Insight Proprietary & Confidential. Do Not Copy or Distribute. © 2024 Insight Direct USA, Inc. All Rights Reserved. 1 Insight Enterprises, Inc. First Quarter 2024 Earnings Conference Call and Webcast

Insight Proprietary & Confidential. Do Not Copy or Distribute. © 2022 Insight Direct USA, Inc. All Rights Reserved. 24 Disclosures ◦ Safe harbor statement This presentation includes “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 related to Insight’s plans and expectations. Statements that are not historical facts, including those related to our expectations about future financial results and the assumptions related thereto, including expectations related to SADA, our expectations regarding supply constraints, our expectations regarding backlog shipments, our expectations as it relates to the holders of our convertible senior notes, future expected trends in the IT market and our opportunities for growth, are forward-looking statements. These forward-looking statements are subject to assumptions, risks and uncertainties which could cause actual results or future events to differ materially from such statements. Insight Enterprises, Inc. (the "Company") undertakes no obligation to update publicly or revise any of the forward-looking statements, except as otherwise required by law. More detailed information about forward-looking statements and risk factors is included in today’s press release and discussed in the Company’s most recently filed periodic reports and subsequent filings with the Securities and Exchange Commission. ◦ Non-GAAP measures This presentation will reference certain non-GAAP financial information as ‘Adjusted’. A reconciliation of non-GAAP financial measures presented in this document to our actual GAAP results is attached to the back of this presentation and included in the press release issued today, which you may find on the Investor Relations section of our website at investor.insight.com. These non-GAAP measures are used by the Company and its management to evaluate financial performance against budgeted amounts, to calculate incentive compensation, to assist in forecasting future performance and to compare the Company’s results to those of the Company’s competitors. The Company believes that these non-GAAP financial measures are useful to investors because they allow for greater transparency, facilitate comparisons to prior periods and the Company’s competitors’ results and assist in forecasting performance for future periods. These non-GAAP financial measures are not prepared in accordance with GAAP and may be different from non- GAAP financial measures presented by other companies. Non-GAAP financial measures should not be considered as a substitute for, or superior to, measures of financial performance prepared in accordance with GAAP. ◦ Constant currency In some instances, the Company refers to changes in net sales, gross profit, earnings from operations and Adjusted earnings from operations on a consolidated basis and in North America, EMEA and APAC excluding the effects of fluctuating foreign currency exchange rates. In addition, the Company refers to changes in Adjusted diluted earnings per share on a consolidated basis excluding the effects of fluctuating foreign currency exchange rates. In computing these changes and percentages, the Company compares the current year amount as translated into U.S. dollars under the applicable accounting standards to the prior year amount in local currency translated into U.S. dollars utilizing the weighted average translation rate for the current period.

Insight Proprietary & Confidential. Do Not Copy or Distribute. © 2022 Insight Direct USA, Inc. All Rights Reserved. 34 Table of Contents ◦ Solutions Integrator Strategy ◦ Areas of Expertise ◦ Solutions at Work ◦ Awards and Recognitions ◦ First Quarter 2024 Highlights and Performance ◦ 2027 KPIs for Success ◦ 2024 Outlook ◦ Appendix

Insight Proprietary & Confidential. Do Not Copy or Distribute. © 2022 Insight Direct USA, Inc. All Rights Reserved. 44 Our strategy is to become THE leading SOLUTIONS INTEGRATOR The pillars of our strategy are: DRIVE PROFITABLE GROWTH We relentlessly pursue high performance, operational excellence and profitable growth. Put clients first We put our clients first, delivering essential value that contributes to their success and making us the partner they can't live without. Deliver differentiation Our combination of innovative and scalable solutions, exceptional talent and unique portfolio strategy gives us a differentiated advantage. Champion culture Our teammates and our culture are our biggest assets. We champion them to deliver the best.

5Insight Proprietary & Confidential. Do Not Copy or Distribute. © 2024 Insight Direct USA, Inc. All Rights Reserved. Our services Managed Services Eliminate business disruption and strategically align resources Consulting Services Create competitive advantages and improve operations by aligning business goals to IT and product strategies Lifecycle Services Simplify supply chain and streamline costs across the global hardware and software lifecycle Intelligent Edge Gather and utilize data in the most efficient way possible to enable real-time decision- making and affect pivotal outcomes Data and Al Leverage analytics and Al to transform business operations and user experiences Modern Infrastructure Architect and modernize multicloud and networking solutions to drive business transformation Modern Apps Create new product experiences and transform legacy applications to drive increased business value Modern Workplace Create a productive, flexible and secure workplace Cybersecurity Mitigate risks and secure business assets Well Positioned to Help Organizations Our expertise

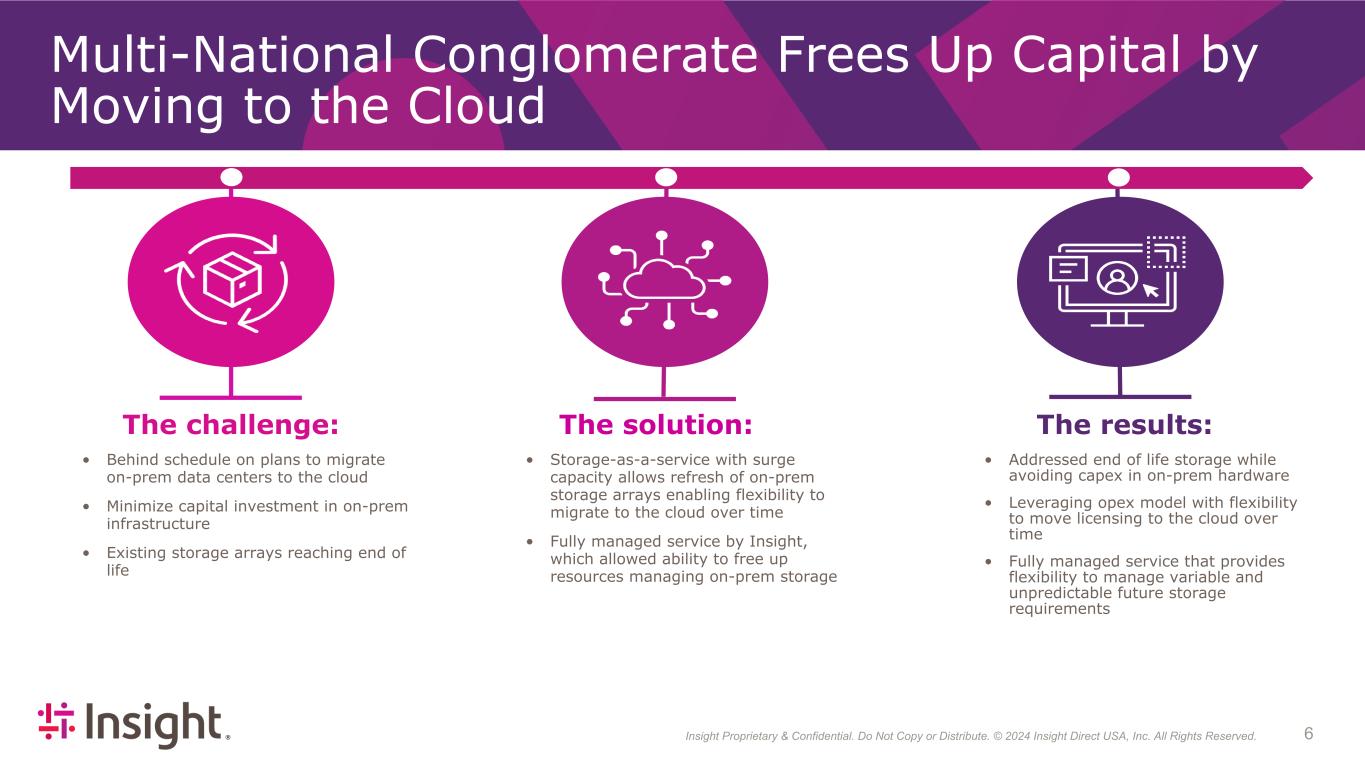

Insight Proprietary & Confidential. Do Not Copy or Distribute. © 2022 Insight Direct USA, Inc. All Rights Reserved. 64 The challenge: The results: • Behind schedule on plans to migrate on-prem data centers to the cloud • Minimize capital investment in on-prem infrastructure • Existing storage arrays reaching end of life • Addressed end of life storage while avoiding capex in on-prem hardware • Leveraging opex model with flexibility to move licensing to the cloud over time • Fully managed service that provides flexibility to manage variable and unpredictable future storage requirements • Storage-as-a-service with surge capacity allows refresh of on-prem storage arrays enabling flexibility to migrate to the cloud over time • Fully managed service by Insight, which allowed ability to free up resources managing on-prem storage The solution: Multi-National Conglomerate Frees Up Capital by Moving to the Cloud

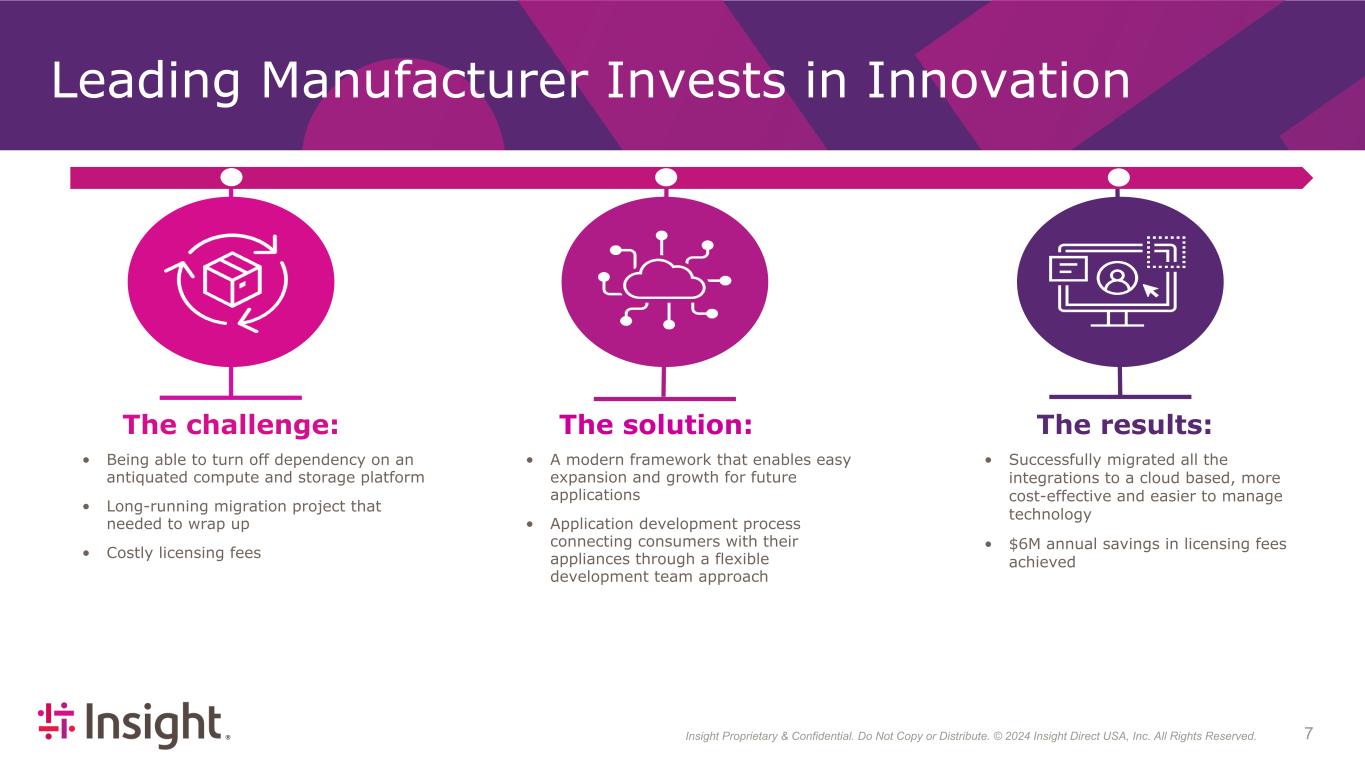

Insight Proprietary & Confidential. Do Not Copy or Distribute. © 2022 Insight Direct USA, Inc. All Rights Reserved. 74 Leading Manufacturer Invests in Innovation The challenge: The results: • Being able to turn off dependency on an antiquated compute and storage platform • Long-running migration project that needed to wrap up • Costly licensing fees • Successfully migrated all the integrations to a cloud based, more cost-effective and easier to manage technology • $6M annual savings in licensing fees achieved The solution: • A modern framework that enables easy expansion and growth for future applications • Application development process connecting consumers with their appliances through a flexible development team approach

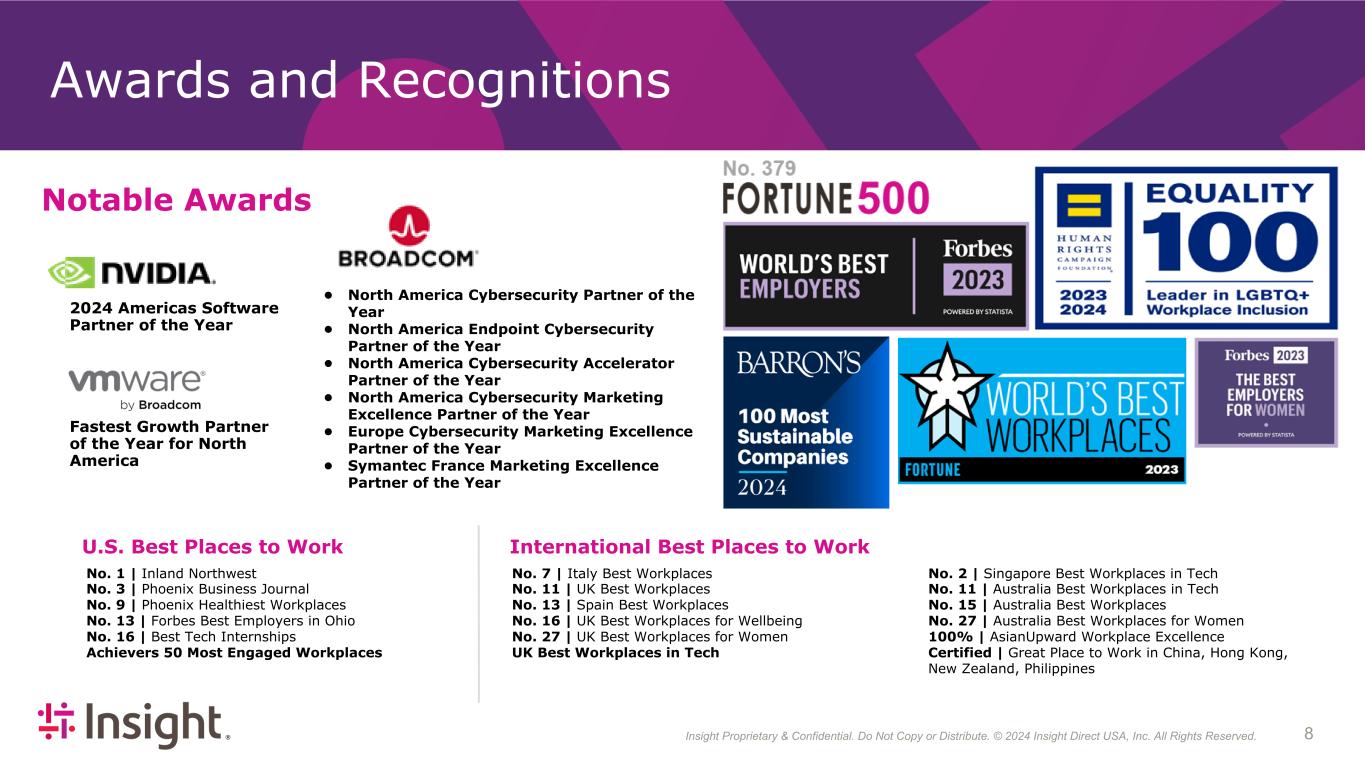

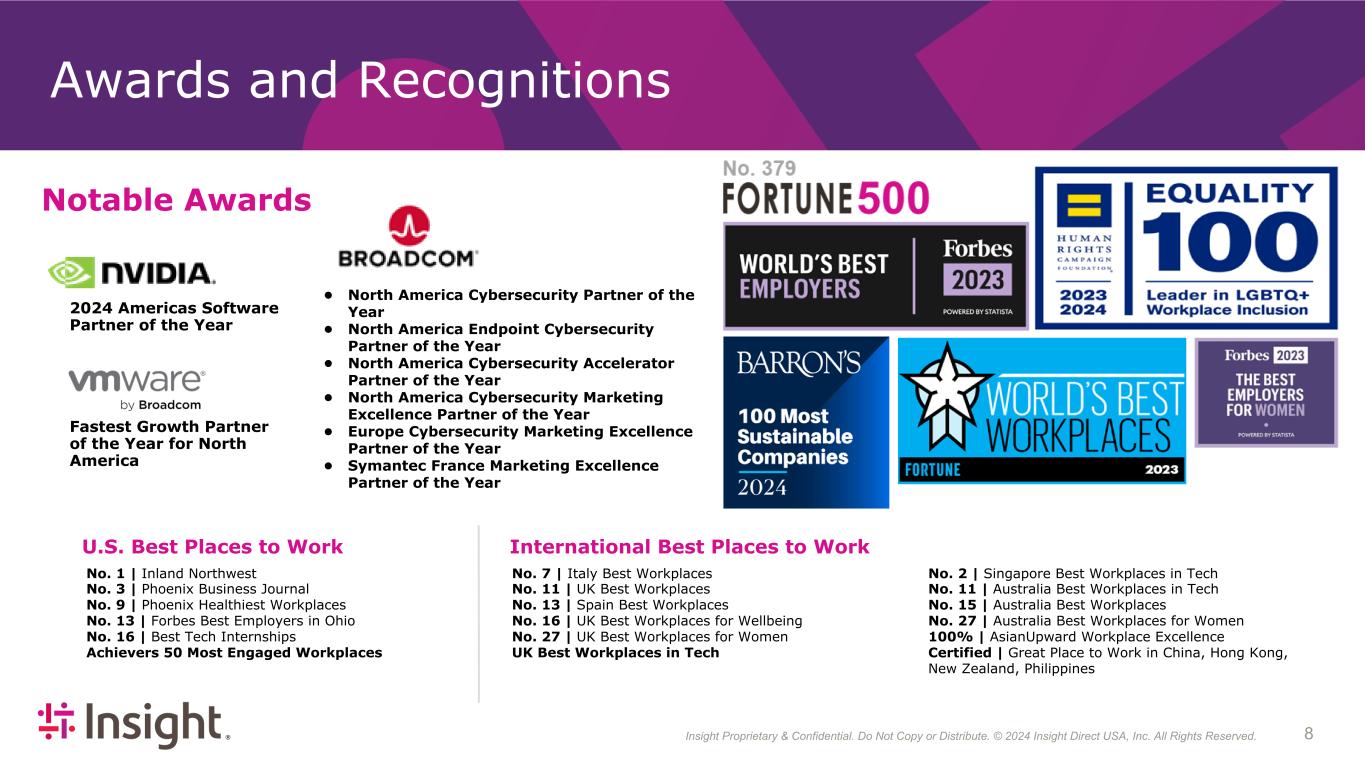

Insight Proprietary & Confidential. Do Not Copy or Distribute. © 2022 Insight Direct USA, Inc. All Rights Reserved. 84 • North America Cybersecurity Partner of the Year • North America Endpoint Cybersecurity Partner of the Year • North America Cybersecurity Accelerator Partner of the Year • North America Cybersecurity Marketing Excellence Partner of the Year • Europe Cybersecurity Marketing Excellence Partner of the Year • Symantec France Marketing Excellence Partner of the Year Awards and Recognitions U.S. Best Places to Work International Best Places to Work No. 1 | Inland Northwest No. 3 | Phoenix Business Journal No. 9 | Phoenix Healthiest Workplaces No. 13 | Forbes Best Employers in Ohio No. 16 | Best Tech Internships Achievers 50 Most Engaged Workplaces No. 7 | Italy Best Workplaces No. 11 | UK Best Workplaces No. 13 | Spain Best Workplaces No. 16 | UK Best Workplaces for Wellbeing No. 27 | UK Best Workplaces for Women UK Best Workplaces in Tech No. 2 | Singapore Best Workplaces in Tech No. 11 | Australia Best Workplaces in Tech No. 15 | Australia Best Workplaces No. 27 | Australia Best Workplaces for Women 100% | AsianUpward Workplace Excellence Certified | Great Place to Work in China, Hong Kong, New Zealand, Philippines Notable Awards 2024 Americas Software Partner of the Year Fastest Growth Partner of the Year for North America

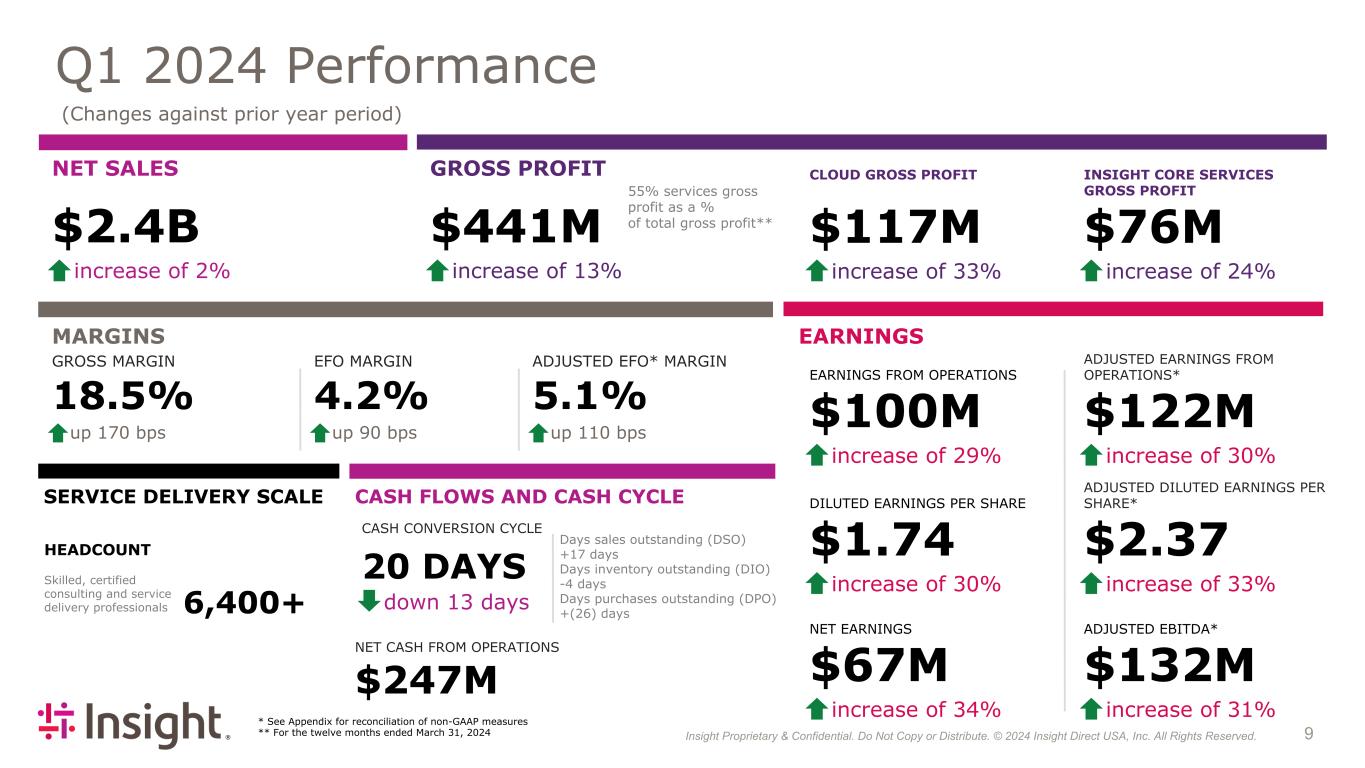

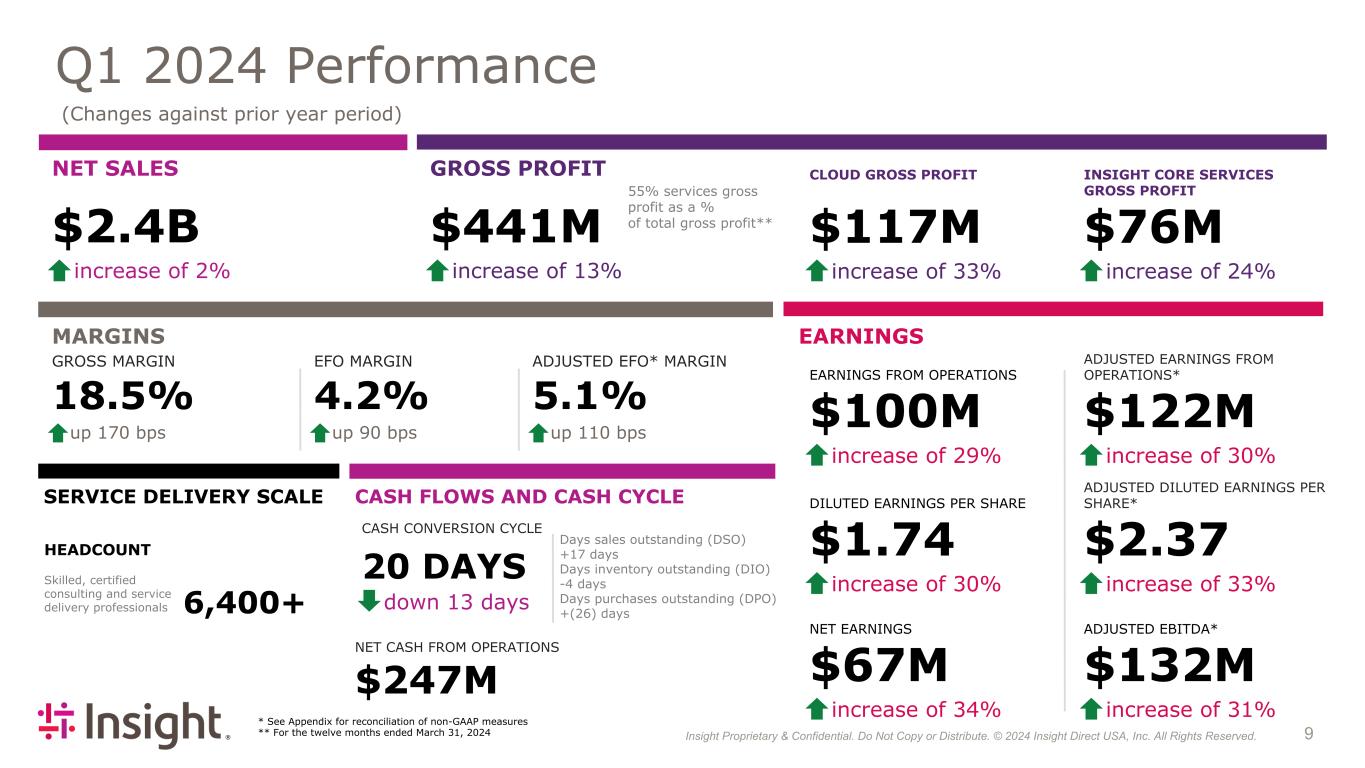

Insight Proprietary & Confidential. Do Not Copy or Distribute. © 2022 Insight Direct USA, Inc. All Rights Reserved. 94 Q1 2024 Performance (Changes against prior year period) * See Appendix for reconciliation of non-GAAP measures ** For the twelve months ended March 31, 2024 NET SALES $2.4B increase of 2% GROSS PROFIT $441M increase of 13% MARGINS GROSS MARGIN 18.5% up 170 bps EFO MARGIN 4.2% up 90 bps ADJUSTED EFO* MARGIN 5.1% up 110 bps EARNINGS CLOUD GROSS PROFIT CLOUD $117M increase of 33% 55% services gross profit as a % of total gross profit** INSIGHT CORE SERVICES GROSS PROFIT $76M increase of 24% EARNINGS FROM OPERATIONS EARNINGS FROM OPERATIONS $100M increase of 29% DILUTED EARNINGS PER SHARE DILUTED EARNINGS PER SHARE $1.74 increase of 30% NET EARNINGS NET EARNINGS $67M increase of 34% ADJUSTED EARNINGS FROM OPERATIONS* $122M increase of 30% ADJUSTED DILUTED EARNINGS PER SHARE* $2.37 increase of 33% ADJUSTED EBITDA* NET EARNINGS ADJUSTED EBITDA* $132M increase of 31% CASH FLOWS AND CASH CYCLE CASH CONVERSION CYCLE 20 DAYS down 13 days Days sales outstanding (DSO) +17 days Days inventory outstanding (DIO) -4 days Days purchases outstanding (DPO) +(26) days NET CASH FROM OPERATIONS $247M SERVICE DELIVERY SCALE HEADCOUNT Skilled, certified consulting and service delivery professionals 6,400+

