Table of Contents

Filed Pursuant to Rule 424(b)(3)

Registration No. 333-175821

Prospectus

Petróleos Mexicanos

Exchange Offers

for

U.S. $1,000,000,000 5.50% Notes due 2021

U.S. $1,250,000,000 6.500% Bonds due 2041

unconditionally guaranteed by

Pemex-Exploration and Production

Pemex-Refining

Pemex-Gas and Basic Petrochemicals

Terms of the Exchange Offers

| • | We are offering to exchange securities that we sold in private offerings for an equal principal amount of new registered securities. |

| • | The exchange offers commence on September 1, 2011 and expire at 5:00 p.m., New York City time, on September 30, 2011, unless we extend them. |

| • | You may withdraw a tender of old securities at any time prior to the expiration of the exchange offers. |

| • | All old securities that are validly tendered and not validly withdrawn will be exchanged. |

| • | We believe that the exchange of securities will not be a taxable exchange for either U.S. or Mexican federal income tax purposes. |

| • | We will not receive any proceeds from the exchange offers. |

| • | The terms of the new securities to be issued are identical to the old securities, except for the transfer restrictions and registration rights relating to the old securities. |

| • | Three of our subsidiary entities will, jointly and severally, guarantee the new securities. The guarantees will be unconditional and irrevocable. These subsidiary entities are Pemex-Exploration and Production, Pemex-Refining and Pemex-Gas and Basic Petrochemicals; we refer to them as the guarantors. |

| • | The new securities will contain provisions regarding acceleration and future modifications to their terms that differ from those applicable to certain of Petróleos Mexicanos, which we refer to as the issuer, and the guarantors’ other outstanding public external indebtedness issued prior to October 2004. Under these provisions, in certain circumstances, the issuer may amend the payment and certain other provisions of the new securities with the consent of the holders of 75% of the aggregate principal amount of the new securities. |

We are not making an offer to exchange securities in any jurisdiction where the offer is not permitted.

Investing in the securities issued in the exchange offers involves certain risks. See “Risk Factors” beginning on page 12.

Neither the U.S. Securities and Exchange Commission (the SEC) nor any state securities commission in the United States of America (the United States) has approved or disapproved the securities to be distributed in the exchange offers, nor have they determined that this prospectus is truthful and complete. Any representation to the contrary is a criminal offense.

September 1, 2011

Table of Contents

| Page | ||||

| 1 | ||||

| 2 | ||||

| 2 | ||||

| 3 | ||||

| 4 | ||||

| 10 | ||||

| 12 | ||||

| 19 | ||||

| 20 | ||||

| 21 | ||||

| 22 | ||||

| 23 | ||||

| 25 | ||||

| 35 | ||||

| 51 | ||||

| 54 | ||||

| 59 | ||||

| 60 | ||||

| 60 | ||||

| 60 | ||||

| 61 | ||||

| 61 | ||||

i

Table of Contents

Terms such as “we,” “us” and “our” generally refer to Petróleos Mexicanos and its consolidated subsidiaries, unless the context otherwise requires.

We will apply, through our listing agent, to have the new securities admitted to trading on the Euro MTF market of the Luxembourg Stock Exchange. The old securities are currently admitted to trading on the Euro MTF market of the Luxembourg Stock Exchange.

The information contained in this prospectus is the exclusive responsibility of the issuer and the guarantors and has not been reviewed or authorized by theComisión Nacional Bancaria y de Valores (National Banking and Securities Commission, or the CNBV) of the United Mexican States, which we refer to as Mexico. Petróleos Mexicanos filed a notice in respect of the offerings of both the old securities and the new securities with the CNBV at the time the old securities of each series were issued. Such notice is a requirement under theLey de Mercado de Valores (the Securities Market Law) in connection with an offering of securities outside of Mexico by a Mexican issuer. Such notice is solely for information purposes and does not imply any certification as to the investment quality of the new securities, the solvency of the issuer or the guarantors or the accuracy or completeness of the information contained in this prospectus. The new securities have not been and will not be registered in theRegistro Nacional de Valores (National Securities Registry), maintained by the CNBV, and may not be offered or sold publicly in Mexico. Furthermore, the new securities may not be offered or sold in Mexico, except through a private placement made to institutional or qualified investors conducted in accordance with article 8 of the Securities Market Law.

You should rely only on the information provided in this prospectus. We have authorized no one to provide you with different information. You should not assume that the information in this prospectus is accurate as of any date other than the date on the front of the document.

We have filed a registration statement with the SEC on Form F-4 covering the new securities. This prospectus does not contain all of the information included in the registration statement. Any statement made in this prospectus concerning the contents of any contract, agreement or other document is not necessarily complete. If we have filed any of those contracts, agreements or other documents as an exhibit to the registration statement, you should read the exhibit for a more complete understanding of the document or matter involved. Each statement regarding a contract, agreement or other document is qualified in its entirety by reference to the actual document.

Petróleos Mexicanos is required to file periodic reports and other information (File No. 0-99) with the SEC under the Securities Exchange Act of 1934, as amended (which we refer to as the Exchange Act). We will also furnish other reports as we may determine appropriate or as the law requires. You may read and copy the registration statement, including the attached exhibits, and any reports or other information we file, at the SEC’s public reference room in Washington, D.C. You can request copies of these documents, upon payment of a duplicating fee, by writing to the SEC’s Public Reference Section at Judiciary Plaza, 100 F Street, N.E., Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further information on the operation of the public reference rooms. In addition, any filings we make electronically with the SEC will be available to the public over the Internet at the SEC’s website at http://www.sec.gov under the name “Mexican Petroleum.”

You may also obtain copies of these documents at the offices of the Luxembourg listing agent, KBL European Private Bankers S.A.

The SEC allows Petróleos Mexicanos to “incorporate by reference” information it files with the SEC, which means that Petróleos Mexicanos can disclose important information to you by referring you to those documents.

1

Table of Contents

The information incorporated by reference is considered to be part of this prospectus, and later information filed with the SEC will update and supersede this information. We incorporate by reference the documents filed by Petróleos Mexicanos listed below:

| • | Petróleos Mexicanos’ annual report on Form 20-F for the year ended December 31, 2010, filed with the SEC on Form 20-F on June 30, 2011, which we refer to as the “Form 20-F”; |

| • | Petróleos Mexicanos’ report relating to our unaudited condensed consolidated results for the three months ended March 31, 2011, furnished to the SEC on Form 6-K on May 25, 2011, which we refer to as the “Form 6-K”; |

| • | Petróleos Mexicanos’ report relating to our unaudited condensed consolidated reports for the six months ended June 30, 2011, furnished to the SEC on Form 6-K on August 30, 2011, which we refer to as the “August Form 6-K”; and |

| • | all of Petróleos Mexicanos’ annual reports on Form 20-F, and all reports on Form 6-K that are designated in such reports as being incorporated into this prospectus, filed with the SEC pursuant to Section 13(a), 13(c) or 15(d) of the Exchange Act after the date of this prospectus and prior to the termination of the exchange offers. |

You may request a copy of any document that is incorporated by reference in this prospectus and that has not been delivered with this prospectus, at no cost, by writing or telephoning Petróleos Mexicanos at: Gerencia Jurídica de Finanzas, Avenida Marina Nacional No. 329, Colonia Petróleos Mexicanos, México D.F. 11311, telephone (52-55) 1944-9325, or by contacting our Luxembourg listing agent at the address indicated on the inside back cover of this prospectus, as long as any of the new securities are admitted to trading on the Euro MTF market of the Luxembourg Stock Exchange, and the rules of such stock exchange so require.To ensure timely delivery, investors must request this information no later than five business days before the date they must make their investment decision.

ELECTRONIC DELIVERY OF DOCUMENTS

We are delivering copies of this prospectus in electronic form through the facilities of The Depository Trust Company (DTC). You may obtain paper copies of the prospectus by contacting the exchange agent or the Luxembourg listing agent at their respective addresses specified on the inside back cover of this prospectus. By participating in the exchange offers, you will (unless you have requested paper delivery of documents) be consenting to electronic delivery of these documents.

References in this prospectus to “U.S. dollars,” “U.S. $,” “dollars” or “$” are to the lawful currency of the United States. References in this prospectus to “pesos” or “Ps.” are to the lawful currency of Mexico. We use the term “billion” in this prospectus to mean one thousand million.

