Washington Mutual, Inc. and WMI Investment Corp. hereby propose the following joint chapter 11 plan pursuant to section 1121(a) of the Bankruptcy Code:

ARTICLE I

DEFINITIONS

As used in the Plan, the following terms shall have the respective meanings specified below and be equally applicable to the singular and plural of the terms defined:

1.1 Accepting Non-Filing WMB Senior Note Holder: A Non-Filing WMB Senior Note Holder that checks the box on the Non-Filing WMB Senior Note Holder Election Form labeled “Grant Plan Section 43.6 Release”.

1.2 Acquisition JPMC Entities: JPMC in its capacity as the “Acquiring Bank” pursuant to the Purchase and Assumption Agreement and each former subsidiary of WMB acquired pursuant to the Purchase and Assumption Agreement (including each entity into which such former subsidiary may have been merged, consolidated or liquidated), together with JPMC in its capacity as the “Purchaser” pursuant to the Purchase and Assumption Agreement.

1.3 Actions: The “Actions,” as defined in the Global Settlement Agreement.

1.4 Admin Account: That certain account identified as Account No. xxxxxx1206, identified by WMI as having a balance as of the Petition Date in the approximate amount of Fifty Two Million Six Hundred Thousand Dollars ($52,600,000.00).

1.5 Administrative Claim Bar Date: Unless otherwise ordered by the Bankruptcy Court, the date established by the Bankruptcy Court and set forth in the Confirmation Order as the last day to file proof of Administrative Expense Claims, which date shall be no more than ninety (90) days after the Effective Date, after which date, any proof of Administrative Expense Claim not filed shall be deemed forever barred, and the Debtors, the Reorganized Debtors, and the Liquidating Trust shall have no obligation with respect thereto; provide d, however, that no proof of Administrative Expense Claim shall be required to be filed if such Administrative Expense Claim shall have been incurred (i) in accordance with an order of the Bankruptcy Court or (ii) with the consent of the Debtors and in the ordinary course of the Debtors’ operations.

1.6 Administrative Expense Claim: A Claim constituting a cost or expense of administration of the Chapter 11 Cases asserted or authorized to be asserted, on or prior to the Administrative Claim Bar Date, in accordance with sections 503(b) and 507(a)(2) of the Bankruptcy Code arising during the period up to and including the Effective Date, including, without limitation, (i) any actual and necessary cost and expense of preserving the estates of the Debtors, (ii) any actual and necessary cost and expense of operating the businesses of the Debtors in Possession, (iii) any post-Petition Da te loan or advance extended by one Debtor to the other Debtor, (iv) any cost and expense of the Debtors in Possession for the management, maintenance, preservation, sale, or other disposition of any assets, (v) the administration and implementation of the Plan, (vi) the administration, prosecution, or defense of Claims by or against the Debtors and for distributions under the Plan, (vii) any guarantee or indemnification

obligation extended by the Debtors in Possession, (viii) any Claim for compensation and reimbursement of expenses arising during the period from and after the Petition Date and prior to the Effective Date and awarded by the Bankruptcy Court in accordance with section 328, 330, 331, or 503(b) of the Bankruptcy Code or otherwise in accordance with the provisions of the Plan, whether fixed before or after the Effective Date, (ix) any fee or charge assessed against the Debtors’ estates pursuant to section 1930, chapter 123, title 28, United States Code, and (x) any tort or extracontractual claims against the Debtors in Possession.

1.7 Affiliate: With respect to any specified Entity, any other Person that directly, or indirectly through one or more intermediaries, controls, is controlled by, or is under common control with, such specified entity.

1.8 Affiliated Banks: WMB and FSB.

1.9 Allowed Administrative Expense Claim: An Administrative Expense Claim, to the extent it is or has become an Allowed Claim.

1.10 Allowed CCB-1 Guarantees Claim: A CCB-1 Guarantees Claim, to the extent set forth on Exhibit “A” hereto.

1.11 Allowed CCB-2 Guarantees Claim: A CCB-2 Guarantees Claim, to the extent set forth on Exhibit “B” hereto.

1.12 Allowed Claim: A Claim against any of the Debtors or the Debtors’ estates, (i) proof of which was filed on or before the date designated by the Bankruptcy Court as the last date for filing such proof of claim against any such Debtor or such Debtor’s estate, or (ii) if no proof of Claim has been timely filed, which has been or hereafter is listed by such Debtor in its Schedules as liquidated in amount and not disputed or contingent, in each such case in clauses (i) and (ii) above, a Claim as to which no objection to the allowance thereof, or action to equitably subordin ate or otherwise limit recovery with respect thereto, has been interposed within the applicable period of limitation fixed by the Plan, the Bankruptcy Code, the Bankruptcy Rules, or a Final Order, or as to which an objection has been interposed and such Claim has been allowed in whole or in part by a Final Order. For purposes of determining the amount of an “Allowed Claim,” there shall be deducted therefrom an amount equal to the amount of any claim that the Debtors may hold against the holder thereof, to the extent such claim may be set off pursuant to applicable bankruptcy and non-bankruptcy law. Without in any way limiting the foregoing, “Allowed Claim” shall include any Claim arising from the recovery of property in accordance with sections 550 and 553 of the Bankruptcy Code and allowed in accordance with section 502(h) of the Bankruptcy Code, any Claim allowed under or pursuant to the terms of the Plan, or any Claim to the extent that it has been allowed pur suant to a Final Order; provided, however, that (i) Claims allowed solely for the purpose of voting to accept or reject the Plan pursuant to an order of the Bankruptcy Court shall not be considered “Allowed Claims” hereunder unless otherwise specified herein or by order of the Bankruptcy Court, (ii) for any purpose under the Plan, “Allowed Claim” shall not include interest, penalties, or late charges arising from or relating to the period from and after the Petition Date, and (iii) “Allowed Claim” shall not include any Claim subject to disallowance in accordance with section 502(d) of the Bankruptcy Code. Notwithstanding the foregoing, a WMB Senior Notes Claim may become an

Allowed WMB Senior Notes Claim (in an amount equal to the principal balance thereof plus all interest accrued thereunder as of the Petition Date) in the manner provided for in Section 21.1(a) hereof.

1.13 Allowed Convenience Claim: A Convenience Claim, to the extent it is or has become an Allowed Claim.

1.14 Allowed General Unsecured Claim: A General Unsecured Claim, to the extent it is or has become an Allowed Claim.

1.15 Allowed JPMC Assumed Liability Claim: A JPMC Assumed Liability Claim, to the extent it is or has become an Allowed Claim.

1.16 Allowed Late-Filed Claim: A Late-Filed Claim to the extent it is or has become an Allowed Claim.

1.17 Allowed PIERS Claim: A PIERS Claim, to the extent set forth on Exhibit “C” hereto.

1.18 Allowed Priority Non-Tax Claim: A Priority Non-Tax Claim, to the extent it is or has become an Allowed Claim.

1.19 Allowed Priority Tax Claim: A Priority Tax Claim, to the extent it is or has become an Allowed Claim.

1.20 Allowed Senior Notes Claim: A Senior Notes Claim, to the extent set forth on Exhibit “D” hereto.

1.21 Allowed Senior Subordinated Notes Claim: A Senior Subordinated Notes Claim, to the extent set forth on Exhibit “E” hereto.

1.22 Allowed Subordinated Claim: A Subordinated Claim, to the extent it is or has become an Allowed Claim.

1.23 Allowed Trustee Claim: A Trustee Claim, to the extent it is or has become an Allowed Claim.

1.24 Allowed Unsecured Claim: An Unsecured Claim, to the extent it is or has become an Allowed Claim.

1.25 Allowed WMB Senior Notes Claim: A WMB Senior Notes Claim, to the extent it is or has become an Allowed Claim.

1.26 Allowed WMB Vendor Claim: A WMB Vendor Claim, to the extent it is or has become an Allowed Claim.

1.27 Allowed WMI Vendor Claim: A WMI Vendor Claim, to the extent it is or has become an Allowed Claim.

1.28 American Savings Escrow Funds: All funds held in escrow in connection with the American Savings Litigation, pursuant to that certain Escrow Agreement, dated December 20, 1996, by and among WMI, Keystone Holdings Partners, L.P., Escrow Partners, L.P. and The Bank of New York.

1.29 American Savings Litigation: That certain litigation styled American Savings Bank, F.A. v. United States, No. 92-872C, currently pending in the United States Court of Federal Claims.

1.30 Anchor Litigation: That certain litigation styled Anchor Savings Bank, FSB v. United States, No. 95-39C, currently pending in the United States Court of Federal Claims, and on appeal in the United States Court of Appeals for the Federal Circuit, as Anchor Savings Bank, FSB v. United States, No. 2008-5175, -5182.

1.31 Assets: With respect to a Debtor, (i) all “property” of such Debtor’s estate, as defined in section 541 of the Bankruptcy Code, including, without limitation, such property as is reflected on such Debtor’s books and records as of the date of the Disclosure Statement Order (including, without limitation, received and anticipated “Net Tax Refunds,” as defined in the Global Settlement Agreement) and certain Plan Contribution Assets transferred to such Debtor pursuant to the Global Settlement Agreement, unless modified pursuant to the Plan or a Fina l Order, and except as transferred pursuant to the Global Settlement Agreement and (ii) all claims and causes of action, and any subsequent proceeds thereof, that have been or may be commenced by such Debtor in Possession or other authorized representative for the benefit of such Debtor’s estate, unless modified pursuant to the Plan or a Final Order, including, without limitation, any claim or cause of action pursuant to chapter 5 of the Bankruptcy Code.