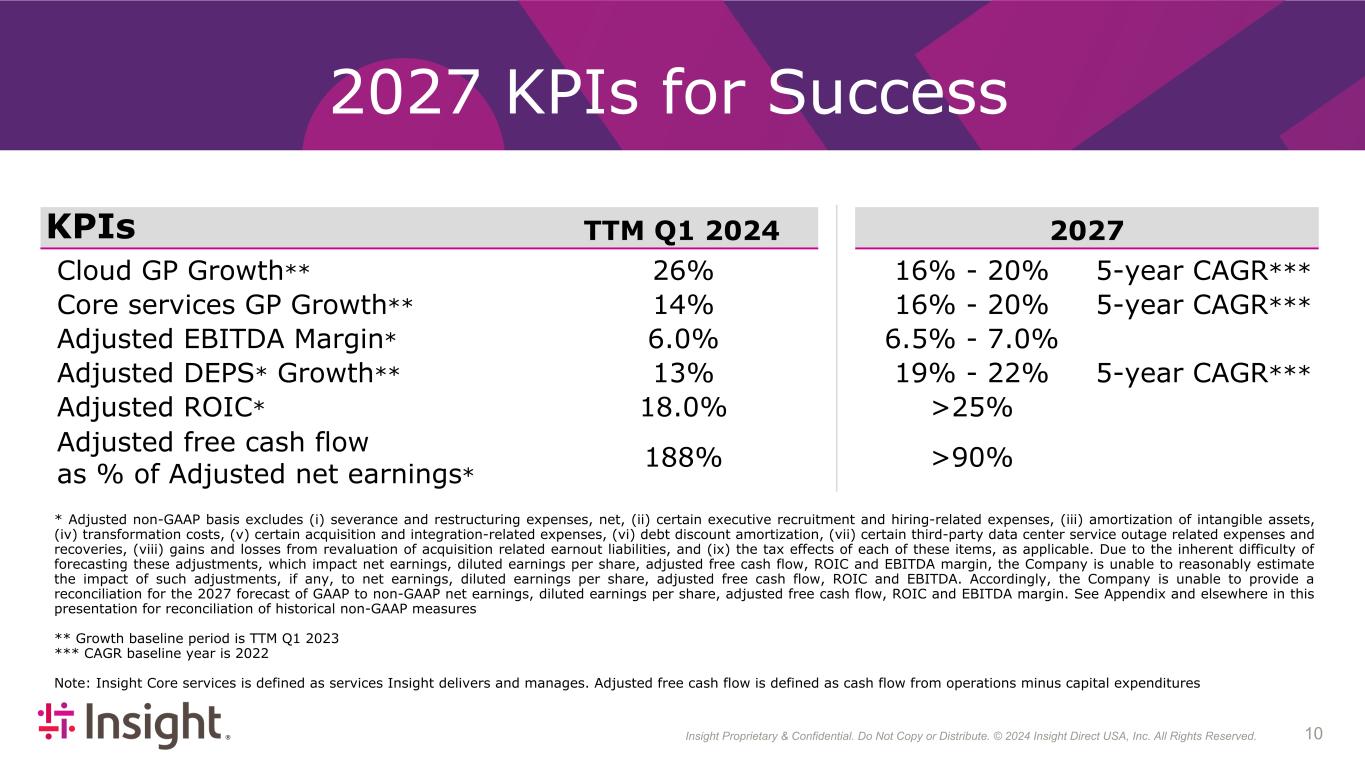

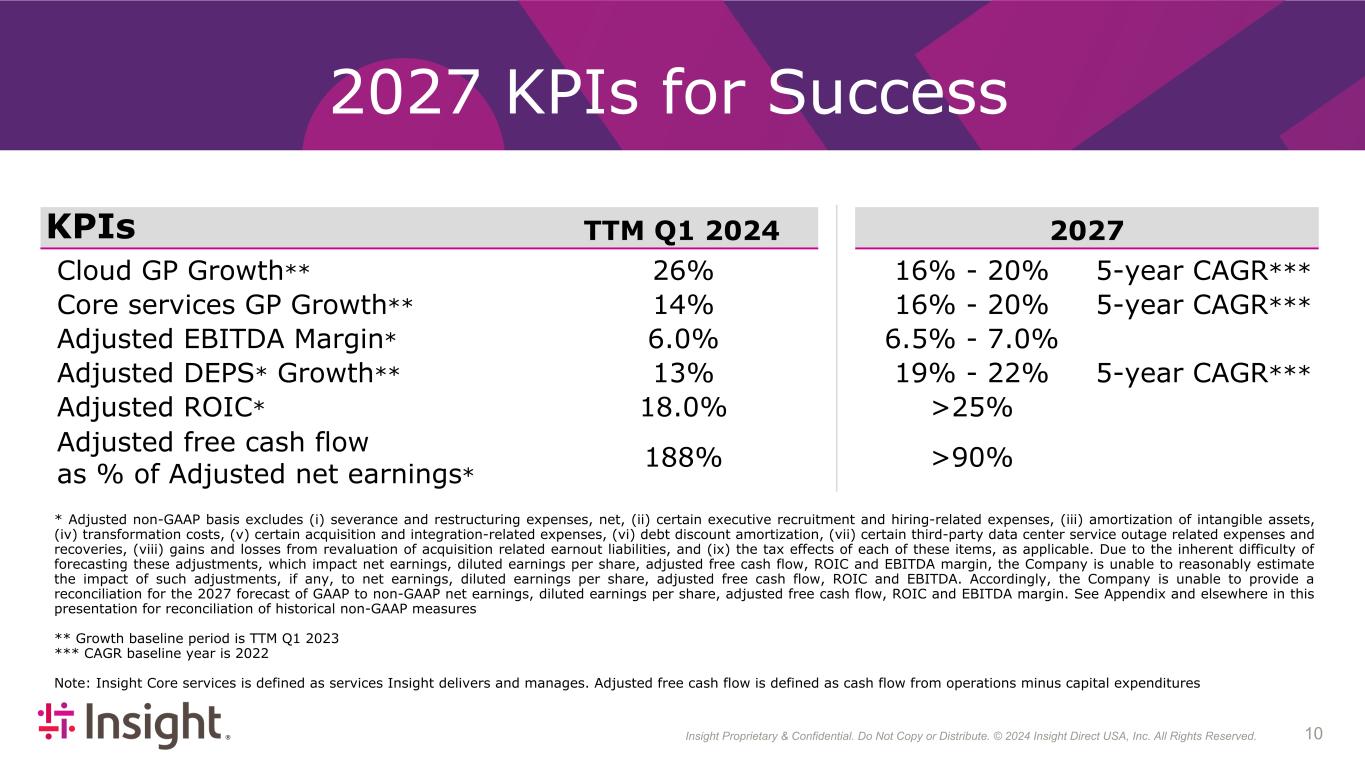

Insight Proprietary & Confidential. Do Not Copy or Distribute. © 2022 Insight Direct USA, Inc. All Rights Reserved. 104 2027 KPIs for Success KPIs TTM Q1 2024 2027 Cloud GP Growth** 26% 16% - 20% 5-year CAGR*** Core services GP Growth** 14% 16% - 20% 5-year CAGR*** Adjusted EBITDA Margin* 6.0% 6.5% - 7.0% Adjusted DEPS* Growth** 13% 19% - 22% 5-year CAGR*** Adjusted ROIC* 18.0% >25% Adjusted free cash flow as % of Adjusted net earnings* 188% >90% * Adjusted non-GAAP basis excludes (i) severance and restructuring expenses, net, (ii) certain executive recruitment and hiring-related expenses, (iii) amortization of intangible assets, (iv) transformation costs, (v) certain acquisition and integration-related expenses, (vi) debt discount amortization, (vii) certain third-party data center service outage related expenses and recoveries, (viii) gains and losses from revaluation of acquisition related earnout liabilities, and (ix) the tax effects of each of these items, as applicable. Due to the inherent difficulty of forecasting these adjustments, which impact net earnings, diluted earnings per share, adjusted free cash flow, ROIC and EBITDA margin, the Company is unable to reasonably estimate the impact of such adjustments, if any, to net earnings, diluted earnings per share, adjusted free cash flow, ROIC and EBITDA. Accordingly, the Company is unable to provide a reconciliation for the 2027 forecast of GAAP to non-GAAP net earnings, diluted earnings per share, adjusted free cash flow, ROIC and EBITDA margin. See Appendix and elsewhere in this presentation for reconciliation of historical non-GAAP measures ** Growth baseline period is TTM Q1 2023 *** CAGR baseline year is 2022 Note: Insight Core services is defined as services Insight delivers and manages. Adjusted free cash flow is defined as cash flow from operations minus capital expenditures

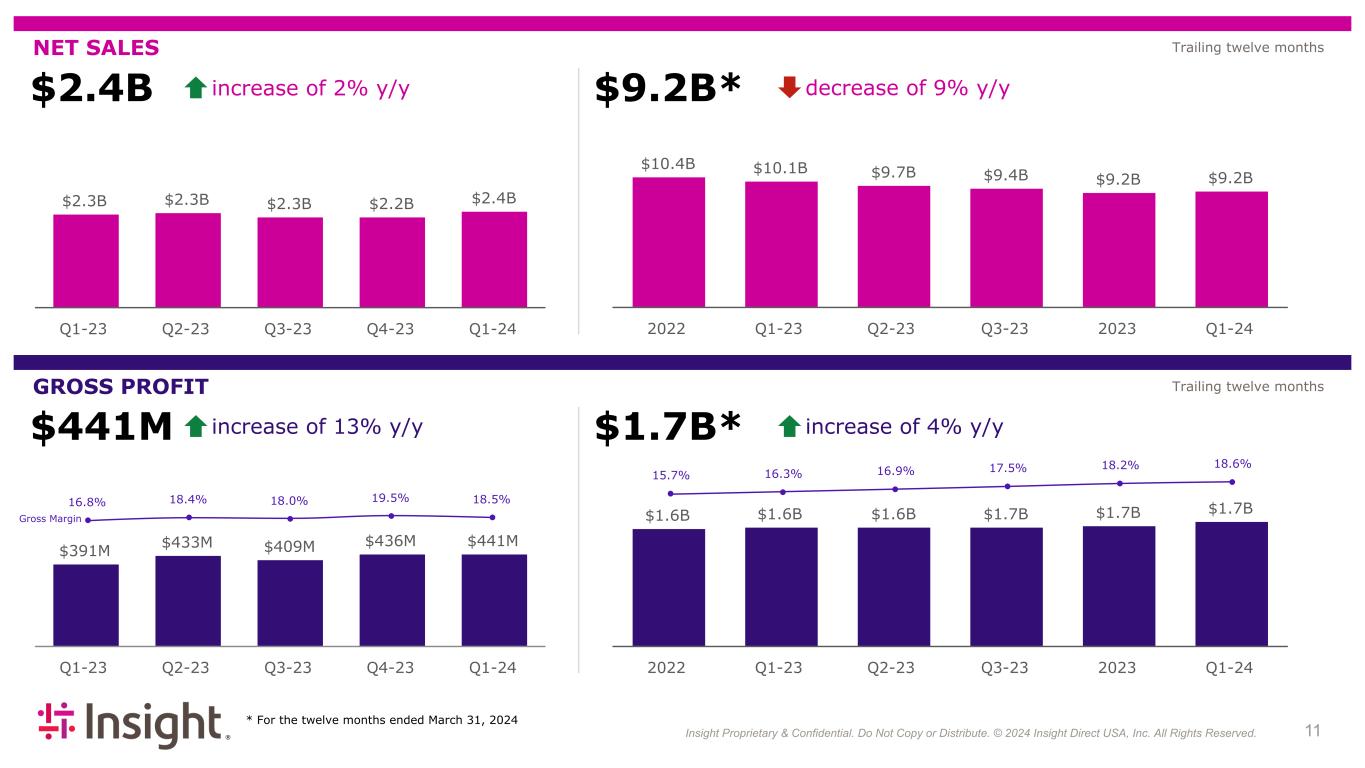

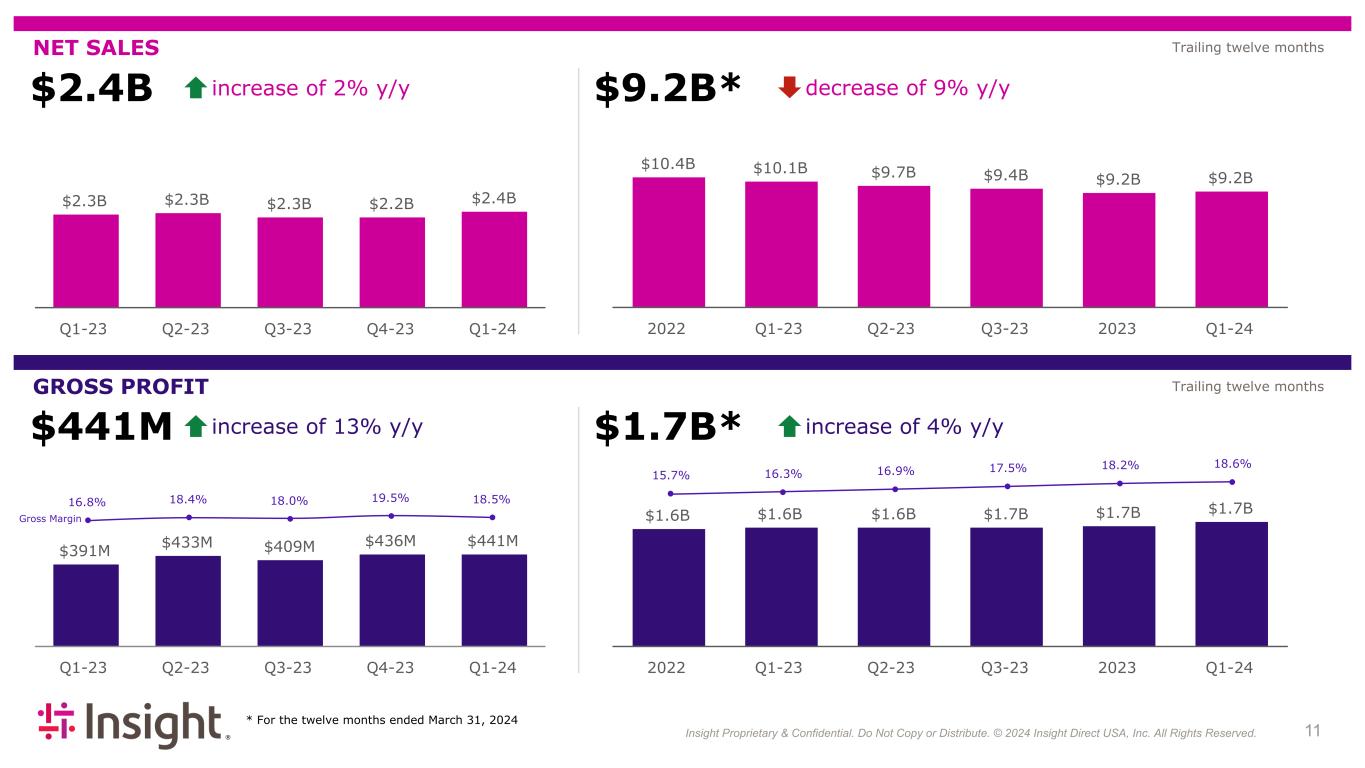

Insight Proprietary & Confidential. Do Not Copy or Distribute. © 2022 Insight Direct USA, Inc. All Rights Reserved. 114 NET SALES GROSS PROFIT * For the twelve months ended March 31, 2024 Trailing twelve months Trailing twelve months $2.4B increase of 2% y/y $2.3B $2.3B $2.3B $2.2B $2.4B Q1-23 Q2-23 Q3-23 Q4-23 Q1-24 $10.4B $10.1B $9.7B $9.4B $9.2B $9.2B 2022 Q1-23 Q2-23 Q3-23 2023 Q1-24 $9.2B* decrease of 9% y/y $441M increase of 13% y/y 16.8% 18.4% 18.0% 19.5% 18.5% $391M $433M $409M $436M $441M Q1-23 Q2-23 Q3-23 Q4-23 Q1-24 $1.7B* increase of 4% y/y 15.7% 16.3% 16.9% 17.5% 18.2% 18.6% $1.6B $1.6B $1.6B $1.7B $1.7B $1.7B 2022 Q1-23 Q2-23 Q3-23 2023 Q1-24 Gross Margin

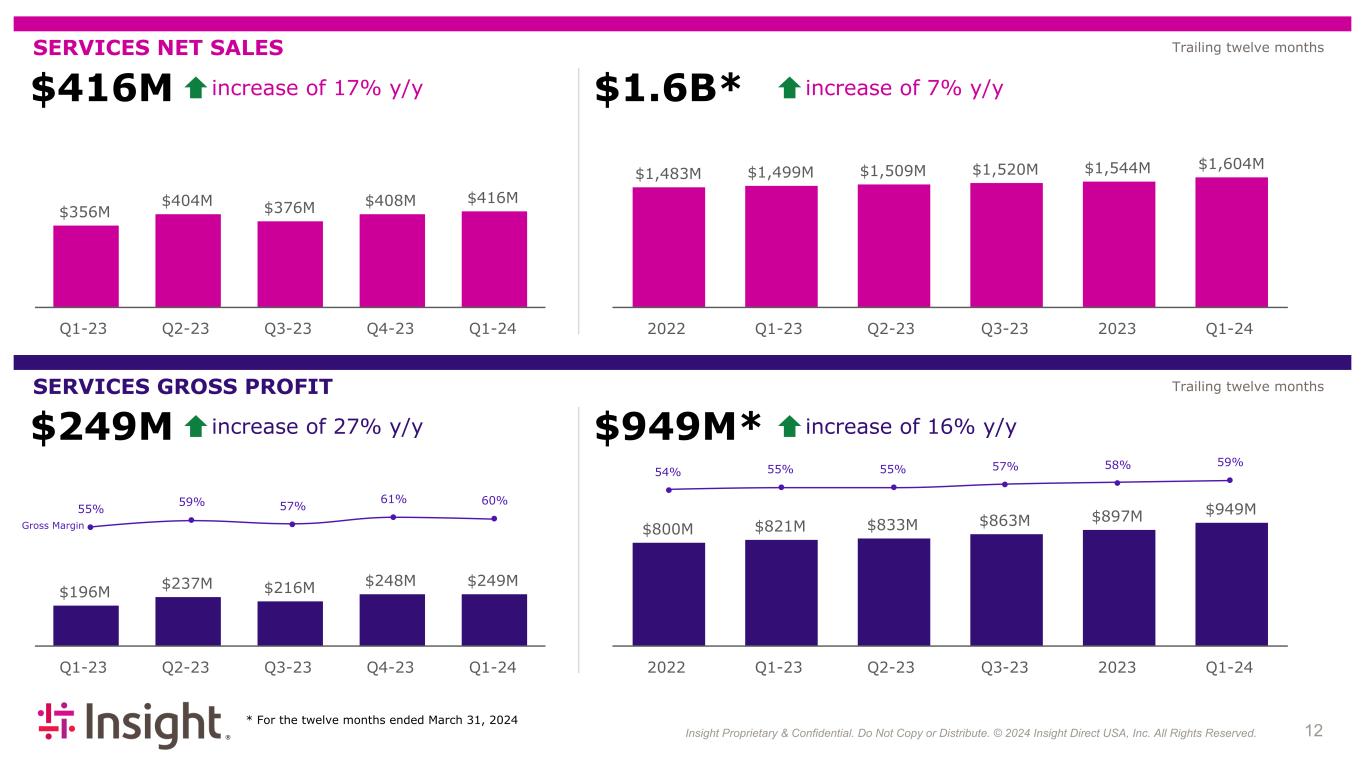

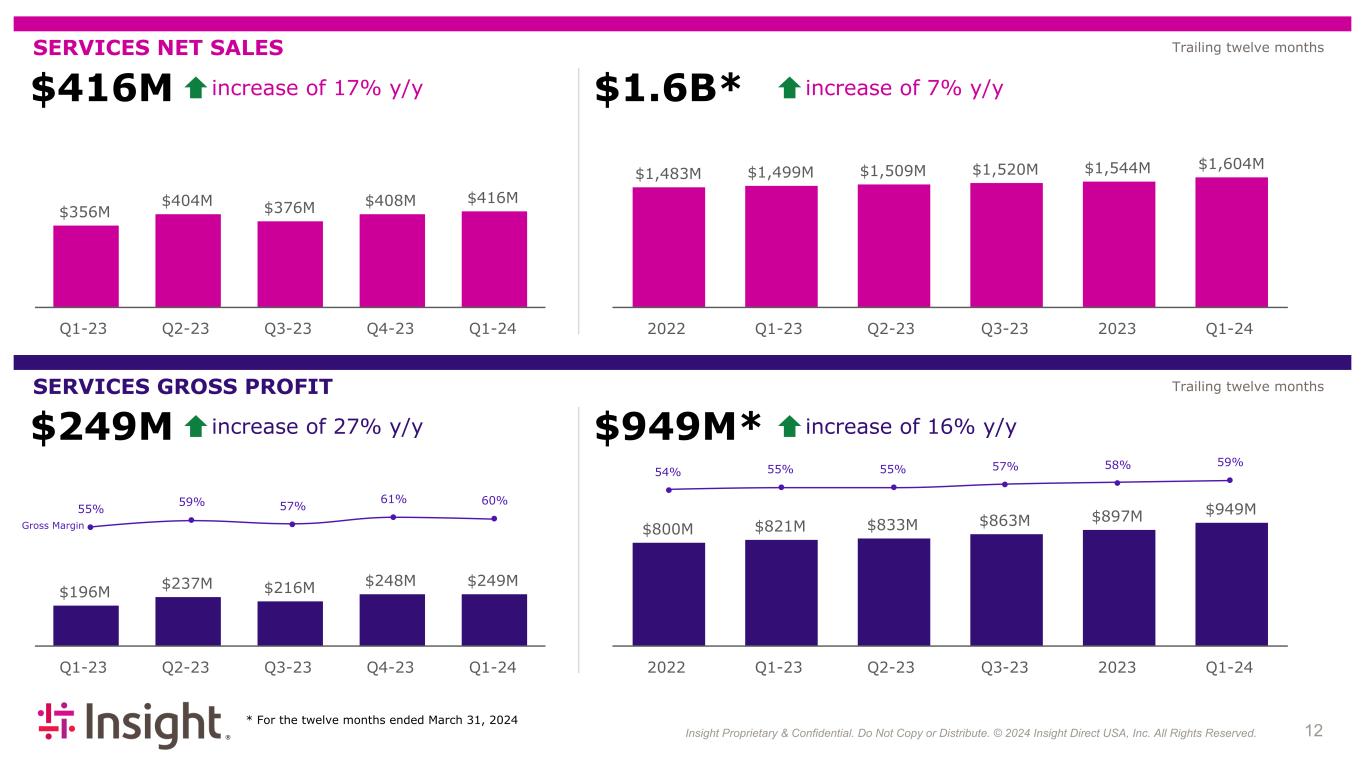

Insight Proprietary & Confidential. Do Not Copy or Distribute. © 2022 Insight Direct USA, Inc. All Rights Reserved. 124 Gross Margin SERVICES NET SALES SERVICES GROSS PROFIT * For the twelve months ended March 31, 2024 Trailing twelve months Trailing twelve months $416M increase of 17% y/y $356M $404M $376M $408M $416M Q1-23 Q2-23 Q3-23 Q4-23 Q1-24 $1,483M $1,499M $1,509M $1,520M $1,544M $1,604M 2022 Q1-23 Q2-23 Q3-23 2023 Q1-24 $1.6B* increase of 7% y/y $196M $237M $216M $248M $249M Q1-23 Q2-23 Q3-23 Q4-23 Q1-24 55% 59% 57% 61% 60% $249M increase of 27% y/y $800M $821M $833M $863M $897M $949M 2022 Q1-23 Q2-23 Q3-23 2023 Q1-24 $949M* increase of 16% y/y 54% 55% 55% 57% 58% 59%

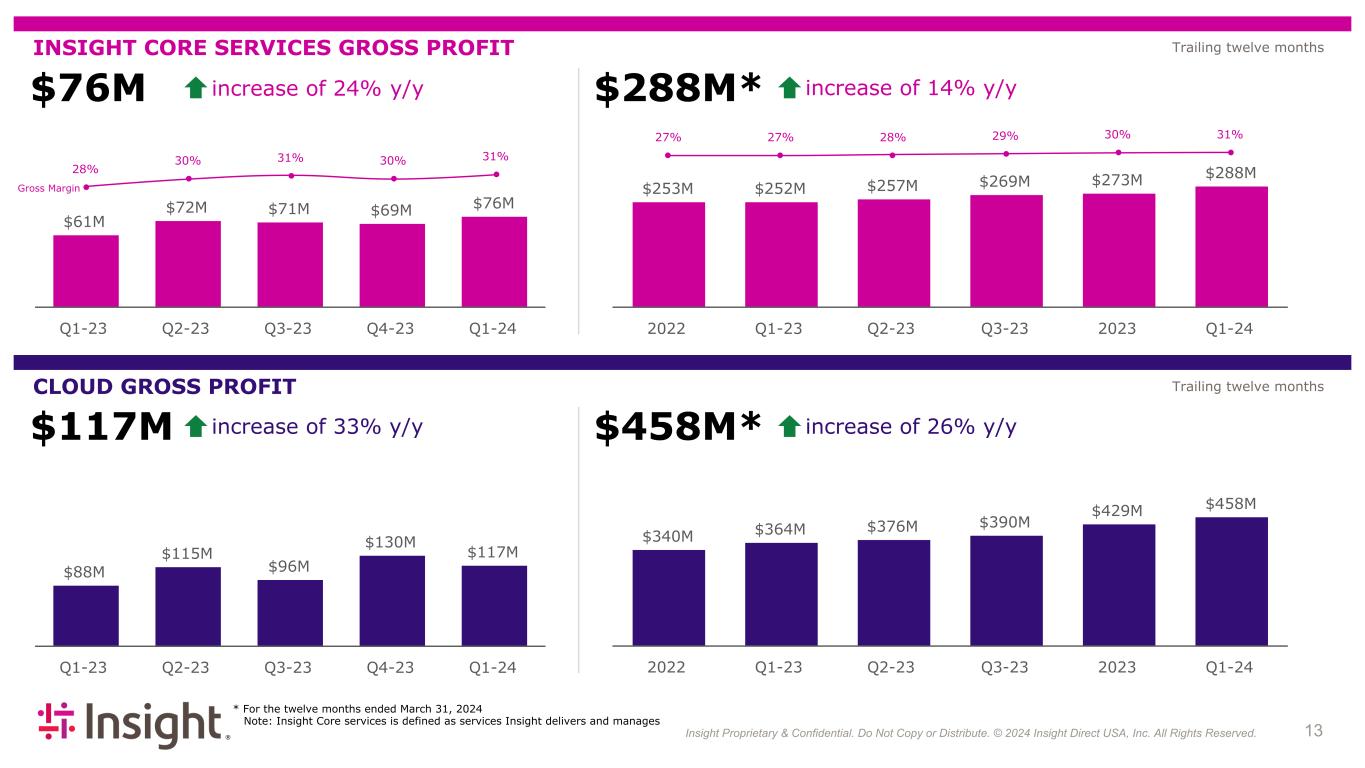

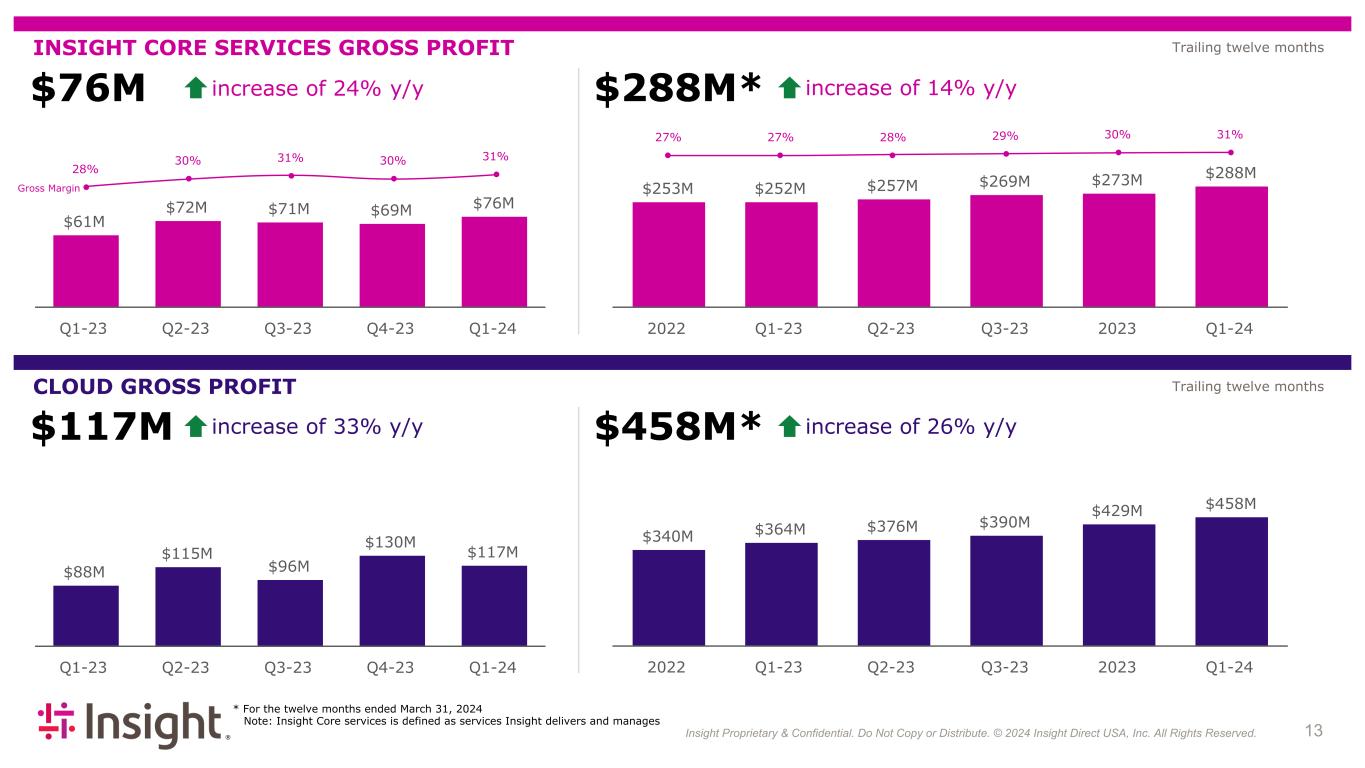

Insight Proprietary & Confidential. Do Not Copy or Distribute. © 2022 Insight Direct USA, Inc. All Rights Reserved. 134 INSIGHT CORE SERVICES GROSS PROFIT CLOUD GROSS PROFIT * For the twelve months ended March 31, 2024 Note: Insight Core services is defined as services Insight delivers and manages Trailing twelve months Trailing twelve months $61M $72M $71M $69M $76M Q1-23 Q2-23 Q3-23 Q4-23 Q1-24 28% 30% 31% 30% 31% $76M increase of 24% y/y Gross Margin $253M $252M $257M $269M $273M $288M 2022 Q1-23 Q2-23 Q3-23 2023 Q1-24 27% 27% 28% 29% 30% 31% $288M* increase of 14% y/y $88M $115M $96M $130M $117M Q1-23 Q2-23 Q3-23 Q4-23 Q1-24 $340M $364M $376M $390M $429M $458M 2022 Q1-23 Q2-23 Q3-23 2023 Q1-24 $117M increase of 33% y/y $458M* increase of 26% y/y