This prospectus contains translations of certain peso amounts into U.S. dollars at specified rates solely for your convenience. You should not construe these translations as representations that the peso amounts actually represent the actual U.S. dollar amounts or could be converted into U.S. dollars at the rate indicated. Unless we indicate otherwise, the U.S. dollar amounts have been translated from pesos at an exchange rate of Ps. 12.3571 to U.S. $1.00, which is the exchange rate that theSecretaría de Hacienda y Crédito Público (the Ministry of Finance and Public Credit) instructed us to use on December 31, 2010.

On August 26, 2011, the noon buying rate for cable transfers in New York reported by the Federal Reserve Bank was Ps. 12.4657 = U.S. $1.00.

2

Table of Contents

PRESENTATION OF FINANCIAL INFORMATION

The audited consolidated financial statements of Petróleos Mexicanos, subsidiary entities and subsidiary companies as of December 31, 2009 and 2010 and for each of the years in the three-year period ended December 31, 2010 are included in Item 18 of the Form 20-F incorporated by reference in this prospectus and the registration statement covering the new securities. We refer to these financial statements as the 2010 financial statements. These consolidated financial statements were prepared in accordance withNormas de Información Financiera Mexicanas(Mexican Financial Reporting Standards, which we refer to as Mexican FRS or NIFs).

We have also incorporated by reference in this prospectus the condensed consolidated interim financial statements of Petróleos Mexicanos, subsidiary entities and subsidiary companies as of June 30, 2011 and for the six month period ended June 30, 2010 and 2011 (which we refer to as the 2011 interim financial statements), which were not audited and were prepared in accordance with Mexican FRS.

Beginning January 1, 2003, we recognized the effects of inflation in accordance with Governmental Standard GS-06 BIS “A” Section C, which required the adoption of Bulletin B-10, “Recognition of the Effects of Inflation on Financial Information,” under Mexican FRS (which we refer to as Bulletin B-10). As a result of the provisions of Bulletin B-10, we restated our consolidated financial statements for the year ended December 31, 2006, in order to present our results for that year on the same basis and purchasing power as the results for the year ended December 31, 2007 with respect to the recognition of the effects of inflation. Consequently, the amounts shown in our consolidated financial statements for the year then ended are expressed in thousands of constant Mexican pesos as of December 31, 2007. The December 31, 2007 restatement factor applied to the financial statements at December 31, 2006 was 1.0376, which corresponds to inflation from January 1, 2006 through December 31, 2007, based on the national consumer price index (NCPI).

In accordance with FRS B-10 “Effects of Inflation” (which we refer to as FRS B-10) commencing January 1, 2008, we no longer use inflation accounting unless the economic environment in which we operate qualifies as “inflationary” as defined by Mexican FRS. Because the economic environment in the three-year periods ended December 31, 2007, 2008 and 2009 did not qualify as inflationary (given that accumulated inflation for such periods was below 26%), we did not use inflation accounting to prepare our consolidated financial statements as of December 31, 2008, 2009 and 2010 and for the years then ended, or our 2011 interim financial statements. As a result, amounts in this prospectus and in the reports incorporated herein are presented in nominal terms; however, such amounts do reflect inflationary effects recognized up to December 31, 2007.

See Note 3(a) to the 2010 financial statements for a summary of the effects of application of FRS B-10 and Notes 3(h), 3(p) and 3(v) to the 2010 financial statements for discussion of the inflation accounting rules applied prior to the adoption of FRS B-10.

In addition to the above, our consolidated financial statements for the years ended December 31, 2006, 2007, 2008 and 2009 have been reclassified in certain accounts with the purpose of making them comparable with our consolidated financial statements as of December 31, 2010.

Mexican FRS differ in certain significant respects from United States Generally Accepted Accounting Principles (which we refer to as U.S. GAAP). The principal differences between our net income and equity under U.S. GAAP and Mexican FRS are described in Note 21 to the 2010 financial statements. Our 2011 interim financial statements have not been reconciled to U.S. GAAP.

3

Table of Contents

The following summary highlights selected information from this prospectus and may not contain all of the information that is important to you. This prospectus includes specific terms of the new securities we are offering, as well as information regarding our business and detailed financial data. We encourage you to read this prospectus in its entirety.

The Issuer

Petróleos Mexicanos is a decentralized public entity of the federal government of Mexico (which we refer to as the Mexican Government). The Federal Congress of Mexico (which we refer to as the Mexican Congress) established Petróleos Mexicanos on June 7, 1938 in conjunction with the nationalization of the foreign oil companies then operating in Mexico. Its operations are carried out through four principal subsidiary entities, which arePemex-Exploración y Producción (Pemex-Exploration and Production),Pemex-Refinación (Pemex-Refining),Pemex-Gas y Petroquímica Básica (Pemex-Gas and Basic Petrochemicals) andPemex-Petroquímica (Pemex-Petrochemicals). Petróleos Mexicanos and each of the subsidiary entities are decentralized public entities of Mexico and legal entities empowered to own property and carry on business in their own names. In addition, a number of subsidiary companies are incorporated into the consolidated financial statements. We refer to Petróleos Mexicanos, the subsidiary entities and these subsidiary companies as PEMEX, and together they comprise Mexico’s state oil and gas company.

The Exchange Offer

On July 26, 2011, we issued U.S. $1,000,000,000 of 5.50% Notes due 2021. We refer to the U.S. $1,000,000,000 of 5.50% Notes due 2021 we issued in July 2011, as the 2021 old securities.

On June 2, 2011, we issued U.S. $1,250,000,000 of 6.500% Bonds due 2041. We refer to the U.S. $1,250,000,000 6.500% Bonds due 2041 that we issued in June 2011 as the 2041 old securities.

We are offering new, registered securities in exchange for the 2021 old securities and the 2041 old securities, which are unregistered and which we

issued and sold in private placements to certain initial purchasers. These initial purchasers sold the 2021 old securities and 2041 old securities in offshore transactions and to qualified institutional buyers in transactions exempt from the registration requirements of the Securities Act of 1933, as amended (which we refer to as the Securities Act). We refer to the 2021 old securities and the 2041 old securities as the “old securities,” and the securities that we are now offering as the “new securities.” The old securities and the new securities are guaranteed by Pemex-Exploration and Production, Pemex-Refining and Pemex-Gas and Basic Petrochemicals.

Registration Rights Agreements

Each time we issued a series of old securities, we also entered into an exchange and registration rights agreement with the initial purchasers of those old securities in which we agreed to do our best to complete an exchange offer of those old securities on or prior to a particular date.

The Exchange Offers

Under the terms of the exchange offers, holders of each series of old securities are entitled to exchange old securities for an equal principal amount of new securities with substantially identical terms.

You should read the discussion under the heading “Description of the New Securities” for further information about the new securities and the discussion under the heading “The Exchange Offers” for more information about the exchange process. The old securities may be tendered only in a principal amount of U.S. $10,000 and integral multiples of U.S. $1,000 in excess thereof.

4

Table of Contents

The series of new securities that we will issue in exchange for old securities will correspond to the series of old securities tendered as follows:

| New Securities Series | Corresponding Old Securities | |

5.50% Notes due 2021, or 2021 new securities | 2021 old securities | |

6.500% Bonds due 2041, or 2041 new securities | 2041 old securities | |

As of the date of this prospectus, the following amounts of each series are outstanding:

| • | U.S. $1,000,000,000 aggregate principal amount of 2021 old securities; and |

| • | U.S. $1,250,000,000 aggregate principal amount of 2041 old securities. |

Resale of New Securities

Based on an interpretation by the SEC staff set forth in no-action letters issued to third parties, we believe that you may offer the new securities issued in the exchange offers for resale, resell them or otherwise transfer them without compliance with the registration and prospectus delivery provisions of the Securities Act, as long as:

| • | you are acquiring the new securities in the ordinary course of your business; |

| • | you are not participating, do not intend to participate, and have no arrangement or understanding with any person to participate, in the distribution of the new securities; and |

| • | you are not an “affiliate” of ours, as defined under Rule 405 of the Securities Act. |

If any statement above is not true and you transfer any new security without delivering a prospectus meeting the requirements of the Securities Act or without an exemption from the registration requirements of the Securities Act, you may incur liability under the Securities Act. We do not assume responsibility for or indemnify you against this liability.

