Insight to Acquire PCM June 24, 2019 EXHIBIT 99.3

Important Information Cautionary Note Regarding Forward-Looking Statements Certain statements contained in this communication may constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements can typically be identified by such words as “aim”, “anticipate,” “believe,” “continue,” “could,” “estimate,” “evolve,” “expect,” “forecast,” “intend,” “looking ahead,” “may,” “opinion,” “plan,” “possible,” “potential,” “project,” “should,” “will,” and variations of such words and other similar expressions. These forward-looking statements are only predictions based on current expectations and assumptions and are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified. There are important factors that could cause actual results to differ materially from the results expressed or implied by forward-looking statements, including (i) the risk factors set forth under “Risk Factors” in Insight’s or PCM’s Annual Report on Form 10-K for the fiscal year ended December 31, 2018, set forth in Insight’s or PCM’s subsequent Quarterly Reports on Form 10-Q or set forth in Insight’s or PCM’s other filings with the SEC and (ii) any of the following: the failure of Insight to obtain the financing anticipated to consummate the Merger; the failure to consummate or a delay in the consummation of the Merger for other reasons; the timing to consummate the Merger; the risk that a condition to the consummation of the Merger, including the receipt of any required regulatory approvals, may not be satisfied or waived; the failure of PCM’s shareholders to approve the Merger; unexpected costs or liabilities in connection with the consummation of the Merger; Insight’s inability to achieve expected synergies and operating efficiencies as a result of the Merger, whether within the expected time frames, without undue difficulty, cost or expense, or at all; Insight’s inability to successfully integrate PCM’s operations into its own, whether within expected time frames, without undue difficulty, cost or expense, or at all; the level of revenues following the transaction, which may be lower than expected; operating costs, customer loss and business disruptions arising from the Merger and the pendency or consummation thereof (including, without limitation, difficulties in maintaining relationships with employees, customers, clients or suppliers), which may be greater than expected; uncertainties surrounding the transaction; the outcome of any legal proceedings related to the transaction; other adverse economic, business, and/or competitive factors; risks that the pending transaction distracts the management of Insight or PCM or disrupts current plans and operations; Insight’s ability to retain key PCM and Insight employees; and other risks to consummation of the transaction, including circumstances that could give rise to the termination of the merger agreement and the risk that the transaction will not be consummated within the expected time period, without undue delay, cost or expense, or at all. All forward-looking statements are qualified by, and should be considered in conjunction with, these cautionary statements. Readers are cautioned not to place undue reliance on any forward-looking statements, which speak only as of the date on which such statements are made. Except as required by applicable law, neither Insight nor PCM undertakes any obligation to update forward-looking statements to reflect events or circumstances arising after such date. Additional Information and Where to Find It In connection with the Merger, PCM will file with the SEC a proxy statement on Schedule 14A (the “Proxy Statement”), as well as other relevant materials regarding the Merger. Following the filing of the definitive Proxy Statement with the SEC, PCM will mail the definitive Proxy Statement and a proxy card to each shareholder entitled to vote at the special meeting relating to the Merger. PCM SHAREHOLDERS ARE URGED TO CAREFULLY READ THE PROXY STATEMENT AND OTHER MATERIALS RELATING TO THE MERGER (AND ANY AMENDMENTS OR SUPPLEMENTS THERETO) AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. The definitive proxy statement, the preliminary proxy statement and other relevant materials regarding the Merger (when they become available), and any other documents filed by [PCM] with the SEC, may be obtained free of charge at the SEC’s website (http://investor.pcm.com or by writing or calling PCM at Office of the Secretary of the Company, 1940 E. Mariposa Avenue, El Segundo, CA 90245 or (310) 354-5600. Participants in the Solicitation PCM and its directors are, and PCM’s officers and Insight and its directors and officers may be deemed to be, participants in the solicitation of proxies from PCM’s shareholders with respect to the Merger described in the Proxy Statement. Information about PCM’s directors and executive officers and their ownership of PCM’s common stock is set forth in PCM’s Form 10-K/A filed with the SEC on April 30, 2019 (PCM’s “Form 10-K/A”). To the extent that holdings of PCM’s securities have changed since the amounts printed in PCM’s Form 10-K/A, such changes have been or will be reflected on Statements of Change in Ownership on Form 4 filed with the SEC. Information regarding the identity of the participants in the proxy solicitation and their direct or indirect interests in the transaction, by security holdings or otherwise, will be set forth in the Proxy Statement and other materials to be filed with SEC in connection with the Merger. Information about the directors and executive officers of Insight is set forth in the proxy statement for Insight’s 2019 Annual Meeting of Stockholders, which was filed with the SEC on April 10, 2019.

