MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion and analysis is intended to assist readers in understanding the consolidated financial condition and results of operations of IBERIABANK Corporation (the “Company”) and its subsidiary as of December 31, 2002 and 2003 and for the years ended December 31, 2001 through 2003. This review should be read in conjunction with the audited consolidated financial statements, accompanying footnotes and supplemental financial data included herein.

FINANCIAL OVERVIEW

The Company’s net income for 2003 totaled $23.6 million, or $3.42 per share on a diluted basis. This is a 13% increase over the $3.02 per share, or $18.5 million earned for 2002. Earnings performance for 2003 was influenced by the acquisition of Acadiana Bancshares, Inc. (“Acadiana”) in the first quarter of 2003, and other factors, the key components of which are summarized below.

| | • | Total assets of the Company increased to $2.1 billion at the end of 2003, or 35%, from $1.6 billion at the end of 2002. This strong growth is reflective not only of the $302.5 million asset base obtained through the Acadiana acquisition, but organic growth through new and deepened client relationships amounting to $242.7 million as well. Shareholders’ equity for the same periods improved from $139.6 million at the end of 2002 to $195.2 million at the end of 2003. |

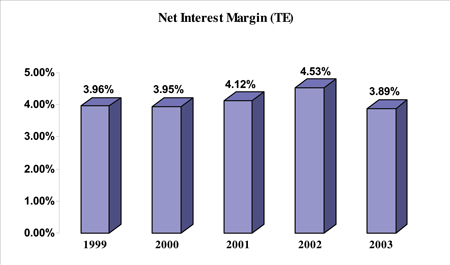

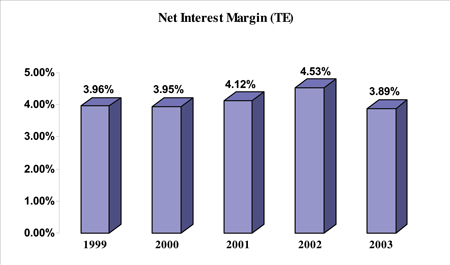

| | • | Net interest income increased by $8.0 million, or 13%. This was largely due to increased volume and improvement in the mix of both earning assets and deposits. The corresponding net interest margin ratio on a tax-equivalent basis declined to 3.89% from 4.53%. This was primarily the result of higher mortgage prepayment speeds which resulted in increased premium amortizations on related products and also a downward trend in spreads associated with the earning asset growth. Additionally, the Acadiana acquisition resulted in increased net interest income, but a reduction of the margin as a result of marking the acquired asset and liability mix to current yields. |

| | • | Improvement in noninterest income of $5.2 million, or 29%, was reflected in 2003 as compared to the prior year. Increased gains on the sales of mortgage loans in the secondary market as mortgage loan refinancing hit all-time highs and also service charge fees derived from deposit accounts were the major contributing factors to the growth. |

| | • | Noninterest expense increased by $6.6 million, or 15%, from 2002 to 2003. The increase was due in part to the inclusion of expenses related to the acquisition of Acadiana. Compensation expense increased $3.5 million mainly as a result of new hires associated with this acquisition. It was also due in part to the rising cost of the Employee Stock Ownership Plan (“ESOP”) as it relates to the improved value of Company stock and continuance of the Company to hire strategically in markets across the state. Other increases were primarily associated with infrastructure improvements. |

| | • | The Company provided $6.3 million for possible loan losses for 2003 as compared to $6.2 million for 2002 to bring the allowance for loan losses as a percent of total loans to 1.29% at the end of the year, as compared to 1.25% at the end of 2002. Net charge-offs for 2003 were $3.6 million, or 0.28% of average loans, compared to $4.2 million, or 0.43% a year earlier. The coverage of nonperforming assets by the allowance for loan losses was 2.5 times at the end of 2003, as compared to 2.0 times at the end of 2002. |

The year 2003 also set the stage for future expansion with the announcements of several strategic hires, the development of a branch in Shreveport, Louisiana and our entrance into Baton Rouge, Louisiana with the acquisition of Alliance Bank of Baton Rouge in the first quarter of 2004. Also scheduled for early in 2004 is the opening of a private banking branch office in New Orleans, Louisiana. These steps take advantage of lending opportunities that are believed to exist due to the size and flexibility of the Company as compared to its competitors, primarily with

commercial and private banking clients. It is anticipated that these relationships will result in increased deposits, as well. The Company will continue to analyze the potential for growth in new and existing markets as they arise.

The Company’s continuing focus is that of a high performing institution. Management believes that improvement in core earnings drives shareholder value and has adopted a mission statement that is designed to provide guidance for management, our associates and Board of Directors regarding the sense of purpose and direction of the Company. We are extremely shareholder and client focused, expect high performance from our associates, believe in a strong sense of community and strive to make the Company a great place to work. Earnings guidance, based on expectations of the Company, is provided during the year through press releases, which are available on our website and also disclosed through the Form 8-K current event filings with the Securities and Exchange Commission (“SEC”).

Inherent in any organization are risks associated with the industry. The most important risk factors affecting the success of the Company are believed to be the management of loan credit risk and interest rate risk, which are discussed under their respective sections entitled “Loans and Asset Quality” and “Asset Liability Management and Market Risk” later in this discussion.

APPLICATION OF CRITICAL ACCOUNTING POLICIES

In preparing financial reports, management is required to apply significant judgment to various accounting, reporting and disclosure matters. Management must use assumptions and estimates to apply these principles where actual measurement is not possible or practical. The accounting principles and methods used by the Company conform with accounting principles generally accepted in the United States and general banking practices. Estimates and assumptions most significant to the Company relate primarily to the allowance for loan losses, intangible assets and stock option compensation. These significant estimates and assumptions are summarized in the following discussion and are further analyzed in the footnotes to the consolidated financial statements.

The determination of the allowance for loan losses, which represents management’s estimate of probable losses inherent in the Company’s credit portfolio, involves a high degree of judgment and complexity. The Company’s policy is to establish reserves for estimated losses on delinquent and other problem loans when it is determined that losses are expected to be incurred on such loans and leases. Management’s determination of the adequacy of the allowance is based on various factors, including an evaluation of the portfolio, past loss experience, current economic conditions, the volume and type of lending conducted by the Company, composition of the portfolio, the amount of the Company’s classified assets, seasoning of the loan portfolio, the status of past due principal and interest payments, and other relevant factors. Changes in such estimates may have a significant impact on the financial statements. For further discussion of the allowance for loan losses, see the Loan and Asset Quality section of this analysis and Note 1 to the Consolidated Financial Statements.

Generally accepted accounting principles require the Company to perform a goodwill valuation at least annually. Impairment testing of goodwill is a two step process that first compares the fair value of goodwill with its carrying amount, and second measures impairment loss by comparing the implied fair value of goodwill with the carrying amount of that goodwill. Based on management’s goodwill impairment tests, there was no impairment of goodwill in 2002 or 2003.

The Company has elected to account for its stock option plans under the intrinsic value method of Accounting Principles Board (APB) Opinion No. 25,Accounting for Stock Issued to Employees. In accordance with APB Opinion No. 25, compensation expense relating to stock options is not reflected in net income provided the exercise price of the stock options granted equals or exceeds the market value of the underlying common stock at the date of grant. The Company’s practice has been to grant options at no less than the fair market value of the stock at the date of grant. Statement of Financial Accounting Standard (FAS) No. 123,Accounting for Stock-Based Compensation, encourages all entities to adopt a fair value based method of accounting for employee stock compensation plans, whereby compensation cost is measured at the grant date based on the value of the award and is recognized over the service period, which is usually the vesting period. Given the Company’s election to continue with the accounting methodology in APB Opinion No. 25, management is required to provide proforma disclosures of net income and earnings per share and other disclosures, as if the fair value based method of accounting had been applied.

Management utilizes the Black-Scholes option valuation model to estimate the fair value of stock options. The option valuation model requires the input of highly subjective assumptions, including the expected stock price volatility. Changes in the subjective input assumptions can materially affect the fair value estimate. For additional discussion of the Company’s stock options plans, see Note 15 to the Consolidated Financial Statements.

FINANCIAL CONDITION

Earning Assets

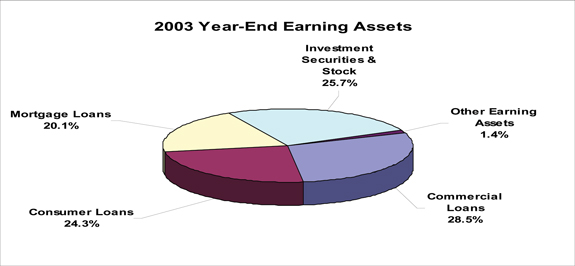

Earning assets are composed of interest or dividend-bearing assets, including loans, securities, short-term investments and loans held for sale. Interest income associated with earning assets is the Company’s primary source of income. Total average earning assets increased $454.7 million, or 34%, in 2003 as compared to 2002. The year-end mix of earning assets shown in the following chart reflects the mix between investment securities and the major loan groups.