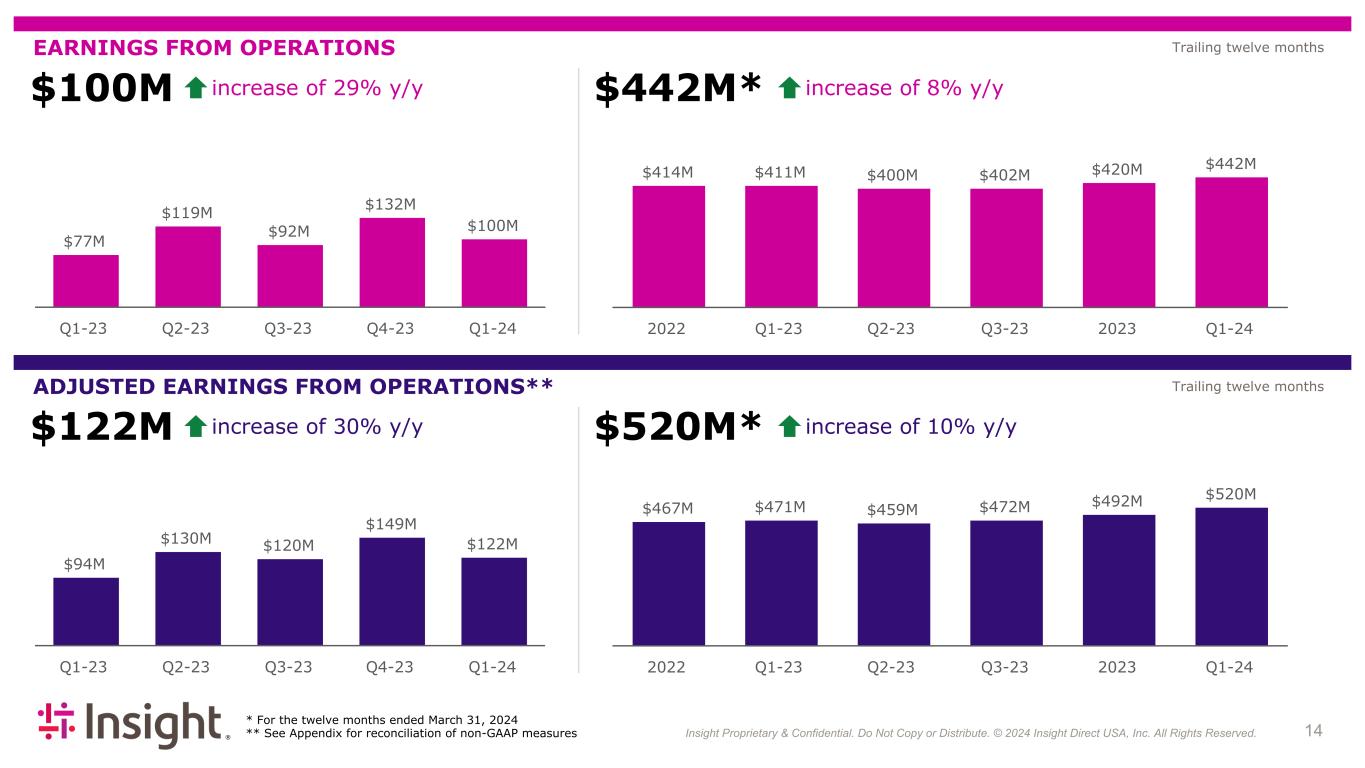

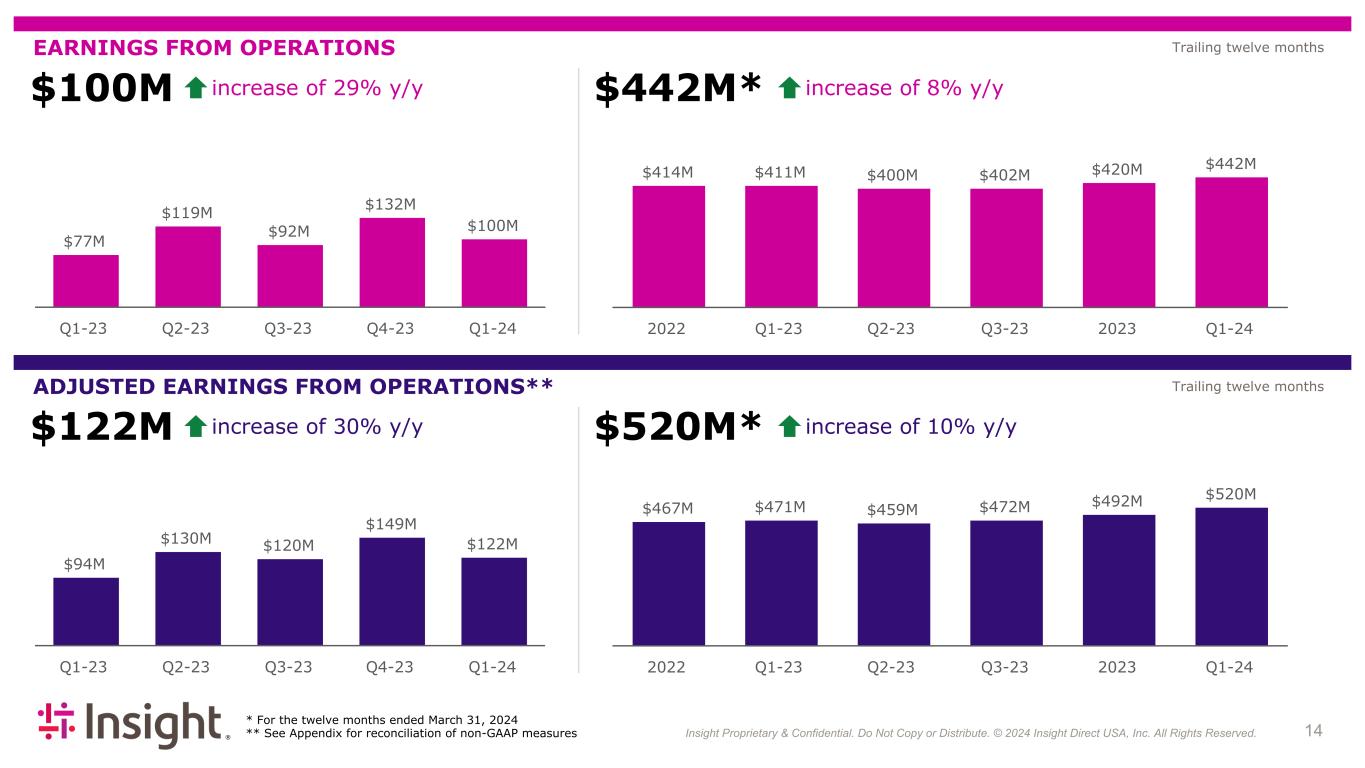

Insight Proprietary & Confidential. Do Not Copy or Distribute. © 2022 Insight Direct USA, Inc. All Rights Reserved. 144 EARNINGS FROM OPERATIONS ADJUSTED EARNINGS FROM OPERATIONS** * For the twelve months ended March 31, 2024 ** See Appendix for reconciliation of non-GAAP measures Trailing twelve months Trailing twelve months $77M $119M $92M $132M $100M Q1-23 Q2-23 Q3-23 Q4-23 Q1-24 $414M $411M $400M $402M $420M $442M 2022 Q1-23 Q2-23 Q3-23 2023 Q1-24 $100M increase of 29% y/y $442M* increase of 8% y/y $94M $130M $120M $149M $122M Q1-23 Q2-23 Q3-23 Q4-23 Q1-24 $122M increase of 30% y/y $467M $471M $459M $472M $492M $520M 2022 Q1-23 Q2-23 Q3-23 2023 Q1-24 $520M* increase of 10% y/y

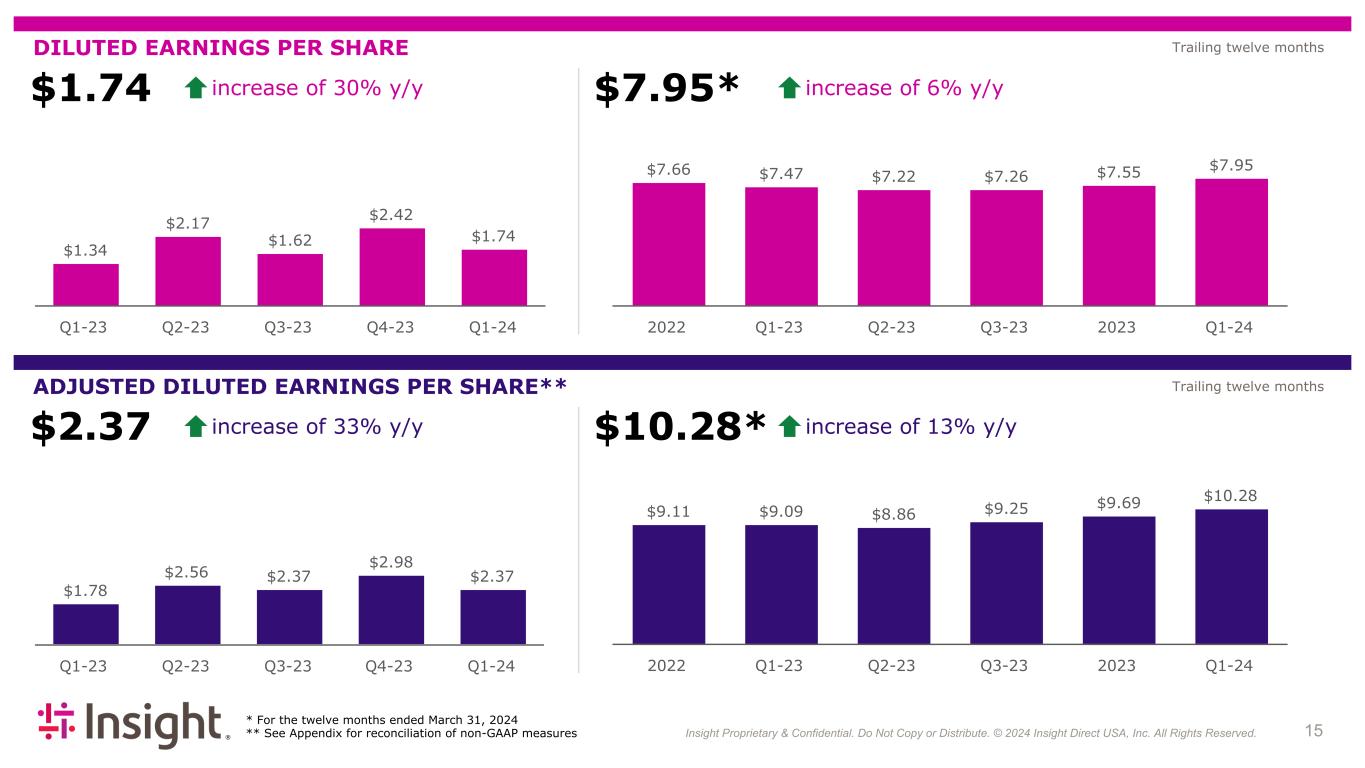

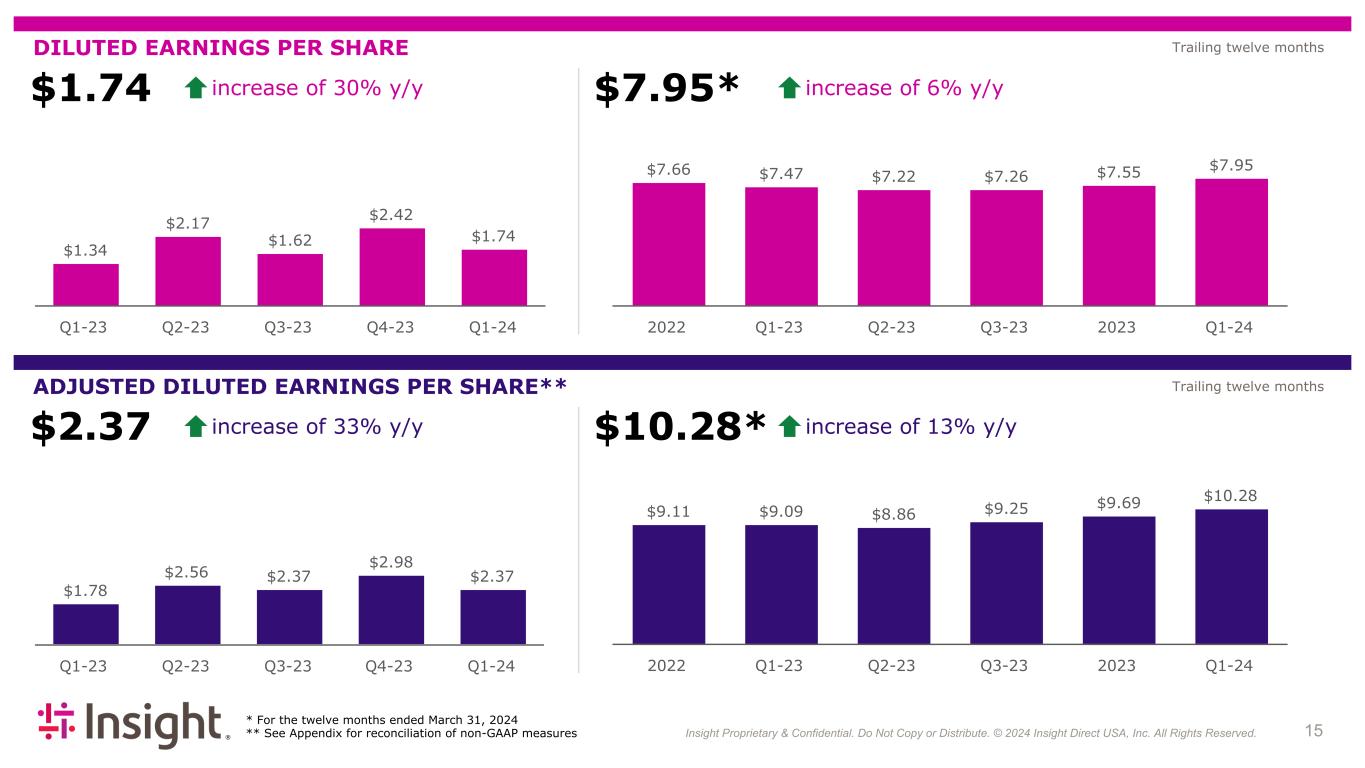

Insight Proprietary & Confidential. Do Not Copy or Distribute. © 2022 Insight Direct USA, Inc. All Rights Reserved. 154 DILUTED EARNINGS PER SHARE ADJUSTED DILUTED EARNINGS PER SHARE** * For the twelve months ended March 31, 2024 ** See Appendix for reconciliation of non-GAAP measures Trailing twelve months Trailing twelve months $1.34 $2.17 $1.62 $2.42 $1.74 Q1-23 Q2-23 Q3-23 Q4-23 Q1-24 $7.66 $7.47 $7.22 $7.26 $7.55 $7.95 2022 Q1-23 Q2-23 Q3-23 2023 Q1-24 $1.78 $2.56 $2.37 $2.98 $2.37 Q1-23 Q2-23 Q3-23 Q4-23 Q1-24 $9.11 $9.09 $8.86 $9.25 $9.69 $10.28 2022 Q1-23 Q2-23 Q3-23 2023 Q1-24 $1.74 increase of 30% y/y $7.95* increase of 6% y/y $2.37 increase of 33% y/y $10.28* increase of 13% y/y

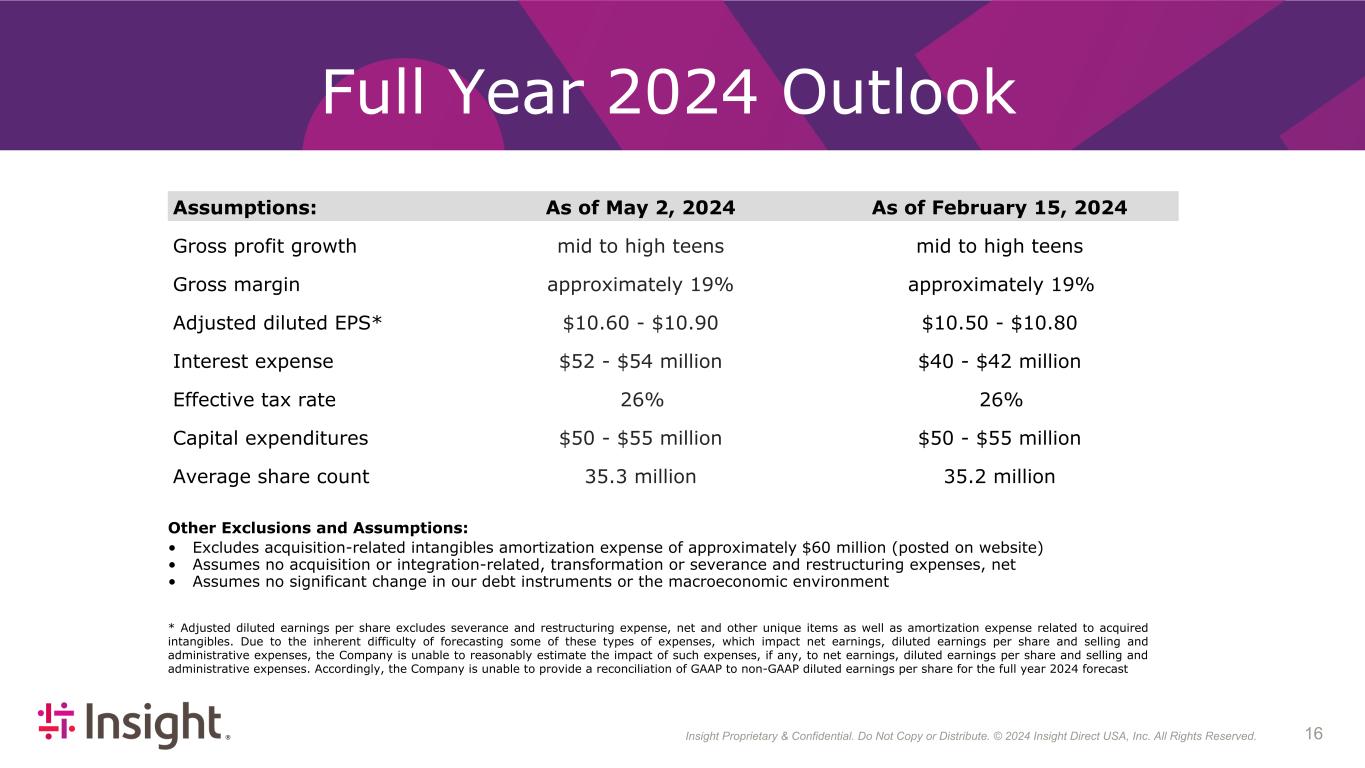

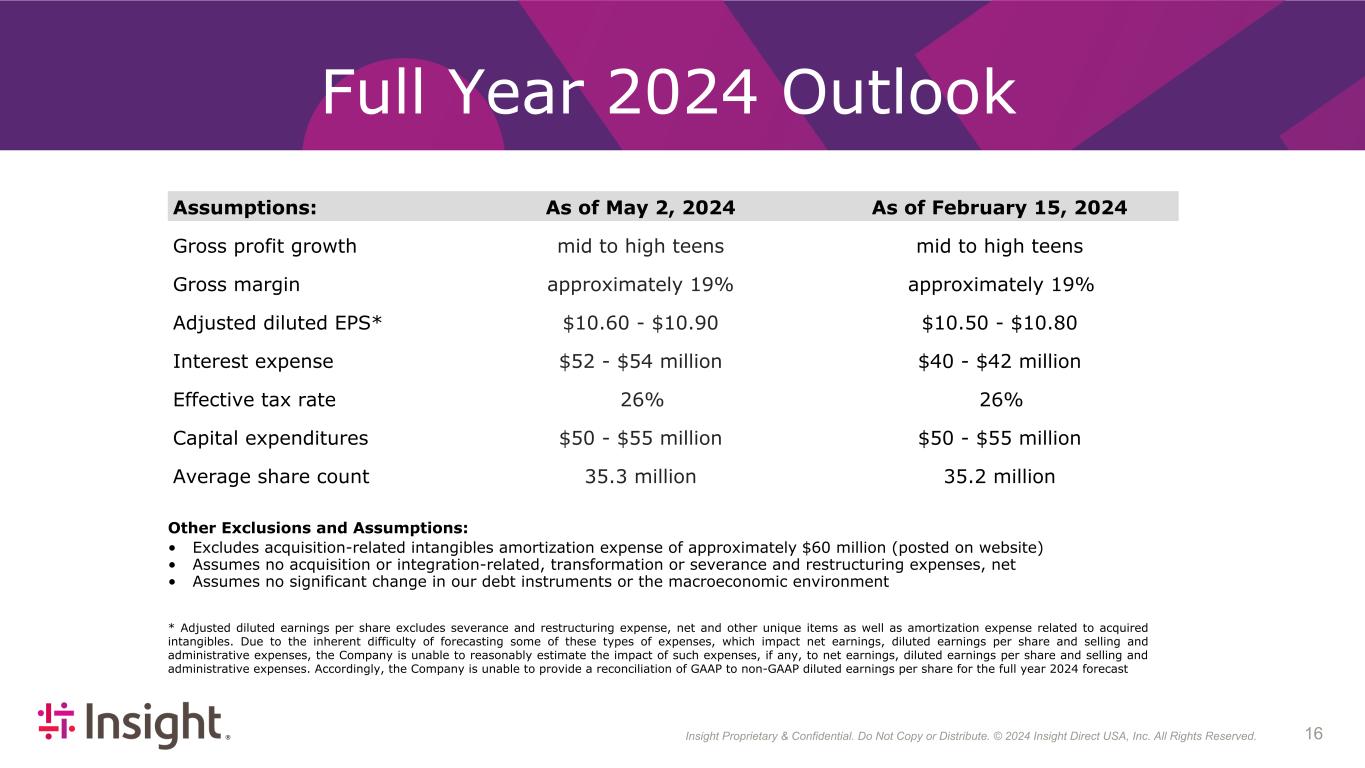

Insight Proprietary & Confidential. Do Not Copy or Distribute. © 2022 Insight Direct USA, Inc. All Rights Reserved. 164 Full Year 2024 Outlook Assumptions: As of May 2, 2024 As of February 15, 2024 Gross profit growth mid to high teens mid to high teens Gross margin approximately 19% approximately 19% Adjusted diluted EPS* $10.60 - $10.90 $10.50 - $10.80 Interest expense $52 - $54 million $40 - $42 million Effective tax rate 26% 26% Capital expenditures $50 - $55 million $50 - $55 million Average share count 35.3 million 35.2 million Other Exclusions and Assumptions: • Excludes acquisition-related intangibles amortization expense of approximately $60 million (posted on website) • Assumes no acquisition or integration-related, transformation or severance and restructuring expenses, net • Assumes no significant change in our debt instruments or the macroeconomic environment * Adjusted diluted earnings per share excludes severance and restructuring expense, net and other unique items as well as amortization expense related to acquired intangibles. Due to the inherent difficulty of forecasting some of these types of expenses, which impact net earnings, diluted earnings per share and selling and administrative expenses, the Company is unable to reasonably estimate the impact of such expenses, if any, to net earnings, diluted earnings per share and selling and administrative expenses. Accordingly, the Company is unable to provide a reconciliation of GAAP to non-GAAP diluted earnings per share for the full year 2024 forecast

Insight Proprietary & Confidential. Do Not Copy or Distribute. © 2024 Insight Direct USA, Inc. All Rights Reserved. 17 Appendix

