Exhibit 99.2

Upbound to Acquire Brigit December 2024 +

Disclaimer 2 Cautionary Note Regarding Forward - Looking Statements This presentation and the related webcast contain forward - looking statements that involve risks and uncertainties. These stateme nts are made under the “safe harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995. Such forward - looking statements generally can be identified by the use of forward - looking terminology such as "may," "will," "expect," "inten d," "could," "estimate," "predict," "continue," "should," "anticipate," "believe," or “confident,” or the negative thereof or va riations thereon or similar terminology and include, among others, statements concerning (a) the anticipated benefits of the proposed tra nsaction, (b) the anticipated impact of the proposed transaction on the combined company's business and future financial and operating results, (c) the anticipated closing date for the proposed transaction, (d) other aspects of both companies' op era tions and operating results, and (e) our goals, plans and projections with respect to our operations, financial position and business strategy. However, there can be no assurance that such expectations will occur. The Company's actual future performa nce could differ materially and adversely from such statements. Factors that could cause or contribute to such material and adverse differences include, but are not limited to: (1) risks relating to the proposed transaction, including ( i ) the inability to obtain regulatory approvals required to consummate the transaction with Brigit on the terms expected, at a ll or in a timely manner, (ii) the impact of the additional debt on the Company's leverage ratio, interest expense and other business and financial imp act s and restrictions due to the additional debt, (iii) the failure of conditions to closing the transaction and the ability of the parties to consummate the proposed transaction on a timely basis or at all, (iv) the failure of the transaction to deliver the estima ted value and benefits expected by the Company, (v) the incurrence of unexpected future costs, liabilities or obligations as a re su lt of the transaction, (vi) the effect of the announcement of the transaction on the ability of the Company or Brigit to retain and hi re necessary personnel and maintain relationships with material commercial counterparties, consumers and others with whom the Company and Brigit do business, (vii) the ability of the Company to successfully integrate Brigit's operations over time, (vi ii) the ability of the Company to successfully implement its plans, forecasts and other expectations with respect to Brigit's bus in ess after the closing and (ix) other risks and uncertainties inherent in a transaction of this size and nature, (2) the general s tre ngth of the economy and other economic conditions affecting consumer preferences, demand, payment behaviors and spending; (3) factors affecting the disposable income available to the Company's and Brigit's current and potential customers; (4) the app eal of the Company's and Brigit's offerings to consumers; (5) the Company's and Brigit's ability to protect their proprietary intellectual property; (6) the impact of the competitive environment in the Company's and Brigit's industries; (7) the Compan y's and Brigit's ability to identify and successfully market products and services that appeal to their current and future target ed customer segments; (8) consumer preferences and perceptions of the Company's and Brigit's brands; (9) the Company's and Brigi t's compliance with applicable laws and regulations and the impact of active enforcement of those laws and regulations, including any changes with respect thereto or attempts to recharacterize their offerings as credit sales, (10) information te chn ology and data security costs; (11) the impact of any breaches in data security or other disturbances to the Company's or Bri git 's information technology and other networks and the Company's and Brigit's ability to protect the integrity and security of ind ivi dually identifiable data of its customers and employees; and (12) the other risks detailed from time to time in the Company's SE C reports, including but not limited to, its Annual Report on Form 10 - K for the year ended December 31, 2023 and in its subsequent Quarterly Reports on Form 10 - Q and Current Reports on Form 8 - K. You are cautioned not to place undue reliance on these forward - looking statements, which speak only as of the date of this presentation. Except as required by law, the Company i s not obligated to publicly release any revisions to these forward - looking statements to reflect the events or circumstances after the date hereof or to reflect the occurrence of unanticipated events. Non - GAAP Financial Measures This presentation and the related webcast contain certain financial information determined by methods other than in accordanc e w ith U.S. Generally Accepted Accounting Principles (GAAP), including (1) Adjusted EBITDA (net earnings before interest, taxes, stock - based compensation, depreciation and amortization, as adjusted for special items) on a consolidated and segment bas is, (2) Net Leverage Ratio (total debt less unrestricted cash, divided by Adjusted EBITDA), (3) Non - GAAP diluted earnings per share (net earnings or loss, as adjusted for special items (as defined below), net of taxes, divided by the numb er of shares of our common stock on a fully diluted basis), (4) ARR (Annualized Recurring Revenue, which is end - of - period monthly gross revenue multiplied by 12) and (5) ARR CAGR. “Special items” refers to certain gains and charges we view as extr aor dinary, unusual or non - recurring in nature or which we believe do not reflect our core business activities. Special items are reported as Other Gains and Charges in our Consolidated Statements of Operations. Because of the inherent uncertainty rel ate d to these special items, management does not believe it is able to provide a meaningful forecast of the comparable GAAP measures or reconciliation to any forecasted GAAP measure without unreasonable effort. These non - GAAP measures are addition al tools intended to assist our management in comparing our performance on a more consistent basis for purposes of business decision - making by removing the impact of certain items management believes do not directly reflect our core operati ons. These measures are intended to assist management in evaluating operating performance and liquidity, comparing performance and liquidity across periods, planning and forecasting future business operations, helping determine levels of op era ting and capital investments and identifying and assessing additional trends potentially impacting our Company that may not be shown solely by comparisons of GAAP measures. Consolidated Adjusted EBITDA is also used as part of our incentive compensat ion program for our executive officers and others. We believe these non - GAAP financial measures also provide supplemental information that is useful to investors, analysts and other external users of our consolidated financial stateme nts in understanding our financial results and evaluating our performance and liquidity from period to period. However, non - GAAP financial measures have inherent limitations and are not substitutes for, or superior to, GAAP financial measures, and they s hou ld be read together with our consolidated financial statements prepared in accordance with GAAP. Further, because non - GAAP financial measures are not standardized, it may not be possible to compare such measures to the non - GAAP financial measures presented by other companies, even if they have the same or similar names.

