Exhibit 99.2 IBERIABANK CORPORATION Acquisition of Gibraltar Private Bank & Trust, Co. October 19, 2017

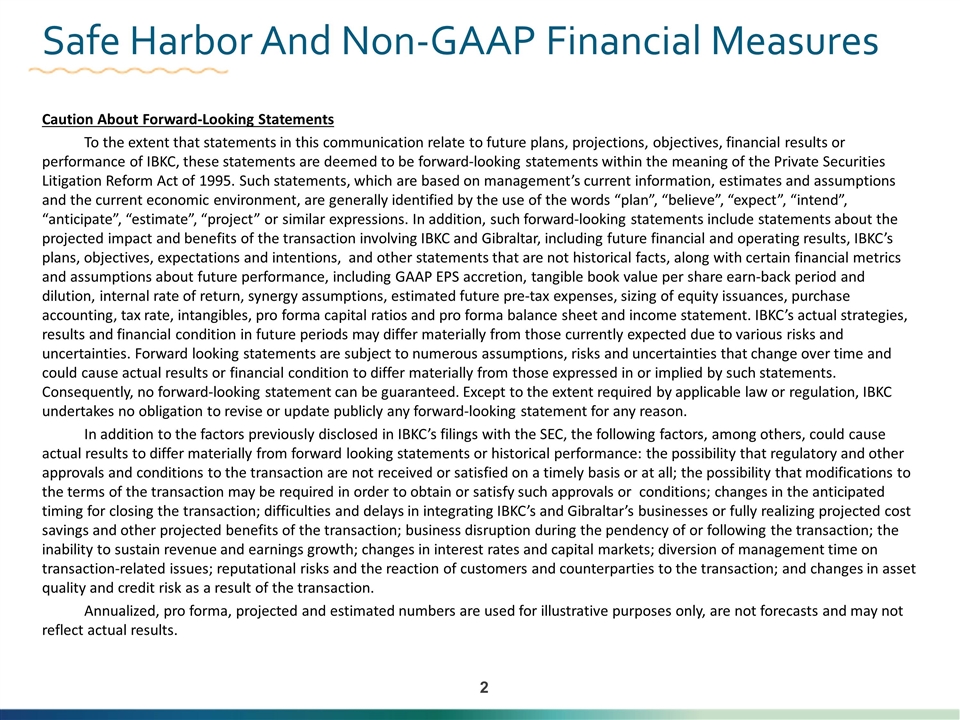

Caution About Forward-Looking Statements To the extent that statements in this communication relate to future plans, projections, objectives, financial results or performance of IBKC, these statements are deemed to be forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements, which are based on management’s current information, estimates and assumptions and the current economic environment, are generally identified by the use of the words “plan”, “believe”, “expect”, “intend”, “anticipate”, “estimate”, “project” or similar expressions. In addition, such forward-looking statements include statements about the projected impact and benefits of the transaction involving IBKC and Gibraltar, including future financial and operating results, IBKC’s plans, objectives, expectations and intentions, and other statements that are not historical facts, along with certain financial metrics and assumptions about future performance, including GAAP EPS accretion, tangible book value per share earn-back period and dilution, internal rate of return, synergy assumptions, estimated future pre-tax expenses, sizing of equity issuances, purchase accounting, tax rate, intangibles, pro forma capital ratios and pro forma balance sheet and income statement. IBKC’s actual strategies, results and financial condition in future periods may differ materially from those currently expected due to various risks and uncertainties. Forward looking statements are subject to numerous assumptions, risks and uncertainties that change over time and could cause actual results or financial condition to differ materially from those expressed in or implied by such statements. Consequently, no forward-looking statement can be guaranteed. Except to the extent required by applicable law or regulation, IBKC undertakes no obligation to revise or update publicly any forward-looking statement for any reason. In addition to the factors previously disclosed in IBKC’s filings with the SEC, the following factors, among others, could cause actual results to differ materially from forward looking statements or historical performance: the possibility that regulatory and other approvals and conditions to the transaction are not received or satisfied on a timely basis or at all; the possibility that modifications to the terms of the transaction may be required in order to obtain or satisfy such approvals or conditions; changes in the anticipated timing for closing the transaction; difficulties and delays in integrating IBKC’s and Gibraltar’s businesses or fully realizing projected cost savings and other projected benefits of the transaction; business disruption during the pendency of or following the transaction; the inability to sustain revenue and earnings growth; changes in interest rates and capital markets; diversion of management time on transaction-related issues; reputational risks and the reaction of customers and counterparties to the transaction; and changes in asset quality and credit risk as a result of the transaction. Annualized, pro forma, projected and estimated numbers are used for illustrative purposes only, are not forecasts and may not reflect actual results. Safe Harbor And Non-GAAP Financial Measures

