Exhibit 99.3

Washington Mutual, Inc.

Prepared Remarks for Third Quarter 2006 Earnings Conference Call

October 18, 2006

Please see the Forward-Looking Statement at the end of this document

| Remarks of Kerry Killinger Chairman and CEO |

Well, good afternoon and thank you for joining us today for a review of our third quarter results.

Q3 2006 Earnings

Earlier today, we announced third quarter net income of $748 million or $0.77 per diluted share. Our earnings included net after tax charges of $31 million, or 3 cents per share associated with the sale of $2.5 billion in mortgage servicing rights that we talked about on our last call. This quarter’s earnings were also reduced by after tax charges of $33 million, or $0.04 per share, related to the company's ongoing productivity and efficiency initiatives.

The Board once again increased the quarterly cash dividend by one cent to 53 cents per share. This now marks the 45th consecutive quarter we’ve done so. Tom will go into more detail on our capital management and share repurchase activities.

Our third quarter results reflect the short-term impact of the MSR sale and our productivity and efficiency initiatives, as well as the challenging interest rate and operating environment that is affecting banks generally. As I said on last quarter’s call and again at our Investor Day in September, we fully anticipated that the MSR sale, the sale of our retail mutual fund management company and our productivity and efficiency initiatives would produce unevenness in our quarterly earnings during the remainder of 2006, and we’ve seen that impact in the earnings we announced today. Nevertheless, when taken together, we continue to expect that these actions will be accretive to earnings in 2007.

We are on track to close the sale of our retail mutual fund management business late in the fourth quarter and expect to record in that period a gain from the sale of approximately $650 million. We also expect that the gain will more than offset the negative impact of the MSR sale and our productivity and efficiency initiatives on full-year 2006 earnings.

| | Prepared Remarks - October 18, 2006 | Page 2 |

In the third quarter, we continued to feel the effects of the difficult interest rate environment throughout our operations. Because the Fed increased rates throughout the second quarter, Fed funds averaged 35 basis points higher in the third quarter than in the second quarter, despite the Fed’s pause in August. In addition, the yield curve became inverted during the third quarter. Both of these conditions contributed to further compression in our net interest margin during the third quarter.

Looking forward, as a point of reference, during the last cycle of Fed tightening, our net interest margin didn’t bottom out until the first quarter after the last Fed increase. Therefore, assuming we’ve seen the last of the Fed increases, we expect that our net interest margin has bottomed out for this cycle and will begin to recover in the fourth quarter.

Given this environment, we were pleased with the strong results we saw in the quarter from our Retail Banking group and Card Services segment and the solid underlying performance in our Commercial Group. However, our Home Loans business continues to underperform in this extremely challenging operating environment, which includes an inverted yield curve, declining volumes and continued overcapacity in the mortgage industry.

Despite the challenging environment impacting the mortgage banking industry, we feel good about the proactive steps we have taken. Our portfolio remains in very good shape and nonperforming assets remain very low. The housing market is clearly weakening, with the pace of housing price appreciation slowing in most regions of the country. We are also experiencing somewhat higher delinquencies and loan losses. However, we began preparing for this possibility quite some time ago and took defensive actions to strengthen our portfolio. So we believe we are well prepared to weather the more difficult credit environment. We also believe that the expansion in our net interest margin should more than offset the higher credit costs, as Tom will review with you later in his guidance for 2007.

In the meantime, we continued to aggressively attack the cost structure in our Home Loans business during the quarter and reduced noninterest expense by 21 percent over the same period a year ago. This was achieved through key productivity and efficiency initiatives. Technology and off-shoring initiatives currently underway are expected to result in further expense reductions in future quarters.

We have significantly modified our Home Loans strategy to be consistent with our overall business model and continue to take appropriate actions to right-size the business for the contracting mortgage lending market.

