audit Committee makes recommendations to the Board of Directors regarding the selection of independent auditors, reviews the results and scope of the audit and other services provided by the Company's independent auditors, and reviews and evaluates the Company's internal control functions. The Company's Audit Committee Charter as adopted by the Board of Directors was attached to last year's proxy statement, dated March 22, 2001, as Appendix A. The Audit Committee met one time during 2001.

Report of the Audit Committee

The Audit Committee has reviewed and discussed with management the financial statements as of and for the year ended December 31, 2001, audited by Arthur Andersen LLP, the Company's independent auditors. The Audit Committee has discussed with Arthur Andersen LLP various matters related to the financial statements, including those matters required to be discussed by Auditing Standards 61,Communication with Audit Committee, as amended, by the Auditing Standards Board of the American Institute of Certified Public Accountants. The Audit Committee has also received and reviewed the written disclosures and the letter from Arthur Andersen LLP required by Independence Standards No. 1,Independence Discussions with Audit Committees, as amended, by the Independence Standards Board, and has discussed with Arthur Andersen LLP its independence.

During fiscal 2001, Arthur Andersen LLP provided services in the following categories and amounts:

AUDIT FEES

Arthur Andersen LLP billed the Company approximately $79,000 in fees for professional services rendered in connection with the audit of the Company's financial statements for the most recent fiscal year and the reviews of the financial statements included in each of the Company's Quarterly Reports on Form 10-Q during the fiscal year ended December 31, 2001.

7

ALL OTHER FEES

Arthur Andersen LLP billed the Company approximately $30,000 in fees for other services rendered to the Company for the fiscal year ended December 31, 2001, primarily related to the following:

- •

- Tax compliance and consulting, and preparation of tax returns, and

- •

- Compliance review of stock registrations.

Arthur Andersen LLP did not provide any services related to financial information systems design and implementation during 2001. The Audit Committee has considered whether the provision of service other than audit services is compatible with maintaining the auditors independence and believes that such services does not affect the independence of the auditors.

Based upon the Audit Committee's review and discussions with management and Arthur Andersen LLP, it has recommended to the Board of Directors that the audited financial statements be included in the Company's Annual Report on Form 10-K for the fiscal year ending December 31, 2001, for filing with the Securities and Exchange Commission.

Audit Committee of the Board of Directors

Fredric J. Feldman, Ph.D., Chairman

Mr. John H. Trimmer

Dr. Elisabeth L. Evans

PROPOSAL 2:

AMENDMENT TO THE OSTEX INTERNATIONAL, INC. 1994 STOCK OPTION PLAN

The Board of Directors has unanimously adopted, subject to shareholder approval, an amendment to increase the number of shares of Common Stock authorized for issuance under the Company's Amended and Restated 1994 Stock Option Plan (the "1994 Plan") from 3,000,000 shares to 3,750,000 shares. The amendment will become effective only upon receipt of approval by the shareholders. The Board of Directors recommends a vote FOR the amendment to the 1994 Plan.

Amendment to Increase the Number of Reserved Shares

As amended, the number of shares of Common Stock available for issuance under the 1994 Plan will be increased from 3,000,000 shares to 3,750,000 shares. As of March 14, 2002, 546,000 shares remained available for grant under the 1994 Plan, and 2,364,000 shares were subject to outstanding options under the 1994 Plan. On that date, the closing price per share of Common Stock on the Nasdaq National Market was $2.58. Approximately 50 persons are eligible to participate in the 1994 Plan. The proposed amendment is designed to help the Company continue to attract and retain the best available personnel for positions of substantial responsibility, and to provide an incentive to officers, employee directors, employees, consultants and advisors of the Company. The Board believes that existing option grants have contributed substantially to the successful achievement of the above objectives.

A copy of the 1994 Plan, as proposed to be amended, is attached to this Proxy Statement as Appendix A and is incorporated herein by reference. The following description of the 1994 Plan as amended is a summary and does not purport to be a complete description. See Appendix A for more detailed information.

Description of the 1994 Plan

Under the 1994 Plan, options may be granted to employees of the Company or a related corporation, including employees who are directors of the Company, and to consultants and advisors of

8

the Company. The 1994 Plan provides for the grant of both nonqualified stock options and incentive stock options as defined in Section 422 of the Internal Revenue Code of 1986, as amended (the "Code"), however, incentive stock options may only be granted to employees of the Company or a related corporation. Options granted under the 1994 Plan generally become fully vested and exercisable four years from the date of grant. Grants made to new employees typically vest 25% after the first year and 1/48th of the total option each month thereafter and options granted to existing employees typically vest at a rate of 1/48th of the total option monthly from the date of grant. Pending approval of this amendment, an aggregate of 3,750,000 shares of Common Stock will be authorized for issuance under the 1994 Plan, subject to adjustment from time to time for stock dividends and certain other changes in capitalization as provided in the 1994 Plan. In order to comply with Section 162(m) of the Code, no optionee may receive an option for more than 300,000 shares in a single fiscal year; except that newly hired individuals may receive options for up to 800,000 shares of Common Stock.

Administration. The 1994 Plan may be administered by the Board of Directors, or a committee designated by the Board of Directors, which has the full power and authority to administer and interpret the 1994 Plan and to adopt such guidelines, rules, regulations, agreements, and instruments for the administration of the 1994 Plan as it deems necessary or advisable. The 1994 Plan is currently administered by the Compensation Committee of the Board of Directors.

