Thanks, Tom.

In wrapping up our prepared comments, let me offer the perspective of an 18-year CEO and a 35-year financial executive who has been through a lot of cycles.

We are primarily impacted by interest rate, yield curve, housing and economic cycles. Cycles come and go. When cycles are in your favor, you need to plan for the inevitable downturn. And when they are against you, you need to work through them and prepare for the inevitable upturn.

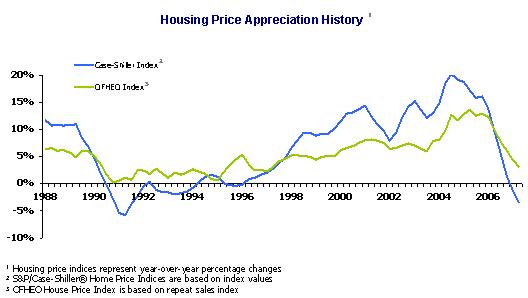

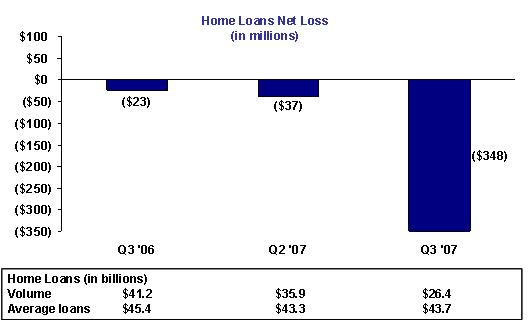

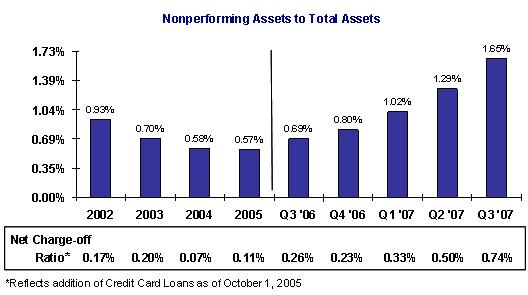

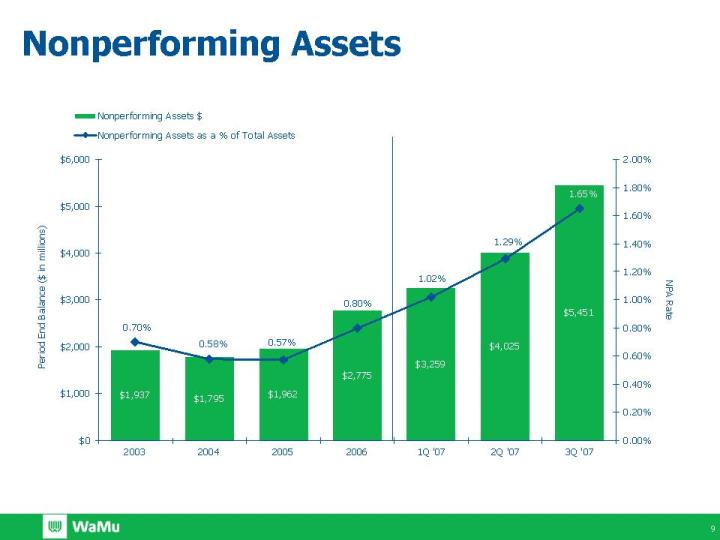

Today, the cycle that is working against us is a declining housing market. As Tom noted, current housing market conditions are very challenging. Housing inventories are rising, demand is falling and prices are declining in most markets. Delinquencies and foreclosures are rising. We expected a downturn from the cyclical highs of a couple of years ago, but as I said earlier, we are definitely experiencing an accelerating downturn at this time. However, I remind everyone that housing will continue to be vital to consumers and will recover at some point. It is not possible to predict the timing, but I expect us to work our way through this downturn and for market conditions to improve.

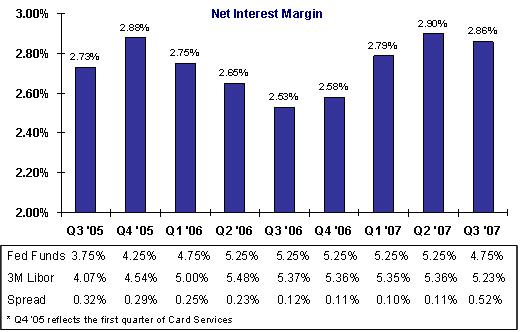

The cycle of rising short term interest rates and an inverted yield curve which negatively impacted us over the past few years appears to be improving. Most forecasters expect short-term interest rates to fall and the yield curve to steepen. However, the capital markets illiquidity we have experience4d has added a new variable.

