Exhibit 99.1

Once In A Blue Moon

Gulf South Bank Conference 2010

Forward Looking Statements Safe Harbor

Statements contained in this presentation which are not historical facts and which pertain to future operating results of IBERIABANK Corporation and its subsidiaries constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements involve significant risks and uncertainties. Actual results may differ materially from the results discussed in these forward-looking statements. Factors that might cause such a difference include, but are not limited to, those discussed in the Company’s periodic filings with the SEC.

Company Overview

3

IBKC Overview

Summary

Headquartered In Lafayette, Louisiana

Since 1887 – 2nd Oldest & 2nd Largest LA-Based Bank $10.4 Billion in Assets Market Cap of Approximately $1.7 Billion Relatively Strong Asset Quality Measures Conservative and We Don’t Cut Corners Minimize Loan Concentrations Core Funded Asset Sensitive Large Fee-Based Businesses Well Versed FDIC-Assisted Transactions Operations in 12 States

IBKC Overview

A Few Recent Activities

First FDIC-Assisted Acquisition (ANB In 2Q08) $110 Million Common Stock Issued (4Q08)

Added Teams In Mobile, New Orleans & Houston (1Q09) First In U.S. To Pay Back TARP Preferred Stock (1Q09) Second in U.S. To Buy Back TARP Warrants (2Q09) Changed Thrift Sub. Name To IBERIABANK fsb (2Q09) Second FDIC Acquisition (CapitalSouth In 3Q09) Added Team In Birmingham (3Q09) $165 Million Common Stock Issued (3Q09) Third & Fourth FDIC Acquisitions (Orion/Century In 4Q09) $329 Million Common Stock Issued (1Q10) Conversions of CapitalSouth And Century (4Q09 & 2Q10)

Markets

6

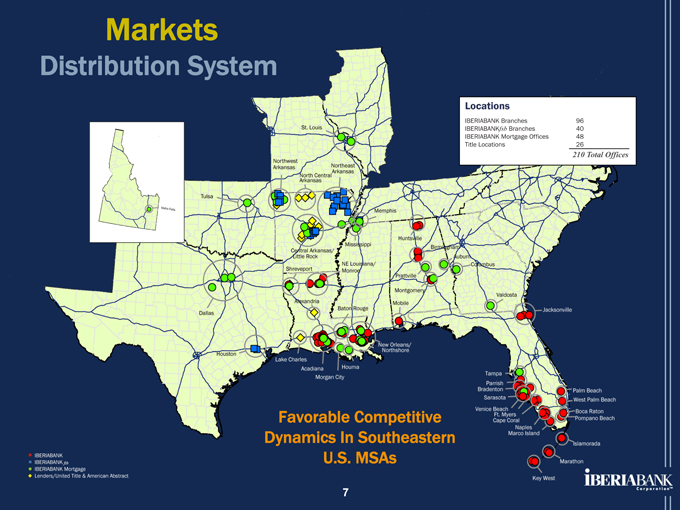

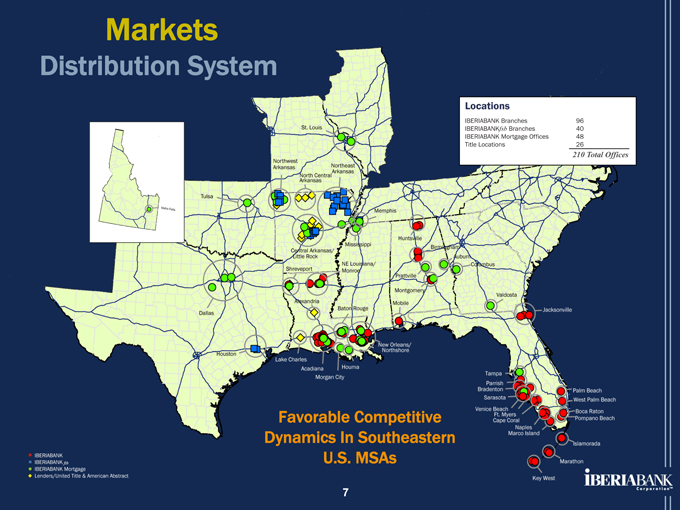

Markets

Distribution System

Locations

IBERIABANK Branches 96

IBERIABANKfsb Branches 40

IBERIABANK Mortgage Offices 48

Title Locations 26

210 Total Offices

Favorable Competitive Dynamics In Southeastern U.S. MSAs

7

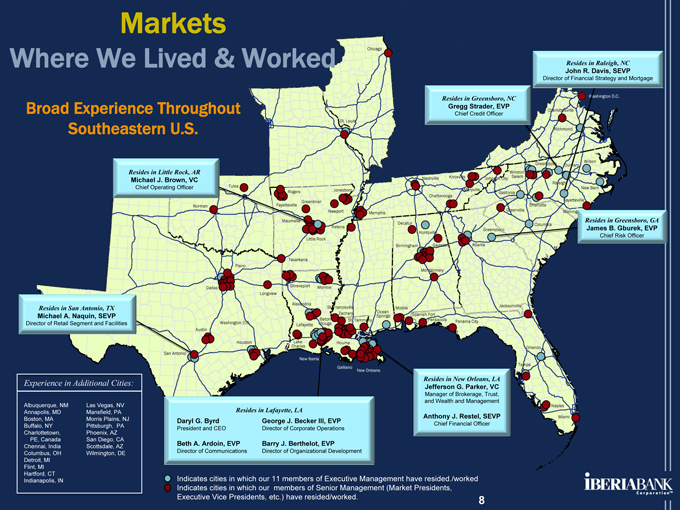

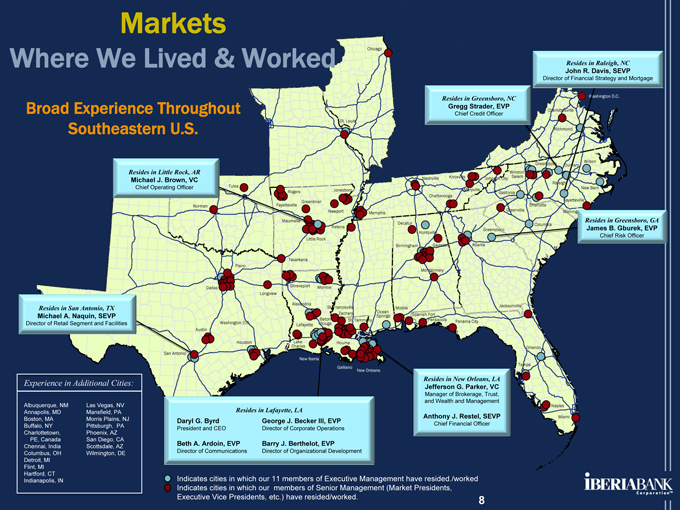

Markets

Where We Lived & Worked

Broad Experience Throughout Southeastern U.S.

Resides in Greensboro, NC

Gregg Strader, EVP

Chief Credit Officer

Resides in Raleigh, NC

John R. Davis, SEVP

Director of Financial Strategy and Mortgage

Resides in Little Rock, AR

Michael J. Brown, VC

Chief Operating Officer

Resides in San Antonio, TX

Michael A. Naquin, SEVP

Director of Retail Segment and Facilities

Resides in Greensboro, GA

James B. Gburek, EVP

Chief Risk Officer

Resides in Lafayette, LA

Daryl G. Byrd George J. Becker III, EVP

President and CEO Director of Corporate Operations

Beth A. Ardoin, EVP Barry J. Berthelot, EVP

Director of Communications Director of Organizational Development

Resides in New Orleans, LA

Jefferson G. Parker, VC

Manager of Brokerage, Trust, and Wealth and Management

Anthony J. Restel, SEVP

Chief Financial Officer

Experience in Additional Cities:

Albuquerque, NM Las Vegas, NV

Annapolis, MD Mansfield, PA

Boston, MA Morris Plains, NJ

Buffalo, NY Pittsburgh, PA

Charlottetown, Phoenix, AZ

PE, Canada San Diego, CA

Chennai, India Scottsdale, AZ

Columbus, OH Wilmington, DE

Detroit, MI

Flint, MI

Hartford, CT

Indianapolis, IN

Indicates cities in which our 11 members of Executive Management have resided./worked Indicates cities in which our members of Senior Management (Market Presidents, Executive Vice Presidents, etc.) have resided/worked. 8

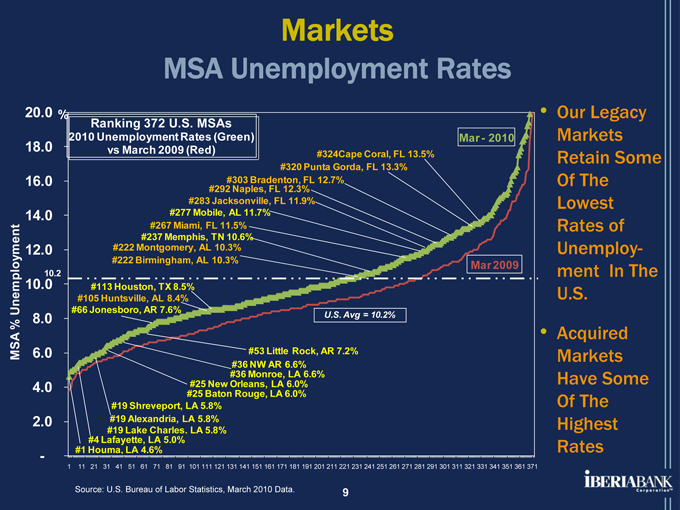

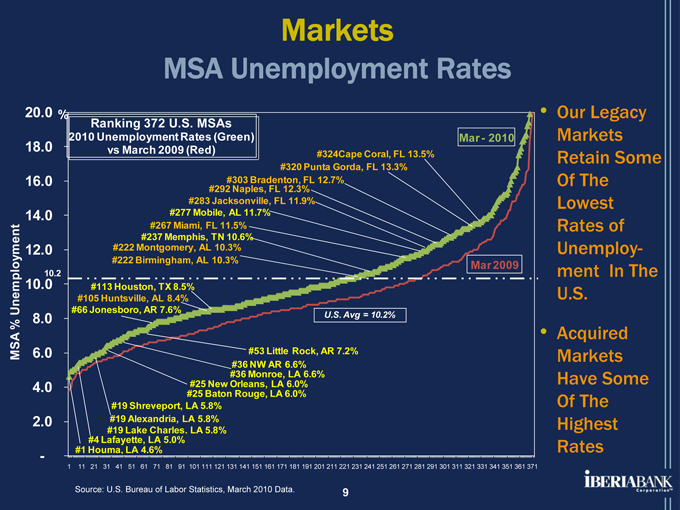

Markets

MSA Unemployment Rates

Ranking 372 U.S. MSAs 2010 Unemployment Rates (Green) vs March 2009 (Red)

20.0 % 18.0 16.0 14.0

12.0 10.0 10.2 8.0

6.0 4.0 2.0 -

MSA Unemployment%

#324Cape Coral, FL 13.5% #320 Punta Gorda, FL 13.3%

#292 #303 Naples, Bradenton, FL 12.3% FL 12.7% #283 Jacksonville, FL 11.9% #277 Mobile, AL 11.7% #267 Miami, FL 11.5% #237 Memphis, TN 10.6% #222 Montgomery, AL 10.3% #222 Birmingham, AL 10.3%

#113 Houston, TX 8.5% #105 Huntsville, AL 8.4% #66 Jonesboro, AR 7.6%

#53 Little Rock, AR 7.2% #36 NW AR 6.6% #36 Monroe, LA 6.6% #25 New Orleans, LA 6.0% #25 Baton Rouge, LA 6.0% #19 Shreveport, LA 5.8% #19 Alexandria, LA 5.8% #19 Lake Charles, LA 5.8%

#4 Lafayette, LA 5.0%

#1 Houma, LA 4.6%

U.S. Avg = 10.2%

Mar - 2010

Mar 2009

1 11 21 31 41 51 61 71 81 91 101 111 121 131 141 151 161 171 181 191 201 211 221 231 241 251 261 271 281 291 301 311 321 331 341 351 361 371

Our Legacy Markets Retain Some Of The Lowest Rates of Unemployment In The U.S.

Acquired Markets Have Some Of The Highest Rates

Source: U.S. Bureau of Labor Statistics, March 2010 Data. 9

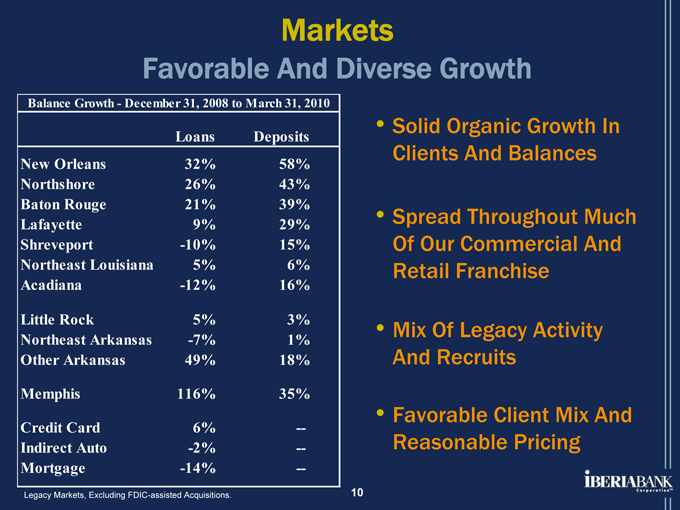

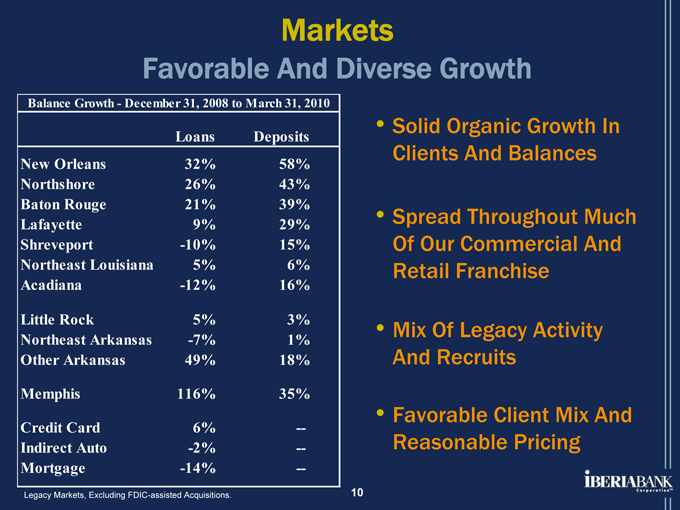

Markets

Favorable And Diverse Growth

Balance Growth - December 31, 2008 to March 31, 2010

Loans Deposits

New Orleans 32% 58%

Northshore 26% 43%

Baton Rouge 21% 39%

Lafayette 9% 29%

Shreveport -10% 15%

Northeast Louisiana 5% 6%

Acadiana -12% 16%

Little Rock 5% 3%

Northeast Arkansas -7% 1%

Other Arkansas 49% 18%

Memphis 116% 35%

Credit Card 6% -

Indirect Auto -2% -

Mortgage -14% -

Solid Organic Growth In Clients And Balances

Spread Throughout Much Of Our Commercial And Retail Franchise

Mix Of Legacy Activity And Recruits

Favorable Client Mix And Reasonable Pricing

Legacy Markets, Excluding FDIC-assisted Acquisitions.

10

Markets

Organic Growth And Recruiting

Commercial Banking Teams Formed In:

• Memphis

• Mobile

• Houston

• Birmingham

Commercial/ Retail Recruits Added In:

• New Orleans

• Lafayette

• Jonesboro

• Sarasota

• Naples

Mortgage Origination Teams Formed In:

• Montgomery

• Birmingham

• Auburn

• Columbus

• Valdosta

• Idaho Falls

• Tampa

• Ft. Myers

11

Asset Quality

12

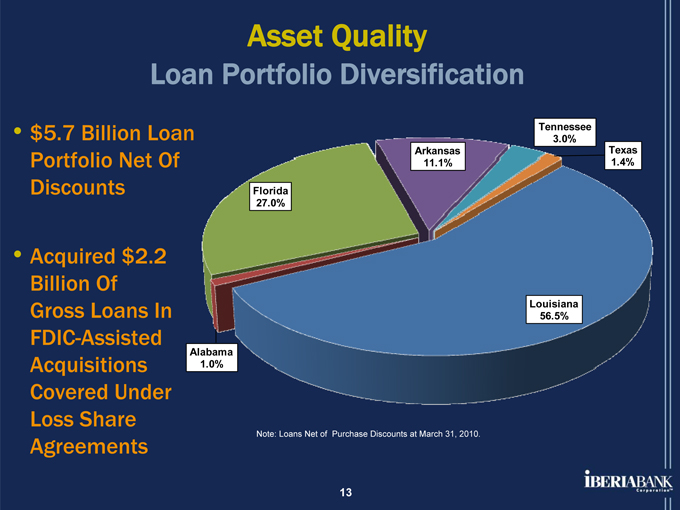

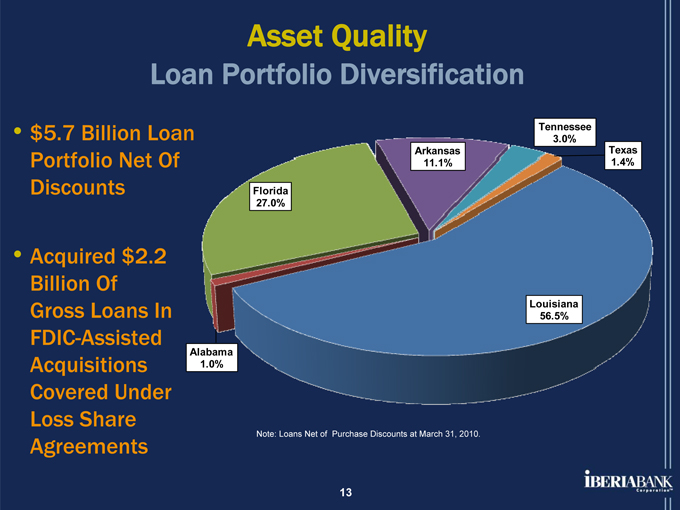

Asset Quality

Loan Portfolio Diversification

$5.7 Billion Loan Portfolio Net Of Discounts

Acquired $2.2 Billion Of Gross Loans In FDIC-Assisted Acquisitions Covered Under Loss Share Agreements

Tennessee 3.0%

Arkansas 11.1%

Florida 27.0%

Alabama 1.0%

Texas 1.4%

Louisiana 56.5%

Note: Loans Net of Purchase Discounts at March 31, 2010.

