Exhibit 13

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion and analysis is intended to assist readers in understanding the consolidated financial condition and results of operations of IBERIABANK Corporation (the “Company”) and its subsidiary as of December 31, 2003 and 2004 and for the years ended December 31, 2002 through 2004. This review should be read in conjunction with the audited consolidated financial statements, accompanying footnotes and supplemental financial data included herein.

OVERVIEW

The Company’s net income for 2004 totaled $27.3 million, or $3.76 per share on a diluted basis. This is a 10% increase over the $3.42 per share, or $23.6 million earned for 2003. Earnings performance for 2004 was influenced by the acquisitions of Alliance Bank of Baton Rouge (“Alliance”) in the first quarter of 2004 and Acadiana Bancshares, Inc. (“Acadiana”) in the first quarter of 2003, and other factors, the key components of which are summarized below.

| | • | | Total assets at December 31, 2004 were $2.4 billion, up $332.8 million, or 15.7%, from $2.1 billion at December 31, 2003. This growth level is the result of strong organic growth through new and deepened client relationships amounting to $260.6 million as well as the $72.2 million asset base obtained through the Alliance acquisition. Shareholders’ equity increased by $25.0 million, or 12.8%, from $195.2 million at December 31, 2003 to $220.2 million at December 31, 2004. |

| | • | | Total loans at December 31, 2004 were $1.7 billion, an increase of $238.3 million, or 16.9%, from $1.4 billion at December 31, 2003. The increase from year end 2003 is reflective of internally generated growth of $184.6 million and the $53.7 million loan base acquired from Alliance. |

| | • | | Total customer deposits increased $184.4 million, or 11.6%, from $1.6 billion at December 31, 2003 to $1.8 billion at December 31, 2004. The increase from year end 2003 is the result of strong organic growth amounting to $122.6 million, as well as $61.8 million in customer deposits obtained through the Alliance acquisition. |

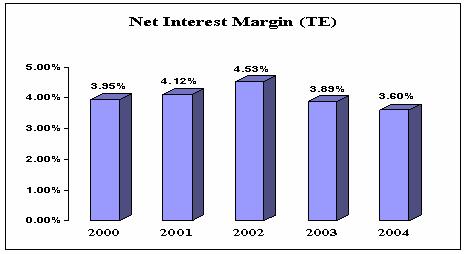

| | • | | Net interest income for the year increased $7.0 million, or 10.3%, in 2004 versus 2003. This increase is largely attributable to increased volume. The corresponding net interest margin ratio on a tax-equivalent basis declined to 3.60% from 3.89% for the years ended December 31, 2004 and 2003, respectively, due to competitive pricing and the re-pricing mix of the Company’s assets and liabilities. Additionally, the Acadiana and Alliance acquisitions resulted in increased net interest income, but a reduction of the margin as a result of marking the acquired asset and liability mixes to current yields. |

| | • | | Noninterest income increased $153,000, or 0.7%, for 2004 as compared to 2003. Increases in service charge revenues on deposit accounts and gains on sales of investment securities and other revenue enhancement initiatives were largely offset by declines in gains on the sale of mortgage loans. |

| | • | | Noninterest expense increased by $4.3 million, or 8.4%, for 2004 as compared to 2003. This increase was primarily due to higher compensation expense as a result of additional staff related to the Acadiana and Alliance acquisitions, as well as strategic hires over the past 18 months. |

| | • | | Due to continued improvement in credit quality, the Company has been able to reduce the provision for loan losses from $6.3 million during 2003 to $4.0 million during 2004. As of December 31, 2004, the allowance for loan losses as a percent of total loans was 1.22%, compared to 1.29% at December 31, 2003. Net charge-offs for 2004 were $2.7 million, or 0.18%, of average loans on an annualized basis, compared to $3.6 million, or 0.28%, a year earlier. The coverage of net charge-offs by the provision for loan losses was 1.47 times in 2004 |

1

| | and 1.75 times in 2003. The coverage of nonperforming assets by the allowance for loan losses was 3.27 times at the end of 2004, as compared to 2.51 times at December 31, 2003. |

| | • | | The Company completed the acquisition of Alliance in February 2004. The acquisition expanded the Company’s presence into Baton Rouge, Louisiana. At the time of acquisition, Alliance had total assets of $72 million, loans of $54 million, deposits of $62 million and shareholders’ equity of $10 million. |

| | • | | In September 2004, the Company announced a definitive merger agreement with American Horizons Bancorp, Inc. (“American Horizons”) of Monroe, Louisiana. The transaction was completed on January 31, 2005. At December 31, 2004, American Horizons had total assets of $251 million, loans of $201 million, deposits of $193 million and shareholders’ equity of $23 million. |

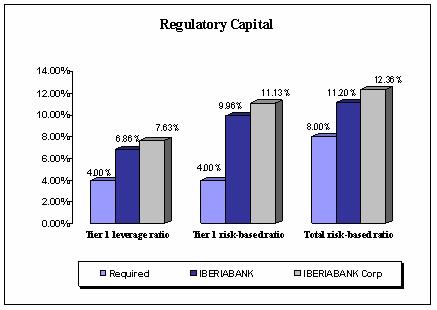

| | • | | In September 2004, the Company announced the closing of its third trust preferred securities offering totaling $10 million. The trust preferred securities were issued by a newly established subsidiary of the Company, IBERIABANK Statutory Trust III, a Delaware statutory business trust. The trust preferred securities are expected to qualify as Tier I capital for regulatory purposes. |

| | • | | During 2004, the Company’s Board of Directors declared cash dividends totaling $1.06 per common share, an 18% increase compared to 2003. |

The Company’s successful expansion into new Louisiana markets boosted momentum throughout 2004. This expansion included the development of a branch in Shreveport, Louisiana, our entrance into Baton Rouge, Louisiana with the acquisition of Alliance in the first quarter of 2004, the opening of a private banking branch office in New Orleans, Louisiana and the establishment of three loan production offices (“LPOs”) in Alexandria, Houma and Mandeville, Louisiana. The Company will continue to analyze the potential for growth in new and existing markets as they arise.

The Company’s continuing focus is that of a high performing institution. Management believes that improvement in core earnings drives shareholder value and has adopted a mission statement that is designed to provide guidance for management, our associates and Board of Directors regarding the sense of purpose and direction of the Company. We are very shareholder and client focused, expect high performance from our associates, believe in a strong sense of community and strive to make the Company a great place to work. Earnings guidance, based on expectations of the Company, is provided during the year through press releases, which are available on our website and also disclosed through the Form 8-K current event filings with the Securities and Exchange Commission (“SEC”).

Inherent in any organization are risks associated with the industry. The most important risk factors affecting the success of the Company are believed to be the management of loan credit risk and interest rate risk, which are discussed under their respective sections entitled “Asset Quality and Allowance for Loan Losses” and “Asset/ Liability Management and Market Risk” later in this discussion.

APPLICATION OF CRITICAL ACCOUNTING POLICIES

In preparing financial reports, management is required to apply significant judgment to various accounting, reporting and disclosure matters. Management must use assumptions and estimates to apply these principles where actual measurement is not possible or practical. The accounting principles and methods used by the Company conform with accounting principles generally accepted in the United States and general banking practices. Estimates and assumptions most significant to the Company relate primarily to the allowance for loan losses, intangible assets and stock option compensation. These significant estimates and assumptions are summarized in the following discussion and are further analyzed in the footnotes to the consolidated financial statements.

The determination of the allowance for loan losses, which represents management’s estimate of probable losses inherent in the Company’s credit portfolio, involves a high degree of judgment and complexity. The Company’s policy is to establish reserves for estimated losses on delinquent and other problem loans when it is determined that losses are expected to be incurred on such loans and leases. Management’s determination of the adequacy of the allowance is based on various factors, including an evaluation of the portfolio, past loss experience, current

2

economic conditions, the volume and type of lending conducted by the Company, composition of the portfolio, the amount of the Company’s classified assets, seasoning of the loan portfolio, the status of past due principal and interest payments, and other relevant factors. Changes in such estimates may have a significant impact on the financial statements. For further discussion of the allowance for loan losses, see the Asset Quality and Allowance for Loan Losses section of this analysis and Note 1 to the Consolidated Financial Statements.

Generally accepted accounting principles require the Company to perform a goodwill valuation at least annually. Impairment testing of goodwill is a two step process that first compares the fair value of goodwill with its carrying amount, and second measures impairment loss by comparing the implied fair value of goodwill with the carrying amount of that goodwill. Based on management’s goodwill impairment tests, there was no impairment of goodwill in 2003 or 2004.