Retail Banking

Our Retail Banking operations continued their strong performance in the third quarter. Income from continuing operations of $651 million was up 10 percent from the same quarter a year ago. Retail banking net income, excluding the contribution from portfolio management, was up 29 percent from the same quarter a year ago.

| | Prepared Remarks - October 18, 2006 | Page 3 |

Our new WaMu Free Checking™ product continued to drive strong growth in checking accounts. Net checking accounts in retail and small business combined were up 21 percent from the third quarter a year ago, with over 307,000 net new accounts continuing to benefit from the second quarter launch of our new WaMu Free Checking™. Year to date, our net new checking accounts of 1.1 million were up more than 50 percent over the same period last year.

New account growth contributed to an increase in depositor and other retail banking fees to $655 million in the third quarter, up 13 percent from last year and 17 percent year to date.

In the third quarter, retail banking households were up 10 percent year over year and 3 percent on a linked quarter basis.

On the deposit front, average retail deposits grew one percent from the prior quarter including 6 percent growth in our small business deposits, which were up 19 percent year over year.

We opened 25 new stores during the third quarter, bringing the total to 89 for the year. At the same time, we have continued to drive improved operating efficiency, reducing our operating expenses 3 percent on a linked quarter basis.

Card Services

Turning to Card Services…

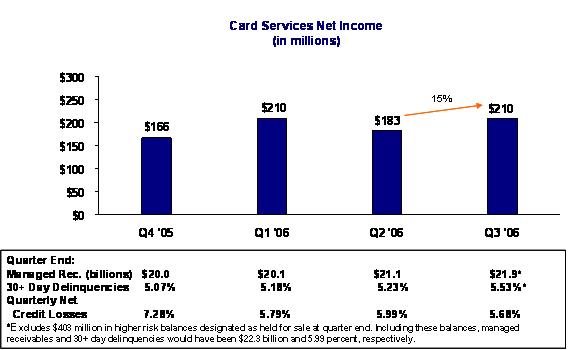

Card Services delivered another quarter of excellent financial performance. Net income of $210 million was up $27 million, or 15 percent, from the second quarter.

Managed receivables growth of 4 percent on a linked quarter basis was very strong, with quarter-end balances at just under $22 billion, reflecting increases across all of our marketing channels. The ending balance does not include $403 million in higher risk accounts designated as held for sale in the quarter in anticipation of a sale planned for the fourth quarter.

| | Prepared Remarks - October 18, 2006 | Page 4 |

Total new accounts of 815,000 in the quarter were on par with the second quarter with strong performance in both the national and retail channels. On the partnership front, we launched a comprehensive affinity credit card for sports fans - the ESPN Total Access Visa card - on September 1.

Credit ratios for the third quarter remained very strong compared to historic averages. While net credit losses for the quarter were down from the second quarter to 5.68 percent, 30-plus day delinquencies did go up to 5.53 percent at quarter end. And, while delinquencies in general were up, the impact was mitigated by a reduction in delinquent accounts related to the planned sale of higher risk accounts.

Commercial Group

Despite the challenging interest rate environment, the Commercial Group continued to drive strong loan volume in the quarter at $3.1 billion, up 3 percent from the third quarter a year ago and up 5 percent from the prior quarter.

Net income of $101 million for the quarter, which was down 3 percent from last year’s third quarter and up slightly from the second quarter, continued to feel the impact of margin compression resulting from the repricing lag in our adjustable-rate, multi-family loan portfolio.

| | Prepared Remarks - October 18, 2006 | Page 5 |

Average loan balances for Commercial, which are comprised primarily of multi-family loans, increased 7 percent from the same quarter in the prior year and 3 percent from the prior quarter and partially offset the impact of the margin compression in both quarters.

We continue to be pleased with this business and continue to invest in growth, adding loan consultants in New York and other Northeast markets.

We completed our acquisition of Commercial Capital Bancorp on October 1, further enhancing our commercial and retail banking business in California and further diversifying the asset generation capabilities and sources of earnings for the company. The combination adds $4.1 billion in primarily multi-family loans.

Home Loans

As I mentioned earlier, our Home Loans results reflect the impact of current interest rates and the competitive environment. For the third quarter, Home Loans reported a net loss of $33 million versus net income of $302 million in the prior year and $31 million on a linked quarter basis.

