Insight Enterprises Third Quarter 2019 Earnings Conference Call Exhibit 99.2

Disclosures Safe harbor statement This presentation includes “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 related to Insight’s plans and expectations. Statements that are not historical facts, including statements about future trends in the IT market and our opportunities for growth, are forward-looking statements. These forward-looking statements are subject to assumptions, risks and uncertainties which could cause actual results or future events to differ materially from such statements. The Company undertakes no obligation to update publicly or revise any of the forward-looking statements, except as otherwise required by law. More detailed information about risk factors is included in today’s press release and discussed in the Company’s most recently filed periodic reports and subsequent filings with the Securities and Exchange Commission. Non-GAAP measures This presentation will reference certain non-GAAP financial information as ‘Adjusted’. A reconciliation of non-GAAP financial measures presented in this document to our actual GAAP results is attached to the back of this presentation and included in the press release issued today, which you may find on the Investor Relations section of our website at investor.insight.com. Constant currency In some instances the Company refers to changes in net sales, gross profit and earnings from operations on a consolidated basis and in North America, EMEA and APAC excluding the effects of fluctuating foreign currency exchange rates. In computing these changes and percentages, the Company compares the current year amount as translated into U.S. dollars under the applicable accounting standards to the prior year amount in local currency translated into U.S. dollars utilizing the weighted average translation rate for the current period.

Agenda Opening Comments Highlights Third quarter 2019 consolidated results PCM integration update Case study Strategic assets & priorities Business Review Third quarter 2019 financial results by region Taxes and cash flow Capital allocation priorities Closing Comments & 2019 Guidance

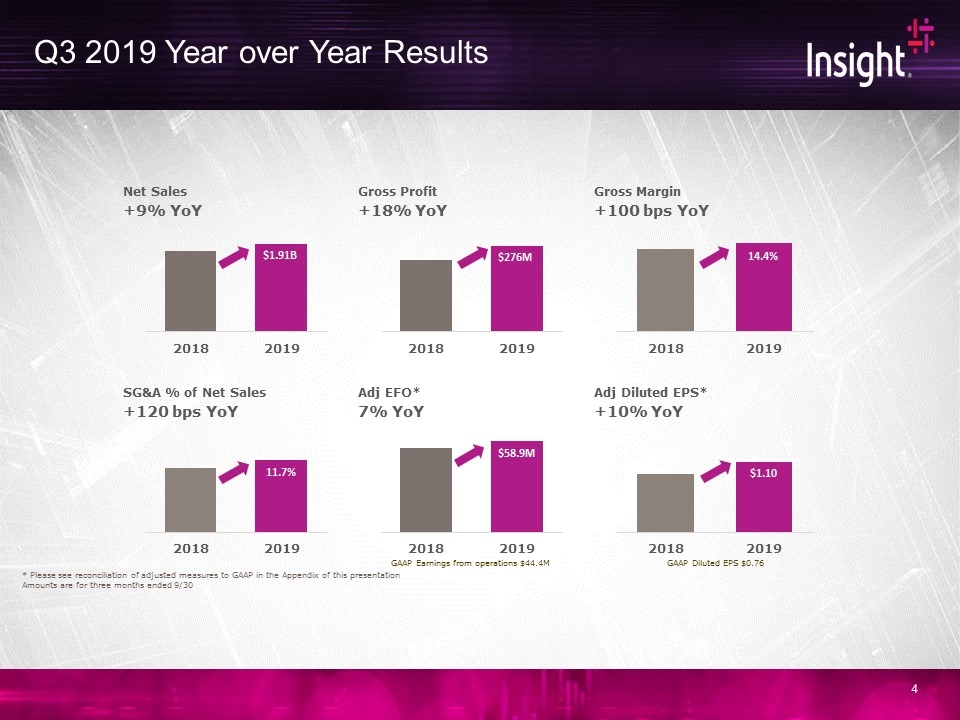

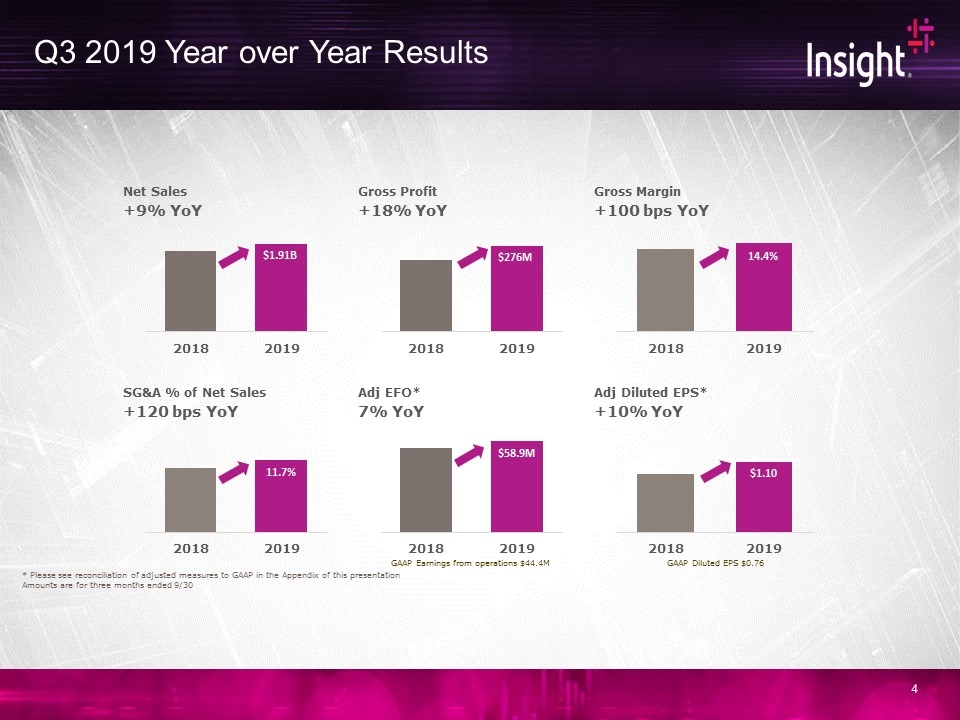

Q3 2019 Year over Year Results * Please see reconciliation of adjusted measures to GAAP in the Appendix of this presentation Amounts are for three months ended 9/30 GAAP Earnings from operations $44.4M GAAP Diluted EPS $0.76 Net Sales Gross Profit Gross Margin +9% YoY +18% YoY +100 bps YoY SG&A % of Net Sales Adj EFO* Adj Diluted EPS* +120 bps YoY 7% YoY +10% YoY $1.91B 2018 2019 $276M 2018 2019 $58.9M 2018 2019 11.7% 2018 2019 14.4% 2018 2019 $1.10 2018 2019

