1Q09 Earnings Conference Call Supplemental Materials April 22, 2009 Exhibit 99.2 |

2 Forward Looking Statements Forward Looking Statements Safe Harbor Safe Harbor Statements contained in this presentation which are Statements contained in this presentation which are not historical facts and which pertain to future not historical facts and which pertain to future operating results of IBERIABANK Corporation and its operating results of IBERIABANK Corporation and its subsidiaries constitute “forward-looking statements” subsidiaries constitute “forward-looking statements” within the meaning of the Private Securities Litigation within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking Reform Act of 1995. These forward-looking statements involve significant risks and uncertainties. statements involve significant risks and uncertainties. Actual results may differ materially from the results Actual results may differ materially from the results discussed in these forward-looking statements. discussed in these forward-looking statements. Factors that might cause such a difference include, Factors that might cause such a difference include, but are not limited to, those discussed in the but are not limited to, those discussed in the Company’s periodic filings with the SEC. Company’s periodic filings with the SEC. |

3 Introductory Comments |

4 Introductory Comments Introductory Comments Summary - Summary - Position Position Favorable Balance Sheet Composition Favorable Balance Sheet Composition Very Balanced; Core Funded; Low C&D Exposure Very Balanced; Core Funded; Low C&D Exposure Continued Good Asset Quality And Well Capitalized Continued Good Asset Quality And Well Capitalized Returned TARP Preferred; Warrants--Work In Progress Returned TARP Preferred; Warrants--Work In Progress Favorable Interest Rate And Credit Risk Positioning Favorable Interest Rate And Credit Risk Positioning $26 Million Unrealized Gain In Investment Portfolio $26 Million Unrealized Gain In Investment Portfolio Future Growth Engines: Memphis, Mobile, & Houston Future Growth Engines: Memphis, Mobile, & Houston We Avoided What Ails The Banking Industry We Avoided What Ails The Banking Industry Remain Well Positioned For Future Opportunities Remain Well Positioned For Future Opportunities |

5 Introductory Comments Introductory Comments Summary – Summary – 1Q09 1Q09 Seasonal Slow Loan Growth; Strong Deposit Growth Seasonal Slow Loan Growth; Strong Deposit Growth Margin Compression Due To Late-2008 Fed Rate Cuts Margin Compression Due To Late-2008 Fed Rate Cuts T/E Net Interest Income Down $0.8mm (-2%) T/E Net Interest Income Down $0.8mm (-2%) NPAs/Assets = 0.95%, Up From 0.83% (+$6 mm) NPAs/Assets = 0.95%, Up From 0.83% (+$6 mm) 30+ Days Past Due = 1.55%, Down From 1.63% 30+ Days Past Due = 1.55%, Down From 1.63% Net COs/Avg Net COs/Avg Loans = 0.24%, Down From 0.53% Loans = 0.24%, Down From 0.53% Provision = $3.0mm, Down $3.2mm (-51%; 4Q Fraud) Provision = $3.0mm, Down $3.2mm (-51%; 4Q Fraud) No Security Or Asset Sale Gains In 1Q09 (-$1.2mm) No Security Or Asset Sale Gains In 1Q09 (-$1.2mm) Nonint Nonint Income Up $3.3mm (+16%; Mortgage-Driven) Income Up $3.3mm (+16%; Mortgage-Driven) EPS = $0.36, Down 37% -- EPS = $0.36, Down 37% -- Driven By Equity Events Driven By Equity Events |

6 Introductory Comments Introductory Comments YTD 2009 Price Change By Index YTD 2009 Price Change By Index Source: SNL Through April 20, 2009 Source: SNL Through April 20, 2009 +1% - 45% - 40% - 35% - 30% - 25% - 20% -15% -10% - 5% 0% 5% % Change In Price - YTD 2009 Through 4/20/09 Western Banks Southeast Banks Small Cap Banks Banks $5B-$10B Assets Banks >$10B Assets Banks Large Cap Banks KBW Bank Mid Cap Banks Midwest Banks Banks $1B-$5B Assets NASDAQ Banks TARP Participants New England Banks Thrifts Micro Cap Banks SNL All Financial Institutions Southwest Banks Mid-Atlantic Banks Dow Jones Ind Avg Bank Pink Sheets Banks < $250M Assets Banks $250-$500M Assets Banks $500M-$1B Assets S&P Small-Cap Russell 2000 IBERIABANK Corporation SNL Reported Indexes |

7 Introductory Comments Introductory Comments Last 12 Months Price Change By Index Last 12 Months Price Change By Index Source: SNL Through April 20, 2009 Source: SNL Through April 20, 2009 +3% - 65% - 60% - 55% - 50% - 45% - 40% - 35% - 30% - 25% - 20% -15% -10% -5% 0% 5% % Change In Price - Last 12 Months Through 4/20/09 Southeast Banks TARP Participants KBW Bank Banks >$10B Assets Large Cap Banks Mid Cap Banks Banks SNL All Financial Institutions New England Banks Mid-Atlantic Banks Midwest Banks Thrifts Micro Cap Banks Banks $250-$500M Assets Western Banks Small Cap Banks Banks $1B-$5B Assets Southwest Banks NASDAQ Banks Banks < $250M Assets Dow Jones Ind Avg Banks $500M-$1B Assets Banks $5B-$10B Assets Bank Pink Sheets Russell 2000 S&P Small-Cap IBERIABANK Corporation SNL Reported Indexes |

8 Introductory Comments Introductory Comments Annual Change In Stock Price Annual Change In Stock Price 58% 27% 45% 47% 13% -4% 16% -21% 3% 5% -60% -40% -20% 0% 20% 40% 60% 2000 2001 2002 2003 2004 2005 2006 2007 2008 YTD 2009 IBKC S&P Banks NASDAQ Banks DJIA S&P 500 Russell 2000 Source: Stifel Nicolaus through April 17, 2009 |

9 Introductory Comments Introductory Comments Strategic Goals & Priorities Strategic Goals & Priorities • • Double-Digit Annual EPS Growth Double-Digit Annual EPS Growth • • ROTE Of 23% - ROTE Of 23% - 25% 25% • • Bank Tangible Efficiency < 50% Bank Tangible Efficiency < 50% • • Top Quartile Asset Quality Top Quartile Asset Quality • • Develop Memphis, Mobile & Houston Develop Memphis, Mobile & Houston • • Deepen Share In Little Rock, Baton Rouge, Deepen Share In Little Rock, Baton Rouge, New Orleans, And Shreveport New Orleans, And Shreveport • • Expand Investment Management Business Expand Investment Management Business • • Provide Depth For Unusual Opportunities Provide Depth For Unusual Opportunities • • Grind Our Way Through The Credit Cycle Grind Our Way Through The Credit Cycle Strategic Strategic Goals Goals 18-Month 18-Month Priorities Priorities |

10 Asset Quality |

11 Asset Quality Asset Quality Credit Development Update Credit Development Update Loan Fraud In Northeast Arkansas At Pulaski Loan Fraud In Northeast Arkansas At Pulaski • • Charge-Off Of $3.6 Million Or $0.17 EPS Impact In 4Q08 Charge-Off Of $3.6 Million Or $0.17 EPS Impact In 4Q08 • • No Change In Current Status No Change In Current Status Commercial Relationship At IBERIABANK Commercial Relationship At IBERIABANK • • Term Loans Totaling $8.6 Million On Four Aircraft Term Loans Totaling $8.6 Million On Four Aircraft • • Primary Guarantor Deposited $3.2 Million In Escrow To Cover Primary Guarantor Deposited $3.2 Million In Escrow To Cover Shortfalls Shortfalls • • Loans On Four Aircraft Were 30 Days Past Due At 4Q08 Loans On Four Aircraft Were 30 Days Past Due At 4Q08 • • One Airplane Sold During 1Q09 At No Loss; 3 Aircraft Remain One Airplane Sold During 1Q09 At No Loss; 3 Aircraft Remain • • Relationship Moved To Nonperforming Status In 1Q09 ($7 Million) Relationship Moved To Nonperforming Status In 1Q09 ($7 Million) • • Any Loss On This Relationship Is Expected To Be Immaterial Any Loss On This Relationship Is Expected To Be Immaterial |

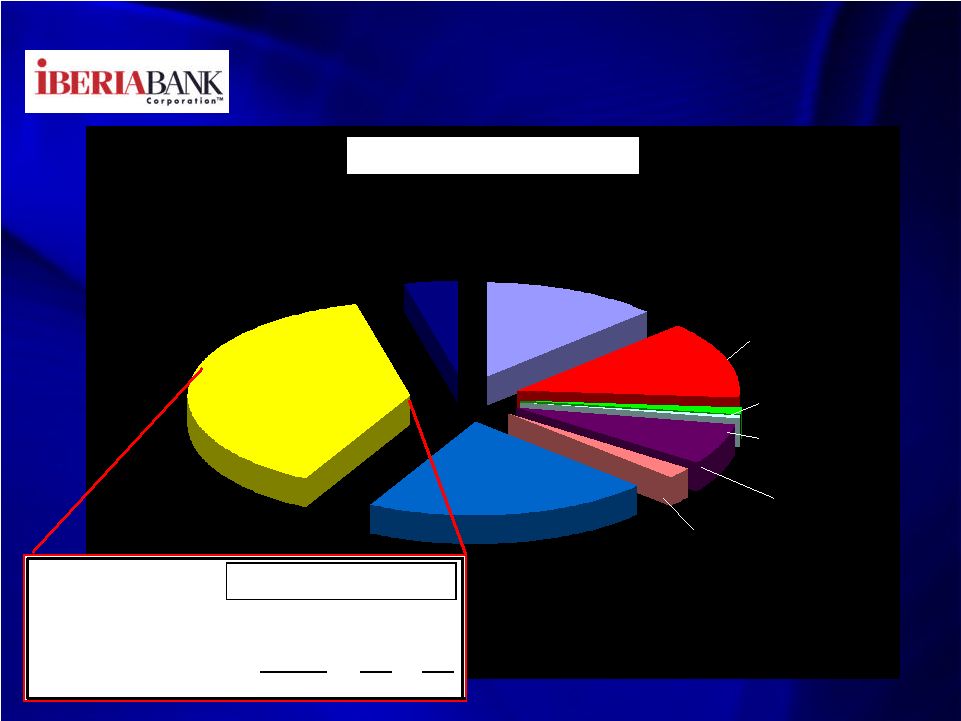

12 Asset Quality Asset Quality Loan Portfolio Mix Loan Portfolio Mix Loan Portfolio Composition Business 21% All Other Loans 4% Residential 13% Indirect Automobile 7% Other Consumer 2% Automobile 1% Home Equity 13% Commercial RE 38% Credit Card 1% $000s % of CRE % Loans C&D-Pulaski 23,950 $ 2% 1% C&D-IBERIABANK 151,258 11% 4% CRE-Owner Occupied 654,677 46% 17% CRE-Non-Owner Occupied 603,512 42% 16% Total Commercial RE 1,433,397 $ 100% 38% |

