issued or delivered, or the amount of the cash payment will be multiplied by the applicable performance factor. The form of settlement (i.e. cash, treasury settled, delivery of previously issued shares), performance criteria (in the case of PSUs) and payout date(s) (between one and three years after grant date) of the RSUs and PSUs will be set by the Human Resources and Compensation Committee at the time of grant.

On each dividend payment date for the Class BNon-Voting Shares, additional RSUs or PSUs, as applicable, will be credited to the holder’s RSU or PSU account equal to, for each RSU or PSU, the amount of the per Class BNon-Voting Share dividend divided by the then current Unit Price, provided the holder is still a director of, or employed by, the Company on such date.

The maximum number of Class BNon-Voting Shares issuable under the New RSU/PSU Plan is 5,000,000 Class BNon-Voting Shares in the aggregate, representing less than 1% of the issued and outstanding Class A Shares and Class BNon-Voting Shares as at November 27, 2018. The total number of Class BNon-Voting Shares issuable to Insiders (as defined in Part I of the TSX Company Manual), at any time, under the New RSU/PSU Plan, together with all of the Company’s other Security Based Compensation Arrangements (as defined in Part VI of the TSX Company Manual), shall not exceed 10% of the issued and outstanding Class BNon-Voting Shares. The total number of Class BNon-Voting Shares issued to Insiders, within any12-month period, under all of the Company’s Security Based Compensation Arrangements shall not exceed 10% of the issued and outstanding Class BNon-Voting Shares.

As at the date of this proxy circular, solely cash settled RSUs or PSUs have been granted under the New RSU/PSU Plan (i.e. no RSUs or PSUs that settle by the issuance of Class BNon-Voting Shares from treasury or by purchases of Class BNon-Voting Shares on the TSX have been issued under the New RSU/PSU plan). Outstanding RSUs and PSUs granted under the Current RSU/PSU Plan will be settled in cash in accordance with their terms.

Long-term Incentives

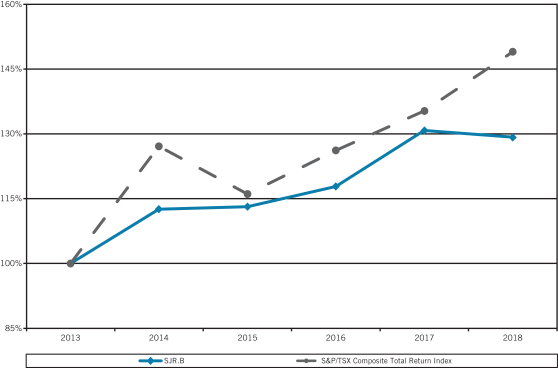

The purpose of the long-term“at-risk” compensation is to provide additional compensation on a periodic basis to ensure a continued balanced performance focus with the overall objective of creating shareholder value. The benefits of option awards require sustained performance through effective execution of the Company’s strategic initiatives.

Stock option awards are discretionary and are granted by the Human Resources and Compensation Committee from time to time. When stock options are granted, the Company’s current practice is to award options for terms of ten years with 20% of the options in a grant vesting on each of the first through fifth anniversaries of the grant date.

The Company has preferred to reward executive performance through the short-term incentive program and, as a result, longer-term incentives such as stock option awards were limited. This decision is, in part, based on the significant equity ownership of two of its NEOs that are members of the Shaw family, which controls the Company through its holdings of Class A Shares and holds a significant interest in Class BNon-Voting Shares (see “Voting Shares and Principal Holders Thereof”).

Stock Option Plan

Options to acquire Class BNon-Voting Shares are granted pursuant to the Company’s Stock Option Plan. The Stock Option Plan provides that options may be granted to directors, officers, employees and consultants of the Company and for such number of Class BNon-Voting Shares as the Board, or a committee thereof, determines in its discretion, at an exercise price not less than the closing price of the Class BNon-Voting Shares on the TSX on the trading day immediately preceding the date on which the options are granted. An option shall not be immediately exercisable, but rather, shall be exercisable on vesting dates determined by the Board from time to time. Unless otherwise determined by the Board, options expire ten years from the date of grant, and subject to limited exceptions, must be exercised while the optionee is a director, officer,

| | |

Proxy Circular Shaw Communications Inc. | | 35 |