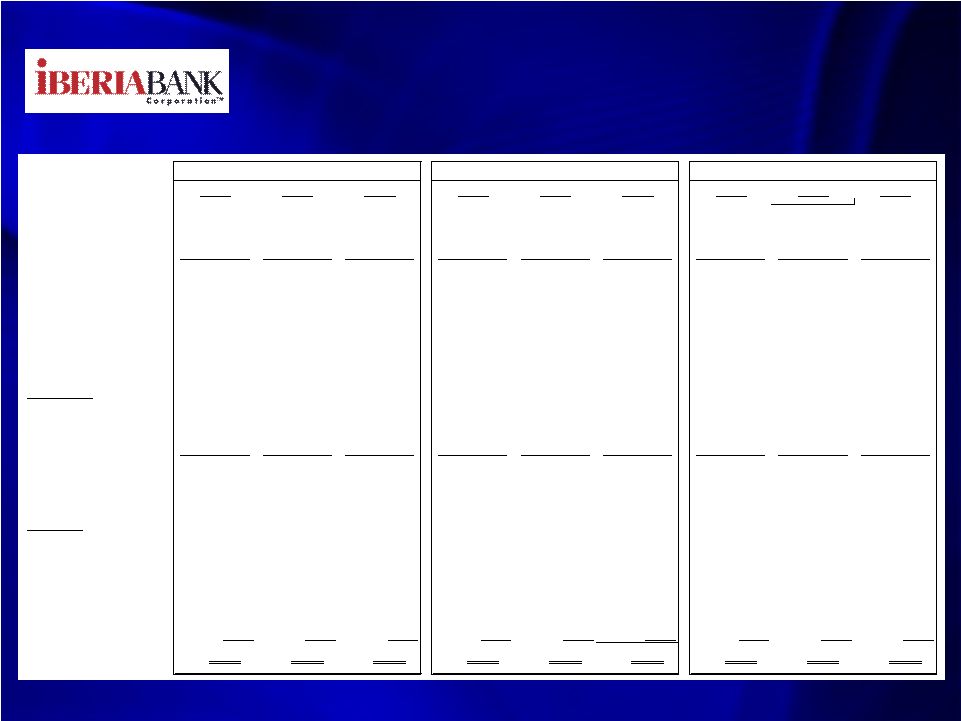

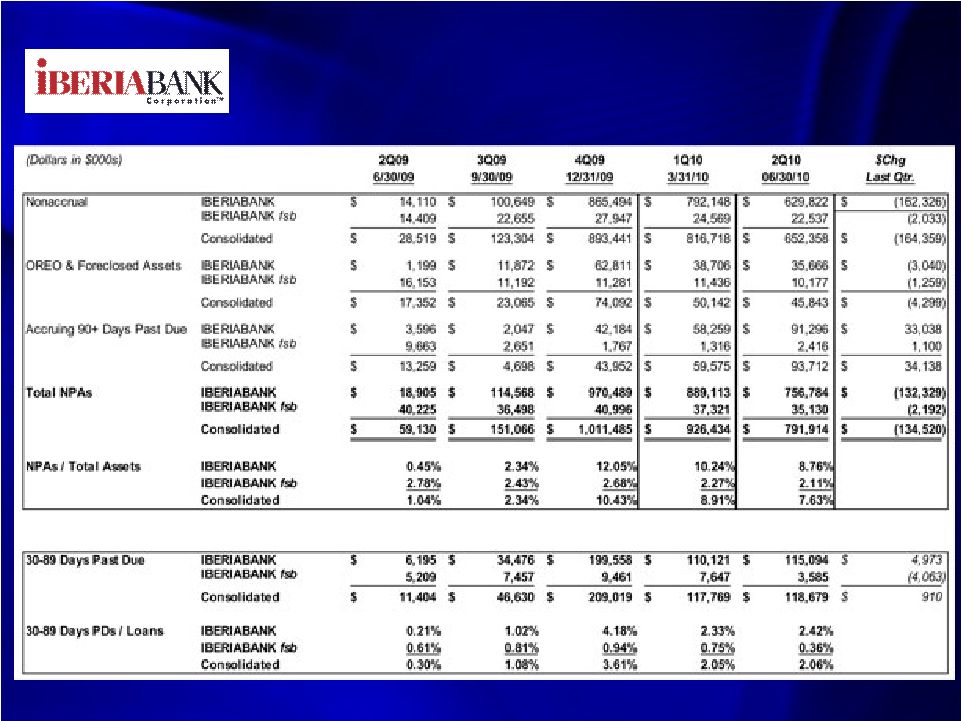

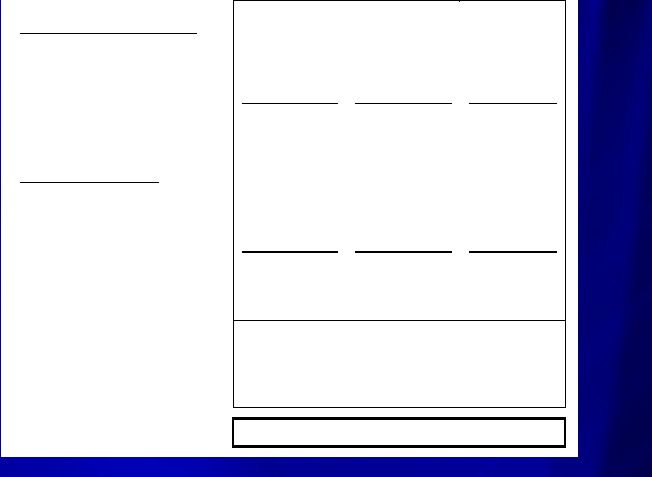

25 Asset Quality 2Q10 Compared To Prior Quarters Note: Includes FDIC Assisted Acquisitions ($thousands) 4Q09 1Q10 2Q10 4Q09 1Q10 2Q10 4Q09 1Q10 2Q10 Nonaccruals 865,494 $ 792,148 $ 629,822 $ 27,947 $ 24,569 $ 22,537 $ 893,441 $ 816,717 $ 652,358 $ OREO & Foreclosed 62,811 38,706 35,666 11,281 11,436 10,177 74,092 50,142 45,843 90+ Days Past Due 42,184 58,259 91,296 1,767 1,316 2,416 43,952 59,575 93,712 Nonperforming Assets 970,489 $ 889,113 $ 756,784 $ 40,996 $ 37,321 $ 35,130 $ 1,011,485 $ 926,434 $ 791,914 $ NPAs/Assets 12.05% 10.24% 8.76% 2.68% 2.27% 2.11% 10.43% 8.91% 7.63% NPAs/(Loans + OREO) 20.05% 18.67% 15.77% 4.03% 3.64% 3.49% 17.27% 16.00% 13.64% LLR/Loans 0.72% 0.93% 1.59% 2.12% 1.98% 2.04% 0.96% 1.11% 1.67% Net Charge-Offs/Loans 0.04% 0.13% 0.47% 0.78% 1.41% 0.31% 0.18% 0.36% 0.44% Past