13 Asset Quality Asset Quality Pulaski Pulaski Builder Builder Exposure Exposure Development Lot House <100% House 100% Development House <100% House 100% Loans Loans Complete Complete Loans Lots Complete Complete Memphis Area 2,063 $ 2,434 $ - $ 4,496 $ 1 64 0 31 North Mississippi - - - 774 0 0 0 4 Little Rock 2,273 298 80 2,627 1 8 1 14 Northeast Ark. - 820 - 490 0 16 0 3 Northwest Ark. - 1,206 - 4,524 0 24 0 29 Total 4,336 $ 4,758 $ 80 $ 12,911 $ 2 112 1 81 On 12/31/08 4,336 $ 5,384 $ 360 $ 17,870 $ 2 135 4 105 % Of Total - 3/31/09 20% 22% 0% 58% 1% 57% 1% 41% % Of Total - 12/31/08 16% 19% 1% 64% 1% 55% 2% 43% By Dollar Amount ($000) Number # Of Loans $ Funded % Of Line Average Funded Committed Committed %Total Funded $ Funded Builder Loans Memphis Area 8,993 $ 9,007 $ 41 40.7% 100% 219,353 $ North Mississippi 774 772 4 3.5% 100% 193,402 $ Little Rock 5,278 5,386 23 23.9% 98% 229,492 $ Northeast Ark. 1,310 1,310 11 5.9% 100% 119,052 $ Northwest Ark. 5,731 5,732 51 25.9% 100% 112,365 $ Total 22,086 $ 22,207 $ 130 100.0% 99% 169,889 $ On 12/31/08 27,951 $ 28,227 $ 163 100.0% 99% 171,478 $ By Dollar Amount ($000) % Balance Funded Loans Discounts & % Discounts & Balance Current 30- 59 60- 89 > 90 Nonaccrual Reserves Nonaccrual Reserves Builder Loans Memphis Area 8,993 $ 4,228 $ 787 $ - $ - $ 3,978 $ 1,032 $ 44.2% 11.47% North Mississippi 774 - - - - 774 4 100.0% 0.47% Little Rock 5,278 5,018 225 - - 35 155 0.7% 2.93% Northeast Ark. 1,310 642 - - - 668 150 51.0% 11.44% Northwest Ark. 5,731 2,639 628 - - 2,464 535 43.0% 9.34% Total 22,086 $ 12,527 $ 1,639 $ - $ - $ 7,919 $ 1,875 $ 35.9% 8.49% On 12/31/08 27,951 $ 15,249 $ 2,355 $ - $ - $ 10,347 $ 2,429 $ 37.0% 8.69% By Dollar Amount ($000) # Of Days Past Due |

14 Asset Quality Asset Quality IBERIABANK IBERIABANK Builder & Non-Builder Builder & Non-Builder C&D Exposure C&D Exposure # Of Loans $ Funded % Of Line Average Funded Committed Committed %Total Funded $ Funded Lafayette 28,003 $ 30,942 $ 63 18.5% 91% 444,487 $ Community Bank 1,151 1,466 9 0.8% 79% 127,865 $ Baton Rouge 39,893 51,034 158 26.4% 78% 252,490 $ New Orleans 19,583 21,588 13 12.9% 91% 1,506,405 $ Northshore 18,494 22,313 14 12.2% 83% 1,320,974 $ Shreveport 21,938 24,261 18 14.5% 90% 1,218,799 $ NE Louisiana 1,489 2,094 10 1.0% 71% 148,930 $ Regional Comm. North 20,707 28,627 7 13.7% 72% 2,958,097 $ Total 151,258 $ 182,326 $ 292 100.0% 83% 518,007 $ On 12/31/08 168,070 $ 218,439 $ 355 100.0% 77% 473,436 $ By Dollar Amount ($000) <100% 100% <100% 100% Complete Complete Complete Complete Lafayette 5,106 $ 22,897 $ 12 51 Community Bank 217 934 2 7 Baton Rouge 11,696 28,197 82 76 New Orleans 5,212 14,372 4 9 Northshore 4,450 14,044 4 10 Shreveport 8,176 13,762 5 13 NE Louisiana 16 1,473 2 8 Regional Comm. North 4,336 16,371 2 5 Total 39,208 $ 112,050 $ 113 179 On 12/31/08 63,645 $ 104,425 $ 166 189 By Dollar Amount ($000) Number % Balance Funded Loans Discounts & % Discounts & Balance Current 30- 59 60- 89 > 90 Nonaccrual Reserves Nonaccrual Reserves Lafayette 28,003 $ 27,709 $ - $ - $ - $ 293 $ 245 $ 1.0% 0.87% Community Bank 1,151 1,151 - - - - 7 0.0% 0.60% Baton Rouge 39,893 37,468 382 - 459 1,584 251 4.0% 0.63% New Orleans 19,583 19,583 - - - - 211 0.0% 1.08% Northshore 18,494 18,494 - - - - 196 0.0% 1.06% Shreveport 21,938 21,938 - - - - 241 0.0% 1.10% NE Louisiana 1,489 1,489 - - - - 5 0.0% 0.31% Regional Comm. North 20,707 20,707 - - - - 228 0.0% 1.10% Total 151,258 $ 148,539 $ 382 $ - $ 459 $ 1,878 $ 1,383 $ 1.2% 0.91% On 12/31/08 168,070 $ 164,323 $ 1,517 $ - $ 640 $ 1,589 $ 1,525 $ 0.9% 0.91% By Dollar Amount ($000) # Of Days Past Due |

15 Asset Quality Asset Quality 1Q09 Compared To Prior Quarters 1Q09 Compared To Prior Quarters ($thousands) 3Q08 4Q08 1Q09 3Q08 4Q08 1Q09 3Q08 4Q08 1Q09 Nonaccruals 5,784 $ 6,487 $ 15,883 $ 20,297 $ 21,337 $ 17,867 $ 26,081 $ 27,825 $ 33,750 $ OREO & Foreclosed 959 2,167 1,692 11,485 14,146 14,336 12,444 16,312 16,028 90+ Days Past Due 1,567 1,309 1,655 3,329 1,172 1,297 4,895 2,481 2,952 Nonperforming Assets 8,309 $ 9,962 $ 19,230 $ 35,111 $ 36,655 $ 33,500 $ 43,420 $ 46,618 $ 52,730 $ NPAs/Assets 0.22% 0.26% 0.48% 2.23% 2.42% 2.31% 0.81% 0.83% 0.95% NPAs/(Loans + OREO) 0.28% 0.34% 0.66% 4.13% 4.28% 3.92% 1.15% 1.24% 1.40% LLR/Loans 0.91% 0.92% 0.96% 1.67% 1.68% 1.64% 1.09% 1.09% 1.11% Net Charge-Offs/Loans 0.03% 0.11% 0.15% 1.02% 1.93% 0.58% 0.26% 0.53% 0.24% Past Dues: 30-89 Days Past Due 6,329 $ 18,810 $ 7,278 $ 7,525 $ 12,050 $ 14,232 $ 13,854 $ 30,860 $ 21,510 $ 90+ days Past Due 1,567 1,309 1,655 3,329 1,172 1,297 4,895 2,481 2,952 Nonaccual Loans 5,784 6,487 15,883 20,297 21,337 17,867 26,081 27,825 33,750 Total 30+ Past Dues 13,679 $ 26,606 $ 24,816 $ 31,151 $ 34,560 $ 33,396 $ 44,830 $ 61,166 $ 58,212 $ % Loans 0.49% 0.92% 0.85% 3.71% 4.10% 3.97% 1.24% 1.63% 1.55% Loan Mix: Commercial 55.5% 57.6% 59.0% 61.8% 60.4% 61.2% 57.0% 58.3% 59.5% Consumer 14.5% 14.0% 14.0% 24.0% 23.7% 23.2% 16.7% 16.2% 16.1% Mortgage 16.9% 15.9% 15.0% 7.7% 8.7% 8.6% 14.8% 14.3% 13.6% Business Banking 3.7% 3.3% 2.9% 2.2% 2.7% 2.5% 3.3% 3.1% 2.8% Indirect 9.4% 9.2% 9.1% 0.0% 0.0% 0.0% 7.2% 7.1% 7.0% Credit Cards 0.0% 0.0% 0.0% 4.3% 4.5% 4.5% 1.0% 1.0% 1.0% Total Loans 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% IBERIABANK Corporation Pulaski IBERIABANK |