Loans and Asset Quality –The loan portfolio increased $367.9 million, or 35.2%, to $1.4 billion at December 31, 2003, compared to $1.0 billion at December 31, 2002. The increase in loans since year-end 2002 was due to non-acquisition related internal growth of $202.5 million, as well as $192.3 million of additional loans obtained through the acquisition of Acadiana, less the sale of $26.9 million of residential mortgage loans obtained through the acquisition. Commercial loans increased $139.0 million, or 33.6%, mortgage loans increased $165.7 million, or 74.1%, and consumer loans increased $63.2 million, or 15.5%. Excluding the accounting effect of the acquisition, commercial loans increased $68.5 million, residential mortgage loans increased $102.7 million and consumer loans increased $31.3 million.

Growth in the commercial loan portfolio came primarily from traditional commercial, private banking and institutional sectors of the New Orleans and Acadiana Markets, with no one customer representing a disproportionate percentage of the increase. Mortgage loan growth is primarily the result of larger private banking residential and construction loan originations that provide relationships with high net worth clients. The Company continues to sell the majority of conforming fixed rate mortgage loan originations and recognize the associated fee income rather than assume the rate risk associated with these longer term assets. Consumer loans are mainly composed of indirect automobile loans collateralized by both new and used vehicles, home equity loans and other consumer loans. Consumer loan growth came primarily from retail home equity loans and was bolstered by a modest increase in other consumer categories. The Company maintains a focus on loans believed to be prime, or lower risk, consumer loans.

The loss of any one customer, or group of customers engaged in similar activities, would not have a material adverse effect on the Company. The percentage of fixed rate loans within the total loan portfolio has decreased slightly from 71% in 2002 to 69% in 2003.

The following table sets forth the composition of the Company’s loan portfolio as of December 31 for the years indicated.

TABLE 1 – LOAN PORTFOLIO COMPOSITION

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | December 31,

| |

(dollars in thousands)

| | 2003

| | | | | 2002

| | | | | 2001

| | | | | 2000

| | | | | 1999

| | | |

Commercial loans: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Real estate | | $ | 352,031 | | 25 | % | | $ | 254,688 | | 25 | % | | $ | 228,284 | | 24 | % | | $ | 196,479 | | 21 | % | | $ | 157,248 | | 19 | % |

Other | | | 201,020 | | 14 | | | | 159,339 | | 15 | | | | 117,530 | | 12 | | | | 78,986 | | 8 | | | | 82,485 | | 10 | |

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

Total commercial loans | | | 553,051 | | 39 | | | | 414,027 | | 40 | | | | 345,814 | | 36 | | | | 275,465 | | 29 | | | | 239,733 | | 29 | |

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

Mortgage loans: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Residential 1-4 family | | | 338,965 | | 24 | | | | 207,130 | | 20 | | | | 198,403 | | 21 | | | | 279,193 | | 30 | | | | 266,161 | | 31 | |

Construction | | | 50,295 | | 4 | | | | 16,470 | | 1 | | | | 5,915 | | 1 | | | | 7,482 | | 1 | | | | 6,381 | | 1 | |

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

Total mortgage loans | | | 389,260 | | 28 | | | | 223,600 | | 21 | | | | 204,318 | | 22 | | | | 286,675 | | 31 | | | | 272,542 | | 32 | |

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

Loans to individuals: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Indirect automobile | | | 229,636 | | 16 | | | | 219,280 | | 21 | | | | 220,698 | | 23 | | | | 205,143 | | 22 | | | | 179,350 | | 21 | |

Home equity | | | 174,740 | | 12 | | | | 122,799 | | 12 | | | | 114,056 | | 12 | | | | 108,070 | | 11 | | | | 91,531 | | 11 | |

Other | | | 65,662 | | 5 | | | | 64,786 | | 6 | | | | 71,129 | | 7 | | | | 65,172 | | 7 | | | | 59,722 | | 7 | |

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

Total consumer loans | | | 470,038 | | 33 | | | | 406,865 | | 39 | | | | 405,883 | | 42 | | | | 378,385 | | 40 | | | | 330,603 | | 39 | |

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

| | | | | | | | | | |

Total loans receivable | | $ | 1,412,349 | | 100 | % | | $ | 1,044,492 | | 100 | % | | $ | 956,015 | | 100 | % | | $ | 940,525 | | 100 | % | | $ | 842,878 | | 100 | % |

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

Commercial Loans.Commercial real estate and commercial business loans generally have shorter repayment periods and more frequent repricing opportunities than residential 1-4 family loans. The Company has increased its investment in commercial real estate loans from $254.7 million, or 24.4% of the total loan portfolio, as of December 31, 2002, to $352.0 million, or 24.9% of the total loan portfolio, as of December 31, 2003. The properties securing the Company’s commercial real estate loans are located in the Company’s market area, and include owner-occupied, multi-family, strip shopping centers, professional office buildings, small retail establishments and warehouses. The Company’s underwriting standards generally provide for loan terms of three to five years, with amortization schedules of no more than twenty years. Low loan-to-value ratios are maintained and usually limited to no more than 80%. As a rule, the Company obtains personal guarantees of the principals as additional security for most commercial real estate loans.

As of December 31, 2003, the Company’s commercial business loans amounted to $201.0 million, or 14.2% of the Company’s gross loan portfolio. The Company originates commercial business loans on a secured and, to a lesser extent, unsecured basis. The Company’s commercial business loans may be structured as term loans or revolving lines of credit. Term loans are generally structured with terms of no more than three to five years, with amortization schedules of no more than seven years. The Company’s commercial business term loans are generally secured by equipment, machinery or other corporate assets. The Company also provides for revolving lines of credit generally structured as advances upon perfected security interests in accounts receivable and inventory. Revolving lines of credit generally have an annual maturity. As a rule, the Company obtains personal guarantees of the principals as additional security for commercial business loans.

Mortgage Loans.Residential 1-4 family loans comprise substantially all of the Company’s mortgage loans. Properties located in its market area and originated under terms and documentation which permit their sale in the secondary market secure the vast majority of the Company’s residential 1-4 family mortgage loan portfolio. To reduce portfolio rate risk, the Company’s practice has been to sell, or hold for sale in the secondary market, the majority of all conforming fixed rate mortgage loan originations and retain adjustable rate mortgage loan originations in the portfolio. Larger mortgage loans of private banking clients and prospects are also retained to enhance relationships, and also due to the expected shorter durations and relatively lower servicing costs associated with loans of this size.

As a result of the decline in long-term rates over the past three years, with a low point in the middle of 2003, there was a considerable amount of refinancing activity in mortgage loan portfolios industry-wide as well as increased construction lending. Accordingly, mortgage loan originations hit record levels in 2003. Consistent with previous practice, the Company continued to sell in the secondary market the majority of newly originated and refinanced conventional loans, as well as a portion of the construction loans as they move to long-term financing. This was done to reduce portfolio rate risk on loans with longer expected durations and limited cross-sell opportunities. During 2003, the mortgage loan portfolio grew by $165.7 million, or 74.1%. The increase was due to internal growth of $102.7 million plus $89.9 million of residential mortgage loans obtained through the acquisition of Acadiana, net of $26.9 million of this group sold immediately after the acquisition due to expected prepayment acceleration. Mortgage loan internal growth was primarily the result of construction lending and retention of larger private banking residential loans. Additionally, opportunities available in the secondary market afforded the ability to selectively purchase in-market jumbo (over $333,700 individually) mortgage loans as part of the Company’s efforts to expand private banking relationships. If conventional mortgage rates remain unchanged or increase, it is expected that mortgage loan activity will slow as a result of the smaller population of existing mortgage loans that would benefit from refinancing. At December 31, 2003, $278.8 million, or 71.6%, of the Company’s residential 1-4 family mortgage and construction loans were fixed rate loans and $110.5 million, or 28.4%, were adjustable rate loans.

Consumer Loans.The Company offers consumer loans in order to provide a full range of retail financial services to its customers. The Company originates substantially all of such loans in its primary market area. At December 31, 2003, $470.0 million, or 33.3% of the Company’s total loan portfolio, was comprised of consumer loans, compared to $406.9 million, or 39.0% at the end of 2002. During 2003, the consumer loan portfolio increased $63.2 million, or 15.5%. The increase was due to $31.9 million of consumer loans obtained through the acquisition of Acadiana, as well as internal growth of $31.3 million.

