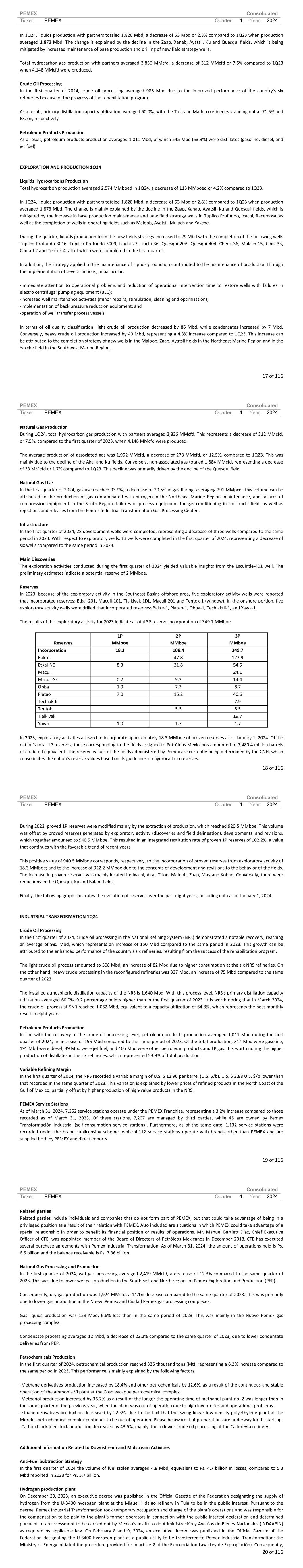

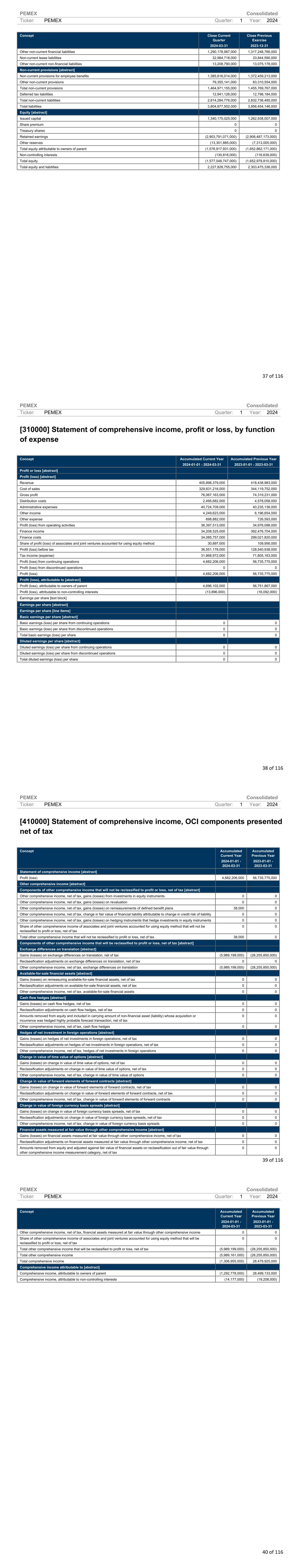

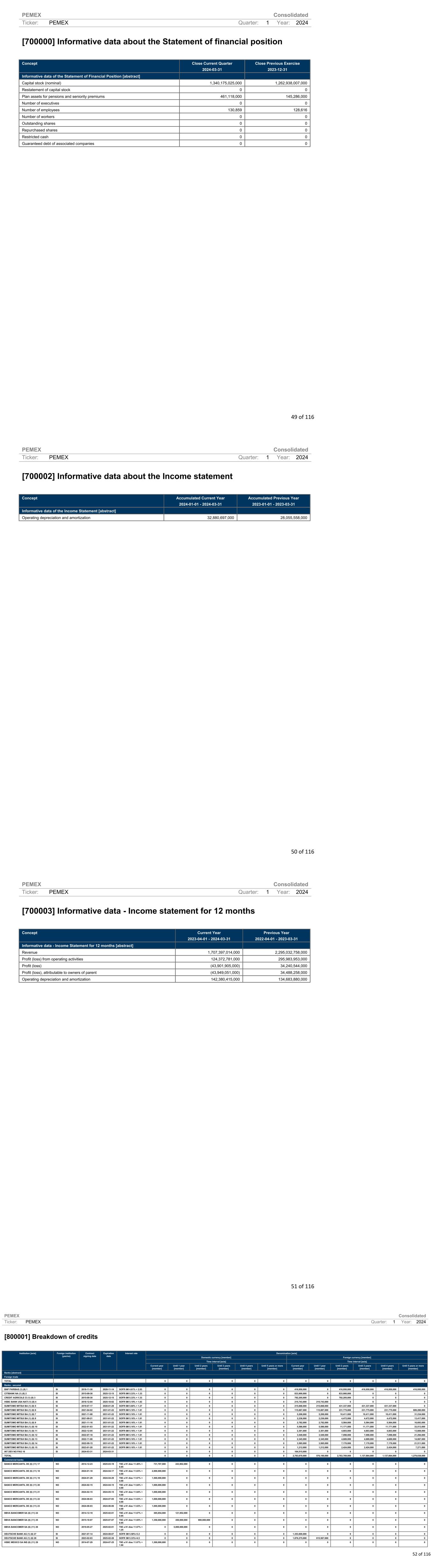

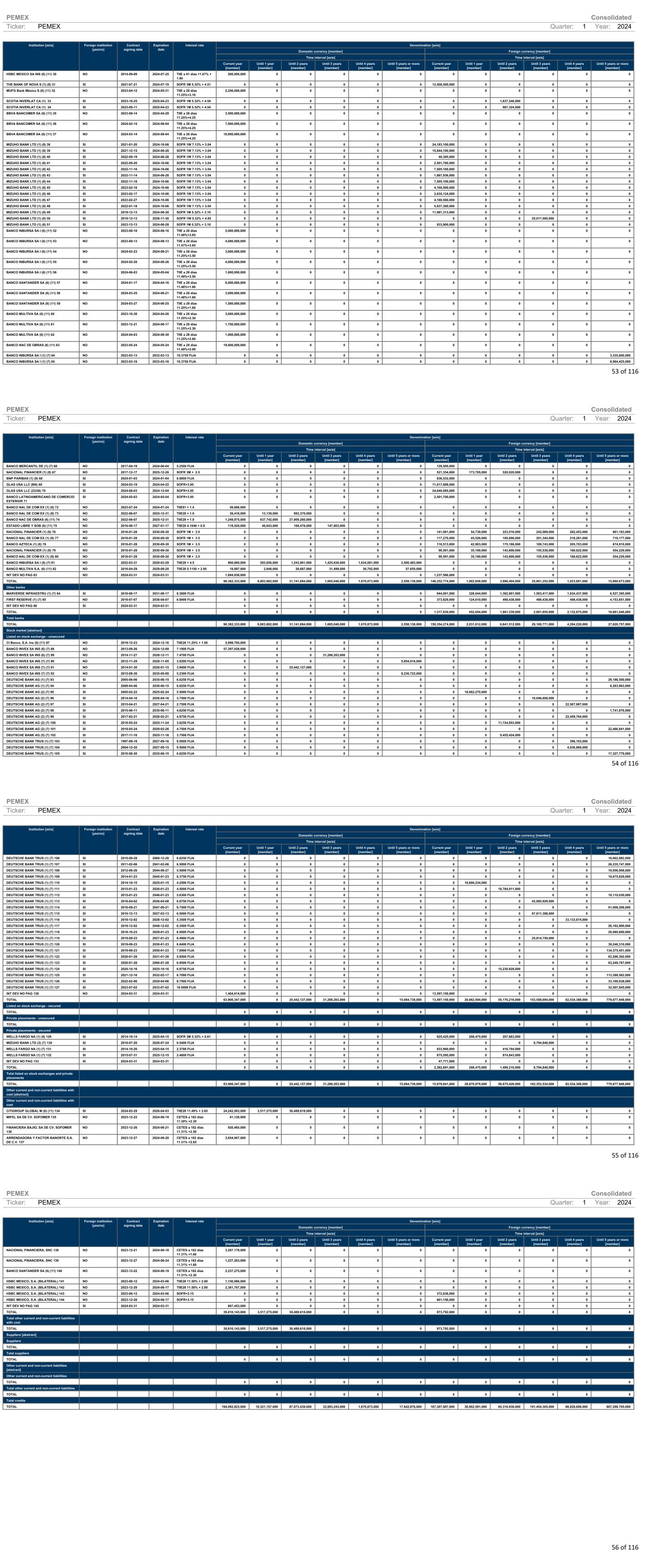

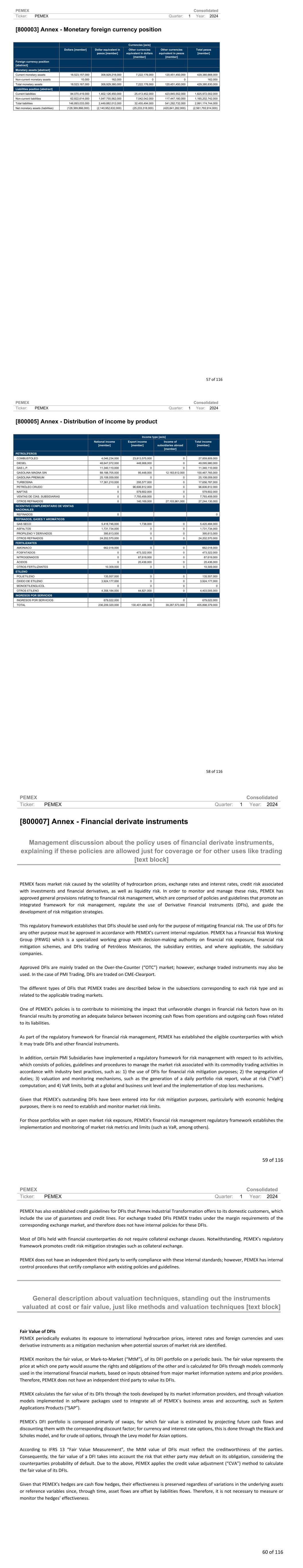

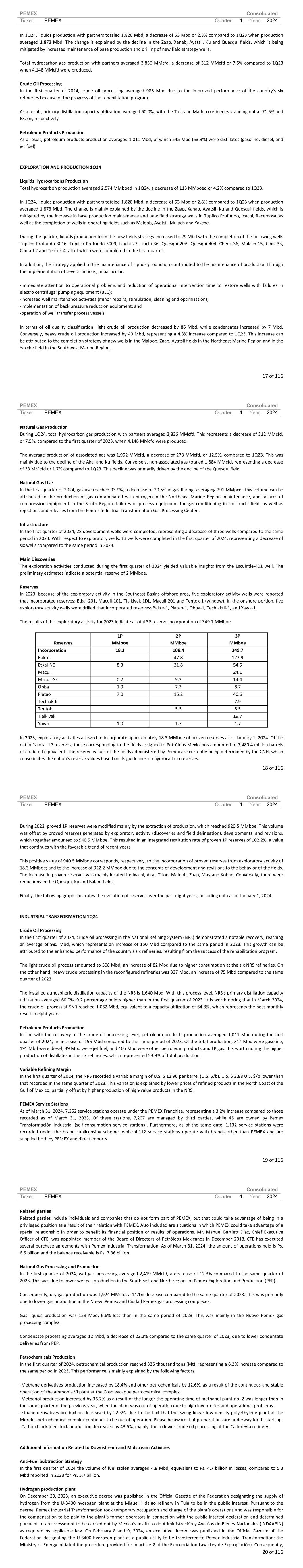

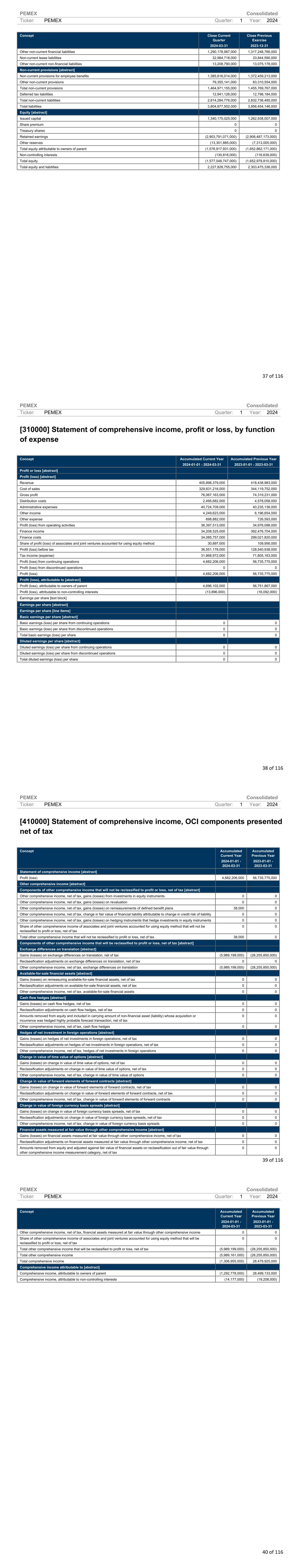

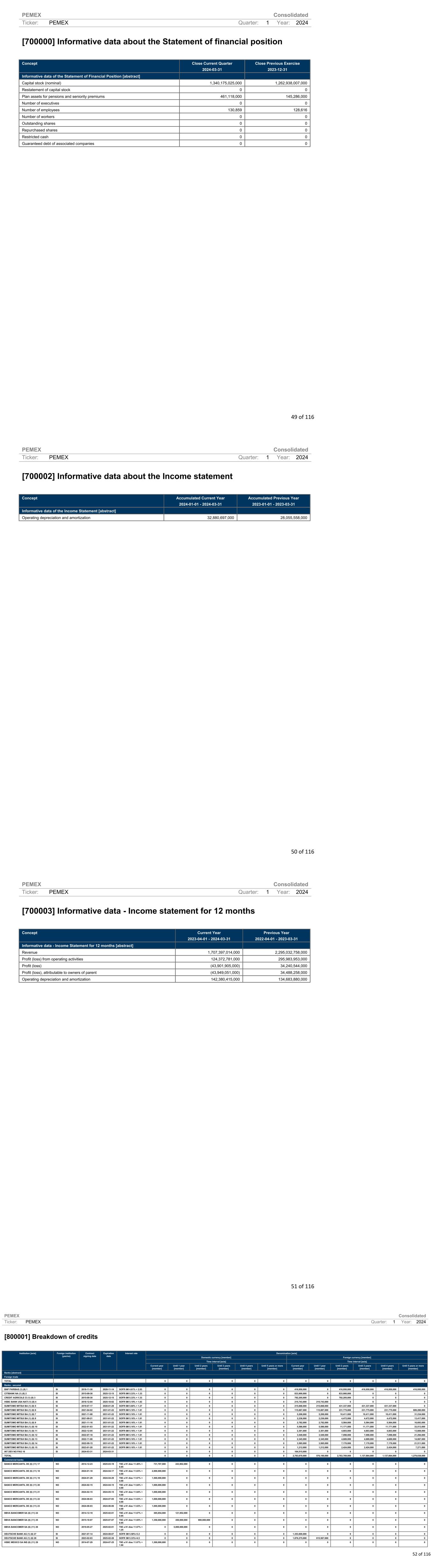

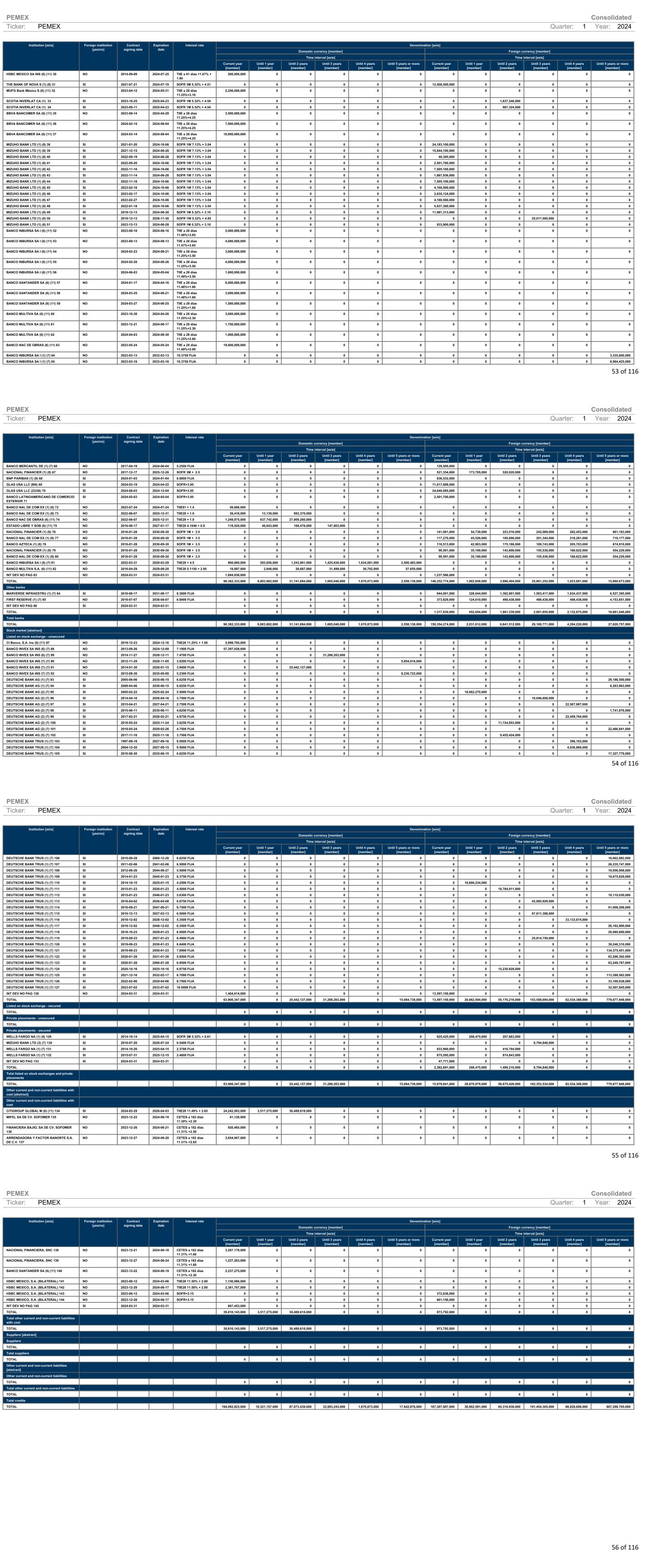

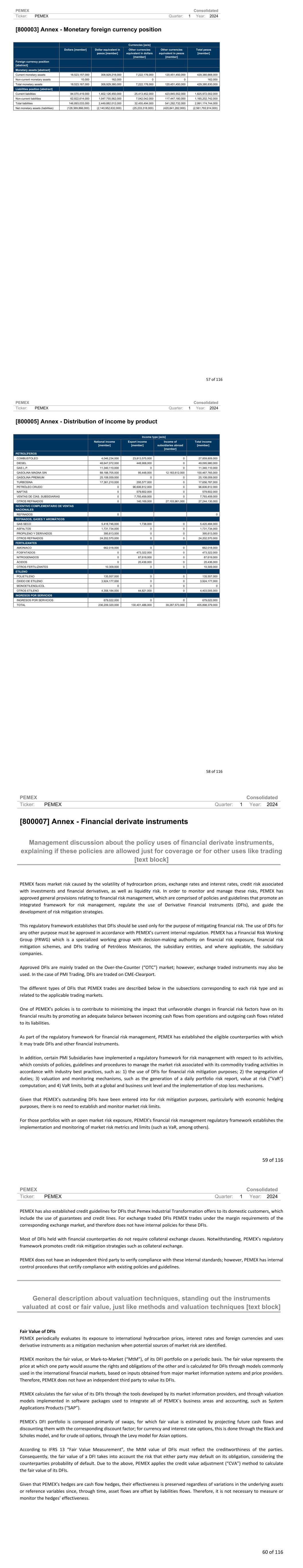

PEMEX Consolidated Ticker: PEMEX Quarter: 1 Year: 2024 1 of 116 Quarterly Financial Information [105000] Management commentary .................................................................................................................................2 [110000] General information about financial statements ...........................................................................................35 [210000] Statement of financial position, current/non-current.....................................................................................36 [310000] Statement of comprehensive income, profit or loss, by function of expense ...........................................38 [410000] Statement of comprehensive income, OCI components presented net of tax .........................................39 [520000] Statement of cash flows, indirect method ......................................................................................................41 [610000] Statement of changes in equity - Accumulated Current ..............................................................................43 [610000] Statement of changes in equity - Accumulated Previous ............................................................................46 [700000] Informative data about the Statement of financial position .........................................................................49 [700002] Informative data about the Income statement...............................................................................................50 [700003] Informative data - Income statement for 12 months.....................................................................................51 [800001] Breakdown of credits ........................................................................................................................................52 [800003] Annex - Monetary foreign currency position..................................................................................................57 [800005] Annex - Distribution of income by product .....................................................................................................58 [800007] Annex - Financial derivate instruments ..........................................................................................................59 [800100] Notes - Subclassifications of assets, liabilities and equities .......................................................................71 [800200] Notes - Analysis of income and expense.......................................................................................................75 [800500] Notes - List of notes ..........................................................................................................................................76 [800600] Notes - List of accounting policies ..................................................................................................................77 [813000] Notes - Interim financial reporting ...................................................................................................................78 Exhibit 1 PEMEX Consolidated Ticker: PEMEX Quarter: 1 Year: 2024 2 of 116 [105000] Management commentary Management commentary [text block] In addition to this document, the Company is providing a report to publish its preliminary financial and operational results as of March 31, 2024. The Company encourages the reader to analyze this document together with the information provided in said report and annexes in addition to the transcript of its conference call announcing its quarterly results. All comparisons are made against the same period of the previous year unless otherwise specified. This call was made on April 26, 2024. Annexes, transcripts, and relevant documents related to this call can be found at www.pemex.com/en/investors. Information Summary First Quarter 2024 In the first quarter of 2024 (1Q24), Petróleos Mexicanos' financial policy remained committed to providing optimal support to the operation. The Exploration and Production strategy continued to give priority to the accelerated development of new fields, to reduce the time to put recent discoveries into operation and to the early incorporation of production from exploratory wells, mostly in onshore and shallow water areas, as well as to mitigate the decline of mature fields. However, the natural decline of fields and adverse weather conditions that resulted in delays in the completion of wells, resulted in an average production of 1,820 Mbd in 1Q24, 53 Mbd lower than the 1,873 Mbd observed in the comparable period of 2023. In Industrial Transformation, we continued with the implementation of the infrastructure rehabilitation and timely maintenance plan to recover the capacity of the National Refining System and improve the efficiency of its operation. This was reflected in positive results in terms of crude oil processing, which in the first quarter of 2024 reached 985 Mbd, 150 Mbd higher than the 835 Mbd recorded in the January-March 2023 period. In terms of financial results, operating income amounted to MXN 36.4 billion in 1Q24, MXN 1.4 billion higher than in 1Q23. However, a 6.7% appreciation of the peso against the US dollar in 1Q23, higher than the 1.4% appreciation observed in 1Q24, resulted in a decrease in foreign exchange profit, which impacted on net income, which in 1Q24 was MXN 4.7 billion, MXN 56.7 billion lower than in the same period of2023. The financing strategy continued to be executed in coordination with the Ministry of Finance and Public Credit, with a focus on securing the company's liquidity needs in an optimal and timely manner, while seeking to reduce the debt balance. This, together with significant support from the Federal Government, resulted in a USD 4.5 billion reduction in the debt balance in 1Q24, which stood at USD 101.5 billion at the end of the quarter. Likewise, efforts were maintained to strengthen the strategy in terms of environmental, social and governance criteria, concluding with a key milestone for these purposes, since in March 2024 the Board of Directors approved the Sustainability Plan, which represents the framework for action to advance in the achievement of the company's objectives in these areas. PEMEX Consolidated Ticker: PEMEX Quarter: 1 Year: 2024 3 of 116 Main Results 1Q23 1Q24 Change % Operative (Mbd) Crude Oil Production 1,873 1,820 (2.8) Crude Oil Processing 835 985 18.0 Financial (Ps. million) Operating Income (loss) 34,976 36,398 4.1 Net Income (loss) 56,736 4,682 (91.7) EBITDA 118,452 92,459 (21.9) Disclosure of nature of business [text block] Petróleos Mexicanos, its Productive State-owned Subsidiaries, its Affiliates, and its Subsidiary Entities (PEMEX), comprise the oil and gas Productive State-Owned Company of the United Mexican States. Petróleos Mexicanos is a Productive State-Owned Company of the Federal Government of Mexico, with legal personality and equity, with technical, operational and managerial autonomy, as established on the Law of Petróleos Mexicanos. Disclosure of management's objectives and its strategies for meeting those objectives [text block] Petróleos Mexicanos is Mexico's oil and gas production company, whose objective is to compete in an open market