postpetition periods (including, but not limited to, the fees and expenses of the Senior Notes Indenture Trustee and its professionals). The Senior Notes Indenture Trustee and the Debtors reserved all rights with respect to this Remaining Senior Notes Indenture Trustee Claim, except with respect to any objections based on timeliness, which were waived with prejudice.

Remaining Senior Subordinated Notes Indenture Trustee Claim, except with respect to any objections based on timeliness, which were waived with prejudice.

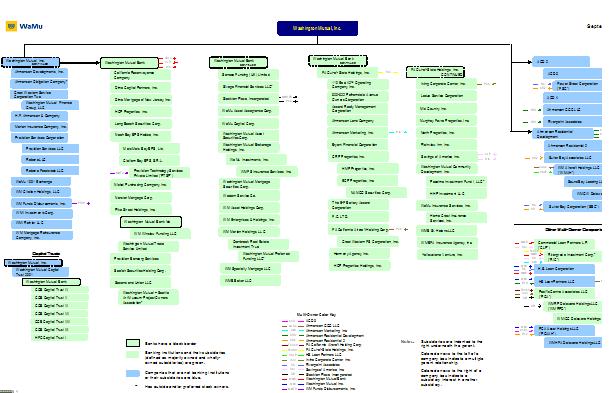

The PIERS Common Securities are junior in right of payment to the prior payment in full of the PIERS Preferred Securities. Pursuant to that certain Guarantee Agreement, dated as of April 30, 2001, the PIERS Preferred Securities issued by WMCT 2001 were guaranteed by WMI to the extent WMCT 2001 fails to satisfy its obligations to holders of the PIERS Preferred Securities.

The proceeds from the issuance of the PIERS Preferred Securities, together with the proceeds of the related issuance of PIERS Common Securities, were invested by WMCT 2001 in junior subordinated deferrable interest debentures issued by WMI (the “Junior Subordinated Debentures”), pursuant to that certain Indenture, dated as of April 30, 2001, as supplemented by that certain First Supplemental Indenture, dated as of April 30, 2001, each of which is between WMI and BNY Mellon as Indenture Trustee (the “Junior Subordinated Notes Indenture”). Pursuant to such investment, WMCT 2001 acquired approximately $1.185 billion of 5.375% Junior Subordinated Debentures, due in 2041. The Junior Subordinated Debentures are subordinated in right of payment to the prior payment in full of all senior indebtedness, as defined in the indenture governing the Junior Subordinated Debentures.

A schematic of the foregoing transaction is as follows:

$1.15 B

Investment

23,000,000

PIERS Units

100% of C/S

(711,300 Shares)

3% of Total Capital

($35.565 mm)

$1.185565 B of

Subordinated Notes

Total Proceeds

($1.185565 B)

External Investors

Washington Mutual, Inc.

Washington Mutual Capital Trust 2001

Step 1B

Step 1A

Step 2

Notes Issuance | Maturity Date | Allowed Principal | Allowed Accrued Interest43 | Allowed Total Amount |

| Preferred Securities | May 1, 2041 | $756,230,623.24 | $9,443,576.39 | $765,674,199.63 |

Common Securities44 | May 1, 2041 | $23,387,254.01 | $292,052.86 | $23,679,306.87 |

| $789,353,506.50 |

| b. | Classification of PIERS Claims Pursuant to the Seventh Amended Plan |

Pursuant to the Seventh Amended Plan, the PIERS Claims are classified and treated as indebtedness. Pursuant to the September Opinion, the Bankruptcy Court ruled that the PIERS Claims are properly classified as debt. (See September Opinion at 108 (“[I]t is clear that the PIERS are debt, not equity.”).) No value is being distributed to PIERS Preferred Security holders pursuant to the Seventh Amended Plan on account of the warrant component of the PIERS Preferred Securities. Further, WMI is not retaining any payments it receives on account of the PIERS Common Securities. (See Seventh Amended Plan § 20.1.)

| 6. | Preferred Equity Interests |

| a. | Series K Preferred Stock. |

On September 18, 2006, WMI issued 20,000,000 depositary shares of its Series K Perpetual Non-Cumulative Floating Rate Preferred Stock, with no par value (the “Series K Preferred Stock”). The Series K Preferred Stock has a face value of $500 million. Ownership of the Series K Preferred Stock is held in the form of depositary shares, each of which represents a 1/40,000th ownership interest in one share of the Series K Preferred Stock. The Series K Preferred Stock dividend rate is adjustable each quarter and is calculated at the 3-month LIBOR plus 70 basis points. The Series K Preferred Stock ranks senior to common shares both as to dividend and liquidation preferences, in parity to all series of preferred stock and junior to all senior and subordinated indebtedness of WMI. Except under limited circumstances, the Series K Preferred Stock does not have voting rights. As of the Petition Date, 500 shares of Series K Preferred Stock were issued and outstanding. The number of outstanding shares of Series K Preferred Stock has not changed since the Petition Date.

| b. | Series R Preferred Stock |

On December 17, 2007, WMI issued 3,000,000 shares of its 7.75% Series R Non-Cumulative Perpetual Convertible Preferred Stock (the “Series R Preferred Stock”). The Series R Preferred Stock has an aggregate face value of $3 billion. The Series R Preferred Stock ranks senior to common shares both as to dividend and liquidation preferences, in parity to all series of preferred stock and junior to all senior and subordinated indebtedness of WMI. Except under limited circumstances, the Series R Preferred Stock does not have voting rights. Pursuant to its terms, each share of Series R Preferred Stock is convertible to a certain number of shares of WMI’s common stock, plus cash in lieu of fractional shares, subject to anti-dilution adjustments. As of the Petition Date, 3,000,000 shares of Series

_______________________________

43 Interest is calculated as of the Petition Date.

44 These securities are owned by WMI.

R Preferred Stock were issued and outstanding. The number of outstanding shares of Series R Preferred Stock has not changed since the Petition Date.

| c. | Series I, J, L, M and N Preferred Stock (the “REIT Series”) |

In February of 2006, Washington Mutual Preferred Funding LLC (“WMPF”) was formed to issue securities qualifying for regulatory capital under applicable banking rules and regulations. The only assets of WMPF were indirect interests in various residential mortgage and home equity loans and other permitted investments. In 2006 and 2007, WMPF issued approximately $4,000,000,000 liquidation preference value of perpetual fixed and fixed-to-floating rate preferred securities (representing 40,000 shares) which were acquired by various issuer trusts which issued the Trust Preferred Securities in a like amount to investors. Specifically, the Trust Preferred Securities include those certain (i) Washington Mutual Preferred Funding (Cayman) I Ltd. 7.25% Perpetual Non-Cumulative Preferred Securities, Series A-1, (ii) Washington Mutual Preferred (Cayman) I Ltd. 7.25% Perpetual Non-Cumulative Preferred Securities, Series A-2, (iii) Washington Mutual Preferred Funding Trust I Fixed-to-Floating Rate Perpetual Non-Cumulative Trust Securities, (iv) Washington Mutual Preferred Funding Trust II Fixed-to-Floating Rate Perpetual Non-Cumulative Trust Securities, (v) Washington Mutual Preferred Funding Trust III Fixed-to-Floating Rate Perpetual Non-Cumulative Trust Securities, and (vi) Washington Mutual Preferred Funding Trust IV Fixed-to-Floating Rate Perpetual Non-Cumulative Trust Securities.

On September 26, 2008, pursuant to a letter from the OTS, dated September 25, 2008, WMI issued a press release stating that it had exchanged the Trust Preferred Securities issued by WMPF for 4,000,000 depositary shares, each representing 1/1,000th of a share of a related class of WMI’s preferred stock, as applicable, of Perpetual Non-Cumulative Fixed and Fixed-to-Floating Rate Preferred Stock in Series I, J, L, M and N45 (defined in the Seventh Amended Plan as the “REIT Series”)—none of which were outstanding prior to September 25, 2008. At the direction of the OTS, on September 25, 2008, employees of WMI and WMB executed an Assignment Agreement, which purported to assign the right, title, and interest in the Trust Preferred Securities to WMB as of that date.

The Trust Preferred Securities were subject to a conditional exchange feature whereby they would be transferred to WMI and the prior holders would receive, in exchange, the REIT Series, upon the occurrence of an “Exchange Event,” defined as, among other things: (i) the undercapitalization of WMB under OTS’ “prompt correction action” regulations, (ii) WMB being placed into receivership, or (iii) the OTS, in its sole discretion, directing the exchange in anticipation of WMB becoming “undercapitalized” or the OTS taking supervisory action limiting the payment of dividends by WMB.

