Exhibit 13

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion and analysis is intended to assist readers in understanding the consolidated financial condition and results of operations of IBERIABANK Corporation (the “Company”) and its wholly owned subsidiaries, IBERIABANK, Lenders Title Company (“LTC”), IBERIA Capital Partners, LLC (“ICP”), IB Aircraft Holdings, LLC, IBERIA Asset Management Inc. (“IAM”), and IBERIA CDE, LLC, as of December 31, 2010 and 2009 and for the years ended December 31, 2008 through 2010. This discussion should be read in conjunction with the audited consolidated financial statements, accompanying footnotes and supplemental financial data included herein.

The Company offers commercial and retail banking products and services to customers in locations in six states through IBERIABANK. The Company also operates mortgage production offices in 12 states through IBERIABANK’s subsidiary, IBERIABANK Mortgage Company (“IMC”), and offers a full line of title insurance and closing services throughout Arkansas and Louisiana through LTC and its subsidiaries. ICP provides equity research, institutional sales and trading, and corporate finance services. IB Aircraft Holdings, LLC owns a fractional share of an aircraft used by management of the Company and its subsidiaries. IAM provides wealth management and trust services for commercial and private banking clients. CDE is utilized to purchase tax credits.

EXECUTIVE OVERVIEW

The Company’s results of operations and financial condition were impacted by a number of significant events during 2010. Management undertook these strategic initiatives to position the Company for future growth through core earnings and provide additional capital to fund the Company’s growing operations.

During the year, the Company had solid growth in its balance sheet, both organically and through acquisitions, and continued growth in most core earnings drivers. During 2010, the Company fortified its capital position, enhanced its liquidity, expanded its customer base, created a new noninterest income channel through its capital markets group, and expanded its wealth management business. In addition, the Company successfully integrated and converted its recent Florida acquisitions to IBERIABANK’s processes and systems.

Acquisition Activity during 2010 and 2009

Consistent with the Company’s growth strategy over the past 12 years, the Company completed four acquisitions during 2010 and 2009 that significantly grew the Company’s asset base and extended the Company’s footprint into two new states. The Company’s results of operations, financial condition, and liquidity for the years ended December 31, 2010 and 2009 were significantly impacted by IBERIABANK’s whole-bank purchase and assumption of assets and liabilities of CapitalSouth Bank, a full-service commercial bank headquartered in Birmingham, Alabama (“CSB”), from the Federal Deposit Insurance Corporation (“FDIC”) on August 21, 2009; the whole-bank purchase and assumption of assets and liabilities of Orion Bank (“Orion”), a full-service Florida-chartered commercial bank headquartered in Naples, Florida, and Century Bank, FSB (“Century”), a full-service federal thrift headquartered in Sarasota, Florida, from the FDIC, each on November 13, 2009; and the whole-bank purchase and assumption of assets and liabilities of Sterling Bank (“Sterling”), a Florida state-chartered bank headquartered in Lantana, Florida, on July 23, 2010. As a result of the CSB acquisition, IBERIABANK now operates 10 former CSB branches in four Metropolitan Statistical Areas (“MSAs”): Birmingham, Montgomery, and Huntsville, Alabama, and Jacksonville, Florida. IBERIABANK now operates 23 former Orion branches in five Florida MSAs and 11 former Century branches in Sarasota and Bradenton, Florida after the Orion and Century acquisitions. IBERIABANK now operates six former Sterling branches in southeast Florida.

The four acquisitions were accounted for under the purchase method of accounting in accordance with Accounting Standards Codification (“ASC”) Topic No. 805. Major categories of assets purchased and liabilities assumed, as well as the gain recorded (if any) on each transaction (shown as total equity), are presented in the following table. Both the purchased assets and assumed liabilities were recorded at their respective acquisition date fair values. Identifiable intangible assets, including core deposit intangible assets, were recorded at fair value. Because the fair value of assets acquired and intangible assets created as a result of the acquisition exceeds the fair value of liabilities assumed in the CSB, Orion, and Century acquisitions, the provisions of ASC 805 allow the Company to record a gain resulting from each of these acquisitions in its consolidated statements of income in the period of acquisition. During the first quarter of 2010, the Company received notification of additional settlement items from the

FDIC and increased the total gain recorded on the transactions by $3.8 million. This gain adjustment is included in noninterest income on the Company’s consolidated statements of income for the year ended December 31, 2010.

During 2010, the Company revised its settlement liability with the FDIC on the Orion acquisition, the result of which was an increase in net income of $7.1 million for the year ended December 31, 2009. The final settlement liability was identified in 2010 through the operation of the Company’s internal control over financial reporting as it related to the Company’s acquisition accounting. As a result, the information included in this discussion, as well as the consolidated financial statements and footnotes, includes the effect this correction had on the previously reported financial statements for the year ended December 31, 2009. For additional information on this change, see Note 1 of the footnotes to the consolidated financial statements.

SUMMMARY OF 2010 AND 2009 ACQUISITION ACTIVITY

| | | | | | | | | | | | | | | | | | | | |

| (dollars in thousands) | | CapitalSouth | | | Orion | | | Century | | | Sterling | | | Total | |

| | | | | |

Assets | | | | | | | | | | | | | | | | | | | | |

Investment securities | | $ | 46,027 | | | $ | 230,968 | | | $ | 22,128 | | | $ | 53,551 | | | $ | 352,674 | |

Loans | | | 363,117 | | | | 961,094 | | | | 417,561 | | | | 151,301 | | | | 1,893,073 | |

Other real estate owned | | | 10,244 | | | | 28,505 | | | | 21,150 | | | | 5,725 | | | | 65,624 | |

Core deposit intangible | | | 377 | | | | 10,421 | | | | 2,243 | | | | 1,568 | | | | 14,609 | |

FDIC loss share receivable | | | 88,093 | | | | 711,756 | | | | 232,053 | | | | 66,826 | | | | 1,098,728 | |

Goodwill | | | — | | | | — | | | | — | | | | 7,148 | | | | 7,148 | |

Other assets | | | 102,805 | | | | 434,507 | | | | 116,874 | | | | 28,099 | | | | 682,285 | |

| | | | | | | | | | | | | | | | | | | | |

Total Assets | | | 610,663 | | | | 2,377,251 | | | | 812,009 | | | | 314,218 | | | | 4,114,141 | |

| | | | | |

Liabilities | | | | | | | | | | | | | | | | | | | | |

Interest-bearing deposits | | | 461,348 | | | | 1,748,749 | | | | 504,875 | | | | 260,750 | | | | 2,975,722 | |

Noninterest-bearing deposits | | | 56,543 | | | | 134,337 | | | | 110,940 | | | | 26,264 | | | | 328,084 | |

Borrowings | | | 30,619 | | | | 344,690 | | | | 143,006 | | | | 26,295 | | | | 544,610 | |

Other liabilities | | | 4,916 | | | | 15,642 | | | | 1,586 | | | | 909 | | | | 23,053 | |

| | | | | | | | | | | | | | | | | | | | |

Total Liabilities | | | 553,425 | | | | 2,243,418 | | | | 760,407 | | | | 314,218 | | | | 3,871,469 | |

| | | | | |

Total Equity | | | 57,238 | | | | 133,833 | | | | 51,602 | | | | — | | | | 242,673 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Total Liabilities and Equity | | $ | 610,663 | | | $ | 2,377,251 | | | $ | 812,009 | | | $ | 314,218 | | | $ | 4,114,141 | |

| | | | | | | | | | | | | | | | | | | | |

Other Acquisition Activity

In addition to the acquisitions completed during 2009 and 2010, the Company has been an active acquirer over the previous six years. From 2003 through 2008, the Company completed the following acquisitions, presented with intangible assets created and selected assets and liabilities acquired for each acquisition:

SUMMARY OF ACQUISITION ACTIVITY FROM 2003 TO 2008

| | | | | | | | | | | | | | | | | | | | | | | | |

(dollars in millions) | | | | | | | | | | | | | | | | | | |

Acquisition | | Acquisition

Date | | | Total

Assets

Acquired | | | Total

Loans

Acquired | | | Total

Deposits

Acquired | | | Goodwill | | | Other

Intangible

Assets | |

Acadiana Bancshares, Inc. | | | 2003 | | | $ | 308.1 | | | $ | 189.6 | | | $ | 210.0 | | | $ | 24.1 | | | $ | 4.4 | |

Alliance Bank of Baton Rouge | | | 2004 | | | | 71.7 | | | | 53.1 | | | | 61.8 | | | | 5.2 | | | | 1.2 | |

American Horizons Bancorp, Inc. | | | 2005 | | | | 243.8 | | | | 194.7 | | | | 192.7 | | | | 28.1 | | | | 5.0 | |

Pulaski Investment Corporation | | | 2007 | | | | 477.2 | | | | 367.7 | | | | 422.6 | | | | 92.4 | | | | 10.9 | |