Indirect automobile loans comprised the largest component of the Company’s consumer loan portfolio. Independent automobile dealerships originate these loans and forward applications to Company personnel for approval or denial. The Company relies on the dealerships, in part, for loan qualifying information. To that extent, there is risk inherent in indirect automobile loans associated with fraud or negligence by the automobile dealership. To limit this risk, an emphasis is placed on established dealerships that have demonstrated reputable behavior, both within the communities we serve and through long-term relationships with the Company. Growth in the indirect automobile loan category was $10.4 million, or 4.7%. This growth was achieved while maintaining a focus on prime, or low risk, paper. Captive finance companies continue to provide a high level of competition for this business. At December 31, 2003, $229.6 million, or 16.3% of the Company’s total loan portfolio, consisted of indirect automobile loans.

The remainder of the consumer loan portfolio at December 31, 2003 was composed of home equity loans, direct automobile loans, credit card loans and other consumer loans. Consumer loan growth, primarily driven by $51.9 million in home equity loans, was bolstered by a modest increase in other consumer categories. At December 31, 2003, $174.7 million, or 12.4% of the Company’s total loan portfolio, made up the home equity loan balance. At December 31, 2003, the Company’s direct automobile loans amounted to $24.8 million, or 1.8% of the Company’s total loan portfolio. The Company’s VISA and MasterCard credit card loans totaled $9.0 million, or 0.6% of the Company’s total loan portfolio at such date. The Company’s other personal consumer loans amounted to $31.9 million, or 2.3% of the Company’s total loan portfolio, at December 31, 2003.

Loan Maturities.The following table sets forth the scheduled contractual maturities of the Company’s loan portfolio at December 31, 2003, unadjusted for scheduled principal reductions, prepayments or repricing opportunities. Demand loans, loans having no stated schedule of repayments and no stated maturity and overdraft loans are reported as due in one year or less. The average life of a loan may be substantially less than the contractual terms because of prepayments. As a result, scheduled contractual amortization of loans is not reflective of the expected term of the Company’s loan portfolio. Over 78% of the value of loans with maturities greater than one year bears a fixed rate of interest.

TABLE 2 – LOAN MATURITIES BY TYPE

| | | | | | | | | | | | |

(dollars in thousands)

| | One Year or Less

| | One Through Five Years

| | After Five Years

| | Total

|

Commercial real estate | | $ | 89,982 | | $ | 207,223 | | $ | 54,826 | | $ | 352,031 |

Commercial other | | | 81,686 | | | 77,150 | | | 42,184 | | | 201,020 |

Mortgage residential 1-4 family | | | 6,309 | | | 15,111 | | | 317,545 | | | 338,965 |

Mortgage construction | | | 50,295 | | | — | | | — | | | 50,295 |

Consumer | | | 103,564 | | | 239,206 | | | 127,268 | | | 470,038 |

| | |

|

| |

|

| |

|

| |

|

|

Total | | $ | 331,836 | | $ | 538,690 | | $ | 541,823 | | $ | 1,412,349 |

| | |

|

| |

|

| |

|

| |

|

|

Asset Quality.The credit quality of the Company’s assets has continued to improve as management has assertively worked to enhance underwriting risk/return dynamics within the loan portfolio. Over time, management has significantly increased the allowance for loan losses, tightened underwriting guidelines and procedures, adopted more conservative consumer loan charge-off and nonaccrual guidelines, rewritten the loan policy and developed an internal loan review function. As the Company has transitioned the loan portfolio to be more representative of a commercial bank, there is recognition of a potential for higher charge-off and nonperforming levels, but also a potential higher level of return for investors. Management believes that historically it has recognized and disclosed significant problem loans quickly and taken prompt action in addressing material weaknesses in those credits. The Company will continue to monitor the risk adjusted level of return within the loan portfolio.

Written underwriting standards established by the Board of Directors and management govern the lending activities of the Company. The commercial credit department, in conjunction with senior lending personnel, underwrites all commercial business and commercial real estate loans. The Company provides centralized underwriting of all residential mortgage, construction and consumer loans. Established loan origination procedures require appropriate documentation including financial data and credit reports. For loans secured by real property, the Company generally requires property appraisals, title insurance or a title opinion, hazard insurance and flood insurance, where appropriate.

Loan payment performance is monitored and late charges are assessed on past due accounts. A centralized department collects delinquent consumer, residential mortgage and construction loans. Every effort is made to minimize any potential loss, including instituting legal proceedings, as necessary. Commercial loans of the Company are periodically reviewed through a loan review process. All other loans are also subject to loan review through a periodic sampling process.

The Company utilizes an asset risk classification system in compliance with guidelines established by the Federal Reserve Board as part of its efforts to improve commercial asset quality. In connection with examinations of insured institutions, both federal and state examiners also have the authority to identify problem assets and, if appropriate, classify them. There are three classifications for problem assets: “substandard,” “doubtful” and “loss.” Substandard assets have one or more defined weaknesses and are characterized by the distinct possibility that the insured institution will sustain some loss if the deficiencies are not corrected. Doubtful assets have the weaknesses of substandard assets with the additional characteristic that the weaknesses make collection or liquidation in full questionable and there is a high probability of loss based on currently existing facts, conditions and values. An asset classified as loss is not considered collectable and of such little value that continuance as an asset of the Company is not warranted. Commercial loans with adverse classifications are reviewed by the Loan Committee of the Board of Directors at least monthly. Loans are placed on nonaccrual status when, in the judgment of management, the probability of collection of interest is deemed to be insufficient to warrant further accrual. When a loan is placed on nonaccrual status, previously accrued but unpaid interest for the current year is deducted from interest income. Prior year interest is charged-off to the allowance for loan losses.

At December 31, 2003, the Company had $12.4 million of assets classified as substandard, $501,000 of assets classified as doubtful, and no assets classified as loss. At such date, the aggregate of the Company’s classified assets amounted to 0.61% of total assets.

Real estate acquired by the Company as a result of foreclosure or by deed-in-lieu of foreclosure is classified as real estate owned until sold, and is carried at the balance of the loan at the time of acquisition or at estimated fair value less estimated costs to sell, whichever is less.

Under Generally Accepted Accounting Principles, the Company is required to account for certain loan modifications or restructurings as “troubled debt restructurings.” In general, the modification or restructuring of a debt constitutes a troubled debt restructuring if the Company for economic or legal reasons related to the borrower’s financial difficulties grants a concession to the borrower that the Company would not otherwise consider under current market conditions. Debt restructurings or loan modifications for a borrower do not necessarily always constitute troubled debt restructurings, however, and troubled debt restructurings do not necessarily result in nonaccrual loans. The Company had no troubled debt restructuring as of December 31, 2003.

Nonperforming loans, defined for these purposes as nonaccrual loans plus accruing loans past due 90 days or more, totaled $5.1 million and $4.3 million at December 31, 2003 and 2002, respectively. The Company’s foreclosed property amounted to $2.1 million and $2.3 million at December 31, 2003 and 2002, respectively. Nonperforming assets, which consist of nonperforming loans plus foreclosed property, were $7.3 million, or 0.34% of total assets at December 31, 2003, compared to $6.6 million, or 0.42% of total assets at December 31, 2002.

The Company has shown continuing improvement in asset quality despite annualized double-digit growth in loans. Although the balance of nonperforming assets increased, the relative level of these assets as a percentage of total assets declined considerably from 0.42% at the end of 2002 to 0.34% at the end of 2003. The increase in nonperforming assets of $646,000 during this period was due to increases in the amount of nonaccrual loans and loans past due, partially offset by reductions in the amount of foreclosed property. Foreclosed properties, representing approximately 29% of total nonperforming assets, declined slightly. This category is principally composed of one commercial real estate property, which was sold to a third party in January 2004. The following table sets forth the composition of the Company’s nonperforming assets, including accruing loans past due 90 or more days, as of the dates indicated.

