Exhibit 99.2

3Q10 Earnings Conference Call

Supplemental Materials

October 26, 2010

Forward Looking Statements

Safe Harbor

Statements contained in this presentation which are not historical facts and which pertain to future operating results of IBERIABANK Corporation and its subsidiaries constitute “forward -looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These forward -looking statements involve significant risks and uncertainties. Actual results may differ materially from the results discussed in these forward -looking statements. Factors that might cause such a difference include, but are not limited to, those discussed in the Company’s periodic and other filings with the SEC.

Introductory Comments

Introductory Comments

Summary – Position

Favorable Balance Sheet Composition

Very Balanced; Core Funded; Low C&D Exposure Continued Good Asset Quality; Extraordinary Capital Favorable Interest Rate And Credit Risk Positioning Some of the Highest Capital Ratios of Bank Holding Companies with More Than $5 Billion in Assets Approximately $1.0 Billion in Excess Cash Future Growth Engines in Multiple Markets Strategic Recruiting Continued During The 3rd Quarter Fortunately, We Avoided What Ails The Banking Industry Remain Well Positioned For Future Opportunities

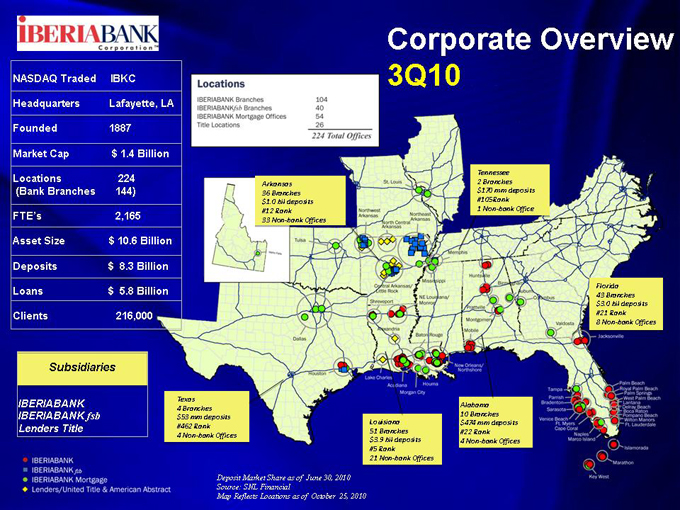

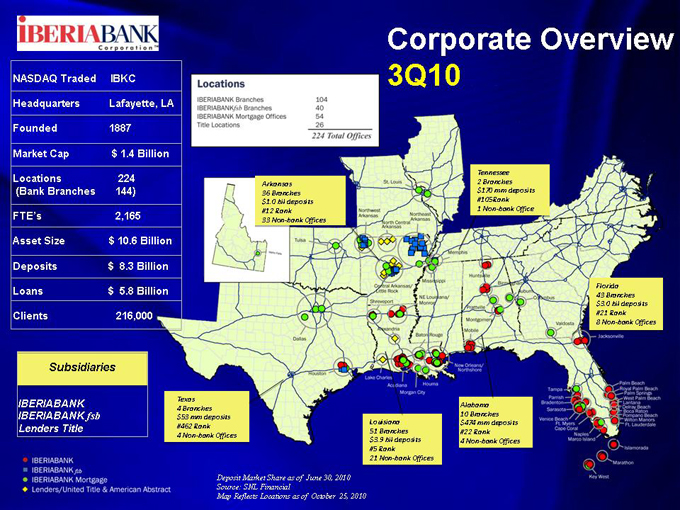

NASDAQ Traded IBKC Headquarters Lafayette, LA Founded 1887 Market Cap $ 1.4 Billion

Locations 224 (Bank Branches 144)

FTE’s 2,165 Asset Size $ 10.6 Billion Deposits $ 8.3 Billion Loans $ 5.8 Billion Clients 216,000

Corporate Overview 3Q10

Offices

Deposit Market Share as of June 30, 2010 Source: SNL Financial Map Reflects Locations as of October 25, 2010

Arkansas

36 Branches $1.0 bil deposits #12 Rank 33 Non-bank Offices

Tennessee

2 | | Branches $170 mm deposits #105Rank 1 Non-bank Office |

Florida

43 Branches $3.0 bil deposits #21 Rank 8 Non-bank Offices

Alabama

10 Branches $474 mm deposits #22 Rank 4 Non-bank Offices

Louisiana

51 Branches $3.9 bil deposits #5 Rank 21 Non-bank

Texas

4 | | Branches $53 mm deposits #462 Rank 4 Non-bank Offices |

Subsidiaries

IBERIABANK

IBERIABANK fsb Lenders Title

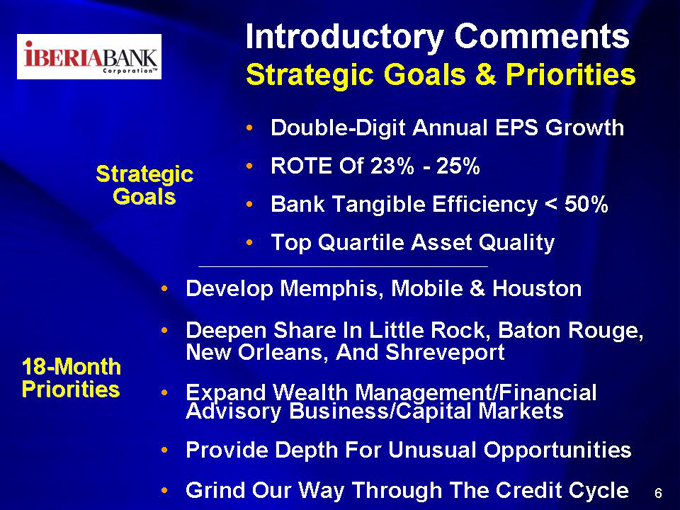

Introductory Comments

Strategic Goals & Priorities

Double -Digit Annual EPS Growth ROTE Of 23%—25% Bank Tangible Efficiency < 50% Top Quartile Asset Quality

Develop Memphis, Mobile & Houston

Deepen Share In Little Rock, Baton Rouge, New Orleans, And Shreveport Expand Wealth Management/Financial Advisory Business/Capital Markets Provide Depth For Unusual Opportunities Grind Our Way Through The Credit Cycle

Strategic Goals

18-Month Priorities

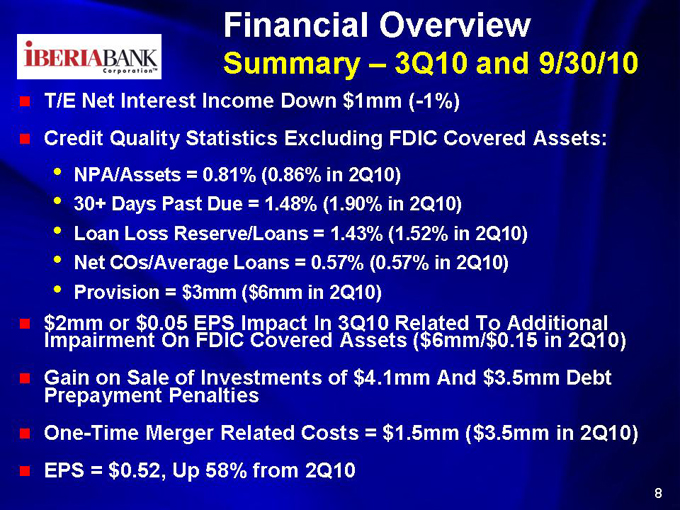

Financial Overview

Financial Overview

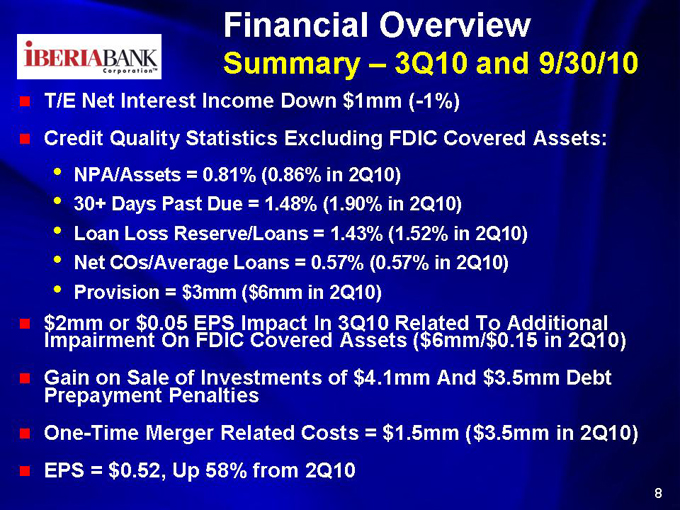

Summary – 3Q10 and 9/30/10

T/E Net Interest Income Down $1mm (-1%)

Credit Quality Statistics Excluding FDIC Covered Assets:

NPA/Assets = 0.81% (0.86% in 2Q10) 30+ Days Past Due = 1.48% (1.90% in 2Q10) Loan Loss Reserve/Loans = 1.43% (1.52% in 2Q10) Net COs/Average Loans = 0.57% (0.57% in 2Q10) Provision = $3mm ($6mm in 2Q10)

$2mm or $0.05 EPS Impact In 3Q10 Related To Additional Impairment On FDIC Covered Assets ($6mm/$0.15 in 2Q10) Gain on Sale of Investments of $4.1mm And $3.5mm Debt Prepayment Penalties One-Time Merger Related Costs = $1.5mm ($3.5mm in 2Q10) EPS = $0.52, Up 58% from 2Q10

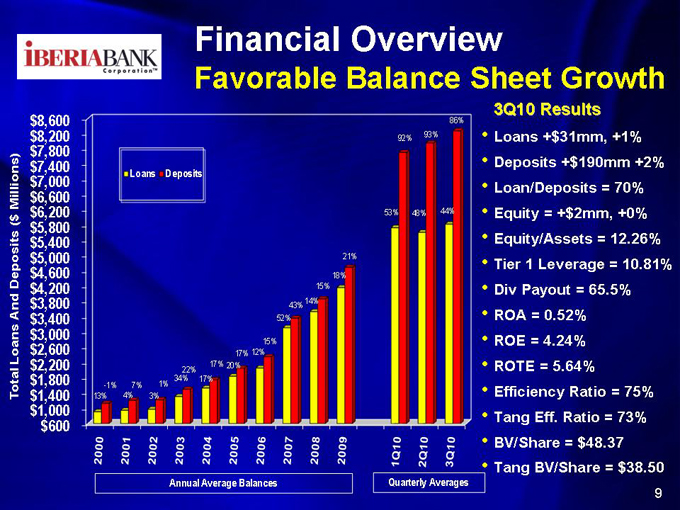

Financial Overview

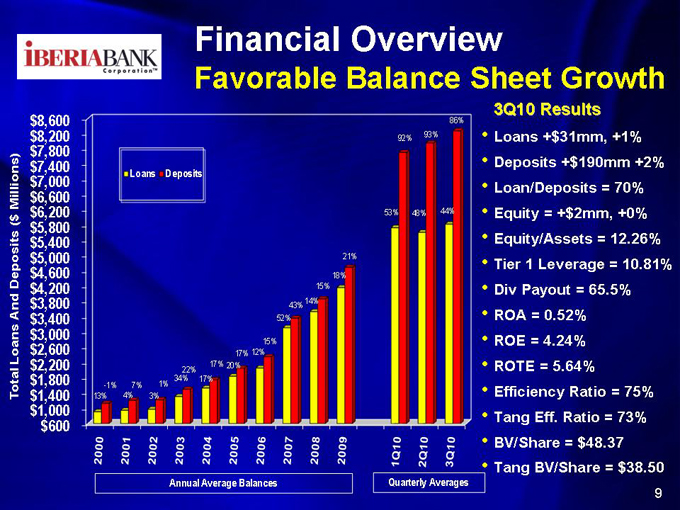

Favorable Balance Sheet Growth

$8,600 $8,200 $7,800 $7,400 $7,000 Millions) $6,600 $ $6,200 ( $5,800 $5,400 $5,000 Deposits $4,600 $4,200 And $3,800 $3,400 $3,000 Loans $2,600 $2,200 Total $1,800 $1,400 $1,000 $600

3Q10 Results

Loans +$31mm, +1% Deposits +$190mm +2% Loan/Deposits = 70% Equity = +$2mm, +0% Equity/Assets = 12.26% Tier 1 Leverage = 10.81% Div Payout = 65.5% ROA = 0.52% ROE = 4.24% ROTE = 5.64% Efficiency Ratio = 75% Tang Eff. Ratio = 73% BV/Share = $48.37 Tang BV/Share = $38.50

Annual Average Balances Quarterly Averages

9

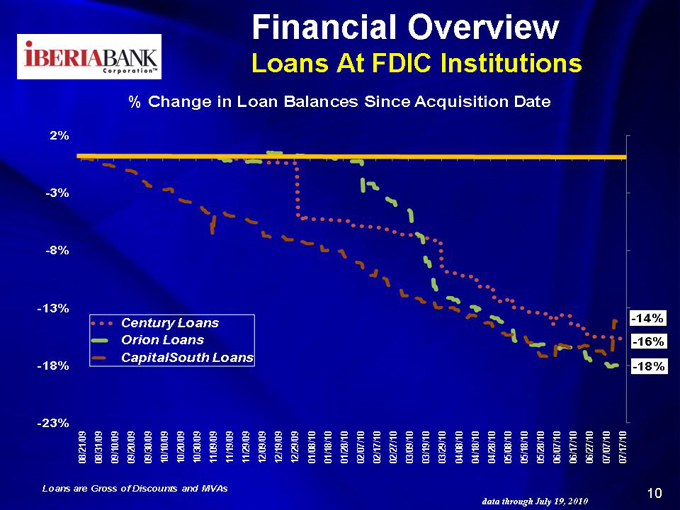

Financial Overview

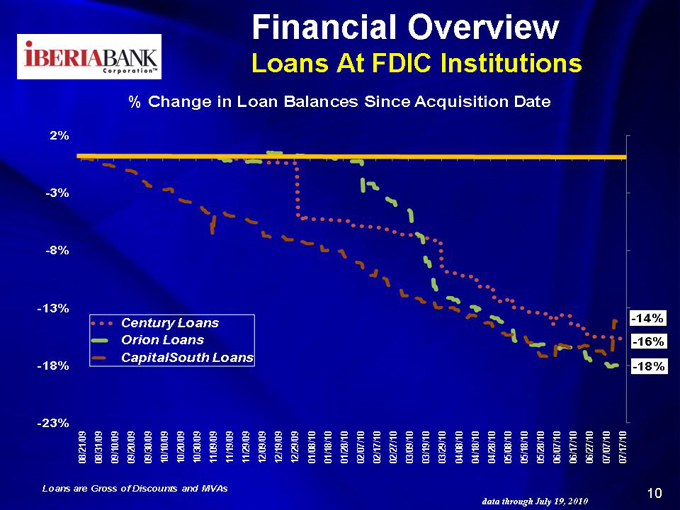

Loans At FDIC Institutions

% Change in Loan Balances Since Acquisition Date

2% -3% -8% -13% -18% -23%

Century Loans Orion Loans CapitalSouth Loans

-14% - -16%

-18%

08/21/09 08/31/09 09/10/09 09/20/09 09/30/09 10/10/09 10/20/09 10/30/09 11/09/09 11/19/09 11/29/09 12/09/09 12/19/09 12/29/09 01/08/10 01/18/10 01/28/10 02/07/10 02/17/10 02/27/10 03/09/10 03/19/10 03/29/10 04/08/10 04/18/10 04/28/10 05/08/10 05/18/10 05/28/10 06/07/10 06/17/10 06/27/10 07/07/10 07/17/10

Loans are Gross of Discounts and MVAs 10 data through July 19, 2010

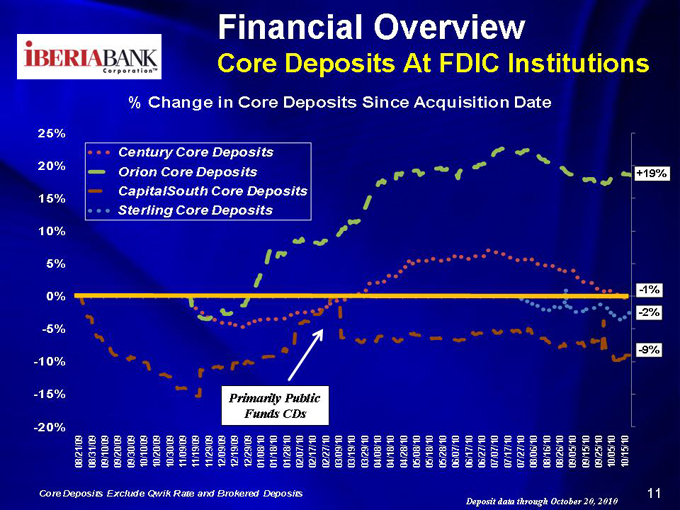

Financial Overview

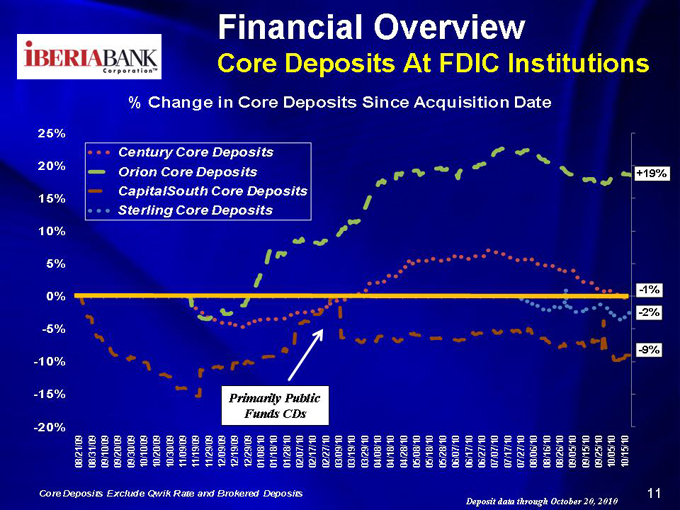

Core Deposits At FDIC Institutions

% Change in Core Deposits Since Acquisition Date

25% 20% 15% 10% 5% 0% -5% -10% -15% -20%

Century Core Deposits Orion Core Deposits CapitalSouth Core Deposits Sterling Core Deposits

Primarily Public Funds CDs

+19%

-1%

-2%

-9%

08/21/09 08/31/09 09/10/09 09/20/09 09/30/09 10/10/09 10/20/09 10/30/09 11/09/09 11/19/09 11/29/09 12/09/09 12/19/09 12/29/09 01/08/10 01/18/10 01/28/10 02/07/10 02/17/10 02/27/10 03/09/10 03/19/10 03/29/10 04/08/10 04/18/10 04/28/10 05/08/10 05/18/10 05/28/10 06/07/10 06/17/10 06/27/10 07/07/10 07/17/10 07/27/10 08/06/10 08/16/10 08/26/10 09/05/10 09/15/10 09/25/10 10/05/10 10/15/10