The Compensation Committee selects the participants to receive stock options and determines the number of shares, the type of option, the exercise price, the time or times at which options may be exercised and the other terms and conditions of option grants. The exercise price for options may not be less than the fair market value of the Common Stock on the date of grant. In the event of stock dividends, splits, and similar capital changes, the 1994 Plan provides for appropriate adjustments in the number of shares available for options and the number and per share exercise prices of shares subject to outstanding options.

Term and Expiration of Option. The term of each option is determined by the Compensation Committee but may not exceed ten years from the date of grant for incentive stock options. If an optionee's relationship with the Company or a related corporation ceases for any reason (other than termination due to death or disability as defined in the 1994 Plan), the optionee may exercise vested options during the 90-day period following such cessation (unless the options terminate or expire sooner by their terms). If an optionee dies or becomes disabled, options vested as of the date of death or disability may be exercised prior to the earlier of the option's specified expiration date and one year from the date of the optionee's death or disability. If an employee terminates employment due to death or disability and had been continuously employed by the Company for a minimum of two years, outstanding options will become fully vested and exercisable for one year after the date of termination. The Board of Directors has the authority to extend the expiration dates of outstanding options, provided that it may not extend an option beyond its original term (e.g., ten years from date of grant). A transfer of employment between the Company and a related corporation or a change in status from employee to consultant will not be deemed a termination of employment under the 1994 Plan. Employment will be deemed to continue during a Company-approved leave of absence, except that, with respect to incentive stock options, employment will only be deemed to continue during the first 90 days of such leave unless the employee's re-employment rights are guaranteed by statute or contract.

Exercise of Options. The exercise price for shares subject to options may be paid for in cash or by check. Unless the Compensation Committee determines otherwise, the exercise price may also be paid with shares of Common Stock held by the optionee for at least six months (or any shorter period of time required to avoid a charge to the Company's earnings for financial reporting purposes), delivery of an irrevocable subscription agreement to take and pay for the shares within a year of exercise or any other consideration permitted by the Compensation Committee. The optionee must also pay to the

9

Company, at the time of purchase, the amount of federal, state, and local withholding taxes required to be withheld by the Company, if any.

Adjustment of Shares. In the event the Company declares a dividend payable in Common Stock or otherwise subdivides or combines its Common Stock, the plan administrator will proportionately adjust the number of shares of Common Stock available for issuance under the 1994 Plan and will further proportionately adjust the number of shares and/or the exercise price of any outstanding options.

Change in Control. Unless provided otherwise in an option agreement, in the event of a change in control of the Company, outstanding options will become fully vested and immediately exercisable. A "change in control" is defined under the 1994 Plan as (i) the acquisition by any person (other than a shareholder on the effective date of the 1994 Plan, the Company, a subsidiary or an employee benefit plan of the Company) of beneficial ownership of 50% or more of the voting power of the Company's outstanding securities or (ii) the occurrence of a transaction requiring shareholder approval and involving the sale of all or substantially all of the assets of the Company or the merger of the Company with or into another corporation. Unless outstanding options are assumed by a successor corporation or unless the change in control is pursuant to clause (i) above, options will terminate immediately following the change in control. Upon the liquidation or dissolution of the Company, all outstanding options will terminate; provided, however, that prior to the effective date of such liquidation or dissolution, an optionee has the right to exercise his or her options in whole or in part whether or not the vesting requirements set forth in the option agreement have been satisfied.

Transferability. Options granted under the 1994 Plan are transferable only by will or by the laws of descent and distribution.

Amendment or Termination. The 1994 Plan may be modified, amended, or terminated by the Board of Directors at any time, except that an amendment or modification will not affect previously granted options without an optionee's consent. Shareholder approval is required for any amendment that increases the number of shares subject to the 1994 Plan (other than in connection with automatic adjustments due to changes in capitalization or the assumption or substitution of options in connection with mergers or acquisitions), changes the persons eligible to receive options, or which is otherwise subject to shareholder approval under applicable securities laws or tax laws.

Federal Income Tax Consequences

The following is a summary of the material U.S. federal income tax consequences to the Company and to any person granted an option under the 1994 Plan who is subject to taxation in the United States. The summary is based on the Code and the United States Treasury regulations promulgated thereunder. The summary is not intended to be a complete analysis of all potential tax consequences that may be important to participants in the 1994 Plan. Therefore, we strongly encourage optionees to consult their own tax advisors as to the specific federal income tax or other tax consequences of their participation in the 1994 Plan.

Nonqualified Stock Options. Generally, the grant of a nonqualified stock option will not result in any federal income tax consequences to the participant or to the Company. Upon the exercise of a nonqualified stock option, the optionee will recognize ordinary income in an amount equal to the excess of the fair market value of the shares on the date of exercise over the amount paid for the stock upon exercise of the option. Subject to certain limitations, the Company generally will be entitled to a corresponding business expense deduction equal to the ordinary income recognized by the optionee.

Upon disposition of those shares, the optionee will recognize capital gain or loss equal to the difference between the amount realized on the disposition of such stock over the sum of the amount paid for such stock plus any amount recognized as ordinary income upon exercise of the option. Such

10

capital gain or loss will be characterized as short-term or long-term, depending upon how long the stock was held.

Slightly different rules may apply to optionees who acquire stock subject to certain repurchase options or who are subject to Section 16(b) of the Exchange Act.