16 Asset Quality Asset Quality Trends – Trends – Entity NPAs & Past Dues Entity NPAs & Past Dues (Dollars in $000s) 4Q07 1Q08 2Q08 3Q08 Q408 Q109 $Chg 12/31/07 3/31/08 6/30/08 9/30/08 12/31/08 3/31/09 Last Qtr. Nonaccrual Louisiana 3,545 $ 4,408 $ 6,295 $ 5,784 $ 6,487 $ 15,883 $ 9,396 $ Pulaski 32,562 29,698 24,534 20,297 21,337 17,867 (3,470) Consolidated 36,107 $ 34,107 $ 30,829 $ 26,081 $ 27,825 $ 33,750 $ 5,926 $ OREO & Foreclosed Assets Louisiana 1,688 $ 2,164 $ 850 $ 959 $ 2,167 $ 1,692 $ (475) $ Pulaski 7,726 7,560 8,862 11,485 14,146 14,336 190 Consolidated 9,414 $ 9,724 $ 9,712 $ 12,444 $ 16,312 $ 16,028 $ (285) $ Accruing 90+ Days Past Due Louisiana 1,684 $ 1,437 $ 867 $ 1,567 $ 1,309 $ 1,655 $ 346 $ Pulaski 971 2,394 501 3,329 1,172 1,297 125 Consolidated 2,655 $ 3,831 $ 1,367 $ 4,895 $ 2,481 $ 2,952 $ 471 $ Total NPAs Louisiana 6,917 $ 8,009 $ 8,012 $ 8,309 $ 9,963 $ 19,230 $ 9,267 $ Pulaski 41,258 39,653 33,896 35,111 36,655 33,500 (3,155) Consolidated 48,176 $ 47,662 $ 41,908 $ 43,420 $ 46,618 $ 52,730 $ 6,112 $ NPAs / Total Assets Louisiana 0.19% 0.22% 0.22% 0.22% 0.26% 0.48% Pulaski 3.13% 2.73% 2.12% 2.23% 2.42% 2.31% Consolidated 0.98% 0.93% 0.79% 0.81% 0.83% 0.95% 30-89 Days Past Due Louisiana 10,042 $ 9,604 $ 7,842 $ 6,329 $ 18,810 $ 7,278 $ (11,532) $ Pulaski 8,202 9,725 8,722 7,525 12,050 14,232 2,182 Consolidated 18,244 $ 19,329 $ 16,564 $ 13,854 $ 30,860 $ 21,510 $ (9,351) $ 30-89 Days PDs / Loans Louisiana 0.38% 0.36% 0.29% 0.23% 0.65% 0.25% Pulaski 0.97% 1.25% 1.01% 0.90% 1.43% 1.69% Consolidated 0.53% 0.56% 0.47% 0.38% 0.82% 0.57% |

17 Asset Quality Asset Quality Trends – Trends – Entity LLR & Net COs Entity LLR & Net COs (Dollars in $000s) 4Q07 1Q08 2Q08 3Q08 Q408 Q109 $Chg 12/31/07 3/31/08 6/30/08 9/30/08 12/31/08 3/31/09 Last Qtr. Loan Loss Reserve* Louisiana 24,417 $ 24,434 $ 24,962 $ 25,528 $ 26,671 $ 27,866 $ 1,195 $ Pulaski 13,868 14,769 14,791 14,022 14,201 13,796 (405) Consolidate 38,285 $ 39,203 $ 39,753 $ 39,551 $ 40,872 $ 41,662 $ 790 $ LLR / Total Loans Louisiana 0.93% 0.92% 0.92% 0.91% 0.92% 0.96% Pulaski 1.72% 1.89% 1.81% 1.67% 1.68% 1.64% Consolidate 1.12% 1.14% 1.12% 1.09% 1.09% 1.11% Net Charge-Offs Louisiana 230 $ 678 $ 283 $ 183 $ 801 $ 1,052 $ 251 $ Pulaski 178 1,100 702 2,150 4,084 1,190 (2,894) Consolidate 408 $ 1,778 $ 985 $ 2,333 $ 4,885 $ 2,242 $ (2,643) $ Net COs/Avg Loans Louisiana 0.12% 0.10% 0.04% 0.03% 0.11% 0.15% Pulaski 0.14% 0.58% 0.35% 1.02% 1.93% 0.58% Consolidate 0.12% 0.21% 0.11% 0.26% 0.53% 0.24% LLR Coverage Of NPAs Louisiana 353% 305% 312% 307% 268% 145% Pulaski 34% 37% 44% 40% 39% 41% Consolidate 79% 82% 95% 91% 88% 79% * Does not include loan discounts associated with acquisitions. |

18 Asset Quality Asset Quality Loan Mix And 30 Days+ Past Due Loan Mix And 30 Days+ Past Due (Dollars in $000s) 4Q07 1Q08 2Q08 3Q08 Q408 Q109 12/31/07 3/31/08 6/30/08 9/30/08 12/31/08 3/31/09 % of Outstandings Commercial 56.7% 57.1% 56.2% 57.0% 58.3% 59.5% Mortgage 16.8% 16.6% 15.8% 14.8% 14.3% 13.6% Consumer 16.0% 16.3% 16.7% 16.7% 16.2% 16.1% Indirect 7.0% 7.0% 7.0% 7.2% 7.1% 7.0% Business Banking 1.8% 2.1% 3.4% 3.3% 3.1% 2.8% Credit Cards 1.7% 0.9% 0.9% 1.0% 1.0% 1.0% Total Loans 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% Past Due 30+ Days* Commercial 1.95% 2.00% 1.60% 1.31% 1.91% 1.82% Mortgage 1.06% 0.90% 0.95% 1.00% 0.97% 0.85% Consumer 1.74% 1.66% 1.45% 1.43% 1.55% 1.53% Indirect 1.21% 0.97% 0.75% 0.89% 1.08% 0.97% Business Banking 0.11% 1.30% 0.75% 0.77% 1.10% 0.83% Credit Cards 0.82% 1.44% 1.02% 1.15% 1.55% 1.63% Total Loans 1.66% 1.69% 1.38% 1.24% 1.63% 1.55% Louisiana 0.59% 0.59% 0.55% 0.49% 0.91% 0.85% Pulaski 4.93% 4.99% 3.88% 3.71% 4.10% 3.97% Consolidated 1.66% 1.69% 1.38% 1.24% 1.63% 1.55% * Includes nonaccruing loans |

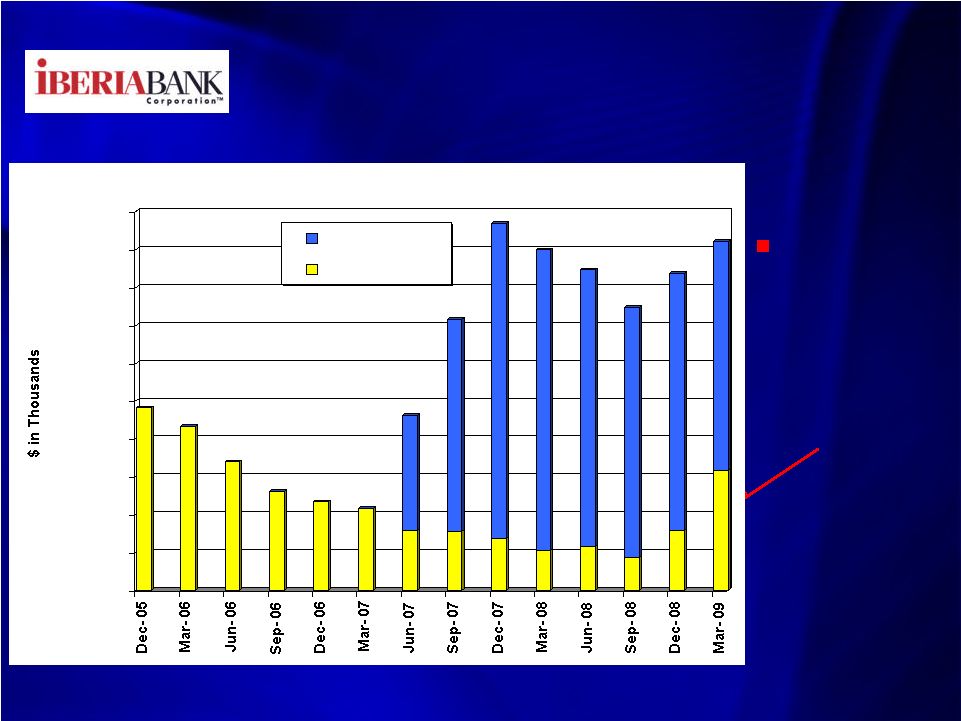

19 Asset Quality Asset Quality Consolidated – Consolidated – Classified Assets Classified Assets Note: Classified Assets Include Substandard, Doubtful and Loss Note: Classified Assets Include Substandard, Doubtful and Loss Increase At Increase At IBERIABANK IBERIABANK In 1Q09 Due In 1Q09 Due Primarily To Primarily To $7 Million $7 Million Aircraft Aircraft Relationship Relationship $- $5,000 $10,000 $15,000 $20,000 $25,000 $30,000 $35,000 $40,000 $45,000 $50,000 Classified Assets - IBERIABANK & Pulaski Pulaski IBERIABANK |

20 Asset Quality Asset Quality Loan Loss Reserve Loan Loss Reserve Louisiana Franchise – Louisiana Franchise – Improved Situation Improved Situation • • 85% Of LA Loan Portfolio Is In South Louisiana 85% Of LA Loan Portfolio Is In South Louisiana • • South Louisiana Credits Performing Very Well South Louisiana Credits Performing Very Well • • Classified Assets And NPAs Remain Strong Classified Assets And NPAs Remain Strong • • $2.2 Million Loan Loss Provision In 1Q09 (4Q08 = $1.9 Million) $2.2 Million Loan Loss Provision In 1Q09 (4Q08 = $1.9 Million) Pulaski Franchise – Pulaski Franchise – Mixed Situation Mixed Situation • • Excluding Builder Portfolio, Loan Portfolio Is In Good Shape Excluding Builder Portfolio, Loan Portfolio Is In Good Shape • • Construction Portfolio Continues To Progress Construction Portfolio Continues To Progress • • Continuing To Aggressively Address Potential Problems Continuing To Aggressively Address Potential Problems • • $0.8 Million Loan Loss Provision in 1Q09 (4Q08 = $4.3 Million) $0.8 Million Loan Loss Provision in 1Q09 (4Q08 = $4.3 Million) $2.2 Million In Net $2.2 Million In Net Charge-Offs In Charge-Offs In 1Q09 (0.24% Of 1Q09 (0.24% Of Average Loans) Average Loans) 1Q08 2Q08 3Q08 4Q08 1Q09 Net Charge-Offs 1,778 $ 985 $ 2,333 $ 4,885 $ 2,242 $ Loan Growth (63) 1,302 968 1,256 150 Change In Asset Quality 980 (750) (1,171) 65 640 Loan Loss Provision 2,695 $ 1,537 $ 2,131 $ 6,206 $ 3,032 $ Net Charge-Offs/Avg. Loans 0.21% 0.11% 0.26% 0.53% 0.24% Loan Loss Reserve/Loans 1.14% 1.12% 1.09% 1.09% 1.11% |