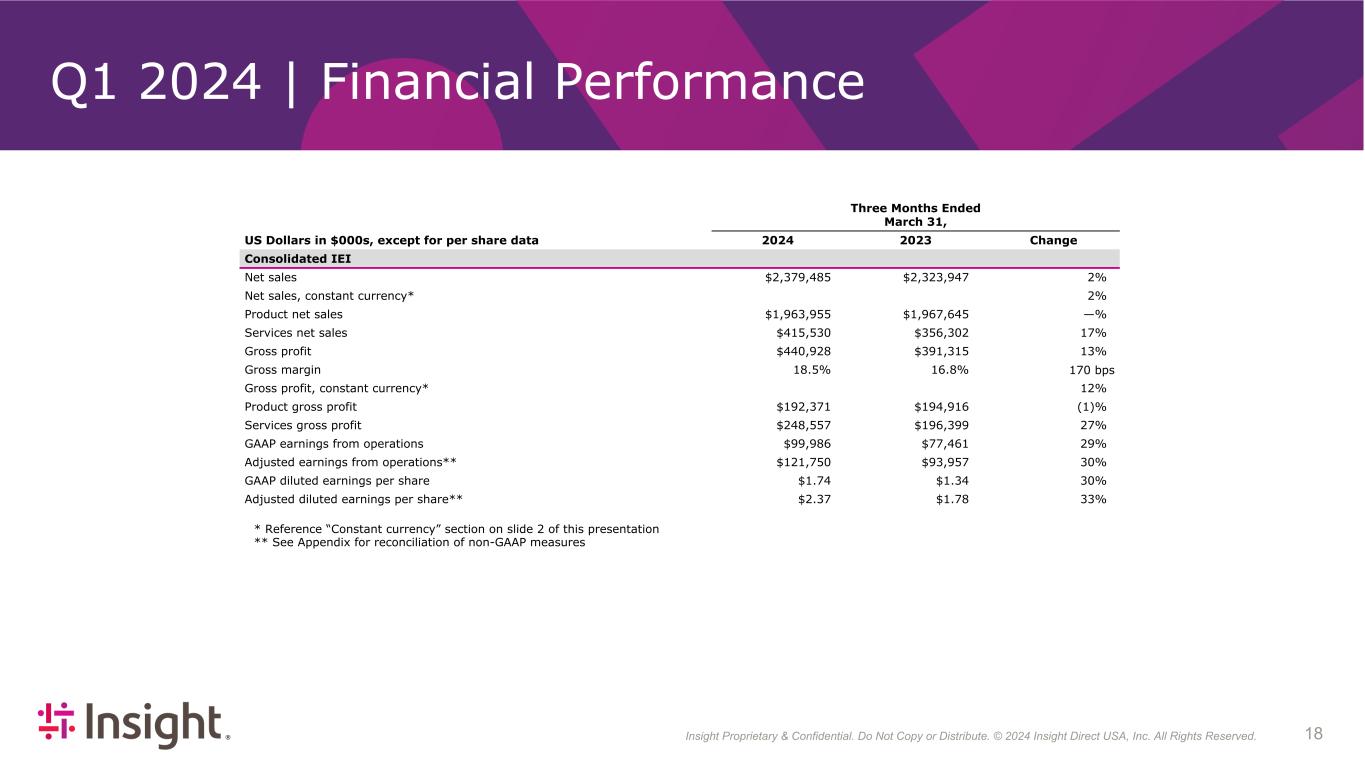

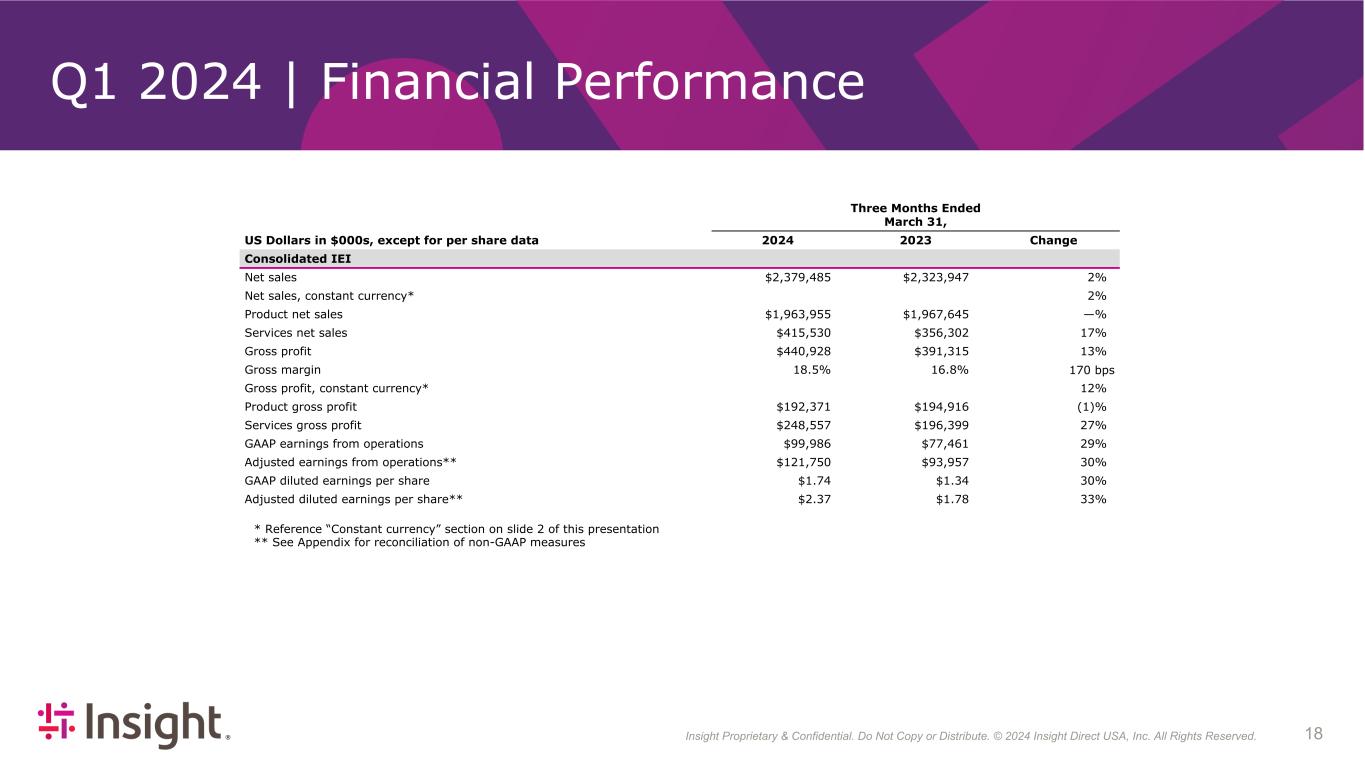

Insight Proprietary & Confidential. Do Not Copy or Distribute. © 2022 Insight Direct USA, Inc. All Rights Reserved. 184 Q1 2024 | Financial Performance Three Months Ended March 31, US Dollars in $000s, except for per share data 2024 2023 Change Consolidated IEI Net sales $2,379,485 $2,323,947 2 % Net sales, constant currency* 2 % Product net sales $1,963,955 $1,967,645 — % Services net sales $415,530 $356,302 17 % Gross profit $440,928 $391,315 13 % Gross margin 18.5 % 16.8 % 170 bps Gross profit, constant currency* 12 % Product gross profit $192,371 $194,916 (1) % Services gross profit $248,557 $196,399 27 % GAAP earnings from operations $99,986 $77,461 29 % Adjusted earnings from operations** $121,750 $93,957 30 % GAAP diluted earnings per share $1.74 $1.34 30 % Adjusted diluted earnings per share** $2.37 $1.78 33 % * Reference “Constant currency” section on slide 2 of this presentation ** See Appendix for reconciliation of non-GAAP measures

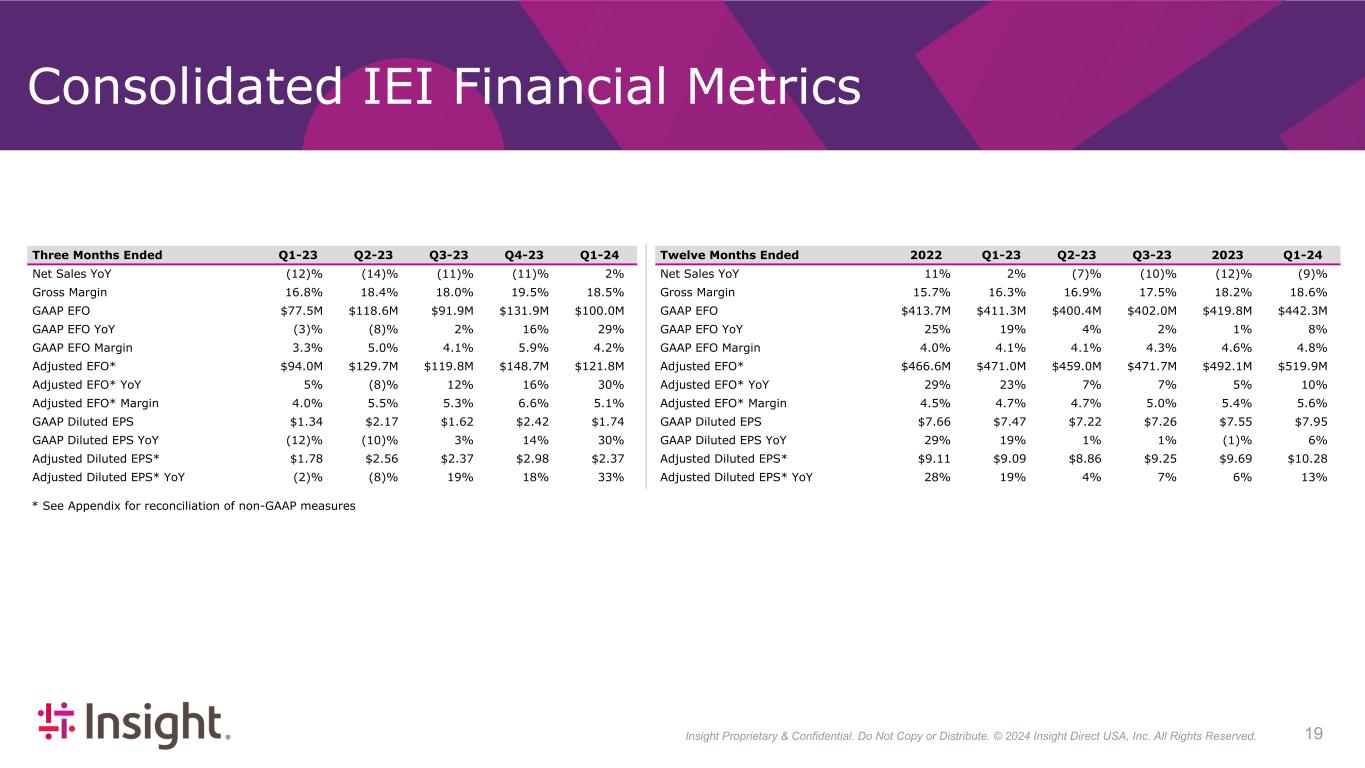

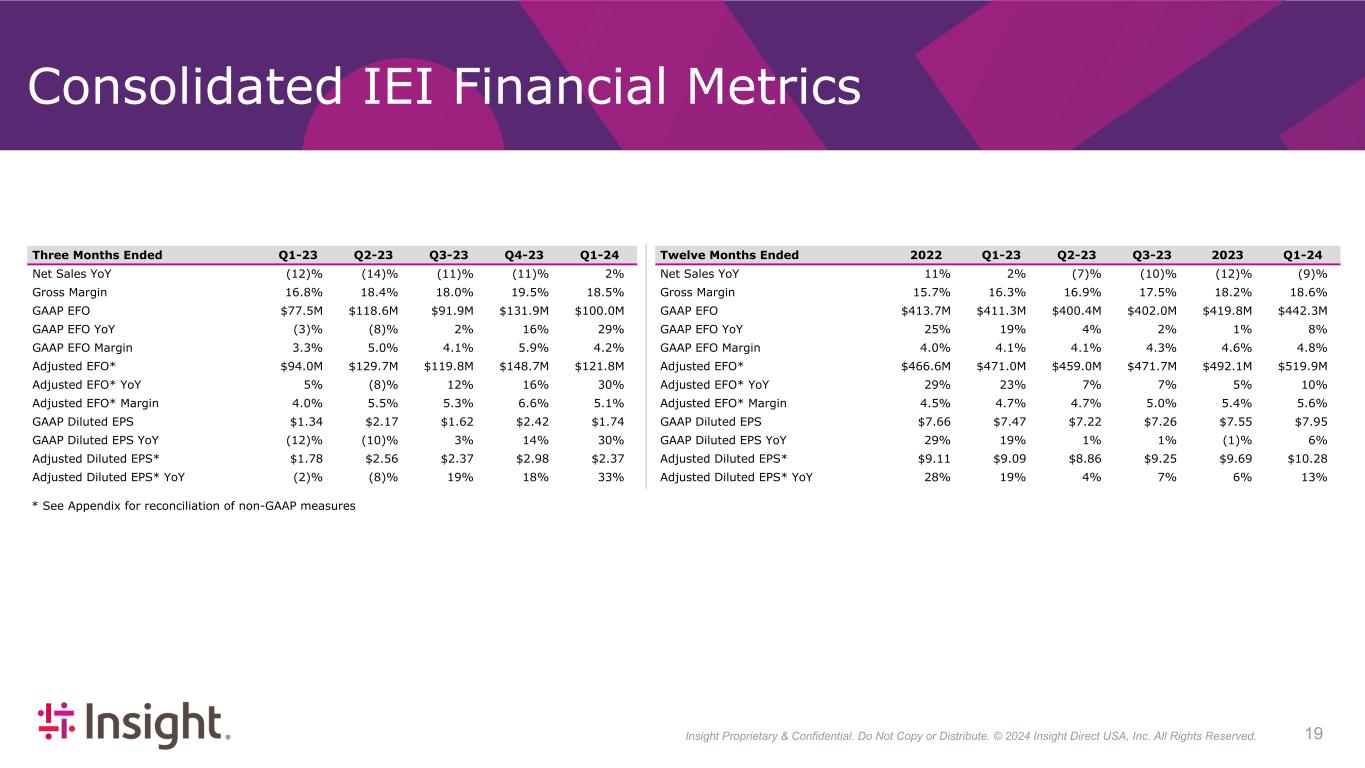

Insight Proprietary & Confidential. Do Not Copy or Distribute. © 2022 Insight Direct USA, Inc. All Rights Reserved. 194 * See Appendix for reconciliation of non-GAAP measures Consolidated IEI Financial Metrics Three Months Ended Q1-23 Q2-23 Q3-23 Q4-23 Q1-24 Net Sales YoY (12) % (14) % (11) % (11) % 2 % Gross Margin 16.8 % 18.4 % 18.0 % 19.5 % 18.5 % GAAP EFO $77.5M $118.6M $91.9M $131.9M $100.0M GAAP EFO YoY (3) % (8) % 2 % 16 % 29 % GAAP EFO Margin 3.3 % 5.0 % 4.1 % 5.9 % 4.2 % Adjusted EFO* $94.0M $129.7M $119.8M $148.7M $121.8M Adjusted EFO* YoY 5 % (8) % 12 % 16 % 30 % Adjusted EFO* Margin 4.0 % 5.5 % 5.3 % 6.6 % 5.1 % GAAP Diluted EPS $1.34 $2.17 $1.62 $2.42 $1.74 GAAP Diluted EPS YoY (12) % (10) % 3 % 14 % 30 % Adjusted Diluted EPS* $1.78 $2.56 $2.37 $2.98 $2.37 Adjusted Diluted EPS* YoY (2) % (8) % 19 % 18 % 33 % Twelve Months Ended 2022 Q1-23 Q2-23 Q3-23 2023 Q1-24 Net Sales YoY 11 % 2 % (7) % (10) % (12) % (9) % Gross Margin 15.7 % 16.3 % 16.9 % 17.5 % 18.2 % 18.6 % GAAP EFO $413.7M $411.3M $400.4M $402.0M $419.8M $442.3M GAAP EFO YoY 25 % 19 % 4 % 2 % 1 % 8 % GAAP EFO Margin 4.0 % 4.1 % 4.1 % 4.3 % 4.6 % 4.8 % Adjusted EFO* $466.6M $471.0M $459.0M $471.7M $492.1M $519.9M Adjusted EFO* YoY 29 % 23 % 7 % 7 % 5 % 10 % Adjusted EFO* Margin 4.5 % 4.7 % 4.7 % 5.0 % 5.4 % 5.6 % GAAP Diluted EPS $7.66 $7.47 $7.22 $7.26 $7.55 $7.95 GAAP Diluted EPS YoY 29 % 19 % 1 % 1 % (1) % 6 % Adjusted Diluted EPS* $9.11 $9.09 $8.86 $9.25 $9.69 $10.28 Adjusted Diluted EPS* YoY 28 % 19 % 4 % 7 % 6 % 13 %

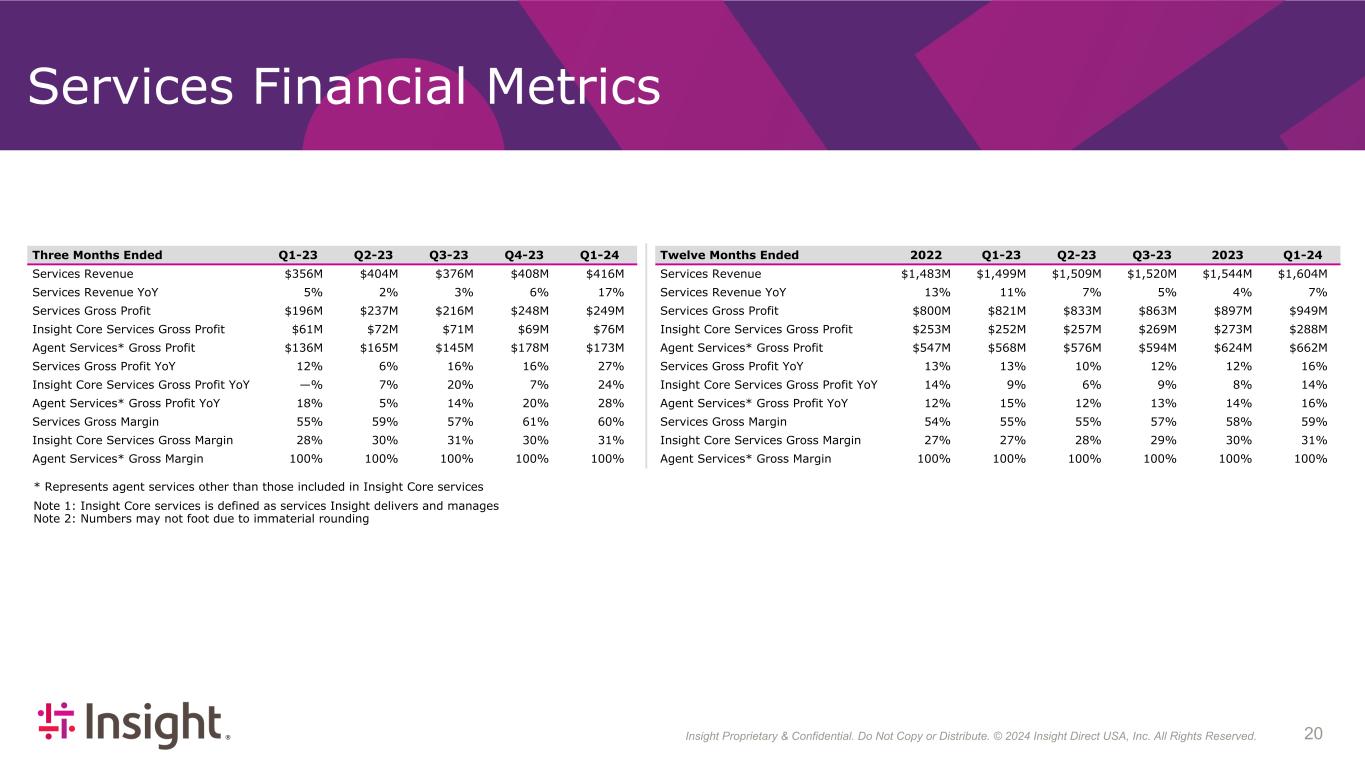

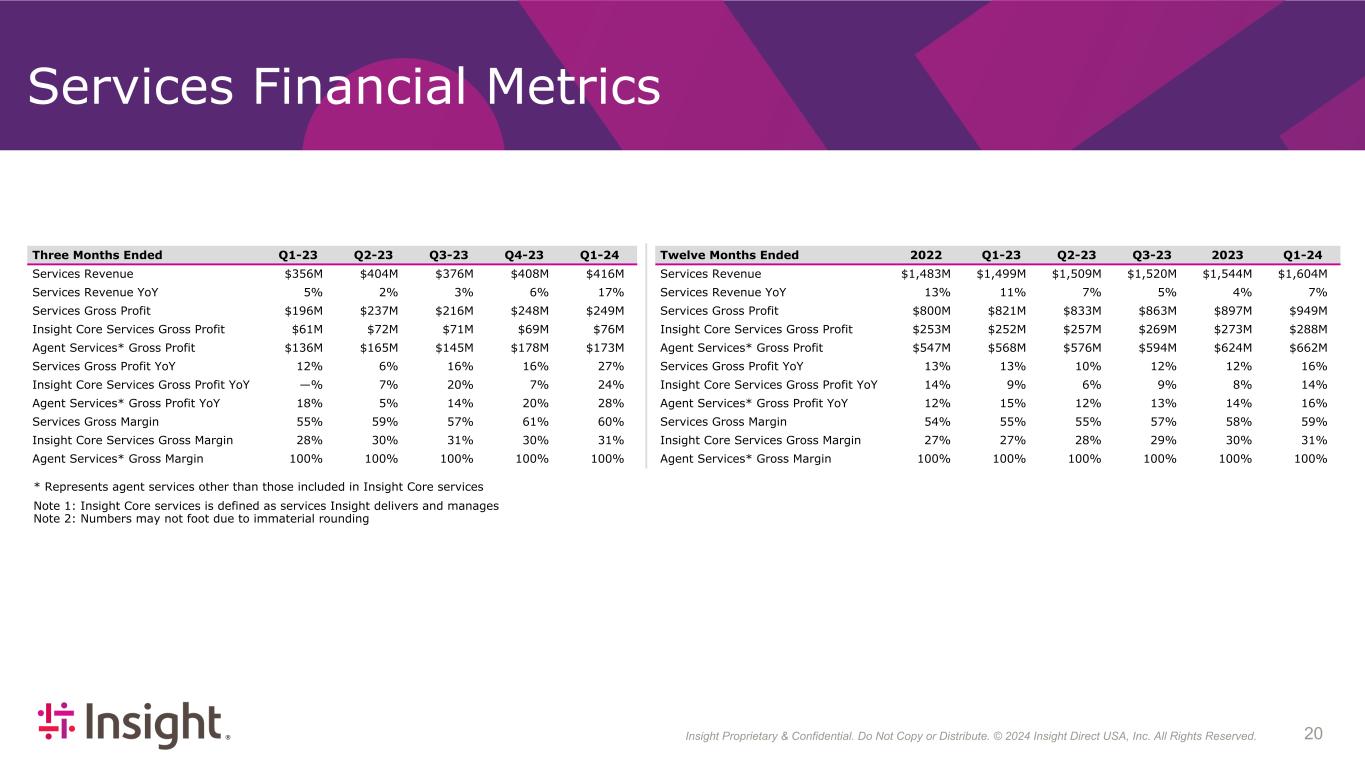

Insight Proprietary & Confidential. Do Not Copy or Distribute. © 2022 Insight Direct USA, Inc. All Rights Reserved. 204 Services Financial Metrics Three Months Ended Q1-23 Q2-23 Q3-23 Q4-23 Q1-24 Services Revenue $356M $404M $376M $408M $416M Services Revenue YoY 5% 2% 3% 6% 17% Services Gross Profit $196M $237M $216M $248M $249M Insight Core Services Gross Profit $61M $72M $71M $69M $76M Agent Services* Gross Profit $136M $165M $145M $178M $173M Services Gross Profit YoY 12% 6% 16% 16% 27% Insight Core Services Gross Profit YoY —% 7% 20% 7% 24% Agent Services* Gross Profit YoY 18% 5% 14% 20% 28% Services Gross Margin 55% 59% 57% 61% 60% Insight Core Services Gross Margin 28% 30% 31% 30% 31% Agent Services* Gross Margin 100% 100% 100% 100% 100% Twelve Months Ended 2022 Q1-23 Q2-23 Q3-23 2023 Q1-24 Services Revenue $1,483M $1,499M $1,509M $1,520M $1,544M $1,604M Services Revenue YoY 13% 11% 7% 5% 4% 7% Services Gross Profit $800M $821M $833M $863M $897M $949M Insight Core Services Gross Profit $253M $252M $257M $269M $273M $288M Agent Services* Gross Profit $547M $568M $576M $594M $624M $662M Services Gross Profit YoY 13% 13% 10% 12% 12% 16% Insight Core Services Gross Profit YoY 14% 9% 6% 9% 8% 14% Agent Services* Gross Profit YoY 12% 15% 12% 13% 14% 16% Services Gross Margin 54% 55% 55% 57% 58% 59% Insight Core Services Gross Margin 27% 27% 28% 29% 30% 31% Agent Services* Gross Margin 100% 100% 100% 100% 100% 100% * Represents agent services other than those included in Insight Core services Note 1: Insight Core services is defined as services Insight delivers and manages Note 2: Numbers may not foot due to immaterial rounding

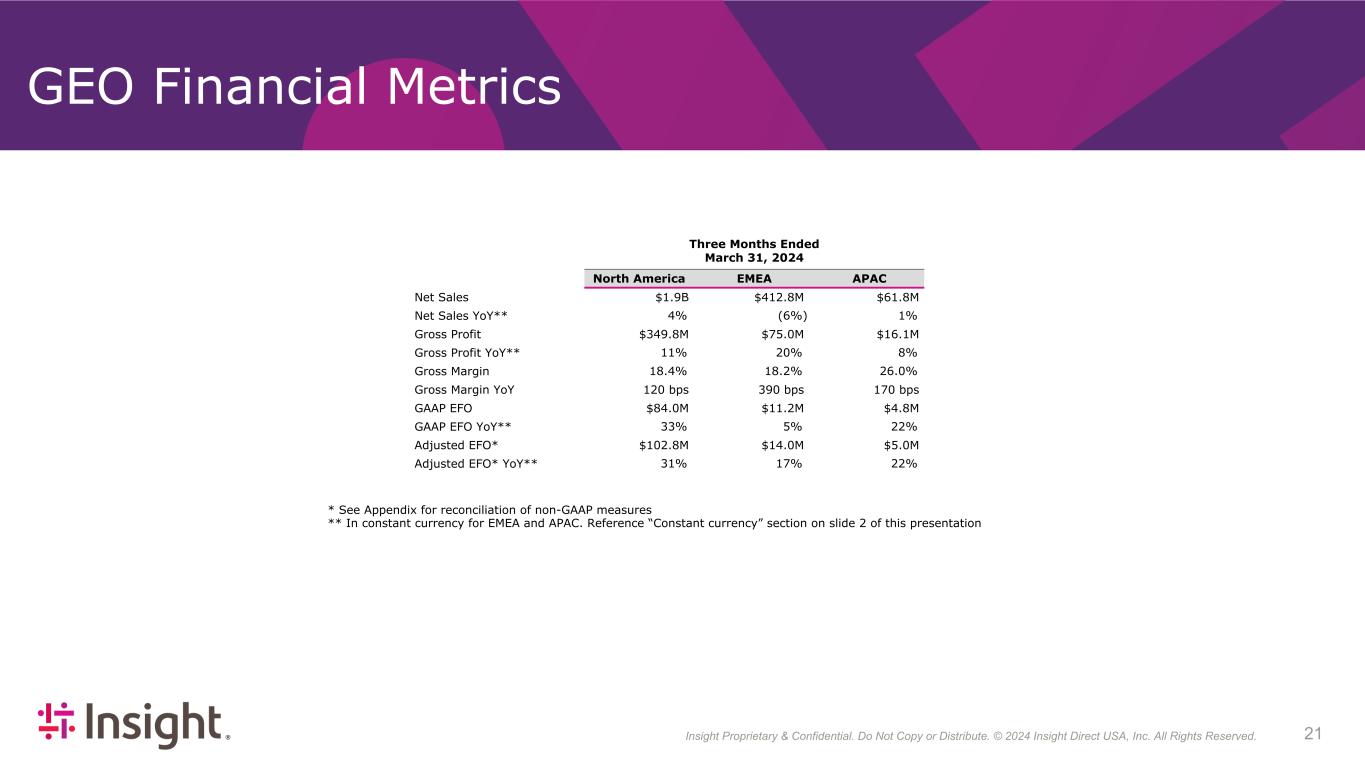

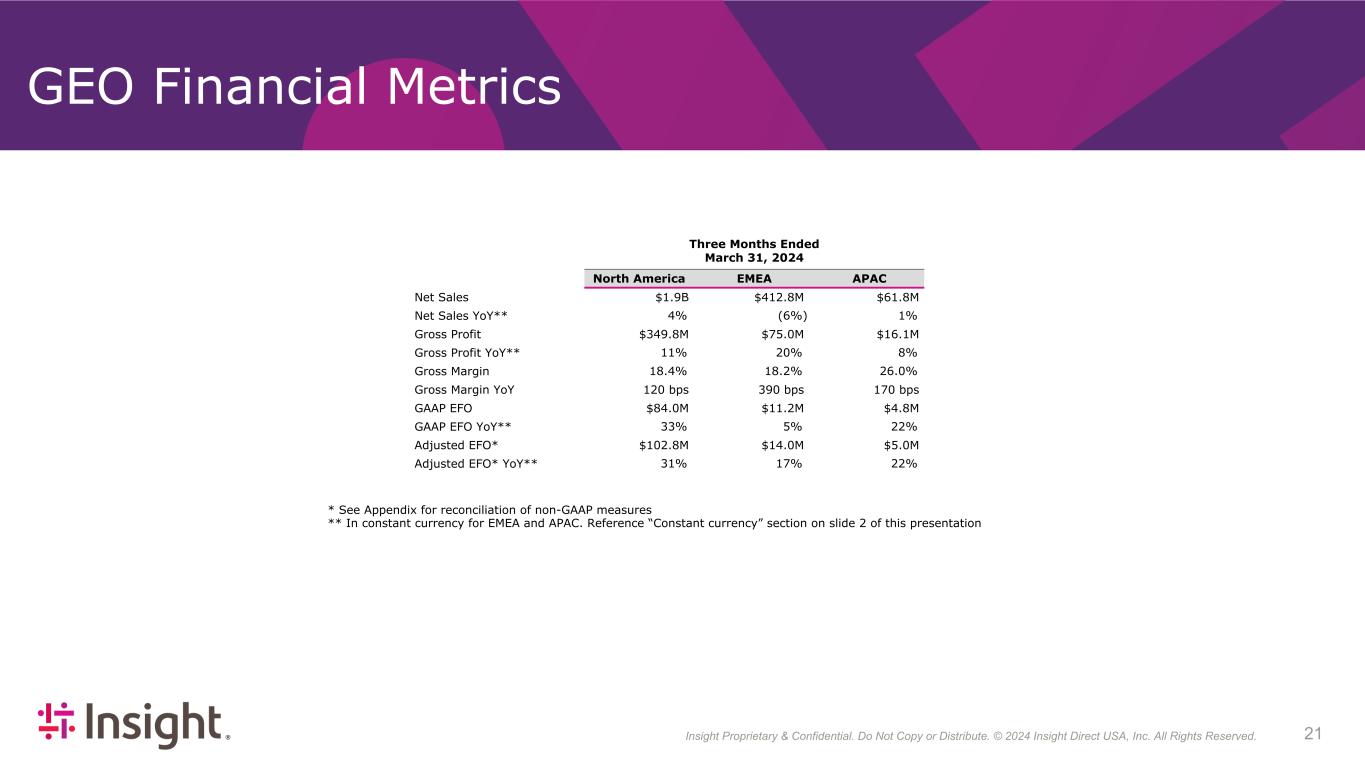

Insight Proprietary & Confidential. Do Not Copy or Distribute. © 2022 Insight Direct USA, Inc. All Rights Reserved. 214 * See Appendix for reconciliation of non-GAAP measures ** In constant currency for EMEA and APAC. Reference “Constant currency” section on slide 2 of this presentation GEO Financial Metrics Three Months Ended March 31, 2024 North America EMEA APAC Net Sales $1.9B $412.8M $61.8M Net Sales YoY** 4% (6%) 1% Gross Profit $349.8M $75.0M $16.1M Gross Profit YoY** 11% 20% 8% Gross Margin 18.4% 18.2% 26.0% Gross Margin YoY 120 bps 390 bps 170 bps GAAP EFO $84.0M $11.2M $4.8M GAAP EFO YoY** 33% 5% 22% Adjusted EFO* $102.8M $14.0M $5.0M Adjusted EFO* YoY** 31% 17% 22%

