Exhibit 99.2 Accelerating Virtual Rent-To-Own Growth Through Acquisition of Merchants Preferred July 15, 2019

Transaction Overview 0.116.222 Strategic transaction creates what we believe will be the best offer in the rent-to-own industry by 0.74.140 combining Merchants Preferred’s (“MP”) proven virtual model with Acceptance Now’s (“ANow”) unique staffed model 82.172.255 Rent-A-Center will acquire Merchants Preferred for total consideration of 243.91.95 approximately $47.5 million based on Rent-A-Center’s closing stock price on July 12, 2019, of $27.83. 255.192.0 Transaction Consideration consists of $28 million in cash and a minimum of 701,918 shares of Rent- 146.208.80 Structure A-Center common stock The total consideration and the number of shares issued will depend upon the stock price at closing but, the number of shares are expected to be as stated above Accelerates expansion into the virtual rent-to-own space with advanced technology and back-office infrastructure for use across Rent-A-Center platforms Enhances ability to expand into large, national retail and online partners Creates potential to expand into additional product verticals outside of home Strategic Rationale furnishings and electronics Provides strategic advantage of offering both staffed and virtual models Adds an additional 2,500 locations to the Acceptance Now platform Expected Closing Acquisition has been unanimously approved by Rent-A-Center’s Board and Conditions Expected to close in the third quarter, subject to customary closing conditions Source: Company information 2