1.32 Avoidance Actions: Any and all avoidance, recovery, subordination or other actions or remedies against Entities that may be brought by or on behalf of a Debtor or its estate under the Bankruptcy Code or applicable non-bankruptcy law, including, without limitation, actions, settlements or remedies under sections 510, 542, 543, 544, 545, 547, 548, 549, 550, 551, 552 and 553 of the Bankruptcy Code.

1.33 Ballot: The form distributed to each holder of an impaired Claim entitled to vote on the plan (as set forth herein), on which is to be indicated, among other things, acceptance or rejection of the Plan.

1.34 Ballot Date: The date(s) established by the Bankruptcy Court and set forth in the Disclosure Statement Order or the Supplemental Disclosure Statement Order, as the case may be, for the submission of Ballots and the election of alternative treatments pursuant to the terms and provisions of the Plan.

1.35 Bankruptcy Code: The Bankruptcy Reform Act of 1978, as amended, to the extent codified in title 11, United States Code, as applicable to the Chapter 11 Cases.

1.36 Bankruptcy Court: The United States Bankruptcy Court for the District of Delaware or such other court having jurisdiction over the Chapter 11 Cases.

1.37 Bankruptcy Rules: The Federal Rules of Bankruptcy Procedure, as promulgated by the United States Supreme Court under section 2075 of title 28 of the United States Code, as applicable to the Chapter 11 Cases.

1.38 Bankruptcy Stay Motions: The motions by the FDIC Receiver and JPMC to stay or dismiss the Turnover Action and the JPMC Action in favor of proceedings before the United States District Court for the District of Columbia in the WMI Action.

1.39 BB Liquidating Trust Interests: Those certain Liquidating Trust Interests that are to be distributed to holders of Allowed WMB Senior Notes Claims and Accepting Non-Filing WMB Senior Note Holders, which interests, in the aggregate, shall represent an undivided interest in WMI’s share of the Homeownership Carryback Refund Amount, as defined and set forth in Section 2.4 of the Global Settlement Agreement, in an amount equal to Three Hundred Thirty-Five Million Dollars ($335,000,000.00).

1.40 Benefit Plan: Any employee welfare benefit plan, employee pension benefit plan, or a plan that is both an employee welfare benefit plan and an employee pension benefit plan within the meaning of Section 3(3) of ERISA, including, without limitation, those benefit plans listed on Exhibit “F” hereto, or any such similar employee benefit plan or arrangement that any of the Debtors maintained prior to the Petition Date; provided, however, that th e term “Benefit Plan” does not include the WaMu Savings Plan (#002) and does not include any plan policy, or arrangement transferred to JPMC pursuant to the Global Settlement Agreement.

1.41 BKK Group: Collectively, the BKK Joint Defense Group, as defined in the BKK Settlement Agreement, Atlantic Richfield Corporation, THUMS Long Beach Company, Shell Exploration & Production Company, Shell Oil Company and Bayer CropScience Inc.

1.42 BKK Liabilities: Any and all liabilities and obligations of the WMI Entities (other than WMI Rainier LLC) for remediation or clean-up costs and expenses (and excluding tort and tort related liabilities, if any) in excess of applicable and available insurance arising from or relating to (i) the BKK Litigation, (ii) the Amended Consent Decree, dated March 6, 2006, entered in connection therewith, and (iii) that certain Amended and Restated Joint Defense, Privilege and Confidentiality Agreement, dated as of February 28, 2005, by and among the BKK Joint Defense Group, as defined there in.

1.43 BKK Litigation: That certain litigation styled California Department of Toxic Substances Control, et al. v. American Honda Motor Co., Inc., et al., No. CV05-7746 CAS (JWJx), currently pending in the United States District Court for the Central District of California.

1.44 BKK Proofs of Claim: The BKK Liabilities-related proofs of claim filed against the Debtors and the Debtors’ chapter 11 estates numbered 2138, 2213, 2233, 2405, 2467, 2693 and 3148.

1.45 BKK Settlement Agreement: That certain Settlement Agreement, dated as of December 3, 2010, by and among the Debtors, JPMC, the CDTSC and the BKK Group, setting forth the compromise and settlement between the parties.

1.46 Bond Claim: Any Claim against the Debtors set forth on Schedule 2.23 to the Global Settlement Agreement filed by any of the Bonding Companies, to the extent such Claim constitutes an Allowed JPMC Assumed Liability Claim.

1.47 Bond Indemnity: That certain General Agreement of Indemnity, as amended, dated as of June 14, 1999, executed and delivered by WMI, pursuant to which, among other things, the Bonds were to be issued and WMI agreed to pay all losses and expenses of the Bonding Companies associated therewith.

1.48 Bonding Companies: Safeco Insurance Company and such other insurance or bonding companies that issued Bonds pursuant to the Bond Indemnity.

1.49 Bonds: The bonds issued by the Bonding Companies on behalf of one or more of the Affiliated Banks or their Affiliates, each as identified on Exhibit “D” to the Global Settlement Agreement, together with the numbers of the respective proofs of Claim that have been filed with the Bankruptcy Court in connection therewith.

1.50 Business Day: A day other than a Saturday, Sunday, or any other day on which commercial banking institutions in New York, New York are required or authorized to close by law or executive order.

1.51 Cash: Lawful currency of the United States, including, but not limited to, bank deposits, checks representing good funds, and other similar items.

1.52 Cash Equivalents: Equivalents of Cash in the form of readily marketable securities or instruments issued by a person other than the Debtors, including, without limitation, readily marketable direct obligations of, or obligations guaranteed by, the United States of America, commercial paper of domestic corporations carrying a Moody’s Rating of “A” or better, or equivalent rating of any other nationally recognized rating service, or interest-bearing certificates of deposit or other similar obligations of domestic banks or other financial institutions having a share holders’ equity or equivalent capital of not less than One Hundred Million Dollars ($100,000,000.00), having maturities of not more than one (1) year, at the then best generally available rates of interest for like amounts and like periods.

1.53 Causes of Action: All Claims, actions, causes of action, rights to payment, choses in action, suits, debts, dues, sums of money, accounts, reckonings, bonds, bills, specialties, covenants, contracts, controversies, agreements, promises, variances, trespasses, damages, judgments, remedies, rights of set-off, third-party claims, subrogation claims, contribution claims, reimbursement claims, indemnity claims, counterclaims, and cross claims (including, but not limited to, all claims for breach of fiduciary duty, negligence, malpractice, breach of contract, aiding and abetting, fraud, inducement, avoidance, recovery, subordination, and all Avoidance Actions) of any of the Debtors and/or their estates that are pending or may be asserted against any Entity on or after the date hereof, based in law or equity, including, but not limited to, under the Bankruptcy Code, whether known, unknown, reduced to judgment, not

reduced to judgment, liquidated, unliquidated, fixed, contingent, matured, unmatured, disputed, undisputed, secured or unsecured and whether assented or assertable directly or derivatively, in law, equity or otherwise and whether asserted or unasserted as of the date of entry of the Confirmation Order.

1.54 CCB-1 Common Securities: The common securities set forth on Exhibit “A” hereto.

1.55 CCB-1 Guarantees: The guarantees issued and delivered by WMI in accordance with the terms and conditions of the CCB-1 Guarantee Agreements, and set forth on Exhibit “A” hereto.

1.56 CCB-1 Guarantees Claim: An Unsecured Claim arising from or relating to the CCB-1 Guarantees.

1.57 CCB-1 Guarantee Agreements: Those certain agreements titled “Guarantee of Washington Mutual, Inc.,” dated as of November 1, 2007, pursuant to which WMI guaranteed payment of the obligations and liabilities of WMB under certain agreements and related securities issued by the CCB Capital Trust IV, CCB Capital Trust V, CCB Capital Trust VII, and CCB Capital Trust VIII.

1.58 CCB-1 Preferred Securities: The preferred securities set forth on Exhibit “A” hereto.

1.59 CCB-1 Trustee: Wilmington Trust Company, as Trustee, or its duly appointed successor, solely in its capacity as trustee with regard to each of the CCB-1 Guarantee Agreements.

1.60 CCB-2 Common Securities: The common securities set forth on Exhibit “B” hereto.

1.61 CCB-2 Guarantees: The guarantees issued and delivered by WMI in accordance with the terms and conditions of the CCB-2 Guarantee Agreements, and set forth on Exhibit “B” hereto.

1.62 CCB-2 Guarantees Claim: An Unsecured Claim arising from or relating to the CCB-2 Guarantees.

1.63 CCB-2 Guarantee Agreements: Those certain agreements titled “Guarantee of Washington Mutual, Inc.,” dated as of November 1, 2007, pursuant to which WMI guaranteed payment of the obligations and liabilities of WMB under certain agreements and related securities issued by the HFC Capital Trust I, CCB Capital Trust VI, and CCB Capital Trust IX.

1.64 CCB-2 Preferred Securities: The preferred securities set forth on Exhibit “B” hereto.

1.65 CCB-2 Trustees: Wilmington Trust Company, as Trustee, and Deutsche Bank Trust Company Americas, as Trustee, or their duly appointed successors, solely in their capacities as trustees with regard to each of the CCB-2 Guarantee Agreements.

