- COOP Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

S-8 Filing

Mr. Cooper (COOP) S-8Registration of securities for employees

Filed: 1 Aug 18, 12:00am

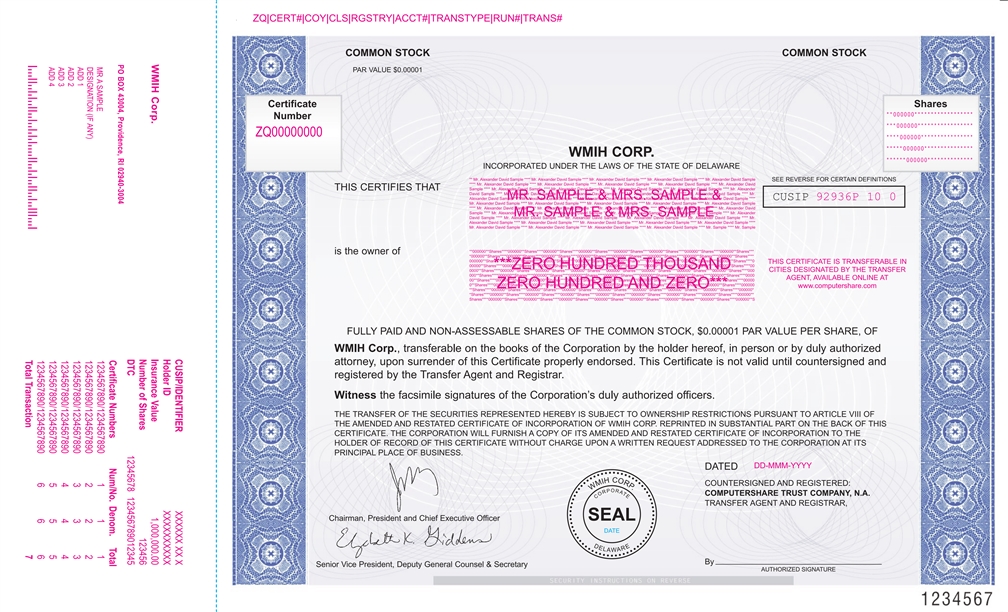

Exhibit 4.3

THIS CERTIFIES THAT is the owner of CUSIP DATED COUNTERSIGNED AND REGISTERED: COMPUTERSHARE TRUST COMPANY, N.A. TRANSFER AGENT AND REGISTRAR, FULLY PAID AND NON-ASSESSABLE SHARES OF THE COMMON STOCK, $0.00001 PAR VALUE PER SHARE, OF WMIH Corp., transferable on the books of the Corporation by the holder hereof, in person or by duly authorized attorney, upon surrender of this Certificate properly endorsed. This Certificate is not valid until countersigned and registered by the Transfer Agent and Registrar. Witness the facsimile signatures of the Corporation’s duly authorized officers. THE TRANSFER OF THE SECURITIES REPRESENTED HEREBY IS SUBJECT TO OWNERSHIP RESTRICTIONS PURSUANT TO ARTICLE VIII OF THE AMENDED AND RESTATED CERTIFICATE OF INCORPORATION OF WMIH CORP. REPRINTED IN SUBSTANTIAL PART ON THE BACK OF THIS CERTIFICATE. THE CORPORATION WILL FURNISH A COPY OF ITS AMENDED AND RESTATED CERTIFICATE OF INCORPORATION TO THE HOLDER OF RECORD OF THIS CERTIFICATE WITHOUT CHARGE UPON A WRITTEN REQUEST ADDRESSED TO THE CORPORATION AT ITS PRINCIPAL PLACE OF BUSINESS. COMMON STOCK PAR VALUE $0.00001 COMMON STOCK SEE REVERSE FOR CERTAIN DEFINITIONS Certificate Number Shares . WMIH CORP. INCORPORATED UNDER THE LAWS OF THE STATE OF DELAWARE Chairman, President and Chief Executive Officer Senior Vice President, Deputy General Counsel & Secretary By AUTHORIZED SIGNATURE DATE DEL AWAR E CO R PO RATE WMIH CORP. ZQ|CERT#|COY|CLS|RGSTRY|ACCT#|TRANSTYPE|RUN#|TRANS# 92936P 10 0 DD-MMM-YYYY * * 000000* * * * * * * * * * * * * * * * * * * * * 000000* * * * * * * * * * * * * * * * * * * * * 000000* * * * * * * * * * * * * * * * * * * * * 000000* * * * * * * * * * * * * * * * * * * * * 000000* * * * * * * * * * * * * * ** Mr. Alexander David Sample **** Mr. Alexander David Sample **** Mr. Alexander David Sample **** Mr. Alexander David Sample **** Mr. Alexander David Sample **** Mr. Alexander David Sample **** Mr. Alexander David Sample **** Mr. Alexander David Sample **** Mr. Alexander David Sample **** Mr. Alexander David Sample **** Mr. Alexander David Sample **** Mr. Alexander David Sample **** Mr. Alexander David Sample **** Mr. Alexander David Sample **** Mr. Alexander David Sample **** Mr. Alexander David Sample **** Mr. Alexander David Sample **** Mr. Alexander David Sample **** Mr. Alexander David Sample **** Mr. Alexander David Sample **** Mr. Alexander David Sample **** Mr. Alexander David Sample **** Mr. Alexander David Sample **** Mr. Alexander David Sample **** Mr. Alexander David Sample **** Mr. Alexander David Sample **** Mr. Alexander David Sample **** Mr. Alexander David Sample **** Mr. Alexander David Sample **** Mr. Alexander David Sample **** Mr. Alexander David Sample **** Mr. Alexander David Sample **** Mr. Alexander David Sample **** Mr. Alexander David Sample **** Mr. Alexander David Sample **** Mr. Alexander David Sample **** Mr. Alexander David Sample **** Mr. Alexander David Sample **** Mr. Alexander David Sample **** Mr. Alexander David Sample **** Mr. Alexander David Sample **** Mr. Alexander David Sample **** Mr. Alexander David Sample **** Mr. Alexander David Sample **** Mr. Alexander David Sample **** Mr. Alexander David Sample **** Mr. Alexander David Sample **** Mr. Alexander David Sample **** Mr. Alexander David Sample **** Mr. Alexander David Sample **** Mr. Alexander David Sample **** Mr. Alexander David Sample **** Mr. Sample **** Mr. Sample **000000**Shares****000000**Shares****000000**Shares****000000**Shares****000000**Shares****000000**Shares****000000**Shares****000000**Shares*** *000000**Shares****000000**Shares****000000**Shares****000000**Shares****000000**Shares****000000**Shares****000000**Shares****000000**Shares**** 000000**Shares****000000**Shares****000000**Shares****000000**Shares****000000**Shares****000000**Shares****000000**Shares****000000**Shares****0 00000**Shares****000000**Shares****000000**Shares****000000**Shares****000000**Shares****000000**Shares****000000**Shares****000000**Shares****00 0000**Shares****000000**Shares****000000**Shares****000000**Shares****000000**Shares****000000**Shares****000000**Shares****000000**Shares****000 000**Shares****000000**Shares****000000**Shares****000000**Shares****000000**Shares****000000**Shares****000000**Shares****000000**Shares****0000 00**Shares****000000**Shares****000000**Shares****000000**Shares****000000**Shares****000000**Shares****000000**Shares****000000**Shares****00000 0**Shares****000000**Shares****000000**Shares****000000**Shares****000000**Shares****000000**Shares****000000**Shares****000000**Shares****000000 **Shares****000000**Shares****000000**Shares****000000**Shares****000000**Shares****000000**Shares****000000**Shares****000000**Shares****000000* *Shares****000000**Shares****000000**Shares****000000**Shares****000000**Shares****000000**Shares****000000**Shares****000000**Shares****000000** Shares****000000**Shares****000000**Shares****000000**Shares****000000**Shares****000000**Shares****000000**Shares****000000**Shares****000000**S ***ZERO HUNDRED THOUSAND ZERO HUNDRED AND ZERO*** MR. SAMPLE & MRS. SAMPLE & MR. SAMPLE & MRS. SAMPLE ZQ00000000 Certificate Numbers 1234567890/1234567890 1234567890/1234567890 1234567890/1234567890 1234567890/1234567890 1234567890/1234567890 1234567890/1234567890 Total Transaction Num/No. 123456 Denom. 123456 Total 1234567 MR A SAMPLE DESIGNATION (IF ANY) ADD 1 ADD 2 ADD 3 ADD 4 WMIH Corp. PO BOX 43004, Providence, RI 02940-3004 CUSIP/IDENTIFIER XXXXXX XX X Holder ID XXXXXXXXXX Insurance Value 1,000,000.00 Number of Shares 123456 DTC 12345678 123456789012345 THIS CERTIFICATE IS TRANSFERABLE IN CITIES DESIGNATED BY THE TRANSFER AGENT, AVAILABLE ONLINE AT www.computershare.com