If you are a broker-dealer and receive new securities for your own account in exchange for old securities that you acquired as a result of market making or other trading activities, you must acknowledge that you will deliver a prospectus meeting the requirements of the Securities Act in connection with any resale of the new securities. We will make this prospectus available to broker-dealers for use in resales for 180 days after the expiration date of the exchange offers.

Consequences of Failure to Exchange Old Securities

If you do not exchange your old securities for new securities, you will continue to hold your old securities. You will no longer be able to require that we register the old securities under the Securities Act. In addition, you will not be able to offer or sell the old securities unless:

| • | they are registered under the Securities Act; or |

| • | you offer or sell them under an exemption from the requirements of, or in a transaction not subject to, the Securities Act. |

Expiration Date

The exchange offers will expire at 5:00 p.m., New York City time, on September 30, 2011, unless we decide to extend the expiration date.

Interest on the New Securities

The 2021 new securities will accrue interest at 5.50% per year, accruing from July 21, 2011. We will pay interest on the 2021 new securities on January 21 and July 21 of each year.

The 2041 new securities will accrue interest at 6.500% per year, accruing from June 2, 2011, the date on which the old securities were issued. We will pay interest on the new securities on June 2 and December 2 of each year.

5

Table of Contents

Conditions to the Exchange Offers

We may terminate the exchange offers and refuse to accept any old securities for exchange if:

| • | there has been a change in applicable law or the SEC staff’s interpretation of applicable law, and the exchange offers are not permitted under applicable law or applicable SEC staff interpretations of law; or |

| • | there is a stop order in effect or threatened with respect to the exchange offers or the indenture governing those securities. |

We have not made the exchange offers contingent on holders tendering any minimum principal amount of old securities for exchange.

Certain Deemed Representations, Warranties and Undertakings

If you participate in the exchange offers, you will be deemed to have made certain acknowledgments, representations, warranties and undertakings. See “The Exchange Offers—Holders’ Deemed Representations, Warranties and Undertakings.”

Procedure for Tendering Old Securities

If you wish to accept the exchange offers, you must deliver electronically your acceptance together with your old securities through DTC’s Automated Tender Offer Program (ATOP) system.

If you are not a direct participant in DTC, you must, in accordance with the rules of the DTC participant who holds your securities, arrange for a direct participant in DTC to submit your acceptance to DTC electronically.

Withdrawal Rights

You may withdraw the tender of your old securities at any time prior to 5:00 p.m., New York City time, on the expiration date, unless we have already accepted your old securities. To withdraw, you must send a written notice of withdrawal to the exchange agent through the electronic submission of

a message in accordance with the procedures of DTC’s ATOP system by 5:00 p.m., New York City time, on the scheduled expiration date. We may extend the expiration date without extending withdrawal rights.

If you are not a direct participant in DTC, you must, in accordance with the rules of the DTC participant who holds your securities, arrange for a direct participant in DTC to submit your written notice of withdrawal to DTC electronically by 5:00 p.m., New York City time, on the expiration date.

Acceptance of Old Securities and Delivery of New Securities

If all of the conditions to the exchange offers are satisfied or waived, we will accept any and all old securities that are properly tendered in the exchange offers prior to 5:00 p.m., New York City time, on the expiration date. We will deliver the new securities promptly after expiration of the exchange offers.

Tax Considerations

We believe that the exchange of old securities for new securities will not be a taxable exchange for U.S. federal and Mexican income tax purposes. You should consult your tax advisor about the tax consequences of the exchange offers as they apply to your individual circumstances.

Fees and Expenses

We will bear all expenses related to consummating the exchange offers and complying with the exchange and registration rights agreements. The initial purchasers have agreed to reimburse us for certain of these expenses.

Exchange Agent

Deutsche Bank Trust Company Americas is serving as the exchange agent for the exchange offers. The exchange agent’s address, telephone number and facsimile number are included under the heading “The Exchange Offers—The Exchange Agent; Luxembourg Listing Agent.”

6

Table of Contents

Description of the New Securities

Issuer

Petróleos Mexicanos.

Guarantors

Pemex-Exploration and Production, Pemex-Refining and Pemex-Gas and Basic Petrochemicals will jointly and severally unconditionally guarantee the payment of principal and interest on the new securities.

New Securities Offered

| • | U.S. $1,000,000,000 aggregate principal amount of 5.50% Notes due 2021. |

| • | U.S. $1,250,000,000 aggregate principal amount of 6.500% Bonds due 2041. |

The form and terms of each series of new securities are the same as the form and terms of the old securities of the corresponding series, except that:

| • | the new securities will be registered under the Securities Act and therefore will not bear legends restricting their transfer; |

| • | holders of the new securities will not be entitled to some of the benefits of the exchange and registration rights agreements; and |

| • | we will not issue the new securities under our medium-term note program. |

The new securities will evidence the same debt as the old securities.

Maturity Dates

| • | 2021 new securities mature on January 21, 2021. |

| • | 2041 new securities mature on June 2, 2041. |

Interest Payment Dates

| • | For the 2021 new securities, January 21 and July 21 of each year. |

| • | For the 2041 new securities, June 2 and December 2 of each year. |

Consolidation with Other Securities

The 2021 new securities will be consolidated to form a single series with, and will be fully fungible with, the U.S. $1,997,607,000 principal amount of our outstanding 5.50% notes due 2021 that we issued in October 2010 upon the consummation of the exchange offers that we commenced in August 2010.

Further Issues

We may, without your consent, increase the size of the issue of any series of new securities or create and issue additional securities with either the same terms and conditions or the same except for the issue price, the issue date and the amount of the first payment of interest;provided that such additional securities do not have, for the purpose of U.S. federal income taxation, a greater amount of original issue discount than the affected new securities have as of the date of the issue of the additional securities. These additional securities may be consolidated to form a single series with the corresponding new securities.

Withholding Tax; Additional Amounts

We will make all principal and interest payments on the new securities without any withholding or deduction for Mexican withholding taxes, unless we are required by law to do so. In some cases where we are obliged to withhold or deduct a portion of the payment, we will pay additional amounts so that you will receive the amount that you would have received had no tax been withheld or deducted. For a description of when you would be entitled to receive additional amounts, see “Description of the New Securities—Additional Amounts.”

Tax Redemption

If, as a result of certain changes in Mexican law, the issuer or any guarantor is obligated to pay additional amounts on interest payments on the new securities at a rate in excess of 10% per year, then we may choose to redeem those new securities.

7

Table of Contents

If we redeem any new securities, we will pay 100% of their outstanding principal amount, plus accrued and unpaid interest and any additional amounts payable up to the date of our redemption.

Redemption of the New Securities at the Option of the Issuer

The issuer may at its option redeem the 2021 new securities or the 2041 new securities, in whole or in part, at any time or from time to time prior to their maturity, at a redemption price equal to the principal amount thereof, plus the Make-Whole Amount (as defined under “Description of the New Securities—Redemption of the New Securities at the Option of the Issuer”), plus accrued interest on the principal amount of the 2021 new securities or the 2041 new securities, as the case may be, to the date of redemption.

Ranking of the New Securities and the Guaranties

The new securities:

| • | will be our direct, unsecured and unsubordinated public external indebtedness, and |

| • | will rank equally in right of payment with each other and with all our existing and future unsecured and unsubordinated public external indebtedness. |

The guaranties of the new securities by each of the guarantors will constitute direct, unsecured and unsubordinated public external indebtedness of each guarantor, and will rankpari passu with each other and with all other present and future unsecured and unsubordinated public external indebtedness of each of the guarantors. As of December 31, 2010, Pemex-Refining had outstanding U.S. $270.8 million of financial leases which will, with respect to the assets securing those financial leases, rank prior to the new securities and the guaranties.

Negative Pledge

None of the issuer or the guarantors or their respective subsidiaries will create security interests in our crude oil and crude oil receivables to secure any public external indebtedness. However, we may enter

into up to U.S. $4 billion of receivables financings and similar transactions in any year and up to U.S. $12 billion of receivables financings and similar transactions in the aggregate.