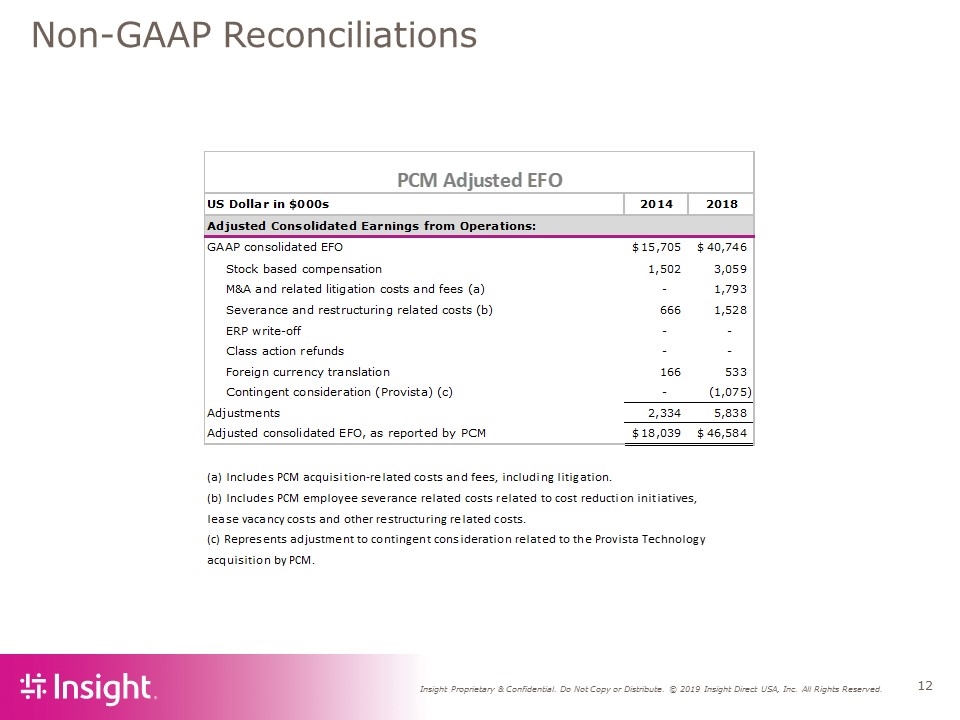

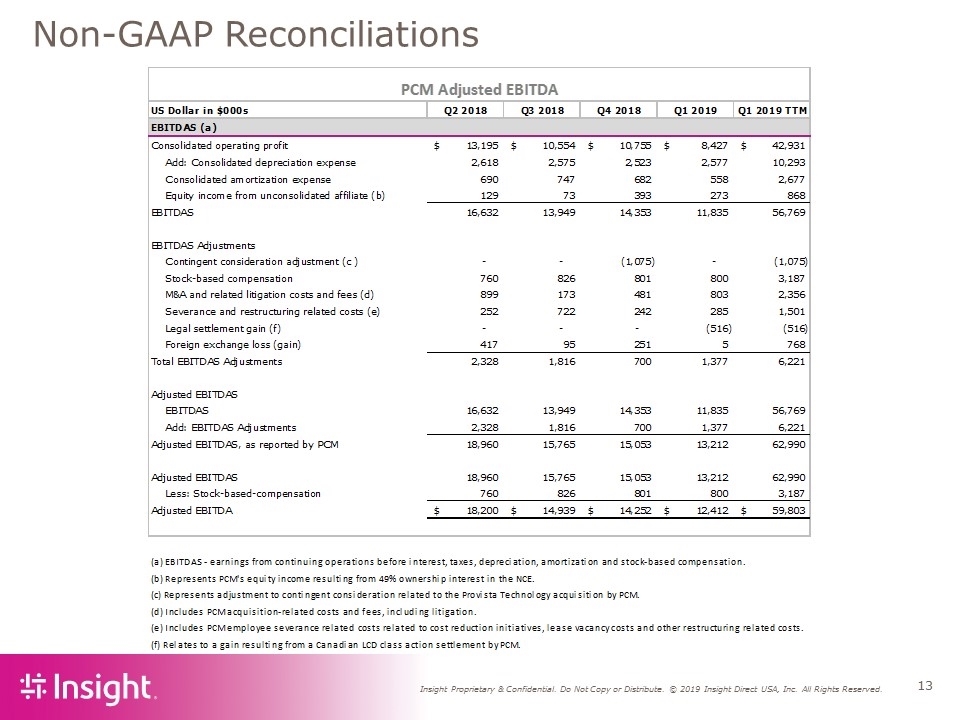

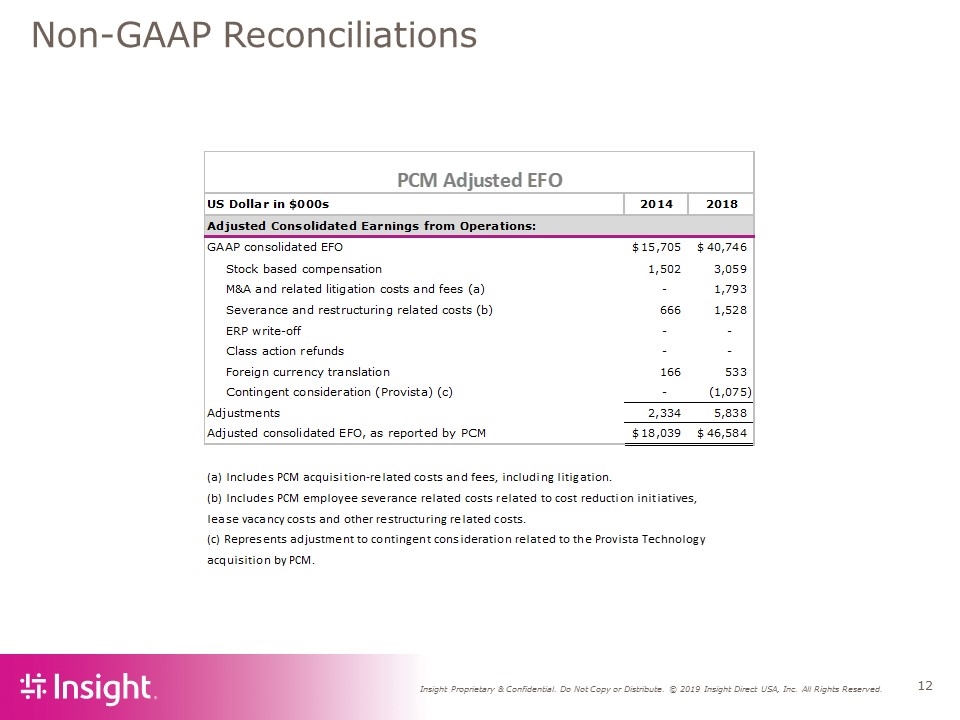

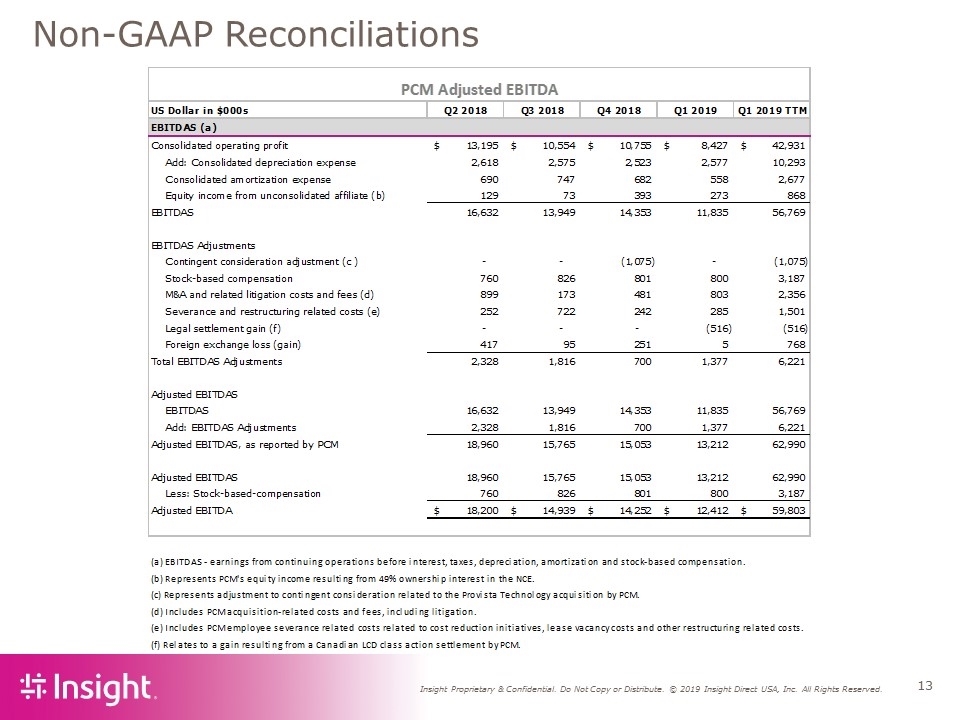

Non-GAAP Measures In this presentation, we will present non-GAAP measures related to the historical performance of PCM. Non-GAAP measures presented include PCMs earnings before interest, taxes, depreciation and amortization expenses (EBITDA), Adjusted EBITDA and non-GAAP Earnings from Operations (Adjusted EFO). These financial measures are not determined in accordance with accounting principles generally accepted in the United States of America, or GAAP. Adjusted EBITDA and Adjusted EFO remove the effect of severance and restructuring related expenses related to PCMs cost reduction initiatives and stock-based compensation, as well as uncommon, non-recurring or special items. Depreciation and amortization expenses primarily represent an allocation to current expense of the cost of historical capital expenditures and for acquired intangible assets resulting from prior business acquisitions made by PCM. EBITDA, Adjusted EBITDA and Adjusted EFO should be used in conjunction with other GAAP financial measures and are not presented as an alternative measure of operating results, as determined in accordance with GAAP. We believe that these non-GAAP financial measures allow a more meaningful comparison of our operating performance trends to both management and investors that is more indicative of our consolidated operating results across reporting periods. We believe that Adjusted EBITDA and Adjusted EFO provide a better understanding of our company’s operating performance and cash flows. A reconciliation of the non-GAAP consolidated financial measures is included in a table at the back of this presentation.

