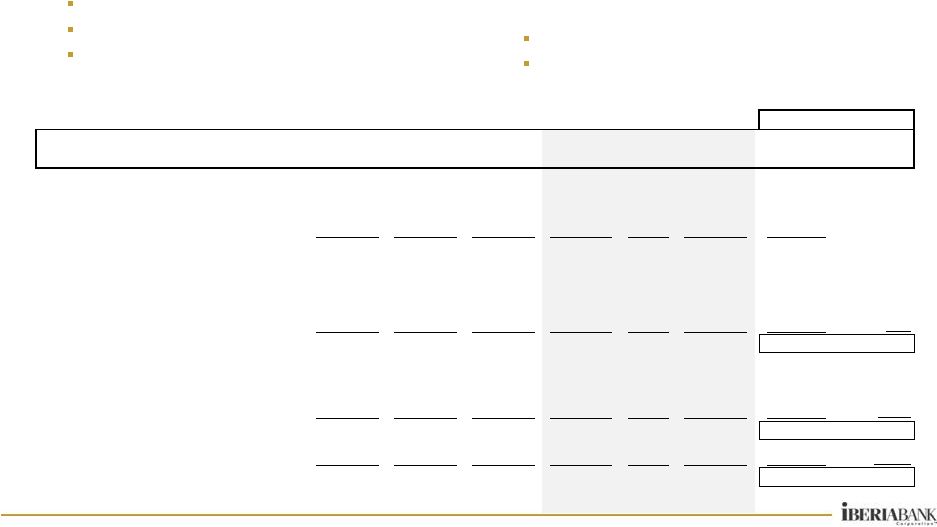

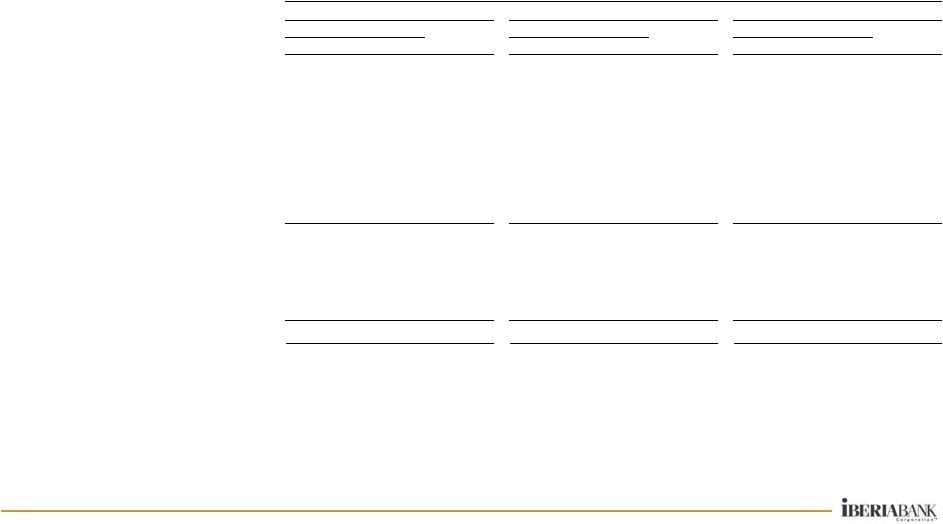

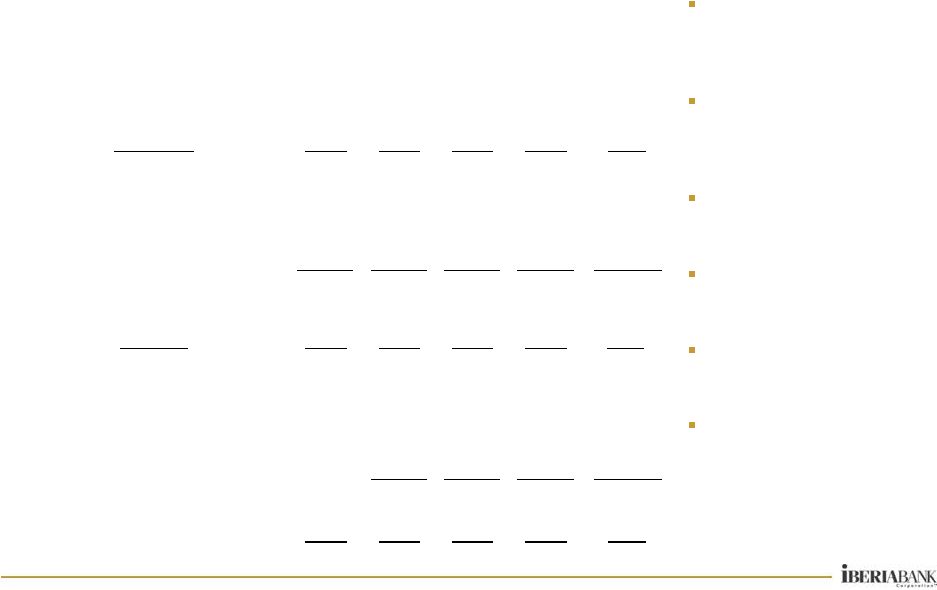

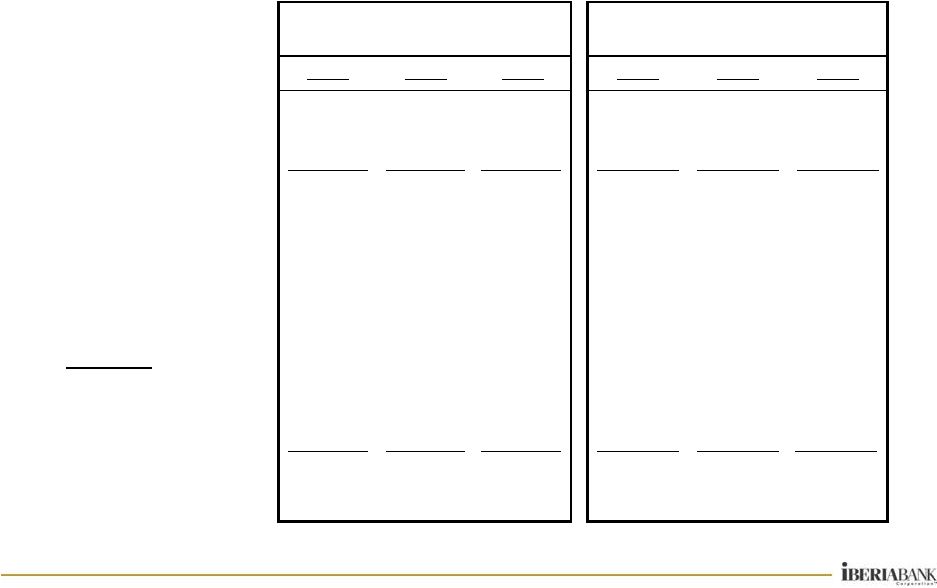

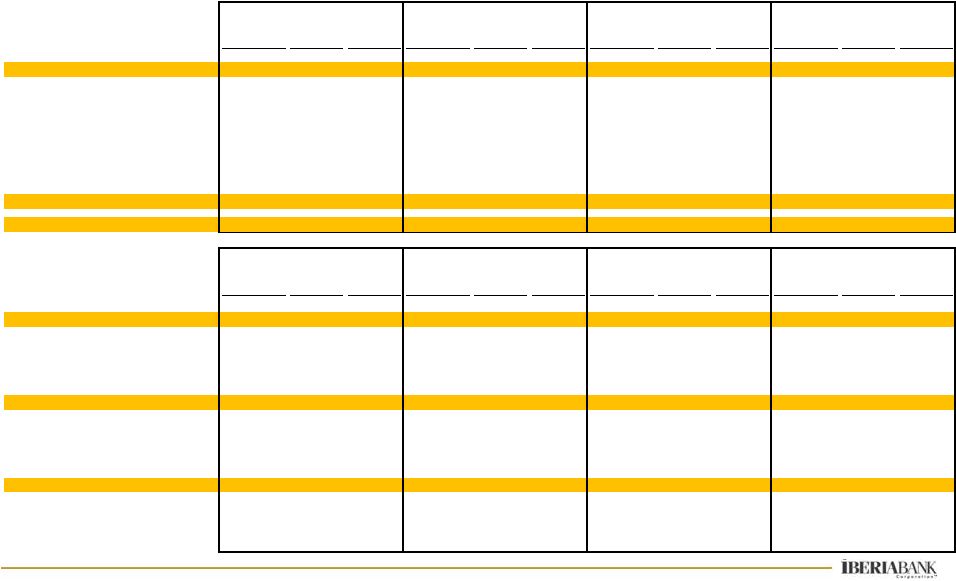

26 Appendix Appendix FDIC Covered Loan Portfolio Roll Forward 26 Average Income / Expense Average Yield Average Income / Expense Average Yield Average Income / Expense Average Yield Average Income / Expense Average Yield Covered Loans 1,350,935 55,518 16.139% 1,293,160 52,019 15.968% 1,218,933 51,150 16.661% 1,153,954 55,400 18.878% Mortgage Loans 218,922 4,799 8.768% 211,640 4,946 9.347% 196,969 5,128 10.414% 169,580 5,306 12.517% Indirect Automobile - - 0.000% - - 0.000% - - 0.000% (0) - 0.000% Credit Card 957 15 6.246% 901 14 6.199% 862 14 6.629% 853 14 6.746% Consumer 162,815 3,701 9.019% 155,406 3,895 10.080% 150,236 4,324 11.577% 149,877 5,282 14.020% Line Of Credit-Consumer Loans 79,220 2,502 12.528% 75,164 2,927 15.663% 72,370 2,953 16.410% 72,598 3,462 18.971% Commercial & Business Banking 889,481 44,502 19.581% 850,519 40,238 18.719% 798,767 38,731 19.186% 761,048 41,335 21.257% Loans