TABLE 3 – NONPERFORMING ASSETS AND TROUBLED DEBT RESTRUCTURINGS

| | | | | | | | | | | | | | | | | | | | |

| | | December 31,

| |

(dollars in thousands)

| | 2003

| | | 2002

| | | 2001

| | | 2000

| | | 1999

| |

Nonaccrual loans: | | | | | | | | | | | | | | | | | | | | |

Commercial, financial and agricultural | | $ | 1,838 | | | $ | 1,693 | | | $ | 4,088 | | | $ | 5,169 | | | $ | 1,293 | |

Mortgage | | | 552 | | | | 334 | | | | 122 | | | | 137 | | | | 208 | |

Loans to individuals | | | 1,512 | | | | 1,230 | | | | 1,053 | | | | 161 | | | | 429 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total nonaccrual loans | | | 3,902 | | | | 3,257 | | | | 5,263 | | | | 5,467 | | | | 1,930 | |

Accruing loans 90 days or more past due | | | 1,220 | | | | 1,086 | | | | 1,691 | | | | 2,074 | | | | 1,203 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total nonperforming loans (1) | | | 5,122 | | | | 4,343 | | | | 6,954 | | | | 7,541 | | | | 3,133 | |

Foreclosed property | | | 2,134 | | | | 2,267 | | | | 6,009 | | | | 421 | | | | 185 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total nonperforming assets (1) | | | 7,256 | | | | 6,610 | | | | 12,963 | | | | 7,962 | | | | 3,318 | |

Performing troubled debt restructurings | | | — | | | | — | | | | — | | | | — | | | | — | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total nonperforming assets and troubled debt restructurings (1) | | $ | 7,256 | | | $ | 6,610 | | | $ | 12,963 | | | $ | 7,962 | | | $ | 3,318 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Nonperforming loans to total loans (1) | | | 0.36 | % | | | 0.42 | % | | | 0.73 | % | | | 0.80 | % | | | 0.37 | % |

Nonperforming assets to total assets (1) | | | 0.34 | % | | | 0.42 | % | | | 0.91 | % | | | 0.57 | % | | | 0.24 | % |

Nonperforming assets and troubled | | | | | | | | | | | | | | | | | | | | |

debt restructurings to total assets (1) | | | 0.34 | % | | | 0.42 | % | | | 0.91 | % | | | 0.57 | % | | | 0.24 | % |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| (1) | Nonperforming loans and assets include accruing loans 90 days or more past due |

Allowance For Loan Losses.Based on facts and circumstances available, management of the Company believes that the allowance for loan losses was adequate at December 31, 2003 to cover any potential losses in the Company’s loan portfolio. However, future adjustments to this allowance may be necessary, and the Company’s results of operations could be adversely affected if circumstances differ substantially from the assumptions used by management in determining the allowance for loan losses. Losses in the loan portfolio, net of recoveries, are charged-off against the allowance and reduce the balance. Provisions for loan losses, which are charged against income, increase the allowance.

In determining the amount of the allowance for loan losses, management uses information from its portfolio management process, relationship managers and ongoing loan review efforts to stratify the loan portfolio into asset risk classifications and assign a general or specific reserve allocation. General reserve estimated loss percentages are based on the current and historical loss experience of each loan category, regulatory guidelines for losses, the status of past due payments, and management’s judgment of economic conditions and related level of risk assumed. Specific reserves are determined on a loan-by-loan basis based on management’s evaluation of loss exposure for each credit, given current payment status of the loan and the value of any underlying collateral. Loans for which specific reserves are provided are excluded from the general reserve calculations described above to prevent duplicate reserves. Additionally, an unallocated reserve for the total loan portfolio is established to address 1) the imprecision and estimation risk inherent in the calculations of general and specific reserves, and 2) management’s evaluation of various conditions that are not directly measured by any other component of the allowance. Such components would include current general economic conditions affecting key lending areas, credit quality trends, collateral values, loan volumes and concentrations, seasoning of the loan portfolios and the findings of internal credit examinations.

The following table presents the allocation of the allowance for loan losses and the percentage of the total amount of loans in each loan category listed as of the dates indicated.

TABLE 4 – ALLOCATION OF THE ALLOWANCE FOR LOAN LOSSES

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | December 31,

| |

(dollars in thousands)

| | 2003

| | | | | 2002

| | | | | 2001

| | | | | 2000

| | | | | 1999

| | | |

Commercial, financial and agricultural | | $ | 9,237 | | 39 | % | | $ | 6,243 | | 40 | % | | $ | 5,066 | | 36 | % | | $ | 4,152 | | 29 | % | | $ | 3,484 | | 29 | % |

Real estate – mortgage | | | 913 | | 24 | | | | 569 | | 20 | | | | 555 | | 21 | | | | 763 | | 30 | | | | 773 | | 31 | |

Real estate – construction | | | 135 | | 4 | | | | 45 | | 1 | | | | 17 | | 1 | | | | 21 | | 1 | | | | 18 | | 1 | |

Loans to individuals | | | 5,707 | | 33 | | | | 4,992 | | 39 | | | | 5,000 | | 42 | | | | 4,616 | | 40 | | | | 3,828 | | 39 | |

Unallocated | | | 2,238 | | N/A | | | | 1,252 | | N/A | | | | 479 | | N/A | | | | 687 | | N/A | | | | 646 | | N/A | |

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

Total allowance for loan losses | | $ | 18,230 | | 100 | % | | $ | 13,101 | | 100 | % | | $ | 11,117 | | 100 | % | | $ | 10,239 | | 100 | % | | $ | 8,749 | | 100 | % |

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

The allowance for loan losses amounted to $18.2 million, or 1.29% and 355.9% of total loans and total nonperforming loans, respectively, at December 31, 2003 compared to 1.25% and 301.6%, respectively, at December 31, 2002. The allowance for loan losses increased $5.1 million, or 39.1%, from $13.1 million at December 31, 2002. The increase included a $6.3 million provision for loan losses and $2.4 million assigned to loans acquired as part of the Acadiana acquisition. On a percentage basis, net charge-offs for 2003 were 0.28% of total average loans, down from 0.43% in 2002. The Company believes this level of net charge-offs was more favorable than that of peer institutions with assets in the $1 to $3 billion range based on data published by the Federal Financial Institutions Examination Council (“FFIEC”). The following table sets forth the activity in the Company’s allowance for loan losses during the periods indicated.

TABLE 5 – SUMMARY OF ACTIVITY IN THE ALLOWANCE FOR LOAN LOSSES

| | | | | | | | | | | | | | | | | | | | |

| | | Years Ended December 31,

| |

(dollars in thousands)

| | 2003

| | | 2002

| | | 2001

| | | 2000

| | | 1999

| |

Allowance at beginning of period | | $ | 13,101 | | | $ | 11,117 | | | $ | 10,239 | | | $ | 8,749 | | | $ | 7,135 | |

Allowance from acquisition | | | 2,439 | | | | — | | | | — | | | | — | | | | — | |

Provisions | | | 6,300 | | | | 6,197 | | | | 5,046 | | | | 3,861 | | | | 2,836 | |

Charge-offs: | | | | | | | | | | | | | | | | | | | | |

Commercial, financial and agricultural | | | 1,617 | | | | 1,331 | | | | 1,861 | | | | 1,174 | | | | 140 | |

Mortgage | | | 37 | | | | 60 | | | | 15 | | | | 37 | | | | 71 | |

Loans to individuals | | | 3,128 | | | | 3,391 | | | | 2,797 | | | | 1,654 | | | | 1,460 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total charge-offs | | | 4,782 | | | | 4,782 | | | | 4,673 | | | | 2,865 | | | | 1,671 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Recoveries: | | | | | | | | | | | | | | | | | | | | |

Commercial, financial and agricultural | | | 504 | | | | 68 | | | | 110 | | | | 52 | | | | 86 | |

Mortgage | | | 21 | | | | 35 | | | | 17 | | | | 22 | | | | 37 | |

Loans to individuals | | | 647 | | | | 466 | | | | 378 | | | | 420 | | | | 326 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total recoveries | | | 1,172 | | | | 569 | | | | 505 | | | | 494 | | | | 449 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Net charge-offs | | | (3,610 | ) | | | (4,213 | ) | | | (4,168 | ) | | | (2,371 | ) | | | (1,222 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Allowance at end of period | | $ | 18,230 | | | $ | 13,101 | | | $ | 11,117 | | | $ | 10,239 | | | $ | 8,749 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Allowance for loan losses to nonperforming assets(1) | | | 251.2 | % | | | 198.2 | % | | | 85.8 | % | | | 128.6 | % | | | 263.7 | % |

Allowance for loan losses to total loans at end of period | | | 1.29 | % | | | 1.25 | % | | | 1.16 | % | | | 1.09 | % | | | 1.04 | % |

Net charge-offs to average loans | | | 0.28 | % | | | 0.43 | % | | | 0.44 | % | | | 0.26 | % | | | 0.15 | % |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| (1) | Nonperforming loans and assets include accruing loans 90 days or more past due |

Investment Securities – The Company’s investment securities consist primarily of securities issued by the U.S. Government and federal agency obligations and mortgage-backed securities. As of December 31, 2003, the Company’s investment securities available for sale amounted to $426.1 million, which includes a pre-tax net unrealized gain of $1.4 million, and its investment securities held to maturity amounted to $53.5 million with a pre-tax net unrealized gain of $1.7 million. At such date, investment securities available for sale consisted of $350.9 million of mortgage-backed securities, $48.2 million of obligations of state and political subdivisions, $27.0 million of U.S. Government and federal agency obligations, and $57,000 of marketable equity securities. At December 31, 2003, investment securities held to maturity consisted of $23.3 million of mortgage-backed securities, $17.1 million of obligations of state and political subdivisions, and $13.1 million of U.S. Government and federal agency obligations. See Note 3 of the Consolidated Financial Statements.