1.66 CDTSC: California Department of Toxic Substances Control.

1.67 Chapter 11 Cases: The jointly administered cases commenced by the Debtors styled as In re Washington Mutual, Inc., et al. and being jointly administered in the Bankruptcy Court, Case No. 08-12229 (MFW), under chapter 11 of the Bankruptcy Code.

1.68 Claim: Any right to payment or performance, whether or not such right is reduced to judgment, liquidated, unliquidated, fixed, contingent, matured, unmatured, disputed, undisputed, legal, equitable, secured, or unsecured, known or unknown or asserted or unasserted; or any right to an equitable remedy for breach or enforcement of performance, whether or not such right to an equitable remedy is reduced to judgment, fixed, contingent, matured, unmatured, disputed, undisputed, secured, or unsecured, and all debts, suits, damages, rights, remedies, losses, liabilities, obligations, jud gments, actions, causes of action, demands, or claims of every kind or nature whatsoever, in law, at equity, or otherwise.

1.69 Class: A category of holders of Claims or Equity Interests set forth in Article IV of the Plan.

1.70 Common Equity Interest: An Equity Interest represented by the 3,000,000,000 authorized shares of common stock of WMI, including, without limitation, one of the 1,704,958,913 shares of common stock of WMI issued and outstanding as of the Petition Date, or any interest or right to convert into such an Equity Interest or acquire any Equity Interest of WMI that was in existence immediately prior to or on the Petition Date.

1.71 Confirmation Date: The date on which the Clerk of the Bankruptcy Court enters the Confirmation Order on the docket.

1.72 Confirmation Hearing: The hearing conducted by the Bankruptcy Court pursuant to section 1128(a) of the Bankruptcy Code to consider confirmation of the Plan, as such hearing may be adjourned or continued from time to time.

1.73 Confirmation Order: The order of the Bankruptcy Court confirming the Plan in accordance with section 1129 of the Bankruptcy Code, approving the compromise and settlement set forth in the Global Settlement Agreement and directing the consummation of the transactions contemplated therein, which order shall be in form and substance satisfactory to the Debtors, JPMC, the Creditors’ Committee and the FDIC Receiver and FDIC Corporate.

1.74 Convenience Claim: A Claim equal to or less than Fifty Thousand Dollars ($50,000.00) or greater than Fifty Thousand Dollars ($50,000.00) but, with respect to which, the holder thereof voluntarily reduces such Claim to Fifty Thousand Dollars ($50,000.00) on the Ballot; provided, however, that, for purposes of the Plan and the distributions to be made hereunder, “Convenience Claim” shall not include (i) an Administrative Expense Claim, (ii) a Priority Tax Claim, (iii) a Priority Non-Tax Claim, (iv) a Senior Notes Claim, (v) a Senior Subordinated Notes Claim, (vi) any JPMC Assumed Liability Claim, (vii) a WMB Vendor

Claim, (viii) a WMI Vendor Claim, (ix) a CCB-1 Guarantees Claim, (x) a CCB-2 Guarantees Claim, (xi) a PIERS Claim, (xii) a WMB Notes Claim, (xiii) a Subordinated Claim, (xiv) a Trustee Claim, (xv) a Late-Filed Claim, and (xvi) any other Claim that is a component of a larger Claim, portions of which may be held by one or more holders of Allowed Claims.

1.75 Creditor: Any Entity holding a Claim against one or more of the Debtors or the Debtors’ estates or, pursuant to section 102(2) of the Bankruptcy Code, against property of the Debtors, including, without limitation, a Claim against either one of the Debtors or Debtors in Possession of a kind specified in section 502(g), 502(h), or 502(i) of the Bankruptcy Code.

1.76 Creditor Cash: On the Effective Date (or as soon as practicable thereafter when the Disbursing Agent is prepared to make its initial distribution pursuant to Section 32.1 of the Plan), the excess, if any, of (i) all Cash and Cash Equivalents to be distributed by the Disbursing Agent in accordance with the Plan over (ii) such amounts of Cash (a) reasonably determined by the Disbursing Agent as necessary to satisfy, in accordance with the terms and conditions of the Plan, Allowed Administrative Expense Claims, Allowed Priority Tax Claims (to the extent necessary), Allowed Priority N on-Tax Claims, Allowed Convenience Claims, Trustee Claims, the fees and expenses owed to certain Creditors’ professionals pursuant to Section 43.18 herein, and fees and expenses of the Disbursing Agent as of the Effective Date, (b) necessary to fund the Liquidating Trust in accordance with Article XXVIII of the Plan, as reasonably determined by the Debtors, (c) necessary to make pro rata distributions to holders of Disputed Claims as if such Disputed Claims were, at such time, Allowed Claims, (d) necessary to make pro rata distributions to holders of Administrative Expense Claims that have not yet been filed or Allowed as of the Effective Date, and (e) such other amounts reasonably determined by the Disbursing Agent (in consultation with the Liquidating Trustee) as necessary to fund the ongoing operations of the Liquidating Trust during the period from the Effective Date up to and including such later date as the Disbursing Agent shall reasonably determine; provided, however, that “Creditor Cash” shall include Cash in the Vendor Escrow only to the extent of WMI’s share of Cash remaining in such escrow after payment of Allowed WMI Vendor Claims.

1.77 Creditors’ Committee: The official committee of unsecured creditors appointed in the Chapter 11 Cases pursuant to section 1102(a) of the Bankruptcy Code.

1.78 Debtors: WMI and WMI Investment.

1.79 Debtors’ Claims: The proof of claim filed by the Debtors and each of WMI’s direct and indirect non-banking subsidiaries, on December 30, 2008, with the FDIC Receiver in connection with WMB’s receivership, asserting claims on behalf of the Debtors’ chapter 11 estates, and as asserted in the WMI Action.

1.80 Debtors in Possession: The Debtors as debtors in possession pursuant to sections 1101(1), 1107(a), and 1108 of the Bankruptcy Code.

1.81 Dime Inc.: Dime Bancorp, Inc.

1.82 Dime Warrant Litigation: That certain litigation styled Broadbill Investment Corp., et al. v. Washington Mutual, Inc., Adversary Pro. No. 10-50911 (MFW), currently pending in the Bankruptcy Court.

1.83 Dime Warrants: Those certain Litigation Tracking Warrants™ for shares of Dime Inc. common stock based on the value of the recovery in the Anchor Litigation, which warrants, as a result of the merger of Dime Inc. into WMI, are now exchangeable for and into shares of Common Equity Interests in WMI upon certain conditions.

1.84 Disbursing Agent: With respect to (a) the initial distribution of (i) Cash pursuant to Article III of the Plan to holders of Allowed Administrative Expense Claims and, to the extent applicable, Allowed Priority Tax Claims as of the Effective Date, (ii) Cash to holders of Allowed Priority Non-Tax Claims as of the Effective Date, (iii) Cash to holders of Allowed Convenience Claims, Allowed WMI Claims, Trustee Claims, and the fees and expenses owed to certain Creditors’ professionals pursuant to Section 43.18 hereof, in each case as of the Effective Date, (iv) Creditor Cash pur suant to Section 32.1 hereof, and (v) Reorganized Common Stock and Liquidating Trust Interests to or for the benefit of holders of Allowed Senior Notes Claims, Allowed Senior Subordinated Notes Claims, Allowed CCB-1 Guarantees Claims, Allowed CCB-2 Guarantees Claims, Allowed PIERS Claims, and Allowed Late-Filed Claims, as applicable, the Reorganized Debtors or the Reorganized Debtors’ designee and (b) with respect to all other distributions, the Liquidating Trustee or any Entity in its capacity as a disbursing agent. The Disbursing Agent also shall, at the election of JPMC, make the distribution to each Releasing REIT Trust Holder set forth in Article XXIII of the Plan from Cash or stock transferred by JPMC to the Disbursing Agent for that purpose. In their role as Disbursing Agent, the Reorganized Debtors shall hold Cash, Creditor Cash, Reorganized Common Stock, and Liquidating Trust Interests as agent only, and shall not have any ownership interest in such cash, stock or interes ts.

1.85 Disclosure Statement: The disclosure statement relating to the Plan and approved by the Bankruptcy Court pursuant to section 1125 of the Bankruptcy Code.

1.86 Disclosure Statement Order: The Final Order of the Bankruptcy Court approving the Disclosure Statement in accordance with section 1125 of the Bankruptcy Code.

1.87 Disputed Accounts: The amounts and intercompany balances identified with the account numbers set forth on Exhibit “E” to the Global Settlement Agreement.

1.88 Disputed Claim: A Claim against the Debtors, to the extent the allowance of such Claim is the subject of a timely objection or request for estimation in accordance with the Plan, the Bankruptcy Code, the Bankruptcy Rules, or the Confirmation Order, or is otherwise disputed by the Debtors in accordance with applicable law, and which objection, request for estimation, or dispute has not been withdrawn, with prejudice, or determined by a Final Order.

1.89 Distribution Record Date: The Effective Date.

1.90 Effective Date: The first (1st) Business Day on which (i) the Confirmation Order is a Final Order, (ii) all of the conditions precedent to confirmation of the Plan specified in Section 38.1 of the Plan shall have been satisfied or waived, as provided in Section 38.2 of the Plan, and (iii) all the conditions precedent to the effectiveness of the Plan specified in Section 39.1 of the Plan shall have been satisfied or waived as provided in Section 39.2 of the Plan.

1.91 Entity: A Person, a corporation, a general partnership, a limited partnership, a limited liability company, a limited liability partnership, an association, a joint stock company, a joint venture, an estate, a trust, an unincorporated organization, a governmental unit or any subdivision thereof, including, without limitation, the office of the United States Trustee, or any other entity.