Pocahontas Bankcorp, Inc. | | | 2007 | | | | 700.2 | | | | 409.9 | | | | 582.4 | | | | 42.0 | | | | 7.0 | |

United Title of Louisiana, Inc. | | | 2007 | | | | 0.4 | | | | — | | | | — | | | | 4.2 | | | | 1.2 | |

Kingdom Capital Management, Inc. | | | 2008 | | | | 0.7 | | | | — | | | | — | | | | 0.6 | | | | — | |

American Abstract and Title Company | | | 2008 | | | | 5.1 | | | | — | | | | — | | | | 5.0 | | | | — | |

ANB Financial, N.A. | | | 2008 | | | | 239.9 | | | | 1.9 | | | | 189.7 | | | | — | | | | 1.9 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total Acquisitions, 2003-2008 | | | | | | $ | 2,047.1 | | | $ | 1,216.9 | | | $ | 1,659.2 | | | $ | 201.6 | | | $ | 31.6 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Balance Sheet Position and Results of Operations

The Company’s income available to common shareholders for 2010 totaled $48.8 million, or $1.88 per share on a diluted basis, a 68.5% decrease compared to the $155.0 million earned for 2009. On a per share basis, this represents a 77.6% decrease from the $8.41 per diluted share earned in 2009. The decrease in per share earnings was primarily a result of the gains the Company recorded on its three acquisitions in 2009. Total acquisition gains of $238.9 million drove earnings in 2009. Key components of the Company’s 2010 performance are summarized below.

| | • | | Total assets at December 31, 2010 were $10.0 billion, up $330.8 million, or 3.4%, from $9.7 billion at December 31, 2009. The increase was primarily the result of assets acquired from the Sterling acquisition completed in July 2010. Assets acquired totaled $314.2 million at the time of acquisition, which included loans of $151.3 million and a loss share receivable of $66.8 million. |

| | • | | Total loans at December 31, 2010 were $6.0 billion, an increase of $251.0 million, or 4.3%, from $5.8 billion at December 31, 2009. Loan growth was a result of $151.3 million in loans acquired, as well as organic growth of $99.7 million, or 1.7%. Excluding loans covered by loss share agreements (“covered loans”) with the FDIC, organic growth was $319.6 million, or 7.8%, during the year. |

| | • | | Total customer deposits increased $359.0 million, or 4.8%, from $7.6 billion at December 31, 2009 to $7.9 billion at December 31, 2010. The increase was primarily the result of the $287.0 million in deposits obtained in the acquisition completed during 2010, but also includes organic growth of $72.0 million. Total interest-bearing deposits increased $355.1 million, or 5.3%, during 2010. Total noninterest-bearing accounts increased $3.9 million, or 0.4%, during 2010. Although deposit competition remained intense through much of 2010, the Company was able to generate strong organic growth across its many deposit products. Organic deposit growth was driven by growth in the Company’s newer markets of Mobile and Houston, as well as growth in many of the Company’s core markets. |

| | • | | Shareholders’ equity increased $342.1 million, or 35.6%, from $961.3 million at December 31, 2009 to $1.3 billion at December 31, 2010. The increase is the result of earnings for the year and the Company’s common stock issuance of 6.0 million shares during the first quarter of 2010. |

| | • | | Net interest income increased $108.8 million, or 63.0%, in 2010 when compared to 2009. This increase is largely attributable to a $3.6 billion increase in average net earning assets. From 2009 to 2010, the corresponding net interest margin ratio on a tax-equivalent basis decreased four basis points to 3.05% from 3.09% due to changes in the volume and mix of the Company’s assets and liabilities and rate decreases driven by federal funds, Treasury, and other Company borrowing rate decreases during 2010. Most of the Company’s variable rate loans and deposits are tied to these rates and thus the repricing of these assets and liabilities during 2010 decreased both the average earning asset yield and the interest-bearing liability rate. |

| | • | | Noninterest income decreased $210.6 million, or 61.1%, for 2010 when compared to 2009. The decrease was primarily driven by gains from the Company’s acquisitions in 2009. Offsetting the decrease in acquisition gains were increases of $12.6 million in gains on the sale of loans, primarily from IBERIABANKfsb’s mortgage origination subsidiary, IBERIABANK Mortgage Company (“IMC”), and broker commissions of $2.9 million. |

| | • | | Noninterest expense increased $81.0 million, or 36.3%, for 2010 when compared to 2009. The increase was attributed to higher salaries and employee benefits from the acquisitions, as well as increased occupancy, equipment, and other branch expenses resulting from the Company’s expanded footprint. In addition to personnel and other costs related to the expanding size of the Company, noninterest expenses were driven higher in 2010 with conversion- and integration-related expenses from the Company’s three Florida acquisitions during 2009 and 2010. |

| | • | | The Company recorded a provision for loan losses of $42.5 million during 2010, compared to a provision of $45.4 million in 2009. The provision was primarily the result of net charge-offs in 2010 of $27.0 million, or 0.47% of average loans, but also included a provision of $15.5 million for loan growth and changes in asset quality during the year. As of December 31, 2010, the allowance for loan losses as a percent of total loans was 2.26%, compared to 0.96% at December 31, 2009. |

| | • | | Despite the tough market conditions experienced in the industry during 2010, the Company paid cash dividends totaling $1.36 per common share, consistent with dividends paid in 2009. The Company’s dividend payout ratio to common shareholders was 74.7%. |

The Company’s focus is that of a high performing institution. Management believes that improvement in core earnings drives shareholder value and has adopted a mission statement that is designed to provide guidance for management, our associates and Board of Directors regarding the sense of purpose and direction of the Company. We are very shareholder and client focused, expect high performance from our associates, believe in a strong sense of community and strive to make the Company a great place to work.

During 2010, the Company continued to execute its business model successfully, as evidenced by its completion of the Sterling acquisition and new branch expansion, expanding the Company’s presence in Florida. In addition, the Company experienced solid organic loan and deposit growth during the year, despite the challenges the entire industry faced in 2010. The Company remains well positioned for future growth opportunities, as evidenced by abundant liquidity, core funding, and capitalization levels.

APPLICATION OF CRITICAL ACCOUNTING POLICIES

In preparing financial reports, management is required to apply significant judgment to various accounting, reporting and disclosure matters. Management must use assumptions and estimates to apply these principles where actual measurement is not possible or practical. The accounting principles and methods used by the Company conform with accounting principles generally accepted in the United States and general banking practices. Estimates and assumptions most significant to the Company relate primarily to the calculation of the allowance for loan losses, the valuation of goodwill, intangible assets and other purchase accounting adjustments, the valuation of share-based compensation, and the accounting for acquired loans and the related FDIC loss share receivable. These significant estimates and assumptions are summarized in the following discussion and are further analyzed in the footnotes to the consolidated financial statements.

Allowance for Loan Losses

The determination of the allowance for loan losses, which represents management’s estimate of probable losses inherent in the Company’s loan portfolio, involves a high degree of judgment and complexity. The Company’s policy is to establish reserves for estimated losses on delinquent and other problem loans when it is determined that losses are expected to be incurred on such loans. Management’s determination of the adequacy of the allowance is based on various factors, including an evaluation of the portfolio, past loss experience, current economic conditions, the volume and type of lending conducted by the Company, composition of the portfolio, the amount of the Company’s classified assets, seasoning of the loan portfolio, the status of past due principal and interest payments, and other relevant factors. Changes in such estimates may have a significant impact on the financial statements. For further discussion of the allowance for loan losses, see the Asset Quality and Allowance for Loan Losses sections of this analysis and Note 1 and Note 6 of the footnotes to the consolidated financial statements.

Valuation of Goodwill, Intangible Assets and Other Purchase Accounting Adjustments

The Company accounts for acquisitions in accordance with ASC Topic No. 805, which requires the use of the purchase method of accounting. For purchase acquisitions, the Company is required to record the assets acquired, including identified intangible assets, and liabilities assumed, at their fair value, which in many instances involves estimates based on third party valuations, such as appraisals, or internal valuations based on discounted cash flow analyses or other valuation techniques. The determination of the useful lives of intangible assets is subjective as is the appropriate amortization period for such intangible assets. In addition, purchase acquisitions typically result in recording goodwill. The Company performs a goodwill valuation at least annually. Impairment testing of goodwill is a two step process that first compares the fair value of goodwill with its carrying amount, and second measures impairment loss by comparing the implied fair value of goodwill with the carrying amount of that goodwill. Based on management’s goodwill impairment test, there was no impairment of goodwill at October 1, 2010. In 2009, LTC had an impairment of goodwill of $9.7 million, and the Company recorded the charge through its statement of income for the year ended December 31, 2009. For additional information on goodwill and intangible assets, see Note 1 and Note 9 of the footnotes to the consolidated financial statements.

Share-based Compensation

Management utilizes the Black-Scholes option valuation model to estimate the fair value of stock options. The option valuation model requires the input of highly subjective assumptions, including expected stock price volatility and option life. These subjective input assumptions materially affect the fair value estimate.