Pursuant to the Global Settlement Agreement, and as more fully set forth therein (a) JPMC or its designee will be deemed to be the sole legal, equitable and beneficial owner of the Trust Preferred Securities, (b) the WMI Entities will be deemed to have sold, transferred, and assigned any and all right, title and interest the WMI Entities may have or may ever have had in the Trust Preferred Securities, (c) any obligation of WMI to transfer the Trust Preferred Securities to WMB, including in accordance with that certain Assignment Agreement will be deemed to have been fully satisfied by the contribution to WMB of the Trust Preferred Securities as of September 25, 2008 and thereafter sold and transferred to JPMC in accordance with the Purchase and Assumption Agreement, and (d) all Claims against the Debtors, the WMI Entities, the JPMC Acquisition Entities, the FDIC Receiver, or FDIC Corporate with respect to the Trust Preferred Securities will be released and withdrawn, with prejudice.

Please refer to the Global Settlement Agreement for a complete description of the proposed resolution of disputes relating to the Trust Preferred Securities.

Since the Petition Date, WMI has not made any distributions on or in relation to the Trust Preferred Securities or paid any dividends on account of any class of WMI’s equity securities, including preferred stock relating to the Trust Preferred Securities.

WMI has authorized 3,000,000,000 shares of common stock. As of the close of business on September 26, 2008, WMI had 1,704,958,913 shares of common stock outstanding. Prepetition, WMI’s common stock was traded on the New York Stock Exchange under the symbol “WM.”

V.

OVERVIEW OF THE CHAPTER 11 CASES

| A. | Significant Events Leading To Commencement Of The Chapter 11 Cases |

As extensively reported in the financial press, in mid-2007, the United States residential mortgage market began to experience significant disruptions. These conditions worsened throughout 2007 and 2008, expanding into the broader U.S. credit markets and resulting in greater volatility, less liquidity, widening of credit spreads, significantly depressed volumes in most equity markets, declining asset values, slowed growth in major economies, and declining business and consumer confidence.

In this context, WMI, as the holding company for WMB, a significant originator of residential mortgages, reported decreased earnings and revenue. Throughout 2007 and the first half of 2008, however, WMI had been able to weather the storm in large part due to WMI’s completion, in April 2008, of a significant recapitalization, which resulted in a $7.2 billion capital infusion (the “Capital Raise”) by several institutional investors (the “Institutional Investors”) including TPG Capital L.P. (the “TPG Investors”). Pursuant to this transaction, WMI issued 822,857 shares of common stock and 19,928 shares of newly authorized Series T Contingent Convertible Perpetual Non-Cumulative Preferred Stock to the TPG Investors and 175,500,000 shares of common stock and 36,642 shares of newly authorized Series S Contingent Convertible Perpetual Non-Cumulative Preferred Stock to the Institutional Investors, other than the TPG Investors, at $8.75 per share. Both series of preferred stock were convertible into common stock of WMI and were subsequently converted into WMI common stock prior to the Petition Date. Upon conversion, the TPG Investors received 227.5 million shares of WMI common stock; the other Institutional Investors received 418.8 million shares of WMI common stock.

In mid-2008, WMB struggled to retain its retail deposit base and attract new deposits. During this time, Moody’s Investor Service, Standard & Poor’s and Fitch Ratings downgraded the credit ratings assigned to the unsecured, long-term indebtedness of each of WMI and WMB, feeding the speculation that began to circulate in the market that WMI’s and WMB’s operations and capital positions were unstable. As a result, WMB experienced significant deposit withdrawals of more than $16.7 billion, amounting to more than $2 billion per banking business day, in the ten days immediately prior to the Receivership.

In the midst of these downgrades, the OTS lowered WMB’s supervisory rating of overall condition—commonly referred to as a CAMELS46 rating—rendering WMB ineligible to receive primary

credit from the Federal Reserve Bank’s Discount Window. WMB was, however, able to receive secondary credit from the Discount Window of the Federal Reserve Bank of San Francisco after it had lost its primary Creditor status, and was able to maintain borrowings up to the time of its seizure by the FDIC upon modified and more restricted borrowing terms.

During this ongoing process, WMI endeavored to pursue a merger or sale transaction with another financial institution and considered other strategic alternatives intended to increase WMI’s capital and liquidity levels. On September 25, 2008, while WMI was pursuing these alternatives, the OTS appointed the FDIC as receiver for WMB and advised that the receiver was immediately taking possession of WMB’s assets. The receiver sold substantially all assets of WMB to JPMC pursuant to the Purchase and Assumption Agreement dated the same day. On the day following the Bank Receivership, the Debtors filed these chapter 11 cases to preserve their assets and maximize the value of their estates for the benefit of their Creditors.

| 1. | Certain Administrative Matters |

Due to the limited nature of WMI’s operations, few first-day motions were filed on the Petition Date. The Bankruptcy Court did, however, enter orders authorizing, among other things, (i) the joint administration of the Debtors’ chapter 11 cases; (ii) an extension of time to file the Debtors’ schedules of assets and liabilities and statements of financial affairs; (iii) the waiver of the requirement to file a list of Creditors; and (iv) maintenance by the Debtors of their existing bank accounts and business forms.

| b. | Appointment of the Creditors’ Committee |

Section 1102 of the Bankruptcy Code requires that as soon as practicable after the commencement of a chapter 11 case, the United States Trustee shall appoint an official committee of unsecured Creditors. On October 15, 2008, the U.S. Trustee appointed the following members to form the Creditors’ Committee: The Bank of New York Mellon Trust Company, N.A., Law Debenture Trust Company of New York, Wells Fargo Bank, N.A., and Wilmington Trust Company.47

The Creditors’ Committee retained Pepper Hamilton LLP and Akin Gump Strauss Hauer & Feld LLP as co-counsel. The Creditors’ Committee also retained FTI Consulting, Inc. as its financial advisors.

| c. | Appointment of the Equity Committee |

On January 11, 2010, the U.S. Trustee formed the Equity Committee. Immediately thereafter, the Debtors filed a motion to disband the Equity Committee, which motion was denied by the Bankruptcy Court by order, dated February 17, 2010. As of the date hereof, the Equity Committee is comprised of three members. The Equity Committee originally retained Venable LLP and Benesch, Friedlander, Coplan & Aronoff LLP (“Benesch”) as its counsel. The Equity Committee also retained Peter J. Solomon Company as its financial advisor. On March 4, 2010, Benesch withdrew as Delaware counsel to the Equity Committee. The Bankruptcy Court entered an order authorizing the retention of

_______________________________

Ashby & Geddes, P.A. as Delaware counsel to the Equity Committee on April 8, 2010. The Equity Committee also retained Susman Godfrey LLP as its lead counsel, replacing Venable LLP. Pursuant to an order, dated May 24, 2011, the Equity Committee retained Sullivan Hazeltine Allinson LLC as Delaware special conflicts counsel. In addition, on May 16, 2011, the Equity Committee filed an application to retain BDO USA, LLP (“BDO”) as tax advisor to the Equity Committee, which application the Bankruptcy Court approved, by order, dated June 6, 2011. Pursuant to an order dated July 12, 2011, the Equity Committee also retained Schwabe, Williamson & Wyatt as corporate and securities counsel.

| d. | Retention of Professionals |

On October 30, 2008 and November 6, 2009, the Bankruptcy Court authorized the Debtors to retain Richards, Layton & Finger, P.A. and Weil, Gotshal & Manges LLP as their attorneys, effective as of the Petition Date. The Bankruptcy Court also authorized the Debtors to employ and retain, among others, the following firms: (a) Davis Wright Tremaine LLP, as special counsel; (b) Elliott Greenleaf, as special litigation counsel and conflicts counsel; (c) Gibson, Dunn & Crutcher LLP, as special tax counsel; (d) John W. Wolfe, P.S., as special counsel; (e) Miller & Chevalier Chartered, as special tax counsel; (f) Bingham McCutchen LLP, as successor in interest to McKee Nelson LLP, as special tax counsel; (g) Perkins Coie LLP, as special counsel; (h) Quinn Emanuel Urquhart & Sullivan, LLP, as special litigation counsel and conflicts counsel; (i) Shearman & Sterling LLP, as special tax counsel; (j) Silverstein & Pomerantz LLP, as special tax counsel; (k) Simpson, Thacher & Bartlett LLP, as special counsel, and (l) Klee, Tuchin, Bogdanoff & Stern LLP as special litigation counsel.

The Bankruptcy Court has also authorized the Debtors to employ and retain (a) Alvarez & Marsal North America, LLC, as restructuring advisors to the Debtors; (b) CP Energy Group, LLC, as investment banker; (c) Domain Assets, LLC d.b.a. Consor Intellectual Asset Management, as intellectual property consultants; (d) Grant Thornton LLP, as tax advisors; (e) Kurtzman Carson Consultants LLC, as Claims and noticing agent; (f) PricewaterhouseCoopers LLP, as special accountants; (g) Blackstone, as financial advisor; (h) Ernst & Young LLP as accounting, tax and reporting service provider; and (i) Valuation Research Corporation, as valuation service provider for certain of the Debtors’ assets.