Insight’s Acquisition of PCM Insight to acquire PCM (Nasdaq: “PCMI”) for $35.00 per share Enterprise value (net of cash and debt acquired) of approximately $581 million Implying a synergized EBITDA multiple of ~ 4.5x* Premium of 36% premium to 1-month average closing share price Strengthens position as a leading global provider of Intelligent Technology Solutions by adding new clients and services capabilities, expanding our global footprint, and providing deeper access to attractive, higher-margin end markets. Adds more than $2B to sales, higher gross margins, significant earnings accretion Expected run rate cost synergies of $70 million by the end of 2021 To be financed through cash on hand and borrowings under a new credit facility * Calculated as the implied enterprise value of $581 million divided by LTM EBITDA of $60 million as reported by PCM less stock compensation expense (for the twelve months ended 03/31/19- See non-GAAP reconciliation attached) plus expected run-rate synergies of $70 million

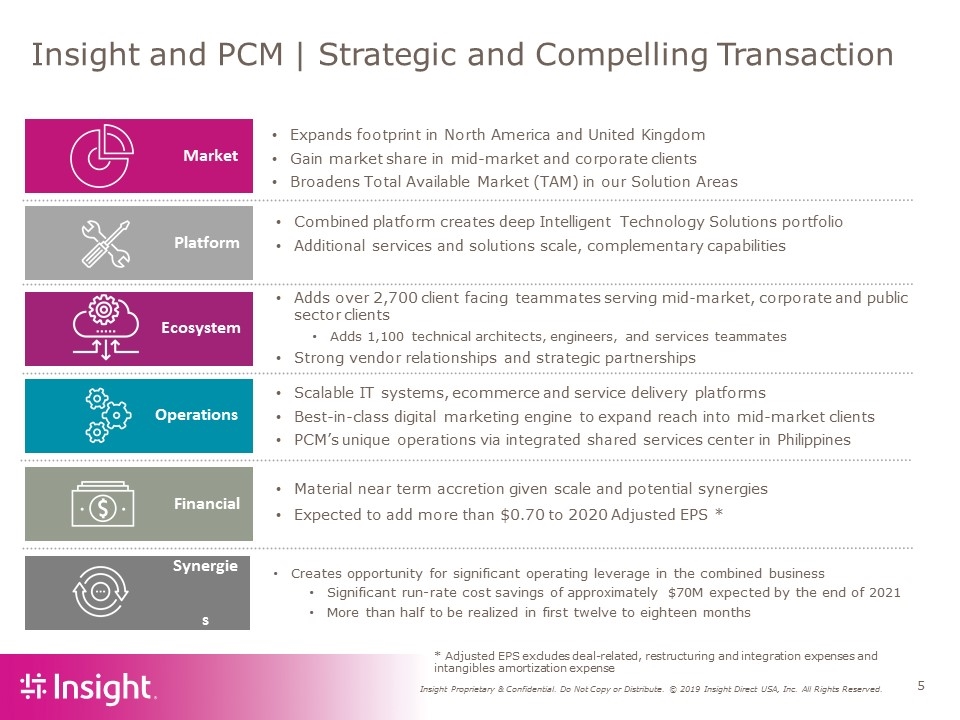

Combined platform creates deep Intelligent Technology Solutions portfolio Additional services and solutions scale, complementary capabilities Platform Insight and PCM | Strategic and Compelling Transaction Market Expands footprint in North America and United Kingdom Gain market share in mid-market and corporate clients Broadens Total Available Market (TAM) in our Solution Areas Adds over 2,700 client facing teammates serving mid-market, corporate and public sector clients Adds 1,100 technical architects, engineers, and services teammates Strong vendor relationships and strategic partnerships Ecosystem Operations Scalable IT systems, ecommerce and service delivery platforms Best-in-class digital marketing engine to expand reach into mid-market clients PCM’s unique operations via integrated shared services center in Philippines Financial Material near term accretion given scale and potential synergies Expected to add more than $0.70 to 2020 Adjusted EPS * Creates opportunity for significant operating leverage in the combined business Significant run-rate cost savings of approximately $70M expected by the end of 2021 More than half to be realized in first twelve to eighteen months Synergies * Adjusted EPS excludes deal-related, restructuring and integration expenses and intangibles amortization expense