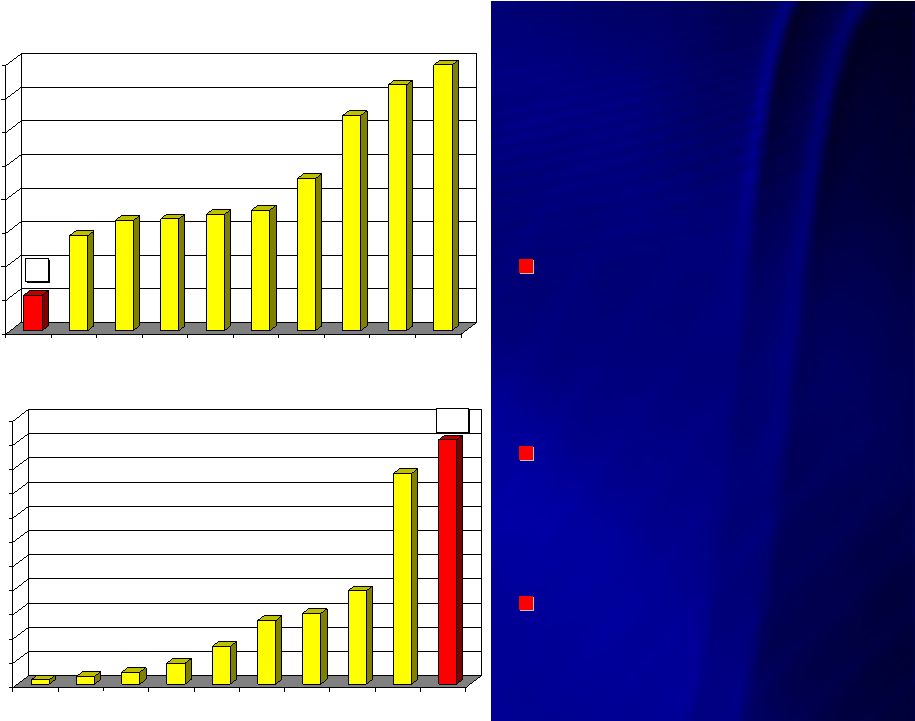

21 Asset Quality Asset Quality C&D Loans C&D Loans Compared To Compared To Peers Peers Source: SNL, using most recent quarterly information Source: SNL, using most recent quarterly information 5% 14% 16% 17% 17% 18% 23% 32% 37% 40% 0% 5% 10% 15% 20% 25% 30% 35% 40% IBKC SFNC CCBG TRMK HBHC BXS WTNY SBCF OZRK UCBI Construction & Land Development Loans / Total Loans (Most Recent Quarter Information) 0% 0% 0% 1% 2% 3% 3% 4% 9% 10% 0.0% 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0% 8.0% 9.0% 10.0% 11.0% BXS OZRK UCBI SFNC HBHC WTNY CCBG TRMK SBCF IBKC C&D Nonaccruals / Total C&D Loans (Most Recent Quarter Information) One Of The Lowest One Of The Lowest Levels Of C&D Loan Levels Of C&D Loan Exposure Compared Exposure Compared To Peers To Peers One Of The Highest One Of The Highest Levels Of C&D Levels Of C&D Nonaccrual Loans Nonaccrual Loans Addressing C&D Addressing C&D Exposure Assertively Exposure Assertively |

22 Asset Quality Asset Quality Commercial Real Estate Portfolio Commercial Real Estate Portfolio $- $1,000,000 $2,000,000 $3,000,000 $4,000,000 $5,000,000 $6,000,000 $7,000,000 $8,000,000 $9,000,000 $10,000,000 CRE Loans Outstanding At March 31, 2009 Non-Builder Portfolio CRE Average = $583,000 |

23 IBERIABANK Pulaski Bank TOTAL Non-Owner Occupied Current 494.0 $ 188.8 $ 682.8 $ Past Due 0.6 7.7 8.4 Nonaccrual 0.8 12.2 13.0 Total 495.4 $ 208.7 $ 704.1 $ % Nonaccrual 0.16% 5.84% 1.84% Owner Occupied Current 590.0 $ 131.4 $ 721.4 $ Past Due 1.1 3.6 4.8 Nonaccrual 1.8 1.3 3.2 Total 593.0 $ 136.3 $ 729.3 $ % Nonaccrual 0.31% 0.97% 0.43% Total CRE 1,088.3 $ 345.1 $ 1,433.4 $ % Nonaccrual 0.24% 3.91% 1.12% Last Qtr (12/31/08) 0.23% 4.83% 1.33% Non-Owner Occup/Tier 1 Cap. 146% 153% 128% Asset Quality Asset Quality Commercial Real Estate Portfolio Commercial Real Estate Portfolio Note: Includes commercial construction and land development loans |

24 Asset Quality Asset Quality Commercial Portfolio Composition Commercial Portfolio Composition 0% 1% 1% 1% 2% 2% 3% 3% 3% 4% 4% 4% 5% 6% 6% 6% 7% 7% 8% 10% 17% 0% 2% 4% 6% 8% 10% 12% 14% 16% 18% % Of Commercial Loan Portfolio At 12/31/08 Communications Education Storage Religious Wholesalers Transport Households Agriculture Retail Manufacturing Real Estate-Other Energy Hospitality Governmental Heavy/Civil Construction Construction Financial/Insurance Other RE-Owner Occupied Medical RE-Non-Owner Occupied Note: Includes commercial construction and land development loans |

25 Consumer Loan Portfolio |

26 Consumer Portfolio Consumer Portfolio By Product – By Product – Score Distribution Score Distribution Note: Excludes Credit Cards Note: Excludes Credit Cards Volume Score Volume Score Volume Score HELOC 119 $ 739 24 $ 735 143 $ 738 Home Equity Loans 205 724 140 726 345 725 Unsecured Lines 14 728 2 728 15 728 Unsecured 18 688 7 682 26 686 Other Secured 40 697 11 684 51 694 Indirect Auto 244 716 - - 244 716 Total 640 $ 716 184 $ 711 823 $ 715 Consumer Portfolio - Product Type And Average Score IBERIABANK Pulaski IBERIABANK Corp Score Intervals HELOC Home Equity Loans Unsecured Lines Unsecured Other Secured Indirect Auto 800 + 11% 12% 3% 5% 13% 13% 750 - 799 35% 34% 22% 21% 24% 29% 700 - 749 25% 25% 27% 25% 19% 22% 650 - 699 15% 15% 22% 21% 16% 17% 600 - 649 8% 7% 11% 12% 11% 9% 550 - 599 3% 4% 7% 7% 7% 5% 500 - 549 3% 3% 4% 5% 6% 4% 450 - 499 0% 1% 1% 2% 1% 1% 400 - 449 0% 0% 0% 0% 0% 0% Other 1% 1% 3% 1% 2% 1% Total 100% 100% 100% 100% 100% 100% Avg. Score 738 725 728 686 694 716 Consumer Portfolio - Score Distribution By Product |

27 Consumer Portfolio Consumer Portfolio Credit Score Distribution Credit Score Distribution Note: Excludes Credit Cards Note: Excludes Credit Cards 0% 5% 10% 15% 20% 25% 30% 35% 40% 800+ 750 - 799 700 - 749 650 - 699 600 - 649 550 - 599 500 - 549 450 - 499 400 - 449 Other Credit Score Pulaski IBERIABANK Cumulative Below Prime = 16% Cumulative Prime = 83% Unscored = 1% |

28 Consumer Consumer Portfolio Portfolio Past Dues Past Dues By Product By Product Generally Generally Good Good Quality, But Quality, But Recent Recent Softness Softness 12/31/07 3/31/08 6/30/08 9/30/08 12/31/08 3/31/09 Home Equity Lines of Credit 30 to 59 Days Past Due 0.44% 1.10% 0.34% 0.31% 0.24% 0.68% 60 to 89 Days Past Due 0.15% 0.04% 0.02% 0.15% 0.13% 0.07% Over 90 Days Past Due 0.00% 0.10% 0.06% 0.09% 0.11% 0.11% Total 30+ Days Past Due 0.59% 1.24% 0.43% 0.55% 0.48% 0.86% Net Charge-Offs 0.12% 0.00% 0.02% 0.01% 0.15% 0.23% Home Equity Term Loans 30 to 59 Days Past Due 0.96% 0.85% 0.35% 0.25% 0.80% 0.56% 60 to 89 Days Past Due 0.17% 0.07% 0.30% 0.18% 0.09% 0.17% Over 90 Days Past Due 0.13% 0.10% 0.11% 0.30% 0.05% 0.06% Total 30+ Days Past Due 1.26% 1.03% 0.77% 0.73% 0.93% 0.79% Net Charge-Offs -0.02% 0.04% 0.01% 0.04% 0.21% 0.13% Indirect Auto Loans 30 to 59 Days Past Due 0.71% 0.49% 0.34% 0.45% 0.59% 0.54% 60 to 89 Days Past Due 0.15% 0.08% 0.04% 0.12% 0.18% 0.12% Over 90 Days Past Due 0.12% 0.03% 0.07% 0.07% 0.05% 0.05% Non Accrual 0.27% 0.39% 0.33% 0.28% 0.30% 0.30% Total 30+ Days PD + NAs 1.24% 1.00% 0.78% 0.92% 1.12% 1.01% Net Charge-Offs 0.18% 0.45% 0.14% 0.20% 0.44% 0.43% Credit Card Loans 30 to 59 Days Past Due 0.36% 0.49% 0.35% 0.49% 0.49% 0.27% 60 to 89 Days Past Due 0.10% 0.26% 0.30% 0.21% 0.45% 0.38% Over 90 Days Past Due 0.36% 0.68% 0.37% 0.45% 0.61% 0.99% Total 30+ Days Past Due 0.82% 1.44% 1.02% 1.15% 1.55% 1.63% Net Charge-Offs 0.71% 2.95% 1.57% 1.05% 1.34% 2.83% Other Consumer Loans 30 to 59 Days Past Due 1.53% 1.63% 1.20% 0.76% 1.20% 1.07% 60 to 89 Days Past Due 0.36% 0.29% 0.90% 0.46% 0.35% 0.15% Over 90 Days Past Due 0.15% 0.14% 0.10% 0.53% 0.82% 0.12% Total 30+ Days Past Due 2.04% 2.05% 2.20% 1.74% 2.37% 1.34% Net Charge-Offs 0.69% 0.66% 1.36% 1.55% 1.88% 2.03% Consumer Portfolio - Quarterly Credit Statistics Loans Past Due As % Of Product Loans |