in Process (461) - 0.000% (469) - 0.000% (272) - 0.000% (3) - 0.000% Overdrafts 0 - 0.000% 0 - 0.000% 0 - 0.000% 0 - 0.000% FDIC Loss Share Receivable 592,985 (29,255) -19.305% 573,776 (27,927) -19.255% 508,443 (28,484) -22.163% 448,746 (33,488) -29.201% Net Covered Loan Portfolio 1,943,920 26,263 5.327% 1,866,937 24,092 5.142% 1,727,375 22,666 5.234% 1,602,700 21,912 5.416% Average Income / Expense Average Yield Average Income / Expense Average Yield Average Income / Expense Average Yield Average Income / Expense Average Yield Covered Loans 1,350,935 55,518 16.139% 1,293,160 52,019 15.968% 1,218,933 51,150 16.661% 1,153,954 55,400 18.878% CapitalSouth Bank 209,043 14,372 26.967% 198,491 6,203 12.416% 187,742 7,077 14.966% 169,584 6,480 15.034% Orion Bank 734,021 29,565 15.817% 710,111 34,820 19.448% 673,068 33,586 19.801% 651,176 35,154 21.221% Century Bank 281,888 5,261 7.387% 264,864 6,697 10.080% 255,610 6,134 10.080% 244,874 8,047 12.967% Sterling Bank 125,983 6,319 19.631% 119,694 4,299 14.239% 102,513 4,353 16.829% 88,322 5,718 25.371% FDIC Loss Share Receivable 592,985 (29,255) -19.305% 