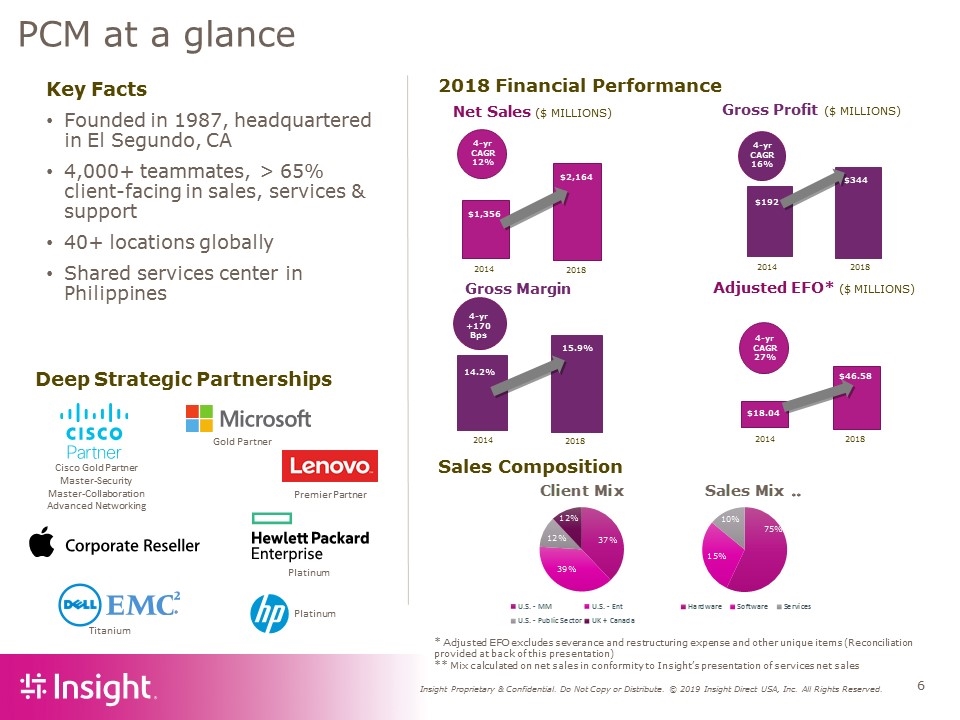

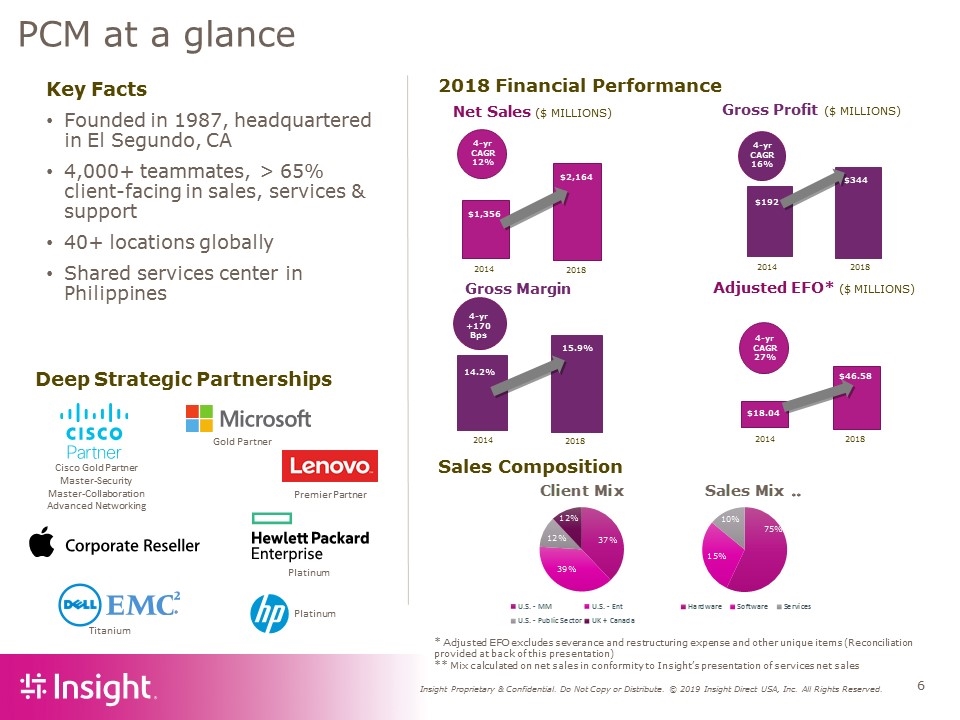

PCM at a glance Key Facts Founded in 1987, headquartered in El Segundo, CA 4,000+ teammates, > 65% client-facing in sales, services & support 40+ locations globally Shared services center in Philippines * Adjusted EFO excludes severance and restructuring expense and other unique items (Reconciliation provided at back of this presentation) ** Mix calculated on net sales in conformity to Insight’s presentation of services net sales 4-yr CAGR 12% $1,356 $2,164 4-yr CAGR 27% $18.04 $46.58 4-yr +170 Bps 14.2% 15.9% 4-yr CAGR 16% $192 $344 Net Sales ($ MILLIONS) Adjusted EFO* ($ MILLIONS) Gross Profit ($ MILLIONS) Gross Margin 2014 2014 2014 2014 2018 2018 2018 2018 2018 Financial Performance Sales Composition Deep Strategic Partnerships ** Cisco Gold Partner Master-Security Master-Collaboration Advanced Networking Titanium Platinum Platinum Premier Partner Gold Partner