29 Consumer Portfolio Consumer Portfolio By Product – By Product – Origination Mix Origination Mix 15% 32% 31% 22% 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% 1Q06 2Q06 3Q06 4Q06 1Q07 2Q07 3Q07 4Q07 1Q08 2Q08 3Q08 4Q08 1Q09 Quarter Originations - Product Total % Home Equity 2nd Home Equity 1st HELOC 2nd HELOC 1st |

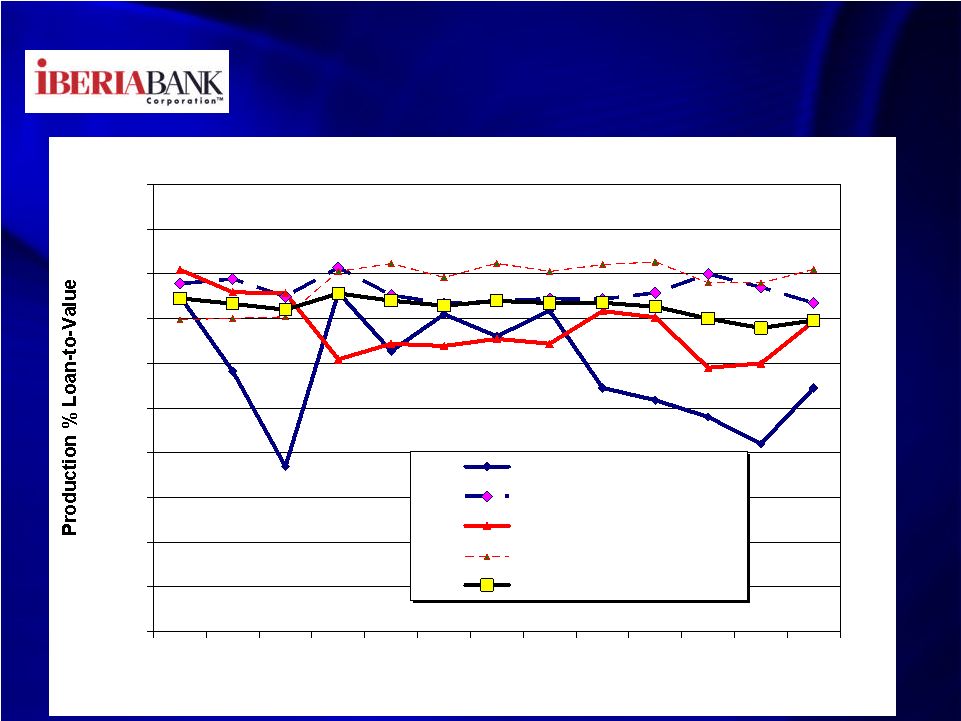

30 Consumer Portfolio Consumer Portfolio By Product – By Product – Loan-To-Values Loan-To-Values Loan-to-Values At Time Of Origination 55% 81% 69% 74% 70% 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% 1Q06 2Q06 3Q06 4Q06 1Q07 2Q07 3Q07 4Q07 1Q08 2Q08 3Q08 4Q08 1Q09 Quarter HELOC 1st HELOC 2nd Home Equity 1st Home Equity 2nd Total |

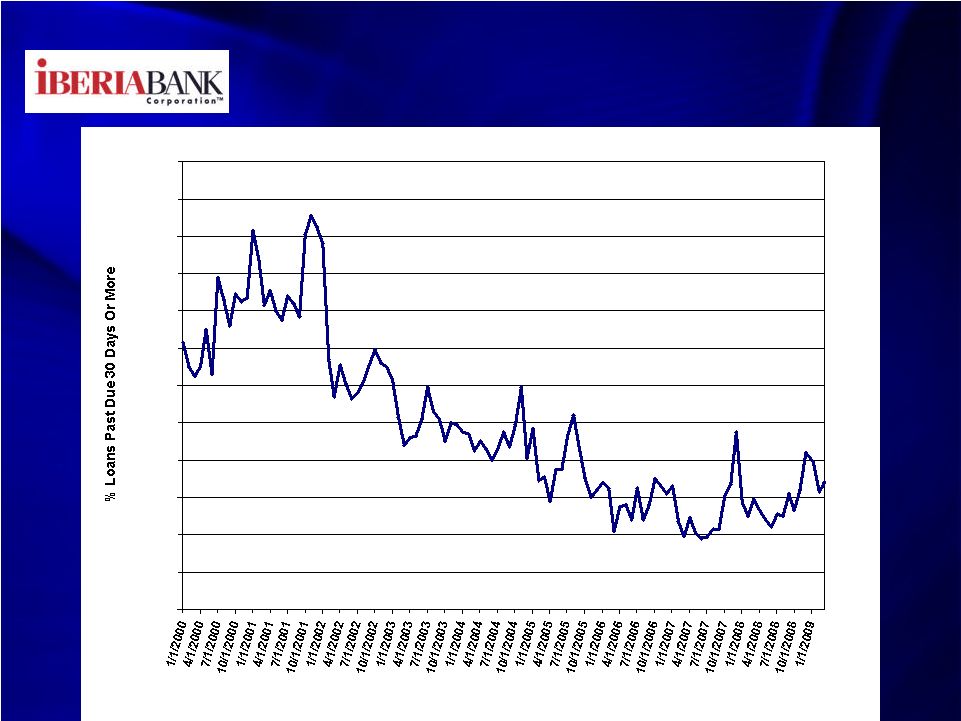

31 Consumer Portfolio Consumer Portfolio Indirect – Indirect – 30+ Days Past Dues 30+ Days Past Dues Loans Past Due 30 Days Or More 0.68% 0.00% 0.20% 0.40% 0.60% 0.80% 1.00% 1.20% 1.40% 1.60% 1.80% 2.00% 2.20% 2.40% Month Note: Excludes Nonaccruing Note: Excludes Nonaccruing Nonaccruing Loans Loans |

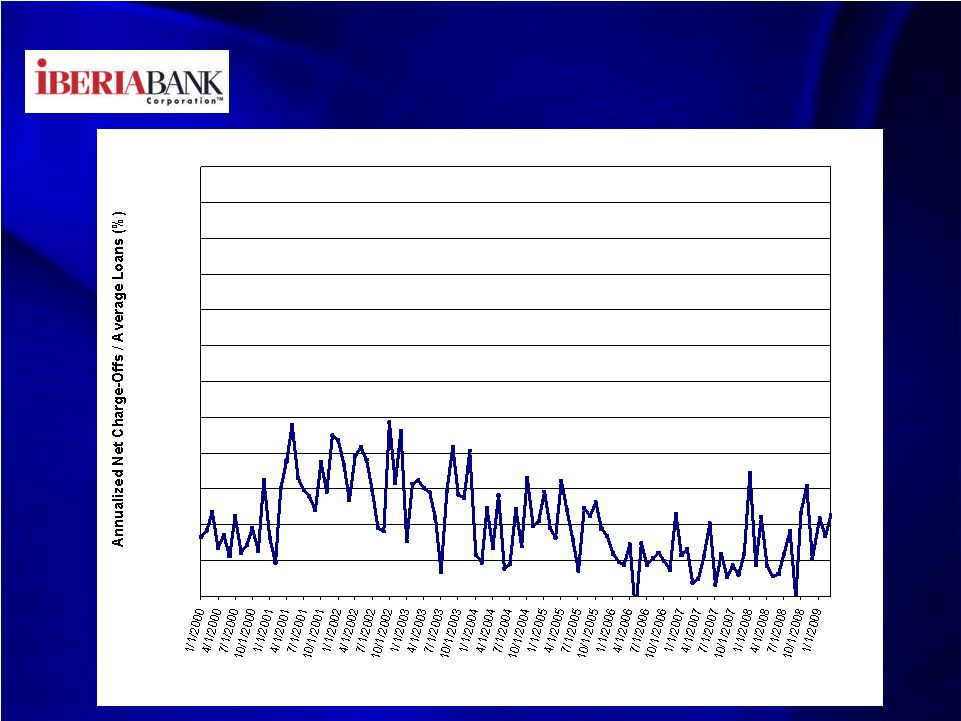

32 Consumer Portfolio Consumer Portfolio Indirect – Indirect – Net Charge-Offs Net Charge-Offs Annualized Net Charge-Offs As % Of Loans 0.45% 0.00% 0.20% 0.40% 0.60% 0.80% 1.00% 1.20% 1.40% 1.60% 1.80% 2.00% 2.20% 2.40% Month |

