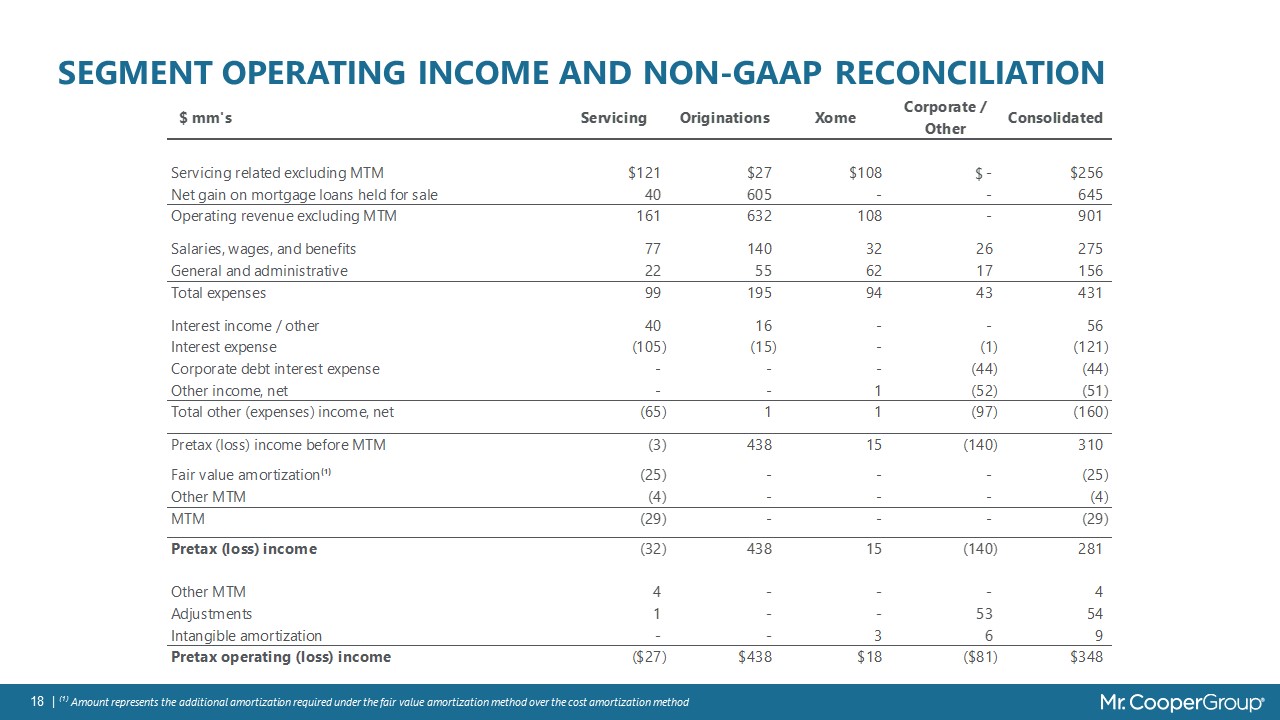

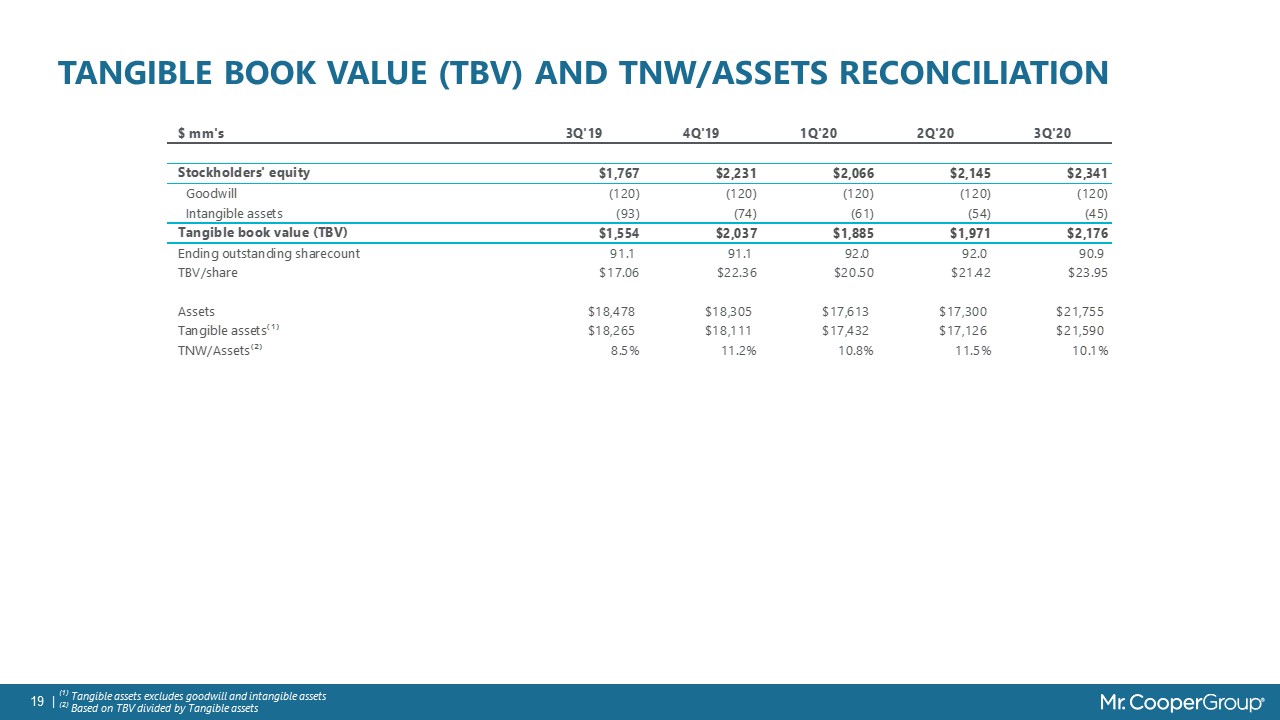

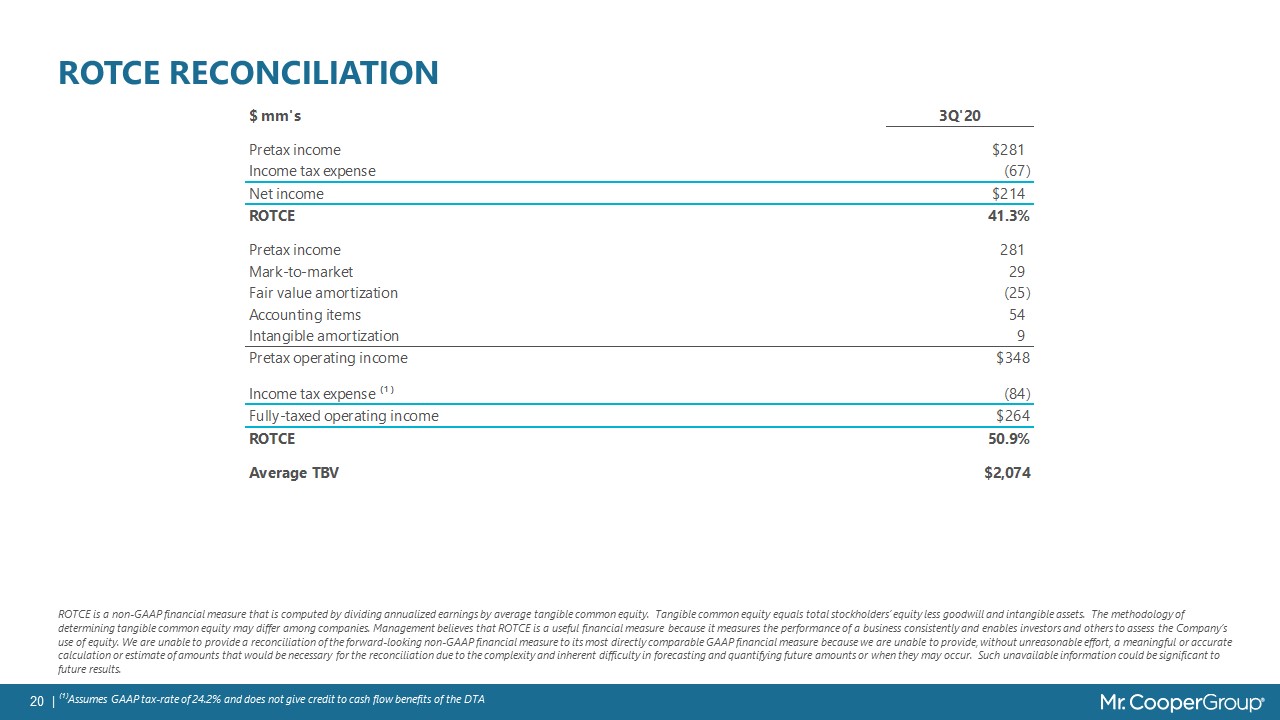

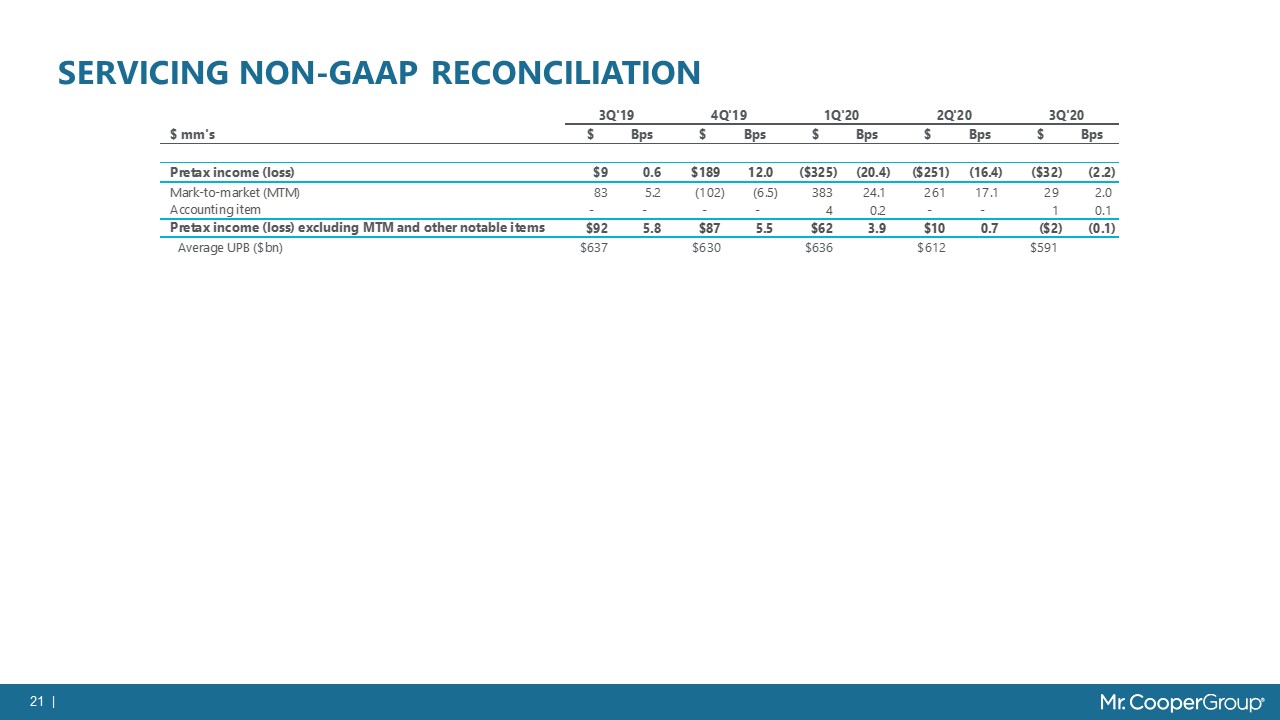

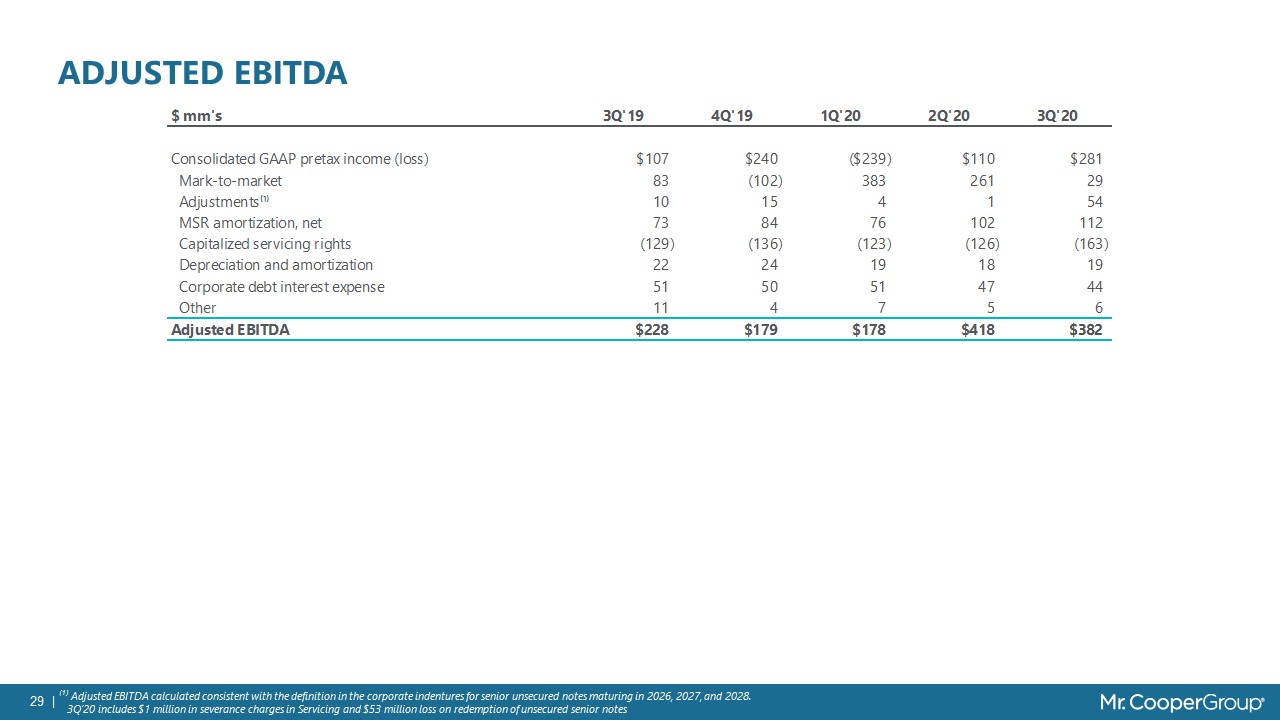

Disclaimer This presentation contains summarized information concerning Mr. Cooper Group Inc. (the “Company” or “Mr. Cooper”) and the Company’s business, operations, financial performance and trends. No representation is made that the information in this presentation is complete. For additional financial, statistical and business related information, as well as information regarding business and segment trends, see the Company’s most recent Annual Report on Form 10-K (“Form 10- K”) and Quarterly Reports on Form 10-Q filed with the U.S. Securities and Exchange Commission (the “SEC”), as well other reports filed with the SEC from time to time. Such reports are or will be available in the Investors section of the Company’s website (www.mrcoopergroup.com) and the SEC’s website (www.sec.gov). This presentation shall not constitute an offer to sell or the solicitation of any offer to buy securities. Any such offer or solicitation would only be made pursuant to a prospectus, offering memorandum or other offering document.Forward Looking Statements. This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including statements regarding Adjusted EBITDA, current initiatives, refinancing opportunities, portfolio growth and a rebound in servicing margins. All statements other than statements of historical or current fact included