The Company has elected to account for its stock option plans under the intrinsic value method of Accounting Principles Board (APB) Opinion No. 25,Accounting for Stock Issued to Employees. In accordance with APB Opinion No. 25, compensation expense relating to stock options is not reflected in net income provided the exercise price of the stock options granted equals or exceeds the market value of the underlying common stock at the date of grant. The Company’s practice has been to grant options at no less than the fair market value of the stock at the date of grant. Statement of Financial Accounting Standard (FAS) No. 123,Accounting for Stock-Based Compensation, encourages all entities to adopt a fair value based method of accounting for employee stock compensation plans, whereby compensation cost is measured at the grant date based on the value of the award and is recognized over the service period, which is usually the vesting period. Given the Company’s election to continue with the accounting methodology in APB Opinion No. 25, management is required to provide proforma disclosures of net income and earnings per share and other disclosures, as if the fair value based method of accounting had been applied. Management utilizes the Black-Scholes option valuation model to estimate the fair value of stock options. The option valuation model requires the input of highly subjective assumptions, including the expected stock price volatility. These subjective input assumptions materially affect the fair value estimate. For additional discussion of the Company’s stock options plans, see Note 15 to the Consolidated Financial Statements.

FINANCIAL CONDITION

Earning Assets

Earning assets are composed of interest or dividend-bearing assets, including loans, securities, short-term investments and loans held for sale. Interest income associated with earning assets is the Company’s primary source of income. Earning assets averaged $2.1 billion during 2004, a $346.5 million, or 19.3%, increase compared to $1.8 billion during 2003. This is primarily the result of strong organic growth, coupled with the Acadiana and Alliance acquisitions.

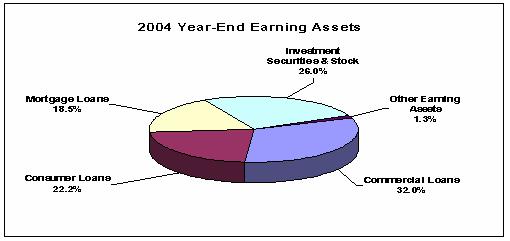

The year-end mix of earning assets shown in the following chart reflects the mix between investment securities and the major loan groups.

3

Loans and Leases – The loan portfolio increased $238.3 million, or 16.9%, to $1.7 billion at December 31, 2004, compared to $1.4 billion at December 31, 2003. The Company’s loan to deposit ratio at December 31, 2004 and December 31, 2003 was 93.1% and 88.9%, respectively. The percentage of fixed rate loans within the total loan portfolio has decreased slightly from 69% at the end of 2003 to 65% as of December 31, 2004.

The following table sets forth the composition of the Company’s loan portfolio as of December 31 for the years indicated.

TABLE 1 – LOAN AND LEASE PORTFOLIO COMPOSITION

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | December 31,

| |

(dollars in thousands)

| | 2004

| | | 2003

| | | 2002

| | | 2001

| | | 2000

| |

Commercial loans: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Real estate | | $ | 419,427 | | 25 | % | | $ | 352,031 | | 25 | % | | $ | 254,688 | | 25 | % | | $ | 228,284 | | 24 | % | | $ | 196,479 | | 21 | % |

Business | | | 307,614 | | 19 | | | | 201,020 | | 14 | | | | 159,339 | | 15 | | | | 117,530 | | 12 | | | | 78,986 | | 8 | |

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

Total commercial loans | | | 727,041 | | 44 | | | | 553,051 | | 39 | | | | 414,027 | | 40 | | | | 345,814 | | 36 | | | | 275,465 | | 29 | |

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

Mortgage loans: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Residential 1-4 family | | | 387,079 | | 23 | | | | 338,965 | | 24 | | | | 207,130 | | 20 | | | | 198,403 | | 21 | | | | 279,193 | | 30 | |

Construction | | | 33,031 | | 2 | | | | 50,295 | | 4 | | | | 16,470 | | 1 | | | | 5,915 | | 1 | | | | 7,482 | | 1 | |

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

Total mortgage loans | | | 420,110 | | 25 | | | | 389,260 | | 28 | | | | 223,600 | | 21 | | | | 204,318 | | 22 | | | | 286,675 | | 31 | |

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

Loans to individuals: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Indirect automobile | | | 222,480 | | 14 | | | | 229,636 | | 16 | | | | 219,280 | | 21 | | | | 220,698 | | 23 | | | | 205,143 | | 22 | |

Home equity | | | 213,533 | | 13 | | | | 174,740 | | 12 | | | | 122,799 | | 12 | | | | 114,056 | | 12 | | | | 108,070 | | 11 | |

Other | | | 67,462 | | 4 | | | | 65,662 | | 5 | | | | 64,786 | | 6 | | | | 71,129 | | 7 | | | | 65,172 | | 7 | |

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

Total consumer loans | | | 503,475 | | 31 | | | | 470,038 | | 33 | | | | 406,865 | | 39 | | | | 405,883 | | 42 | | | | 378,385 | | 40 | |

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

Total loans receivable | | $ | 1,650,626 | | 100 | % | | $ | 1,412,349 | | 100 | % | | $ | 1,044,492 | | 100 | % | | $ | 956,015 | | 100 | % | | $ | 940,525 | | 100 | % |

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

Commercial Loans.Commercial real estate and commercial business loans generally have shorter repayment periods and more frequent repricing opportunities than residential 1-4 family loans. Commercial loans as a percentage of total loans have increased from 39% as of December 31, 2003 to 44% as of December 31, 2004. The Company has increased its investment in commercial real estate loans from $352.0 million, or 24.9% of the total loan portfolio, as of December 31, 2003, to $419.4 million, or 25.4% of the total loan portfolio, as of December 31, 2004. The properties securing the Company’s commercial real estate loans are located in the Company’s market area, and include owner-occupied, multi-family, strip shopping centers, professional office buildings, small retail establishments and warehouses. The Company’s underwriting standards generally provide for loan terms of three to five years, with amortization schedules of no more than twenty years. Low loan-to-value ratios are maintained and usually limited to no more than 80%. As a rule, the Company obtains personal guarantees of the principals as additional security for most commercial real estate loans.

As of December 31, 2004, the Company’s commercial business loans amounted to $307.6 million, or 18.6% of the Company’s gross loan portfolio. This represents a $106.6 million, or 53.0% increase from December 31, 2003. The Company originates commercial business loans on a secured and, to a lesser extent, unsecured basis. The Company’s commercial business loans may be structured as term loans or revolving lines of credit. Term loans are generally structured with terms of no more than three to five years, with amortization schedules of no more than seven years. The Company’s commercial business term loans are generally secured by equipment, machinery or other corporate assets. The Company also provides for revolving lines of credit generally structured as advances upon perfected security interests in accounts receivable and inventory. Revolving lines of credit generally have an annual maturity. As a rule, the Company obtains personal guarantees of the principals as additional security for commercial business loans.

Mortgage Loans.Residential 1-4 family loans comprise substantially all of the Company’s mortgage loans. The vast majority of the Company’s residential 1-4 family mortgage loan portfolio is secured by properties located in its market area and originated under terms and documentation which permit their sale in the secondary market. Larger

4

mortgage loans of private banking clients and prospects are generally retained to enhance relationships, and also due to the expected shorter durations and relatively lower servicing costs associated with loans of this size.

During 2004, the level of mortgage loan refinance activity decreased significantly from the record level of activity in 2003. The Company has continued to sell in the secondary market the majority of newly originated and refinanced conventional loans, as well as a portion of the construction loans as they moved to long-term financing. The Company also releases the servicing of these loans. This was done to reduce portfolio rate risk on loans with longer expected durations and limited cross-sell opportunities. During 2004, the mortgage loan portfolio grew by $30.9 million, or 7.9%. This growth is primarily related to credit extended to high net worth individuals through the private banking area. At December 31, 2004, $283.3 million, or 67.4%, of the Company’s residential 1-4 family mortgage and construction loans were fixed rate loans and $136.8 million, or 32.6%, were adjustable rate loans.

Consumer Loans.The Company offers consumer loans in order to provide a full range of retail financial services to its customers. The Company originates substantially all of such loans in its primary market area. At December 31, 2004, $503.5 million, or 30.5% of the Company’s total loan portfolio, was comprised of consumer loans, compared to $470.0 million, or 33.3% at the end of 2003. During 2004, the consumer loan portfolio increased $33.4 million, or 7.1%. The Company acquired $33.6 million in consumer loans as a result of the Alliance acquisition.

