UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of November, 2005

Commission File Number 0-99

PETROLEOS MEXICANOS

(Exact name of registrant as specified in its charter)

MEXICAN PETROLEUM

(Translation of registrant’s name into English)

United Mexican States

(Jurisdiction of incorporation or organization)

Avenida Marina Nacional No. 329

Colonia Huasteca

Mexico, D.F. 11311

Mexico

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F x Form 40-F ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1)

Yes ¨ No x

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7)

Yes ¨ No x

Indicate by check mark whether the registrant by furnishing the information contained in this form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ¨ No x

| Investor Relations | |

| (5255) 1944 9700 | ||

| ri@dcf.pemex.com |

November 4, 2005

PEMEX unaudited financial results report as of September 30, 2005

Financial highlights | PEMEX, Mexico’s oil and gas company, headed by Luis Ramírez Corzo, announced its unaudited consolidated financial results as of September 30, 2005.

• Total sales increased 18% as compared to the third quarter of 2004, reaching Ps. 241.3 billion (US$22.4 billion)1

• Income before taxes and duties increased 9% as compared to the third quarter of 2004, to Ps. 144.7 billion (US$13.4 billion)

• Net loss for the quarter was Ps. 9.9 billion (US$0.9 billion) |

Table 1

Petróleos Mexicanos, Subsidiary Entities and Subsidiary Companies

Financial results summary

| Third quarter (July - Sep.) | Nine months ending Sep. 30, | |||||||||||||||||||||||||||

| 2004 | 2005 | Change | 2005 | 2004 | 2005 | Change | 2005 | |||||||||||||||||||||

| (Ps. mm) | (US$mm) | (Ps. mm) | (US$mm) | |||||||||||||||||||||||||

Total sales | 204,199 | 241,327 | 18 | % | 37,128 | 22,364 | 574,429 | 662,344 | 15 | % | 87,915 | 61,381 | ||||||||||||||||

Domestic sales(1) | 115,069 | 127,308 | 11 | % | 12,239 | 11,798 | 334,413 | 362,526 | 8 | % | 28,112 | 33,596 | ||||||||||||||||

Exports | 89,131 | 114,020 | 28 | % | 24,889 | 10,566 | 240,015 | 299,818 | 25 | % | 59,803 | 27,785 | ||||||||||||||||

Income before taxes and duties(1) | 132,628 | 144,652 | 9 | % | 12,023 | 13,405 | 336,712 | 405,970 | 21 | % | 69,258 | 37,622 | ||||||||||||||||

Taxes and duties | 126,806 | 154,595 | 22 | % | 27,789 | 14,327 | 351,810 | 413,272 | 17 | % | 61,462 | 38,299 | ||||||||||||||||

Net income (loss) | 5,822 | (9,889 | ) | -270 | % | (15,711 | ) | (916 | ) | (25,745 | ) | (2,885 | ) | 89 | % | 22,859 | (267 | ) | ||||||||||

EBITDA(2) | 132,254 | 177,888 | 35 | % | 45,634 | 16,485 | 363,096 | 470,930 | 30 | % | 107,834 | 43,642 | ||||||||||||||||

EBITDA / Interest expense(3) | 29.2 | 12.9 | 17.0 | 11.7 | ||||||||||||||||||||||||

| * | Unaudited consolidated financial statements prepared in accordance with Mexican Generally Accepted Accounting Principles (Mexican GAAP) issued by the Instituto Mexicano de Contadores Públicos. Inflation recognition is also in accordance with Mexican GAAP. Accordingly, peso figures are presented in constant Mexican pesos as of September 30, 2005. |

| (1) | Includes the Special Tax on Production and Services (IEPS), which was Ps. 12,570 million in third quarter of 2004 and Ps. 2,136 million in the third quarter of 2005. |

| (2) | Excludes IEPS. |

| (3) | Excludes capitalized interest. |

Note: Numbers may not total due to rounding.

| 1 | Amounts in US dollars are translated at the September 30, 2005 exchange rate of Ps.10.7907 per US dollar. |

| PEMEX financial results report as of September 30, 2005 | 1/46 | |||

| www.pemex.com | ||||

| PEMEX | Investor Relations |

Operational highlights | + Total liquid hydrocarbons production totaled 3,701 Mbd, 3.1% less than the production in the third quarter of 2004:

– Crude oil production decreased 95 Mbd, to 3,286 Mbd

– Natural gas liquids production decreased by 5% to 414 Mbd

+ Natural gas production rose 6% to 4,839 million cubic feet per day (MMcfd):

– Gas flaring represented 4.9% of total natural gas production

+ Crude oil exports averaged 1,719 Mbd, 6% lower than the volume registered during the third quarter of 2004 |

Operating items

Exploration and production

Crude oil production | Crude oil production went from 3,382 Mbd in the third quarter of 2004 to 3,286 Mbd in the third quarter of 2005. This variation was mainly due to:

• The impact of Hurricane Emily during the third quarter of 2005 was significant, originating the production shut-in of approximately 107 Mbd, or 9,844 thousand barrels (Mb) in total. The impact of Hurricanes Rita and Katrina was approximately 11 Mbd, or 1,012 Mb in total. Consequently, total production of heavy crude oil decreased by 118 Mbd

• An increase of 22 Mbd in total light and extra-light crude oil production mainly due to the completion and workover of wells at the Bellota-Jujo, Samaria-Luna and Litoral de Tabasco complexes |

Table 2

Petróleos Mexicanos, Subsidiary Entities and Subsidiary Companies

Production of liquid hydrocarbons

| Third quarter (July - Sep.) | Nine months ending Sep. 30, | |||||||||||||||||||

| 2004 | 2005 | Change | 2004 | 2005 | Change | |||||||||||||||

| (Mbd) | (Mbd) | |||||||||||||||||||

Liquid hydrocarbons | 3,818 | 3,701 | -3.1 | % | (117 | ) | 3,840 | 3,772 | -1.8 | % | (67 | ) | ||||||||

Crude oil | 3,382 | 3,286 | -2.8 | % | (95 | ) | 3,395 | 3,342 | -1.6 | % | (53 | ) | ||||||||

Heavy | 2,453 | 2,335 | -4.8 | % | (118 | ) | 2,468 | 2,408 | -2.4 | % | (59 | ) | ||||||||

Light | 789 | 800 | 1.3 | % | 10 | 794 | 797 | 0.3 | % | 3 | ||||||||||

Extra-light | 140 | 152 | 8.6 | % | 12 | 133 | 137 | 2.8 | % | 4 | ||||||||||

Natural gas liquids(1) | 436 | 414 | -5.1 | % | (22 | ) | 444 | 430 | -3.3 | % | (15 | ) | ||||||||

| (1) | Includes condensates. |

Note: Numbers may not total due to rounding.

| PEMEX financial results report as of September 30, 2005 | 2/46 | |||

| www.pemex.com | ||||

| PEMEX | Investor Relations |

| Natural gas production | Natural gas production increased by 6% as compared to the third quarter of 2004. Non-associated gas production increased 20%, while associated gas production decreased 2%. The increase in non-associated gas production was mainly due to the incorporation of new development wells and improvements to the infrastructure at the non-associated natural gas producing basins of Burgos and Veracruz. The decrease in associated gas production was mainly a result of the natural decline in production at the Muspac complex. | |

| Gas flaring | Gas flaring represented 4.9% of total natural gas production. The increase with respect to the third quarter of 2004 was due to maintenance works on the 48 inch natural gas pipeline running from Dos Bocas Marine Terminal to compression facilities in Cunduacán. | |

Table 3

Petróleos Mexicanos, Subsidiary Entities and Subsidiary Companies

Production of natural gas and gas flaring

| Third quarter (July - Sep.) | Nine months ending Sep. 30, | |||||||||||||||||||||||

| 2004 | 2005 | Change | 2004 | 2005 | Change | |||||||||||||||||||

| (MMcfd) | (MMcfd) | |||||||||||||||||||||||

Total | 4,577 | 4,839 | 6 | % | 262 | 4,568 | 4,781 | 5 | % | 212 | ||||||||||||||

Associated | 2,999 | 2,945 | -2 | % | (54 | ) | 3,026 | 2,948 | -3 | % | (78 | ) | ||||||||||||

Non-associated | 1,578 | 1,895 | 20 | % | 316 | 1,542 | 1,833 | 19 | % | 290 | ||||||||||||||

Natural gas flaring | 140 | 239 | 71 | % | 99 | 159 | 179 | 12 | % | 19 | ||||||||||||||

Gas flaring / total production | 3.1 | % | 4.9 | % | 3.5 | % | 3.7 | % | ||||||||||||||||

Note: Numbers may not total due to rounding.

| Wells | During the third quarter of 2005, drilling activity decreased by 6 wells. Exploration wells decreased by 14 wells as compared to the third quarter of 2004, mainly as a result of an adjustment in the exploration strategy and fewer budgetary resources allocated to this activity. Development drilling activity increased by 8 wells. This was principally due to greater availability of drilling rigs at projects under the Multiple Service Contracts, at the Burgos basin, and to higher off-shore drilling activity mainly at the Ku-Maloob-Zaap project. |

| PEMEX financial results report as of September 30, 2005 | 3/46 | |||

| www.pemex.com | ||||

| PEMEX | Investor Relations |

Table 4

Petróleos Mexicanos, Subsidiary Entities and Subsidiary Companies

Drilling activity and inventory of wells

| Third quarter (July - Sep.) | Nine months ending Sep. 30, | |||||||||||||||||||

| 2004 | 2005 | Change | 2004 | 2005 | Change | |||||||||||||||

| (Number of wells) | (Number of wells) | |||||||||||||||||||

Wells drilled | 171 | 165 | -4 | % | (6 | ) | 543 | 562 | 3 | % | 19 | |||||||||

Development | 145 | 153 | 6 | % | 8 | 467 | 509 | 9 | % | 42 | ||||||||||

Exploration | 26 | 12 | -54 | % | (14 | ) | 76 | 53 | -30 | % | (23 | ) | ||||||||

Total operating wells(1) | 5,414 | 5,723 | 6 | % | 309 | |||||||||||||||

Injection | 229 | 238 | 4 | % | 9 | |||||||||||||||

Production | 5,185 | 5,485 | 6 | % | 300 | |||||||||||||||

Crude | 3,023 | 3,046 | 1 | % | 23 | |||||||||||||||

Non-associated gas | 2,162 | 2,439 | 13 | % | 277 | |||||||||||||||

| (1) | As of September 30, 2005. |

Note: Numbers may not total due to rounding.

| Seismic studies | During the third quarter of 2005, the area covered by new 2D seismic studies decreased by 60% as compared to the same quarter of 2004. This reduction was mainly due to less activity in the Muzquiz and Burgos-Herrera projects.