573,776 (27,927) -19.255% 508,443 (28,484) -22.163% 448,746 (33,488) -29.201% CapitalSouth Bank 56,241 (8,707) -60.581% 49,433 (1,917) -15.338% 44,503 (3,285) -29.204% 40,443 (3,213) -31.088% Orion Bank 355,317 (16,430) -18.095% 349,685 (21,626) -24.466% 306,347 (21,149) -27.311% 271,457 (22,983) -33.130% Century Bank 137,868 (761) -2.160% 136,205 (2,380) -6.913% 119,445 (1,911) -6.329% 101,167 (3,875) -14.987% Sterling Bank 43,559 (3,357) -30.153% 38,453 (2,004) -20.621% 38,148 (2,139) -22.181% 35,680 (3,417) -37.472% Net Covered Loan Portfolio 1,943,920 26,263 5.327% 1,866,937 24,092 5.142% 1,727,375 22,666 5.234% 1,602,700 21,912 5.416% CapitalSouth Bank 265,284 5,665 8.406% 247,924 4,286 6.882% 232,245 3,792 6.493% 210,027 3,267 6.133% Orion Bank 1,089,338 13,135 4.756% 1,059,796 13,194 4.952% 979,415 12,436 5.033% 922,633 12,171 5.160% Century Bank 419,756 4,500 4.252% 401,069 4,317 4.309% 375,055 4,224 4.495% 346,041 4,173 4.766% Sterling Bank 169,542 2,963 6.841% 158,148 2,294 5.763% 140,661 2,214 6.236% 124,002 2,301 7.255% 4Q2011 1Q2012 4Q2011 2Q2012 3Q2012 1Q2012 2Q2012 3Q2012 |