and maintain a leadership position in the energy sector, generating economic value through all its business lines, from the hydrocarbons exploration and extraction in Mexico and abroad, to refining, transforming, processing and commercialization of hydrocarbons and derivatives. Disclosure of entity's most significant resources, risks and relationships [text block] PEMEX Consolidated Ticker: PEMEX Quarter: 1 Year: 2024 4 of 116 Risk Factors Related to Our Operations We have a substantial amount of indebtedness and other liabilities and are exposed to significant liquidity constraints, which could make it difficult for us to obtain financing on favorable terms and could adversely affect our financial condition, results of operations and ability to repay our debt and, ultimately, our ability to operate as a going concern without additional support from the Mexican Government, which we may not receive. We have a substantial amount of debt, which we have incurred primarily to fund operating expenses and finance our capital investment projects. Due to our heavy tax burden, our cash flow from operations in recent years has not been sufficient to fund our capital expenditures and other expenses and, accordingly, we face significant indebtedness. Therefore, in order to develop our assigned hydrocarbon reserves, service our indebtedness and amortize scheduled debt maturities, we will need to obtain funds from a broad range of sources, in addition to continuing efficiency and cost-cutting initiatives. There can be no assurances that we will continue to have access to capital on favorable terms or any terms at all. During the first three months period of 2024, we received support from the Mexican Government for strengthen our financial condition, and such additional support may not be available in upcoming years. As of March 31, 2024, our total indebtedness, including accrued interest, was Ps. 1,692.8 billion (U.S. $101.5 billion), in nominal terms, which represented a 5.7% decrease in peso terms compared to our total indebtedness, including accrued interest, of Ps. 1,794.5 billion (U.S. $106.0 billion) as of December 31, 2023. As of March 31, 2023, 46% of our existing debt, or Ps. 779.4 billion (U.S. $46.7 billion), including accrued interest, is scheduled to mature in the next three years, including Ps. 361.4 billion (U.S. $21.7 billion) scheduled to mature in 2024. Our working capital got better from a negative working capital of Ps. 585.2 billion (U.S. $35.0 billion) as of December 31, 2023 to a negative working capital of Ps. 502.5 billion (U.S. $30.1 billion) as of March 31, 2024. Our level of debt may increase further in the short or medium term as a result of new financing activities or future depreciation of the peso as compared to the U.S. dollar and may have an adverse effect on our financial condition, results of operations and liquidity position. To service our debt, we have relied and may continue to rely on a combination of cash flows from our operations, drawdowns under our available credit facilities, capital contributions from the Mexican Government and the incurrence of additional indebtedness (including refinancing of existing indebtedness). During the first three months period of 2024, we received Ps. 77.2 billion (U.S. $4.6 billion) in capital contributions from the Mexican Government, to support our debt repayments. These contributions represented an important source for the payment of our debt during the first three months period of 2024. If we were unable to obtain financing on favorable terms or any terms at all, this could hamper our ability to obtain further financing, to invest in projects, exploit hydrocarbon reserves, and meet our principal and interest payment obligations with our creditors. This risk would be further magnified if we also were unable to receive support from the Mexican Government. As a result, we may be exposed to significant liquidity constraints and may not be able to service our debt, pay our suppliers or make the capital expenditures required to maintain our current production levels and to maintain, and increase, the proved hydrocarbon reserves assigned to us by the Mexican Government, which may adversely affect our financial condition and results of operations. See “—Risk Factors Related to our Relationship with the Mexican Government—We must make significant capital expenditures to maintain our current production levels, and to maintain, as well as increase, the proved hydrocarbon reserves assigned to us by the Mexican Government. Reductions in our income, adjustments to our capital expenditures budget or an inability to obtain financing may limit our ability to make capital investments” below. If such constraints occur at a time when our cash flow from operations is less than the resources necessary to meet our debt service obligations, which was the case for the year ended December 31, 2023, we could be forced to further reduce our planned capital expenditures and implement further austerity measures in order to provide additional liquidity to our operations. A reduction in our capital expenditure program could adversely affect our financial condition and results of operations. Additionally, such measures may not be sufficient for us to meet our obligations.

PEMEX Consolidated Ticker: PEMEX Quarter: 1 Year: 2024 5 of 116 Our condensed consolidated interim financial statements not audited have been prepared on the assumption that we will continue as a going concern. Our condensed consolidated interim financial statements not audited as of March 31, 2023, have been prepared under the assumption that we will continue as a going concern. However, there is material uncertainty that raises significant doubt about our ability to continue operating as a going concern. Our condensed consolidated interim financial statements not audited as of the first three months period of 2024 do not include any adjustments that might result from the outcome of that uncertainty. If the actions we are taking to improve our financial condition, are not successful, we may not be able to continue operating as a going concern. Downgrades in our credit ratings could negatively impact our access to the financial markets and cost of financing. We rely on access to the financial markets to fund our operations and finance the capital expenditures needed to carry out our capital investment projects. Accordingly, credit ratings are important to our business and financial condition, as credit ratings affect the cost and other terms upon which we are able to obtain funding. Ratings address our creditworthiness and the likelihood of timely payment of our long-term debt securities. Ratings are not a recommendation to purchase, hold or sell securities and may be changed, suspended or withdrawn at any time. Our current credit ratings and the rating outlooks depend, in part, on economic conditions and other factors that affect credit risk and are outside our control, as well as assessments of the creditworthiness of Mexico. Certain rating agencies downgraded Mexico’s credit ratings in July 2022 and their assessment of Mexico’s creditworthiness has and may further affect our credit ratings. Further, certain rating agencies recently downgraded our credit rating and ratings outlook during July 2023 and February 2024. We currently have a “split rating” among the rating agencies that formally rate our credit profile. Two of such rating agencies have assigned us a non-investment grade rating and the other agency assigned us an investment grade rating. For more information regarding credit ratings, you can consult our web site www.pemex.com. While these downgrades do not constitute