We may pledge or grant security interests in any of our other assets or the assets of the issuer or the guarantors to secure our debts. In addition, we may pledge oil or oil receivables to secure debts payable in pesos or debts which are different than the new securities, such as commercial bank loans.

Indenture

The new securities will be issued pursuant to an indenture dated as of January 27, 2009, between the issuer and the trustee.

Trustee

Deutsche Bank Trust Company Americas.

Events of Default

The new securities and the indenture under which the new securities will be issued contain certain events of default. If an event of default occurs and is continuing with respect to a series of securities, 20% of the holders of the outstanding securities of that series can require us to pay immediately the principal of and interest on all those securities. For a description of the events of default and their grace periods, you should read “Description of the New Securities—Events of Default; Waiver and Notice.”

Collective Action Clauses

The new securities will contain provisions regarding acceleration and future modifications to their terms that differ from those applicable to certain of the issuer’s and the guarantors’ other outstanding public external indebtedness issued prior to October 2004. Under these provisions, in certain circumstances, the issuer and the guarantors may amend the payment and certain other provisions of a series of new securities with the consent of the holders of 75% of the aggregate principal amount of such new securities.

8

Table of Contents

Governing Law

The new securities and the indenture will be governed by New York law, except that the laws of Mexico will govern the authorization and execution of these documents by Petróleos Mexicanos.

Listing and Trading

We will apply, through our listing agent, to have the new securities listed on the Luxembourg Stock Exchange and admitted to trading on the Euro MTF market of the Luxembourg Stock Exchange. All of the old securities are currently listed on the Luxembourg Stock Exchange and admitted to trading on the Euro MTF market of the Luxembourg Stock Exchange.

Use of Proceeds

We will not receive any cash proceeds from the issuance of the new securities.

Principal Executive Offices

Our headquarters are located at:

Avenida Marina Nacional No. 329

Colonia Petróleos Mexicanos

México, D.F. 11311

Phone: (52-55) 1944-2500.

Risk Factors

Holders of old securities that do not exchange their old securities for new securities will continue to be subject to the restrictions on transfer that are listed on the legends of those old securities. These restrictions will make the old securities less liquid. To the extent that old securities are tendered and accepted in the exchange offers, the trading market, if any, for the old securities would be reduced.

We cannot promise that a market for the new securities will be liquid or will continue to exist. Prevailing interest rates and general market conditions could affect the price of the new securities. This could cause the new securities to trade at prices that may be lower than their principal amount or their initial offering price.

In addition to these risks, there are additional risk factors related to the operations of PEMEX, the Mexican Government’s ownership and control of PEMEX and Mexico generally. These risks are described beginning on page 12.

9

Table of Contents

| Year Ended December 31,(1)(2)(3) | June 30,(1)(4) | |||||||||||||||||||||||||||

| 2006 | 2007 | 2008 | 2009 | 2010 | 2010 | 2011 | ||||||||||||||||||||||

| (unaudited; in millions of pesos, except ratios)(5) | ||||||||||||||||||||||||||||

Income Statement Data | ||||||||||||||||||||||||||||

Amounts in accordance with Mexican FRS: | ||||||||||||||||||||||||||||

Net sales(6) | Ps. 1,106,101 | Ps. 1,139,257 | Ps. 1,328,950 | Ps. 1,089,921 | Ps. 1,282,064 | Ps. 621,449 | Ps. 746,010 | |||||||||||||||||||||

Total sales net of the IEPS tax | 1,106,101 | 1,139,257 | 1,328,950 | 1,089,921 | 1,282,064 | 621,449 | 746,010 | |||||||||||||||||||||

Operating income | 606,868 | 593,652 | 571,111 | 428,277 | 545,521 | 277,774 | 348,101 | |||||||||||||||||||||

Comprehensive financing result | (23,847 | ) | (20,047 | ) | (107,512 | ) | (15,308 | ) | (11,969 | ) | (16,487 | ) | 5,409 | |||||||||||||||

Net income (loss) for the year | 46,953 | (18,308 | ) | (112,076 | ) | (94,662 | ) | (47,463 | ) | (18,662 | ) | 13,308 | ||||||||||||||||

Amounts in accordance with U.S. GAAP: | ||||||||||||||||||||||||||||

Total sales net of IEPS tax | 1,106,101 | 1,139,257 | 1,328,950 | 1,089,921 | 1,282,064 | n.a. | n.a. | |||||||||||||||||||||

Operating income net of IEPS tax | 614,067 | 584,703 | 627,865 | 459,947 | 566,590 | n.a. | n.a. | |||||||||||||||||||||

Comprehensive financing (cost) income | (18,151 | ) | (25,610 | ) | (123,863 | ) | (5,094 | ) | (3,277 | ) | n.a. | n.a. | ||||||||||||||||

Net income (loss) for the period | 56,722 | (32,642 | ) | (67,766 | ) | (52,572 | ) | (17,442 | ) | n.a. | n.a. | |||||||||||||||||

Balance Sheet Data (end of period) | ||||||||||||||||||||||||||||

Amounts in accordance with Mexican FRS: | ||||||||||||||||||||||||||||

Cash and cash equivalents | 195,777 | 170,997 | 114,224 | 159,760 | 133,587 | n.a. | 100,302 | |||||||||||||||||||||

Total assets | 1,250,020 | 1,330,281 | 1,236,837 | 1,332,037 | 1,392,715 | n.a. | 1,401,899 | |||||||||||||||||||||

Long-term debt | 524,475 | 424,828 | 495,487 | 529,258 | 575,171 | n.a. | 541,462 | |||||||||||||||||||||

Total long-term liabilities | 1,032,251 | 990,909 | 1,033,987 | 1,155,917 | 1,299,245 | n.a. | 1,298,152 | |||||||||||||||||||||

Equity (deficit) | 41,456 | 49,908 | 26,885 | (66,840 | ) | (113,783 | ) | n.a. | (102,093 | ) | ||||||||||||||||||

Amounts in accordance with U.S. GAAP: | ||||||||||||||||||||||||||||

Total assets | 1,224,272 | 1,211,719 | 1,239,464 | 1,321,570 | 1,400,191 | n.a. | n.a. | |||||||||||||||||||||

Equity (deficit) | (22,883 | ) | (198,083 | ) | (145,420 | ) | (423,159 | ) | (230,364 | ) | n.a. | n.a. | ||||||||||||||||

Other Financial Data | ||||||||||||||||||||||||||||

Amounts in accordance with Mexican FRS: | ||||||||||||||||||||||||||||

Depreciation and amortization | 65,672 | 72,592 | 89,840 | 76,891 | 96,482 | 45,771 | 46,942 | |||||||||||||||||||||

Investments in fixed assets at cost(7) | 104,647 | 155,121 | 132,092 | 213,232 | 184,584 | 84,993 | 62,498 | |||||||||||||||||||||

Ratio of earnings to fixed charges: | ||||||||||||||||||||||||||||

Mexican FRS(8) | 1.8581 | — | — | — | — | n.a. | n.a. | |||||||||||||||||||||

U.S. GAAP(8) | 2.0680 | — | — | — | — | n.a. | n.a. | |||||||||||||||||||||

Note: n.a. = Not applicable.

| (1) | Includes Petróleos Mexicanos, the subsidiary entities and the subsidiary companies (including the Pemex Project Funding Master Trust, the Fideicomiso Irrevocable de Administración No. F/163 (Fideicomiso F/163) and Pemex Finance, Ltd.). |

| (2) | Mexican FRS differ from U.S. GAAP. For the most significant differences between U.S. GAAP and Mexican FRS affecting PEMEX’s consolidated financial statements, see Note 21 to the 2010 financial statements and “Item 5—Operating and Financial Review and Prospects—U.S. GAAP Reconciliation” in the Form 20-F. |

| (3) | Information derived from PEMEX’s audited consolidated financial statements. |

| (4) | Information derived from PEMEX’s unaudited condensed consolidated results for the six month periods ended June 30, 2010 and 2011, which were furnished to the SEC on Form 6-K on August 30, 2011, 2011. |

| (5) | Figures for 2006 have been restated to constant pesos as of December 31, 2007, by applying the inflation factor, as measured by the NCPI, from December 31, 2006 through December 31, 2007. See the third paragraph of “Presentation of Financial Information” above for the inflation factor. Figures for 2007 are stated in constant pesos as of December 31, 2007. Figures for 2008, 2009, 2010 and 2011 are in nominal pesos. |