Creating a Financial Home for the Underserved 3 Upbound has agreed to acquire Brigit for up to $460M, including $325M payable at closing ; transaction expected to contribute between $70 million and $80 million of Adjusted EBITDA 1 by 2026 A technology and data - driven leader in accessible and inclusive financial products A leading financial health technology company Creates a sophisticated fintech ecosystem ideally suited to support consumers underserved by the traditional financial system Accelerates expansion of leading customer - centric, tech - enabled consumer leasing platform with new products and services that elevate financial opportunity for all Provides opportunities for enhanced customer experience and deepening relationships based on customer needs and behavior Combines two mission - driven companies building innovative solutions for a sizable, important and overlooked segment of the population 1. Non - GAAP Financial Measure. See descriptions toward the beginning of this presentation. Due to the inherent uncertainty related to the special items discussed under “Non - GAAP Financial Measures” above, management does not believe it is able to provide a meaningful forecast of the comparable GAAP measure or reconciliation to any forecasted GAAP measure without unre aso nable effort.

Upbound’s Evolution 4 Pioneering industry leader in the rent - to - own and lease - to - own space Acquires Acima , a leader in virtual LTO, almost doubling the size of the company Rebrands as Upbound with more expansive business strategy to grow virtual technology platform The next exciting chapter… Financial technology that provides new, innovative product offerings utilizing proprietary data analytics Upbound has a storied history of leveraging technology to evolve its operations and its digital and virtual offerings – always in service of customers. Added in 2021 Created in 2023 Founded in 1973 Added Today!

Brigit Overview 1. Source: Assumes all Brigit’s cash advances since inception have assisted customers with avoiding overdraft fees at an estimated $34/overdraft; 2. Source: Brigit company information and estimates; 3. Source: FTI research and Brigit survey. 5 Brigit was launched in 2019 with the goal of helping everyone build a brighter financial future . Consistently ranked among the most downloaded financial health apps 2 Increased Confidence User surveys show 94% of consumers feel better off financially and achieved their financial goals after using the app 3 Subscription model with a suite of products that use AI - and ML - powered cash flow data insights to empower individuals and drive meaningful value for users ~ $1B + saved for users by helping them avoid overdraft fees , putting more money back in consumers’ pockets and facilitating improved financial health 1

Products That Improve Financial Health 6 Bundle of proprietary, AI - and ML - powered financial wellness products and services offered through multiple affordable, user - aligned subscription tiers Instant Cash Get access to EWA / paycheck advance Credit Builder Build credit by growing your savings Smart Alerts & Offers Personalized & actionable financial recommendations Budgeting & Literacy Learn how to better manage finances

Recurring Revenue Model with Growing, Engaged Consumer Base 7 Brigit’s compelling financial profile and user metrics demonstrate strength of underlying business model ~2M monthly active users, up 320% since Jan. 2021 2025E Revenue: $215M - $230M Adj. EBITDA 1 : $25M - $30M Approximately 80% recurring subscription - based revenue ~6 + avg. sessions/month ~40% of new subscribers retained in year 1 2026E Revenue: $350M - $400M Adj. EBITDA 1 : $70M - $80M Source: Brigit company information and estimates. 1. Non - GAAP Financial Measure. See descriptions toward the beginning of this presentation. Due to the inherent uncertainty related to the special items discussed under “Non - GAAP Financial Measures” above, management does not believe it is able to provide a meaningful forecast of the comparable GAAP measure or reconciliation to any forecasted GAAP measure without unre aso nable effort.