a default or an event of default under our debt instruments, they have increased our cost of financing. Further downgrades may have material adverse consequences on our ability to access the financial markets and the terms on which we may obtain financing, including our cost of financing. In turn, this could significantly harm our financial condition, results of operations and ability to meet existing obligations. In addition, in connection with the entry into new financings or amendments to existing financing arrangements, our financial and operational flexibility may be impaired as a result of more restrictive covenants, requirements for security and other terms that may be imposed on “split-rated” entities. Our “split rating” and any further credit rating downgrades could also negatively impact the prices of our debt securities, reduce our potential pool of investors and limit our funding sources, among other consequences. There can be no assurance that we will be able to maintain or improve our current credit ratings or outlook. Crude oil, natural gas and petroleum products prices are volatile, and low crude oil and natural gas prices adversely affect our income and cash flows and the value of the hydrocarbon reserves that we have the right to extract and sell. Most of our cash flow derives from sales of crude oil, petroleum products and natural gas. International prices of crude oil, petroleum products and natural gas are subject to global supply and demand and fluctuate due to many factors beyond our control. These factors include (i) competition within the oil and natural gas industry, (ii) the existence and development of alternative sources of energy, (iii) prices of alternative sources of energy, (iv) the cost of exploration and exploitation of oil fields, (v) international economic trends, (vi) exchange rate fluctuations, (vii) expectations of inflation, (viii) domestic and foreign laws and government regulations, (ix) political, social and other events (including public health events and armed conflict) in major oil- and natural gas-producing and consuming nations, (x) actions taken by Organization of the Petroleum Exporting Countries PEMEX Consolidated Ticker: PEMEX Quarter: 1 Year: 2024 6 of 116 (“OPEC”) members and other oil exporting countries, (xi) trading activity in oil and natural gas and (xii) transactions in derivative financial instruments (“DFIs”) related to oil and gas. When international prices of crude oil, petroleum products and/or natural gas are low, we earn less revenue and, therefore, generate lower cash flows and earn less income before taxes and duties because our costs remain roughly constant. Conversely, when prices of crude oil, petroleum products and/or natural gas are high, we earn more revenue and our income before taxes and duties increases. The Mexican crude oil export price has been extremely volatile in recent years, reaching an unprecedented low of negative U.S. $7.33 per barrel on April 28, 2020 in reaction to the COVID-19 pandemic and actions taken by other oil-producing countries. During the first three months period of 2024, the weighted average Mexican crude oil price remained volatile due to market conditions, averaging U.S. $70.25 per barrel, as compared to U.S. $70.98 per barrel during 2023. Any future decline in international crude oil and natural gas prices will have a negative impact on our results of operations and financial condition. Price fluctuations may also affect estimates of the amount and value of Mexico’s hydrocarbon reserves that we have the right to extract and sell, which could affect our future production levels. See “—Risk Factors Related to our Relationship with the Mexican Government—Hydrocarbon reserves are based on estimates, which are uncertain and subject to revisions” below. We could be affected by the generation of persistent false information and synthetic content, through artificial intelligence and the use of tools for its dissemination that make it difficult to distinguish true information from the media and governments. Misinformation, false information, and synthetic content generated deliberately or not, will be increasingly recurrent, which could cause significant changes in public opinion and distrust in facts and authority. This information is disseminated with specific objectives, such as increasing climate activism, promoting an escalation of conflicts, provoking disagreements that could influence the results of elections and changes of government at a global level, polarization of opinions, reputational damage to individuals and companies, the generation of riots, among others. Likewise, recent technological advances have improved the volume, scope, and effectiveness of counterfeit information, with flows more difficult to track and control. Our business could be negatively impacted by hydrocarbon price volatility as the result of actual or threatened global military or paramilitary activity and any related destabilization of the world energy markets. Our income and cash flows depend on the prices of crude oil, petroleum products and natural gas. Oil prices are highly sensitive to actual and perceived threats to global geopolitical stability and to changes in production from OPEC and OPEC+ member states and other oil-producing nations. An increase, or the threat of an increase, in military or paramilitary activities, including Russian military activities in Ukraine, the conflict in Gaza and disruptions to shipping operations in the Red Sea, could lead to increased volatility in global oil, natural gas and petroleum products prices. The destabilization of or increased volatility in global hydrocarbon prices could reduce the price we receive from our sales and adversely affect our profitability. Increases in oil, gas and petroleum products prices may not persist and could be followed by price decreases based on factors beyond our control, including geopolitical events. Our business may be materially and adversely affected by the emergence of epidemics or pandemics. Public health events, including epidemics and pandemics caused by infectious agents and diseases, such as the COVID-19 pandemic, may adversely impact the health of our workforce, the operations of our partners and suppliers and demand the redesign of routines and procedures. Public health events can also significantly affect the operation of our facilities, including our oil platforms, refineries and terminals, as well as adversely impact the proper functioning of our supply chain. In addition, public PEMEX Consolidated Ticker: PEMEX Quarter: 1 Year: 2024 7 of 116 health events may impact Mexico, the Mexican and/or the global economy and the international prices of, and/or demand for, crude oil, petroleum products and/or natural gas, which may in turn affect our business, results of operations and financial condition. See “—Risk Factors Related to our Operations—Crude oil, natural gas and petroleum products prices are volatile, and low crude oil and natural gas prices adversely affect our income and cash flows and the value of the hydrocarbon reserves that we have the right to extract and sell” above for further information. The impact of current or future public health events is highly uncertain and will depend on numerous evolving factors that we cannot predict, including, but not limited to: the duration, scope, and severity of any such public health event; volatility in oil demand and oil prices; the impact of travel bans, shelter-in-place orders, or work-from-home policies; staffing shortages; interest rate and inflation rate volatility; general economic, financial, and industry conditions, particularly relating