10

Table of Contents

| (6) | Net sales include theImpuesto Especial sobre Producción y Servicios (Special Tax on Production and Services, which we refer to as the IEPS tax) as part of the sales price of the products sold. However, the IEPS tax rate was negative in the years ended December 31, 2006, 2007, 2008, 2009 and 2010, and in the six month periods ended June 30, 2010 and 2011, resulting in no IEPS tax payable during each of those periods. |

| (7) | Includes investments in fixed assets and capitalized interest until 2006, and, beginning in 2007, capitalized comprehensive financial result. The amount of our investment in fixed assets in 2006 and 2007 was derived from our accounting records, but does not appear directly in the corresponding statement of changes in financial position. Beginning with fiscal year 2008, the amount presented for investment in fixed assets is that which is included in the statement of cash flows. See note 3(h) to the 2010 financial statements and “Item 5—Operating and Financial Review and Prospects—Liquidity and Capital Resources” in the Form 20-F. |

| (8) | Under Mexican FRS, earnings for the years ended December 31, 2007, 2008, 2009 and 2010 were insufficient to cover fixed charges. The amount by which fixed charges exceeded earnings was Ps. 16,174 million, Ps. 97,735 million, Ps. 88,310 million and Ps. 46,600 million for the years ended December 31, 2007, 2008, 2009 and 2010, respectively. Under U.S. GAAP, earnings for the years ended December 31, 2007, 2008, 2009 and 2010 were insufficient to cover fixed charges. The amount by which fixed charges exceeded earnings was Ps. 33,160 million, Ps. 56,880 million, Ps. 46,426 million and Ps. 16,839 million for the years ended December 31, 2007, 2008, 2009 and 2010, respectively. |

Source: PEMEX’s consolidated financial statements.

11

Table of Contents

Risk Factors Related to the Operations of PEMEX

Crude oil and natural gas prices are volatile, and low crude oil and natural gas prices adversely affect PEMEX’s income and cash flows and the amount of Mexico’s hydrocarbon reserves.

International crude oil and natural gas prices are subject to global supply and demand and fluctuate due to many factors beyond our control. These factors include competition within the oil and natural gas industry, the prices and availability of alternative sources of energy, international economic trends, exchange rate fluctuations, expectations of inflation, domestic and foreign government regulations or international laws, political and other events in major oil and natural gas producing and consuming nations and actions taken by Organization of the Petroleum Exporting Countries (OPEC) members and other oil exporting countries, trading activity in oil and natural gas and transactions in derivative financial instruments (which we refer to as DFIs) related to oil and gas.

When international crude oil and natural gas prices are low, we earn less export sales revenue and, therefore, generate lower cash flows and earn less income because our costs remain roughly constant. Conversely, when crude oil and natural gas prices are high, we earn more export sales revenue and our income before taxes and duties increases. As a result, future fluctuations in international crude oil and natural gas prices will have a direct effect on our results of operations and financial condition, and may affect Mexico’s hydrocarbon reserves estimates. See “—Risk Factors Related to the Relationship between PEMEX and the Mexican Government—Information on Mexico’s hydrocarbon reserves is based on estimates, which are uncertain and subject to revisions” and “Item 11—Quantitative and Qualitative Disclosures about Market Risk—Hydrocarbon Price Risk” in the Form 20-F.

PEMEX is an integrated oil and gas company and is exposed to production, equipment and transportation risks, criminal acts and deliberate acts of terror.

We are subject to several risks that are common among oil and gas companies. These risks include production risks (fluctuations in production due to operational hazards, natural disasters or weather, accidents, etc.), equipment risks (relating to the adequacy and condition of our facilities and equipment) and transportation risks (relating to the condition and vulnerability of pipelines and other modes of transportation). More specifically, our business is subject to the risks of explosions in pipelines, refineries, plants, drilling wells and other facilities, hurricanes in the Gulf of Mexico and other natural or geological disasters and accidents, fires, mechanical failures and theft.

Our facilities are also subject to the risk of sabotage and terrorism. In July 2007, two of our pipelines were attacked. In September 2007, six different sites were attacked and 12 of our pipelines were affected. The occurrence of any of these events or of accidents connected with production, processing and transporting oil and oil products could result in personal injuries, loss of life, environmental damage with resulting containment, clean-up and repair expenses, equipment damage and damage to our facilities. A shutdown of the affected facilities could disrupt our production and increase our production costs.

We purchase comprehensive insurance policies covering most of these risks; however, these policies may not cover all liabilities, and insurance may not be available for some of the consequential risks. There can be no assurance that accidents or acts of terror will not occur in the future, that insurance will adequately cover the entire scope or extent of our losses or that we may not be found directly liable in connection with claims arising from these or other events. See “Item 4—Information on the Company—Business Overview—PEMEX Corporate Matters—Insurance” in the Form 20-F.

PEMEX has a substantial amount of liabilities that could adversely affect our financial condition and results of operations.

We have a substantial amount of debt. As of December 31, 2010, our total indebtedness, excluding accrued interest, was approximately U.S. $53.2 billion, in nominal terms, which is an 11.1% increase, as compared to our

12

Table of Contents

total indebtedness, excluding accrued interest, of approximately U.S. $47.9 billion at December 31, 2009. Our level of debt may increase further in the near or medium term and may have an adverse effect on our financial condition and results of operations.

To service our debt, we have relied and may continue to rely on a combination of cash flows provided by operations, drawdowns under our available credit facilities and the incurrence of additional indebtedness. Certain rating agencies have expressed concerns regarding the total amount of our debt, our increase in indebtedness over the last several years and our substantial unfunded reserve for retirement pensions and seniority premiums, which as of December 31, 2010 was equal to approximately U.S. $53.5 billion. Due to our heavy tax burden, we have resorted to financings to fund our capital investment projects. Any further lowering of our credit ratings may have adverse consequences on our ability to access the financial markets and/or our cost of financing. If we are unable to obtain financing on favorable terms, this could hamper our ability to obtain further financing as well as hamper investment in facilities financed through debt. As a result, we may not be able to make the capital expenditures needed to maintain our current production levels and to maintain, as well as increase, Mexico’s proved hydrocarbon reserves, which may adversely affect our financial condition and results of operations. See “—Risk Factors Related to the Relationship between PEMEX and the Mexican Government—PEMEX must make significant capital expenditures to maintain its current production levels, and to maintain, as well as increase, Mexico’s hydrocarbon reserves. Mexican Government budget cuts, reductions in PEMEX’s income and inability to obtain financing may limit PEMEX’s ability to make capital investments.”

PEMEX’s compliance with environmental regulations in Mexico could result in material adverse effects on its results of operations.

A wide range of general and industry-specific Mexican federal and state environmental laws and regulations apply to our operations; these laws and regulations are often difficult and costly to comply with and carry substantial penalties for non-compliance. This regulatory burden increases our costs because it requires us to make significant capital expenditures and limits our ability to extract hydrocarbons, resulting in lower revenues. For an estimate of our accrued environmental liabilities, see “Item 4—Information on the Company—Environmental Regulation—Environmental Liabilities” in the Form 20-F. In addition, we have agreed with third parties to make investments to reduce our carbon dioxide emissions. See “Item 4—Information on the Company—Environmental Regulation—Carbon Dioxide Emissions Reduction” in the Form 20-F.

PEMEX publishes less U.S. GAAP financial information than U.S. companies are required to file with the SEC.

We prepare our financial statements according to Mexican FRS, which differ in certain significant respects from U.S. GAAP. See “Item 3—Key Information—Selected Financial Data,” and “Item 5—Operating and Financial Review and Prospects—U.S. GAAP Reconciliation” in the Form 20-F and Note 21 to our consolidated financial statements. As a foreign issuer, we are not required to prepare quarterly U.S. GAAP financial information, and we therefore generally prepare a reconciliation of our net income and equity under Mexican FRS to U.S. GAAP as well as explanatory notes and additional disclosure required under U.S. GAAP on a yearly basis only. As a result, there may be less or different publicly available information about us than there is about U.S. issuers.