The area covered by new 3D seismic studies decreased 88%, mainly at projects such as Golfo de México “B”, Coatzacoalcos, Campeche Oriente and Golfo de México Sur.

The decrease in 2D and 3D seismic information activities is a result of the advance of projects to the information analysis phase. | |

| New approved locations | During the third quarter of 2005, new approved locations for seismic studies decreased by 2, mainly as a result of the advancement of exploratory projects to subsequent phases of study and drilling. | |

Table 5

Petróleos Mexicanos, Subsidiary Entities and Subsidiary Companies

Seismic studies

| Third quarter (July - Sep.) | Nine months ending Sep. 30, | |||||||||||||||||||

| 2004 | 2005 | Change | 2004 | 2005 | Change | |||||||||||||||

Seismic | ||||||||||||||||||||

2D (Km.) | 1,536 | 619 | -60 | % | (918 | ) | 7,416 | 3,326 | -55 | % | (4,090 | ) | ||||||||

3D (Km2) | 9,604 | 1,106 | -88 | % | (8,498 | ) | 23,452 | 6,841 | -71 | % | (16,611 | ) | ||||||||

New approved locations (number) | 46 | 44 | -4 | % | (2 | ) | 85 | 77 | -9 | % | (8 | ) | ||||||||

Note: Numbers may not total due to rounding.

| PEMEX financial results report as of September 30, 2005 | 4/46 | |||

| www.pemex.com | ||||

| PEMEX | Investor Relations |

| Discoveries | Our main discoveries in the third quarter of 2005 were: |

Table 6

Petróleos Mexicanos, Subsidiary Entities and Subsidiary Companies

Main discoveries

Project | 3Q05 | Geologic age | Initial production | Type | ||||

Burgos | Kodiak-1 | Paleocene | 0.7 MMcfd | Non-associated natural gas | ||||

Niquel-1 | Oligocene | 3.8 MMcfd | Natural gas | |||||

- | 0.1 Mbd | Condensates | ||||||

Veracruz | Huace-1 | Miocene | 5.3 MMcfd | Non-associated natural gas | ||||

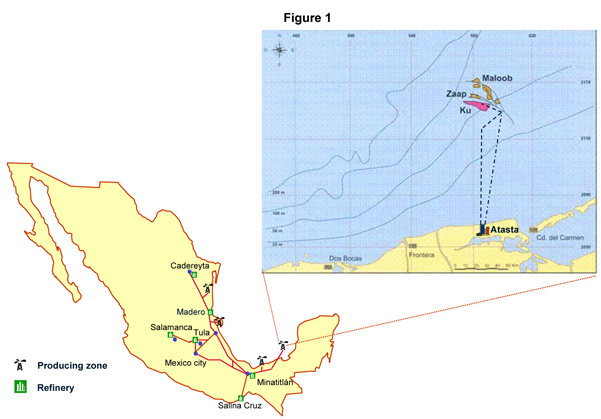

Ku-Maloob- Zaap project | The Ku-Maloob-Zaap project, located in the Campeche Sound in the Gulf of Mexico (Figure 1), includes three fields – Ku, Maloob and Zaap – that produce Maya crude oil with densities from 13° to 25° API. The Maloob field was discovered in 1979, Ku was discovered in 1980 and Zaap in 1990. Currently, most of these fields’ production is obtained by gas lift, which basically consists of the injections of natural gas into wells.

The main objectives of Ku-Maloob-Zaap project are:

• To maintain pressure in the fields by injecting nitrogen

• To increase production through the construction of additional infrastructure and drilling of additional wells

The project contemplates the construction of 17 platforms, the drilling of 103 wells and the installation of approximately 200 kilometers of pipelines. The 17 platforms consist of 7 drilling platforms, 4 for production, 1 for telecommunications, 4 for residential use and 1 riser platform.

Additionally, a floating production, storage and offloading (FPSO) vessel will be incorporated. This FPSO has a production capacity of 200 Mbd of crude oil and 120 MMcfd of natural gas plus 2.2 MMbd of crude oil storage capacity.

By 2010 Ku, Maloob and Zaap are expected to produce an average of 800 Mbd of crude oil and 330 MMcfd of natural gas.

It is expected that the installation of all required platforms will conclude during 2007. Likewise, in that same year, the FPSO is expected to start operations to incorporate early production at Maloob and Zaap.

In 2006, average daily production is estimated to be 370 Mbd of crude oil and it is expected to increase gradually until it reaches approximately 800 Mbd in 2010. This subject to: (i) the conclusion of 99 development wells and (ii) pressure maintenance by means of the injection of up to 500 MMcfd of nitrogen through four injection wells, which is expected to begin at the end of 2006. |

| PEMEX financial results report as of September 30, 2005 | 5/46 | |||

| www.pemex.com | ||||

| PEMEX | Investor Relations |

Gas and basic petrochemicals

Gas processing and dry gas production | During the third quarter of 2005, total on-shore natural gas processing fell by 4%. The decline was a consequence of:

• An increase in the volume of natural gas processed at the off-shore gas treatment facility within Akal-C, in the Cantarell complex. Natural gas processed off-shore is re-injected into the wells in order to improve production

• A decrease in the production of sour wet gas off-shore as a result of infrastructure shut-in’s caused by Hurricane Emily

Sweet wet gas processing increased by 6% due to the increase in production from the Burgos and the Veracruz Basins and the steady operation of the two modular cryogenic plants in the Burgos Gas Processing Center (GPC).

Dry gas production averaged 3,082 MMcfd, 2% less than the production registered in the third quarter of 2004.

Natural gas liquids production decreased by 5% as a result of a lower supply of associated natural gas. |

| PEMEX financial results report as of September 30, 2005 | 6/46 | |||

| www.pemex.com | ||||

| PEMEX | Investor Relations |

Table 7

Petróleos Mexicanos, Subsidiary Entities and Subsidiary Companies

Natural gas processed and dry gas production

| Third quarter (July - Sep.) | Nine months ending Sep. 30, | |||||||||||||||||||

| 2004 | 2005 | Change | 2004 | 2005 | Change | |||||||||||||||

| (MMcfd) | (MMcfd) | |||||||||||||||||||

On-shore gas processed | 3,963 | 3,790 | -4 | % | (173 | ) | 3,961 | 3,897 | -2 | % | (63 | ) | ||||||||

Sour wet gas | 3,279 | 3,064 | -7 | % | (215 | ) | 3,366 | 3,162 | -6 | % | (204 | ) | ||||||||

Sweet wet gas | 684 | 726 | 6 | % | 42 | 595 | 735 | 24 | % | 140 | ||||||||||

Production | ||||||||||||||||||||

Dry gas | 3,140 | 3,082 | -2 | % | (57 | ) | 3,127 | 3,135 | 0 | % | 7 | |||||||||

Natural gas liquids (Mbd)(1) | 436 | 414 | -5 | % | (22 | ) | 444 | 430 | -3 | % | (15 | ) | ||||||||

| (1) | Includes condensates. |

Note: Numbers may not total due to rounding.

Sulfur recovery plant at the Cangrejera GPC | The sulfur recovery plant at the Cangrejera GPC started operating in August 2005. This plant has a nominal capacity of 10 tons per day and it is designed to recover 96% of the sulfur content of the acid gas stream coming from the sweetening section of the fractionation plant located in Cangrejera.

As a result, maximum dioxide sulfur emissions will be 50kg per ton of sulfur processed. This figure is less than 50% of the maximum amount set by the Environmental Ministry and international standards. |

Refining

| Processing | During the third quarter of 2005, total crude oil processing decreased by 1%, resulting from a 1% and 2% reduction in the processing of heavy and light crude oils, respectively. This decrease was due to adverse weather conditions in the Gulf of Mexico, supply disruptions of the electric power provided by Comisión Federal de Electricidad (CFE) and transportation constraints in moving products from southeast Mexico to the Madero and Cadereyta refineries. The transportation constraints are explained by the implementation of safety measures in crude oil and refined products pipelines in order to prevent leakages. |

Table 8

Petróleos Mexicanos, Subsidiary Entities and Subsidiary Companies

Crude oil processing

| Third quarter (July - Sep.) | Nine months ending Sep. 30, | |||||||||||||||||||

| 2004 | 2005 | Change | 2004 | 2005 | Change | |||||||||||||||

| (Mbd) | (Mbd) | |||||||||||||||||||

Total processed | 1,304 | 1,287 | -1 | % | (17 | ) | 1,322 | 1,301 | -2 | % | (21 | ) | ||||||||

Heavy Currents | 555 | 550 | -1 | % | (6 | ) | 544 | 549 | 1 | % | 4 | |||||||||

Light Currents | 749 | 737 | -2 | % | (11 | ) | 778 | 752 | -3 | % | (26 | ) | ||||||||

Note: Numbers may not total due to rounding.

| PEMEX financial results report as of September 30, 2005 | 7/46 | |||

| www.pemex.com | ||||

| PEMEX | Investor Relations |

| Production | During the third quarter of 2005, gasoline, fuel oil and diesel production decreased by 4%, 3% and 4%, respectively. Gasoline and diesel productions declined as a consequence of the decrease in the process of light currents while fuel oil production fell due to high inventories resulting from lower demand from the CFE. |

Table 9

Petróleos Mexicanos, Subsidiary Entities and Subsidiary Companies

Refining production

| Third quarter (July - Sep.) | Nine months ending Sep. 30, | |||||||||||||||||||

| 2004 | 2005 | Change | 2004 | 2005 | Change | |||||||||||||||

| (Mbd) | (Mbd) | |||||||||||||||||||

Total production | 1,587 | 1,533 | -3 | % | (54 | ) | 1,606 | 1,565 | -3 | % | (41 | ) | ||||||||

Gasolines | 474 | 453 | -4 | % | (21 | ) | 472 | 460 | -2 | % | (12 | ) | ||||||||

Fuel oil | 355 | 345 | -3 | % | (10 | ) | 373 | 353 | -5 | % | (19 | ) | ||||||||

Diesel | 323 | 310 | -4 | % | (13 | ) | 327 | 315 | -4 | % | (12 | ) | ||||||||

Liquefied petroleum gas (LPG) | 252 | 240 | -4 | % | (11 | ) | 255 | 249 | -2 | % | (6 | ) | ||||||||

Jet Fuel | 64 | 63 | -2 | % | (1 | ) | 65 | 64 | -1 | % | (1 | ) | ||||||||

Other(1) | 119 | 121 | 2 | % | 2 | 114 | 123 | 8 | % | 9 | ||||||||||

| (1) | Includes mainly parafines, furfural extract and aeroflex. |

Note: Numbers may not total due to rounding.