to liquidity and financial performance, which may be amplified by the effects of public health events; and the long-term effects of any such public health event on the Mexican and global economies, including on global supply chains, consumer confidence and spending, financial markets and the availability of credit for us, our suppliers and our customers, among others. We are an integrated oil and gas company and are exposed to production, equipment and transportation risks, criminal acts, blockades to our facilities and deliberate acts of terror that could adversely affect our business, results of operations and financial condition. We are subject to several risks that are common among oil and gas companies. These risks include (i) production risks, including fluctuations in production due to operational hazards, accidents at our facilities and effects of natural disasters or weather, (ii) equipment risks, including those relating to the adequacy, condition and maintenance of our facilities and equipment and (iii) transportation risks, including those relating to the condition, availability and vulnerability of pipelines and other modes of transportation. Our business is subject to risks of explosions in pipelines, refineries, plants, drilling wells and other facilities, as well as oil spills, hurricanes in the Gulf of Mexico and other natural or geological disasters and accidents, fires and mechanical failures. Our operations are also exposed to risks arising from criminal acts to steal, divert or tamper with our crude oil, natural gas and refined products from our pipeline network, as well as risks arising from materials and equipment theft. In recent years, we have experienced an increase in the illegal “tapping” of our pipelines and the illegal trade in the fuels that we produce. Such criminal activity has led to explosions, property and environmental damage, injuries and loss of life, as well as loss of revenue from the stolen products. The actions we have taken in conjunction with the Mexican Government to reduce the illicit market of fuels have not produced sustained improvement in recent years. In 2023 and 2022, we discovered 14,890 and 13,946 illegal pipeline taps, respectively. We are also subject to the risk that some of our employees may, or may be perceived to, be participating in the illicit market in fuels. In addition, our facilities are exposed to intentional acts of sabotage, terrorism, blockades, theft and piracy. The occurrence of incidents such as these related to the production, processing and transportation of oil and gas products could result in personal injuries, loss of life, environmental damage from the subsequent containment, clean up and repair expenses, equipment damage and damage to our facilities, which in turn could adversely affect our business, results of operations and financial condition. PEMEX Consolidated Ticker: PEMEX Quarter: 1 Year: 2024 8 of 116 We are exposed to cybersecurity incidents, failures and attacks that could adversely affect our business, results of operations and financial condition. Our operations are highly dependent on information technology systems and services. Cyber-threats and cyber-attacks are becoming increasingly sophisticated, coordinated and costly, and could and have been targeted at our operations or information technology systems. If the integrity of our information technology systems were to be compromised due to cyber-attacks, or due to the negligence or misconduct of our employees, our business operations could be disrupted or even paralyzed, and our proprietary information could be stolen or lost. If such information security failures occur, we could face, among other things, (i) disruptions to our operations and critical infrastructure, (ii) regulatory action, (iii) legal liability, (iv) damage to our reputation, (v) a significant reduction in revenues, (vi) an increase in costs (including costs associated with the recovery of information and assets) and (vii) a loss of our investments in areas affected by such cyber-attacks, which in turn could have a material adverse effect on our reputation, results of operations and financial condition. A continued decline in our proved hydrocarbon reserves and production could adversely affect our operating results and financial condition. Some of our existing oil and gas-producing fields are mature and, as a result, our reserves and production may decline as reserves are depleted. In 2023, our total proven reserves had a small increase of 29.6 million barrels of crude oil equivalent, or 0.4%, after accounting for discoveries, extensions, revisions, and delimitations, from 7,450.8 million barrels of crude oil equivalent as of December 31, 2022 to 7,480.4 million barrels of crude oil equivalent as of December 31, 2023. Based on these numbers, our reserve replacement ratio (“RRR”) in 2023 was 103.2%, an increase as compared to a RRR of 102.8% in 2022. Our proven reserves increased from 7,450.8 million barrels of crude oil equivalent as of December 31, 2022 to 7,480.4 million barrels of crude oil equivalent as of December 31, 2023, due to discoveries, developments, delineations and, revisions of our proved reserves, in particular to the recategorization of reserves due to drilling of development wells. Our crude oil production increased by 5.1% in 2023, primarily as a result of the increase in production in our new offshore field projects Maloob, Balam, Esah, Itta, Pokche, Teca, Tlalkivak, Tekel and Ayatsil and onshore field projects Quesqui, Tupilco Profundo, Cibix, Racemosa and Ixachi. There can be no assurance, however, that we will be able to continue to increase, or otherwise stop or reverse the trend of decline in, our proved reserves and production, which at any time could have an adverse effect on our business, results of operations and financial condition. Developments in the oil and gas industry and other factors may result in substantial write-downs of the carrying amount of certain of our assets, which could adversely affect our operating results and financial condition. We evaluate on an annual basis, or more frequently where the circumstances require, the carrying amount of our assets for possible impairment. Our impairment tests are performed by a comparison of the carrying amount of an individual asset or a cash- generating unit with its recoverable amount. Whenever the recoverable amount of an individual asset or cash-generating unit is less than its carrying amount, an impairment loss is recognized to reduce the carrying amount to the recoverable amount. Changes in the economic, regulatory, business or political environment in Mexico or other markets where we operate, such as the liberalization of fuel prices or a significant decline in international crude oil and gas prices, among other factors, may result in the recognition of impairment charges in certain of our assets. Due to fluctuations in the price of crude oil and annual variations in the discount rates, among others, we have performed impairment tests of our non-financial assets (other than inventories and deferred taxes) at the end of each quarter. As of March 31, 2024, 2023 we recognized an impairment charge in the amount of Ps. 7.6 billion and Ps. 40.1 billion, respectively. See Note 13 to our condensed consolidated interim financial statements not audited as of the first three months period of 2024 for further information about the impairment of certain of our assets. Future developments in the economic environment, in the oil and gas industry and other factors could result in further substantial impairment charges, adversely affecting our operating results and financial condition.