For additional discussion of the Company’s stock options plans, sees Notes 1 and 18 of the footnotes to the consolidated financial statements.

Accounting For Acquired Loans and Related FDIC Loss Share Receivable

The Company accounts for its acquisitions under ASC Topic No. 805,Business Combinations, which requires the use of the purchase method of accounting. All identifiable assets acquired, including loans, are recorded at fair value. No allowance for loan losses related to the acquired loans is recorded on the acquisition date as the fair value of the loans acquired incorporates assumptions regarding credit risk. Loans acquired are recorded at fair value in accordance with the fair value methodology prescribed in ASC Topic No. 820, exclusive of the shared-loss agreements with the FDIC. These fair value estimates associated with the loans include estimates related to expected prepayments and the amount and timing of undiscounted expected principal, interest and other cash flows.

Over the life of the acquired loans, the Company continues to estimate cash flows expected to be collected on individual loans or on pools of loans sharing common risk characteristics. The Company evaluates at each balance sheet date whether the estimated cash flows and corresponding present value of its loans determined using the effective interest rates has decreased and if so, recognizes a provision for loan loss in its consolidated statement of income. For any increases in cash flows expected to be collected, the Company adjusts the amount of accretable yield recognized on a prospective basis over the loan’s or pool’s remaining life.

Because the FDIC will reimburse the Company for certain acquired loans should the Company experience a loss, an indemnification asset, the FDIC loss share receivable, is recorded at fair value at the acquisition date. The indemnification asset is recognized at the same time as the indemnified loans, and measured on the same basis, subject to collectability or contractual limitations. The shared loss agreements on the acquisition date reflect the reimbursements expected to be received from the FDIC, using an appropriate discount rate, which reflects counterparty credit risk and other uncertainties.

The shared loss agreements continue to be measured on the same basis as the related indemnified loans. Because the acquired loans are subject to the accounting prescribed by ASC Topic 310, subsequent changes to the basis of the shared loss agreements also follow that model. Deterioration in the credit quality of the loans (immediately recorded as an adjustment to the allowance for loan losses) would immediately increase the basis of the shared loss agreements, with the offset recorded through the consolidated statement of income. Improvements in the credit quality or cash flows of loans (reflected as an adjustment to yield and accreted into income over the remaining life of the loans) decrease the basis of the shared loss agreements, with such decrease being amortized into income over 1) the same period or 2) the life of the shared loss agreements, whichever is shorter. Loss assumptions used in the basis of the indemnified loans are consistent with the loss assumptions used to measure the indemnification asset. Fair value accounting incorporates into the fair value of the indemnification asset an element of the time value of money, which is accreted back into income over the life of the shared loss agreements.

Upon the determination of an incurred loss the indemnification asset will be reduced by the amount owed by the FDIC. A corresponding claim receivable is recorded until cash is received from the FDIC.

For further discussion of the Company’s acquisitions and loan accounting, see Note 3 and Note 5 of the footnotes to the consolidated financial statements.

FINANCIAL CONDITION

EARNING ASSETS

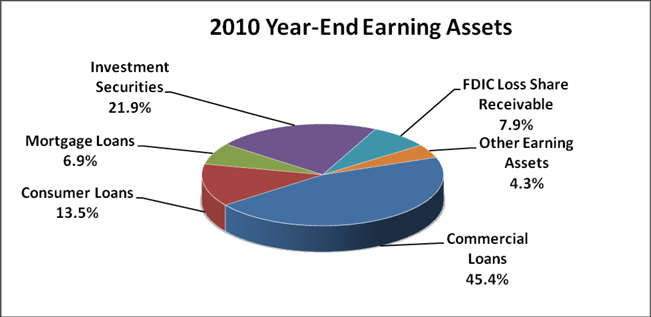

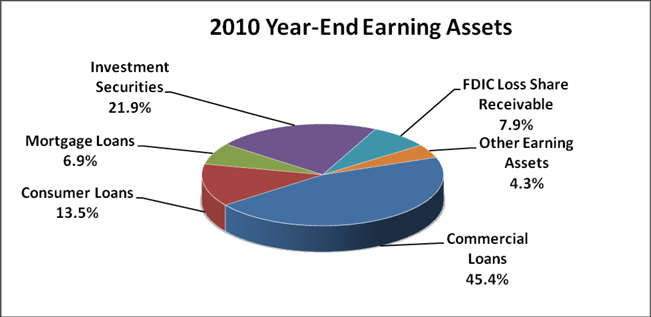

Interest income associated with earning assets is the Company’s primary source of income. Earning assets are composed of interest or dividend-earning assets, including loans, securities, short-term investments and loans held for sale. Earning assets averaged $9.4 billion during 2010, a $3.6 billion, or 63.2%, increase when compared to 2009. The increase is the result of earning assets acquired during 2009 and 2010.

The year-end mix of earning assets is shown in the following chart.

Loans and Leases

The loan portfolio increased $251.0 million, or 4.3%, to $6.0 billion at December 31, 2010, compared to $5.8 billion at December 31, 2009. The increase was primarily from loans acquired in the Sterling acquisition. Excluding the $151.3 million in loans acquired, the Company experienced organic growth of $99.7 million, or 1.7%, during 2010. Organic growth was tempered by a decrease in loans covered by loss share agreements of $219.9 million, or 13.2%, acquired from the 2009 acquisitions of CSB, Orion, and Century. Excluding the covered loan decrease, organic growth was $319.6 million, or 7.8%, during 2010, with growth in both the IBERIABANK and IBERIABANKfsb portfolios.

Non-covered Loans

Because of the loss protection provided by the FDIC, the risks of the CSB, Orion, Century, and Sterling loans and foreclosed real estate are significantly different from those assets not covered under loss share agreements. Accordingly, the Company presents loans subject to the loss share agreements as “covered loans” in the information below and loans that are not subject to the loss share agreement as “non-covered loans.”

The following is a summary of the major categories of non-covered loans outstanding at December 31:

NON-COVERED LOANS RECEIVABLE BY LOAN TYPE

| | | | | | | | |

| (dollars in thousands) | | December 31, | |

Non-covered Loans | | 2010 | | | 2009 | |

| | |

Residential mortgage loans: | | | | | | | | |

| | |

Residential 1-4 family | | $ | 355,164 | | | $ | 434,956 | |

Construction/ Owner-occupied | | | 14,822 | | | | 18,198 | |

| | | | | | | | |

Total residential mortgage loans | | | 369,986 | | | | 453,154 | |

| | |

Commercial loans: | | | | | | | | |

Real estate | | | 1,781,758 | | | | 1,659,844 | |

Business | | | 1,341,338 | | | | 1,086,860 | |

| | | | | | | | |

Total commercial loans | | | 3,123,096 | | | | 2,746,704 | |

| | |

Consumer loans: | | | | | | | | |

Indirect automobile | | | 255,322 | | | | 259,339 | |

Home equity | | | 555,749 | | | | 512,087 | |

Other | | | 148,432 | | | | 142,615 | |

| | | | | | | | |

| | |

Total consumer loans | | | 959,503 | | | | 914,041 | |

| | | | | | | | |

Total non-covered loans receivable | | $ | 4,452,585 | | | $ | 4,113,899 | |

| | | | | | | | |

Covered Loans

The carrying amount of the covered loans at December 31, 2010 consisted of loans accounted for in accordance with ASC Topic 310-30 and loans not subject to ASC Topic 310-30 as detailed in the following table.

COVERED LOANS RECEIVABLE BY LOAN TYPE

| | | | | | | | | | | | |

| (dollars in thousands) | | | | | | | | | |

Covered Loans | | ASC 310-30

Loans | | | Non- ASC 310-30

Loans | | | Total Covered

Loans | |

| | | |

Residential mortgage loans: | | | | | | | | | | | | |

| | | |

Residential 1-4 family | | $ | 50,566 | | | $ | 210,820 | | | $ | 261,386 | |

Construction/ Owner-occupied | | | — | | | | — | | | | — | |

| | | | | | | | | | | | |

Total residential mortgage loans | | | 50,566 | | | | 210,820 | | | | 261,386 | |

| | | |

Commercial loans: | | | | | | | | | | | | |

Real estate | | | 146,331 | | | | 719,032 | | | | 865,363 | |

Business | | | 6,119 | | | | 168,385 | | | | 174,504 | |

| | | | | | | | | | | | |

Total commercial loans | | | 152,450 | | | | 887,417 | | | | 1,039,867 | |

| | | |

Consumer loans: | | | | | | | | | | | | |

Indirect automobile | | | — | | | | — | | | | — | |

Home equity | | | 59,689 | | | | 219,402 | | | | 279,091 | |

Other | | | 543 | | | | 1,860 | | | | 2,403 | |

| | | | | | | | | | | | |

| | | |

Total consumer loans | | | 60,232 | | | | 221,262 | | | | 281,494 | |

| | | | | | | | | | | | |

Total covered loans receivable | | $ | 263,248 | | | $ | 1,319,499 | | | $ | 1,582,747 | |

| | | | | | | | | | | | |

The Company’s year-end loan portfolio is segregated into various components in the following charts.