In addition, the Bankruptcy Court authorized the Debtors to employ professionals utilized in the ordinary course of business, including Arnold & Porter LLP, as litigation counsel; Corporate Counsel Solutions PLLC, to provide information technology and other general contract related legal services; Goodwin Procter LLP, as litigation counsel; Milliman USA, Inc., as reinsurance advisor; The Law Firm of David H. Zielke, PS, as structured finance advisor; Howard IP Law Group, PC, as legal specialist in patent matters; the public relations services of Joele Frank, Wilkinson Brimmer Katcher; Bass, Berry & Sims PLC, as Tennessee tax counsel; Budsberg Law Group, PLLC, as Washington state counsel; and Jenner & Block LLP, as counsel with respect to director and officer insurance issues.

On December 19, 2008, the Debtors filed with the Bankruptcy Court their schedules of assets and liabilities (the “Schedules”) and statements of financial affairs (the “SOFAs”). On January 27, 2009 and February 24, 2009, WMI filed with the Bankruptcy Court its first and second, respectively, amended Schedules. On January 14, 2010, WMI filed with the Bankruptcy Court further amendments to its SOFAs. By order, dated January 30, 2009, the Bankruptcy Court established March 31, 2009 as the deadline for filing proofs of Claim against the Debtors. Over 4,050 proofs of Claim have been filed against the Debtors in these chapter 11 cases.

In the January Opinion, the Bankruptcy Court found that, pursuant to sections 726(a) and 1129 of the Bankruptcy Code, the Debtors must satisfy Late-Filed Claims prior to paying Postpetition

Interest Claims. Accordingly, the Debtors created Class 12A for Late-Filed Claims (i.e., a Claim against any of the Debtors or the Debtors’ estates, (i) proof of which was filed subsequent to March 31, 2009, but prior to the commencement of the hearing on confirmation of the Seventh Amended Plan, and that does not merely amend or supersede any Claim that was filed prior to such date, and (ii) which has not been listed by such Debtor in its Schedules48 as liquidated in amount and not disputed or contingent). Treatment of Late-Filed Claims pursuant to the Seventh Amended Plan is described in greater detail in Section VI.B.13 of this Disclosure Statement.

| f. | Vendor Stipulation/Executory Contracts and Unexpired Leases |

Section 365 of the Bankruptcy Code grants a debtor the power, subject to the approval of the Bankruptcy Court, to assume or reject executory contracts and unexpired leases. If an executory contract or unexpired lease is rejected, the counterparty to the agreement may file a Claim for damages incurred by reason of the rejection. Such Claim is a general unsecured Claim against a debtor’s estate.

Prior to the Petition Date, WMI was party to numerous contracts, many of which were for the benefit of WMB. As a result of the FDIC’s seizure of WMB’s assets, WMI determined that many of these contracts were no longer needed. However, to assist JPMC with the integration of WMB’s business and to mitigate potential administrative Claim exposure against the Debtors’ estates, the Debtors and JPMC entered into a stipulation regarding certain vendor contracts (the “Vendor Stipulation”), which was approved by the Bankruptcy Court by order dated October 16, 2008. Pursuant to the Vendor Stipulation, the Debtors and JPMC agreed that, among other things, (i) JPMC was authorized to negotiate new agreements with WMI’s vendors, (ii) JPMC would pay such vendors for goods and services provided after the Petition Date, and (iii) the Debtors would cooperate with JPMC to ensure continued performance by the vendors. In addition, JPMC is required to give WMI notice twenty (20) days prior to the date it no longer wishes to avail itself of the benefits of certain vendor contracts, after which JPMC is relieved of the related liability. In most instances, upon the Debtors’ receipt of such notice from JPMC, the identified contracts were rejected. Pursuant to the Global Settlement Agreement, on the effective date thereof, the Vendor Stipulation will be terminated and deemed of no further force and effect.

On March 25, 2009, the Bankruptcy Court entered an order establishing procedures for the rejection of executory contracts and unexpired leases. The approved procedures permit the Debtors to reject an executory contract on 10 days notice, without the additional expense to the Debtors’ estates and the attendant delay that would result if the Debtors were required to proceed by separate motion and hearing for every executory contract and unexpired lease they determined to reject. Pursuant to these procedures, the Debtors have rejected numerous unnecessary and economically burdensome contracts.

In addition, to date, outside of the context of the Vendor Stipulation and contracts assigned in conjunction with a sale or settlement, by order dated February 16, 2009, the Bankruptcy Court authorized the Debtors to (i) assume one unexpired lease of nonresidential real property and (ii) assume and assign to JPMC two unexpired leases of nonresidential real property.

| 2. | Litigation with the FDIC and JPMC |

The following is a general overview of the litigation between the Debtors, JPMC and the FDIC that is resolved pursuant to the Global Settlement Agreement. Pursuant to the Global Settlement Agreement, and to the extent and on the terms set forth therein, the parties have agreed to release each

other of the claims described below. As stated, the Bankruptcy Court has approved the Global Settlement Agreement, but the effectiveness of that agreement remains conditioned on, among other things, confirmation and consummation of a plan of reorganization premised upon that agreement.

On December 30, 2008, the Debtors, on their own behalf, and on behalf of each of WMI’s direct and indirect non-banking subsidiaries filed a proof of claim against the FDIC Receiver in connection with WMB’s receivership, asserting claims on behalf of the Debtors’ chapter 11 estates (the “Debtors’ claims”). The Debtors’ proof of claim requested, among other things, compensation for the Debtors’ Equity Interest in WMB, recognition of ownership interests in WMI’s assets claimed by the FDIC, allowance of a protective claim for payment of the Debtors’ deposits, payments of amounts owed to WMI by WMB and the avoidance of certain transfers made by WMI to WMB as a preference or fraudulent transfer, which were transferred or claimed by the FDIC and/or JPMC, and for other money owed by WMB. By letter, dated January 23, 2009, the FDIC notified the Debtors that the FDIC had disallowed the Debtors’ proof of claim in its entirety. The FDIC’s letter also notified the Debtors of their right pursuant to 12 U.S.C. § 1821(d)(6)(A) to challenge the disallowance of their Claim by commencing a lawsuit within sixty (60) days of the notice of disallowance.

Consistent therewith, on March 20, 2009, the Debtors initiated the D.C. Action by filing a complaint in the D.C. District Court (Case No. 09-cv-00533 (RMC)), as required pursuant to 12 U.S.C. § 1821, against the FDIC Receiver and FDIC Corporate. In addition to appealing the disallowance of their proof of claim, the Debtors’ complaint alleged, among other things, that the FDIC sold WMB’s assets for less than they were worth, and as a result, the FDIC breached its statutory duty under the Federal Deposit Insurance Act to maximize the net present value of WMB’s assets. The Debtors’ complaint further alleged that the FDIC’s failure to compensate the Debtors for what they would have received in a straight liquidation constitutes (i) a taking of the Debtors’ property without just compensation in violation of the Fifth Amendment of the U.S. Constitution and (ii) a conversion of the Debtors’ property in violation of the Federal Tort Claims Act.

By motions, dated June 11, 2009 and June 15, 2009, the FDIC Receiver and FDIC Corporate, respectively, filed motions to dismiss the D.C. Action, which motions were opposed by the Debtors. Contemporaneously with their motions to dismiss, the FDIC filed an answer to the Debtors’ complaint, as amended, and counterclaims against the Debtors. The Debtors opposed the FDIC’s motions to dismiss and thereafter, by motion dated July 27, 2009, moved to dismiss the amended counterclaims asserted by the FDIC and to stay the remainder of the D.C. Action, in its entirety, in favor of the pending adversary proceedings in the Bankruptcy Court (the “Debtors’ Motion to Stay/Dismiss”). The FDIC and JPMC both opposed the Debtors’ Motion to Stay/Dismiss. On January 7, 2010, the D.C. District Court granted the Debtors’ Motion to Stay/Dismiss in part and denied all the pending motions to dismiss. Accordingly, the D.C. Action was stayed in its entirety pending outcome of the adversary proceedings pending in the Bankruptcy Court.

JPMC and certain WMB Notes Holders were permitted to intervene in the D.C. Action. The Creditors’ Committee also filed a motion to intervene which was opposed by the FDIC, JPMC and the WMB Notes Holders. The Bankruptcy Court did not rule on the Creditors’ Committee’s proposed intervention.

| b. | The Adversary Proceedings |

As described above, during the course of the chapter 11 cases, the Debtors have engaged in extensive litigation with JPMC. All such litigation relates to or arises from JPMC’s purchase of WMB’s assets.

| (i) | The JPMC Adversary Proceeding |

On March 24, 2009, JPMC commenced the JPMC Adversary Proceeding against the Debtors and the FDIC, styled JPMorgan Chase Bank, N.A. v. Washington Mutual, Inc., et al., Adversary Pro. No. 09-50551(MFW) (the “JPMC Adversary Proceeding”), in the Bankruptcy Court seeking a declaratory judgment with respect to the ownership of certain disputed assets. Those assets and interests include, among others, the Trust Preferred Securities, the right to the Tax Refunds, the Disputed Accounts, certain judgment awards arising from the Goodwill Litigation (as described below), assets of the trusts supporting deferred compensation arrangements covering current and former employees of WMB, equity interests in Visa Inc., certain intellectual property and certain contractual rights.