Investment securities increased by an aggregate of $111.5 million, or 30.3%, to $479.6 million at December 31, 2003, compared to $368.1 million at December 31, 2002. This increase was due to investment securities of $58.9 million obtained through the acquisition of Acadiana and purchases of investment securities amounting to $336.3 million, both of which were partially offset by $176.3 million from maturities, prepayments and calls, $100.1 million from sales of investment securities, $5.8 million from the amortization of premiums and accretion of discounts, and a decrease of $1.5 million in the market value of investment securities available for sale. Funds generated as a result of sales and prepayments were used to fund loan growth and purchase other securities. The Company continues to monitor market conditions and take advantage of market opportunities with appropriate rate and risk return elements. Note 3 of the Consolidated Financial Statements provides further information on the Company’s investment securities.

Other Earning Assets – Included in other earning assets are short-term investments resulting from excess funds that fluctuate daily depending on the funding needs of the Company. These funds are currently invested overnight in an interest-bearing deposit account at the Federal Home Loan Bank (“FHLB”) of Dallas, the total balance of which earns interest at the current FHLB discount rate. The balance in interest-bearing deposits at other institutions decreased $6.5 million, or 23.9%, from $27.2 million at December 31, 2002 to $20.7 million at December 31, 2003. The average rate on these funds during 2003 was 1.21%, compared to 1.59% during 2002.

Also a component of other earning assets are loans held for sale, which decreased $2.9 million, or 33.4%, to $5.8 million at December 31, 2003 compared to $8.7 million at December 31, 2002. Loans held for sale have primarily been fixed rate single-family residential mortgage loans under contract to be sold in the secondary market. In most cases, loans in this category are sold within thirty days. During 2003, approximately 66% of total single-family mortgage originations of the Bank were sold in the secondary market as compared to 72% in 2002.

Funding Sources

Deposits obtained from clients in its primary market areas are the Company’s principal source of funds for use in lending and other business purposes. The Company attracts local deposit accounts by offering a wide variety of accounts, competitive interest rates and convenient branch office locations and service hours. Increasing core deposits through the development of client relationships is a continuing focus of the Company. Other funding sources include short-term and long-term borrowings, subordinated debt and shareholders’ equity. The following discussion highlights the major changes in the mix of funding sources during 2003.

Deposits – The Company has been successful in raising deposits in all of the markets in which it has a presence and believes the increase to be the result of several factors including the development of customer relationships and opportunities in the public funds arena. On average, excluding an increase in time deposits acquired through the acquisition of Acadiana, the Company experienced a decline in fixed rate certificates of deposit due primarily to reduced pricing. The balances stabilized in the latter months of 2003. The decline in average time deposits was offset by increases in other interest-bearing deposit accounts.

Deposits at December 31, 2003 reflected an increase of $346.9 million, or 27.9%, to $1.6 billion as compared to $1.2 billion at December 31, 2002. The growth in deposits includes $210.0 million of deposits acquired from the acquisition of Acadiana, which was completed during the first quarter of 2003. Since the end of 2002, noninterest-

bearing checking accounts increased $30.8 million, or 19.4%, interest-bearing checking account deposits increased $168.1 million, or 59.7%, savings and money market accounts increased $30.8 million, or 9.6%, and certificate of deposit accounts increased $117.2 million, or 24.3%. Excluding the effect of Acadiana, noninterest-bearing checking accounts increased $9.9 million, or 6.2%, interest-bearing checking account deposits increased $130.7 million, or 46.4%, savings and money market accounts increased $17.0 million, or 5.3%, and certificate of deposit accounts decreased $20.7 million, or 4.3%.

Certificates of deposit $100,000 and over increased $64.7 million, or 42.9%, from $150.9 million at December 31, 2002 to $215.7 million at December 31, 2003. At December 31, 2003, $189.8 million, or 11.9%, of the Company’s total deposits were noninterest-bearing, compared to $159.0 million, or 12.8%, at December 31, 2002. The following table shows large-denomination certificates of deposit by remaining maturities. Additional information regarding deposits is provided in Note 8 of the Consolidated Financial Statements.

TABLE 6 – REMAINING MATURITY OF CDS $100,000 AND OVER

| | | | | | | | | |

| | | December 31,

|

(dollars in thousands)

| | 2003

| | 2002

| | 2001

|

3 months or less | | $ | 67,555 | | $ | 45,254 | | $ | 46,846 |

Over 3-12 months | | | 87,869 | | | 68,434 | | | 73,735 |

Over 12-36 months | | | 35,906 | | | 25,081 | | | 25,134 |

More than 36 months | | | 24,329 | | | 12,157 | | | 8,233 |

| | |

|

| |

|

| |

|

|

Total | | $ | 215,659 | | $ | 150,926 | | $ | 153,948 |

| | |

|

| |

|

| |

|

|

Borrowings and Debt – Advances from the FHLB of Dallas may be obtained by the Company upon the security of the common stock it owns in that bank and certain of its residential mortgage loans and investment securities, provided certain standards related to creditworthiness have been met. Such advances are made pursuant to several credit programs, each of which has its own interest rate and range of maturities. The level of short-term borrowings can fluctuate significantly on a daily basis depending on funding needs and the source of funds chosen to satisfy those needs. The Company’s short-term borrowings at December 31, 2003 were comprised of $19.6 million of securities sold under agreements to repurchase and $143.0 million of advances from the FHLB of Dallas. The average amount of short-term borrowings in 2003 was $115.0 million.

The Company’s short-term borrowings of $96.8 million at December 31, 2002 consisted of $21.8 million of securities sold under agreements to repurchase and $75.0 million of advances from the FHLB of Dallas. Total short-term borrowings increased $65.8 million, or 68.0%, to $162.6 million at December 31, 2003 compared to $96.8 million at December 31, 2002. The weighted average rate on short-term borrowings was 1.13% at December 31, 2003, compared to 1.36% at December 31, 2002. For additional information regarding short-term borrowings, see Note 9 of the Consolidated Financial Statements.

At December 31, 2003, the Company’s long-term borrowings increased $80.8 million, or 107.1%, to $156.3 million at December 31, 2003, compared to $75.5 million at December 31, 2002. The primary reason for the increase in long-term debt was due to the assumption of $73.7 million in FHLB of Dallas fixed-rate advances as a result of the Acadiana transaction. The majority of the Company’s long-term borrowings, $135.7 million, were comprised primarily of fixed-rate advances from the FHLB of Dallas which cannot be paid off without incurring substantial prepayment penalties. The remaining debt consists of $20.6 million of junior subordinated debt as a result of a $10.3 million trust preferred offering, which closed in November 2002, and a second $10.3 million offering, which closed in June 2003.

Junior subordinated debt consists of a total of $20.6 million in Junior Subordinated Deferrable Interest Debentures of the Company issued to statutory trusts that were funded by the issuance of floating rate capital securities of the trusts. The issues of $10.3 million each bear interest rates equal to three-month LIBOR plus 3.25% and 3.15%,

respectively. The debentures qualify as Tier 1 Capital for regulatory purposes. The terms of the securities is 30 years and, subject to regulatory requirements, are callable at par by the Company anytime after 5 years. Interest is payable quarterly and may be deferred at any time at the election of the Company for up to 20 consecutive quarterly periods. During any deferral period the Company is subject to certain restrictions, including being prohibited from declaring dividends to its common shareholders. For additional information see Note 10 of the Consolidated Financial Statements.

Shareholders’ Equity – Shareholders’ equity provides a source of permanent funding, allows for future growth and provides the Company with a cushion to withstand unforeseen adverse developments. At December 31, 2003, shareholders’ equity totaled $195.2 million, an increase of $55.6 million, or 39.8%, compared to $139.6 million at December 31, 2002. The increase in shareholders’ equity in 2003 was the result of the issuance of $38.4 million of common stock as a result of the purchase accounting transaction with Acadiana, net income of $23.6 million, $2.2 million of common stock released by the Company’s Employee Stock Ownership Plan (“ESOP”) trust, $1.1 million of common stock earned by participants in the Company’s Recognition and Retention Plan (“RRP”) trust and $3.0 million for the sale of treasury stock for stock options exercised. Such increases were partially offset by cash dividends declared on the Company’s common stock of $6.0 million, repurchases of $6.2 million of the Company’s common stock that were placed into treasury and a $529,000 reduction in other comprehensive income.