13

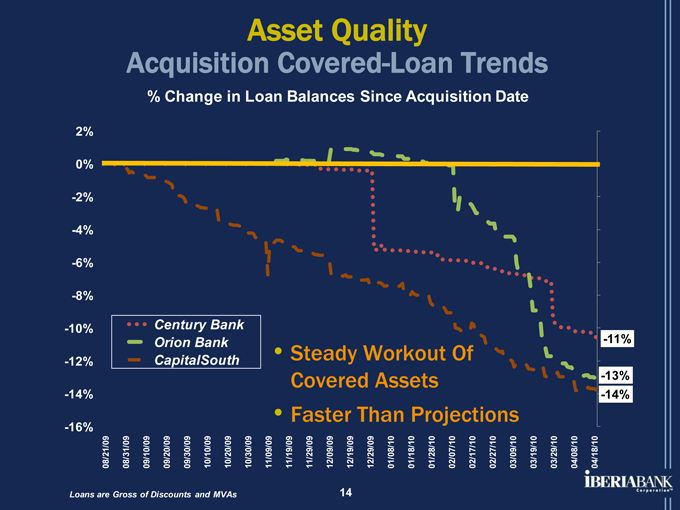

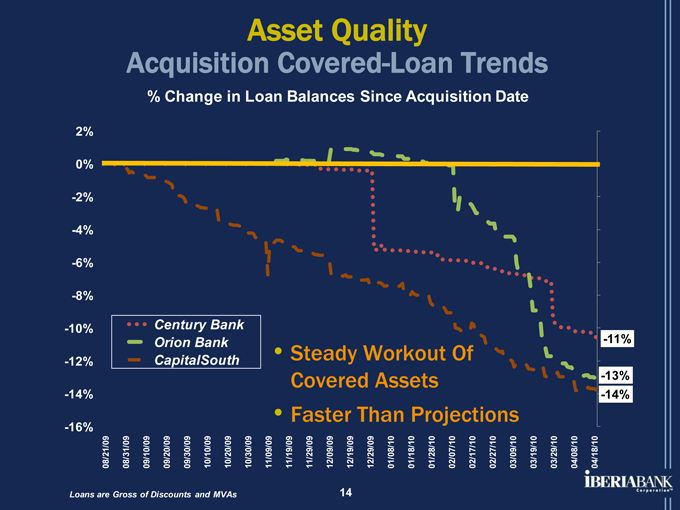

Asset Quality

Acquisition Covered-Loan Trends

% Change in Loan Balances Since Acquisition Date

2% 0% -2% -4% -6% -8% -10% -12% -14% -16%

Century Bank Orion Bank CapitalSouth

Steady Workout Of Covered Assets Faster Than Projections

-11%

-13% -14%

08/21/09 08/31/09 09/10/09 09/20/09 09/30/09 10/10/09 10/20/09 10/30/09 11/09/09 11/19/09 11/29/09 12/09/09 12/19/09 12/29/09 01/08/10 01/18/10 01/28/10 02/07/10 02/17/10 02/27/10 03/09/10 03/19/10 03/29/10 04/08/10 04/18/10

Loans are Gross of Discounts and MVAs

14

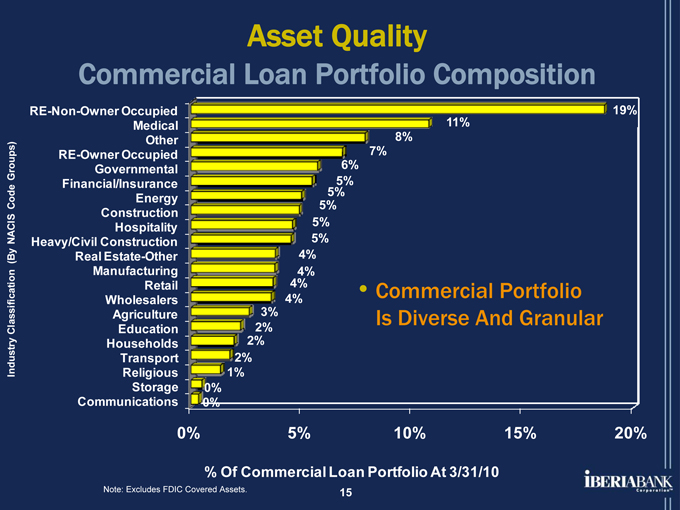

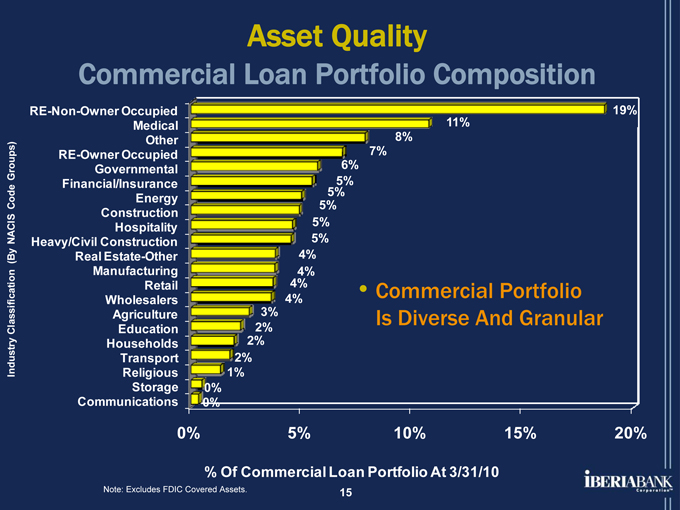

Asset Quality

Commercial Loan Portfolio Composition

RE-Non-Owner Occupied

Medical

Other

RE-Owner Occupied

Governmental

Financial/Insurance

Energy

Construction

Hospitality

Heavy/Civil Construction

Real Estate-Other

Manufacturing

Retail

Wholesalers

Agriculture

Education

Households

Transport

Religious

Storage

Communications

19% 11% 8% 7% 6%

5% 5% 5% 5% 5% 4% 4%

4% • Commercial Portfolio

4%

Is Diverse And Granular

3%

2% 2% 2% 1% 0% 0%

0% 5% 10% 15% 20%

% Of Commercial Loan Portfolio At 3/31/10

Note: Excludes FDIC Covered Assets.

Industry Classification (By NACIS Code Groups)

15

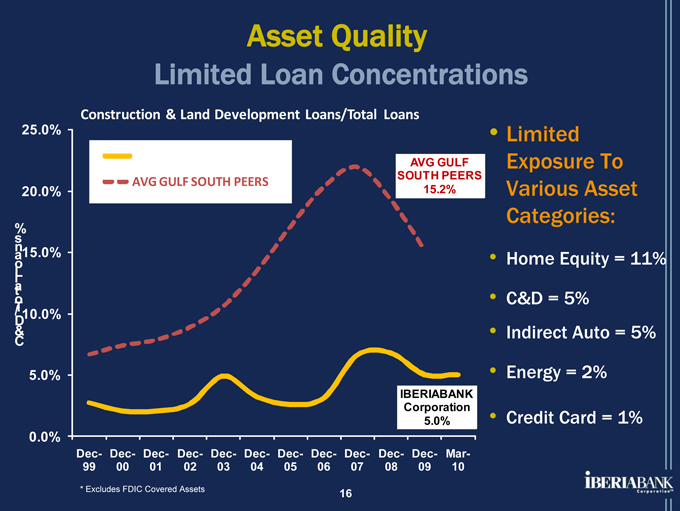

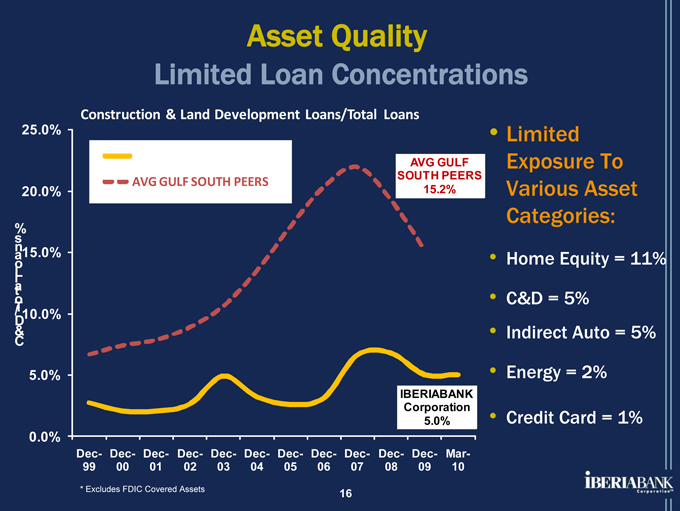

Asset Quality

Limited Loan Concentrations

Construction & Land Development Loans/Total Loans

25.0% 20.0% 15.0% 10.0% 5.0% 0.0%

AVG GULF SOUTH PEERS

AVG GULF SOUTH PEERS

15.2%

IBERIABANK Corporation 5.0%

Limited Exposure To Various Asset Categories:

Home Equity = 11%

C&D = 5% Indirect Auto = 5%

Energy = 2%

Credit Card = 1%

Dec- Dec- Dec- Dec- Dec- Dec- Dec- Dec- Dec- Dec- Dec- Mar-

99 00 01 02 03 04 05 06 07 08 09 10

* | | Excludes FDIC Covered Assets 16 |

C&D Total Loans %

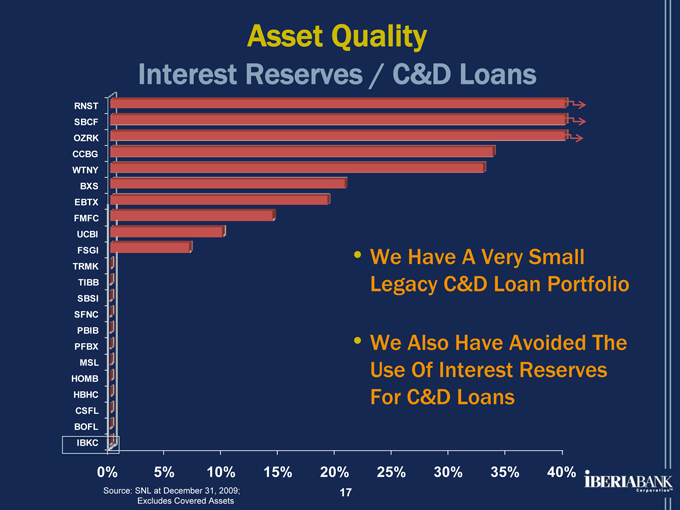

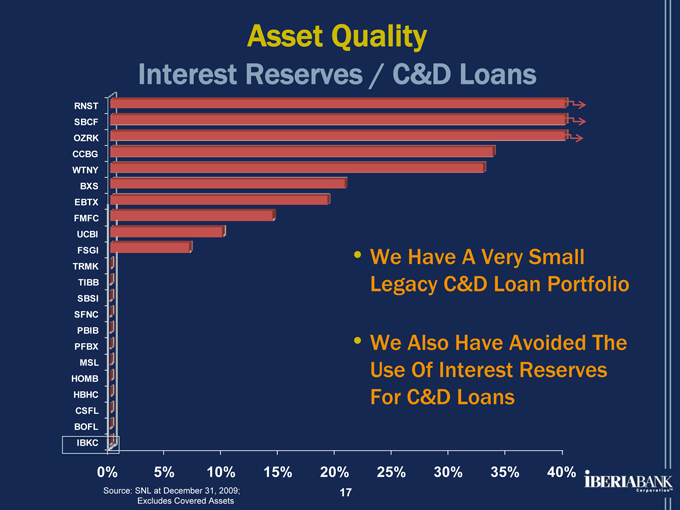

Asset Quality

Interest Reserves / C&D Loans

RNST SBCF OZRK CCBG WTNY

BXS EBTX FMFC UCBI FSGI TRMK

TIBB SBSI SFNC PBIB PFBX

MSL HOMB HBHC CSFL BOFL

IBKC

We Have A Very Small Legacy C&D Loan Portfolio

We Also Have Avoided The Use Of Interest Reserves For C&D Loans

0% 5% 10% 15% 20% 25% 30% 35% 40%

Source: SNL at December 31, 2009; 17 Excludes Covered Assets

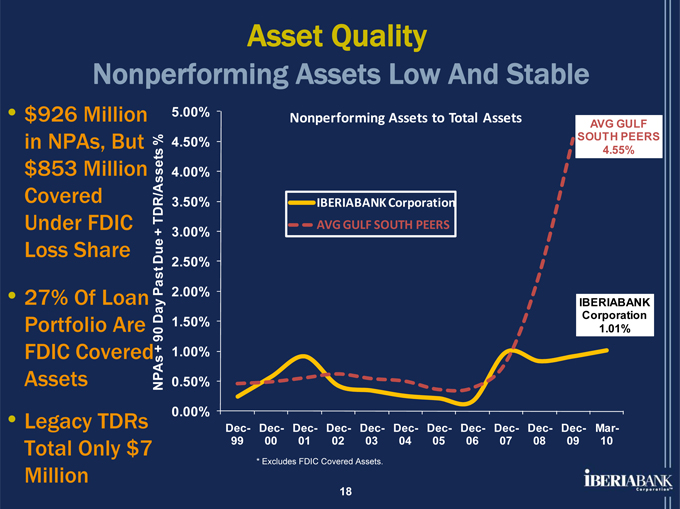

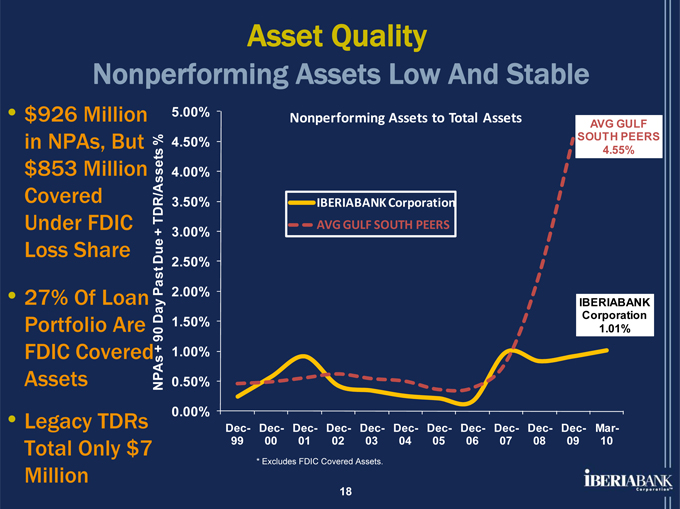

Asset Quality

Nonperforming Assets Low And Stable

$926 Million in NPAs, But $853 Million Covered Under FDIC Loss Share

27% Of Loan Portfolio Are FDIC Covered Assets Legacy TDRs Total Only $7 Million

NPAs 90+ Day Past Due TDR/Assets+ %

5.00% 4.50% 4.00% 3.50% 3.00% 2.50% 2.00% 1.50% 1.00% 0.50% 0.00%

Nonperforming Assets to Total Assets

IBERIABANK Corporation AVG GULF SOUTH PEERS

AVG GULF SOUTH PEERS

4.55%

IBERIABANK Corporation 1.01%

Dec- Dec- Dec- Dec- Dec- Dec- Dec- Dec- Dec- Dec- Dec- Mar-

99 00 01 02 03 04 05 06 07 08 09 10

* | | Excludes FDIC Covered Assets. |

18

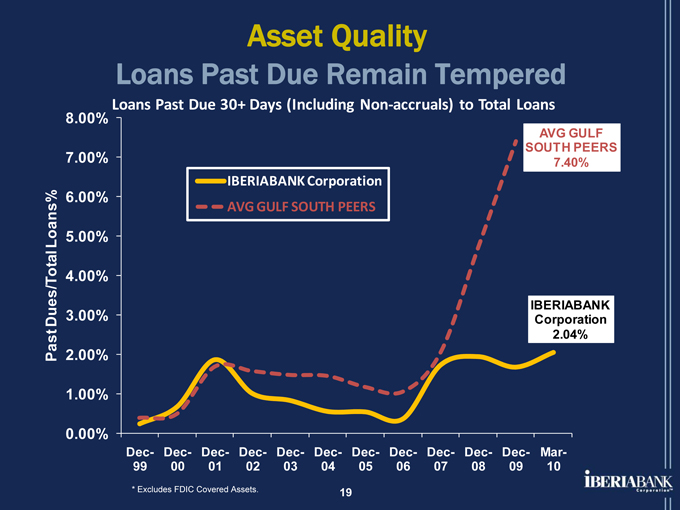

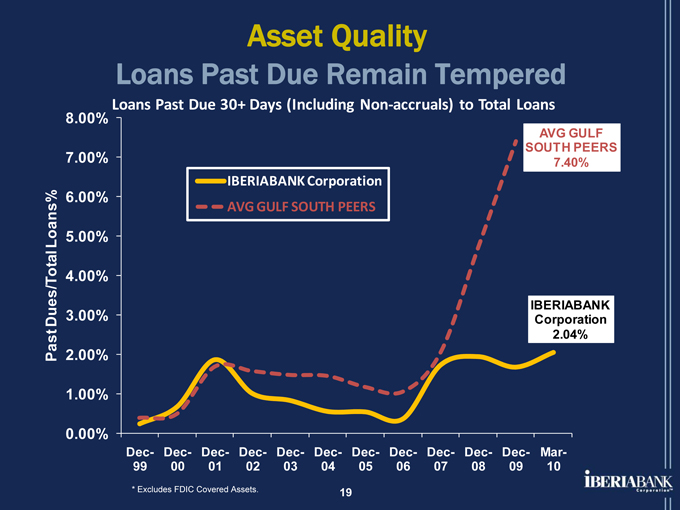

Asset Quality

Loans Past Due Remain Tempered

Loans Past Due 30+ Days (Including Non-accruals) to Total Loans

Past Dues/Total Loans%

8.00% 7.00% 6.00% 5.00% 4.00% 3.00% 2.00% 1.00% 0.00%

IBERIABANK Corporation AVG GULF SOUTH PEERS

AVG GULF SOUTH PEERS

7.40%

IBERIABANK Corporation 2.04%

Dec- Dec- Dec- Dec- Dec- Dec- Dec- Dec- Dec- Dec- Dec- Mar-

99 00 01 02 03 04 05 06 07 08 09 10

* | | Excludes FDIC Covered Assets. 19 |

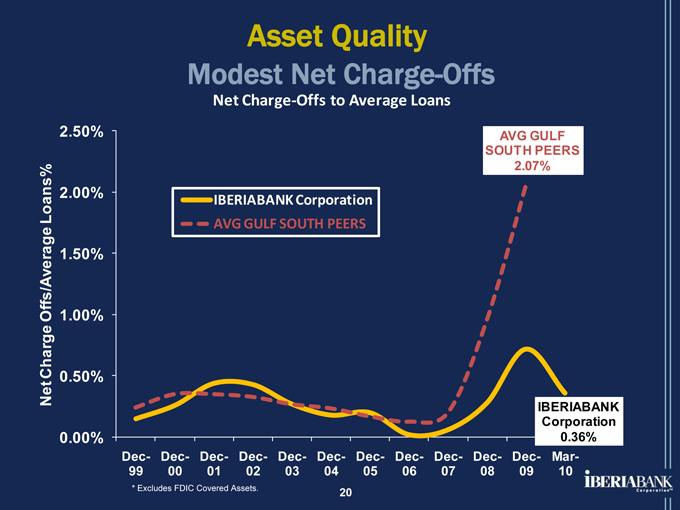

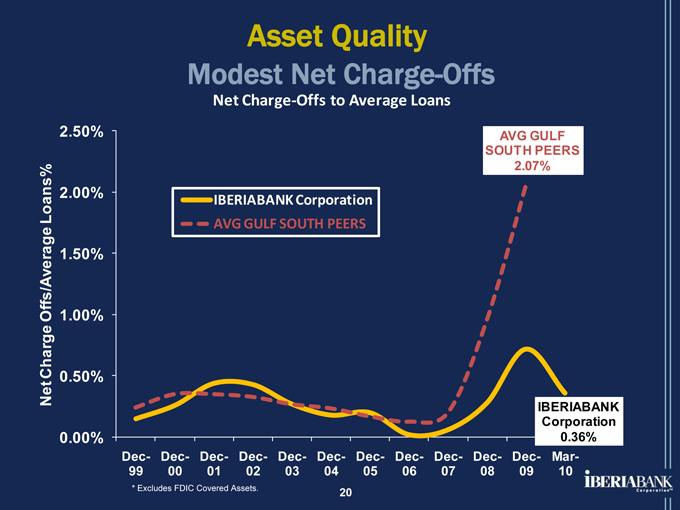

Asset Quality

Modest Net Charge-Offs

Net Charge-Offs to Average Loans

Net Charge Offs/Average Loans%

2.50% 2.00% 1.50% 1.00% 0.50% 0.00%

IBERIABANK Corporation AVG GULF SOUTH PEERS

AVG GULF SOUTH PEERS

2.07%

Dec- Dec- Dec- Dec- Dec- Dec- Dec- Dec- Dec- Dec- Dec- Mar-

99 00 01 02 03 04 05 06 07 08 09 10

* | | Excludes FDIC Covered Assets. 20 |

IBERIABANK Corporation 0.36%

Financials

21

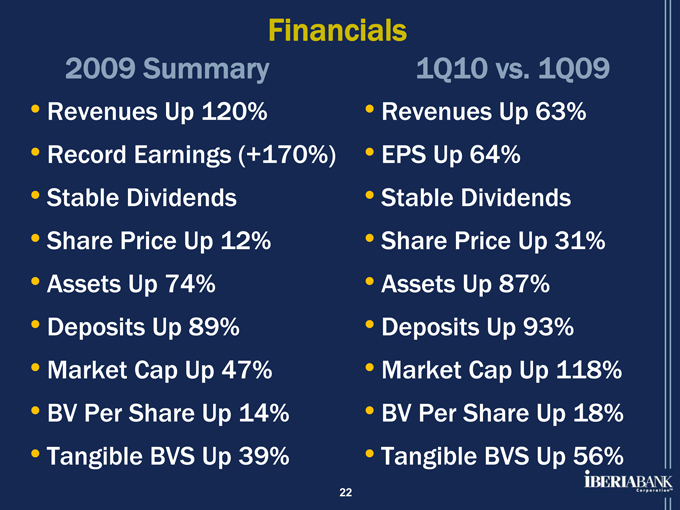

Financials

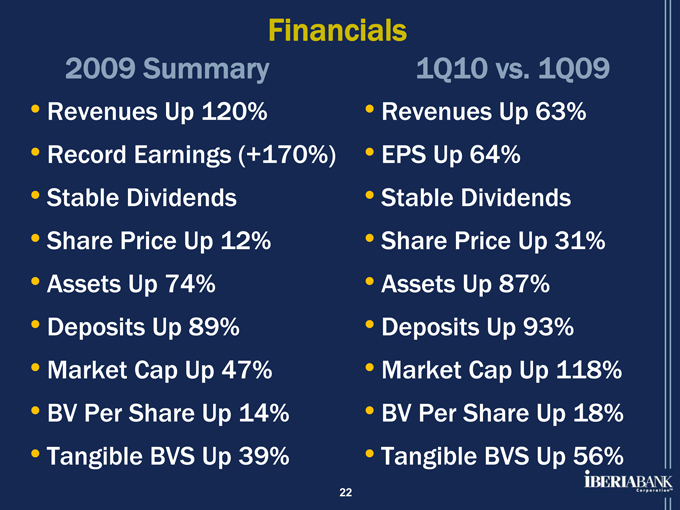

2009 Summary

Revenues Up 120% Record Earnings (+170%) Stable Dividends Share Price Up 12% Assets Up 74% Deposits Up 89% Market Cap Up 47% BV Per Share Up 14% Tangible BVS Up 39%

1Q10 vs. 1Q09

Revenues Up 63% EPS Up 64% Stable Dividends Share Price Up 31% Assets Up 87% Deposits Up 93% Market Cap Up 118% BV Per Share Up 18% Tangible BVS Up 56%

22

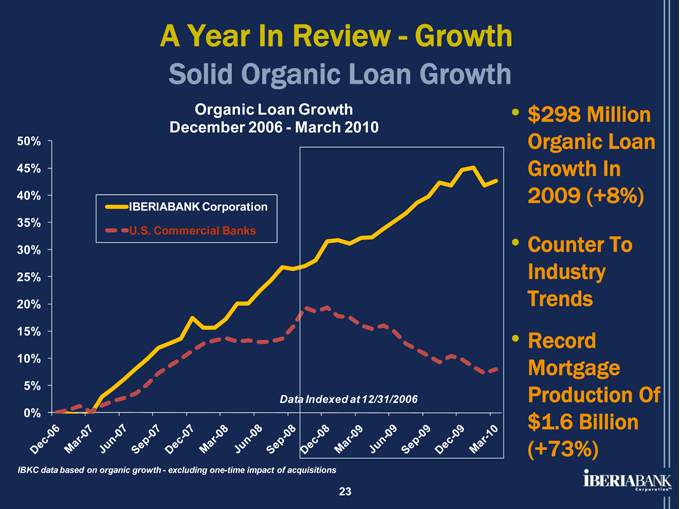

A Year In Review - Growth

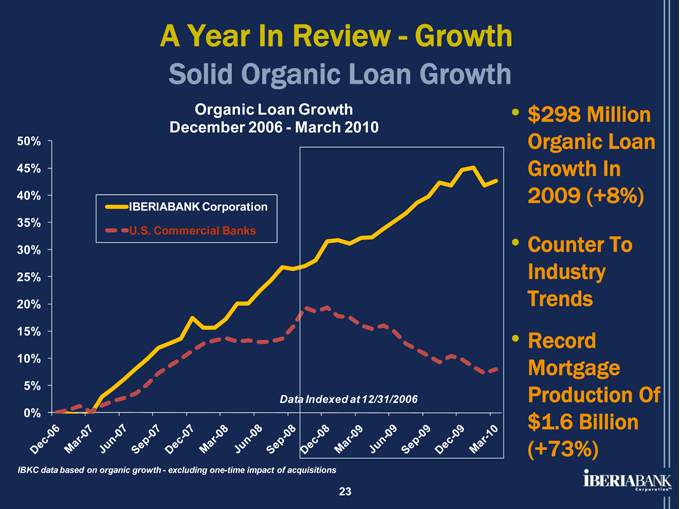

Solid Organic Loan Growth

Organic Loan Growth December 2006 - March 2010

50% 45% 40% 35% 30% 25% 20% 15% 10% 5% 0%

IBERIABANK Corporation

U.S. Commercial Banks

Data Indexed at 12/31/2006

Dec-06

Mar-07

Jun-07

Sep-07

Dec-07

Mar-08

Jun-08

Sep-08

Dec-08

Mar-09

Jun-09

Sep-09

Dec-09

Mar-10

$298 Million Organic Loan Growth In 2009 (+8%)

Counter To Industry Trends Record Mortgage Production Of $1.6 Billion (+73%)

IBKC data based on organic growth - excluding one-time impact of acquisitions

23

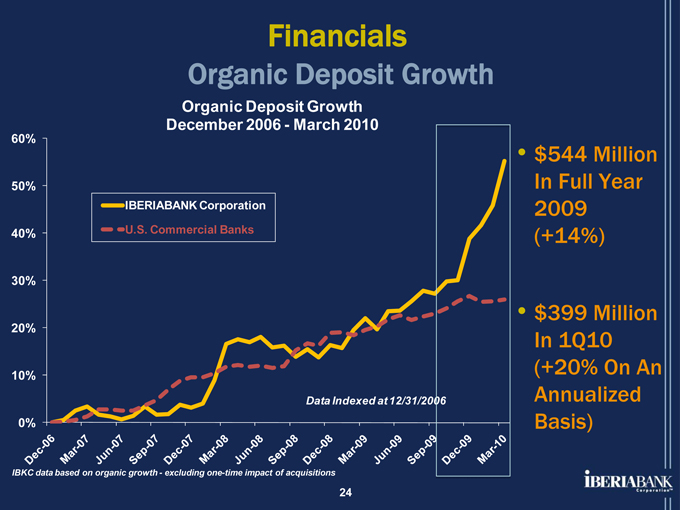

Financials

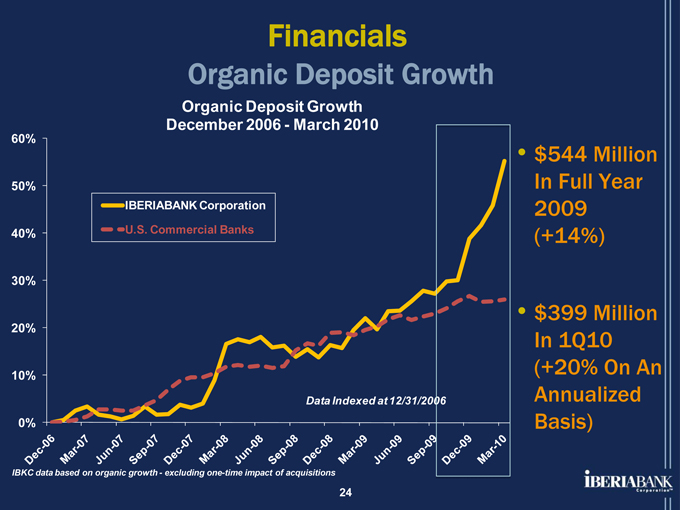

Organic Deposit Growth

Organic Deposit Growth December 2006 - March 2010

60% 50% 40% 30% 20% 10% 0%

IBERIABANK Corporation

U.S. Commercial Banks

Data Indexed at 12/31/2006

Dec-06

Mar-07

Jun-07

Sep-07

Dec-07

Mar-08

Jun-08

Sep-08

Dec-08

Mar-09

Jun-09

Sep-09

Dec-09

Mar-10

IBKC data based on organic growth - excluding one-time impact of acquisitions

24

$544 Million In Full Year 2009 (+14%)

$399 Million In 1Q10 (+20% On An Annualized Basis)

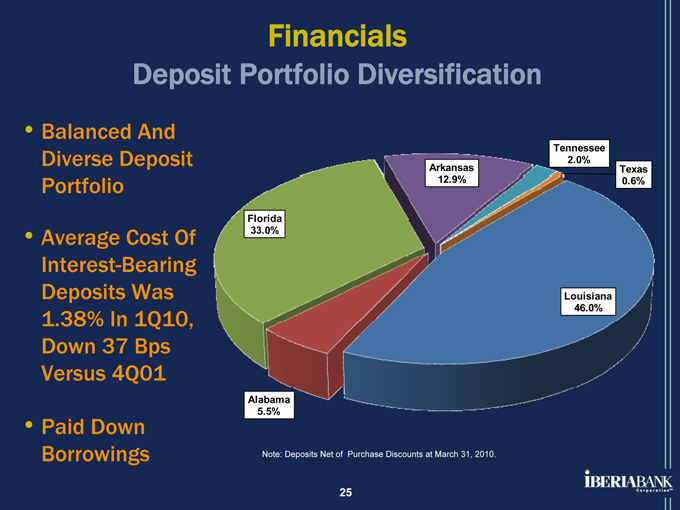

Financials

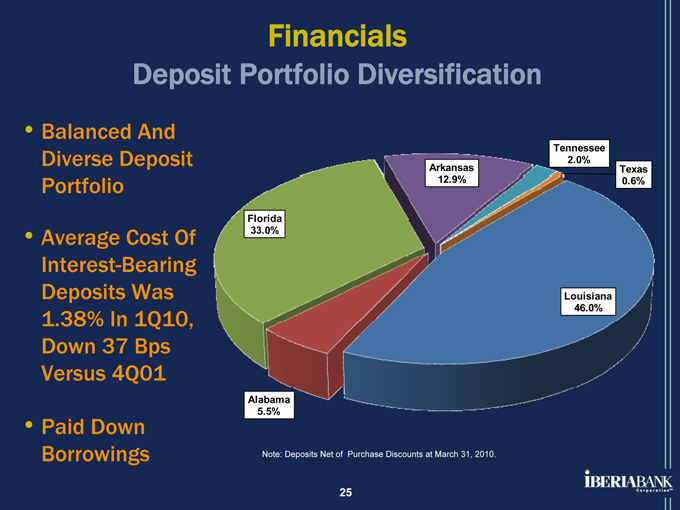

Deposit Portfolio Diversification

Balanced And Diverse Deposit Portfolio

Average Cost Of Interest-Bearing Deposits Was 1.38% In 1Q10, Down 37 Bps Versus 4Q01

Paid Down Borrowings

Florida 33.0%

Arkansas 12.9%

Tennessee 2.0%

Texas 0.6%

Louisiana 46.0%

Alabama 5.5%

Note: Deposits Net of Purchase Discounts at March 31, 2010.