On May 29, 2009, the Debtors filed an answer to JPMC’s complaint and asserted various counterclaims against JPMC claiming ownership rights over disputed assets and seeking avoidance of certain prepetition transfers of assets to WMB and, subsequently to JPMC. JPMC moved to dismiss the counterclaims asserted by the Debtors against JPMC, which motion was opposed by the Debtors, and denied by the Bankruptcy Court by order dated September 14, 2009. On September 18, 2009, JPMC sought leave to appeal the Bankruptcy Court’s ruling, which was opposed by the Debtors. JPMC filed an answer to the Debtors’ counterclaims on September 21, 2009.

The Debtors estimated that certain of their claims and the claims asserted against them in the JPMC Adversary Proceeding could take at least one year, and as much as four years, to fully litigate, depending upon the circumstances and whether the parties to the litigation pursued any appeals.

On April 27, 2009, the Debtors commenced the Turnover Action against JPMC, styled Washington Mutual, Inc. et al. v. JPMorgan Chase Bank, N.A., Adversary Pro. No. 09-50934(MFW) (the “Turnover Action”), in the Bankruptcy Court to recover approximately $4 billion that WMI and WMI Investment had on deposit at WMB and FSB (i.e., the Disputed Accounts), including an Admin Account, which are now held by JPMC, after assuming all the deposit liabilities of WMB and FSB.

JPMC filed a motion to dismiss the Turnover Action, or, in the alternative to consolidate the Turnover Action with the JPMC Adversary Proceeding, which motion was opposed by the Debtors. The FDIC and JPMC also filed motions to stay the Turnover Action and the JPMC Adversary Proceeding, asserting that the Claims must be resolved by the D.C. District Court. At a hearing held before the Bankruptcy Court on June 24, 2009, both of JPMC’s motions and the FDIC’s motion were denied. Orders were entered to this effect on July 6, 2009. Both JPMC and the FDIC have sought leave to appeal the orders denying their motions to dismiss or stay the JPMC Adversary Proceeding and the Turnover Action, which were opposed by the Debtors. JPMC filed counterclaims, as amended, in the Turnover Action on or about August 10, 2009. The Debtors moved to dismiss those counterclaims, which motion is still pending.

By order dated August 28, 2009, the Bankruptcy Court permitted the WMB Notes Holders to intervene in the JPMC Adversary Proceeding and the Turnover Action.

The parties completed briefing on the Debtors’ motion for summary judgment in the Turnover Action, which motion and the oppositions thereto—filed by the FDIC Receiver, JPMC, and the WMB Notes Holders—were considered at a hearing before the Bankruptcy Court on October 22, 2009. Prior to its approval of the Global Settlement Agreement, the Bankruptcy Court’s decision with respect to the Debtors’ summary judgment motion remained sub judice, although the Bankruptcy Court indicated that it was prepared to rule.

| c. | FDIC Motion for Relief from Stay |

On November 4, 2009, the FDIC Receiver filed a motion for relief from the automatic stay to permit the FDIC Receiver to exercise its purported contractual right under the Purchase and Assumption Agreement to direct JPMC to return the Deposits to the FDIC Receiver. The Debtors opposed such relief.

| d. | The Texas Litigation and the Debtors’ 2004 Examination Requests |

On or about February 16, 2009, various insurance company plaintiffs, including American National Insurance Company, filed suit in the 122nd District Court of Galveston County, Texas, in the case captioned American Nat’l Ins. Co., et al. v. JPMC Chase & Co., et al. (Case No. 09-CV-0199) (the “Texas Litigation”). In their complaint, the plaintiffs asserted various causes of action against JPMC in connection with its acquisition of WMB’s assets. Specifically, the plaintiffs asserted that there was a premeditated plan by JPMC designed to damage WMB and FSB, and thereby enable JPMC to acquire WMI’s banking operations at a “fire sale” price. The causes of action asserted by the plaintiffs include various theories of business tort and tortious interference. JPMC has disputed and contested these allegations. Subsequent to the filing of the Texas Litigation, JPMC and the FDIC Receiver, an intervening defendant, removed the action to the United States District Court for the Southern District of Texas (Case No. 09-00044). Upon the motion of the FDIC Receiver, by order, dated September 9, 2009, the United States District Court for the Southern District of Texas then transferred the Texas Litigation to the D.C. District Court (Case No. 09-cv-01743 (RMC)). On April 13, 2010, the D.C. District Court entered an order granting motions to dismiss filed by JPMC and the FDIC Receiver, and stating that (i) the FDIC Receiver was a necessary party to that lawsuit but that (ii) the plaintiffs failed to pursue their Claims against the FDIC Receiver administratively through the exclusive receivership Claims process, such that the plaintiffs’ Claims were barred by the Financial Institutions Reform, Recovery and Enforcement Act (“FIRREA”). On May 10, 2010, the plaintiffs filed a motion to alter or amend the April 13, 2010 judgment and requested leave to file an amended complaint. On June 4, 2010, each of the FDIC and JPMC filed oppositions to plaintiffs’ motion and, on July 19, 2010, the D.C. District Court entered an order denying plaintiffs’ motion, which order the plaintiffs have appealed.

In connection with the Texas Litigation, on May 1, 2009, the Debtors filed a motion (the “Rule 2004 Motion”), pursuant to Bankruptcy Rule 2004, seeking entry of an order directing the examination of JPMC. JPMC opposed the Rule 2004 Motion. By Opinion and Order, dated June 24, 2009, the Bankruptcy Court granted the Rule 2004 Motion. JPMC’s subsequently-filed motion for reconsideration of this Court’s Opinion and Order was denied. Thereafter, JPMC began producing documents to the Debtors for their review.

As a result of the review of certain of the documents produced by JPMC, the Debtors determined that additional fact investigation was necessary. On December 14, 2009, the Debtors filed a motion, pursuant to Bankruptcy Rule 2004, seeking court authority to conduct additional examinations of witnesses and request the production of documents from various third-parties (the “Third Party 2004 Motion”), including, among others, the FDIC, the OTS, the U.S. Department of the Treasury, and former U.S. Treasury secretary Henry M. Paulson, Jr. The Third Party 2004 Motion was denied by the

Bankruptcy Court. Certain third parties, however, agreed to provide documents responsive to the Debtors’ requests on a consensual basis.

| 3. | The Global Settlement Agreement |

As noted above, the Seventh Amended Plan incorporates, and is expressly conditioned upon the effectiveness of, the Global Settlement Agreement, which the Bankruptcy Court approved in both the January Opinion and the September Opinion, and which proposes to compromise and settle certain significant issues in dispute among the parties thereto.

Pursuant to the terms of the Global Settlement Agreement, the Debtors, JPMC, the FDIC Receiver, FDIC Corporate, and the Creditors’ Committee have agreed to compromise, settle and release, as to the parties thereto, certain disputes among such parties including, but not limited to the disputes at issue in (i) the D.C. Action, (ii) the JPMC Adversary Proceeding, (iii) the Turnover Action, (iv) the Rule 2004 Motion, (v) the proof of claim filed by the Debtors and each of WMI’s direct and indirect non-banking subsidiaries with the FDIC Receiver, (vi) the proofs of Claim filed in these Chapter 11 Cases by JPMC and the FDIC Receiver, (vii) the transfer of the Trust Preferred Securities and the consequent issuance of the REIT Series, and (viii) certain other disputed assets and liabilities. The Global Settlement Agreement is incorporated into this Disclosure Statement by reference as if fully set forth herein.

| b. | Certain Terms of the Global Settlement Agreement |

| (i) | Treatment of the Disputed Accounts |

In partial consideration for the assets sold pursuant to the Global Settlement Agreement and the releases and other benefits provided to the Released Parties pursuant to the Seventh Amended Plan, the JPMC Entities (as defined in the Global Settlement Agreement), the FDIC Receiver and FDIC Corporate will (i) waive any and all Claims, rights and liabilities with respect to the funds, in excess of $4 billion, in the Disputed Accounts, and (ii) take such actions, if any, as may be reasonably requested by WMI, including, without limitation, filing with the Bankruptcy Court such notices or pleadings setting forth the waiver of any and all interests in the Disputed Accounts. The FDIC Receiver and FDIC Corporate will waive and release any and all interest in and any and all rights to seize or set off against the Disputed Accounts and any funds contained therein in accordance with Section 9.5 of the Purchase and Assumption Agreement including, without limitation, by withdrawing with prejudice the motion filed by the FDIC Receiver seeking relief from the automatic stay imposed by section 362 of the Bankruptcy Code to permit the FDIC Receiver to exercise its purported contractual right, pursuant to the Purchase and Assumption Agreement, to direct JPMC to transfer the funds on deposit in the Disputed Accounts to the FDIC Receiver (the “FDIC Stay Relief Motion”). JPMC will pay to WMI or such other of the WMI Entities (as defined in the Global Settlement Agreement) as WMI will designate, the amounts contained in the Disputed Accounts as of the effective date of the Global Settlement Agreement, net of eighty percent (80%) of the amounts received by WMI during the period from the Petition Date up to and including the date of the Global Settlement Agreement attributable to refunds of taxes deposited in the Disputed Accounts (including the interest component of any such refunds and interest, if any, earned thereon), free and clear of all liens, Claims, interests and encumbrances of any Person.