RESULTS OF OPERATIONS

The Company reported net income of $23.6 million, $18.5 million and $14.5 million for the years ended December 31, 2003, 2002 and 2001, respectively. Earnings per share (“EPS”) on a diluted basis, including any one-time items, was $3.42 for 2003, $3.02 for 2002 and $2.36 for 2001. In accordance with new accounting standards issued in 2001, the amortization of goodwill ceased completely beginning in 2002. During 2003, interest income increased $9.0 million, interest expense increased $971,000, the provision for loan losses increased $103,000, noninterest income increased $5.2 million, noninterest expense increased $6.6 million and income tax expense increased $1.4 million. Cash earnings, defined as net income before the amortization of acquisition intangibles, amounted to $24.1 million, $18.7 million and $16.9 million for the years ended December 31, 2003, 2002 and 2001, respectively. Included in 2003 earnings are the results of operations of Acadiana from the acquisition date of February 28, 2003 forward.

Net Interest Income – Net interest income is the difference between interest realized on earning assets and interest paid on interest-bearing liabilities. Net interest income is also the driver of core earnings and, as such, is subject to constant scrutiny by management. The rate of return and relative risk associated with earning assets are weighed to determine the appropriateness and mix of earning assets. Additionally, the need for lower cost funding sources is weighed against relationships with clients and future growth requirements. The Company’s average interest rate spread, which is the difference between the yields earned on earning assets and the rates paid on interest-bearing liabilities, was 3.67%, 4.19% and 3.54% during the years ended December 31, 2003, 2002 and 2001, respectively. The Company’s net interest margin on a taxable equivalent (TE) basis, which is net interest income (TE) as a percentage of average earning assets, was 3.89%, 4.53% and 4.12% during the years ended December 31, 2003, 2002 and 2001, respectively.

Net interest income increased $8.0 million, or 13.5%, in 2003 to $67.6 million compared to $59.6 million in 2002. This increase was due to a $9.0 million, or 10.3%, increase in interest income, which was partially offset by a $971,000, or 3.5%, increase in interest expense. In 2002, net interest income increased $5.2 million, or 9.6%, to $59.6 million compared to $54.4 million in 2001. The reason for the increase was an $18.1 million, or 39.2%, decrease in interest expense, which was partially offset by a $12.8 million, or 12.8%, decrease in interest income.

The improvement in net interest income was the result of increased volumes and an improved mix of earning assets and deposits. Although earnings improved through increased net interest income, the related net interest spread and margin ratios compressed, driven in part by prepayments of mortgage instruments as refinancing of residential loans hit all-time highs. Mortgage rates continued their downward trend through the first half of 2003 as the impact of the Federal Reserve Board’s (“FRB”) monetary policy, which took the targeted federal funds rate to a historical low, influenced long-term expectations. This impact was felt generally, and on mortgage products as well, as cash flows associated with existing mortgage products increased through the refinancing or prepayment of the underlying instruments. This resulted in increased cash for reinvestment purposes in a relatively low rate environment. Accordingly, the related premiums shortened also, the impact of which was realized through increased premium amortization on related products in both the bond and loan portfolios which reduced net interest income.

Refinancing of mortgage loans at lower rates for existing customers also served to drive down yields. Conversely, gains associated with the sale of mortgage loans that are recorded as noninterest income, reflected large increases in 2003 and improved earnings. It is anticipated that mortgage loan demand, and concurrently premium amortization associated with mortgage loan products, will slow from the elevated levels experienced in 2003 given the decreasing population of existing mortgage loans that would benefit from refinancing and somewhat higher long-term rate expectations going forward.

Also during 2003, as a result of the low interest rate environment, new volume spreads in other earning assets trended lower as well. On the funding side, the Company issued $10.3 million in junior subordinated debt in 2002 and 2003, swapped to an average rate of 6.28%, which negatively impacts the margin in the short run, but provides additional low-cost capital for future growth. Additionally, the change in the balance sheet mix as a result of the recent Acadiana acquisition and subsequent purchase accounting adjustments marking the Acadiana portfolios to market yields, while positive to net interest income, lowered the net interest spread and margin.

The Company will continue to monitor investment opportunities and weigh the associated risk/return. Volume increases in earning assets and improvements in the mix of earning assets and interest-bearing liabilities should improve net interest income, but may negatively impact the net interest margin ratio. The Company has engaged in interest rate swap transactions, which are a form of derivative financial instrument, to modify the net interest sensitivity to levels deemed to be appropriate. Through this instrument, interest rate risk is managed by hedging with

an interest rate swap contract designed to pay fixed and receive floating interest. The interest rate swaps of the Company were executed to modify net interest sensitivity to levels deemed appropriate.

Average loans made up 72.8% of average earning assets as of December 31, 2003 as compared to 72.7% at December 31, 2002. Overall, average loans increased 34.1% in 2003. The increase in average loans was mainly funded by increased borrowings. Average investment securities made up 24.2% of average earning assets at December 31, 2003 compared to 24.1% at December 31, 2002. Average interest-bearing deposits made up 83.3% of average interest-bearing liabilities at December 31, 2003 compared to 93.1% at December 31, 2002. Average borrowings made up 16.7% of average interest-bearing liabilities at December 31, 2003 compared to 6.9% at December 31, 2002. Tables 7 and 8 further explain the changes in net interest income.

The following table sets forth, for the periods indicated, information regarding (i) the total dollar amount of interest income of the Company from earning assets and the resultant average yields; (ii) the total dollar amount of interest expense on interest-bearing liabilities and the resultant average rate; (iii) net interest income; (iv) net interest spread; and (v) net interest margin. Information is based on average daily balances during the indicated periods. Investment security market value adjustments and trade-date accounting adjustments are not considered to be earning assets and, as such, the net effect is included in nonearning assets. Tax equivalent (TE) yields are calculated using a marginal tax rate of 35%.

TABLE 7 – AVERAGE BALANCES, NET INTEREST INCOME AND INTEREST YIELDS / RATES

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Years Ended December 31,

| |

(dollars in thousands)

| | 2003

| | | 2002

| | | 2001

| |

| | | | | | | | Average | | | | | | | | Average | | | | | | | | Average | |

| | | Average | | | | | Yield/ | | | Average | | | | | Yield/ | | | Average | | | | | Yield/ | |

| | | Balance

| | | Interest

| | Rate

| | | Balance

| | | Interest

| | Rate

| | | Balance

| | | Interest

| | Rate

| |

| | | | | | | | | |

Earning assets: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Loans receivable: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Mortgage loans | | $ | 340,738 | | | $ | 20,628 | | 6.05 | % | | $ | 197,239 | | | $ | 14,881 | | 7.54 | % | | $ | 252,696 | | | $ | 19,859 | | 7.86 | % |

Commercial loans (TE) | | | 511,634 | | | | 25,987 | | 5.26 | | | | 378,090 | | | | 23,211 | | 6.27 | | | | 298,586 | | | | 23,945 | | 7.98 | |

Consumer and other loans | | | 456,766 | | | | 32,602 | | 7.14 | | | | 400,997 | | | | 33,061 | | 8.24 | | | | 396,778 | | | | 35,461 | | 8.94 | |

| | |

|

|

| |

|

| | | | |

|

|

| |

|

| | | | |

|

|

| |

|

| | | |

Total loans | | | 1,309,138 | | | | 79,217 | | 6.12 | | | | 976,326 | | | | 71,153 | | 7.34 | | | | 948,060 | | | | 79,265 | | 8.35 | |

| | |

|

|

| |

|

| | | | |

|

|

| |

|

| | | | |

|

|

| |

|

| | | |

Loans held for sale | | | 14,172 | | | | 893 | | 6.30 | | | | 6,149 | | | | 362 | | 5.89 | | | | 9,184 | | | | 682 | | 7.43 | |

Investment securities (TE) | | | 434,767 | | | | 15,667 | | 3.91 | | | | 323,571 | | | | 15,316 | | 4.93 | | | | 296,782 | | | | 17,833 | | 6.08 | |