Core Deposits Exclude Qwik Rate and Brokered Deposits 11

Deposit data through October 20, 2010

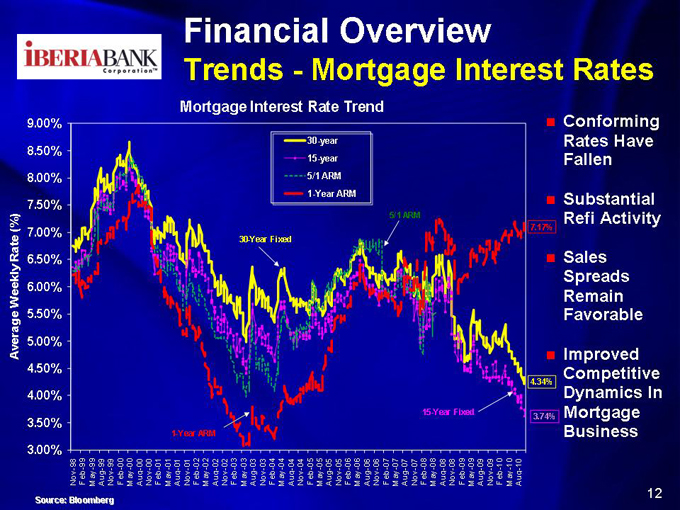

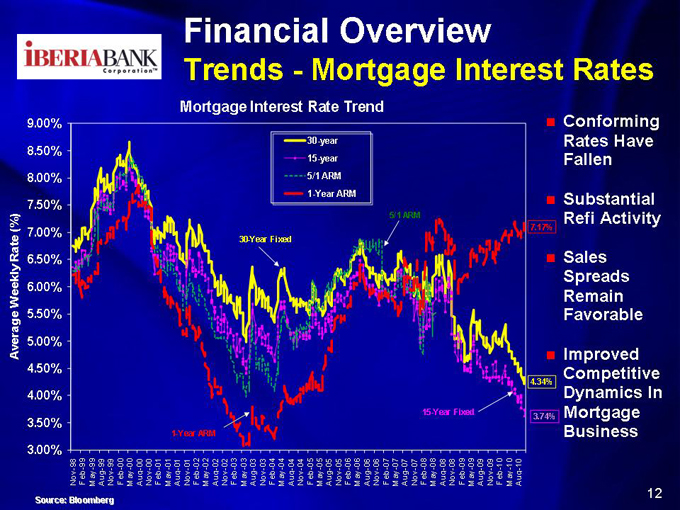

Mortgage Interest Rates

Financial Overview Trends - Mortgage Interest Rate Trend

Rate (%)Weekly Average

9.00% 8.50% 8.00% 7.50% 7.00% 6.50% 6.00% 5.50% 5.00% 4.50% 4.00% 3.50% 3.00%

30-year 15-year 5/1 ARM 1-Year ARM

Conforming Rates Have Fallen Substantial Refi Activity Sales Spreads Remain Favorable Improved Competitive Dynamics In Mortgage Business

Source: Bloomberg

12

Jumbo Mortgage Rates

Financial Overview Trends –

Weekly National 30-Year Mortgage Rates

Conforming Jumbo

Subprime Mtg. Market Gone & Alt-A Market Is Stalled Jumbo Spread Has Narrowed Considerably Mix Of FHA/VA & Conforming Product In September, 31% Of Our Production Was FHA/VA And 62% Was Conventional

8.85% 8.60% 8.35% 8.10% 7.85% 7.60% 7.35% 7.10% 6.85% 6.60% 6.35% 6.10% 5.85% 5.60% 5.35% 5.10% 4.85% 4.60% 4.35% 4.10%

Oct-10 Jul-10 Apr-10 Jan-10 Oct-09 Jul-09 Apr-09 Jan-09 Oct-08 Jul-08 Apr-08 Jan-08 Oct-07 Jul-07 Apr-07 Jan-07 Oct-06 Jul-06 Apr-06 Jan-06 Oct-05 Jul-05 Apr-05 Jan-05 Oct-04 Jul-04 Apr-04 Jan-04 Oct-03 Jul-03 Apr-03 Jan-03 Oct-02 Jul-02 Apr-02 Jan-02 Oct-01 Jul-01 Apr-01 Jan-01 Oct-00 Jul-00 Apr-00 Jan-00 Oct-99 Jul-99 Apr-99 Jan-99 Oct-98 Jul-98 Apr-98 Jan-98 Oct-97 Jul-97

?

58 bps 4.85% 4.27%

Source: Bloomberg

13

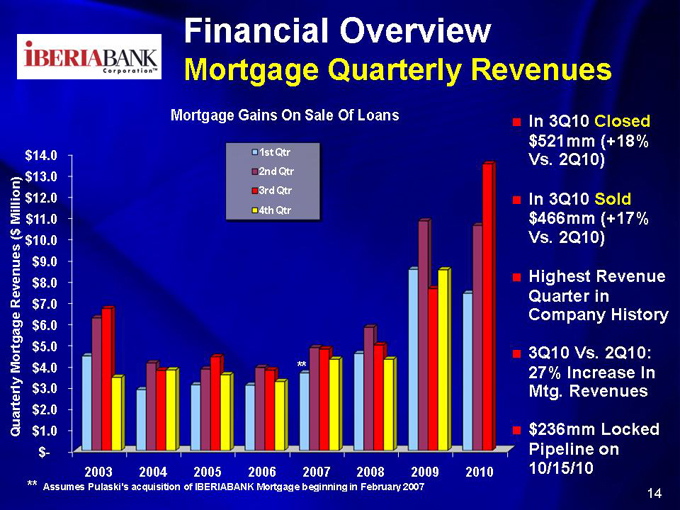

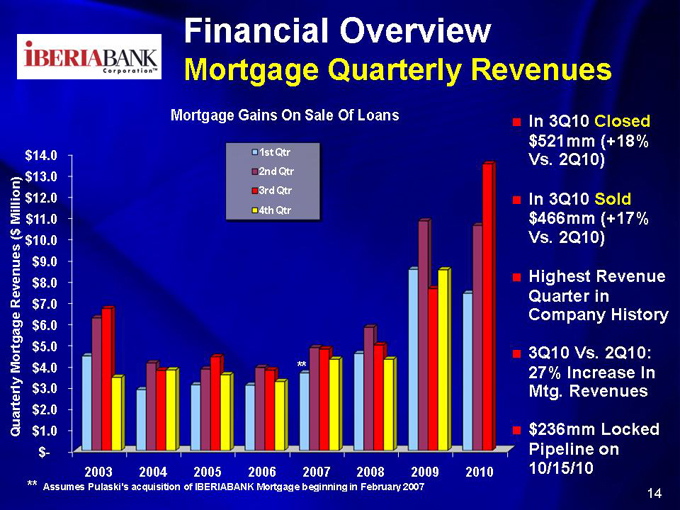

Financial Overview

Mortgage Quarterly Revenues

Mortgage Gains On Sale Of Loans

In 3Q10 Closed $521mm (+18% Vs. 2Q10)

In 3Q10 Sold $466mm (+17% Vs. 2Q10)

Highest Revenue Quarter in Company History

3Q10 Vs. 2Q10: 27% Increase In Mtg. Revenues

$236mm Locked Pipeline on 10/15/10

1st Qtr 2nd Qtr 3rd Qtr 4th Qtr

Million) ( $ Revenues Mortgage Quarterly

$14.0 $13.0 $12.0 $11.0 $10.0 $9.0 $8.0 $7.0 $6.0 $5.0 $4.0 $3.0 $2.0 $1.0 $-

2003 2004 2005 2006 2007 2008 2009 2010

** Assumes Pulaski’s acquisition of IBERIABANK Mortgage beginning in February 2007

14

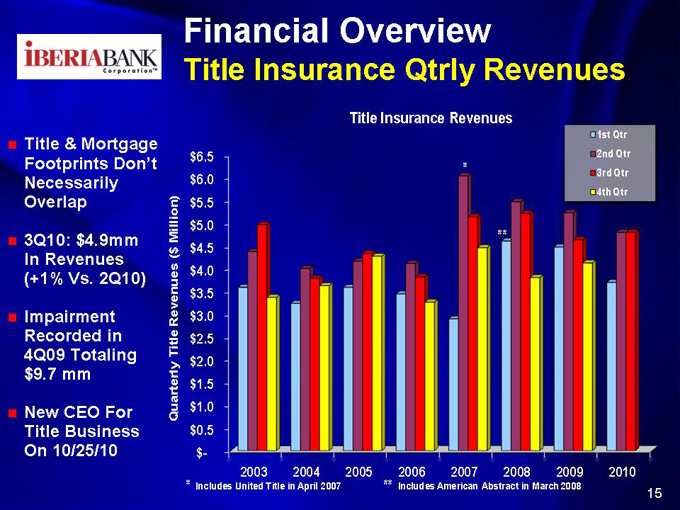

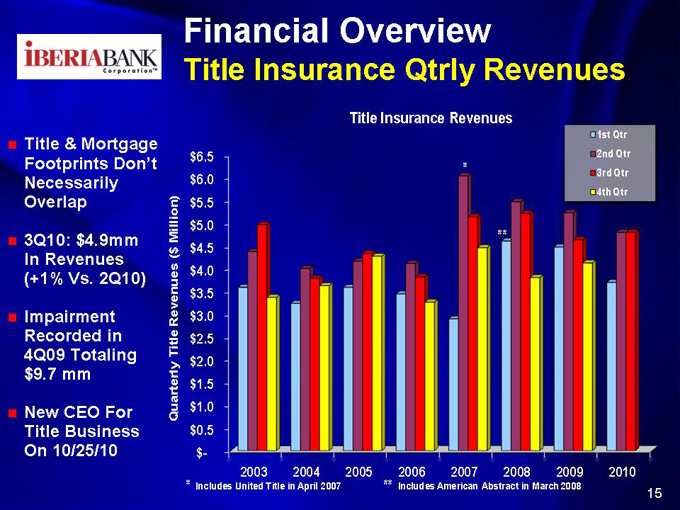

Financial Overview

Title Insurance Qtrly Revenues

Title Insurance Revenues

Title & Mortgage Footprints Don’t Necessarily Overlap

3Q10: $4.9mm In Revenues (+1% Vs. 2Q10)

Impairment Recorded in 4Q09 Totaling $9.7 mm

New CEO For Title Business On 10/25/10

Million) ( $ Revenues Title Quarterly

$6.5 $6.0 $5.5 $5.0 $4.5 $4.0 $3.5 $3.0 $2.5 $2.0 $1.5 $1.0 $0.5 $-

2003 2004 2005 2006 2007 2008 2009 2010

1st Qtr 2nd Qtr 3rd Qtr 4th Qtr

* | | Includes United Title in April 2007 ** Includes American Abstract in March 2008 |

15

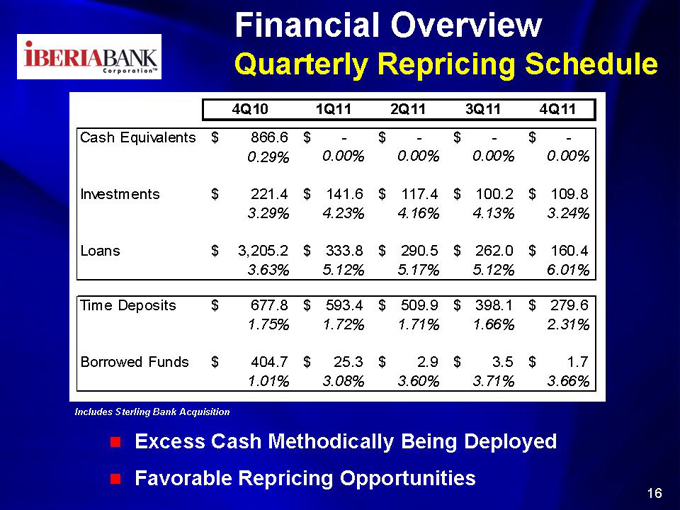

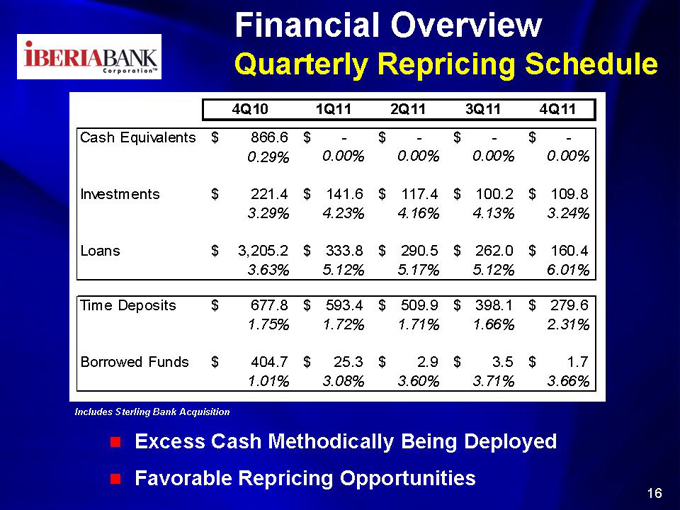

Financial Overview

Quarterly Repricing Schedule

4Q10 1Q11 2Q11 3Q11 4Q11

Cash Equivalents $ 866.6 $— $— $— $ -

1.18% 0.00% 0.00% 0.00% 0.00%

Investments $ 221.4 $ 141.6 $ 117.4 $ 100.2 $ 109.8

3.29% 4.23% 4.16% 4.13% 3.24%

Loans $ 3,205.2 $ 333.8 $ 290.5 $ 262.0 $ 160.4

3.63% 5.12% 5.17% 5.12% 6.01%

Time Deposits $ 677.8 $ 593.4 $ 509.9 $ 398.1 $ 279.6

1.75% 1.72% 1.71% 1.66% 2.31%

Borrowed Funds $ 404.7 $ 25.3 $ 2.9 $ 3.5 $ 1.7

1.01% 3.08% 3.60% 3.71% 3.66%

Includes Sterling Bank Acquisition

Excess Cash Methodically Being Deployed Favorable Repricing Opportunities

16

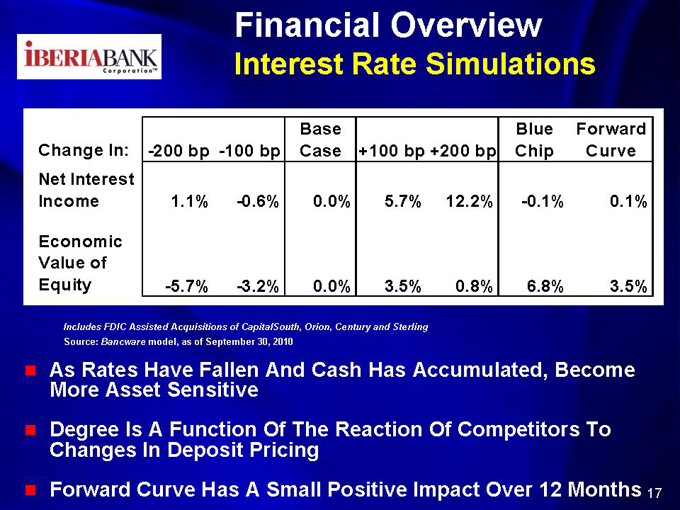

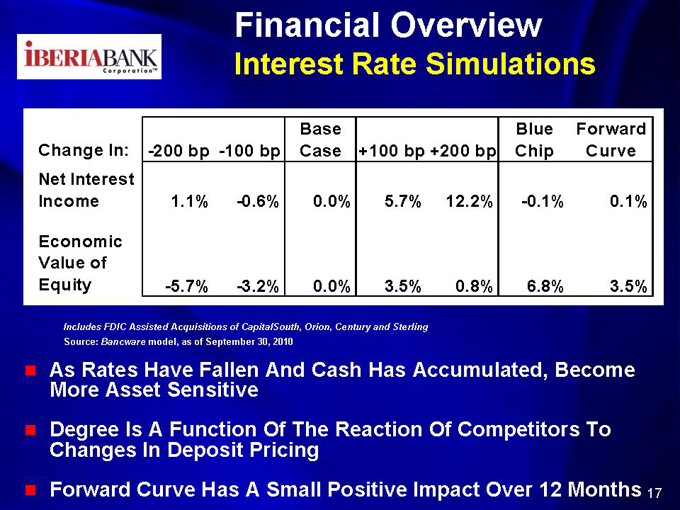

Financial Overview

Interest Rate Simulations

Change In: -200 bp -100 bp Base Case +100 bp +200 bp Blue Chip Forward Curve

Net Interest

Income 1.1% -0.6% 0.0% 5.7% 12.2% - -0.1% 0.1%

Economic

Value of

Equity -5.7% -3.2% 0.0% 3.5% 0.8% 6.8% 3.5%

Includes FDIC Assisted Acquisitions of CapitalSouth, Orion, Century and Sterling

Source: Bancware model, as of September 30, 2010

As Rates Have Fallen And Cash Has Accumulated, Become More Asset Sensitive Degree Is A Function Of The Reaction Of Competitors To Changes In Deposit Pricing Forward Curve Has A Small Positive Impact Over 12 Months

17

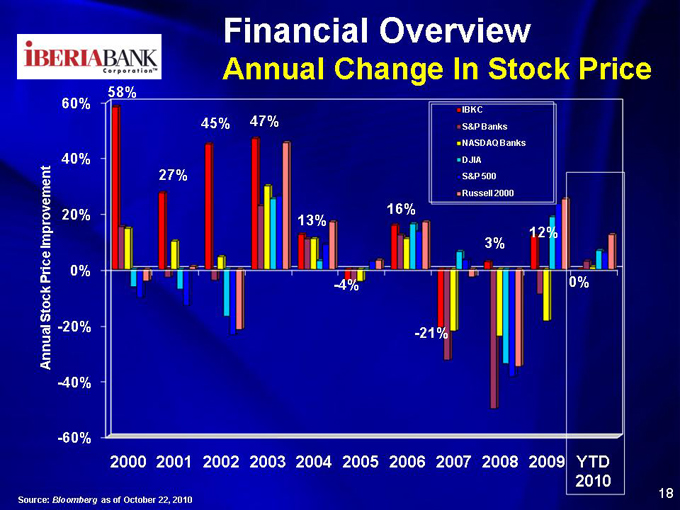

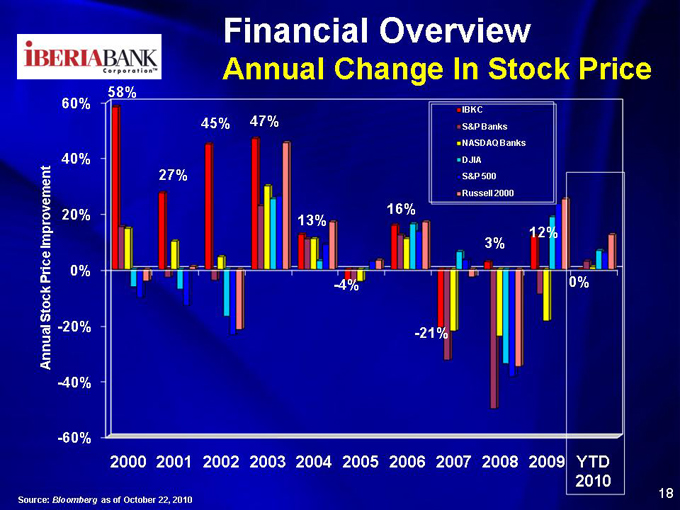

Financial Overview

Annual Change In Stock Price

Improvement Price Stock Annual

60% 40% 20% 0% - -20% -40% -60%

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009

58%

27%

45% 47%

16% 13%

-4%

IBKC S&P Banks NASDAQ Banks DJIA S&P 500 Russell 2000

-21%

12% 3%

0%

YTD 2010

Source: Bloomberg as of October 22, 2010

18

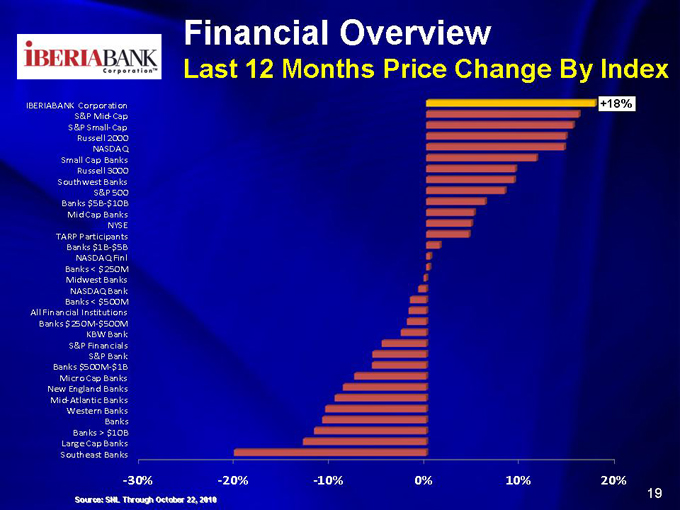

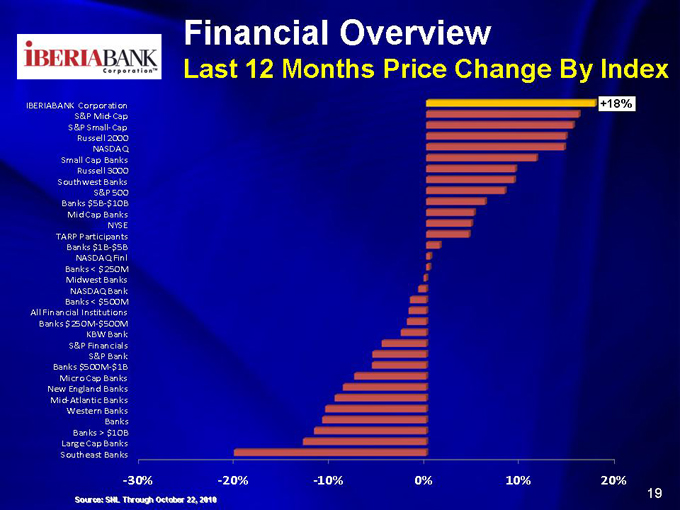

Financial Overview

Last 12 Months Price Change By Index

IBERIABANK Corporation

S&P Mid-Cap S&P Small-Cap Russell 2000 NASDAQ

Small Cap Banks Russell 3000 Southwest Banks S&P 500 Banks $5B-$10B

Mid Cap Banks NYSE

TARP Participants Banks $1B-$5B

NASDAQ Finl Banks < $250M Midwest Banks NASDAQ Bank Banks < $500M

All Financial Institutions Banks $250M-$500M

KBW Bank S&P Financials S&P Bank Banks $500M-$1B

Micro Cap Banks New England Banks Mid-Atlantic Banks Western Banks Banks Banks > $10B