PEMEX Consolidated Ticker: PEMEX Quarter: 1 Year: 2024 9 of 116 Increased competition in the energy sector could adversely affect our business and financial performance. The Mexican Constitution and the Ley de Hidrocarburos (the “Hydrocarbons Law”) allow other oil and gas companies, in addition to us, to carry out certain activities related to the energy sector in Mexico, including exploration and production activities, and the import and sale of gasoline. As a result, we face competition for the right to explore and develop new oil and gas reserves in Mexico. We also face competition in connection with certain refining, transportation and processing activities, as well as the distribution and sale of gasoline and other fuels. Increased competition could make it difficult for us to hire and retain skilled personnel, especially for the sale of gasoline. If we are unable to compete successfully with other oil and gas companies in the energy sector in Mexico, our results of operations and financial condition may be adversely affected. We are subject to Mexican and international anti-corruption, anti-bribery and anti-money laundering laws. Our failure to comply with these laws could result in penalties, which could harm our reputation and have an adverse effect on our business, results of operations and financial condition. We are subject to Mexican and international anti-corruption, anti-bribery and anti-money laundering laws. We maintain a corporate compliance program that includes policies and processes intended to monitor compliance with these laws, such as our internal control system. Our internal control system aims to prevent risks, anticipate any weaknesses arising from our operations or internal control over financial reporting and promote information exchange and communication. However, we are subject to the risk that our management, employees, contractors or any person doing business with us may (i) engage in fraudulent activity, corruption or bribery, (ii) circumvent or override our internal controls and procedures or (iii) misappropriate or manipulate our assets to our detriment. This risk is heightened because we have a large number of complex and significant contracts with local and foreign third parties. Although we have systems and internal policies in place for identifying, monitoring and mitigating these risks, such systems and policies have failed in the past and may not be effective in the future. Further, we cannot ensure that these compliance policies and processes will prevent intentional, reckless or negligent acts committed by our management, employees, contractors or anyone doing business with us. Any failure—real or perceived—to comply with applicable governance or regulatory obligations by our management, employees, contractors or any person doing business could harm our reputation, limit our ability to obtain financing and otherwise have a material adverse effect on our business, financial condition and results of operations. If we fail to comply with any applicable anti-corruption, anti-bribery or anti-money laundering laws, we and our management, employees, contractors or any person doing business with us may be subject to criminal, administrative or civil penalties and other measures, which could in turn have material adverse effects on our reputation, business, financial condition and results of operations. Any investigation of potential violations of anti-corruption, anti-bribery or anti-money laundering laws by governmental authorities in Mexico or other jurisdictions could result in an inability to prepare our condensed consolidated interim financial statements not audited in a timely manner and could adversely impact our reputation, limit our ability to access financial markets and adversely affect our ability to obtain contracts, assignments, permits and other government authorizations necessary to participate in our industry, which, in turn, could have adverse effects on our business, results of operations and financial condition. We participate in strategic alliances, joint ventures and other joint arrangements, which may not perform as expected, could harm our reputation and could have an adverse effect on our business, results of operations and financial condition. We have not entered into any strategic alliances, joint ventures or other joint arrangements since 2018. However, we continue to participate in arrangements entered into before 2018 and currently enter into contratos de servicios integrales de exploración y extracción (long-term service contracts for oil production, or “CSIEEs”). CSIEEs are intended to reduce or reallocate risks in oil and gas exploration and production, refining, transportation and processing activities. Our partners in such arrangements may, as a result of financial or other difficulties, be unable or unwilling to fulfill their financial or other obligations under our agreements, threatening the viability of the relevant project. In addition, our partners may have inconsistent or opposing interests and may act contrary to our policies or objectives, which could be to our overall detriment. If our strategic alliances, joint ventures or other PEMEX Consolidated Ticker: PEMEX Quarter: 1 Year: 2024 10 of 116 joint arrangements do not perform as expected, our reputation may be harmed and our business, financial condition and results of operations could be adversely affected. Our brand and reputation are key assets, and our business may be materially affected by how we are perceived in the media and by investors and rating agencies. Our reputation is a key asset, and perceptions surrounding our commitment to and compliance with environmental, corporate governance and social goals could have a material impact on us, our ability to obtain financing and the value of our debt securities. We are exposed to significant publicity due to our relationship with the Mexican Government and our importance to the Mexican economy. Political and public sentiment regarding the Mexican Government, Mexico, the oil and gas industry and us has resulted and may result in adverse publicity affecting us, which may expose us to reputational harm, regardless of the accuracy of information being publicized. Our exposure to potentially adverse publicity is heightened by the growing role of social media and the increasing sophistication and availability of generative artificial intelligence, which can facilitate the creation of false or misleading information and increase the velocity with which such information is distributed. In addition to the general risk that negative publicity poses to us and our reputation, rating agencies and third party ESG certification agencies may consider publicly available data and information as part of their analysis and methodology. Any such information that adversely affects our reputation could be considered in the assessments by these agencies, which could have a negative impact on us and, in turn, increase our cost of financing. See “—Risk Factors Related to Climate Issues—Deficient performance related to environmental, social and governance (ESG) criteria may adversely impact our reputation and could make it difficult for us to access financing, increase the cost of financing, reduce insurance options or increase the cost of insurance” below. Risk Factors Related to our Relationship with the Mexican Government The Mexican Government controls us, could transfer or reorganize our assets, or may otherwise limit our ability to satisfy our external debt obligations. We are controlled by the Mexican Government and our annual budget may be adjusted by the Mexican Government in certain respects. Pursuant to the Petróleos Mexicanos Law (as defined below), Petróleos Mexicanos was transformed from a decentralized public entity to a productive state-owned company on October 7, 2014. The Petróleos Mexicanos Law establishes a special regime governing, among other things, our budget, debt levels, administrative liabilities, acquisitions, leases, services and public works. This special regime provides Petróleos Mexicanos with additional technical and managerial autonomy and, subject to certain restrictions, with additional autonomy with respect to our budget. Notwithstanding this increased autonomy, the Mexican Government still controls us and, subject to the approval of the Chamber of Deputies, has the power to adjust our targeted net cash flow for the fiscal year based on our projected revenues and expenses, as well as our annual wage and salary expenditures. Adjustments to our annual budget may compromise our ability to develop the reserves assigned to us by the Mexican Government and to successfully compete with other oil and gas companies that may enter the Mexican energy sector. In addition, the Mexican Government’s control over us could adversely affect our ability to make payments on our outstanding securities. Although we are wholly owned by the Mexican Government, our financial obligations do not constitute obligations of, and are not guaranteed by, the Mexican Government. See “—Risk Factors Related to our Relationship with the Mexican Government—Our financial obligations are not guaranteed by the Mexican Government.” The Mexican Government’s agreements with international creditors may affect our external debt obligations. In certain past debt restructurings of the Mexican Government, our external indebtedness was treated on the same terms as the debt of the Mexican Government and other public-sector entities, and it may be treated on similar terms in any future debt restructuring. In addition, Mexico has entered into agreements with official bilateral creditors to reschedule public-sector external debt. The Mexican Government has not requested restructuring of bonds or debt owed to multilateral agencies. PEMEX Consolidated Ticker: PEMEX Quarter: 1 Year: 2024 11 of 116 If the Mexican Constitution and federal law were amended, the Mexican Government would have the power to reorganize our corporate structure, including a transfer of all, or a portion of, our assets to an entity not controlled, directly or indirectly, by the Mexican Government. See “—Risk Factors Related to Mexico” below. Our financial obligations are not guaranteed by the Mexican Government. Although we are wholly owned by the Mexican Government, our financial obligations do not constitute obligations of, and are not guaranteed by, the Mexican Government. Accordingly, the Mexican Government has no legal obligation to make principal or interest payments on our debt, nor would any such obligation arise if we were unable to service our financial obligations. The Mexican Government may cease to support us. The Mexican Government made capital contributions to us of Ps.77.2 billion (U.S.$ 7.7 billion) in the first three months period of 2024 to support our debt service obligations. Given that the Mexican Government is not legally or contractually obligated to make such capital contributions to us or assist us in repaying our debt, it may cease to provide such support at any time. Any change in the Mexican Government’s support of us, including as a result of liquidity constraints or a change in policy objectives, would likely have a material adverse effect on our financial condition and ability to repay our indebtedness, as well as on the market value of our debt securities. We pay significant taxes and duties to the Mexican Government and, if certain conditions are met, we may be required to pay a state dividend, which may limit our capacity to expand our investment program or negatively impact our financial condition generally. We are required to make significant payments to the Mexican Government, including in the form of taxes and duties, which may limit our ability to make capital investments. As of March 31, 2024, our total taxes and duties were Ps. 43.9 billion, or 10.8% of our sales revenues in the form of taxes and duties, which constituted a substantial portion of the Mexican Government’s revenues. On February 13, 2024 was issued a decree tax credit equivalent to 100% of the amount of the right to hydrocarbon extraction and the right to shared utility that corresponds to the months of October, November and December of 2023 for an amount of Ps. 91.5 billion, which reduced the tax burden for fiscal year 2023. As of January 1, 2024, 2023, and 2022, the applicable rate of the DUC was 30.0%, 40.0% and 54.0%, respectively. In addition, we are generally required, subject to the conditions set forth in the Petróleos Mexicanos Law, to pay a state dividend to the Mexican Government. We were not required to pay a state dividend from 2016 through 2023. Although the Mexican Government has on occasion indicated a willingness to reduce its reliance on payments made by us, and recent changes to the fiscal regime applicable to us are designed in part to reduce such reliance by the Mexican Government, we cannot provide any assurances that we will not be required to continue to pay a large proportion of our sales revenue to the Mexican Government. In addition, the Mexican Government may change the applicable rules in the future. The Mexican Government could enter into agreements with other nations to limit production. Although Mexico is not a member of OPEC, it from time to time enters into agreements with OPEC and non-OPEC countries to reduce the global supply of crude oil. We do not control the Mexican Government’s international affairs and the Mexican Government could enter into further agreements with OPEC, OPEC+ or other countries to reduce our crude oil production or exports in the future. A reduction in our oil production or exports may have an adverse effect on our business, results of operations and financial condition. PEMEX Consolidated Ticker: PEMEX Quarter: 1 Year: 2024 12 of 116 The Mexican nation, not us, owns the hydrocarbon reserves located in Mexico and our right to continue to extract these reserves is subject to the approval of the Ministry of Energy. The Mexican Constitution provides that the Mexican nation, not us, owns all petroleum and other hydrocarbon reserves located in Mexican territory. Article 27 of the Mexican Constitution provides that the Mexican Government will carry out exploration and production activities through agreements with third parties and through assignments to and agreements with us. We and other oil and gas companies are allowed to explore and extract the petroleum and other hydrocarbon reserves located in Mexico, subject to assignment of rights by the Secretaría de Energía (Ministry of Energy) and entry into agreements pursuant to a competitive bidding process. Access to crude oil and natural gas reserves is essential to an oil and gas company’s sustained production and generation of income, and our ability to generate income would be materially and adversely affected if the Mexican Government were to restrict or prevent us from exploring or extracting any of the crude oil and natural gas reserves that it has assigned to us, or if we are unable to compete effectively with other oil and gas companies in future bidding rounds for additional exploration and production rights in Mexico. For more information, see “—Risk Factors Related to our Relationship with the Mexican Government—We must make significant capital expenditures to maintain our current production levels, and to maintain, as well as increase, the proved hydrocarbon reserves assigned to us by the Mexican Government. Reductions in our income, adjustments to our capital expenditures budget or an inability to obtain financing may limit our ability to make capital investments” below. Hydrocarbon reserves are based on estimates, which are uncertain and subject to revisions. The information on oil, gas and other reserves set forth in this report is based on estimates. Reserves valuation is a subjective process of estimating underground accumulations of crude oil and natural gas that cannot be measured in an exact manner; the accuracy of any reserves depends on the quality and reliability of available data, engineering and geological interpretation and subjective judgment. Additionally, estimates may be revised based on subsequent results of drilling, testing and production. These estimates are also subject to certain adjustments based on changes in variables, including crude oil prices. Therefore, proved reserves estimates may differ materially from the ultimately recoverable quantities of crude oil and natural gas. Downward revisions in our reserve estimates could lead to lower future production, which could have an adverse effect on our results of operations and financial condition. See “—Risk Factors Related to our Operations—Crude oil, natural gas and petroleum products prices are volatile, and low crude oil and natural gas prices adversely affect our income and cash flows and the value of the hydrocarbon reserves that we have the right to extract and sell” above. We revise our hydrocarbon reserve estimates annually, which may result in material revisions to estimates contained in this report. Our ability to maintain our long-term growth objectives for oil production depends on our ability to successfully develop our reserves, and failure to do so could prevent us from achieving our long-term goals for growth in production. The Comisión Nacional de Hidrocarburos (National Hydrocarbons Commission, or “CNH”) has the authority to review and approve our hydrocarbon reserves estimates and may require us to adjust these estimates. A request to adjust these hydrocarbon reserves estimates could result in our inability to prepare our consolidated financial statements in a timely manner. This could adversely impact our ability to access financial markets and obtain contracts, assignments, permits and other government authorizations necessary to participate in the crude oil and natural gas industry, which, in turn, could have an adverse effect on our business, results of operations and financial condition. We must make significant capital expenditures to maintain our current production levels, and to maintain, as well as increase, the proved hydrocarbon reserves assigned to us by the Mexican Government. Reductions in our income, adjustments to our capital expenditures budget or an inability to obtain financing may limit our ability to make capital investments.