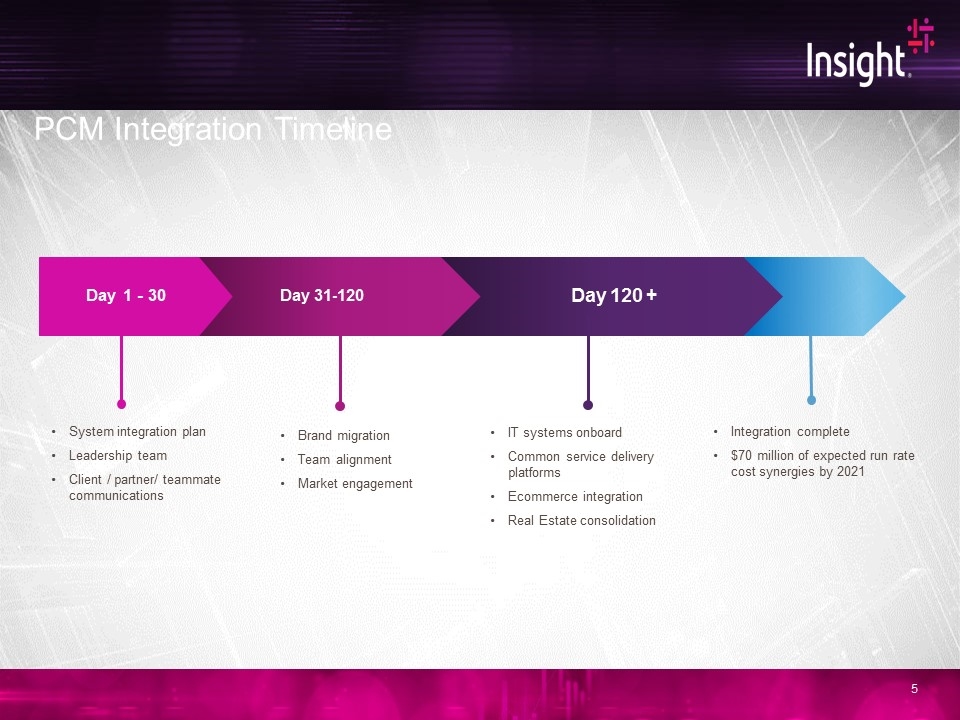

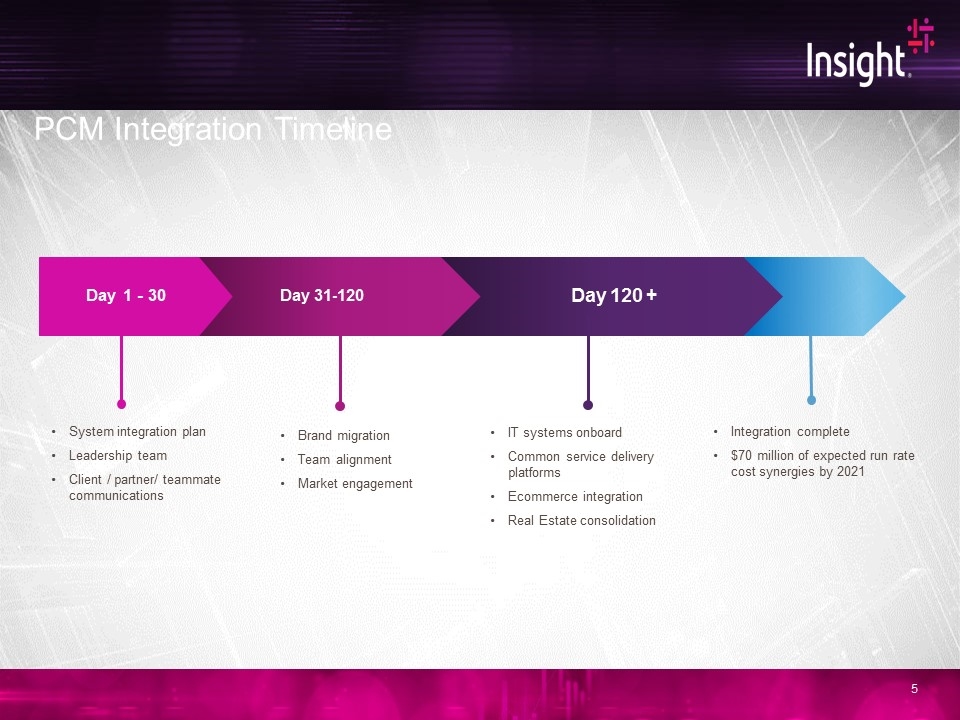

System integration plan Leadership team Client / partner/ teammate communications Day 120 + Day 1 - 30 Day 31-120 Integration complete $70 million of expected run rate cost synergies by 2021 Brand migration Team alignment Market engagement IT systems onboard Common service delivery platforms Ecommerce integration Real Estate consolidation PCM Integration Timeline

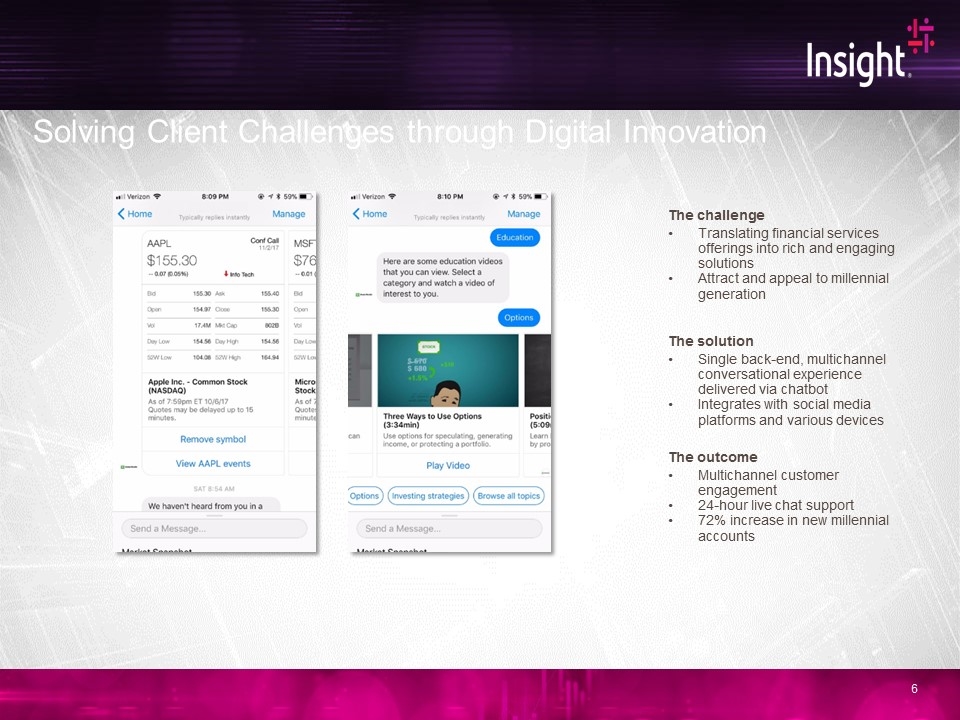

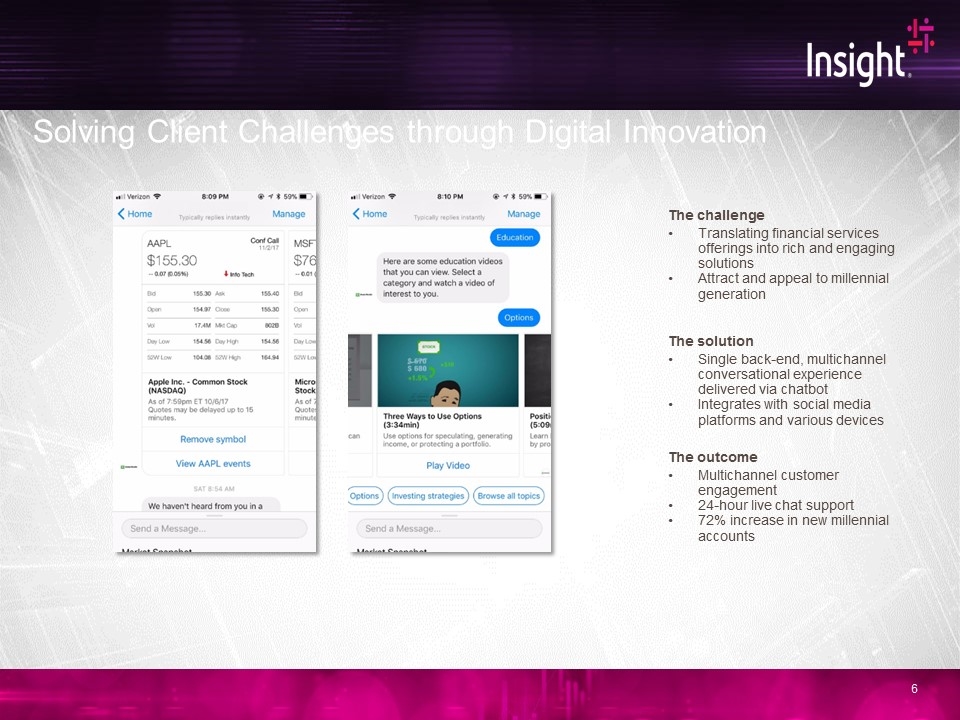

Solving Client Challenges through Digital Innovation The challenge Translating financial services offerings into rich and engaging solutions Attract and appeal to millennial generation The solution Single back-end, multichannel conversational experience delivered via chatbot Integrates with social media platforms and various devices The outcome Multichannel customer engagement 24-hour live chat support 72% increase in new millennial accounts

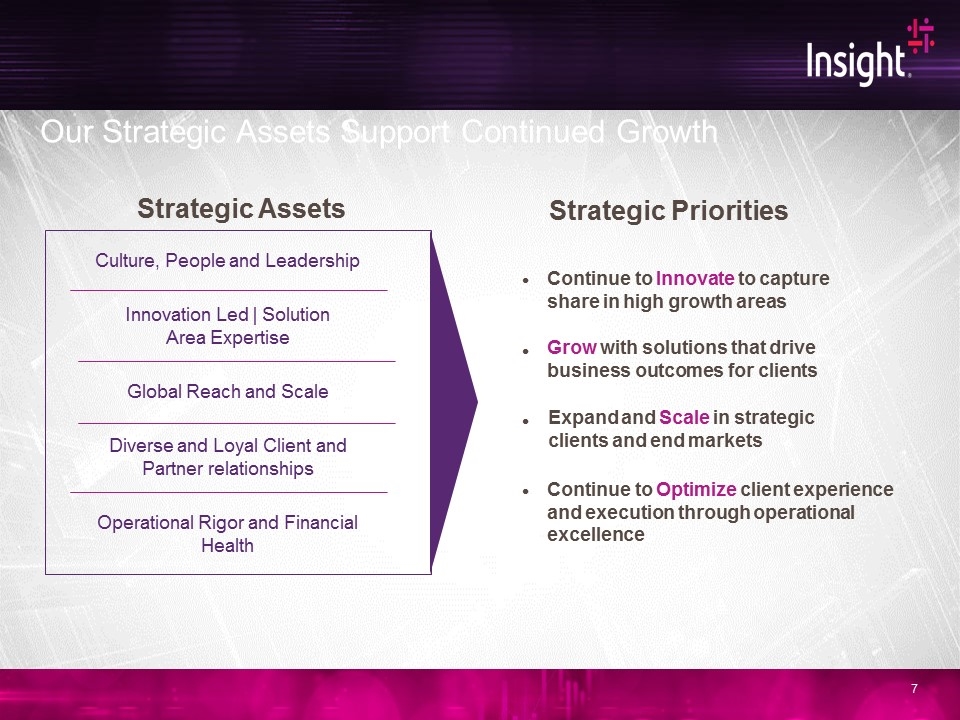

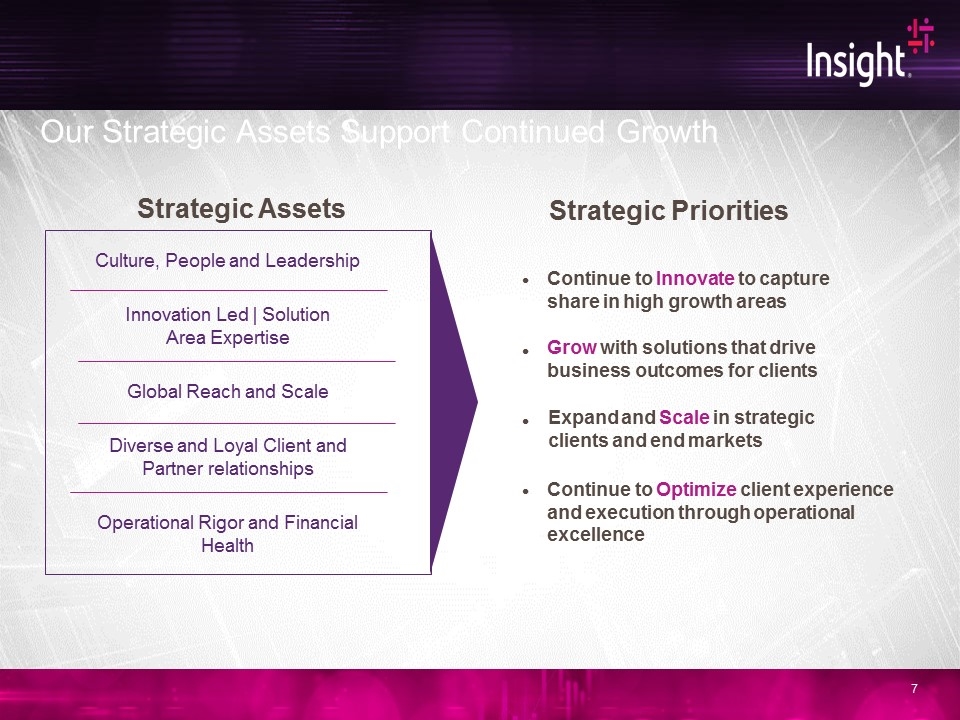

Our Strategic Assets Support Continued Growth Grow with solutions that drive business outcomes for clients Continue to Innovate to capture share in high growth areas Expand and Scale in strategic clients and end markets Continue to Optimize client experience and execution through operational excellence Strategic Priorities Innovation Led | Solution Area Expertise Culture, People and Leadership Global Reach and Scale Diverse and Loyal Client and Partner relationships Operational Rigor and Financial Health • • • • Strategic Assets