Other earning assets | | | 39,440 | | | | 785 | | 1.99 | | | | 36,732 | | | | 721 | | 1.96 | | | | 68,725 | | | | 2,588 | | 3.77 | |

| | |

|

|

| |

|

| | | | |

|

|

| |

|

| | | | |

|

|

| |

|

| | | |

Total earning assets | | | 1,797,517 | | | | 96,562 | | 5.50 | | | | 1,342,778 | | | | 87,552 | | 6.61 | | | | 1,322,751 | | | | 100,368 | | 7.60 | |

| | |

|

|

| |

|

| | | | |

|

|

| |

|

| | | | |

|

|

| |

|

| | | |

Allowance for loan losses | | | (16,491 | ) | | | | | | | | | (11,774 | ) | | | | | | | | | (10,061 | ) | | | | | | |

Nonearning assets | | | 183,669 | | | | | | | | | | 133,415 | | | | | | | | | | 106,290 | | | | | | | |

| | |

|

|

| | | | | | | |

|

|

| | | | | | | |

|

|

| | | | | | |

Total assets | | $ | 1,964,695 | | | | | | | | | $ | 1,464,419 | | | | | | | | | $ | 1,418,980 | | | | | | | |

| | |

|

|

| | | | | | | |

|

|

| | | | | | | |

|

|

| | | | | | |

| | | | | | | | | |

Interest-bearing liabilities: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Deposits: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

NOW accounts | | $ | 358,327 | | | | 3,245 | | 0.91 | | | $ | 258,087 | | | | 3,055 | | 1.18 | | | $ | 207,851 | | | | 3,473 | | 1.67 | |

Savings and money market accounts | | | 354,997 | | | | 2,924 | | 0.82 | | | | 318,708 | | | | 4,353 | | 1.37 | | | | 291,009 | | | | 7,794 | | 2.68 | |

Certificates of deposit | | | 601,339 | | | | 14,865 | | 2.47 | | | | 497,988 | | | | 17,154 | | 3.44 | | | | 572,532 | | | | 30,860 | | 5.39 | |

| | |

|

|

| |

|

| | | | |

|

|

| |

|

| | | | |

|

|

| |

|

| | | |

Total interest-bearing deposits | | | 1,314,663 | | | | 21,034 | | 1.60 | | | | 1,074,783 | | | | 24,562 | | 2.29 | | | | 1,071,392 | | | | 42,127 | | 3.93 | |

Short-term borrowings | | | 115,014 | | | | 1,428 | | 1.22 | | | | 32,961 | | | | 613 | | 1.83 | | | | 13,508 | | | | 617 | | 4.51 | |

Long-term debt | | | 148,841 | | | | 6,467 | | 4.29 | | | | 46,346 | | | | 2,783 | | 5.92 | | | | 47,308 | | | | 3,274 | | 6.83 | |

| | |

|

|

| |

|

| | | | |

|

|

| |

|

| | | | |

|

|

| |

|

| | | |

Total interest-bearing liabilities | | | 1,578,518 | | | | 28,929 | | 1.83 | | | | 1,154,090 | | | | 27,958 | | 2.42 | | | | 1,132,208 | | | | 46,018 | | 4.06 | |

| | | | | | |

|

| | | | | | | | |

|

| | | | | | | | |

|

| | | |

| Noninterest-bearing demand deposits | | | 183,478 | | | | | | | | | | 149,739 | | | | | | | | | | 140,393 | | | | | | | |

| Noninterest-bearing liabilities | | | 22,282 | | | | | | | | | | 19,965 | | | | | | | | | | 12,473 | | | | | | | |

| | |

|

|

| | | | | | | �� |

|

|

| | | | | | | |

|

|

| | | | | | |

Total liabilities | | | 1,784,278 | | | | | | | | | | 1,323,794 | | | | | | | | | | 1,285,074 | | | | | | | |

| Shareholders’ equity | | | 180,417 | | | | | | | | | | 140,625 | | | | | | | | | | 133,906 | | | | | | | |

| | |

|

|

| | | | | | | |

|

|

| | | | | | | |

|

|

| | | | | | |

Total liabilities and shareholders’ equity | | $ | 1,964,695 | | | | | | | | | $ | 1,464,419 | | | | | | | | | $ | 1,418,980 | | | | | | | |

| | |

|

|

| | | | | | | |

|

|

| | | | | | | |

|

|

| | | | | | |

| | | | | | | | | |

| Net earning assets | | $ | 218,999 | | | | | | | | | $ | 188,688 | | | | | | | | | $ | 190,543 | | | | | | | |

| | |

|

|

| | | | | | | |

|

|

| | | | | | | |

|

|

| | | | | | |

| | | | | | | | | |

| Net interest spread | | | | | | $ | 67,633 | | 3.67 | % | | | | | | $ | 59,594 | | 4.19 | % | | | | | | $ | 54,350 | | 3.54 | % |

| | | | | | |

|

| |

|

| | | | | |

|

| |

|

| | | | | |

|

| |

|

|

| | | | | | | | | |

| Net interest income (TE) / Net interest margin (TE) | | | | | | $ | 70,236 | | 3.89 | % | | | | | | $ | 61,063 | | 4.53 | % | | | | | | $ | 54,777 | | 4.12 | % |

| | | | | | |

|

| |

|

| | | | | |

|

| |

|

| | | | | |

|

| |

|

|

The following table analyzes the dollar amount of changes in interest income and interest expense for major components of earning assets and interest-bearing liabilities. The table distinguishes between (i) changes attributable to volume (changes in average volume between periods times the average yield/rate for the two periods), (ii) changes attributable to rate (changes in average rate between periods times the average volume for the two periods), and (iii) total increase (decrease).

TABLE 8 – SUMMARY OF CHANGES IN NET INTEREST INCOME

| | | | | | | | | | | | | | | | | | | | | | | |

| | | 2003 / 2002 Change Attributable To

| | | 2002 / 2001 Change Attributable To

| |

(dollars in thousands)

| | Volume

| | Rate

| | | Total Increase (Decrease)

| | | Volume

| | | Rate

| | | Total Increase (Decrease)

| |

Earning assets: | | | | | | | | | | | | | | | | | | | | | | | |

Loans: | | | | | | | | | | | | | | | | | | | | | | | |

Mortgage loans | | $ | 9,757 | | $ | (4,010 | ) | | $ | 5,747 | | | $ | (4,271 | ) | | $ | (707 | ) | | $ | (4,978 | ) |

Commercial loans | | | 7,491 | | | (4,715 | ) | | | 2,776 | | | | 5,628 | | | | (6,362 | ) | | | (734 | ) |

Consumer and other loans | | | 4,289 | | | (4,748 | ) | | | (459 | ) | | | 362 | | | | (2,762 | ) | | | (2,400 | ) |

Loans held for sale | | | 489 | | | 42 | | | | 531 | | | | (202 | ) | | | (118 | ) | | | (320 | ) |

Investment securities | | | 4,635 | | | (4,284 | ) | | | 351 | | | | 1,439 | | | | (3,956 | ) | | | (2,517 | ) |

Other earning assets | | | 54 | | | 10 | | | | 64 | | | | (916 | ) | | | (951 | ) | | | (1,867 | ) |

| | |

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total net change in income on earning assets | | | 26,715 | | | (17,705 | ) | | | 9,010 | | | | 2,040 | | | | (14,856 | ) | | | (12,816 | ) |

| | |

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Interest-bearing liabilities: | | | | | | | | | | | | | | | | | | | | | | | |

Deposits: | | | | | | | | | | | | | | | | | | | | | | | |

NOW accounts | | | 1,047 | | | (857 | ) | | | 190 | | | | 717 | | | | (1,135 | ) | | | (418 | ) |

Savings and money market accounts | | | 397 | | | (1,826 | ) | | | (1,429 | ) | | | 560 | | | | (4,001 | ) | | | (3,441 | ) |

Certificates of deposit | | | 3,057 | | | (5,346 | ) | | | (2,289 | ) | | | (3,293 | ) | | | (10,413 | ) | | | (13,706 | ) |

Borrowings | | | 6,712 | | | (2,213 | ) | | | 4,499 | | | | 987 | | | | (1,482 | ) | | | (495 | ) |

| | |

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total net change in expense on interest-bearing liabilities | | | 11,213 | | | (10,242 | ) | | | 971 | | | | (1,029 | ) | | | (17,031 | ) | | | (18,060 | ) |

| | |

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Change in net interest income | | $ | 15,502 | | $ | (7,463 | ) | | $ | 8,039 | | | $ | 3,069 | | | $ | 2,175 | | | $ | 5,244 | |

| | |

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Provision for Loan Losses – The allowance for loan losses is maintained at a level considered appropriate by management based on various factors as they relate to the collectability of the Company’s loan portfolio. Increases to the allowance for loan losses are achieved through provisions for loan losses that are charged against income. Management of the Company assesses the allowance for loan losses on a quarterly basis and will make provisions for loan losses as deemed appropriate in order to maintain the adequacy of the allowance for loan losses.

