UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

for the fiscal year ended December 31, 2011

Commission File Number 0-99

PETRÓLEOS MEXICANOS

(Exact name of registrant as specified in its charter)

| | |

| Mexican Petroleum | | United Mexican States |

| (Translation of registrant’s name into English) | | (Jurisdiction of incorporation or organization) |

Avenida Marina Nacional No. 329

Colonia Petróleos Mexicanos

11311 México D.F., México

(Address of principal executive offices)

Rolando Galindo Gálvez

(5255) 1944 9700

ri@pemex.com

Avenida Marina Nacional No. 329

Torre Ejecutiva Piso 38 Colonia Petróleos Mexicanos

11311 México D.F., México

(Name, telephone, e-mail and/or facsimile number and address of company contact person)

Securities registered or to be registered pursuant to Section 12(b) of the Act.None

Securities registered or to be registered pursuant to Section 12(g) of the Act.None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

Title of Each Class

9.50% Global Guaranteed Bonds due 2027

9 1/4% Global Guaranteed Bonds due 2018

8.625% Bonds due 2022

7.375% Notes due 2014

5.75% Notes due 2015

5.75% Guaranteed Notes due 2018

9 1/4% Guaranteed Bonds due 2018

8.625% Guaranteed Bonds due 2023

9.50% Guaranteed Bonds due 2027

6.625% Guaranteed Bonds due 2035

6.625% Guaranteed Bonds due 2038

8.00% Guaranteed Notes due 2019

4.875% Notes due 2015

6.000% Notes due 2020

5.50% Notes due 2021

6.500% Bonds due 2041

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes¨ Nox

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to

Section 13 or 15(d) of the Securities Exchange Act of 1934.

Yes¨ Nox

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yesx No¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act, (Check one):

Large accelerated filer ¨ Accelerated filer ¨ Non-accelerated filer x

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

U.S. GAAP ¨ IFRS ¨ Other x

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

Item 17¨ Item 18x

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes¨ Nox

TABLE OF CONTENTS

i

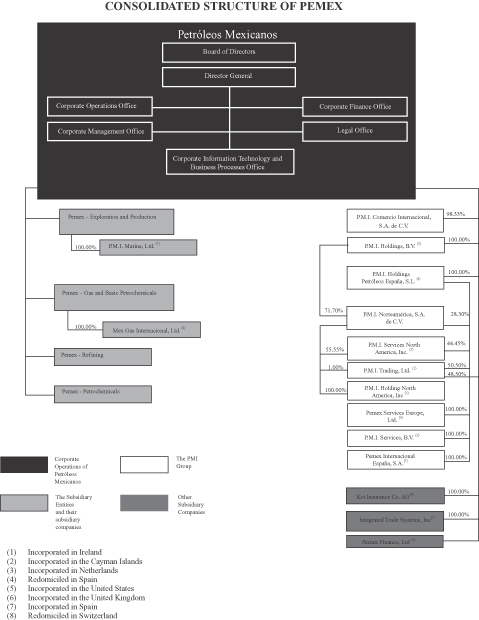

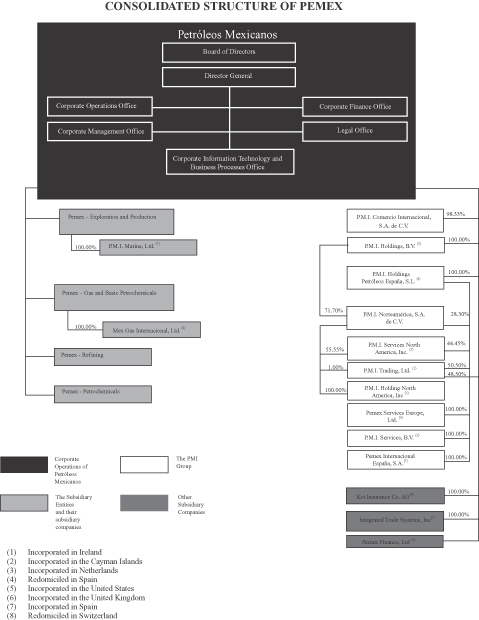

Petróleos Mexicanos and its four subsidiary entities,Pemex-Exploración y Producción (Pemex-Exploration and Production),Pemex-Refinación (Pemex-Refining),Pemex-Gas y Petroquímica Básica (Pemex-Gas and Basic Petrochemicals) andPemex-Petroquímica (Pemex-Petrochemicals and together with Pemex-Exploration and Production, Pemex-Refining and Pemex-Gas and Basic Petrochemicals, collectively referred to as the subsidiary entities), comprise the state oil and gas company of the United Mexican States, which we refer to as Mexico. Each of Petróleos Mexicanos and the subsidiary entities is a decentralized public entity of the Federal Government of Mexico, which we refer to as the Mexican Government, and is a legal entity empowered to own property and carry on business in its own name. In addition, a number of subsidiary companies that are defined in Note 2 and listed in Note 3(b) to our consolidated financial statements incorporated in Item 18, including the Pemex Project Funding Master Trust (which we refer to as the Master Trust) andFideicomiso Irrevocable de Administración No. F/163 (which we refer to as Fideicomiso F/163) (which are described below under “Item 5—Operating and Financial Review and Prospects—Liquidity and Capital Resources—Commitments for Capital Expenditures and Sources of Funding”), are incorporated into the consolidated financial statements; these subsidiary companies are also identified with the corresponding ownership percentages in “––Consolidated Structure of PEMEX” on page 3. Petróleos Mexicanos, the subsidiary entities and the subsidiary companies are collectively referred to as “PEMEX” or “we.”

References herein to “U.S. $,” “$,” “U.S. dollars” or “dollars” are to United States dollars. References herein to “pesos” or “Ps.” are to the legal currency of Mexico. References herein to “euros” or “€” are to the legal currency of the European Economic and Monetary Union. References herein to “pounds” or “£” are to the legal currency of the United Kingdom. References herein to “Swiss Francs” or “CHF” are to the legal currency of the Swiss Confederation. References herein to “Japanese yen” or “¥” are to the legal currency of Japan. References herein to “Australian dollars” or “A$” are to the legal currency of Australia. The term “billion” as used herein means one thousand million.

We maintain our consolidated financial statements and accounting records in pesos. Unless otherwise indicated, we have translated all peso amounts to U.S. dollars in this Form 20-F, including all convenience translations of our consolidated financial statements included herein, at an exchange rate of Ps. 13.9904 = U.S. $1.00, which is the exchange rate that Secretaría de Hacienda y Crédito Público (Ministry of Finance and Public Credit, or the SHCP) instructed us to use on December 31, 2011. You should not construe these translations from pesos into dollars as actually representing such U.S. dollar amounts or meaning that you could convert such amounts into U.S. dollars at the rates indicated. The peso has depreciated substantially in relation to the U.S. dollar since the end of 1994, when the Mexican Government allowed the peso to float freely against the U.S. dollar and the Mexican Government established a broad economic reform program in response to these and other events. Due to the volatility of the peso/dollar exchange rate, the exchange rate on any date subsequent to the date hereof could be materially different from the rate indicated above. See “Item 3—Key Information—Exchange Rates” for information regarding the rates of exchange between pesos and U.S. dollars.

1

FORWARD-LOOKING STATEMENTS

This Form 20-F contains words, such as “believe,” “expect,” “anticipate” and similar expressions that identify forward-looking statements, which reflect our views about future events and financial performance. We have made forward-looking statements that address, among other things, our:

| | • | | drilling and other exploration activities; |

| | • | | import and export activities; |

| | • | | projected and targeted capital expenditures and other costs, commitments and revenues; and |

Actual results could differ materially from those projected in such forward-looking statements as a result of various factors that may be beyond our control. These factors include, but are not limited to:

| | • | | changes in international crude oil and natural gas prices; |

| | • | | effects on us from competition; |

| | • | | limitations on our access to sources of financing on competitive terms; |

| | • | | significant developments in the global economy; |

| | • | | significant economic or political developments in Mexico; |

| | • | | developments affecting the energy sector; and |

| | • | | changes in our regulatory environment. |

Accordingly, you should not place undue reliance on these forward-looking statements. In any event, these statements speak only as of their dates, and we undertake no obligation to update or revise any of them, whether as a result of new information, future events or otherwise.

For a discussion of important factors that could cause actual results to differ materially from those contained in any forward-looking statement, you should see “Item 3—Key Information—Risk Factors.”

PRESENTATION OF INFORMATION CONCERNING RESERVES

The estimates of Mexico’s proved reserves of crude oil and natural gas for the five years ended December 31, 2011 included in this annual report have been calculated according to the technical definitions required by the U.S. Securities and Exchange Commission, or SEC. Although DeGolyer and MacNaughton, Netherland, Sewell International, S. de R.L. de C.V. and Ryder Scott Company, L.P. conducted reserves audits of our estimates of the proved hydrocarbon reserves of Mexico as of December 31, 2011 or January 1, 2012, as applicable, all reserves estimates involve some degree of uncertainty. See “Item 3—Key Information—Risk Factors—Risk Factors Related to the Relationship between PEMEX and the Mexican Government—The Mexican nation, not PEMEX, owns the hydrocarbon reserves in Mexico” and “—Information on Mexico’s hydrocarbon reserves is based on estimates, which are uncertain and subject to revision” for a description of the risks relating to reserves and reserves estimates.

2

3

PART I

| Item 1. | Identity of Directors, Senior Management and Advisers |

Not applicable.

| Item 2. | Offer Statistics and Expected Timetable |

Not applicable.