33 Financial Overview |

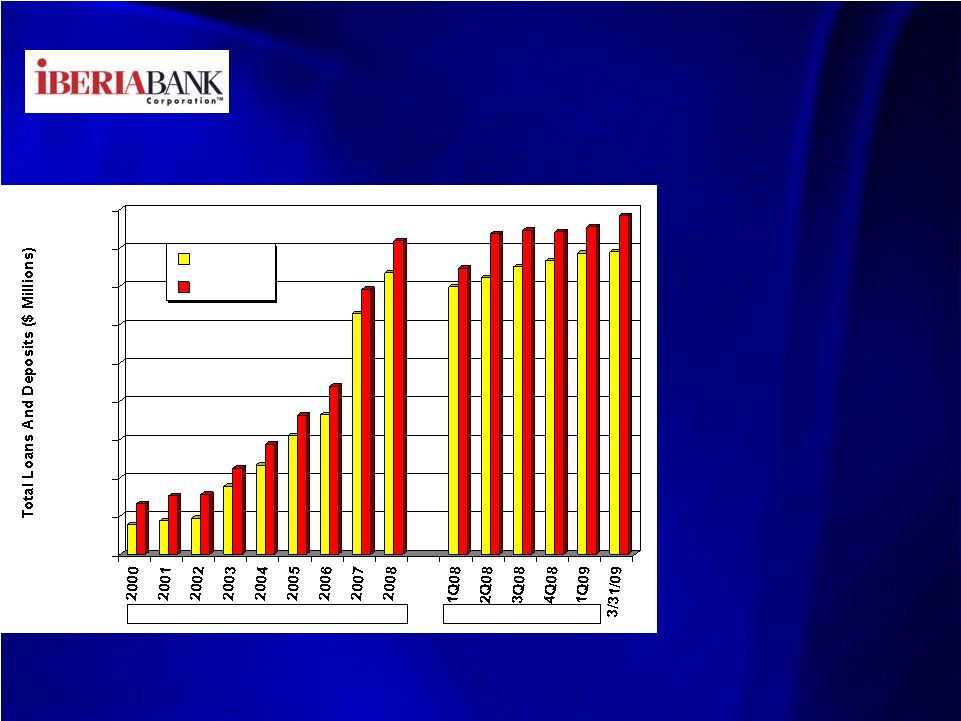

34 Financial Overview Financial Overview Favorable Balance Sheet Growth Favorable Balance Sheet Growth 1Q09 Results • Loans +$14mm, <+1% • Deposits +$138mm +3% • Loan/Deposits = 91% • Equity = -$79mm, -11%* • Equity/Assets = 11.82%* • Tier 1 Leverage = 9.16%* • Div Payout = 91%* • ROA = 0.67%* • ROE = 3.59%* • ROTE = 6.35%* • Efficiency Ratio = 73% • Tang Eff. Ratio = 70% • BV/Share = $40.98* • Tang BV/Share = $24.82* * Includes Impact Of Deemed * Includes Impact Of Deemed Dividends For TARP In 1Q09 Dividends For TARP In 1Q09 $600 $1,000 $1,400 $1,800 $2,200 $2,600 $3,000 $3,400 $3,800 $4,200 Loans Deposits Quarterly Averages Annual Average Balances -1% 20% 17 17% 22% 34% 1% 3% 7% 4% 13% 15% 12% 17 15% 14% 52% 43% 23% 15% 15% 12% 16% 11% 9% 14% 10% 12% |

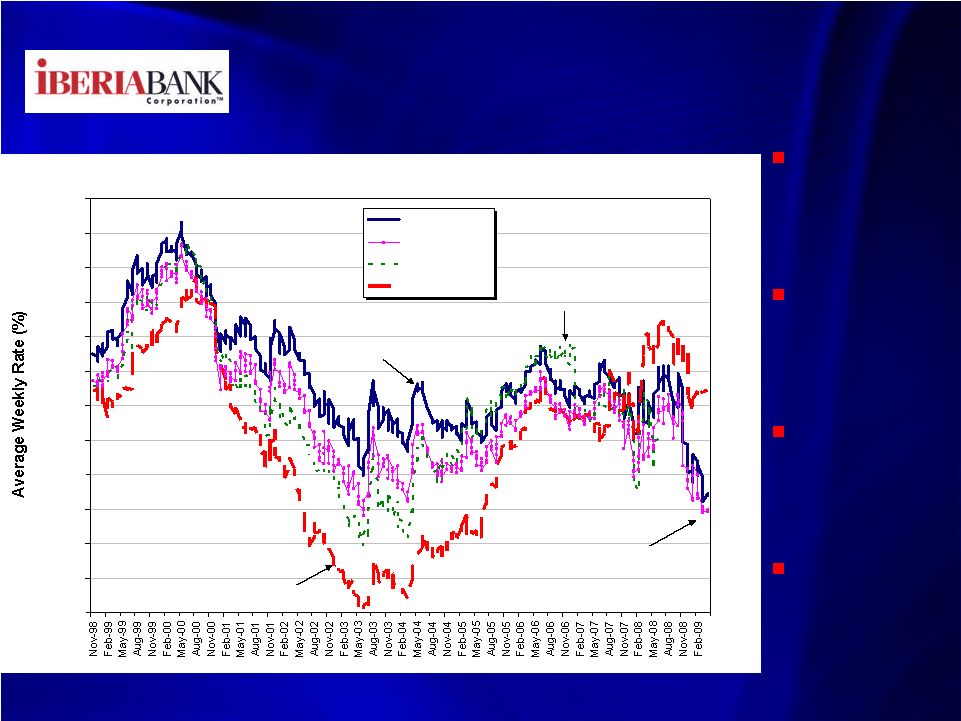

35 Financial Overview Financial Overview Trends - Trends - Mortgage Interest Rates Mortgage Interest Rates Source: Bloomberg Source: Bloomberg Substantial Substantial Drop In Drop In Conforming Conforming Rates Rates Blistering Blistering Refi Refi Activity Activity – – Greatest Greatest Since 2003 Since 2003 Sales Sales Spreads Spreads Remain Remain Favorable Favorable Improved Improved Competitive Competitive Dynamics In Dynamics In Mortgage Mortgage Business Business Mortgage Interest Rate Trend 4.70% 4.46% 6.21% 3.00% 3.50% 4.00% 4.50% 5.00% 5.50% 6.00% 6.50% 7.00% 7.50% 8.00% 8.50% 9.00% 30-year 15-year 5/1 ARM 1-Year ARM 30-Year Fixed 1-Year ARM 5/1 ARM 15-Year Fixed |

36 Financial Overview Financial Overview Trends – Trends – Jumbo Mortgage Rates Jumbo Mortgage Rates Source: Bloomberg Source: Bloomberg Subprime Mtg. Subprime Mtg. Market Gone & Market Gone & Alt-A Market Is Alt-A Market Is Stalled Stalled Jumbo Spread Jumbo Spread Is Very Wide Is Very Wide Shifted These Shifted These Products To Products To FHA/VA & FHA/VA & Conforming Conforming In March 2009, In March 2009, 35% Of Our 35% Of Our Production Production Was FHA/VA Was FHA/VA And 60% Was And 60% Was Conventional Conventional Weekly National 30-Year Mortgage Rates 4.86% 6.37% 4.60% 4.85% 5.10% 5.35% 5.60% 5.85% 6.10% 6.35% 6.60% 6.85% 7.10% 7.35% 7.60% 7.85% 8.10% 8.35% 8.60% Conforming Jumbo 151 bps |

37 Financial Overview Financial Overview Mortgage Quarterly Revenues Mortgage Quarterly Revenues In 1Q09 Closed In 1Q09 Closed $419mm (+129% $419mm (+129% Vs. 4Q08) Vs. 4Q08) In 1Q09 Sold In 1Q09 Sold $400mm (+112% $400mm (+112% Vs. 4Q08) Vs. 4Q08) Highest Qtrly Highest Qtrly Revenues In Revenues In Company History Company History 1Q09 Vs. 4Q08: 1Q09 Vs. 4Q08: +99% Increase In +99% Increase In Mtg. Revenues Mtg. Revenues $150mm Locked $150mm Locked Pipeline 4/17/09 Pipeline 4/17/09 $- $0.5 $1.0 $1.5 $2.0 $2.5 $3.0 $3.5 $4.0 $4.5 $5.0 $5.5 $6.0 $6.5 2003 2004 2005 2006 2007 2008 2009 Mortgage Gains On Sale Of Loans 1st Qtr 2nd Qtr 3rd Qtr 4th Qtr ** ** Assumes Pulaski's acquisition of IBERIABANK Mortgage beginning in February 2007 |

38 Financial Overview Financial Overview Title Insurance Qtrly Title Insurance Qtrly Revenues Revenues Title & Mortgage Title & Mortgage Footprints Don’t Footprints Don’t Necessarily Necessarily Overlap Overlap 1Q09: $4.5mm In 1Q09: $4.5mm In Revenues (+18% Revenues (+18% Vs. 4Q08) Vs. 4Q08) Significant Order Significant Order Count Growth As Count Growth As Refinance Wave Refinance Wave Continues Continues $- $0.5 $1.0 $1.5 $2.0 $2.5 $3.0 $3.5 $4.0 $4.5 $5.0 $5.5 $6.0 $6.5 2003 2004 2005 2006 2007 2008 2009 Title Insurance Revenues 1st Qtr 2nd Qtr 3rd Qtr 4th Qtr * * Includes United Title in April 2007 ** ** Includes American Abstract in March 2008 |

39 Financial Overview Financial Overview Quarterly Repricing Schedule Quarterly Repricing Schedule Excess Cash Methodically Being Deployed Excess Cash Methodically Being Deployed Favorable Deposit Repricing Opportunities Favorable Deposit Repricing Opportunities Paid Off S/T Borrowings With Strong Deposit Growth Paid Off S/T Borrowings With Strong Deposit Growth 2Q09 3Q09 4Q09 1Q10 2Q10 Cash Equivalents 107.6 $ - $ - $ - $ - $ 0.25% 0.00% 0.00% 0.00% 0.00% Investments 166.5 $ 113.5 $ 100.4 $ 84.7 $ 63.2 $ 3.39% 4.95% 4.97% 4.40% 4.76% Loans 1,698.2 $ 210.6 $ 162.8 $ 149.3 $ 126.0 $ 3.57% 6.30% 6.44% 6.38% 6.59% Time Deposits 330.1 $ 320.6 $ 297.4 $ 138.9 $ 123.3 $ 2.56% 2.98% 2.53% 2.95% 2.63% Borrowed Funds 306.0 $ 58.0 $ 31.5 $ 20.2 $ 24.8 $ 2.10% 4.79% 5.37% 5.37% 5.24% |

40 Base Blue Forward Change In: -200 bp -100 bp Case +100 bp +200 bp Chip Curve Net Interest Income -4% -3% 0% 6% 10% 1% 3% Economic Value of Equity -15% -6% 0% 4% 6% -- -- Financial Overview Financial Overview Interest Rate Simulations Interest Rate Simulations Source: Bancware model, as of March 31, 2009 As Rates Have Fallen, Become More Asset Sensitive As Rates Have Fallen, Become More Asset Sensitive Degree Is A Function Of The Reaction Of Competitors To Degree Is A Function Of The Reaction Of Competitors To Changes In Deposit Pricing Changes In Deposit Pricing Forward Curve Has A Positive Impact Over 12 Months Forward Curve Has A Positive Impact Over 12 Months |