1.92 Equity Committee: The official committee of equity security holders appointed in the Chapter 11 Cases.

1.93 Equity Committee Adversary Proceeding: The adversary proceeding commenced in the Chapter 11 Cases by the Equity Committee, styled Official Committee of Equity Security Holders v. Washington Mutual, Inc., Adversary Pro. No. 10-50731 (MFW).

1.94 Equity Committee Action to Compel: The action commenced by the Equity Committee on April 26, 2010 in the Thurston County Superior Court in the state of Washington seeking to compel WMI to convene and hold an annual shareholders’ meeting for the nomination and election of directors in accordance with Washington state law, which action was (i) removed to the United States Bankruptcy Court for the Western District of Washington on May 13, 2010, and (ii) transferred to the Bankruptcy Court pursuant to an order, dated June 21, 2010.

1.95 Equity Interest: The interest of any holder of one or more equity securities of WMI (including, without limitation, voting rights, if any, related to such equity securities) represented by issued and outstanding shares of common or preferred stock or other instrument evidencing a present ownership interest in WMI, whether or not transferable, or any option, warrant, or right, contractual or otherwise, to acquire any such interest, including, without limitation, unvested restricted stock.

1.96 FDIC Claim: The proof of Claim filed by the FDIC Receiver against the Debtors and the Debtors’ estates, in an unliquidated amount, which was assigned claim number 2140.

1.97 FDIC Corporate: The Federal Deposit Insurance Corporation, in its corporate capacity.

1.98 FDIC Receiver: The Federal Deposit Insurance Corporation, in its capacity as receiver for WMB.

1.99 FDIC Stay Relief Motion: That certain Motion of the Federal Deposit Insurance Corporation, as Receiver for Washington Mutual Bank, for an Order Modifying the Automatic Stay, filed by the FDIC Receiver in the Chapter 11 Cases, dated November 4, 2009 [Docket No. 1834], seeking relief from the automatic stay pursuant to section 362 of the Bankruptcy Code in order to exercise rights pursuant to Section 9.5 of the Purchase and Assumption Agreement.

1.100 Final Order: An order or judgment of a court of competent jurisdiction that has been entered on the docket maintained by the clerk of such court and has not been reversed, vacated, or stayed and as to which (i) the time to appeal, petition for certiorari, or move

for a new trial, reargument, or rehearing has expired and as to which no appeal, petition for certiorari, or other proceedings for a new trial, reargument, or rehearing shall then be pending or, (ii) if an appeal, writ of certiorari, new trial, reargument, or rehearing thereof has been sought, (a) such order or judgment shall have been affirmed by the highest court to which such order was appealed, certiorari shall have been denied, or a new trial, reargument, or rehearing shall have been denied or resulted in no modification of such order and (b) the time to take any further appeal, petition for certiorari, or move for a new trial, reargument, or rehearing shall have expired; provided, however, that the possib ility that a motion under Rule 60 of the Federal Rules of Civil Procedure, or any analogous rule under the Bankruptcy Rules or the Local Bankruptcy Rules, may be filed relating to such order shall not prevent such order from being a Final Order, except as provided in the Federal Rules of Appellate Procedure, the Bankruptcy Rules, or the Local Bankruptcy Rules.

1.101 FSB: Washington Mutual Bank fsb.

1.102 General Unsecured Claim: An Unsecured Claim against the Debtors other than a Senior Notes Claim, a Senior Subordinated Notes Claim, a JPMC Assumed Liability Claim, a WMB Vendor Claim, a WMI Vendor Claim, a CCB-1 Guarantees Claim, a CCB-2 Guarantees Claim, a PIERS Claim, a WMB Notes Claim, a Convenience Claim, a Subordinated Claim, a Late-Filed Claim, or a Trustee Claim, including, without limitation, any portion of a larger claim to the extent such portion does not relate to JPMC Assumed Liabilities.

1.103 Global Settlement Agreement: That certain Second Amended and Restated Settlement Agreement, dated as of February 7, 2011, by and among the Debtors, the JPMC Entities, the FDIC Receiver, FDIC Corporate, and the Creditors’ Committee, as may be amended, together with all exhibits annexed thereto, setting forth the compromise and settlement between the parties of, among other things, (i) the WMI Action, (ii) the JPMC Action, (iii) the Turnover Action, (iv) the Rule 2004 Inquiry, (v) the Debtors’ Claims, (vi) the JPMC Claims, (vii) the Bankruptcy Stay Motions and the appea ls therefrom, (viii) the FDIC Claim, and (ix) the asserted transfer of the Trust Preferred Securities and the consequent issuance of the REIT Series, and the sale, free and clear of all Liens, Claims and encumbrances, of the Plan Contribution Assets, a copy of which is annexed hereto as Exhibit “H”.

1.104 Guarantee Agreements: The CCB-1 Guarantee Agreements, CCB-2 Guarantee Agreements, and PIERS Guarantee Agreement.

1.105 Indentures: The Senior Notes Indenture, the Senior Subordinated Notes Indenture, and the Junior Subordinated Notes Indenture.

1.106 Information Demands: Any and all subpoenas and other demands for documents, testimony and other information issued in connection with any current or future pending or threatened legal proceedings (whether judicial, regulatory, administrative, arbitral, investigative, criminal, civil, or otherwise).

1.107 Intercompany Claim: A Claim against any of the WMI Entities held by another of the WMI Entities; provided, however, that “Intercompany Claim” does not include any PIERS Claim.

1.108 Intercompany Notes: Those certain intercompany notes set forth on Exhibit “V” to the Global Settlement Agreement.

1.109 IRC: The Internal Revenue Code of 1986, as amended from time to time.

1.110 IRS: The Internal Revenue Service, an agency of the United States Department of Treasury.

1.111 JPMC: JPMorgan Chase Bank, N.A.

1.112 JPMC Action: The adversary proceeding commenced in the Chapter 11 Cases by JPMC, styled JPMorgan Chase Bank, N.A. v. Washington Mutual, Inc., et al., Adversary Pro. No. 09-50551 (MFW).

1.113 JPMC Allowed Unsecured Claim: Collectively, the JPMC Claims, which shall be deemed an Allowed Claim against WMI and shall be classified with and treated in the same manner as other Allowed General Unsecured Claims pursuant to the Plan; provided, however, that, in the sole and absolute discretion of the Debtors, for purposes of the Global Settlement Agreement, each Allowed Claim constituting the JPMC Allowed Unsecured Claim may be counted as a separate claim for purposes of voting to accept or reject the Plan.

1.114 JPMC Assumed Liabilities: Collectively, and except as otherwise set forth in the Global Settlement Agreement, the obligations, undertakings and liabilities expressly assumed by JPMC and the Acquisition JPMC Entities in the Global Settlement Agreement, as follows: (a) to the extent payment or performance of such liability or obligation arising from or relating to the period from and after the effective date of the Global Settlement Agreement, all obligations, undertakings and liabilities relating to such payment or performance, and (b) to the extent payment or performan ce of such liability or obligation was due during the period prior to the effective date of the Global Settlement Agreement, all obligations, undertakings and liabilities relating to such payment or performance to the extent of, and in the amounts of, the contractual obligations, undertakings and liabilities arising from or relating to such obligations, undertakings and liabilities; provided, however, that, for purposes of clause (b) above, or to the extent that the delay in payment or performance thereof was due to the actions or inactions, as the case may be, of the WMI Entities, “JPMC Assumed Liabilities” shall not include (i) any damages or compensation for any default, failure to perform or delay in the performance or payment of any obligations, undertakings, or liabilities in connection with such assets or agreements, whether or not provided for in any agreement, document, applicable provision of law or otherwise, (ii) any damages, losses, liabilities, claims or causes of action that are based in tort or on any statute, regulation, rule or principle of applicable or common law or promulgated by governmental or regulatory authority or agency, or that otherwise are extra contractual, (iii) any special, exemplary, consequential or punitive damages, or (iv) Taxes other than Taxes that JPMC has specifically agreed to pay pursuant to Section 2.4 of the Global Settlement Agreement.

1.115 JPMC Assumed Liability Claim: A Claim arising from or relating to a JPMC Assumed Liability.

1.116 JPMC Claims: The proofs of Claim filed by JPMC against the Debtors and the Debtors’ estates, as listed in Exhibit “A” to the Global Settlement Agreement and as resolved in accordance with Section 2.22 of the Global Settlement Agreement.

1.117 JPMC Entities: JPMC, collectively with those of its Affiliates that have filed proofs of Claims against the Debtors or that are Acquisition JPMC Entities.

1.118 JPMC Policies: All BOLI/COLI policies and the proceeds thereof set forth on Exhibit “N” to the Global Settlement Agreement, and all CCBI split dollar policies set forth on Exhibit “O” to the Global Settlement Agreement.

1.119 JPMC Rabbi Trust/Policy Claim: Any Claim against the Debtors and their chapter 11 estates set forth on Schedule 2.9(a) to the Global Settlement Agreement filed by a beneficiary of the JPMC Rabbi Trusts or the JPMC Policies, to the extent such Claim constitutes an Allowed JPMC Assumed Liability Claim and to the extent payable, in whole or in part, by the Debtors or the Debtors’ chapter 11 estates.

1.120 JPMC Rabbi Trusts: The “rabbi trusts” set forth on Exhibit “M” to the Global Settlement Agreement, including all assets therein.