Large Cap Banks Southeast Banks

-30% -20% -10% 0% 10% 20%

Source: SNL Through October 22, 2010

+18%

19

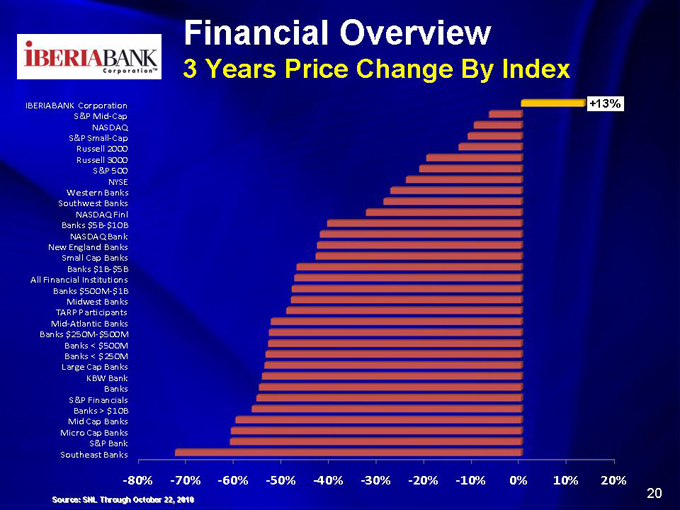

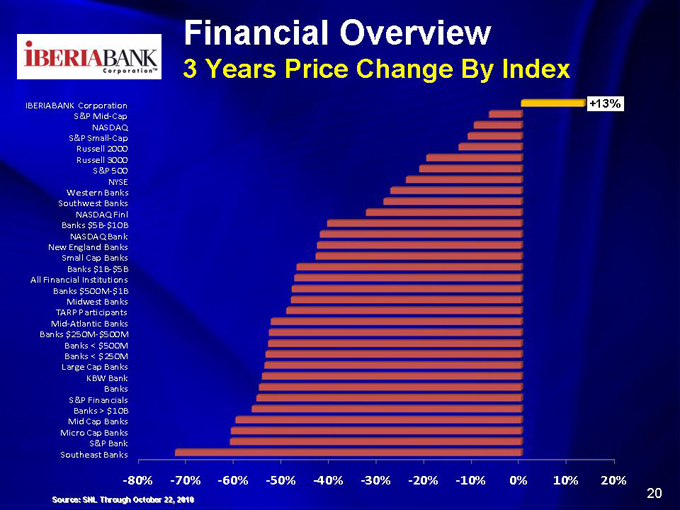

Financial Overview

3 | | Years Price Change By Index |

IBERIABANK Corporation

S&P Mid-Cap NASDAQ S&P Small-Cap Russell 2000 Russell 3000 S&P 500 NYSE Western Banks Southwest Banks NASDAQ Finl Banks $5B-$10B

NASDAQ Bank New England Banks Small Cap Banks Banks $1B-$5B

All Financial Institutions Banks $500M-$1B

Midwest Banks TARP Participants Mid-Atlantic Banks Banks $250M-$500M

Banks < $500M Banks < $250M Large Cap Banks KBW Bank Banks S&P Financials Banks > $10B

Mid Cap Banks Micro Cap Banks S&P Bank Southeast Banks

-80% -70% -60% -50% -40% -30% -20% -10% 0% 10% 20%

Source: SNL Through October 22, 2010

+13%

20

Asset Quality

21

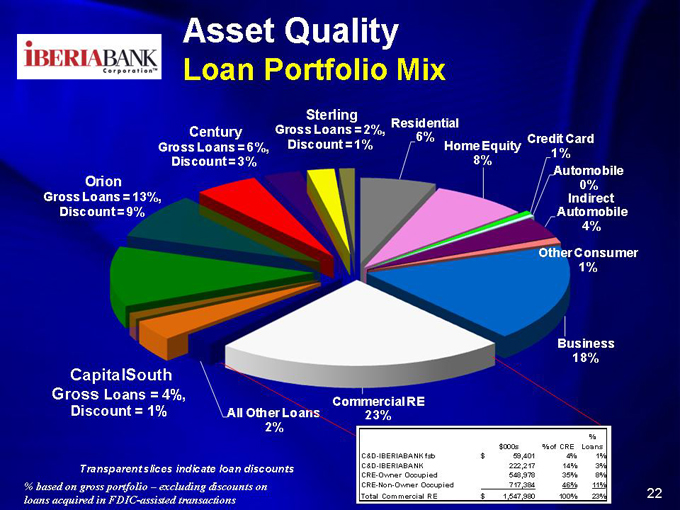

Asset Quality

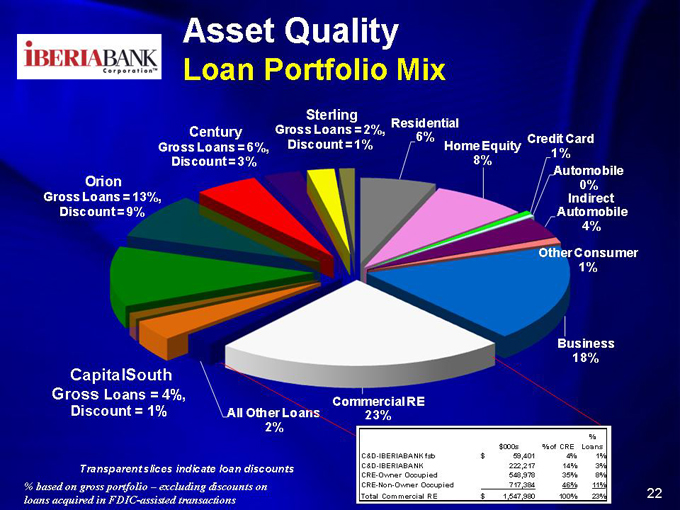

Loan Portfolio Mix

Orion Gross Loans = 13%, Discount = 9%

Century

Gross Loans = 6%, Discount = 3%

Sterling

Gross Loans = 2%, Discount = 1%

Residential 6%

Home Equity

8%

Credit Card 1%

Automobile 0%

Indirect Automobile 4%

Other Consumer 1%

Business 18%

Commercial RE 23%

All Other Loans 2%

CapitalSouth

Gross Loans = 4%, Discount = 1%

Transparent slices indicate loan discounts

% based on gross portfolio – excluding discounts on loans acquired in FDIC-assisted transactions

% $000s % of CRE Loans C&D-IBERIABANK fsb $ 59,401 4% 1% C&D-IBERIABANK 222,217 14% 3% CRE-Owner Occupied 548,978 35% 8% CRE-Non-Owner Occupied 717,384 46% 11% Total Commercial RE $ 1,547,980 100% 23%

22

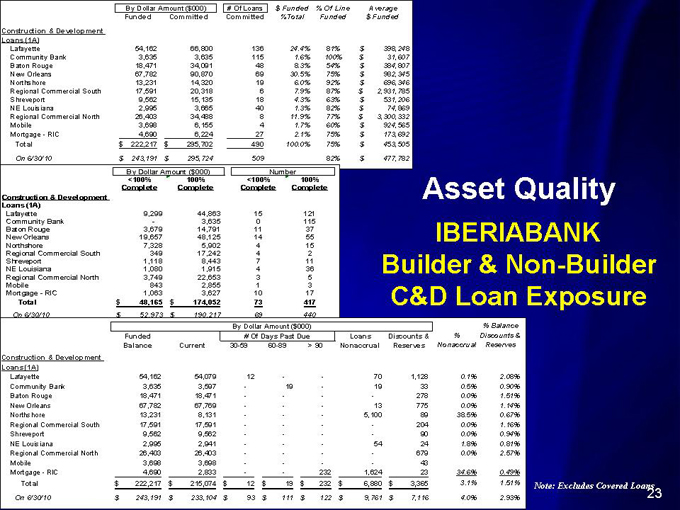

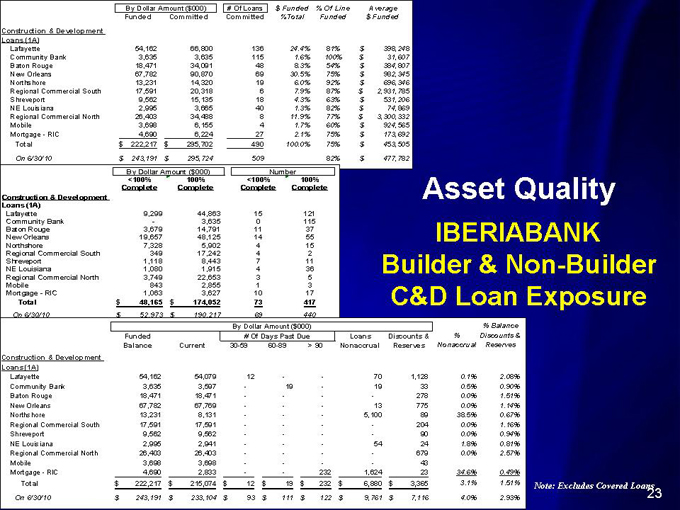

By Dollar Amount ($000) # Of Loans $ Funded % Of Line Average

Funded Committed Committed %Total Funded $ Funded

Construction & Development

Loans (1A)

Lafayette 54,162 66,800 136 24.4% 81% $ 398,248

Community Bank 3,635 3,635 115 1.6% 100% $ 31,607

Baton Rouge 18,471 34,091 48 8.3% 54% $ 384,807

New Orleans 67,782 90,870 69 30.5% 75% $ 982,345

Northshore 13,231 14,320 19 6.0% 92% $ 696,346

Regional Commercial South 17,591 20,318 6 7.9% 87% $ 2,931,785

Shreveport 9,562 15,135 18 4.3% 63% $ 531,206

NE Louisiana 2,995 3,665 40 1.3% 82% $ 74,869

Regional Commercial North 26,403 34,488 8 11.9% 77% $ 3,300,332

Mobile 3,698 6,155 4 1.7% 60% $ 924,565

Mortgage—RIC 4,690 6,224 27 2.1% 75% $ 173,692

Total $ 222,217 $ 295,702 490 100.0% 75% $ 453,505

On 6/30/10 $ 243,191 $ 295,724 509 82% $ 477,782

By Dollar Amount ($000) Number

<100% Complete 100% Complete <100% Complete 100% Complete

Construction & Development

Loans (1A)

Lafayette 9,299 44,863 15 121

Community Bank — 3,635 0 115

Baton Rouge 3,679 14,791 11 37

New Orleans 19,657 48,125 14 55

Northshore 7,328 5,902 4 15

Regional Commercial South 349 17,242 4 2

Shreveport 1,118 8,443 7 11

NE Louisiana 1,080 1,915 4 36

Regional Commercial North 3,749 22,653 3 5

Mobile 843 2,855 1 3

Mortgage—RIC 1,063 3,627 10 17

Total $ 48,165 $ 174,052 73 417

On 6/30/10 $ 52,973 $ 190,217 69 440

By Dollar Amount ($000) Discounts & Reserves % Nonaccrual % Balance

Funded # Of Days Past Due Loans Discounts &

Balance Current 30-59 60-89 > 90 Nonaccrual Reserves

Construction & Development

Loans (1A)

Lafayette 54,162 54,079 12 —— 70 1,128 0.1% 2.08%

Community Bank 3,635 3,597 — 19 — 19 33 0.5% 0.90%

Baton Rouge 18,471 18,471 ———— 278 0.0% 1.51%

New Orleans 67,782 67,769 ——— 13 775 0.0% 1.14%

Northshore 13,231 8,131 ——— 5,100 89 38.5% 0.67%

Regional Commercial South 17,591 17,591 ———— 204 0.0% 1.16%

Shreveport 9,562 9,562 ———— 90 0.0% 0.94%

NE Louisiana 2,995 2,941 ——— 54 24 1.8% 0.81%

Regional Commercial North 26,403 26,403 ———— 679 0.0% 2.57%

Mobile 3,698 3,698 ———— 43

Mortgage—RIC 4,690 2,833 —— 232 1,624 23 34.6% 0.49%

Total $ 222,217 $ 215,074 $ 12 $19 $232 $ 6,880 $ 3,365 3.1% 1.51%

On 6/30/10 $ 243,191 $ 233,104 $ 93 $111 $122 $ 9,761 $ 7,116 4.0% 2.93%

Note: Excludes Covered Loans

Asset Quality

IBERIABANK Builder & Non-Builder C&D Loan Exposure

23

Asset Quality

3Q10 Compared To Prior Quarters

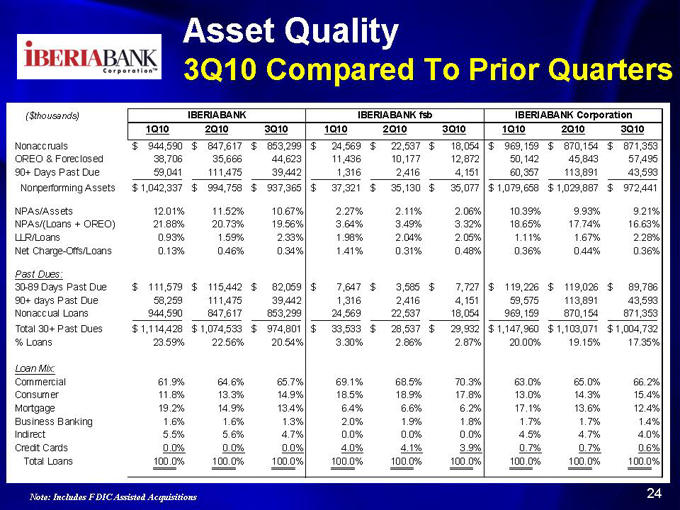

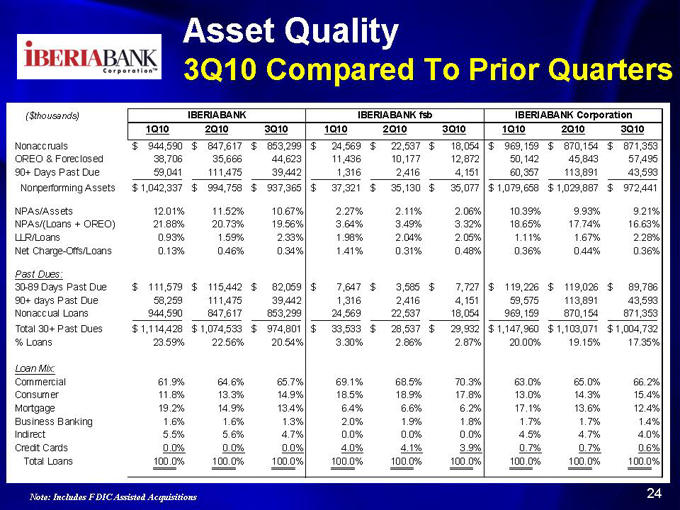

($thousands) IBERIABANK IBERIABANK fsb IBERIABANK Corporation

1Q10 2Q10 3Q10 1Q10 2Q10 3Q10 1Q10 2Q10 3Q10

Nonaccruals $ 944,590 $ 847,617 $ 853,299 $ 24,569 $ 22,537 $ 18,054 $ 969,159 $ 870,154 $ 871,353

OREO & Foreclosed 38,706 35,666 44,623 11,436 10,177 12,872 50,142 45,843 57,495

90+ Days Past Due 59,041 111,475 39,442 1,316 2,416 4,151 60,357 113,891 43,593

Nonperforming Assets $ 1,042,337 $ 994,758 $ 937,365 $ 37,321 $ 35,130 $ 35,077 $ 1,079,658 $ 1,029,887 $ 972,441

NPAs/Assets 12.01% 11.52% 10.67% 2.27% 2.11% 2.06% 10.39% 9.93% 9.21%

NPAs/(Loans + OREO) 21.88% 20.73% 19.56% 3.64% 3.49% 3.32% 18.65% 17.74% 16.63%

LLR/Loans 0.93% 1.59% 2.33% 1.98% 2.04% 2.05% 1.11% 1.67% 2.28%

Net Charge-Offs/Loans 0.13% 0.46% 0.34% 1.41% 0.31% 0.48% 0.36% 0.44% 0.36%

Past Dues:

30-89 Days Past Due $ 111,579 $ 115,442 $ 82,059 $ 7,647 $ 3,585 $ 7,727 $ 119,226 $ 119,026 $ 89,786

90+ days Past Due 58,259 111,475 39,442 1,316 2,416 4,151 59,575 113,891 43,593

Nonaccual Loans 944,590 847,617 853,299 24,569 22,537 18,054 969,159 870,154 871,353

Total 30+ Past Dues $ 1,114,428 $ 1,074,533 $ 974,801 $ 33,533 $ 28,537 $ 29,932 $ 1,147,960 $ 1,103,071 $ 1,004,732

% Loans 23.59% 22.56% 20.54% 3.30% 2.86% 2.87% 20.00% 19.15% 17.35%

Loan Mix:

Commercial 61.9% 64.6% 65.7% 69.1% 68.5% 70.3% 63.0% 65.0% 66.2%

Consumer 11.8% 13.3% 14.9% 18.5% 18.9% 17.8% 13.0% 14.3% 15.4%

Mortgage 19.2% 14.9% 13.4% 6.4% 6.6% 6.2% 17.1% 13.6% 12.4%

Business Banking 1.6% 1.6% 1.3% 2.0% 1.9% 1.8% 1.7% 1.7% 1.4%

Indirect 5.5% 5.6% 4.7% 0.0% 0.0% 0.0% 4.5% 4.7% 4.0%

Credit Cards 0.0% 0.0% 0.0% 4.0% 4.1% 3.9% 0.7% 0.7% 0.6%

Total Loans 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0%

Note: Includes FDIC Assisted Acquisitions

24

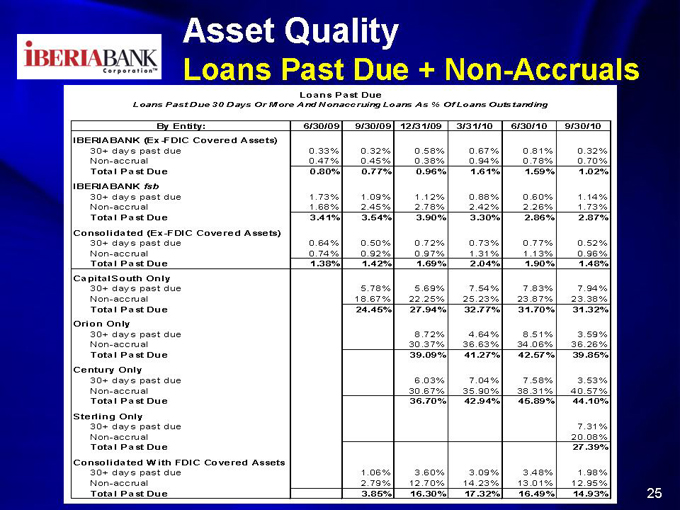

Asset Quality

Loans Past Due + Non-Accruals

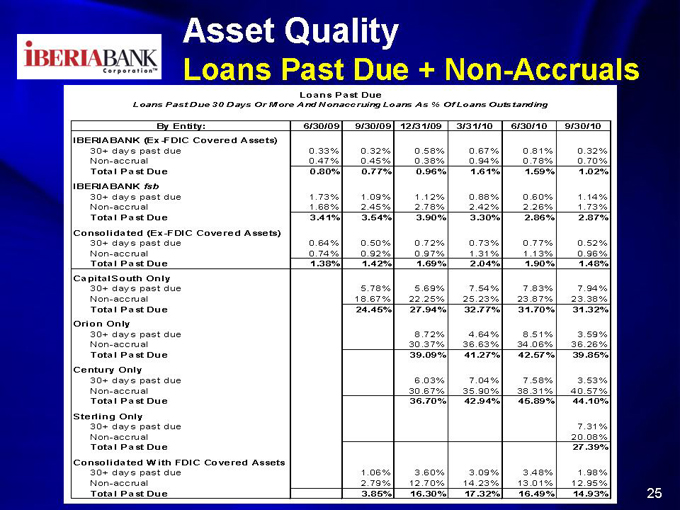

Loans Past Due

Loans Past Due 30 Days Or More And Nonaccruing Loans As % Of Loans Outstanding

By Entity: 6/30/09 9/30/09 12/31/09 3/31/10 6/30/10 9/30/10

IBERIABANK (Ex-FDIC Covered Assets)