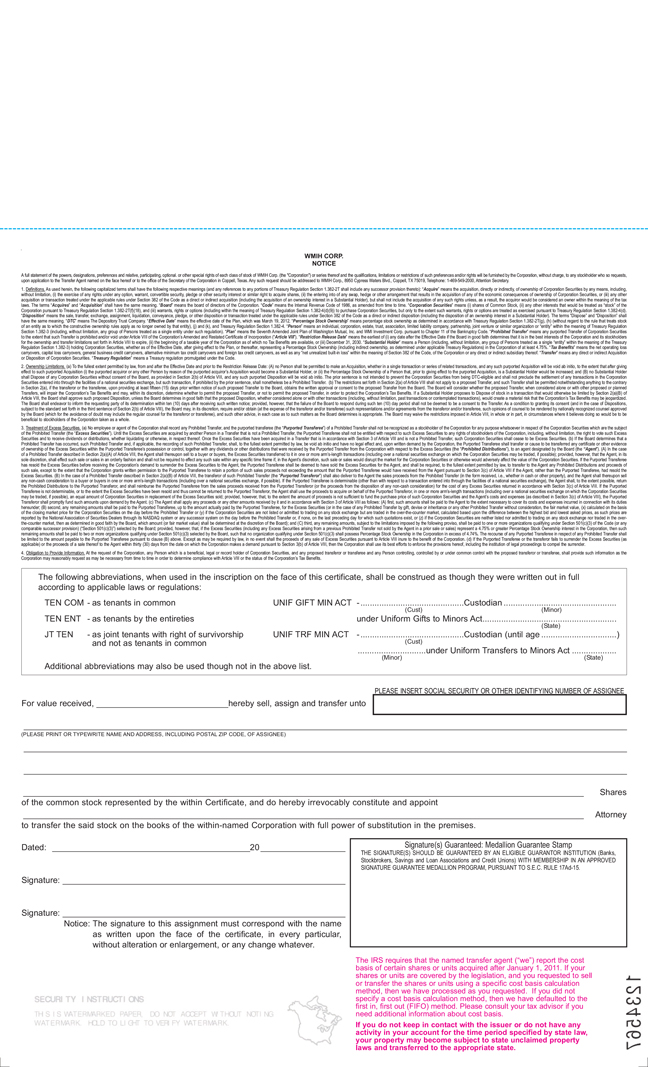

The IRS requires that the named transfer agent (“we”) report the cost

basis of certain shares or units acquired after January 1, 2011. If your

shares or units are covered by the legislation, and you requested to sell

or transfer the shares or units using a specific cost basis calculation

method, then we have processed as you requested. If you did not

specify a cost basis calculation method, then we have defaulted to the

first in, first out (FIFO) method. Please consult your tax advisor if you

need additional information about cost basis.

If you do not keep in contact with the issuer or do not have any

activity in your account for the time period specified by state law,

your property may become subject to state unclaimed property

laws and transferred to the appropriate state.