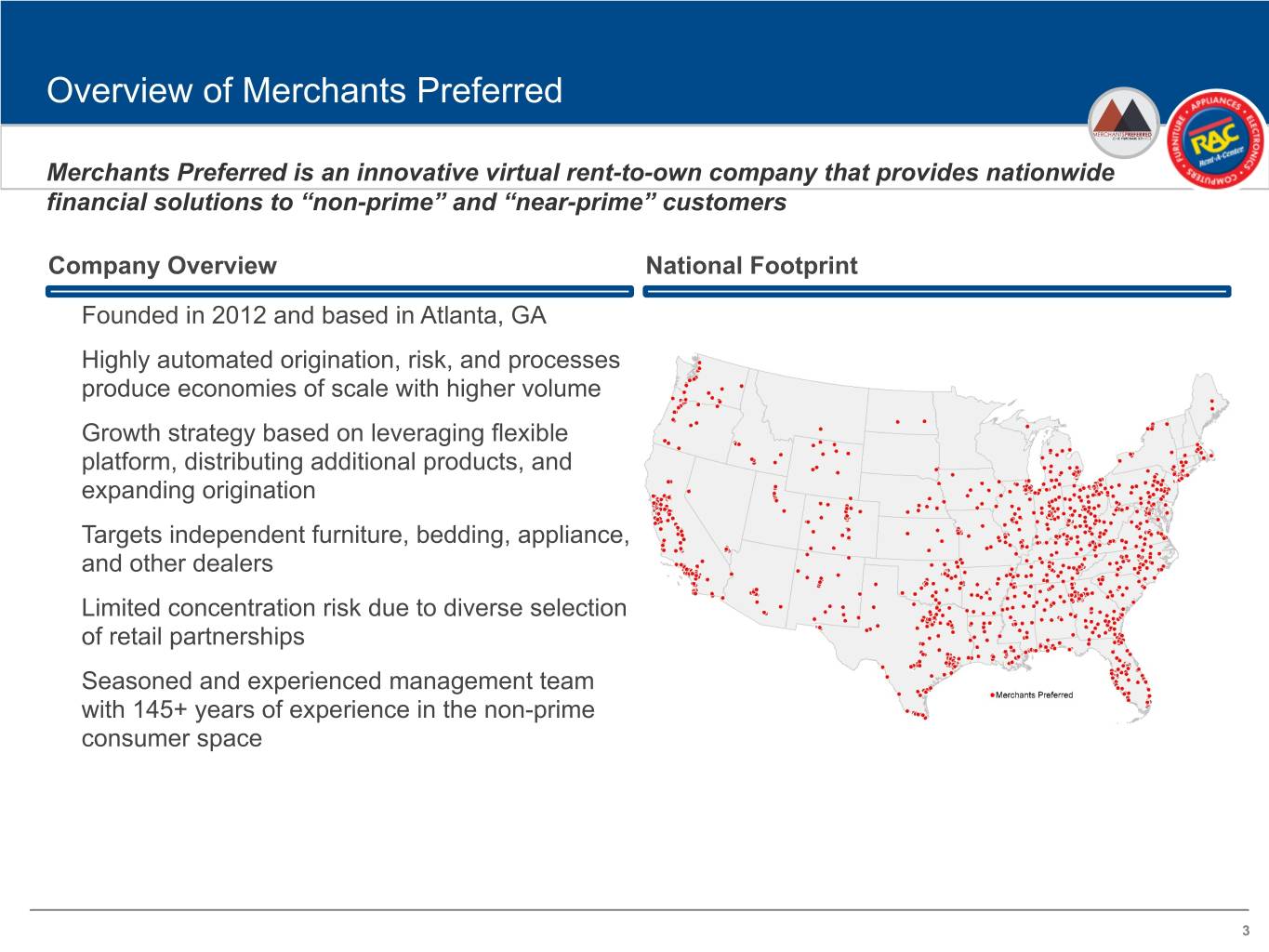

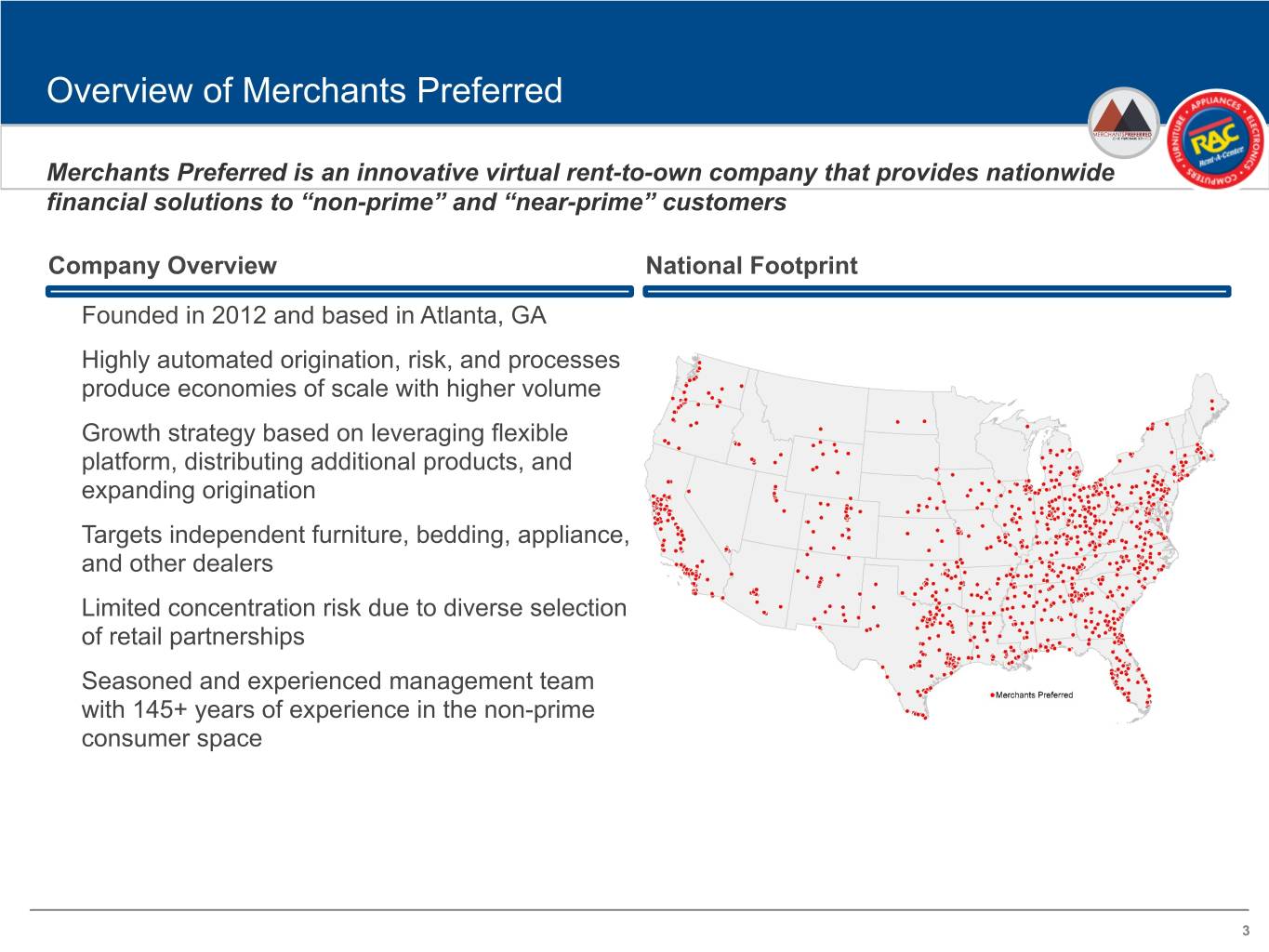

Overview of Merchants Preferred 0.116.222 Merchants Preferred is an innovative virtual rent-to-own company that provides nationwide 0.74.140 financial solutions to “non-prime” and “near-prime” customers 82.172.255 Company Overview National Footprint 243.91.95 Founded in 2012 and based in Atlanta, GA 255.192.0 Highly automated origination, risk, and processes 146.208.80 produce economies of scale with higher volume Growth strategy based on leveraging flexible platform, distributing additional products, and expanding origination Targets independent furniture, bedding, appliance, and other dealers Limited concentration risk due to diverse selection of retail partnerships Seasoned and experienced management team with 145+ years of experience in the non-prime consumer space 3

Strategic Benefits 0.116.222 Merchants Preferred scalable technology offering will accelerate the Acceptance Now growth plan 0.74.140 by at least 18 months 82.172.255 Benefits to Rent-A-Center Benefits to Retail Partners 243.91.95 Infrastructure upgrades Customer reach advantage 255.192.0 Technology: Cut development time and costs Only rent-to-own company serving both the banked and Decision engine: Acquire a robust platform and team unbanked customer in our retail partner locations 146.208.80 Call center: Acquire process and integrated technology Generates incremental sales New customer growth Accelerate expansion Flexible RTO options Grow doors by utilizing the MP sales team Flexibility of selecting a rent-to-own option that suits the needs Strong pipeline from both MP and ANow of the retail partner’s business Leverage technology Staffed, virtual or hybrid model Gain market share in over $20 billion virtual RTO market Experience and culture e-Commerce integration Combine MP’s proven virtual model with ANow’s Enhanced ability to integrate e-commerce platforms with a manned offer rent-to-own option Combine MP’s unique technology expertise with ANow’s rent- to-own experience Portfolio diversification Support and online portal Strengthen existing and develop new vendor relationships Multifaceted support team Ability to expand into additional product verticals Strong retail partner service through centralized support team and online portal 4