SELECTED FINANCIAL DATA

The selected financial data set forth below should be read in conjunction with our consolidated financial statements included in Item 18.

The selected financial data set forth below as of and for the five years ended December 31, 2011 have been derived from our consolidated financial statements for the years ended December 31, 2007 and 2008, which are not included herein, and the consolidated financial statements of PEMEX for the years ended December 31, 2009, 2010 and 2011, which are included in Item 18 of this report. PEMEX’s consolidated financial statements for each of the five fiscal years ended December 31, 2011 were audited by KPMG Cárdenas Dosal, S.C., an independent registered public accounting firm.

Our consolidated financial statements for the years ended December 31, 2007, 2008, 2009, 2010 and 2011 were prepared in accordance withNormas de Información Financiera Mexicanas(Mexican Financial Reporting Standards, or Mexican FRS or NIFs). Our consolidated financial statements include the recognition of the effects of inflation on the financial information through December 31, 2007, based on the Mexican National Consumer Price Index (NCPI) published byBanco de México and in accordance with Mexican FRS B-10 “Effects of Inflation” (which we refer to as FRS B-10). Commencing January 1, 2008, we have no longer used inflation accounting because the economic environment in which we operate, in which the accumulated inflation over the past three years was below 26%, has not qualified as “inflationary,” as defined by Mexican FRS. As a result, amounts in this report are presented in nominal terms; however, such amounts do reflect accumulated inflationary effects recognized up to December 31, 2007.

In addition to the above, our consolidated financial statements for the years ended December 31, 2007, 2008, 2009 and 2010 have been reclassified in certain accounts with the purpose of making them comparable with our consolidated financial statements as of December 31, 2011.

During 2011, accounting changes were made, as disclosed in Note 3(ab) to the consolidated financial statements. As a result, the consolidated financials statements as of December 31, 2010, the statements of financial position as of December 31, 2008, 2009 and 2010 and the statements of income for the years then ended, were adjusted to recognize the effects of the application of FRS C-4 “Inventories.”

Mexican FRS differ in certain significant respects from United States Generally Accepted Accounting Principles (which we refer to as U.S. GAAP). The principal differences between our net income and equity under U.S. GAAP and Mexican FRS are described in Note 21 to our consolidated financial statements included herein and in “Item 5—Operating and Financial Review and Prospects—U.S. GAAP Reconciliation.”

Beginning with the fiscal year starting January 1, 2012, Mexican issuers that disclose information through the Bolsa Mexicana de Valores, S.A.B. de C.V. (the Mexican Stock Exchange, which we refer to as the BMV) are required to prepare financial statements in accordance with International Financial Reporting Standards(IFRS) as issued by the International Accounting Standards Board (IASB). In addition, these financial statementsmust be audited in accordance with International Standards on Auditing, as required by theComisión Nacional Bancaria y de Valores (National Banking and Securities Commission, which we refer to as the CNBV), and in accordance with the standards of the Public Company Accounting Oversight Board (United States) for SEC filing

purposes. We will begin presenting financial statements in accordance with IFRS for the year ending December 31, 2012, with an official IFRS “adoption date” of January 1, 2012 and a “transition date” to IFRS of January 1, 2011.

4

Selected Financial Data of PEMEX

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Year Ended December 31,(1) | |

| | | 2007(2) | | | 2008 | | | 2009 | | | 2010 | | | 2011 | | | 2011(3) | |

| | | (in millions of pesos, except ratios) | | | (in millions of

U.S. dollars) | |

Income Statement Data | | | | | | | | | | | | | | | | | | | | | | | | |

Amounts in accordance with Mexican FRS: | | | | | | | | | | | | | | | | | | | | | | | | |

Net sales | | | Ps. 1,139,257 | | | | Ps. 1,328,950 | | | | Ps. 1,089,921 | | | | Ps. 1,282,064 | | | | Ps. 1,558,429 | | | U.S. $ | 111,393 | |

Operating income | | | 593,652 | | | | 572,365 | | | | 428,570 | | | | 546,457 | | | | 681,425 | | | | 48,707 | |

Comprehensive financing result | | | (20,047 | ) | | | (107,512 | ) | | | (15,308 | ) | | | (11,969 | ) | | | (91,641 | ) | | | (6,550 | ) |

Net income (loss) for the year | | | (18,308 | ) | | | (110,823 | ) | | | (94,370 | ) | | | (46,527 | ) | | | (91,483 | ) | | | (6,539 | ) |

Amounts in accordance with U.S. GAAP: | | | | | | | | | | | | | | | | | | | | | | | | |

Net sales | | | 1,139,257 | | | | 1,328,950 | | | | 1,089,921 | | | | 1,282,064 | | | | 1,558,429 | | | | 111,393 | |

Operating income | | | 584,703 | | | | 629,119 | | | | 460,239 | | | | 567,525 | | | | 675,896 | | | | 48,311 | |

Comprehensive financing result (cost) income | | | (25,610 | ) | | | (123,863 | ) | | | (5,094 | ) | | | (3,277 | ) | | | (106,616 | ) | | | (7,621 | ) |

Net income (loss) for the period | | | (32,642 | ) | | | (66,512 | ) | | | (52,280 | ) | | | (16,507 | ) | | | (109,949 | ) | | | (7,859 | ) |

Balance Sheet Data (end of period) | | | | | | | | | | | | | | | | | | | | | | | | |

Amounts in accordance with Mexican FRS: | | | | | | | | | | | | | | | | | | | | | | | | |

Cash and cash equivalents | | | 170,997 | | | | 114,224 | | | | 159,760 | | | | 133,587 | | | | 117,100 | | | | 8,370 | |

Total assets | | | 1,330,281 | | | | 1,238,091 | | | | 1,333,583 | | | | 1,395,197 | | | | 1,533,345 | | | | 109,600 | |

Long-term debt | | | 424,828 | | | | 495,487 | | | | 529,258 | | | | 575,171 | | | | 672,275 | | | | 48,053 | |

Total long-term liabilities | | | 990,909 | | | | 1,033,987 | | | | 1,155,917 | | | | 1,299,245 | | | | 1,473,794 | | | | 105,343 | |

Equity (deficit) | | | 49,908 | | | | 28,139 | | | | (65,294 | ) | | | (111,302 | ) | | | (193,919 | ) | | | (13,861 | ) |

Amounts in accordance with U.S. GAAP: | | | | | | | | | | | | | | | | | | | | | | | | |

Total assets | | | 1,211,719 | | | | 1,240,718 | | | | 1,321,570 | | | | 1,402,672 | | | | 1,515,359 | | | | 108,314 | |

Equity (deficit) | | | (198,083 | ) | | | (144,166 | ) | | | (423,159 | ) | | | (227,882 | ) | | | (326,202 | ) | | | (23,316 | ) |

Other Financial Data | | | | | | | | | | | | | | | | | | | | | | | | |

Amounts in accordance with Mexican FRS: | | | | | | | | | | | | | | | | | | | | | | | | |

Depreciation and amortization | | | 72,592 | | | | 89,840 | | | | 76,891 | | | | 96,482 | | | | 97,753 | | | | 6,987 | |

Investments in fixed assets at cost(4) | | | 155,121 | | | | 132,092 | | | | 213,232 | | | | 184,584 | | | | 175,850 | | | | 12,569 | |

Ratio of earnings to fixed charges: | | | | | | | | | | | | | | | | | | | | | | | | |

Mexican FRS(5) | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

U.S. GAAP(5) | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

| (1) | Includes Petróleos Mexicanos, the subsidiary entities and the subsidiary companies (including the Master Trust, Fideicomiso F/163 and Pemex Finance, Ltd.). |

| (2) | Figures for 2007 are stated in constant pesos as of December 31, 2007. |

| (3) | Translations into U.S. dollars of amounts in pesos have been made at the exchange rate established by the SHCP for accounting purposes of Ps. 13.9904 = U.S. $1.00 at December 31, 2011. Such translations should not be construed as a representation that the peso amounts have been or could be converted into U.S. dollar amounts at the foregoing or any other rate. |

| (4) | Includes capitalized comprehensive financing result. The amount of our investment in fixed assets in 2007 was derived from our accounting records, but does not appear directly in the corresponding statement of changes in financial position. Beginning with our 2008 fiscal year, the amount presented for investment in fixed assets is that which is included in the statement of cash flows. See Note 3(l) to our consolidated financial statements included herein and “Item 5—Operating and Financial Review and Prospects—Liquidity and Capital Resources.” |

| (5) | Under Mexican FRS, earnings for the years ended December 31, 2007, 2008, 2009, 2010 and 2011 were insufficient to cover fixed charges. The amount by which fixed charges exceeded earnings was Ps. 16,174 million, Ps. 96,481 million, Ps. 88,542 million, Ps. 45,873 million and Ps. 89,529 million for the years ended December 31, 2007, 2008, 2009, 2010 and 2011, respectively. Under U.S. GAAP, earnings for the years ended December 31, 2007, 2008, 2009, 2010 and 2011 were insufficient to cover fixed charges. The amount by which fixed charges exceeded earnings was Ps. 33,160 million, Ps. 55,626 million, Ps. 46,658 million, Ps. 16,112 million and Ps. 110,034 million for the years ended December 31, 2007, 2008, 2009, 2010 and 2011, respectively. |

Source: PEMEX’s consolidated financial statements.