1.121 Junior Subordinated Notes Indenture: That certain Indenture, dated as of April 30, 2001, as supplemented by that certain First Supplemental Indenture, dated as of April 30, 2001, between WMI and The Bank of New York, as Trustee.

1.122 Lakeview Plan: That certain Retirement Income Plan for the Salaried Employees of Lakeview Savings Bank, which plan is intended to satisfy the tax requirements of Section 401 of the IRC and is sponsored by WMI.

1.123 Late-Filed Claim: A Claim against any of the Debtors or the Debtors’ estates, (i) proof of which was filed subsequent to the date designated by the Bankruptcy Court as the last date for filing such proof of claim against any such Debtor or such Debtors’ estate, but prior to the commencement of the Confirmation Hearing, and which is not merely amending or superseding a Claim that was filed prior to such date, and (ii) which has not been listed by such Debtor in its Schedules as liquidated in amount and not disputed or contingent.

1.124 Lien: Any charge against or interest in property to secure payment of a debt or performance of an obligation.

1.125 Liquidating Trust: The Entity to be created on or after the Confirmation Date in accordance with the provisions of Article XXVIII hereof and the Liquidating Trust Agreement, for the benefit of (i) holders of Allowed Senior Notes Claims, Allowed Senior Subordinated Notes Claims, Allowed General Unsecured Claims, Allowed CCB-1 Guarantees Claims, Allowed CCB-2 Guarantees Claims, Allowed PIERS Claims, Allowed WMB Senior Notes Claims, Allowed Late-Filed Claims, and Allowed Subordinated Claims, (ii) Accepting Non-Filing WMB Senior Note Holders, and (iii) in certain circumstances, holde rs of Preferred Equity Interests and REIT Series, in accordance with the terms and provisions of the Plan.

1.126 Liquidating Trust Agreement: The Liquidating Trust Agreement, substantially in the form contained in the Plan Supplement, pursuant to which the Liquidating Trustee shall manage and administer the Liquidating Trust Assets and distribute the proceeds thereof, if any.

1.127 Liquidating Trust Assets: From and after the Effective Date, all Assets of the Debtors (including, without limitation, certain Plan Contribution Assets) except (i) Cash to be distributed by the Reorganized Debtors as Disbursing Agent to holders of Allowed Administrative Expense Claims, Allowed Priority Tax Claims (to the extent applicable), Allowed Priority Non-Tax Claims, Allowed Convenience Claims, Allowed WMI Vendor Claims, Allowed Trustee Claims, and the fees and expenses owed to certain Creditors’ professionals pursuant to Section 43.18 herein, in each case as of the Effective Date, (ii) Cash necessary to reimburse the Reorganized Debtors for fees and expenses incurred in connection with initial distributions made by the Reorganized Debtors as Disbursing Agent, (iii) Creditor Cash on the Effective Date and (iv) the equity interests in WMI Investment (all the assets of which, for the avoidance of doubt, shall be contributed to the Liquidating Trust, including any Intercompany Claims), WMMRC and WMB.

1.128 Liquidating Trust Beneficiaries: The (i) holders of Allowed Senior Notes Claims, Allowed Senior Subordinated Notes Claims, Allowed General Unsecured Claims, Allowed CCB-1 Guarantees Claims, Allowed CCB-2 Guarantees Claims, Allowed PIERS Claims, Allowed Late-Filed Claims, and Allowed WMB Senior Notes Claims, (ii) Accepting Non-Filing WMB Senior Note Holders, and (iii) in certain circumstances, holders of Allowed Subordinated Claims, Preferred Equity Interests and REIT Series, to the extent such holders have received Liquidating Trust Interests under the Plan (and any transferee th ereof, and any subsequent transferee of any transferor of Liquidating Trust Interests).

1.129 Liquidating Trust Claims Reserve: Any Liquidating Trust Assets allocable to, or retained on account of, Disputed Claims, even if held in commingled accounts.

1.130 Liquidating Trustee: William C. Kosturos, as “Managing Trustee,” CSC Trust Company of Delaware, as “Resident Trustee,” and such additional trustee(s) as may be appointed by the Trust Advisory Board in accordance with applicable law.

1.131 Liquidating Trust Interests: The beneficial interests in the Liquidating Trust allocable to certain holders of Allowed Claims and Equity Interests (and any transferee thereof, and any subsequent transferee of any transferor of Liquidating Trust Interests) in accordance with the terms and conditions of Article XXVIII of the Plan, including, without limitation, the BB Liquidating Trust Interests; provided, however, that (i) the BB Liquidating Trust Inter ests shall only be distributed to holders of Allowed WMB Senior Notes Claims and Accepting Non-Filing WMB Senior Note Holders and (ii) for purposes of distributing Liquidating Trust Interests, “Pro Rata Share” shall not include the BB Liquidating Trust Interests.

1.132 Local Bankruptcy Rules: The Local Rules of Bankruptcy Practice and Procedure of the United States Bankruptcy Court for the District of Delaware, as amended from time to time.

1.133 Non-Filing WMB Senior Note Holder: A holder of a WMB Senior Note who did not timely file a proof of Claim against the Debtors.

1.134 Non-Filing WMB Senior Note Holders Election Form: The form distributed to each Non-Filing WMB Senior Note Holder on which each such holder shall indicate, among other things, whether or not such holder elects to grant certain releases (as described therein and in the Plan) in order to share in their Pro Rata Share of BB Liquidating Trust Interests, as set forth in Section 21.1(b) of the Plan.

1.135 Other Benefit Plan Claim: Any Claim against the Debtors set forth on Schedule 2.9(c) to the Global Settlement Agreement filed by a beneficiary of a benefit plan listed on Exhibit “P” to the Global Settlement Agreement, to the extent such Claim constitutes an Allowed JPMC Assumed Liability Claim.

1.136 Other Subordinated Claim: A Claim determined pursuant to a Final Order to be subordinated in accordance with section 510(b), to the extent that such Claim related to the purchase or sale of a debt security (rather than an equity security), or 510(c) of the Bankruptcy Code; provided, however, that “Other Subordinated Claim” shall not include Allowed Senior Notes Claims, Allowed Senior Subordinated Notes Claims, Allowed JPMC Assumed Liability Claims, Allowed WMB Vendor Claims, Allowed WMI Vendor Claims, Allowed Convenience Claims, Allowed CCB-1 Guarantees Claims, Allowed CCB-2 Guarantees Claims, Allowed PIERS Claims, and Allowed Trustee Claims; and, provided further that, any Claim related to the purchase or sale of an equity security that is subordinated in accordance with section 510(b) of the Bankruptcy Code shall be classified with and receive the treatment provided for the REIT Series, Preferred Equity Interests, or Common Equity Interests, as appropriate.

1.137 Penalty Claim: A Claim for a fine, penalty, forfeiture, or for multiple, exemplary, or punitive damages, or otherwise not predicated upon compensatory damages, that is subject to subordination in accordance with section 726(a)(4) of the Bankruptcy Code or otherwise, as determined pursuant to a Final Order.

1.138 Pension Plans: The WaMu Pension Plan and the Lakeview Plan.

1.139 Person: An individual, partnership, corporation, limited liability company, cooperative, trust, unincorporated organization, association, joint venture, government, or agency or political subdivision thereof, or any other form of legal entity.

1.140 Petition Date: September 26, 2008, the date on which each of the respective Debtors filed its voluntary petition for relief commencing the Chapter 11 Cases.

1.141 PIERS Claim: An Unsecured Claim arising from or related to the PIERS Trust Agreement, the PIERS Guarantee Agreement and the Junior Subordinated Notes Indenture, on account of the PIERS Common Securities or the PIERS Preferred Securities.

1.142 PIERS Common Securities: The common securities set forth on Exhibit “C” hereto.

1.143 PIERS Guarantee Agreement: That certain Guarantee Agreement, dated as of April 30, 2001, as amended by that certain Amendment No. 1 to the Guarantee Agreement, dated as of May 16, 2001, between WMI, as Guarantor, and The Bank of New York, as Guarantee Trustee.

1.144 PIERS Preferred Securities: The preferred securities set forth on Exhibit “C” hereto.

1.145 PIERS Trust Agreement: That certain Amended and Restated Declaration of Trust, Washington Mutual Capital Trust 2001, dated as of April 30, 2001.

1.146 PIERS Trustee: Wells Fargo Bank, National Association, solely in its capacity as successor in interest to The Bank of New York Mellon Trust Company, solely in its capacity as successor in interest to The Bank of New York, or its duly appointed successor, as Trustee and as Guarantee Trustee, solely in its capacity as trustee with regard to the Junior Subordinated Notes Indenture and the PIERS Guarantee Agreement.

1.147 Plan: This Modified Sixth Amended Joint Plan of Affiliated Debtors Pursuant to Chapter 11 of the United States Bankruptcy Code, including, without limitation, the exhibits and schedules hereto, as the same may be amended, supplemented, or modified from time to time in accordance with the provisions of the Bankruptcy Code and the terms hereof.

1.148 Plan Contribution Assets: All right, title and interest of the WMI Entities, the JPMC Entities, and the FDIC Receiver and FDIC Corporate in and to the assets set forth on Exhibit “G” to the Global Settlement Agreement, which shall be sold, pursuant to the Plan and as required by the Global Settlement Agreement, free and clear of all Liens, Claims and encumbrances.