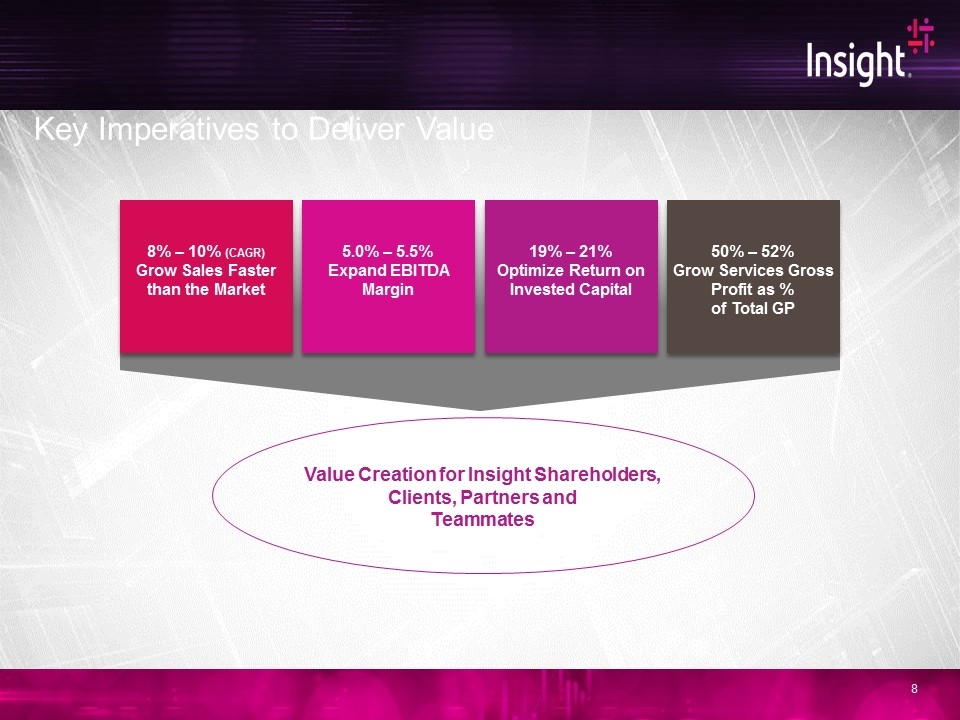

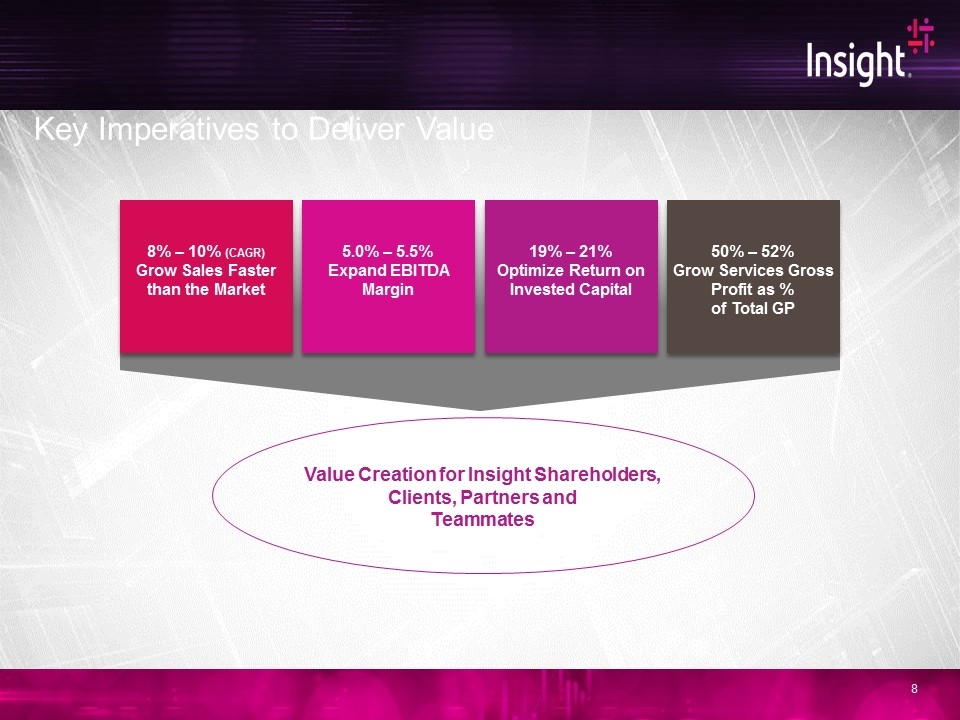

5.0% – 5.5% Expand EBITDA Margin 19% – 21% Optimize Return on Invested Capital 50% – 52% Grow Services Gross Profit as % of Total GP Value Creation for Insight Shareholders, Clients, Partners and Teammates 8% – 10% (CAGR) Grow Sales Faster than the Market Key Imperatives to Deliver Value