25

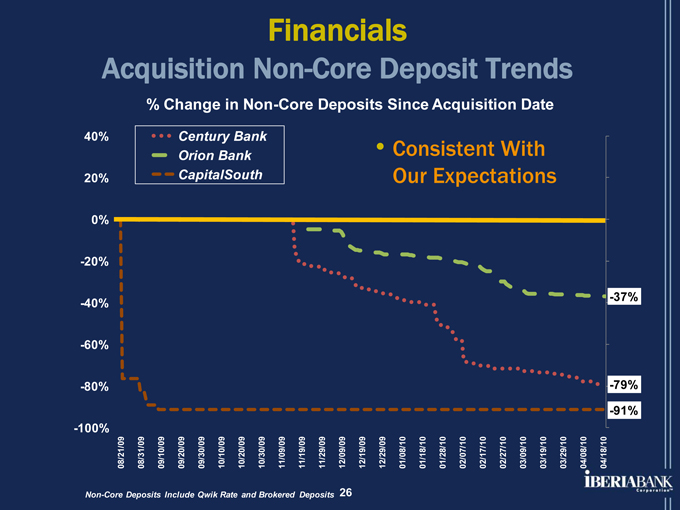

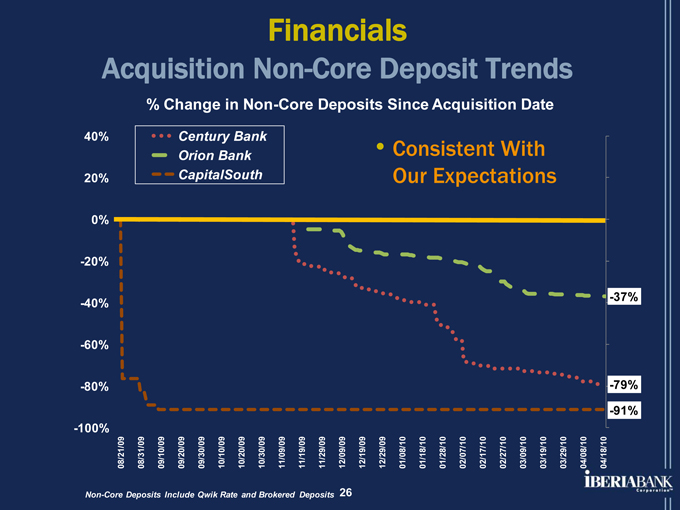

Financials

Acquisition Non-Core Deposit Trends

% Change in Non-Core Deposits Since Acquisition Date

Century Bank Orion Bank CapitalSouth

Consistent With Our Expectations

40% 20% 0% -20% -40% -60% -80% -100%

-37%

-79%

-91%

08/21/09 08/31/09 09/10/09 09/20/09 09/30/09 10/10/09 10/20/09 10/30/09 11/09/09 11/19/09 11/29/09 12/09/09 12/19/09 12/29/09 01/08/10 01/18/10 01/28/10 02/07/10 02/17/10 02/27/10 03/09/10 03/19/10 03/29/10 04/08/10 04/18/10

Non-Core Deposits Include Qwik Rate and Brokered Deposits 26

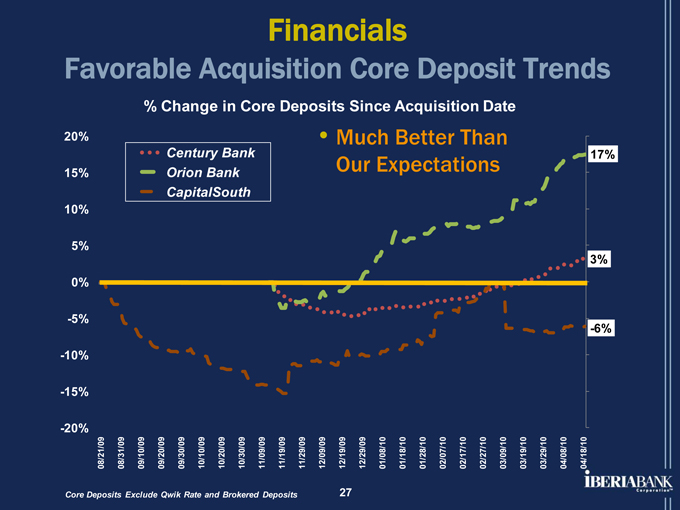

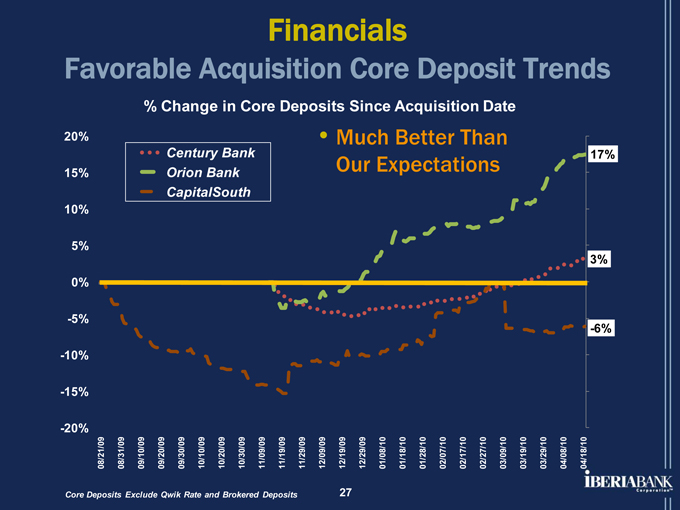

Financials

Favorable Acquisition Core Deposit Trends

% Change in Core Deposits Since Acquisition Date

Century Bank Orion Bank CapitalSouth

Much Better Than Our Expectations

20% 15% 10% 5% 0% -5% -10% -15% -20%

08/21/09 08/31/09 09/10/09 09/20/09 09/30/09 10/10/09 10/20/09 10/30/09 11/09/09 11/19/09 11/29/09 12/09/09 12/19/09 12/29/09 01/08/10 01/18/10 01/28/10 02/07/10 02/17/10 02/27/10 03/09/10 03/19/10 03/29/10 04/08/10 04/18/10

17% 3% -6%

Core Deposits Exclude Qwik Rate and Brokered Deposits 27

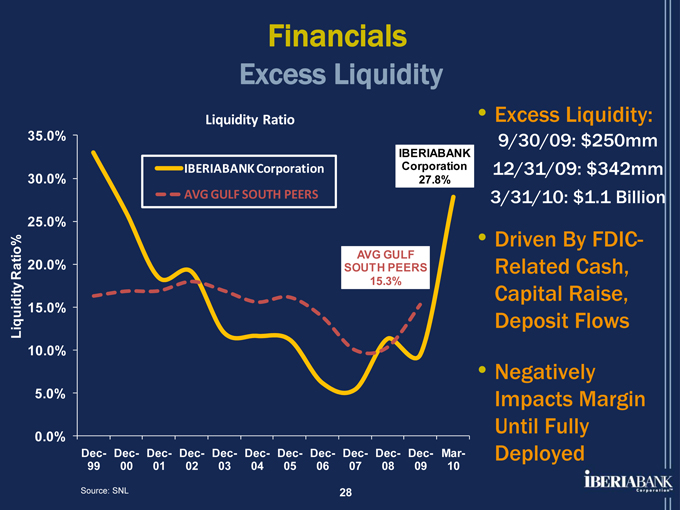

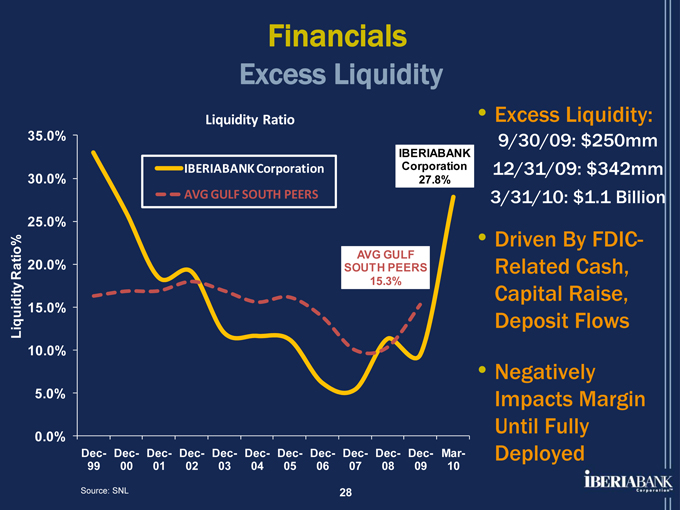

Financials

Excess Liquidity

Liquidity Ratio

IBERIABANK Corporation AVG GULF SOUTH PEERS

IBERIABANK Corporation 27.8%

AVG GULF SOUTH PEERS

15.3%

Liquidity Ratio%

35.0% 30.0% 25.0% 20.0% 15.0% 10.0% 5.0% 0.0%

Excess Liquidity:

9/30/09: $250mm 12/31/09: $342mm 3/31/10: $1.1 Billion

Driven By FDIC-Related Cash, Capital Raise, Deposit Flows

Negatively Impacts Margin Until Fully Deployed

Dec- Dec- Dec- Dec- Dec- Dec- Dec- Dec- Dec- Dec- Dec- Mar-

99 00 01 02 03 04 05 06 07 08 09 10

Source: SNL

28

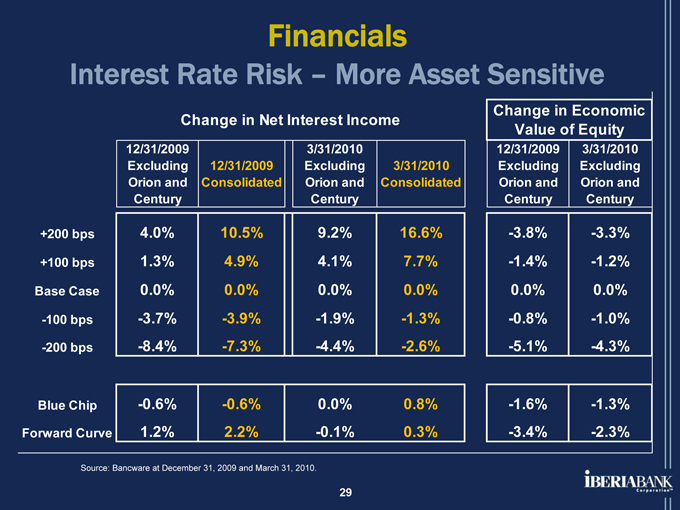

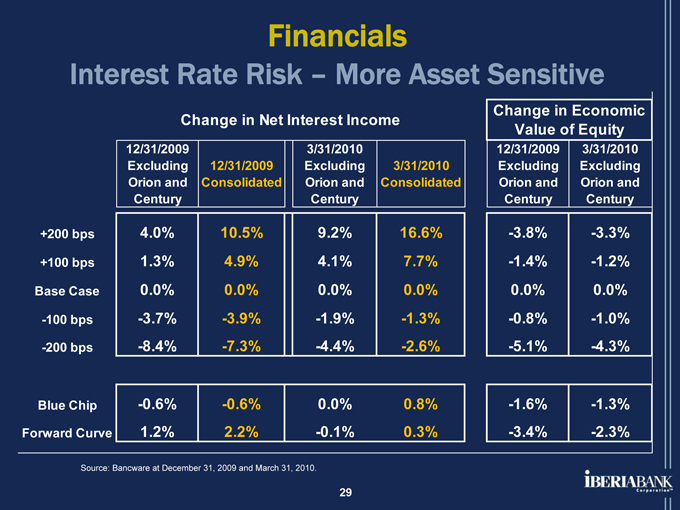

Financials

Interest Rate Risk – More Asset Sensitive

Change in Net Interest Income

12/31/2009 3/31/2010

Excluding 12/31/2009 Excluding 3/31/2010

Orion and Consolidated Orion and Consolidated

Century Century

+200 bps 4.0% 10.5% 9.2% 16.6%

+100 bps 1.3% 4.9% 4.1% 7.7%

Base Case 0.0% 0.0% 0.0% 0.0%

-100 bps -3.7% -3.9% -1.9% -1.3%

-200 bps -8.4% -7.3% -4.4% -2.6%

Blue Chip -0.6% -0.6% 0.0% 0.8%

Forward Curve 1.2% 2.2% -0.1% 0.3%

Change in Economic

Value of Equity

12/31/2009 3/31/2010

Excluding Excluding

Orion and Orion and

Century Century

-3.8% -3.3%

-1.4% -1.2%

0.0% 0.0%

-0.8% -1.0%

-5.1% -4.3%

-1.6% -1.3%

-3.4% -2.3%

Source: Bancware at December 31, 2009 and March 31, 2010.

29

FDIC-Assisted Opportunities

30

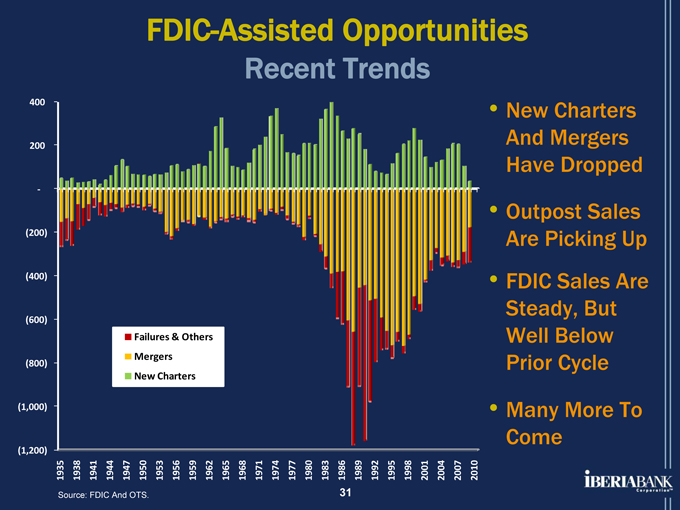

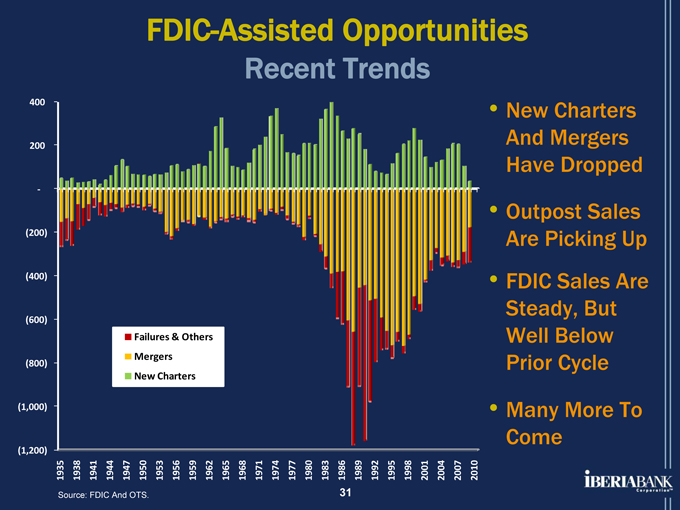

FDIC-Assisted Opportunities

Recent Trends

400 200 -(200) (400) (600) (800) (1,000) (1,200)

Failures & Others Mergers New Charters

New Charters

And Mergers Have Dropped

Outpost Sales Are Picking Up FDIC Sales Are Steady, But Well Below Prior Cycle

Many More To Come

1935

Source: 1938 FDIC 1941 And 1944

1947

OTS. 1950 1953 1956 1959 1962 1965 1968 1971 1974 1977 1980 1983

31 1986 1989 1992 1995 1998 2001 2004 2007 2010

FDIC-Assisted Opportunities

Our Recently Completed Acquisitions

August 21, 2009 HQ in Birmingham, AL

10 Offices In AL and FL $546 Million Deposits $493 Million Loans

Conversion Completed on November 7-8, 2009 Pre-Tax Gain of $58 Million in 3Q09

November 13, 2009 HQ in Sarasota, FL

11 Offices In Florida $690 Million Deposits $699 Million Loans

Conversion Completed on April 24-25, 2010 Pre-Tax Gain of $52 Million in 4Q09 and 1Q10

November 13, 2009 HQ in Naples, FL

23 Offices In Florida $2.1 Billion Deposits $1.7 Billion Loans

Conversion Scheduled For Completion in 2Q10 Pre-Tax Gain of $122 Million in 4Q09 and 1Q10

32

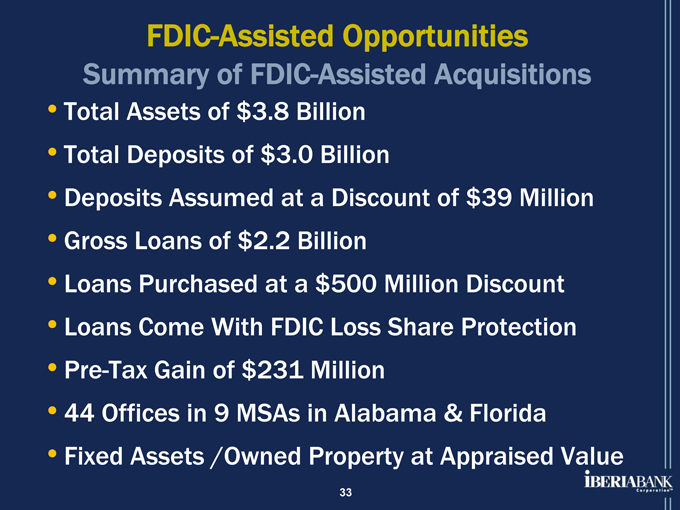

FDIC-Assisted Opportunities

Summary of FDIC-Assisted Acquisitions

Total Assets of $3.8 Billion Total Deposits of $3.0 Billion

Deposits Assumed at a Discount of $39 Million Gross Loans of $2.2 Billion Loans Purchased at a $500 Million Discount Loans Come With FDIC Loss Share Protection Pre-Tax Gain of $231 Million