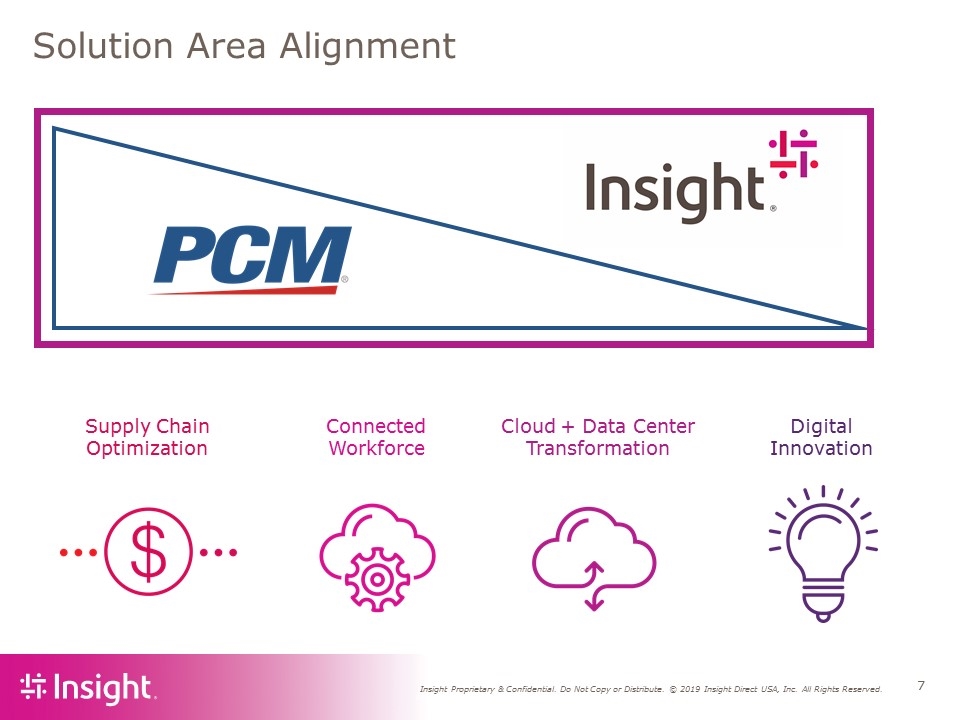

Supply Chain Optimization Connected Workforce Cloud + Data Center Transformation Digital Innovation Insight Proprietary & Confidential. Do Not Copy or Distribute. © 2019 Insight Direct USA, Inc. All Rights Reserved. Solution Area Alignment