5

EXCHANGE RATES

The following table sets forth, for the periods indicated, the high, low, average and period-end exchange rates for the purchase of U.S. dollars, expressed in pesos per U.S. dollar. These rates have not been restated in constant currency units.

| | | | | | | | | | | | | | | | |

Period | | Exchange Rate | |

| Year Ended December 31, | | High | | | Low | | | Average(1) | | | Period End | |

2007 | | | 11.269 | | | | 10.667 | | | | 10.925 | | | | 10.917 | |

2008 | | | 13.935 | | | | 9.917 | | | | 11.212 | | | | 13.832 | |

2009 | | | 15.406 | | | | 12.632 | | | | 13.578 | | | | 13.058 | |

2010 | | | 13.194 | | | | 12.156 | | | | 12.635 | | | | 12.383 | |

2011 | | | 14.254 | | | | 11.505 | | | | 12.427 | | | | 13.951 | |

November 2011 | | | 14.254 | | | | 13.383 | | | | 13.695 | | | | 13.620 | |

December 2011 | | | 13.993 | | | | 13.489 | | | | 13.775 | | | | 13.951 | |

2012 | | | | | | | | | | | | | | | | |

January 2012 | | | 13.750 | | | | 12.925 | | | | 13.383 | | | | 13.036 | |

February 2012 | | | 12.951 | | | | 12.625 | | | | 12.783 | | | | 12.794 | |

March 2012 | | | 12.990 | | | | 12.628 | | | | 12.752 | | | | 12.812 | |

April 2012(2) | | | 13.229 | | | | 12.730 | | | | 13.030 | | | | 13.121 | |

| (1) | Average of month-end rates, except for 2011 and 2012 monthly exchange rates. |

| (2) | For the period from April 1, 2012 to April 20, 2012. |

Source:Noon buying rate for cable transfers in New York reported by the Federal Reserve.

The noon buying rate for cable transfers in New York reported by the Federal Reserve on April 20, 2012 was Ps. 13.121 = U.S. $1.00.

RISK FACTORS

Risk Factors Related to the Operations of PEMEX

Crude oil and natural gas prices are volatile and low crude oil and natural gas prices adversely affect PEMEX’s income and cash flows and the amount of Mexico’s hydrocarbon reserves.

International crude oil and natural gas prices are subject to global supply and demand and fluctuate due to many factors beyond our control. These factors include competition within the oil and natural gas industry, the prices and availability of alternative sources of energy, international economic trends, exchange rate fluctuations, expectations of inflation, domestic and foreign government regulations or international laws, political and other events in major oil and natural gas producing and consuming nations and actions taken by Organization of the Petroleum Exporting Countries (OPEC) members and other oil exporting countries, trading activity in oil and natural gas and transactions in derivative financial instruments (which we refer to as DFIs) related to oil and gas.

When international crude oil and natural gas prices are low, we earn less export sales revenue and, therefore, generate lower cash flows and earn less income, because our costs remain roughly constant. Conversely, when crude oil and natural gas prices are high, we earn more export sales revenue and our income before taxes and duties increases. As a result, future fluctuations in international crude oil and natural gas prices will have a direct effect on our results of operations and financial condition, and may affect Mexico’s hydrocarbon reserves estimates. See “—Risk Factors Related to the Relationship between PEMEX and the Mexican Government—Information on Mexico’s hydrocarbon reserves is based on estimates, which are uncertain and subject to revisions” and “Item 11—Quantitative and Qualitative Disclosures about Market Risk—Hydrocarbon Price Risk.”

6

PEMEX is an integrated oil and gas company and is exposed to production, equipment and transportation risks, criminal acts and deliberate acts of terror.

We are subject to several risks that are common among oil and gas companies. These risks include production risks (fluctuations in production due to operational hazards, natural disasters or weather, accidents, etc.), equipment risks (relating to the adequacy and condition of our facilities and equipment) and transportation risks (relating to the condition and vulnerability of pipelines and other modes of transportation). More specifically, our business is subject to the risks of explosions in pipelines, refineries, plants, drilling wells and other facilities, hurricanes in the Gulf of Mexico and other natural or geological disasters and accidents, fires and mechanical failures. Criminal attempts to divert our crude oil, natural gas or refined products from our pipeline network and facilities for illegal sale have resulted in explosions, property and environmental damage, injuries and loss of lives.

Our facilities are also subject to the risk of sabotage, terrorism and cyber attacks. In July 2007, two of our pipelines were attacked. In September 2007, six different sites were attacked and 12 of our pipelines were affected. The occurrence of any of these events or of accidents connected with production, processing and transporting oil and oil products could result in personal injuries, loss of life, environmental damage with resulting containment, clean-up and repair expenses, equipment damage and damage to our facilities. A shutdown of the affected facilities could disrupt our production and increase our production costs. As of the date of this report, there have been no similar occurrences since 2007. Though we have established cybersecurity systems and procedures to protect our information technology and have not yet suffered a cyber attack, if the integrity of our information technology were ever compromised due to a cyber attack, our business operations could be disrupted and our proprietary information could be lost or stolen.

We purchase comprehensive insurance policies covering most of these risks; however, these policies may not cover all liabilities, and insurance may not be available for some of the consequential risks. There can be no assurance that accidents or acts of terror will not occur in the future, that insurance will adequately cover the entire scope or extent of our losses or that we may not be found directly liable in connection with claims arising from these or other events. See “Item 4—Information on the Company—Business Overview—PEMEX Corporate Matters—Insurance.”

PEMEX has a substantial amount of liabilities that could adversely affect our financial condition and results of operations.

We have a substantial amount of debt. As of December 31, 2011, our total indebtedness, excluding accrued interest, was approximately U.S. $55.3 billion, in nominal terms, which is a 3.9% increase as compared to our total indebtedness, excluding accrued interest, of approximately U.S. $53.2 billion at December 31, 2010. Our level of debt may increase further in the near or medium term and may have an adverse effect on our financial condition and results of operations.

To service our debt, we have relied and may continue to rely on a combination of cash flows provided by operations, drawdowns under our available credit facilities and the incurrence of additional indebtedness. Certain rating agencies have expressed concerns regarding the total amount of our debt, our increase in indebtedness over the last several years and our substantial unfunded reserve for retirement pensions and seniority premiums, which as of December 31, 2011 was equal to approximately U.S. $52.2 billion. Due to our heavy tax burden, we have resorted to financings to fund our capital investment projects. Any further lowering of our credit ratings may have adverse consequences on our ability to access the financial markets and/or our cost of financing. If we were unable to obtain financing on favorable terms, this could hamper our ability to obtain further financing as well as hamper investment in facilities financed through debt. As a result, we may not be able to make the capital expenditures needed to maintain our current production levels and to maintain, as well as increase, Mexico’s proved hydrocarbon reserves, which may adversely affect our financial condition and results of operations. See “—Risk Factors Related to the Relationship between PEMEX and the Mexican Government—PEMEX must make significant capital expenditures to maintain its current production levels, and to maintain, as well as

7

increase, Mexico’s proved hydrocarbon reserves. Mexican Government budget cuts, reductions in PEMEX’s income and inability to obtain financing may limit PEMEX’s ability to make capital investments.”

PEMEX’s compliance with environmental regulations in Mexico could result in material adverse effects on its results of operations.

A wide range of general and industry-specific Mexican federal and state environmental laws and regulations apply to our operations; these laws and regulations are often difficult and costly to comply with and carry substantial penalties for non-compliance. This regulatory burden increases our costs because it requires us to make significant capital expenditures and limits our ability to extract hydrocarbons, resulting in lower revenues. For an estimate of our accrued environmental liabilities, see “Item 4—Information on the Company—Environmental Regulation—Environmental Liabilities.” In addition, we have agreed with third parties to make investments to reduce our carbon emissions. See “Item 4—Information on the Company—Environmental Regulation—Carbon Dioxide Emissions Reduction.”

PEMEX publishes less U.S. GAAP financial information than U.S. companies are required to file with the SEC.

We prepare our financial statements according to Mexican FRS, which differ in certain significant respects from U.S. GAAP. See “Item 3—Key Information—Selected Financial Data,” “Item 5—Operating and Financial Review and Prospects—U.S. GAAP Reconciliation” and Note 21 to our consolidated financial statements included herein. As a foreign issuer, we are not required to prepare quarterly U.S. GAAP financial information, and we therefore generally prepare a reconciliation of our net income (loss) and equity (deficit) under Mexican FRS to U.S. GAAP as well as explanatory notes and additional disclosure required under U.S. GAAP on a yearly basis only. As a result, there may be less or different publicly available information about us than there is about U.S. issuers.

Risk Factors Related to the Relationship between PEMEX and the Mexican Government

The Mexican Government controls PEMEX and it could limit PEMEX’s ability to satisfy its external debt obligations or could reorganize or transfer PEMEX or its assets.

Petróleos Mexicanos is a decentralized public entity of the Mexican Government, and therefore the Mexican Government controls us, as well as our annual budget, which is approved by theCámara de Diputados (Chamber of Deputies). However, our financing obligations do not constitute obligations of and are not guaranteed by the Mexican Government. The Mexican Government has the power to intervene directly or indirectly in our commercial and operational affairs. Intervention by the Mexican Government could adversely affect our ability to make payments under any securities issued by us.

The Mexican Government’s agreements with international creditors may affect our external debt obligations. In certain past debt restructurings of the Mexican Government, Petróleos Mexicanos’ external indebtedness was treated on the same terms as the debt of the Mexican Government and other public sector entities. In addition, Mexico has entered into agreements with official bilateral creditors to reschedule public sector external debt. Mexico has not requested restructuring of bonds or debt owed to multilateral agencies.