My attitude on difficult cycles is that you may not like them, but you must deal with them. And the faster you deal with them, the better. When difficult conditions hit, as owners of the company, we need to ask three key questions: Is management on top of the situation? Does the company have the financial strength to make it through the bottom of the cycle? Does the company have growth prospects once the cycle improves?

On the first point, I believe this management team is strong, deep and is diligently addressing the challenges posed by this environment.

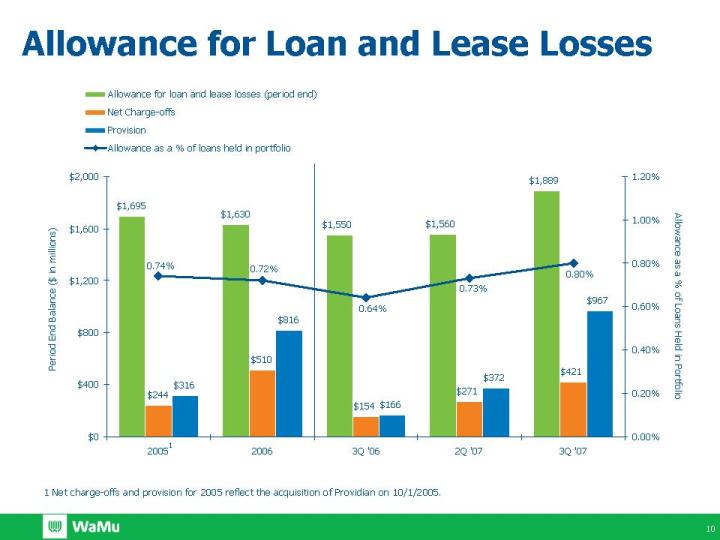

Regarding our financial strength, we have appropriate capital and sources of liquidity to work our way through the cycle.

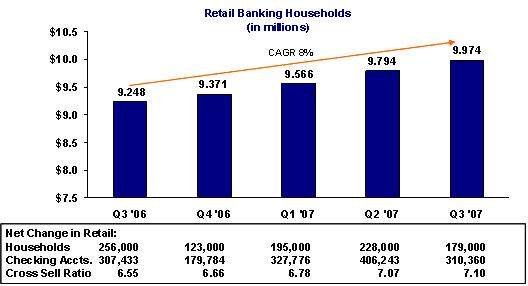

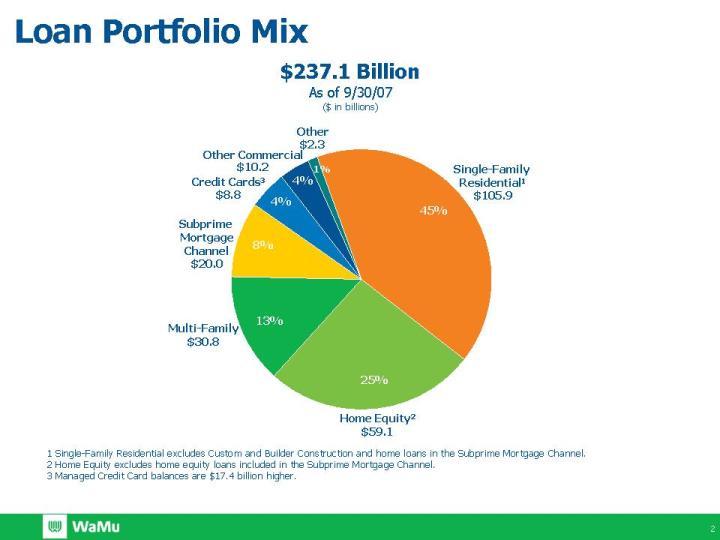

And regarding future growth prospects, we have a high growth retail banking powerhouse driving strong customer growth, increasing cross sales and double digit fee income growth. We have great opportunities to further increase our sales of credit cards, mortgage loans, securities and insurance products to our banking customers. And we are doing the right things to make our home loans operations profitable once the environment stabilizes.

We have also vigorously attacked expenses, giving us excellent operating leverage.

And finally, we have good margin expansion potential if the interest rate environment were to return to more normal conditions. The Fed has reduced rates 50 basis points and appears ready to reduce rates further if economic conditions warrant it. As Tom commented, our short-term funding is primarily LIBOR based which typically follows the Fed Funds rate. A return to a more normal yield curve and lower LIBOR rates would be quite beneficial to our net interest margin.