in this presentation that address activities, events, conditions or developments that the Company expects, believes or anticipates will or may occur in the future are forward-looking statements. Forward-looking statements give the Company’s current expectations and projections relating to the Company’s financial condition, results of operations, plans, objectives, future performance and business and these statements are not guarantees of future performance. Forward-looking statements may include the words “anticipate,” “estimate,” “expect,” “project,” “intend,” “plan,” “believe,” “strategy,” “future,” “opportunity,” “may,” “should,” “will,” “would,” “will be,” “will continue,” “will likely result,” and similar expressions. Such forward-looking statements involve risks and uncertainties that may cause actual events, results or performance to differ materially from those indicated by such statements, including the severity and duration of the COVID-19 pandemic; the pandemic’s impact on the U.S. and global economies; federal, state and local government responses to the pandemic; borrower forbearance rates and availability of financing. Certain of these risks are identified and discussed in documents Mr. Cooper has filed or will file from time to time with the SEC. These risk factors will be important to consider in determining future results and should be reviewed in their entirety. These forward-looking statements are expressed in good faith, and Mr. Cooper believes there is a reasonable basis for them. However, the events, results or trends identified in these forward-looking statements may not occur or be achieved. Forward-looking statements speak only as of the date they are made, and Mr. Cooper is not under any obligation, and expressly disclaims any obligation, to update, alter or otherwise revise any forward-looking statement, except as required by law. Readers should carefully review the statements set forth in the reports that Mr. Cooper has filed or will file from time to time with the SEC.Basis of Presentation. For purposes of Mr. Cooper's financial statement presentation, Mr. Cooper Group Inc. was determined to be the accounting acquirer in the July 2018 merger with WMIH Corp. “Predecessor” financial information relates to Nationstar Mortgage Holdings Inc. and “Successor” financial information relates to Mr. Cooper. The financial results for the nine months ended September 30, 2020, the nine months ended September 30, 2019, the three months ended September 30, 2020, the three months ended June 30, 2020, the three months ended March 31, 2020, the three months ended December 31, 2020, and the three months ended September 30, 2019 reflect the results of the Successor. With respect to the Company’s financial results for the year ended December 31, 2018, which are not included herein, the Company presented its results on a “combined” basis by combining the results of the Predecessor for the seven months ended July 31, 2018 with the results of the Successor for the five months ended December 31, 2018. Although the separate financial