The Mexican Government would have the power, if theConstitución Política de los Estados Unidos Mexicanos (Political Constitution of the United Mexican States) and federal law were amended, to reorganize PEMEX, including a transfer of all or a portion of Petróleos Mexicanos and the subsidiary entities or their assets to an entity not controlled by the Mexican Government. Such a reorganization or transfer could adversely affect production, cause a disruption in our workforce and our operations and cause us to default on certain obligations. See also “—Considerations Related to Mexico” below.

8

Petróleos Mexicanos and the subsidiary entities pay special taxes and duties to the Mexican Government, which may limit PEMEX’s capacity to expand its investment program.

PEMEX pays a substantial amount of taxes and duties to the Mexican Government, particularly on the revenues of Pemex-Exploration and Production, which may limit PEMEX’s ability to make capital investments. In 2011, approximately 56.2% of the sales revenues of PEMEX was used to pay taxes and duties to the Mexican Government. These special taxes and duties constitute a substantial portion of the Mexican Government’s revenues. For further information, see “Item 4—Information on the Company—Taxes and Duties” and “Item 5—Operating and Financial Review and Prospects—IEPS Tax, Hydrocarbon Duties and Other Taxes.”

The Mexican Government has entered into agreements with other nations to limit production.

Although Mexico is not a member of OPEC, in the past it has entered into agreements with OPEC and non-OPEC countries to reduce global crude oil supply. We do not control the Mexican Government’s international affairs and the Mexican Government could agree with OPEC or other countries to reduce our crude oil production or exports in the future. A reduction in our oil production or exports could reduce our revenues.

The Mexican Government has imposed price controls in the domestic market on PEMEX’s products.

The Mexican Government has from time to time imposed price controls on the sales of natural gas, liquefied petroleum gas (LPG), gasoline, diesel, gas oil intended for domestic use and fuel oil number 6, among others. As a result of these price controls, PEMEX has not been able to pass on all of the increases in the prices of its product purchases to its customers in the domestic market. We do not control the Mexican Government’s domestic policies and the Mexican Government could impose additional price controls on the domestic market in the future. The imposition of such price controls would adversely affect our results of operations. For more information, see “Item 4—Information on the Company—Business Overview—Refining—Pricing Decrees” and “Item 4—Information on the Company—Business Overview—Gas and Basic Petrochemicals—Pricing Decrees.”

The Mexican nation, not PEMEX, owns the hydrocarbon reserves in Mexico.

The Political Constitution of the United Mexican States provides that the Mexican nation, not PEMEX, owns all petroleum and other hydrocarbon reserves located in Mexico. Although Mexican law gives Pemex-Exploration and Production the exclusive right to exploit Mexico’s hydrocarbon reserves, it does not preclude the Mexican Congress from changing current law and assigning some or all of these rights to another company. Such an event would adversely affect our ability to generate income.

Information on Mexico’s hydrocarbon reserves is based on estimates, which are uncertain and subject to revisions.

The information on oil, gas and other reserves set forth in this Form 20-F is based on estimates. Reserves valuation is a subjective process of estimating underground accumulations of crude oil and natural gas that cannot be measured in an exact manner; the accuracy of any reserves estimate depends on the quality and reliability of available data, engineering and geological interpretation and subjective judgment. Additionally, estimates may be revised based on subsequent results of drilling, testing and production. These estimates are also subject to certain adjustments based on changes in variables, including crude oil prices. Therefore, proved reserves estimates may differ materially from the ultimately recoverable quantities of crude oil and natural gas. See “—Risk Factors Related to the Operations of PEMEX—Crude oil and natural gas prices are volatile and low crude oil and natural gas prices adversely affect PEMEX’s income and cash flows and the amount of Mexico’s hydrocarbon reserves.” Pemex-Exploration and Production revises its estimates of Mexico’s hydrocarbon reserves annually, which may result in material revisions to our estimates of Mexico’s hydrocarbon reserves.

9

PEMEX must make significant capital expenditures to maintain its current production levels, and to maintain, as well as increase, Mexico’s proved hydrocarbon reserves. Mexican Government budget cuts, reductions in PEMEX’s income and inability to obtain financing may limit PEMEX’s ability to make capital investments.

We invest funds to maintain, as well as increase, the amount of extractable hydrocarbon reserves in Mexico. We also continually invest capital to enhance our hydrocarbon recovery ratio and improve the reliability and productivity of our infrastructure. While the replacement rate for proved hydrocarbon reserves has increased in recent years, from 77.1% in 2009 to 85.8% in 2010, the overall replacement rate remained less than 100% until 2011, which represents a decline in Mexico’s proved hydrocarbon reserves. Nevertheless, in 2011 the replacement rate for proved hydrocarbon reserves was 101.1%. Pemex-Exploration and Production’s crude oil production decreased by 6.8% from 2008 to 2009, by 1.0% from 2009 to 2010, and by 1.0% from 2010 to 2011, primarily as a result of the decline of production in the Cantarell project. Our ability to make capital expenditures is limited by the substantial taxes that we pay to the Mexican Government and cyclical decreases in our revenues primarily related to lower oil prices. In addition, budget cuts imposed by the Mexican Government and the availability of financing may also limit our ability to make capital investments. For more information, see “Item 4—Information on the Company—History and Development—Capital Expenditures and Investments.”

PEMEX may claim some immunities under the Foreign Sovereign Immunities Act and Mexican law, and your ability to sue or recover may be limited.

Petróleos Mexicanos and the subsidiary entities are decentralized public entities of the Mexican Government. Accordingly, you may not be able to obtain a judgment in a U.S. court against us unless the U.S. court determines that we are not entitled to sovereign immunity with respect to that action. In addition, Mexican law does not allow attachment prior to judgment or attachment in aid of execution upon a judgment by Mexican courts upon the assets of Petróleos Mexicanos or the subsidiary entities. As a result, your ability to enforce judgments against us in the courts of Mexico may be limited. We also do not know whether Mexican courts would enforce judgments of U.S. courts based on the civil liability provisions of the U.S. federal securities laws. Therefore, even if you were able to obtain a U.S. judgment against us, you might not be able to obtain a judgment in Mexico that is based on that U.S. judgment. Moreover, you may not be able to enforce a judgment against our property in the United States except under the limited circumstances specified in the Foreign Sovereign Immunities Act of 1976, as amended. Finally, if you were to bring an action in Mexico seeking to enforce our obligations under any of our securities, satisfaction of those obligations may be made in pesos, pursuant to the laws of Mexico.

PEMEX’s directors and officers, as well as some of the experts named in this Form 20-F, reside outside the United States. Substantially all of our assets and those of most of our directors, officers and experts are located outside the United States. As a result, you may not be able to effect service of process on our directors or officers or those experts within the United States.

Considerations Related to Mexico

Economic conditions and government policies in Mexico and elsewhere may have a material impact on PEMEX’s operations.

A deterioration in Mexico’s economic condition, social instability, political unrest or other adverse social developments in Mexico could adversely affect our business and financial condition. Those events could also lead to increased volatility in the foreign exchange and financial markets, thereby affecting our ability to obtain new financing and service foreign debt. Additionally, the Mexican Government may cut spending in the future. These cuts could adversely affect our business, financial condition and prospects. In the past, Mexico has experienced several periods of slow or negative economic growth, high inflation, high interest rates, currency devaluation and other economic problems. These problems may worsen or reemerge, as applicable, in the future, and could adversely affect our business and our ability to service our debt. A worsening of international financial or economic conditions, including a slowdown in growth or recessionary conditions in Mexico’s trading partners, including the United States, or the emergence of a new financial crisis, could have adverse effects on the Mexican economy, our financial condition and our ability to service our debt.

10

Changes in exchange rates or in Mexico’s exchange control laws may hamper the ability of PEMEX to service its foreign currency debt.

The Mexican Government does not currently restrict the ability of Mexican companies or individuals to convert pesos into U.S. dollars or other currencies, and Mexico has not had a fixed exchange rate control policy since 1982. However, in the future, the Mexican Government could impose a restrictive exchange control policy, as it has done in the past. We cannot provide assurances that the Mexican Government will maintain its current policies with regard to the peso or that the peso’s value will not fluctuate significantly in the future. The peso has been subject to significant devaluations against the U.S. dollar in the past and may be subject to significant fluctuations in the future. Mexican Government policies affecting the value of the peso could prevent us from paying our foreign currency obligations.

Most of our debt is denominated in U.S. dollars. In the future, we may incur additional indebtedness denominated in U.S. dollars or other currencies. Declines in the value of the peso relative to the U.S. dollar or other currencies may increase our interest costs in pesos and result in foreign exchange losses to the extent that we have not hedged the exposure with derivative financial instruments.

For information on historical peso/U.S. dollar exchange rates, see “Item 3—Key Information—Exchange Rates.”

Political conditions in Mexico could materially and adversely affect Mexican economic policy and, in turn, PEMEX’s operations.

Political events in Mexico may significantly affect Mexican economic policy and, consequently, our operations. On December 1, 2006, Felipe de Jesús Calderón Hinojosa, a member of thePartido Acción Nacional(National Action Party, or PAN), formally assumed office for a six-year term as the President of Mexico. Currently, no political party holds a simple majority in either house of the Mexican Congress.