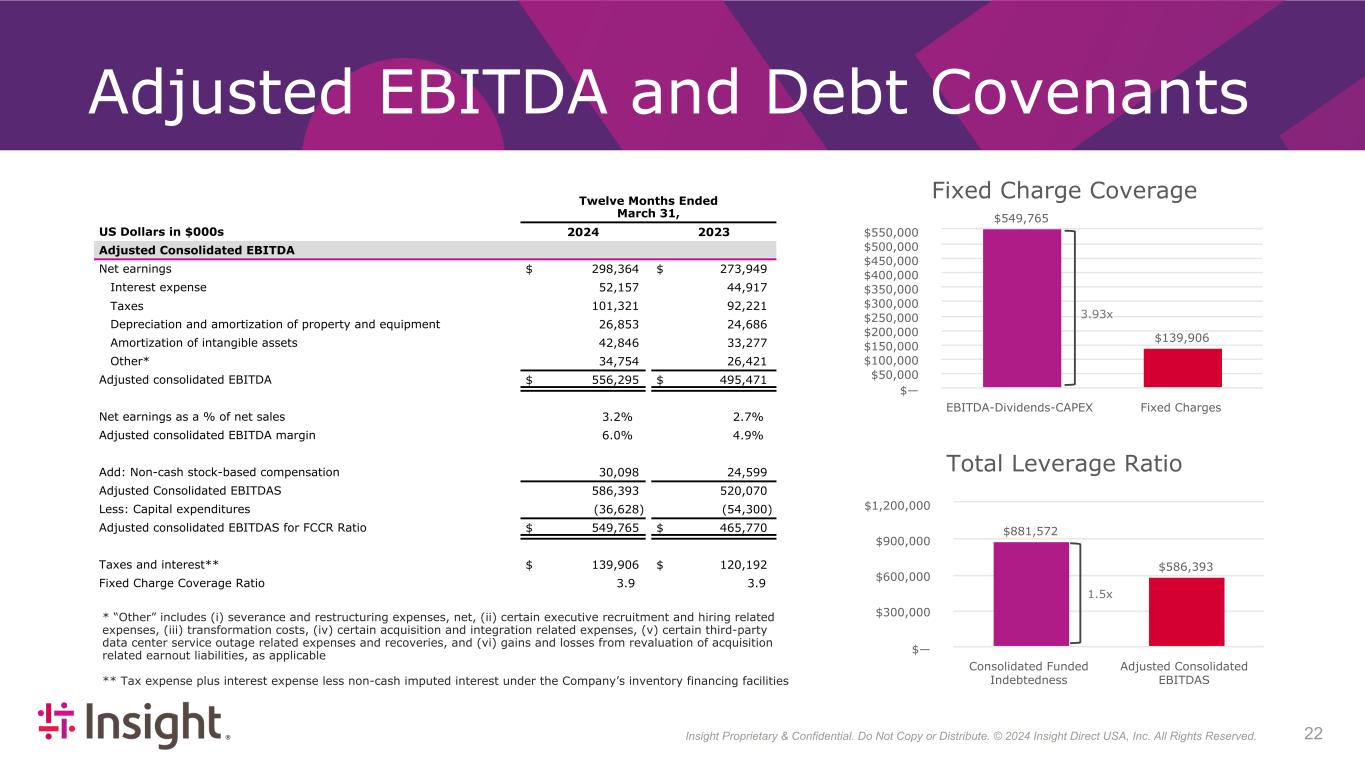

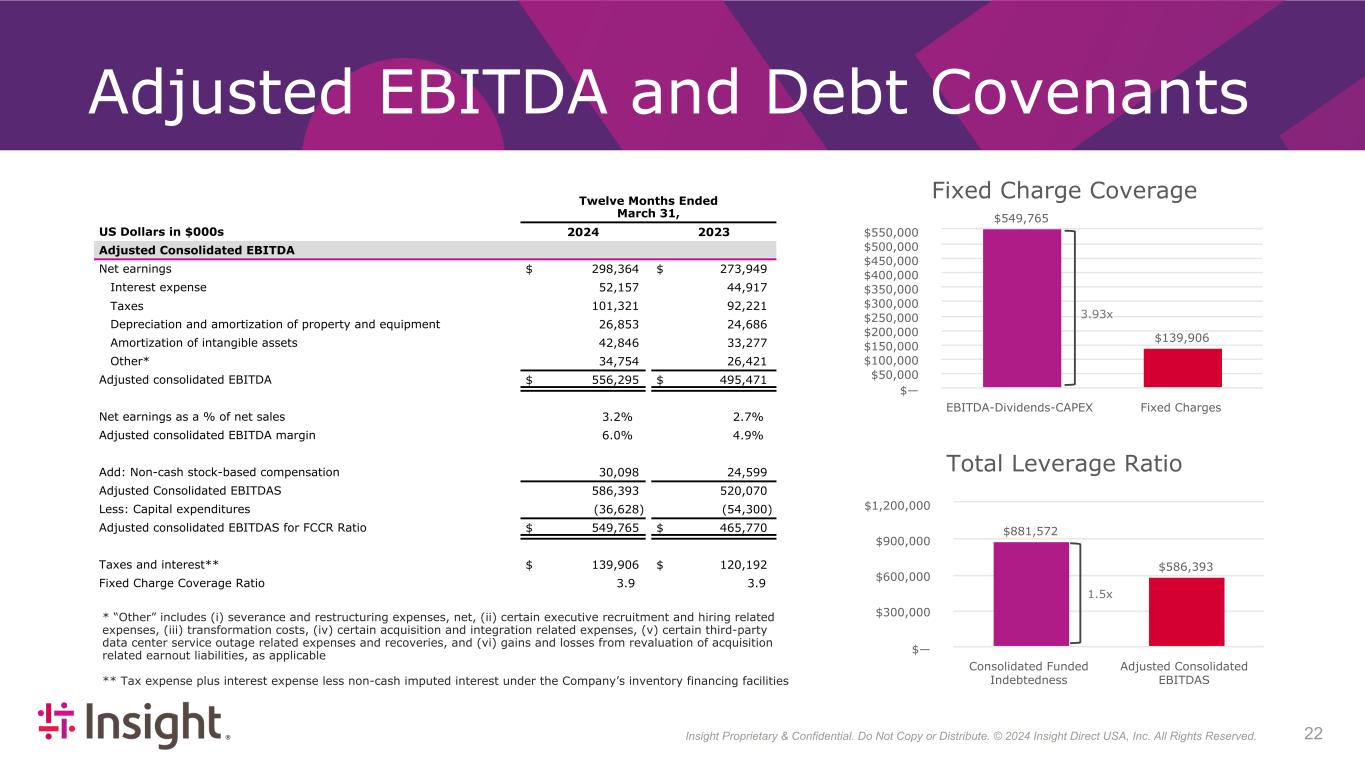

Insight Proprietary & Confidential. Do Not Copy or Distribute. © 2022 Insight Direct USA, Inc. All Rights Reserved. 224 Adjusted EBITDA and Debt Covenants Twelve Months Ended March 31, US Dollars in $000s 2024 2023 Adjusted Consolidated EBITDA Net earnings $ 298,364 $ 273,949 Interest expense 52,157 44,917 Taxes 101,321 92,221 Depreciation and amortization of property and equipment 26,853 24,686 Amortization of intangible assets 42,846 33,277 Other* 34,754 26,421 Adjusted consolidated EBITDA $ 556,295 $ 495,471 Net earnings as a % of net sales 3.2 % 2.7 % Adjusted consolidated EBITDA margin 6.0 % 4.9 % Add: Non-cash stock-based compensation 30,098 24,599 Adjusted Consolidated EBITDAS 586,393 520,070 Less: Capital expenditures (36,628) (54,300) Adjusted consolidated EBITDAS for FCCR Ratio $ 549,765 $ 465,770 Taxes and interest** $ 139,906 $ 120,192 Fixed Charge Coverage Ratio 3.9 3.9 Fixed Charge Coverage $549,765 $139,906 EBITDA-Dividends-CAPEX Fixed Charges $— $50,000 $100,000 $150,000 $200,000 $250,000 $300,000 $350,000 $400,000 $450,000 $500,000 $550,000 Total Leverage Ratio $881,572 $586,393 Consolidated Funded Indebtedness Adjusted Consolidated EBITDAS $— $300,000 $600,000 $900,000 $1,200,000 * “Other” includes (i) severance and restructuring expenses, net, (ii) certain executive recruitment and hiring related expenses, (iii) transformation costs, (iv) certain acquisition and integration related expenses, (v) certain third-party data center service outage related expenses and recoveries, and (vi) gains and losses from revaluation of acquisition related earnout liabilities, as applicable ** Tax expense plus interest expense less non-cash imputed interest under the Company’s inventory financing facilities 3.93x 1.5x

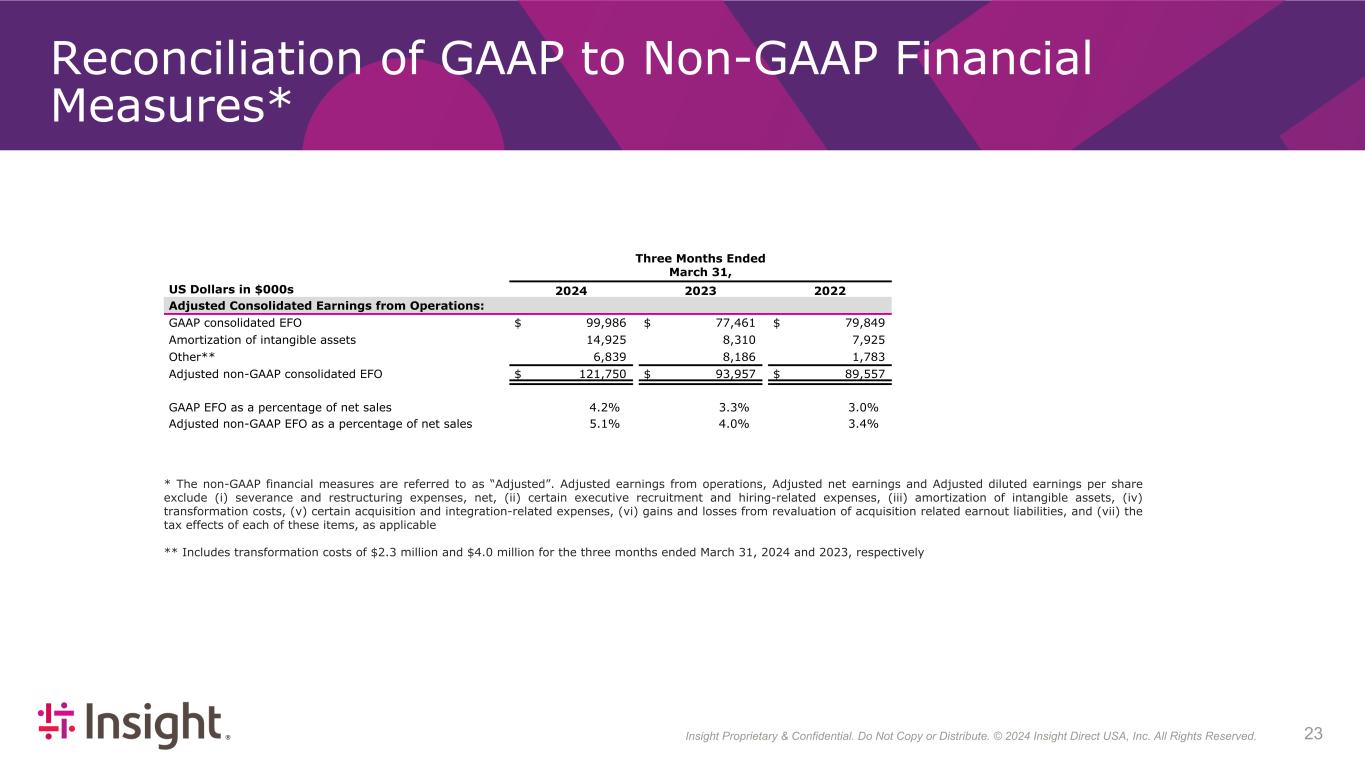

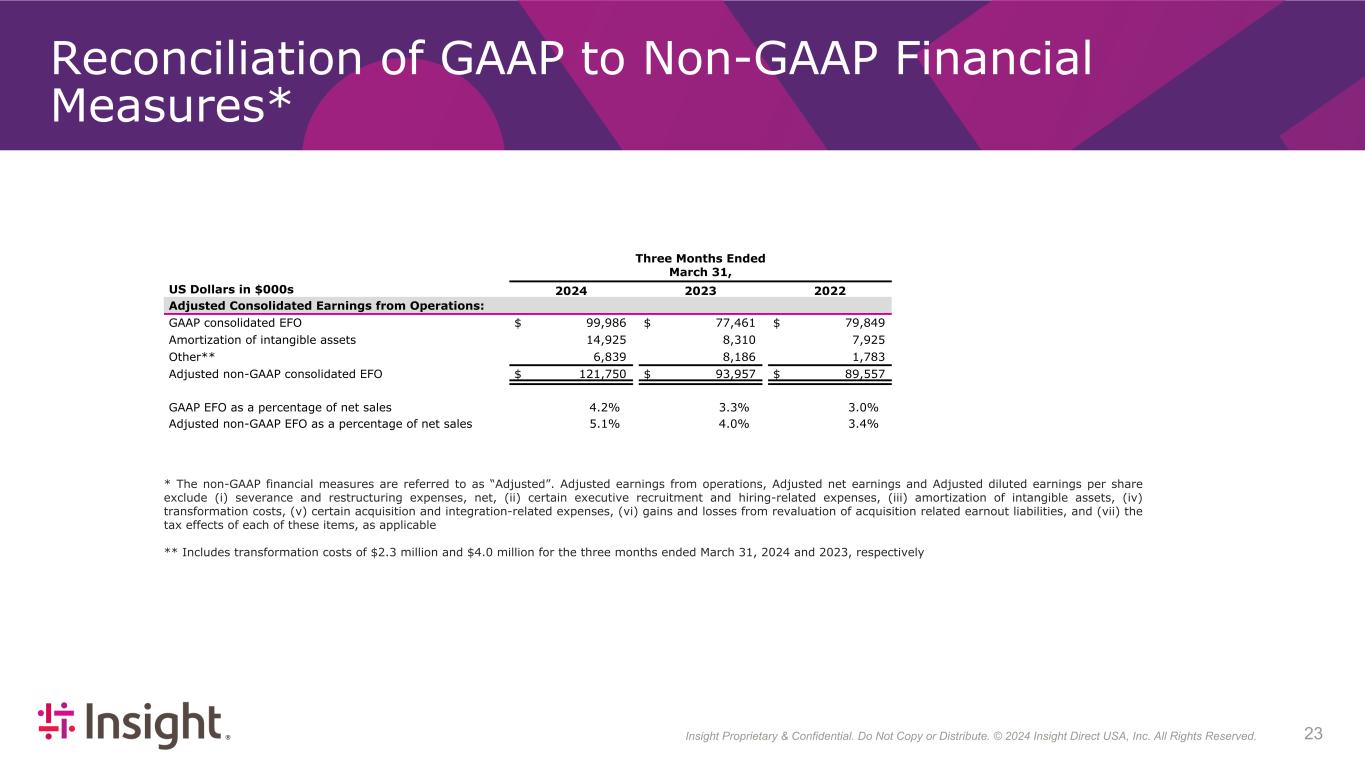

Insight Proprietary & Confidential. Do Not Copy or Distribute. © 2022 Insight Direct USA, Inc. All Rights Reserved. 234 Reconciliation of GAAP to Non-GAAP Financial Measures* Three Months Ended March 31, US Dollars in $000s 2024 2023 2022 Adjusted Consolidated Earnings from Operations: GAAP consolidated EFO $ 99,986 $ 77,461 $ 79,849 Amortization of intangible assets 14,925 8,310 7,925 Other** 6,839 8,186 1,783 Adjusted non-GAAP consolidated EFO $ 121,750 $ 93,957 $ 89,557 GAAP EFO as a percentage of net sales 4.2 % 3.3 % 3.0 % Adjusted non-GAAP EFO as a percentage of net sales 5.1 % 4.0 % 3.4 % * The non-GAAP financial measures are referred to as “Adjusted”. Adjusted earnings from operations, Adjusted net earnings and Adjusted diluted earnings per share exclude (i) severance and restructuring expenses, net, (ii) certain executive recruitment and hiring-related expenses, (iii) amortization of intangible assets, (iv) transformation costs, (v) certain acquisition and integration-related expenses, (vi) gains and losses from revaluation of acquisition related earnout liabilities, and (vii) the tax effects of each of these items, as applicable ** Includes transformation costs of $2.3 million and $4.0 million for the three months ended March 31, 2024 and 2023, respectively

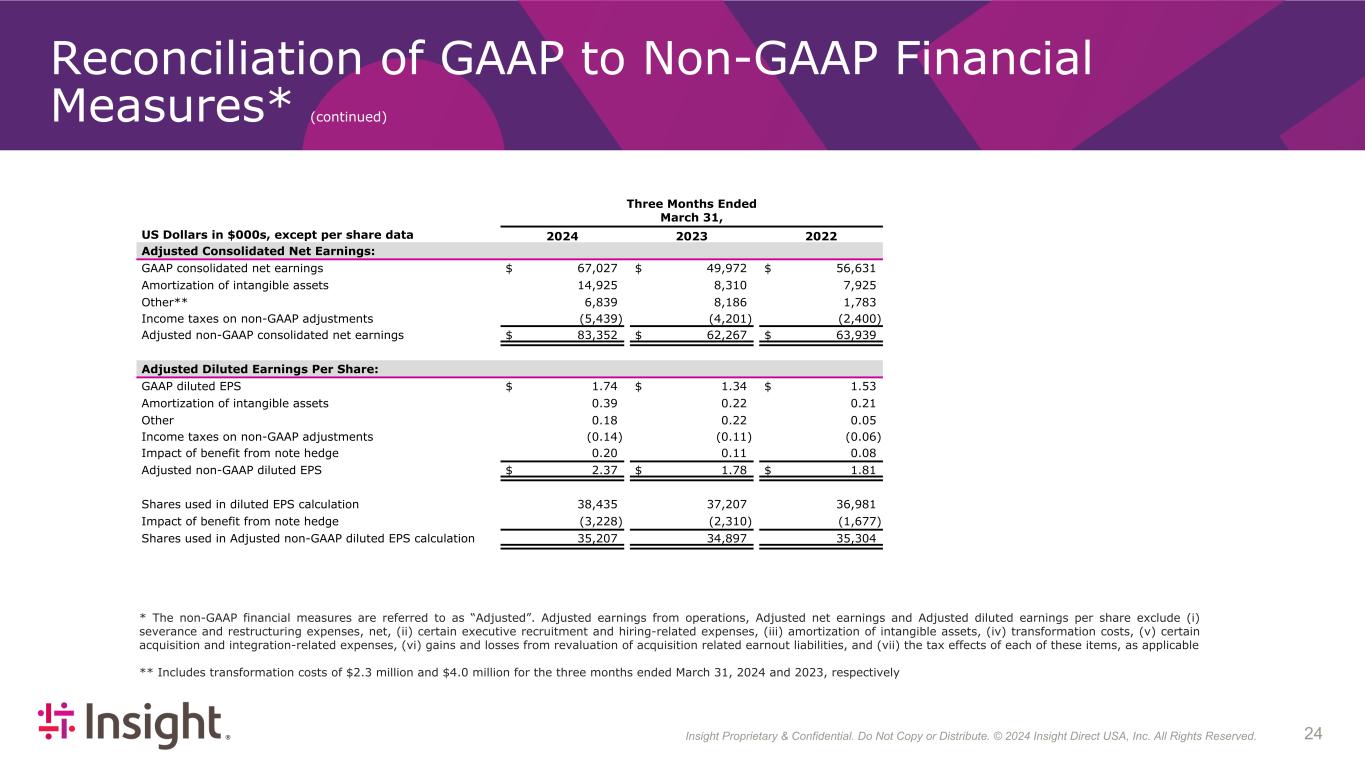

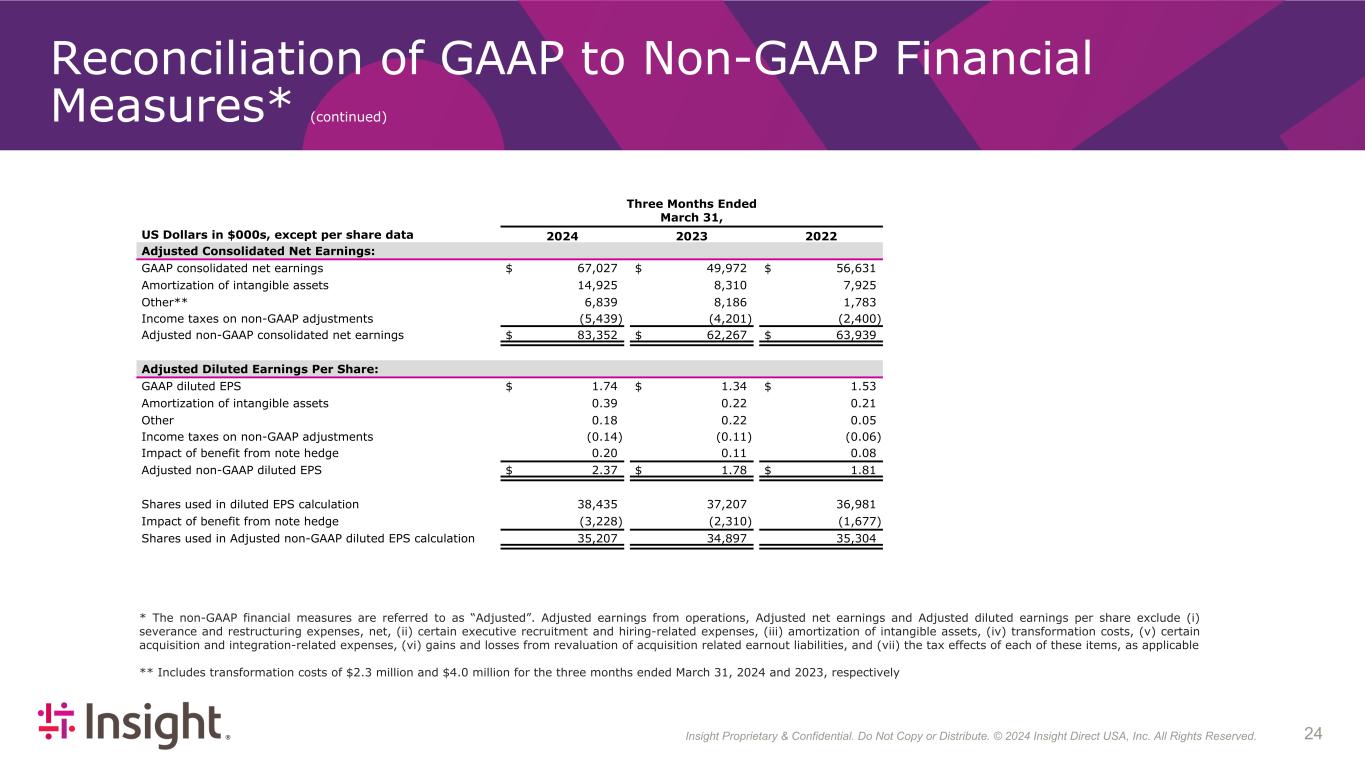

Insight Proprietary & Confidential. Do Not Copy or Distribute. © 2022 Insight Direct USA, Inc. All Rights Reserved. 244 Reconciliation of GAAP to Non-GAAP Financial Measures* (continued) Three Months Ended March 31, US Dollars in $000s, except per share data 2024 2023 2022 Adjusted Consolidated Net Earnings: GAAP consolidated net earnings $ 67,027 $ 49,972 $ 56,631 Amortization of intangible assets 14,925 8,310 7,925 Other** 6,839 8,186 1,783 Income taxes on non-GAAP adjustments (5,439) (4,201) (2,400) Adjusted non-GAAP consolidated net earnings $ 83,352 $ 62,267 $ 63,939 Adjusted Diluted Earnings Per Share: GAAP diluted EPS $ 1.74 $ 1.34 $ 1.53 Amortization of intangible assets 0.39 0.22 0.21 Other 0.18 0.22 0.05 Income taxes on non-GAAP adjustments (0.14) (0.11) (0.06) Impact of benefit from note hedge 0.20 0.11 0.08 Adjusted non-GAAP diluted EPS $ 2.37 $ 1.78 $ 1.81 Shares used in diluted EPS calculation 38,435 37,207 36,981 Impact of benefit from note hedge (3,228) (2,310) (1,677) Shares used in Adjusted non-GAAP diluted EPS calculation 35,207 34,897 35,304 * The non-GAAP financial measures are referred to as “Adjusted”. Adjusted earnings from operations, Adjusted net earnings and Adjusted diluted earnings per share exclude (i) severance and restructuring expenses, net, (ii) certain executive recruitment and hiring-related expenses, (iii) amortization of intangible assets, (iv) transformation costs, (v) certain acquisition and integration-related expenses, (vi) gains and losses from revaluation of acquisition related earnout liabilities, and (vii) the tax effects of each of these items, as applicable ** Includes transformation costs of $2.3 million and $4.0 million for the three months ended March 31, 2024 and 2023, respectively