For value received, hereby sell, assign and transfer unto

Shares

Attorney

Dated: _20

Signature:

Signature:

Notice: The signature to this assignment must correspond with the name

as written upon the face of the certificate, in every particular,

without alteration or enlargement, or any change whatever.

PLEASE INSERT SOCIAL SECURITY OR OTHER IDENTIFYING NUMBER OF ASSIGNEE

(PLEASE PRINT OR TYPEWRITE NAME AND ADDRESS, INCLUDING POSTAL ZIP CODE, OF ASSIGNEE)

of the common stock represented by the within Certificate, and do hereby irrevocably constitute and appoint

to transfer the said stock on the books of the within-named Corporation with full power of substitution in the premises.

.

1. Definitions. As used herein, the following capitalized terms shall have the following respective meanings (and any references to any portions of Treasury Regulation Section 1.382-2T shall include any successor provision thereto): “Acquire” means the acquisition, directly or indirectly, of ownership of Corporation Securities by any means, including,

without limitation, (i) the exercise of any rights under any option, warrant, convertible security, pledge or other security interest or similar right to acquire shares, (ii) the entering into of any swap, hedge or other arrangement that results in the acquisition of any of the economic consequences of ownership of Corporation Securities, or (iii) any other

acquisition or transaction treated under the applicable rules under Section 382 of the Code as a direct or indirect acquisition (including the acquisition of an ownership interest in a Substantial Holder), but shall not include the acquisition of any such rights unless, as a result, the acquiror would be considered an owner within the meaning of the tax

laws. The terms “Acquires” and “Acquisition” shall have the same meaning. “Board” means the board of directors of the Corporation. “Code” means the Internal Revenue Code of 1986, as amended from time to time. “Corporation Securities” means (i) shares of Common Stock, (ii) any other interests that would be treated as “stock” of the

Corporation pursuant to Treasury Regulation Section 1.382-2T(f)(18), and (iii) warrants, rights or options (including within the meaning of Treasury Regulation Section 1.382-4(d)(9)) to purchase Corporation Securities, but only to the extent such warrants, rights or options are treated as exercised pursuant to Treasury Regulation Section 1.382-4(d).

“Disposition” means the sale, transfer, exchange, assignment, liquidation, conveyance, pledge, or other disposition or transaction treated under the applicable rules under Section 382 of the Code as a direct or indirect disposition (including the disposition of an ownership interest in a Substantial Holder). The terms “Dispose” and “Disposition” shall

have the same meaning. “DTC” means The Depository Trust Company. “Effective Date” means the effective date of the Plan, which was March 19, 2012. “Percentage Stock Ownership” means percentage stock ownership as determined in accordance with Treasury Regulation Section 1.382-2T(g), (h) (without regard to the rule that treats stock

of an entity as to which the constructive ownership rules apply as no longer owned by that entity), (j) and (k), and Treasury Regulation Section 1.382-4. “Person” means an individual, corporation, estate, trust, association, limited liability company, partnership, joint venture or similar organization or “entity” within the meaning of Treasury Regulation

Section 1.382-3 (including, without limitation, any group of Persons treated as a single entity under such regulation). “Plan” means the Seventh Amended Joint Plan of Washington Mutual, Inc. and WMI Investment Corp. pursuant to Chapter 11 of the Bankruptcy Code. “Prohibited Transfer” means any purported Transfer of Corporation Securities

to the extent that such Transfer is prohibited and/or void under Article VIII of the Corporation’s Amended and Restated Certificate of Incorporation (“Article VIII”). “Restriction Release Date” means the earliest of (i) any date after the Effective Date if the Board in good faith determines that it is in the best interests of the Corporation and its stockholders

for the ownership and transfer limitations set forth in Article VIII to expire, (ii) the beginning of a taxable year of the Corporation as of which no Tax Benefits are available, or (iii) December 31, 2030. “Substantial Holder” means a Person (including, without limitation, any group of Persons treated as a single “entity” within the meaning of the Treasury

