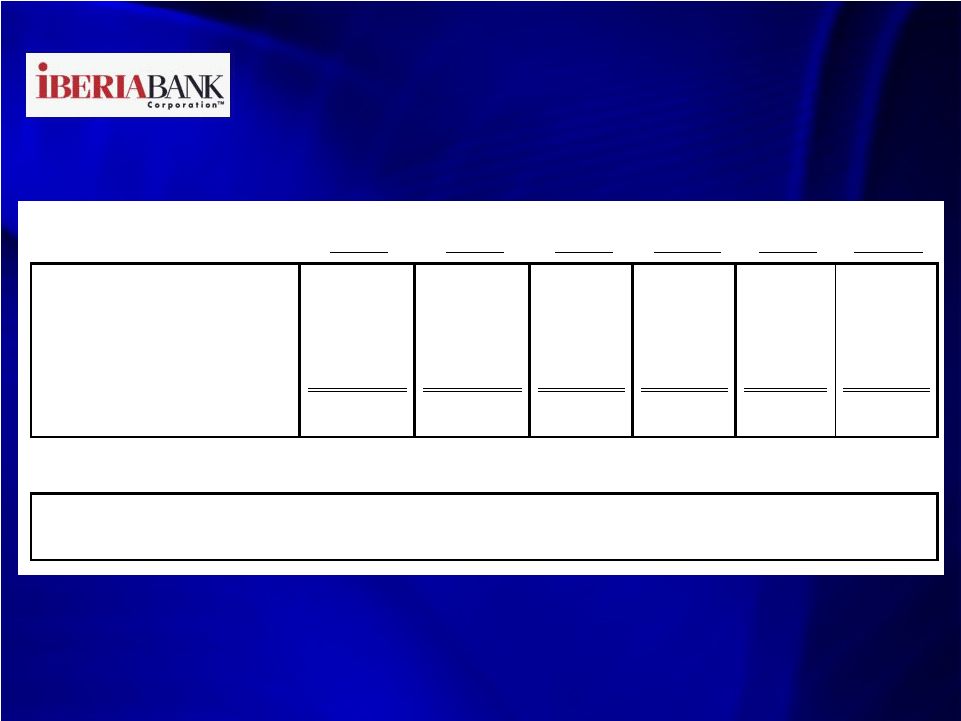

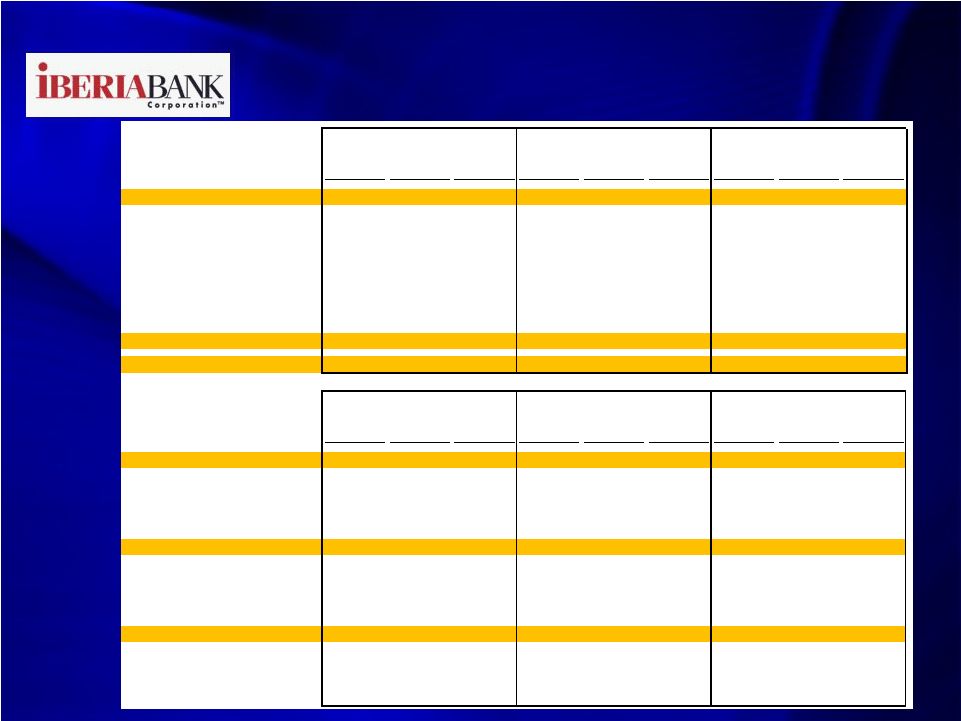

40 Loss Share Performance Covered Loan Portfolio Rollforward ($ in thousands) Average Income / Expense Average Yield Average Income / Expense Average Yield Average Income / Expense Average Yield Covered Loans 1,571,248 36,709 9.199% 1,466,627 39,453 10.592% 1,545,551 54,118 14.049% Mortgage Loans 289,197 7,479 10.345% 247,827 6,159 9.941% 253,360 6,865 10.839% Indirect Automobile - - 0.000% - - 0.000% - - 0.000% Credit Card 1,204 25 8.374% 1,154 20 6.934% 1,083 19 7.091% Consumer 190,836 2,893 6.015% 213,082 3,225 6.005% 196,378 3,926 8.107% Line Of Credit-Consumer Loans 84,514 1,623 7.618% 79,958 4,582 22.733% 79,580 7,391 37.664% Commercial & Business Banking 1,004,908 24,688 9.636% 924,098 25,467 10.792% 1,015,204 35,917 14.155% Loans in Process 589 - 0.000% 508 - 0.000% (54) - 0.000% Overdrafts 1 - 0.000% 0 - 0.000% 0 - 0.000% FDIC Loss Share Receivable 865,810 (5,025) -2.271% 899,558 (8,619) -3.749% 708,809 (21,913) -12.366% Net Covered Loan Portfolio 2,437,058 31,684 5.133% 2,366,185 30,834 5.143% 2,254,360 32,205 5.744% Average Income / Expense Average Yield Average Income / Expense Average Yield Average Income / Expense Average Yield Covered Loans 1,571,248 