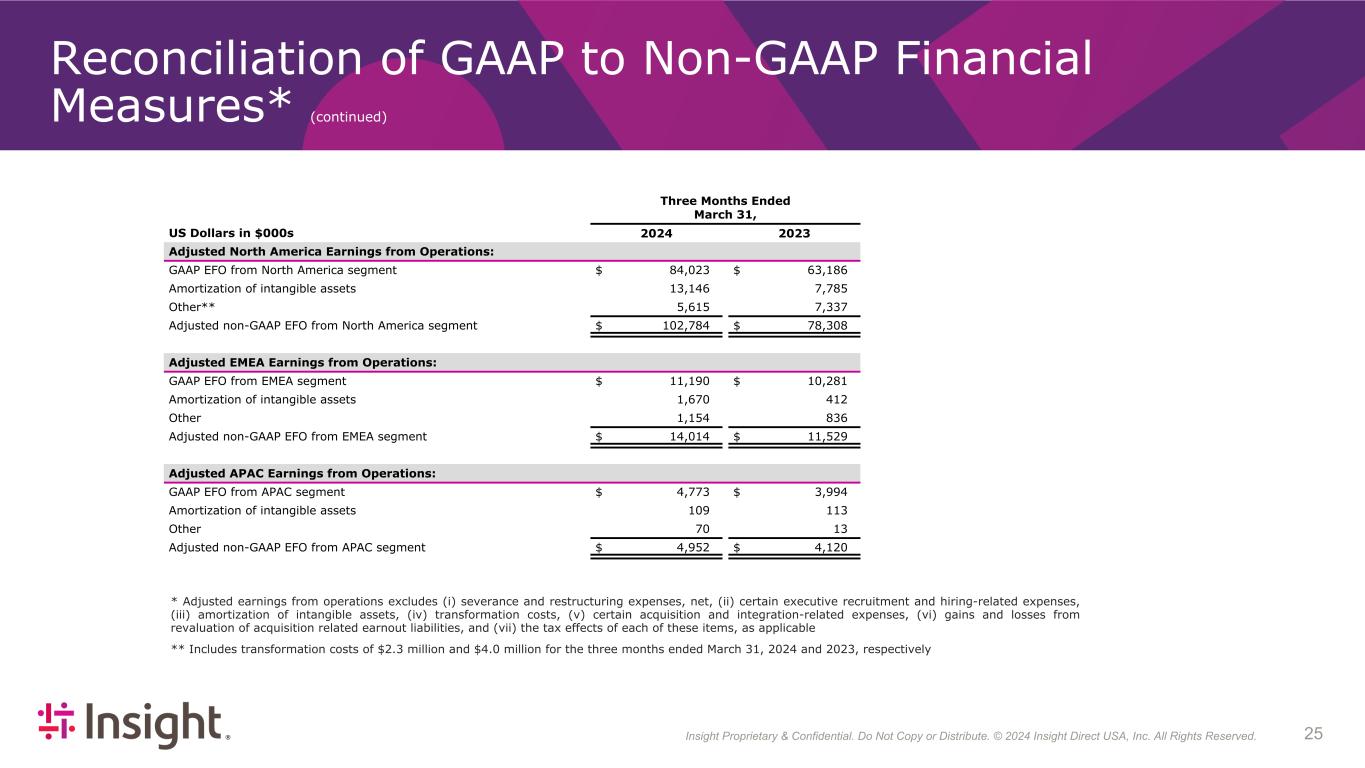

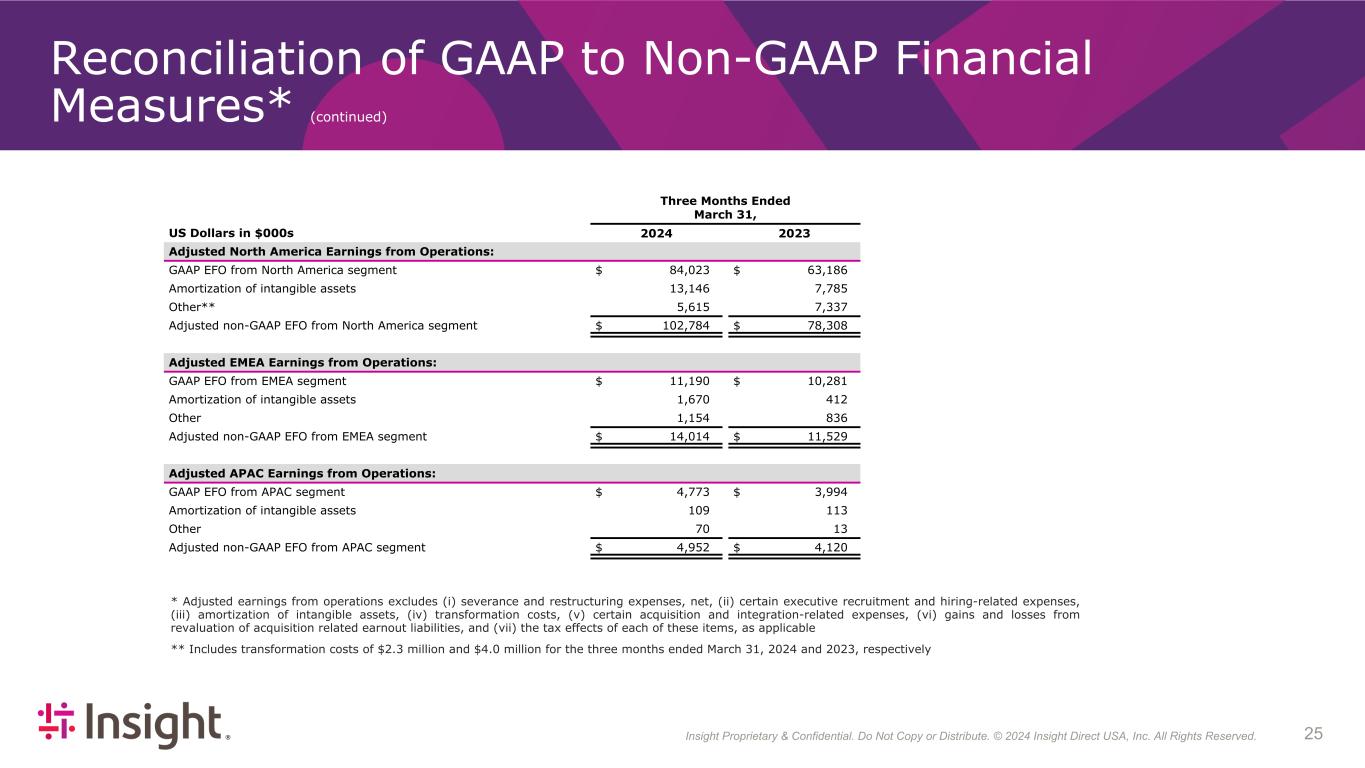

Insight Proprietary & Confidential. Do Not Copy or Distribute. © 2022 Insight Direct USA, Inc. All Rights Reserved. 254 Reconciliation of GAAP to Non-GAAP Financial Measures* (continued) Three Months Ended March 31, US Dollars in $000s 2024 2023 Adjusted North America Earnings from Operations: GAAP EFO from North America segment $ 84,023 $ 63,186 Amortization of intangible assets 13,146 7,785 Other** 5,615 7,337 Adjusted non-GAAP EFO from North America segment $ 102,784 $ 78,308 Adjusted EMEA Earnings from Operations: GAAP EFO from EMEA segment $ 11,190 $ 10,281 Amortization of intangible assets 1,670 412 Other 1,154 836 Adjusted non-GAAP EFO from EMEA segment $ 14,014 $ 11,529 Adjusted APAC Earnings from Operations: GAAP EFO from APAC segment $ 4,773 $ 3,994 Amortization of intangible assets 109 113 Other 70 13 Adjusted non-GAAP EFO from APAC segment $ 4,952 $ 4,120 * Adjusted earnings from operations excludes (i) severance and restructuring expenses, net, (ii) certain executive recruitment and hiring-related expenses, (iii) amortization of intangible assets, (iv) transformation costs, (v) certain acquisition and integration-related expenses, (vi) gains and losses from revaluation of acquisition related earnout liabilities, and (vii) the tax effects of each of these items, as applicable ** Includes transformation costs of $2.3 million and $4.0 million for the three months ended March 31, 2024 and 2023, respectively

Insight Proprietary & Confidential. Do Not Copy or Distribute. © 2022 Insight Direct USA, Inc. All Rights Reserved. 264 Three Months Ended March 31, US Dollars in $000s 2024 2023 Adjusted Consolidated EBITDA GAAP consolidated net earnings $ 67,027 $ 49,972 Interest expense 15,269 11,688 Income tax expense 21,165 16,389 Depreciation and amortization of property and equipment 6,961 6,353 Amortization of intangible assets 14,925 8,310 Other* 6,839 8,186 Adjusted non-GAAP EBITDA $ 132,186 $ 100,898 Net earnings as a % of net sales 2.8 % 2.2 % Adjusted non-GAAP EBITDA margin 5.6 % 4.3 % * Includes transformation costs of $2.3 million and $4.0 million for the three months ended March 31, 2024 and 2023, respectively Reconciliation of GAAP to Non-GAAP Financial Measures (continued)

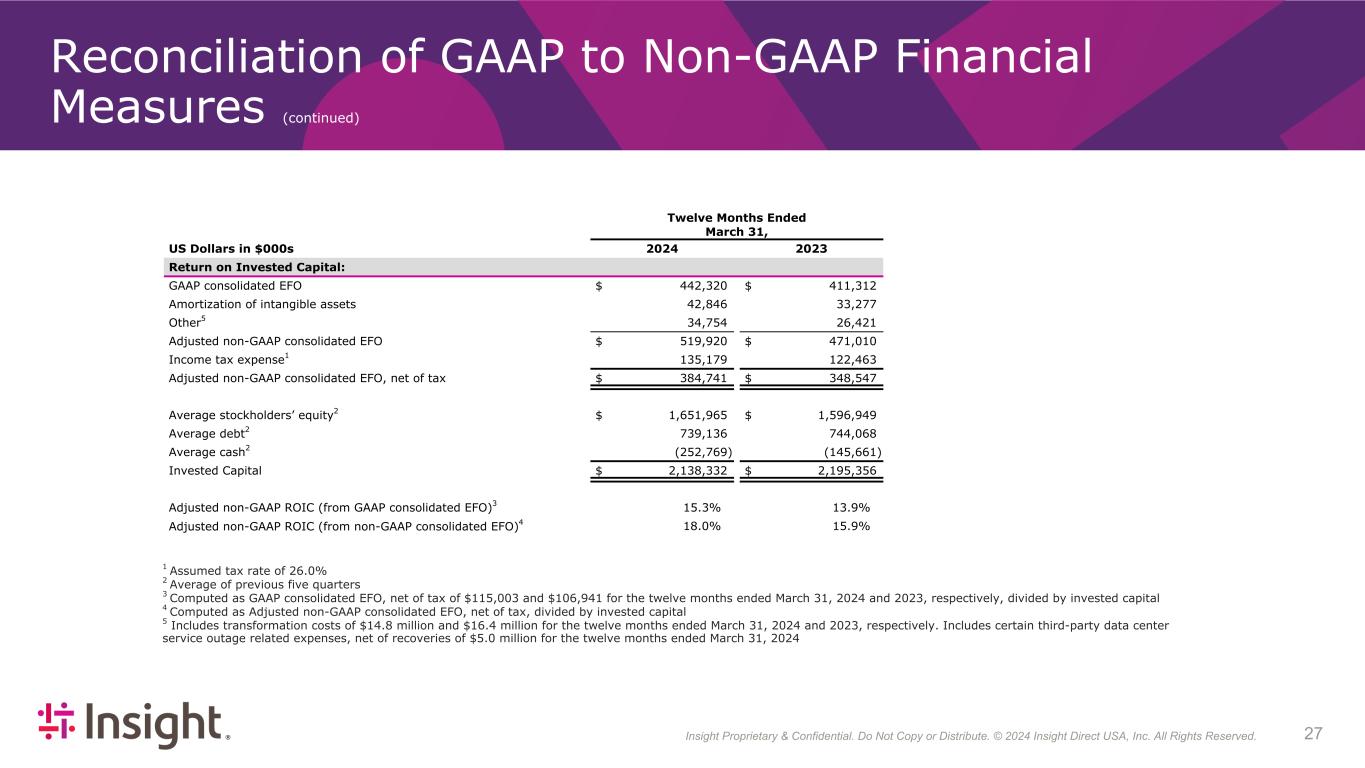

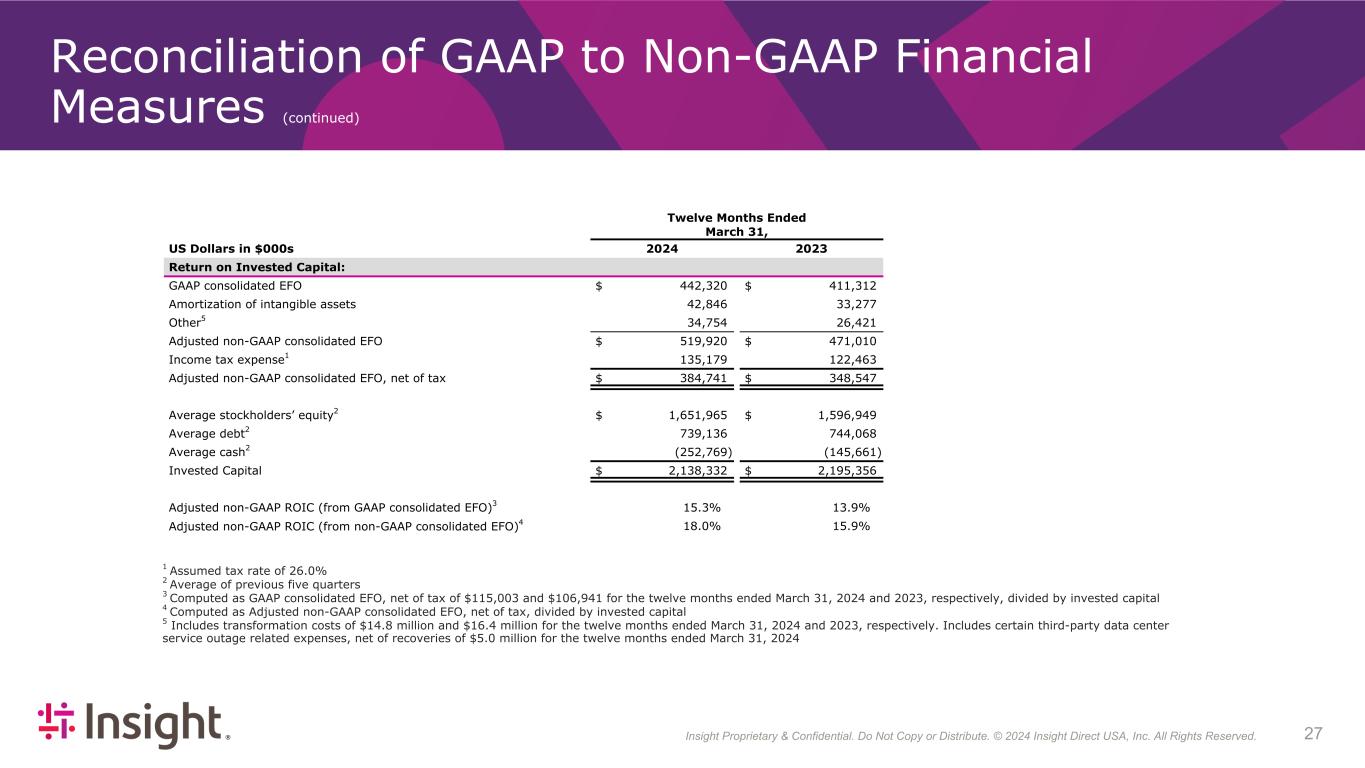

Insight Proprietary & Confidential. Do Not Copy or Distribute. © 2022 Insight Direct USA, Inc. All Rights Reserved. 274 Reconciliation of GAAP to Non-GAAP Financial Measures (continued) 1 Assumed tax rate of 26.0% 2 Average of previous five quarters 3 Computed as GAAP consolidated EFO, net of tax of $115,003 and $106,941 for the twelve months ended March 31, 2024 and 2023, respectively, divided by invested capital 4 Computed as Adjusted non-GAAP consolidated EFO, net of tax, divided by invested capital 5 Includes transformation costs of $14.8 million and $16.4 million for the twelve months ended March 31, 2024 and 2023, respectively. Includes certain third-party data center service outage related expenses, net of recoveries of $5.0 million for the twelve months ended March 31, 2024 Twelve Months Ended March 31, US Dollars in $000s 2024 2023 Return on Invested Capital: GAAP consolidated EFO $ 442,320 $ 411,312 Amortization of intangible assets 42,846 33,277 Other5 34,754 26,421 Adjusted non-GAAP consolidated EFO $ 519,920 $ 471,010 Income tax expense1 135,179 122,463 Adjusted non-GAAP consolidated EFO, net of tax $ 384,741 $ 348,547 Average stockholders’ equity2 $ 1,651,965 $ 1,596,949 Average debt2 739,136 744,068 Average cash2 (252,769) (145,661) Invested Capital $ 2,138,332 $ 2,195,356 Adjusted non-GAAP ROIC (from GAAP consolidated EFO)3 15.3 % 13.9 % Adjusted non-GAAP ROIC (from non-GAAP consolidated EFO)4 18.0 % 15.9 %

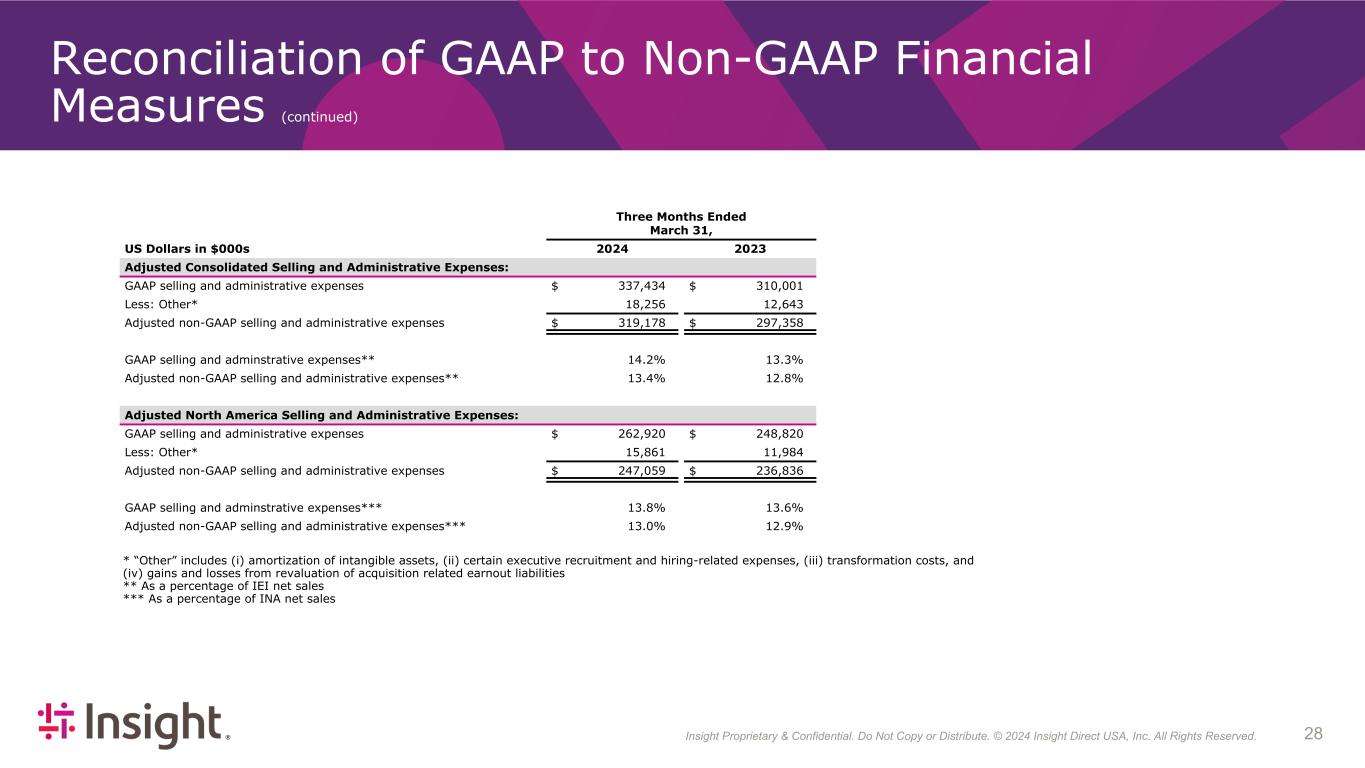

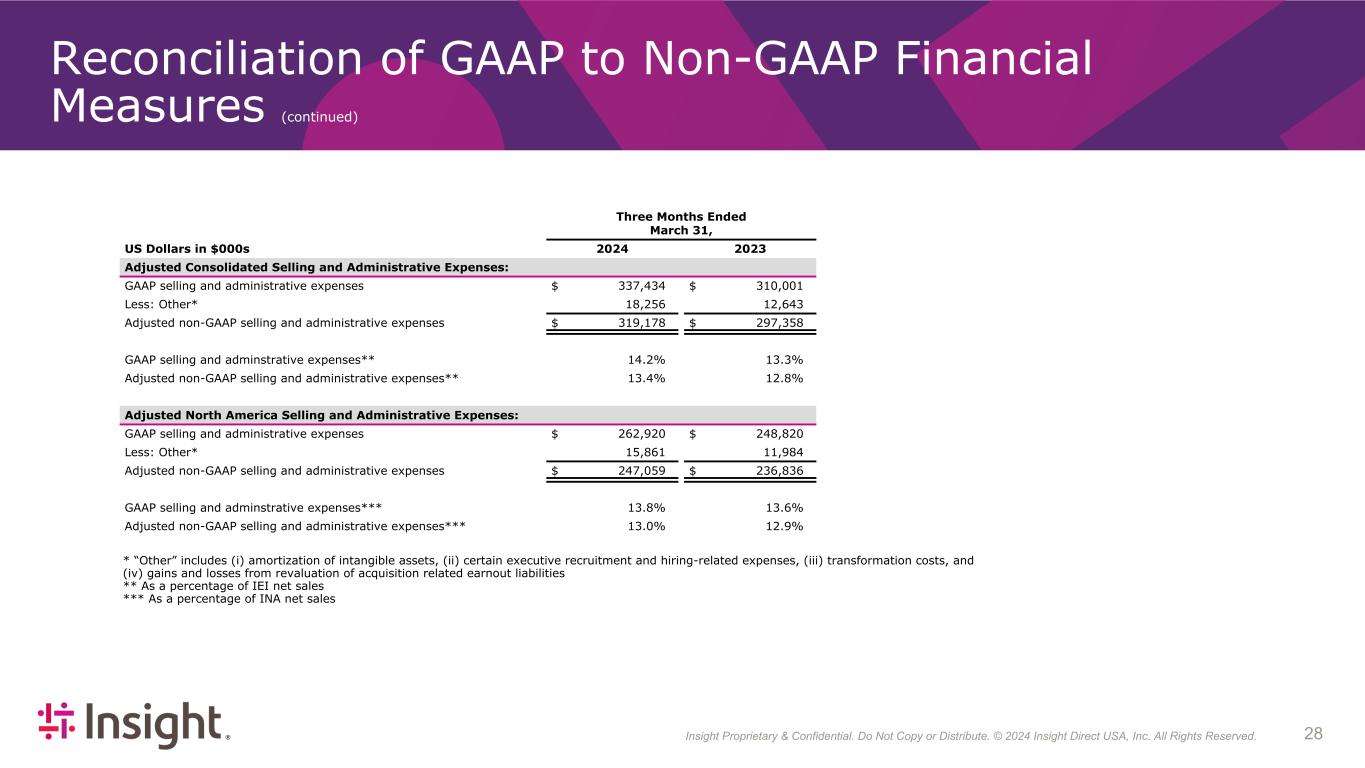

Insight Proprietary & Confidential. Do Not Copy or Distribute. © 2022 Insight Direct USA, Inc. All Rights Reserved. 284 Reconciliation of GAAP to Non-GAAP Financial Measures (continued) Three Months Ended March 31, US Dollars in $000s 2024 2023 Adjusted Consolidated Selling and Administrative Expenses: GAAP selling and administrative expenses $ 337,434 $ 310,001 Less: Other* 18,256 12,643 Adjusted non-GAAP selling and administrative expenses $ 319,178 $ 297,358 GAAP selling and adminstrative expenses** 14.2 % 13.3 % Adjusted non-GAAP selling and administrative expenses** 13.4 % 12.8 % Adjusted North America Selling and Administrative Expenses: GAAP selling and administrative expenses $ 262,920 $ 248,820 Less: Other* 15,861 11,984 Adjusted non-GAAP selling and administrative expenses $ 247,059 $ 236,836 GAAP selling and adminstrative expenses*** 13.8 % 13.6 % Adjusted non-GAAP selling and administrative expenses*** 13.0 % 12.9 % * “Other” includes (i) amortization of intangible assets, (ii) certain executive recruitment and hiring-related expenses, (iii) transformation costs, and (iv) gains and losses from revaluation of acquisition related earnout liabilities ** As a percentage of IEI net sales *** As a percentage of INA net sales

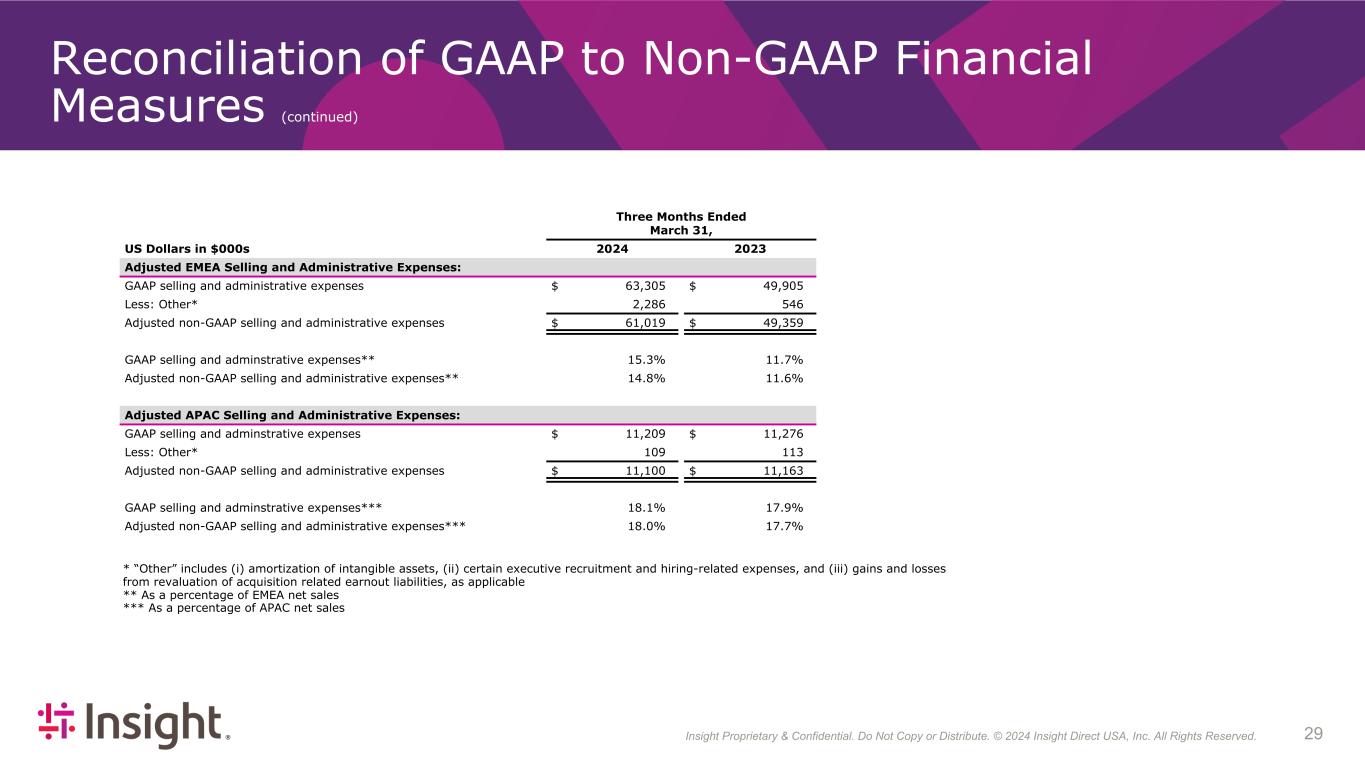

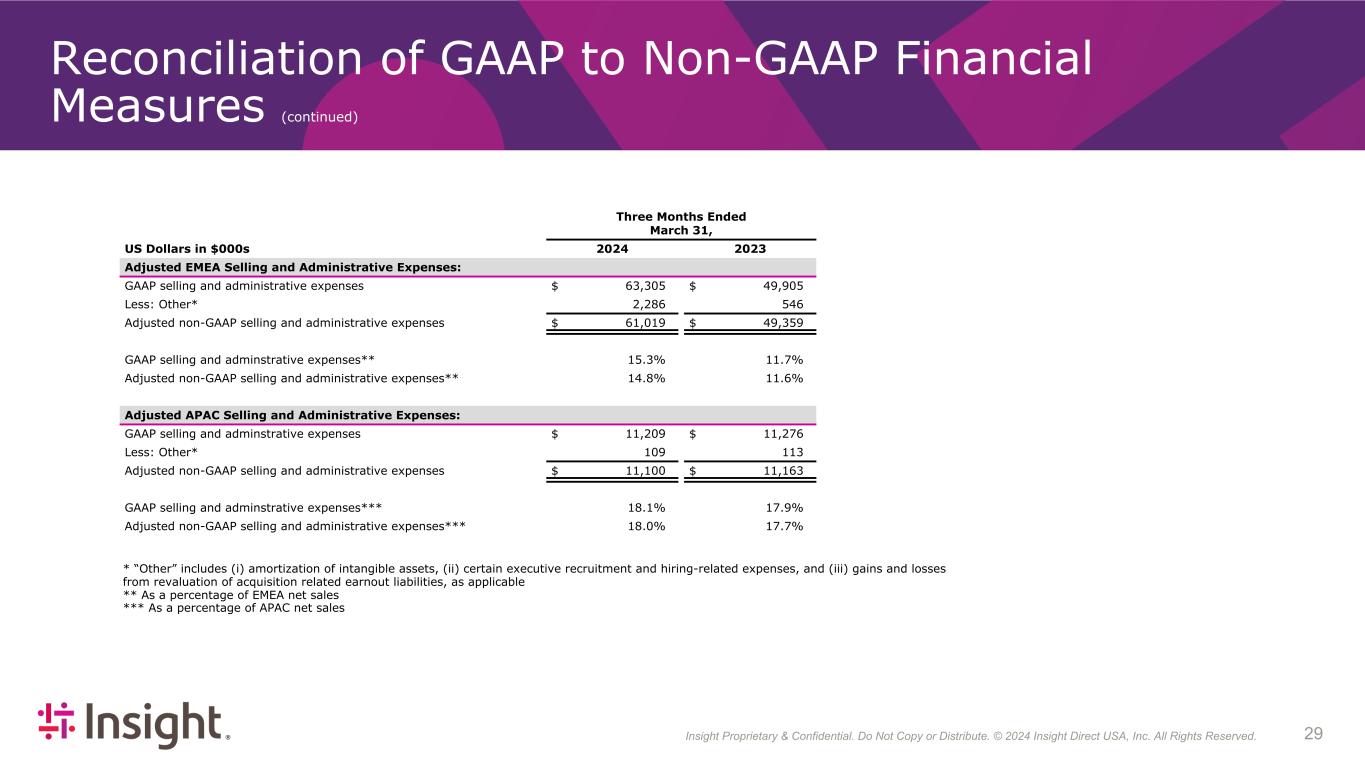

Insight Proprietary & Confidential. Do Not Copy or Distribute. © 2022 Insight Direct USA, Inc. All Rights Reserved. 294 Reconciliation of GAAP to Non-GAAP Financial Measures (continued) Three Months Ended March 31, US Dollars in $000s 2024 2023 Adjusted EMEA Selling and Administrative Expenses: GAAP selling and administrative expenses $ 63,305 $ 49,905 Less: Other* 2,286 546 Adjusted non-GAAP selling and administrative expenses $ 61,019 $ 49,359 GAAP selling and adminstrative expenses** 15.3 % 11.7 % Adjusted non-GAAP selling and administrative expenses** 14.8 % 11.6 % Adjusted APAC Selling and Administrative Expenses: GAAP selling and adminstrative expenses $ 11,209 $ 11,276 Less: Other* 109 113 Adjusted non-GAAP selling and administrative expenses $ 11,100 $ 11,163 GAAP selling and adminstrative expenses*** 18.1 % 17.9 % Adjusted non-GAAP selling and administrative expenses*** 18.0 % 17.7 % * “Other” includes (i) amortization of intangible assets, (ii) certain executive recruitment and hiring-related expenses, and (iii) gains and losses from revaluation of acquisition related earnout liabilities, as applicable ** As a percentage of EMEA net sales *** As a percentage of APAC net sales