Incentive Stock Options. The incentive stock options granted under the 1994 Plan are intended to qualify for the favorable federal income tax treatment accorded "incentive stock options" under the Code. Generally, the grant or exercise of an incentive stock option does not result in federal income tax consequences to the optionee or to the Company. However, the exercise of an incentive stock option will generally increase the optionee's alternative minimum tax liability, if any.

The federal income tax consequences of a disposition of stock acquired through exercise of an incentive stock option will depend on the period such stock is held prior to disposition. If a participant holds stock acquired through exercise of an incentive stock option for at least one year from the date of exercise of the option and two years from the date of grant of the option, the optionee will recognize long-term capital gain or loss in the year of disposition, equal to the difference between the amount realized on the disposition of the stock and the amount paid for the stock on exercise of the option.

Generally, if an optionee disposes of the stock before the expiration of either of the statutory holding periods described above (a "disqualifying disposition"), the optionee will recognize ordinary income in the lesser of (i) the excess of the fair market value of the shares received on the exercise date over the exercise price and (ii) the excess of the amount realized on the disposition of the shares over the exercise price. Subject to certain limitations, to the extent the optionee recognized ordinary income by reason of a disqualifying disposition of the stock over the exercise price, the Company generally will be entitled to a corresponding business expense deduction in the taxable year during which the disqualifying disposition was made.

Generally, in the taxable year of a disqualifying disposition, the optionee will also recognize capital gain or loss equal to the difference between the amount realized by the optionee upon that disposition of the shares over the sum of the amount paid for such stock plus any amount recognized as ordinary income by reason of the disqualifying disposition. Such capital gain or loss will be characterized as short-term or long-term, depending upon how long the stock was held. Long-term capital gains generally are subject to lower tax rates than ordinary income and short-term capital gains. Currently, the maximum long-term capital gains rate for federal income tax purposes is 20%, while the maximum ordinary income rate is 38.6%. Slightly different rules may apply to optionees who acquire stock subject to certain repurchase options or who are subject to Section 16 of the Exchange Act.

Potential limitation on our deductions. Section 162(m) of the Code precludes a deduction for compensation paid to our chief executive officer and our four highest compensated officer (other than our chief executive officer) to the extent that such compensation exceeds $1,000,000 for a taxable year. If certain requirements are met, qualified performance-based compensation is disregarded for purposes of the $1,000,000 limitation.

THE BOARD OF DIRECTORS RECOMMENDS A VOTEFOR THE APPROVAL OF THE AMENDMENT TO THE COMPANY'S 1994 STOCK OPTION PLAN.

11

PROPOSAL 3:

RATIFICATION OF SELECTION OF INDEPENDENT AUDITORS

The Board of Directors has selected Arthur Andersen LLP as the Company's independent auditors for the year ending December 31, 2002, and has further directed that management submit the selection of independent auditors for ratification by the shareholders at the Annual Meeting. Arthur Andersen LLP has audited the Company's financial statements since the Company's inception in 1989. Representatives of Arthur Andersen LLP are expected to be present at the Annual Meeting and will have an opportunity to make a statement if they so desire and will be available to respond to appropriate questions.

Shareholder ratification of the selection of Arthur Andersen LLP as the Company's independent auditors is not required by the Company's Bylaws or otherwise. However, the Board of Directors is submitting the selection of Arthur Andersen LLP to the shareholders for ratification as a matter of good corporate practice. If the shareholders fail to ratify the selection, the Board of Directors will reconsider whether or not to retain that firm. Even if the selection is ratified, the Board of Directors in its discretion may direct the appointment of a different independent accounting firm at any time during the year if the Board of Directors determines that such a change would be in the best interests of the Company and its shareholders.

THE BOARD OF DIRECTORS RECOMMENDS A VOTEFOR THE RATIFICATION OF THE SELECTION OF ARTHUR ANDERSEN LLP AS INDEPENDENT AUDITORS OF THE COMPANY.

12

EXECUTIVE COMPENSATION

Executive Compensation Table

The following table sets forth certain information regarding compensation awarded to, earned by, or paid to the Company's Chief Executive Officer and each of the Company's four most highly compensated executive officers (other than the Chief Executive Officer) who earned more than $100,000 in 2001 (the "Named Executive Officers"), during the years ended December 31, 2001, 2000 and 1999.

| |

| |

| |

| |

| | Long Term

Compensation

| |

| |

|---|

| |

| | Annual Compensation

| | Awards

| |

| |

|---|

Name and

principal position

| | Year

| | Salary

| | Bonus

| | Other annual

compensation

| | Securities Underlying

Options (#)

| | All other

compensation

| |

|---|

Thomas A. Bologna, Chairman, President &

Chief Executive Officer | | 2001

2000

1999 | | $

$

$ | 373,000

345,000

316,000 | | $

$

$ | —

60,000

55,000 | | $

$

$ | 28,000

25,000

26,000 | (1)

| 300,000

258,000

290,000 | | $

$

$ | 40,409

36,000

36,000 | (2)

|

Thomas F. Broderick,

Vice President, Patent &

General Counsel | | 2001

2000

1999 | | $

$

$ | 194,000

184,000

170,000 | | $

$ | —

11,000 | | | | | 20,000

60,000

30,000 | | | | |

Cory J. Smith,

Vice President,

Manufacturing | | 2001

2000

1999 | | $

$

$ | 118,000

110,000

102,000 | | $

$ | —

12,000 | | |

| | 30,000

50,500

7,000 | | | | |

J. Daniel Clemens,

Vice President,

Product Development | | 2001

2000

1999 | | $

$

$ | 118,000

110,000

102,000 | | $

$ | —

12,000 | | | | | 30,000

30,500

5,000 | | | | |

Michael C. Perry,

Vice President,

Sales(3) | | 2001

2000 | | $

$ | 127,000

109,000 | | $

$ | —

6,000 | | | | | 23,000

48,000 | |

$ |

25,000 |

(4) |

- (1)

- Represents gross up to compensate for income taxes with respect to living and traveling expenses.