Refining margin | In the third quarter of 2005, Mexico’s refining margin increased by 72%, to US$5.51 per barrel, from US$3.21 per barrel in the third quarter of 2004. This increase is mainly a result of higher prices for refined products. | |

| Franchises | As of September 30, 2005, the number of franchised gas stations rose 7% to 7,041, from 6,562 as of September 30, 2004. | |

Petrochemicals

| Petrochemicals production | Total petrochemicals production for the third quarter of 2005 was 2,599 thousand tons (Mt), 3% less than that observed in the same quarter of 2004. This decrease was mainly driven by lower production levels in ammonia plants, due to high natural gas prices. However, production increases were registered in low density polyethylene, ethylene oxide and paraxylene (aromatic), as a result of the expansion of the third train in the low density polyethylene plant, catalyst substitution in the ethylene oxide plant and increased utilization of capacity in the paraxylene plant, all in La Cangrejera Petrochemical Center. |

| PEMEX financial results report as of September 30, 2005 | 8/46 | |||

| www.pemex.com | ||||

| PEMEX | Investor Relations |

Table 10

Petróleos Mexicanos, Subsidiary Entities and Subsidiary Companies

Production of petrochemicals

| Third quarter (July - Sep.) | Nine months ending Sep. 30, | |||||||||||||||||||

| 2004 | 2005 | Change | 2004 | 2005 | Change | |||||||||||||||

| (Mt) | (Mt) | |||||||||||||||||||

Total production | 2,667 | 2,599 | -3 | % | (68 | ) | 7,922 | 7,959 | 0 | % | 37 | |||||||||

Methane derivatives | ||||||||||||||||||||

Ammonia | 176 | 130 | -26 | % | (46 | ) | 459 | 399 | -13 | % | (60 | ) | ||||||||

Methanol | 50 | 9 | -82 | % | (41 | ) | 127 | 81 | -36 | % | (46 | ) | ||||||||

Ethane derivatives | ||||||||||||||||||||

Ethylene | 253 | 254 | 0 | % | 0 | 764 | 805 | 5 | % | 41 | ||||||||||

Ethylene oxide | 62 | 77 | 25 | % | 16 | 217 | 259 | 19 | % | 42 | ||||||||||

Low density polyethylene | 65 | 77 | 18 | % | 12 | 195 | 213 | 9 | % | 18 | ||||||||||

High density polyethylene | 46 | 39 | -14 | % | (6 | ) | 135 | 124 | -8 | % | (11 | ) | ||||||||

Aromatics and derivatives | ||||||||||||||||||||

Toluene | 42 | 64 | 54 | % | 23 | 152 | 191 | 25 | % | 39 | ||||||||||

Ethylbenzene | 47 | 44 | -6 | % | (3 | ) | 131 | 114 | -13 | % | (17 | ) | ||||||||

Benzene | 31 | 43 | 41 | % | 13 | 92 | 127 | 37 | % | 35 | ||||||||||

Propylene and derivatives | ||||||||||||||||||||

Acrylonitrile | 15 | 21 | 39 | % | 6 | 54 | 53 | -2 | % | (1 | ) | |||||||||

Polypropylene | 108 | 102 | -6 | % | (6 | ) | 312 | 288 | -8 | % | (25 | ) | ||||||||

Others(1) | 1,774 | 1,740 | -2 | % | (35 | ) | 5,283 | 5,304 | 0 | % | 22 | |||||||||

| (1) | Includes glycols, heavy reformed, oxygen, hydrogen, nitrogen, clorhidric acid, muriatic acid, hexane, heptanes and others. |

Note: Numbers may not total due to rounding.

| Fénix project | The new scope of the Fénix Project includes the expansion of La Cangrejera ethylene cracker and the Morelos ethylene cracker, from 600 to 875 Mt per year each. The expanded facilities will require natural gasolines, which will be supplied by PEMEX and were previously exported, due to the lack of processing capacity. The intermediate petrochemicals products produced will be used as inputs for polyethylene production and some other products produced in new facilities. These facilities are a new polyethylene plant and a new aromatic train. Their construction is expected to occur in alliance with Grupo Idesa, S.A. de C.V., Nova Chemicals Corporation and Indelpro, S.A. de C.V. | |

| Petrochemicals merger | On September 15, 2004 a resolution was published in the Official Gazette of the Federation (Diario Oficial de la Federacíon) authorizing the Ministry of Energy to carry out the merger of the seven subsidiaries of Pemex Petrochemicals. A year later, on September 15, 2005, the Ministry of Energy requested a 6 months extension. | |

| PEMEX financial results report as of September 30, 2005 | 9/46 | |||

| www.pemex.com | ||||

| PEMEX | Investor Relations |

International trade2

Crude oil exports | In the third quarter of 2005, PEMEX’s crude oil exports averaged 1,719 Mbd, 6% lower than the volume registered during the third quarter of 2004. Approximately 82% of the total crude oil exports were heavy crude oil (Maya), while the rest consisted of light and extra-light crude oil (Isthmus and Olmeca).

79% of the total crude oil exports were delivered to the United States, while the remaining 21% were distributed among Europe (12%) and the rest of America (9%).

The weighted average export price of the Mexican crude oil basket was US$49.54 per barrel, as compared to US$33.49 per barrel in the third quarter of 2004. | |

Refined products and petrochemicals exports | Exports of refined products averaged 180 Mbd, 35% higher than those in the third quarter of 2004. This was primarily due to higher availability of long residue, light cycle oil, jet fuel and heavy naphtha. Moreover, the jet fuel exported by ground transportation to the airports located in the south Texas area registered a significant growth.

Petrochemical exports decreased by 13%, or 29 Mt, totaling 195 Mt for the quarter. This increase was attributable to the greater availability of sulfur, monoethyleneglycol (MEG), ethylene, diethylenglycol and benzene. | |

Table 11

Petróleos Mexicanos, Subsidiary Entities and Subsidiary Companies

Exports(1)

| Third quarter (July - Sep.) | Nine months ending Sep. 30, | |||||||||||||||||||

| 2004 | 2005 | Change | 2004 | 2005 | Change | |||||||||||||||

Crude oil exports (Mbd)(2) | ||||||||||||||||||||

Total | 1,837 | 1,719 | -6 | % | (118 | ) | 1,837 | 1,793 | -2 | % | (44 | ) | ||||||||

Heavy | 1,585 | 1,414 | -11 | % | (171 | ) | 1,603 | 1,525 | -5 | % | (79 | ) | ||||||||

Light | 35 | 88 | 154 | % | 54 | 15 | 50 | 229 | % | 35 | ||||||||||

Extra-light | 218 | 217 | -1 | % | (1 | ) | 219 | 218 | 0 | % | (0 | ) | ||||||||

Average price (US$/b) | 33.49 | 49.54 | 48 | % | 16 | 30.19 | 41.76 | 38 | % | 12 | ||||||||||

Refined products (Mbd) | 133 | 180 | 35 | % | 46 | 157 | 184 | 17 | % | 27 | ||||||||||

Petrochemicals (Mt) | 224 | 195 | -13 | % | (29 | ) | 693 | 676 | -2 | % | (17 | ) | ||||||||

| (1) | Source: PMI. Does not consider third party operations by PMI. |

| (2) | Excludes the volume of crude oil under processing agreements. |

Note: Numbers may not total due to rounding.

| 2 | Source: PMI. |

| PEMEX financial results report as of September 30, 2005 | 10/46 | |||

| www.pemex.com | ||||

| PEMEX | Investor Relations |

| Imports | Natural gas imports averaged 448 MMcfd, 48% less than the imports registered during the third quarter of 2004. Imports decreased due to an increase in PEMEX’s production and a lower domestic demand.

Imports of refined products increased by 39%, from 276 Mbd in the third quarter of 2004 to 383 Mbd. The increase was a result of:

• Higher gasoline imports due to lower refineries’ output and a higher domestic demand for gasoline

• Higher demand from the CFE for fuel oil

• An increase in ultra-low sulfur diesel imports

Petrochemicals imports decreased by 5%, as compared to the third quarter of 2004, to 91 Mt, due to a reduction in imports of polymers, toluene, xylene and isobutene. |

Table 12

Petróleos Mexicanos, Subsidiary Entities and Subsidiary Companies

Imports(1)

| Third quarter (July - Sep.) | Nine months ending Sep. 30, | |||||||||||||||||||

| 2004 | 2005 | Change | 2004 | 2005 | Change | |||||||||||||||

Natural gas (MMcfd) | 859 | 448 | -48 | % | (410 | ) | 754 | 545 | -28 | % | (209 | ) | ||||||||

Refined products (Mbd)(2) | 276 | 383 | 39 | % | 108 | 283 | 372 | 31 | % | 89 | ||||||||||

Petrochemicals (Mt) | 95 | 91 | -5 | % | (5 | ) | 207 | 239 | 15 | % | 32 | |||||||||

| (1) | Source: PMI except natural gas imports. Does not consider third party operations by PMI. |

| (2) | Includes the volume of imported products under processing agreements. Also, 61 Mbd and 59 Mbd of LPG for the third quarter of 2004 and 2005, respectively; and 76 Mbd and 63 Mbd of LPG for the first nine months of 2004 and 2005, respectively. |

Note: Numbers may not total due to rounding.