Talented, Passionate Team 8 Industry Leading Team Bringing Niche Experience from… Zuben Mathews Brigit Co - founder and CEO Top - tier fintech pioneers who are experts on the financially underserved, with a sharp and deeply - informed vision and the talent to execute it Hamel Kothari Brigit Co - founder and CTO

Strategic Rationale 9 A significant next step in Upbound’s strategy to expand its ecosystem of technology solutions for underserved consumers, which is core to its mission to elevate financial opportunity for all Strategic Transaction Providing Significant Growth Opportunities and Proprietary AI/ML Technologies Shared Values and Target Customers 1 Broadening Relevance to an Expanding TAM 2 Differentiated Industry - Leading Platform 3 Data and Tech Enhances Customer Insights 4 Strategic Growth and Diversification 5

Both organizations driven by dedication to financially underserved consumers 1. Shared Values and Target Customers 10 Combination connects product solutions with access to funds Similar customer segments means combination will accelerate our missions and customer reach and lifetime value

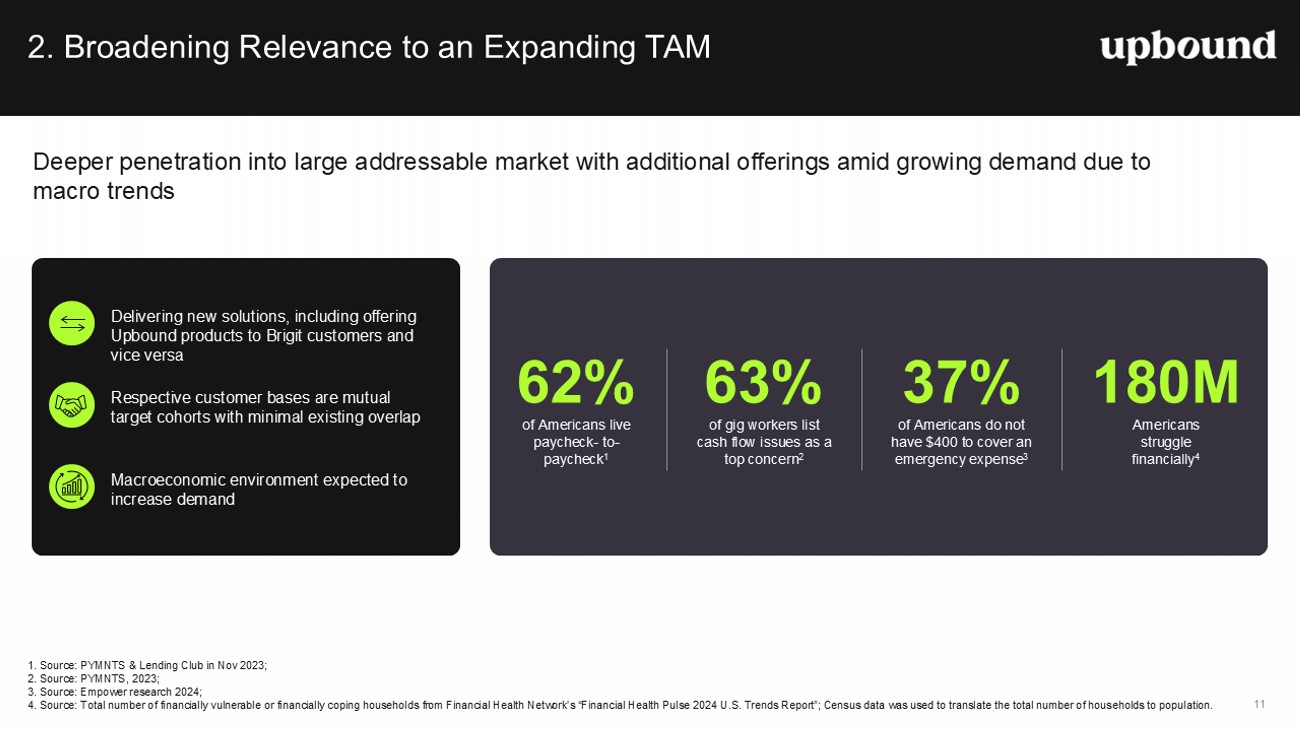

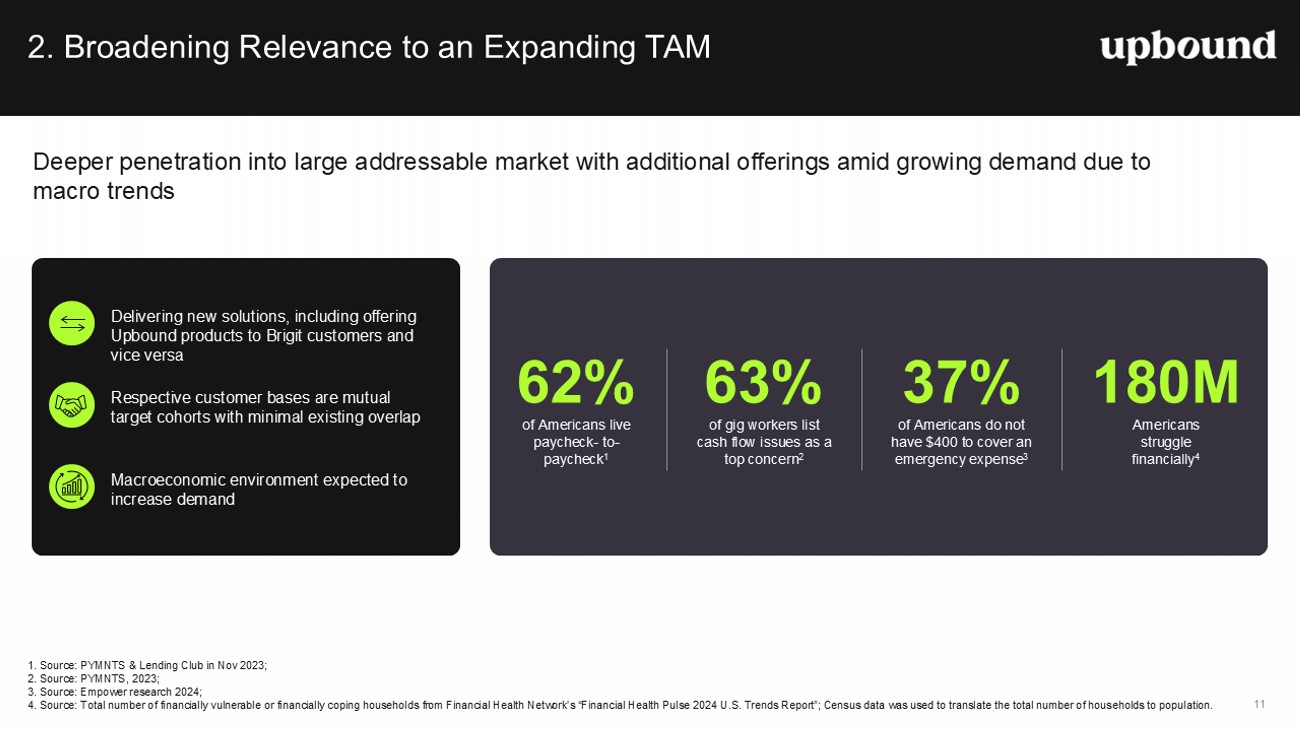

63% of gig workers list cash flow issues as a top concern 2 37 % of Americans do not have $400 to cover an emergency expense 3 180M Americans struggle financially 4 62% of Americans live paycheck - to - paycheck 1 2. Broadening Relevance to an Expanding TAM 1. Source: PYMNTS & Lending Club in Nov 2023; 2. Source: PYMNTS, 2023; 3. Source: Source: Empower research 2024; 4. Source: Total number of financially vulnerable or financially coping households from Financial Health Network’s “Financial He alt h Pulse 2024 U.S. Trends Report”; Census data was used to translate the total number of households to population. 11 Deeper penetration into large addressable market with additional offerings amid growing demand due to macro trends Delivering new solutions, including offering Upbound products to Brigit customers and vice versa Respective customer bases are mutual target cohorts with minimal existing overlap Macroeconomic environment expected to increase demand

3. Differentiated Industry - Leading Platform 12 Adding Brigit’s products and technology is expected to create a smarter financial solutions ecosystem to support a broader market of underserved consumers 12 Adds new products that benefit consumers and retailers An R&D innovation hub and significant technology talent to develop future products and services for our targeted consumers Improves our core business with enhanced consumer insights, new underwriting capabilities and improved account management Provides consumers greater economic access and a path towards financial flexibility Holistic view of our customers will enable personalized financial journeys that drive engagement

Built by analyzing billions of individual cash flow data points from thousands of banks Servicing & Account Management Platform Underwriting & Risk Platform 4. Data and Tech Enhances Customer Insights 13 Proprietary cash flow recommendation engine is bank - agnostic and utilizes real - time, holistic and verified data Cash Flow Data Behavior & Life Events Triggers Spending Patterns Real - time Repayment Info Borrowing Patterns Fraud Factors Granular Employment Metadata Customer Profile Cohorts Thousands more… Marketing & Cross Sell Engine