If PEMEX were unable to properly adopt and implement International Financial Reporting Standards, its ability to produce and publish timely and accurate financial information could be materially affected.

Beginning with the fiscal year starting January 1, 2012, Mexican issuers with securities registered in the National Securities Registry of the CNBV will be required to prepare financial statements in accordance with International Financial Reporting Standards (IFRS) as issued by the International Accounting Standards Board. In addition, these financial statements will be audited in accordance with International Standards on Auditing. In connection with this implementation, we will be required to evaluate our internal controls over financial

13

Table of Contents

reporting in order to verify that they will continue to be effective once the implementation of IFRS is complete. However, we cannot be certain that no event will occur which could prevent us from adopting, by the deadline established by the CNBV, the modifications necessary to issue our financial statements under IFRS. If we were not able to implement IFRS by the date required, our ability to issue timely and accurate financial information could be materially affected. Consequently, we could be subject to penalties for such non-compliance, including having our securities delisted from theBolsa Mexicana de Valores, S.A.B. de C.V. (which we refer to as the BMV). As of the date of this prospectus, we are in the process of implementing IFRS and expect to fulfill this requirement.

Risk Factors Related to the Relationship between PEMEX and the Mexican Government

The Mexican Government controls PEMEX and it could limit PEMEX’s ability to satisfy its external debt obligations or could reorganize or transfer PEMEX or its assets.

Petróleos Mexicanos is a decentralized public entity of the Mexican Government, and therefore the Mexican Government controls us, as well as our annual budget, which is approved by theCámara de Diputados (Chamber of Deputies). However, our financing obligations do not constitute obligations of and are not guaranteed by the Mexican Government. The Mexican Government has the power to intervene directly or indirectly in our commercial and operational affairs. Intervention by the Mexican Government could adversely affect our ability to make payments under any securities issued by us.

The Mexican Government’s agreements with international creditors may affect our external debt obligations. In certain past debt restructurings of the Mexican Government, Petróleos Mexicanos’ external indebtedness was treated on the same terms as the debt of the Mexican Government and other public sector entities. In addition, Mexico has entered into agreements with official bilateral creditors to reschedule public sector external debt. Mexico has not requested restructuring of bonds or debt owed to multilateral agencies.

The Mexican Government would have the power, if theConstitución Política de los Estados Unidos Mexicanos (Political Constitution of the United Mexican States) and federal law were amended, to reorganize PEMEX, including a transfer of all or a portion of Petróleos Mexicanos and the subsidiary entities or their assets to an entity not controlled by the Mexican Government. Such a reorganization or transfer could adversely affect production, cause a disruption in our workforce and our operations and cause us to default on certain obligations. See also “—Considerations Related to Mexico” below.

Petróleos Mexicanos and the subsidiary entities pay special taxes, duties and dividends to the Mexican Government, which may limit PEMEX’s capacity to expand its investment program.

PEMEX pays a substantial amount of taxes and duties to the Mexican Government, particularly on the revenues of Pemex-Exploration and Production, which may limit PEMEX’s ability to make capital investments. In 2010, approximately 51.0% of the sales revenues of PEMEX was used to pay taxes to the Mexican Government. These special taxes, duties and dividends constitute a substantial portion of the Mexican Government’s revenues. For further information, see “Item 4—Information on the Company—Taxes and Duties,” “Item 5—Operating and Financial Review and Prospects—IEPS Tax, Hydrocarbon Duties and Other Taxes,” and “Item 5—Operating and Financial Review and Prospects—Liquidity and Capital Resources—Equity Structure and Certificates of Contribution ‘A’” in the Form 20-F.

The Mexican Government has entered into agreements with other nations to limit production.

Although Mexico is not a member of OPEC, in the past it has entered into agreements with OPEC and non-OPEC countries to reduce global crude oil supply. We do not control the Mexican Government’s international affairs and the Mexican Government could agree with OPEC or other countries to reduce our crude oil production or exports in the future. A reduction in our oil production or exports could reduce our revenues.

14

Table of Contents

The Mexican Government has imposed price controls in the domestic market on PEMEX’s products.

The Mexican Government has from time to time imposed price controls on the sales of natural gas, liquefied petroleum gas (LPG), gasoline, diesel, gas oil intended for domestic use and fuel oil number 6, among others. As a result of these price controls, PEMEX has not been able to pass on all of the increases in the prices of its product purchases to its customers in the domestic market. We do not control the Mexican Government’s domestic policies and the Mexican Government could impose additional price controls on the domestic market in the future. The imposition of such price controls would adversely affect our results of operations. For more information, see “Item 4—Information on the Company—Business Overview—Refining—Pricing Decrees” and “Item 4—Information on the Company—Business Overview—Gas and Basic Petrochemicals—Pricing Decrees” in the Form 20-F.

The Mexican nation, not PEMEX, owns the hydrocarbon reserves in Mexico.

The Political Constitution of the United Mexican States provides that the Mexican nation, not PEMEX, owns all petroleum and other hydrocarbon reserves located in Mexico. Although Mexican law gives Pemex-Exploration and Production the exclusive right to exploit Mexico’s hydrocarbon reserves, it does not preclude the Mexican Congress from changing current law and assigning some or all of these rights to another company. Such an event would adversely affect our ability to generate income.

Information on Mexico’s hydrocarbon reserves is based on estimates, which are uncertain and subject to revisions.

The information on oil, gas and other reserves set forth in the Form 20-F is based on estimates. Reserves valuation is a subjective process of estimating underground accumulations of crude oil and natural gas that cannot be measured in an exact manner; the accuracy of any reserves estimate depends on the quality and reliability of available data, engineering and geological interpretation and subjective judgment. Additionally, estimates may be revised based on subsequent results of drilling, testing and production. These estimates are also subject to certain adjustments based on changes in variables, including crude oil prices. Therefore, proved reserves estimates may differ materially from the ultimately recoverable quantities of crude oil and natural gas. See “—Risk Factors Related to the Operations of PEMEX—Crude oil and natural gas prices are volatile and low crude oil and natural gas prices adversely affect PEMEX’s income and cash flows and the amount of Mexico’s hydrocarbon reserves.” Pemex-Exploration and Production revises its estimates of Mexico’s hydrocarbon reserves annually, which may result in material revisions to our estimates of Mexico’s hydrocarbon reserves.

PEMEX must make significant capital expenditures to maintain its current production levels, and to maintain, as well as increase, Mexico’s proved hydrocarbon reserves. Mexican Government budget cuts, reductions in PEMEX’s income and inability to obtain financing may limit PEMEX’s ability to make capital investments.

We invest funds to maintain, as well as increase, the amount of extractable hydrocarbon reserves in Mexico. We also continually invest capital to enhance our hydrocarbon recovery ratio and improve the reliability and productivity of our infrastructure. While the replacement rate for proved hydrocarbon reserves has increased in recent years, from 71.8% in 2008 to 77.1% in 2009 and to 85.8% in 2010, the overall replacement rate is still less than 100%, which represents a decline in Mexico’s proved hydrocarbon reserves. Pemex-Exploration and Production’s crude oil production decreased by 9.2% from 2007 to 2008, by 6.8% from 2008 to 2009 and by 1.0% from 2009 to 2010, primarily as a result of the decline of production in the Cantarell project. Our ability to make capital expenditures is limited by the substantial taxes that we pay to the Mexican Government and cyclical decreases in our revenues primarily related to lower oil prices. In addition, budget cuts imposed by the Mexican Government and the availability of financing may also limit our ability to make capital investments. For more information, see “Item 4—Information on the Company—History and Development—Capital Expenditures and Investments” in the Form 20-F.

15

Table of Contents

PEMEX may claim some immunities under the Foreign Sovereign Immunities Act and Mexican law, and your ability to sue or recover may be limited.