Presidential and federal congressional elections in Mexico will be held in July 2012. The Mexican presidential election will result in a change in administration, as presidential reelection is not permitted in Mexico. As a result, we cannot predict whether changes in Mexican governmental policy will result from the change in administration. Any such changes could adversely affect economic conditions or the industry in which we operate in Mexico and therefore our results of operations and financial position.

Mexico has experienced a period of increasing criminal violence and such activities could affect PEMEX’s operations.

Recently, Mexico has experienced a period of increasing criminal violence, primarily due to the activities of drug cartels and related criminal organizations. In response, the Mexican Government has implemented various security measures and has strengthened its military and police forces. Despite these efforts, drug-related crime continues to exist in Mexico. These activities, their possible escalation and the violence associated with them, in an extreme case, may have a negative impact on our financial condition and results of operations.

11

| Item 4. | Information on the Company |

HISTORY AND DEVELOPMENT

We are the largest company in Mexico, and according to the December 12, 2011 issue ofPetroleum Intelligence Weekly, we were the fourth largest crude oil producer and the eleventh largest oil and gas company in the world based on data from the year 2010. In 1938, President Lázaro Cárdenas del Río nationalized the foreign-owned oil companies which were then operating in Mexico, and the Mexican Congress established Petróleos Mexicanos by a decree effective on July 20, 1938. Since 1938, Mexican federal laws and regulations have entrusted Petróleos Mexicanos with the central planning and management of Mexico’s petroleum industry. On July 17, 1992, the Mexican Congress created the subsidiary entities out of operations that had previously been directly managed by Petróleos Mexicanos. Petróleos Mexicanos and its four subsidiary entities, Pemex-Exploration and Production, Pemex-Refining, Pemex-Gas and Basic Petrochemicals and Pemex-Petrochemicals, are decentralized public entities of the Mexican Government, and each is a legal entity empowered to own property and carry on business in its own name.

PEMEX’s executive offices are located at Avenida Marina Nacional No. 329, Colonia Petróleos Mexicanos, México, D.F. 11311, México. PEMEX’s telephone number is (52-55) 1944-2500.

The activities of Petróleos Mexicanos and its subsidiary entities are regulated primarily by:

| | • | | theLey Reglamentaria del Artículo 27 Constitucional en el Ramo del Petróleo (Regulatory Law to Article 27 of the Political Constitution of the United Mexican States Concerning Petroleum Affairs, which we also refer to as the Regulatory Law); and |

| | • | | theLey de Petróleos Mexicanos (Petróleos Mexicanos Law). |

The Regulatory Law and the Petróleos Mexicanos Law grant Petróleos Mexicanos and certain of the subsidiary entities the exclusive right to:

| | • | | explore, exploit, refine, transport, store, distribute and sell (first-hand) crude oil; |

| | • | | explore, exploit, produce and sell (first-hand) natural gas and transport and store natural gas, to the extent the transportation and storage activities are inextricably linked with such exploitation and production; and |

| | • | | produce, store, transport, distribute and sell (first-hand) the derivatives of petroleum (including petroleum products) and natural gas used as basic industrial raw materials that constitute basic petrochemicals, which include ethane, propane, butanes, pentanes, hexanes, heptanes, naphthas, carbon black feedstocks and methane, but, in the case of methane, only if obtained from hydrocarbons used as basic raw materials by the petrochemical industry and obtained from deposits located in Mexico. |

The operating activities of Petróleos Mexicanos are allocated among the four subsidiary entities, each of which has the characteristics of a subsidiary of Petróleos Mexicanos. The principal business lines of the subsidiary entities are as follows:

| | • | | Pemex-Exploration and Production explores for and exploits crude oil and natural gas and transports, stores and markets these hydrocarbons; |

| | • | | Pemex-Refining refines petroleum products and derivatives that may be used as basic industrial raw materials and stores, transports, distributes and markets these products and derivatives; |

| | • | | Pemex-Gas and Basic Petrochemicals processes natural gas, natural gas liquids and derivatives that may be used as basic industrial raw materials and stores, transports, distributes and markets these products and derivatives and produces, stores, transports, distributes and markets basic petrochemicals; and |

12

| | • | | Pemex-Petrochemicals engages in industrial petrochemical processes and stores, distributes and markets petrochemicals other than basic petrochemicals. |

Under the Petróleos Mexicanos Law, which replaced theLey Orgánica de Petróleos Mexicanos y Organismos Subsidiarios(Organic Law of Petróleos Mexicanos and the Subsidiary Entities), the subsidiary entities were to continue to conduct business in accordance with their mandates under existing law until the President of Mexico issued a reorganization decree, based on a proposal by the Board of Directors of Petróleos Mexicanos. The Board of Directors of Petróleos Mexicanos submitted a proposal to the President of Mexicoproviding that the existing structure of the subsidiary entities be maintained, and on March 22, 2012, the President of Mexico issued the Decreto que tiene por objeto establecer la estructura, el funcionamiento y el control de los organismos subsidiarios de Petróleos Mexicanos(Decree to establish the structure, operation and control of the subsidiary entities of Petróleos Mexicanos, which we refer to as the Subsidiary Entities Decree), which was published in the Official Gazette of the Federation and became effective as of that date. The Subsidiary Entities Decree, consistent with the recommendation of the Board of Directors of Petróleos Mexicanos, maintains the existence of the four subsidiary entities.

In 1995, the Mexican Congress amended the Regulatory Law to allow private and social sector companies, which include labor-controlled organizations and industries, to participate, with the Mexican Government’s approval, in the storage, distribution and transportation of natural gas. Pursuant to the Regulatory Law, as amended, these types of companies may construct, own and operate pipelines, installations and equipment. Since 1997, the Mexican Government has required that we divest our existing natural gas distribution assets but has allowed us to retain exclusive authority over the exploration, exploitation, production and first-hand sale of natural gas, as well as the transportation and storage inextricably linked with this type of exploitation and production. See “Item 4—Information on the Company—Business Overview—Gas and Basic Petrochemicals—Private Sector Participation in Natural Gas Distribution.”

The Regulatory Law and the Petróleos Mexicanos Law have allowed us to co-generate electric energy and to enter into agreements with theComisión Federal de Electricidad (Federal Electricity Commission) to sell our excess production to this entity. The funds and the public investment projects required to carry out these co-generation works and allow the acquisition of any excess production by the Federal Electricity Commission must be included in the annualPresupuesto de Egresos de la Federación (Federal Expenditures Budget), which is subject to discussion by and approval of the Chamber of Deputies.

On November 13, 2008, amendments to theLey Federal de Presupuesto y Responsabilidad Hacendaria(Federal Law of Budget and Fiscal Accountability) were published in the Official Gazette of the Federation, which became effective on November 14, 2008. Under these amendments:

| | • | | As of January 30, 2009, our debt related toProyectos de Infraestructura Productiva de Largo Plazo(long-term productive infrastructure projects, which we refer to as PIDIREGAS) was included in our balance sheet prepared underNormas Específicas de Información Financiera Gubernamental para el Sector Paraestatal(Mexican Specific Standards for Governmental Financial Information for Public Sector Entities) and is now recognized as public sector debt. For Mexican FRS purposes, all of our PIDIREGAS-related financing and assets were already included in our consolidated balance sheet and, therefore, these amendments did not have a material effect on our consolidated balance sheet or income statement for any period. |

| | • | | During the second half of 2009, Petróleos Mexicanos assumed, as primary obligor, all payment obligations under PIDIREGAS financing entered into by the Master Trust and Fideicomiso F/163, our principal PIDIREGAS financing vehicles. |

In November 2008, the Petróleos Mexicanos Law was adopted by the Mexican Congress and several other laws were adopted or amended, as part of what we refer to below as the 2008 reforms. None of these laws included any amendment to the Political Constitution of the United Mexican States.

13

PEMEX expects to benefit in several ways from the 2008 reforms. In particular, we expect to improve, among other things, our decision-making processes and our execution capabilities through the adoption of corporate governance practices in line with international standards, the creation of seven executive committees to support the Board of Directors of Petróleos Mexicanos, the appointment of professional members to the Boards of Directors of Petróleos Mexicanos and each of the subsidiary entities (see “Item 6—Directors, Senior Management and Employees”) and the ability to issuebonos ciudadanos (Citizen Bonds) linked to our performance.

As a result of the 2008 reforms, we are now permitted to have a more flexible contracting structure for our core production activities. In order to strengthen our ability to enter into these contracts, we are authorized to offer cash incentives to contractors that provide us with access to new technologies, faster execution or greater profits, subject to the requirements that our payment obligations under construction and services contracts must always be satisfied in cash and that in no case may we grant ownership rights over hydrocarbons to our contractors. See “Item 4—Information on the Company—Business Overview—Exploration and Production—Integrated Exploration and Production Contracts.”

Capital Expenditures and Investments

The following table shows our capital expenditures, excluding maintenance, for each of the five years ended December 31, 2011, and the budget for such expenditures for 2012 and 2013. Capital expenditure amounts are derived from our budgetary records, which record such amounts on a cash basis. Accordingly, these capital expenditure amounts do not correspond to capital expenditure amounts included in our financial statements prepared in accordance with Mexican FRS.