5. Strategic Growth and Diversification Source: Brigit company information and estimates; 1. Non - GAAP Financial Measure. See descriptions toward the beginning of this presentation. Due to the inherent uncertainty related to the special items discussed under “Non - GAAP Financial Measures” above, management does not believe it is able to provide a meaningful forecast of the comparable GAAP measure or reconciliation to any forecasted GAAP measure without un reasonable effort; 2. ARR: Annualized Recurring Revenue is a non - GAAP financial metric defined as end - of - period monthly gross revenue multiplied by 12 . 14 14 14 Brigit’s impressive growth and financials place it among the top tier of leading fintech companies Expect addition of Brigit to diversify revenue and Adjusted EBITDA mix over time 47% Brigit ARR CAGR, 2020 - 2023 1,2 40% P aying subscriber CAGR, 2020 - 2023 80 % Subscription - based revenue $100M+ In ARR reached in the first 5 years 1,2 2026 Expected to be accretive to Adjusted EBITDA by approximately $70M - $80M 1 Within four years Expect Upbound revenue/EBITDA will be ~2/3 derived from virtual and digital platforms , while our core RTO business will remain a priority offering in our growing product set 2025 Expected to be accretive to Adjusted EBITDA by approximately $25M - $30M 1 Within four years Expect Upbound revenue/Adjusted EBITDA 1 will be ~2/3 derived from virtual and digital platforms ( Acima /Brigit), while core rent - to - own business will remain a priority offering to serve and acquire new customers