Regulation Section 1.382-3) holding Corporation Securities, whether as of the Effective Date, after giving effect to the Plan, or thereafter, representing a Percentage Stock Ownership (including indirect ownership, as determined under applicable Treasury Regulations) in the Corporation of at least 4.75%. “Tax Benefits” means the net operating loss

carryovers, capital loss carryovers, general business credit carryovers, alternative minimum tax credit carryovers and foreign tax credit carryovers, as well as any “net unrealized built-in loss” within the meaning of Section 382 of the Code, of the Corporation or any direct or indirect subsidiary thereof. “Transfer” means any direct or indirect Acquisition

or Disposition of Corporation Securities. “Treasury Regulation” means a Treasury regulation promulgated under the Code.

2. Ownership Limitations. (a) To the fullest extent permitted by law, from and after the Effective Date and prior to the Restriction Release Date: (A) no Person shall be permitted to make an Acquisition, whether in a single transaction or series of related transactions, and any such purported Acquisition will be void ab initio, to the extent that after giving

effect to such purported Acquisition (i) the purported acquiror or any other Person by reason of the purported acquiror’s Acquisition would become a Substantial Holder, or (ii) the Percentage Stock Ownership of a Person that, prior to giving effect to the purported Acquisition, is a Substantial Holder would be increased; and (B) no Substantial Holder

shall Dispose of any Corporation Securities without consent of the Board, as provided in Section 2(b) of Article VIII, and any such purported Disposition will be void ab initio. The prior sentence is not intended to prevent the Corporation Securities from being DTC-eligible and shall not preclude the settlement of any transactions in the Corporation

Securities entered into through the facilities of a national securities exchange, but such transaction, if prohibited by the prior sentence, shall nonetheless be a Prohibited Transfer. (b) The restrictions set forth in Section 2(a) of Article VIII shall not apply to a proposed Transfer, and such Transfer shall be permitted notwithstanding anything to the contrary

in Section 2(a), if the transferor or the transferee, upon providing at least fifteen (15) days prior written notice of such proposed Transfer to the Board, obtains the written approval or consent to the proposed Transfer from the Board. The Board will consider whether the proposed Transfer, when considered alone or with other proposed or planned

Transfers, will impair the Corporation’s Tax Benefits and may, within its discretion, determine whether to permit the proposed Transfer, or not to permit the proposed Transfer, in order to protect the Corporation’s Tax Benefits. If a Substantial Holder proposes to Dispose of stock in a transaction that would otherwise be limited by Section 2(a)(B) of

Article VIII, the Board shall approve such proposed Disposition, unless the Board determines in good faith that the proposed Disposition, whether considered alone or with other transactions (including, without limitation, past transactions or contemplated transactions), would create a material risk that the Corporation’s Tax Benefits may be jeopardized.

The Board shall endeavor to inform the requesting party of its determination within ten (10) days after receiving such written notice; provided, however, that the failure of the Board to respond during such ten (10) day period shall not be deemed to be a consent to the Transfer. As a condition to granting its consent (and in the case of Dispositions,

subject to the standard set forth in the third sentence of Section 2(b) of Article VIII), the Board may, in its discretion, require and/or obtain (at the expense of the transferor and/or transferee) such representations and/or agreements from the transferor and/or transferee, such opinions of counsel to be rendered by nationally recognized counsel approved

by the Board (which for the avoidance of doubt may include the regular counsel for the transferor or transferee), and such other advice, in each case as to such matters as the Board determines is appropriate. The Board may waive the restrictions imposed in Article VIII, in whole or in part, in circumstances where it believes doing so would be to be

beneficial to stockholders of the Corporation taken as a whole.