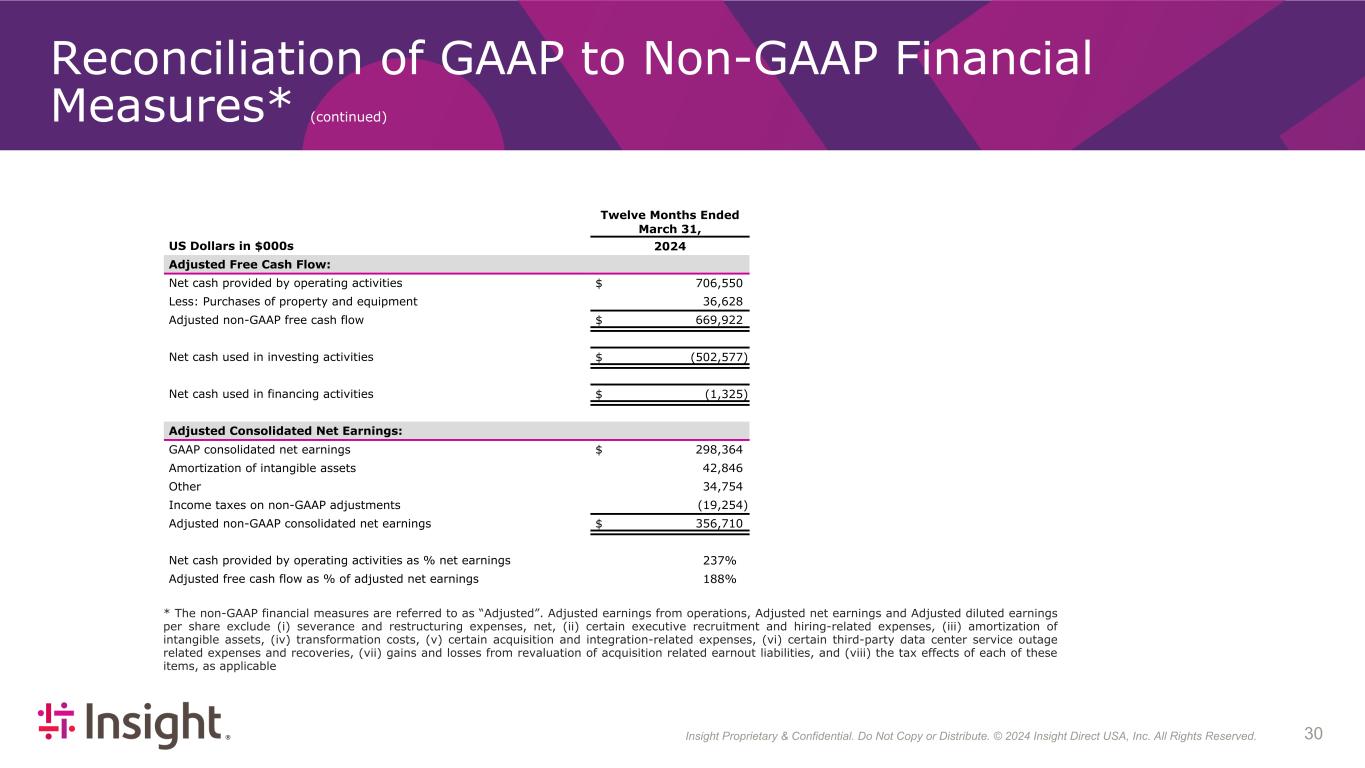

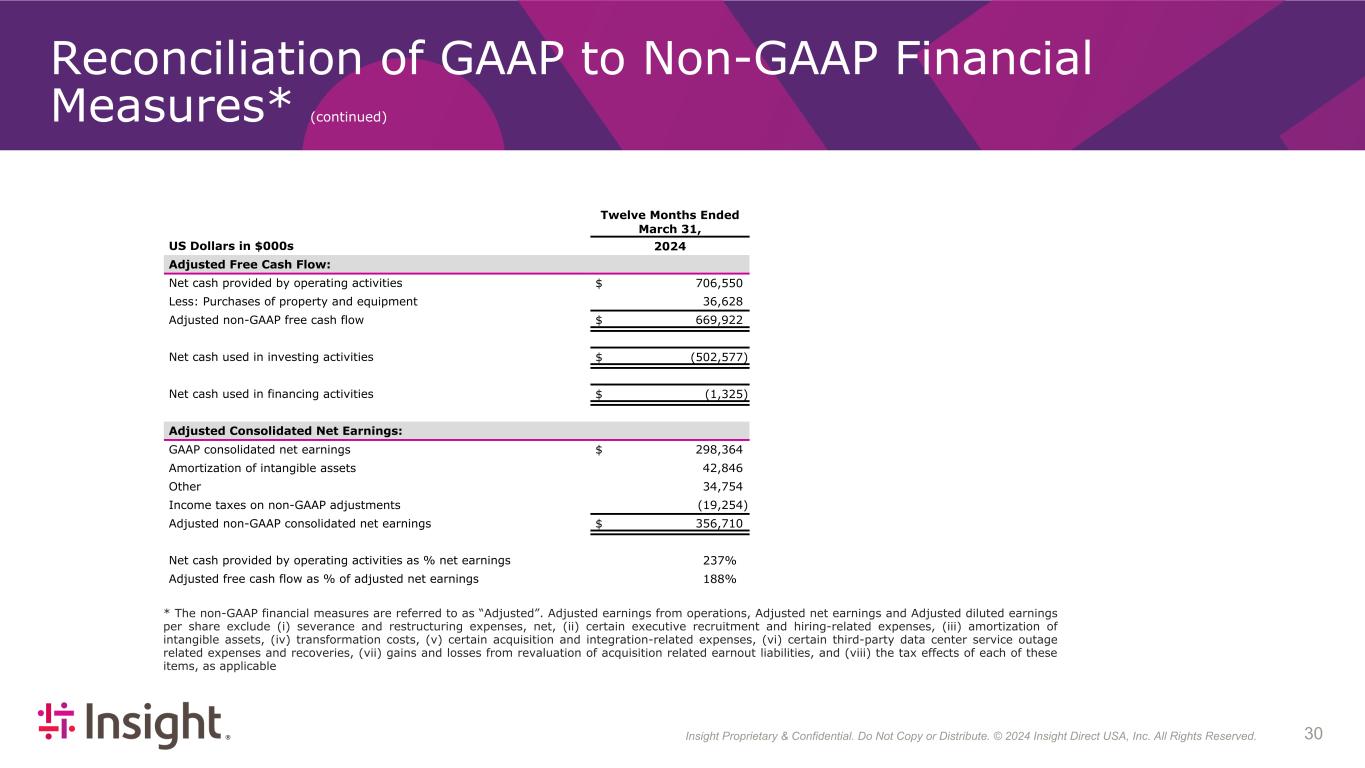

Insight Proprietary & Confidential. Do Not Copy or Distribute. © 2022 Insight Direct USA, Inc. All Rights Reserved. 304 Reconciliation of GAAP to Non-GAAP Financial Measures* (continued) Twelve Months Ended March 31, US Dollars in $000s 2024 Adjusted Free Cash Flow: Net cash provided by operating activities $ 706,550 Less: Purchases of property and equipment 36,628 Adjusted non-GAAP free cash flow $ 669,922 Net cash used in investing activities $ (502,577) Net cash used in financing activities $ (1,325) Adjusted Consolidated Net Earnings: GAAP consolidated net earnings $ 298,364 Amortization of intangible assets 42,846 Other 34,754 Income taxes on non-GAAP adjustments (19,254) Adjusted non-GAAP consolidated net earnings $ 356,710 Net cash provided by operating activities as % net earnings 237 % Adjusted free cash flow as % of adjusted net earnings 188 % * The non-GAAP financial measures are referred to as “Adjusted”. Adjusted earnings from operations, Adjusted net earnings and Adjusted diluted earnings per share exclude (i) severance and restructuring expenses, net, (ii) certain executive recruitment and hiring-related expenses, (iii) amortization of intangible assets, (iv) transformation costs, (v) certain acquisition and integration-related expenses, (vi) certain third-party data center service outage related expenses and recoveries, (vii) gains and losses from revaluation of acquisition related earnout liabilities, and (viii) the tax effects of each of these items, as applicable

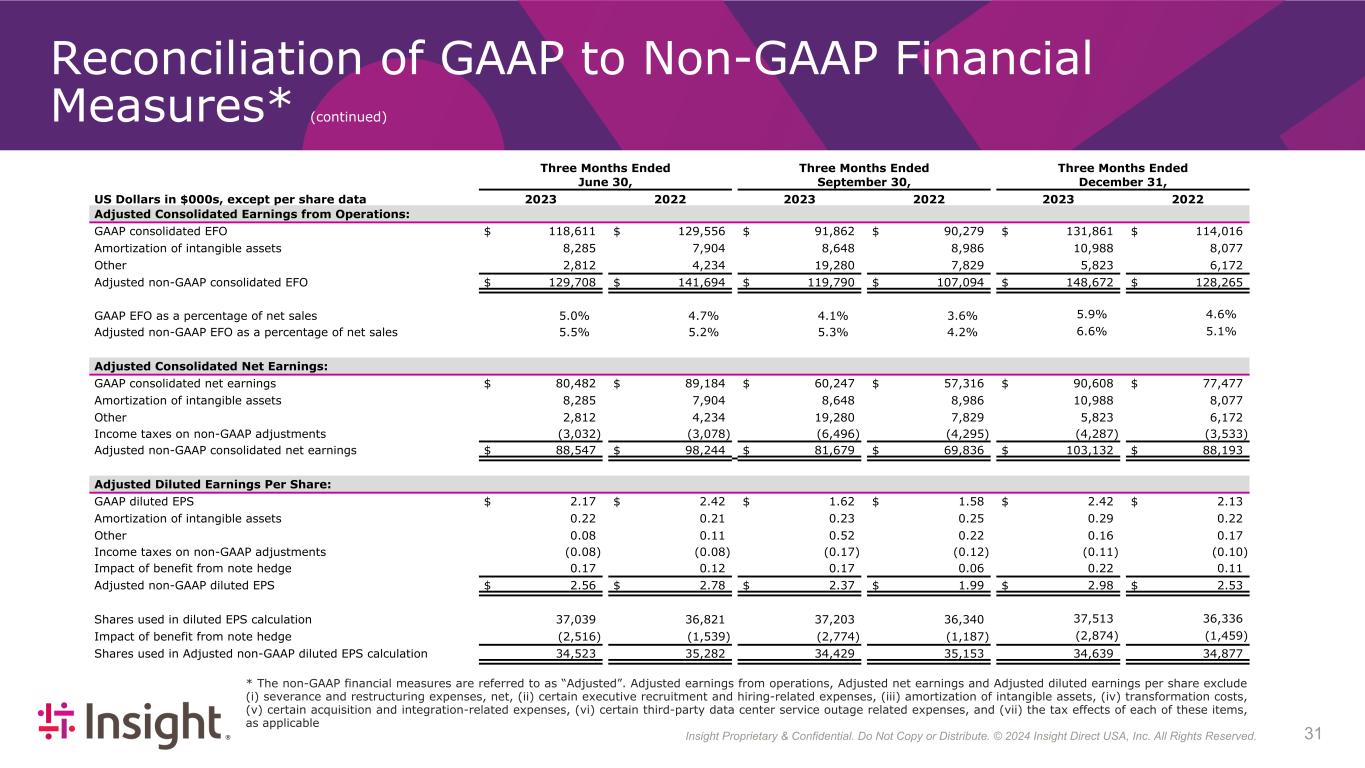

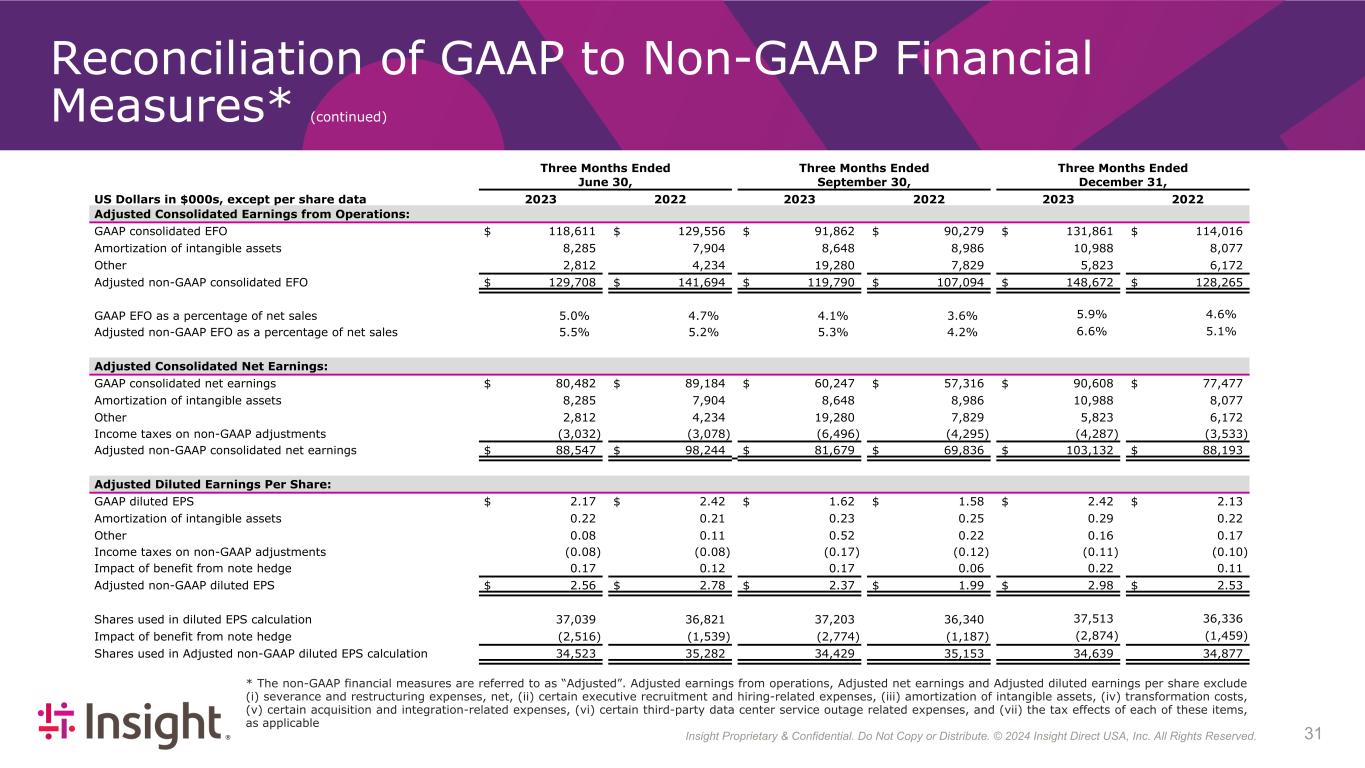

Insight Proprietary & Confidential. Do Not Copy or Distribute. © 2022 Insight Direct USA, Inc. All Rights Reserved. 314 Reconciliation of GAAP to Non-GAAP Financial Measures* (continued) Three Months Ended Three Months Ended Three Months Ended June 30, September 30, December 31, US Dollars in $000s, except per share data 2023 2022 2023 2022 2023 2022 Adjusted Consolidated Earnings from Operations: GAAP consolidated EFO $ 118,611 $ 129,556 $ 91,862 $ 90,279 $ 131,861 $ 114,016 Amortization of intangible assets 8,285 7,904 8,648 8,986 10,988 8,077 Other 2,812 4,234 19,280 7,829 5,823 6,172 Adjusted non-GAAP consolidated EFO $ 129,708 $ 141,694 $ 119,790 $ 107,094 $ 148,672 $ 128,265 GAAP EFO as a percentage of net sales 5.0 % 4.7 % 4.1 % 3.6 % 5.9% 4.6% Adjusted non-GAAP EFO as a percentage of net sales 5.5 % 5.2 % 5.3 % 4.2 % 6.6% 5.1% Adjusted Consolidated Net Earnings: GAAP consolidated net earnings $ 80,482 $ 89,184 $ 60,247 $ 57,316 $ 90,608 $ 77,477 Amortization of intangible assets 8,285 7,904 8,648 8,986 10,988 8,077 Other 2,812 4,234 19,280 7,829 5,823 6,172 Income taxes on non-GAAP adjustments (3,032) (3,078) (6,496) (4,295) (4,287) (3,533) Adjusted non-GAAP consolidated net earnings $ 88,547 $ 98,244 $ 81,679 $ 69,836 $ 103,132 $ 88,193 Adjusted Diluted Earnings Per Share: GAAP diluted EPS $ 2.17 $ 2.42 $ 1.62 $ 1.58 $ 2.42 $ 2.13 Amortization of intangible assets 0.22 0.21 0.23 0.25 0.29 0.22 Other 0.08 0.11 0.52 0.22 0.16 0.17 Income taxes on non-GAAP adjustments (0.08) (0.08) (0.17) (0.12) (0.11) (0.10) Impact of benefit from note hedge 0.17 0.12 0.17 0.06 0.22 0.11 Adjusted non-GAAP diluted EPS $ 2.56 $ 2.78 $ 2.37 $ 1.99 $ 2.98 $ 2.53 Shares used in diluted EPS calculation 37,039 36,821 37,203 36,340 37,513 36,336 Impact of benefit from note hedge (2,516) (1,539) (2,774) (1,187) (2,874) (1,459) Shares used in Adjusted non-GAAP diluted EPS calculation 34,523 35,282 34,429 35,153 34,639 34,877 * The non-GAAP financial measures are referred to as “Adjusted”. Adjusted earnings from operations, Adjusted net earnings and Adjusted diluted earnings per share exclude (i) severance and restructuring expenses, net, (ii) certain executive recruitment and hiring-related expenses, (iii) amortization of intangible assets, (iv) transformation costs, (v) certain acquisition and integration-related expenses, (vi) certain third-party data center service outage related expenses, and (vii) the tax effects of each of these items, as applicable

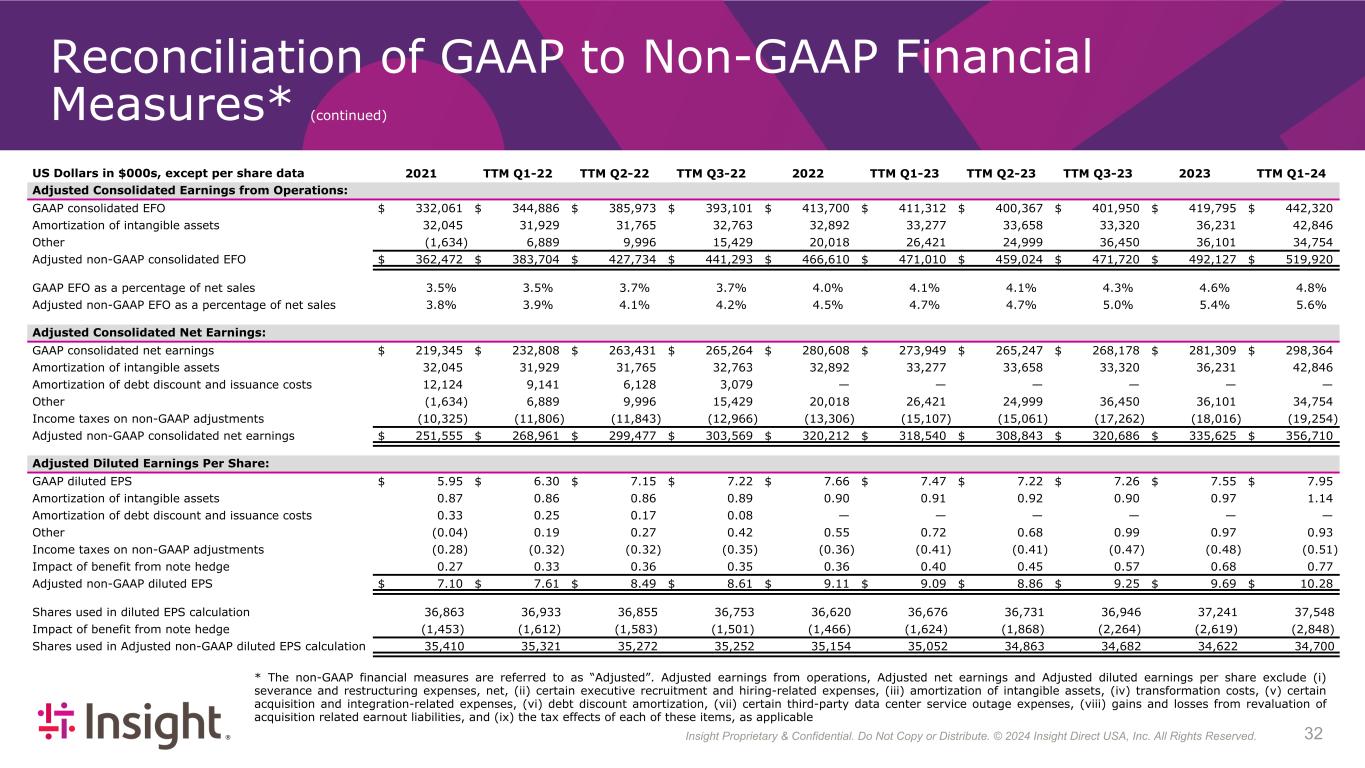

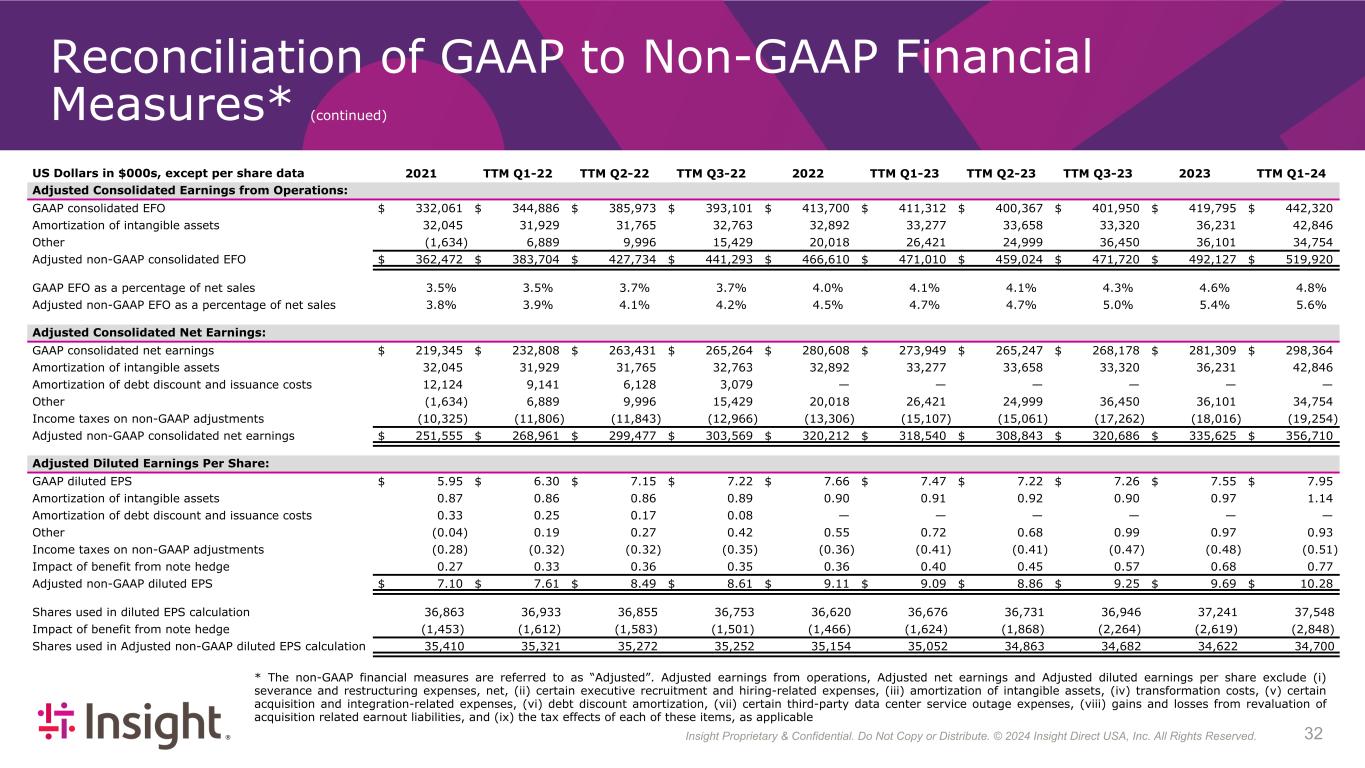

Insight Proprietary & Confidential. Do Not Copy or Distribute. © 2022 Insight Direct USA, Inc. All Rights Reserved. 324 Reconciliation of GAAP to Non-GAAP Financial Measures* (continued) * The non-GAAP financial measures are referred to as “Adjusted”. Adjusted earnings from operations, Adjusted net earnings and Adjusted diluted earnings per share exclude (i) severance and restructuring expenses, net, (ii) certain executive recruitment and hiring-related expenses, (iii) amortization of intangible assets, (iv) transformation costs, (v) certain acquisition and integration-related expenses, (vi) debt discount amortization, (vii) certain third-party data center service outage expenses, (viii) gains and losses from revaluation of acquisition related earnout liabilities, and (ix) the tax effects of each of these items, as applicable US Dollars in $000s, except per share data 2021 TTM Q1-22 TTM Q2-22 TTM Q3-22 2022 TTM Q1-23 TTM Q2-23 TTM Q3-23 2023 TTM Q1-24 Adjusted Consolidated Earnings from Operations: GAAP consolidated EFO $ 332,061 $ 344,886 $ 385,973 $ 393,101 $ 413,700 $ 411,312 $ 400,367 $ 401,950 $ 419,795 $ 442,320 Amortization of intangible assets 32,045 31,929 31,765 32,763 32,892 33,277 33,658 33,320 36,231 42,846 Other (1,634) 6,889 9,996 15,429 20,018 26,421 24,999 36,450 36,101 34,754 Adjusted non-GAAP consolidated EFO $ 362,472 $ 383,704 $ 427,734 $ 441,293 $ 466,610 $ 471,010 $ 459,024 $ 471,720 $ 492,127 $ 519,920 GAAP EFO as a percentage of net sales 3.5 % 3.5 % 3.7 % 3.7 % 4.0 % 4.1 % 4.1 % 4.3 % 4.6 % 4.8 % Adjusted non-GAAP EFO as a percentage of net sales 3.8 % 3.9 % 4.1 % 4.2 % 4.5 % 4.7 % 4.7 % 5.0 % 5.4 % 5.6 % Adjusted Consolidated Net Earnings: GAAP consolidated net earnings $ 219,345 $ 232,808 $ 263,431 $ 265,264 $ 280,608 $ 273,949 $ 265,247 $ 268,178 $ 281,309 $ 298,364 Amortization of intangible assets 32,045 31,929 31,765 32,763 32,892 33,277 33,658 33,320 36,231 42,846 Amortization of debt discount and issuance costs 12,124 9,141 6,128 3,079 — — — — — — Other (1,634) 6,889 9,996 15,429 20,018 26,421 24,999 36,450 36,101 34,754 Income taxes on non-GAAP adjustments (10,325) (11,806) (11,843) (12,966) (13,306) (15,107) (15,061) (17,262) (18,016) (19,254) Adjusted non-GAAP consolidated net earnings $ 251,555 $ 268,961 $ 299,477 $ 303,569 $ 320,212 $ 318,540 $ 308,843 $ 320,686 $ 335,625 $ 356,710 Adjusted Diluted Earnings Per Share: GAAP diluted EPS $ 5.95 $ 6.30 $ 7.15 $ 7.22 $ 7.66 $ 7.47 $ 7.22 $ 7.26 $ 7.55 $ 7.95 Amortization of intangible assets 0.87 0.86 0.86 0.89 0.90 0.91 0.92 0.90 0.97 1.14 Amortization of debt discount and issuance costs 0.33 0.25 0.17 0.08 — — — — — — Other (0.04) 0.19 0.27 0.42 0.55 0.72 0.68 0.99 0.97 0.93 Income taxes on non-GAAP adjustments (0.28) (0.32) (0.32) (0.35) (0.36) (0.41) (0.41) (0.47) (0.48) (0.51) Impact of benefit from note hedge 0.27 0.33 0.36 0.35 0.36 0.40 0.45 0.57 0.68 0.77 Adjusted non-GAAP diluted EPS $ 7.10 $ 7.61 $ 8.49 $ 8.61 $ 9.11 $ 9.09 $ 8.86 $ 9.25 $ 9.69 $ 10.28 Shares used in diluted EPS calculation 36,863 36,933 36,855 36,753 36,620 36,676 36,731 36,946 37,241 37,548 Impact of benefit from note hedge (1,453) (1,612) (1,583) (1,501) (1,466) (1,624) (1,868) (2,264) (2,619) (2,848) Shares used in Adjusted non-GAAP diluted EPS calculation 35,410 35,321 35,272 35,252 35,154 35,052 34,863 34,682 34,622 34,700

