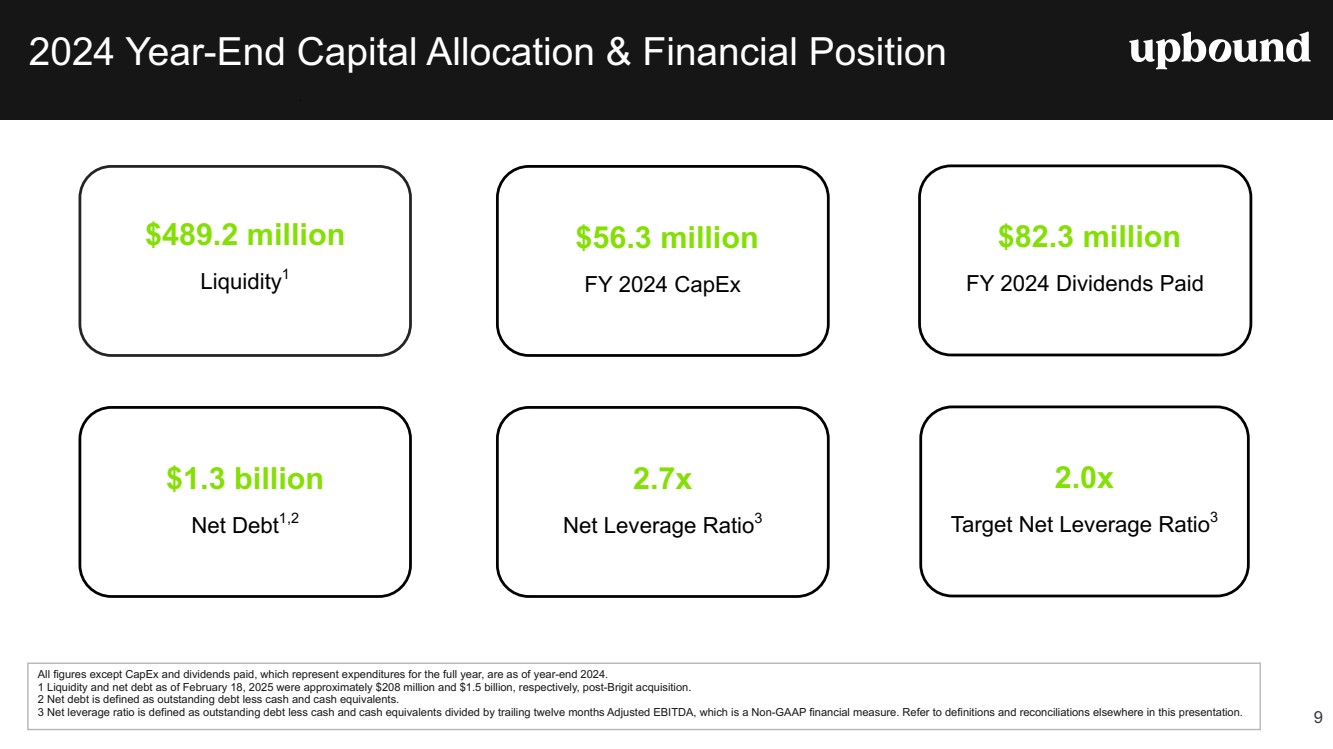

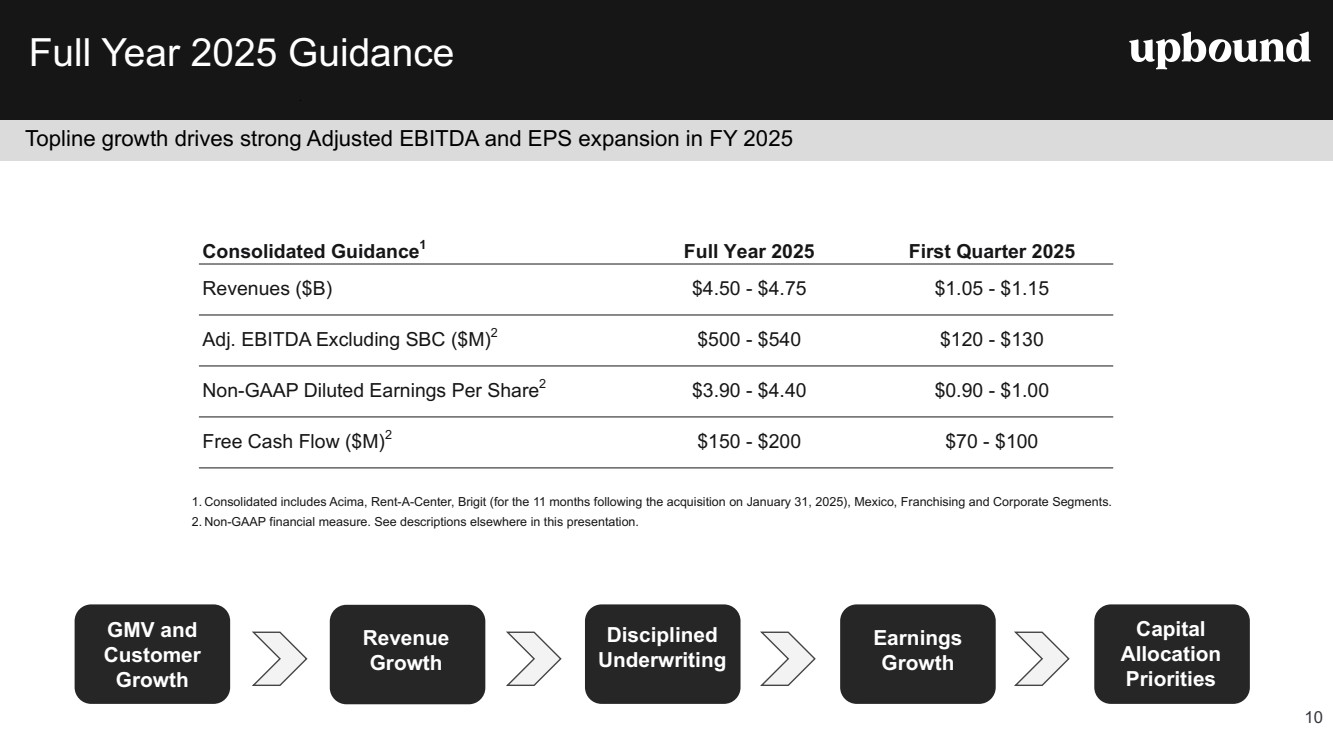

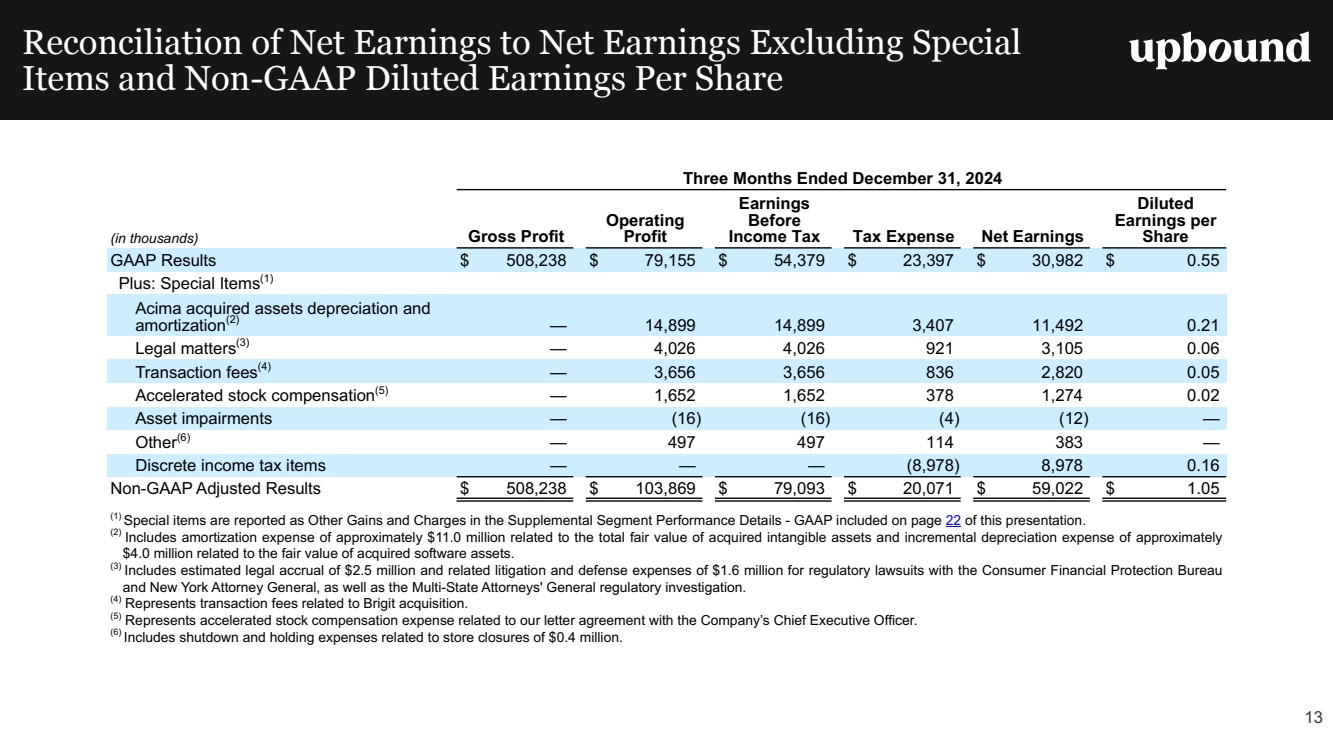

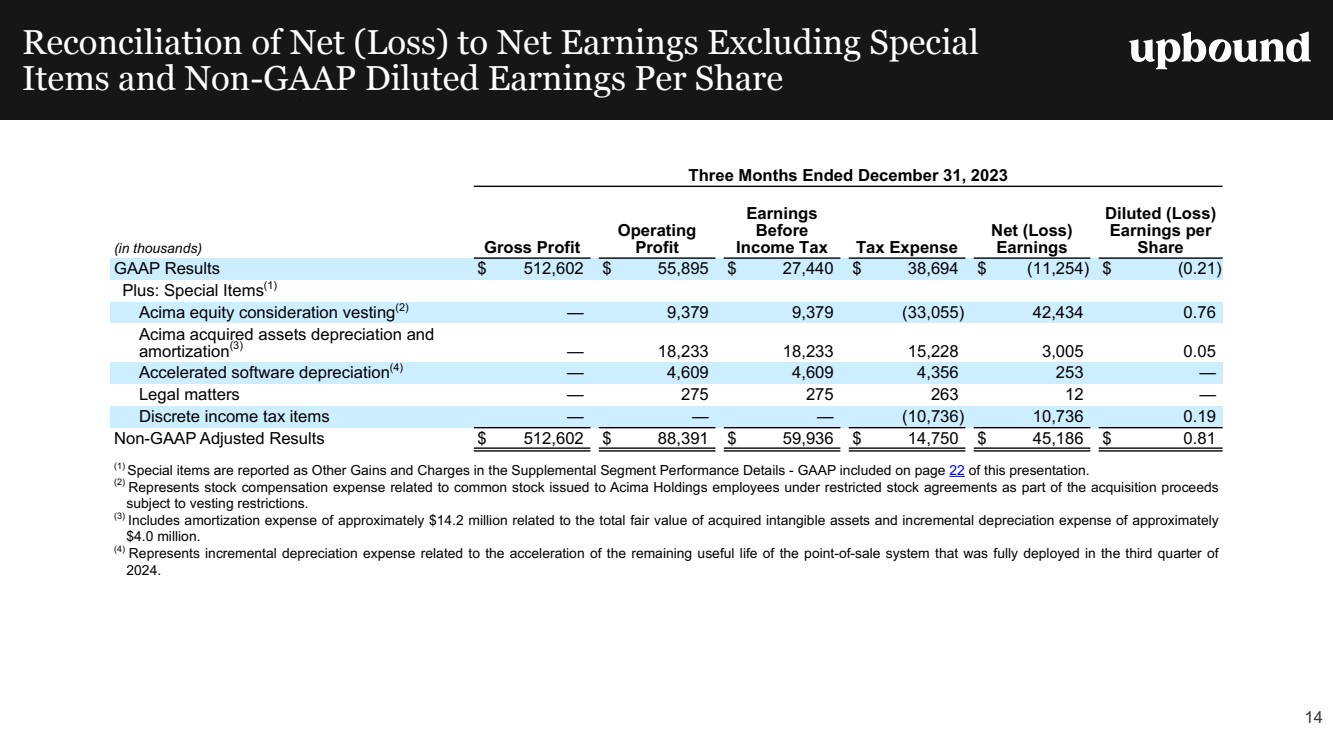

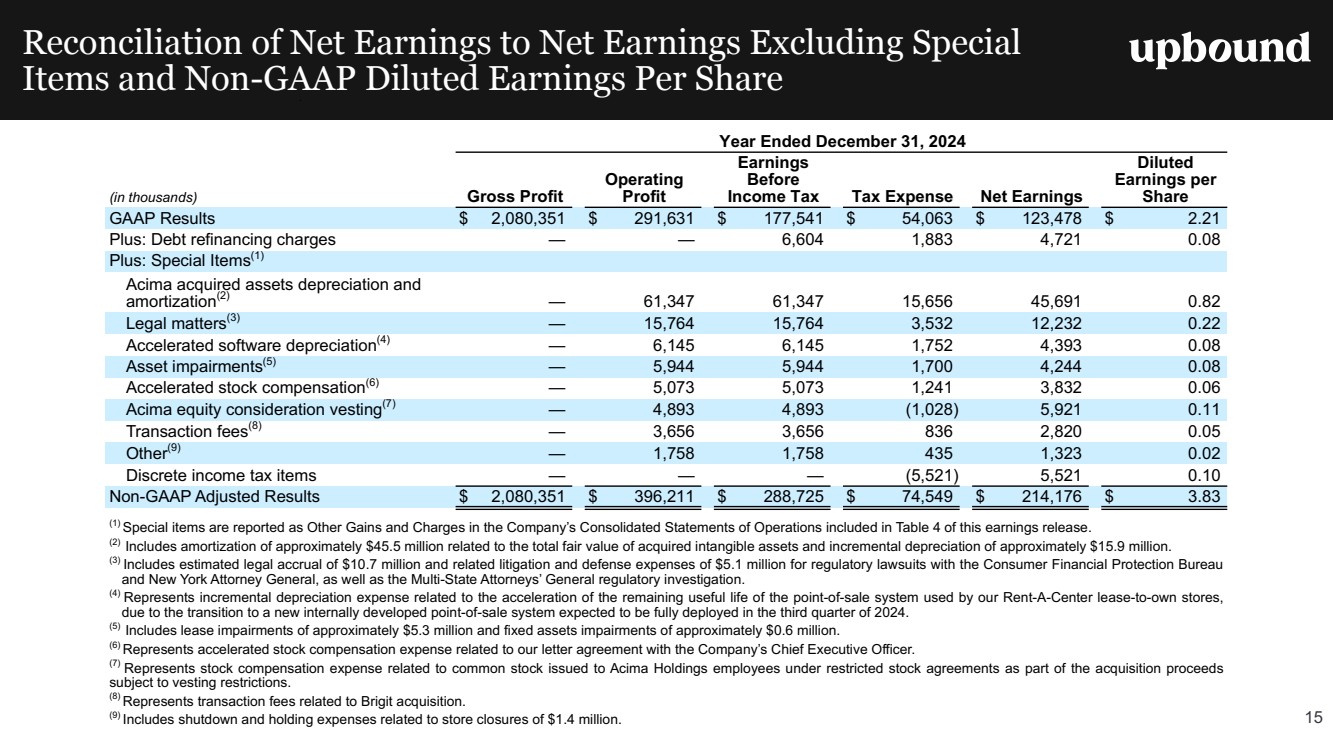

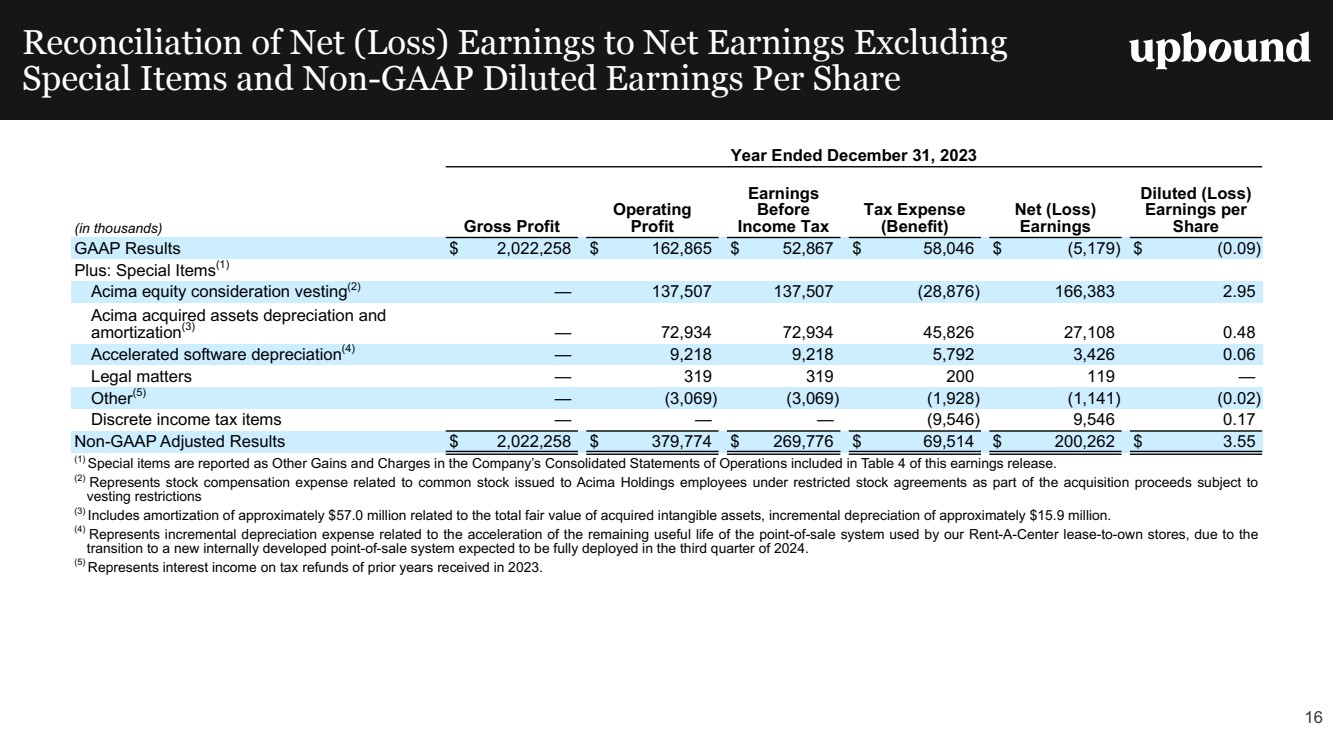

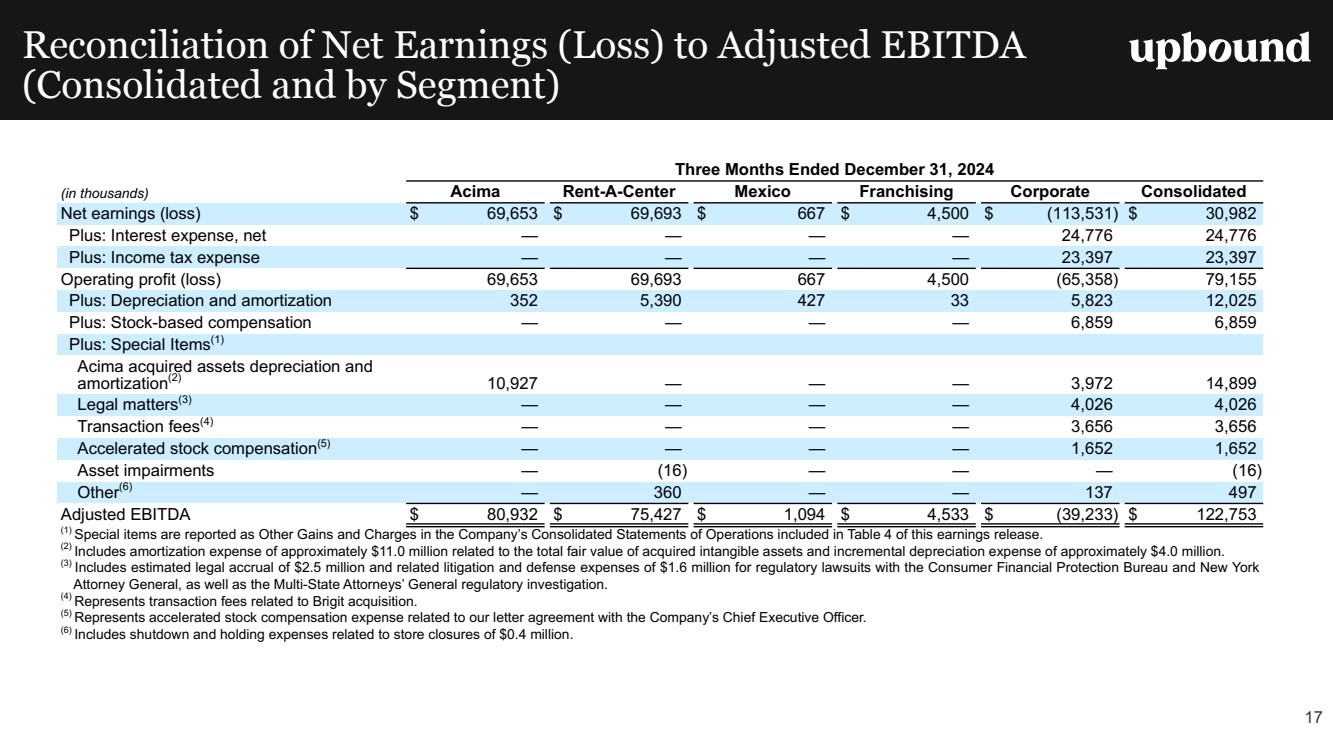

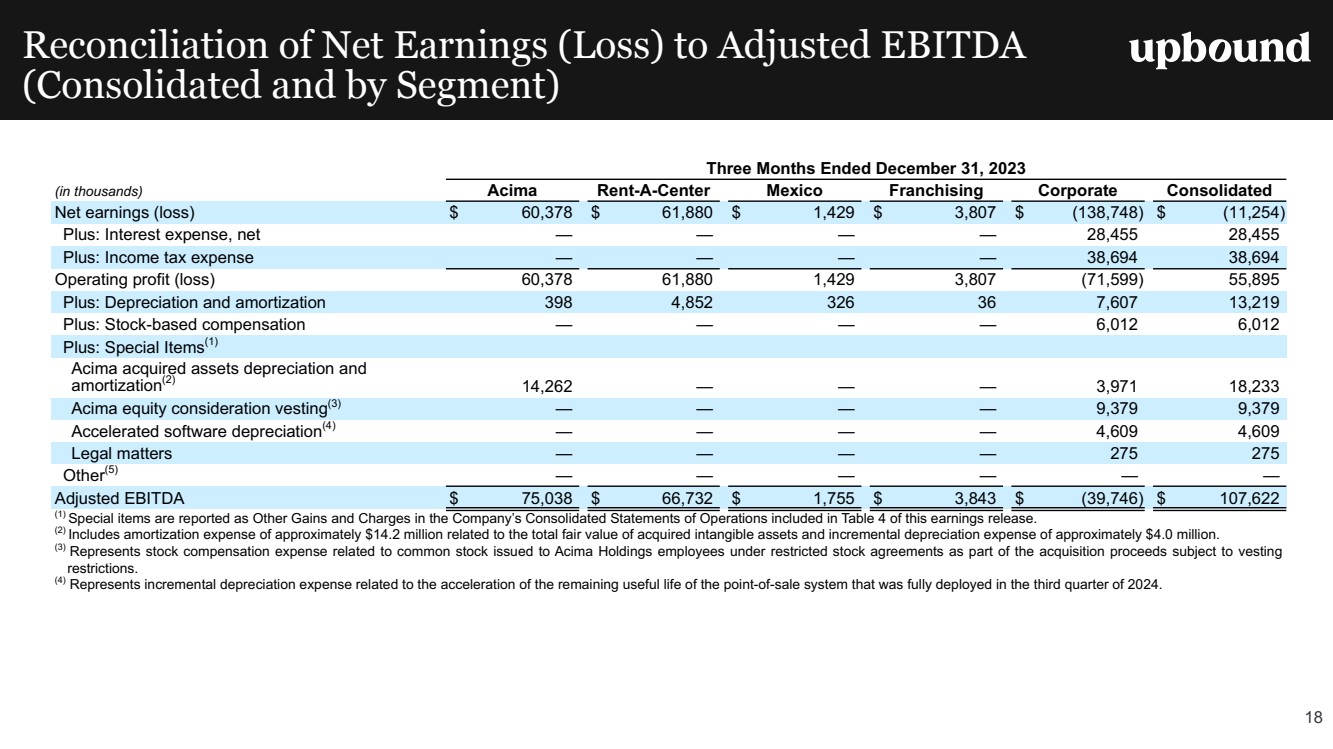

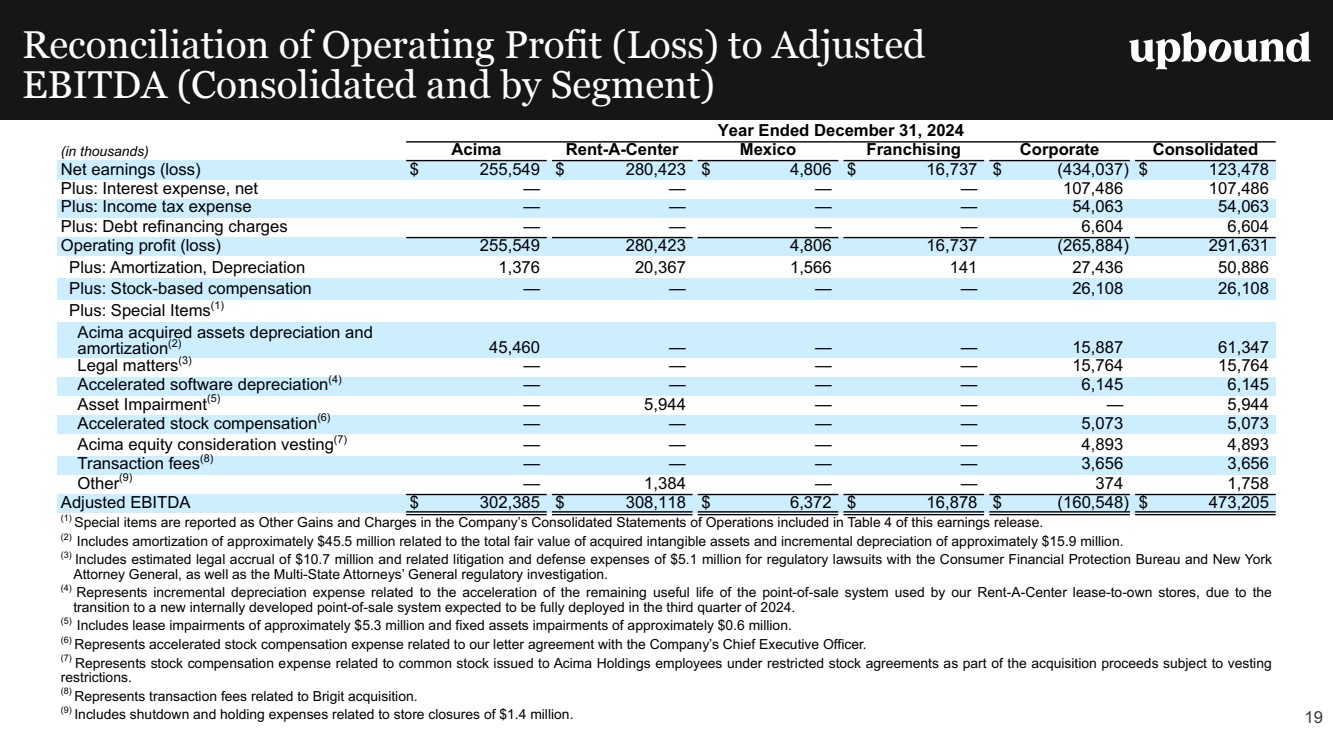

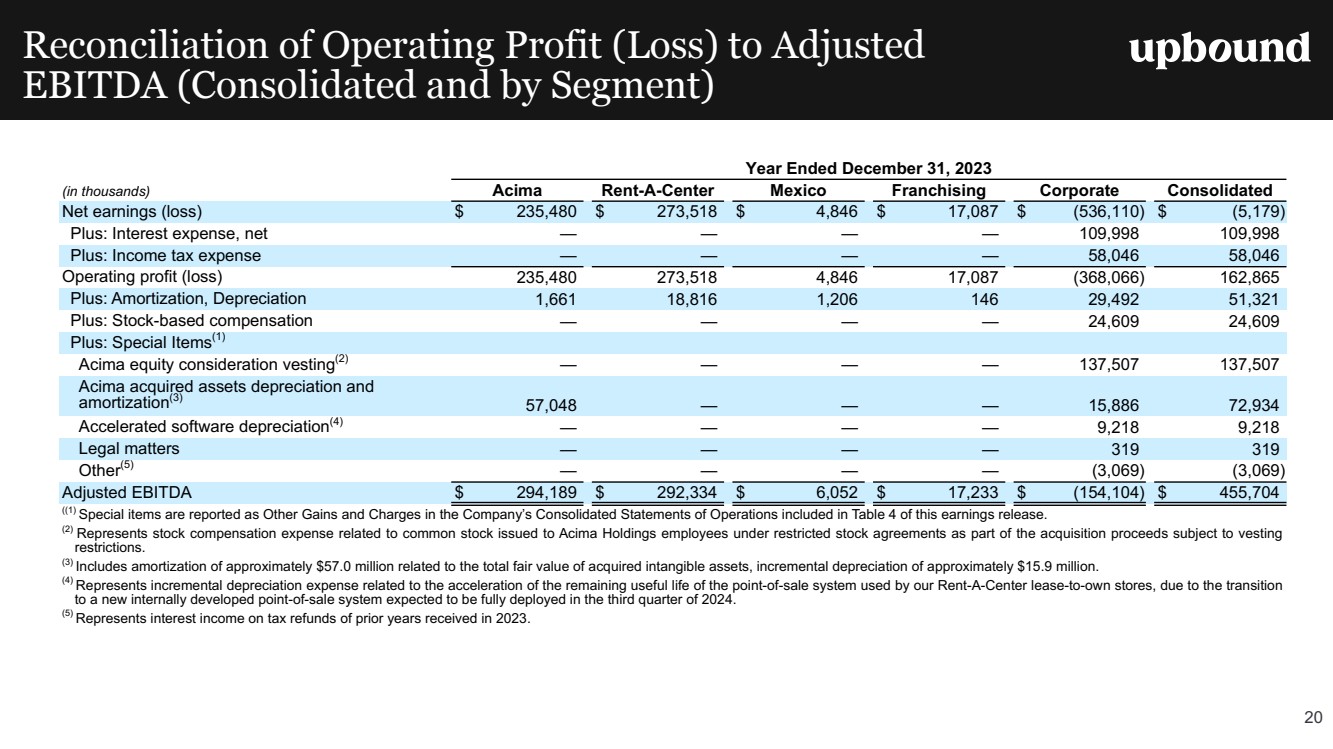

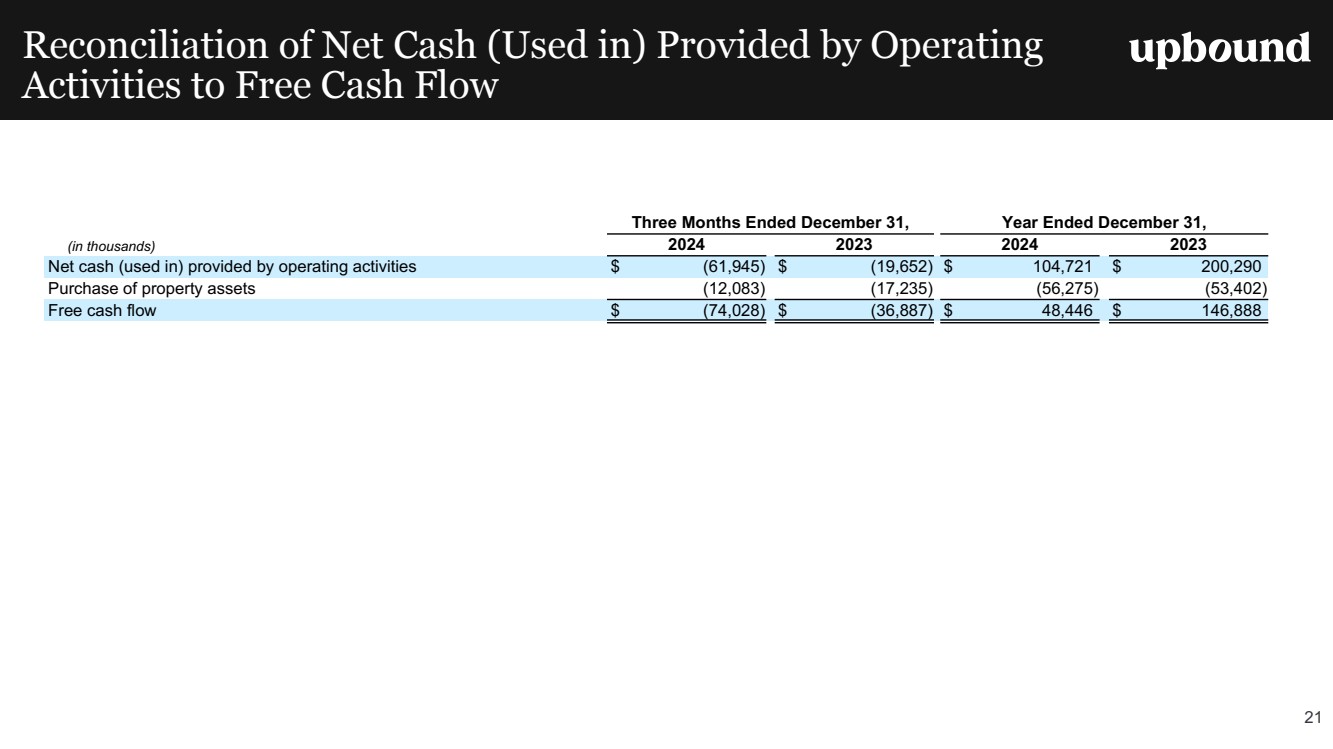

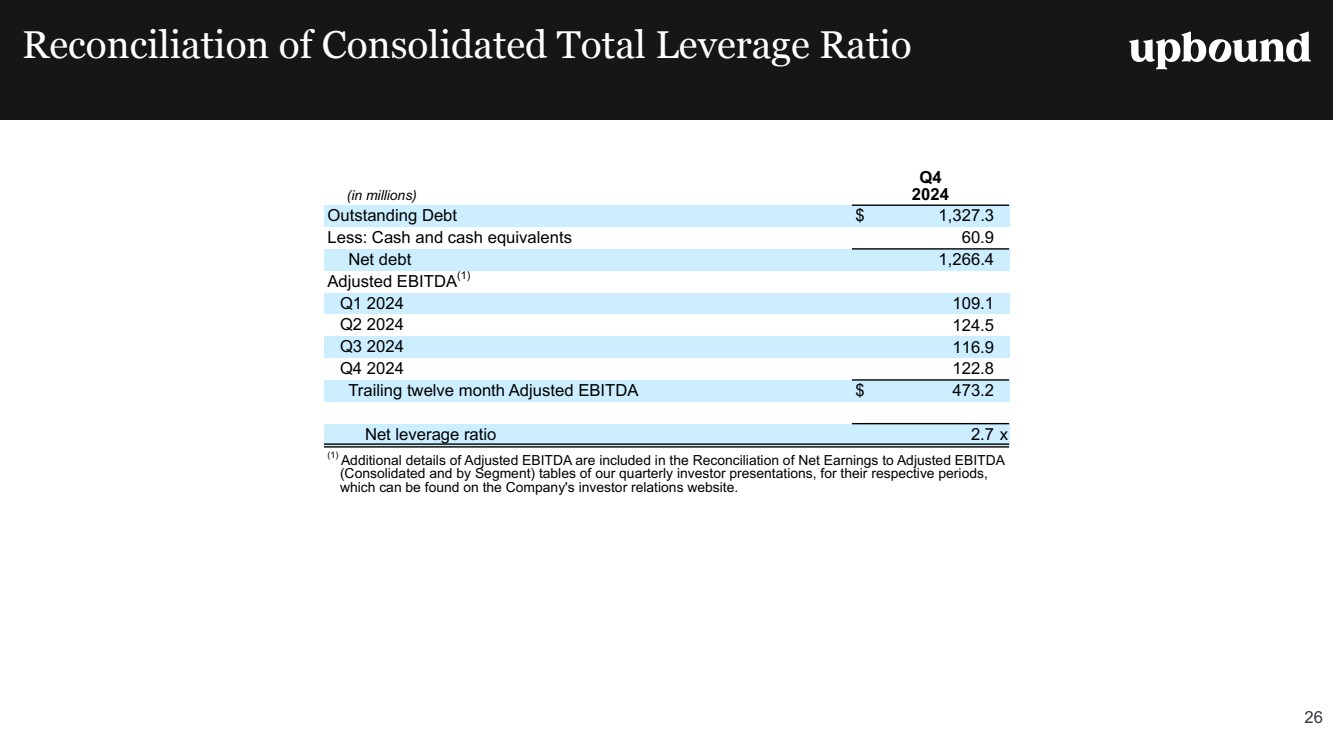

| Disclosures 2 Forward-Looking Statements This communication contains forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995, including, among others, statements regarding our goals, plans and projections with respect to our operations, financial position and business strategy, including those related to the closing of our acquisition of Bridge IT, Inc. ("Brigit") on