1.149 Plan Supplement: A separate volume, to be filed with the clerk of the Bankruptcy Court, including, among other documents, forms of (i) the Liquidating Trust Agreement, (ii) the Reorganized Debtors By-laws, if applicable, (iii) the Reorganized Debtors’ Certificates of Incorporation, if applicable, (iv) a schedule of executory contracts and unexpired leases to be assumed or assumed and assigned pursuant to Section 36.1 of the Plan, and (v) a registration rights agreement (if any) with respect to the Reorganized Common Stock, which, in each case, shall be in form and substance satisfactory to the Creditors’ Committee. The Plan Supplement (containing drafts or final versions of the foregoing documents) shall be filed with the clerk of the Bankruptcy Court as soon as practicable (but in no event later than fifteen (15) days) prior to the Ballot Date, or on such other date as the Bankruptcy Court establishes.

1.150 Plan Support Agreement: That certain Plan Support Agreement, dated as of October 6, 2010, by and among the Debtors and the Settlement WMB Senior Note Holders, a copy of which is attached as Exhibit F to the Disclosure Statement.

1.151 Postpetition Interest Claim: A Claim against any of the Debtors or the Debtors’ estates for interest accrued in respect of an outstanding obligation or liability that is the subject of an Allowed Claim during the period from the Petition Date up to and including the date of final payment in full of such Allowed Claim, calculated at the contract rate set forth in any agreement related to such Allowed Claim or, if no such rate or contract exists, at the federal

judgment rate, provided that interest shall continue to accrue only on the then outstanding and unpaid obligation or liability, including any Postpetition Interest Claim thereon, that is the subject of an Allowed Claim.

1.152 Preferred Equity Interest: An Equity Interest represented by an issued and outstanding share of preferred stock of WMI prior to or on the Petition Date, including, without limitation, those certain (i) Series K Perpetual Non-Cumulative Floating Rate Preferred Stock and (ii) Series R Non-Cumulative Perpetual Convertible Preferred Stock, but not including the REIT Series.

1.153 Priority Non-Tax Claim: A Claim entitled to priority in payment pursuant to section 507(a)(4), 507(a)(5), 507(a)(7), or 507(a)(9) of the Bankruptcy Code.

1.154 Priority Tax Claim: A Claim of a governmental unit against the Debtors of the kind entitled to priority in payment pursuant to sections 502(i) and 507(a)(8) of the Bankruptcy Code.

1.155 Privileges: All attorney-client privileges, work product protections, and other immunities or protections from disclosure held by the Debtors.

1.156 Pro Rata Share: With respect to Allowed Claims (i) within the same Class, the proportion that an Allowed Claim bears to the sum of all Allowed Claims within such Class, and (ii) among all Classes, the proportion that a Class of Allowed Claims bears to the sum of all Allowed Claims, without regard to subordination; provided, however, that, notwithstanding the foregoing, for purposes of distributing Creditor Cash and Liquidating Trust Interests, “P ro Rata Share” shall not include Administrative Expense Claims, Priority Tax Claims, Priority Non-Tax Claims, JPMC Assumed Liability Claims, WMB Vendor Claims, WMI Vendor Claims, WMB Senior Notes Claims, Convenience Claims, Subordinated Claims and Trustee Claims. With respect to redistributions of Liquidating Trust Interests to holders of Allowed Subordinated Claims, the proportion that an Allowed Subordinated Claim bears to the sum of all Allowed Subordinated Claims; and, provided further, that, with respect to distribution of BB Liquidating Trust Interests to holders of Allowed WMB Senior Notes Claims and Accepting Non-Filing WMB Senior Note Holders, “Pro Rata Share” shall mean the proportion that an Allowed WMB Senior Notes Claim or the aggregate face amount of WMB Senior Notes, plus inter est accrued to the Petition Date, held by an Accepting Non-Filing WMB Senior Note Holder bears to the aggregate of (i) all Allowed WMB Senior Notes Claims and (ii) the aggregate face amount of WMB Senior Notes, plus interest accrued to the Petition Date, held by Accepting Non-Filing WMB Senior Note Holders. With respect to Equity Interests (i) within the same Class, the proportion that an Equity Interest bears to the sum of all Equity Interests within such Class, and (ii) among all Classes, the proportion that a Class of Equity Interests bears to the sum of all Equity Interests; provided, however, that, notwithstanding the foregoing, for purposes of redistributing Liquidating Trust Interests, “Pro Rata Share” shall not include Dime Warrants or Common Equity Interests.

1.157 Purchase and Assumption Agreement: That certain Purchase and Assumption Agreement, Whole Bank, dated September 25, 2008, between the FDIC Receiver, FDIC Corporate, and JPMC, as amended, modified or supplemented prior to the date hereof.

1.158 Qualified Plan Claim: Any Claim against the Debtors and their chapter 11 estates set forth on Schedule 2.10 to the Global Settlement Agreement filed by any Person arising from or relating to the WaMu Pension Plan or the Lakeview Plan, to the extent such Claim constitutes an Allowed JPMC Assumed Liability Claim.

1.159 Receivership: WMB’s receivership.

1.160 Registry Funds: The funds deposited into the registry of the Bankruptcy Court with respect to the American Savings Litigation.

1.161 REIT Series: Those certain (i) Series I Perpetual Non-Cumulative Fixed-to-Floating Preferred Stock, (ii) Series J Perpetual Non-Cumulative Fixed Rate Preferred Stock, (iii) Series L Perpetual Non-Cumulative Fixed-to-Floating Rate Preferred Stock, (iv) Series M Perpetual Non- Cumulative Fixed-to-Floating Rate Preferred Stock, and (v) Series N Perpetual Non-Cumulative Fixed-to-Floating Rate Preferred Stock.

1.162 Related Actions: The “Related Actions,” as defined in the Global Settlement Agreement.

1.163 Related Persons: With respect to any Entity, such predecessors, successors and assigns (whether by operation of law or otherwise) and their respective present Affiliates and each of their respective current and former members, partners, equity holders, officers, directors, employees, managers, shareholders (other than holders of Equity Interests of WMI), partners, financial advisors, attorneys, accountants, investment bankers, consultants, agents and professionals (including, without limitation, any and all professionals retained by WMI or the Creditors’ Committee in the Ch apter 11 Cases either (a) pursuant to an order of the Bankruptcy Court other than ordinary course professionals or (b) as set forth on Schedule 3.1(a) to the Global Settlement Agreement), or other representatives, nominees or investment managers, each acting in such capacity, and any Entity claiming by or through any of them (including their respective officers, directors, managers, shareholders, partners, employees, members and professionals), but, under all circumstances, excluding the “Excluded Parties,” as such term is defined in the Global Settlement Agreement.

1.164 Released Claims: Collectively, (a) with respect to those Entities party to the Global Settlement Agreement, claims and causes of action released thereunder, (b) claims or causes of action that arise in, relate to or have been or could have been asserted (i) in the Chapter 11 Cases, the Receivership or the Related Actions, or (ii) by the Debtors (with respect to releases given by the Debtors) and by Creditors relating to Claims or holders of Equity Interests relating to Equity Interests, as the case may be, they have against the Debtors (with respect to releases given by Creditors or holders of Equity Interests, as the case may be), and (c) claims that otherwise arise from or relate to the Receivership, the Purchase and Assumption Agreement, the 363 Sale and Settlement, as defined in the Global Settlement Agreement, the Plan, the Global Settlement Agreement, and the negotiations and compromises set forth in the Global Settlement Agreement and the Plan, including, without limitation, in connection with or related to any of the Debtors, the Affiliated Banks, and their respective subsidiaries, assets, liabilities, operations, property or estates, the assets to be received by JPMC pursuant to the Global Settlement Agreement, the Debtors’ Claims, the JPMC Claims, the FDIC Claim, the WMI/WMB

Intercompany Claims, any intercompany claims on the books of WMI or WMB related to the WaMu Pension Plan or the Lakeview Plan, or the Trust Preferred Securities (including, without limitation, the creation of the Trust Preferred Securities, the financing associated therewith, the requested assignment of the Trust Preferred Securities by the Office of Thrift Supervision and the transfer and the asserted assignment of the Trust Preferred Securities subsequent thereto); provided, however, that “Released Claims” does not include (1) any and all claims that the JPMC Entities, the Receivership, the FDIC Receiver and the FDIC Corporate are entitled to assert against each other or any other defenses th ereto pursuant to the Purchase and Assumption Agreement, which claims and defenses shall continue to be governed by the Purchase and Assumption Agreement, (2) any and all claims held by Entities against WMB, the Receivership and the FDIC Receiver solely with respect to the Receivership, and (3) any avoidance action or claim objection regarding an Excluded Party or the WMI Entities, WMB, each of the Debtors’ estates, the Reorganized Debtors and their respective Related Persons; and, provided, further, that “Released Claims” is not intended to release, nor shall it have the effect of releasing, any party from the performance of its obligations in accordance with the Confirmation Order or the Plan.

1.165 Released Parties: Collectively, each of the Debtors, WMB, each of the Debtors’ estates, the JPMC Entities, the FDIC Receiver and FDIC Corporate, and the Related Persons of each of the JPMC Entities, FDIC Corporate and the FDIC Receiver.