results of the Predecessor for the seven months ended July 31, 2018 and the Successor for the five months ended December 31, 2018 are each separately presented under generally accepted accounting principles (“GAAP”) in the United States, the combined results reported reflect non-GAAP financial measures, because a different basis of accounting was used with respect to the financial results for the Predecessor as compared to the financial results of the Successor.Non-GAAP Measures. This presentation contains certain references to non-GAAP measures, including tangible book value, Adjusted EBITDA, ROTCE and Operating ROTCE and the related ratio data. The Company believes that investors consider these non‐GAAP measures of financial results to be important supplemental measures of the Company’s performance and believe these measures are frequently used by securities analysts, investors and other interested parties in the evaluation of companies in the Company’s industry. Additionally, the Company believes issuers of non-investment grade securities present Adjusted EBITDA and the related ratio data because investors, analysts and rating agencies consider them useful in measuring the ability of those issuers to meet debt service obligations. These non‐GAAP measures of financial results have limitations as analytical tools, and should not be considered in isolation, or as substitutes for analysis of the Company’s results as reported under GAAP. Some of these limitations are: (i) they do not reflect all the Company’s cash expenditures, future requirements for capital expenditures or contractual commitments; (ii) Adjusted EBITDA does not reflect the significant interest expense or the cash requirements necessary to service interest or principal payments on the Company’s corporate debt; (iii) they do not reflect any cash income taxes that the Company may be required to pay; (iv) although depreciation and amortization, changes in fair value of MSRs and amortization of MSRs are non-cash charges, the assets being depreciated and amortized will often have to be replaced in the future and Adjusted EBITDA does not reflect any cash requirements for such replacements; (v) they do not reflect changes in, or cash requirements for, the Company’s working capital needs; (vi) they are not adjusted for all non-cash income or expense items that are reflected in the Company’s statements of cash flows; and (vii) other companies in the industry may calculate tangible book value, Adjusted EBITDA, ROTCE and Operating ROTCE differently, limiting their usefulness as comparative measures. Because of these limitations, tangible book value, Adjusted EBITDA, ROTCE and Operating ROTCE should not be considered as measures of discretionary cash available to the Company to service indebtedness or invest in the business. The Company compensates for these limitations by relying primarily on GAAP results and using tangible book value, Adjusted EBITDA, ROTCE and Operating ROTCE only for supplemental purposes. Please refer to the Appendix for more information on non-GAAP measures.