30+ days past due 0.33% 0.32% 0.58% 0.67% 0.81% 0.32%

Non-accrual 0.47% 0.45% 0.38% 0.94% 0.78% 0.70%

Total Past Due 0.80% 0.77% 0.96% 1.61% 1.59% 1.02%

IBERIABANK fsb

30+ days past due 1.73% 1.09% 1.12% 0.88% 0.60% 1.14%

Non-accrual 1.68% 2.45% 2.78% 2.42% 2.26% 1.73%

Total Past Due 3.41% 3.54% 3.90% 3.30% 2.86% 2.87%

Consolidated (Ex-FDIC Covered Assets)

30+ days past due 0.64% 0.50% 0.72% 0.73% 0.77% 0.52%

Non-accrual 0.74% 0.92% 0.97% 1.31% 1.13% 0.96%

Total Past Due 1.38% 1.42% 1.69% 2.04% 1.90% 1.48%

CapitalSouth Only

30+ days past due 5.78% 5.69% 7.54% 7.83% 7.94%

Non-accrual 18.67% 22.25% 25.23% 23.87% 23.38%

Total Past Due 24.45% 27.94% 32.77% 31.70% 31.32%

Orion Only

30+ days past due 8.72% 4.64% 8.51% 3.59%

Non-accrual 30.37% 36.63% 34.06% 36.26%

Total Past Due 39.09% 41.27% 42.57% 39.85%

Century Only

30+ days past due 6.03% 7.04% 7.58% 3.53%

Non-accrual 30.67% 35.90% 38.31% 40.57%

Total Past Due 36.70% 42.94% 45.89% 44.10%

Sterling Only

30+ days past due 7.31%

Non-accrual 20.08%

Total Past Due 27.39%

Consolidated With FDIC Covered Assets

30+ days past due 1.06% 3.60% 3.09% 3.48% 1.98%

Non-accrual 2.79% 12.70% 14.23% 13.01% 12.95%

Total Past Due 3.85% 16.30% 17.32% 16.49% 14.93%

25

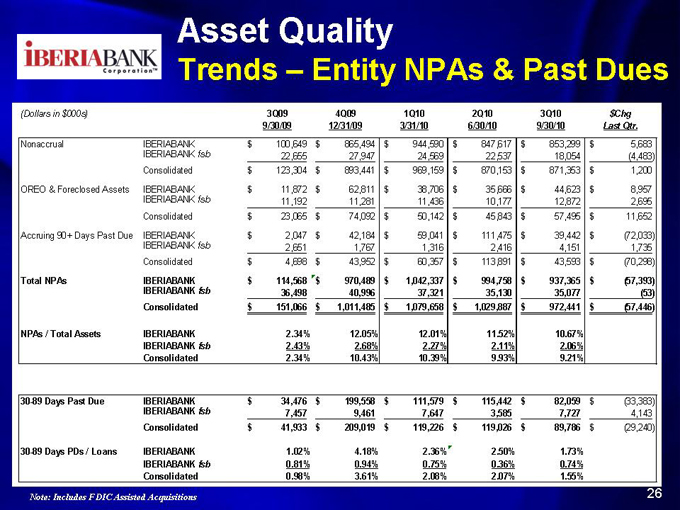

Asset Quality

Trends – Entity NPAs & Past Dues

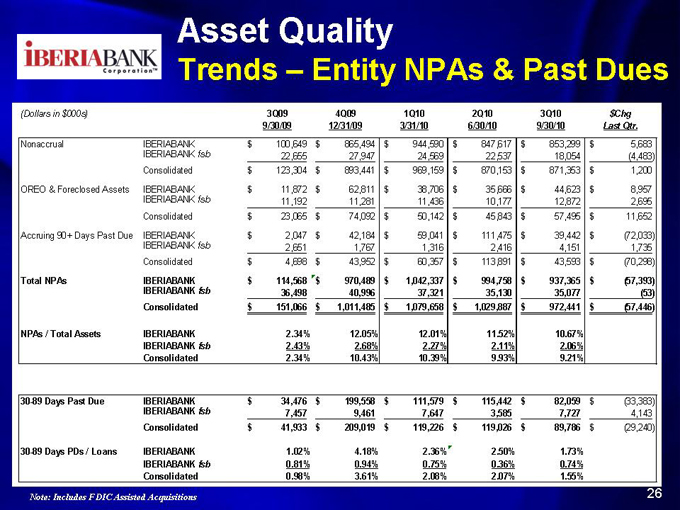

(Dollars in $000s) 3Q09 4Q09 1Q10 2Q10 3Q10 $Chg

9/30/09 12/31/09 3/31/10 6/30/10 9/30/10 Last Qtr.

Nonaccrual IBERIABANK $ 100,649 $ 865,494 $ 944,590 $ 847,617 $ 853,299 $ 5,683

IBERIABANK fsb 22,655 27,947 24,569 22,537 18,054 (4,483)

Consolidated $ 123,304 $ 893,441 $ 969,159 $ 870,153 $ 871,353 $ 1,200

OREO & Foreclosed Assets IBERIABANK $ 11,872 $ 62,811 $ 38,706 $ 35,666 $ 44,623 $ 8,957

IBERIABANK fsb 11,192 11,281 11,436 10,177 12,872 2,695

Consolidated $ 23,065 $ 74,092 $ 50,142 $ 45,843 $ 57,495 $ 11,652

Accruing 90+ Days Past Due IBERIABANK $ 2,047 $ 42,184 $ 59,041 $ 111,475 $ 39,442 $ (72,033)

IBERIABANK fsb 2,651 1,767 1,316 2,416 4,151 1,735

Consolidated $ 4,698 $ 43,952 $ 60,357 $ 113,891 $ 43,593 $ (70,298)

Total NPAs IBERIABANK $ 114,568 $ 970,489 $ 1,042,337 $ 994,758 $ 937,365 $ (57,393)

IBERIABANK fsb 36,498 40,996 37,321 35,130 35,077 (53)

Consolidated $ 151,066 $ 1,011,485 $ 1,079,658 $ 1,029,887 $ 972,441 $ (57,446)

NPAs / Total Assets IBERIABANK 2.34% 12.05% 12.01% 11.52% 10.67%

IBERIABANK fsb 2.43% 2.68% 2.27% 2.11% 2.06%

Consolidated 2.34% 10.43% 10.39% 9.93% 9.21%

30-89 Days Past Due IBERIABANK $ 34,476 $ 199,558 $ 111,579 $ 115,442 $ 82,059 $ (33,383)

IBERIABANK fsb 7,457 9,461 7,647 3,585 7,727 4,143

Consolidated $ 41,933 $ 209,019 $ 119,226 $ 119,026 $ 89,786 $ (29,240)

30-89 Days PDs / Loans IBERIABANK 1.02% 4.18% 2.36% 2.50% 1.73%

IBERIABANK fsb 0.81% 0.94% 0.75% 0.36% 0.74%

Consolidated 0.98% 3.61% 2.08% 2.07% 1.55%

Note: Includes FDIC Assisted Acquisitions

26

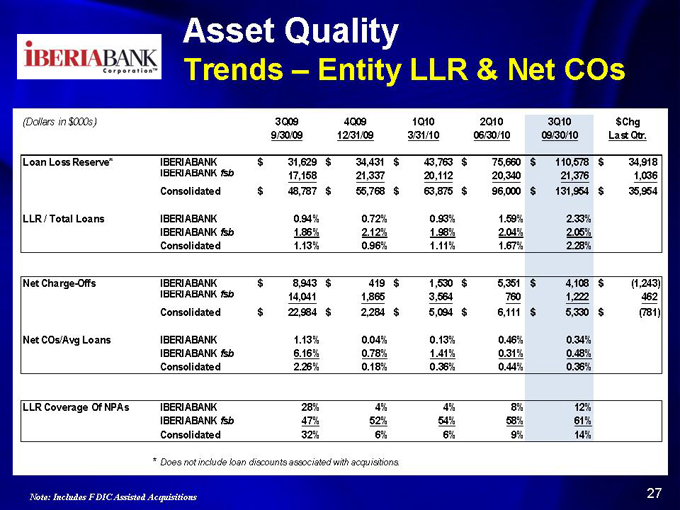

Asset Quality

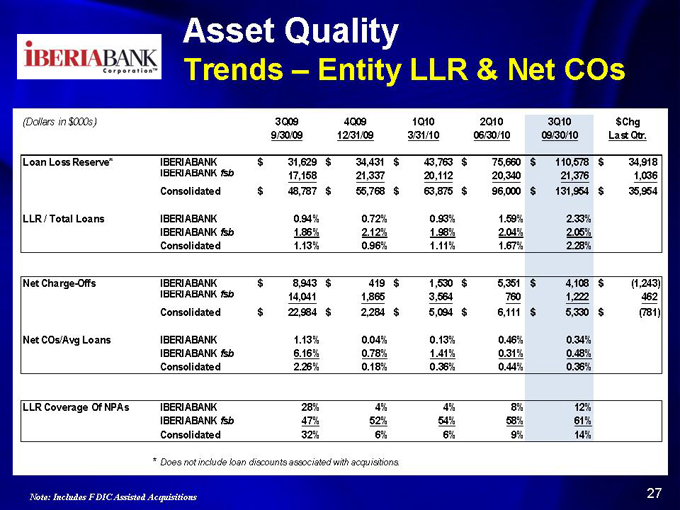

Trends – Entity LLR & Net COs

(Dollars in $000s) 3Q09 4Q09 1Q10 2Q10 3Q10 $Chg

9/30/09 12/31/09 3/31/10 06/30/10 09/30/10 Last Qtr.

Loan Loss Reserve* IBERIABANK $ 31,629 $ 34,431 $ 43,763 $ 75,660 $ 110,578 $ 34,918

IBERIABANK fsb 17,158 21,337 20,112 20,340 21,376 1,036

Consolidated $ 48,787 $ 55,768 $ 63,875 $ 96,000 $ 131,954 $ 35,954

LLR / Total Loans IBERIABANK 0.94% 0.72% 0.93% 1.59% 2.33%

IBERIABANK fsb 1.86% 2.12% 1.98% 2.04% 2.05%

Consolidated 1.13% 0.96% 1.11% 1.67% 2.28%

Net Charge-Offs IBERIABANK $ 8,943 $ 419 $ 1,530 $ 5,351 $ 4,108 $ (1,243)

IBERIABANK fsb 14,041 1,865 3,564 760 1,222 462

Consolidated $ 22,984 $ 2,284 $ 5,094 $ 6,111 $ 5,330 $ (781)

Net COs/Avg Loans IBERIABANK 1.13% 0.04% 0.13% 0.46% 0.34%

IBERIABANK fsb 6.16% 0.78% 1.41% 0.31% 0.48%

Consolidated 2.26% 0.18% 0.36% 0.44% 0.36%

LLR Coverage Of NPAs IBERIABANK 28% 4% 4% 8% 12%

IBERIABANK fsb 47% 52% 54% 58% 61%

Consolidated 32% 6% 6% 9% 14%

* | | Does not include loan discounts associated with acquisitions. |

Note: Includes FDIC Assisted Acquisitions

27

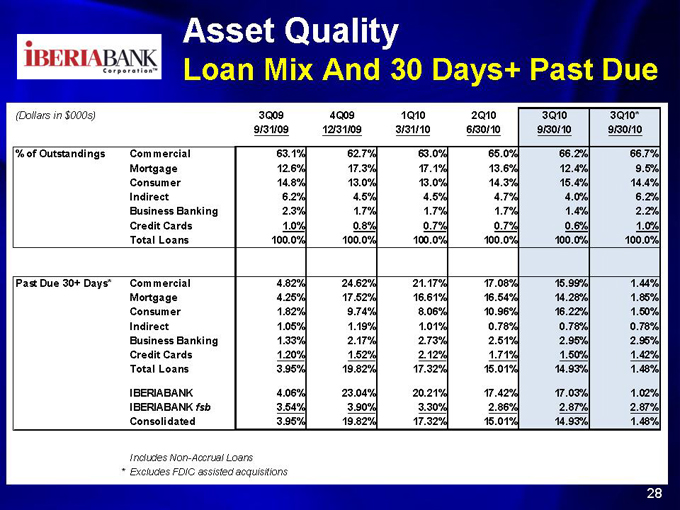

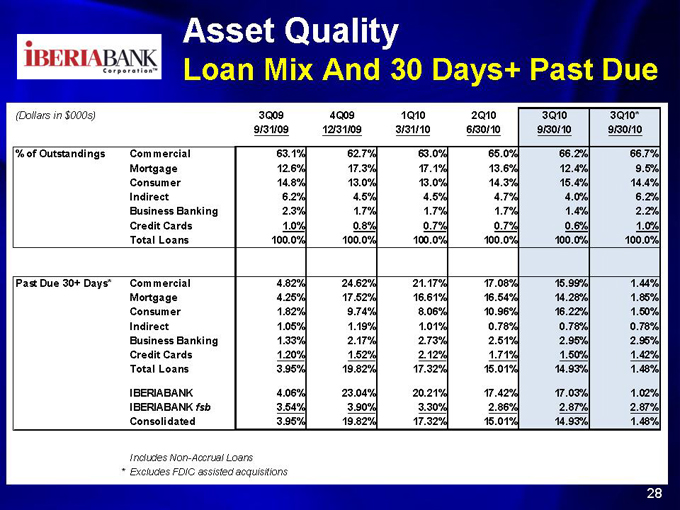

Asset Quality

Loan Mix And 30 Days+ Past Due

(Dollars in $000s) 3Q09 4Q09 1Q10 2Q10 3Q10 3Q10*

9/31/09 12/31/09 3/31/10 6/30/10 9/30/10 9/30/10

% of Outstandings Commercial 63.1% 62.7% 63.0% 65.0% 66.2% 66.7%

Mortgage 12.6% 17.3% 17.1% 13.6% 12.4% 9.5%

Consumer 14.8% 13.0% 13.0% 14.3% 15.4% 14.4%

Indirect 6.2% 4.5% 4.5% 4.7% 4.0% 6.2%

Business Banking 2.3% 1.7% 1.7% 1.7% 1.4% 2.2%

Credit Cards 1.0% 0.8% 0.7% 0.7% 0.6% 1.0%

Total Loans 100.0% 100.0% 100.0% 100.0% 100.0% 100.0%

Past Due 30+ Days* Commercial 4.82% 24.62% 21.17% 17.08% 15.99% 1.44%

Mortgage 4.25% 17.52% 16.61% 16.54% 14.28% 1.85%

Consumer 1.82% 9.74% 8.06% 10.96% 16.22% 1.50%

Indirect 1.05% 1.19% 1.01% 0.78% 0.78% 0.78%

Business Banking 1.33% 2.17% 2.73% 2.51% 2.95% 2.95%

Credit Cards 1.20% 1.52% 2.12% 1.71% 1.50% 1.42%

Total Loans 3.95% 19.82% 17.32% 15.01% 14.93% 1.48%

IBERIABANK 4.06% 23.04% 20.21% 17.42% 17.03% 1.02%

IBERIABANK fsb 3.54% 3.90% 3.30% 2.86% 2.87% 2.87%

Consolidated 3.95% 19.82% 17.32% 15.01% 14.93% 1.48%

Includes Non-Accrual Loans

* | | Excludes FDIC assisted acquisitions |

28

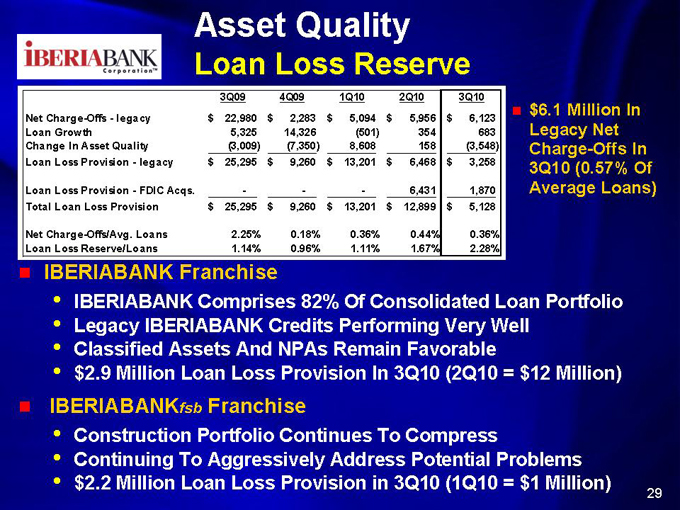

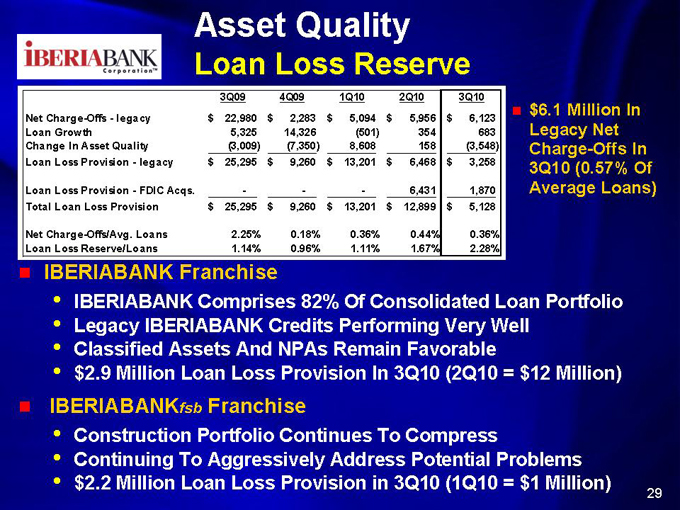

Asset Quality

Loan Loss Reserve

3Q09 4Q09 1Q10 2Q10 3Q10

Net Charge-Offs—legacy $ 22,980 $ 2,283 $ 5,094 $ 5,956 $ 6,123

Loan Growth 5,325 14,326 (501) 354 683

Change In Asset Quality (3,009) (7,350) 8,608 158 (3,548)

Loan Loss Provision—legacy $ 25,295 $ 9,260 $ 13,201 $ 6,468 $ 3,258

Loan Loss Provision—FDIC Acqs. ——— 6,431 1,870

Total Loan Loss Provision $ 25,295 $ 9,260 $ 13,201 $ 12,899 $ 5,128

Net Charge-Offs/Avg. Loans 2.25% 0.18% 0.36% 0.44% 0.36%

Loan Loss Reserve/Loans 1.14% 0.96% 1.11% 1.67% 2.28%

$6.1 Million In Legacy Net Charge -Offs In 3Q10 (0.57% Of Average Loans)