The Company’s loan to deposit ratio at December 31, 2010 and December 31, 2009 was 76.3% and 76.6%, respectively. The percentage of fixed rate loans to total loans increased slightly from 48.2% at the end of 2009 to 48.4% as of December 31, 2010. The table below sets forth the composition of the Company’s loan portfolio as of December 31st for the years indicated, with a discussion of activity by major loan types following.

TOTAL LOANS RECEIVABLE BY LOAN TYPE

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (dollars in thousands) | | 2010 | | | 2009 | | | December 31,

2008 | | | 2007 | | | 2006 | |

| | | | | | | | | | |

Commercial loans: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Real estate | | $ | 2,647,107 | | | | 44 | % | | $ | 2,500,433 | | | | 43 | % | | $ | 1,522,965 | | | | 41 | % | | $ | 1,369,882 | | | | 40 | % | | $ | 750,051 | | | | 34 | % |

Business | | | 1,515,856 | | | | 25 | | | | 1,217,326 | | | | 21 | | | | 775,625 | | | | 21 | | | | 634,495 | | | | 18 | | | | 461,048 | | | | 21 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total commercial loans | | | 4,162,963 | | | | 69 | | | | 3,717,759 | | | | 64 | | | | 2,298,590 | | | | 62 | | | | 2,004,377 | | | | 58 | | | | 1,211,099 | | | | 55 | |

| | | | | | | | | | |

Mortgage loans: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Residential 1-4 family | | | 616,550 | | | | 10 | | | | 975,395 | | | | 17 | | | | 498,740 | | | | 13 | | | | 515,912 | | | | 15 | | | | 431,585 | | | | 19 | |

Construction/Owner- occupied | | | 14,822 | | | | — | | | | 32,857 | | | | 1 | | | | 36,693 | | | | 1 | | | | 60,558 | | | | 2 | | | | 45,285 | | | | 2 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total mortgage loans | | | 631,372 | | | | 10 | | | | 1,008,252 | | | | 18 | | | | 535,433 | | | | 14 | | | | 576,470 | | | | 17 | | | | 476,870 | | | | 21 | |

| | | | | | | | | | |

Loans to individuals: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Indirect automobile | | | 255,322 | | | | 4 | | | | 259,339 | | | | 4 | | | | 265,722 | | | | 7 | | | | 240,860 | | | | 7 | | | | 228,301 | | | | 10 | |

Home equity | | | 834,840 | | | | 14 | | | | 649,821 | | | | 11 | | | | 501,036 | | | | 13 | | | | 424,716 | | | | 12 | | | | 233,885 | | | | 10 | |

Other | | | 150,835 | | | | 3 | | | | 149,194 | | | | 3 | | | | 143,621 | | | | 4 | | | | 183,616 | | | | 6 | | | | 83,847 | | | | 4 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total consumer loans | | | 1,240,997 | | | | 21 | | | | 1,058,354 | | | | 18 | | | | 910,379 | | | | 24 | | | | 849,192 | | | | 25 | | | | 546,033 | | | | 24 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | |

Total loans receivable | | $ | 6,035,332 | | | | 100 | % | | $ | 5,784,365 | | | | 100 | % | | $ | 3,744,402 | | | | 100 | % | | $ | 3,430,039 | | | | 100 | % | | $ | 2,234,002 | | | | 100 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Commercial Loans

Commercial real estate and commercial business loans generally have shorter repayment periods and more frequent repricing opportunities than residential 1-4 family loans. Total commercial loans increased $445.2 million, or 12.0% during 2010, with $376.4 million of the increase, or 84.5%, due to the legacy IBERIABANK and IBERIABANKfsbloans. The Company’s focus on growing its commercial loan portfolio continued in 2010 as commercial loans as a percentage of total loans increased from 64% at December 31, 2009 to 69% at December 31, 2010.

The Company has increased its investment in commercial real estate loans from $2.5 billion, or 43% of the total loan portfolio at December 31, 2009, to $2.6 billion, or 44% of the total loan portfolio at December 31, 2010. The Company’s underwriting standards generally provide for loan terms of three to five years, with amortization schedules of generally no more than twenty years. Low loan-to-value ratios are maintained and usually limited to no more than 80%. In addition, the Company obtains personal guarantees of the principals as additional security for most commercial real estate loans.

As of December 31, 2010, the Company’s commercial business loans totaled $1.5 billion, or 25% of the Company’s total loan portfolio. This represents a $298.5 million, or 24.5% increase from December 31, 2009. The Company originates commercial business loans on a secured and, to a lesser extent, unsecured basis. The Company’s commercial business loans may be structured as term loans or revolving lines of credit. Term loans are generally structured with terms of no more than three to five years, with amortization schedules of generally no more than seven years. The Company’s commercial business term loans are generally secured by equipment, machinery or other corporate assets. The Company also provides for revolving lines of credit generally structured as advances upon perfected security interests in accounts receivable and inventory. Revolving lines of credit generally have an annual maturity. The Company obtains personal guarantees of the principals as additional security for most commercial business loans.

On a portfolio basis, total IBERIABANK commercial loans, excluding covered loans, increased $267.8 million, or 13.1%, and IBERIABANK fsb commercial loans increased 15.4%, or $108.6 million. Growth in the legacy IBERIABANK portfolio was due primarily to the newer markets the Company entered in 2009, as the Mobile, Alabama market grew its loan portfolio $35.7 million, or 83.2%. The Birmingham, Alabama market, which IBERIABANK entered in 2009, also grew $155.1 million during the year. In IBERIABANK’s more mature markets, Baton Rouge, Louisiana growth of $41.5 million, or 20.0%, also contributed to the overall commercial loan portfolio increase. Offsetting these increases were decreases in the Lafayette, Louisiana and Shreveport, Louisiana markets, which were due primarily to loan payments. The increase in IBERIABANKfsb commercial loans was driven by loan growth in the Houston, Texas, Little Rock, Arkansas, and Memphis, Tennessee markets. The Houston market

grew its loan portfolio $140.2 million, or 231.9%, during the year. The Little Rock commercial loan portfolio increased $18.5 million, or 9.3%, while the Memphis market recorded growth of $22.8 million, or 17.9%, in its commercial portfolio.

Mortgage Loans

Residential 1-4 family loans comprise most of the Company’s mortgage loans. The vast majority of the Company’s residential 1-4 family mortgage loan portfolio is secured by properties located in its market areas and originated under terms and documentation which permit their sale in the secondary market. Larger mortgage loans of private banking clients and prospects are generally retained to enhance relationships, and also due to the expected shorter durations and relatively lower servicing costs associated with loans of this size. The Company does not originate or hold high loan to value, negative amortization, option ARM, or other exotic mortgage loans in its portfolio.

The Company continues to sell the majority of conforming mortgage loan originations in the secondary market and recognize the associated fee income rather than assume the rate risk associated with these longer term assets. The Company also releases the servicing of these loans upon sale. Total residential mortgage loans decreased $376.9 million, or 37.4%, compared to December 31, 2009. Of the total mortgage loan decrease from December 31, 2009, $293.7 million, or 52.9%, was a result of a decrease in mortgage loans covered by loss share agreements, partially the result of the reclassification of a portion of covered loans as home equity loans upon system conversion to conform to the Company’s reporting guidelines. The remaining decrease was attributable to legacy assets, as loans were paid down and new mortgage loan originations slowed. At December 31, 2010, $329.3 million, or 52.2%, of the Company’s residential 1-4 family mortgage and construction loans were fixed rate loans and $302.0 million, or 47.8%, were adjustable rate loans.

Consumer Loans

The Company offers consumer loans in order to provide a full range of retail financial services to its customers. The Company originates substantially all of such loans in its primary market areas. At December 31, 2010, $1.2 billion, or 21%, of the Company’s total loan portfolio was comprised of consumer loans, compared to $1.1 billion, or 18% at the end of 2009. The $182.6 million increase in total consumer loans compared to December 31, 2009 was driven by home equity loan growth of $185.0 million, primarily the result of the loan reclassification mentioned previously, offset by decreases in the Company’s indirect automobile portfolios. Consumer loan growth in the Company’s non-covered loan portfolio was impacted by the Company’s tightened underwriting standards, a response to a weakened national and regional economy.

Consistent with 2009, home equity loans comprised the largest component of the Company’s consumer loan portfolio at December 31, 2010. The balance of home equity loans increased $185.0 million, or 28.5%, from $649.8 million at December 31, 2009 to $834.8 million at December 31, 2010. Non-covered IBERIABANK home equity loans increased $44.7 million, or 13.0%, during 2010, while IBERIABANKfsb home equity loans decreased only $1.0 million, or less than 1%. IBERIABANK fsb home equity loan originations were offset by customer payments and charge-offs.