In addition, JPMC, as successor to WMB, will (i) release any security interest in or lien upon that certain administrative account, having a balance, as of the Petition Date, in the approximate amount of $52.6 million (the “Admin Account”) and the monies contained therein and (ii) release and

otherwise transfer the Admin Account and the funds contained therein in accordance with the direction of WMI.

| (ii) | Allocation of the Tax Refunds |

WMI believes that, in total, the Tax Group is entitled to federal and state Tax Refunds, net of tax payments estimated to be owed to taxing authorities, of approximately $5.5 to $5.8 billion in taxes in the aggregate, including interest through a projected future date of receipt. Over 90% of this amount reflects the federal income tax refunds already received, with certain unrelated federal tax refund litigation still pending.49 On August 27, 2010, the Bankruptcy Court approved a Stipulation Regarding Establishment of Segregated Account for Tax-Related Payments, among the Debtors, the FDIC Receiver and JPMC, pursuant to which the parties agreed to a protocol for the deposit and retention of the Tax Refunds, as they are received, in a segregated interest bearing account, pending approval and consummation of the Global Settlement Agreement. This account has been established and all Tax Refunds received since the execution of the Global Settlement Agreement have been deposited therein. This includes federal Tax Refunds (approximately $5.278 billion in amount),50 and state Tax Refunds totaling approximately $4.3 million.

Allocation of the Tax Refunds. The ownership of the Tax Refunds is in dispute. Pursuant to the Global Settlement Agreement, the parties thereto have agreed to share the Tax Refunds as follows:

The First Portion. The amount of net Tax Refunds (including state and local income taxes) that are received, and would have been receivable absent the Worker, Homeownership, and Business Assistance Act of 2009’s extension of the federal net operating loss (“NOL”) carryback period (the “First Portion”) will be allocated as follows: 20% of such refunds allocated to the Debtors and the remaining 80% of such refunds to JPMC. The Debtors currently estimate that the First Portion of the Tax Refunds will be approximately $2.7 to $3.0 billion in the aggregate, approximately $540 to $600 million of which will be allocated to the Debtors’ estates.

The Second Portion. Any additional net Tax Refunds, attributable to the Worker, Homeownership, and Business Assistance Act of 2009, will be allocated as follows: 69.643% of such refunds will be allocated to WMI and 30.357% of such refunds will be allocated to the FDIC Receiver.

_______________________________

49 Certain of the pending federal tax refund litigations relate to claimed deductions for the amortization and abandonment of certain assets in certain tax years of a predecessor company in the time period 1991 through 1998. These assets were acquired by the predecessor company in exchange for its acquisition of certain failed institutions in the early 1980’s. The first of these refund claims was filed in the U.S. District Court of Western Washington at Seattle (“District Court”). In this case, the Debtors and the Government each filed a Motion for Summary Judgment seeking a determination as to whether the Tax Group was entitled to a tax basis in the specified assets. The District Court ruled in favor of the Government. Washington Mutual, Inc. v. United States, No. C06-1550-JCC (W.D. Wash. August 12, 2008). The Debtors appealed this decision to the U.S. Court of Appeals for the Ninth Circuit (“Ninth Circuit”), which reversed the decision of the District Court. Washington Mutual, Inc. v. U.S., 636 F.3d 1207 (9th Cir. March 3, 2011). The Ninth Circuit remanded the case to the District Court to determine the amount of tax basis and the corresponding amount of tax refunds. The government did not appeal the Ninth Circuit decision to the United States Supreme Court. A trial to determine the amount of tax basis and refund is scheduled to commence on March 26, 2012 in the District Court.

50 The Debtors estimate that, in the aggregate, another $200 million to $500 million of net Tax Refunds could be recovered through ongoing tax litigation and negotiation. Because such refunds are part of the First Portion (as defined below), WMI’s portion of these refunds would be 20% of the total received.

As described more fully in Sections III.B.6.b and V.B.5.g(i) hereof, pursuant to the terms of the Seventh Amended Plan, a certain portion of WMI’s share of such refunds will be distributed to certain holders of WMB Senior Notes, in the aggregate amount of Three Hundred Thirty-Five Million Dollars ($335 million). The Debtors have received the Second Portion of the Tax Refunds in the amount of $2.779 billion, approximately $1.94 billion of which would be allocated to the Debtors’ estates, including any distribution that may be payable to holders of WMB Senior Notes.

Per the Global Settlement Agreement, the Debtors currently estimate that their share of the total estimated Tax Refunds will be approximately $2.17 billion, after the distribution that may be payable to holders of WMB Senior Notes.

| (iii) | Transfer of Assets to JPMC |

Pursuant to the Global Settlement Agreement, WMI, WMI Investment, Ahmanson Obligation Company, H.S. Loan Corporation, WAMU 1031 Exchange, WMMRC, WM Citation Holdings, LLC, WMI Rainier LLC and Washington Mutual Capital Trust 2001 (collectively, the “WMI Entities”), the FDIC Receiver and the Receivership, will sell, transfer, and assign (or cause to be sold, transferred or assigned) to the JPMC Entities, and the JPMC Entities will acquire, pursuant to the Seventh Amended Plan and sections 363 and 365 of the Bankruptcy Code, free and clear of all liens, Claims and encumbrances, or otherwise waive and relinquish any and all right, title and interest any of the WMI Entities, the FDIC Receiver and the Receivership may have in the following assets, each of which is described in detail herein: (i) the Trust Preferred Securities, (ii) the Washington Mutual, Inc. Flexible Benefits Plan (the “Medical Plan”) and any checks made out to or received by WMI or otherwise for the benefit of the Medical Plan including pharmacy rebates in connection with contracts associated with the Medical Plan which includes uncashed checks in an amount equal to the pharmacy rebates received by the WMI Entities from and after the Petition Date currently estimated to be approximately $776,000, (iii) those certain JPMC Rabbi Trusts, set forth in the Global Settlement Agreement and the Seventh Amended Plan, and certain JPMC Policies (i.e., BOLI/COLI policies and the proceeds thereof), as identified in the Global Settlement Agreement and as defined in the Seventh Amended Plan, (iv) the two defined benefit plans sponsored by WMI, the WaMu Pension Plan (the “WaMu Pension Plan”) and the Retirement Income Plan for the Salaried Employees of Lakeview Savings Bank (the “Lakeview Pension Plan” and, together, the “Pension Plans”) and all of WMI’s interest in the assets contained in any Pension Plan-related trusts or assets that are otherwise associated with such plans (subject to the correction and satisfaction of certain potential defects and remediation obligations, as set forth in the Global Settlement Agreement), (v) the proceeds of litigation commenced by Anchor Savings Bank FSB, described herein, (vi) the Visa Shares and the VISA Strategic Agreement (as defined in the Global Settlement Agreement), (vii) certain intellectual property identified in the Global Settlement Agreement and as described below, (viii) WMI Investment’s indirect membership interest in a portfolio holding company, JPMC Wind Investment Portfolio LLC, which owns an Equity Interest in certain wind investment projects, discussed below, (ix) certain bonds issued by certain insurance or bonding companies on behalf of WMB and FSB, pursuant to that certain general agreement of indemnity, dated as of June 14, 1999, executed and delivered by WMI, and (x) certain Tax Refunds (as discussed herein and as set forth in Section 2.4 of the Global Settlement Agreement), in each case, free and clear of all liens, Claims, interests and encumbrances, except for any Claim that is an Allowed JPMC Assumed Liability.

| (iv) | Transfer of Assets to the Debtors |

The Global Settlement Agreement provides that the JPMC Entities will sell, transfer, and assign to the WMI Entities, and the WMI Entities will acquire, pursuant to the Seventh Amended Plan and sections 363 and 365 of the Bankruptcy Code, any and all right, title and interest any of the JPMC Entities may have in (i) certain rabbi trusts and certain BOLI-COLI policies and the proceeds thereof,

identified in the Global Settlement Agreement, (ii) the stock of H.S. Loan Corporation, 98.67% of which is owned by WMI and 1.33% of which is owned by WMB, (iii) the WMI Intellectual Property (as defined in the Global Settlement Agreement), and (iv) WMI’s portion of the Tax Refunds, as set forth herein and in Section 2.4 of the Global Settlement Agreement, in each case, free and clear of all liens, claims, interests and encumbrances of any entity.