Business Review

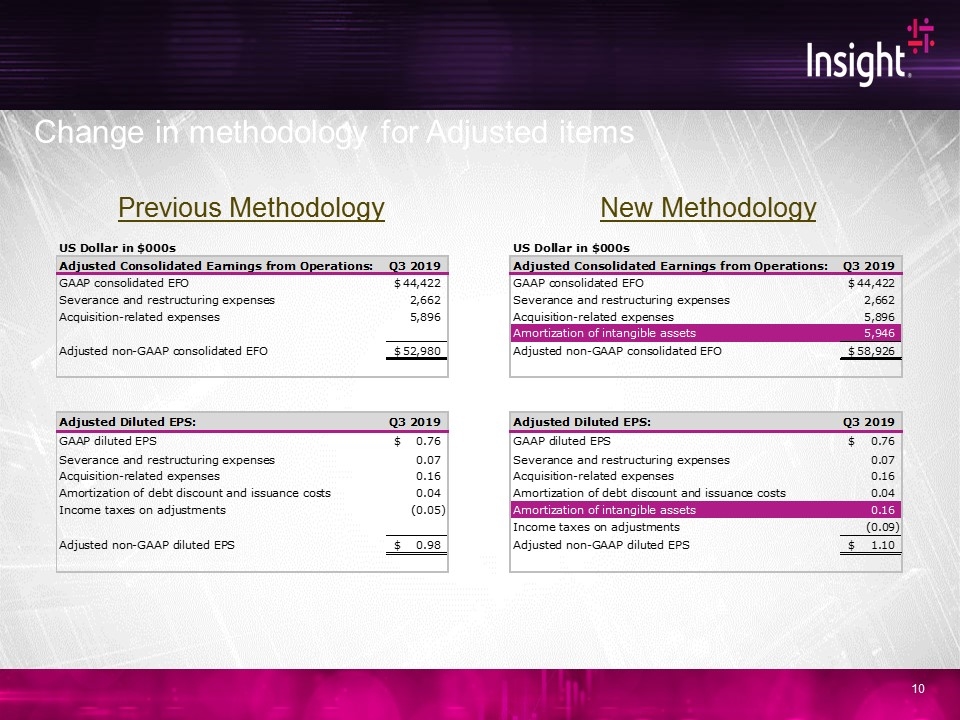

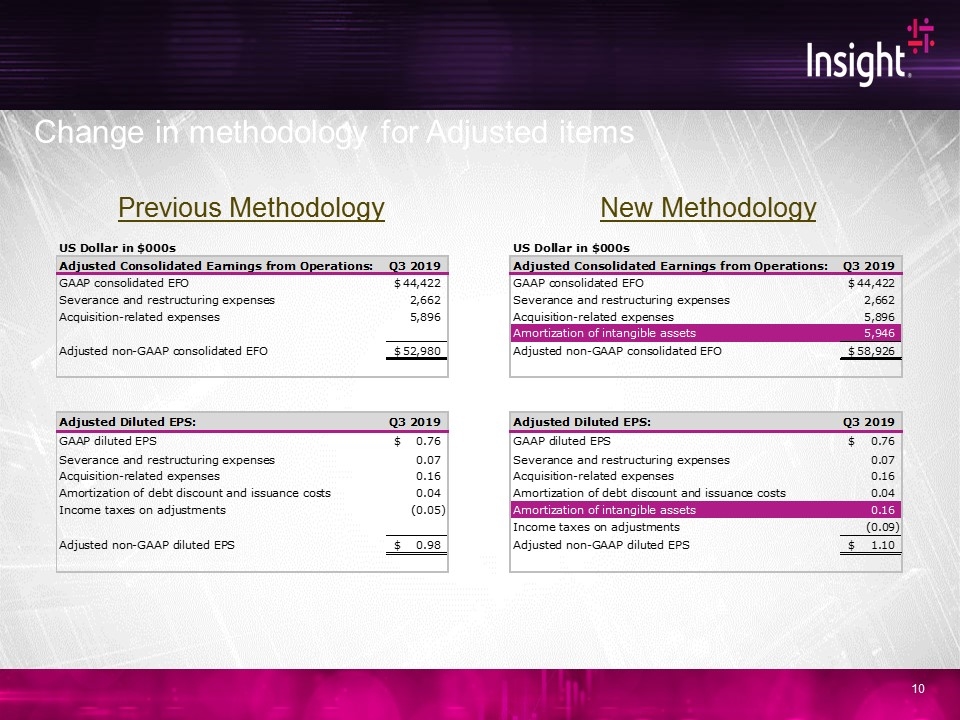

Change in methodology for Adjusted items Previous Methodology New Methodology

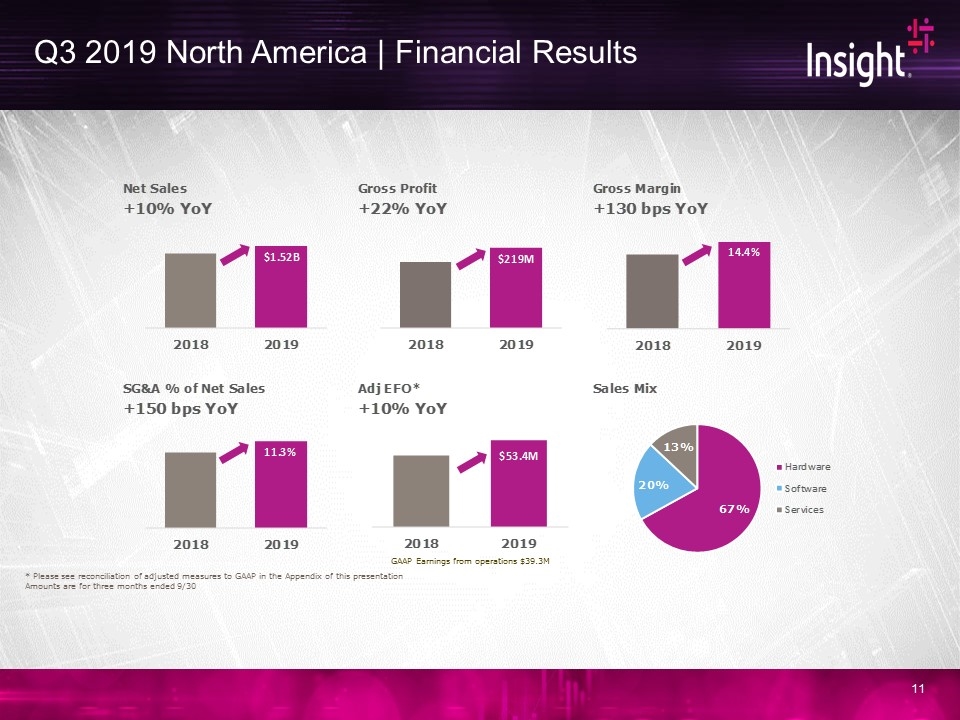

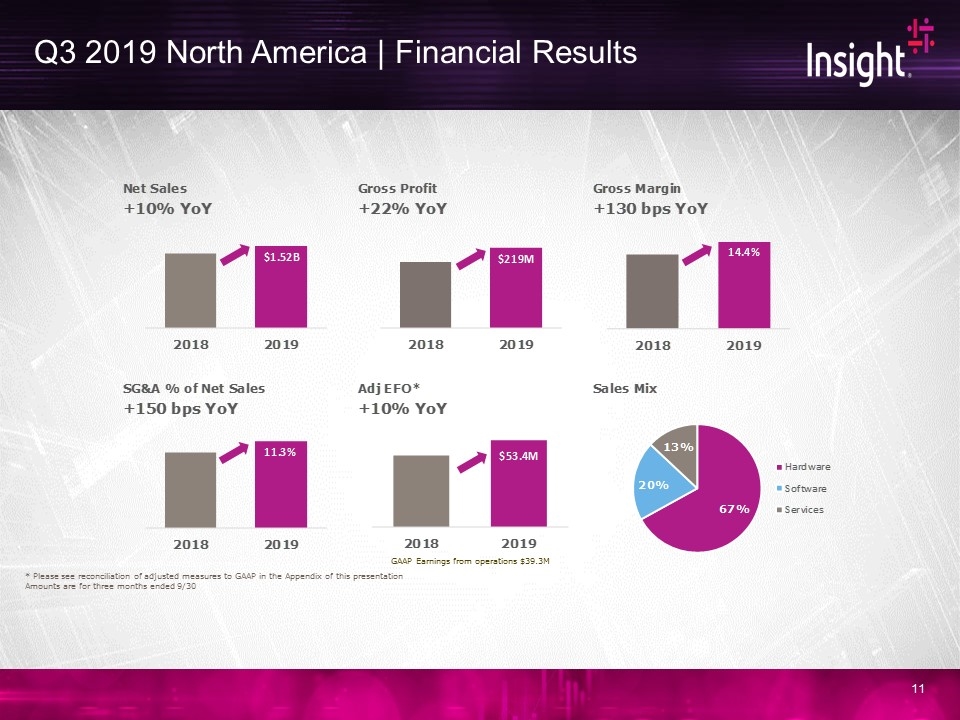

Q3 2019 North America | Financial Results * Please see reconciliation of adjusted measures to GAAP in the Appendix of this presentation Amounts are for three months ended 9/30 GAAP Earnings from operations $39.3M

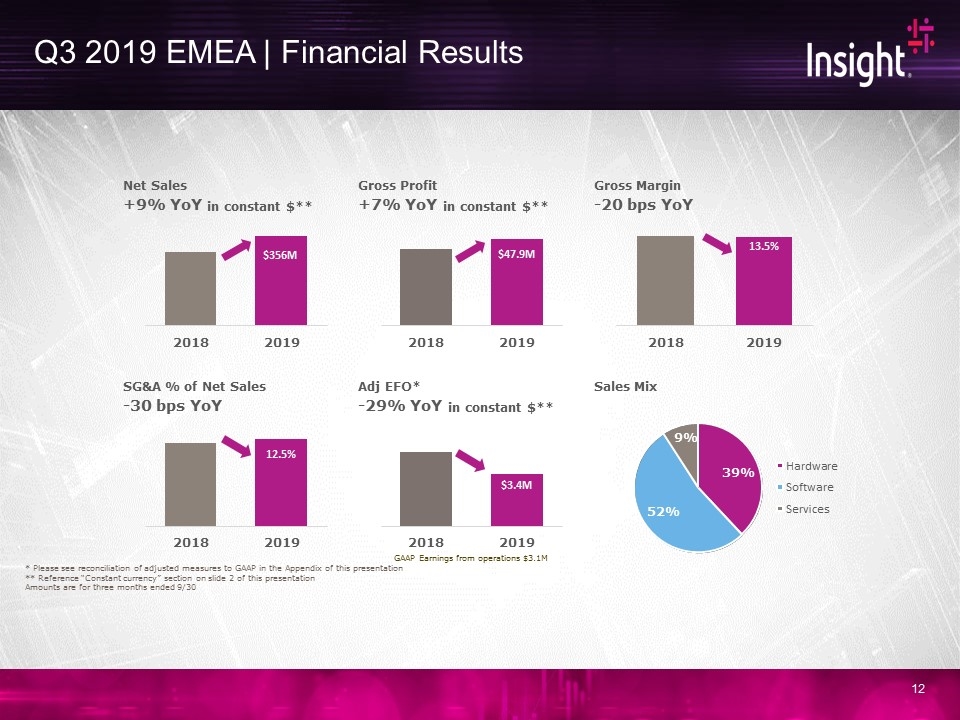

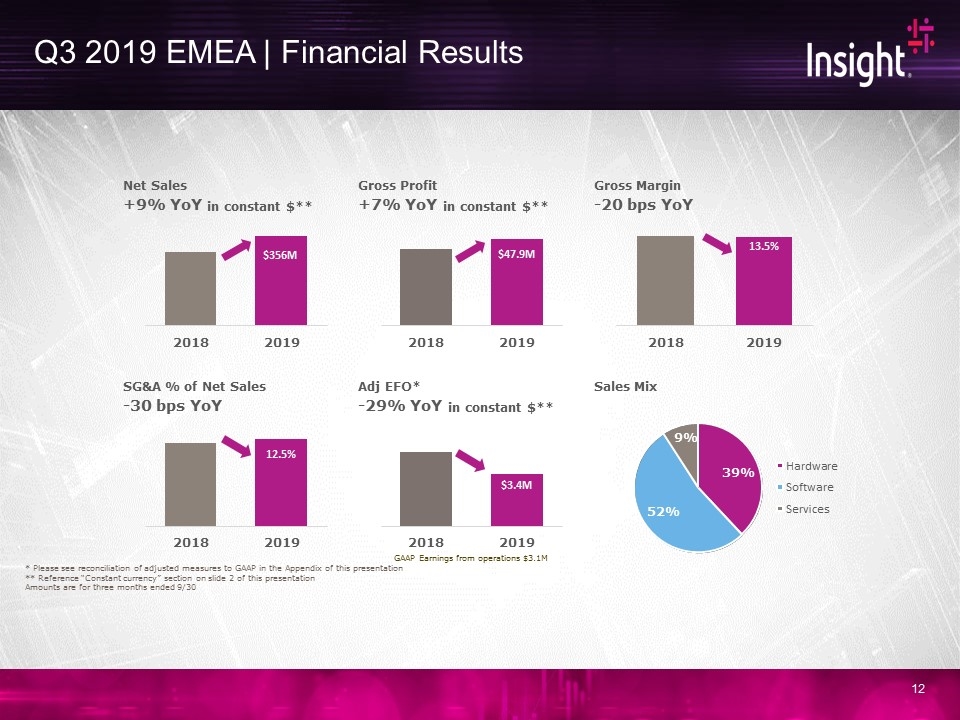

Q3 2019 EMEA | Financial Results * Please see reconciliation of adjusted measures to GAAP in the Appendix of this presentation ** Reference “Constant currency” section on slide 2 of this presentation Amounts are for three months ended 9/30 GAAP Earnings from operations $3.1M Net Sales Gross Profit Gross Margin +9% YoY in constant $** +7% YoY in constant $** -20 bps YoY SG&A % of Net Sales Adj EFO* Sales Mix -30 bps YoY -29% YoY in constant $** $356M 2018 2019 $47.9M 2018 2019 $3.4M 2018 2019 12.5% 2018 2019 13.5% 2018 2019 39% 52% 9% Hardware Software Services