Indirect automobile loans comprised the second largest component of the Company’s consumer loan portfolio. Independent automobile dealerships originate these loans and forward applications to Company personnel for approval or denial. The Company relies on the dealerships, in part, for loan qualifying information. To that extent, there is risk inherent in indirect automobile loans associated with fraud or negligence by the automobile dealership. To limit this risk, an emphasis is placed on established dealerships that have demonstrated reputable behavior, both within the communities we serve and through long-term relationships with the Company. The balance of indirect automobile loans decreased $4.0 million during 2010, from $259.3 million at December 31, 2009 to $255.3 million at December 31, 2010, as the Company retained its focus on prime or low risk paper. The indirect portfolio remained steady at 4% of the total loan portfolio.

The remainder of the consumer loan portfolio at December 31, 2010 was composed of direct automobile loans, credit card loans and other consumer loans, and comprised 2.5% of the overall loan portfolio. At December 31, 2010, the Company’s direct automobile loans totaled $31.3 million, a $0.7 million increase over December 31, 2009. The Company’s credit card loans totaled $44.1 million, a 1.1% decrease from December 31, 2009, and the Company’s other personal consumer loans amounted to $75.5 million, a 1.9% increase from December 31, 2009.

Loan Maturities

The following table sets forth the scheduled contractual maturities of the Company’s loan portfolio at December 31, 2010, unadjusted for scheduled principal reductions, prepayments or repricing opportunities. Demand loans, loans having no stated schedule of repayments and no stated maturity and overdraft loans are reported as due in one year or less. The average life of a loan may be substantially less than the contractual terms because of prepayments. As a result, scheduled contractual amortization of loans is not reflective of the expected term of the Company’s loan portfolio. Of the loans with maturities greater than one year, approximately 80.0% of the value of these loans bears a fixed rate of interest.

LOAN MATURITIES BY LOAN TYPE

| | | | | | | | | | | | | | | | |

| (dollars in thousands) | | One Year

Or Less | | | One Through

Five Years | | | After

Five Years | | | Total | |

Commercial real estate | | $ | 1,363,904 | | | $ | 1,027,259 | | | $ | 255,944 | | | $ | 2,647,107 | |

Commercial business | | | 778,557 | | | | 457,352 | | | | 279,947 | | | | 1,515,856 | |

Mortgage | | | 69,125 | | | | 107,664 | | | | 454,583 | | | | 631,372 | |

Consumer | | | 486,683 | | | | 379,280 | | | | 375,034 | | | | 1,240,997 | |

| | | | | | | | | | | | | | | | |

| | | | |

Total loans receivable | | $ | 2,698,270 | | | $ | 1,971,555 | | | $ | 1,365,507 | | | $ | 6,035,332 | |

| | | | | | | | | | | | | | | | |

Mortgage Loans Held for Sale

Loans held for sale increased $17.0 million, or 25.3%, to $83.9 million at December 31, 2010, compared to $66.9 million at December 31, 2009. The increase in the balance during 2010 was a result of increased origination. The Company originated $1.8 billion in mortgage loans during 2010, with $516.1 million during the fourth quarter alone. Originations were $185.4 million, 11.7% higher than during 2009. In the fourth quarter of 2010, originations were 47.3% higher than the same period of 2009. Sales of mortgage loans totaled $1.8 billion during 2010, an 11.4% increase over 2009. Fourth quarter sales were 79.9% higher than in the fourth quarter of 2009.

Loans held for sale have primarily been fixed rate single-family residential mortgage loans under contract to be sold in the secondary market. In most cases, loans in this category are sold within thirty days. Buyers generally have recourse to return a purchased loan to the Company under limited circumstances. Recourse conditions may include fraud in the origination, breach of representations or warranties, and documentation deficiencies. At December 31, 2010, the Company has $2.7 million in loans that have recourse conditions for which a buyer has notified the Company of potential recourse action. The Company has recorded a reserve of $0.8 million for the potential repurchase at December 31, 2010. During 2010, an insignificant number of loans were returned to the Company.

Asset Quality

Over time, the Company’s loan portfolio has transitioned to be more representative of a commercial bank. Accordingly, there is the potential for a higher level of return for investors, but also the potential for higher charge-off and nonperforming levels. As a result, in previous years management has tightened underwriting guidelines and procedures, adopted more conservative loan charge-off and nonaccrual guidelines, rewritten the loan policy and developed an internal loan review function to address the changing risk of the Company’s loan portfolio. As a result of management’s enhancements to underwriting risk/return dynamics within the loan portfolio over time, the credit quality of the Company’s assets has remained strong. Despite declines in asset quality in portions of the Company’s total loan portfolio, management believes asset quality remains favorable when compared to its peers. Management also believes that historically it has recognized and disclosed significant problem loans quickly and taken prompt action in addressing material weaknesses in those credits. Deterioration in asset quality during 2010 was primarily attributable to a limited number of larger isolated credits and not a significant shift in overall portfolio quality and this impact is described in the “Covered Loans” section below. Consistent with 2009, the Company’s purchase and assumption of assets and liabilities of CSB, Orion, Century, and Sterling significantly impacted overall asset quality. Management seeks to recognize and disclose significant problem loans quickly and take prompt action to address material weaknesses in those credits. The Company will continue to closely monitor the risk-adjusted level of return within the loan portfolio.

Written underwriting standards established by the Board of Directors and management govern the lending activities of the Company. The commercial credit department, in conjunction with senior lending personnel, underwrites all commercial business and commercial real estate loans. The Company provides centralized underwriting of all residential mortgage, construction and consumer loans. Established loan origination procedures require appropriate documentation including financial data and credit reports. For loans secured by real property, the Company generally requires property appraisals, title insurance or a title opinion, hazard insurance and flood insurance, where appropriate.

Loan payment performance is monitored and late charges are assessed on past due accounts. A centralized department administers delinquent loans. Every effort is made to minimize any potential loss, including instituting legal proceedings, as necessary. Commercial loans of the Company are periodically reviewed through a loan review process. All other loans are also subject to loan review through a periodic sampling process.

The Company utilizes an asset risk classification system in compliance with guidelines established by the Federal Reserve Board as part of its efforts to improve commercial asset quality. In connection with examinations of insured institutions, both federal and state examiners also have the authority to identify problem assets and, if appropriate, classify them. There are three

classifications for problem assets: “substandard,” “doubtful” and “loss.” Substandard assets have one or more defined weaknesses and are characterized by the distinct possibility that the insured institution will sustain some loss if the deficiencies are not corrected. Doubtful assets have the weaknesses of substandard assets with the additional characteristic that the weaknesses make collection or liquidation in full questionable and there is a high probability of loss based on currently existing facts, conditions and values. An asset classified as loss is not considered collectable and of such little value that continuance as an asset of the Company is not warranted. Commercial loans with adverse classifications are reviewed by the Loan Committee of the Board of Directors at least monthly. Loans are placed on nonaccrual status when they are 90 days or more past due, unless in the judgment of management, the probability of collection of interest is deemed to be sufficient to warrant further accrual. When a loan is placed on nonaccrual status, previously accrued but unpaid interest for the current year is deducted from interest income. Prior year interest is charged-off to the allowance for loan losses.

Real estate acquired by the Company as a result of foreclosure or by deed-in-lieu of foreclosure is classified as other real estate owned (“OREO”) until sold, and is carried at the balance of the loan at the time of acquisition or at estimated fair value less estimated costs to sell, whichever is less.

Under generally accepted accounting principles, the Company is required to account for certain loan modifications or restructurings as “troubled debt restructurings”. In general, the modification or restructuring of a debt constitutes a troubled debt restructuring if the Company for economic or legal reasons related to the borrower’s financial difficulties grants a concession to the borrower that the Company would not otherwise consider under current market conditions. Debt restructurings or loan modifications for a borrower do not necessarily constitute troubled debt restructurings, however, and troubled debt restructurings do not necessarily result in nonaccrual loans.

Nonperforming Assets

The Company defines nonperforming assets as nonaccrual loans, accruing loans more than 90 days past due, and OREO and foreclosed property.

Due to the significant difference in the accounting for the covered loans and the loss sharing agreements with the FDIC, the Company believes that asset quality measures excluding the covered loans are generally more meaningful. Purchased impaired loans had evidence of deterioration in credit quality prior to acquisition, and thus the fair value of these loans as of the acquisition date included an estimate of credit losses. These loans, as well as acquired loans with no evidence of credit deterioration at acquisition, are accounted for on a pool basis, and these pools are considered to be performing. Purchased impaired loans were not classified as nonperforming assets at December 31, 2010 or 2009, as the loans are considered to be performing under FASB ASC Topic 310-30. As a result, interest income, through the accretion of the difference between the carrying value of the loans and the expected cash flows, is being recognized on all purchased loans accounted for under FASB ASC Topic 310-30. Therefore, management has included asset quality measures that exclude covered loans in the table in this section.