Indirect automobile loans comprised the largest component of the Company’s consumer loan portfolio. Independent automobile dealerships originate these loans and forward applications to Company personnel for approval or denial. The Company relies on the dealerships, in part, for loan qualifying information. To that extent, there is risk inherent in indirect automobile loans associated with fraud or negligence by the automobile dealership. To limit this risk, an emphasis is placed on established dealerships that have demonstrated reputable behavior, both within the communities we serve and through long-term relationships with the Company. The balance of indirect automobile loans decreased from $229.6 million, or 16.3% of the Company’s total loan portfolio to $222.5 million, or 13.5% at December 31, 2003 and 2004, respectively, as the Company retained its focus on prime, or low risk, paper.

Home equity loans comprised the second largest component of the Company’s consumer loan portfolio. The balance of home equity loans increased $38.8 million, or 22.2% from $174.7 million at December 31, 2003 to $213.5 million at December 31, 2004.

The remainder of the consumer loan portfolio at December 31, 2004 was composed of direct automobile loans, credit card loans and other consumer loans. At December 31, 2004, the Company’s direct automobile loans amounted to $20.1 million, or 1.2% of the Company’s total loan portfolio. The Company’s VISA and MasterCard credit card loans totaled $8.7 million, or 0.5% of the Company’s total loan portfolio at such date. The Company’s other personal consumer loans amounted to $38.7 million, or 2.3% of the Company’s total loan portfolio, at December 31, 2004.

Loan Maturities.The following table sets forth the scheduled contractual maturities of the Company’s loan portfolio at December 31, 2004, unadjusted for scheduled principal reductions, prepayments or repricing opportunities. Demand loans, loans having no stated schedule of repayments and no stated maturity and overdraft loans are reported as due in one year or less. The average life of a loan may be substantially less than the contractual terms because of prepayments. As a result, scheduled contractual amortization of loans is not reflective of the expected term of the Company’s loan portfolio. Of the loans with maturities greater than one year, approximately 75% of the value of these loans bears a fixed rate of interest.

TABLE 2 – LOAN MATURITIES BY TYPE

| | | | | | | | | | | | |

(dollars in thousands)

| | One Year

Or Less

| | One Through

Five Years

| | After Five Years

| | Total

|

Commercial real estate | | $ | 95,857 | | $ | 238,626 | | $ | 84,944 | | $ | 419,427 |

Commercial business | | | 150,061 | | | 94,517 | | | 63,036 | | | 307,614 |

Mortgage | | | 8,461 | | | 20,559 | | | 391,090 | | | 420,110 |

Consumer | | | 127,840 | | | 239,681 | | | 135,954 | | | 503,475 |

| | |

|

| |

|

| |

|

| |

|

|

Total | | $ | 382,219 | | $ | 593,383 | | $ | 675,024 | | $ | 1,650,626 |

| | |

|

| |

|

| |

|

| |

|

|

5

Asset Quality and Allowance for Loan Losses – Over time, the loan portfolio has transitioned to be more representative of a commercial bank. Accordingly, there is recognition of the potential for a higher level of return for investors, but also of the potential for higher charge-off and nonperforming levels. In recognition of this, management has tightened underwriting guidelines and procedures, adopted more conservative loan charge-off and nonaccrual guidelines, rewritten the loan policy, developed an internal loan review function and significantly increased the allowance for loan losses. As a result, the credit quality of the Company’s assets has continued to improve as management assertively works to enhance underwriting risk/return dynamics within the loan portfolio. Management believes that historically it has recognized and disclosed significant problem loans quickly and taken prompt action in addressing material weaknesses in those credits. The Company will continue to monitor the risk adjusted level of return within the loan portfolio.

Written underwriting standards established by the Board of Directors and management govern the lending activities of the Company. The commercial credit department, in conjunction with senior lending personnel, underwrites all commercial business and commercial real estate loans. The Company provides centralized underwriting of all residential mortgage, construction and consumer loans. Established loan origination procedures require appropriate documentation including financial data and credit reports. For loans secured by real property, the Company generally requires property appraisals, title insurance or a title opinion, hazard insurance and flood insurance, where appropriate.

Loan payment performance is monitored and late charges are assessed on past due accounts. A centralized department collects delinquent loans. Every effort is made to minimize any potential loss, including instituting legal proceedings, as necessary. Commercial loans of the Company are periodically reviewed through a loan review process. All other loans are also subject to loan review through a periodic sampling process.

The Company utilizes an asset risk classification system in compliance with guidelines established by the Federal Reserve Board as part of its efforts to improve commercial asset quality. In connection with examinations of insured institutions, both federal and state examiners also have the authority to identify problem assets and, if appropriate, classify them. There are three classifications for problem assets: “substandard,” “doubtful” and “loss.” Substandard assets have one or more defined weaknesses and are characterized by the distinct possibility that the insured institution will sustain some loss if the deficiencies are not corrected. Doubtful assets have the weaknesses of substandard assets with the additional characteristic that the weaknesses make collection or liquidation in full questionable and there is a high probability of loss based on currently existing facts, conditions and values. An asset classified as loss is not considered collectable and of such little value that continuance as an asset of the Company is not warranted. Commercial loans with adverse classifications are reviewed by the Loan Committee of the Board of Directors at least monthly. Loans are placed on nonaccrual status when, in the judgment of management, the probability of collection of interest is deemed to be insufficient to warrant further accrual. When a loan is placed on nonaccrual status, previously accrued but unpaid interest for the current year is deducted from interest income. Prior year interest is charged-off to the allowance for loan losses.

At December 31, 2004, the Company had $10.3 million of assets classified as substandard, $610,000 of assets classified as doubtful, and no assets classified as loss. At such date, the aggregate of the Company’s classified assets amounted to 0.45% of total assets.

Real estate acquired by the Company as a result of foreclosure or by deed-in-lieu of foreclosure is classified as real estate owned until sold, and is carried at the balance of the loan at the time of acquisition or at estimated fair value less estimated costs to sell, whichever is less.

Under Generally Accepted Accounting Principles, the Company is required to account for certain loan modifications or restructurings as “troubled debt restructurings.” In general, the modification or restructuring of a debt constitutes a troubled debt restructuring if the Company for economic or legal reasons related to the borrower’s financial difficulties grants a concession to the borrower that the Company would not otherwise consider under current market conditions. Debt restructurings or loan modifications for a borrower do not necessarily always constitute troubled debt restructurings, however, and troubled debt restructurings do not necessarily result in nonaccrual loans. The Company had no troubled debt restructurings as of December 31, 2004.

6

Nonperforming loans, defined for these purposes as nonaccrual loans plus accruing loans past due 90 days or more, totaled $5.7 million and $5.1 million at December 31, 2004 and 2003, respectively. The Company’s foreclosed property amounted to $492,000 and $2.1 million at December 31, 2004 and 2003, respectively. Nonperforming assets, which consist of nonperforming loans plus foreclosed property, were $6.2 million, or 0.25% of total assets at December 31, 2004, compared to $7.3 million, or 0.34% of total assets at December 31, 2003.

The Company has shown continuing improvement in asset quality despite annualized double-digit growth in loans. The balance of nonperforming assets as a percentage of total assets declined considerably from 0.34% at the end of 2003 to 0.25% at the end of 2004. The decrease in nonperforming assets of $1.1 million during this period was primarily due to the sale of one commercial real estate property, which was sold to a third party in January 2004. The following table sets forth the composition of the Company’s nonperforming assets, including accruing loans past due 90 or more days, as of the dates indicated.