1.166 Releasing REIT Trust Holder: A holder of REIT Series that (i) votes to accept the Plan, (ii) does not otherwise interpose an objection to confirmation of the Plan as it relates to the REIT Series or the Trust Preferred Securities, (iii) acknowledges that JPMC or its designee is the sole legal, equitable and beneficial owner of the Trust Preferred Securities for all purposes and that such REIT Series holder has no legal, equitable or beneficial interest in the Trust Preferred Securities, and (iv) executes and delivers the release of claims against the “Releasees”, as s et forth in Section 2.24 of the Global Settlement Agreement and as incorporated into the Ballots distributed to holders of REIT Series; provided, however, that, in the event that Class 19 votes to accept the Plan in accordance with section 1126 of the Bankruptcy Code, “Releasing REIT Trust Holder” shall be deemed to include each holder of the REIT Series and each holder of the REIT Series shall be deemed to have executed and delivered the release of claims against the Releasees (as defined in the Global Settlement Agreement), as set forth in Section 2.24 of the Global Settlement Agreement, and shall receive the requisite payment or distribution from JPMC in accordance with the provisions of Section 2.24 of the Global Settlement Agreement and the Plan.

1.167 Reorganized Common Stock: Subject to the provisions of Section 32.1(a) hereof, the One Hundred Sixty Million (160,000,000) shares of duly authorized common stock of Reorganized WMI to be issued as of the Effective Date, with a par value of $0.00001 per share; provided, however, that the total number of shares of duly authorized common stock of Reorganized WMI to be issued as of the Effective Date shall be subject to further adjustment such that the agg regate dollar amount of such shares, at an issue price of $1.00 per share, shall be equal to the value of Reorganized WMI, as determined by Blackstone Advisory Partners, L.P., as of the Effective Date, and as reflected in the Confirmation Order.

1.168 Reorganized Debtors: The Debtors from and after the Effective Date.

1.169 Reorganized Debtors By-Laws: The respective by-laws of the Reorganized Debtors, which by-laws shall be in substantially the form included in the Plan Supplement and shall be in form and substance reasonably satisfactory to the Creditors’ Committee.

1.170 Reorganized Debtors Certificates of Incorporation: The respective Certificates of Incorporation of the Reorganized Debtors, which certificates shall be in substantially the form included in the Plan Supplement and shall be in form and substance reasonably satisfactory to the Creditors’ Committee.

1.171 Reorganized WMI: WMI, on and after the Effective Date, which shall include One Hundred Percent (100%) of the equity interests of WMI Investment, WMMRC and WMB.

1.172 Retention/Sale Transaction: With the consent of the Creditors’ Committee, either (a) a determination by the Debtors to (i) retain the issued and outstanding equity interests of WMMRC and (ii) contribute such equity interests to the Liquidating Trust, with all dividends resulting therefrom, including, without limitation, from the liquidation of the assets of WMMRC, to be distributed in accordance with the provisions of Article XXXII of the Plan, or (b) a determination by the Debtors to sell all or a portion of the equity interests in WMMRC or substantially all of the assets of WMMRC pursuant to one or more transactions.

1.173 Rule 2004 Inquiry: That certain discovery authorized by the Bankruptcy Court and conducted by the Debtors, pursuant to Bankruptcy Rule 2004, in order to facilitate the Debtors’ inquiry into the existence of potential additional claims and causes of action of the Debtors and the Debtors’ chapter 11 estates against JPMC.

1.174 Rule 2019 Appeal: The appeal filed on December 14, 2009 by the WMI Noteholders Group from the Bankruptcy Court order, dated December 2, 2009, granting JPMC’s Motion to Compel the Washington Mutual, Inc. Noteholders Group to Comply with Rule 2019 of the Federal Rules of Bankruptcy.

1.175 Schedules: Collectively, the schedules of assets and liabilities, schedules of current income and expenditures, schedules of executory contracts and unexpired leases, and statements of financial affairs filed by the Debtors pursuant to section 521 of the Bankruptcy Code, Bankruptcy Rule 1007, and the Official Bankruptcy Forms in the Chapter 11 Cases, as may have been amended or supplemented through the Confirmation Date pursuant to Bankruptcy Rule 1007.

1.176 Section 510(b) Subordinated WMB Notes Claim: A WMB Notes Claim, to the extent determined pursuant to a Final Order to be subordinated in accordance with section 510(b) of the Bankruptcy Code; provided, however, that, for all purposes, and for the avoidance of doubt, to the extent that a holder of an Allowed WMB Senior Notes Claim receives a distribution pursuant to the Plan, such holder shall be deemed to have released any and all Section 510(b) Subord inated WMB Notes Claims that such holder may have.

1.177 Securities Litigations: Collectively, the litigations styled (i) In re Washington Mutual Securities Litigation, Case No. C-08-387(MJP), (ii) South Ferry LP #2,

Individually and on Behalf of All Others Similarly Situated v. Killinger, Case No. C04-1599 (MJP), and (iii) Boilermakers National Annuity Trust Fund, on Behalf of Itself and All Others Similarly Situated v. WAMU Mortgage Pass-Through Certificates, Series AR1, et al., Case No. C09-0051 (MJP), each pending in the United States District Court for the Western District of Washington.

1.178 Senior Notes: The promissory notes and debentures issued and delivered by WMI in accordance with the terms and conditions of the Senior Notes Indenture and set forth on Exhibit “D” hereto.

1.179 Senior Notes Claim: An Unsecured Claim arising from or relating to the Senior Notes.

1.180 Senior Notes Indenture: That certain Senior Debt Securities Indenture, dated as of August 10, 1999, as supplemented by that certain First Supplemental Indenture and Second Supplemental Indenture, dated as of August 1, 2002 and November 20, 2002, respectively, between WMI and The Bank of New York, as Trustee.

1.181 Senior Notes Indenture Trustee: The Bank of New York Mellon Trust Company, solely in its capacity as successor in interest to The Bank of New York, solely in its capacity as successor in interest to Harris Trust and Savings Bank, as Trustee, or its duly appointed successor, solely in its capacity as indenture trustee with regard to the Senior Notes Indenture.

1.182 Senior Subordinated Notes: The promissory notes and debentures issued and delivered by WMI in accordance with the terms and conditions of the Senior Subordinated Notes Indenture and set forth on Exhibit “E” hereto.

1.183 Senior Subordinated Notes Claim: An Unsecured Claim arising from or relating to the Senior Subordinated Notes.

1.184 Senior Subordinated Notes Indenture: That certain Subordinated Debt Securities Indenture, dated as of April 4, 2000, as supplemented by that certain First Supplemental Indenture and Second Supplemental Indenture, dated as of August 1, 2002 and March 16, 2004, respectively, between WMI and The Bank of New York, as Trustee.

1.185 Senior Subordinated Notes Indenture Trustee: Law Debenture Trust Company of New York, solely in its capacity as successor in interest to The Bank of New York Mellon Trust Company, solely in its capacity as successor in interest to The Bank of New York, solely in its capacity as successor in interest to Harris Trust and Savings Bank, as Trustee, or its duly appointed successor, solely in its capacity as indenture trustee with regard to the Senior Subordinated Notes Indenture.

1.186 Settlement WMB Senior Note Holders: Each of the signatories, other than the Debtors, to the Plan Support Agreement.

1.187 Stock Trading Order: That certain Final Order Pursuant to Sections 105(a) and 362 of the Bankruptcy Code Establishing Notification Procedures and Approving

Restrictions on Certain Transfers of Interests in the Debtors’ Estates, dated November 18, 2008, entered by the Bankruptcy Court in the Chapter 11 Cases [Docket No. 315].

1.188 Subordinated Claim: A Penalty Claim, an Other Subordinated Claim, or a Section 510(b) Subordinated WMB Notes Claim.

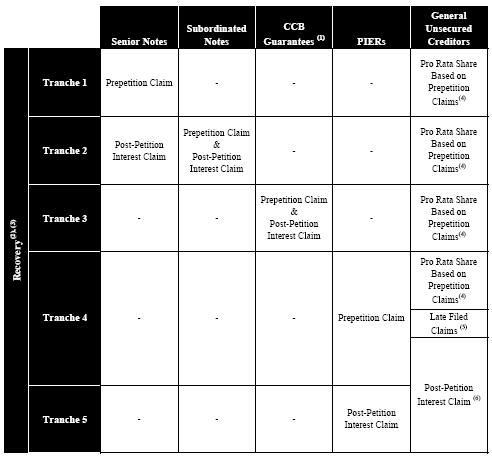

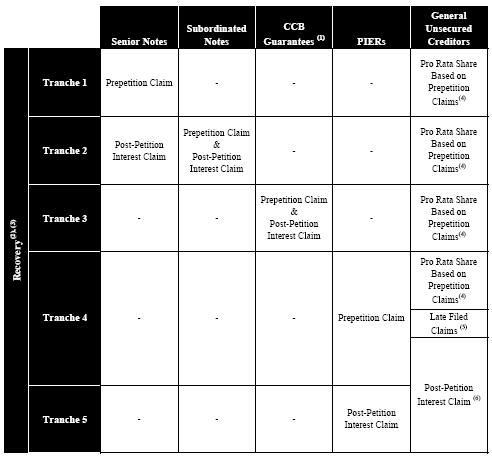

1.189 Subordination Model: The model developed by Alvarez & Marsal LLC for the Debtors, a copy of which is attached hereto as Exhibit “G,” which implements the Debtors’ interpretation of the respective subordination provisions in the Senior Subordinated Notes Indenture, CCB-1 Guarantee Agreements, CCB-2 Guarantee Agreements, Junior Subordinated Notes Indenture and PIERS Guarantee Agreement; provided, however, that, to the extent that th e priorities set forth in the Subordination Model or herein conflict with the contractual subordination provisions of the Senior Subordinated Notes Indenture, CCB-1 Guarantee Agreements, CCB-2 Guarantee Agreements, Junior Subordinated Notes Indenture and/or PIERS Guarantee Agreement, the contractual subordination and subrogation provisions of such Indentures and Guarantee Agreements shall govern and shall be enforced pursuant to section 510(a) of the Bankruptcy Code; and, provided, further, that any disagreement with the priorities or distributions set forth herein or in the Subordination Model shall be raised prior to, and decided at, the Confirmation Hearing, and all issues with respect to contractual subordination and subrogation not resolved at the Confirmation Hearing shall be governed pursuant to the Subordination Model or, if the decision of the Bankruptcy Court at the Conf irmation Hearing differs from the Subordination Model, then all issues with respect to contractual subordination and subrogation shall be governed pursuant to such decision.