Capital Expenditures

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Year ended December 31,(1) | | | Budget

2012 | | | Budget

2013 | |

| | | 2007 | | | 2008 | | | 2009 | | | 2010 | | | 2011 | | | |

| | | (in millions of pesos)(2) | |

Pemex-Exploration and Production | | | Ps. 115,563 | | | | Ps. 136,102 | | | | Ps. 180,507 | | | | Ps. 194,838 | | | | Ps. 177,059 | | | | Ps. 192,953 | | | | Ps. 208,575 | |

Pemex-Refining | | | 15,979 | | | | 17,380 | | | | 18,526 | | | | 22,636 | | | | 25,157 | | | | 45,930 | | | | 58,871 | |

Pemex-Gas and Basic Petrochemicals | | | 4,004 | | | | 4,203 | | | | 3,941 | | | | 3,887 | | | | 3,019 | | | | 6,126 | | | | 8,074 | |

Pemex-Petrochemicals | | | 1,139 | | | | 1,614 | | | | 2,053 | | | | 2,462 | | | | 2,426 | | | | 4,212 | | | | 15,130 | |

Petróleos Mexicanos | | | 227 | | | | 439 | | | | 560 | | | | 206 | | | | 717 | | | | 700 | | | | 2,137 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total capital expenditures | | | Ps. 136,913 | | | | Ps. 159,738 | | | | Ps. 205,587 | | | | Ps. 224,029 | | | | Ps. 208,378 | | | | Ps. 249,921 | | | | Ps. 292,787 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Note: Numbers may not total due to rounding.

| (1) | Includes capitalized interest during construction period for the years 2007, 2008 and 2009. Does not include capitalized interest for the years 2010, 2011, 2012 and 2013. |

| (2) | Figures for 2007, 2008, 2009, 2010 and 2011 are stated in nominal pesos. Figures for 2012 and 2013 are stated in constant 2012 pesos. |

Source: Petróleos Mexicanos.

14

Total Capital Expenditures.The following table sets forth our total capital expenditures by project, excluding maintenance, for the five years ended December 31, 2011, as well as the budget for such expenditures for 2012.

Capital Expenditures

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Year ended December 31,(1)(2) | | | | |

| | | 2007 | | | 2008 | | | 2009 | | | 2010 | | | 2011 | | | Budget

2012(3) | |

| | | (in millions of pesos)(4) | |

Pemex-Exploration and Production | | | | | | | | | | | | | | | | | | | | | | | | |

Cantarell | | P | s. 21,009 | | | P | s. 29,073 | | | P | s. 41,002 | | | P | s. 38,437 | | | P | s. 36,303 | | | P | s. 48,249 | |

Strategic Gas Program | | | 20,211 | | | | 26,717 | | | | 28,626 | | | | 27,944 | | | | 27,790 | | | | 34,819 | |

Aceite Terciario del Golfo | | | 4,103 | | | | 8,998 | | | | 20,607 | | | | 28,262 | | | | 21,919 | | | | 15,378 | |

Ku-Maloob-Zaap | | | 32,165 | | | | 21,124 | | | | 20,894 | | | | 18,350 | | | | 21,554 | | | | 22,804 | |

Burgos | | | 12,106 | | | | 13,182 | | | | 19,410 | | | | 29,704 | | | | 19,564 | | | | 11,128 | |

Antonio J. Bermúdez | | | 6,568 | | | | 8,728 | | | | 10,442 | | | | 9,853 | | | | 11,218 | | | | 13,311 | |

Delta del Grijalva | | | 1,596 | | | | 4,078 | | | | 4,571 | | | | 5,904 | | | | 6,501 | | | | 5,326 | |

Bellota-Chinchorro | | | 2,364 | | | | 3,912 | | | | 4,496 | | | | 5,518 | | | | 4,912 | | | | 4,053 | |

Integral Poza Rica | | | 469 | | | | 1,382 | | | | 2,122 | | | | 2,936 | | | | 4,687 | | | | 2,921 | |

Tamaulipas-Constituciones | | | 147 | | | | 768 | | | | 987 | | | | 1,967 | | | | 3,800 | | | | 1,516 | |

Chuc | | | 1,931 | | | | 1,702 | | | | 3,469 | | | | 2,619 | | | | 3,730 | | | | 8,205 | |

Jujo-Tecominoacán | | | 2,851 | | | | 5,655 | | | | 5,419 | | | | 6,584 | | | | 3,658 | | | | 3,779 | |

Cactus-Sitio Grande | | | 669 | | | | 1,069 | | | | 1,127 | | | | 1,384 | | | | 1,995 | | | | 1,885 | |

Integral Yaxché | | | 593 | | | | 1,722 | | | | 4,552 | | | | 3,963 | | | | 1,986 | | | | 4,342 | |

El Golpe-Puerto Ceiba | | | 1,492 | | | | 1,924 | | | | 1,706 | | | | 847 | | | | 1,274 | | | | 2,381 | |

Arenque | | | 3,143 | | | | 1,629 | | | | 1,829 | | | | 1,155 | | | | 1,159 | | | | 1,048 | |

Och-Uech-Kax | | | 19 | | | | 100 | | | | 324 | | | | 1,160 | | | | 1,084 | | | | 979 | |

Ek-Balam | | | 1,114 | | | | 1,406 | | | | 4,143 | | | | 2,766 | | | | 725 | | | | 1,692 | |

Caan | | | 682 | | | | 827 | | | | 1,654 | | | | 1,112 | | | | 658 | | | | 1,407 | |

Ayín-Alux | | | 15 | | | | 34 | | | | 1,116 | | | | 1,212 | | | | 591 | | | | 85 | |

Carmito-Artesa | | | 118 | | | | 160 | | | | 160 | | | | 452 | | | | 319 | | | | 684 | |

Cárdenas(5) | | | 325 | | | | 669 | | | | 1,111 | | | | 1,062 | | | | 226 | | | | — | |

Lakach | | | — | | | | 152 | | | | 43 | | | | 1,032 | | | | 128 | | | | 700 | |

Other Exploratory Projects(6) | | | — | | | | — | | | | — | | | | — | | | | — | | | | 4,856 | |

Administrative and Technical Support | | | 1,874 | | | | 1,091 | | | | 695 | | | | 613 | | | | 1,280 | | | | 1,406 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total | | | 115,563 | | | | 136,102 | | | | 180,507 | | | | 194,838 | | | | 177,059 | | | | 192,953 | |

Pemex-Refining | | | | | | | | | | | | | | | | | | | | | | | | |

Fuel Quality Investments | | | — | | | | — | | | | 429 | | | | 3,313 | | | | 6,571 | | | | 10,119 | |

Minatitlán Refinery Reconfiguration | | | 9,257 | | | | 7,156 | | | | 5,159 | | | | 4,633 | | | | 2,850 | | | | 1,357 | |

Tuxpan Pipeline and Storage and Distribution Terminals | | | — | | | | — | | | | 650 | | | | 823 | | | | 770 | | | | 1,090 | |

Residual Conversion from Salamanca Refinery | | | — | | | | — | | | | 104 | | | | 64 | | | | 78 | | | | 4,140 | |

New Refinery at Tula | | | — | | | | — | | | | 39 | | | | 139 | | | | 60 | | | | 6,155 | |

Others | | | 6,722 | | | | 10,223 | | | | 12,145 | | | | 13,664 | | | | 14,827 | | | | 23,068 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total | | | 15,979 | | | | 17,380 | | | | 18,526 | | | | 22,636 | | | | 25,157 | | | | 45,930 | |

Pemex-Gas and Basic Petrochemicals | | | | | | | | | | | | | | | | | | | | | | | | |

Cryogenic Plant at Poza Rica GPC | | | — | | | | — | | | | 640 | | | | 1,767 | | | | 1,103 | | | | 601 | |

Preservation of Processing Capacity at the Nuevo Pemex GPC | | | — | | | | — | | | | 2 | | | | 280 | | | | 228 | | | | 214 | |

Rehabilitation of Fire Protection Network at GPCs | | | — | | | | 189 | | | | 292 | | | | 162 | | | | 125 | | | | 396 | |

Conservation of Operational Reliability at Poza Rica GPC | | | — | | | | 85 | | | | 294 | | | | 166 | | | | 92 | | | | 169 | |

Refurbishment, Modification and Modernization of Nationwide Pumping and Compression Stations | | | 20 | | | | 38 | | | | 67 | | | | 39 | | | | 47 | | | | 205 | |

Rehabilitation and Integration of Burners Venting System at Ciudad Pemex GPC | | | — | | | | 15 | | | | 252 | | | | 205 | | | | 31 | | | | 163 | |

Modernization of Systems for Monitoring, Control and Supervision of Transportation by Pipeline | | | — | | | | — | | | | — | | | | — | | | | 24 | | | | 96 | |

Petrochemical Pipelines via Agave 2004 | | | — | | | | — | | | | — | | | | 2 | | | | — | | | | 585 | |

Infrastructure for Transportation of Petrochemical Products from Nuevo Pemex-Cactus to Coatzacoalcos | | | — | | | | — | | | | — | | | | 2 | | | | — | | | | 472 | |

Modular Cryogenic Plants in Station 19 in Reynosa GPC | | | 1,707 | | | | 1,333 | | | | 275 | | | | — | | | | — | | | | — | |

Others | | | 2,277 | | | | 2,543 | | | | 2,119 | | | | 1,264 | | | | 1,369 | | | | 3,226 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total | | | 4,004 | | | | 4,203 | | | | 3,941 | | | | 3,887 | | | | 3,019 | | | | 6,126 | |

15

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Year ended December 31,(1)(2) | | | | |

| | | 2007 | | | 2008 | | | 2009 | | | 2010 | | | 2011 | | | Budget

2012(3) | |

| | | (in millions of pesos)(4) | |

Pemex-Petrochemicals | | | | | | | | | | | | | | | | | | | | | | | | |

Modernization and Expansion of Capacity of Aromatics Train I at Cangrejera PC | | | 218 | | | | 16 | | | | 442 | | | | 1,354 | | | | 941 | | | | 728 | |