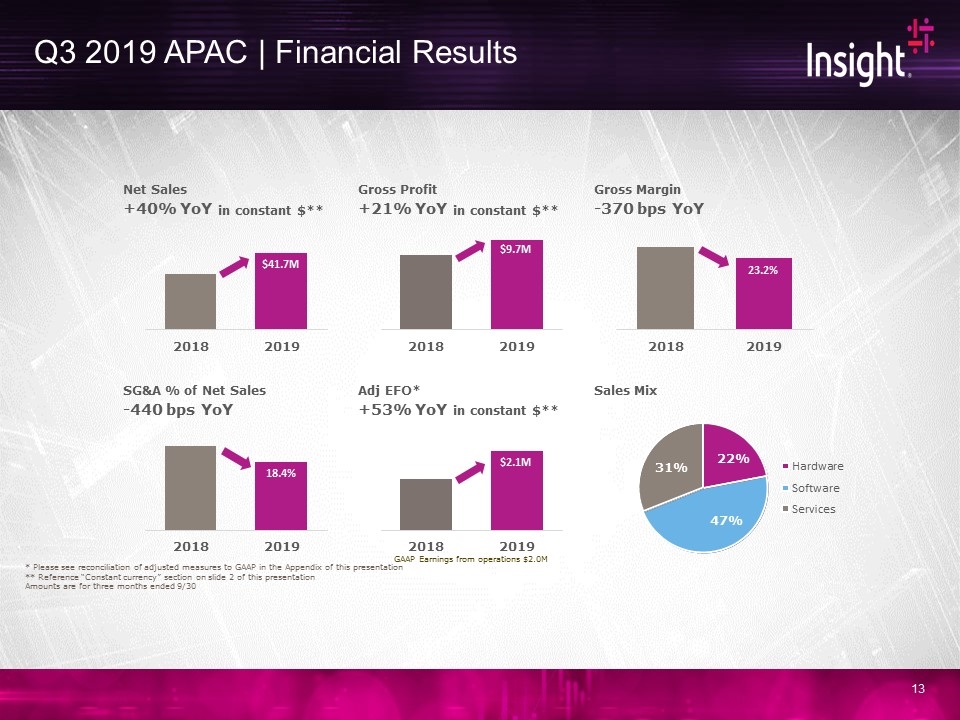

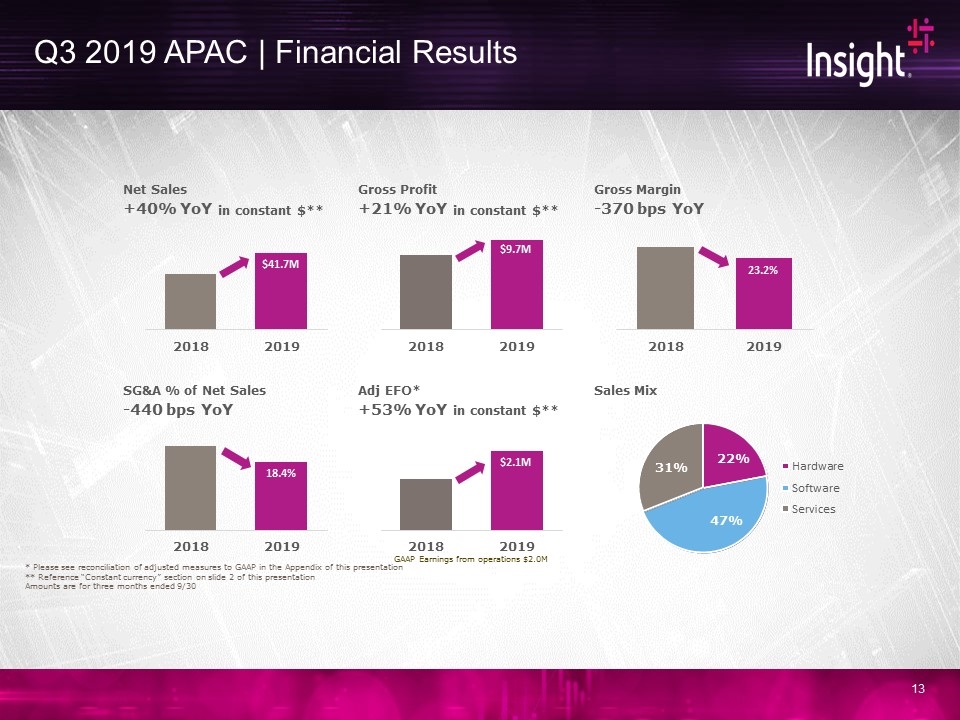

Q3 2019 APAC | Financial Results * Please see reconciliation of adjusted measures to GAAP in the Appendix of this presentation ** Reference “Constant currency” section on slide 2 of this presentation Amounts are for three months ended 9/30 GAAP Earnings from operations $2.0M Net Sales Gross Profit Gross Margin +40% YoY in constant $** +21% YoY in constant $** -370 bps YoY SG&A % of Net Sales Adj EFO* Sales Mix -440 bps YoY +53% YoY in constant $** $41.7M 2018 2019 $9.7M 2018 2019 $2.1M 2018 2019 18.4% 2018 2019 23.2% 2018 2019 22% 47% 31% Hardware Software Services

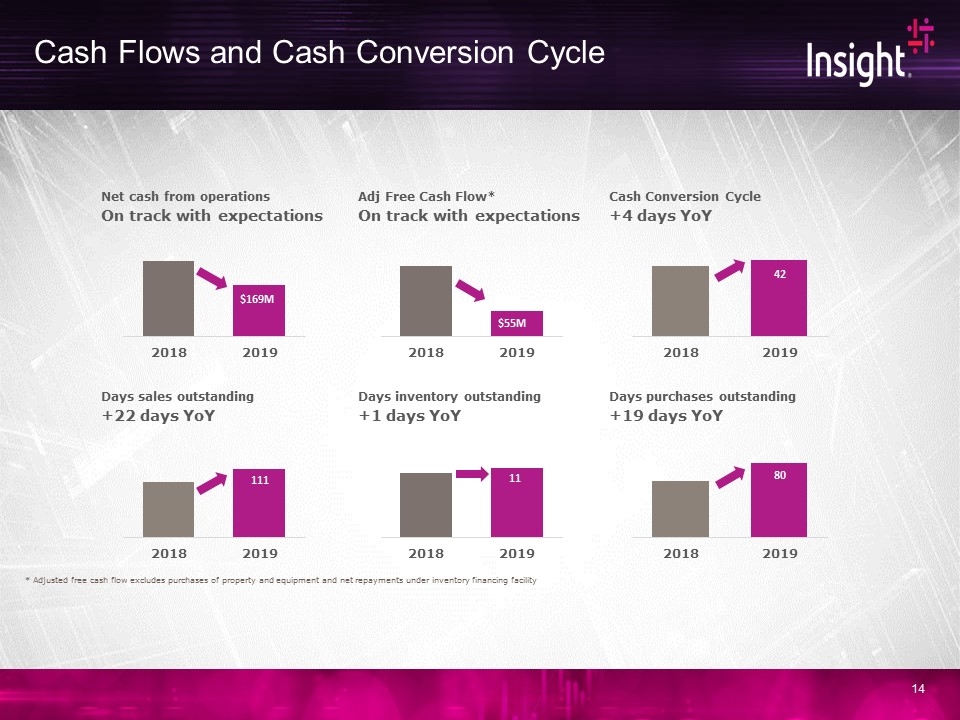

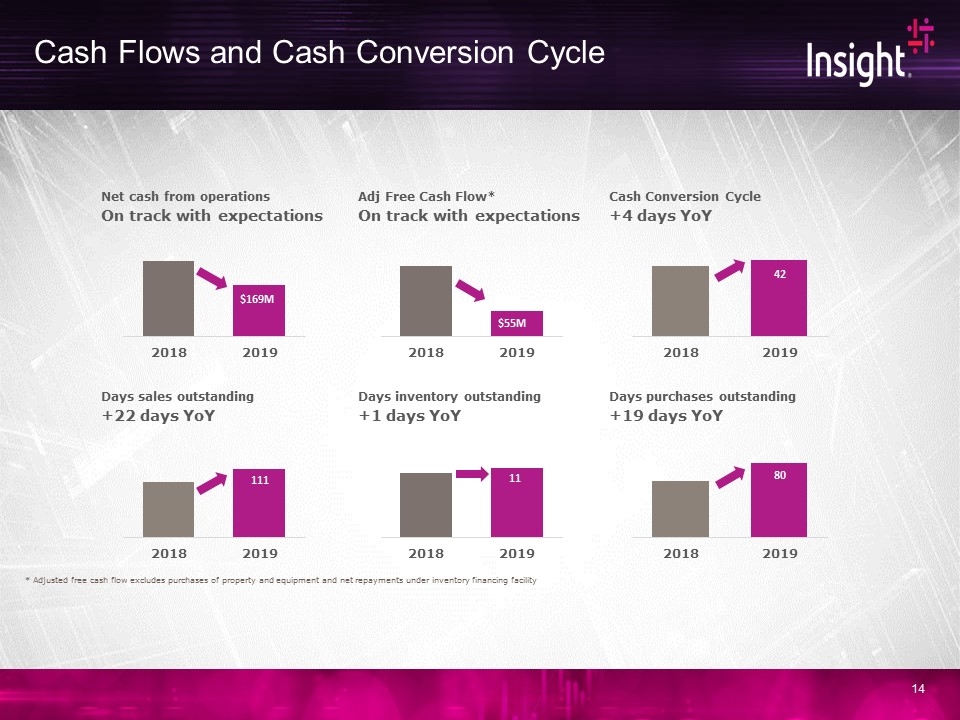

Cash Flows and Cash Conversion Cycle * Adjusted free cash flow excludes purchases of property and equipment and net repayments under inventory financing facility Net cash from operations Adj Free Cash Flow* Cash Conversion Cycle On track with expectations On track with expectations +4 days YoY Days sales outstanding Days inventory outstanding Days purchases outstanding +22 days YoY +1 days YoY +19 days YoY $169M 2018 2019 $55M 2018 2019 11 2018 2019 111 2018 2019 42 2018 2019 80 2018 2019