IBERIABANK Franchise

• IBERIABANK Comprises 82% Of Consolidated Loan Portfolio

• Legacy IBERIABANK Credits Performing Very Well • • Classified Assets And NPAs Remain Favorable $2.9 Million Loan Loss Provision In 3Q10 (2Q10 = $12 Million)

IBERIABANK fsb Franchise

• Construction Portfolio Continues To Compress

• Continuing To Aggressively Address Potential Problems • $2.2 Million Loan Loss Provision in 3Q10 (1Q10 = $1 Million)

29

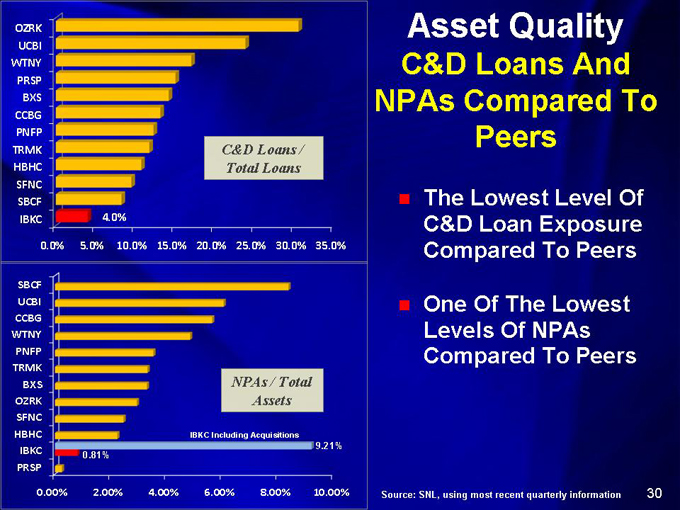

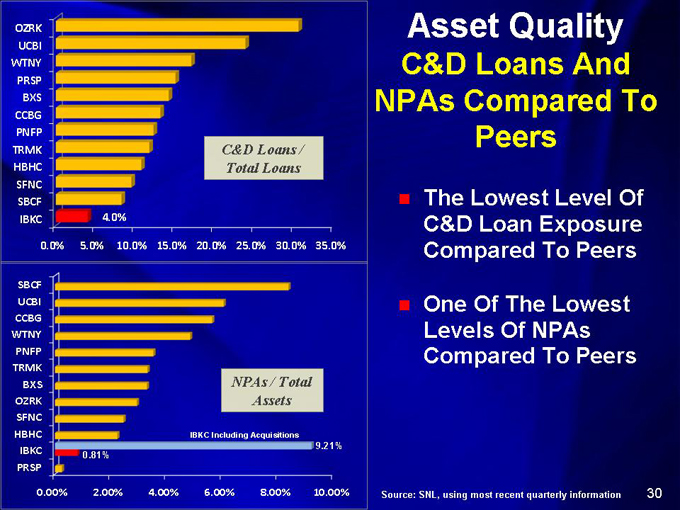

OZRK UCBI WTNY PRSP

BXS CCBG PNFP TRMK HBHC SFNC SBCF

IBKC

0.0% 5.0% 10.0% 15.0% 20.0% 25.0% 30.0% 35.0%

4.0%

C&D Loans / Total Loans

SBCF UCBI CCBG WTNY PNFP TRMK

BXS OZRK SFNC HBHC IBKC PRSP

0.00% 2.00% 4.00% 6.00% 8.00% 10.00%

IBKC Including Acquisitions

0.81% 9.21%

NPAs / Total Assets

Asset Quality

C&D Loans And NPAs Compared To Peers

The Lowest Level Of C&D Loan Exposure Compared To Peers

One Of The Lowest Levels Of NPAs Compared To Peers

Source: SNL, using most recent quarterly information

30

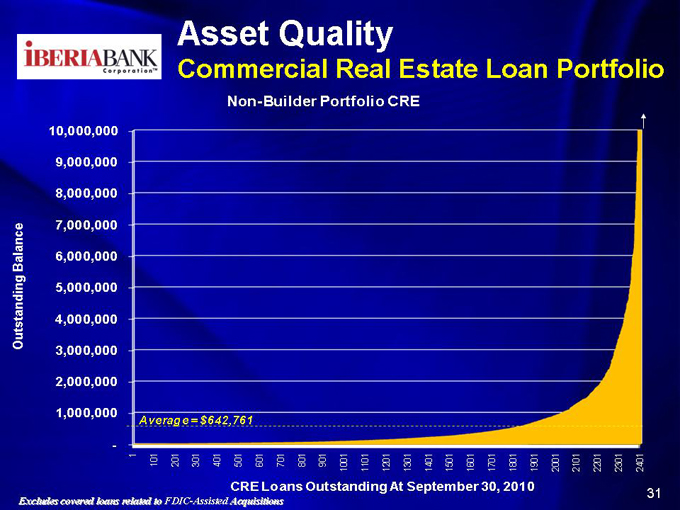

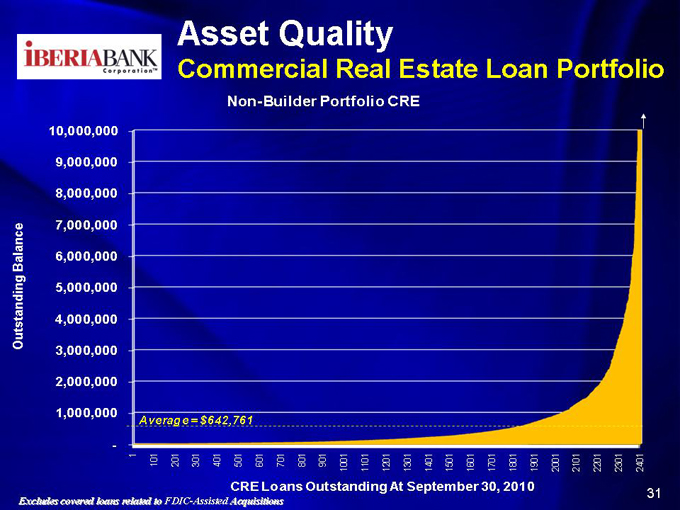

Asset Quality

Commercial Real Estate Loan Portfolio

Non-Builder Portfolio CRE

Balance Outstanding

10,000,000 9,000,000 8,000,000 7,000,000 6,000,000 5,000,000 4,000,000 3,000,000 2,000,000 1,000,000

1 | | 101 201 301 401 501 601 701 801 901 1001 1101 1201 1301 1401 1501 1601 1701 1801 1901 2001 2101 2201 2301 2401 |

Average = $642,761

CRE Loans Outstanding At September 30, 2010

Excludes covered loans related to FDIC-Assisted Acquisitions

31

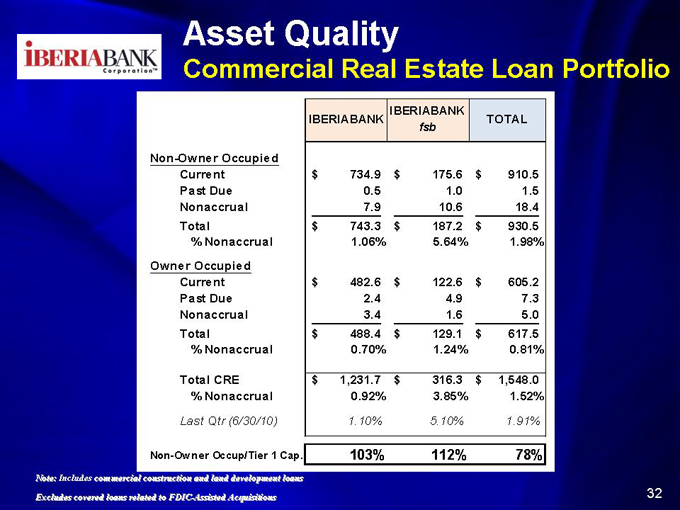

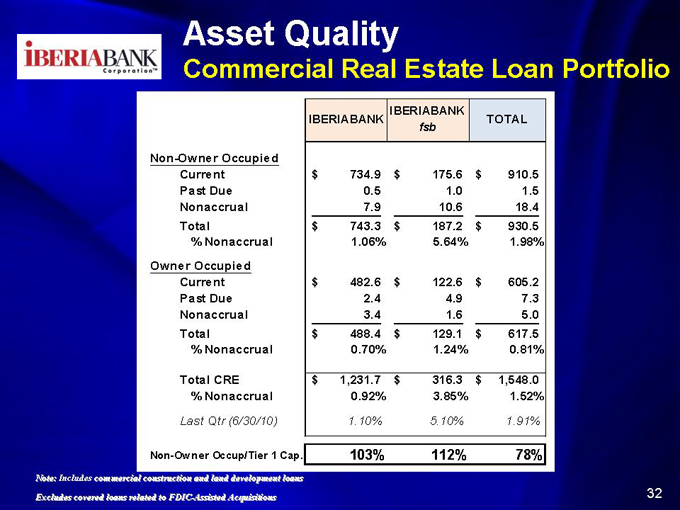

Asset Quality

Commercial Real Estate Loan Portfolio

IBERIABANK IBERIABANK TOTAL

fsb

Non-Owner Occupied

Current $ 734.9 $ 175.6 $ 910.5

Past Due 0.5 1.0 1.5

Nonaccrual 7.9 10.6 18.4

Total $ 743.3 $ 187.2 $ 930.5

% Nonaccrual 1.06% 5.64% 1.98%

Owner Occupied

Current $ 482.6 $ 122.6 $ 605.2

Past Due 2.4 4.9 7.3

Nonaccrual 3.4 1.6 5.0

Total $ 488.4 $ 129.1 $ 617.5

% Nonaccrual 0.70% 1.24% 0.81%

Total CRE $ 1,231.7 $ 316.3 $ 1,548.0

% Nonaccrual 0.92% 3.85% 1.52%

Last Qtr (6/30/10) 1.10% 5.10% 1.91%

Non-Owner Occup/Tier 1 Cap. 103% 112% 78%

Note: Includes commercial construction and land development loans

Excludes covered loans related to FDIC-Assisted Acquisitions

32

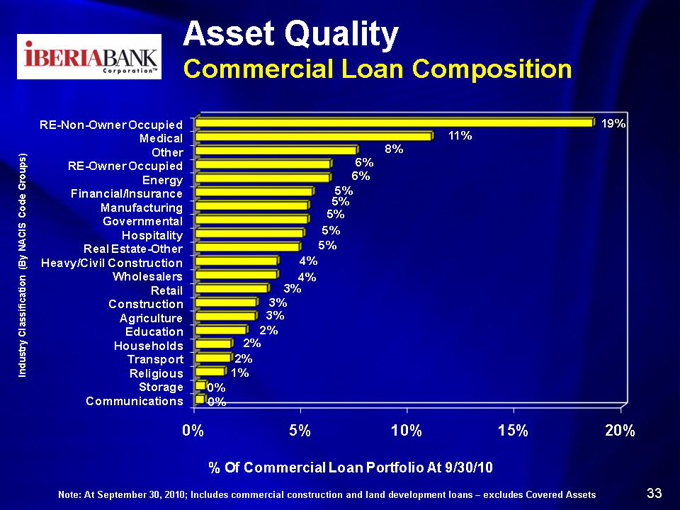

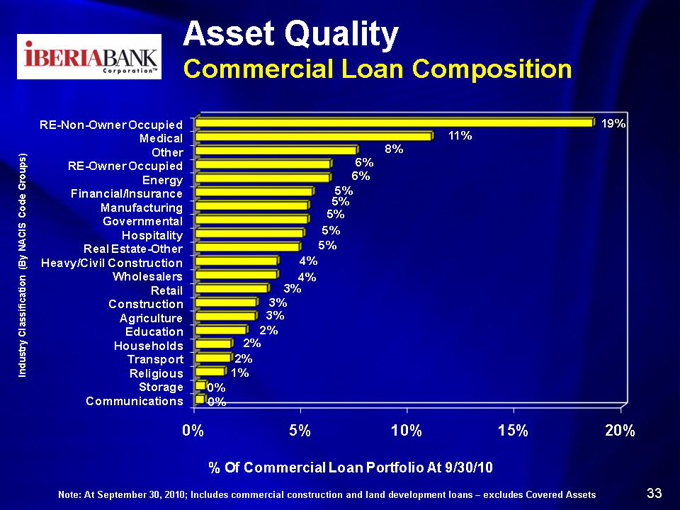

Asset Quality

Commercial Loan Composition

Groups) Code NACIS (By Classification Industry

RE-Non-Owner Occupied Medical Other RE-Owner Occupied Energy Financial/Insurance Manufacturing Governmental Hospitality Real Estate-Other Heavy/Civil Construction Wholesalers Retail Construction Agriculture Education Households Transport Religious Storage Communications

0% 5% 10% 15% 20%

19% 11% 8% 6% 6% 5% 5% 5% 5% 5% 4% 4% 3% 3% 3% 2% 2% 2% 1% 0% 0%

% Of Commercial Loan Portfolio At 9/30/10

Note: At September 30, 2010; Includes commercial construction and land development loans – excludes Covered Assets

33

Consumer Loan Portfolio

34

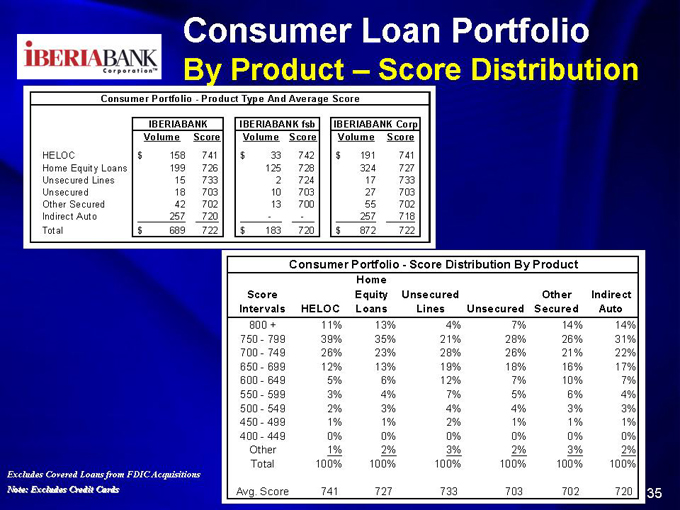

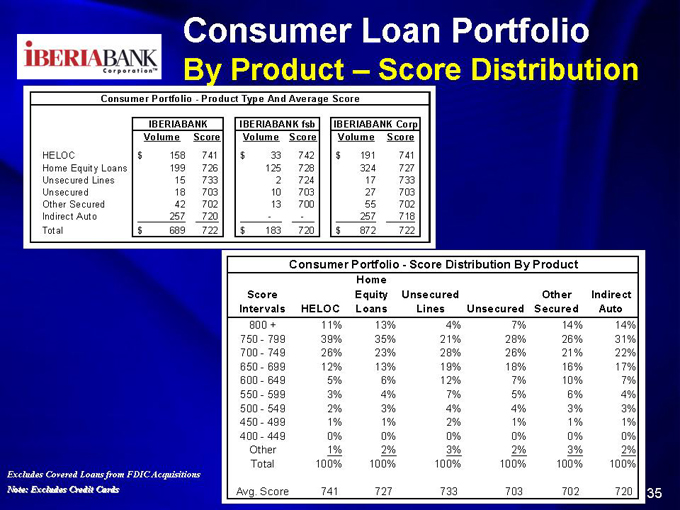

Consumer Loan Portfolio

By Product – Score Distribution

Consumer Portfolio—Product Type And Average Score

IBERIABANK IBERIABANK fsb IBERIABANK Corp

Volume Score Volume Score Volume Score

HELOC $ 158 741 $ 33 742 $ 191 741

Home Equity Loans 199 726 125 728 324 727

Unsecured Lines 15 733 2 724 17 733

Unsecured 18 703 10 703 27 703

Other Secured 42 702 13 700 55 702

Indirect Auto 257 720 —— 257 718

Total $ 689 722 $ 183 720 $ 872 722

Consumer Portfolio—Score Distribution By Product

Score Intervals HELOC Equity Loans Unsecured Lines Home Unsecured Secured Other Auto Indirect