44 Offices in 9 MSAs in Alabama & Florida Fixed Assets /Owned Property at Appraised Value

33

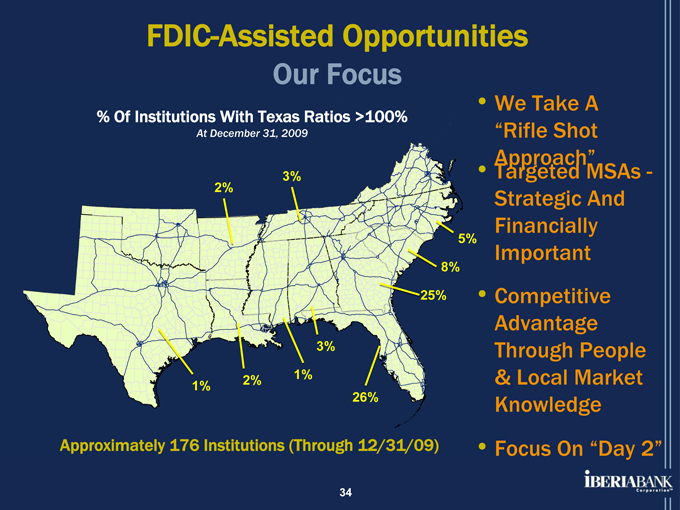

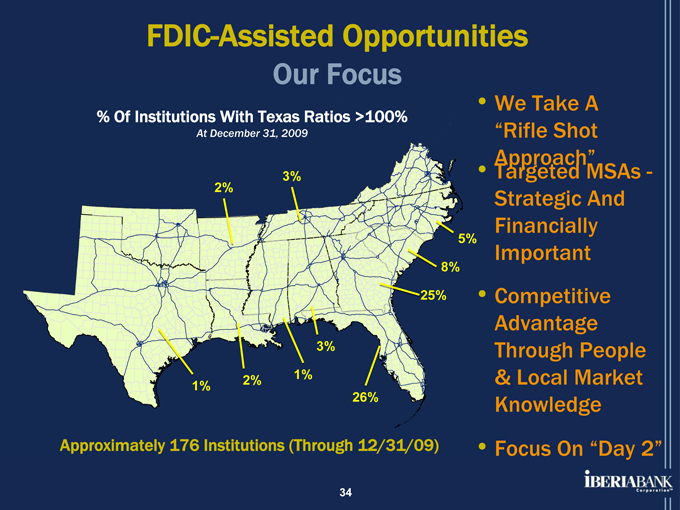

FDIC-Assisted Opportunities

Our Focus

% Of Institutions With Texas Ratios >100%

At December 31, 2009

We Take A “Rifle Shot Approach” Targeted MSAs -Strategic And Financially Important Competitive Advantage Through People

& Local Market Knowledge Focus On “Day 2”

3% 2%

5% 8% 25%

3%

2% 1% 1%

26%

Approximately 176 Institutions (Through 12/31/09)

34

Shareholders

35

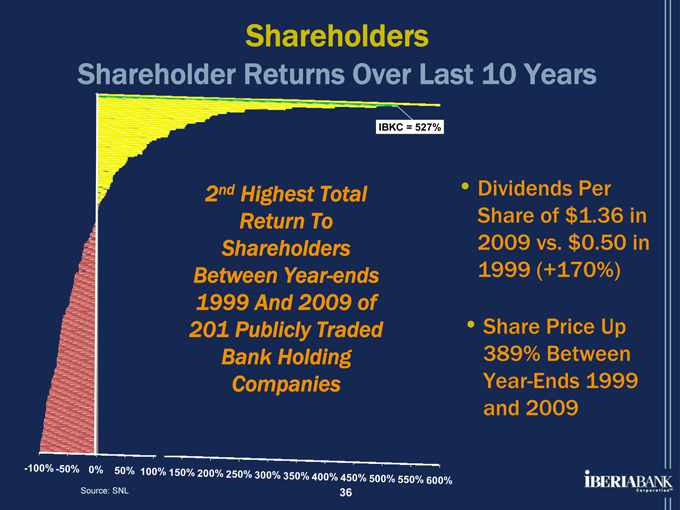

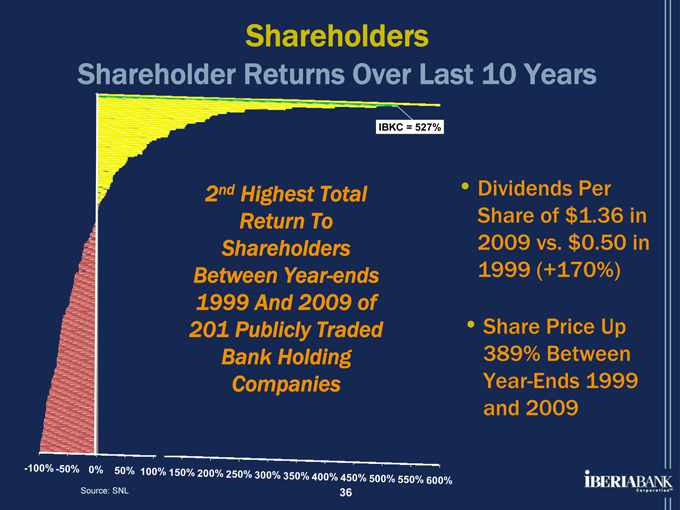

Shareholders

Shareholder Returns Over Last 10 Years

IBKC = 527%

2nd Highest Total Return To Shareholders Between Year-ends 1999 And 2009 of 201 Publicly Traded Bank Holding Companies

Dividends Per Share of $1.36 in 2009 vs. $0.50 in 1999 (+170%)