| (v) | Additional Consideration to the Debtors |

As additional consideration for the asset sale and compromise and settlement embodied in the Global Settlement Agreement, and as further consideration for the releases and other benefits provided to JPMC pursuant to the Seventh Amended Plan, the parties have agreed that (i) JPMC will pay WMI $25 million for WMI’s 3.147 million Class B shares of Visa Inc., WMI will retain all dividends with respect thereto received prior to the effective date of the Global Settlement Agreement, and JPMC will assume liabilities of the WMI Entities relating to that certain “Interchange” litigation (described in Section V.B.6.i below), as set forth in the Global Settlement Agreement; (ii) JPMC will (a) assume all obligations of WMB, WMB’s subsidiaries or JPMC to subsidiaries of WMI pursuant to certain intercompany notes, resulting in a net amount of approximately $180 million of principal and interest which will be paid by JPMC to WMI, (b) JPMC, the FDIC Receiver and WMI will waive all remaining intercompany claims, resulting in a net amount of approximately $9 million of WMI receivables that WMI has agreed to waive, and (c) each of JPMC and the FDIC Receiver will waive their Claims against WMI, which total approximately $274 million, regarding certain disputed liabilities related to the funding of the WaMu Pension Plan; (iii) JPMC will cause its affiliates to continue providing loan servicing with respect to certain mortgage loans owned by the Debtors or their affiliates and the remittal of checks and payments received in connection therewith; (iv) JPMC will (a) assume any and all liabilities and obligations of the WMI Entities for remediation or clean-up costs and expenses, in excess of applicable and available insurance, arising from or relating to that certain litigation styled California Dept. of Toxic Substances Control, et al. v. American Honda Motor Co., Inc., et al., No. CV05-7746 CAS (JWJ), currently pending in the United States District Court for the Central District of California (the “BKK Litigation”), and certain agreements related thereto (the “BKK Liabilities”), (b) pay or fund the payment of BKK Liabilities to the extent such liabilities are not covered by applicable insurance policies, (c) defend the Debtors against and reimburse the Debtors for any distribution which the Debtors become obligated to make on account of remediation or clean-up costs and expenses not otherwise covered by the BKK-Related Policies (as defined in the Global Settlement Agreement) and/or reimbursed by the BKK-Related Carriers (as defined in the Global Settlement Agreement), and (d) indemnify (subject to certain limitations with respect to WMI Rainier LLC) the WMI Entities for the BKK Liabilities to the extent that such liabilities are not covered by applicable insurance policies; provided, however, that nothing in the Seventh Amended Plan or the Confirmation Order is intended to, nor shall it, release any non-Debtor or non-Debtor Entity that may be a Released Party or a Related Person, in connection with any legal action or Claim brought by CDTSC or the BKK Group relating to the BKK Site that is the subject of the BKK Litigation; (v) JPMC will assume the JPMC Assumed Liabilities (as defined the Seventh Amended Plan), namely certain liabilities in connection with the assets it receives pursuant to the Global Settlement Agreement and, on or after the Effective Date of the Seventh Amended Plan, JPMC will pay or fund the payment of certain Allowed Claims arising from or relating to such liabilities (defined as Allowed JPMC Assumed Liability Claims in the Seventh Amended Plan); (vi) the JPMC Entities, the FDIC Receiver and FDIC Corporate (as applicable) will be deemed to have waived and released any and all rights and claims relating to any claims or causes of action associated with the American Savings Litigation, including rights and claims to the Registry Funds and the American Savings Escrow (discussed below); (vii) JPMC has agreed to (a) pay or otherwise satisfy any proofs of claim filed against the Debtors by vendors with respect to services, software licenses, or goods provided to WMB and its subsidiaries (whether prior or subsequent to JPMC’s acquisition of the assets of WMB) pursuant to contracts between WMB and/or one or more of its subsidiaries and such vendors (to the extent such portion of any such Claim becomes an

Allowed Claim and to the extent payable, in whole or in part, by the Debtors), (b) pay to WMI $50 million, which funds will be deposited into an escrow account to be used by the Debtors for the satisfaction of Claims against WMI by vendors with respect to services, software licenses or goods asserted to have been provided by the counterparties to or for the benefit of WMB or its subsidiaries prior to the Petition Date pursuant to agreements between WMI and such vendors to the extent such portion of any such Claim becomes an Allowed Claim and to the extent payable, in whole or in part, by the Debtors (the “Vendor Escrow”), and (c) to the extent that any funds remain in escrow following (1) the payment or satisfaction of all WMI Vendor Claims (including, without limitation, the withdrawal, with prejudice, of all related proofs of Claim) and (2) the payment of all fees and expenses associated with such escrow, such excess funds will be distributed equally to WMI and JPMC. The Debtors reviewed all WMI Vendor Claims and estimate that the aggregate amount of all WMI Vendor Claims will be less than $50 million.

The JPMC Entities filed over 40 proofs of claim against the Debtors’ chapter 11 estates. In large part, JPMC’s proofs of claim are filed in unliquidated amounts. The JPMC Allowed Unsecured Claim will be deemed an Allowed Claim against WMI and will be classified with and treated in the same manner as other Allowed General Unsecured Claims under the Seventh Amended Plan, including, without limitation, with respect to distributions pursuant to the Seventh Amended Plan; provided, however, that, in partial consideration for the releases and other benefits provided to JPMC pursuant to the Seventh Amended Plan and the Global Settlement Agreement, JPMC will waive any distribution JPMC otherwise would be entitled to receive on account of the JPMC Allowed Unsecured Claim.

| (vii) | Additional Consideration to the FDIC |

Except as provided above in connection with the allocation of the second portion of the federal income tax refunds attributable to the Worker, Homeownership, and Business Assistance Act of 2009 and as set forth in Section 2.4 of the Global Settlement Agreement and the Seventh Amended Plan, the FDIC Receiver will not be entitled to receive distributions on account of its proof of claim filed against the Debtors (previously defined as the “FDIC Claim”) or otherwise. In further consideration for the satisfaction, settlement, release and discharge of, and in exchange for, the FDIC Claim, the FDIC Receiver, FDIC Corporate and the Receivership will receive the releases set forth in the Global Settlement Agreement and the Seventh Amended Plan.

| (viii) | JPMC Settlement with the Releasing REIT Trust Holders |

Pursuant to the Global Settlement Agreement and in consideration for certain releases by Releasing REIT Trust Holders described in the next paragraph, JPMC will pay, or transfer to the Disbursing Agent for payment to each Releasing REIT Trust Holder cash in an amount equal to $12,500.00 (calculated by dividing $50 million by the number of issued and outstanding shares of REIT Series) times the number of shares of REIT Series held by such Releasing REIT Trust Holder on the on the voting record date for the Sixth Amended Plan 51; provided, however, that, at the election of JPMC, the amount payable to Releasing REIT Trust Holders pursuant to Section 2.24 of the Global Settlement Agreement may be paid in shares of common stock of JPMC, having an aggregate value equal to the

amount of cash to be paid pursuant to Section 2.24 of the Global Settlement Agreement, valued at the average trading price during the thirty (30) day period immediately preceding the Effective Date.

The Seventh Amended Plan defines a “Releasing REIT Trust Holder” as a holder of REIT Series that (i) voted to accept the Sixth Amended Plan and, to the extent such holder is a holder of REIT Series as of the Voting Record Date with respect to solicitation of acceptances to the Seventh Amended Plan, votes to accept the Seventh Amended Plan and grants the releases set forth in the Non-Debtor Release Provision (Section 41.6 of the Seventh Amended Plan), (ii) did not interpose an objection to confirmation of the Sixth Amended Plan as it related to the REIT Series or the Trust Preferred Securities, (iii) with respect to the Seventh Amended Plan, does not otherwise interpose an objection to confirmation of the Seventh Amended Plan as it relates to the REIT Series or the Trust Preferred Securities, (iv) acknowledges that JPMC or its designee is the sole legal, equitable and beneficial owner of the Trust Preferred Securities for all purposes and that such REIT Series holder has no legal, equitable or beneficial interest in the Trust Preferred Securities, and (v) in connection with the solicitation of acceptances to the Sixth Amended Plan, executed and delivered the release of claims against the “Releasees”, as set forth in Section 2.24 of the Global Settlement Agreement and as incorporated into the Ballots distributed to holders of REIT Series (such releases, the “REIT Releases”).

The Sixth Amended Plan provided that if the holders of REIT Series had voted to accept the Sixth Amended Plan, “Releasing REIT Trust Holder” would have been deemed to include each and every holder of the REIT Series and each such holder would have been deemed to have executed and delivered the release of Claims set forth in Section 2.24 of the Global Settlement Agreement (i.e., the REIT Releases), and receive the requisite payment from JPMC. In connection with the solicitation of votes and elections with respect to the Sixth Amended Plan, however, the class of REIT Series voted to reject the Sixth Amended Plan. Accordingly, only REIT Series holders for which items (i) through (v) above apply will be (a) bound by the REIT Releases and (b) receive the payment from JPMC.

Pursuant to the solicitation of the Sixth Amended Plan, holders of REIT Series holding approximately twenty-five percent (25%) of the REIT Series shares elected to grant the REIT Releases and, thus, share in the JPMC distribution. The Debtors did not resolicit elections to grant the REIT Releases from holders of REIT Series in connection with the Debtors’ solicitation of the Modified Sixth Amended Plan and will not do so in connection with the Seventh Amended Plan. Nonetheless, as must all holders Claims and Equity Interests, holders of REIT Series must submit Non-Debtor Release Elections (as defined in Section XI.B.1.a hereof) to receive a distribution from the Debtors.