Petróleos Mexicanos and the subsidiary entities are decentralized public entities of the Mexican Government. Accordingly, you may not be able to obtain a judgment in a U.S. court against us unless the U.S. court determines that we are not entitled to sovereign immunity with respect to that action. In addition, Mexican law does not allow attachment prior to judgment or attachment in aid of execution upon a judgment by Mexican courts upon the assets of Petróleos Mexicanos or the subsidiary entities. As a result, your ability to enforce judgments against us in the courts of Mexico may be limited. We also do not know whether Mexican courts would enforce judgments of U.S. courts based on the civil liability provisions of the U.S. federal securities laws. Therefore, even if you were able to obtain a U.S. judgment against us, you might not be able to obtain a judgment in Mexico that is based on that U.S. judgment. Moreover, you may not be able to enforce a judgment against our property in the United States except under the limited circumstances specified in the Foreign Sovereign Immunities Act of 1976, as amended (the Immunities Act). Finally, if you were to bring an action in Mexico seeking to enforce our obligations under any of our securities, satisfaction of those obligations may be made in pesos, pursuant to the laws of Mexico.

PEMEX’s directors and officers, as well as some of the experts named in this document or the Form 20-F, reside outside the United States. Substantially all of our assets and those of most of our directors, officers and experts are located outside the United States. As a result, you may not be able to effect service of process on our directors or officers or those experts within the United States.

Considerations Related to Mexico

Economic conditions and government policies in Mexico and elsewhere may have a material impact on PEMEX’s operations.

A deterioration in Mexico’s economic condition, social instability, political unrest or other adverse social developments in Mexico could adversely affect our business and financial condition. Those events could also lead to increased volatility in the foreign exchange and financial markets, thereby affecting our ability to obtain new financing and service foreign debt. Additionally, the Mexican Government may cut spending in the future. These cuts could adversely affect our business, financial condition and prospects. In the past, Mexico has experienced several periods of slow or negative economic growth, high inflation, high interest rates, currency devaluation and other economic problems. These problems may worsen or reemerge, as applicable, in the future, and could adversely affect our business and our ability to service our debt. A worsening of international financial or economic conditions, including a slowdown in growth or recessionary conditions in Mexico’s trading partners or the emergence of a new financial crisis, could have adverse effects on the Mexican economy, on our financial condition and on our ability to service our debt.

Changes in exchange rates or in Mexico’s exchange control laws may hamper the ability of PEMEX to service its foreign currency debt.

The Mexican Government does not currently restrict the ability of Mexican companies or individuals to convert pesos into U.S. dollars or other currencies, and Mexico has not had a fixed exchange rate control policy since 1982. However, in the future, the Mexican Government could impose a restrictive exchange control policy, as it has done in the past. We cannot provide assurances that the Mexican Government will maintain its current policies with regard to the peso or that the peso’s value will not fluctuate significantly in the future. The peso has been subject to significant devaluations against the U.S. dollar in the past and may be subject to significant fluctuations in the future. Mexican Government policies affecting the value of the peso could prevent us from paying our foreign currency obligations.

Most of our debt is denominated in U.S. dollars. In the future, we may incur additional indebtedness denominated in U.S. dollars or other currencies. Declines in the value of the peso relative to the U.S. dollar or other currencies may increase our interest costs in pesos and result in foreign exchange losses.

16

Table of Contents

For information on historical peso/U.S. dollar exchange rates, see “Item 3—Key Information—Exchange Rates” in the Form 20-F.

Political conditions in Mexico could materially and adversely affect Mexican economic policy and, in turn, PEMEX’s operations.

Political events in Mexico may significantly affect Mexican economic policy and, consequently, our operations. On December 1, 2006, Felipe de Jesús Calderón Hinojosa, a member of thePartido Acción Nacional(National Action Party, or PAN), formally assumed office for a six-year term as the President of Mexico. Currently, no political party holds a simple majority in either house of the Mexican Congress.

Mexico has experienced a period of increasing criminal violence and such activities could affect PEMEX’s operations.

Recently, Mexico has experienced a period of increasing criminal violence, primarily due to the activities of drug cartels and related organized crime. In response, the Mexican Government has implemented various security measures and has strengthened its military and police forces. Despite these efforts, drug-related crime continues to exist in Mexico. These activities, their possible escalation and the violence associated with them, in an extreme case, may have a negative impact on our financial condition and results of operations.

Risks Related to Non-Participation in the Exchange Offers

If holders of old securities do not participate in the exchange offers, the old securities will continue to be subject to transfer restrictions.

Holders of old securities that are not registered under the Securities Act who do not exchange these unregistered old securities for new securities will continue to be subject to the restrictions on transfer that are listed on the legends of those old securities. These restrictions will make the old securities less liquid. To the extent that old securities are tendered and accepted in the exchange offers, the trading market, if any, for the old securities would be reduced.

Risks Related to the New Securities

The market for the new securities or the old securities may not be liquid, and market conditions could affect the price at which the new securities or the old securities trade.

The issuer will apply, through its listing agent, to have the new securities admitted to trading on the Euro MTF market of the Luxembourg Stock Exchange. All of the old securities are currently admitted to trading on the Euro MTF. In the event that the new securities are admitted to trading on the Euro MTF, we will use our best efforts to maintain such listing;providedthat if legislation is adopted in Luxembourg in a manner that would require us to publish our financial statements according to accounting principles or standards that are materially different from those we apply in our financial reporting under the securities laws of Mexico and the United States or that would otherwise impose requirements on us or the guarantors that we determine in good faith are unduly burdensome, the issuer may de-list the new securities and/or the old securities. The issuer will use its reasonable best efforts to obtain an alternative admission to listing, trading or quotation for such securities by another listing authority, exchange or system within or outside the European Union, as the issuer may reasonably decide, although there can be no assurance that such alternative listing will be obtained.

In addition, the issuer cannot promise that a market for either the new securities or the old securities will be liquid or will continue to exist. Prevailing interest rates and general market conditions could affect the price of the new securities or the old securities. This could cause the new securities or the old securities to trade at prices that may be lower than their principal amount or their initial offering price.

17

Table of Contents

The new securities will contain provisions that permit the issuer to amend the payment terms of the new securities without the consent of all holders.

The new securities will contain provisions regarding acceleration and voting on amendments, modifications and waivers which are commonly referred to as “collective action clauses.” Under these provisions, certain key terms of a series of the new securities may be amended, including the maturity date, interest rate and other payment terms, without the consent of all of the holders. See “Description of the New Securities—Modification and Waiver.”

18

Table of Contents

This prospectus contains words, such as “believe,” “expect,” “anticipate” and similar expressions that identify forward-looking statements, which reflect our views about future events and financial performance. We have made forward-looking statements that address, among other things, our:

| • | drilling and other exploration activities; |

| • | import and export activities; |

| • | projected and targeted capital expenditures and other costs, commitments and revenues; and |

| • | liquidity. |

Actual results could differ materially from those projected in such forward-looking statements as a result of various factors that may be beyond our control. These factors include, but are not limited to:

| • | changes in international crude oil and natural gas prices; |

| • | effects on us from competition; |

| • | limitations on our access to sources of financing on competitive terms; |

| • | significant developments in the global economy; |

| • | significant economic or political developments in Mexico; |

| • | developments affecting the energy sector; and |

| • | changes in our regulatory environment. |

Accordingly, you should not place undue reliance on these forward-looking statements. In any event, these statements speak only as of their dates, and we undertake no obligation to update or revise any of them, whether as a result of new information, future events or otherwise.

For a discussion of important factors that could cause actual results to differ materially from those contained in any forward-looking statement, you should read “Risk Factors” above.

19

Table of Contents

We will not receive any cash proceeds from the issuance of the new securities under the exchange offers. In consideration for issuing the new securities as contemplated in this prospectus, we will receive in exchange an equal principal amount of old securities, which will be cancelled. Accordingly, the exchange offers will not result in any increase in our indebtedness or the guarantors’ indebtedness. The net proceeds we received from issuing the old securities were and are being used to finance our investment program.

20

Table of Contents

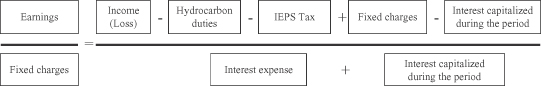

RATIO OF EARNINGS TO FIXED CHARGES

PEMEX’s ratio of earnings to fixed charges is calculated as follows:

Fixed charges for this purpose consist of the sum of interest expense plus interest capitalized during the period. Fixed charges do not take into account exchange gain or loss attributable to PEMEX’s indebtedness. Mexican FRS differs in certain significant respects from U.S. GAAP. The material differences as they relate to PEMEX’s financial statements are described in Note 21 to the 2010 financial statements.