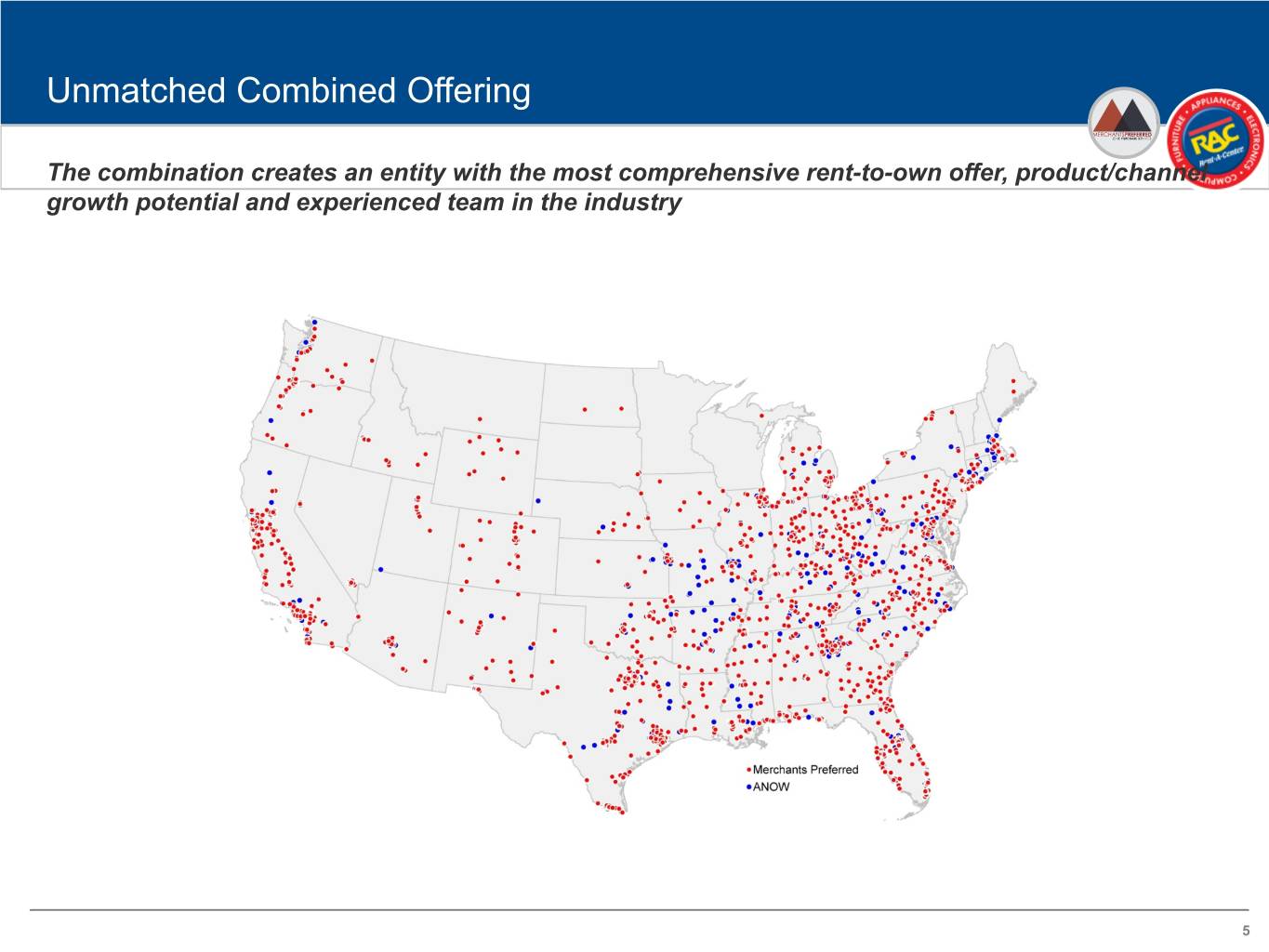

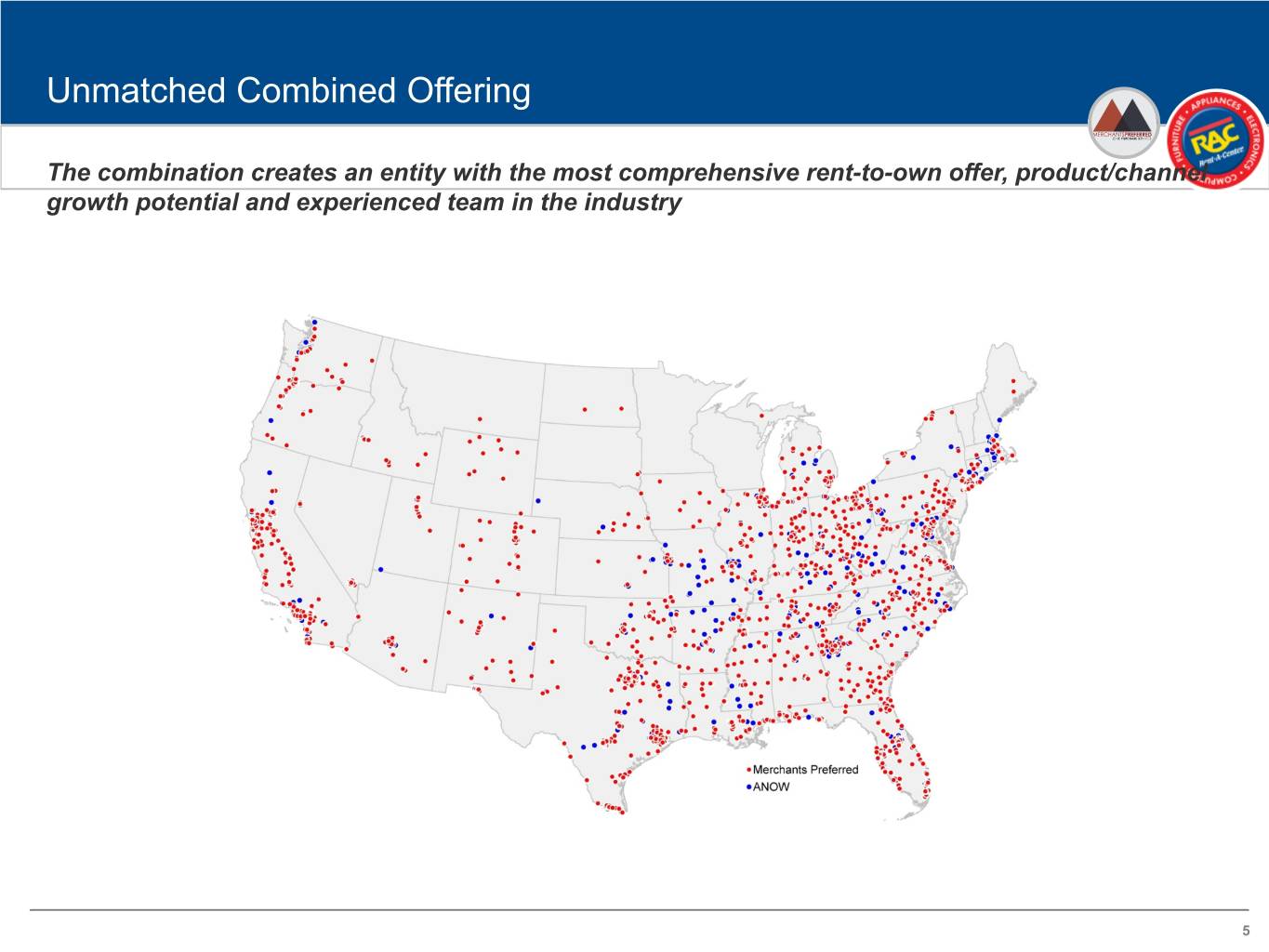

Unmatched Combined Offering 0.116.222 The combination creates an entity with the most comprehensive rent-to-own offer, product/channel 0.74.140 growth potential and experienced team in the industry 82.172.255 243.91.95 255.192.0 146.208.80 5

Safe Harbor 0.116.222 Forward-Looking Statements This presentation contains forward-looking statements that involve risks and uncertainties. Such forward-looking statements generally can be identified by the use of forward- 0.74.140 looking terminology such as "may," "will," "expect," "intend," "could," "estimate," "predict," "continue," "should," "anticipate," "believe," or “confident,” or the negative thereof or variations thereon or similar terminology. The Company believes that the expectations reflected in such forward-looking statements are accurate. However, there can be no 82.172.255 assurance that such expectations will occur. Factors that could impact such expectations include, but are not limited to: the ability to satisfy all conditions required to successfully complete the acquisition; the ability to realize the strategic benefits from the acquisition, including achieving expected synergies and operating efficiencies from 243.91.95 the acquisition; the ability to successfully integrate Merchants Preferred’s operations which may be more difficult, time-consuming or costly than expected; operating costs, loss of retail partners and business disruption arising from the acquisition; the ability to retain certain key employees at Merchants Preferred; risks related to Merchants Preferred’s virtual rent-to-own business; the Company's transition to more-readily scalable, “cloud-based” solutions; the Company's ability to develop and successfully 255.192.0 implement digital or E-commerce capabilities, including mobile applications; information technology and data security costs; the impact of any breaches in data security or other disturbances to the Company's information technology and other networks and the Company's ability to protect the integrity and security of individually identifiable data 146.208.80 of its customers and employees; and the other risks detailed from time to time in the Company's SEC reports, including but not limited to, its Annual Report on Form 10-K for the year ended December 31, 2018, and its Quarterly Report on Form 10-Q for the quarter ended March 31, 2019. 6