41 Markets |

42 Markets Markets Memphis Opportunity Memphis Opportunity $28 Billion Deposit Memphis Market $28 Billion Deposit Memphis Market - - A A Unique Growth Opportunity Unique Growth Opportunity Large & Small Banks Have Experienced Difficulties Large & Small Banks Have Experienced Difficulties Currently Recruited 7 Team Members Currently Recruited 7 Team Members $22mm Deposits, $86mm In Credit Commitments & $80mm Pipeline $22mm Deposits, $86mm In Credit Commitments & $80mm Pipeline Source: FDIC For Memphis MSA At June 30, 2008 Source: FDIC For Memphis MSA At June 30, 2008 First Horizon 36.6% Regions 15.2% SunTrust 8.2% BancorpSouth 3.9% Bank of America 3.5% |

43 Markets - Markets - Branches Branches Branch Expansion Initiative Branch Expansion Initiative Period-End Loan And Deposit Volumes 13 Offices 13 Offices 1Q09 Loans 1Q09 Loans Of $146 mm Of $146 mm (+65% Over (+65% Over 1-Year) 1-Year) 1Q09 1Q09 Deposits Of Deposits Of $207 mm $207 mm (+22% Over (+22% Over 1-Year) 1-Year) Closed One Closed One Office Office (Prairieville) (Prairieville) $- $25 $50 $75 $100 $125 $150 $175 $200 $225 Deposits Loans |

44 Markets – Markets – Branches Branches Historical Office Optimization Historical Office Optimization Entered 3 New Markets Entered 3 New Markets Acquired 12 Offices (All) Acquired 12 Offices (All) Closed/Consolidated 18 Closed/Consolidated 18 Offices (All Types) Offices (All Types) Opened 10 New Bank Opened 10 New Bank Offices Offices Opened 7 Mortgage Opened 7 Mortgage Offices Offices Divested/Sold 1 Office Divested/Sold 1 Office 5 Office Realignments 5 Office Realignments Entered 13 New Markets Entered 13 New Markets Acquired 94 Offices (All) Acquired 94 Offices (All) Closed/Consolidated 23 Closed/Consolidated 23 Offices (All Types) Offices (All Types) Opened 12 New Bank Opened 12 New Bank Offices Offices Opened 7 Mortgage Opened 7 Mortgage Offices Offices Opened 1 Title Office Opened 1 Title Office 11 Office Realignments 11 Office Realignments 1999 Through 2005 1999 Through 2005 Since 2005 Since 2005 |

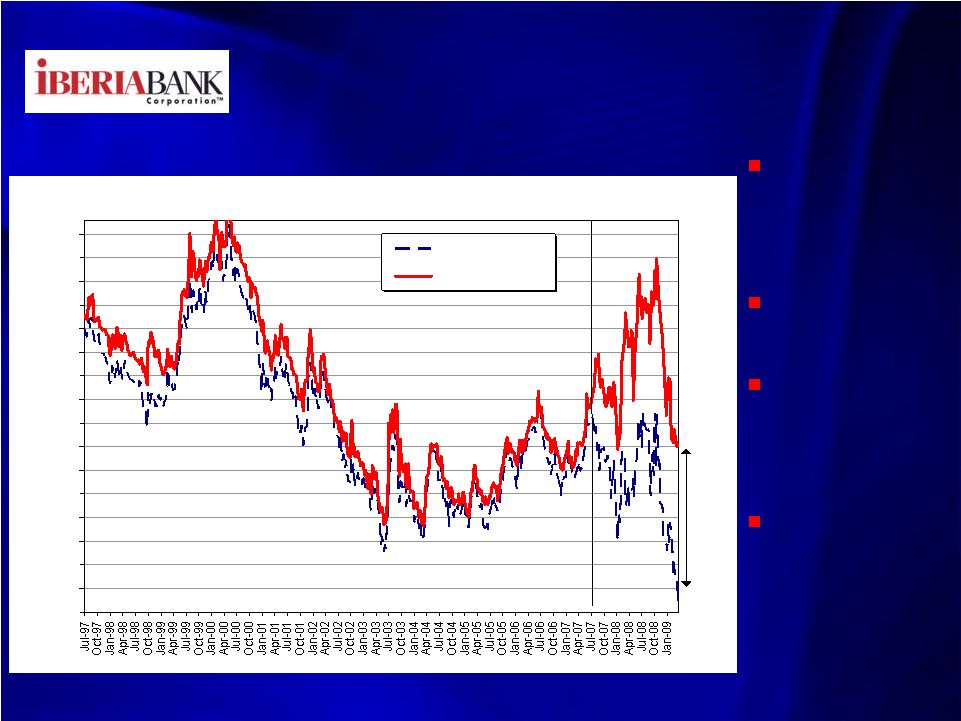

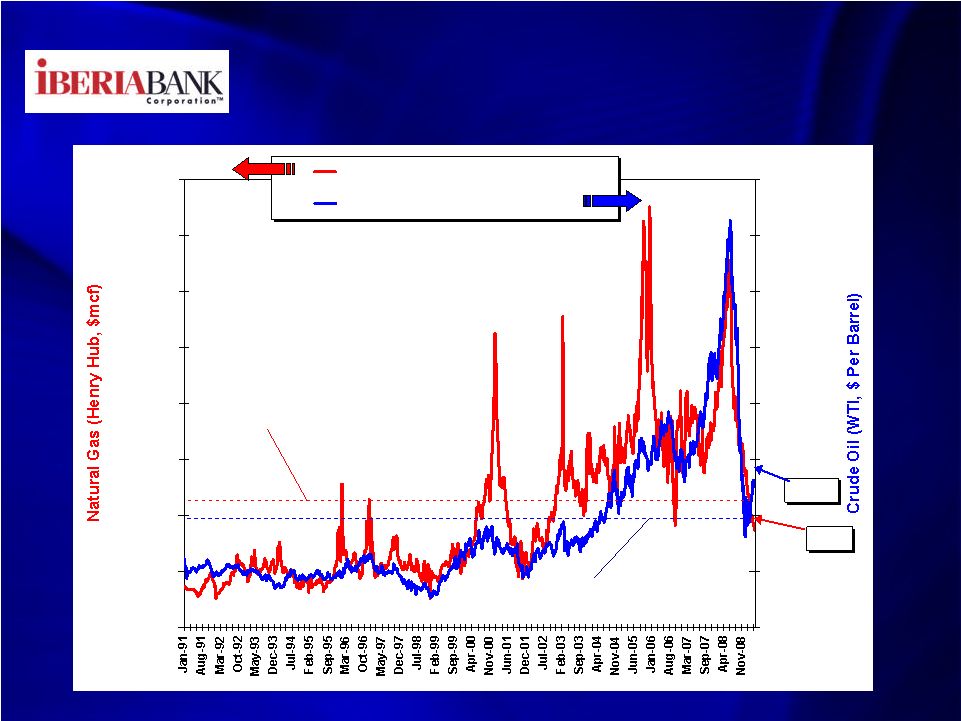

45 Markets – Markets – Local Economies Local Economies Oil & Gas Impact Oil & Gas Impact Source: Bloomberg Source: Bloomberg $3.47 $50.33 $- $2.00 $4.00 $6.00 $8.00 $10.00 $12.00 $14.00 $16.00 $- $20.00 $40.00 $60.00 $80.00 $100.00 $120.00 $140.00 $160.00 Natural Gas (Left Scale) Crude Oil (Right Scale) Natural Gas Crude Oil Natural Gas Average = $4.03 Crude Oil Average = $34.82 |

46 Markets – Markets – Local Economies Local Economies Unemployment – Unemployment – Vs. U.S. MSAs Vs. U.S. MSAs Source: U.S. Department of Labor, Bureau of Labor Statistics Source: U.S. Department of Labor, Bureau of Labor Statistics Curve Has Curve Has Continued Continued To Shift To Shift Upward Upward Belly Of The Belly Of The Curve Hit Curve Hit Worst Worst Consistently Consistently Low Rates Of Low Rates Of Unemploy- Unemploy- ment ment In Our In Our MSAs MSAs Many Of Our Many Of Our Markets Markets Showed Showed Relative Relative Improvement Improvement Ranking 372 U.S. MSAs February 2009 Unemployment Rates (Blue) Dashed Lines: Nov 07, Feb 08, Aug 08 & Nov 08 - 2.0 4.0 6.0 8.0 10.0 12.0 14.0 16.0 18.0 20.0 1 11 21 31 41 51 61 71 81 91 101 111 121 131 141 151 161 171 181 191 201 211 221 231 241 251 261 271 281 291 301 311 321 331 341 351 361 371 8.9% U.S. Avg = 8.9% #1 Houma, LA 3.5% #4 Lafayette, LA 3.9% #24 Baton Rouge, LA 5.1% #40 Alexandria, LA 5.5% #31 New Orleans, LA 5.3% #85 Shreveport, LA 6.8% #46 NW AR 5.8% #56 Little Rock, AR 6.0% #82 Jonesboro, AR 6.7% #207 Memphis, TN 8.9% Nov 07 Feb 08 #17 Lake Charles, LA 4.9% #50 Monroe, LA 5.9% % Feb 09 Aug 08 Nov 08 #71 Houston, TX 6.4% #177 Mobile, AL 8.5% |

47 Markets – Markets – Local Economies Local Economies Housing’s Share Of State GDP Housing’s Share Of State GDP Source: NAHB; Figures represent 2005 levels as indicative of peak period US Average: 16.6% Arkansas: 12.4% Mississippi: 12.1% Louisiana: 9.4% 5.0% 10.0% 15.0% 20.0% 25.0% 30.0% Nevada Hawaii Florida Arizona California Maryland Colorado Idaho Montana Oregon New Jersey Virginia Washington New Vermont Rhode Island Utah Maine South Carolina Massachusett United States Illinois Minnesota New York Georgia North Carolina Wisconsin Michigan Connecticut Tennessee Pennsylvania Missouri New Mexico Ohio Indiana Alabama Kentucky Kansas Wyoming West Virginia Arkansas Iowa Oklahoma Mississippi Nebraska Texas Delaware South Dakota North Dakota District of Alaska Louisiana Housing Share Of State GDP Nationwide, Housing Peaked In 2005 Housing Was A Substantial Contributor To State Economic Growth--Now Working In Reverse Our Markets: Minimal Impact |