Nonperforming assets not covered by FDIC loss share agreements totaled $69.4 million at December 31, 2010, an increase of $9.4 million, or 15.6%, from December 31, 2009. The following table sets forth the composition of the Company’s non-covered nonperforming assets, including accruing loans past due 90 or more days, as of the dates indicated.

NONPERFORMING ASSETS AND TROUBLED DEBT RESTRUCTURINGS

| | | | | | | | | | | | | | | | | | | | |

| | | December 31, | |

| (dollars in thousands) | | 2010 | | | 2009 | | | 2008 | | | 2007 | | | 2006 | |

| | | | | |

Nonaccrual loans: | | | | | | | | | | | | | | | | | | | | |

Commercial, financial and agricultural | | $ | 35,457 | | | $ | 31,029 | | | $ | 21,433 | | | $ | 30,740 | | | $ | 745 | |

Mortgage | | | 5,917 | | | | 3,314 | | | | 2,423 | | | | 2,098 | | | | 353 | |

Loans to individuals | | | 8,122 | | | | 5,504 | | | | 3,969 | | | | 3,268 | | | | 1,603 | |

| | | | | | | | | | | | | | | | | | | | |

Total nonaccrual loans | | | 49,496 | | | | 39,847 | | | | 27,825 | | | | 36,107 | | | | 2,701 | |

| | | | | |

Accruing loans 90 days or more past due | | | 1,455 | | | | 4,960 | | | | 2,481 | | | | 2,655 | | | | 310 | |

| | | | | | | | | | | | | | | | | | | | |

Total nonperforming loans(1) | | | 50,951 | | | | 44,807 | | | | 30,306 | | | | 38,762 | | | | 3,011 | |

| | | | | |

Foreclosed property | | | 18,496 | | | | 15,281 | | | | 16,312 | | | | 9,413 | | | | 2,008 | |

| | | | | | | | | | | | | | | | | | | | |

Total nonperforming assets(1) | | | 69,447 | | | | 60,088 | | | | 46,618 | | | | 48,175 | | | | 5,019 | |

| | | | | |

Troubled debt restructurings in compliance with modified terms (2) | | | 14,968 | | | | — | | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Total nonperforming assets and troubled debt restructurings (1) | | $ | 84,415 | | | $ | 60,088 | | | $ | 46,618 | | | $ | 48,175 | | | $ | 5,019 | |

| | | | | | | | | | | | | | | | | | | | |

Nonperforming loans to total loans(1) | | | 1.14 | % | | | 1.09 | % | | | 0.81 | % | | | 1.13 | % | | | 0.13 | % |

Nonperforming assets to total assets(1) | | | 0.91 | % | | | 0.91 | % | | | 0.83 | % | | | 0.98 | % | | | 0.16 | % |

Nonperforming assets and troubled debt restructurings to total assets(1) | | | 1.10 | % | | | 0.91 | % | | | 0.83 | % | | | 0.98 | % | | | 0.16 | % |

Allowance for loan losses to nonperforming loans (3) | | | 122.59 | % | | | 124.14 | % | | | 134.87 | % | | | 98.77 | % | | | 993.76 | % |

Allowance for loan losses to total loans (3) | | | 1.40 | % | | | 1.36 | % | | | 1.09 | % | | | 1.12 | % | | | 1.34 | % |

| (1) | Nonperforming loans and assets include accruing loans 90 days or more past due. |

| (2) | Troubled debt restructurings for December 31, 2010 do not include $2,504,000 in troubled debtrestructurings included in total nonaccrual loans of $49,496,000 above. |

| (3) | The allowance for loan losses excludes the portion of the allowance related to covered loans discussed below |

Nonperforming loans were 1.14% of total non-covered loans at December 31, 2010, five basis points higher than at December 31, 2009. If covered loans meeting nonperforming criteria are included, nonperforming loans would have been 14.40% of total loans before discounts (i.e., based on the contractual unpaid principal balance) at December 31, 2010, and 13.33% at December 31, 2009. The allowance for loan losses as a percentage of nonperforming loans was 122.59% at December 31, 2010 and 124.14% at December 31, 2009. Including covered assets, the allowance coverage of total loans before application of covered loan discounts would have been 2.02% at December 31, 2010 and 0.79% at December 31, 2009.

The increase in nonperforming assets from December 31, 2009 was primarily a result of additional nonaccrual loans at December 31, 2010, as these nonaccrual loans increased $9.6 million, or 24.2%. Offsetting this increase was a decrease of $3.5 million, or 70.7%, in accruing loan balances greater than 90 days past due. IBERIABANK accounted for the increase in nonaccrual loans, as IBERIABANKfsb’s nonaccrual loans decreased $0.7 million, or 2.4%, from December 31, 2009. Nonperforming assets totaled $69.4 million at December 31, 2010, with IBERIABANK accounting for $28.1 million, or 40.5%, of nonperforming assets at December 31, 2010, and IBERIABANKfsb accounting for 59.5%, or $41.3 million.

Nonperforming assets at IBERIABANK increased $9.0 million, or 47.4%, from December 31, 2009. Increases in nonaccrual loans and OREO properties were offset by a decrease of $3.2 million in accruing loans 90 days past due. Nonaccrual loans at IBERIABANK increased $10.3 million, or 86.8%, from December 31, 2009. The increase was primarily the result of four credits at IBERIABANK which totaled $11.7 million at December 31, 2010. The four credits were put on nonaccrual status during the year based on their payment history. These credits have been reviewed for impairment and had specific reserves on their outstanding balance at December 31, 2010 to cover probable losses. The increase in nonaccrual loans was primarily from these isolated credits and did not reflect a significant decline in overall portfolio quality.

IBERIABANKfsb’s nonperforming assets totaled $41.3 million at December 31, 2010, including $27.3 million of nonaccrual loans, compared to $41.0 million in nonperforming assets at December 31, 2009. The $0.3 million increase since the end of 2009

was primarily the result of an increase in OREO properties of $1.3 million, offset by decrease in nonperforming loans of $1.0 million, or 3.4%. The Company’s efforts to address risk in the IBERIABANKfsb portfolio led to the decrease in nonperforming assets at IBERIABANKfsb.

Nonperforming asset balances as a percentage of total assets have remained at a relatively low level. Total nonperforming assets were 0.91% of non-covered assets at December 31, 2010, consistent with December 31, 2009. In response to a slight decline in asset quality during 2010, the Company increased its reserve for loan losses, which in turn increased the reserve coverage of total non-covered loans to 1.40% at December 31, 2010, four basis points above December 31, 2009.

Loans defined as troubled debt restructurings (“TDR’s”) not included in nonperforming assets increased to $15.0 million at December 31, 2010. These loans were restructured during 2010, as there were no TDR’s that were considered performing at December 31, 2009. Five commercial relationships account for 98.7%, or $14.8 million, of that total. These five credits were current or less than 30 days past due at December 31, 2010. Total TDRs not covered by loss share agreements totaled $17.5 million at December 31, 2010, with $15.1 million at IBERIABANK and $2.4 million at IBERIBANKfsb.

Management continually monitors loans and transfers loans to nonaccrual status when warranted. Net charge-offs on non-covered loans in 2010 were $26.7 million, or 0.63% of average loans, as compared to $30.6 million, or 0.79%, for 2009. The decrease in net charge-offs from 2009 was primarily a result of a significant decrease in IBERIABANKfsb charge-offs during the current year, primarily in the commercial portfolio, as the Company experienced some asset quality deterioration in the third quarter of 2009.

At December 31, 2010, excluding loans covered by the FDIC loss share agreements, the Company had $102.2 million of commercial assets classified as substandard, $3.6 million of assets classified as doubtful, and no assets classified as loss. At such date, the aggregate of the Company’s classified assets amounted to 1.05% of total assets, 1.75% of total loans, and 2.37% of non-covered loans. At December 31, 2009, the aggregate of the Company’s classified assets, $67.7 million, amounted to 0.70% of total assets, 1.17% of total loans, and 1.41% of non-covered loans.

Of the $102.2 million in substandard loans at December 31, 2010, substandard loans at IBERIABANK totaled $41.4 million, or 40.5% of all substandard loans, and substandard loans at IBERIABANKfsbwere $60.8 million, or 59.5%. Eight relationships at IBERIABANK accounted for 82.8% of total substandard loans. At IBERIABANKfsb, twelve relationships accounted for $45.5 million, or 75.8%, of total substandard loans. A reserve for loan losses has been recorded for all substandard loans at December 31, 2010 according to the Company’s allowance policy.