Financial results as of September 30, 2005

Total sales

| Total sales | During the third quarter of 2005, total sales (including the special tax on production and services, or IEPS) increased by 18% in constant pesos to Ps. 241.3 billion (US$22.4 billion), as compared to Ps. 204.2 billion in the third quarter of 2004. |

| PEMEX financial results report as of September 30, 2005 | 11/46 | |||

| www.pemex.com | ||||

| PEMEX | Investor Relations |

| Domestic sales | Domestic sales, including IEPS, increased 11% to Ps. 127.3 billion (US$11.8 billion), from Ps. 115.1 billion. Domestic sales, net of IEPS, increased 22% to Ps. 125.2 billion (US$11.6 billion) from Ps. 102.5 billion. The increase in total domestic sales was attributable to the following:

• Natural gas sales increased 21.8% to Ps. 21.6 billion (US$2.0 billion) from Ps. 17.7 billion. Natural gas sales volume decreased 7% to 2,612 MMcfd from 2,809 MMcfd. The average sales price of natural gas was US$8.12 per million British Thermal Units (MMBtu) as compared to US$6.20 per MMBtu in the third quarter of 2004

• Sales of refined products, net of IEPS, grew 23% to Ps. 98.3 billion (US$9.1 billion) from Ps. 79.9 billion. Refined products sales volume increased 3% to 1,756 Mbd, from 1,707 Mbd. The IEPS generated by these sales decreased 83% to Ps. 2.1 billion (US$0.2 billion) from Ps. 12.6 billion. Sales of refined products, including IEPS, increased 9% to Ps. 100.4 billion (US$9.3 billion) from Ps. 92.5 billion

• Petrochemical sales increased 9% to Ps. 5.3 billion (US$0.5 billion) from Ps. 4.8 billion. Petrochemicals sales volume grew 9% to 965 Mt from 888 Mt |

Table 13

Petróleos Mexicanos, Subsidiary Entities and Subsidiary Companies

Domestic sales

| Third quarter (July - Sep.) | Nine months ending Sep. 30, | |||||||||||||||||||||||

| 2004 | 2005 | Change | 2005 | 2004 | 2005 | Change | 2005 | |||||||||||||||||

| (Ps. mm) | (US$mm) | (Ps. mm) | (US$mm) | |||||||||||||||||||||

Domestic sales including IEPS | 115,069 | 127,308 | 11 | % | 12,239 | 11,798 | 334,413 | 362,526 | 8 | % | 28,112 | 33,596 | ||||||||||||

Domestic sales without IEPS | 102,498 | 125,172 | 22 | % | 22,673 | 11,600 | 286,599 | 344,796 | 20 | % | 58,196 | 31,953 | ||||||||||||

Natural gas | 17,745 | 21,613 | 21.8 | % | 3,867 | 2,003 | 52,131 | 56,576 | 9 | % | 4,444 | 5,243 | ||||||||||||

Refined products including IEPS | 92,505 | 100,441 | 9 | % | 7,937 | 9,308 | 269,217 | 290,270 | 8 | % | 21,053 | 26,900 | ||||||||||||

Refined products | 79,935 | 98,305 | 23 | % | 18,371 | 9,110 | 221,403 | 272,540 | 23 | % | 51,136 | 25,257 | ||||||||||||

IEPS | 12,570 | 2,136 | -83 | % | (10,434 | ) | 198 | 47,814 | 17,730 | -63 | % | (30,084 | ) | 1,643 | ||||||||||

Petrochemical products | 4,819 | 5,254 | 9 | % | 435 | 487 | 13,065 | 15,680 | 20 | % | 2,615 | 1,453 | ||||||||||||

| * | Unaudited consolidated financial statements prepared in accordance with Mexican Generally Accepted Accounting Principles (Mexican GAAP) issued by the Instituto Mexicano de Contadores Públicos. Inflation recognition is also in accordance with Mexican GAAP. Accordingly, peso figures are presented in constant Mexican pesos as of September 30, 2005. |

Note: Numbers may not total due to rounding.

Table 14

Petróleos Mexicanos, Subsidiary Entities and Subsidiary Companies

Volume of domestic sales(1)

| Third quarter (July - Sep.) | Nine months ending Sep. 30, | |||||||||||||||||||

| 2004 | 2005 | Change | 2004 | 2005 | Change | |||||||||||||||

Natural gas (MMcfd) | 2,809 | 2,612 | -7 | % | (197 | ) | 2,755 | 2,684 | -3 | % | (71 | ) | ||||||||

Refined products (Mbd) | 1,707 | 1,756 | 3 | % | 49 | 1,707 | 1,764 | 3 | % | 57 | ||||||||||

Gasoline | 631 | 670 | 6 | % | 39 | 627 | 662 | 6 | % | 35 | ||||||||||

Other(1) | 1,076 | 1,086 | 1 | % | 10 | 1,080 | 1,102 | 2 | % | 22 | ||||||||||

Petrochemicals (Mt) | 888 | 965 | 9 | % | 77 | 2,610 | 2,828 | 8 | % | 218 | ||||||||||

| (1) | Includes: 309 Mbd and 294 Mbd of LPG for the third quarter of 2004 and 2005, respectively, and 323 Mbd and 308 Mbd of LPG for the first nine months of 2004 and 2005, respectively. |

Note: Numbers may not total due to rounding.

| PEMEX financial results report as of September 30, 2005 | 12/46 | |||

| www.pemex.com | ||||

| PEMEX | Investor Relations |

| Exports | Export sales totaled Ps. 114.0 billion (US$10.6 billion), 28% higher than the Ps. 89.1 billion registered in the third quarter of 2004. The distribution of export sales for the third quarter of 2005, as compared to the same period of 2004, was as follows:

• Crude oil and condensates export sales increased 26% to Ps. 102.4 billion (US$9.5 billion) from Ps. 81.4 billion. Crude oil exports volume fell 6% to 1,719 Mbd from 1,837 Mbd

• Refined products export sales rose 55% to Ps. 11.0 billion (US$1.0 billion) from Ps. 7.1 billion. Refined products exports volume grew 35% to 180 Mbd from 133 Mbd

• Petrochemical products export sales increased 6% to Ps. 0.6 billion (US$0.1 billion) from Ps. 0.6 billion. Petrochemical products exports volume decreased 13% to 195 Mt from 224 Mt |

Table 15

Petróleos Mexicanos, Subsidiary Entities and Subsidiary Companies

Exports

| Third quarter (July - Sep.) | Nine months ending Sep. 30, | |||||||||||||||||||||

| 2004 | 2005 | Change | 2005 | 2004 | 2005 | Change | 2005 | |||||||||||||||

| (Ps. mm) | (US$mm) | (Ps. mm) | (US$mm) | |||||||||||||||||||

Total exports | 89,131 | 114,020 | 28 | % | 24,889 | 10,566 | 240,015 | 299,818 | 25 | % | 59,803 | 27,785 | ||||||||||

Crude oil and condensates | 81,445 | 102,400 | 26 | % | 20,955 | 9,490 | 217,330 | 268,562 | 24 | % | 51,232 | 24,888 | ||||||||||

Refined products | 7,100 | 10,998 | 55 | % | 3,898 | 1,019 | 20,703 | 28,269 | 37 | % | 7,566 | 2,620 | ||||||||||

Petrochemical products | 585 | 622 | 6 | % | 37 | 58 | 1,982 | 2,986 | 51 | % | 1,004 | 277 | ||||||||||

| * | Unaudited consolidated financial statements prepared in accordance with Mexican Generally Accepted Accounting Principles (Mexican GAAP) issued by the Instituto Mexicano de Contadores Públicos. Inflation recognition is also in accordance with Mexican GAAP. Accordingly, peso figures are presented in constant Mexican pesos as of September 30, 2005. |

Note: Numbers may not total due to rounding.

Costs and operating expenses

| Costs and expenses remained stable | Costs and operating expenses fell Ps. 189 million to Ps. 94.5 billion (US$8.8 billion). | |

| Cost of sales | Cost of sales decrease 6%, or Ps. 4.8 billion, to Ps. 75.3 billion (US$7.0 billion). The decrease was the result of the following:

• A Ps. 10.0 billion decrease in operational maintenance

• A Ps. 6.7 billion decrease in the variation of inventories

• A Ps. 12.0 billion increase in imports of products | |

| Distribution expenses | Transportation expenses increased 20%, from Ps. 4.7 billion to Ps. 5.6 billion (US$0.5 billion). | |

| Administrative expenses | Administrative expenses increased 37%, from Ps. 10.0 billion to Ps. 13.7 billion (US$1.3 billion). | |

| PEMEX financial results report as of September 30, 2005 | 13/46 | |||

| www.pemex.com | ||||

| PEMEX | Investor Relations |

| Cost of the reserve for retirement payments | The cost of the reserve for retirement payments, pensions and indemnities increased 30%, from Ps. 10.4 billion to Ps. 13.6 billion (US$1.3 billion). This cost is distributed among cost of sales, distribution expenses and administrative expenses. The increase in the cost of the reserve for retirement payments was the result of not only the natural evolution of the reserve, but also the incorporation of medical services into the reserve. |

Operating income

| Operating income increased 34% | Operating income in the third quarter of 2005 totaled Ps. 146.8 billion (US$13.6 billion), and was 34% higher than the comparable figure for the third quarter of 2004 of Ps. 109.5 billion.

Excluding IEPS, operating income grew 49%, or Ps. 47.8 billion, to Ps. 144.7 billion (US$13.4 billion) from Ps. 96.9 billion. |

Comprehensive financing cost

| Increase of comprehensive financing cost | Comprehensive financing cost increased by Ps. 19.0 billion, from a revenue of Ps. 9.9 billion to a cost of Ps. 9.1 billion (US$0.8 billion). This increase was caused by:

• An increase of Ps. 9.2 billion in net interest expense

• An increase of Ps. 5.7 billion in the net foreign exchange loss

• An increase of Ps. 4.1 billion in the monetary position |

| PEMEX financial results report as of September 30, 2005 | 14/46 | |||

| www.pemex.com | ||||

| PEMEX | Investor Relations |

| Net interest expense | Net interest expense increased 327%, from Ps. 2.8 billion to Ps. 12.0 billion (US$1.1 billion).