Home loan volume declined by 11 percent on a linked quarter basis and 32 percent from the third quarter of last year, commensurate with higher interest rates and the general slowing of the housing market. We are seeing the effects of our strategy to shift toward higher margin products. This is reflected in the mix of originations during the quarter. Fixed-rate originations declined from 39 percent of home loan volume in the third quarter of last year to 26 percent in the most recent quarter. Option ARMs continued to comprise approximately 30 percent of volume, similar to the same quarter a year ago, but hybrid ARMs were much more popular, growing from only 29 percent last year to 44 percent of volume in the third quarter.

Both our gain on sale and MSR hedging costs are being negatively impacted by the difficult interest rate environment and competitive pressures. Tom will go into more detail regarding the performance of both of these items. I will just offer the following:

We've taken a number of specific actions, both strategic and tactical, to position the Home Loans business for focused growth. We're continuing our efforts to produce greater volumes of higher margin loans and an efficient operating platform.

Finally, we've established a clear strategic direction by which we will drive our actions over the next few years.

Summary

Before I turn the call over to Tom, I’d like to comment on the Interagency Guidance on Nontraditional Mortgage Product Risks issued by the banking regulators at the end of September.

| | Prepared Remarks - October 18, 2006 | Page 6 |

We continue to evaluate the guidance. However, based on preliminary analysis and initial discussions with our regulator, the OTS, while we expect some changes, the impact on the origination of the Option ARM products in our Home Loans group appears limited.

For the guidance to be truly effective in safeguarding consumers, we do believe all mortgage lenders should be held to the same standards.

As we have said, the Option ARM product is an attractive product for many of our customers and we remain committed to offering a range of products to meet their needs. We have more than 20 years experience underwriting and originating Option ARM loans through many market cycles. We understand that the best mortgage customer is a well-informed borrower. That's why we focus on providing clear, understandable disclosures for our customers and ongoing training for our sales force.

The quality of our Option ARM portfolio remains strong. At the end of the third quarter, the current estimated loan-to-value ratio of our Option ARM portfolio was 57 percent, with an average FICO of 707.

I’ll now turn it over to Tom to go into more specifics on our financial performance.

| Remarks of Tom Casey Executive Vice President and CFO |

This has been a very active quarter with the closing of our MSR sale, announcement of the sale of our retail mutual fund management business and ongoing operating efficiency initiatives. All these activities are designed to position us for a much stronger financial performance next year and at the end of my remarks, I’ll review our current outlook for 2007.

Asset Growth and Net Interest Margin

So let’s start by looking at asset growth. We held average assets relatively flat with the second quarter at approximately $350 billion. Year over year asset growth was 7 percent. However, while there was little average asset growth over the prior quarter, we did see some remixing in our average assets as single-family residential mortgages were down $2.2 billion, and prime home equity was up $991 million, multi-family was up $809 million and on-balance sheet card receivables were up $610 million.

The third quarter net interest margin of 2.53 percent was down 12 basis points from 2.65 percent in the second quarter. While the yield on our earning assets increased 21 basis points in the quarter, this was more than offset by a 36 basis point increase in the cost of our interest-bearing liabilities. While the Fed “paused” in August, short-term rates were up in the quarter driving increases in wholesale borrowing rates and the cost of deposits as consumers continue to move funds to higher rate money market and CD products.

| | Prepared Remarks - October 18, 2006 | Page 7 |

Credit

Shifting to credit.

As expected, the credit environment appears to be normalizing after a period of historically low levels of credit losses. Net charge-offs were up $38 million from the second quarter, primarily driven by a $21 million increase in charge-offs in specialty mortgage finance. Nonperforming assets were up $232 million to 69 basis points of total assets, up 7 basis points from the second quarter, but still well within our target of below one percent.

The provision for loan and lease losses of $166 million in the third quarter reflected a slight decline in the loan portfolio, as well as net charge-offs of $154 million. The third quarter provision also reflected refinements to our reserve methodology and an adjustment of the provision related to the planned sale of $403 million of higher risk credit card accounts. Without the impact of these two items, the provision would have been similar to that of the second quarter.