- (2)

- Represents living and traveling expenses and insurance premiums paid on behalf of Mr. Bologna.

- (3)

- Joined the Company in February 2000.

- (4)

- Represents relocation expenses paid to or on behalf of Mr. Perry.

13

Option Grants in 2001

The following table sets forth certain information regarding stock options granted to the Named Executive Officers during the year ended December 31, 2001.

| | Individual Grants

| | Potential realizable

value at assumed

annual rates of stock

price appreciation for

option term(4)

|

|---|

| | Number of

securities

underlying

options

granted

| |

| |

| |

|

|---|

| | Percentage of

total options

granted to

employees(1)

| |

| |

|

|---|

Name

| | Exercise

price per

share(2)

| | Expiration

Date(3)

|

|---|

| | 5%

| | 10%

|

|---|

| Thomas A. Bologna | | 200,000 | (5) | 30.17 | % | $ | 1.56 | | 1/18/2011 | | $ | 196,215 | | $ | 497,248 |

| Thomas A. Bologna | | 100,000 | (6) | 15.08 | % | $ | 1.39 | | 8/14/2011 | | $ | 87,416 | | $ | 221,530 |

| Thomas F. Broderick | | 15,000 | (5) | 2.26 | % | $ | 1.56 | | 1/18/2011 | | $ | 14,716 | | $ | 37,294 |

| Thomas F. Broderick | | 5,000 | (6) | 0.75 | % | $ | 1.39 | | 8/14/2011 | | $ | 4,371 | | $ | 11,077 |

| Cory J. Smith | | 20,000 | (5) | 5.03 | % | $ | 1.56 | | 1/18/2011 | | $ | 19,622 | | $ | 49,725 |

| Cory J. Smith | | 10,000 | (6) | 3.44 | % | $ | 1.39 | | 8/14/2011 | | $ | 8,742 | | $ | 22,153 |

| J. Daniel Clemens | | 20,000 | (5) | 3.02 | % | $ | 1.56 | | 1/18/2011 | | $ | 19,622 | | $ | 49,725 |

| J. Daniel Clemens | | 10,000 | (6) | 1.51 | % | $ | 1.39 | | 8/14/2011 | | $ | 8,742 | | $ | 22,153 |

| Michael C. Perry | | 15,000 | (5) | 2.26 | % | $ | 1.56 | | 1/18/2011 | | $ | 14,716 | | $ | 37,294 |

| Michael C. Perry | | 8,000 | (6) | 1.21 | % | $ | 1.39 | | 8/14/2011 | | $ | 6,993 | | $ | 17,722 |

- (1)

- Based on a total of 662,950 shares subject to options granted to employees during 2001.

- (2)

- The exercise price equals the fair market value on the date of grant based on the closing price of the Common Stock as reported by the Nasdaq National Market.

- (3)

- Options have terms of ten years from the date of grant and become exercisable generally over a period of four years. Upon the occurrence of certain business transactions, the exercisability of the options is accelerated.

- (4)

- Assumes all options are exercised at the end of their respective 10-year terms. The dollar amounts under these columns are the result of calculations at the 5% and 10% rates required by applicable regulations of the SEC and, therefore, are not intended to forecast possible future appreciation, if any, of the Common Stock price. Actual gains, if any, on stock option exercises depend on the future performance of the Common Stock and overall stock market conditions, as well as the option holders' continued employment through the vesting period. The amount reflected in this table may not necessarily be achieved.

- (5)

- Relates to stock options granted in January 2001 to all employees of the Company.

- (6)

- Relates to stock options granted in August 2001 to certain employees of the Company.

14

Aggregate Option Exercise and Year-End Option Values for 2001

The following table sets forth certain information regarding the exercise of stock options by our Named Executive Officers during the last fiscal year and the value of the Named Executive Officers' unexercised options as of December 31, 2001.

| |

| |

| | Number of shares

underlying unexercised

options at fiscal

year end

| | Value of unexercised

in-the-money

options at fiscal

year end(2)

|

|---|

| | Shares acquired on exercise

| | Value realized ($)(1)

|

|---|

Name

|

|---|

| | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

|---|

| Thomas A. Bologna | | | | | | | 1,035,125 | | 512,875 | | $ | 359,646 | | $ | 452,354 |

| Thomas F. Broderick | | | | | | | 198,229 | | 61,771 | | $ | 41,819 | | $ | 37,831 |

| J. Daniel Clemens | | 25,000 | | $ | 38,000 | | 82,990 | | 45,010 | | $ | 17,425 | | $ | 31,663 |

| Michael C. Perry | | | | | | | 25,271 | | 45,729 | | $ | 5,034 | | $ | 20,946 |

| Cory J. Smith | | | | | | | 92,006 | | 60,969 | | $ | 49,497 | | $ | 39,270 |

- (1)

- Determined by the aggregate value on the date of exercise based on the $1.60 closing price of the Company's Common Stock as reported by the Nasdaq National Market minus the aggregate exercise price paid by the executive officer.