TABLE 3 – NONPERFORMING ASSETS AND TROUBLED DEBT RESTRUCTURINGS

| | | | | | | | | | | | | | | | | | | | |

| | | December 31,

| |

(dollars in thousands)

| | 2004

| | | 2003

| | | 2002

| | | 2001

| | | 2000

| |

Nonaccrual loans: | | | | | | | | | | | | | | | | | | | | |

Commercial, financial and agricultural | | $ | 1,936 | | | $ | 1,838 | | | $ | 1,693 | | | $ | 4,088 | | | $ | 5,169 | |

Mortgage | | | 735 | | | | 552 | | | | 334 | | | | 122 | | | | 137 | |

Loans to individuals | | | 1,784 | | | | 1,512 | | | | 1,230 | | | | 1,053 | | | | 161 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total nonaccrual loans | | | 4,455 | | | | 3,902 | | | | 3,257 | | | | 5,263 | | | | 5,467 | |

Accruing loans 90 days or more past due | | | 1,209 | | | | 1,220 | | | | 1,086 | | | | 1,691 | | | | 2,074 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total nonperforming loans(1) | | | 5,664 | | | | 5,122 | | | | 4,343 | | | | 6,954 | | | | 7,541 | |

Foreclosed property | | | 492 | | | | 2,134 | | | | 2,267 | | | | 6,009 | | | | 421 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total nonperforming assets(1) | | | 6,156 | | | | 7,256 | | | | 6,610 | | | | 12,963 | | | | 7,962 | |

Performing troubled debt restructurings | | | — | | | | — | | | | — | | | | — | | | | — | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total nonperforming assets and troubled debt restructurings(1) | | $ | 6,156 | | | $ | 7,256 | | | $ | 6,610 | | | $ | 12,963 | | | $ | 7,962 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Nonperforming loans to total loans(1) | | | 0.34 | % | | | 0.36 | % | | | 0.42 | % | | | 0.73 | % | | | 0.80 | % |

Nonperforming assets to total assets(1) | | | 0.25 | % | | | 0.34 | % | | | 0.42 | % | | | 0.91 | % | | | 0.57 | % |

Nonperforming assets and troubled debt restructurings to total assets(1) | | | 0.25 | % | | | 0.34 | % | | | 0.42 | % | | | 0.91 | % | | | 0.57 | % |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| (1) | Nonperforming loans and assets include accruing loans 90 days or more past due |

Allowance For Loan Losses.Based on facts and circumstances available, management of the Company believes that the allowance for loan losses was adequate at December 31, 2004 to cover any potential losses in the Company’s loan portfolio. However, future adjustments to this allowance may be necessary, and the Company’s results of operations could be adversely affected if circumstances differ substantially from the assumptions used by management in determining the allowance for loan losses. Losses in the loan portfolio, net of recoveries, are charged-off against the allowance and reduce the balance. Provisions for loan losses, which are charged against income, increase the allowance.

In determining the amount of the allowance for loan losses, management uses information from its portfolio management process, relationship managers and ongoing loan review efforts to stratify the loan portfolio into asset risk classifications and assigns a general or specific reserve allocation. The foundation for the allowance is a detailed review of the overall loan portfolio and its performance. The portfolio is segmented into homogenous pools (i.e., commercial, business banking, consumer, mortgage, indirect, and credit card), which are analyzed based on risk factors, current and historical performance and specific loan reviews (for significant loans). Consideration is given to the specific risk within these segments, the maturity of these segments (e.g., rapid growth versus fully seasoned), the Company’s strategy for each segment (e.g., growth versus maintain), and the historical loss rate for these segments both at the Company and its peers. Consideration is also given to the impact of a number of relevant

7

external factors that influence components of the loan portfolio or the portfolio as a whole, including current and projected economic conditions.

Loan portfolios tied to acquisitions made during the year are incorporated into the Company’s allowance process. If the acquisition has an impact on the level of exposure to a particular segment, industry or geographic market, this increase in exposure is factored into the allowance determination process. Generally, acquisitions have higher levels of risk of loss based on differences in credit culture, portfolio management practices and the Company’s emphasis on early detection and management of deteriorating loans.

General reserve estimated loss percentages are based on the current and historical loss experience of each loan category, regulatory guidelines for losses, the status of past due payments, and management’s judgment of economic conditions and the related level of risk assumed. Relative to homogenous loan pools such as mortgage, consumer, indirect and credits cards, the Company has established a general reserve level using information such as actual loan losses, the seasoning of the pool, identified loan impairment, acquisitions, and current and projected economic conditions. General reserves for these pools are adjusted for loans that are considered past due, based on the correlation between historical losses and the payment performance of a loan pool.

The commercial segment of the Company’s loan portfolio is initially assigned a general reserve also based on performance of that portion of the loan portfolio and other general factors discussed earlier. The commercial portion of the portfolio is further segmented by collateral type, which based on experience has a direct relationship to the level of loss experienced if a problem develops. Reserves are set based on management’s assessment of this risk of loss. As commercial loans deteriorate, the Company reviews each for impairment and proper loan grading. Loans on the Company’s Watch List carry higher levels of reserve based largely on a higher level of loss experience for these loans. Loss experience for Watch List loans is reviewed periodically during the year.

Specific reserves are determined for commercial loans individually based on management’s evaluation of loss exposure for each credit, given current payment status of the loan and the value of any underlying collateral. Loans for which specific reserves are provided are excluded from the general reserve calculations described above to prevent duplicate reserves. Additionally, an unallocated reserve for the total loan portfolio is established to address the imprecision and estimation risk inherent in the calculations of general and specific reserves, and management’s evaluation of various conditions that are not directly measured by any other component of the allowance. Such components would include current economic conditions affecting key lending areas, credit quality trends, collateral values, loan volumes and concentrations, seasoning of the loan portfolio and the findings of internal credit examinations.

Based on the allowance determination process, the Company determines the current potential risk of loss that exists in the portfolio, even if not fully reflected in current credit statistics, such as nonperforming assets or nonperforming loans. To determine risk of loss, and in turn the appropriateness of the allowance, the Company extends its analysis to a number of other factors, including the level of delinquencies and delinquency trends; the level and mix of Criticized, Classified and Pass/Watch loans; reserve levels relative to nonperforming assets, nonperforming loans, and net charge-offs; the level and trend in consumer and commercial bankruptcies; and financial performance trends in specific businesses and industries to which the Company lends. In response to rapid growth and changes in the mix of the loan portfolio, the Company has increased its required allowance over time and feels that the allowance adequately reflects the current level of risk and incurred losses within the loan portfolio.

8

The following table presents the allocation of the allowance for loan losses and the percentage of the total amount of loans in each loan category listed as of the dates indicated.

TABLE 4 – ALLOCATION OF THE ALLOWANCE FOR LOAN LOSSES

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | December 31,

| |

| | | 2004

| | | 2003

| | | 2002

| | | 2001

| | | 2000

| |

| | | Reserve %

| | | % of

Loans

| | | Reserve %

| | | % of

Loans

| | | Reserve %

| | | % of

Loans

| | | Reserve %

| | | % of

Loans

| | | Reserve %

| | | % of

Loans

| |

Commercial, financial and agricultural | | 55 | % | | 44 | % | | 51 | % | | 39 | % | | 48 | % | | 40 | % | | 46 | % | | 36 | % | | 41 | % | | 29 | % |

Real estate – mortgage | | 5 | | | 23 | | | 5 | | | 24 | | | 4 | | | 20 | | | 5 | | | 21 | | | 7 | | | 30 | |

Real estate – construction | | — | | | 2 | | | 1 | | | 4 | | | — | | | 1 | | | — | | | 1 | | | — | | | 1 | |

Loans to individuals | | 30 | | | 31 | | | 31 | | | 33 | | | 38 | | | 39 | | | 45 | | | 42 | | | 45 | | | 40 | |

Unallocated | | 10 | | | — | | | 12 | | | — | | | 10 | | | — | | | 4 | | | — | | | 7 | | | — | |

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

Total allowance for loan losses | | 100 | % | | 100 | % | | 100 | % | | 100 | % | | 100 | % | | 100 | % | | 100 | % | | 100 | % | | 100 | % | | 100 | % |

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

The allowance for loan losses amounted to $20.1 million, or 1.22% and 355.2% of total loans and total nonperforming loans, respectively, at December 31, 2004 compared to 1.29% and 355.9%, respectively, at December 31, 2003. The allowance for loan losses increased $1.9 million, or 10.3%, from $18.2 million at December 31, 2003. The increase included a $4.0 million provision for loan losses and $587,000 assigned to loans acquired as part of the Alliance acquisition. Net charge-offs for 2004 were $2.7 million, or 0.18% of total average loans, down from $3.6 million, or 0.28% in 2003. The Company believes this level of net charge-offs was more favorable than that of peer institutions with assets in the $1 to $3 billion range based on data published by the Federal Financial Institutions Examination Council (“FFIEC”). The following table sets forth the activity in the Company’s allowance for loan losses during the periods indicated.