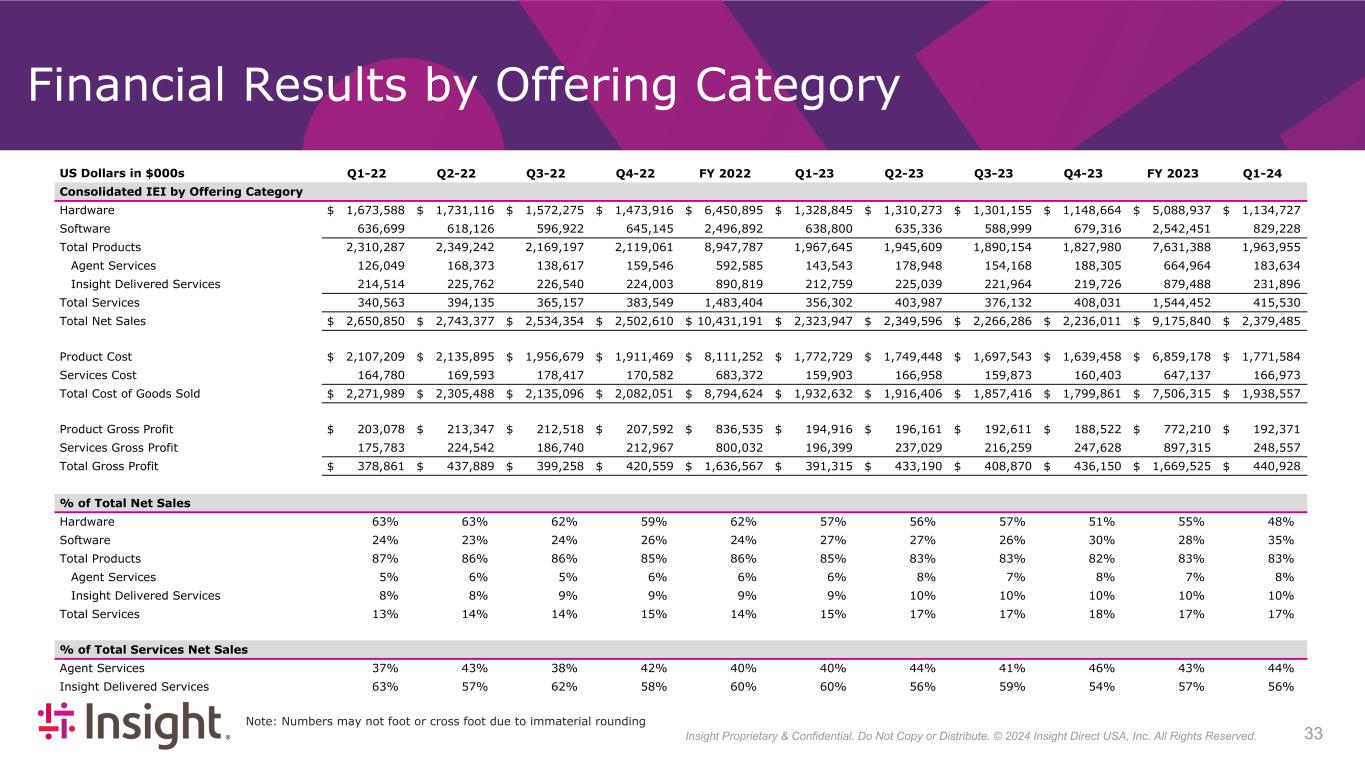

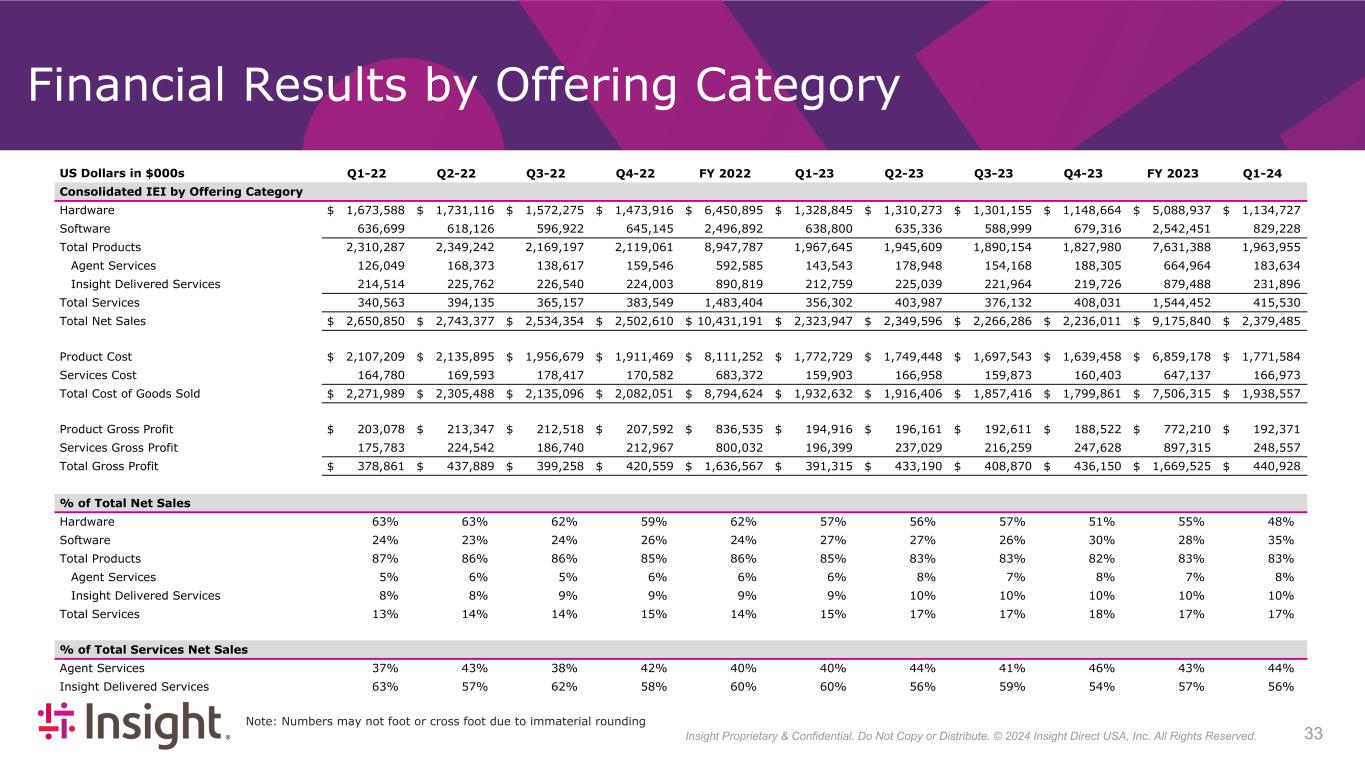

Insight Proprietary & Confidential. Do Not Copy or Distribute. © 2022 Insight Direct USA, Inc. All Rights Reserved. 334 Financial Results by Offering Category US Dollars in $000s Q1-22 Q2-22 Q3-22 Q4-22 FY 2022 Q1-23 Q2-23 Q3-23 Q4-23 FY 2023 Q1-24 Consolidated IEI by Offering Category Hardware $ 1,673,588 $ 1,731,116 $ 1,572,275 $ 1,473,916 $ 6,450,895 $ 1,328,845 $ 1,310,273 $ 1,301,155 $ 1,148,664 $ 5,088,937 $ 1,134,727 Software 636,699 618,126 596,922 645,145 2,496,892 638,800 635,336 588,999 679,316 2,542,451 829,228 Total Products 2,310,287 2,349,242 2,169,197 2,119,061 8,947,787 1,967,645 1,945,609 1,890,154 1,827,980 7,631,388 1,963,955 Agent Services 126,049 168,373 138,617 159,546 592,585 143,543 178,948 154,168 188,305 664,964 183,634 Insight Delivered Services 214,514 225,762 226,540 224,003 890,819 212,759 225,039 221,964 219,726 879,488 231,896 Total Services 340,563 394,135 365,157 383,549 1,483,404 356,302 403,987 376,132 408,031 1,544,452 415,530 Total Net Sales $ 2,650,850 $ 2,743,377 $ 2,534,354 $ 2,502,610 $ 10,431,191 $ 2,323,947 $ 2,349,596 $ 2,266,286 $ 2,236,011 $ 9,175,840 $ 2,379,485 Product Cost $ 2,107,209 $ 2,135,895 $ 1,956,679 $ 1,911,469 $ 8,111,252 $ 1,772,729 $ 1,749,448 $ 1,697,543 $ 1,639,458 $ 6,859,178 $ 1,771,584 Services Cost 164,780 169,593 178,417 170,582 683,372 159,903 166,958 159,873 160,403 647,137 166,973 Total Cost of Goods Sold $ 2,271,989 $ 2,305,488 $ 2,135,096 $ 2,082,051 $ 8,794,624 $ 1,932,632 $ 1,916,406 $ 1,857,416 $ 1,799,861 $ 7,506,315 $ 1,938,557 Product Gross Profit $ 203,078 $ 213,347 $ 212,518 $ 207,592 $ 836,535 $ 194,916 $ 196,161 $ 192,611 $ 188,522 $ 772,210 $ 192,371 Services Gross Profit 175,783 224,542 186,740 212,967 800,032 196,399 237,029 216,259 247,628 897,315 248,557 Total Gross Profit $ 378,861 $ 437,889 $ 399,258 $ 420,559 $ 1,636,567 $ 391,315 $ 433,190 $ 408,870 $ 436,150 $ 1,669,525 $ 440,928 % of Total Net Sales Hardware 63 % 63 % 62 % 59 % 62 % 57 % 56 % 57 % 51 % 55 % 48 % Software 24 % 23 % 24 % 26 % 24 % 27 % 27 % 26 % 30 % 28 % 35 % Total Products 87 % 86 % 86 % 85 % 86 % 85 % 83 % 83 % 82 % 83 % 83 % Agent Services 5 % 6 % 5 % 6 % 6 % 6 % 8 % 7 % 8 % 7 % 8 % Insight Delivered Services 8 % 8 % 9 % 9 % 9 % 9 % 10 % 10 % 10 % 10 % 10 % Total Services 13 % 14 % 14 % 15 % 14 % 15 % 17 % 17 % 18 % 17 % 17 % % of Total Services Net Sales Agent Services 37 % 43 % 38 % 42 % 40 % 40 % 44 % 41 % 46 % 43 % 44 % Insight Delivered Services 63 % 57 % 62 % 58 % 60 % 60 % 56 % 59 % 54 % 57 % 56 % Note: Numbers may not foot or cross foot due to immaterial rounding

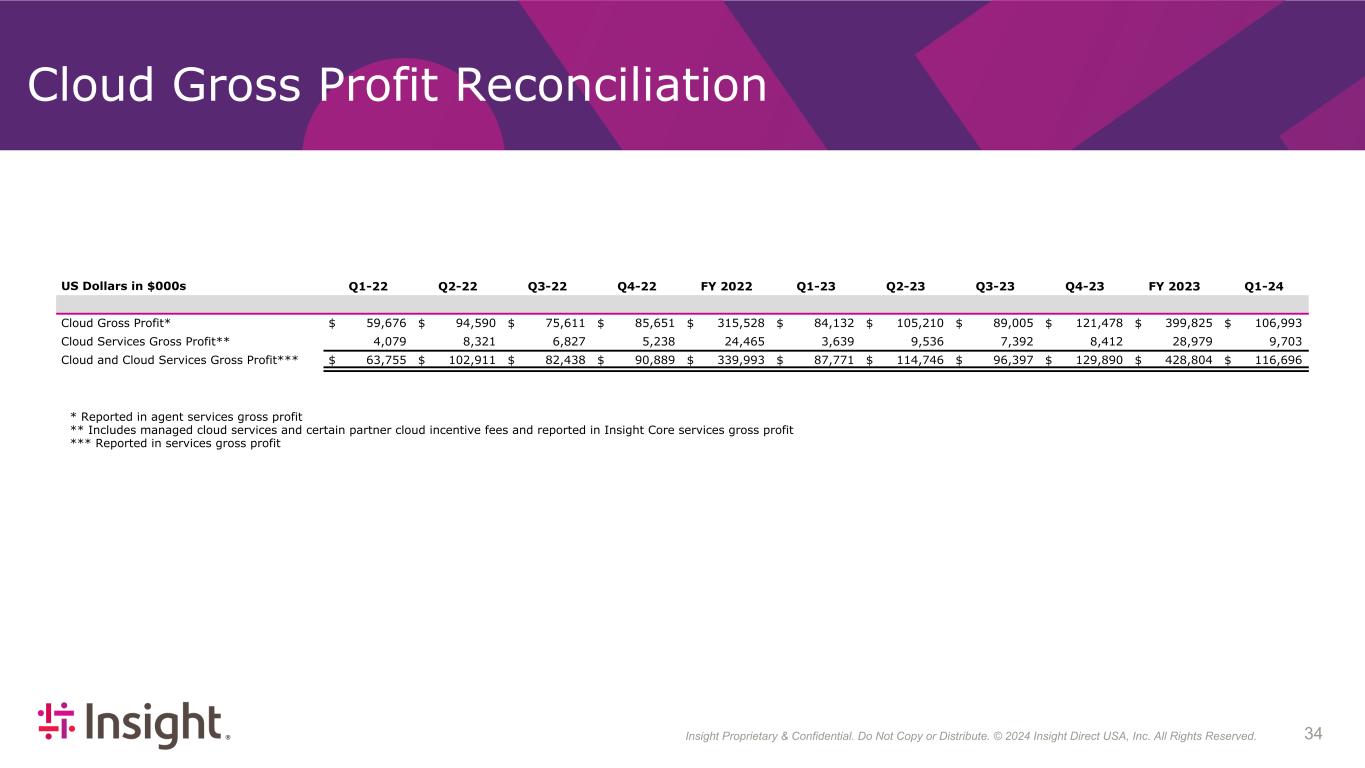

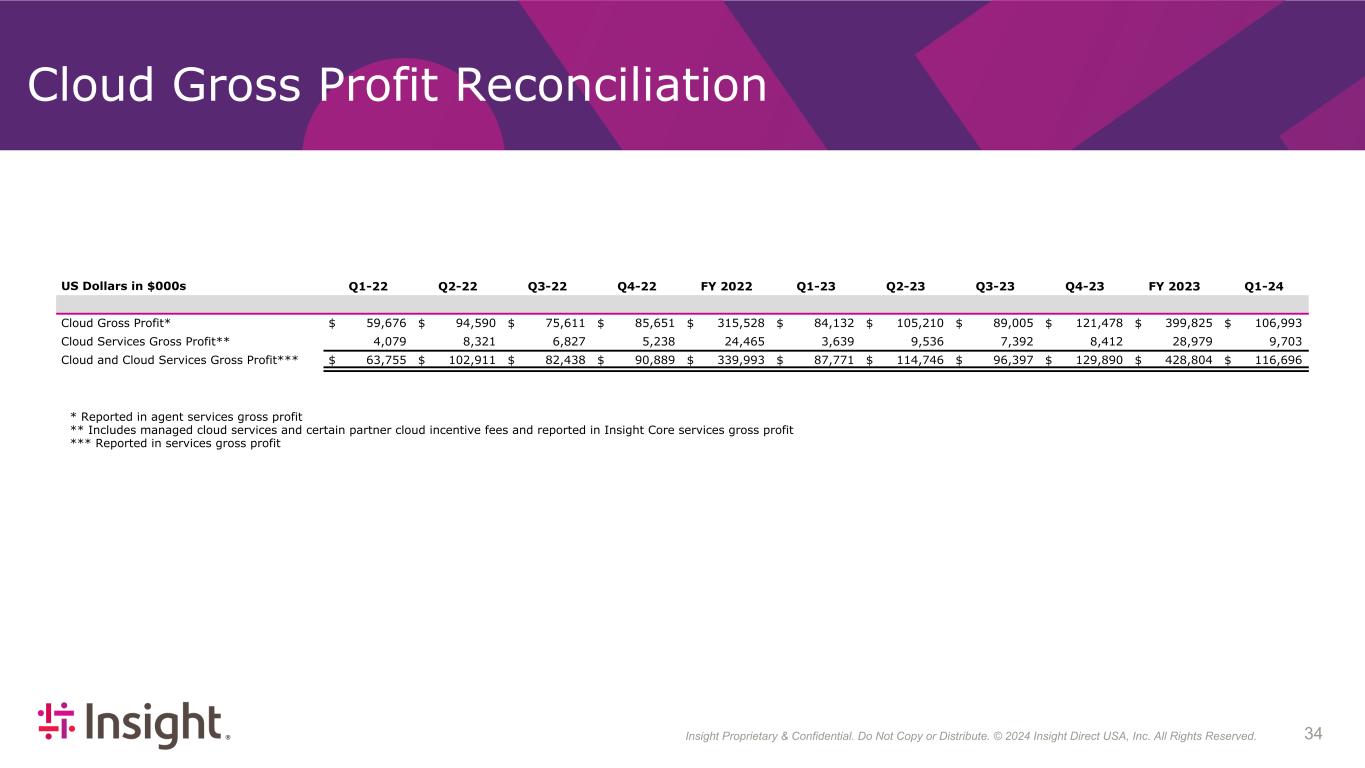

Insight Proprietary & Confidential. Do Not Copy or Distribute. © 2022 Insight Direct USA, Inc. All Rights Reserved. 344 Cloud Gross Profit Reconciliation US Dollars in $000s Q1-22 Q2-22 Q3-22 Q4-22 FY 2022 Q1-23 Q2-23 Q3-23 Q4-23 FY 2023 Q1-24 Cloud Gross Profit* $ 59,676 $ 94,590 $ 75,611 $ 85,651 $ 315,528 $ 84,132 $ 105,210 $ 89,005 $ 121,478 $ 399,825 $ 106,993 Cloud Services Gross Profit** 4,079 8,321 6,827 5,238 24,465 3,639 9,536 7,392 8,412 28,979 9,703 Cloud and Cloud Services Gross Profit*** $ 63,755 $ 102,911 $ 82,438 $ 90,889 $ 339,993 $ 87,771 $ 114,746 $ 96,397 $ 129,890 $ 428,804 $ 116,696 * Reported in agent services gross profit ** Includes managed cloud services and certain partner cloud incentive fees and reported in Insight Core services gross profit *** Reported in services gross profit

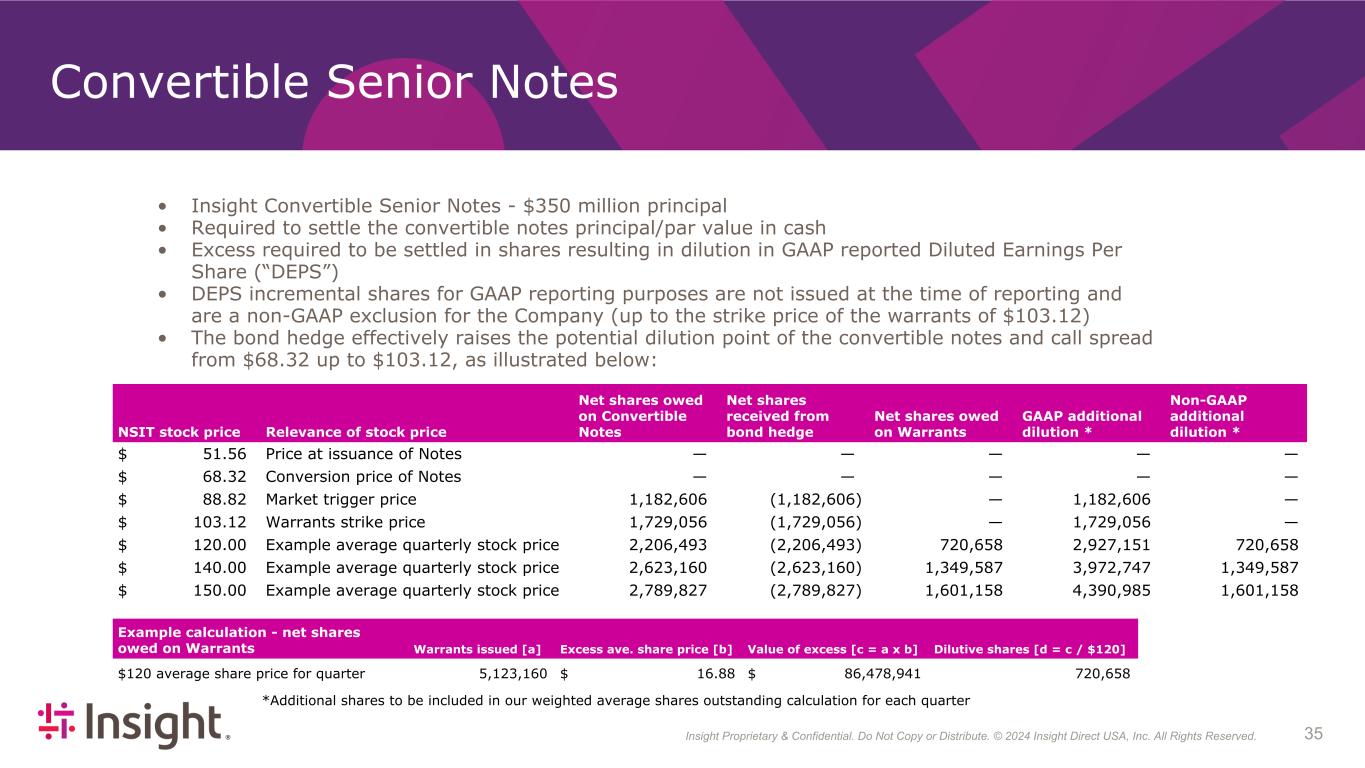

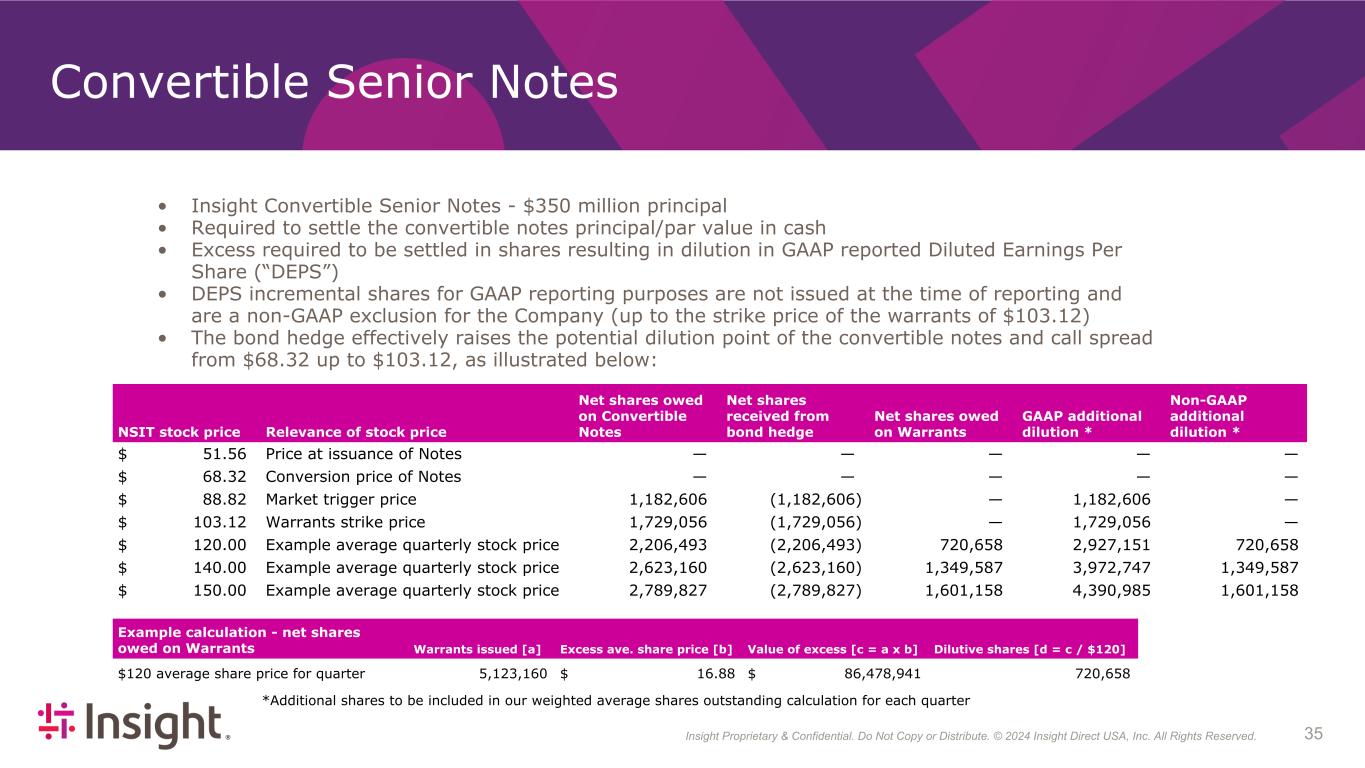

Insight Proprietary & Confidential. Do Not Copy or Distribute. © 2022 Insight Direct USA, Inc. All Rights Reserved. 354 Convertible Senior Notes • Insight Convertible Senior Notes - $350 million principal • Required to settle the convertible notes principal/par value in cash • Excess required to be settled in shares resulting in dilution in GAAP reported Diluted Earnings Per Share (“DEPS”) • DEPS incremental shares for GAAP reporting purposes are not issued at the time of reporting and are a non-GAAP exclusion for the Company (up to the strike price of the warrants of $103.12) • The bond hedge effectively raises the potential dilution point of the convertible notes and call spread from $68.32 up to $103.12, as illustrated below: NSIT stock price Relevance of stock price Net shares owed on Convertible Notes Net shares received from bond hedge Net shares owed on Warrants GAAP additional dilution * Non-GAAP additional dilution * $ 51.56 Price at issuance of Notes — — — — — $ 68.32 Conversion price of Notes — — — — — $ 88.82 Market trigger price 1,182,606 (1,182,606) — 1,182,606 — $ 103.12 Warrants strike price 1,729,056 (1,729,056) — 1,729,056 — $ 120.00 Example average quarterly stock price 2,206,493 (2,206,493) 720,658 2,927,151 720,658 $ 140.00 Example average quarterly stock price 2,623,160 (2,623,160) 1,349,587 3,972,747 1,349,587 $ 150.00 Example average quarterly stock price 2,789,827 (2,789,827) 1,601,158 4,390,985 1,601,158 Example calculation - net shares owed on Warrants Warrants issued [a] Excess ave. share price [b] Value of excess [c = a x b] Dilutive shares [d = c / $120] $120 average share price for quarter 5,123,160 $ 16.88 $ 86,478,941 720,658 *Additional shares to be included in our weighted average shares outstanding calculation for each quarter