- (2)

- Based on the $2.50 closing price of the Company's Common Stock on December 31, 2001, as reported by the Nasdaq National Market, minus the per-share exercise price, multiplied by the number of shares underlying the option.

Compensation Committee Interlocks and Insider Participation

During 2001, the Company's Compensation Committee consisted of Messrs. Cable, Trimmer and Dr. Eyre, all of whom were nonemployee directors. To the Company's knowledge, no member of the Compensation Committee has a relationship that would constitute an interlocking relationship with executive officers or directors of another entity.

Mr. Cable is Chairman of the Board of Trustees of the Washington Research Foundation (the "WRF"), a not-for-profit licensing agency dedicated to the transfer to the private sector of technology developed at the University of Washington (the "University"). During the year ended December 31, 2001, the Company incurred $214,000 in royalty expense for OSTEOMARK® kit revenue in accordance with the Company's worldwide exclusive license agreements with the WRF for the bone resorption test and osteoclast colony stimulating factor technologies.

Dr. Eyre has been the Burgess Professor of Orthopaedics at the University since 1985. The Company entered into a research agreement with the University which extended through December 31, 2001. Pursuant to this agreement, the Company is obligated to fund certain research activities conducted by Dr. Eyre. During the year ended December 31, 2001, the Company paid the University approximately $150,000 under this agreement. The Company has also entered into an agreement with Dr. Eyre for research and consulting services. See "Consulting Agreements with Directors" on page 6 of this Proxy Statement for further information.

Compensation Committee Report on Executive Compensation

The Compensation Committee of the Board of Directors (the "Committee") is responsible for determining the compensation of the executive officers of the Company. During 2001, the Committee was comprised of three directors who are not employees of the Company. In making its determinations, the Committee relies on input from compensation consultants and industry surveys, and reviews appropriate decisions with all nonemployee directors who constitute a majority of the full Board of Directors.

15

Executive Compensation Policy. The Company's executive compensation program reflects the policy that executives' rewards should be structured to closely align their interests with those of the shareholders. The program emphasizes stock-based incentives, and extends these concepts beyond the executive officer population to all of the Company's full-time employees in the interest of motivation, teamwork, and fairness. The Company's executive compensation programs are designed to attract and retain experienced and well-qualified executive officers who will enhance the performance of the Company and build shareholder value. The Company's executive compensation program generally includes two components: base salary and stock options.

In setting the compensation level for executive officers, the Committee is guided by the following considerations:

- •

- Compensation levels should be competitive with compensation generally being paid to executives in the biotechnology and diagnostic industries to ensure the Company's ability to attract and retain superior executives;

- •

- A significant portion of executive officer compensation should be paid in the form of equity-based incentives to link closely shareholder and executive interests and to encourage stock ownership by executive officers; and

- •

- Each individual executive officer's compensation should reflect the performance of the Company as a whole and the performance of the executive officer.

Base Salary. An executive officer's base salary is determined by the Company's overall performance, the responsibility of the particular position, and an assessment of the person's performance against individual responsibilities and objectives, including, where appropriate, the impact of such performance on the business results of the Company. The Committee also may consider nonfinancial indicators including, but not limited to, strategic developments for which an executive officer has responsibility, intangible elements of managerial performance and levels of compensation to maintain competitive levels with similar companies in the biotechnology and diagnostic industries. The companies surveyed for compensation levels include some of the companies in the JP Morgan H&Q Healthcare Index included in the performance graph on page 18. Generally, unless special circumstances apply, the Committee sets executive salaries at or near the midpoint of the range indicated by the surveys depending on the applicable experience level of the executive officer and subject to minimum salaries established in an employment agreement with the executive. See "Employment, Termination and Change In Control Agreements" of this Proxy Statement for further information. Executive officer salaries are reviewed annually and adjusted each January based on the above information and taking into consideration industry compensation based on a survey report published by Radford and Associates, an independent consulting group.

Stock Options. The Company grants a stock option in connection with an executive's initial employment with the Company. In making such grants the Committee evaluates the long-term incentive packages offered to the Company's executives in relation to the long-term incentive packages offered by other biotechnology and diagnostic companies that the Committee considers to be in the Company's peer group. These option grants reflect the Committee's policy of encouraging long-term performance and promoting executive retention while further aligning management's and shareholders' interests in the performance of the Company's Common Stock. Through 1996, it was the Company's policy to grant stock options annually to executives and other employees. The Company ended this policy in 1997 but may, from time to time, grant stock options to executives other than in connection with their initial employment.

Compensation of the Chief Executive Officer. Mr. Bologna's employment with the Company began in July 1997. The Compensation Committee set Mr. Bologna's compensation to be competitive with base salaries paid to other executives in the biotechnology industry with similar responsibilities and

16

seniority. In 2001, Mr. Bologna's annual base salary was increased to $373,000. Additionally in 2001, Mr. Bologna was granted stock options for the purchase of 300,000 shares. See "Employment, Termination and Change in Control Agreements" for additional information.