800 + 11% 13% 4% 7% 14% 14%

750 — 799 39% 35% 21% 28% 26% 31%

700 — 749 26% 23% 28% 26% 21% 22%

650 — 699 12% 13% 19% 18% 16% 17%

600 — 649 5% 6% 12% 7% 10% 7%

550 — 599 3% 4% 7% 5% 6% 4%

500 — 549 2% 3% 4% 4% 3% 3%

450 — 499 1% 1% 2% 1% 1% 1%

400 — 449 0% 0% 0% 0% 0% 0%

Other 1% 2% 3% 2% 3% 2%

Total 100% 100% 100% 100% 100% 100%

Avg. Score 741 727 733 703 702 720

Excludes Covered Loans from FDIC Acquisitions Note: Excludes Credit Cards

35

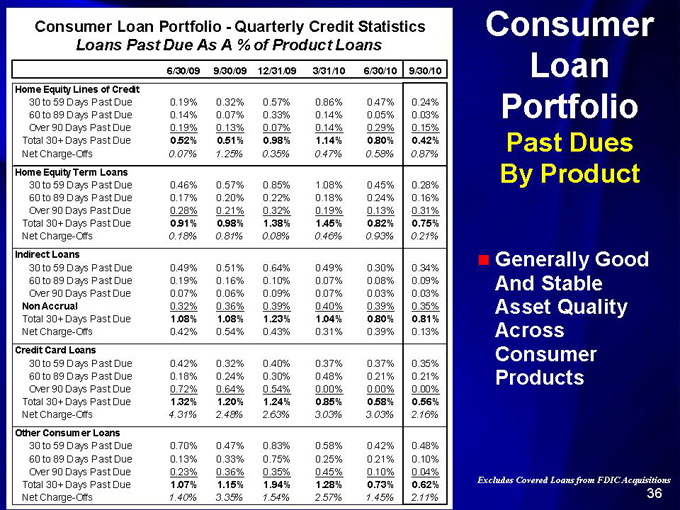

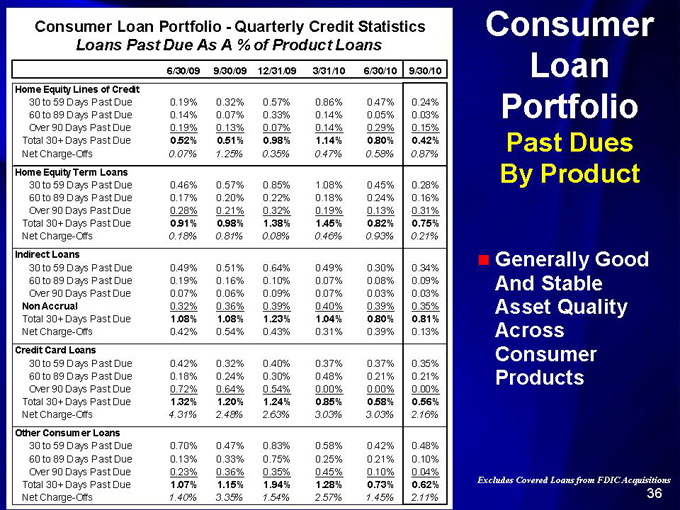

Consumer Loan Portfolio—Quarterly Credit Statistics

Loans Past Due As A % of Product Loans

6/30/09 9/30/09 12/31/09 3/31/10 6/30/10 9/30/10

Home Equity Lines of Credit

30 to 59 Days Past Due 0.19% 0.32% 0.57% 0.86% 0.47% 0.24%

60 to 89 Days Past Due 0.14% 0.07% 0.33% 0.14% 0.05% 0.03%

Over 90 Days Past Due 0.19% 0.13% 0.07% 0.14% 0.29% 0.15%

Total 30+ Days Past Due 0.52% 0.51% 0.98% 1.14% 0.80% 0.42%

Net Charge-Offs 0.07% 1.25% 0.35% 0.47% 0.58% 0.87%

Home Equity Term Loans

30 to 59 Days Past Due 0.46% 0.57% 0.85% 1.08% 0.45% 0.28%

60 to 89 Days Past Due 0.17% 0.20% 0.22% 0.18% 0.24% 0.16%

Over 90 Days Past Due 0.28% 0.21% 0.32% 0.19% 0.13% 0.31%

Total 30+ Days Past Due 0.91% 0.98% 1.38% 1.45% 0.82% 0.75%

Net Charge-Offs 0.18% 0.81% 0.08% 0.46% 0.93% 0.21%

Indirect Loans

30 to 59 Days Past Due 0.49% 0.51% 0.64% 0.49% 0.30% 0.34%

60 to 89 Days Past Due 0.19% 0.16% 0.10% 0.07% 0.08% 0.09%

Over 90 Days Past Due 0.07% 0.06% 0.09% 0.07% 0.03% 0.03%

Non Accrual 0.32% 0.36% 0.39% 0.40% 0.39% 0.35%

Total 30+ Days Past Due 1.08% 1.08% 1.23% 1.04% 0.80% 0.81%

Net Charge-Offs 0.42% 0.54% 0.43% 0.31% 0.39% 0.13%

Credit Card Loans

30 to 59 Days Past Due 0.42% 0.32% 0.40% 0.37% 0.37% 0.35%

60 to 89 Days Past Due 0.18% 0.24% 0.30% 0.48% 0.21% 0.21%

Over 90 Days Past Due 0.72% 0.64% 0.54% 0.00% 0.00% 0.00%

Total 30+ Days Past Due 1.32% 1.20% 1.24% 0.85% 0.58% 0.56%

Net Charge-Offs 4.31% 2.48% 2.63% 3.03% 3.03% 2.16%

Other Consumer Loans

30 to 59 Days Past Due 0.70% 0.47% 0.83% 0.58% 0.42% 0.48%

60 to 89 Days Past Due 0.13% 0.33% 0.75% 0.25% 0.21% 0.10%

Over 90 Days Past Due 0.23% 0.36% 0.35% 0.45% 0.10% 0.04%

Total 30+ Days Past Due 1.07% 1.15% 1.94% 1.28% 0.73% 0.62%

Net Charge-Offs 1.40% 3.35% 1.54% 2.57% 1.45% 2.11%

Consumer Loan Portfolio

Past Dues By Product

Generally Good And Stable Asset Quality Across Consumer Products

Excludes Covered Loans from FDIC Acquisitions

36

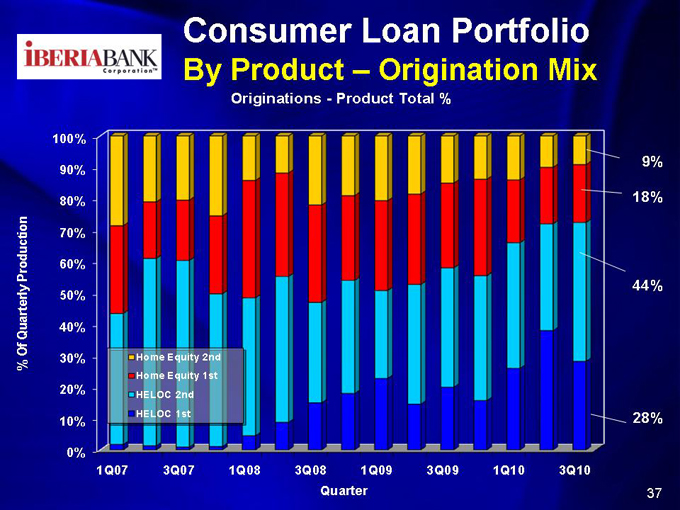

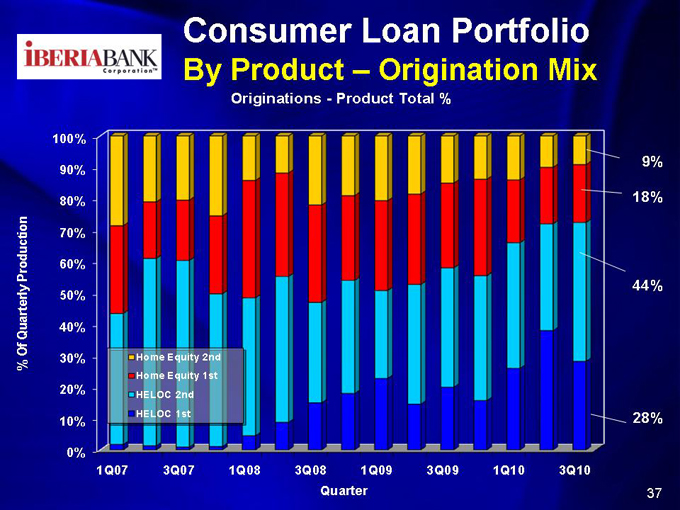

Consumer Loan Portfolio

By Product – Origination Mix

Originations—Product Total %

Production Quarterly Of %

100% 90% 80% 70% 60% 50% 40% 30% 20% 10% 0%

1Q07 3Q07 1Q08 3Q08 1Q09 3Q09 1Q10 3Q10

9%

18%

44%

28%

Quarter

Home Equity 2nd Home Equity 1st HELOC 2nd HELOC 1st

37

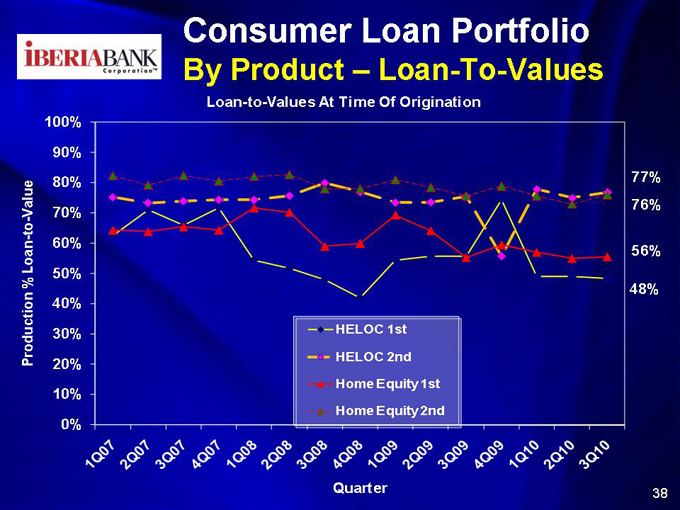

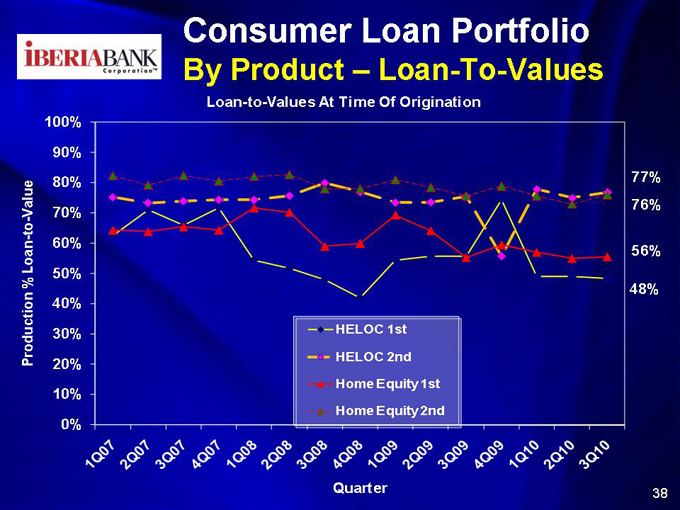

Consumer Loan Portfolio

By Product – Loan -To-Values

Loan-to-Values At Time Of Origination

- Value—to Loan % Production

100% 90% 80% 70% 60% 50% 40% 30% 20% 10% 0%

77% 76%

56%

48%

HELOC 1st HELOC 2nd Home Equity 1st Home Equity 2nd

Quarter

38

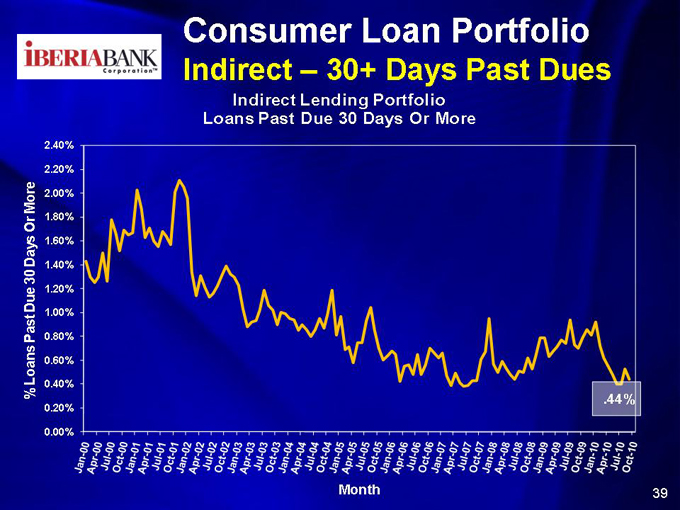

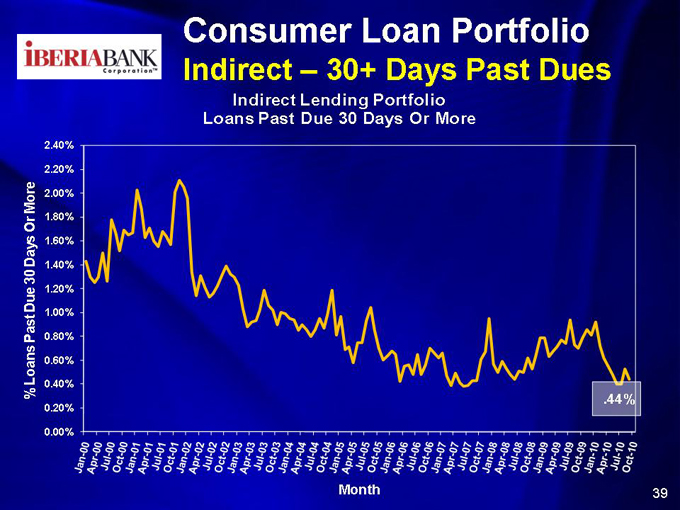

Consumer Loan Portfolio

Indirect – 30+ Days Past Dues

Indirect Lending Portfolio

Loans Past Due 30 Days Or More

More Or Days 30 Due Past Loans %

2.40% 2.20% 2.00% 1.80% 1.60% 1.40% 1.20% 1.00% 0.80% 0.60% 0.40% 0.20% 0.00%

Month

.44%

39

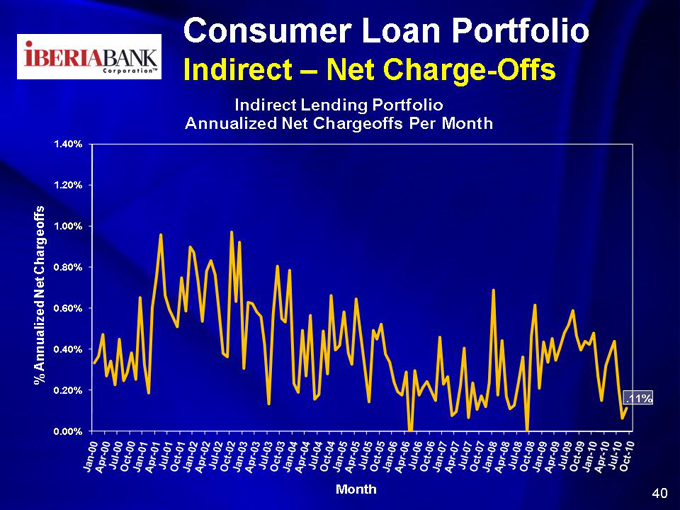

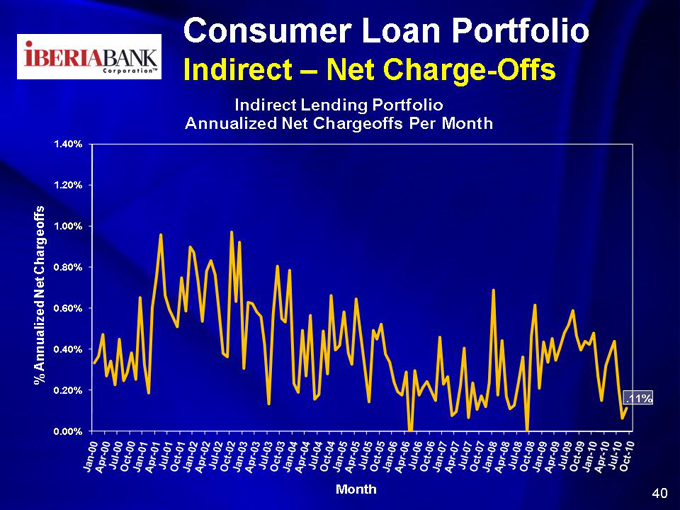

Consumer Loan Portfolio

Indirect – Net Charge -Offs

Indirect Lending Portfolio

Annualized Net Chargeoffs Per Month

Chargeoffs Net Annualized %

1.40% 1.20% 1.00% 0.80% 0.60% 0.40% 0.20% 0.00%

.11%

Month

40

STERLING BANK ACQUISITION July 23, 2010

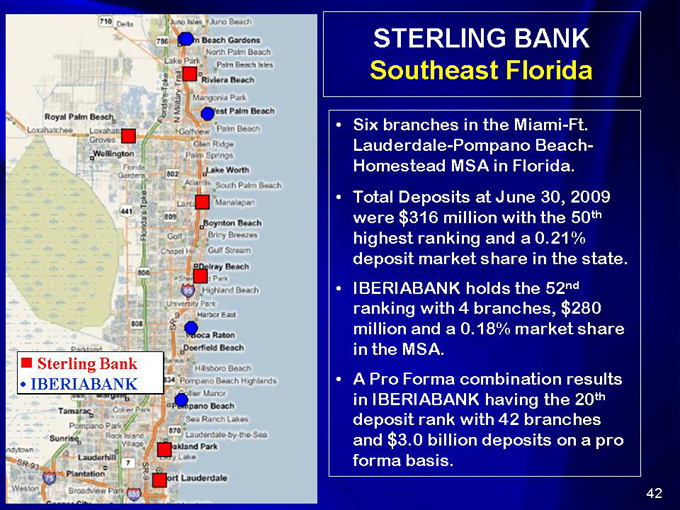

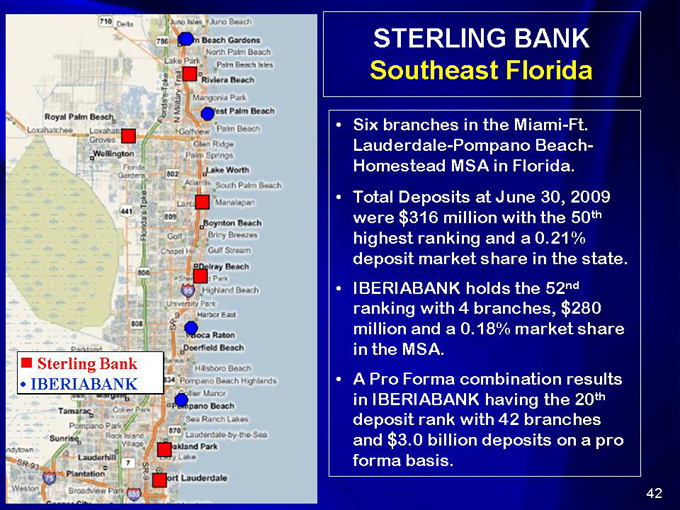

STERLING BANK Southeast Florida

Six branches in the Miami-Ft. Lauderdale -Pompano Beach-Homestead MSA in Florida. Total Deposits at June 30, 2009 were $316 million with the 50th highest ranking and a 0.21% deposit market share in the state.

IBERIABANK holds the 52nd ranking with 4 branches, $280 million and a 0.18% market share in the MSA. A Pro Forma combination results in IBERIABANK having the 20th deposit rank with 42 branches and $3.0 billion deposits on a pro forma basis.

42

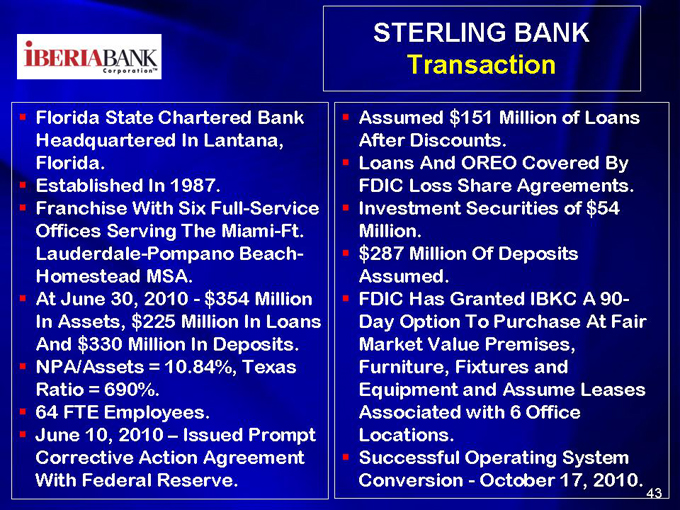

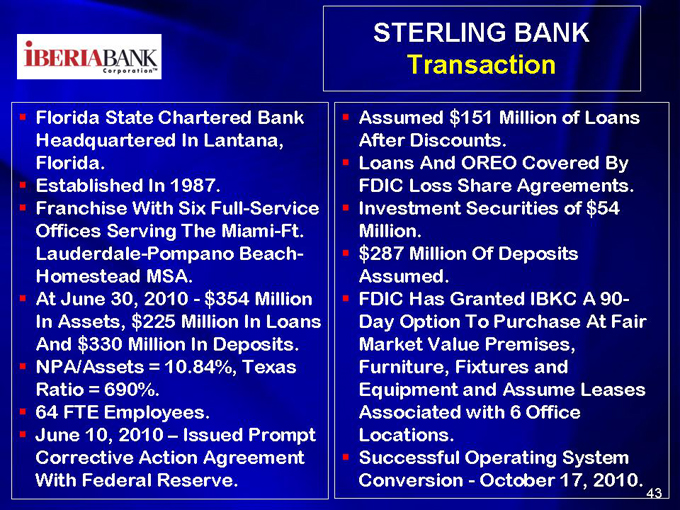

Florida State Chartered Bank Headquartered In Lantana, Florida.

Established In 1987.

Franchise With Six Full-Service Offices Serving The Miami-Ft. Lauderdale -Pompano Beach-Homestead MSA.

At June 30, 2010—$354 Million In Assets, $225 Million In Loans And $330 Million In Deposits.

NPA/Assets = 10.84%, Texas Ratio = 690%.

64 FTE Employees.

June 10, 2010 – Issued Prompt Corrective Action Agreement With Federal Reserve.

STERLING BANK Transaction

?Assumed $151 Million of Loans After Discounts.

?Loans And OREO Covered By FDIC Loss Share Agreements. ?Investment Securities of $54 Million. ?$287 Million Of Deposits Assumed. ?FDIC Has Granted IBKC A 90-Day Option To Purchase At Fair Market Value Premises, Furniture, Fixtures and Equipment and Assume Leases Associated with 6 Office Locations.

?Successful Operating System Conversion—October 17, 2010.