Maintaining Production Capacity, Storage and Distribution of Ammonia at the Cosoleacaque PC | | | — | | | | — | | | | — | | | | — | | | | 110 | | | | 440 | |

Modernization and Expansion of Capacity of Ethane Derivatives Chain I at Morelos PC | | | 506 | | | | 507 | | | | 284 | | | | 56 | | | | 86 | | | | 30 | |

Maintaining Production Capacity of Ethane Derivatives Chain IV at Morelos PC | | | — | | | | — | | | | — | | | | 4 | | | | 78 | | | | 395 | |

Maintaining Production Capacity of Ethane Derivatives Chain II at Morelos PC | | | — | | | | 267 | | | | 218 | | | | 224 | | | | 78 | | | | 240 | |

Maintaining Production Capacity of Ethane Derivatives II at Cangrejera PC | | | 1 | | | | 10 | | | | 16 | | | | 3 | | | | 50 | | | | 153 | |

Modernization and Optimization of Auxiliary Services Infrastructure I at Morelos PC | | | 6 | | | | 70 | | | | 57 | | | | 57 | | | | 45 | | | | — | |

Maintaining Production Capacity of Auxiliary Services Infrastructure I at Pajaritos PC | | | — | | | | 7 | | | | 3 | | | | 7 | | | | 41 | | | | 142 | |

Maintaining Production Capacity of Aromatics Train II at Cangrejera PC | | | 21 | | | | 29 | | | | 73 | | | | 53 | | | | 30 | | | | 39 | |

Rehabilitation of Facilities for Physical Security at Morelos PC | | | — | | | | — | | | | — | | | | 6 | | | | 1 | | | | 152 | |

Maintaining Production Capacity of Ethylene Plant at Cangrejera PC | | | — | | | | — | | | | — | | | | — | | | | — | | | | 157 | |

Expansion of Styrene Plant at Cangrejera PC | | | 46 | | | | 16 | | | | 1 | | | | — | | | | — | | | | — | |

Others | | | 341 | | | | 693 | | | | 958 | | | | 698 | | | | 966 | | | | 1,736 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total | | | 1,139 | | | | 1,614 | | | | 2,053 | | | | 2,462 | | | | 2,426 | | | | 4,212 | |

Petróleos Mexicanos | | | | | | | | | | | | | | | | | | | | | | | | |

Total | | | 227 | | | | 439 | | | | 560 | | | | 206 | | | | 717 | | | | 700 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total capital expenditures | | | Ps. 136,913 | | | | Ps. 159,738 | | | | Ps. 205,587 | | | | Ps. 224,029 | | | | Ps. 208,378 | | | | Ps. 249,921 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Notes: Numbers may not total due to rounding.

GPC = Gas Processing Complex.

PC = Petrochemical Complex.

| (1) | Amounts based on cash basis method of accounting. |

| (2) | Includes capitalized interest during construction period for the years 2007, 2008, and 2009. Does not include capitalized interest for the years 2010, 2011 and 2012. |

| (4) | Figures for 2007, 2008, 2009, 2010 and 2011 are stated in nominal pesos. Figures for 2012 are stated in constant 2012 pesos. |

| (5) | As of January 1, 2012, the Cárdenas project was merged into the Bellota-Chinchorro project. |

| (6) | As of January 1, 2012, the Campeche Oriente exploratory project (a project formerly supported by Ku-Maloob-Zaap project resources) and the Comalcalco exploratory project (a project formerly supported by Bellota-Chinchorro project resources) were designated as separate projects and funds were allocated to them as stand-alone projects. |

| Source: | Petróleos Mexicanos. |

16

Capital Expenditures Budget.The following table sets forth our approved capital expenditures budget for 2012 and estimates for the years 2013 through 2015. These figures are subject to change in accordance with our future investment plans and the provisions of subsequent budgetary approvals.

Approved Capital Expenditures Budget

| | | | | | | | | | | | | | | | |

| | | Year ended December 31,(1) | |

| | | 2012 | | | 2013 | | | 2014 | | | 2015 | |

| | | (in millions of constant 2012 pesos) | |

Pemex-Exploration and Production | | | | | | | | | | | | | | | | |

Cantarell | | | Ps. 48,249 | | | | Ps. 46,632 | | | | Ps. 39,669 | | | | Ps. 22,324 | |

Strategic Gas Program | | | 34,819 | | | | 37,339 | | | | 30,210 | | | | 24,102 | |

Ku-Maloob-Zaap | | | 22,804 | | | | 30,123 | | | | 27,741 | | | | 19,467 | |

Aceite Terciario del Golfo | | | 15,378 | | | | 14,032 | | | | 14,199 | | | | 18,419 | |

Antonio J. Bermúdez | | | 13,311 | | | | 6,924 | | | | 5,033 | | | | 2,548 | |

Burgos | | | 11,128 | | | | 13,954 | | | | 16,359 | | | | 13,914 | |

Chuc | | | 8,205 | | | | 10,615 | | | | 6,348 | | | | 735 | |

Delta del Grijalva | | | 5,326 | | | | 4,909 | | | | 1,803 | | | | 2,109 | |

Integral Yaxché | | | 4,342 | | | | 4,945 | | | | 1,518 | | | | 1,676 | |

Bellota-Chinchorro | | | 4,053 | | | | 2,405 | | | | 1,956 | | | | 1,392 | |

Jujo-Tecominoacán | | | 3,779 | | | | 3,033 | | | | 3,315 | | | | 1,823 | |

Integral Poza Rica | | | 2,921 | | | | 1,352 | | | | 1,424 | | | | 651 | |

El Golpe-Puerto Ceiba | | | 2,381 | | | | 1,785 | | | | 1,229 | | | | 391 | |

Cactus-Sitio Grande | | | 1,885 | | | | 1,235 | | | | 354 | | | | 240 | |

Ek-Balam | | | 1,692 | | | | 4,242 | | | | 1,996 | | | | 1,238 | |

Tamaulipas-Constituciones | | | 1,516 | | | | 1,155 | | | | 1,347 | | | | 1,164 | |

Caan | | | 1,407 | | | | 1,797 | | | | 1,766 | | | | 1,001 | |

Arenque | | | 1,048 | | | | 2,236 | | | | 2,552 | | | | 3,738 | |

Och-Uech-Kax | | | 979 | | | | 324 | | | | 76 | | | | 46 | |

Lakach | | | 700 | | | | 10,808 | | | | 5,336 | | | | 578 | |

Carmito-Artesa | | | 684 | | | | 309 | | | | 206 | | | | 188 | |

Ayín-Alux | | | 85 | | | | 330 | | | | 105 | | | | 361 | |

Other Exploratory Projects | | | 4,856 | | | | 7,138 | | | | 8,378 | | | | 11,647 | |

Administrative and Technical Support | | | 1,406 | | | | 953 | | | | 265 | | | | 202 | |

| | | | | | | | | | | | | | | | |

Total | | | 192,953 | | | | 208,575 | | | | 173,185 | | | | 129,952 | |

Pemex-Refining | | | | | | | | | | | | | | | | |

Fuel Quality Investments | | | 10,119 | | | | 7,630 | | | | — | | | | — | |

New Refinery at Tula (pre-investment study) | | | 6,155 | | | | 1,036 | | | | 1,141 | | | | 763 | |

Residual Conversion from Salamanca Refinery | | | 4,140 | | | | 15,121 | | | | 11,760 | | | | 5,023 | |

Minatitlán Refinery Reconfiguration | | | 1,357 | | | | — | | | | — | | | | — | |

Tuxpan Pipeline and Storage and Distribution Terminals | | | 1,090 | | | | — | | | | — | | | | — | |

Others | | | 23,068 | | | | 35,085 | | | | 11,153 | | | | 4,765 | |

| | | | | | | | | | | | | | | | |

Total | | | 45,930 | | | | 58,871 | | | | 24,055 | | | | 10,551 | |

Pemex-Gas and Basic Petrochemicals | | | | | | | | | | | | | | | | |

Cryogenic Plant at Poza Rica GPC | | | 601 | | | | — | | | | — | | | | — | |

Petrochemical Pipelines via Agave 2004 | | | 585 | | | | 410 | | | | — | | | | — | |

Infrastructure for Transportation of Petrochemical Products from Nuevo Pemex-Cactus to Coatzacoalcos | | | 472 | | | | 1,168 | | | | 701 | | | | — | |

Rehabilitation of Fire Protection Network at GPCs | | | 396 | | | | 272 | | | | 721 | | | | 369 | |

17

| | | | | | | | | | | | | | | | |

| | | Year ended December 31,(1) | |

| | | 2012 | | | 2013 | | | 2014 | | | 2015 | |

| | | (in millions of constant 2012 pesos) | |

Preservation of Processing Capacity at the Nuevo Pemex GPC | | | 214 | | | | 288 | | | | 344 | | | | 415 | |

Refurbishment, Modification and Modernization of Nationwide Pumping and Compression Stations | | | 205 | | | | 266 | | | | 266 | | | | 400 | |

Conservation of Operational Reliability at the Poza Rica GPC | | | 169 | | | | 10 | | | | — | | | | — | |

Rehabilitation and Integration of Burners Venting System in Ciudad Pemex GPC | | | 163 | | | | — | | | | — | | | | — | |