Interest expense increased Ps. 9.2 billion, while interest income decreased Ps. 0.1 billion.

The increase is mainly due to the mark-to-market valuation of the prepayment, in July 2005, of the Petróleos Mexicanos bonds held by the Pemex Project Funding Master Trust. The mark-to-market value of these bonds was approximately US$0.4 billion higher than its face value of US$2.3 billion. The prepayment is related to the exchange of Petróleos Mexicanos bonds for Pemex Project Funding Master Trust’s effected in December 2004, in order to transfer cash from Petróleos Mexicanos to Pidiregas funds. The net present value of the bond exchange was zero excluding transaction costs. The premium paid to the investors who participated in the bond exchange before December 15, 2004, was 0.25% and was registered in December 2004.

In addition, as described ahead, as of July 1, 2005, the debt of Pemex Finance, Ltd. is consolidated in the financial statements of Petróleos Mexicanos. As a result, the interest expense now reflects the interest expense of Pemex Finance, Ltd. | |

| Foreign exchange loss | Net foreign exchange loss totaled Ps. 0.2 billion (US$0.02 billion) in the third quarter of 2005 as compared to a net foreign exchange gain of Ps. 5.5 billion in the third quarter of 2004.

This decrease was primarily a consequence of the depreciation of the Mexican peso against the US dollar by 0.1%, during the third quarter of 2005, as compared to an appreciation of 1.2% in the comparable period of 2004. | |

| Monetary gain | The monetary gain was Ps. 3.0 billion (US$0.3 billion), representing a 58% decrease from the monetary gain for the third quarter of 2004.

The decrease in the monetary gain was due to a drop in inflation from 0.9% to 0.4% in the third quarter of 2005. | |

| PEMEX financial results report as of September 30, 2005 | 15/46 | |||

| www.pemex.com | ||||

| PEMEX | Investor Relations |

Table 16

Petróleos Mexicanos, Subsidiary Entities and Subsidiary Companies

Comprehensive financing cost

| Third quarter (July - Sep.) | Nine months ending Sep. 30, | |||||||||||||||||||||||||||||

| 2004 | 2005 | Change | 2005 | 2004 | 2005 | Change | 2005 | |||||||||||||||||||||||

| (Ps. mm) | (US$mm) | (Ps. mm) | (US$mm) | |||||||||||||||||||||||||||

Comprehensive financing cost | (9,859 | ) | 9,098 | 18,957 | 843 | 8,948 | 3,730 | -58 | % | (5,218 | ) | 346 | ||||||||||||||||||

Interest income | (1,733 | ) | (1,787 | ) | (54 | ) | (166 | ) | (8,595 | ) | (14,487 | ) | (5,892 | ) | (1,343 | ) | ||||||||||||||

Interest expense | 4,531 | 13,738 | 203 | % | 9,207 | 1,273 | 21,342 | 40,124 | 88 | % | 18,782 | 3,718 | ||||||||||||||||||

Foreign exchange loss (gain) | (5,484 | ) | 193 | 5,676 | 18 | 8,574 | (16,053 | ) | (24,626 | ) | (1,488 | ) | ||||||||||||||||||

Monetary loss (gain) | (7,173 | ) | (3,045 | ) | 4,127 | (282 | ) | (12,373 | ) | (5,854 | ) | 6,519 | (543 | ) | ||||||||||||||||

| * | Unaudited consolidated financial statements prepared in accordance with Mexican Generally Accepted Accounting Principles (Mexican GAAP) issued by the Instituto Mexicano de Contadores Públicos. Inflation recognition is also in accordance with Mexican GAAP. Accordingly, peso figures are presented in constant Mexican pesos as of September 30, 2005. |

Note: Numbers may not total due to rounding.

Other revenues

Other net revenues | Other net revenues decreased 48% to Ps. 7.0 billion (US$0.6 billion). The corresponding figure for the third quarter of 2004 was a net revenue of Ps. 13.3 billion.

The decrease was mainly due to the cancellation of the recognition of impairment of fixed assets registered during the third quarter of 2004, which was not observed during the corresponding period of 2005.

The impairment of fixed assets was calculated in accordance with Accounting Bulletin C-15 “Impairment of the Value of Fixed Assets and Disposal” which requires the recognition in net income of the difference between the value of the asset registered and the present value of the expected future flows associated with the asset. |

Income before taxes and duties

Income before taxes | Income before taxes and duties was Ps. 144.7 billion (US$13.4 billion), compared to Ps. 132.6 billion. The 9% increase was principally the result of an increase of Ps. 37.3 billion in operating income. This increase was partially offset by a Ps. 19.0 billion increase in comprehensive financing cost and a Ps. 6.3 billion reduction in other net revenues. |

| PEMEX financial results report as of September 30, 2005 | 16/46 | |||

| www.pemex.com | ||||

| PEMEX | Investor Relations |

Taxes and duties

| 22% increase | Petróleos Mexicanos and its subsidiary entities pay taxes and duties equivalent to 60.8% of total sales3. This includes the special tax on production and services (IEPS) that applies to gasoline.

Taxes and duties paid increased 22%, from Ps. 126.8 billion to Ps. 154.6 billion (US$14.3 billion). | |

| IEPS | IEPS is paid by the end consumer of gasoline and PEMEX is an intermediary between the Ministry of Finance (SHCP) and the end consumer. The Ministry of Finance determines the retail price of gasoline. Recently, gasoline prices have remained nearly unchanged because changes are linked to increases in the consumer price index. When PEMEX sells gasoline, it retains an amount based on an estimate of its production cost, assuming efficient refinery operation. The difference between the retail price and the cost that PEMEX retains is primarily IEPS, which PEMEX collects and passes on to the federal government.

Therefore, when the crude oil price and the production cost of gasoline are high, the IEPS decreases. The converse is true when crude oil prices are low.

The IEPS totaled Ps. 2.1 billion (US$0.2 billion), Ps. 10.4 billion lower than that observed during the third quarter of 2004 of Ps. 12.6 billion (US$1.2 billion). | |

| 3 | PEMEX’s subsidiary companies that are located in México pay corporate income tax on the same basis as private sector companies in México. |

| PEMEX financial results report as of September 30, 2005 | 17/46 | |||

| www.pemex.com | ||||

| PEMEX | Investor Relations |

Excess gains duty | In 2005, the excess gains duty replaced the prior duty for exploration, gas, refining and petrochemicals infrastructure (duty for infrastructure or AOI). The excess gains duty is equal to 39.2% of the revenues from crude oil export sales in excess of the threshold price set by the Mexican Government of US$23.00 per barrel. For 2005, the proceeds of this duty paid in excess of US$27.00 per barrel will be allocated as follows:

• 50% to the investment in infrastructure in exploration, production, gas, refining and petrochemicals that Petróleos Mexicanos and its subsidiary entities undertake

• 50% to programs and investment projects in infrastructure of the Federal States of the Mexican Republic

During the third quarter of 2005, the excess gains duty paid by PEMEX totaled Ps. 17.6 billion (US$1.6 billion) while in the same quarter of 2004, the duty for infrastructure totaled Ps. 10.0 billion.

The reimbursement of the excess gains duty during the first half of 2005 was Ps. 3.9 billion (US$0.4 billion). On May 13, 2005, PEMEX received Ps. 0.7 billion (US$0.06 billion) and on August 10, 2005, PEMEX received Ps. 3.2 billion (US$0.3 billion).

PEMEX expects that the total reimbursement of the excess gains duty for 2005 will be Ps. 23.5 billion (US$2.2 billion). The advance reimbursements of the third and fourth quarters are expected to be received in November and December 2005, respectively. The reimbursements corresponding to the first six months of 2005 will be used for investments this year, whereas the resources collected during the third and fourth quarters will be used in 2006. |

Table 17

Petróleos Mexicanos, Subsidiary Entities and Subsidiary Companies

Taxes and duties

| Third quarter (July - Sep.) | Nine months ending Sep. 30, | |||||||||||||||||||||||

| 2004 | 2005 | Change | 2005 | 2004 | 2005 | Change | 2005 | |||||||||||||||||

| (Ps. mm) | (US$mm) | (Ps. mm) | (US$mm) | |||||||||||||||||||||

Total taxes and duties | 126,806 | 154,595 | 22 | % | 27,789 | 14,327 | 351,810 | 413,272 | 17 | % | 61,462 | 38,299 | ||||||||||||

Hydrocarbon extraction duties and other | 104,221 | 134,843 | 29 | % | 30,622 | 12,496 | 280,741 | 356,486 | 27 | % | 75,745 | 33,036 | ||||||||||||

Special Tax on Production and Services (IEPS) | 12,570 | 2,136 | -83 | % | (10,434 | ) | 198 | 47,814 | 17,730 | -63 | % | (30,084 | ) | 1,643 | ||||||||||

Excess gains duty(1) | 10,016 | 17,617 | 76 | % | 7,601 | 1,633 | 23,255 | 39,056 | 68 | % | 15,801 | 3,619 | ||||||||||||

| * | Unaudited consolidated financial statements prepared in accordance with Mexican Generally Accepted Accounting Principles (Mexican GAAP) issued by the Instituto Mexicano de Contadores Públicos. Inflation recognition is also in accordance with Mexican GAAP. Accordingly, peso figures are presented in constant Mexican pesos as of September 30, 2005. |

| (1) | For 2004, amount represents the duty for infrastructure. |

Note: Numbers may not total due to rounding.

| PEMEX financial results report as of September 30, 2005 | 18/46 | |||

| www.pemex.com | ||||

| PEMEX | Investor Relations |

Net income

| Net loss of Ps. 9.9 billion | PEMEX registered a net loss of Ps. 9.9 billion (US$0.9 billion), compared to a net gain of Ps. 5.8 billion. The Ps. 15.7 billion decrease in the net loss is explained by:

• An increase of Ps. 37.3 billion in operating income

• An increase of Ps. 19.0 billion in the comprehensive financing cost

• A decrease of Ps. 6.3 billion in other revenues

• An increase of Ps. 27.8 in taxes and duties |

EBITDA

| EBITDA increased 35% | EBITDA increased 35%, from Ps. 132.3 billion to Ps. 177.9 billion (US$16.5 billion). EBITDA is reconciled to net loss as shown in the following table: |

Table 18

Petróleos Mexicanos, Subsidiary Entities and Subsidiary Companies

EBITDA reconciliation

| Third quarter (July - Sep.) | Nine months ending Sep. 30, | |||||||||||||||||||||||||||||

| 2004 | 2005 | Change | 2005 | 2004 | 2005 | Change | 2005 | |||||||||||||||||||||||

| (Ps. mm) | (US$mm) | (Ps. mm) | (US$mm) | |||||||||||||||||||||||||||

Net income (loss) | 5,822 | (9,889 | ) | -270 | % | (15,711 | ) | (916 | ) | (25,745 | ) | (2,885 | ) | -89 | % | 22,859 | (267 | ) | ||||||||||||

+ Taxes and duties | 126,806 | 154,595 | 22 | % | 27,789 | 14,327 | 351,810 | 413,272 | 17 | % | 61,462 | 38,299 | ||||||||||||||||||

- Special Tax on Production and Services (IEPS) | 12,570 | 2,136 | -83 | % | (10,434 | ) | 198 | 47,814 | 17,730 | -63 | % | (30,084 | ) | 1,643 | ||||||||||||||||

+ Comprehensive financing cost | (9,859 | ) | 9,098 | -192 | % | 18,957 | 843 | 8,948 | 3,730 | -58 | % | (5,218 | ) | 346 | ||||||||||||||||

+ Depreciation and amortization | 11,621 | 12,701 | 9 | % | 1,080 | 1,177 | 32,381 | 36,976 | 14 | % | 4,595 | 3,427 | ||||||||||||||||||

+ Cost of the reserve for retirement payments | 10,433 | 13,573 | 30 | % | 3,140 | 1,258 | 32,870 | 41,985 | 28 | % | 9,115 | 3,891 | ||||||||||||||||||

- Cummulative effect due to the adoption of new accounting standards | — | 55 | 55 | 5.1 | (10,646 | ) | 4,417 | -141 | % | 15,063 | 409 | |||||||||||||||||||

EBITDA | 132,254 | 177,888 | 35 | % | 45,634 | 16,485 | 363,096 | 470,930 | 30 | % | 107,834 | 43,642 | ||||||||||||||||||

| * | Unaudited consolidated financial statements prepared in accordance with Mexican Generally Accepted Accounting Principles (Mexican GAAP) issued by the Instituto Mexicano de Contadores Públicos. Inflation recognition is also in accordance with Mexican GAAP. Accordingly, peso figures are presented in constant Mexican pesos as of September 30, 2005. |

Note: Numbers may not total due to rounding.

| PEMEX financial results report as of September 30, 2005 | 19/46 | |||

| www.pemex.com | ||||

| PEMEX | Investor Relations |

Total assets

| Total assets increased 5% | As of September 30, 2005, total assets were Ps. 1,044.9 billion (US$96.8 billion), representing a 5%, or Ps. 52.4 billion, increase as compared to total assets as of September 30, 2004. The changes in the components of total assets were as follows:

• Cash and cash equivalents decreased by 14%, or Ps. 18.6 billion

• Accounts receivable increased by 59%, or Ps. 49.4 billion

• The value of inventories increased by 40%, or Ps. 15.1 billion, as a result of higher hydrocarbon prices

• Properties and equipment increased by 8%, or Ps. 44.0 billion, reflecting new investments

• Other assets decreased by 30%, or Ps. 47.8 billion, mainly as a result of the application of the new Bulletin D-3 “Labor Obligations”, which separates pensions from benefits and no longer requires a minimal reserve for benefits in the reserve for retirement payments, pensions and seniority premiums |

Total liabilities

| Liabilities increased 5% | Total liabilities increased by 5% to Ps. 1,031.5 billion (US$95.6 billion)

• Short-term liabilities increased by 12%, or Ps. 18.6 billion, to Ps. 172.7 billion (US$16.0 billion), primarily as a result of the increase in taxes payable and financial derivative instruments

• Long-term liabilities increased by 4%, or Ps. 34.3 billion, to Ps. 858.9 billion (US$79.6 billion), due to the increase in long-term documented debt

Total debt is discussed at greater length under “Financing Activities”. |

| PEMEX financial results report as of September 30, 2005 | 20/46 | |||

| www.pemex.com | ||||

| PEMEX | Investor Relations |

| Reserve for retirement payments | The reserve for retirement payments, pensions and seniority premiums decreased by 1%, to Ps. 342.7 billion (US$31.8 billion) from Ps. 346.1 billion. The Ps. 3.5 billion decrease resulted from:

• A decrease of Ps. 41.8 billion due to a change in accounting standard in accordance with Bulletin D-3 “Labor Obligations” that separates pensions and benefits and no longer requires a minimal reserve for retirements benefits

• An increase of Ps. 14.3 billion due to a decrease of one year in the funding period

• A partially offsetting increase of Ps. 12.1 billion due to the difference between actual and expected wage negotiations

• An increase of Ps. 3.0 billion due to a decrease in the pension fund

• An increase of Ps. 4.5 billion due to one more year of payroll seniority

• An increase of Ps. 4.1 billion due to changes in actuarial assumptions

• An increase of Ps. 0.2 billion due to the establishment of a reserve of severance payments

• An increase of Ps. 8.6 billion due to the application of the Voluntary Retirement Program

• A decrease of Ps. 8.5 billion due to the recognition of the initial effect in 2004 of the medical services provided to all employees, active and non-active |

Equity

| Decrease of 4% | PEMEX’s equity decreased by 4%, or Ps. 0.5 billion, from Ps. 13.9 billion to Ps. 13.4 billion (US$1.2 billion). The decrease in equity was due to:

• An offsetting effect of Ps. 35.5 billion due to the capitalization of the duty for infrastructure paid in 2004

• A decrease of Ps. 7.0 billion attributable to the excess of the threshold affecting the intangible asset associated with the reserve for retirement payments, pensions and seniority premiums

• A decrease of Ps. 6.4 billion due to the restatement of equity

• A decrease of Ps. 10.0 billion due to the application of the Bulletin C-10 “Derivative Financial Instruments and Hedge Operations”

• An increase of Ps. 12.5 billion in cumulative net losses |

| PEMEX financial results report as of September 30, 2005 | 21/46 | |||

| www.pemex.com | ||||

| PEMEX | Investor Relations |

Results by segment

| Operating income | The operating loss of Pemex Refining totaled Ps. 18.2 billion (US$1.7 billion), Ps. 8.7 billion higher as compared to the September 30, 2004. It is worth mentioning that since February 2005, the reference price of some products marketed by refining, mainly diesel and magna gasoline, has been higher to the retail established price. The difference would be equal to a negative IEPS tax. Nevertheless, since negative taxes do not exist, the price received by refining is limited by the retail established price generating an additional loss. The operating loss of Pemex Petrochemicals totaled Ps. 6.2 billion (US$0.6 billion), Ps. 0.2 billion higher as compared to the September 30, 2004. |

Changes in financial position

Funds provided by operating activities | Funds provided by operating activities totaled Ps. 49.1 billion (US$4.6 billion). The increase of Ps. 17.5 billion is primarily due to the increase in the variation of the intangible asset derived from the actuarial computation of labor obligations and other assets and taxes payable. | |

Funds provided by financing activities | Funds provided by financing activities totaled Ps. 34.3 billion (US$3.2 billion). The decrease of Ps. 21.9 billion is mainly due to the amortization of securities. | |

Funds used in investing activities | Funds used in investing activities totaled to Ps. 58.0 billion (US$5.4 billion) as a result of an increase in fixed assets.

Taking into account exploration and non-successful drilling expenses, as well as non-capitalized maintenance, funds used in investing activities totaled Ps. 84.7 billion (US$7.8 billion) | |

Change in functional currency

Change in the functional currency of the Master Trust | As of September 30, 2005 the US dollar remains as the Master Trust functional currency for financial information under Mexican Generally Accepted Accounting Principles (Mexican GAAP). |

| PEMEX financial results report as of September 30, 2005 | 22/46 | |||

| www.pemex.com | ||||

| PEMEX | Investor Relations |

Annual Report amendment under the 20-F form format for the Securities and Exchange Commission (SEC)

| 20-F amendment | The United States Securities and Exchange Commission periodically makes detailed revisions to annual reports under 20-F form format. In 2005, the SEC revised PEMEX’s 20-F form as of December 31, 2004. This revision resulted in an amendment that basically consists of corrections to the company’s information by segment including: (i) Petróleos Mexicanos (Corporate), (ii) Subsidiary Entities that guarantees PEMEX’s debt (Pemex Exploración y Producción, Pemex Gas y Petroquímica Básica and Pemex Refinación) and (iii) Pemex Petroquímica. |

Financing activities

Financing activities

Funds raised year to date | Year to date, US$8.5 billion were raised as follows:

• US$1.9 billion in foreign capital markets

• US$2.9 billion in the Mexican capital market

• US$0.9 billion in the Mexican capital market, as part of the pre-funding of the financing requirements for 2006

• US$2.2 billion in bank loans

• US$0.6 billion from export credit agencies (ECA’s)

Approximately 60% of this amount has been raised in the international markets, and the rest was raised in the Mexican market. | |

Financing program for the remainder of 2005 | For the rest of 2005, PEMEX plans to raise approximately an additional US$1 billion, which is expected to be financed by export credit agencies (ECA’s). Additionally, and depending on market conditions, PEMEX may continue pre-funding its financing program for 2006. | |

| PEMEX financial results report as of September 30, 2005 | 23/46 | |||

| www.pemex.com | ||||

| PEMEX | Investor Relations |

Capital markets

| Master Trust | During 2005, the Pemex Project Funding Master Trust, a Delaware trust controlled by, and whose debt is guaranteed by PEMEX, entered into the following financings:

• On February 24, 2005, it issued EUR1.0 billion of its 5.5% coupon notes due 2025

• On March 22, 2005, it entered into a syndicated credit facility of US$4.3 billion divided into two tranches:

• US$2.2 billion maturing on 2010 bearing an interest rate of LIBOR plus 50 basis points

• US$2.1 billion maturing on 2012 bearing an interest rate of LIBOR plus 65 basis points

• Of the US$4.3 billion obtained in this credit facility, US$2.2 billion were used to refinance current syndicated credit facilities and the rest was used to finance this year’s capital expenditures.

