Free signup for more

- Track your favorite companies

- Receive email alerts for new filings

- Personalized dashboard of news and more

- Access all data and search results

Filing tables

IBKC similar filings

- 17 Jun 09 Other Events

- 27 May 09 Other Events

- 20 May 09 Entry into a Material Definitive Agreement

- 6 May 09 Statements contained in this presentation which are

- 28 Apr 09 Departure of Directors or Certain Officers

- 24 Apr 09 Departure of Directors or Certain Officers

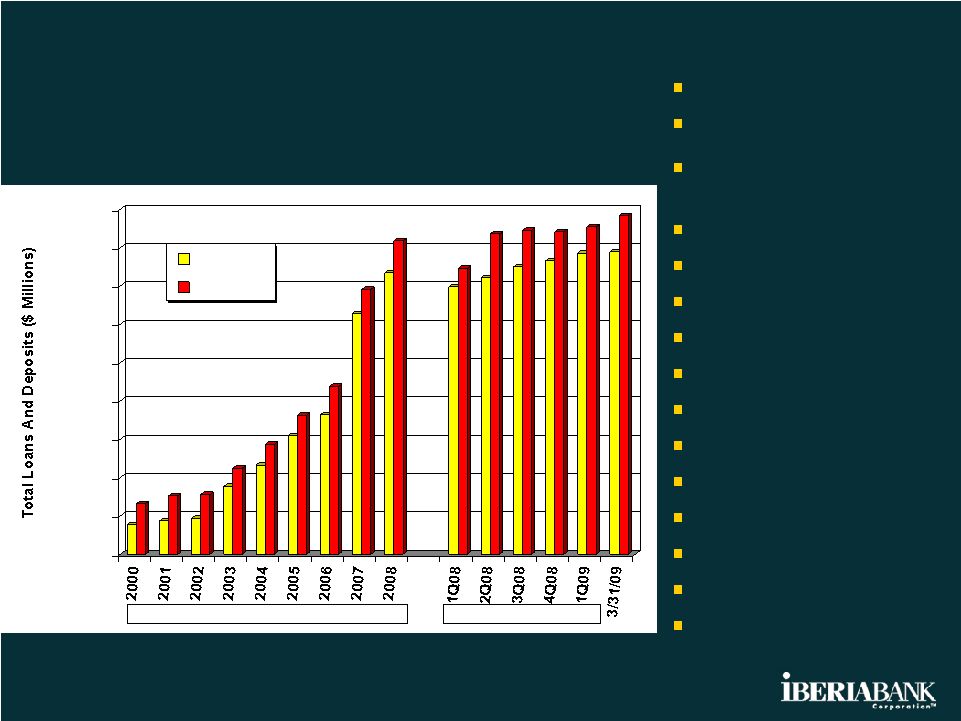

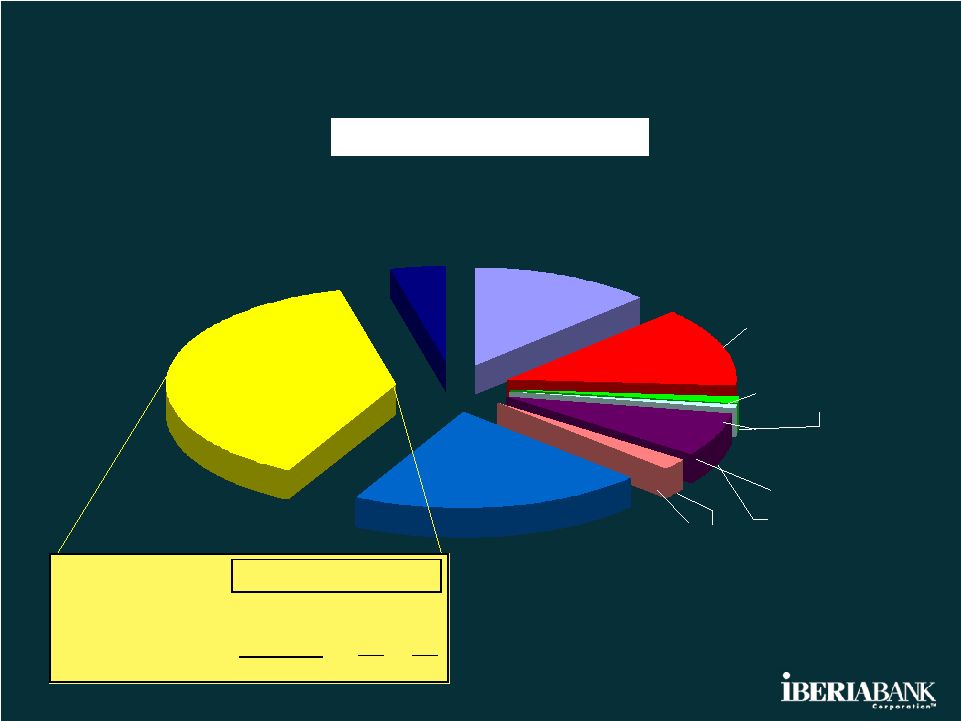

- 22 Apr 09 IBERIABANK Corporation Reports First Quarter 2009 Results

Filing view

External links