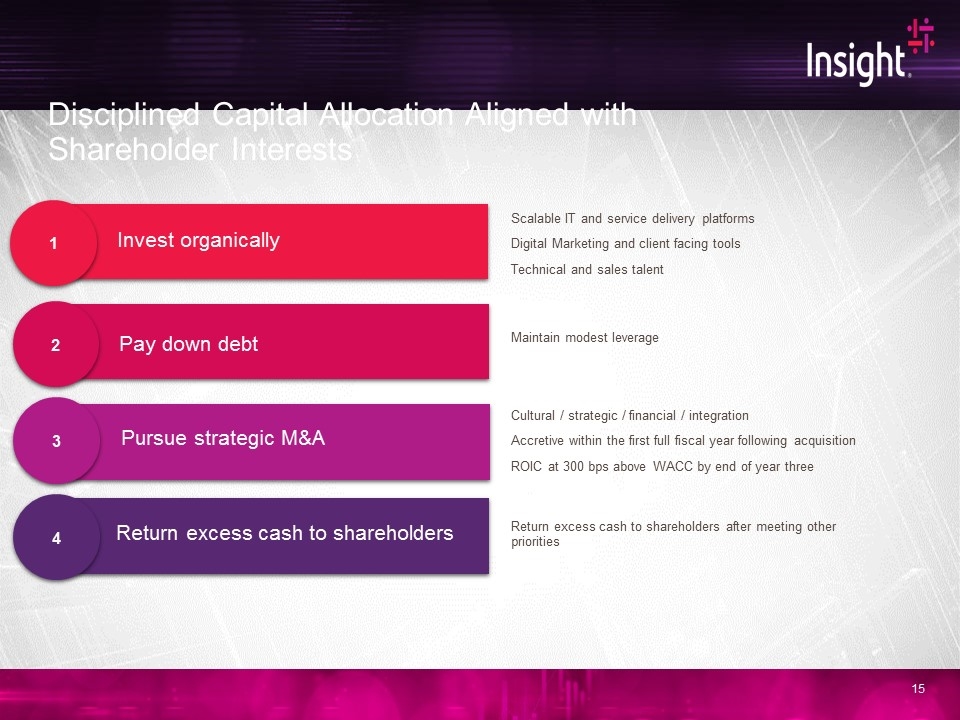

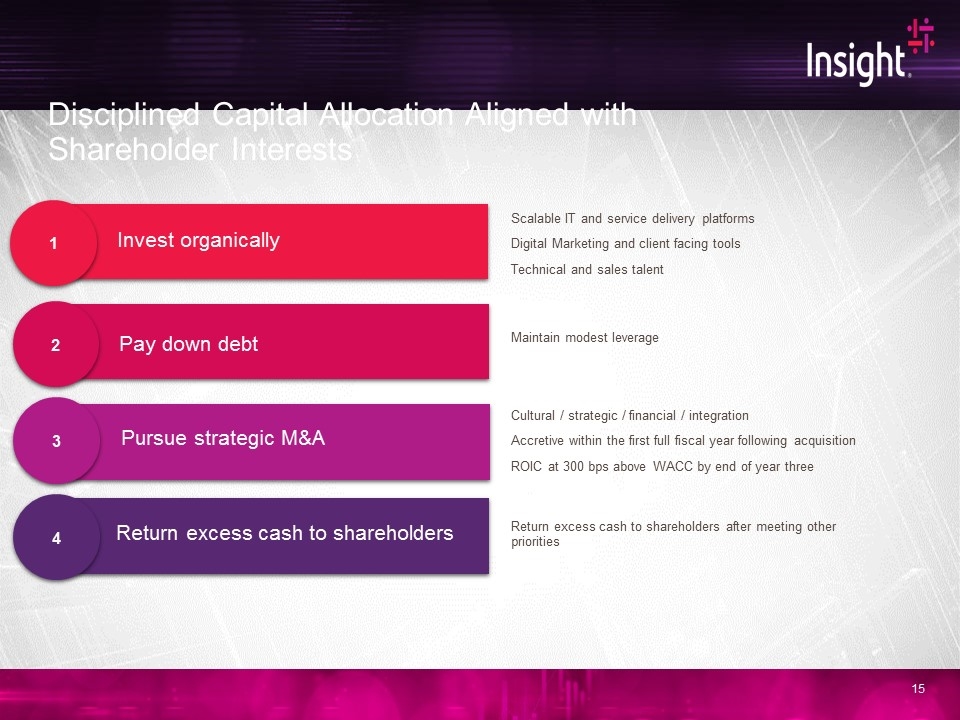

Disciplined Capital Allocation Aligned with Shareholder Interests 1 Pay down debt Invest organically 2 4 Return excess cash to shareholders Scalable IT and service delivery platforms Digital Marketing and client facing tools Technical and sales talent Cultural / strategic / financial / integration Accretive within the first full fiscal year following acquisition ROIC at 300 bps above WACC by end of year three Return excess cash to shareholders after meeting other priorities Pursue strategic M&A Maintain modest leverage 3

Closing Comments & 2019 Guidance

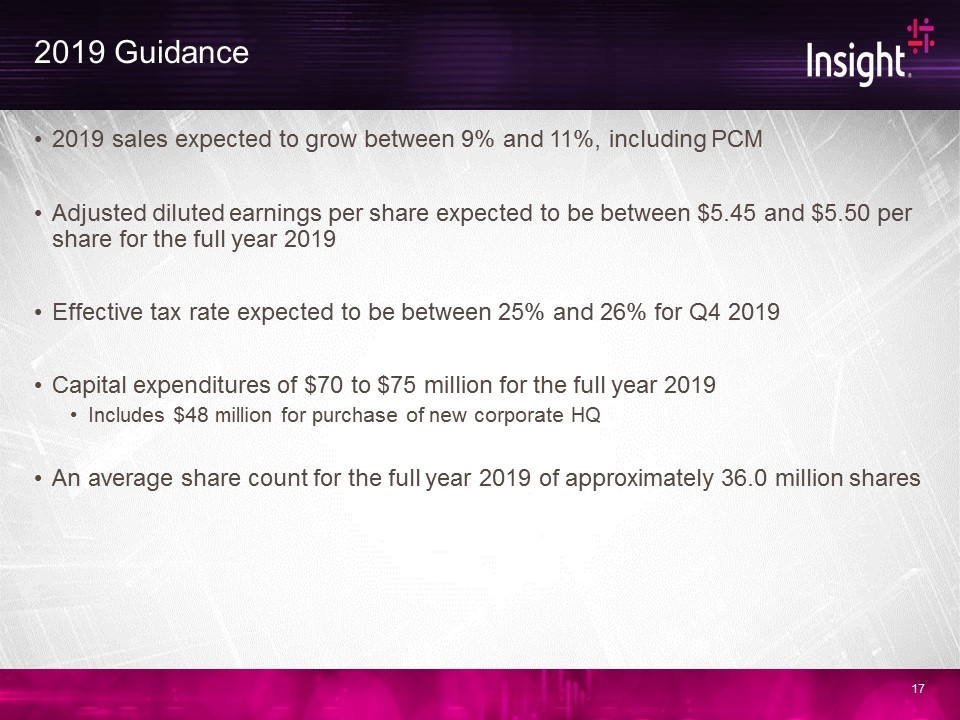

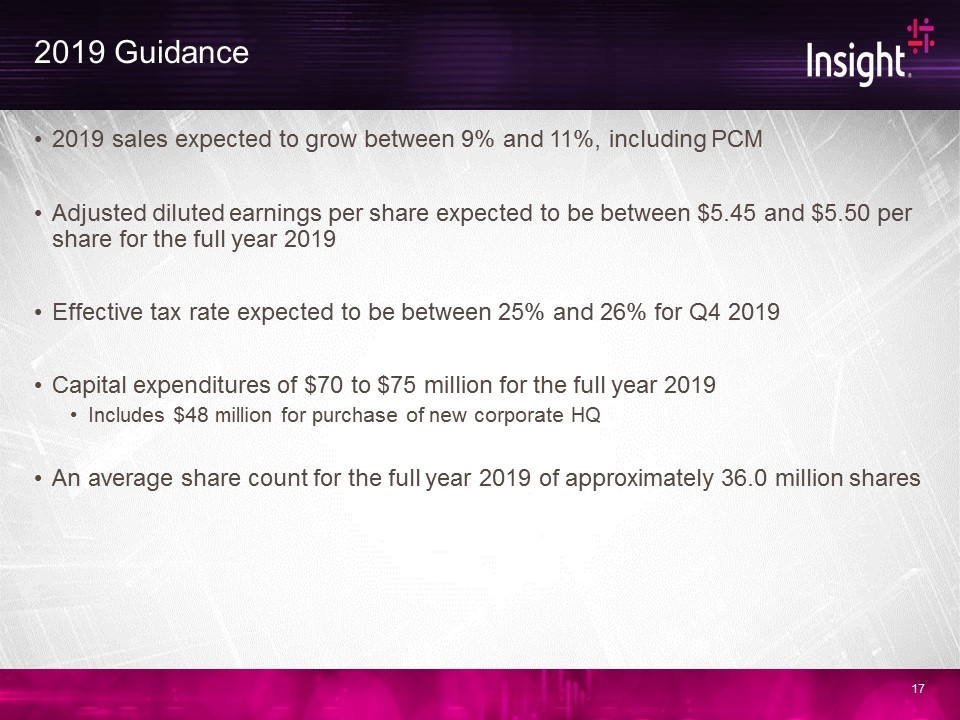

2019 Guidance 2019 sales expected to grow between 9% and 11%, including PCM Adjusted diluted earnings per share expected to be between $5.45 and $5.50 per share for the full year 2019 Effective tax rate expected to be between 25% and 26% for Q4 2019 Capital expenditures of $70 to $75 million for the full year 2019 Includes $48 million for purchase of new corporate HQ An average share count for the full year 2019 of approximately 36.0 million shares