The following table sets forth PEMEX’s consolidated ratio of earnings to fixed charges for the five-year period ended December 31, 2010, in accordance with Mexican FRS and U.S. GAAP.

| Year Ended December 31, 2010 | ||||||||||||||||||||

| 2006 | 2007 | 2008 | 2009 | 2010 | ||||||||||||||||

Ratio of earnings to fixed charges: | ||||||||||||||||||||

Mexican FRS(1) | 1.8581 | — | — | — | — | |||||||||||||||

U.S. GAAP(1) | 2.0680 | — | — | — | — | |||||||||||||||

| (1) | Under Mexican FRS, earnings for the years ended December 31, 2007, 2008, 2009 and 2010 were insufficient to cover fixed charges. The amount by which fixed charges exceeded earnings was Ps. 16,174 million, Ps. 97,735 million, Ps. 88,310 million and Ps. 46,600 million for the years ended December 31, 2007, 2008, 2009 and 2010, respectively. Under U.S. GAAP, earnings for the years ended December 31, 2007, 2008, 2009 and 2010 were insufficient to cover fixed charges. The amount by which fixed charges exceeded earnings was Ps. 33,160 million, Ps. 56,880 million, Ps. 46,426 million and Ps. 16,839 million for the years ended December 31, 2007, 2008, 2009 and 2010, respectively. |

Source: PEMEX’s financial statements.

21

Table of Contents

The following table sets forth the capitalization of PEMEX at June 30, 2011 as calculated in accordance with Mexican FRS.

| At June 30, 2011(1)(2) | ||||||||

| (millions of pesos or U.S. dollars) | ||||||||

Long-term external debt | Ps. 440,632 | U.S. $ | 37,219 | |||||

Long-term domestic debt | 100,830 | 8,517 | ||||||

|

|

|

| |||||

Total long-term debt(3) | 541,462 | 45,736 | ||||||

|

|

|

| |||||

Certificates of Contribution “A”(4) | 96,958 | 8,190 | ||||||

Mexican Government increase in equity of subsidiary entities | 180,382 | 15,236 | ||||||

Legal reserve | 988 | 83 | ||||||

Donation surplus | 3,486 | 294 | ||||||

Other comprehensive income | 2,740 | 231 | ||||||

Accumulated losses from prior years | (399,954 | ) | (33,783 | ) | ||||

Net income for the period | 13,308 | 1,124 | ||||||

|

|

|

| |||||

Total equity (deficit) | (102,093 | ) | (8,624 | ) | ||||

|

|

|

| |||||

Total capitalization | Ps. 439,369 | U.S. $ | 37,112 | |||||

|

|

|

| |||||

Note: Numbers may not total due to rounding.

| (1) | Unaudited. Convenience translations into U.S. dollars of amounts in pesos have been made at the established exchange rate of Ps. 11.8389 = U.S. $1.00 at June 30, 2011. Such translations should not be construed as a representation that the peso amounts have been or could be converted into U.S. dollar amounts at the foregoing or any other rate. |

| (2) | As of the date of this prospectus, there has been no material change in the capitalization of PEMEX since June 30, 2011, except for (a) PEMEX’s undertaking of the new financings described in “Item 5—Operating and Financial Review and Prospects—Liquidity and Capital Resources—Financing Activities—2011 Financing Activities” in the Form 20-F and (b) the issuance by Petróleos Mexicanos of U.S. $1,000,000,000 of 2021 old securities on July 26, 2011. |

| (3) | Total long-term debt does not include short-term indebtedness of Ps. 88.4 billion (U.S. $7.5 billion) at June 30, 2011. See “Liquidity and Capital Resources” in the Form 6-K. |

| (4) | Equity instruments held by the Mexican Government. |

Source: PEMEX’s 2011 interim financial statements.

22

Table of Contents

The guarantors—Pemex-Exploration and Production, Pemex-Refining and Pemex-Gas and Basic Petrochemicals—are decentralized public entities of Mexico, which were created by the Mexican Congress on July 17, 1992 out of operations that had previously been directly managed by Petróleos Mexicanos. Each of the guarantors is a legal entity empowered to own property and carry on business in its own name. The executive offices of each of the guarantors are located at Avenida Marina Nacional No. 329, Colonia Petróleos Mexicanos, México, D.F. 11311, México. PEMEX’s telephone number is (52-55) 1944-2500.

The activities of the issuer and the guarantors are regulated primarily by:

| • | theLey Reglamentaria del Artículo 27 Constitucional en el Ramo del Petróleo (Regulatory Law to Article 27 of the Political Constitution of the United Mexican States Concerning Petroleum Affairs, or the Regulatory Law); and |

| • | theLey de Petróleos Mexicanos (Petróleos Mexicanos Law). |

The operating activities of the issuer are allocated among the guarantors and the other subsidiary entity, Pemex-Petrochemicals, each of which has the characteristics of a subsidiary of the issuer. The principal business lines of the guarantors are as follows:

| • | Pemex-Exploration and Production explores for and exploits crude oil and natural gas and transports, stores and markets these hydrocarbons; |

| • | Pemex-Refining refines petroleum products and derivatives that may be used as basic industrial raw materials and stores, transports, distributes and markets these products and derivatives; and |

| • | Pemex-Gas and Basic Petrochemicals processes natural gas, natural gas liquids and derivatives that may be used as basic industrial raw materials and stores, transports, distributes and markets these products and produces, stores, transports, distributes and markets basic petrochemicals. |

For further information about the legal framework governing the guarantors, see “Item 4—Information on the Company—History and Development” in the Form 20-F. Copies of the Petróleos Mexicanos Law will be available at the specified offices of Deutsche Bank Trust Company Americas and the paying agent and transfer agent in Luxembourg.

The guarantors have been consolidated with PEMEX in the 2010 financial statements included in the Form 20-F and the interim financial statements as of and for the six months ended June 30, 2010 and 2011 incorporated by reference in this prospectus. See Notes 17 and 22 to the 2010 financial statements and Note 13 to the June 30, 2011 interim financial statements for the selected consolidating balanced sheet, statement of operations and statement of cash flow data for the guarantors that are utilized to produce the consolidated financial statements of PEMEX. None of the guarantors publish their own financial statements.

The following is a brief description of each guarantor.

Pemex-Exploration and Production

Pemex-Exploration and Production explores for and produces crude oil and natural gas, primarily in the northeastern and southeastern regions of Mexico and offshore in the Gulf of Mexico. In nominal peso terms, our capital investment in exploration and production activities increased by 7.9% in 2010, and we continued to finance an array of programs to expand production capacity and efficiency. As a result of our investments in previous years, our total hydrocarbon production reached a level of approximately 3,792 thousand barrels of oil equivalent per day in 2010. Pemex-Exploration and Production’s crude oil production decreased by 1.0% from 2009 to 2010, averaging 2,575.9 thousand barrels per day in 2010, primarily as a result of the decline of the Cantarell project. This reduction in crude oil production was less than the decrease of 6.8% reported in 2009, due to increased crude oil production in the following projects: Ku-Maloob-Zaap, Crudo Ligero Marino, Delta del Grijalva and Ixtal Manik. In addition, the Akal field in the Cantarell project registered a decrease in its annual

23

Table of Contents

rate of decline in production beginning in the second half of 2009, and another reduction in its annual rate of decline in production during the second half of 2010. Pemex-Exploration and Production’s natural gas production (excluding natural gas liquids) decreased by 0.2% from 2009 to 2010, averaging 7,020.0 million cubic feet per day in 2010. This decrease in natural gas production was a result of lower volumes from the Cantarell and Burgos projects. Exploration drilling activity decreased by 48.0% from 2009 to 2010, from 75 exploratory wells completed in 2009 to 39 exploratory wells completed in 2010. Development drilling activity increased by 17.6% from 2009 to 2010, from 1,075 development wells completed in 2009 to 1,264 development wells completed in 2010. In 2010, we completed the drilling of 1,303 wells in total. Our drilling activity in 2010 was focused on increasing the production of non-associated gas in the Burgos and Macuspana projects and of heavy crude oil in the Ku-Maloob-Zaap and Cantarell projects.