TABLE 5 – SUMMARY OF ACTIVITY IN THE ALLOWANCE FOR LOAN LOSSES

| | | | | | | | | | | | | | | | | | | | |

| | | Years Ended December 31,

| |

(dollars in thousands)

| | 2004

| | | 2003

| | | 2002

| | | 2001

| | | 2000

| |

Allowance at beginning of period | | $ | 18,230 | | | $ | 13,101 | | | $ | 11,117 | | | $ | 10,239 | | | $ | 8,749 | |

Allowance from acquisition | | | 587 | | | | 2,439 | | | | — | | | | — | | | | — | |

Provisions | | | 4,041 | | | | 6,300 | | | | 6,197 | | | | 5,046 | | | | 3,861 | |

| | | | | |

Charge-offs: | | | | | | | | | | | | | | | | | | | | |

Commercial, financial and agricultural | | | 986 | | | | 1,617 | | | | 1,331 | | | | 1,861 | | | | 1,174 | |

Mortgage | | | 91 | | | | 37 | | | | 60 | | | | 15 | | | | 37 | |

Loans to individuals | | | 3,035 | | | | 3,128 | | | | 3,391 | | | | 2,797 | | | | 1,654 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total charge-offs | | | 4,112 | | | | 4,782 | | | | 4,782 | | | | 4,673 | | | | 2,865 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Recoveries: | | | | | | | | | | | | | | | | | | | | |

Commercial, financial and agricultural | | | 272 | | | | 504 | | | | 68 | | | | 110 | | | | 52 | |

Mortgage | | | 1 | | | | 21 | | | | 35 | | | | 17 | | | | 22 | |

Loans to individuals | | | 1,097 | | | | 647 | | | | 466 | | | | 378 | | | | 420 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total recoveries | | | 1,370 | | | | 1,172 | | | | 569 | | | | 505 | | | | 494 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Net charge-offs | | | 2,742 | | | | 3,610 | | | | 4,213 | | | | 4,168 | | | | 2,371 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Allowance at end of period | | $ | 20,116 | | | $ | 18,230 | | | $ | 13,101 | | | $ | 11,117 | | | $ | 10,239 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Allowance for loan losses to nonperforming assets(1) | | | 326.8 | % | | | 251.2 | % | | | 198.2 | % | | | 85.8 | % | | | 128.6 | % |

Allowance for loan losses to total loans at end of period | | | 1.22 | % | | | 1.29 | % | | | 1.25 | % | | | 1.16 | % | | | 1.09 | % |

Net charge-offs to average loans | | | 0.18 | % | | | 0.28 | % | | | 0.43 | % | | | 0.44 | % | | | 0.26 | % |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| (1) | Nonperforming loans and assets include accruing loans 90 days or more past due |

Investment Securities- The Company’s investment securities consist primarily of securities issued by the U.S. Government and federal agency obligations, obligations of state and political subdivisions and mortgage-backed securities. As of December 31, 2004, the Company’s investment securities available for sale amounted to $526.9 million, which includes a pre-tax net unrealized gain of $1.1 million, and its investment securities held to maturity amounted to $40.0 million with a pre-tax net unrealized gain of $1.0 million. At such date, investment securities

9

available for sale consisted of $425.3 million of mortgage-backed securities, $48.4 million of obligations of state and political subdivisions, and $53.2 million of U.S. Government and federal agency obligations. At December 31, 2004, investment securities held to maturity consisted of $12.9 million of mortgage-backed securities, $14.0 million of obligations of state and political subdivisions, and $13.1 million of U.S. Government and federal agency obligations.

Investment securities increased by an aggregate of $87.3 million, or 18.2%, to $567.0 million at December 31, 2004. This is compared to $479.6 million at December 31, 2003. This increase was due to investment securities of $11.2 million obtained through the acquisition of Alliance and purchases of investment securities amounting to $269.1 million, both of which were partially offset by $147.6 million from maturities, prepayments and calls, $42.3 million from sales of investment securities, $2.8 million from the amortization of premiums and accretion of discounts, and a decrease of $0.3 million in the market value of investment securities available for sale. Funds generated as a result of sales and prepayments were used to fund loan growth and purchase other securities. The Company continues to monitor market conditions and take advantage of market opportunities with appropriate rate and risk return elements. Note 3 of the Consolidated Financial Statements provides further information on the Company’s investment securities.

Other Earning Assets – Included in other earning assets are short-term investments resulting from excess funds that fluctuate daily depending on the funding needs of the Company. These funds are currently invested overnight in an interest-bearing deposit account at the Federal Home Loan Bank (“FHLB”) of Dallas, the total balance of which earns interest at the current FHLB discount rate. The balance in interest-bearing deposits at other institutions decreased $1.4 million, or 6.7%, from $20.7 million at December 31, 2003 to $19.3 million at December 31, 2004. The average rate on these funds during 2004 was 1.46%, compared to 1.21% during 2003.

Also a component of other earning assets are loans held for sale, which increased $2.3 million, or 40.3%, to $8.1 million at December 31, 2004 compared to $5.8 million at December 31, 2003. Loans held for sale have primarily been fixed rate single-family residential mortgage loans under contract to be sold in the secondary market. In most cases, loans in this category are sold within thirty days. During 2004, approximately 89% of total single-family mortgage originations of the Company were sold in the secondary market as compared to 66% in 2003.

Funding Sources

Deposits obtained from clients in its primary market areas are the Company’s principal source of funds for use in lending and other business purposes. The Company attracts local deposit accounts by offering a wide variety of accounts, competitive interest rates and convenient branch office locations and service hours. Increasing core deposits through the development of client relationships is a continuing focus of the Company. Borrowings have become an increasingly important funding source as the Company has grown. Other funding sources include subordinated debt and shareholders’ equity. The following discussion highlights the major changes in the mix of funding sources during 2004.

Deposits – The Company has been successful in raising deposits in the markets in which it has a presence and believes the increase to be the result of several factors including the development of customer relationships and opportunities in the public funds arena. The following table sets forth the composition of the Company’s deposits at the dates indicated.

TABLE 6 – DEPOSIT COMPOSITION

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | December 31,

| |

(dollars in thousands)

| | 2004

| | | 2003

| | | 2002

| | | 2001

| | | 2000

| |

Noninterest-bearing DDA | | $ | 218,859 | | 12 | % | | $ | 189,786 | | 12 | % | | $ | 159,005 | | 13 | % | | $ | 154,580 | | 12 | % | | $ | 129,468 | | 11 | % |

NOW accounts | | | 532,584 | | 30 | | | | 449,938 | | 28 | | | | 281,825 | | 23 | | | | 243,685 | | 20 | | | | 182,668 | | 16 | |

Savings and money market | | | 393,772 | | 22 | | | | 350,295 | | 22 | | | | 319,495 | | 25 | | | | 305,059 | | 25 | | | | 261,986 | | 23 | |

Certificates of deposit | | | 628,274 | | 36 | | | | 599,087 | | 38 | | | | 481,907 | | 39 | | | | 534,070 | | 43 | | | | 569,065 | | 50 | |

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

Total deposits | | $ | 1,773,489 | | 100 | % | | $ | 1,589,106 | | 100 | % | | $ | 1,242,232 | | 100 | % | | $ | 1,237,394 | | 100 | % | | $ | 1,143,187 | | 100 | % |

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

10

Deposits at December 31, 2004 reflected an increase of $184.4 million, or 11.6%, to $1.8 billion as compared to $1.6 billion at December 31, 2003. The growth in deposits includes $61.8 million of deposits acquired from the acquisition of Alliance. Since the end of 2003, noninterest-bearing checking accounts increased $29.1 million, or 15.3%, interest-bearing checking account deposits increased $82.6 million, or 18.4%, savings and money market accounts increased $43.5 million, or 12.4%, and certificate of deposit accounts increased $29.2 million, or 4.9%. Excluding the effect of Alliance, noninterest-bearing checking accounts increased $17.2 million, or 9.0%, interest-bearing checking account deposits increased $72.3 million, or 16.1%, savings and money market accounts increased $15.6 million, or 4.5%, and certificate of deposit accounts increased $17.5 million, or 2.9%. At December 31, 2004, $218.9 million, or 12.3%, of the Company’s total deposits were noninterest-bearing, compared to $189.8 million, or 11.9%, at December 31, 2003.

Certificates of deposit $100,000 and over increased $20.1 million, or 9.3%, from $215.7 million at December 31, 2003 to $235.7 million at December 31, 2004. The following table shows large-denomination certificates of deposit by remaining maturities. Additional information regarding deposits is provided in Note 8 of the Consolidated Financial Statements.