Credit card managed delinquencies were up 30 basis points in the quarter to 5.53 percent. Adjusting for the $403 million planned sale, delinquencies would have been 5.99 percent, as they return to a more normal level after the change in bankruptcy regulation last year.

| | Prepared Remarks - October 18, 2006 | Page 8 |

Noninterest Income

Noninterest income of $1.6 billion was flat from the second quarter, but up 30 percent over the third quarter of last year. The year-over-year increase was due primarily to the addition of $534 million in Card Services income and higher depositor and other retail banking fee income.

Depositor and other retail banking fees of $655 million were up 13 percent from the third quarter of 2005, due to strong account growth. On a linked quarter basis depositor fees were up a modest 2 percent. Adjusting for the one-time incentive payment of $21 million from Master Card in the second quarter, depositor and other retail banking fees would have been up 6 percent on continued strong account growth.

As Kerry discussed, the Home Loans business continues to be challenged by lower volume from the slowdown in the housing market and a difficult interest rate environment. Reflecting these pressures, gain on sale in the third quarter was $119 million, down from $251 million in the second quarter.

Declining mortgage rates and an inverted yield curve during the quarter created a more expensive hedging environment for the MSR. As a result, MSR hedging costs for the quarter were $78 million, up from $45 million in the second quarter. Given the more challenging hedging environment, we benefited from having completed the sale of approximately one third of our servicing portfolio on July 31st. As a result, the third quarter had two months of lower hedging costs, but future quarters will see the full impact.

Noninterest Expense

Looking at noninterest expense, on a year-over-year basis the addition of Card Services and the costs associated with our growth initiatives pushed expenses up 17 percent.

For the quarter, expenses of $2.2 billion were down slightly as we reduced the number of employees by 9 percent during the third quarter.

Third quarter expenses included $58 million in costs associated with the MSR sale and $52 million in charges related to our ongoing productivity and efficiency efforts. Adjusting for these items, our annual noninterest expense run rate in the third quarter was $8.3 billion.

Capital Management

Before I go through our outlook for the rest of ’06 and ’07, I want to highlight a few items in the capital management and funding area.

As part of our ongoing efforts to enhance our capital structure and diversify our funding sources, we undertook several important transactions during the quarter. First, we issued $500 million in perpetual preferred stock, which allows us to reduce our cost of capital as well as partially fund our stock buyback program. During the quarter, we repurchased 18.8 million shares of common stock through a combination of open market and accelerated share repurchases.

| | Prepared Remarks - October 18, 2006 | Page 9 |

We also expanded our fixed income investor base with our first euro-denominated, sub-debt deal totaling 1.5 billion euros, as well as a $5.1 billion European covered bond transaction. The covered bond deal was the first by a U.S. bank and represents a new form of funding at attractive rates to reduce our dependence on the FHLB system.

At quarter end, our tangible capital ratio was 5.86 percent, well in excess of our target ratio of greater than 5.50 percent as we held capital levels temporarily higher to accommodate the acquisition of CCBI which closed on October 1st.

| | Prepared Remarks - October 18, 2006 | Page 10 |

Earnings Driver Guidance

Now let’s walk through our present view concerning our six earnings drivers for the remainder of this year and then what we see for 2007.

Driver | 2006 Guidance | 2007 Guidance |

1) Average assets | 5-7% growth | 0 - 5% growth |

2) Net interest margin | 2.60 - 2.65% | 2.85 - 2.95% |

3) Credit provisioning | $650-750 million | $850 - $950 million |

4) Depositor and other retail banking fees | 15-17% growth | 10 - 12% growth |

5) Noninterest income | $6.3-6.5 billion | $6.5 - $6.8 billion |

6) Noninterest expense | $8.6-8.8 billion | $8.3 - $8.5 billion |

7) Discontinued operations | $700 million | -- |

| 1) | Average assets |

For the first nine months of this year, our average assets are up 6 percent from average assets for all of 2005. Although credit spreads improved modestly in the third quarter, they still remain relatively tight from historical levels. Due to the limited attractiveness of balance sheet growth and the relative appeal of the risk-adjusted returns from share repurchases, we don’t see much asset growth between now and the end of the year. So I don’t see much change to our 5 to 7 percent growth for 2006.