Accordingly, REIT Release elections submitted by holders of REIT Series in connection with the solicitation of votes and elections with respect to the Sixth Amended Plan will be the only elections honored for determining which holders are entitled to receive the above-described supplemental distribution from JPMC. Such elections will remain binding and effective on such holders, and such holders will be deemed “Releasing REIT Trust Holders” pursuant to the Seventh Amended Plan. Notwithstanding the foregoing, all holders of REIT Series, including those deemed “Releasing REIT Trust Holders,” must submit or resubmit, as the case may be, Non-Debtor Release Elections in connection with the solicitation of votes and elections on the Seventh Amended Plan to receive a distribution from the Debtors. Any and all prior Non-Debtor Release Elections will be disregarded for this purpose with respect to the Seventh Amended Plan.

| (ix) | JPMC Reservation of Rights |

The Global Settlement Agreement described in this Disclosure Statement has been incorporated into and made part of the Seventh Amended Plan in order to resolve the outstanding substantive, procedural and jurisdictional disputes among the parties thereto. In the event this Disclosure

Statement is not approved in a form acceptable to JPMC, or the Global Settlement Agreement is not approved and the Seventh Amended Plan is not confirmed by the Bankruptcy Court, and either the Global Settlement Agreement or the Seventh Amended Plan does not become effective, JPMC has reserved all of its rights with respect to all the disputes among the parties, including, without limitation, the right to dispute any of the statements and characterizations contained in this Disclosure Statement. Without limiting the generality of the foregoing, JPMC has advised the Debtors that absent (i) approval of the Global Settlement Agreement, (ii) confirmation of the Seventh Amended Plan, and (iii) the occurrence of the Effective Date, JPMC (a) continues to object to the jurisdiction of the Bankruptcy Court to hear and determine Claims or matters relating to the Receivership, whether in the pending litigations or otherwise, and (b) reserves all rights to disagree with or otherwise dispute any of the facts or characterizations as set forth by the Debtors in this Disclosure Statement or otherwise.

| 4. | The Appointment of the Examiner and the Examiner’s Report |

On April 26, 2010, the Equity Committee filed a motion [D.I. 3579] for the appointment of an examiner pursuant to section 1104(c) of the Bankruptcy Code (the “Examiner Motion”) to investigate (i) the extent to which there are potential claims and causes of action held by the Debtors’ estates against any person or entity, and the merit and value of those claims, arising from circumstances leading to the OTS’s closure of WMB and appointment of the FDIC Receiver and the FDIC’s sale of WMB’s assets to JPMC, (ii) the extent to which there are potential claims and causes of action held by the Debtors’ estates arising from breach of fiduciary duty or other legal duties by WMI’s officers, directors, and employees, (iii) the disputes at issue in the Turnover Action, (iv) the existence and valuation of WMI tax attributes, principally its NOLs, and the meaning and impact of the Tax Sharing Agreement on the disputes, (v) the proper ownership, valuation and asset affiliation of the Trust Preferred Securities, (v) the communications and negotiations that led to the Global Settlement Agreement, (vi) the Debtors’ potential claims for fraudulent conveyance or for the recovery of preferential transfers, including those related to WMI’s capital contributions to WMB, and (vii) the merits and valuation of any other claims of the Debtors that would be released pursuant to the Global Settlement Agreement and the nature and valuation of any other assets that would be transferred to JPMC pursuant or the FDIC Receiver pursuant thereto.

On May 4, 2010, the Debtors filed an objection [D.I. 3626] to the Examiner Motion and objections were also filed by JPMC, the Creditors’ Committee and the WMI Noteholders Group. Responsive papers were also filed by the U.S. Trustee, the FDIC, and the WMB Notes Holders, among others [D.I. 3625, 3627, 3626, 3629, & 3633]. At a hearing, held on May 5, 2010, the Bankruptcy Court denied the Examiner Motion and entered an order to this effect [D.I. 3633]. The Equity Committee moved [D.I. 3929] for permission to appeal the Bankruptcy Court’s decision directly to the United States Court of Appeals for the Third Circuit (the “Third Circuit”), which motion was opposed by the Debtors and the Creditors’ Committee [D.I. 4386 & 4397]. On June 7, 2010, the Bankruptcy Court entered an order certifying the Equity Committee’s appeal directly to the Third Circuit [D.I. 4639]. On July 7, 2010, the Equity Committee filed a petition with the Third Circuit requesting that the Third Circuit hear the appeal and, on July 19, 2010, the Debtors filed an opposition to such petition. Notwithstanding its pending appeal, on June 8, 2010, the Equity Committee filed a renewed motion for the appointment of an examiner pursuant to section 1104(c) of the Bankruptcy Code (the “Renewed Examiner Motion”) [D.I. 4644]. The Debtors and other parties in interest filed objections to the Renewed Examiner Motion. [D.I. 4680, 4681, 4682, 4683, 4685, 4686, & 4728] Notwithstanding the Debtors’ objection to the Renewed Examiner Motion, in the interest of cooperation and of providing guidance to the Bankruptcy Court and parties in interest with respect to their assessment of the Sixth Amended Plan and the Global Settlement Agreement, the Debtors consented to, and the Bankruptcy Court directed, the appointment of an examiner to investigate (i) the claims and assets that may be property of the Debtors’ estates that are proposed to be conveyed, released or otherwise compromised and settled pursuant to the Global Settlement Agreement, and (ii) such other claims, assets and causes of action that will be retained by the Debtors and/or the

proceeds thereof, if any, distributed to Creditors and/or equity interest holders pursuant to the Sixth Amended Plan, and the claims and defenses of third parties thereto [D.I. 5120]. The U.S. Trustee chose, and the Bankruptcy Court approved of, Joshua R. Hochberg (the “Examiner”). Based upon the appointment of the Examiner, the pending appeal filed by the Equity Committee was dismissed.

Pursuant to the order directing his appointment, the Examiner investigated and prepared a report, filed on November 2, 2010 [D.I. 5735] and made publicly available by the Debtors on the same day at www.kccllc.net/wamu (with the exception of certain confidential information contained therein) [D.I. 5791], in which the Examiner concluded that the Global Settlement Agreement is fair, reasonable, and in the best interests of the Debtors’ estates. Certain of the Examiner’s findings are set forth below.

| a. | Certain Claims and Assets Settled Pursuant to the Global Settlement Agreement |

With respect to the $4 billion on deposit in the Disputed Accounts, the Debtors had made a substantial showing they were entitled to the entire Deposits. Nevertheless, the Examiner concluded that, even if the Debtors prevailed in recovering the Deposits, “there still is a maze of legal issues that remain to be litigated and that could prevent an expeditious recovery of the Deposits.” With respect to the disputed Tax Refunds, the Examiner concluded that “WMB has meritorious claims to all or most of these refunds” and “WMI ultimately will not be entitled to retain most of the refunds.” With respect to the Trust Preferred Securities, the Examiner concluded that (a) significant arguments supported the conclusion that the Trust Preferred Securities were automatically conveyed to WMI, (b) it was unlikely that WMI could avoid the prepetition down streaming of the Trust Preferred Securities to WMB by WMI, and (c) even if such transfer was avoided, there would be no material improvement for the estates’ other Creditors and equity interest holders, because such avoidance would lead to an equivalent corresponding claim. With respect to the BOLI/COLI Policies, the Examiner concluded that the vast majority of such policies belonged to WMB and were conveyed to JPMC when it purchased WMB’s assets. Finally, the Examiner concluded that potential avoidance and fraudulent conveyance actions, which could result in the return of as much as $6.5 billion to the Debtors, would likely fail or would lead to an equivalent corresponding claims and, hence, be of no material benefit to the estates’ other Creditors and equity interest holders.

| b. | Certain Potential Claims and Causes of Action Against Non-Debtors |

With respect to JPMC, the Examiner investigated potential claims that JPMC (a) breached contractual obligations to WMI, (b) tortiously interfered with WMI’s or WMB’s business, and (c) conspired with others in violation of antitrust laws. The Examiner “did not uncover facts likely to support viable claims against JPMC that would generate significant benefits for the Debtors” and concluded that “it would be difficult to establish that JPMC’s actions caused the demise of WMB or resulted in damages to WMB and WMI.”

With respect to the FDIC, the Examiner investigated potential claims that the FDIC (a) breached statutory or fiduciary duties as receiver by selling WMB for less than possible, (b) breached statutory or fiduciary duties by conducting an unfair bidding process in conjunction with the seizure and sale of WMB, and (c) tortiously interfered with WMI’s business expectancy by prematurely disclosing to JPMC and other third parties the intended seizure of WMB. The Examiner concluded that it was highly unlikely that any claims against the FDIC would succeed. Specifically, the Examiner found that the bidding process for WMB was reasonably fair and that JPMC was the only potential bidder willing to pay anything for WMB’s assets without substantial government guarantees.