48 Markets – Markets – Local Economies Local Economies Freddie Mac – Freddie Mac – Regional Prices Regional Prices FHLMC, “National Home-Value Drop Accelerated FHLMC, “National Home-Value Drop Accelerated in Fourth Quarter”, February 27, 2009 in Fourth Quarter”, February 27, 2009 Last 5-Year Housing Price Last 12 4Q08 vs. Region States Included Change Months 3Q08 West South Central LA, AR, TX, OK 23.5% -0.1% -1.6% East South Central TN, AL, MS, KY 19.8% -2.7% -2.3% Middle Atlantic NY, NJ, PA 27.2% -4.1% -2.7% West North Central IA, KS, MN, MO, ND, NE, SD 9.1% -3.8% -3.0% New England CT, MA, ME, NH, RI, VT 7.3% -6.6% -3.3% East North Central IL, IN, MI, OH, WI -0.1% -5.8% -4.9% Mountain AZ, CO, ID, MT, NM, NV, UT, WY 24.6% -9.2% -5.0% South Atlantic NC, SC, FL, GA, VA, MD, WV, DC, DE 16.7% -11.4% -6.5% Pacific CA, OR, WA, HI, AK 4.6% -23.0% -8.1% United States 12.8% -9.5% -4.8% Source: Freddie Mac Source: Freddie Mac |

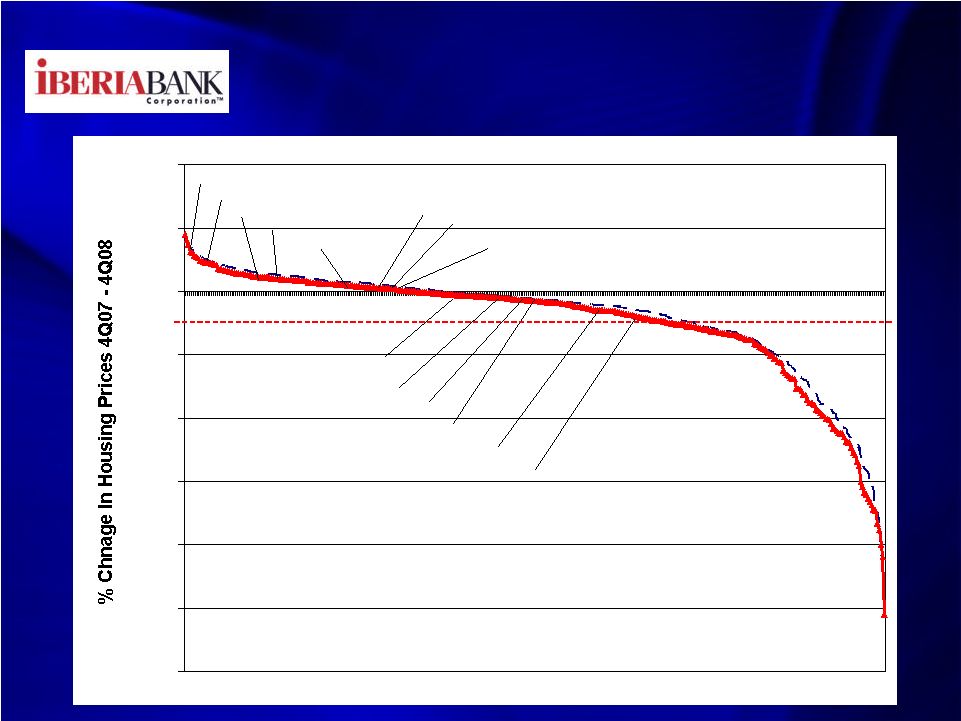

49 Markets – Markets – Local Economies Local Economies Housing Price Change Vs. U.S. MSAs Housing Price Change Vs. U.S. MSAs -60% -50% -40% -30% -20% -10% 0% 10% 20% 1 21 41 61 81 101 121 141 161 181 201 221 241 261 281 301 321 341 361 381 Source: Freddie Mac 4Q08 Data #117 Houma +0.2% #51 Shreveport +2.0% #144 Baton Rouge -0.5% #95 Little Rock +0.8% #182 Alexandria -1.3% #40 Lake Charles +2.3% #5 Monroe +6.1% #119 Mobile +0.1% #103 Jonesboro +0.6% #14 Houston +4.5% #249 NW Arkansas -4.1% #191 New Orleans -1.5% #222 Memphis -2.8% #177 Lafayette -1.1% -4.6% Average of MSAs |

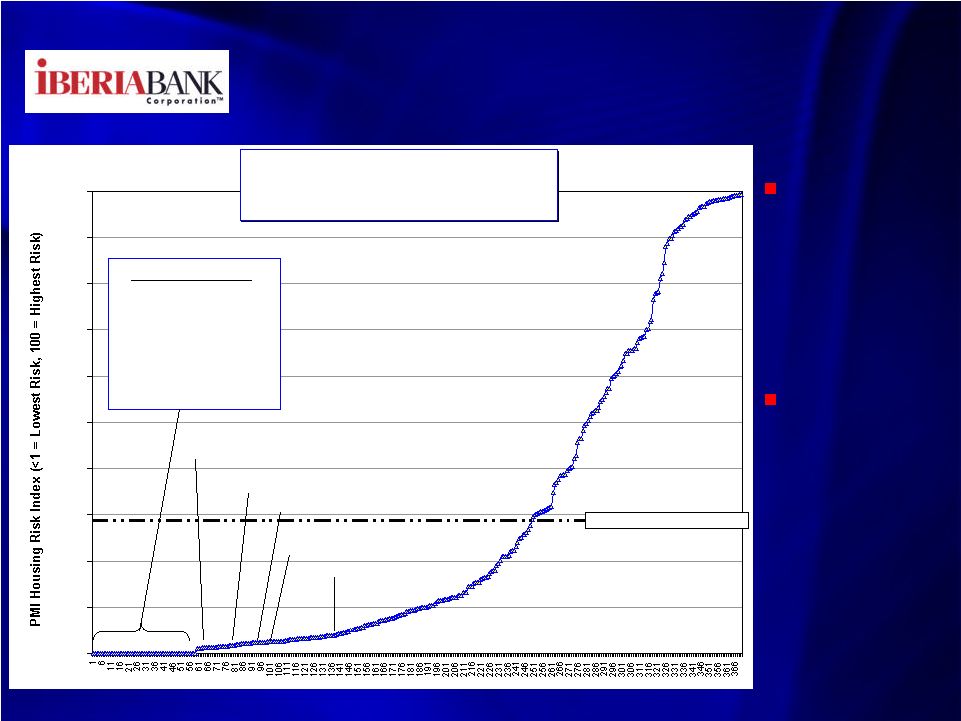

50 Markets – Markets – Local Economies Local Economies House Price Decline Probability House Price Decline Probability Local Housing Local Housing Prices Did Not Prices Did Not Escalate Escalate Rapidly, So Rapidly, So Little House Little House Price “Snap- Price “Snap- Back” Back” According To According To PMI, Our PMI, Our Markets Have Markets Have Some Of The Some Of The Lowest Lowest Probabilities Probabilities To Exhibit To Exhibit Housing Price Housing Price Declines Over Declines Over Next 2 Years Next 2 Years Source: PMI Economic Real Estate Trends, Winter 2009 Source: PMI Economic Real Estate Trends, Winter 2009 Ranking 381 U.S. MSAs PMI Housing Risk Index Probability That House Prices Will Be Lower In 2 Years 0 10 20 30 40 50 60 70 80 90 100 28.9 MSA Average = 28.9 Baton Rouge, LA 2.5 Alexandria, LA 1.3 New Orleans, LA 2.6 Lowest Ratings (<1.0): Houma, LA Jonesboro, AR, Lafayette, LA, Lake Charles, LA, Little Rock, AR, Monroe, LA, Shreveport, LA NW AR 4.3 Memphis, TN 2.1 |

51 Dallas, TX (Mortgage) Dallas, TX (Mortgage) Austin, TX Austin, TX Rochester, NY Rochester, NY San Antonio, TX San Antonio, TX Augusta, GA Augusta, GA Baton Rouge, LA Baton Rouge, LA Memphis, TN Memphis, TN Oklahoma City, OK Oklahoma City, OK Albany, NY Albany, NY Indianapolis, IN Indianapolis, IN Columbia, SC Columbia, SC Scranton, PA Scranton, PA Omaha, NE Omaha, NE Markets – Markets – Local Economies Local Economies Forbes – Forbes – Strongest Housing Mkts Strongest Housing Mkts McAllen, TX McAllen, TX Syracuse, NY Syracuse, NY Pittsburgh, PA Pittsburgh, PA Buffalo, NY Buffalo, NY El Paso, TX El Paso, TX Tulsa, OK (Mortgage) Tulsa, OK (Mortgage) Houston, TX Houston, TX Charleston, SC Charleston, SC Little Rock, AR Little Rock, AR Birmingham, AL Birmingham, AL Ft. Worth, TX Ft. Worth, TX New Orleans, LA New Orleans, LA Forbes, “America’s 25 Strongest Housing Markets, January 7, 2009: Forbes, “America’s 25 Strongest Housing Markets, January 7, 2009: |

52 Summary Of IBKC Summary Of IBKC Industry Operating Environment--Challenging Industry Operating Environment--Challenging • • Housing Housing • • Credit Risk Credit Risk • • Interest Rate Risk Interest Rate Risk • • Operations Risk Operations Risk We Tend To Move “Ahead Of The Curve” We Tend To Move “Ahead Of The Curve” Focus On Long-Term Investments & Payback Focus On Long-Term Investments & Payback Organic And External Growth Organic And External Growth Both Expense Control And Revenue Growth Both Expense Control And Revenue Growth EPS/Stock Price Linkage - EPS/Stock Price Linkage - Shareholder Focus Shareholder Focus Favorable Risk/Return Compared To Peers Favorable Risk/Return Compared To Peers |