Compliance With Internal Revenue Code Section 162(m). Section 162(m) of the Internal Revenue Code generally disallows a tax deduction to publicly held companies for annual compensation in excess of $1 million earned by the chief executive officer or any of the other four most highly compensated officers. The deduction limit does not apply, however, to performance-based compensation that satisfies certain requirements. The Committee's policy is generally to provide executive compensation that is fully deductible by the Company for income tax purposes. No executive officer of the Company earned or is expected to earn compensation in excess of $1 million in 2001 that would not qualify as performance-based compensation. The Company's stock option program is qualified as performance-based for future option grants.

Compensation Committee of the Board of Directors

Mr. Thomas J. Cable, Chairman

Dr. David R. Eyre

Mr. John Trimmer

Employment, Termination and Change in Control Agreements

Employment Agreement with the Chief Executive Officer. In July 1997, Mr. Bologna entered into an employment agreement with the Company that provides for an initial annual base salary of $275,000 and the grant of a stock option for 700,000 shares of Common Stock vesting over four years. The base salary will be increased effective on the first anniversary of employment by not less than 10% of the initial base salary and, thereafter, further increases to the base salary will be determined by the Board of Directors. In addition, the employment agreement authorized a $50,000 bonus for Mr. Bologna for services rendered through December 1997, of which $25,000 was to be paid upon execution of the agreement and $25,000 was to be paid in January 1998.

The Company has obtained term life insurance on Mr. Bologna, which provides for payment to Mr. Bologna's family in the event of his death of an amount equal to his annual base salary. During the term of Mr. Bologna's employment, the Company will also reimburse Mr. Bologna for or pay directly the reasonable expense of (i) recurring travel between Washington State and California and (ii) expenses associated with living in Washington. To the extent the reimbursement for living expenses or direct payment is treated as taxable income, Mr. Bologna is entitled to a gross up to compensate for any and all income taxes that Mr. Bologna may be required to pay with respect to such reimbursement and gross up.

The employment agreement is terminable at will by either party. In the event that the Board of Directors terminates Mr. Bologna's employment without cause, Mr. Bologna will be entitled to all accrued compensation and Company benefits as well as the then existing base salary Mr. Bologna would have received if his employment had continued for 12 months from the date of termination. If such termination occurs without cause in connection with or at any time following a change in control (as defined in the Company's 1994 Plan), Mr. Bologna shall be entitled to a lump sum payment equal to two years' base salary, plus a bonus of 30% of such amount and continuation of benefits for a period of 24 months following such termination.

Change In Control Agreements. Pursuant to the 1994 Plan and the Directors Plan, in the event of a change in control of the Company, any outstanding option granted under either plan will become fully vested and immediately exercisable. A "change in control" is defined under both plans as (i) the acquisition by any person (other than a shareholder on the date of the plan, the Company or a subsidiary or employee benefit plan of the Company) of beneficial ownership of 50% or more of the

17

voting power of the Company's outstanding securities or (ii) the occurrence of a transaction requiring shareholder approval and involving the sale of all or substantially all of the assets of the Company or the merger of the Company with or into another corporation. In addition, upon the liquidation or dissolution of the Company, all outstanding options will terminate; provided, however, that prior to such liquidation or dissolution, an option holder has the right to exercise his or her options in whole or in part whether or not the vesting requirements set forth in the option agreement have been satisfied.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 requires the Company's officers and directors, and persons who own more than 10% of the Common Stock, to file reports of ownership and change in ownership with the SEC. Officers, directors and greater than 10% shareholders are required by SEC regulations to furnish the Company with copies of all Section 16(a) reports that they file.

To the Company's knowledge, based solely on its review of the copies of such reports furnished to the Company and written representations that no other reports were required, all Section 16(a) filing requirements applicable to its officers, directors and greater than 10% shareholders were satisfied during the fiscal year ending December 31, 2001, except that Mr. Clemens failed to file a Form 4 following the exercise of certain stock options on June 4, 2001 and Dr. Eyre failed to file Forms 4 following the sale of an aggregate 6,000 shares of the Company's Common Stock on May 22, 2001 and following the exercise of certain stock options on June 1, 2001. Both Mr. Clemens and Dr. Eyre subsequently reported the above transactions on Forms 5 timely filed with the SEC with 45 days of the Company's fiscal year end.

18

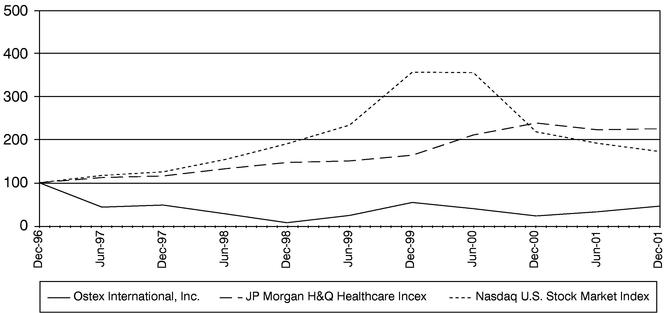

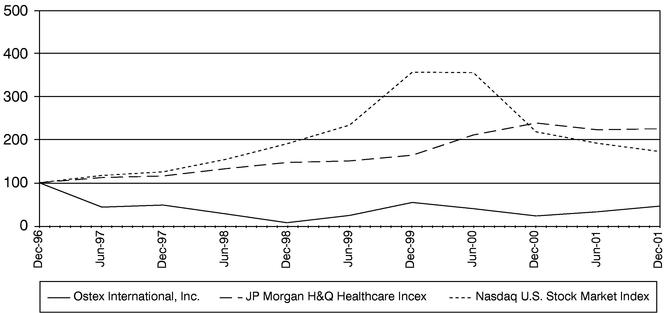

PERFORMANCE GRAPH

Comparison of the Cumulative Total Return on Common Stock During the

Period from December 31, 1996 to December 31, 2001 among Ostex

International, Inc., the JP Morgan H&Q Healthcare Index,

and the Nasdaq U.S. Stock Market Index.