January 31, 2025. Such forward-looking statements generally can be identified by the use of forward-looking terminology such as "may," "will," "expect," "intend," "could," "estimate," "predict," "continue," “maintain,” "should," "anticipate," "believe," or “confident,” or the negative thereof or variations thereon or similar terminology. Such forward-looking statements are based on particular assumptions that our management has made in light of its experience and its perception of expected future developments and other factors that it believes are appropriate under the circumstances, and are subject to various risks and uncertainties. Factors that could cause or contribute to material and adverse differences between actual and anticipated results include, but are not limited to, (1) the possibility that costs, difficulties or disruptions related to the integration of Brigit operations into our other operations will be greater than expected; (2) the possibility that the anticipated benefits from the Brigit acquisition may not be fully realized or may take longer to realize than expected; (2) our ability to (i) effectively adjust to changes in the composition of our offerings and product mix as a result of acquiring Brigit and continue to maintain the quality of existing offerings and (ii) successfully introduce other new product or service offerings on a timely and cost-effective basis; (3) changes in our future cash requirements as a result of the Brigit acquisition, whether caused by unanticipated increases in capital expenditures or working capital needs, unanticipated liabilities or otherwise; (4) our ability to retain the talent and dedication of key employees of Brigit; (5) the general strength of the economy and other economic conditions affecting consumer preferences and spending, including the availability of credit to the Company's target consumers and to other consumers, impacts from continued inflation, central bank monetary policy initiatives to address inflation concerns and a possible recession or slowdown in economic growth, and (6) the other risks detailed from time to time in the reports filed by us with the Securities and Exchange Commission, including our Annual Report on Form 10-K for the year ended December 31, 2023, as well as subsequent Quarterly Reports on Form 10-Q or Current Reports on Form 8-K. You are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date of this communication. Except as required by law, we are not obligated to, and do not undertake to, publicly release any revisions to these forward-looking statements to