43

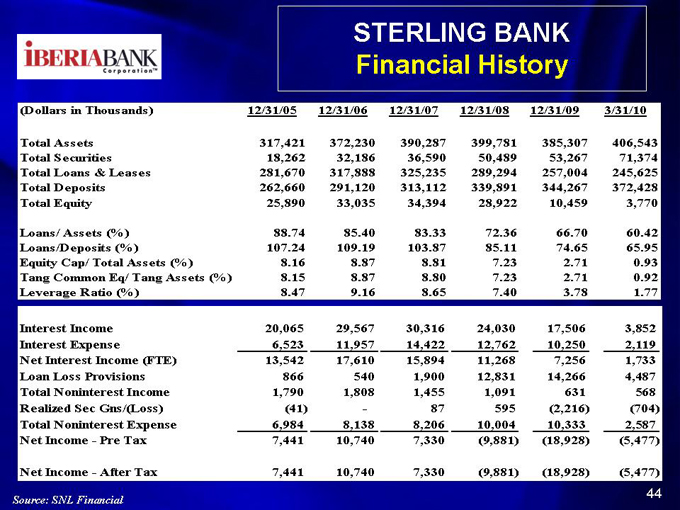

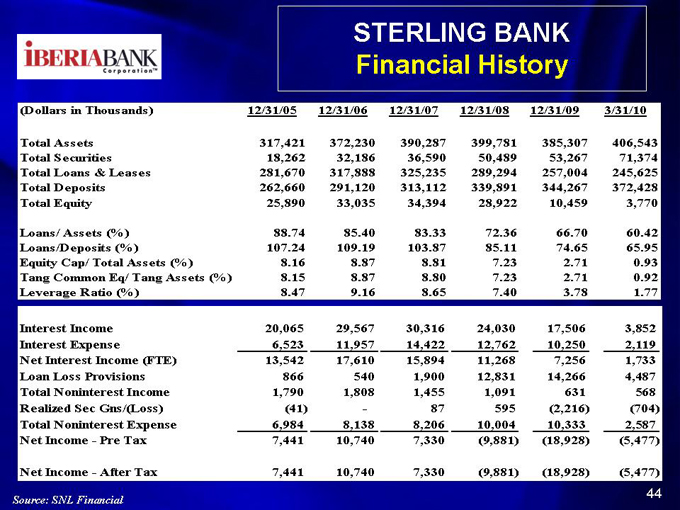

STERLING BANK Financial History

(Dollars in Thousands) 12/31/05 12/31/06 12/31/07 12/31/08 12/31/09 3/31/10

Total Assets 317,421 372,230 390,287 399,781 385,307 406,543

Total Securities 18,262 32,186 36,590 50,489 53,267 71,374

Total Loans & Leases 281,670 317,888 325,235 289,294 257,004 245,625

Total Deposits 262,660 291,120 313,112 339,891 344,267 372,428

Total Equity 25,890 33,035 34,394 28,922 10,459 3,770

Loans/ Assets (%) 88.74 85.40 83.33 72.36 66.70 60.42

Loans/Deposits (%) 107.24 109.19 103.87 85.11 74.65 65.95

Equity Cap/ Total Assets (%) 8.16 8.87 8.81 7.23 2.71 0.93

Tang Common Eq/ Tang Assets (%) 8.15 8.87 8.80 7.23 2.71 0.92

Leverage Ratio (%) 8.47 9.16 8.65 7.40 3.78 1.77

Interest Income 20,065 29,567 30,316 24,030 17,506 3,852

Interest Expense 6,523 11,957 14,422 12,762 10,250 2,119

Net Interest Income (FTE) 13,542 17,610 15,894 11,268 7,256 1,733

Loan Loss Provisions 866 540 1,900 12,831 14,266 4,487

Total Noninterest Income 1,790 1,808 1,455 1,091 631 568

Realized Sec Gns/(Loss) (41) - 87 595 (2,216) (704)

Total Noninterest Expense 6,984 8,138 8,206 10,004 10,333 2,587

Net Income - Pre Tax 7,441 10,740 7,330 (9,881) (18,928) (5,477)

Net Income - After Tax 7,441 10,740 7,330 (9,881) (18,928) (5,477)

44

Source: SNL Financial

STERLING BANK Branches

1189 Hypoloxo Rd – Lantana

2764 So Congress Ave –Palm Springs

900 SE 6th Ave – Delray Beach

119 South State Rd 7 – Royal Palm Beach

45

STERLING BANK Branches

1201 S. Andrews Ave – Ft. Lauderdale

2465 Wilton Dr – Wilton Manors

1101 N Congress Ave -Boynton Beach FL 33426

• Current Sterling Bank Lantana Location Will Be Relocated To This Boynton Beach, Florida Branch in January, 2011.

46

Markets

47

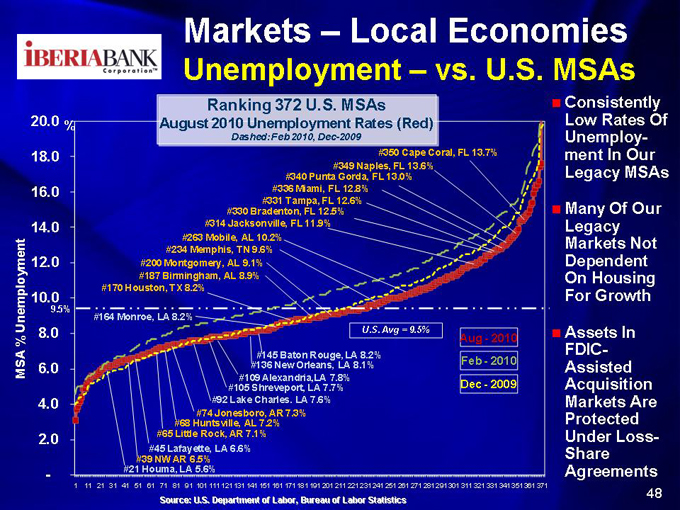

Markets – Local Economies

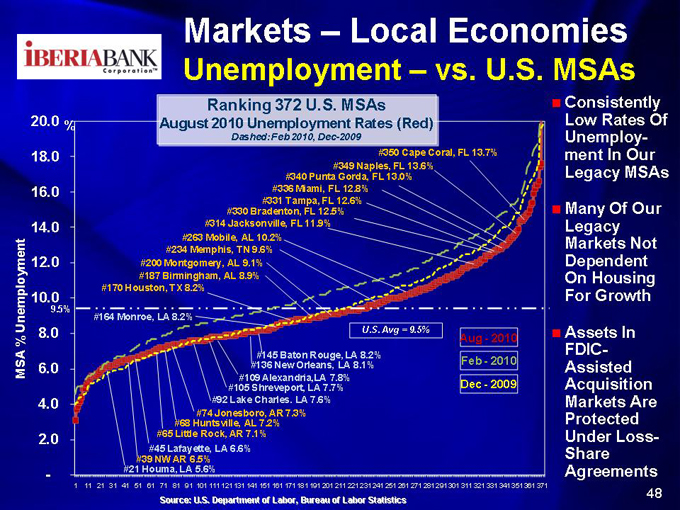

Unemployment – vs. U.S. MSAs

Ranking 372 U.S. MSAs August 2010 Unemployment Rates (Red)

Dashed: Feb 2010, Dec-2009

Consistently Low Rates Of Unemploy -ment In Our Legacy MSAs

Many Of Our Legacy Markets Not Dependent On Housing For Growth

Assets In FDIC-Assisted Acquisition Markets Are Protected Under Loss-Share Agreements

Source: U.S. Department of Labor, Bureau of Labor Statistics

#350 Cape Coral, FL 13.7% #349 Naples, FL 13.6% #340 Punta Gorda, FL 13.0% #336 Miami, FL 12.8% #331 Tampa, FL 12.6% #330 Bradenton, FL 12.5% #314 Jacksonville, FL 11.9% #263 Mobile, AL 10.2% #234 Memphis, TN 9.6% #200 Montgomery, AL 9.1% #187 Birmingham, AL 8.9% #170 Houston, TX 8.2%

#164 Monroe, LA 8.2%

U.S. Avg = 9.5%

Aug - 2010 Feb - 2010 Dec - 2009

#145 Baton Rouge, LA 8.2% #136 New Orleans, LA 8.1% #109 Alexandria,LA 7.8% #105 Shreveport, LA 7.7% #92 Lake Charles, LA 7.6% #74 Jonesboro, AR 7.3% #68 Huntsville, AL 7.2% #65 Little Rock, AR 7.1% #45 Lafayette, LA 6.6% #39 NW AR 6.5% #21 Houma, LA 5.6%

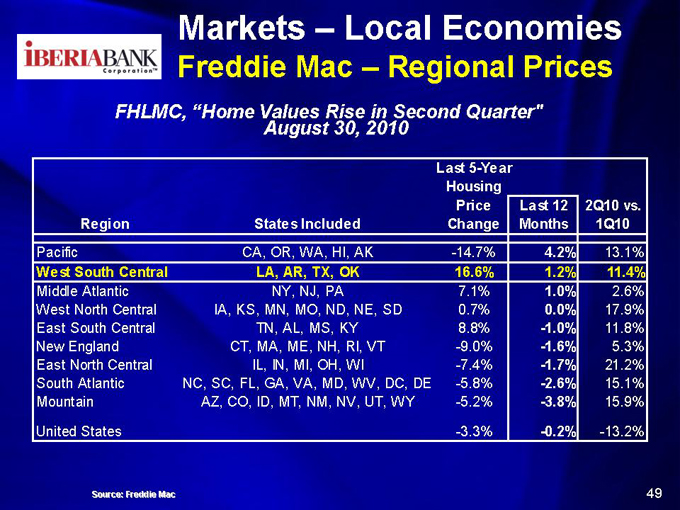

Markets – Local Economies

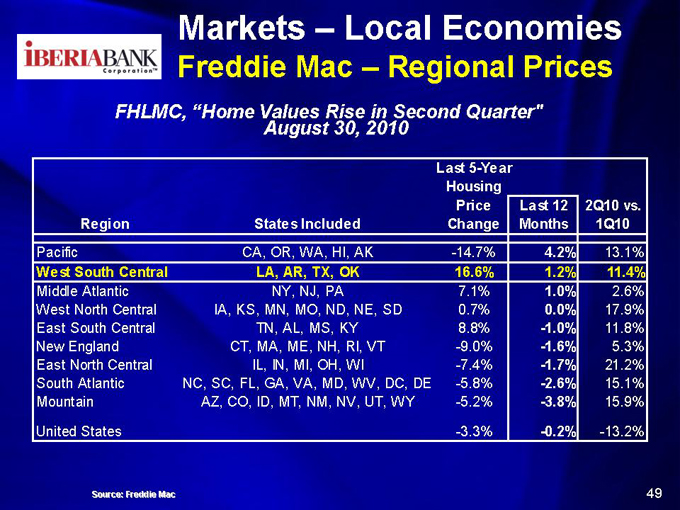

Freddie Mac – Regional Prices

FHLMC, “Home Values Rise in Second Quarter” August 30, 2010

Last 5-Year

Housing

Price Last 12 2Q10 vs.

Region States Included Change Months 1Q10

Pacific CA, OR, WA, HI, AK -14.7% 4.2% 13.1%

West South Central LA, AR, TX, OK 16.6% 1.2% 11.4%

Middle Atlantic NY, NJ, PA 7.1% 1.0% 2.6%

West North Central IA, KS, MN, MO, ND, NE, SD 0.7% 0.0% 17.9%

East South Central TN, AL, MS, KY 8.8% -1.0% 11.8%

New England CT, MA, ME, NH, RI, VT -9.0% -1.6% 5.3%

East North Central IL, IN, MI, OH, WI -7.4% -1.7% 21.2%

South Atlantic NC, SC, FL, GA, VA, MD, WV, DC, DE -5.8% -2.6% 15.1%

Mountain AZ, CO, ID, MT, NM, NV, UT, WY -5.2% -3.8% 15.9%

United States -3.3% -0.2% -13.2%

Source: Freddie Mac

49

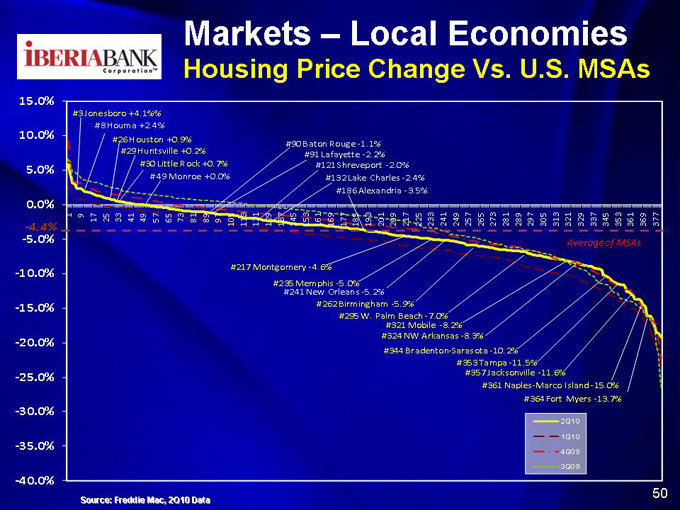

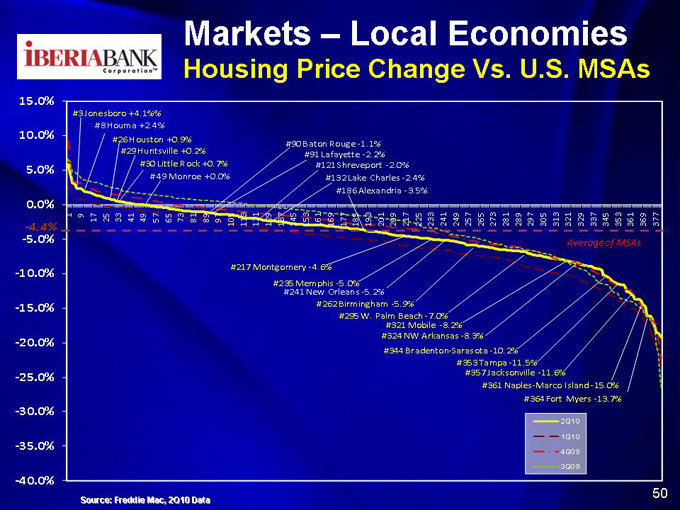

Markets – Local Economies

Housing Price Change Vs. U.S. MSAs

15.0% 10.0% 5.0%

0.0%

-4.4%

-5.0% -10.0% -15.0% -20.0% -25.0% -30.0% -35.0% -40.0%

#3 Jonesboro +4.1%% #8 Houma +2.4%

#26 Houston +0.9% #90 Baton Rouge -1.1% #29 Huntsville +0.2% #91 Lafayette -2.2% #30 Little Rock +0.7% #121 Shreveport -2.0% # 49 Monroe +0.0% #132 Lake Charles -2.4% #186 Alexandria -3.5%

#217 Montgomery -4.6%

#235#241 NewMemphis Orleans -5.0% -5.2% #262 Birmingham -5.9% #295 W. Palm Beach -7.0% #321 Mobile -8.2% #324 NW Arkansas -8.3% #344 Bradenton -Sarasota -10.2% #353 Tampa -11.5% #357 Jacksonville -11.6%

#361 Naples-Marco Island -15.0% #364 Fort Myers -13.7%

2Q10 1Q10 4Q09 3Q09

Source: Freddie Mac, 2Q10 Data

50

Markets – Local Economies

House Price Decline Probability

2 | | Next Over Decline Price Housing Years Of Probablity % |

Local Housing Prices Did Not Escalate Rapidly, So Little House Price “Snap-Back”

According To PMI, Our Legacy Markets Have Some Of The Lowest Probabilities To Exhibit Housing Price Declines Over Next 2 Years

Little Rock, AR 1.7% Jonesboro, AR 1.7%

Lake Charles, LA 11.% Huntsville, AL 11.3% Monroe, LA 14.3% Shreveport, LA 15.9% Lafayette, LA 16.3% Tulsa, OK 16.7% Memphis, TN 17.5%

Alexandria, LA 32.3% Houston, TX 41.3% Baton Rouge, LA 41.6% Mobile, AL 43.6%

Jacksonville, FL 99.9% Bradenton, FL 99.9% Cape Coral, FL 99.9% Naples, FL 99.9% Tampa, FL 99.9% W. Palm Beach, FL 99.9%

New Orleans, LA 20.8% NW Arkansas, 21.9% Birmingham, AL 23.2%

1Q10 4Q09 3Q09 2Q09

Source: PMI Economic Real Estate Trends

100% 90% 80% 70% 60% 50% 40% 30% 20% 10% 0%

1 | | 13 25 37 49 61 73 85 97 109 121 133 145 157 169 181 193 205 217 229 241 253 265 277 289 301 313 325 337 349 361 373 |

51

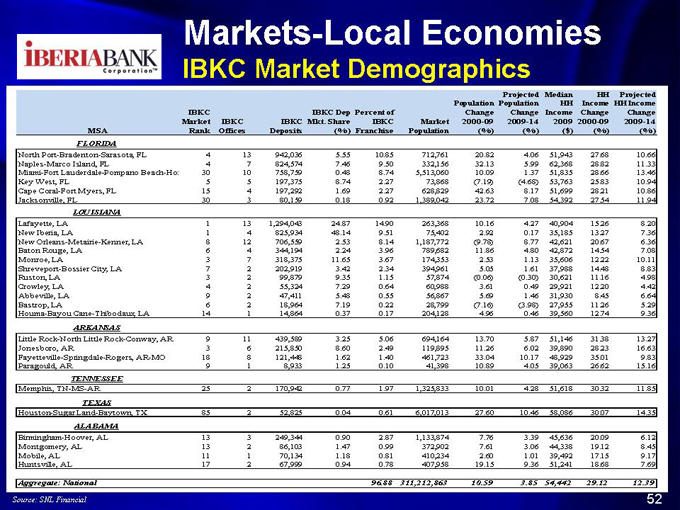

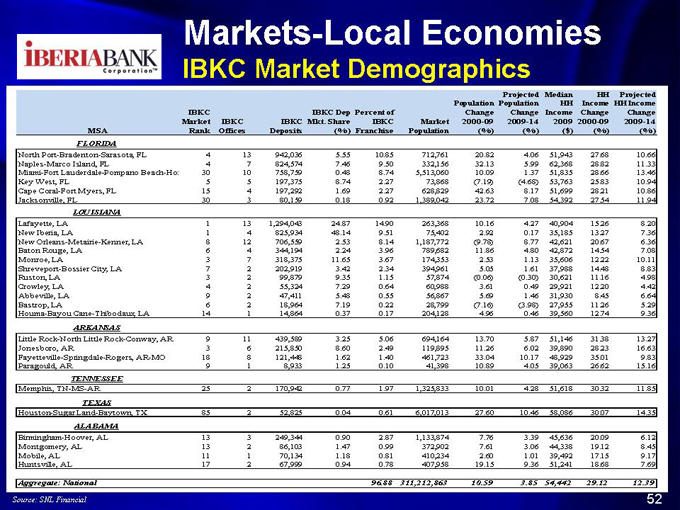

Markets -Local Economies

IBKC Market Demographics

MSA

IBKC

Market

Rank

IBKC Offices

IBKC

Deposits

IBKC Dep

Mkt. Share

(% )

Percent of

IBKC

Franchise

Market

Population

Population

Change

2000-09

(% )

Projected Population Change 2009-14

(% )

Median

HH

Income

2009

($)

HH Income Change 2000-09

(% )

Projected

HH Income

Change

2009-14

(% )

FLORIDA

North Port-Bradenton-Sarasota, FL 4 13 942,036 5.55 10.85 712,761 20.82 4.06 51,943 27.68 10.66

Naples-Marco Island, FL 4 7 824,574 7.46 9.50 332,156 32.13 5.99 62,368 28.82 11.33

Miami-Fort Lauderdale-Pompano Beach-Hom 30 10 758,759 0.48 8.74 5,513,060 10.09 1.37 51,835 28.66 13.46

Key West, FL 5 5 197,375 8.74 2.27 73,868 (7.19) (4.68) 53,763 25.83 10.94

Cape Coral-Fort Myers, FL 15 4 197,292 1.69 2.27 628,829 42.63 8.17 51,699 28.21 10.86

Jacksonville, FL 30 3 80,159 0.18 0.92 1,389,042 23.72 7.08 54,392 27.54 11.94

LOUISIANA

Lafayette, LA 1 13 1,294,043 24.87 14.90 263,368 10.16 4.27 40,904 15.26 8.20

New Iberia, LA 1 4 825,934 48.14 9.51 75,402 2.92 0.17 35,185 13.27 7.36

New Orleans-Metairie-Kenner, LA 8 12 706,559 2.53 8.14 1,187,772 (9.78) 8.77 42,621 20.67 6.36

Baton Rouge, LA 6 4 344,194 2.24 3.96 789,682 11.86 4.80 42,872 14.54 7.08

Monroe, LA 3 7 318,375 11.65 3.67 174,353 2.53 1.13 35,606 12.22 10.11

Shreveport-Bossier City, LA 7 2 202,919 3.42 2.34 394,961 5.05 1.61 37,988 14.48 8.83