TABLE 7 – REMAINING MATURITY OF CDS $100,000 AND OVER

| | | | | | | | | |

| | | December 31,

|

(dollars in thousands)

| | 2004

| | 2003

| | 2002

|

3 months or less | | $ | 53,355 | | $ | 67,555 | | $ | 45,254 |

Over 3-12 months | | | 81,908 | | | 87,869 | | | 68,434 |

Over 12-36 months | | | 72,126 | | | 35,906 | | | 25,081 |

More than 36 months | | | 28,335 | | | 24,329 | | | 12,157 |

| | |

|

| |

|

| |

|

|

Total | | $ | 235,724 | | $ | 215,659 | | $ | 150,926 |

| | |

|

| |

|

| |

|

|

Borrowings and Debt -Advances from the FHLB of Dallas may be obtained by the Company upon the security of the common stock it owns in that bank and certain of its real estate loans and investment securities, provided certain standards related to creditworthiness have been met. Such advances are made pursuant to several credit programs, each of which has its own interest rate and range of maturities. The level of short-term borrowings can fluctuate significantly on a daily basis depending on funding needs and the source of funds chosen to satisfy those needs. The Company’s short-term borrowings at December 31, 2004 were comprised of $192.0 million of advances from the FHLB of Dallas and $44.5 million of securities sold under agreements to repurchase. The average amount of short-term borrowings in 2004 was $188.6 million.

The Company’s short-term borrowings at December 31, 2003 were comprised of $19.6 million of securities sold under agreements to repurchase and $143.0 million of advances from the FHLB of Dallas. The average amount of short-term borrowings in 2003 was $115.0 million. Total short-term borrowings increased $73.9 million, or 45.4%, to $236.5 million at December 31, 2004 compared to $162.6 million at December 31, 2003. The weighted average rate on short-term borrowings was 2.01% at December 31, 2004, compared to 1.13% at December 31, 2003. For additional information regarding short-term borrowings, see Note 9 of the Consolidated Financial Statements.

The Company’s long-term borrowings increased $49.8 million, or 31.9%, to $206.1 million at December 31, 2004, compared to $156.3 million at December 31, 2003. The primary reason for the increase in long-term debt was to match fund selected loan growth and to take advantage of relatively low rates on these borrowings. The majority of the Company’s long-term borrowings, $140.2 million, were comprised of fixed-rate advances from the FHLB of Dallas which cannot be paid off without incurring substantial prepayment penalties.Remaining FHLB advances of $35.0 million consist of variable rate advances based on three-month LIBOR.

The Company’s remaining debt consists of $30.9 million of junior subordinated debt as a result of three separate $10.3 million trust preferred offerings. The junior subordinated debt consists of junior subordinated deferrable interest debentures of the Company issued to statutory trusts that were funded by the issuance of floating rate capital securities of the trusts. The issuances bear interest rates equal to three-month LIBOR plus 3.25%, 3.15% and 2.00%,

11

respectively. The debentures qualify as Tier 1 Capital for regulatory purposes. The terms of the securities are 30 years and, subject to regulatory requirements, are callable at par by the Company anytime after 5 years. Interest is payable quarterly and may be deferred at any time at the election of the Company for up to 20 consecutive quarterly periods. During any deferral period the Company is subject to certain restrictions, including being prohibited from declaring dividends to its common shareholders. For additional information see Note 10 of the Consolidated Financial Statements.

Shareholders’ Equity – Shareholders’ equity provides a source of permanent funding, allows for future growth and provides the Company with a cushion to withstand unforeseen adverse developments. At December 31, 2004, shareholders’ equity totaled $220.2 million, an increase of $25.0 million, or 12.8%, compared to $195.2 million at December 31, 2003. The increase in shareholders’ equity in 2004 was the result of the issuance of $15.5 million of common stock as a result of the purchase accounting transaction with Alliance, net income of $27.3 million, $2.6 million of common stock released by the Company’s Employee Stock Ownership Plan (“ESOP”) trust, $1.4 million of common stock earned by participants in the Company’s Recognition and Retention Plan (“RRP”) trust, $4.1 million for the sale of treasury stock for stock options exercised and a $207,000 increase in other comprehensive income. Such increases were partially offset by cash dividends declared on the Company’s common stock of $7.3 million and repurchases of $18.9 million of the Company’s common stock that were placed into treasury.

On June 25, 2004, the Company announced a new Stock Repurchase Program authorizing the repurchase of up to 175,000 common shares. During the year ended December 31, 2004, the Company repurchased a total of 326,667 shares of its Common Stock under publicly announced Stock Repurchase Programs. The following table details these purchases during the year.

TABLE 8 – STOCK REPURCHASES

| | | | | | | | | |

Period

| | Number of Shares

Purchased

| | Average

Price Paid per Share

| | Number of Shares

Purchased as Part of

Publicly Announced

Repurchase Plans

| | Maximum Number of

Shares that May Yet

Be Purchased Under

Repurchase Plans

|

February 2004 | | 37,700 | | $ | 60.77 | | 37,700 | | 230,600 |

March 2004 | | 14,400 | | $ | 60.91 | | 14,400 | | 216,200 |

April 2004 | | 19,400 | | $ | 57.49 | | 19,400 | | 196,800 |

May 2004 | | 137,867 | | $ | 57.95 | | 137,867 | | 58,933 |

June 2004 | | 60,000 | | $ | 56.93 | | 60,000 | | 173,933 |

July 2004 | | 6,000 | | $ | 56.55 | | 6,000 | | 167,933 |

August 2004 | | 46,100 | | $ | 54.87 | | 46,100 | | 121,833 |

October 2004 | | 5,200 | | $ | 58.41 | | 5,200 | | 116,633 |

| | |

| |

|

| |

| | |

Total | | 326,667 | | $ | 57.74 | | 326,667 | | |

| | |

| |

|

| |

| | |

No shares were repurchased during January, September, November or December 2004. No shares were repurchased during the year ended December 31, 2004, other than through publicly announced plans.

RESULTS OF OPERATIONS

The Company reported net income of $27.3 million, $23.6 million and $18.5 million for the years ended December 31, 2004, 2003 and 2002, respectively. Earnings per share (“EPS”) on a diluted basis was $3.76 for 2004, $3.42 for 2003 and $3.02 for 2002. During 2004, interest income increased $12.0 million, interest expense increased $5.1 million, the provision for loan losses decreased $2.3 million, noninterest income increased $153,000, noninterest expense increased $4.3 million and income tax expense increased $1.4 million. Cash earnings, defined as net income before the amortization of acquisition intangibles, amounted to $27.9 million, $24.1 million and $18.7

12

million for the years ended December 31, 2004, 2003 and 2002, respectively. Included in earnings are the results of operations of Alliance from the acquisition date of February 28, 2004 forward. Results of operations of Acadiana are included from the acquisition date of February 28, 2003 forward.

Net Interest Income – Net interest income is the difference between interest realized on earning assets and interest paid on interest-bearing liabilities. Net interest income is also the driver of core earnings and, as such, is subject to constant scrutiny by management. The rate of return and relative risk associated with earning assets are weighed to determine the appropriateness and mix of earning assets. Additionally, the need for lower cost funding sources is weighed against relationships with clients and future growth requirements. The Company’s average interest rate spread, which is the difference between the yields earned on earning assets and the rates paid on interest-bearing liabilities, was 3.40%, 3.67% and 4.19% during the years ended December 31, 2004, 2003 and 2002, respectively. The Company’s net interest margin on a taxable equivalent (TE) basis, which is net interest income (TE) as a percentage of average earning assets, was 3.60%, 3.89% and 4.53% during the years ended December 31, 2004, 2003 and 2002, respectively.

Net interest income increased $7.0 million, or 10.3%, in 2004 to $74.6 million compared to $67.6 million in 2003. This increase was due to a $12.0 million, or 12.5%, increase in interest income, which was partially offset by a $5.1 million, or 17.5%, increase in interest expense. In 2003, net interest income increased $8.0 million, or 13.5%, to $67.6 million compared to $59.6 million in 2002. This increase was due to a $9.0 million, or 10.3%, increase in interest income, which was partially offset by a $971,000, or 3.5%, increase in interest expense.

The improvement in net interest income was the result of increased volumes and an improved mix of earning assets and deposits. Although earnings improved through increased net interest income, the related net interest spread and margin ratios compressed, driven in part by the rise in short-term interest rates and the associated repricing of the Company’s short-term borrowings and indexed customer deposits. The Company’s earning assets are not repricing as quickly as its liabilities.

On the funding side, the Company issued $10.3 million in junior subordinated debt in each year from 2002 to 2004, swapped to an average rate of 6.17%, which negatively impacts the margin in the short run, but provides additional low-cost capital for future growth.