PEMEX Consolidated Ticker: PEMEX Quarter: 1 Year: 2024 13 of 116 Because our ability to maintain, as well as increase, our oil production levels is highly dependent on our ability to successfully develop existing hydrocarbon reserves and, in the long term, on our ability to obtain the right to develop additional reserves, we continually invest capital to enhance our hydrocarbon recovery factor and improve the reliability and productivity of our infrastructure. The development of the reserves assigned to us by the Mexican Government demands significant capital investments and poses significant operational challenges. Our right to develop such reserves is conditioned upon our ability to develop such reserves in accordance with our development plans, which were based on our technical, financial and operational capabilities at the time such reserves were assigned. We cannot provide assurances that we will have, or will be able to obtain, in the time frame that we expect or at all, sufficient resources or the technical capacity necessary to explore and extract the reserves that the Mexican Government assigned to us or the reserves that the Mexican Government may assign to us in the future. In the past, we have reduced our capital expenditures in response to declining oil prices, and unless we are able to increase our capital expenditures, we may not be able to develop the reserves assigned to us in accordance with our development plans. If we fail to develop the reserves assigned to us in accordance with our development plans, we could lose the right to continue to extract such reserves, which could in turn adversely affect our operating results and financial condition. Our ability to make capital expenditures is limited by the substantial taxes and duties that we pay to the Mexican Government, the ability of the Mexican Government to adjust certain aspects of our annual budget, cyclical decreases in our revenues related to lower oil prices and any constraints on our liquidity. Our ability to make the capital investments that are necessary to maintain current production levels depends on the availability of financing. While competitive bidding rounds for exploration and extraction of hydrocarbons through the bidding process known as Rondas are currently suspended, this risk may be exacerbated if there is increased competition in the oil and gas sector in Mexico, as this may increase the cost of obtaining additional acreage in potential future bidding rounds for the rights to new reserves. For more information on the liquidity constraints we are exposed to, see “— Risk Factors Related to our Operations—We have a substantial amount of indebtedness and other liabilities and are exposed to significant liquidity constraints, which could make it difficult for us to obtain financing on favorable terms and could adversely affect our financial condition, results of operations and ability to repay our debt and, ultimately, our ability to operate as a going concern without additional support from the Mexican Government, which we may not receive” above. In addition, we have entered into strategic alliances, joint ventures and other joint arrangements with third parties in order to develop our reserves. If our partners were to significantly default on their obligations to us, we may be unable to maintain production levels or extract from our reserves. Moreover, we cannot assure you that these strategic alliances, joint ventures and other joint arrangements will be successful or reduce our capital commitments. For more information, see “—Risk Factors Related to Our Operations—We participate in strategic alliances, joint ventures and other joint arrangements, which may not perform as expected, could harm our reputation and could have an adverse effect on our business, results of operations and financial condition” above. The Mexican Government has historically imposed price controls in the domestic market on our products. The Mexican Government has from time to time imposed price controls on the sales of natural gas, liquefied petroleum gas, gasoline, diesel, gas oil intended for domestic use, fuel oil and other products. As a result of these price controls, we have not been able to pass on all of the increases in the prices of our product purchases to our customers in the domestic market. In accordance with the Ley de Ingresos de la Federación para el Ejercicio Fiscal de 2017 (2017 Federal Revenue Law), during 2017, the Mexican Government gradually removed price controls on gasoline and diesel as part of the liberalization of fuel prices in Mexico. As of the date of this report, sales prices of gasoline and diesel remain fully liberalized and are determined by the free market. However, we do not control the Mexican Government’s domestic policies and the Mexican Government could impose additional price controls on the domestic market in the future. The imposition of such price controls would adversely affect our results of operations. PEMEX Consolidated Ticker: PEMEX Quarter: 1 Year: 2024 14 of 116 Risk Factors Related to Mexico Economic conditions and government policies in Mexico and elsewhere may have a material impact on our operations. A deterioration in Mexico’s economic condition, social instability, political unrest or other adverse social developments in Mexico could adversely affect our business and financial condition. Such events could also lead to increased volatility in the foreign exchange and financial markets, thereby affecting our ability to obtain new financing on favorable terms or at all and service our debt. In the past, the Mexican Government has implemented budget cuts in response to declines in international crude oil prices and global economic conditions and it may reduce our budget in the future. Any new budget cuts could adversely affect the Mexican economy and, consequently, our business, results of operations and financial condition and ability to service our debt. See “Risk Factors—Risk Factors Related to our Relationship with the Mexican Government—The Mexican Government controls us, could transfer or reorganize our assets, or may otherwise limit our ability to satisfy our external debt obligations” above. Mexico has experienced periods of slow or negative economic growth, high inflation, high interest rates, currency devaluation and other economic problems. These problems may worsen and could adversely affect our financial condition, as well as our ability to service our debt in the absence of additional support from the Mexican Government. A deterioration in international financial or economic conditions, such as a slowdown in growth or recessionary conditions in Mexico’s trading partners, including the United States, or the emergence of a new financial crisis, could have adverse effects on the Mexican economy, our financial condition and our ability to service our debt, including by adversely affecting the Mexican Government’s ability to support us. Mexico has experienced a period of heightened criminal activity, which could affect our operations. In recent years, Mexico has experienced a period of heightened criminal activity, primarily due to the activities of drug cartels and related criminal organizations. In addition, the development of the illicit market in fuels in Mexico has led to heightened theft and illegal trade in the fuels that we produce. In response, the Mexican Government has implemented various security measures and has strengthened its military and police forces, and we have established various strategic measures aimed at decreasing incidents of theft and other criminal activity directed at our facilities and products. Criminal activity continues to exist in Mexico and is likely to continue. Criminal activities and the damage to human life and property associated with them may negatively impact our business continuity, financial condition and results of operations. Economic and political developments in Mexico may adversely affect Mexican economic policy and, in turn, our operations. Political events in Mexico may significantly affect Mexican economic policy and, consequently, our operations. The current administration and the Mexican Congress have the power to revise the legal framework that governs us. We cannot predict how any future policies could impact our results of operations and financial position, nor can we provide any assurances that political developments in Mexico will not have an adverse effect on the Mexican economy, the Mexican oil and gas industry or on our business, results of operations, financial condition and ability to service our debt. Economic and political developments in Mexico and the United States may adversely affect Mexican economic policy and, in turn, our operations. Presidential and federal congressional elections will be held in Mexico and the United States in June 2024 and November 2024, respectively. The Mexican presidential election will result in a change in administration, as presidential reelection is not permitted in Mexico. The presidential election in the United States may result in a change in administration. We cannot predict the impact that political developments in Mexico and the United States may have on the Mexican economy or the oil and gas industry, nor can we provide any assurances that these events, over which we have no control, will not have a material adverse effect on our business, results of operations and financial condition, including our ability to repay our debt. PEMEX Consolidated Ticker: PEMEX Quarter: 1 Year: 2024 15 of 116 Economic conditions in Mexico are highly correlated with economic conditions in the United States due to the physical proximity and the high degree of economic activity between the two countries. As a result, political developments in the United States, including changes in the American administration and governmental policies, can also have an impact on the exchange rate between the U.S. dollar and the Mexican peso, economic conditions in Mexico and the global capital markets. In addition, because the Mexican economy is heavily influenced by the U.S. economy, policies that may be adopted by the U.S. government that are unfavorable to Mexico may adversely affect economic conditions in Mexico. As of March 31, 2024, our export sales to the United States amounted to Ps. 121,014 million, representing 29.8% of total sales and 71.3% of export sales for the year. Beginning in 2003 under the North American Free Trade Agreement (“NAFTA”), exports of petrochemical products from Mexico to the United States have enjoyed a zero-tariff and, subject to limited exceptions, exports of crude oil and petroleum products have also been free or exempt from tariffs. On November 30, 2018, the Presidents of Mexico and the United States and the Prime Minister of Canada signed the United States-Mexico-Canada Agreement (the “USMCA”). The USMCA came into force on July 1, 2020 and replaced NAFTA. While the USMCA provides that exports of petrochemical products from Mexico to the United States will continue to enjoy a zero-tariff rate, any future shift in the trade relationships between Mexico, the United States and Canada could require us to renegotiate our contracts or lose business, resulting in a material adverse impact on our business and results of operations. The macroeconomic environment in which we operate is beyond our control and the future economic environment may be less favorable than in recent years. The risks associated with current and potential changes in the Mexican and United States political environment and economies are significant and could have an adverse effect on our financial condition, results of operations and ability to repay our debt. Changes in Mexico’s exchange control laws may hamper our ability to service our foreign currency debt. The Mexican Government does not currently restrict the ability of Mexican companies or individuals to convert pesos into other currencies. However, we cannot provide assurances that the Mexican Government will maintain its current policies regarding the peso. The Mexican Government has imposed foreign exchange controls in the past and could do so again in the future. If imposed, Mexican Government policies preventing us from exchanging pesos into U.S. dollars could hamper our ability to service our debt, the majority of which is denominated in currencies other than pesos, and other foreign currency obligations. Risk Factors Related to the Certificados Bursátiles. Secondary Market for the Certificados Bursátiles. Currently, Certificados Bursátiles (peso-denominated publicly traded notes) present low operation levels in the secondary market and the Company cannot provide assurances that there will be a sustained development of said market. These notes have been registered in the Registro Nacional de Valores (Mexican National Securities Registry, RNV) and are traded in the Bolsa Mexicana de Valores, S.A.B. de C.V. (Mexican Stock Exchange). Notwithstanding, the Company cannot provide assurances that there will be an active market to trade these Certificados Bursátiles, or that they will be traded at par or above its initial offering. The previous could limit the holders’ capacity to sell them at the price, moment and amount that they may wish to. Therefore, potential investors must be prepared to assume the risk in investing in Certificados Bursátiles until their maturity. To promote liquidity to Certificados Bursátiles, in November 2013, the Company established a Market-Makers Program for its peso-denominated Certificados Bursátiles at fixed and floating rates, and for the Certificados Bursátiles in the form of Global Depositary Notes. This program is directed to financial institutions under applicable laws and with regard to the operating rules set forth by the Company in its website. PEMEX Consolidated Ticker: PEMEX Quarter: 1 Year: 2024 16 of 116 Financial obligations compliance. The Company considers it has fulfilled in a timely and orderly manner, with the reports registered with the SEC and every requirement from said authority. The Company is aware of both the principal payment and the interest generated by those securities. The Company files with the SEC its Annual Report in the 20-F Form. Additionally, the Company provides information regarding relevant events and quarterly reports (current quarter as compared to same quarter of the previous year) to foreign investors that it files with Mexican regulators CNBV and BMV, through the filing of Forms 6-K with the SEC. The Company considers it has fulfilled in a timely and orderly manner, with the quarterly reports and information regarding relevant events that it files with Mexican regulators BMV and CNBV. In addition, the company has presented copy of corresponding quarterly reports to the Luxembourg Stock Exchange and Switzerland’s Stock Exchange, regarding the securities listed in every one of them. The Company considers it has delivered in a timely and orderly manner, for the last three years, the reports that Mexican and foreign legislation require it to do, regarding periodic information and relevant events. Use of Proceeds. The total amount of resources obtained from the Company’s issuance of Certificados Bursátiles have entered the Company’s treasury and have been allocated in accordance to the company’s and its subsidiaries’ investment programs. Public Domain Documents. This quarterly report can be accessed through the CNBV’s information center, on its website, www.cnbv.gob.mx, and in the BMV, on its website, www.bmv.com.mx, or at the company’s website, www.pemex.com. In addition, any public information that the Company has delivered to national and foreign securities regulators under the Ley del Mercado de Valores (Securities Market Law) and other applicable normativity can be accessed at the Company’s website, www.pemex.com and be obtained as per request of any investor through a written request to the Company, located at Avenida Marina Nacional No. 329, Torre Ejecutiva, Piso 38, Colonia Verónica Anzures, Alcaldía Miguel Hidalgo, C.P. 11300, Ciudad de México, México, Telephone No.: +52 (55) 9126-2940, E- mail: ri@pemex.com, to the Investor Relations Office. Disclosure of results of operations and prospects [text block] Operating Summary Hydrocarbons Production Total hydrocarbon production in 1Q24 averaged 2,574 MMboed, a decrease of 113 MMboed or 4.2% compared to 1Q23.

