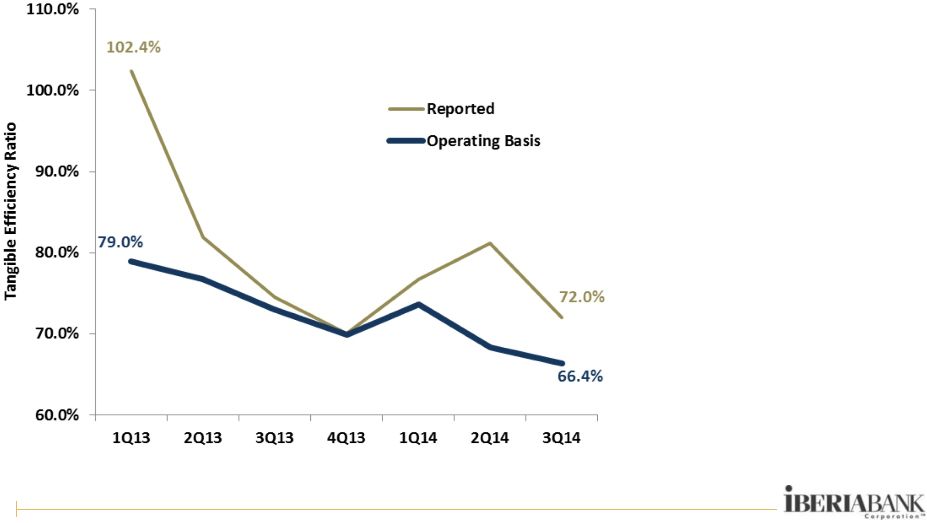

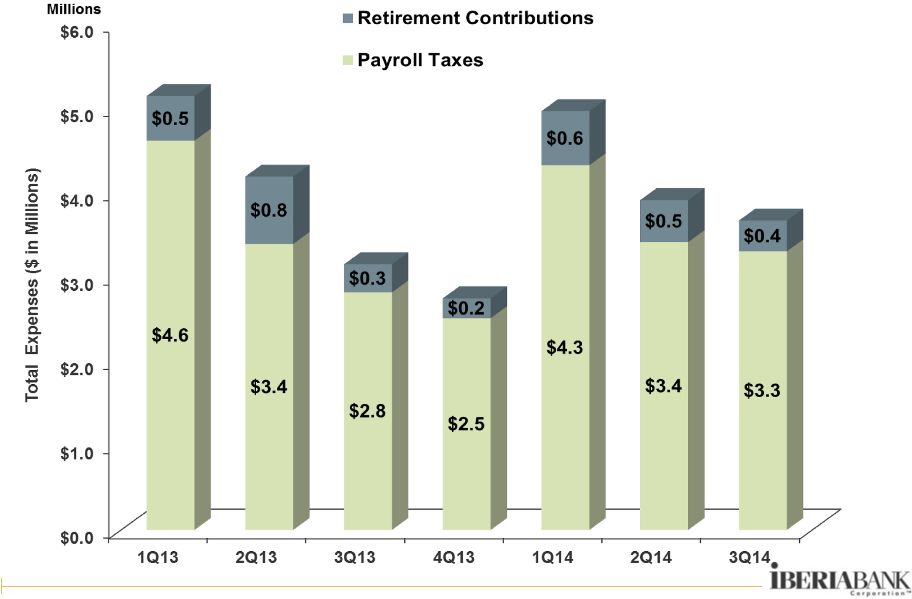

APPENDIX Non-Interest Expense Trends 43 Linked quarter increases/decreases of: Salary and benefits expense $0.4 mil Credit/Loan related expense 1.5 Hospitalization expense 1.0 Other Incentives (1.6) Increased due to the timing and consummation of Teche and First Private added approximately $1.7 million in operating expenses in 3Q14 • Non-interest expenses excluding non-operating items up $3.4 million, or 3%, as compared to 2Q14 • Total expenses down $7.3 million, or -6%, in 3Q14 • Severance expense down $4.2 million, mostly related to Teche acquisition • Impairment of long-lived assets up $3.0 million • Merger-related expense decreased $8.7 million • Operating Tangible Efficiency Ratio of 66.4%, down 190 bps Non-interest Expense ($000s) 3Q13 4Q13 1Q14 2Q14 3Q14 $ Change % Change Mortgage Commissions 4,238 $ 3,169 $ 2,215 $ 3,481 $ 3,912 $ 431 $ 12% Hospitalization Expense 4,303 3,899 3,944 3,661 4,611 950 26% Other Salaries and Benefits 50,140 52,108 53,582 55,921 54,898 (1,023) -2% Salaries and Employee Benefits 58,681 $ 59,176 $ 59,741 $ 63,063 $ 63,421 $ 358 $ 1% Credit/Loan Related 5,248 2,776 3,560 3,093 4,569 1,476 48% Occupancy and Equipment 13,863 13,971 13,775 13,918 14,580 662 5% Amortization of Acquisition Intangibles 1,179 1,177 1,218 1,244 1,493 249 20% All Other Non-interest Expense 26,933 25,328 27,328 28,913 29,602 689 2% Nonint. Exp. (Ex-Non-Operating Exp.) 105,904 $ 102,428 $ 105,622 $ 110,231 $ 113,666 $ 3,435 $ 3% Severance 554 216 119 5,466 1,226 (4,240) -78% Occupancy and Branch Closure Costs 594 - 17 14 - (14) -100% Storm-related expenses - - 184 4 1 (3) -78% Impairment of Long-lived Assets, net of gains on sales 977 (225) 541 1,241 4,213 2,972 239% Provision for FDIC clawback liability 667 - - - (797) (797) 100% Debt Prepayment - - - - - - 0% Termination of Debit Card Rewards Program - (311) (22) - - - 0% Consulting and Professional (630) - - - - - 0% Merger-Related Expenses 85 566 967 10,419 1,752 (8,667) -83% Total Non-interest Expense 108,152 $ 102,674 $ 107,428 $ 127,375 $ 120,060 $ (7,315) $ -6% Tangible Efficiency Ratio - excl Nonop-Exp 73.0% 69.9% 73.6% 68.3% 66.4% 3Q14 vs. 2Q14 |