As a result of continued improvement in asset quality, the Company reported no significant change in the loan loss provision, even as loans increased at a double-digit pace. During 2003, the Company made a provision for loan losses of $6.3 million compared to $6.2 million and $5.0 million for 2002 and 2001, respectively. Net loan charge-offs were $3.6 million for 2003 compared to $4.2 million for 2002. The slightly higher provision for 2003 is attributable to loan growth and changes in the mix of loans from period to period, offset by improved charge-offs to the previously established reserves and overall improvement in asset quality. The allowance for loan losses as a percentage of outstanding loans, net of unearned income, was 1.29% at December 31, 2003, compared to 1.25% at year-end 2002. A discussion of credit quality can be found in the section on “Loans and Asset Quality” in this analysis.

Noninterest Income – The Company reported noninterest income of $23.1 million compared to $17.9 million for 2002. The primary reasons for the $5.2 million, or 29.1%, increase in noninterest income were a $2.1 million, or 101.8%, increase in gains on the sale of mortgage loans in the secondary market, a $1.7 million, or 17.0%, increase in service charges on deposit accounts, a $201,000, or 12.5%, increase in ATM fee income from increased usage, a $310,000, or 25.6%, increase in earnings and cash surrender value of bank owned life insurance, a $594,000, or 60.8%, increase in broker sales commissions, and a $39,000 increase in other net noninterest income. These increases were partially offset by a $72,000, or 17.7%, decrease in gains on sale of assets. Additionally, the year 2003 included a $267,000 gain on the sale of investment securities compared to a $42,000 loss in 2002. It is anticipated that a rise in mortgage rates will have a dampening effect on the residential loan refinancing market and moderate mortgage loan sales and related gains.

Total noninterest income amounted to $17.9 million and $15.1 million for the years ended December 31, 2002 and 2001, respectively. The primary reasons for the $2.7 million, or 18.0%, increase in noninterest income was a $1.9

million, or 24.0%, increase in service charges on deposit accounts, a $934,000, or 338.3%, increase in earnings and cash surrender value of bank owned life insurance, a $118,000, or 7.9%, increase in ATM fee income from increased usage, and a $105,000, or 34.9%, increase in gain on sale of assets. These increases were partially offset by a $153,000, or 6.8%, decrease in gains on the sale of mortgage loans in the secondary market and a $51,000, decrease in other net noninterest income. The additional gain on the sale of mortgage loans in 2001 was solely attributable to the sale of a select group of older mortgage loans originated through the construction process in previous years. Additionally, the year 2002 included a $42,000 loss on the sale of investment securities compared to a $119,000 gain in 2001.

Noninterest Expense – Ongoing attention to expense control is part of the corporate culture. As a result, increased expenses are primarily related to the impact of the Acadiana acquisition which was completed in the first quarter of 2003 and infrastructure improvements throughout the Company. Noninterest expense includes costs related to salary and employee benefits, occupancy and equipment, communication and delivery, marketing and business development, amortization of acquisition intangibles and other expenses. Noninterest expense amounted to $50.6 million, $44.0 million and $41.7 million for the three years ended December 31, 2003, 2002 and 2001, respectively. The principal reason for the $6.6 million, or 15.0%, increase in noninterest expense for 2003 compared to 2002 was an increase in salaries and employee benefits of $3.5 million, or 15.3%, due largely to the increased staffing levels associated with the Acadiana acquisition and management’s commitment to hire strategically and compensate competitively across the markets. In addition, the Company also experienced a rising cost of employee benefits due in part to the increased market value of the Company’s common stock as it relates to the Company’s ESOP amounting to $332,000. Other expense increases included $841,000 in building and occupancy expense, $538,000 in amortization of acquisition intangibles related to the Acadiana acquisition, $405,000 in the franchise and share tax assessments, $249,000 in marketing and business development expense, $211,000 in communication and delivery expense, $207,000 in data processing expense, primarily as a result of technology improvements, $158,000 in printing and supplies expense, and $379,000 in legal and professional expense. Additionally, the Company recorded a prepayment penalty of $236,000 on the early retirement of long-term debt outstanding at the FHLB of Dallas. Other net noninterest expenses increased $935,000. Such increases were partially offset by a $1.1 million decrease in OREO related charges due to a reduced level of OREO properties and writedowns.

The principal reason for the $2.3 million, or 5.6%, increase in noninterest expense for 2002 compared to 2001 was an increase in salaries and employee benefits of $1.9 million, or 8.9%. This was due in part to improving the delivery system across the state, management’s commitment to improve overall staffing and competitive compensation across the markets. In addition, the Company also experienced a rising cost associated with employee benefits due in part to the increased market value of the Company’s common stock as it relates to the Company’s ESOP amounting to $383,000. Other expense increases included $324,000 in the franchise and share tax assessments, $130,000 in marketing and business development expense, $200,000 in data processing expense, primarily as a result of improvements in technology, $686,000 in legal and professional expense, and $1.3 million in OREO related charges, primarily related to writedowns. Other net noninterest expenses increased by $635,000. Such increases were partially offset by a $66,000, or 8.8%, decrease in printing and supplies expense, and a pre-tax decrease of $2,751,000 from non-amortization of goodwill as a result of adopting FAS 142.

Income Taxes – For the years ended December 31, 2003, 2002 and 2001 the Company incurred income tax expense of $10.2 million, $8.8 million and $8.2 million, respectively. The Company’s effective tax rate amounted to 30.3%, 32.2% and 36.2% during 2003, 2002 and 2001, respectively. The difference between the effective tax rate and the statutory tax rate primarily relates to variances in items that are either nontaxable or non-deductible, primarily the effect of tax-exempt income, the non-deductibility of part of the amortization of acquisition intangibles, and the non-deductible portion of the ESOP compensation expense. The change in the effective rate for 2002 was mainly attributable to the elimination of the non-deductible portion of goodwill upon the adoption of FAS 142 and additional tax-exempt income. For more information, see Note 12 of the Consolidated Financial Statements.

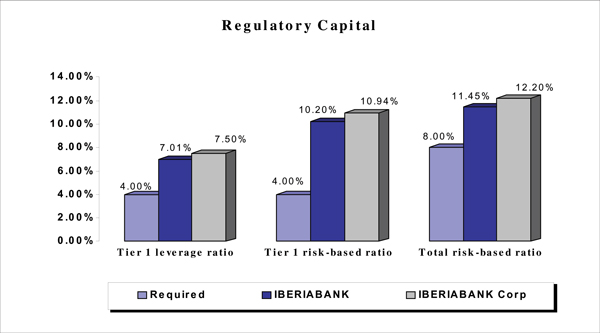

CAPITAL RESOURCES

Federal regulations impose minimum regulatory capital requirements on all institutions with deposits insured by the Federal Deposit Insurance Corporation. The FRB imposes similar capital regulations on bank holding companies. Compliance with bank and bank-holding company regulatory capital requirements, which include leverage and risk-

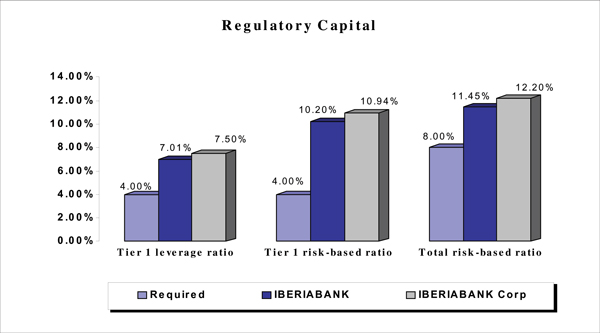

based capital guidelines, are monitored by the Company on an ongoing basis. Under the risk-based capital method, a risk weight is assigned to balance sheet and off-balance sheet items based on regulatory guidelines. At December 31, 2003, the Company exceeded all regulatory capital ratio requirements with a Tier 1 leverage capital ratio of 7.50%, a Tier 1 risk-based capital ratio of 10.94% and a total risk-based capital ratio of 12.20%. At December 31, 2003, IBERIABANK (the “Bank”) exceeded all regulatory capital ratio requirements with a Tier 1 leverage capital ratio of 7.01%, a Tier 1 risk-based capital ratio of 10.20% and a total risk-based capital ratio of 11.45%.

In addition, the Company issued junior subordinated debt totaling $20.6 million, which may be included in Tier 1 capital up to 25% of the total of the Company’s core capital elements, including the junior subordinated debt. For additional information, see Note 10 of the Consolidated Financial Statements.

LIQUIDITY