| | 12/96

| | 6/97

| | 12/97

| | 6/98

| | 12/98

| | 6/99

| | 12/99

| | 6/00

| | 12/00

| | 6/01

| | 12/01

|

|---|

| Ostex International, Inc. | | 100 | | 43 | | 48 | | 27 | | 7 | | 24 | | 55 | | 40 | | 23 | | 33 | | 45 |

| Nasdaq U.S. Stock Market Index | | 100 | | 116 | | 125 | | 154 | | 191 | | 233 | | 357 | | 355 | | 218 | | 192 | | 172 |

| JP Morgan H&Q Healthcare Index | | 100 | | 112 | | 116 | | 133 | | 147 | | 151 | | 164 | | 211 | | 238 | | 223 | | 225 |

The above graph assumes $100 invested on December 31, 1996 in the Common Stock, the Nasdaq U.S. Stock Market and the JP Morgan H&Q Healthcare Index with all dividends reinvested. The Company has not paid cash dividends on its Common Stock. Stock performance shown in the above graph for the Common Stock is historical and not necessarily indicative of future price performance.

19

SHAREHOLDERS' PROPOSALS FOR NEXT ANNUAL MEETING

Shareholders' proposals or nominations for members to the Board of Directors to be presented at the Company's 2003 annual meeting of shareholders and to be included in the Company's Proxy Statement and form of proxy card relating to such meeting must be received in writing by the Company no later than November 28, 2002, with information regarding such proposal or nominee. Such proposals or nominations should be directed to the Secretary of the Company, 2203 Airport Way South, Suite 400, Seattle, Washington 98134.

Pursuant to Rule 14a-4(c), under the Securities Exchange Act of 1934, as amended, the Company intends to retain discretionary authority to vote proxies with respect to shareholder proposals for which the proponent does not seek inclusion of the proposed matter in the Company's proxy statement for the Company's 2003 Annual Meeting of Shareholders, except in circumstances where (i) the Company receives notice of the proposed matter no later than February 4, 2003, and (ii) the proponent complies with the other requirements set forth in Rule 14a-4.

OTHER BUSINESS

The Board of Directors does not intend to bring any other business before the Annual Meeting, nor is the Board aware of any other matter to be brought before the Annual Meeting, except as specified in the Notice of Annual Meeting of Shareholders. However, as to any other business that may properly come before the Annual Meeting, it is intended that proxies, in the form enclosed, will be voted in respect thereto, in accordance with the judgment of the persons voting such proxies.

ANNUAL REPORT

A copy of the Company's 2001 Annual Report to Shareholders for the year ended December 31, 2001 accompanies this Proxy Statement. A copy of the Company's Annual Report on Form 10-K will be furnished without charge to beneficial shareholders of record upon request to Ostex International, Inc., 2203 Airport Way South, Suite 400, Seattle, Washington 98134.

Seattle, Washington

March 28, 2002

20

APPENDIX A

OSTEX INTERNATIONAL, INC.

AMENDED AND RESTATED 1994 STOCK OPTION PLAN

As proposed to be amended by vote of the shareholders at the 2002 Annual Meeting

This 1994 Stock Option Plan (the "Plan") provides for the grant of options to acquire shares of Common Stock, $.01 par value (the "Common Stock"), of Ostex International, Inc., a Washington corporation (the "Company"). Stock options granted under this Plan that qualify under Section 422 of the Internal Revenue Code of 1986, as amended (the "Code"), are referred to in this Plan as "Incentive Stock Options." Incentive Stock Options and stock options that do not qualify under Section 422 of the Code ("Nonqualified Stock Options") granted under this Plan are referred to as "Options."

1. Purposes

The purposes of this Plan are to retain the services of valued key employees and consultants of the Company, and such other persons as the Plan Administrator shall select in accordance with Section 3 below, to encourage such persons to acquire a greater proprietary interest in the Company, thereby strengthening their incentive to achieve the objectives of the shareholders of the Company, and to serve as an aid and inducement in the hiring of new employees, consultants and other persons selected by the Plan Administrator.

2. Administration

This Plan shall be administered by the Board of Directors of the Company (the "Board"), except that the Board may, in its discretion, establish a committee composed of members of the Board or other persons to administer this Plan, which committee (the "Committee") may be an executive, compensation or other committee, including a separate committee especially created for this purpose. The Committee shall have such of the powers and authority vested in the Board hereunder as the Board may delegate to it (including the power and authority to interpret any provision of this Plan or of any Option). The members of any such Committee shall serve at the discretion of the Board. The Board, or the Committee if one has been established by the Board, are referred to in this Plan as the "Plan Administrator." Following registration of any of the Company's securities under Section 12 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), no person shall serve as a member of the Plan Administrator if his or her service would disqualify this Plan from eligibility under Securities and Exchange Commission Rule 16b-3, as amended from time to time, or any successor rule or regulatory requirement;provided, that the Plan Administrator shall consist of at least the minimum number of persons required by Securities and Exchange Commission Rule 16b-3, as amended, or any successor rule or regulatory requirement. If, and so long as, the Company has a class of equity securities registered under Section 12 of the Exchange Act, the Board of Directors in determining the membership of any such committee shall, with respect to option grants to any persons subject to or likely to become subject to Section 16 of the Exchange Act, give due consideration to the provisions regarding (a) "outside directors" as contemplated by Section 162(m) of the Code and (b) "nonemployee directors" as contemplated by Rule 16b-3 under the Exchange Act.