Share Price Up 389% Between Year-Ends 1999 and 2009

-100% -50% 0% 50% 100% 150%

200% 250% 300% 350% 400% 450%

500% 550% 600%

Source: SNL 36

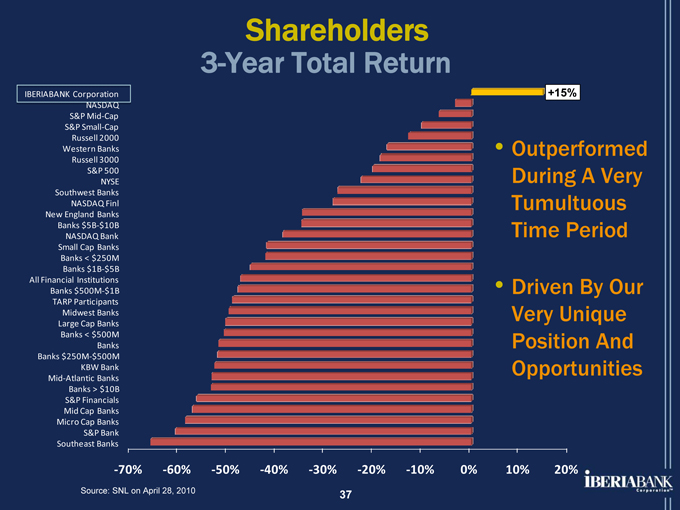

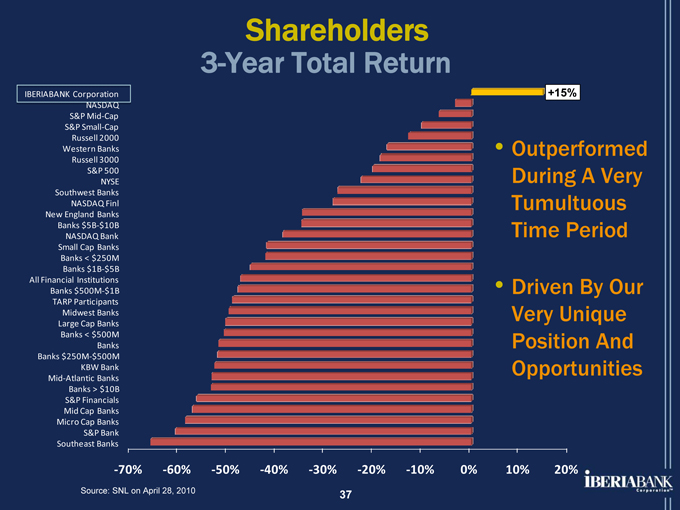

Shareholders

3-Year Total Return

IBERIABANK Corporation

NASDAQ

S&P Mid-Cap

S&P Small-Cap

Russell 2000

Western Banks

Russell 3000

S&P 500

NYSE

Southwest Banks

NASDAQ Finl

New England Banks

Banks $5B-$10B

NASDAQ Bank

Small Cap Banks

Banks < $250M

Banks $1B-$5B

All Financial Institutions

Banks $500M-$1B

TARP Participants

Midwest Banks

Large Cap Banks

Banks < $500M

Banks

Banks $250M-$500M

KBW Bank

Mid-Atlantic Banks

Banks > $10B

S&P Financials

Mid Cap Banks

Micro Cap Banks

S&P Bank

Southeast Banks

+15%

• Outperformed During A Very Tumultuous Time Period

• Driven By Our Very Unique Position And Opportunities

-70% -60% -50% -40% -30% -20% -10% 0% 10% 20%

Source: SNL on April 28, 2010 37

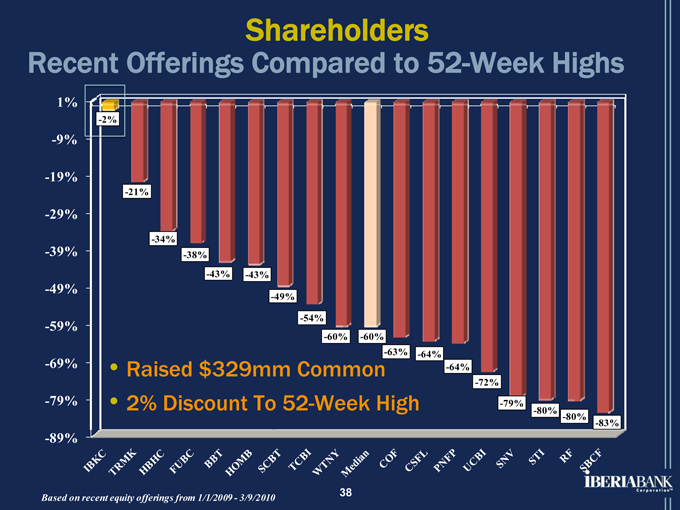

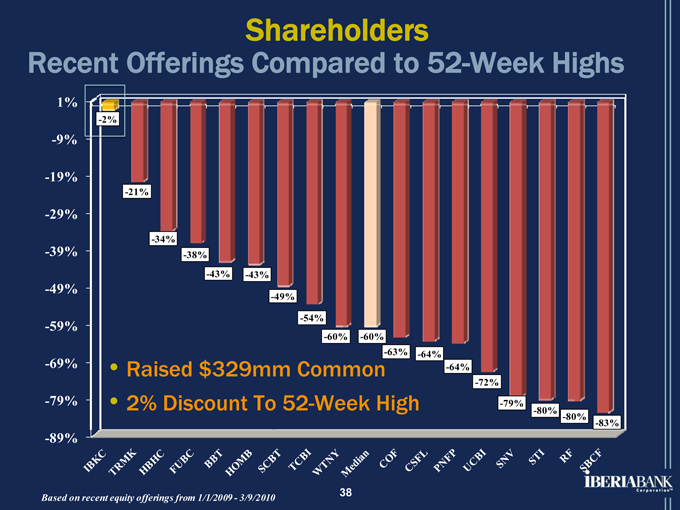

Shareholders

Recent Offerings Compared to 52-Week Highs

1% -9% -19% -29% -39% -49% -59% -69% -79% -89%

-2%

-21%

-34% -38%

-43% -43%

-49%

-54%

-60% -60%

-63% -64%

• Raised $329mm Common -64%

-72%

• 2% Discount To 52-Week High -79%

-80% -80% -83%

IBKC

TRMK

HBHC

FUBC

BBT

HOMB

SCBT

TCBI

WTNY

Median

COF

CSFL

PNFP

UCBI

SNV STI

RF

SBCF

38

Based on recent equity offerings from 1/1/2009 - 3/9/2010

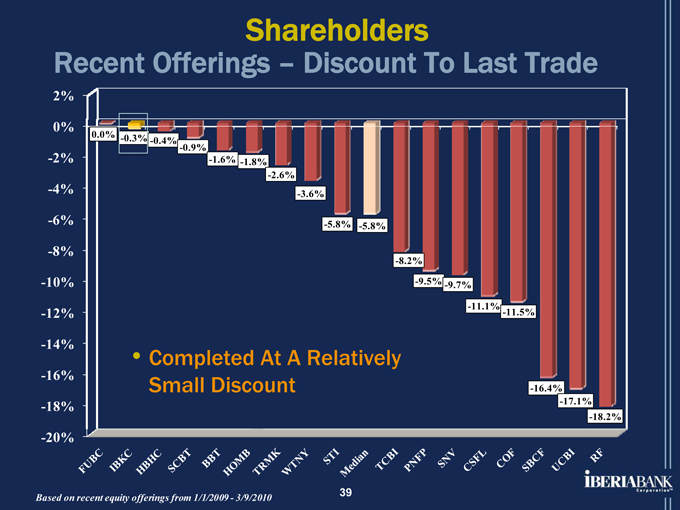

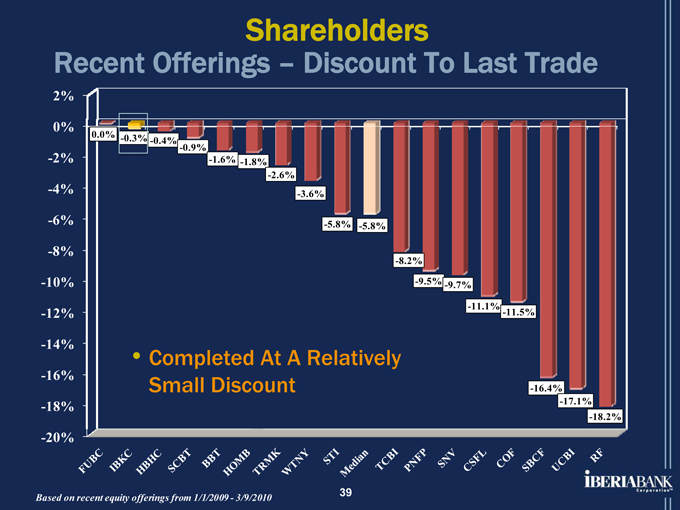

Shareholders

Recent Offerings – Discount To Last Trade

2% 0% -2% -4% -6% -8% -10% -12% -14% -16% -18% -20%

Completed At A Relatively Small Discount

0.0%

-0.3% -0.4% -0.9%

-1.6% -1.8% -2.6% -3.6%

-5.8% -5.8%

-8.2%

-9.5% -9.7% -11.1% -11.5%

-16.4% -17.1% -18.2%

IBKC

TRMK

HBHC

FUBC

BBT

HOMB

SCBT

TCBI

WTNY

Median

COF

CSFL

PNFP

UCBI

SNV STI

RF

SBCF

39

Based on recent equity offerings from 1/1/2009 - 3/9/2010

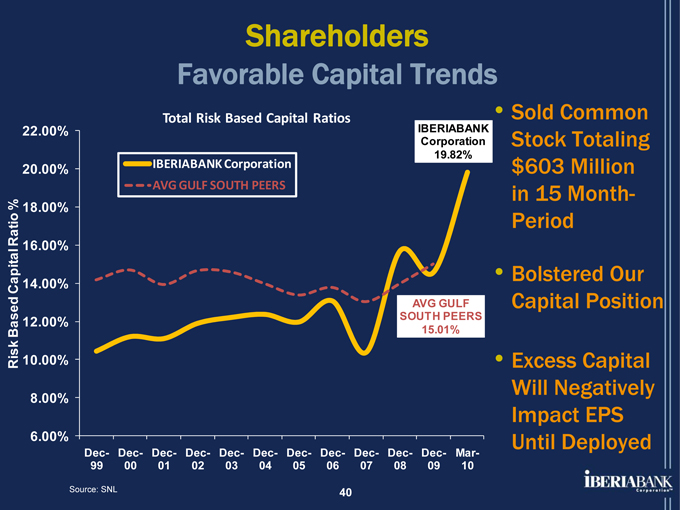

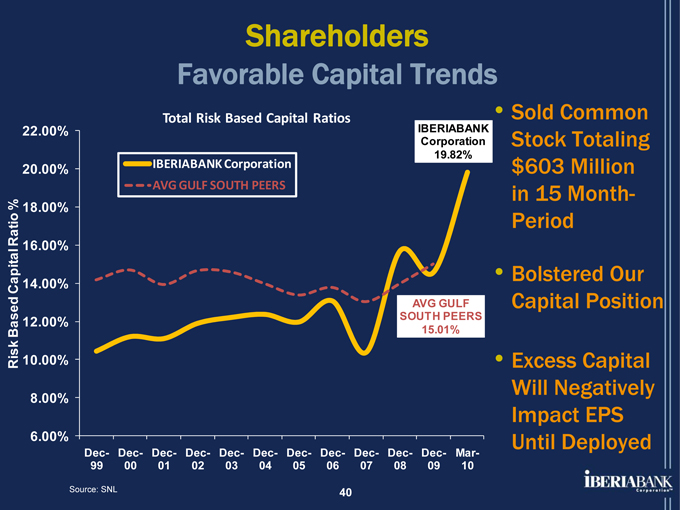

Shareholders

Favorable Capital Trends

Total Risk Based Capital Ratios

IBERIABANK Corporation 19.82%

IBERIABANK Corporation AVG GULF SOUTH PEERS

AVG GULF SOUTH PEERS

15.01%

Risk Based Capital Ratio %

22.00% 20.00% 18.00% 16.00% 14.00% 12.00% 10.00% 8.00% 6.00%

Dec- Dec- Dec- Dec- Dec- Dec- Dec- Dec- Dec- Dec- Dec- Mar-

99 00 01 02 03 04 05 06 07 08 09 10

Source: SNL 40

Sold Common Stock Totaling $603 Million in 15 Month-Period

Bolstered Our Capital Position

Excess Capital Will Negatively Impact EPS Until Deployed

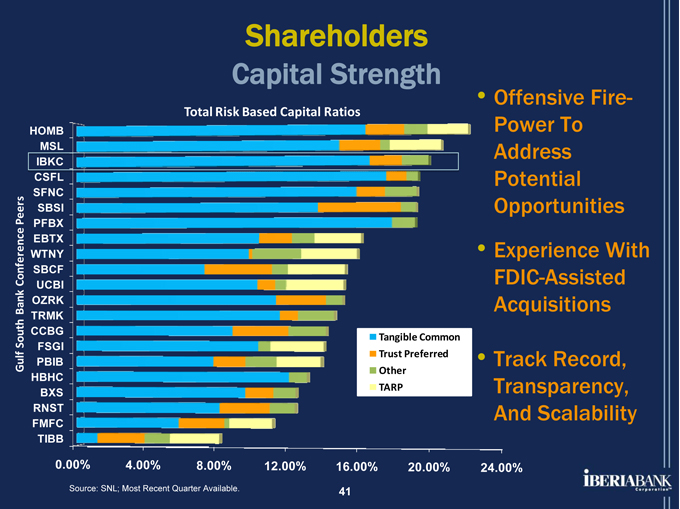

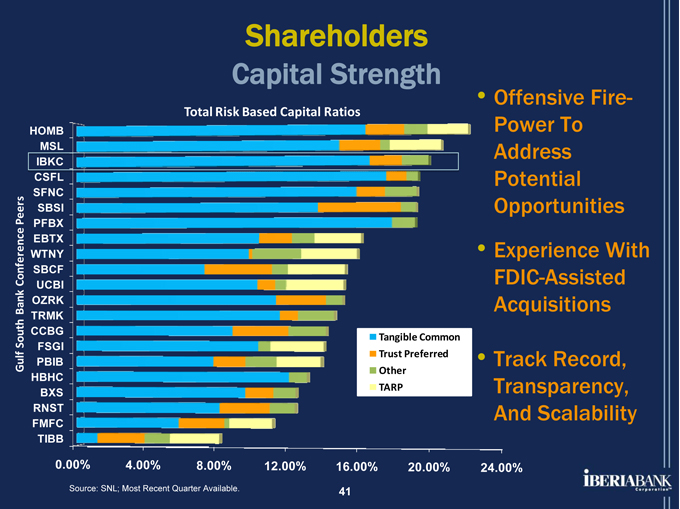

Shareholders

Capital Strength

Total Risk Based Capital Ratios

Gulf South Bank Conference Peers

HOMB MSL

IBKC CSFL SFNC SBSI PFBX EBTX WTNY SBCF UCBI OZRK TRMK CCBG

FSGI PBIB HBHC

BXS RNST FMFC TIBB

Offensive Fire-Power To Address Potential Opportunities Experience With FDIC-Assisted Acquisitions

Track Record, Transparency, And Scalability

Tangible Common Trust Preferred Other TARP

0.00% 4.00% 8.00% 12.00% 16.00% 20.00% 24.00%

Source: SNL; Most Recent Quarter Available. 41

Summary

42

Summary

A Few Recent Activities

Longevity And Experience

Economically Vibrant Legacy Markets

Diversified Markets And Revenues

Multiple Growth Engines (Organic And M&A)

Disciplined, Yet Opportunistic

Exceptional Asset Quality

Outsized FDIC Loss Share Protection

Tremendous Liquidity And Capital

Funded By Stable Core Deposits

Asset Sensitive Balance Sheet

Unique Business Model

Favorable Risk/Return Trade-Off

43

IBERIA BANK

44

Appendix

45

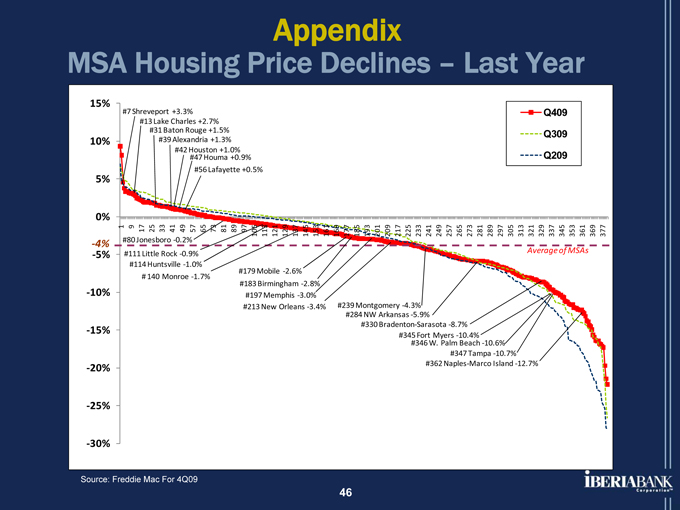

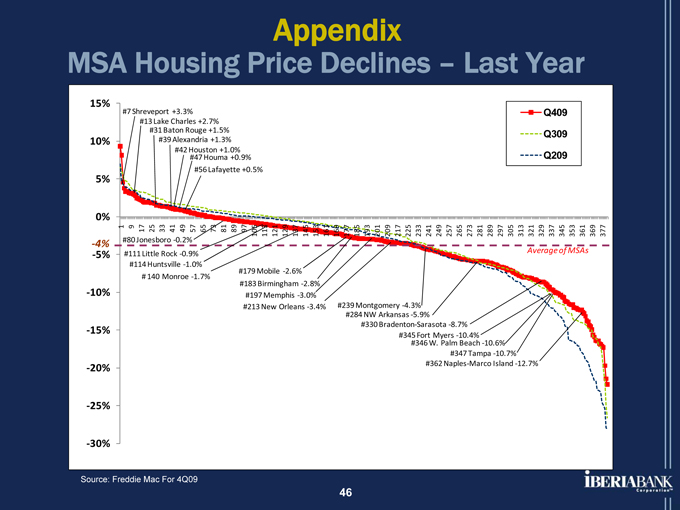

Appendix

MSA Housing Price Declines – Last Year

15% 10% 5%

0%

-4%

-5% -10% -15% -20% -25% -30%

#7 Shreveport +3.3% #13 Lake Charles +2.7% #31 Baton Rouge +1.5% #39 Alexandria +1.3% #42 Houston +1.0% #47 Houma +0.9% #56 Lafayette +0.5%

Q409 Q309 Q209

#80 Jonesboro -0.2% #111 Little Rock -0.9% #114 Huntsville -1.0%

# 140 Monroe -1.7%

#179 Mobile -2.6% #183 Birmingham -2.8% #197 Memphis -3.0% #213 New Orleans -3.4%

#239 Montgomery -4.3% #284 NW Arkansas -5.9%

#330 Bradenton-Sarasota -8.7%

#345 #346 Fort W. Myers Palm - 10.4% Beach -10.6% #347 Tampa -10.7% #362 Naples-Marco Island -12.7%

1

9

17

25

33

41

49

57

65

73

81

89

97

105

113

121

129

137

145

153

161

169

177

185

193

201

209

217

225

233

241

249

257

265

273

281

289

297

305

313

321

329

337

345

353

361

369

377

Average of MSAs

Source: Freddie Mac For 4Q09

46

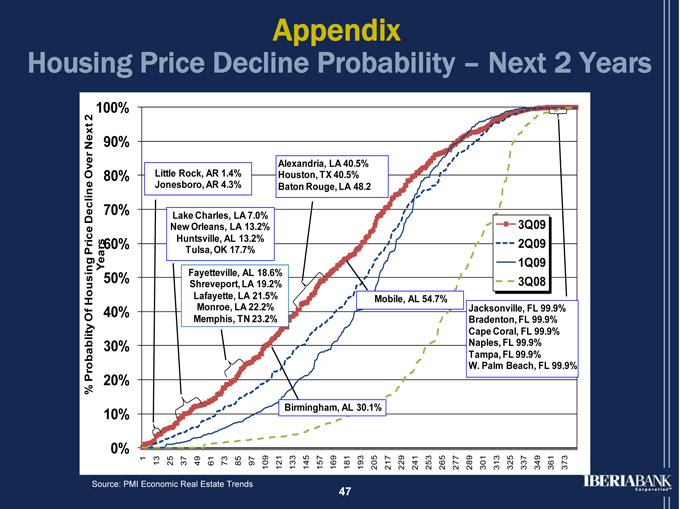

Appendix

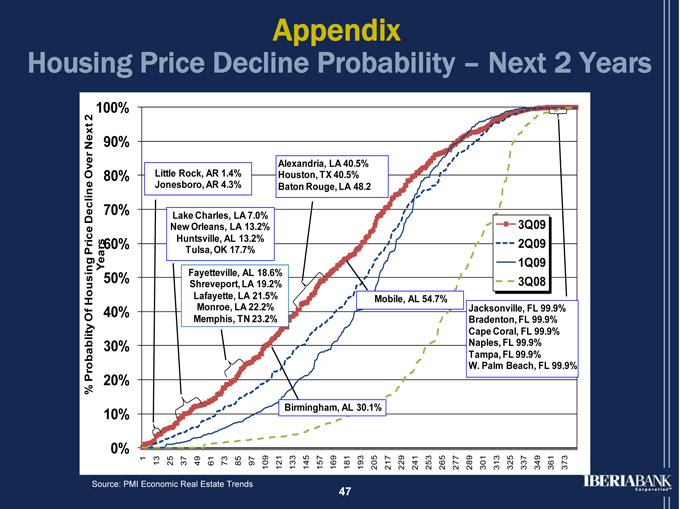

Housing Price Decline Probability – Next 2 Years

% Probablity Of Housing Price Decline Over Next 2

100% 90% 80% 70%

Years 60%

50% 40% 30% 20% 10% 0%

Little Rock, AR 1.4% Jonesboro, AR 4.3%

Alexandria, LA 40.5% Houston, TX 40.5% Baton Rouge, LA 48.2

Lake Charles, LA 7.0% New Orleans, LA 13.2% Huntsville, AL 13.2% Tulsa, OK 17.7%

Fayetteville, AL 18.6% Shreveport, LA 19.2% Lafayette, LA 21.5% Monroe, LA 22.2% Memphis, TN 23.2%

Mobile, AL 54.7%

3Q09 2Q09 1Q09 3Q08

Jacksonville, FL 99.9% Bradenton, FL 99.9% Cape Coral, FL 99.9% Naples, FL 99.9% Tampa, FL 99.9% W. Palm Beach, FL 99.9%

Birmingham, AL 30.1%

13

25

37

49

61

73

85

97

109

121

133

145

157

169

181

193

205

217

229

241

253

265

277

289

301

313

325

337

349

361

373

Source: PMI Economic Real Estate Trends

47

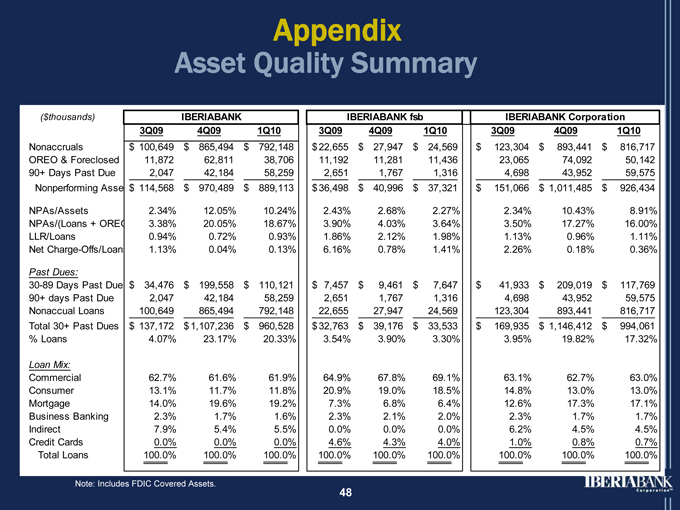

Appendix

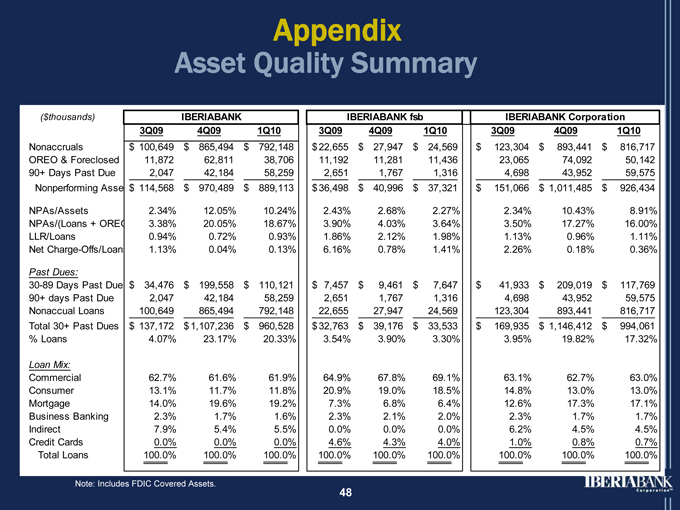

Asset Quality Summary

($thousands) IBERIABANK IBERIABANK fsb IBERIABANK Corporation

3Q09 4Q09 1Q10 3Q09 4Q09 1Q10 3Q09 4Q09 1Q10

Nonaccruals $ 100,649 $ 865,494 $ 792,148 $ 22,655 $ 27,947 $ 24,569 $ 123,304 $ 893,441 $ 816,717

OREO & Foreclosed 11,872 62,811 38,706 11,192 11,281 11,436 23,065 74,092 50,142

90+ Days Past Due 2,047 42,184 58,259 2,651 1,767 1,316 4,698 43,952 59,575

Nonperforming Asse $ 114,568 $ 970,489 $ 889,113 $ 36,498 $ 40,996 $ 37,321 $ 151,066 $ 1,011,485 $ 926,434

NPAs/Assets 2.34% 12.05% 10.24% 2.43% 2.68% 2.27% 2.34% 10.43% 8.91%

NPAs/(Loans + OREO 3.38% 20.05% 18.67% 3.90% 4.03% 3.64% 3.50% 17.27% 16.00%

LLR/Loans 0.94% 0.72% 0.93% 1.86% 2.12% 1.98% 1.13% 0.96% 1.11%

Net Charge-Offs/Loans 1.13% 0.04% 0.13% 6.16% 0.78% 1.41% 2.26% 0.18% 0.36%

Past Dues:

30-89 Days Past Due $ 34,476 $ 199,558 $ 110,121 $ 7,457 $ 9,461 $ 7,647 $ 41,933 $ 209,019 $ 117,769

90+ days Past Due 2,047 42,184 58,259 2,651 1,767 1,316 4,698 43,952 59,575

Nonaccual Loans 100,649 865,494 792,148 22,655 27,947 24,569 123,304 893,441 816,717

Total 30+ Past Dues $ 137,172 $ 1,107,236 $ 960,528 $ 32,763 $ 39,176 $ 33,533 $ 169,935 $ 1,146,412 $ 994,061

% Loans 4.07% 23.17% 20.33% 3.54% 3.90% 3.30% 3.95% 19.82% 17.32%

Loan Mix:

Commercial 62.7% 61.6% 61.9% 64.9% 67.8% 69.1% 63.1% 62.7% 63.0%

Consumer 13.1% 11.7% 11.8% 20.9% 19.0% 18.5% 14.8% 13.0% 13.0%

Mortgage 14.0% 19.6% 19.2% 7.3% 6.8% 6.4% 12.6% 17.3% 17.1%

Business Banking 2.3% 1.7% 1.6% 2.3% 2.1% 2.0% 2.3% 1.7% 1.7%

Indirect 7.9% 5.4% 5.5% 0.0% 0.0% 0.0% 6.2% 4.5% 4.5%

Credit Cards 0.0% 0.0% 0.0% 4.6% 4.3% 4.0% 1.0% 0.8% 0.7%

Total Loans 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0%

Note: Includes FDIC Covered Assets.