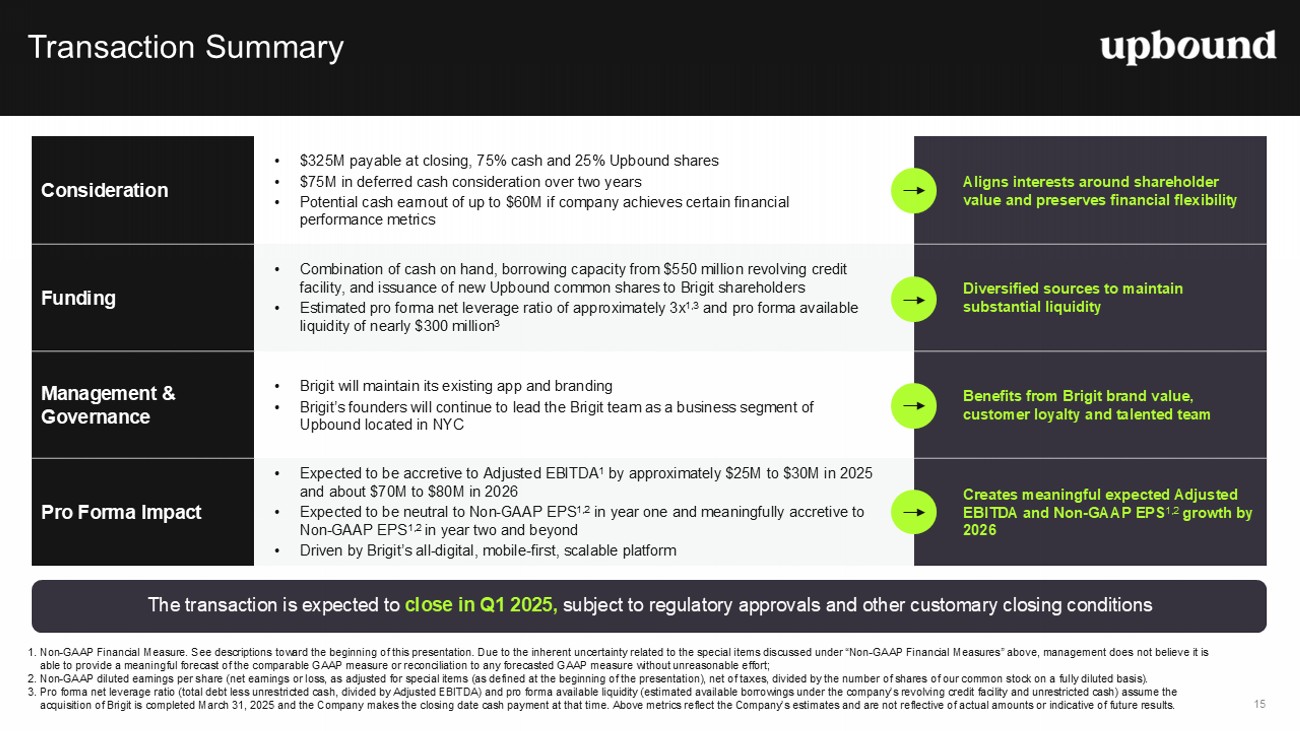

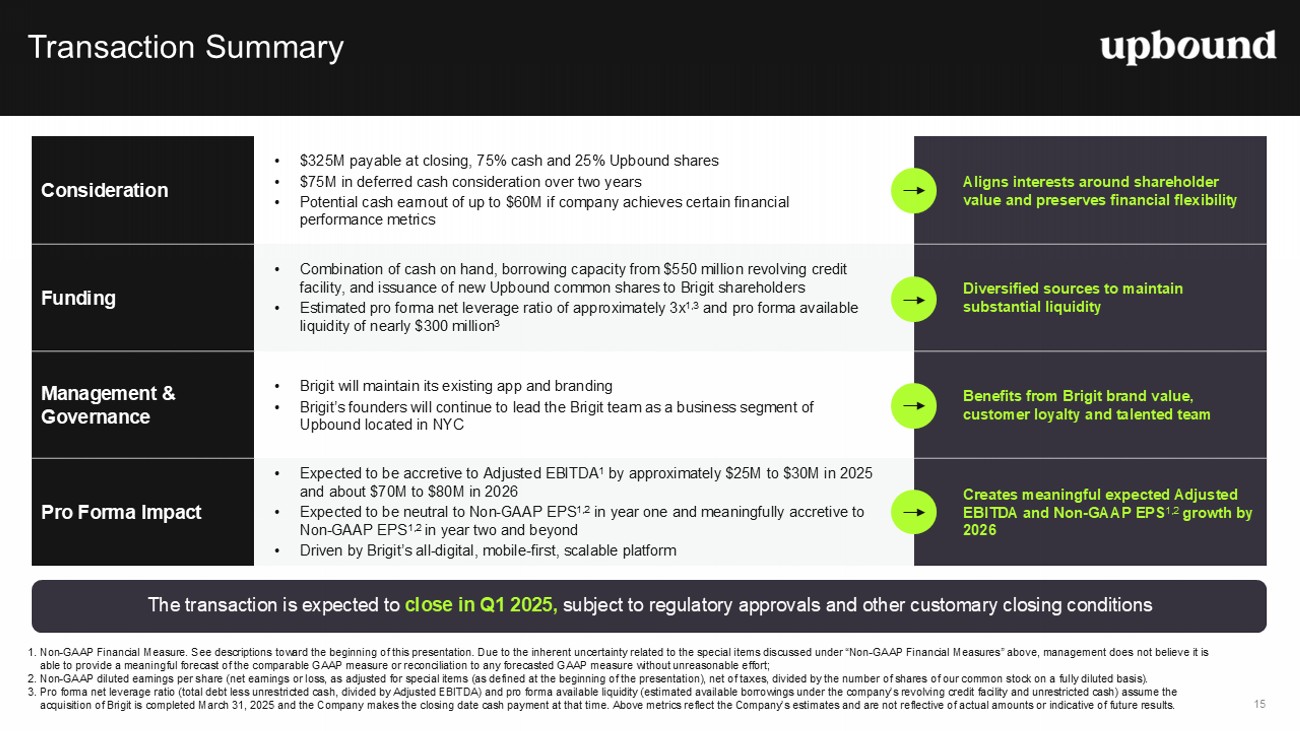

Transaction Summary 1. Non - GAAP Financial Measure. See descriptions toward the beginning of this presentation. Due to the inherent uncertainty related to the special items discussed under “Non - GAAP Financial Measures” above, management does not believe it is able to provide a meaningful forecast of the comparable GAAP measure or reconciliation to any forecasted GAAP measure without un reasonable effort; 2. Non - GAAP diluted earnings per share (net earnings or loss, as adjusted for special items (as defined at the beginning of the pre sentation), net of taxes, divided by the number of shares of our common stock on a fully diluted basis). 3. Pro forma net leverage ratio (total debt less unrestricted cash, divided by Adjusted EBITDA) and pro forma available liquidit y ( estimated available borrowings under the company’s revolving credit facility and unrestricted cash) assume the acquisition of Brigit is completed March 31, 2025 and the Company makes the closing date cash payment at that time. Above met ric s reflect the Company’s estimates and are not reflective of actual amounts or indicative of future results. 