In addition to the problem loans described above, excluding covered loans, there were $55.7 million of loans classified special mention at December 31, 2010, which in management’s opinion were subject to potential future rating downgrades. Special mention loans are defined as loans where known information about possible credit problems of the borrower cause management to have some doubt as to the ability of these borrowers to comply with the present loan repayment terms and which may result in future disclosure of these loans as nonperforming. Special mention loans decreased $12.6 million, or 18.4%, from December 31, 2009. Loans rated as special mention totaled $42.9 million at IBERIABANK, or 0.87% of the total IBERIABANK loan portfolio and 1.28% of the non-covered loan portfolio, at December 31, 2010. Total special mention loans decreased $2.9 million, or 6.3%, this year. Ten relationships accounted for $32.6 million, or 76.1%, of total IBERIABANK special mention loans. At IBERIABANKfsb, special mention loans totaled $12.9 million, or 1.16%, of the total IBERIABANKfsb loan portfolio. Special mention loans at IBERIABANKfsbdecreased $9.6 million, or 42.8%, during the year. Five relationships accounted for $8.8 million, or 68.6%, of total IBERIABANKfsb special mention loans.

Past Due Loans

Past due status is based on the contractual terms of loans. At December 31, 2010, loans past due 30 days or more excluding covered loans were 0.96% of total IBERIABANK loans and 2.87% of total IBERIABANKfsb loans. On a consolidated basis, total past due loans excluding covered loans were 1.44% of total loans at December 31, 2010, a decrease of 25 basis points from December 31, 2009. Including covered loans, loans past due 30 days or more would have been 14.54% of total loans before discount adjustments at December 31, 2010 and 16.30% at December 31, 2009. Past due loans by portfolio are presented in the following table.

PAST DUE LOANS TO TOTAL LOANS

| | | | | | | | |

| | | December 31, 2010 | | | December 31, 2009 | |

IBERIABANK | | | | | | | | |

(Excluding FDIC Covered Loans) | | | | | | | | |

30+ days past due | | | 0.30 | % | | | 0.58 | % |

Non-accrual loans | | | 0.66 | % | | | 0.38 | % |

| | | | | | | | |

Total past due loans | | | 0.96 | % | | | 0.96 | % |

| | |

IBERIABANK fsb | | | | | | | | |

30+ days past due | | | 0.41 | % | | | 1.12 | % |

Non-accrual loans | | | 2.46 | % | | | 2.78 | % |

| | | | | | | | |

Total past due loans | | | 2.87 | % | | | 3.90 | % |

| | |

IBERIABANK Corporation | | | | | | | | |

(Excluding FDIC Covered Loans) | | | | | | | | |

30+ days past due | | | 0.33 | % | | | 0.72 | % |

Non-accrual loans | | | 1.11 | % | | | 0.97 | % |

| | | | | | | | |

Total past due loans | | | 1.44 | % | | | 1.69 | % |

| | | | | | | | |

At IBERIABANKfsb, past due loans decreased $7.4 million, or 18.9%, from December 31, 2009, to $31.8 million, and drove the 25 basis point decrease in consolidated past due loans. The decrease was a result of the Company’s efforts to address the credit quality issues in its portfolio. Loans past due less than 90 days decreased to $3.1 million, or 0.28% of loans, which was a decrease of $6.4 million, or 67.6%, from December 31, 2009.

IBERIABANK past due loans (including nonaccrual loans) increased $2.4 million, or 7.9%, from December 31, 2009 and was the result of the larger commercial nonaccrual credits mentioned previously. Accruing loans past due decreased $7.9 million, or 43.7%, from December 31, 2009. Total IBERIABANK loans past due held steady at 0.96% of total loans.

Covered Loans

The loans and foreclosed real estate that were acquired in the CSB, Orion, Century, and Sterling acquisitions in 2009 and 2010 are covered by loss share agreements between the FDIC and IBERIABANK, which afford IBERIABANK significant loss protection. As a result of the loss protection provided by the FDIC, the risk of loss on the acquired loans and foreclosed real estate is significantly different from those assets not covered under the loss share agreements.

At their acquisition dates, covered assets were recorded at their fair value, which included an estimate of credit losses. The Company estimated the fair value of the total acquired loan portfolios by segregating the total portfolio into loan pools with similar characteristics, which included loan performance at the time of acquisition, loan type based on regulatory reporting guidelines, the nature of collateral, interest rate type, and loan payment type. Covered assets were segregated by pools with evidence of credit deterioration and pools considered to be performing at the time of acquisition. From these pools, the Company used certain loan information, including outstanding principal balance, weighted average maturity, weighted average term to re-price (if a variable rate loan), weighted average margin, and weighted average interest rate to estimate the expected cash flow for each loan pool. Each loan pool was then recorded at fair value based on the Company’s estimate of cash flows expected to be collected on each loan pool sharing common risk characteristics.

Although covered loans are not included in the Company’s nonperforming assets, in accordance with bank regulatory reporting standards, both acquired loans considered impaired at the time of acquisition and those performing at the time of acquisition that meet the Company’s definition of a nonperforming loan at each balance sheet date are discussed below. Included in the discussion are all covered loans that are contractually past due based on the number of days past due. Certain measures of the asset quality of covered loans are discussed below. Loan balances are reported before consideration of applied loan discounts, as these discounts were recorded based on the estimated cash flow of the total loan pool and not on a specific loan basis. Because of the loss share agreements, balances discussed below are for general comparative purposes only and do not represent the Company’s risk of loss on covered assets. Because these assets are covered by the loss share agreements with the FDIC, 80% of incurred losses are reimbursable from the FDIC.

Total covered loans past due at December 31, 2010 totaled $916.4 million before discounts, a decrease of $160.7 million, or 14.9%, from December 31, 2009. The decrease in nonperforming loans was a result of a decrease of $73.8 million, or 33.0%, in accruing loans past due and a decrease of $86.8 million, or 10.2%, in nonaccrual loans. Past due loans included $766.7 million in

loans that would otherwise meet the Company’s definition of nonaccrual loans and $149.7 million in accruing loans past due. Of the $149.7 million in accruing loans past due, $98.0 million, or 65.5%, were past due less than 90 days. The indemnification agreements on covered assets include a provision for recapture of a portion of interest if the interest is included in total losses on the covered asset.

Allowance for Loan Losses

The determination of the allowance for loan losses, which represents management’s estimate of probable losses inherent in the Company’s credit portfolio, involves a high degree of judgment and complexity. The Company establishes general reserves on the Company’s loan portfolios described in detail below and specific reserves for estimated losses on delinquent and other problem loans when it is determined that losses are probable on such loans. Management’s determination of the adequacy of the allowance is based on various factors, including an evaluation of the portfolio, past loss experience, current economic conditions, the volume and type of lending conducted by the Company, composition of the portfolio, the amount of the Company’s classified assets, seasoning of the loan portfolio, the status of past due principal and interest payments, and other relevant factors. Changes in such estimates may have a significant impact on the consolidated financial statements.

The foundation of the allowance for the Company’s commercial segment is the credit risk rating of each relationship within the portfolio. The credit risk of each borrower is assessed, and a risk grade is assigned. The portfolios are further segmented by facility or collateral ratings. The dual risk grade for each loan is determined by the relationship manager and other approving officers and changed from time to time to reflect an ongoing assessment of the risk. Grades are reviewed on specific loans by senior management and as part of the Company’s internal loan review process. The commercial loan loss allowance is determined for all pass-rated borrowers based upon the borrower risk rating, the expected default probabilities of each rating category, and the outstanding loan balances by risk grade. For borrowers that are rated special mention or below, the higher of the migration analysis and Company established minimum reserve percentages apply. In addition, consideration is given to historical loss experience by internal risk rating, current economic conditions, industry performance trends, geographic or borrower concentrations within each portfolio segment, the current business strategy and credit process, loan underwriting criteria, loan workout procedures, and other pertinent information.

Reserves are determined for each impaired commercial loan based on management’s evaluation of the borrower’s overall financial condition, resources, and payment record; the prospects for support from any financially responsible guarantors; and the realizable value of any collateral. Reserves are established for these loans based upon an estimate of probable losses for the individual loans deemed to be impaired. This estimate considers all available evidence including the present value of the expected future cash flows and the fair value of collateral less disposal costs. Loans for which impaired reserves are provided are excluded from the general reserve calculations described above to prevent duplicate reserves.

The allowance also consists of reserves for unimpaired loans that encompass qualitative economic factors and specific market risk components. The foundation for the general consumer allowance is a review of the loan portfolios and the performance of those portfolios. This review is accomplished by first segmenting the portfolio into homogenous pools. Residential mortgage loans, direct consumer loans, consumer home equity, indirect consumer loans, credit card, and the business banking portfolio each are considered separately. The historical performance of each of these pools is analyzed by examining the level of charge-offs over a specific period of time. The historical average charge-off level for each pool is updated at least quarterly.

In addition to this base analysis, the consumer portfolios are also analyzed for specific risks within each segment. The risk analysis considers the Company’s current strategy for each segment, the maturity of each segment, expansion into new markets, the deployment of newly developed products and any other significant factors impacting that segment. Current regional and national economic factors are an important dimension of the assessment and impact each portfolio segment. The general economic factors are evaluated and adjusted quarterly, if necessary.