The Company will continue to monitor investment opportunities and weigh the associated risk/return. Volume increases in earning assets and improvements in the mix of earning assets and interest-bearing liabilities should improve net interest income, but may negatively impact the net interest margin ratio. The Company has engaged in interest rate swap transactions, which are a form of derivative financial instrument, to modify the net interest sensitivity to levels deemed to be appropriate. Through this instrument, interest rate risk is managed by hedging with an interest rate swap contract designed to pay fixed and receive floating interest. The interest rate swaps of the

13

Company were executed to modify net interest sensitivity to levels deemed appropriate. Average loans made up 71.4% of average earning assets as of December 31, 2004 as compared to 72.8% at December 31, 2003. Overall, average loans increased 16.9% in 2004. The increase in average loans was funded by increased customer deposits and borrowings. Average investment securities made up 26.3% of average earning assets at December 31, 2004 compared to 24.2% at December 31, 2003. Average interest-bearing deposits made up 81.0% of average interest-bearing liabilities at December 31, 2004 compared to 83.3% at December 31, 2003. Average borrowings made up 19.0% of average interest-bearing liabilities at December 31, 2004 compared to 16.7% at December 31, 2003. Tables 9 and 10 further explain the changes in net interest income.

The following table sets forth, for the periods indicated, information regarding (i) the total dollar amount of interest income of the Company from earning assets and the resultant average yields; (ii) the total dollar amount of interest expense on interest-bearing liabilities and the resultant average rate; (iii) net interest income; (iv) net interest spread; and (v) net interest margin. Information is based on average daily balances during the indicated periods. Investment security market value adjustments and trade-date accounting adjustments are not considered to be earning assets and, as such, the net effect is included in nonearning assets. Tax equivalent (TE) yields are calculated using a marginal tax rate of 35%.

TABLE 9 – AVERAGE BALANCES, NET INTEREST INCOME AND INTEREST YIELDS / RATES

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Years Ended December 31,

| |

| | | 2004

| | | 2003

| | | 2002

| |

(dollars in thousands)

| | Average

Balance

| | | Interest

| | Average

Yield/

Rate

| | | Average

Balance

| | | Interest

| | Average

Yield/

Rate

| | | Average

Balance

| | | Interest

| | Average

Yield/

Rate

| |

Earning assets: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Loans receivable: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Mortgage loans | | $ | 399,681 | | | $ | 21,861 | | 5.47 | % | | $ | 340,738 | | | $ | 20,628 | | 6.05 | % | | $ | 197,239 | | | $ | 14,881 | | 7.54 | % |

Commercial loans (TE) | | | 636,359 | | | | 29,882 | | 4.85 | | | | 511,634 | | | | 25,987 | | 5.26 | | | | 378,090 | | | | 23,211 | | 6.27 | |

Consumer and other loans | | | 494,348 | | | | 32,488 | | 6.57 | | | | 456,766 | | | | 32,602 | | 7.14 | | | | 400,997 | | | | 33,061 | | 8.24 | |

| | |

|

|

| |

|

| |

|

| |

|

|

| |

|

| |

|

| |

|

|

| |

|

| |

|

|

Total loans | | | 1,530,388 | | | | 84,231 | | 5.57 | | | | 1,309,138 | | | | 79,217 | | 6.12 | | | | 976,326 | | | | 71,153 | | 7.34 | |

| | |

|

|

| |

|

| |

|

| |

|

|

| |

|

| |

|

| |

|

|

| |

|

| |

|

|

Loans held for sale | | | 10,391 | | | | 520 | | 5.00 | | | | 14,172 | | | | 893 | | 6.30 | | | | 6,149 | | | | 362 | | 5.89 | |

Investment securities (TE) | | | 563,271 | | | | 22,974 | | 4.32 | | | | 434,767 | | | | 15,667 | | 3.91 | | | | 323,571 | | | | 15,316 | | 4.93 | |

Other earning assets | | | 39,986 | | | | 885 | | 2.21 | | | | 39,440 | | | | 785 | | 1.99 | | | | 36,732 | | | | 721 | | 1.96 | |

| | |

|

|

| |

|

| |

|

| |

|

|

| |

|

| |

|

| |

|

|

| |

|

| |

|

|

Total earning assets | | | 2,144,036 | | | | 108,610 | | 5.18 | | | | 1,797,517 | | | | 96,562 | | 5.50 | | | | 1,342,778 | | | | 87,552 | | 6.61 | |

| | |

|

|

| |

|

| |

|

| |

|

|

| |

|

| |

|

| |

|

|

| |

|

| |

|

|

Allowance for loan losses | | | (19,488 | ) | | | | | | | | | (16,491 | ) | | | | | | | | | (11,774 | ) | | | | | | |

Nonearning assets | | | 213,598 | | | | | | | | | | 183,669 | | | | | | | | | | 133,415 | | | | | | | |

| | |

|

|

| | | | | | | |

|

|

| | | | | | | |

|

|

| | | | | | |

Total assets | | $ | 2,338,146 | | | | | | | | | $ | 1,964,695 | | | | | | | | | $ | 1,464,419 | | | | | | | |

| | |

|

|

| | | | | | | |

|

|

| | | | | | | |

|

|

| | | | | | |

Interest-bearing liabilities: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Deposits: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

NOW accounts | | $ | 510,187 | | | $ | 5,613 | | 1.10 | % | | $ | 358,327 | | | $ | 3,245 | | 0.91 | % | | $ | 258,087 | | | $ | 3,055 | | 1.18 | % |

Savings and money market accounts | | | 403,331 | | | | 3,116 | | 0.77 | | | | 354,997 | | | | 2,924 | | 0.82 | | | | 318,708 | | | | 4,353 | | 1.37 | |

Certificates of deposit | | | 624,959 | | | | 15,108 | | 2.42 | | | | 601,339 | | | | 14,865 | | 2.47 | | | | 497,988 | | | | 17,154 | | 3.44 | |

| | |

|

|

| |

|

| |

|

| |

|

|

| |

|

| |

|

| |

|

|

| |

|

| |

|

|

Total interest-bearing deposits | | | 1,538,477 | | | | 23,837 | | 1.55 | | | | 1,314,663 | | | | 21,034 | | 1.60 | | | | 1,074,783 | | | | 24,562 | | 2.29 | |

| | |

|

|

| |

|

| |

|

| |

|

|

| |

|

| |

|

| |

|

|

| |

|

| |

|

|

Short-term borrowings | | | 188,589 | | | | 2,644 | | 1.38 | | | | 115,014 | | | | 1,428 | | 1.22 | | | | 32,961 | | | | 613 | | 1.83 | |

Long-term debt | | | 173,386 | | | | 7,501 | | 4.26 | | | | 148,841 | | | | 6,467 | | 4.29 | | | | 46,346 | | | | 2,783 | | 5.92 | |

| | |

|

|

| |

|

| |

|

| |

|

|

| |

|

| |

|

| |

|

|

| |

|

| |

|

|

Total interest-bearing liabilities | | | 1,900,452 | | | | 33,982 | | 1.78 | | | | 1,578,518 | | | | 28,929 | | 1.83 | | | | 1,154,090 | | | | 27,958 | | 2.42 | |

| | |

|

|

| |

|

| |

|

| |

|

|

| |

|

| |

|

| |

|

|

| |

|

| |

|

|

Noninterest-bearing demand deposits | | | 208,887 | | | | | | | | | | 183,478 | | | | | | | | | | 149,739 | | | | | | | |

Noninterest-bearing liabilities | | | 18,121 | | | | | | | | | | 22,282 | | | | | | | | | | 19,965 | | | | | | | |

| | |

|

|

| | | | | | | |

|

|

| | | | | | | |

|

|

| | | | | | |

Total liabilities | | | 2,127,460 | | | | | | | | | | 1,784,278 | | | | | | | | | | 1,323,794 | | | | | | | |

Shareholders’ equity | | | 210,686 | | | | | | | | | | 180,417 | | | | | | | | | | 140,625 | | | | | | | |

| | |

|

|

| | | | | | | |

|

|

| | | | | | | |

|

|

| | | | | | |

Total liabilities and shareholders’ equity | | $ | 2,338,146 | | | | | | | | | $ | 1,964,695 | | | | | | | | | $ | 1,464,419 | | | | | | | |

| | |

|

|

| | | | | | | |

|

|

| | | | | | | |

|

|

| | | | | | |

Net earning assets | | $ | 243,584 | | | | | | | | | $ | 218,999 | | | | | | | | | $ | 188,688 | | | | | | | |

Net interest spread | | | | | | $ | 74,628 | | 3.40 | % | | | | | | $ | 67,633 | | 3.67 | % | | | | | | $ | 59,594 | | 4.19 | % |

Net interest income (TE) /

Net interest margin (TE) | | | | | | $ | 77,490 | | 3.60 | % | | | | | | $ | 70,236 | | 3.89 | % | | | | | | $ | 61,063 | | 4.53 | % |

| | | | | | |

|

| |

|

| | | | | |

|

| |

|

| | | | | |

|

| |

|

|

14

The following table analyzes the dollar amount of changes in interest income and interest expense for major components of earning assets and interest-bearing liabilities. The table distinguishes between (i) changes attributable to volume (changes in average volume between periods times the average yield/rate for the two periods), (ii) changes attributable to rate (changes in average rate between periods times the average volume for the two periods), and (iii) total increase (decrease).