48

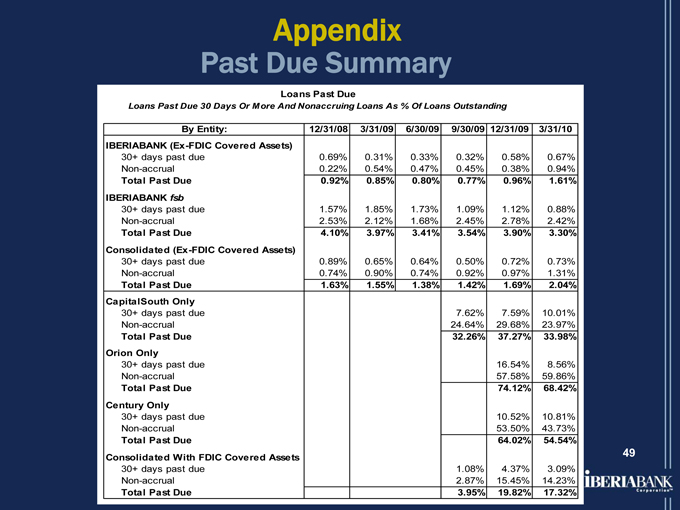

Appendix

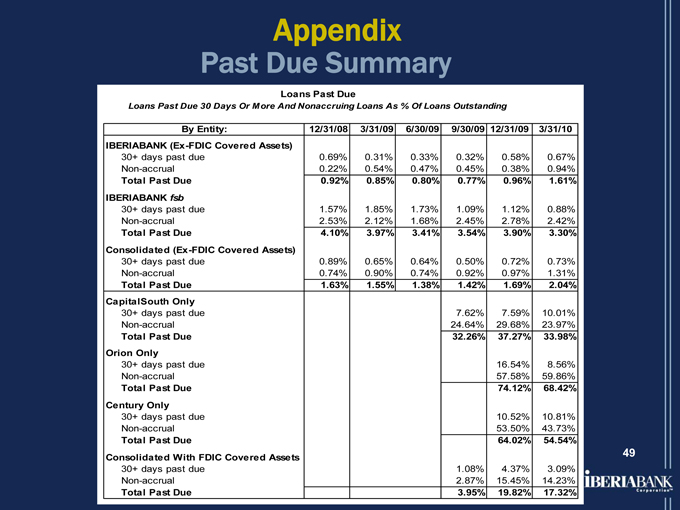

Past Due Summary

Loans Past Due

Loans Past Due 30 Days Or More And Nonaccruing Loans As % Of Loans Outstanding

By Entity: 12/31/08 3/31/09 6/30/09 9/30/09 12/31/09 3/31/10

IBERIABANK (Ex-FDIC Covered Assets)

30+ days past due 0.69% 0.31% 0.33% 0.32% 0.58% 0.67%

Non-accrual 0.22% 0.54% 0.47% 0.45% 0.38% 0.94%

Total Past Due 0.92% 0.85% 0.80% 0.77% 0.96% 1.61%

IBERIABANK fsb

30+ days past due 1.57% 1.85% 1.73% 1.09% 1.12% 0.88%

Non-accrual 2.53% 2.12% 1.68% 2.45% 2.78% 2.42%

Total Past Due 4.10% 3.97% 3.41% 3.54% 3.90% 3.30%

Consolidated (Ex-FDIC Covered Assets)

30+ days past due 0.89% 0.65% 0.64% 0.50% 0.72% 0.73%

Non-accrual 0.74% 0.90% 0.74% 0.92% 0.97% 1.31%

Total Past Due 1.63% 1.55% 1.38% 1.42% 1.69% 2.04%

CapitalSouth Only

30+ days past due 7.62% 7.59% 10.01%

Non-accrual 24.64% 29.68% 23.97%

Total Past Due 32.26% 37.27% 33.98%

Orion Only

30+ days past due 16.54% 8.56%

Non-accrual 57.58% 59.86%

Total Past Due 74.12% 68.42%

Century Only

30+ days past due 10.52% 10.81%

Non-accrual 53.50% 43.73%

Total Past Due 64.02% 54.54%

Consolidated With FDIC Covered Assets

30+ days past due 1.08% 4.37% 3.09%

Non-accrual 2.87% 15.45% 14.23%

Total Past Due 3.95% 19.82% 17.32%

49

Appendix

Other Asset Quality Information

(Dollars in $000s) 1Q09 2Q09 3Q09 4Q09 1Q10** 1Q10

3/31/09 6/30/09 9/31/09 12/31/09 3/31/10 3/31/10

% of Outstandings Commercial 59.5% 60.9% 63.1% 62.7% 65.3% 63.0%

Mortgage 13.6% 12.5% 12.6% 17.3% 10.6% 17.1%

Consumer 16.1% 15.9% 14.8% 13.0% 14.6% 13.0%

Indirect 7.0% 7.1% 6.2% 4.5% 6.2% 4.5%

Business Banking 2.8% 2.6% 2.3% 1.7% 2.3% 1.7%

Credit Cards 1.0% 1.0% 1.0% 0.8% 1.0% 0.7%

Total Loans 100.0% 100.0% 100.0% 100.0% 100.0% 100.0%

Past Due 30+ Days* Commercial 1.82% 1.45% 4.82% 24.62% 2.15% 21.17%

Mortgage 0.85% 1.25% 4.25% 17.52% 1.78% 16.72%

Consumer 1.53% 1.20% 1.82% 9.74% 2.06% 8.06%

Indirect 0.97% 1.06% 1.05% 1.19% 1.01% 1.01%

Business Banking 0.83% 1.29% 1.33% 2.17% 2.73% 2.73%

Credit Cards 1.63% 1.32% 1.20% 1.52% 1.73% 2.12%

Total Loans 1.55% 1.38% 3.95% 19.82% 2.04% 17.34%

IBERIABANK 0.85% 0.80% 4.06% 23.04% 1.61% 20.24%

IBERIABANK fsb 3.97% 3.41% 3.54% 3.90% 3.30% 3.30%

Consolidated 1.55% 1.38% 3.95% 19.82% 2.04% 17.34%

* | | Includes nonaccruing loans |

** Excludes FDIC assisted acquisitions

50

Consumer Portfolio - Quarterly Credit Statistics

Loans Past Due As A % of Product Loans

12/31/08 3/31/09 6/30/09 9/30/09 12/31/09 3/31/10

Home Equity Lines of Credit

30 to 59 Days Past Due 0.24% 0.68% 0.19% 0.32% 0.57% 0.86%

60 to 89 Days Past Due 0.13% 0.07% 0.14% 0.07% 0.33% 0.14%

Over 90 Days Past Due 0.11% 0.11% 0.19% 0.13% 0.07% 0.14%

Total 30+ Days Past Due 0.48% 0.86% 0.52% 0.51% 0.98% 1.14%

Net Charge-Offs 0.15% 0.23% 0.07% 1.25% 0.35% 0.47%

Home Equity Term Loans

30 to 59 Days Past Due 0.80% 0.56% 0.46% 0.57% 0.85% 1.08%

60 to 89 Days Past Due 0.09% 0.17% 0.17% 0.20% 0.22% 0.18%

Over 90 Days Past Due 0.05% 0.06% 0.28% 0.21% 0.32% 0.19%

Total 30+ Days Past Due 0.93% 0.79% 0.91% 0.98% 1.38% 1.45%

Net Charge-Offs 0.21% 0.13% 0.18% 0.81% 0.08% 0.46%

Indirect Loans

30 to 59 Days Past Due 0.59% 0.54% 0.49% 0.51% 0.64% 0.49%

60 to 89 Days Past Due 0.18% 0.12% 0.19% 0.16% 0.10% 0.07%

Over 90 Days Past Due 0.05% 0.05% 0.07% 0.06% 0.09% 0.07%

Non Accrual 0.30% 0.30% 0.32% 0.36% 0.39% 0.40%

Total 30+ Days Past Due 1.12% 1.00% 1.08% 1.08% 1.23% 1.04%

Net Charge-Offs 0.44% 0.43% 0.42% 0.54% 0.43% 0.31%

Credit Card Loans

30 to 59 Days Past Due 0.49% 0.27% 0.42% 0.32% 0.40% 0.37%

60 to 89 Days Past Due 0.45% 0.38% 0.18% 0.24% 0.30% 0.48%

Over 90 Days Past Due 0.61% 0.99% 0.72% 0.64% 0.54% 0.00%

Total 30+ Days Past Due 1.55% 1.63% 1.32% 1.20% 1.24% 0.85%

Net Charge-Offs 1.34% 2.82% 4.31% 2.48% 2.63% 3.03%

Other Consumer Loans

30 to 59 Days Past Due 1.20% 1.07% 0.70% 0.47% 0.83% 0.58%

60 to 89 Days Past Due 0.35% 0.15% 0.13% 0.33% 0.75% 0.25%

Over 90 Days Past Due 0.82% 0.12% 0.23% 0.36% 0.35% 0.45%

Total 30+ Days Past Due 2.37% 1.34% 1.07% 1.15% 1.94% 1.28%

Net Charge-Offs 1.88% 2.03% 1.40% 3.35% 1.54% 2.57%

Source: SNL on April 28, 2010 21

Appendix

Consumer Portfolio Past Dues

51

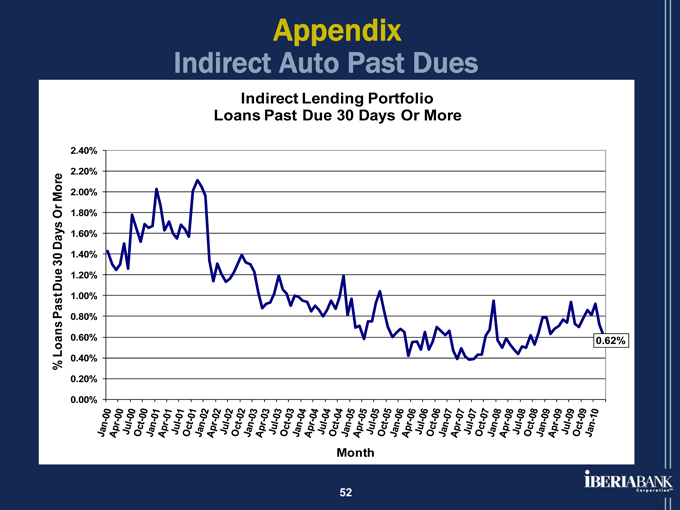

Appendix

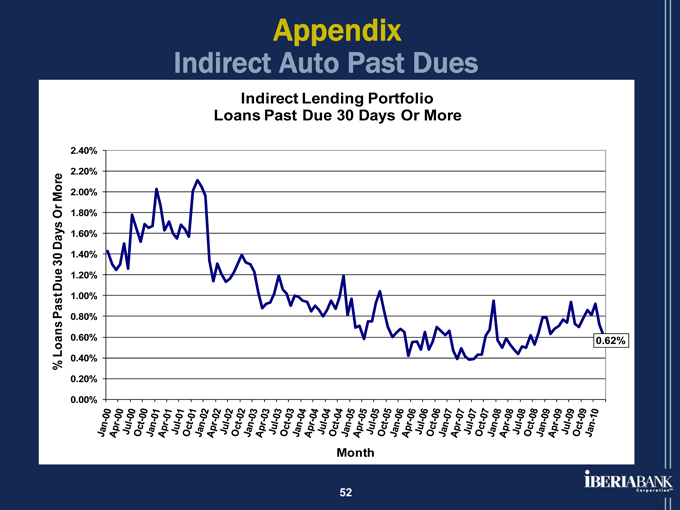

Indirect Auto Past Dues

Indirect Lending Portfolio Loans Past Due 30 Days Or More

% Loans Past Due 30 Days Or More

2.40% 2.20% 2.00% 1.80% 1.60% 1.40% 1.20% 1.00% 0.80% 0.60% 0.40% 0.20% 0.00%

0.62%

Jan-00

Apr-00

Jul-00

Oct-00

Jan-01

Apr-01

Jul-01

Oct-01

Jan-02

Apr-02

Jul-02

Oct-02

Jan-03

Apr-03

Jul-03

Oct-03

Jan-04

Apr-04

Jul-04

Oct-04

Jan-05

Apr-05

Jul-05

Oct-05

Jan-06

Apr-06

Jul-06

Oct-06

Jan-07

Apr-07

Jul-07

Oct-07

Jan-08

Apr-08

Jul-08

Oct-08

Jan-09

Apr-09

Jul-09

Oct-09

Jan-10

Month

52

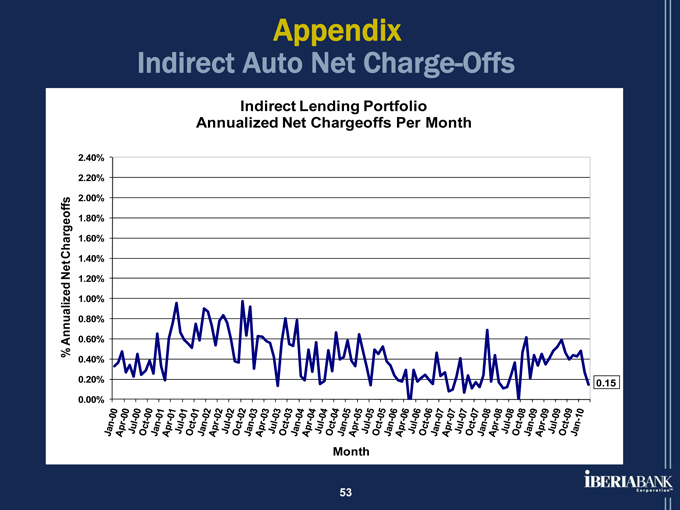

Appendix

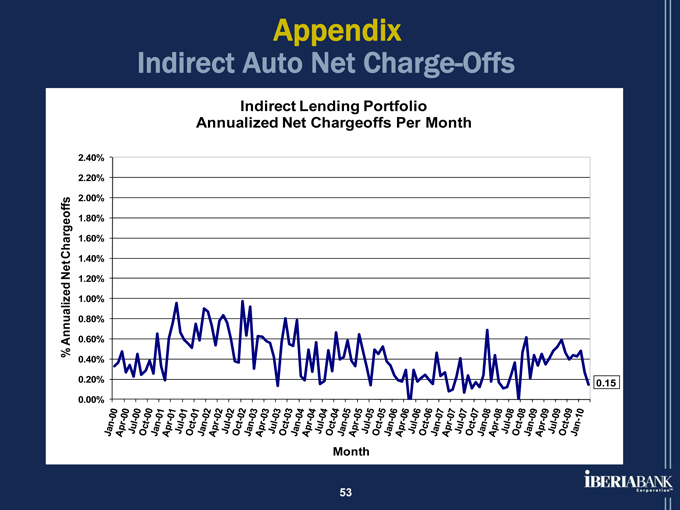

Indirect Auto Net Charge-Offs

Indirect Lending Portfolio Annualized Net Chargeoffs Per Month

% Annualized Net Chargeoffs

2.40% 2.20% 2.00% 1.80% 1.60% 1.40% 1.20% 1.00% 0.80% 0.60% 0.40% 0.20% 0.00%

Jan-00

Apr-00

Jul-00

Oct-00

Jan-01

Apr-01

Jul-01

Oct-01

Jan-02

Apr-02

Jul-02

Oct-02

Jan-03

Apr-03

Jul-03

Oct-03

Jan-04

Apr-04

Jul-04

Oct-04

Jan-05

Apr-05

Jul-05

Oct-05

Jan-06

Apr-06

Jul-06

Oct-06

Jan-07

Apr-07

Jul-07

Oct-07

Jan-08

Apr-08

Jul-08

Oct-08

Jan-09

Apr-09

Jul-09

Oct-09

Jan-10

Month

0.15

53

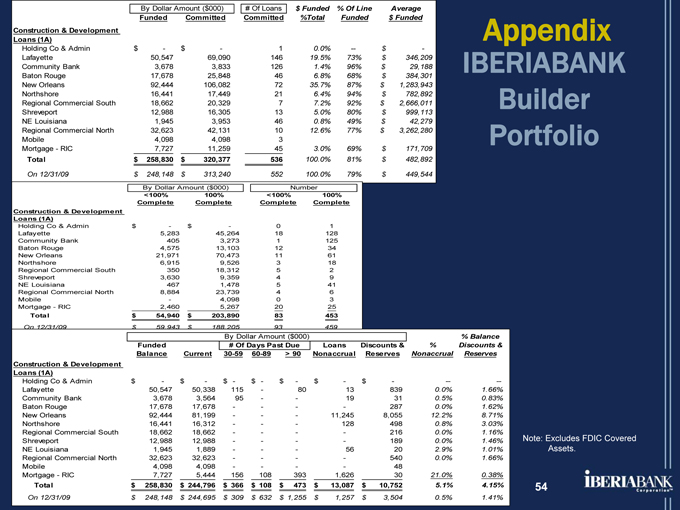

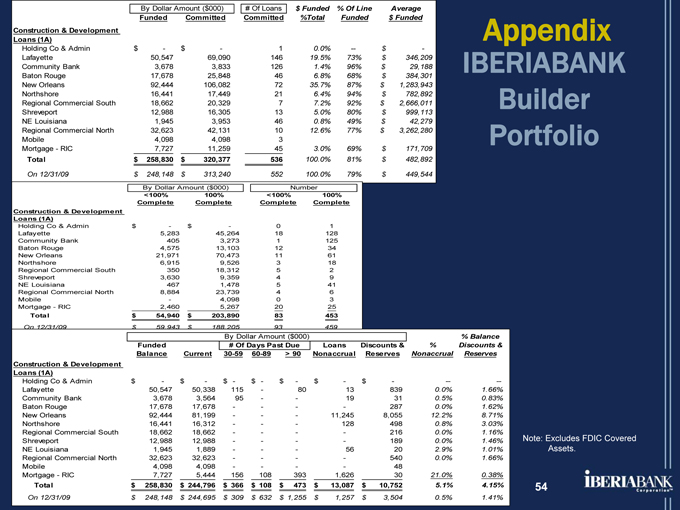

By Dollar Amount ($000) # Of Loans $ Funded% Of Line Average

Funded Committed Committed%Total Funded $ Funded

Construction & Development

Loans (1A)