Dues: 30-89 Days Past Due 199,558 $ 110,121 $ 115,094 $ 9,461 $ 7,647 $ 3,585 $ 209,019 $ 117,769 $ 118,679 $ 90+ days Past Due 42,184 58,259 91,296 1,767 1,316 2,416 43,952 59,575 93,712 Nonaccual Loans 865,494 792,148 629,822 27,947 24,569 22,537 893,441 816,717 652,358 Total 30+ Past Dues 1,107,236 $ 960,528 $ 836,213 $ 39,176 $ 33,533 $ 28,537 $ 1,146,412 $ 994,061 $ 864,750 $ % Loans 23.17% 20.33% 17.55% 3.90% 3.30% 2.86% 19.82% 17.32% 15.01% Loan Mix: Commercial 61.6% 61.9% 64.6% 67.8% 69.1% 68.5% 62.7% 63.0% 65.0% Consumer 11.7% 11.8% 13.3% 19.0% 18.5% 18.9% 13.0% 13.0% 14.3% Mortgage 19.6% 19.2% 14.9% 6.8% 6.4% 6.6% 17.3% 17.1% 13.6% Business Banking 1.7% 1.6% 1.6% 2.1% 2.0% 1.9% 1.7% 1.7% 1.7% Indirect 5.4% 5.5% 5.6% 0.0% 0.0% 0.0% 4.5% 4.5% 4.7% Credit Cards 0.0% 0.0% 0.0% 4.3% 4.0% 4.1% 0.8% 0.7% 0.7% Total Loans 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% IBERIABANK IBERIABANK fsb IBERIABANK Corporation |