Loan portfolios tied to acquisitions made during the year are incorporated into the Company’s allowance process. If the acquisition has an impact on the level of exposure to a particular segment, industry or geographic market, this increase in exposure is factored into the allowance determination process. Generally, acquisitions have higher levels of risk of loss based on differences in credit culture and portfolio management practices.

Acquired loans follow the reserve standard set in ASC Topic No. 310-30. At acquisition, the Company reviews each loan or loan pool to determine whether there is evidence of deterioration in credit quality since origination and if it is probable that the Company will be unable to collect all amounts due according to the loan’s contractual terms. The Company considers expected prepayments and estimates the amount and timing of undiscounted expected principal, interest and other cash flows for each loan meeting the criteria above, and determines the excess of the loan’s scheduled contractual principal and contractual interest payments over all cash flows expected at acquisition as an amount that should not be accreted (nonaccretable difference). The remaining amount, representing the excess of the loan’s or pool’s cash flows expected to be collected over the book value of the loan, is accreted into interest income over the remaining life of the loan or pool (accretable yield). The Company records a

discount on these loans at acquisition to record them at their realizable cash flow. As a result, acquired loans subject to ASC Topic No. 310-30 are excluded from the calculation of loan loss reserves at the acquisition date.

Loans acquired in the CSB, Orion, Century, and Sterling acquisitions were recorded at their acquisition date fair value, which was based on expected cash flows and included an estimation of expected future loan losses. Under current accounting principles, information regarding the Company’s estimate of loan fair values may be adjusted for a period of up to one year as the Company continues to refine its estimate of expected future cash flows in the acquired portfolio. Within a one-year period, if the Company discovers that it has materially underestimated the loan losses inherent in the loan portfolio at the acquisition date, it will retroactively reduce or eliminate the gain recorded on the acquisition. If the Company determines that losses arose after the acquisition date, the additional losses are reflected as a provision for loan losses. Because acquired impaired loans follow the reserve standard set in ASC Topic No. 310-30, and acquired performing loans follow the same standard by analogy, the Company estimates the current amount and timing of expected principal, interest, and other cash flows for each loan pool and compares the total expected cash flow of the loan pools to the book value of the loan pools. If the expected cash flow is below the recorded book value, the Company records an allowance on the loan pool through an adjustment to its provision for loan losses and the FDIC loss share receivable. During the year ended December 31, 2010, the Company recorded an allowance for loan losses of $73.6 million to reserve for the portion of probable losses arising in the covered loan portfolio after the respective acquisition dates. Because the Company has addressed deterioration in the covered loan portfolio on a pool basis, the Company has recorded an allowance for the full amount of expected losses in loan pools identified as having evidence of additional deterioration arising after acquisition. For loan pools that have exhibited an improvement in asset quality since acquisition, the Company will accrete the improvement in cash flows into income over the life of the loan pool.

Based on facts and circumstances available, management of the Company believes that the allowance for loan losses is adequate at December 31, 2010 to cover probable losses in the Company’s loan portfolio. However, future adjustments to the allowance may be necessary, and the Company’s results of operations could be adversely affected, if circumstances differ substantially from the assumptions used by management in determining the allowance for loan losses.

The following tables set forth the activity in the Company’s allowance for loan losses during the periods indicated.

SUMMARY OF ACTIVITY IN THE ALLOWANCE FOR LOAN LOSSES

| | | | | | | | | | | | | | | | | | | | |

| | | | | | Year Ended December 31, | | | | |

| | | | | |

| (dollars in thousands) | | 2010 | | | 2009 | | | 2008 | | | 2007 | | | 2006 | |

| | | | | |

Balance, beginning of period | | $ | 55,768 | | | $ | 40,872 | | | $ | 38,285 | | | $ | 29,922 | | | $ | 38,082 | |

Addition due to purchase transaction | | | — | | | | — | | | | — | | | | 8,746 | | | | — | |

Adjustment for loans transferred to held for sale | | | — | | | | — | | | | — | | | | — | | | | — | |

Provision charged (reversed) to operations | | | 42,451 | | | | 45,370 | | | | 12,568 | | | | 1,525 | | | | (7,803 | ) |

Provision recorded through the FDIC loss share receivable | | | 64,922 | | | | 147 | | | | — | | | | — | | | | — | |

| | | | | |

Charge-offs: | | | | | | | | | | | | | | | | | | | | |

Commercial, financial and agricultural | | | 23,634 | | | | 25,204 | | | | 7,696 | | | | 956 | | | | 336 | |

Mortgage | | | 1,068 | | | | 311 | | | | 128 | | | | 56 | | | | 97 | |

Loans to individuals | | | 9,156 | | | | 7,752 | | | | 5,057 | | | | 3,694 | | | | 2,188 | |

| | | | | | | | | | | | | | | | | | | | |

Total charge-offs | | | 33,858 | | | | 33,267 | | | | 12,881 | | | | 4,706 | | | | 2,621 | |

| | | | | |

Recoveries: | | | | | | | | | | | | | | | | | | | | |

Commercial, financial and agricultural | | | 4,863 | | | | 1,016 | | | | 1,164 | | | | 1,118 | | | | 539 | |

Mortgage | | | 77 | | | | 67 | | | | 56 | | | | 84 | | | | 36 | |

Loans to individuals | | | 1,877 | | | | 1,563 | | | | 1,680 | | | | 1,597 | | | | 1,689 | |

| | | | | | | | | | | | | | | | | | | | |

Total recoveries | | | 6,817 | | | | 2,646 | | | | 2,900 | | | | 2,799 | | | | 2,264 | |

| | | | | | | | | | | | | | | | | | | | |

Net charge-offs | | | 27,041 | | | | 30,621 | | | | 9,981 | | | | 1,907 | | | | 357 | |

| | | | | | | | | | | | | | | | | | | | |

Balance, end of period | | $ | 136,100 | | | $ | 55,768 | | | $ | 40,872 | | | $ | 38,285 | | | $ | 29,922 | |

| | | | | |

Allowance for loan losses to nonperforming assets(1) (2) | | | 89.9 | % | | | 92.6 | % | | | 87.7 | % | | | 79.5 | % | | | 596.2 | % |

Allowance for loan losses to total loans at end of period | | | 2.26 | % | | | 0.96 | % | | | 1.09 | % | | | 1.12 | % | | | 1.34 | % |

Net charge-offs to average loans | | | 0.47 | % | | | 0.73 | % | | | 0.28 | % | | | 0.06 | % | | | 0.02 | % |

| | | | | | | | | | | | | | | | | | | | |

| (1) | Nonperforming assets include accruing loans 90 days or more past due. |

| (2) | For December 31, 2010 and 2009, the allowance for loan losses in the calculation does not include the allowance allocated to covered assets. |

| | | | | | | | | | | | | | | | |

| | | December 31, 2010 | |

| | | IBERIABANK | | | | | | | |

| (dollars in thousands) | | Covered

Loans | | | Non-covered

loans | | | IBERIABANK fsb | | | Total | |

| | | | |

Balance, beginning of period | | $ | 145 | | | $ | 34,286 | | | $ | 21,337 | | | $ | 55,768 | |

Provision for loan losses before benefit attributable to FDIC loss share agreements | | | 73,819 | | | | 21,180 | | | | 12,374 | | | | 107,373 | |

| | | | |

Benefit attributable to FDIC loss share agreements | | | (64,922 | ) | | | — | | | | — | | | | (64,922 | ) |

| | | | | | | | | | | | | | | | |

Net provision for loan losses | | | 8,897 | | | | 21,180 | | | | 12,374 | | | | 42,451 | |

| | | | |

Increase in FDIC loss share receivable | | | 64,922 | | | | — | | | | — | | | | 64,922 | |

Loans charged-off | | | (325 | ) | | | (18,311 | ) | | | (15,222 | ) | | | (33,858 | ) |

Recoveries | | | 1 | | | | 4,856 | | | | 1,960 | | | | 6,817 | |

| | | | | | | | | | | | | | | | |

| | | | |

Balance, end of period | | $ | 73,640 | | | $ | 42,011 | | | $ | 20,449 | | | $ | 136,100 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | December 31, 2009 | |

| | | IBERIABANK | | | | | | | |

| (dollars in thousands) | | Covered

Loans | | | Non-covered

loans | | | IBERIABANK fsb | | | Total | |

Balance, beginning of period | | $ | — | | | $ | 26,671 | | | $ | 14,201 | | | $ | 40,872 | |

Provision for loan losses before benefit attributable to FDIC loss share agreements | | | — | | | | 18,577 | | | | 26,793 | | | | 45,370 | |

| | | | |

Benefit attributable to FDIC loss share agreements | | | — | | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | |

Net provision for loan losses | | | — | | | | 18,577 | | | | 26,793 | | | | 45,370 | |

| | | | |

Increase in FDIC loss share receivable | | | 147 | | | | — | | | | — | | | | 147 | |

Loans charged-off | | | (2 | ) | | | (12,957 | ) | | | (20,309 | ) | | | (33,267 | ) |