Looking forward into 2007, at least for the first half, we don’t see a lot of opportunities to grow the balance sheet. So right now, our outlook has the balance sheet growing between 0 and 5 percent. Within this range, we will be disciplined across all asset categories, adding loans to the balance sheet only when market conditions and returns warrant doing so. In the meantime, we expect to continue to deploy capital through the payment of dividends and stock buybacks, while maintaining the flexibility to more aggressively grow the balance sheet should the opportunity arise.

| 2) | Net Interest Margin |

Assuming the Fed is done tightening rates, we expect to see some improvement in the NIM in the fourth quarter, partially offset by continued pressure on deposit pricing and funding costs. Year to date, our NIM is 2.64 percent, so with some improvement from the third quarter level of 2.53 percent, I think we will come in for the year at around 2.60 to 2.65 percent.

| | Prepared Remarks - October 18, 2006 | Page 11 |

For 2007, we anticipate additional recovery in our net interest margin, primarily driven by asset repricing, along with our ongoing asset remix. But the projected interest rate environment remains difficult. The yield curve is expected to remain inverted in the short-term with the forward curve indicating potential steepening towards the end of 2007, when short-term rates are expected to decline. With that assumption, we expect our margin to be in the range of 2.85 to 2.95 percent for the full year. If the slope of the curve steepens more quickly, we would expect further improvement in our net interest margin. However if short term rates begin to rise again that would put additional pressure on our NIM outlook.

We’ll continue to monitor this closely and provide updates on our outlook each quarter.

| 3) | Credit provisioning |

Year-to-date, our provision for loan and lease losses is at $472 million. As we are seeing increases in nonperforming assets, delinquencies and charge-offs, we anticipate a higher level of provisioning in the fourth quarter. Therefore, we expect our full-year 2006 provision to be at the higher end of our range of $650 to $750 million.

For 2007, taking into consideration the likelihood of a more challenging credit environment, as well as continued remixing of our assets including growth in card receivables, we are currently expecting our credit provision to be in line with the range of $850 to $950 million.

| 4) | Depositor and Other Retail Banking Fees |

Year to date, depositor and other retail banking fees are up 17 percent. Given the continued strong net new account growth and fee income driven by our new WaMu Free Checking™ product, we are maintaining our current 2006 guidance for growth in depositor and other retail banking fees in the range of 15 to 17 percent.

We anticipate much of the momentum in household and account growth to continue in 2007, but coming off an extremely strong year in 2006, we are expecting depositor and other retail banking fee growth in the range of 10 to 12 percent for next year.

| 5) | Noninterest Income |

In looking at noninterest income for 2006, we are currently at $4.8 billion year to date. While lower gain on sale is putting pressure on noninterest income, with the continued strength of our retail banking fees and credit card income we still expect to come in within the range of $6.3 billion to $6.5 billion for the year.

For 2007, we are not changing our forecast for noninterest income from the range of $6.5 to $6.8 billion. We anticipate that the year-over-year growth will be attributable to growth in depositor and other retail banking fees - the primary driver of noninterest income - as we expect revenue from Home Loans to remain under pressure with lower volumes and lower gain on sale for mortgage loans.

| 6) | Noninterest Expense |

Now, noninterest expense.

Year to date, our noninterest expense is at $6.6 billion. With the acceleration of our productivity initiatives and costs associated with the MSR sale, we expect to be at the higher end of our range of $8.6 to $8.8 billion.

However, we’ve made great progress this year, as our annualized run rate in the third quarter was $8.3 billion, when you exclude the costs associated with our productivity initiatives and the MSR sale.

For 2007, we fully expect to continue to fund our growth, while benefiting from a net decrease in our expense base. Reflecting this improved expense base and the sale of our retail mutual fund management business, we currently expect our expenses to be between $8.3 and $8.5 billion in 2007.

| 7) | Discontinued Operations |

Finally, discontinued operations…

We expect to close the sale of our retail mutual fund management business late in the fourth quarter and to record in the period an estimated gain of approximately $650 million, maintaining our pretax guidance for income from discontinued operations, including WM Advisors’ operating earnings for the year, at approximately $700 million.