15 Aligns interests around shareholder value and preserves financial flexibility • $325M payable at closing, 75% cash and 25% Upbound shares • $75M in deferred cash consideration over two years • Potential cash earnout of up to $60M if company achieves certain financial performance metrics Consideration Diversified sources to maintain substantial liquidity • Combination of cash on hand, borrowing capacity from $550 million revolving credit facility, and issuance of new Upbound common shares to Brigit shareholders • Estimated pro forma net leverage ratio of approximately 3x 1,3 and pro forma available liquidity of nearly $300 million 3 Funding Benefits from Brigit brand value, customer loyalty and talented team • Brigit will maintain its existing app and branding • Brigit’s founders will continue to lead the Brigit team as a business segment of Upbound located in NYC Management & Governance Creates meaningful expected Adjusted EBITDA and Non - GAAP EPS 1,2 growth by 2026 • Expected to be accretive to Adjusted EBITDA 1 by approximately $25M to $30M in 2025 and about $70M to $80M in 2026 • Expected to be neutral to Non - GAAP EPS 1,2 in year one and meaningfully accretive to Non - GAAP EPS 1,2 in year two and beyond • Driven by Brigit’s all - digital, mobile - first, scalable platform Pro Forma Impact The transaction is expected to close in Q1 2025, subject to regulatory approvals and other customary closing conditions