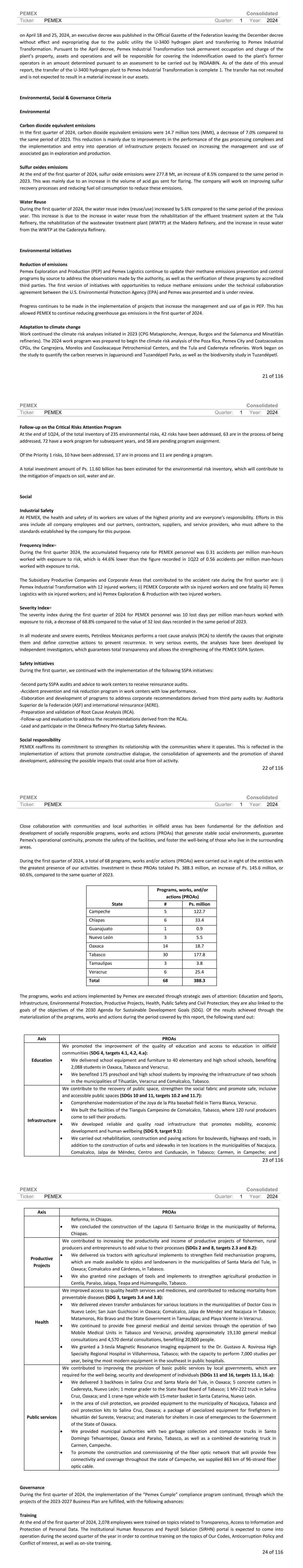

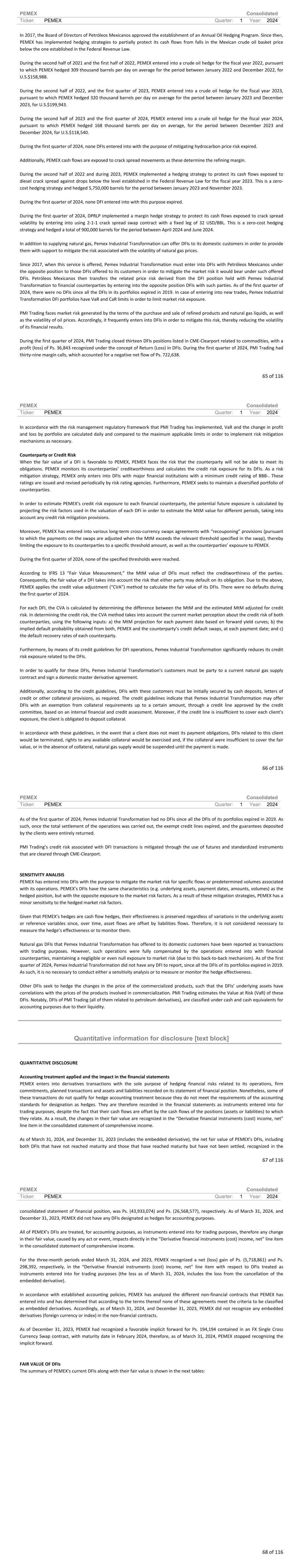

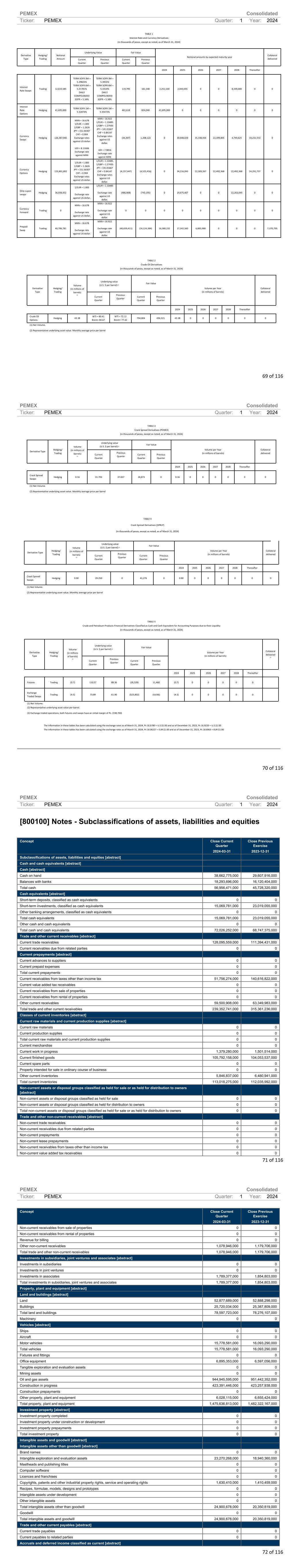

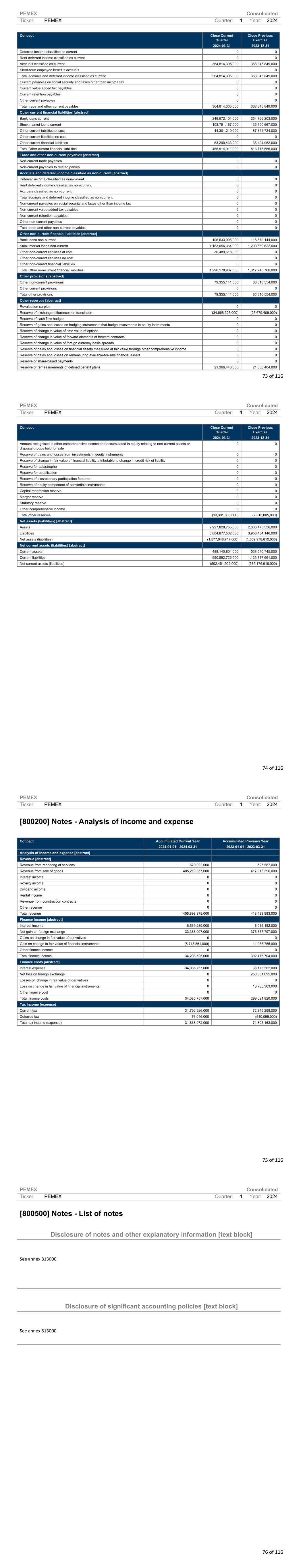

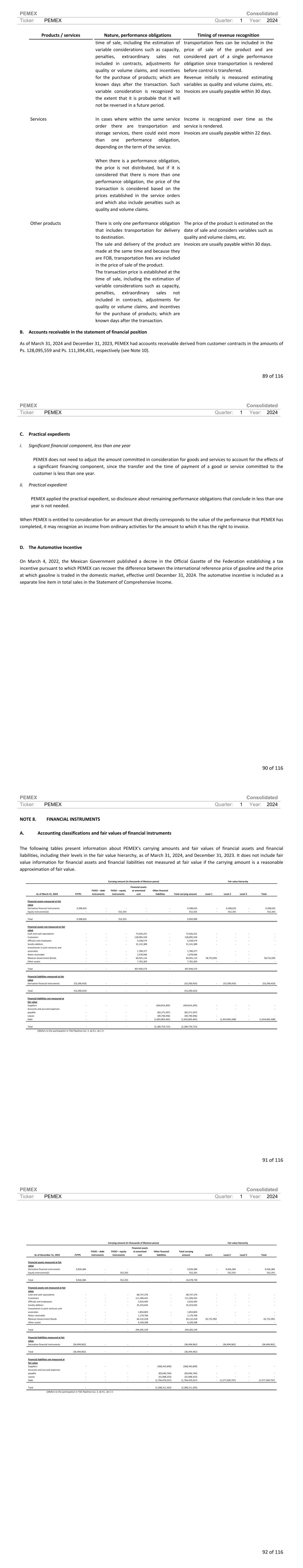

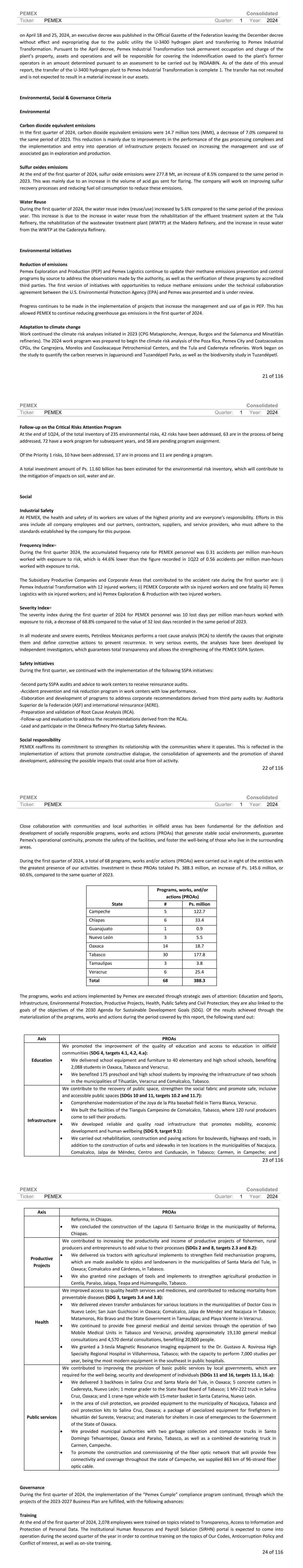

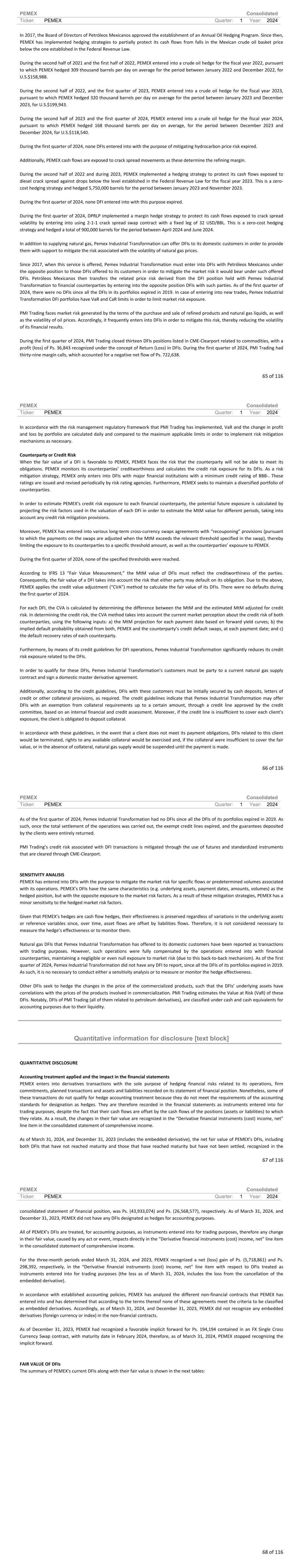

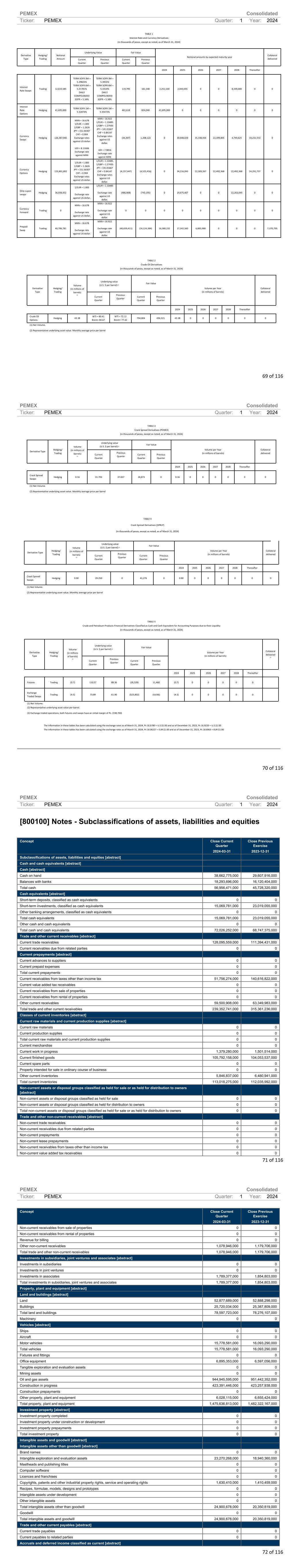

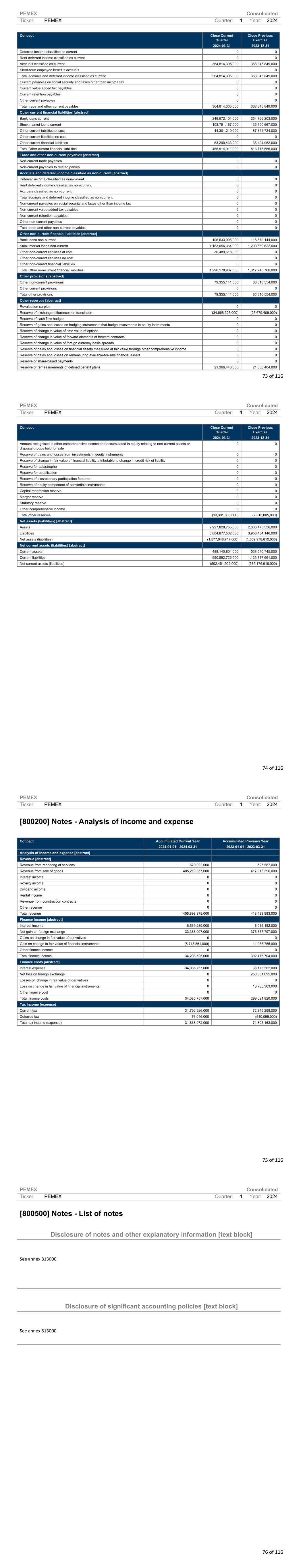

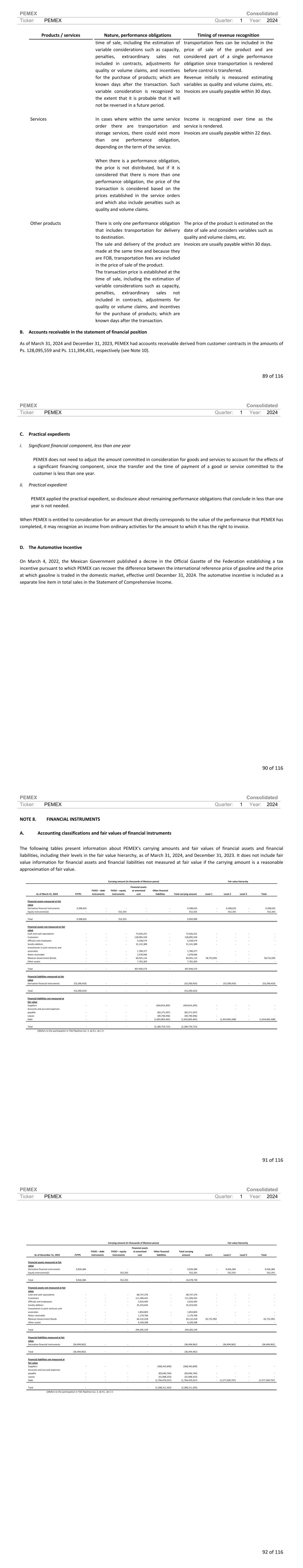

PEMEX Consolidated Ticker: PEMEX Quarter: 1 Year: 2024 17 of 116 In 1Q24, liquids production with partners totaled 1,820 Mbd, a decrease of 53 Mbd or 2.8% compared to 1Q23 when production averaged 1,873 Mbd. The change is explained by the decline in the Zaap, Xanab, Ayatsil, Ku and Quesqui fields, which is being mitigated by increased maintenance of base production and drilling of new field strategy wells. Total hydrocarbon gas production with partners averaged 3,836 MMcfd, a decrease of 312 MMcfd or 7.5% compared to 1Q23 when 4,148 MMcfd were produced. Crude Oil Processing In the first quarter of 2024, crude oil processing averaged 985 Mbd due to the improved performance of the country's six refineries because of the progress of the rehabilitation program. As a result, primary distillation capacity utilization averaged 60.0%, with the Tula and Madero refineries standing out at 71.5% and 63.7%, respectively. Petroleum Products Production As a result, petroleum products production averaged 1,011 Mbd, of which 545 Mbd (53.9%) were distillates (gasoline, diesel, and jet fuel). EXPLORATION AND PRODUCTION 1Q24 Liquids Hydrocarbons Production Total hydrocarbon production averaged 2,574 MMboed in 1Q24, a decrease of 113 MMboed or 4.2% compared to 1Q23. In 1Q24, liquids production with partners totaled 1,820 Mbd, a decrease of 53 Mbd or 2.8% compared to 1Q23 when production averaged 1,873 Mbd. The change is mainly explained by the decline in the Zaap, Xanab, Ayatsil, Ku and Quesqui fields, which is mitigated by the increase in base production maintenance and new field strategy wells in Tupilco Profundo, Ixachi, Racemosa, as well as the completion of wells in operating fields such as Maloob, Ayatsil, Mulach and Yaxche. During the quarter, liquids production from the new fields strategy increased to 29 Mbd with the completion of the following wells Tupilco Profundo-3016, Tupilco Profundo-3009, Ixachi-27, Ixachi-36, Quesqui-20A, Quesqui-404, Cheek-36, Mulach-15, Cibix-33, Camatl-2 and Tentok-4, all of which were completed in the first quarter. In addition, the strategy applied to the maintenance of liquids production contributed to the maintenance of production through the implementation of several actions, in particular: -Immediate attention to operational problems and reduction of operational intervention time to restore wells with failures in electro centrifugal pumping equipment (BEC); -increased well maintenance activities (minor repairs, stimulation, cleaning and optimization); -implementation of back pressure reduction equipment; and -operation of well transfer process vessels. In terms of oil quality classification, light crude oil production decreased by 86 Mbd, while condensates increased by 7 Mbd. Conversely, heavy crude oil production increased by 40 Mbd, representing a 4.3% increase compared to 1Q23. This increase can be attributed to the completion strategy of new wells in the Maloob, Zaap, Ayatsil fields in the Northeast Marine Region and in the Yaxche field in the Southwest Marine Region. PEMEX Consolidated Ticker: PEMEX Quarter: 1 Year: 2024 18 of 116 Natural Gas Production During 1Q24, total hydrocarbon gas production with partners averaged 3,836 MMcfd. This represents a decrease of 312 MMcfd, or 7.5%, compared to the first quarter of 2023, when 4,148 MMcfd were produced. The average production of associated gas was 1,952 MMcfd, a decrease of 278 MMcfd, or 12.5%, compared to 1Q23. This was mainly due to the decline of the Akal and Ku fields. Conversely, non-associated gas totaled 1,884 MMcfd, representing a decrease of 33 MMcfd or 1.7% compared to 1Q23. This decline was primarily driven by the decline of the Quesqui field. Natural Gas Use In the first quarter of 2024, gas use reached 93.9%, a decrease of 20.6% in gas flaring, averaging 291 MMpcd. This volume can be attributed to the production of gas contaminated with nitrogen in the Northeast Marine Region, maintenance, and failures of compression equipment in the South Region, failures of process equipment for gas conditioning in the Ixachi field, as well as rejections and releases from the Pemex Industrial Transformation Gas Processing Centers. Infrastructure In the first quarter of 2024, 28 development wells were completed, representing a decrease of three wells compared to the same period in 2023. With respect to exploratory wells, 13 wells were completed in the first quarter of 2024, representing a decrease of six wells compared to the same period in 2023. Main Discoveries The exploration activities conducted during the first quarter of 2024 yielded valuable insights from the Escuintle-401 well. The preliminary estimates indicate a potential reserve of 2 MMboe. Reserves In 2023, because of the exploratory activity in the Southeast Basins offshore area, five exploratory activity wells were reported that incorporated reserves: Etkal-201, Macuil-101, Tlalkivak 1DL, Macuil-201 and Tentok-1 (window). In the onshore portion, five exploratory activity wells were drilled that incorporated reserves: Bakte-1, Platao-1, Obba-1, Techiaktli-1, and Yawa-1. The results of this exploratory activity for 2023 indicate a total 3P reserve incorporation of 349.7 MMboe. Reserves 1P MMboe 2P MMboe 3P MMboe Incorporation 18.3 108.4 349.7 Bakte 47.8 172.9 Etkal-NE 8.3 21.8 54.5 Macuil 24.1 Macuil-SE 0.2 9.2 14.4 Obba 1.9 7.3 8.7 Platao 7.0 15.2 40.6 Techiaktli 7.9 Tentok 5.5 5.5 Tlalkivak 19.7 Yawa 1.0 1.7 1.7 In 2023, exploratory activities allowed to incorporate approximately 18.3 MMboe of proven reserves as of January 1, 2024. Of the nation's total 1P reserves, those corresponding to the fields assigned to Petróleos Mexicanos amounted to 7,480.4 million barrels of crude oil equivalent. The reserve values of the fields administered by Pemex are currently being determined by the CNH, which consolidates the nation's reserve values based on its guidelines on hydrocarbon reserves. PEMEX Consolidated Ticker: PEMEX Quarter: 1 Year: 2024 19 of 116 During 2023, proved 1P reserves were modified mainly by the extraction of production, which reached 920.5 MMboe. This volume was offset by proved reserves generated by exploratory activity (discoveries and field delineation), developments, and revisions, which together amounted to 940.5 MMboe. This resulted in an integrated restitution rate of proven 1P reserves of 102.2%, a value that continues with the favorable trend of recent years. This positive value of 940.5 MMboe corresponds, respectively, to the incorporation of proven reserves from