Appendix

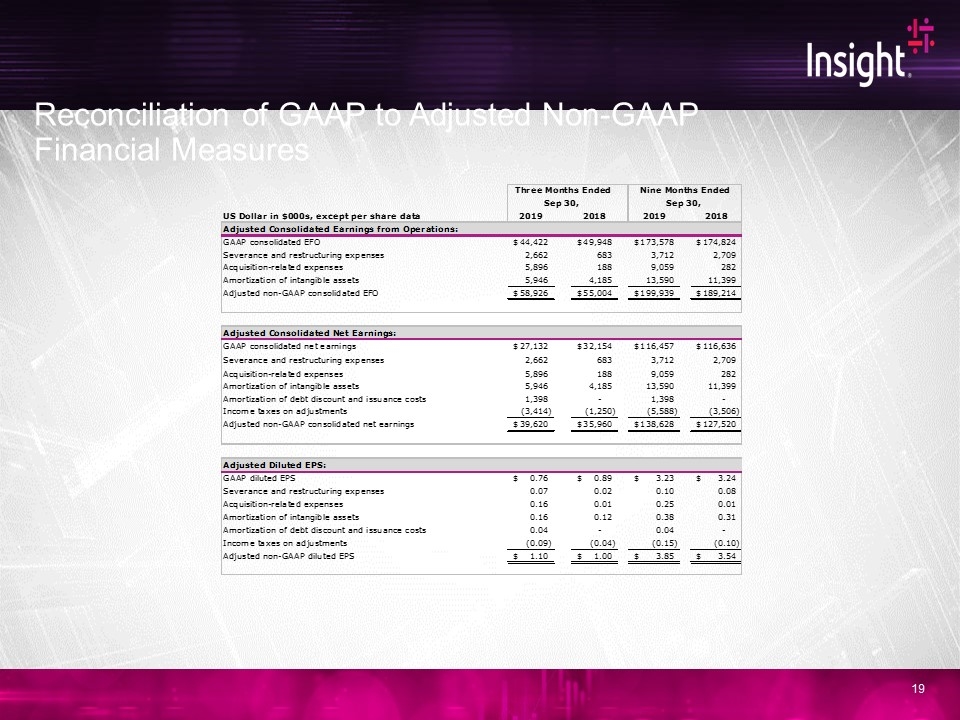

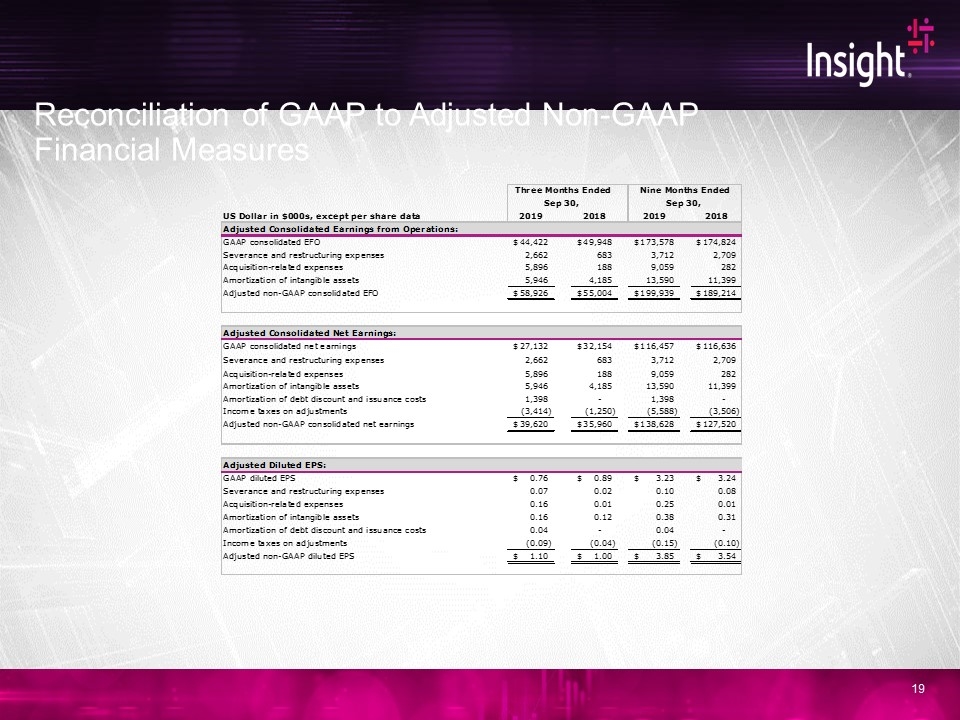

Reconciliation of GAAP to Adjusted Non-GAAP Financial Measures

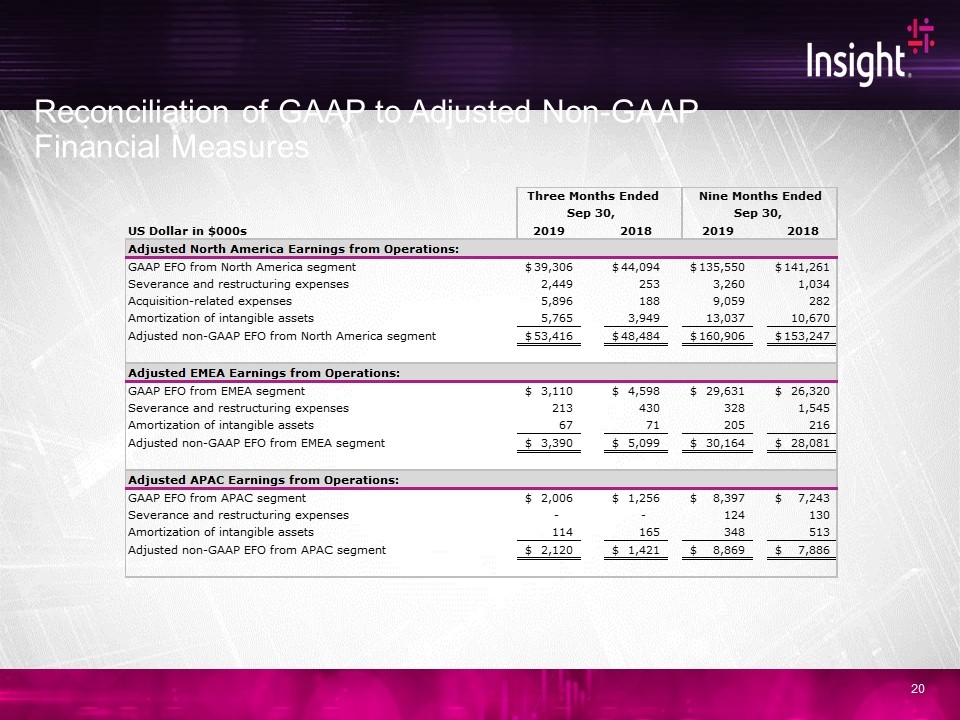

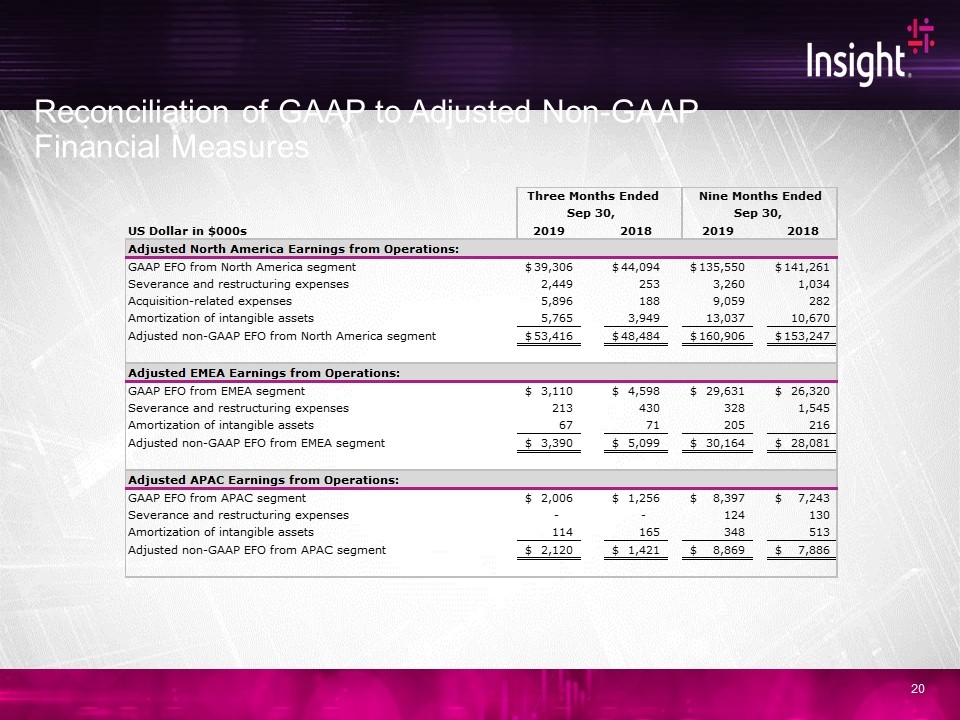

Reconciliation of GAAP to Adjusted Non-GAAP Financial Measures

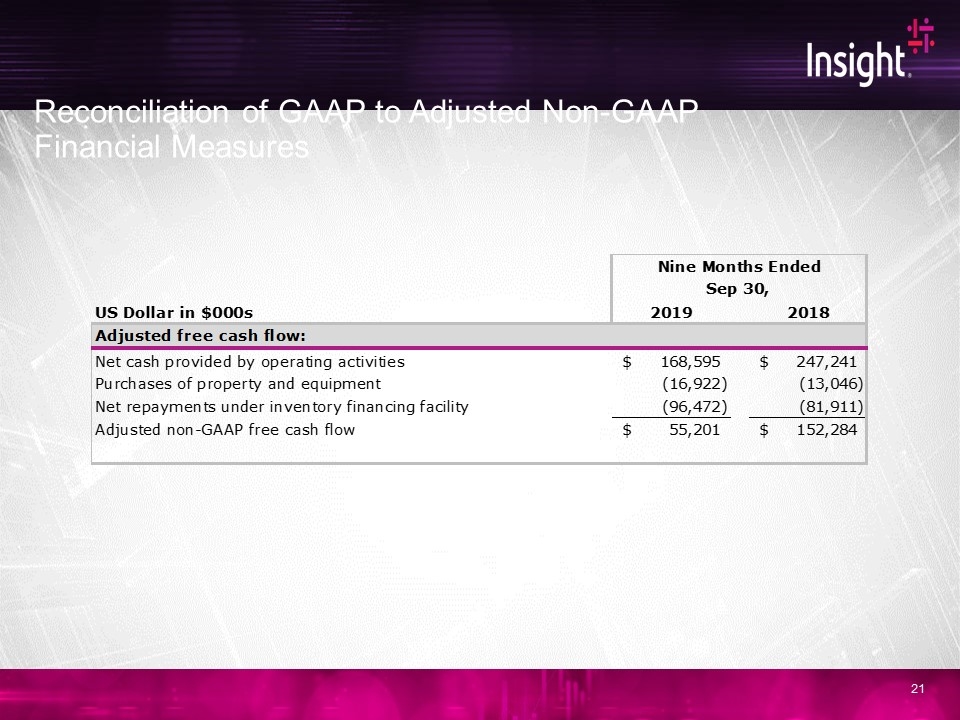

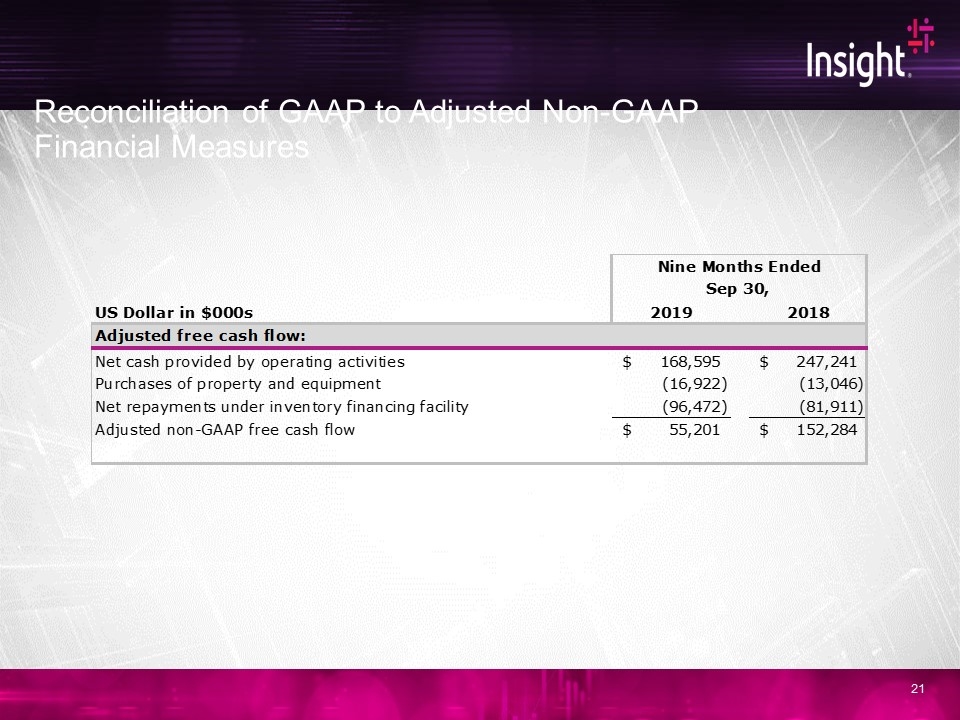

Reconciliation of GAAP to Adjusted Non-GAAP Financial Measures

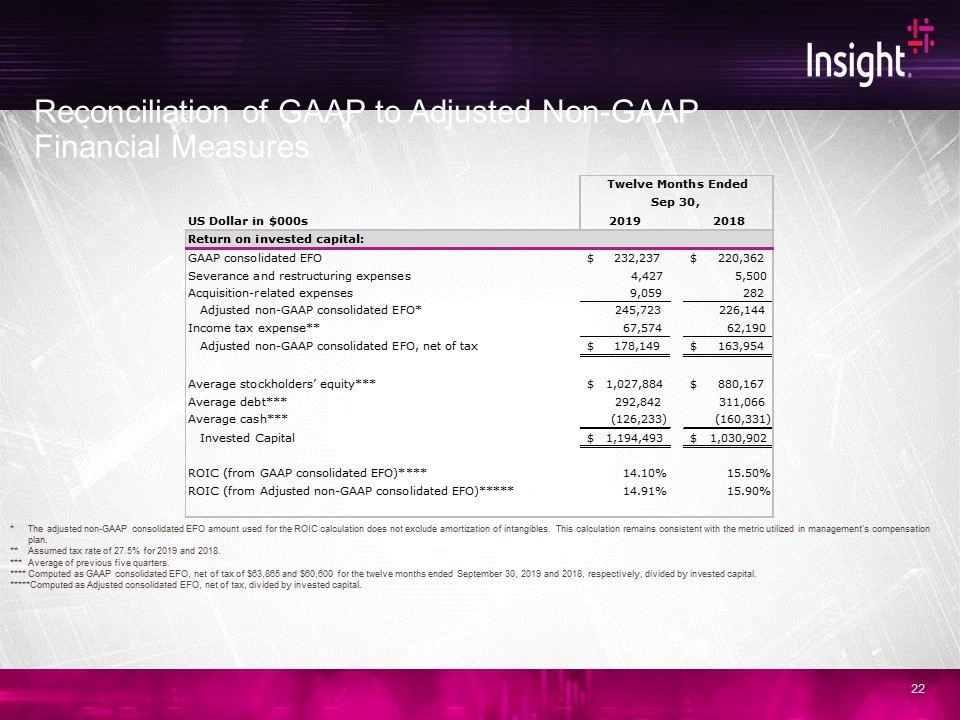

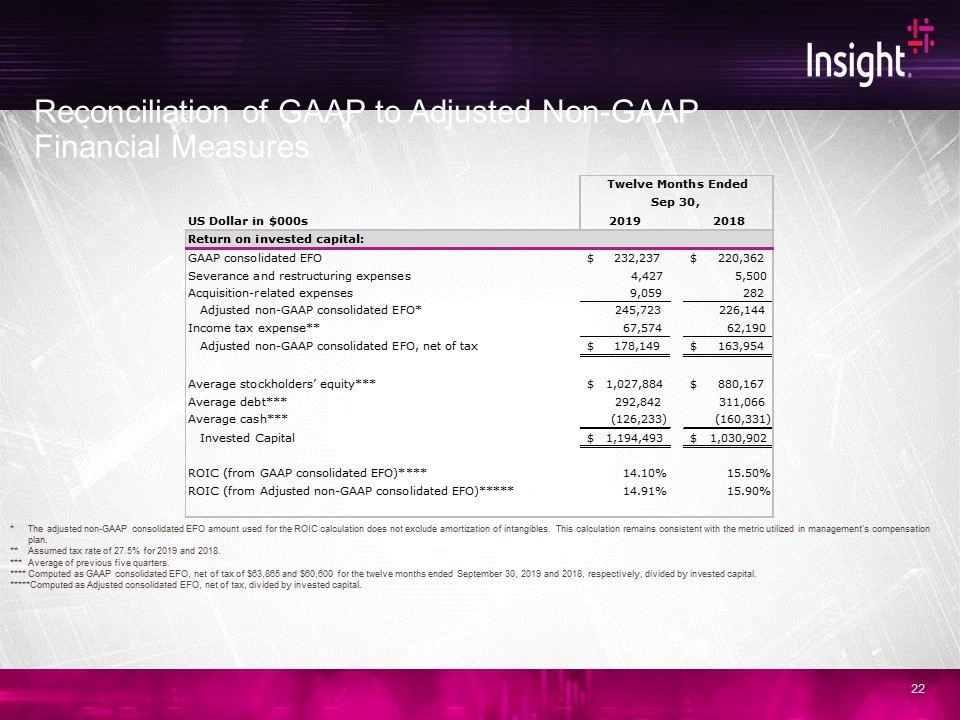

Reconciliation of GAAP to Adjusted Non-GAAP Financial Measures *The adjusted non-GAAP consolidated EFO amount used for the ROIC calculation does not exclude amortization of intangibles. This calculation remains consistent with the metric utilized in management’s compensation plan. **Assumed tax rate of 27.5% for 2019 and 2018. ***Average of previous five quarters. ****Computed as GAAP consolidated EFO, net of tax of $63,865 and $60,600 for the twelve months ended September 30, 2019 and 2018, respectively, divided by invested capital. *****Computed as Adjusted consolidated EFO, net of tax, divided by invested capital.