3. Treatment of Excess Securities. (a) No employee or agent of the Corporation shall record any Prohibited Transfer, and the purported transferee (the “Purported Transferee”) of a Prohibited Transfer shall not be recognized as a stockholder of the Corporation for any purpose whatsoever in respect of the Corporation Securities which are the subject

of the Prohibited Transfer (the “Excess Securities”). Until the Excess Securities are acquired by another Person in a Transfer that is not a Prohibited Transfer, the Purported Transferee shall not be entitled with respect to such Excess Securities to any rights of stockholders of the Corporation, including, without limitation, the right to vote such Excess

Securities and to receive dividends or distributions, whether liquidating or otherwise, in respect thereof. Once the Excess Securities have been acquired in a Transfer that is in accordance with Section 3 of Article VIII and is not a Prohibited Transfer, such Corporation Securities shall cease to be Excess Securities. (b) If the Board determines that a

Prohibited Transfer has occurred, such Prohibited Transfer and, if applicable, the recording of such Prohibited Transfer, shall, to the fullest extent permitted by law, be void ab initio and have no legal effect and, upon written demand by the Corporation, the Purported Transferee shall transfer or cause to be transferred any certificate or other evidence

of ownership of the Excess Securities within the Purported Transferee’s possession or control, together with any dividends or other distributions that were received by the Purported Transfer from the Corporation with respect to the Excess Securities (the “Prohibited Distributions”), to an agent designated by the Board (the “Agent”). (A) In the case

of a Prohibited Transfer described in Section 2(a)(A) of Article VIII, the Agent shall thereupon sell to a buyer or buyers, the Excess Securities transferred to it in one or more arm’s-length transactions (including over a national securities exchange on which the Corporation Securities may be traded, if possible); provided, however, that the Agent, in its

sole discretion, shall effect such sale or sales in an orderly fashion and shall not be required to effect any such sale within any specific time frame if, in the Agent’s discretion, such sale or sales would disrupt the market for the Corporation Securities or otherwise would adversely affect the value of the Corporation Securities. If the Purported Transferee

has resold the Excess Securities before receiving the Corporation’s demand to surrender the Excess Securities to the Agent, the Purported Transferee shall be deemed to have sold the Excess Securities for the Agent, and shall be required, to the fullest extent permitted by law, to transfer to the Agent any Prohibited Distributions and proceeds of

such sale, except to the extent that the Corporation grants written permission to the Purported Transferee to retain a portion of such sales proceeds not exceeding the amount that the Purported Transferee would have received from the Agent pursuant to Section 3(c) of Article VIII if the Agent, rather than the Purported Transferee, had resold the

Excess Securities. (B) In the case of a Prohibited Transfer described in Section 2(a)(B) of Article VIII, the transferor of such Prohibited Transfer (the “Purported Transferor”) shall also deliver to the Agent the sales proceeds from the Prohibited Transfer (in the form received, i.e., whether in cash or other property), and the Agent shall thereupon sell

any non-cash consideration to a buyer or buyers in one or more arm’s-length transactions (including over a national securities exchange, if possible). If the Purported Transferee is determinable (other than with respect to a transaction entered into through the facilities of a national securities exchange), the Agent shall, to the extent possible, return

the Prohibited Distributions to the Purported Transferor, and shall reimburse the Purported Transferee from the sales proceeds received from the Purported Transferor (or the proceeds from the disposition of any non-cash consideration) for the cost of any Excess Securities returned in accordance with Section 3(c) of Article VIII. If the Purported

Transferee is not determinable, or to the extent the Excess Securities have been resold and thus cannot be returned to the Purported Transferor, the Agent shall use the proceeds to acquire on behalf of the Purported Transferor, in one or more arm’s-length transactions (including over a national securities exchange on which the Corporation Securities

may be traded, if possible), an equal amount of Corporation Securities in replacement of the Excess Securities sold; provided, however, that, to the extent the amount of proceeds is not sufficient to fund the purchase price of such Corporation Securities and the Agent’s costs and expenses (as described in Section 3(c) of Article VIII), the Purported