Modernization of Systems for Monitoring, Control and Supervision of Transportation by Pipeline | | | 96 | | | | 153 | | | | — | | | | — | |

Station of Compression of the Gulf | | | — | | | | 265 | | | | — | | | | — | |

Others | | | 3,226 | | | | 5,242 | | | | 5,793 | | | | 2,514 | |

| | | | | | | | | | | | | | | | |

Total | | | 6,126 | | | | 8,074 | | | | 7,825 | | | | 3,698 | |

Pemex-Petrochemicals | | | | | | | | | | | | | | | | |

Modernization and Expansion of Capacity of the Aromatics Train I at Cangrejera PC | | | 728 | | | | 1,625 | | | | 2,195 | | | | 296 | |

Maintaining Production Capacity, Storage and Distribution of Ammonia at the Cosoleacaque PC | | | 440 | | | | 75 | | | | 189 | | | | — | |

Maintaining Production Capacity of Ethane Derivatives Chain IV at Morelos PC | | | 395 | | | | 220 | | | | 308 | | | | 230 | |

Maintaining Production Capacity of Ethane Derivatives Chain II at Morelos PC | | | 240 | | | | 160 | | | | 623 | | | | — | |

Maintaining Production Capacity of Ethylene Plant at Cangrejera PC | | | 157 | | | | 587 | | | | 79 | | | | — | |

Maintaining Production Capacity of Ethane Derivatives II at Cangrejera PC | | | 153 | | | | 168 | | | | 429 | | | | 393 | |

Rehabilitation of Facilities for Physical Security at Morelos PC | | | 152 | | | | 93 | | | | — | | | | — | |

Maintaining Production Capacity of Auxiliary Services Infrastructure I at Pajaritos PC | | | 142 | | | | 38 | | | | 39 | | | | — | |

Maintaining Production Capacity of Aromatics Train II at Cangrejera PC | | | 39 | | | | 88 | | | | 72 | | | | — | |

Modernization and Expansion of Capacity of Ethane Derivatives Chain I at Morelos PC | | | 30 | | | | 1,723 | | | | 1,404 | | | | 95 | |

Expansion of Styrene Plant at Cangrejera PC | | | — | | | | 693 | | | | 1,071 | | | | 249 | |

Modernization and Optimization of Auxiliary Services Infrastructure I at Morelos PC | | | — | | | | 135 | | | | 222 | | | | — | |

Others | | | 1,736 | | | | 9,524 | | | | 7,443 | | | | 2,354 | |

| | | | | | | | | | | | | | | | |

Total | | | 4,212 | | | | 15,130 | | | | 14,074 | | | | 3,618 | |

Petróleos Mexicanos | | | | | | | | | | | | | | | | |

Total | | | 700 | | | | 2,137 | | | | 1,468 | | | | 416 | |

| | | | | | | | | | | | | | | | |

Total Capital Expenditures Budget | | | Ps. 249,921 | | | | Ps. 292,787 | | | | Ps. 220,607 | | | | Ps. 148,235 | |

| | | | | | | | | | | | | | | | |

Notes: Numbers may not total due to rounding.

GPC = Gas Processing Complex.

PC = Petrochemical Complex.

| (1) | Amounts based on cash basis method of accounting. |

Source: Petróleos Mexicanos.

18

We have budgeted a total of Ps. 249.9 billion in constant 2012 pesos for capital expenditures in 2012. We expect to direct Ps. 193.0 billion (or 77.2% of our total capital expenditures) to exploration and production programs in 2012.

Our main objectives for upstream investment are to maximize the long-term economic value, and to increase and improve the quality of Mexico’s oil and gas reserves, enhance Pemex-Exploration and Production’s reserves recovery ratio, improve the reliability of its production and transportation infrastructure for crude oil and natural gas operations and continue to emphasize industrial safety and environmental compliance. Our 2012 budget objectives include increasing crude oil production from the 2011 production level and increasing the supply of natural gas for the domestic market in the medium to long term. In addition, we plan to increase our investments in the deep waters of certain areas of the Gulf of Mexico, including Golfo de México B, Golfo de México Sur and Área Perdido, investments which are currently funded by the Cantarell project and the Lakach project and may be funded as stand-alone projects in the future.

Our downstream investment program seeks to improve the quality of our product selection and the reliability of our logistics and distribution services, to achieve a level of efficiency similar to that of our international competitors and to continue to emphasize industrial safety and environmental compliance. In addition, on August 12, 2009, with the required donation of land for the project by the government of the state of Hidalgo having been completed, we announced the construction of a new refinery in Tula. The refinery is expected to begin production in 2016 and to have a crude oil processing capacity of 250 thousand barrels per day. See “—Business Overview—Refining—New Refinery at Tula” in this Item 4. We are also planning to renovate and upgrade our refinery in Salamanca, in the state of Guanajuato.

BUSINESS OVERVIEW

Overview by Business Segment

Exploration and Production

Pemex-Exploration and Production’s primary objectives for 2012 include: (1) increasing current crude oil production levels in order to satisfy domestic demand and have surpluses available for export; (2) maintaining natural gas production levels in order to attempt to satisfy domestic demand and avoid increasing our dependence on natural gas imports; (3) continuing to increase the replacement rate of proved and total reserves; (4) maintaining discovery and development costs similar to those of our international competitors; and (5) improving performance in terms of industrial security and environmental protection, as well as continuing to build relationships with the communities in which we operate. Our upstream investment program seeks to meet these objectives by: maximizing the value of produced reserves; improving the quality of our product selection; and improving the reliability of our logistics and distribution services to achieve an optimal level of efficiency, while continuing to emphasize industrial safety and environmental compliance.

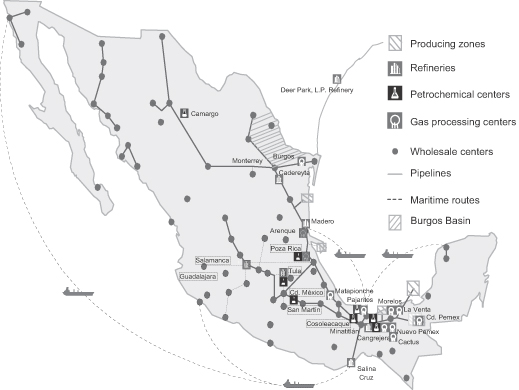

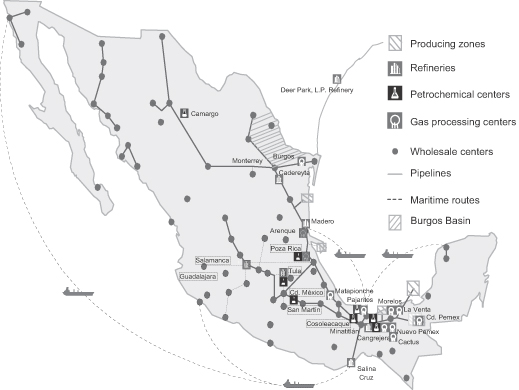

Pemex-Exploration and Production explores for and produces crude oil and natural gas, primarily in the northeastern and southeastern regions of Mexico and offshore in the Gulf of Mexico. In nominal peso terms, our capital investment in exploration and production activities decreased by 9.1% in 2011. As a result of our investments in previous years, our total hydrocarbon production reached a level of approximately 3,720 thousand barrels of oil equivalent per day in 2011. Pemex-Exploration and Production’s crude oil production decreased by 1.0% from 2010 to 2011, averaging 2,550.1 thousand barrels per day in 2011, primarily as a result of the decline of the Cantarell project, which was partially offset by increased crude oil production in the following projects: Ku-Maloob-Zaap, Crudo Ligero Marino, Delta del Grijalva, Ixtal Manik, Yaxché and Ogarrio-Magallanes. Pemex-Exploration and Production’s natural gas production (excluding natural gas liquids) decreased by 6.1% from 2010 to 2011, averaging 6,594.1 million cubic feet per day in 2011. This decrease in natural gas production was a result of lower volumes from the Cantarell, Burgos and Veracruz projects. Exploration drilling activity decreased by 15.4% from 2010 to 2011, from 39 exploratory wells completed in 2010 to 33 exploratory wells

19

completed in 2011. Development drilling activity decreased by 20.8% from 2010 to 2011, from 1,264 development wells completed in 2010 to 1,001 development wells completed in 2011. In 2011, we completed the drilling of 1,034 wells in total. Our drilling activity in 2011 was focused on increasing the production of non-associated gas in the Burgos, Veracruz and Macuspana projects and of heavy crude oil in the Cantarell and Ku-Maloob-Zaap projects.

In 2011, our reserves replacement rate (which we refer to as the RRR) was 101.1%, which was 15.3 percentage points higher than our RRR in 2010, which was 85.8%.

Our well-drilling activities during 2011 led to significant onshore and offshore discoveries. The main discoveries included heavy crude oil reserves located in the Southeastern basins, specifically in the Northeastern and Southwestern Marine regions, and light crude oil reserves located in both the Southwestern Marine and Southern regions. In addition, exploration activities in the Northern region led to the discovery of additional non-associated gas reserves in the Veracruz and Burgos basins. Our current challenge with respect to these discoveries is their immediate development in order to increase current production levels.

Pemex-Exploration and Production’s production goals for 2012 include increasing its crude oil production to approximately 2.6 million barrels per day and maintaining natural gas production above 6.0 billion cubic feet per day, in order to better satisfy domestic demand for natural gas, and thus lower the rate of increase of imports of natural gas and natural gas derivatives.

Refining