36,709 9.199% 1,466,627 39,453 10.592% 1,545,551 54,118 14.049% CapitalSouth Bank 273,100 5,268 7.634% 250,865 8,355 13.171% 251,762 10,188 16.262% Orion Bank 817,253 20,627 9.881% 742,289 24,721 13.046% 823,081 32,651 16.025% Century Bank 366,169 8,860 9.580% 332,360 3,878 4.610% 339,135 9,156 10.795% Sterling Bank 114,725 1,953 5.860% 141,113 2,499 6.770% 131,574 2,123 6.472% FDIC Loss Share Receivable 865,810 (5,025) -2.271% 899,558 (8,619) -3.749% 708,809 (21,913) -12.366% CapitalSouth Bank 77,103 (954) -4.840% 79,553 (2,600) -12.788% 58,914 (1,877) -12.744% Orion Bank 551,435 (4,562) -3.237% 555,610 (5,568) -3.921% 418,948 (18,861) -18.009% Century Bank 186,425 349 0.732% 197,355 (593) -1.177% 163,829 (1,385) -3.383% Sterling Bank 50,847 141 1.089% 67,040 142 0.830% 67,119 210 1.253% Net Covered Loan Portfolio 2,437,058 31,684 5.133% 2,366,185 30,834 5.143% 2,254,360 32,205 5.744% CapitalSouth Bank 350,204 4,314 4.887% 330,418 5,756 6.921% 310,676 8,311 10.762% Orion Bank 1,368,688 16,066 4.596% 1,297,899 19,153 5.783% 1,242,029 13,790 4.546% Century Bank 552,594 9,209 6.595% 529,715 3,285 2.457% 502,963 7,770 6.177% Sterling Bank 165,573 2,095 4.393% 208,153 2,641 4.854% 198,692 2,333 4.709% 3Q2010 4Q2010 1Q2011 3Q2010 4Q2010 1Q2011 |