1.190 Supplemental Disclosure Statement: The supplemental disclosure statement relating to the elections to be made pursuant to the Plan, including, without limitation, the election pursuant to Section 43.6 hereof, pursuant to section 1125 of the Bankruptcy Code or such other provisions of the Bankruptcy Code or the Bankruptcy Rules as may be applicable.

1.191 Supplemental Disclosure Statement Order: The Final Order of the Bankruptcy Court approving the Supplemental Disclosure Statement in accordance with section 1125 of the Bankruptcy Code or such other applicable provisions of the Bankruptcy Code or the Bankruptcy Rules as may be applicable.

1.192 Tax Authority: A federal, state, local, or foreign government, or agency, instrumentality, or employee thereof, court, or other body (if any) charged with the administration of any law relating to Taxes.

1.193 Taxes: All (i) federal, state, local, or foreign taxes, including, without limitation, all net income, alternative minimum, net worth or gross receipts, capital, value added, franchise, profits, and estimated taxes, and (ii) interest, penalties, fines, additions to tax or additional amounts imposed by any Tax Authority or paid in connection with any item described in clause (i) hereof.

1.194 Tax Refunds: To the extent of the Debtors’ rights, title and interest therein in whatever capacity, all refunds of Taxes of the Debtors and any consolidated, combined or unitary tax group of which the Debtors are members for taxable periods ended on or before

December 31, 2009, including all of the Debtors’ rights, title and interest in and with respect to any “Net Tax Refunds” as defined in the Global Settlement Agreement, including, without limitation, any interest received with respect to such refunds.

1.195 Tax Return: A return, declaration, form, election letter, report, statement, estimate, information return, or other information filed or required to be filed with respect to any Taxes, including any schedule or attachment thereto or amendment thereof, including any claim for a Tax Refund.

1.196 Texas Litigation: That certain litigation styled American National Insurance Company v. FDIC, Case No. 09-1743 (RMC), with respect to which the United States District Court for the District of Columbia entered an order granting motions to dismiss filed by JPMC and the FDIC Receiver.

1.197 Tranquility: Tranquility Master Fund, Ltd.

1.198 Tranquility Claim: The proof of claim filed by Tranquility, assigned claim number 2206 by the Debtors’ claims agent, or any subsequent amendments or modifications thereto, including, but not limited to, the asserted proof of claim filed by Tranquility on November 30, 2010.

1.199 Transferred Intellectual Property: The intellectual property listed on Exhibit “W” to the Global Settlement Agreement.

1.200 Treasury Regulations: The United States Department of Treasury regulations promulgated under the IRC.

1.201 Trust Advisory Board: The trust advisory board provided for in the Liquidating Trust Agreement, which board shall (i) be initially comprised of three (3) members selected jointly by the Debtors and the Creditors’ Committee, and one (1) member selected by the Equity Committee and approved by the Debtors and the Creditors’ Committee, and (ii) have an oversight function with respect to the Liquidating Trust, and the composition of which may change only in accordance with the Liquidating Trust Agreement.

1.202 Trustee Claims: The Claims of the Senior Notes Indenture Trustee, Senior Subordinated Notes Indenture Trustee, CCB-1 Trustee, CCB-2 Trustees, PIERS Trustee, and Trust Preferred Trustees, pursuant to the Senior Notes Indenture, Senior Subordinated Notes Indenture, CCB-1 Guarantee Agreements, CCB-2 Guarantee Agreements, Junior Subordinated Notes Indenture and PIERS Guarantee Agreement, and Trust Preferred Securities documents, respectively, for reasonable fees and expenses, including, without limitation, reasonable attorneys’ fees and expenses.

1.203 Trustee Distribution Expenses: The reasonable, direct, out-of-pocket costs and expenses incurred by the Trustees in connection with making distributions pursuant to the Plan.

1.204 Trustees: The Senior Notes Indenture Trustee, Senior Subordinated Notes Indenture Trustee, CCB-1 Trustee, CCB-2 Trustees, PIERS Trustee, and Trust Preferred Trustees.

1.205 Trust Preferred Securities: Collectively, those certain (i) Washington Mutual Preferred (Cayman) I Ltd. 7.25% Perpetual Non-Cumulative Preferred Securities, Series A-1, (ii) Washington Mutual Preferred (Cayman) I Ltd. 7.25% Perpetual Non-Cumulative Preferred Securities, Series A-2, (iii) Washington Mutual Preferred Funding Trust I Fixed-to-Floating Rate Perpetual Non-Cumulative Trust Securities, (iv) Washington Mutual Preferred Funding Trust II Fixed-to-Floating Rate Perpetual Non-Cumulative Trust Securities, (v) Washington Mutual Preferred Funding Tru st III Fixed-to-Floating Rate Perpetual Non-Cumulative Trust Securities, and (vi) Washington Mutual Preferred Funding Trust IV Fixed-to-Floating Rate Perpetual Non-Cumulative Trust Securities.

1.206 Trust Preferred Trustees: Wilmington Trust Company, solely in its capacity as Property Trustee, Delaware Trustee, Transfer Agent and Registrar for Washington Mutual Preferred Funding Trust I, Washington Mutual Preferred Funding Trust II, Washington Mutual Preferred Funding Trust III and Washington Mutual Preferred Funding Trust IV, Wilmington Trust (Cayman) Ltd., solely in its capacity as Preferred Securities Paying Agent, Securities Registrar and Transfer Agent for Washington Mutual Preferred Funding (Cayman) I, Ltd. and Maples Finance Limited as Original Trustee for Washington Mutual Preferred Funding (Cayman) I Ltd.

1.207 Turnover Action: The adversary proceeding commenced in the Chapter 11 Cases by the Debtors, styled Washington Mutual, Inc., et al. v. JPMorgan Chase Bank, N.A., Adversary Pro. No. 09-50934 (MFW).

1.208 Unidentified Intellectual Property: The trademarks, patents, domain names and copyrighted materials (whether or not the subject of registration) that were used by WMB by license or otherwise, or were available for WMB’s use, prior to the Petition Date, but are not listed on Exhibits “W” or “Y” to the Global Settlement Agreement.

1.209 Unsecured Claim: A Claim against the Debtors, other than an Administrative Expense Claim, a Priority Tax Claim, a Priority Non-Tax Claim, a Convenience Claim, a Trustee Claim or a Subordinated Claim; provided, however, that, in the event that the Bankruptcy Court determines, pursuant to a Final Order, that the Dime Warrants constitute Claims, such Claims shall be considered to be Unsecured Claims and, pursuant to such Final Order, shall be treated as G eneral Unsecured Claims in accordance with Class 12 of the Plan or as otherwise determined by the Bankruptcy Court.

1.210 Vendor Escrow: The escrow administered by WMI, or its successor in interest, containing Fifty Million Dollars ($50,000,000.00) paid by JPMC pursuant to the terms of the Global Settlement Agreement, which funds shall be used in connection with the satisfaction of Allowed WMI Vendor Claims and, upon payment of all such Claims and all fees and expenses associated with such escrow, which remaining funds shall be distributed equally to WMI and JPMC.

1.211 Visa Claims: Any Claim against the Debtors set forth on Schedule 2.15(a) to the Global Settlement Agreement filed in connection with the Visa Shares or any litigation or agreement relating thereto, and the Claims asserted by VISA U.S.A. Inc. in its proof of claim filed against the Debtors and the Debtors’ chapter 11 cases, Claim No. 2483, pertaining to the VISA Strategic Agreement to the extent such Claim constitutes an Allowed JPMC Assumed Liability Claim.

1.212 Visa Shares: The 3.147 million Class B shares of Visa Inc. held by WMI and set forth on the Schedules and/or WMI’s books and records as of the Petition Date.

1.213 Voting Record Date: The date established by the Bankruptcy Court in the Disclosure Statement Order for the purpose of determining the holders of Allowed Claims and Equity Interests entitled to vote on the Plan.

1.214 WaMu Pension Plan: That certain WaMu Pension Plan, which plan is intended to satisfy the tax requirements of Section 401 of the IRC and is sponsored by WMI.

1.215 WMB: Washington Mutual Bank.

1.216 WMB Intellectual Property: The intellectual property listed on Exhibit “X” to the Global Settlement Agreement.

1.217 WMB Global Note Program: That certain program, established by WMB in 2005, providing for the issuance of up to $22 billion in debt financing, pursuant to which WMB issued Senior Global Notes and Subordinated Global Notes.

1.218 WMB Notes Claim: A WMB Senior Notes Claim or a WMB Subordinated Notes Claim.

1.219 WMB Senior Notes: The Senior Global Notes issued by WMB pursuant to the WMB Global Note Program.