Transferor shall promptly fund such amounts upon demand by the Agent. (c) The Agent shall apply any proceeds or any other amounts received by it and in accordance with Section 3 of Article VIII as follows: (A) first, such amounts shall be paid to the Agent to the extent necessary to cover its costs and expenses incurred in connection with its duties

hereunder; (B) second, any remaining amounts shall be paid to the Purported Transferee, up to the amount actually paid by the Purported Transferee, for the Excess Securities (or in the case of any Prohibited Transfer by gift, devise or inheritance or any other Prohibited Transfer without consideration, the fair market value, (x) calculated on the basis

of the closing market price for the Corporation Securities on the day before the Prohibited Transfer or (y) if the Corporation Securities are not listed or admitted to trading on any stock exchange but are traded in the over-the-counter market, calculated based upon the difference between the highest bid and lowest asked prices, as such prices are

reported by the National Association of Securities Dealers through its NASDAQ system or any successor system on the day before the Prohibited Transfer or, if none, on the last preceding day for which such quotations exist, or (z) if the Corporation Securities are neither listed nor admitted to trading on any stock exchange nor traded in the overthe-

counter market, then as determined in good faith by the Board, which amount (or fair market value) shall be determined at the discretion of the Board); and (C) third, any remaining amounts, subject to the limitations imposed by the following proviso, shall be paid to one or more organizations qualifying under Section 501(c)(3) of the Code (or any

comparable successor provision) (“Section 501(c)(3)”) selected by the Board; provided, however, that, if the Excess Securities (including any Excess Securities arising from a previous Prohibited Transfer not sold by the Agent in a prior sale or sales) represent a 4.75% or greater Percentage Stock Ownership interest in the Corporation, then such

remaining amounts shall be paid to two or more organizations qualifying under Section 501(c)(3) selected by the Board, such that no organization qualifying under Section 501(c)(3) shall possess Percentage Stock Ownership in the Corporation in excess of 4.74%. The recourse of any Purported Transferee in respect of any Prohibited Transfer shall

be limited to the amount payable to the Purported Transferee pursuant to clause (B) above. Except as may be required by law, in no event shall the proceeds of any sale of Excess Securities pursuant to Article VIII inure to the benefit of the Corporation. (d) If the Purported Transferee or the transferor fails to surrender the Excess Securities (as

applicable) or the proceeds of a sale thereof to the Agent within thirty (30) days from the date on which the Corporation makes a demand pursuant to Section 3(b) of Article VIII, then the Corporation shall use its best efforts to enforce the provisions hereof, including the institution of legal proceedings to compel the surrender.

4. Obligation to Provide Information. At the request of the Corporation, any Person which is a beneficial, legal or record holder of Corporation Securities, and any proposed transferor or transferee and any Person controlling, controlled by or under common control with the proposed transferor or transferee, shall provide such information as the

Corporation may reasonably request as may be necessary from time to time in order to determine compliance with Article VIII or the status of the Corporation’s Tax Benefits.

Signature(s) Guaranteed: Medallion Guarantee Stamp

THE SIGNATURE(S) SHOULD BE GUARANTEED BY AN ELIGIBLE GUARANTOR INSTITUTION (Banks,

Stockbrokers, Savings and Loan Associations and Credit Unions) WITH MEMBERSHIP IN AN APPROVED

SIGNATURE GUARANTEE MEDALLION PROGRAM, PURSUANT TO S.E.C. RULE 17Ad-15.

The following abbreviations, when used in the inscription on the face of this certificate, shall be construed as though they were written out in full

according to applicable laws or regulations:

TEN COM - as tenants in common UNIF GIFT MIN ACT -Custodian

(Cust) (Minor)

TEN ENT - as tenants by the entireties under Uniform Gifts to Minors Act

(State)

JT TEN - as joint tenants with right of survivorship UNIF TRF MIN ACT -Custodian (until age )

and not as tenants in common (Cust)

under Uniform Transfers to Minors Act

(Minor) (State)

Additional abbreviations may also be used though not in the above list.

WMIH CORP.

NOTICE

A full statement of the powers, designations, preferences and relative, participating, optional. or other special rights of each class of stock of WMIH Corp. (the “Corporation”) or series thereof and the qualifications, limitations or restrictions of such preferences and/or rights will be furnished by the Corporation, without charge, to any stockholder who so requests,