• On June 8, 2005, it issued US$ 1.5 billion notes divided in two tranches:

• US$1.0 billion maturing on 2015 with a 5.57% coupon

• US$0.5 billion maturing 2035 with a 6.625% coupon

• On July 18, 2005, it amended its US$1.25 billion revolving syndicated credit facility originally signed in June 2004. The amendment involved:

• A reduction of the interest rate margins over LIBOR payable

• A reduction of the commitment fee

• A one year extension of the maturity of the facility

• On August 31, 2005 it issued US$ 175 million notes bearing interest rate at LIBOR plus 0.425% maturing on 2008 | |

| F/163 | During 2005, the Trust F/163, a Mexican trust controlled by, and whose debt is guaranteed by PEMEX, entered into the following financings

• On December 23, 2004, it issued in the Mexican market notes denominated in Unidades de Inversión (Units of Investment or UDI’s) equivalent to Ps. 5.0 billion. The notes issued are zero-coupon with a 9.01% interest rate yield and a 15 year maturity

• On February 1, 2005, it reopened the UDI’s issuance for an amount equivalent to Ps. 6 billion with a 9.07% interest rate yield and a 15 year maturity

• On February 11, 2005, it issued in the Mexican market notes for Ps.15 billion. The issuance was done in two tranches:

• Ps. 7.5 billion, with a floating coupon rate equal to 91 days CETES plus 51 basis points, due in 2010

• Ps. 7.5 billion, with a floating coupon rate equal to 182 days CETES plus 57 basis points, due in 2013

• On May 13, 2005, it reopened the February 2005 issuance for Ps.10 billion, divided in two tranches:

• Ps. 5.013 billion, with a yield equal to 91 days CETES plus 49 basis points, due in 2010

• Ps. 4.987 billion, with a yield equal to 182 days CETES plus 55 basis points, due in 2013

• On July 29, 2005, it issued in the Mexican market Ps. 5 billion of notes with stripped coupons at 9.91% and a 10 year maturity

• On October 21, 2005, it reopened the issuance of July 2005 by issuing Ps. 4,500 million, and it also issued in the Mexican market notes for Ps.5,500 million with a floating coupon rate equal to 91 days CETES plus 35 basis points, due in 2011 | |

| PEMEX financial results report as of September 30, 2005 | 24/46 | |||

| www.pemex.com | ||||

| PEMEX | Investor Relations |

Pemex Finance | On June 27, 2005, Pemex Finance, Ltd. redeemed the following series of its outstanding notes which were financially guaranteed by an insurance policy and therefore were rated AAA:

The notes selected for redemption were trading in the secondary market at return rates similar to those of the bonds that are not financially guaranteed by an insurance policy, and that are issued by other PEMEX financing vehicles. The approximate principal amount of the redeemed notes was US$994 million:

• US$194 million principal amount of 6.55% notes due 2008

• US$400 million principal amount of 6.30% notes due 2010

• US$250 million principal amount of 7.33% notes due 2012

• US$150 million principal amount of 7.80% notes due 2013

The notes were redeemed at a price equal to the principal amount thereof plus accrued interest thereon and make-whole premium. The outstanding principal amount of the remaining Pemex Finance, Ltd. notes is US$2.4 billion with maturities between 2007 and 2018. |

Total debt

Total debt of US$48.0 billion | Total consolidated debt including accrued interest was Ps. 517.8 billion (US$48.0 billion). This figure represents an increase of 3%, or Ps.15.2 billion, compared to the figure recorded on September 30, 2004. Total debt includes:

• Documented debt of Petróleos Mexicanos, the Pemex Project Funding Master Trust, Trust F/163, RepCon Lux S.A. and Pemex Finance, Ltd

• Notes payable to contractors

On July 1, 2005, PEMEX entered into an option agreement with BNP Paribas Private Bank and Trust Cayman Limited to acquire 100% of the shares of Pemex Finance, Ltd. As a result, the financial results of Pemex Finance, Ltd., under Mexican Generally Accepted Accounting Principles, are consolidated into the financial statements of Petróleos Mexicanos. Consequently, sales of accounts receivable were reclassified into documented debt. This option can only be exercised once the remaining debt of Pemex Finance, Ltd., which is approximately US$2.4 billion, has been redeemed. | |

Net debt of US$37.6 billion | Net debt, or the difference between debt and cash equivalents, increased Ps. 33.8 billion, to Ps. 406.1 billion (US$ 37.6 billion) as of September 30, 2005, from Ps. 372.3 billion. | |

| PEMEX financial results report as of September 30, 2005 | 25/46 | |||

| www.pemex.com | ||||

| PEMEX | Investor Relations |

Table 19

Petróleos Mexicanos, Subsidiary Entities and Subsidiary Companies

Consolidated total debt

| As of September 30, | ||||||||||||

| 2004 | 2005 | Change | 2005 | |||||||||

| (Ps. mm) | (US$mm) | |||||||||||

Documented debt(1) | 449,408 | 503,514 | 12 | % | 54,106 | 46,662 | ||||||

Short-term | 59,949 | 20,537 | -66 | % | (39,413 | ) | 1,903 | |||||

Long-term | 389,459 | 482,978 | 24 | % | 93,519 | 44,759 | ||||||

Notes payable to contractors | 14,941 | 14,309 | -4 | % | (632 | ) | 1,326 | |||||

Short-term | 2,723 | 1,680 | -38 | % | (1,043 | ) | 156 | |||||

Long-term | 12,218 | 12,629 | 3 | % | 410 | 1,170 | ||||||

Sale of future accounts receivable(2) | 38,263 | — | -100 | % | (38,263 | ) | — | |||||

Long-term | 38,263 | — | -100 | % | (38,263 | ) | — | |||||

Total debt | 502,612 | 517,823 | 3 | % | 15,211 | 47,988 | ||||||

Short-term | 62,672 | 22,217 | -65 | % | (40,455 | ) | 2,059 | |||||

Long-term | 439,940 | 495,606 | 13 | % | 55,666 | 45,929 | ||||||

Cash & cash equivalents | 130,333 | 111,766 | -14 | % | (18,568 | ) | 10,358 | |||||

Total net debt | 372,279 | 406,057 | 9 | % | 33,778 | 37,630 | ||||||

| * | Unaudited consolidated financial statements prepared in accordance with Mexican Generally Accepted Accounting Principles (Mexican GAAP) issued by the Instituto Mexicano de Contadores Públicos. Inflation recognition is also in accordance with Mexican GAAP. Accordingly, peso figures are presented in constant Mexican pesos as of September 30, 2005. |

| (1) | Consistent with debt figures presented in U.S. Securities and Exchange Commission filings. |

| (2) | Represents Pemex Finance debt. |

Note: Numbers may not total due to rounding.

Short-term debt | Total debt with a remaining maturity of less than twelve months was Ps. 22.2 billion (US$2.1 billion), including:

• Ps. 20.5 billion (US$1.9 billion) in documented debt

• Ps. 1.7 billion (US$0.2 billion) in notes payable to contractors | |

Long-term debt | Total long-term debt was Ps. 495.6 billion (US$45.9 billion). This figure includes:

• Ps. 483.0 billion (US$44.8 billion) in documented debt

• Ps. 12.6 billion (US$1.2 billion) in notes payable to contractors | |

| PEMEX financial results report as of September 30, 2005 | 26/46 | |||

| www.pemex.com | ||||

| PEMEX | Investor Relations |

| Maturity profile | The following table shows the maturity profile of PEMEX’s total debt by currency: |

Table 20

Petróleos Mexicanos, Subsidiary Entities and Subsidiary Companies

Maturity profile

| As of September 30, | ||||

| (Ps. mm) | US$mm | |||

Documented debt in pesos | 94,838 | 8,789 | ||

2005 | 337 | 31 | ||

January - September 2006 | 2,333 | 216 | ||

October 2006 - September 2007 | 555 | 51 | ||

October 2007 - September 2008 | 17,499 | 1,622 | ||

October 2008 - September 2009 | 3,333 | 309 | ||

October 2009 and beyond | 70,782 | 6,560 | ||

Documented debt in other currencies | 422,985 | 39,199 | ||

2005 | 10,706 | 992 | ||

January - September 2006 | 20,056 | 1,859 | ||

October 2006 - September 2007 | 43,289 | 4,012 | ||

October 2007 - September 2008 | 39,369 | 3,648 | ||

October 2008 - September 2009 | 59,190 | 5,485 | ||

October 2009 and beyond | 250,375 | 23,203 | ||

Total debt | 517,823 | 47,988 | ||

| * | Unaudited consolidated financial statements prepared in accordance with Mexican Generally Accepted Accounting Principles (Mexican GAAP) issued by the Instituto Mexicano de Contadores Públicos. Inflation recognition is also in accordance with Mexican GAAP. Accordingly, peso figures are presented in constant Mexican pesos as of September 30, 2005. |

Note: Numbers may not total due to rounding.

| Duration | PEMEX plans to smooth its maturity profile regardless of the duration of its outstanding debt. The average duration of its debt exposure is presented in the following table. |

Table 21

Petróleos Mexicanos, Subsidiary Entities and Subsidiary Companies

Average duration of debt exposure

| As of September 30, | |||||||

| 2004 | 2005 | Change | |||||

| (Years) | |||||||

U.S. Dollars | 4.4 | 4.1 | (0.3 | ) | |||

Mexican pesos | 0.6 | 2.2 | 1.6 | ||||

Euros | 0.9 | 1.2 | 0.3 | ||||

Japanese yen | 2.8 | 2.3 | (0.5 | ) | |||

Swiss francs | 0.4 | 0.2 | (0.2 | ) | |||

Total | 3.9 | 3.8 | (0.2 | ) | |||

Note: Numbers may not total due to rounding.