Finally, the Examiner investigated whether WMI was insolvent throughout 2008, including an evaluation of WMB’s liquidity. The Examiner concluded that WMB’s liquidity on September 25, 2008 was questionable and whether it would have survived if it had not been seized is open to debate; as such, the OTS reached reasonable conclusions that WMB was unlikely to meet its depositors’ demands and was operating in an unsafe and unsound condition. Additionally, there were no viable claims that could be made against OTS based on the theory that they improvidently closed WMB.

| 5. | Certain Significant Litigations |

| a. | The Equity Committee’s Actions to Compel a Shareholders’ Meeting |

On March 3, 2010, the Equity Committee commenced an action in the Bankruptcy Court, styled Official Committee of Equity Security Holders v. WMI, et al., Adv. Pro. No. 10-50731 (MFW), seeking to compel WMI to convene and hold an annual shareholders’ meeting for the nomination and election of its board of directors under Washington law (the “Action to Compel a Shareholders’ Meeting”). On March 11, 2010, the Equity Committee filed a motion for summary judgment, seeking an order requiring WMI to convene and hold such a meeting [Adv. Proc. No. 10-50731, D.I. 3]. In the alternative, the Equity Committee sought relief from the automatic stay to seek such relief in Washington state court. The Debtors opposed the Equity Committee’s motion [Adv. Proc. No. 10-50731, D.I. 9]. At a hearing before the Bankruptcy Court on April 21, 2010, the Bankruptcy Court determined that the automatic stay was not applicable, but did not consider the Equity Committee’s summary judgment motion.

On April 26, 2010, plaintiffs Michael Willingham and Esopus Creek Value L.P., each of whom were then members of the Equity Committee, filed an action against WMI in the Superior Court of the State of Washington, for the County of Thurston. On May 13, 2010, WMI removed this action to the United States District Court for the Western District of Washington (the “Washington District Court”), from which it was automatically referred to the United States Bankruptcy Court for the Western District of Washington and assigned to Bankruptcy Judge Paul B. Snyder. On May 14, 2010, WMI filed a motion to transfer venue to the United States District Court for the District of Delaware for referral to the United States Bankruptcy Court for the District of Delaware. On May 21, 2010, plaintiffs filed a motion to remand the action to Washington state court. A hearing on the motions to transfer and remand was held on June 11, 2010. By order, dated June 21, 2010, Judge Snyder of the United States Bankruptcy Court for the Western District of Washington granted WMI’s motion to transfer the case and preserved the issue of remand for determination by this Bankruptcy Court. On June 28, 2010, plaintiffs withdrew their remand motion. From July through September 2010, the members of the Equity Committee produced various documents requested by the Debtors, and were also deposed by the Debtors. On August 23, 2010, by order of the court, this adversary proceeding was consolidated with the Action to Compel a Shareholders’ Meeting [Adv. Proc. No. 10-50731, D.I. 58]

The Bankruptcy Court’s approval of the Examiner (discussed in Section V. B.4. above) and subsequent approval of the Global Settlement Agreement pursuant to the January Opinion (as reaffirmed in the September Opinion) as fair, reasonable and in the best interests of the Debtors’ estates has mooted the relief sought by the Equity Committee in its Action to Compel a Shareholders’ Meeting.

| b. | The Equity Committee Appeal of the Bankruptcy Court’s Approval of the Global Settlement Agreement Pursuant to the January Opinion |

On January 19, 2011, the Equity Committee filed a notice of appeal of that portion of the January Opinion finding that the Global Settlement Agreement satisfies the requisite standards for approval [D.I. 6573]. On the same date, the Equity Committee filed a petition seeking certification of

direct appeal to the Third Circuit [D.I. 6575]. By order, dated February 8, 2011 [D.I. 6703], the Bankruptcy Court denied the Equity Committee’s motion for a direct appeal to the Third Circuit and, therefore, the Equity Committee’s appeal currently is pending in the United States District Court for the District of Delaware (the “Delaware District Court”), styled as Official Committee of Equity Security Holders v. Washington Mutual, Inc., et al., Civil Action No. 11-158 (earlier defined as the “January Equity Committee Appeal”).

On February 25, 2011, the Equity Committee filed in the Delaware District Court (i) a motion for leave to appeal [January Equity Committee Appeal, D.I. 7] (the “Motion for Leave”) and (ii) a motion for relief from the District Court’s Standing Order requiring mediation of bankruptcy appeals and for the setting of a briefing schedule and calendaring of argument of the Equity Committee’s appeal [January Equity Committee Appeal, D.I. 8] (“Motion for a Briefing Schedule”).

On March 11, 2011, the Debtors filed (i) an opposition to the Motion for Leave and (ii) a cross motion to dismiss the January Equity Committee Appeal for lack of jurisdiction [January Equity Committee Appeal, D.I. 11] (the “Cross Motion to Dismiss”), which JPMC and the Creditors’ Committee joined [January Equity Committee Appeal, D.I. 12-13]. On March 18, 2011, the Equity Committee filed an omnibus reply in support of its Motion for Leave and opposing the Cross Motion to Dismiss [January Equity Committee Appeal, D.I. 16]. On April 4, 2011, the Equity Committee filed a statement asserting that the Motion for Leave has been fully briefed, and requesting oral argument thereon [January Equity Committee Appeal, D.I. 19]. On April 5, 2011, the Debtors responded that the Cross Motion to Dismiss has also fully briefed, and that oral argument is not necessary for the Delaware District Court to decide either motion [January Equity Committee Appeal, D.I. 19]. In the alternative, the Debtors further requested that, if the Delaware District Court elects to hear oral argument on the Motion for Leave, it schedule argument on the Cross Motion to Dismiss concurrent therewith. The Debtors have also opposed the Motion for a Briefing Schedule [January Equity Committee Appeal, D.I. 9], which the Creditors’ Committee joined [January Equity Committee Appeal, D.I. 10]. On March 21, 2011, the Equity Committee requested oral argument on the Motion for a Briefing Schedule [January Equity Committee Appeal, D.I. 17]. The Delaware District Court has not yet ruled on this request or on any of the pending motions.

Pursuant to the Global Settlement Agreement, upon the effective date thereof, the Debtors will be deemed to have transferred, as of the Petition Date, any and all rights they may have or may ever have had in the Trust Preferred Securities to JPMC, free and clear of liens, and JPMC will be deemed to be the sole legal, equitable and beneficial owner thereof.

The Trust Preferred Securities were subject to a conditional exchange (the “Conditional Exchange”) feature whereby they would be transferred to WMI and the prior holders would receive, in exchange, depositary shares, each representing 1/1,000th of a share of a related series of preferred stock of WMI, upon the occurrence of one or more certain exchange events, including, among other things: (i) the undercapitalization of WMB under OTS’ “prompt correction action” regulations, (ii) WMB being placed into receivership, or (iii) the OTS, in its sole discretion, directing the exchange in anticipation of WMB becoming “undercapitalized” or the OTS taking supervisory action limiting the payment of dividends by WMB (each, an “Exchange Event”). WMI had a written commitment to the OTS that, upon the occurrence of the Conditional Exchange, WMI would automatically contribute the Trust Preferred Securities to WMB (the “Downstream Undertaking”).

On September 26, 2008, in accordance with the terms governing the Trust Preferred Securities and as directed in a letter from the OTS, dated September 25, 2008, WMI issued a press release

stating that an Exchange Event had occurred and that the Trust Preferred Securities would be exchanged for depositary shares, each representing 1/1,000th of a share of a related series of WMI’s preferred stock, as applicable, of Perpetual Non-Cumulative Fixed or Fixed-to-Floating Rate Preferred Stock (as the case may be) in Series I, J, L, M and N (defined in the Seventh Amended Plan as the “REIT Series”)—none of which were outstanding prior to September 25, 2008. At the direction of the OTS, on September 25, 2008, employees of WMI and WMB executed an Assignment Agreement which purported to assign the right, title and interest in the Trust Preferred Securities to WMB as of that date (the “Assignment Agreement”).

On July 6, 2010, certain entities that assert interests in the Trust Preferred Securities (the “TPS Plaintiffs”) commenced an adversary proceeding (the “TPS Action”) against JPMC, WMI, WMPF, Washington Mutual Preferred Funding (Cayman) I Ltd., Washington Mutual Preferred Funding Trust I, Washington Mutual Preferred Funding Trust II, Washington Mutual Preferred Funding Trust III and Washington Mutual Preferred Funding Trust IV (collectively, the “TPS Defendants”) seeking, among other relief, a declaratory judgment that (i) the Conditional Exchange52 was never consummated and cannot be consummated, (ii) neither WMI nor JPMC has any right, title or interest in the Trust Preferred Securities, (iii) the Trust Preferred Securities and any Claim thereto do not constitute property of WMI’s estate, and (iv) the Trust Preferred Securities remain with investors who held such securities immediately prior to 8:00 a.m. on September 26, 2008.