I’ll now turn it back over to Kerry for his summary comments.

| | Prepared Remarks - October 18, 2006 | Page 12 |

| Remarks of Kerry Killinger Chairman and CEO (continued) |

Let me wrap this up by saying that 2006 is a transition period for the company setting the stage for much stronger performance in the future.

During this period, the management team has worked diligently to make the tough decisions that will drive productivity, while lowering costs and improving service levels. This is hard work and I’m proud of what we’ve accomplished.

| · | Excluding the charges for our efficiency initiatives and costs related to the sale of our mortgage servicing rights, our noninterest expense annualized run rate of $8.3 billion is down 9 percent in the third quarter from $9.1 billion in the fourth quarter of 2005. |

| · | We reduced the number of employees by 16 percent, or nearly 10,000 year to date, due in part to our success in offshoring approximately 3,700 additional positions. This leveraging of offshore resources not only significantly reduces expense, but also makes our cost structure more responsive to changing business volumes. |

| · | We also relocated many of our back office positions to lower cost, domestic locations, such as San Antonio and Jacksonville. |

| · | In our Home Loans group, we have been very aggressive in right-sizing our operations to the slowing mortgage market, reducing our noninterest expense by 21 percent over the past 12 months. |

| · | And, in the process of integrating Card Services, we achieved every goal we set out when we announced the acquisition and, in fact, exceeded our estimated cost savings by 60 percent. |

So overall, while I’m pleased with the progress on our business initiatives, due to the difficult operating environment, it’s yet to be reflected in our bottom line. But, as we look forward to next year, assuming that the economy slows but remains relatively healthy and short-term interest rates are stable as Tom described, we believe that our net interest margin should show nice recovery and more than offset the higher credit costs anticipated from a more normalized credit environment.

We also see increases in our noninterest income driven by growth in our Retail Banking and Card Services operations, yet lower operating expenses - all of which will bode well for improved operating performance next year.

With that, Steve, Tom and I are happy to field your questions.

| | Prepared Remarks - October 18, 2006 | Page 13 |

Forward Looking Statement

This release contains forward-looking statements, which are not historical facts and pertain to future operating results. These forward-looking statements are within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements include, but are not limited to, statements about our plans, objectives, expectations and intentions and other statements contained in this document that are not historical facts. When used in this presentation, the words “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates,” or words of similar meaning, or future or conditional verbs, such as “will,” “would,” “should,” “could,” or “may” are generally intended to identify forward-looking statements. These forward-looking statements are inherently subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond our control. In addition, these forward-looking statements are subject to assumptions with respect to future business strategies and decisions that are subject to change. Actual results may differ materially from the results discussed in these forward-looking statements for the reasons, among others, discussed under the heading “Factors That May Affect Future Results” in Washington Mutual’s 2005 Annual Report on Form 10-K/A and “Cautionary Statements” in our Form 10-Q/A for the quarter ended March 31, 2006 and Form 10-Q for the quarter ended June 30, 2006 which include:

| § | volatile interest rates which impact the mortgage banking business; |

| § | rising interest rates, unemployment and decreases in housing prices impact credit performance; |

| § | risks related to the option adjustable-rate mortgage product; |

| § | risks related to subprime lending; |

| § | risks related to the integration of the Card Services business; |

| § | risks related to credit card operations; |

| § | changes in the regulation of financial services companies, housing government-sponsored enterprises and credit card lenders; |

| § | competition from banking and nonbanking companies; |

| § | general business and economic conditions, including movements in interest rates, the slope of the yield curve, and the potential overextension of housing prices in certain geographic markets; and |

| § | negative public opinion which may impact the Company’s reputation. |

There are other factors not described in our 2005 Form 10-K/A and 2006 Forms 10-Q and which are beyond the Company’s ability to anticipate or control that could cause results to differ.