Ruston, LA 3 2 99,879 9.35 1.15 57,874 (0.06) (0.30) 30,621 11.16 4.98

Crowley, LA 4 2 55,324 7.29 0.64 60,988 3.61 0.49 29,921 12.20 4.42

Abbeville, LA 9 2 47,411 5.48 0.55 56,867 5.69 1.46 31,930 8.45 6.64

Bastrop, LA 6 2 18,964 7.19 0.22 28,799 (7.16) (3.98) 27,955 11.26 5.29

Houma-Bayou Cane-Thibodaux, LA 14 1 14,864 0.37 0.17 204,128 4.96 0.46 39,560 12.74 9.36

ARKANSAS

Little Rock-North Little Rock-Conway, AR 9 11 439,589 3.25 5.06 694,164 13.70 5.87 51,146 31.38 13.27

Jonesboro, AR 3 6 215,850 8.60 2.49 119,895 11.26 6.02 39,890 28.23 16.63

Fayetteville-Springdale-Rogers, AR-MO 18 8 121,448 1.62 1.40 461,723 33.04 10.17 48,929 35.01 9.83

Paragould, AR 9 1 8,933 1.25 0.10 41,398 10.89 4.05 39,063 26.62 15.16

TENNESSEE

Memphis, TN-MS-AR 25 2 170,942 0.77 1.97 1,325,833 10.01 4.28 51,618 30.32 11.85

TEXAS

Houston-Sugar Land-Baytown, TX 85 2 52,825 0.04 0.61 6,017,013 27.60 10.46 58,086 30.07 14.35

ALABAMA

Birmingham-Hoover, AL 13 3 249,344 0.90 2.87 1,133,874 7.76 3.39 45,636 20.09 6.12

Montgomery, AL 13 2 86,103 1.47 0.99 372,902 7.61 3.06 44,338 19.12 8.45

Mobile, AL 11 1 70,134 1.18 0.81 410,234 2.60 1.01 39,492 17.15 9.17

Huntsville, AL 17 2 67,999 0.94 0.78 407,958 19.15 9.36 51,241 18.68 7.69

Aggregate: National 96.88 311,212,863 10.59 3.85 54,442 29.12 12.39

Source: SNL Financial

52

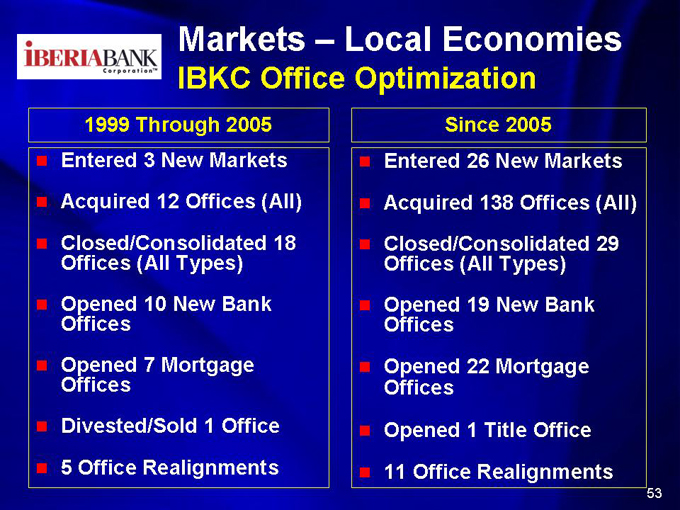

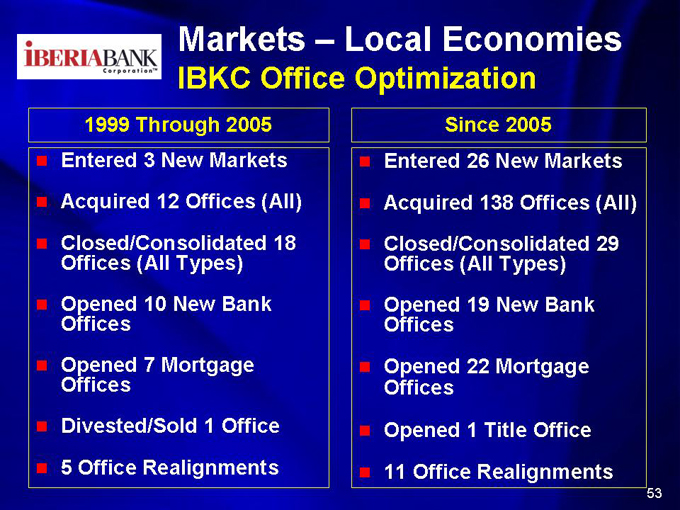

Markets – Local Economies

IBKC Office Optimization

1999 Through 2005

Entered 3 New Markets Acquired 12 Offices (All) Closed/Consolidated 18 Offices (All Types) Opened 10 New Bank Offices Opened 7 Mortgage Offices Divested/Sold 1 Office 5 Office Realignments

Since 2005

Entered 26 New Markets Acquired 138 Offices (All) Closed/Consolidated 29 Offices (All Types) Opened 19 New Bank Offices Opened 22 Mortgage Offices Opened 1 Title Office 11 Office Realignments

53

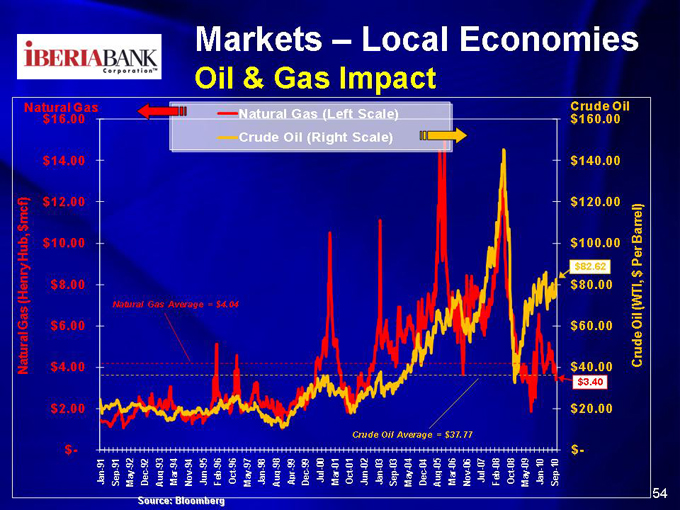

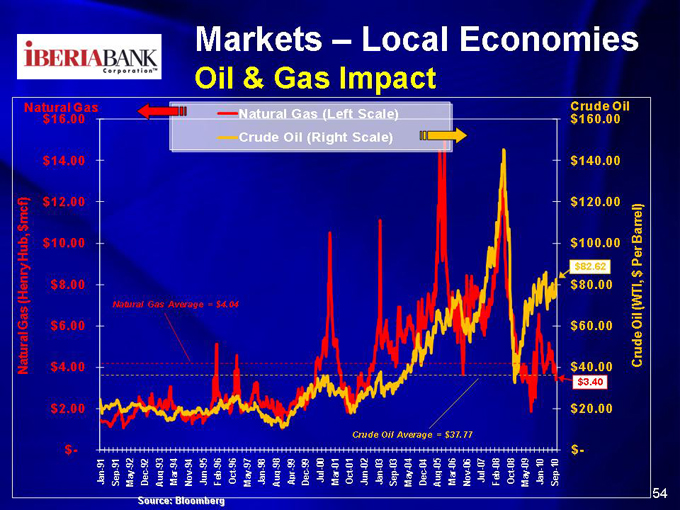

Markets – Local Economies

Oil & Gas Impact

$ mcf) Hub, (Henry Gas Natural

Natural Gas $16.00

$14.00 $12.00 $10.00 $8.00 $6.00 $4.00 $2.00 $-

Natural Gas (Left Scale) Crude Oil (Right Scale)

Crude Oil

$160.00

$140.00

$120.00

$100.00

$82.62

$80.00

$60.00

$40.00

$3.40

$20.00

$-

91 - 91 - 92 92 - 93 - 94 - 94 - 95 - 96 - 96 97 - 98 - 98 99 - 99 - 00 01 - - 01 02 - 03 - 03 - 04 04 - 05 - - 06 06 - 07 - - 08 - 08 - 09 10 10 -

- - - - -Jan p y g Oct y Jan g pr Jul Oct p y g Jul Oct y Jan p Se Ma Dec Au Mar Nov Jun Feb Ma Au A Dec Mar Jun Jan Se Ma Dec Au Mar Nov Feb Ma Se

Crude Oil Average = $37.77

Natural Gas Average = $4.04

Barrel) Per $ (WTI, Oil Crude

Source: Bloomberg

54

Summary Of IBKC

Industry Operating Environment - Challenging

Housing

Credit Risk Interest Rate Risk Operations Risk

We Tend To Move “Ahead Of The Curve” Focus On Long-Term Investments & Payback Organic And External Growth Expense Controls And Revenue Growth EPS/Stock Price Linkage - Shareholder Focus Favorable Risk/Return Compared To Peers

55

Loss Share Accounting Example

56

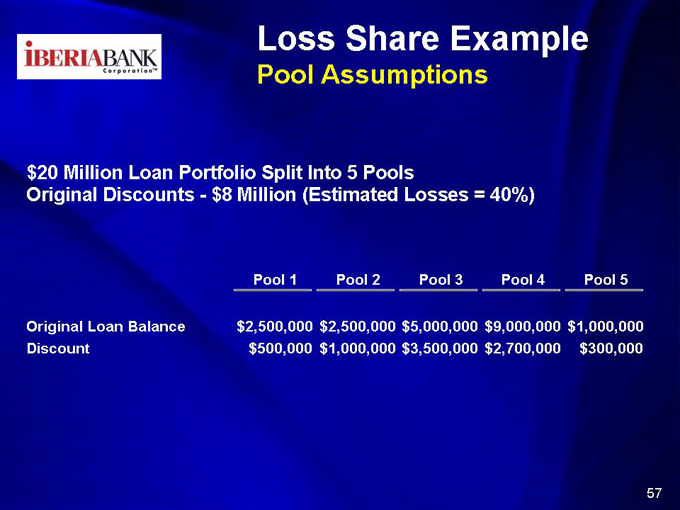

Loss Share Example

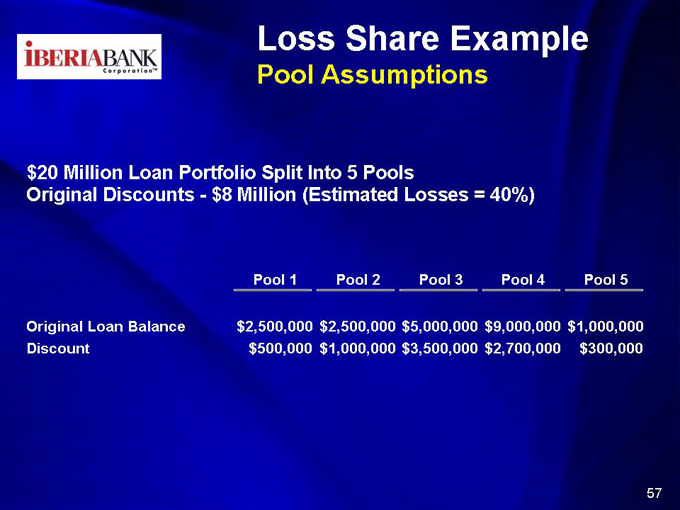

Pool Assumptions

$20 Million Loan Portfolio Split Into 5 Pools

Original Discounts - $8 Million (Estimated Losses = 40%)

Original Loan Balance Discount

Pool 1 Pool 2 Pool 3 Pool 4 Pool 5

$2,500,000 $2,500,000 $5,000,000 $9,000,000 $1,000,000 $500,000 $1,000,000 $3,500,000 $2,700,000 $300,000

57

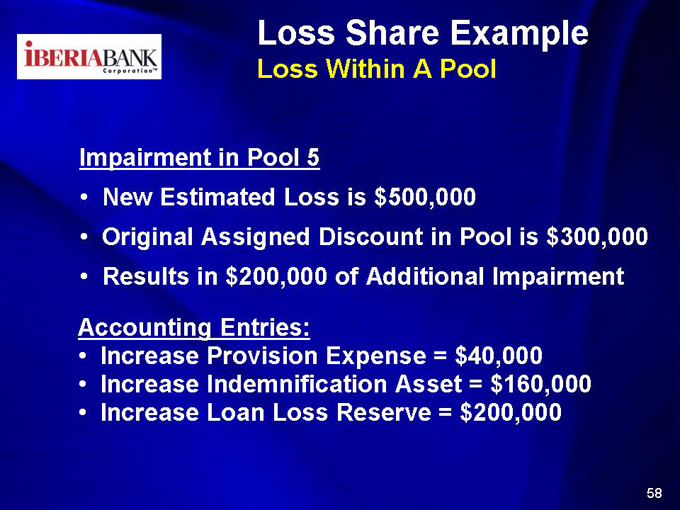

Loss Share Example

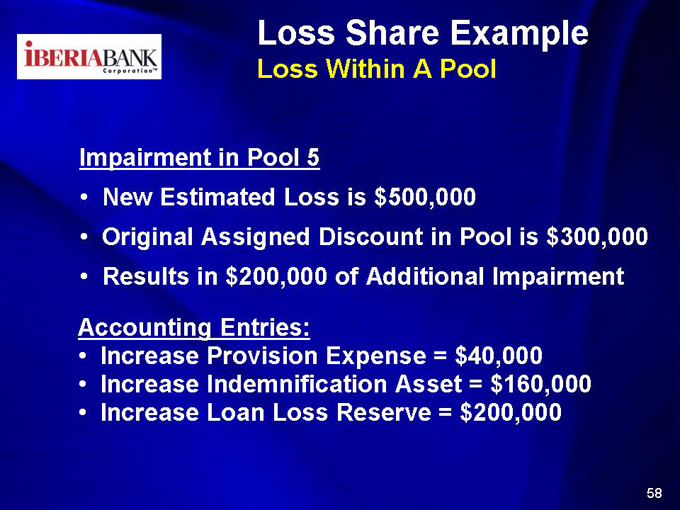

Loss Within A Pool

Impairment in Pool 5

• New Estimated Loss is $500,000

• Original Assigned Discount in Pool is $300,000

• Results in $200,000 of Additional Impairment

Accounting Entries:

• Increase Provision Expense = $40,000

• Increase Indemnification Asset = $160,000

• Increase Loan Loss Reserve = $200,000

58

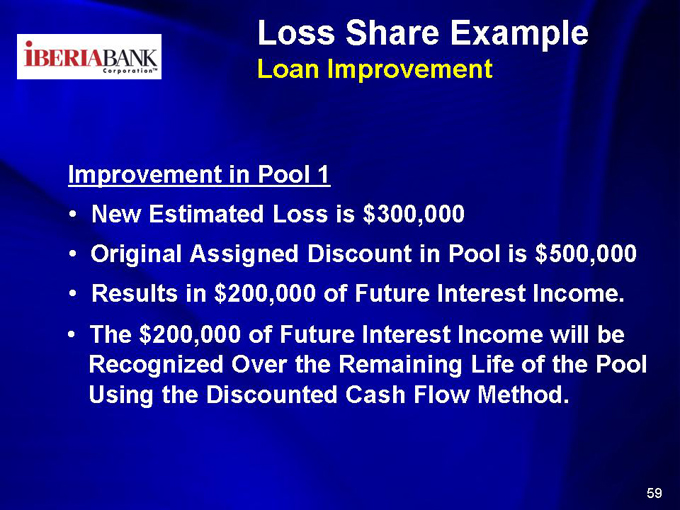

Loss Share Example

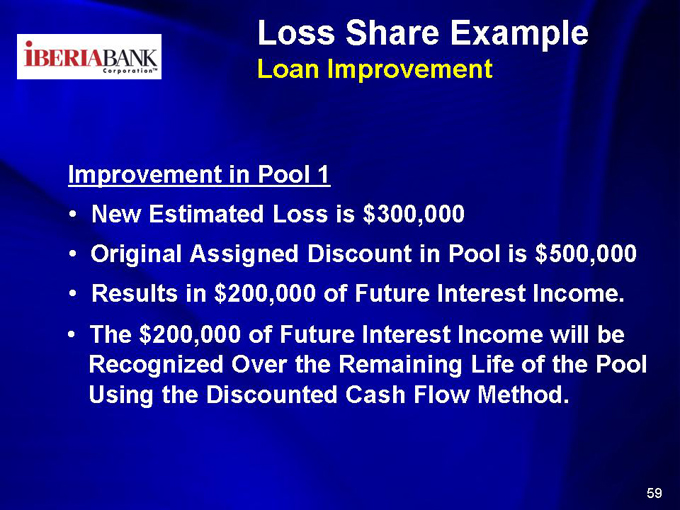

Loan Improvement

Improvement in Pool 1

• New Estimated Loss is $300,000

• Original Assigned Discount in Pool is $500,000

• Results in $200,000 of Future Interest Income.

• The $200,000 of Future Interest Income will be Recognized Over the Remaining Life of the Pool Using the Discounted Cash Flow Method.

59

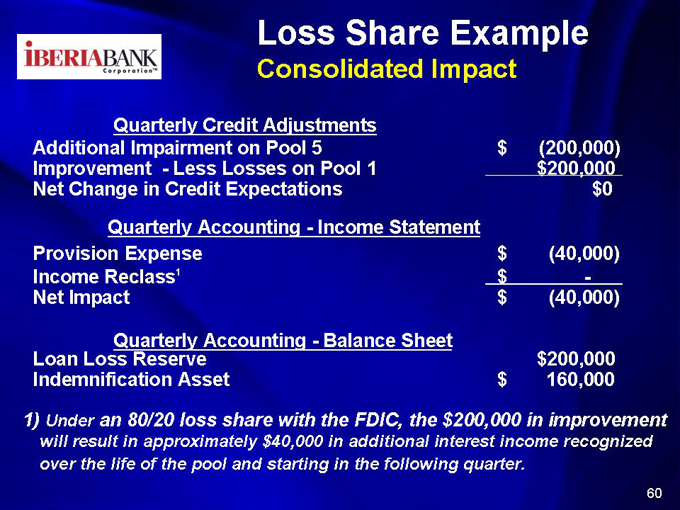

Loss Share Example

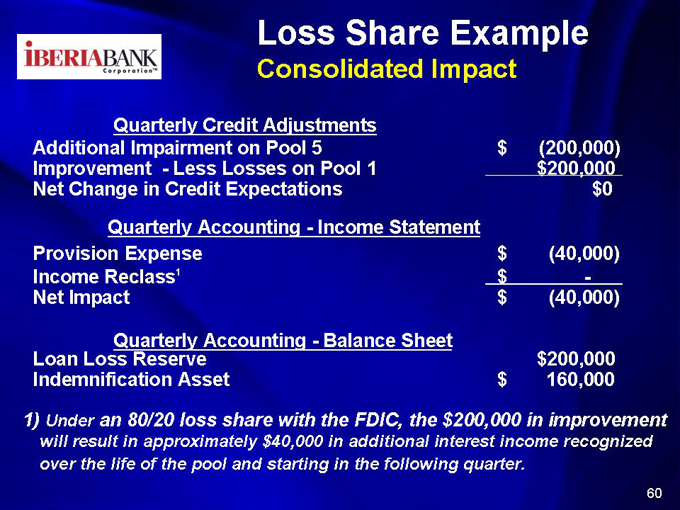

Consolidated Impact

Quarterly Credit Adjustments

Additional Impairment on Pool 5 $ (200,000) Improvement - Less Losses on Pool 1 $200,000 Net Change in Credit Expectations $0 Quarterly Accounting - Income Statement Provision Expense $ (40,000) Income Reclass 1 $ -Net Impact $ (40,000)

Quarterly Accounting - Balance Sheet

Loan Loss Reserve $200,000 Indemnification Asset $ 160,000

1) Under an 80/20 loss share with the FDIC, the $200,000 in improvement will result in approximately $40,000 in additional interest income recognized over the life of the pool and starting in the following quarter.

60