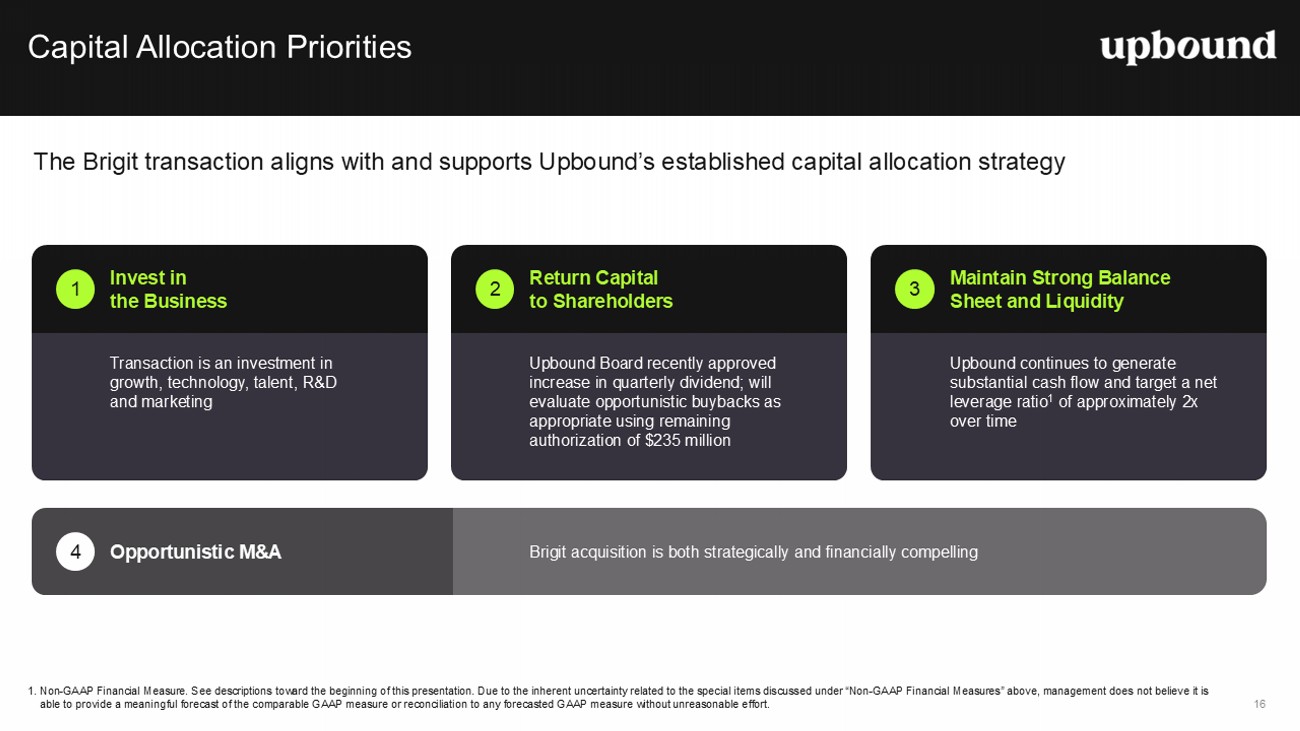

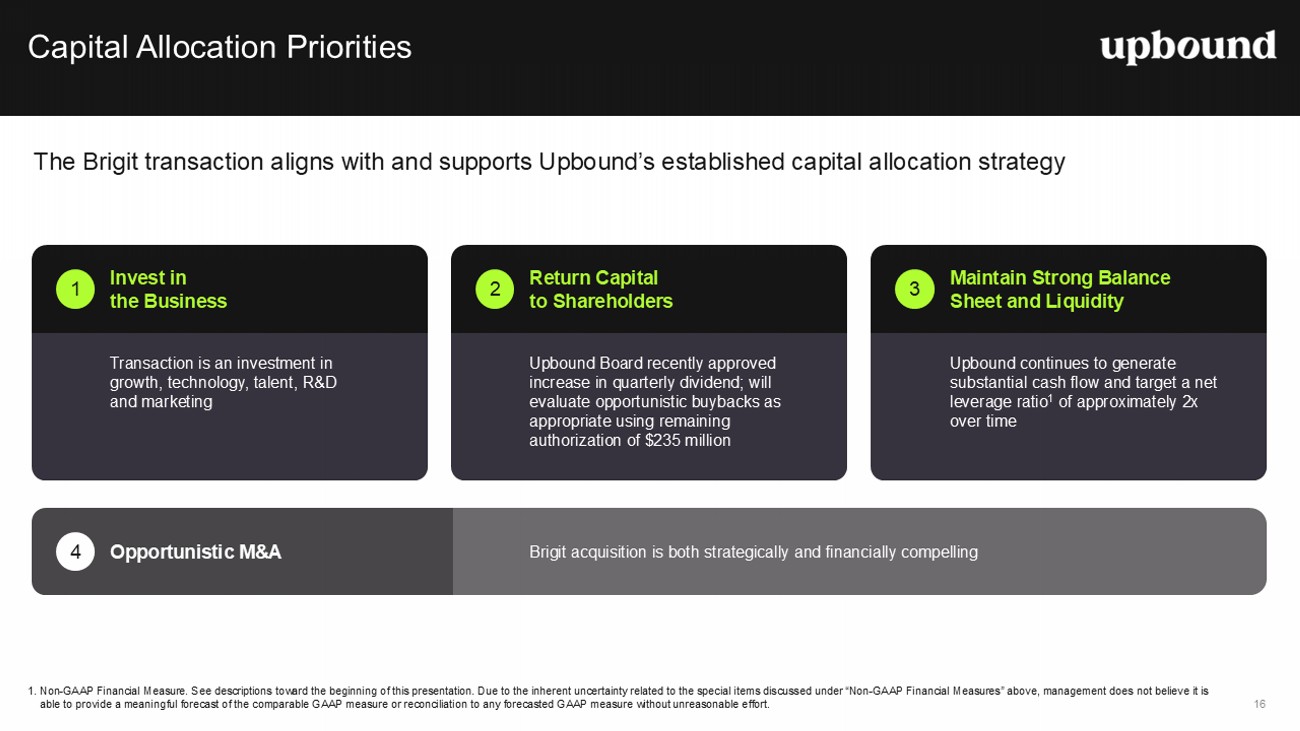

Capital Allocation Priorities 1. Non - GAAP Financial Measure. See descriptions toward the beginning of this presentation. Due to the inherent uncertainty related to the special items discussed under “Non - GAAP Financial Measures” above, management does not believe it is able to provide a meaningful forecast of the comparable GAAP measure or reconciliation to any forecasted GAAP measure without un reasonable effort. 16 Invest in the Business Transaction is an investment in growth, technology, talent, R&D and marketing 1 Opportunistic M&A Brigit acquisition is both strategically and financially compelling 4 The Brigit transaction aligns with and supports Upbound’s established capital allocation strategy Return Capital to Shareholders Upbound Board recently approved increase in quarterly dividend; will evaluate opportunistic buybacks as appropriate using remaining authorization of $235 million 2 Maintain Strong Balance Sheet and Liquidity Upbound continues to generate substantial cash flow and target a net leverage ratio 1 of approximately 2x over time 3

Creating a Financial Home for the Underserved 17 Upbound has agreed to acquire Brigit for up to $460M, including $325M payable at closing ; transaction expected to contribute between $70 million and $80 million of Adjusted EBITDA 1 by 2026 A technology and data - driven leader in accessible and inclusive financial products A leading financial health technology company Creates a sophisticated fintech ecosystem ideally suited to support consumers underserved by the traditional financial system Accelerates expansion of leading customer - centric, tech - enabled consumer leasing platform with new products and services that elevate financial opportunity for all Provides opportunities for enhanced customer experience and deepening relationships based on customer needs and behavior Combines two mission - driven companies building innovative solutions for a sizable, important and overlooked segment of the population 1. Non - GAAP Financial Measure. See descriptions toward the beginning of this presentation. Due to the inherent uncertainty related to the special items discussed under “Non - GAAP Financial Measures” above, management does not believe it is able to provide a meaningful forecast of the comparable GAAP measure or reconciliation to any forecasted GAAP measure without unre aso nable effort.