Subject to the provisions of this Plan, and with a view to effecting its purpose, the Plan Administrator shall have sole authority, in its absolute discretion, to: (a) construe and interpret this Plan; (b) define the terms used in this Plan; (c) prescribe, amend and rescind rules and regulations relating to this Plan; (d) correct any defect, supply any omission or reconcile any inconsistency in this Plan; (e) determine the individuals to whom Options shall be granted under this Plan and whether the Option is an Incentive Stock Option or a Nonqualified Stock Option; (f) determine the time or times

A-1

at which Options shall be granted under this Plan; (g) determine the number of shares of Common Stock subject to each Option, the exercise price of each Option, the duration of each Option and the times at which each Option shall become exercisable; (h) determine all other terms and conditions of Options; and (i) make all other determinations necessary or advisable for the administration of this Plan. All decisions, determinations and interpretations made by the Plan Administrator shall be binding and conclusive on all participants in this Plan and on their legal representatives, heirs and beneficiaries.

3. Eligibility

Incentive Stock Options may be granted to any individual who, at the time the Option is granted, is an employee of the Company or any Related Corporation (as defined below), including employees who are directors of the Company ("Employees"). Nonqualified Stock Options may be granted to Employees and to such other persons other than directors who are not Employees as the Plan Administrator shall select. Options may be granted in substitution for outstanding Options of another corporation in connection with the merger, consolidation, acquisition of property or stock or other reorganization between such other corporation and the Company or any subsidiary of the Company. Options also may be granted in exchange for outstanding Options. Any person to whom an Option is granted under this Plan is referred to as an "Optionee."

As used in this Plan, the term "Related Corporation," when referring to a subsidiary corporation, shall mean any corporation (other than the Company) in an unbroken chain of corporations beginning with the Company if, at the time of the granting of the Option, each of the corporations other than the last corporation in the unbroken chain owns stock possessing fifty percent (50%) or more of the total combined voting power of all classes of stock of one of the other corporations in such chain. When referring to a parent corporation, the term "Related Corporation" shall mean any corporation (other than the Company) in an unbroken chain of corporations ending with the Company if, at the time of granting of the Option, each of the corporations other than the Company owns stock possessing fifty percent (50%) or more of the total combined voting power of all classes of stock of one of the other corporations in such chain.

4. Stock

Options to purchase a maximum of 3,750,000 shares of the Company's Common Stock may be issued pursuant to the Plan, subject to adjustment as provided in Section 5.13.1 below;provided, that any shares of Common Stock received or withheld by the Company as payment for shares of Common Stock purchased upon exercise of Options pursuant to Section 5.9 below shall be added to the number of such shares as to which Options may be granted. The number of shares with respect to which Options may be granted hereunder is subject to adjustment as set forth in Section 5.13 below. In the event that any outstanding Option expires or is terminated for any reason, the shares of Common Stock allocable to the unexercised portion of such Option may again be subject to an Option to the same Optionee or to a different person eligible under Section 3 above. Notwithstanding the foregoing, the aggregate number of shares that may be issued under Incentive Stock Options shall not exceed 3,750,000.

5. Terms and Conditions of Options

Each Option granted under this Plan shall be evidenced by a written agreement approved by the Plan Administrator (the "Agreement"). Agreements may contain such additional provisions, not

A-2

inconsistent with this Plan, as the Plan Administrator in its discretion may deem advisable. All Options also shall comply with the following requirements:

5.1 Number of Shares and Type of Option

Each Agreement shall state the number of shares of Common Stock to which it pertains and whether the Option is intended to be an Incentive Stock Option or a Nonqualified Stock Option. In the absence of action to the contrary by the Plan Administrator in connection with the grant of an Option, all Options shall be Nonqualified Stock Options. The aggregate fair market value (determined at the Date of Grant, as defined below) of the stock with respect to which Incentive Stock Options are exercisable for the first time by the Optionee during any calendar year (granted under this Plan and all other Incentive Stock Option plans of the Company, a Related Corporation or a predecessor corporation) shall not exceed such limit as may be prescribed by the Code as it may be amended from time to time. Any Option which exceeds the annual limit shall not be void but rather shall be a Nonqualified Stock Option.

(a) Limitation on Number of Shares Underlying Options. Subject to adjustment from time to time as provided in Section 5.13 below, the Plan Administrator shall not grant options to any person in any one fiscal year of the Company in an amount that exceeds, in the aggregate, 300,000 shares of Common Stock, except that the amount may be up to, but not exceed, in the aggregate, 800,000 shares of Common Stock for any newly hired person in any one fiscal year of the Company. This limitation shall be applied in a manner consistent with the requirements of, and only to the extent required for compliance with, the exclusion from the limitation on deductibility of compensation under Section 162(m) of the Code.

5.2 Date of Grant

Each Agreement shall state the date the Plan Administrator has deemed to be the effective date of the Option for purposes of this Plan (the "Date of Grant").

5.3 Option Price