Holding Co & Admin $- $- 1 0.0% - $ -

Lafayette 50,547 69,090 146 19.5% 73% $ 346,209

Community Bank 3,678 3,833 126 1.4% 96% $ 29,188

Baton Rouge 17,678 25,848 46 6.8% 68% $ 384,301

New Orleans 92,444 106,082 72 35.7% 87% $ 1,283,943

Northshore 16,441 17,449 21 6.4% 94% $ 782,892

Regional Commercial South 18,662 20,329 7 7.2% 92% $ 2,666,011

Shreveport 12,988 16,305 13 5.0% 80% $ 999,113

NE Louisiana 1,945 3,953 46 0.8% 49% $ 42,279

Regional Commercial North 32,623 42,131 10 12.6% 77% $ 3,262,280

Mobile 4,098 4,098 3

Mortgage - RIC 7,727 11,259 45 3.0% 69% $ 171,709

Total $ 258,830 $ 320,377 536 100.0% 81% $ 482,892

On 12/31/09 $ 248,148 $ 313,240 552 100.0% 79% $ 449,544

By Dollar Amount ($000) Number

<100% 100% <100% 100%

Complete Complete Complete Complete

Construction & Development

Loans (1A)

Holding Co & Admin $-$-0 1

Lafayette 5,283 45,264 18 128

Community Bank 405 3,273 1 125

Baton Rouge 4,575 13,103 12 34

New Orleans 21,971 70,473 11 61

Northshore 6,915 9,526 3 18

Regional Commercial South 350 18,312 5 2

Shreveport 3,630 9,359 4 9

NE Louisiana 467 1,478 5 41

Regional Commercial North 8,884 23,739 4 6

Mobile - 4,098 0 3

Mortgage - RIC 2,460 5,267 20 25

Total $ 54,940 $ 203,890 83 453

On 12/31/09 $ 59,943 $ 188,205 93 459

By Dollar Amount ($000)% Balance

Funded # Of Days Past Due Loans Discounts &% Discounts &

Balance Current 30-59 60-89 > 90 Nonaccrual Reserves Nonaccrual Reserves

Construction & Development

Loans (1A)

Holding Co & Admin $- $- $- $- $- $- $-

Lafayette 50,547 50,338 115 - 80 13 839 0.0% 1.66%

Community Bank 3,678 3,564 95 - 19 31 0.5% 0.83%

Baton Rouge 17,678 17,678 - 287 0.0% 1.62%

New Orleans 92,444 81,199 - 11,245 8,055 12.2% 8.71%

Northshore 16,441 16,312 - 128 498 0.8% 3.03%

Regional Commercial South 18,662 18,662 - 216 0.0% 1.16%

Shreveport 12,988 12,988 - 189 0.0% 1.46%

NE Louisiana 1,945 1,889 - 56 20 2.9% 1.01%

Regional Commercial North 32,623 32,623 - 540 0.0% 1.66%

Mobile 4,098 4,098 - 48

Mortgage - RIC 7,727 5,444 156 108 393 1,626 30 21.0% 0.38%

Total $ 258,830 $ 244,796 $ 366 $ 108 $ 473 $ 13,087 $ 10,752 5.1% 4.15%

On 12/31/09 $ 248,148 $ 244,695 $ 309 $ 632 $ 1,255 $ 1,257 $ 3,504 0.5% 1.41%

Appendix

IBERIABANK Builder Portfolio

Note: Excludes FDIC Covered Assets.

54

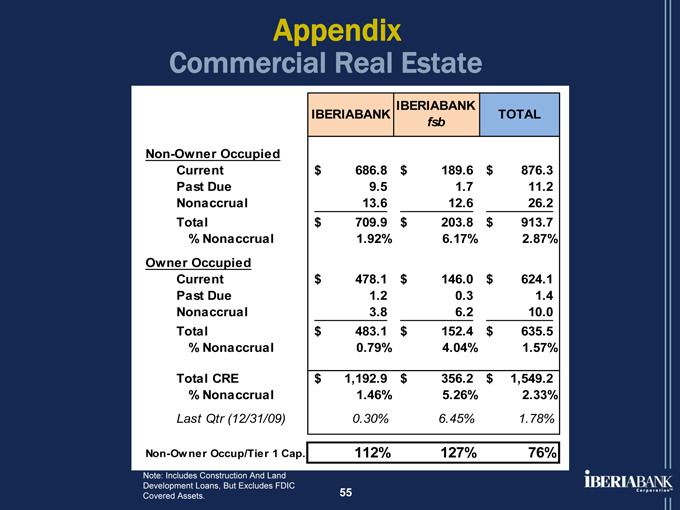

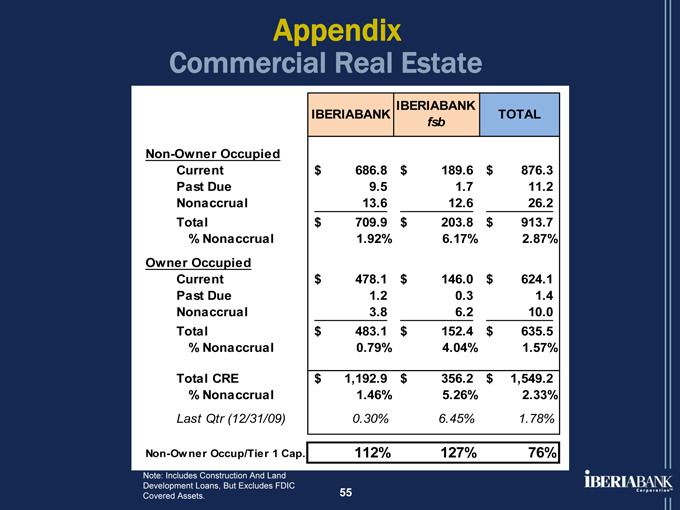

Appendix

Commercial Real Estate

IBERIABANK IBERIABANK TOTAL

fsb

Non-Owner Occupied

Current $ 686.8 $ 189.6 $ 876.3

Past Due 9.5 1.7 11.2

Nonaccrual 13.6 12.6 26.2

Total $ 709.9 $ 203.8 $ 913.7

% Nonaccrual 1.92% 6.17% 2.87%

Owner Occupied

Current $ 478.1 $ 146.0 $ 624.1

Past Due 1.2 0.3 1.4

Nonaccrual 3.8 6.2 10.0

Total $ 483.1 $ 152.4 $ 635.5

% Nonaccrual 0.79% 4.04% 1.57%

Total CRE $ 1,192.9 $ 356.2 $ 1,549.2

% Nonaccrual 1.46% 5.26% 2.33%

Last Qtr (12/31/09) 0.30% 6.45% 1.78%

Non-Owner Occup/Tier 1 Cap. 112% 127% 76%

Note: Includes Construction And Land Development Loans, But Excludes FDIC

Covered Assets. 55

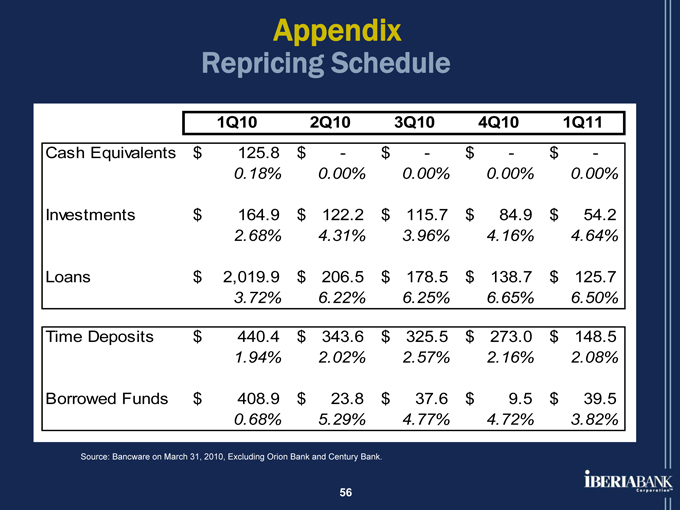

Appendix

Repricing Schedule

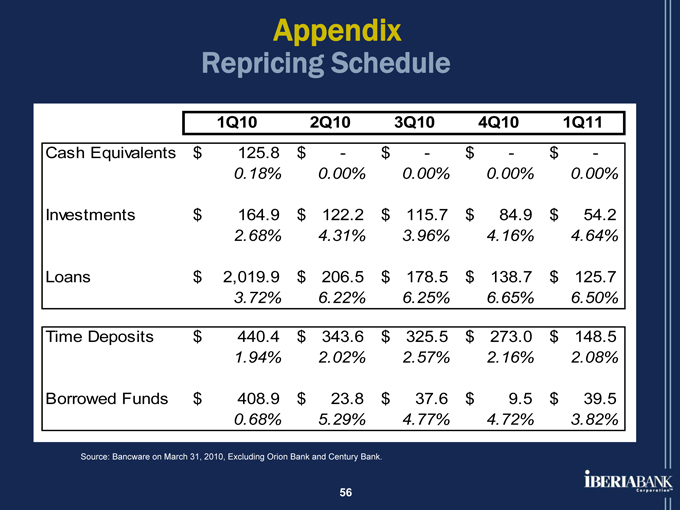

1Q10 2Q10 3Q10 4Q10 1Q11

Cash Equivalents $ 125.8 $ - $ - $ - $ -

0.18% 0.00% 0.00% 0.00% 0.00%

Investments $ 164.9 $ 122.2 $ 115.7 $ 84.9 $ 54.2

2.68% 4.31% 3.96% 4.16% 4.64%

Loans $ 2,019.9 $ 206.5 $ 178.5 $ 138.7 $ 125.7

3.72% 6.22% 6.25% 6.65% 6.50%

Time Deposits $ 440.4 $ 343.6 $ 325.5 $ 273.0 $ 148.5

1.94% 2.02% 2.57% 2.16% 2.08%

Borrowed Funds $ 408.9 $ 23.8 $ 37.6 $ 9.5 $ 39.5

0.68% 5.29% 4.77% 4.72% 3.82%

Source: Bancware on March 31, 2010, Excluding Orion Bank and Century Bank.

56

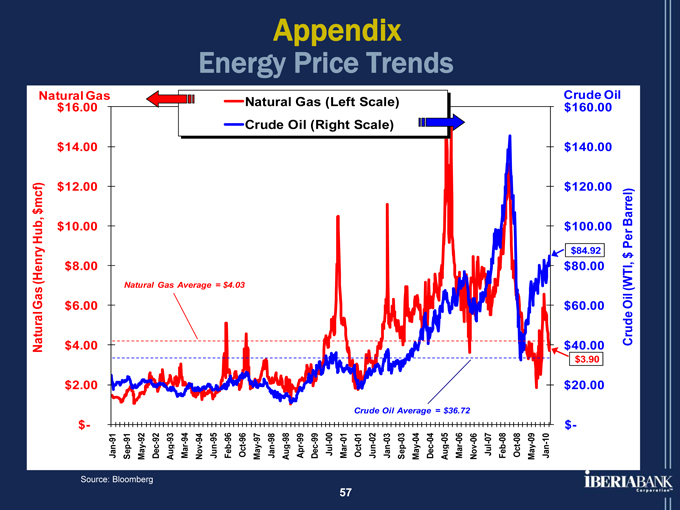

Appendix

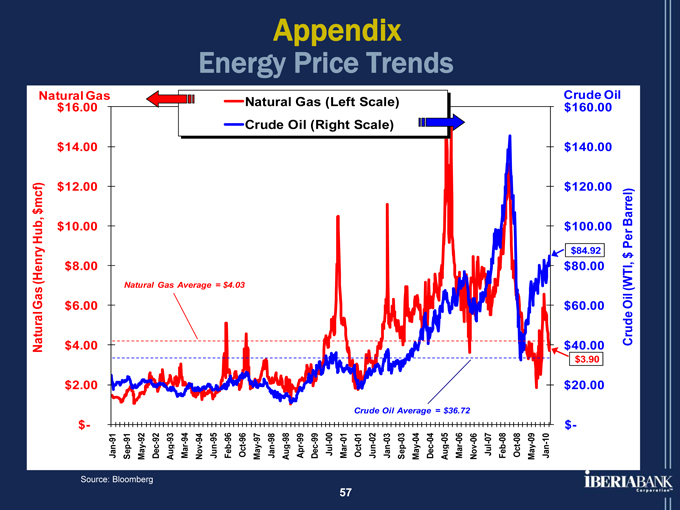

Energy Price Trends

Natural Gas (Henry Hub, $mcf)

Natural Gas $16.00

$14.00 $12.00 $10.00 $8.00 $6.00 $4.00 $2.00 $-

Natural Gas (Left Scale) Crude Oil (Right Scale)

Natural Gas Average = $4.03

Crude Oil Average = $36.72

Jan-91

Sep-91

May-92

Dec-92

Aug-93

Mar-94

Nov-94

Jun-95

Feb-96

Oct-96

May-97

Jan-98

Aug-98

Apr-99

Dec-99

Jul-00

Mar-01

Oct-01

Jun-02

Jan-03

Sep-03

May-04

Dec-04

Aug-05

Mar-06

Nov-06

Jul-07

Feb-08

Oct-08

May-09

Jan-10

Crude

$160.00

$140.00

$120.00

$100.00

$84.92

$80.00

$60.00

$40.00

$3.90

$20.00

$-

Crude Oil (WTI, $ Per Barrel)

Source: Bloomberg

57

Appendix

Mortgage Quarterly Revenues

Mortgage Gains On Sale Of Loans

Quarterly Mortgage Revenues ($ Million) $

$11.0 $10.0 $9.0 $8.0 $7.0 $6.0 $5.0 $4.0 $3.0 $2.0 $1.0 $-

1st Qtr 2nd Qtr 3rd Qtr 4th Qtr

2003 2004 2005 2006 2007 2008 2009 2010

** Assumes Pulaski’s acquisition of IBERIABANK Mortgage beginning in February 2007

58

In 1Q10 Closed $295mm (-16% Vs. 4Q09)

In 1Q10 Sold $287mm (-14% Vs. 4Q09)

5th Highest Revenue Quarter in Company History

1Q10 Vs. 4Q09: 13% Decrease In Mtg. Revenues

$169mm Locked Pipeline 4/16/10

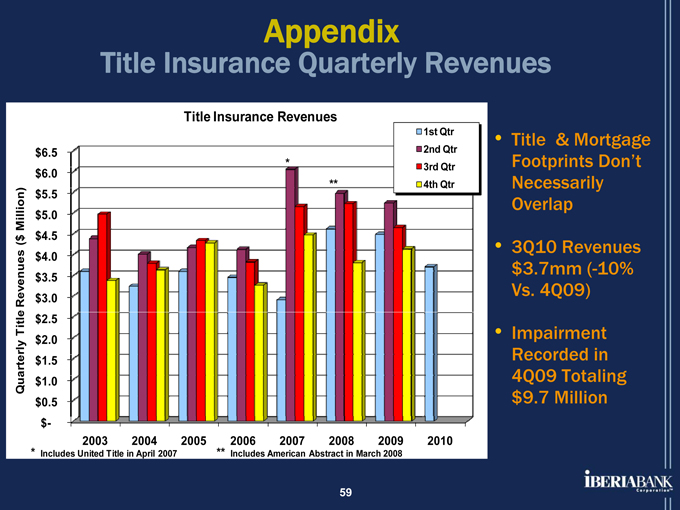

Appendix

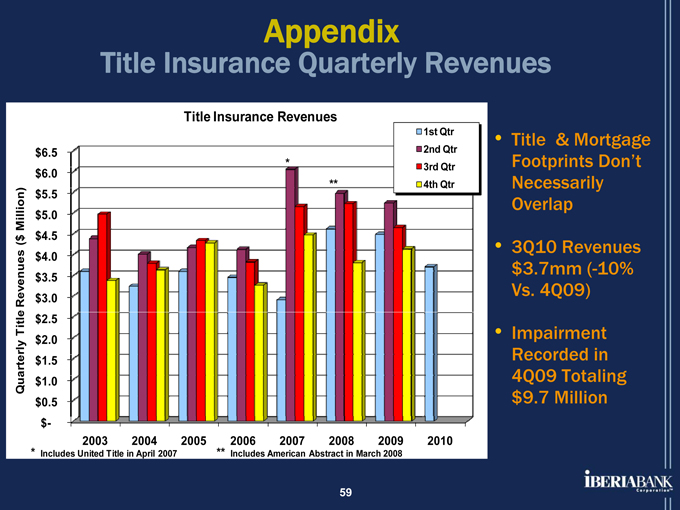

Title Insurance Quarterly Revenues

Quarterly Title Revenues ($ Million)

$6.5 $6.0 $5.5 $5.0 $4.5 $4.0 $3.5 $3.0 $2.5 $2.0 $1.5 $1.0 $0.5 $-

2003 2004 2005 2006 2007 2008 2009 2010

Includes United Title in April 2007 ** Includes American Abstract in March 2008

Title Insurance Revenues

1st Qtr 2nd Qtr 3rd Qtr 4th Qtr

Title & Mortgage Footprints Don’t Necessarily Overlap

3Q10 Revenues $3.7mm (-10% Vs. 4Q09)

Impairment Recorded in 4Q09 Totaling $9.7 Million

59

60