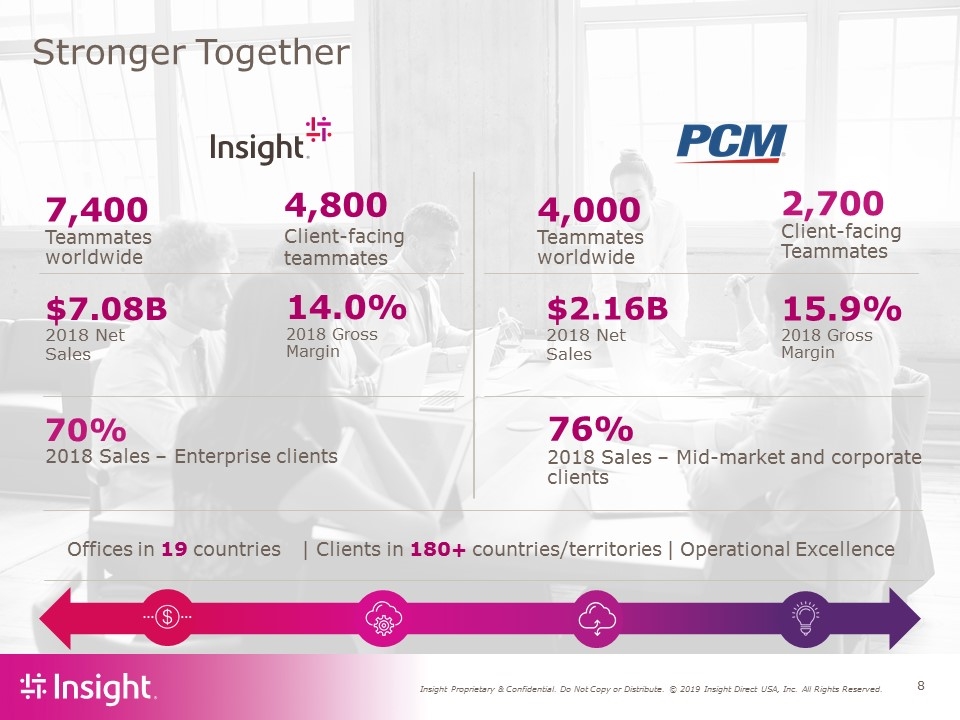

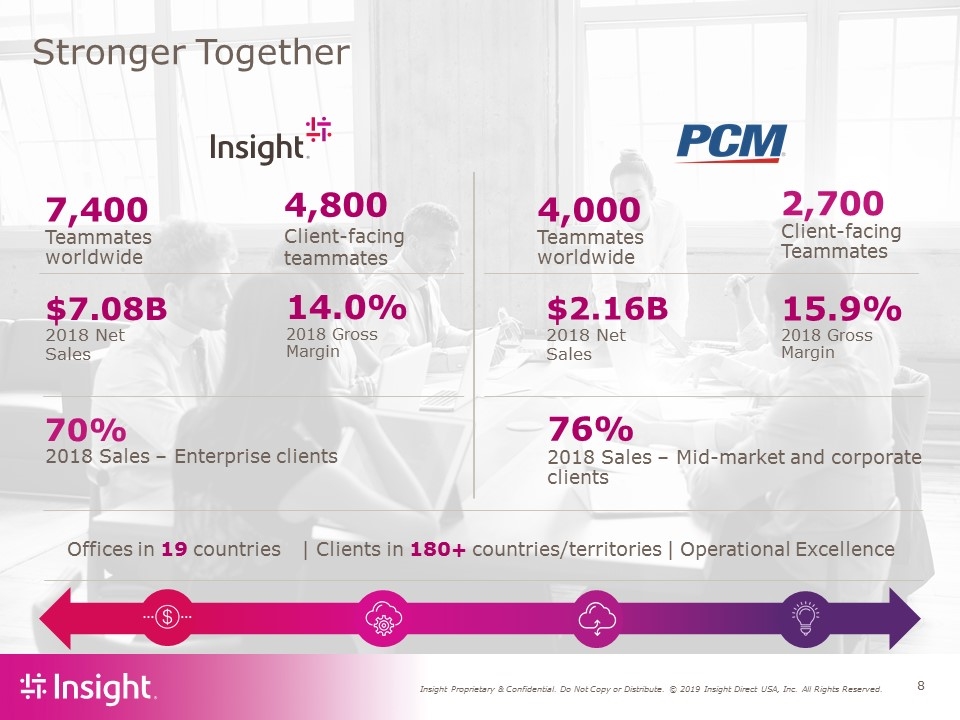

7,400 Teammates worldwide 4,800 Client-facing teammates Offices in 19 countries| Clients in 180+ countries/territories | Operational Excellence 4,000 Teammates worldwide 2,700 Client-facing Teammates Stronger Together $7.08B 2018 Net Sales 14.0% 2018 Gross Margin $2.16B 2018 Net Sales 15.9% 2018 Gross Margin 76% 2018 Sales – Mid-market and corporate clients 70% 2018 Sales – Enterprise clients