reflect any events or circumstances after the date hereof or to reflect the occurrence of unanticipated events. Use of Non-GAAP Financial Measures This communication contains certain financial information determined by methods other than in accordance with U.S. Generally Accepted Accounting Principles (GAAP), including (1) Non-GAAP diluted earnings per share (net earnings or loss, as adjusted for special items (as defined below), net of taxes, divided by the number of shares of our common stock on a fully diluted basis), (2) Adjusted EBITDA (net earnings before interest, taxes, stock-based compensation, depreciation and amortization, as adjusted for special items) on a consolidated and segment basis, (3) Adjusted EBITDA margin (Adjusted EBITDA divided by total revenue) on a consolidated and segment basis, (4) Free Cash Flow (net cash provided by operating activities less capital expenditures), (5) Net debt (outstanding debt less cash and cash equivalents), and (6) Net leverage ratio (outstanding debt less cash and cash equivalents divided by trailing twelve months Adjusted EBITDA). “Special items” refers to certain gains and charges we view as extraordinary, unusual or non-recurring in nature or which we believe do not reflect our core business activities. Special items are reported as Other Gains and Charges in our Consolidated Statements of Operations. For the periods presented herein, these special items are described in the quantitative reconciliation tables included in the appendix of this presentation. Because of the inherent uncertainty related to these special items, management does not believe it is able to provide a meaningful forecast of the comparable GAAP measures or reconciliation to any forecasted GAAP measure without unreasonable effort. These non-GAAP measures are additional tools intended to assist our management in comparing our performance on a more consistent basis for purposes of business decision-making by removing the impact of certain items management believes do not directly reflect our core operations. These measures are intended to assist management in evaluating operating performance and liquidity, comparing performance and liquidity across periods, planning and forecasting future business operations, helping determine levels of operating and capital investments and identifying and assessing additional trends potentially impacting our Company that may not be shown solely by comparisons of GAAP measures. Consolidated Adjusted EBITDA is also used as part of our incentive compensation program for our executive officers and others. We believe these non-GAAP financial measures also provide supplemental information that is useful to investors, analysts and other external users of our consolidated financial statements in understanding our financial results and evaluating our performance and liquidity from period to period. However, non-GAAP financial measures have inherent limitations and are not substitutes for, or superior to, GAAP financial measures, and they should be read together with our consolidated financial statements prepared in accordance with GAAP. Further, because non-GAAP financial measures are not standardized, it may not be possible to compare such measures to the non-GAAP financial measures presented by other companies, even if they have the same or similar names. Note that all sources in this presentation are from Company reports and Company estimates unless otherwise noted. |