exploratory activity of 18.3 MMboe; and to the increase of 922.2 MMboe due to the concepts of development and revisions to the behavior of the fields. The increase in proven reserves was mainly located in: Ixachi, Akal, Trion, Maloob, Zaap, May and Koban. Conversely, there were reductions in the Quesqui, Ku and Balam fields. Finally, the following graph illustrates the evolution of reserves over the past eight years, including data as of January 1, 2024. INDUSTRIAL TRANSFORMATION 1Q24 Crude Oil Processing In the first quarter of 2024, crude oil processing in the National Refining System (NRS) demonstrated a notable recovery, reaching an average of 985 Mbd, which represents an increase of 150 Mbd compared to the same period in 2023. This growth can be attributed to the enhanced performance of the country's six refineries, resulting from the success of the rehabilitation program. The light crude oil process amounted to 508 Mbd, an increase of 82 Mbd due to higher consumption at the six NRS refineries. On the other hand, heavy crude processing in the reconfigured refineries was 327 Mbd, an increase of 75 Mbd compared to the same quarter of 2023. The installed atmospheric distillation capacity of the NRS is 1,640 Mbd. With this process level, NRS's primary distillation capacity utilization averaged 60.0%, 9.2 percentage points higher than in the first quarter of 2023. It is worth noting that in March 2024, the crude oil process at SNR reached 1,062 Mbd, equivalent to a capacity utilization of 64.8%, which represents the best monthly result in eight years. Petroleum Products Production In line with the recovery of the crude oil processing level, petroleum products production averaged 1,011 Mbd during the first quarter of 2024, an increase of 156 Mbd compared to the same period of 2023. Of the total production, 314 Mbd were gasoline, 191 Mbd were diesel, 39 Mbd were jet fuel, and 466 Mbd were other petroleum products and LP gas. It is worth noting the higher production of distillates in the six refineries, which represented 53.9% of total production. Variable Refining Margin In the first quarter of 2024, the NRS recorded a variable margin of U.S. $ 12.96 per barrel (U.S. $/b), U.S. $ 2.88 U.S. $/b lower than that recorded in the same quarter of 2023. This variation is explained by lower prices of refined products in the North Coast of the Gulf of Mexico, partially offset by higher production of high-value products in the NRS. PEMEX Service Stations As of March 31, 2024, 7,252 service stations operate under the PEMEX Franchise, representing a 3.2% increase compared to those recorded as of March 31, 2023. Of these stations, 7,207 are managed by third parties, while 45 are owned by Pemex Transformación Industrial (self-consumption service stations). Furthermore, as of the same date, 1,132 service stations were recorded under the brand sublicensing scheme, while 4,112 service stations operate with brands other than PEMEX and are supplied both by PEMEX and direct imports. PEMEX Consolidated Ticker: PEMEX Quarter: 1 Year: 2024 20 of 116 Related parties Related parties include individuals and companies that do not form part of PEMEX, but that could take advantage of being in a privileged position as a result of their relation with PEMEX. Also included are situations in which PEMEX could take advantage of a special relationship in order to benefit its financial position or results of operations. Mr. Manuel Bartlett Díaz, Chief Executive Officer of CFE, was appointed member of the Board of Directors of Petróleos Mexicanos in December 2018. CFE has executed several purchase agreements with Pemex Industrial Transformation. As of March 31, 2024, the amount of operations held is Ps. 6.5 billion and the balance receivable is Ps. 7.36 billion. Natural Gas Processing and Production In the first quarter of 2024, wet gas processing averaged 2,419 MMcfd, a decrease of 12.3% compared to the same quarter of 2023. This was due to lower wet gas production in the Southeast and North regions of Pemex Exploration and Production (PEP). Consequently, dry gas production was 1,924 MMcfd, a 14.1% decrease compared to the same quarter of 2023. This was primarily due to lower gas production in the Nuevo Pemex and Ciudad Pemex gas processing complexes. Gas liquids production was 158 Mbd, 6.6% less than in the same period of 2023. This was mainly in the Nuevo Pemex gas processing complex. Condensate processing averaged 12 Mbd, a decrease of 22.2% compared to the same quarter of 2023, due to lower condensate deliveries from PEP. Petrochemicals Production In the first quarter of 2024, petrochemical production reached 335 thousand tons (Mt), representing a 6.2% increase compared to the same period in 2023. This performance is mainly explained by the following factors: -Methane derivatives production increased by 18.4% and other petrochemicals by 12.6%, as a result of the continuous and stable operation of the ammonia VI plant at the Cosoleacaque petrochemical complex. -Methanol production increased by 36.7% as a result of the longer the operating time of methanol plant no. 2 was longer than in the same quarter of the previous year, when the plant was out of operation due to high inventories and operational problems. -Ethane derivatives production decreased by 22.3%, due to the fact that the Swing linear low density polyethylene plant at the Morelos petrochemical complex continues to be out of operation. Please be aware that preparations are underway for its start-up. -Carbon black feedstock production decreased by 43.5%, mainly due to lower crude oil processing at the Cadereyta refinery. Additional Information Related to Downstream and Midstream Activities Anti-Fuel Subtraction Strategy In the first quarter of 2024 the volume of fuel stolen averaged 4.8 Mbd, equivalent to Ps. 4.7 billion in losses, compared to 5.3 Mbd reported in 2023 for Ps. 5.7 billion. Hydrogen production plant On December 29, 2023, an executive decree was published in the Official Gazette of the Federation designating the supply of hydrogen from the U-3400 hydrogen plant at the Miguel Hidalgo refinery in Tula to be in the public interest. Pursuant to the decree, Pemex Industrial Transformation took temporary occupation and charge of the plant’s operations and was responsible for the compensation to be paid to the plant’s former operators in connection with the public interest declaration and determined pursuant to an assessment to be carried out by Mexico’s Instituto de Administración y Avalúos de Bienes Nacionales (INDAABIN) as required by applicable law. On February 8 and 9, 2024, an executive decree was published in the Official Gazette of the Federation designating the U-3400 hydrogen plant as a public utility to be transferred to Pemex Industrial Transformation; the Ministry of Energy initiated the procedure provided for in article 2 of the Expropriation Law (Ley de Expropiación). Consequently,