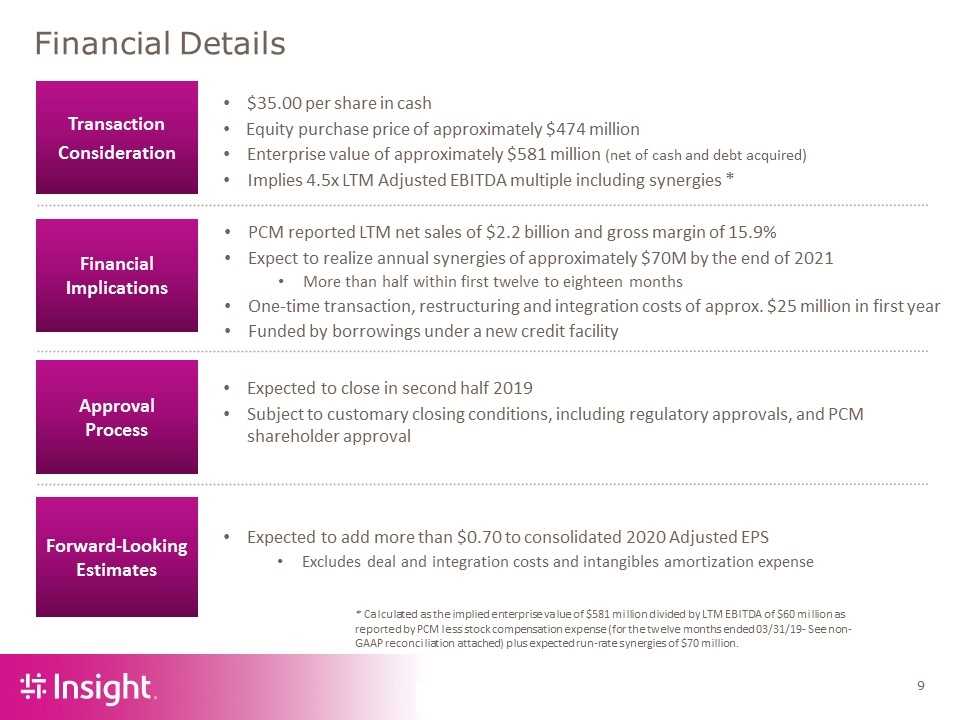

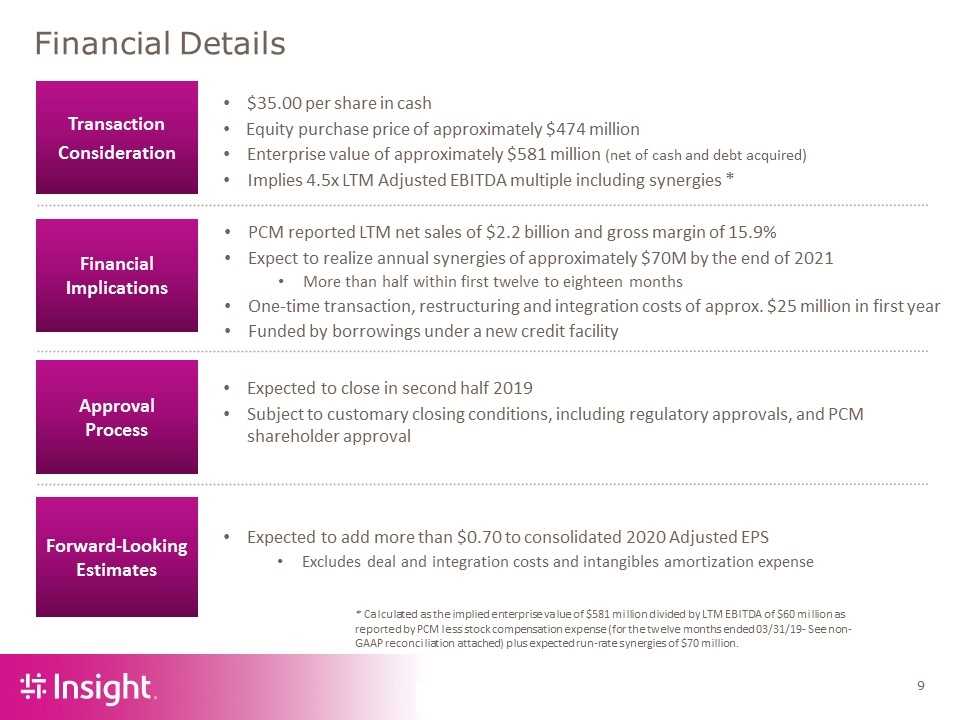

Financial Details $35.00 per share in cash Equity purchase price of approximately $474 million Enterprise value of approximately $581 million (net of cash and debt acquired) Implies 4.5x LTM Adjusted EBITDA multiple including synergies * PCM reported LTM net sales of $2.2 billion and gross margin of 15.9% Expect to realize annual synergies of approximately $70M by the end of 2021 More than half within first twelve to eighteen months One-time transaction, restructuring and integration costs of approx. $25 million in first year Funded by borrowings under a new credit facility Transaction Consideration Approval Process Financial Implications Forward-Looking Estimates Expected to add more than $0.70 to consolidated 2020 Adjusted EPS Excludes deal and integration costs and intangibles amortization expense * Calculated as the implied enterprise value of $581 million divided by LTM EBITDA of $60 million as reported by PCM less stock compensation expense (for the twelve months ended 03/31/19- See non-GAAP reconciliation attached) plus expected run-rate synergies of $70 million. Expected to close in second half 2019 Subject to customary closing conditions, including regulatory approvals, and PCM shareholder approval

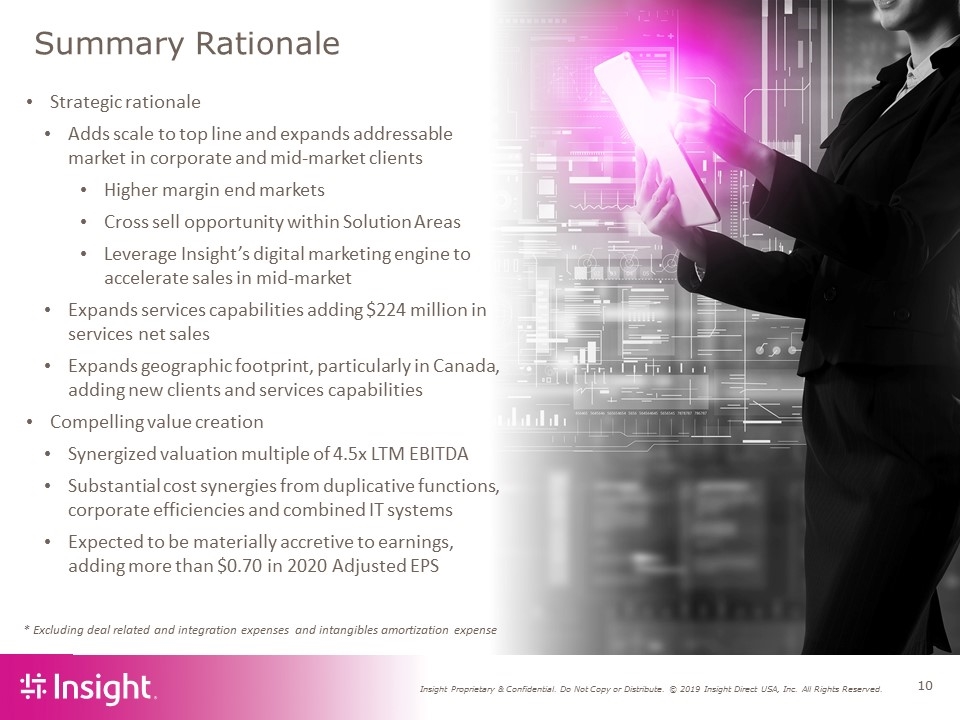

Summary Rationale Strategic rationale Adds scale to top line and expands addressable market in corporate and mid-market clients Higher margin end markets Cross sell opportunity within Solution Areas Leverage Insight’s digital marketing engine to accelerate sales in mid-market Expands services capabilities adding $224 million in services net sales Expands geographic footprint, particularly in Canada, adding new clients and services capabilities Compelling value creation Synergized valuation multiple of 4.5x LTM EBITDA Substantial cost synergies from duplicative functions, corporate efficiencies and combined IT systems Expected to be materially accretive to earnings, adding more than $0.70 in 2020 Adjusted EPS * Excluding deal related and integration expenses and intangibles amortization expense

Thank you. Questions?

Non-GAAP Reconciliations

Non-GAAP Reconciliations