TABLE 10 – SUMMARY OF CHANGES IN NET INTEREST INCOME

| | | | | | | | | | | | | | | | | | | | | | | |

| | | 2004 / 2003

Change Attributable To

| | | 2003 / 2002 Change Attributable To

| |

(dollars in thousands)

| | Volume

| | | Rate

| | | Total

Increase

(Decrease)

| | | Volume

| | Rate

| | | Total

Increase

(Decrease)

| |

Earning assets: | | | | | | | | | | | | | | | | | | | | | | | |

Loans: | | | | | | | | | | | | | | | | | | | | | | | |

Mortgage loans | | $ | 3,396 | | | $ | (2,163 | ) | | $ | 1,233 | | | $ | 9,757 | | $ | (4,010 | ) | | $ | 5,747 | |

Commercial loans | | | 6,096 | | | | (2,201 | ) | | | 3,895 | | | | 7,491 | | | (4,715 | ) | | | 2,776 | |

Consumer and other loans | | | 2,576 | | | | (2,690 | ) | | | (114 | ) | | | 4,289 | | | (4,748 | ) | | | (459 | ) |

Loans held for sale | | | (214 | ) | | | (159 | ) | | | (373 | ) | | | 489 | | | 42 | | | | 531 | |

Investment securities | | | 4,936 | | | | 2,371 | | | | 7,307 | | | | 4,635 | | | (4,284 | ) | | | 351 | |

Other earning assets | | | 11 | | | | 89 | | | | 100 | | | | 54 | | | 10 | | | | 64 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

| |

|

|

| |

|

|

|

Total net change in income on earning assets | | | 16,801 | | | | (4,753 | ) | | | 12,048 | | | | 26,715 | | | (17,705 | ) | | | 9,010 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

| |

|

|

| |

|

|

|

Interest-bearing liabilities: | | | | | | | | | | | | | | | | | | | | | | | |

Deposits: | | | | | | | | | | | | | | | | | | | | | | | |

NOW accounts | | | 1,523 | | | | 845 | | | | 2,368 | | | | 1,047 | | | (857 | ) | | | 190 | |

Savings and money market accounts | | | 386 | | | | (194 | ) | | | 192 | | | | 397 | | | (1,826 | ) | | | (1,429 | ) |

Certificates of deposit | | | 577 | | | | (334 | ) | | | 243 | | | | 3,057 | | | (5,346 | ) | | | (2,289 | ) |

Borrowings | | | 2,843 | | | | (593 | ) | | | 2,250 | | | | 6,712 | | | (2,213 | ) | | | 4,499 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

| |

|

|

| |

|

|

|

Total net change in expense on interest-bearing liabilities | | | 5,329 | | | | (276 | ) | | | 5,053 | | | | 11,213 | | | (10,242 | ) | | | 971 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

| |

|

|

| |

|

|

|

Change in net interest income | | $ | 11,472 | | | $ | (4,477 | ) | | $ | 6,995 | | | $ | 15,502 | | $ | (7,463 | ) | | $ | 8,039 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

| |

|

|

| |

|

|

|

Interest income includes interest income earned on earning assets as well as applicable loan fees earned. Interest income that would have been earned on nonaccrual loans had they been on accrual status is not included in the data reported above.

Provision for Loan Losses - The allowance for loan losses is maintained at a level considered appropriate by management based on various factors as they relate to the collectability of the Company’s loan portfolio. Increases to the allowance for loan losses are achieved through provisions for loan losses that are charged against income. Management of the Company assesses the allowance for loan losses on a quarterly basis and will make provisions for loan losses as deemed appropriate in order to maintain the adequacy of the allowance for loan losses.

As a result of continued improvement in asset quality, the Company decreased the provision for loan losses by 35.9% from $6.3 million in 2003 to $4.0 million in 2004. The provision for loan losses was $6.2 million in 2002. Net loan charge-offs were $2.7 million for 2004 compared to $3.6 million for 2003. The allowance for loan losses as a percentage of outstanding loans, net of unearned income, was 1.22% at December 31, 2004, compared to 1.29% at year-end 2003. A discussion of credit quality can be found in the section on “Asset Quality and Allowance for Loan Losses” in this analysis.

Noninterest Income – The Company reported noninterest income of $23.2 million compared to $23.1 million for 2003. The following table illustrates the primary components of noninterest income for the years indicated.

15

TABLE 11 – NONINTEREST INCOME

| | | | | | | | | | | | | | | | |

(dollars in thousands)

| | 2004

| | 2003

| | Percent

Increase

(Decrease)

| | | 2002

| | | Percent

Increase

(Decrease)

| |

Service charges on deposit accounts | | $ | 12,317 | | $ | 11,683 | | 5.4 | % | | $ | 9,984 | | | 17.0 | % |

ATM/debit card fee income | | | 2,012 | | | 1,810 | | 11.2 | | | | 1,609 | | | 12.5 | |

Bank owned life insurance | | | 1,663 | | | 1,521 | | 9.3 | | | | 1,211 | | | 25.6 | |

Gain on sale of loans, net | | | 2,794 | | | 4,199 | | (33.5 | ) | | | 2,081 | | | 101.8 | |

Gain on sale of assets | | | 220 | | | 334 | | (34.1 | ) | | | 406 | | | (17.7 | ) |

Gain (loss) on sale of investments, net | | | 698 | | | 267 | | 161.4 | | | | (42 | ) | | 735.7 | |

Other income | | | 3,513 | | | 3,250 | | 8.1 | | | | 2,617 | | | 24.2 | |

| | |

|

| |

|

| |

|

| |

|

|

| |

|

|

Total noninterest income | | $ | 23,217 | | $ | 23,064 | | 0.7 | % | | $ | 17,866 | | | 29.1 | % |

| | |

|

| |

|

| |

|

| |

|

|

| |

|

|

Noninterest income increased $153,000 from 2003 to 2004 primarily due to a $634,000 increase in service charges on deposit accounts as a result of the implementation of revenue enhancement strategies, a $202,000 increase in ATM/debit card fees from increased usage and a $431,000 increase in gains on the sale of investment securities. Noninterest income was adversely impacted by a $1.4 million decrease in gains on the sale of mortgage loans in the secondary market as refinance activity slowed from 2003’s record level and a $114,000 decrease in gains on the sales of assets.

The Company reported noninterest income of $23.1 million in 2003 compared to $17.9 million for 2002. The primary reasons for the $5.2 million increase were a $2.1 million increase in gains on the sale of mortgage loans in the secondary market, a $1.7 million increase in service charges on deposit accounts, a $201,000 increase in ATM fee income from increased usage, a $310,000 increase in earnings and cash surrender value of bank owned life insurance and a $594,000 increase in broker sales commissions. These increases were partially offset by a $72,000 decrease in gains on sale of assets. Additionally, the year 2003 included a $267,000 gain on the sale of investment securities compared to a $42,000 loss in 2002.

Noninterest Expense – Ongoing attention to expense control is part of the Company’s corporate culture. The Company reported noninterest expense of $54.9 million compared to $50.6 million for 2003. The following table illustrates the primary components of noninterest expense for the years indicated.

TABLE 12 – NONINTEREST EXPENSE

| | | | | | | | | | | | | | | |

(dollars in thousands)

| | 2004

| | 2003

| | Percent

Increase

(Decrease)

| | | 2002

| | Percent

Increase

(Decrease)

| |

Salaries and employee benefits | | $ | 29,846 | | $ | 26,585 | | 12.3 | % | | $ | 23,066 | | 15.3 | % |

Occupancy and equipment | | | 6,834 | | | 6,273 | | 8.9 | | | | 5,432 | | 15.5 | |

Franchise and shares tax | | | 2,607 | | | 2,086 | | 25.0 | | | | 1,681 | | 24.1 | |

Communication and delivery | | | 2,814 | | | 2,762 | | 1.9 | | | | 2,551 | | 8.3 | |

Marketing and business development | | | 1,582 | | | 1,255 | | 26.1 | | | | 1,006 | | 24.8 | |

Data processing | | | 1,492 | | | 1,663 | | (10.3 | ) | | | 1,456 | | 14.2 | |

Printing, stationery and supplies | | | 845 | | | 845 | | 0.0 | | | | 687 | | 23.0 | |