| PEMEX financial results report as of September 30, 2005 | 27/46 | |||

| www.pemex.com | ||||

| PEMEX | Investor Relations |

| Interest rate risk | PEMEX´s policy is to maintain a balance between fixed and floating rate liabilities in order to mitigate the impact of fluctuations in interest rates. As of September 30, 2005, approximately 64% of PEMEX’s debt exposure carried a fixed interest rate, and 36% of its debt bore interest at floating rates. | |

| More financing in pesos | Although most of PEMEX’s debt is U.S. dollar denominated and at fixed rates, due to an increase in peso denominated financing, PEMEX’s U.S. dollar debt exposure has decreased about 8 percentage points. | |

| Debt exposure | The following table sets forth PEMEX’s debt exposure to currency and interest rate risk: | |

Table 22

Petróleos Mexicanos, Subsidiary Entities and Subsidiary Companies

Debt exposure

(excluding accrued interest)

| As of September 30, | ||||||||||||||||||

| 2004 | 2005 | 2004 | 2005 | 2004 | 2005 | |||||||||||||

Percentage At fixed rate | ||||||||||||||||||

| By currency | At floating rate | |||||||||||||||||

U.S. Dollars | 87.86 | % | 80.09 | % | 68.40 | % | 68.01 | % | 31.60 | % | 31.99 | % | ||||||

Mexican pesos | 11.89 | % | 19.75 | % | 14.98 | % | 49.05 | % | 85.02 | % | 50.95 | % | ||||||

Euros | 0.01 | % | 0.00 | % | 16.08 | % | 28.45 | % | 83.92 | % | 71.55 | % | ||||||

Japanese yen | 0.23 | % | 0.16 | % | 100.00 | % | 100.00 | % | 0.00 | % | 0.00 | % | ||||||

Swiss francs | 0.001 | % | 0.0002 | % | 0.00 | % | 0.00 | % | 100.00 | % | 100.00 | % | ||||||

Total | 100.00 | % | 100.00 | % | 62.11 | % | 64.32 | % | 37.89 | % | 35.68 | % | ||||||

Note: Numbers may not total due to rounding.

| Crude oil price risk | PEMEX maintained its short-term hedging program, which was established in the first quarter of 2005, to mitigate the impact of crude oil price volatility on its cash flows.

The program consists of acquiring options in order to hedge against potential crude oil price reductions during 2005. The underlying volume accounted for approximately 7% of PEMEX’s annual crude oil production. |

| PEMEX financial results report as of September 30, 2005 | 28/46 | |||

| www.pemex.com | ||||

| PEMEX | Investor Relations |

Other relevant topics

| New fiscal regime | On October 20, 2005, the Chamber of Deputies approved a new fiscal regime for PEMEX based on the observations sent to the Congress by President Vicente Fox on September 1, 2005.

The President’s observations refer to the proposal to modify PEMEX’s fiscal regime which had been approved on June 28, 2005, by the Chamber of Deputies in an Extraordinary Session. This proposal had been previously approved by the Senate on April 27, 2005.

The observations generally focused on three aspects:

• Technical issues and clarifications on PEMEX’s fiscal regime

• Clarifications about the allocation of excess resources to states and municipalities

• The linkage of PEMEX’s fiscal regime to the implementation of best practices on corporate governance

In case the new fiscal regime is approved, it will go into effect on January 1, 2006.

Under the proposed new tax regime, Pemex Exploration and Production will be governed by theLey Federal de Derechos and the tax regime for the other subsidiary entities will continue to be governed by theLey de Ingresos de la Federación. The new fiscal regime for Pemex Exploration and Production consists of the following duties:

• Ordinary duty on hydrocarbons.- From 2006 to 2009, a variable tax rate will apply, depending on the average Mexican crude oil export price and the specific year4. The rate would vary from 78.68% to 87.81% in 2006, and would become a uniform rate of 79% in 2010 and thereafter. This duty would apply to the value of extracted production minus certain permitted deductions (including specific investments, some costs and expenses and the other duties)5

• Duty on hydrocarbons for the oil revenues stabilization fund.- The rate will range from 1% to 10%, on the value of the extracted crude oil production, depending on the average Mexican crude oil export price, and only if the crude oil export price exceeds US$22 per barrel6

• Extraordinary duty on crude oil exports.- The rate will be 13.1% on the realized value of oil exports in excess of estimated value of oil exports budgeted by Congress. This duty is to be credited against the duty for hydrocarbons for the oil revenues stabilization fund. The proceeds from this duty will be destined to the states through the stabilization fund of the states’ revenues

• Duty on hydrocarbons fo the fund for scientific and technological research on energy.- The rate will be 0.05% on the value of extracted production. Based on the Federal Budget, the proceeds will be destined to the Mexican Petroleum Institute (IMP) |

| 4 | See Table A10 |

| 5 | See Table A11 |

| 6 | See Table A12 |

| PEMEX financial results report as of September 30, 2005 | 29/46 | |||

| www.pemex.com | ||||

| PEMEX | Investor Relations |

• Duty on hydrocarbons for fiscal monitoring of oil activities.- The rate will be 0.003% on the value of extracted production. Based on the Federal Budget, the proceeds will be destined to the Auditoría Superior de la Federación (Federal Auditing entity)

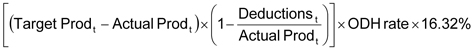

• Additional duty.- From 2006 to 2008, this duty will be applied if and only if the actual annual crude oil production is below the target production for a given year7 | ||

| Presidential energy proposal | On September 12, 2005, President Vicente Fox announced a new proposal containing ten energy related measures. These measures are aimed at managing the emergency caused by Hurricane Katrina, which increased energy costs, and strengthening permanently the national energy supply structure.

The President sent to the Chamber of Deputies an initiative containing constitutional reforms designed to complement public investment in exploration and development activities related to non associated natural gas with private investment.

The President also sent an initiative to amend the Reglamentary Law on Oil Subjects of the Article 27 of the Mexican Constitution, as well as to modify three articles of the Federal Energy Regulatory Commission Law. The purpose of this initiative is to complement public investment in transport and storage infrastructure for crude oil and its derivatives with private investment.

In addition, President Vicente Fox issued decrees that would implement price caps for natural gas, liquefied petroleum gas (LPG) and electricity.

As a result, LPG and natural gas retail prices do not reflect in its entirety the increase of the international reference prices used to determine prices in Mexico.

President Vicente Fox also announced his intention to diversify natural gas supply sources, an energy program to support micro, small and medium-sized enterprises, plans to construct the first wind power plant and the active participation of the Mexican society in energy policy definition. | |

| Hurricane Emergency Response Plan (PREH) | Since 1998, PEMEX has utilized the Hurricane Emergency Response Plan (PREH) to respond in an orderly and timely fashion to the presence of hurricanes. Some of the main actions that comprise the PREH are partial or total evacuation of off-shore personnel, well shut-in’s, temporary hydrocarbon output suspension and facilities protection measures. | |

| Hurricane Katrina | Hurricane Katrina affected nine US refineries located in the Gulf of Mexico. Four of these refineries have a commercial relationship with PEMEX but only one requested the deferral of seven Maya crude cargoes, which contained a total of 3.5 million barrels.

PEMEX undertook the appropriate steps to allocate the deferred cargoes within its customers’ portfolio. | |

| 7 | See Table A13 and methodology of calculation |

| PEMEX financial results report as of September 30, 2005 | 30/46 | |||

| www.pemex.com | ||||

| PEMEX | Investor Relations |

| Hurricane Rita | Hurricane Rita deferred the offloading of fuel at the Progresso Terminal in the Peninsula of Yucatán, which caused delays in the delivery of fuels to service stations. This situation was reversed once the offloading and pumping of fuels resumed. There were no supply shortages.

In addition, PEMEX evacuated approximately 200 workers from the Ocean Whittington and Hacuriyu V exploratory drilling platforms, which are located in the north of the Gulf of Mexico. There was no impact on crude oil production.

A storm contingency plan was implemented at Deer Park refinery, in Houston. All the personnel were evacuated and the facility was temporarily closed.

PEMEX performed a detailed inspection of the infrastructure within Mexico in order to guarantee the existence of optimal safety conditions and renew operations as soon as possible.

According to the Hurricane Emergency Response Plan Working Group there were no damages to the infrastructure and operations were fully resumed. | |

| Hurricane Stan | According to the Hurricane Emergency Response Plan Working Group there were no damages to the infrastructure and operations were fully resumed. | |

| Indirect effects of hurricanes | In order to reduce the indirect impacts caused by Hurricanes Katrina and Rita on PEMEX’s operations, as a consequence of the damages caused in the United States, several actions were implemented to guarantee the supply of natural gas, liquefied petroleum gas (LPG), gasoline and diesel including the following:

• Regarding the supply of natural gas, PEMEX secured this through additional imports (275 MMcfd) via the Mexico – US border

• Regarding the supply of LPG, current storage levels are sufficient

• Regarding the supply of gasoline, PEMEX has diversified its sources by purchasing fuels from alternative suppliers

• Regarding the supply of diesel, the current import program is adequate

PEMEX leased two very large crude carriers (VLCC’s) to reduce the possibility of production shut-ins, due to storage capacity restrictions derived from the deferment of crude oil loadings. | |

| PEMEX financial results report as of September 30, 2005 | 31/46 | |||

| www.pemex.com | ||||

| PEMEX | Investor Relations |

| New collective bargaining agreement | On August 25, 2005, PEMEX and the Union executed a new collective bargaining agreement that became effective retroactively on August 1, 2005, in accordance with the terms of an extension granted during the negotiation process. By reaching an agreement before September 1, 2005, PEMEX and the Union averted a threatened labor strike. The terms of the new agreement provide for a 4.1% increase in wages and a 1.9% increase in other benefits. By its terms, the new collective bargaining agreement is scheduled to expire on July 31, 2007.