Important Additional Information and Where to Find It This communication is being made in respect of the proposed merger transaction involving IBKC, IBERIABANK and Gibraltar. In connection with the proposed merger, IBKC intends to file a registration statement on Form S-4 with the SEC, which will include a proxy statement of Gibraltar and a prospectus of IBKC. IBKC also plans to file other documents regarding the proposed merger transaction with the SEC. A definitive proxy statement/prospectus will also be sent to Gibraltar’s shareholders seeking any required shareholder approval. This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. Before making any voting or investment decision, investors and securityholders of Gibraltar are urged to carefully read the entire registration statement and proxy statement/prospectus, when they become available, and any other relevant documents filed with the SEC, as well as any amendments or supplements to these documents, because they will contain important information about the proposed transaction. These documents, as well as other filings containing information about IBKC and Gibraltar, will be available without charge at the SEC’s website at http://www.sec.gov. Alternatively, these documents, when available, can be obtained without charge from IBKC’s website at http://www.iberiabank.com. IBKC and Gibraltar, and certain of their respective directors, executive officers and other members of management and employees may be deemed to be participants in the solicitation of proxies from the shareholders of Gibraltar in respect of the proposed merger transaction. Information regarding the directors and executive officers of IBKC is contained in IBKC’s Annual Report on Form 10-K for the year ended December 31, 2016 and its Proxy Statement on Schedule 14A, as filed with the SEC on April 7, 2017. Information regarding the directors and executive officers of Gibraltar who may be deemed participants in the solicitation of the shareholders of Gibraltar in connection with the proposed transaction will be included in the proxy statement/prospectus for Gibraltar’s special meeting of shareholders, which will be filed by IBKC with the SEC. Additional information regarding the interests of those participants and other persons who may be deemed participants in the transaction may be obtained by reading the registration statement and the proxy statement/prospectus when they become available. Free copies of these documents may be obtained as described in the preceding paragraph. . Safe Harbor And Non-GAAP Financial Measures

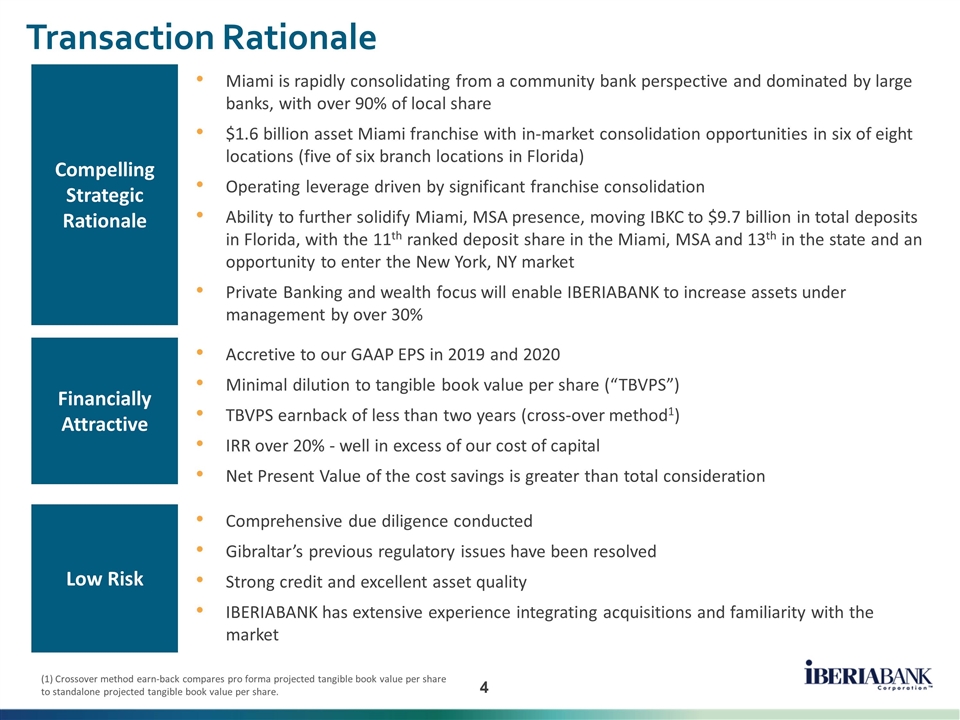

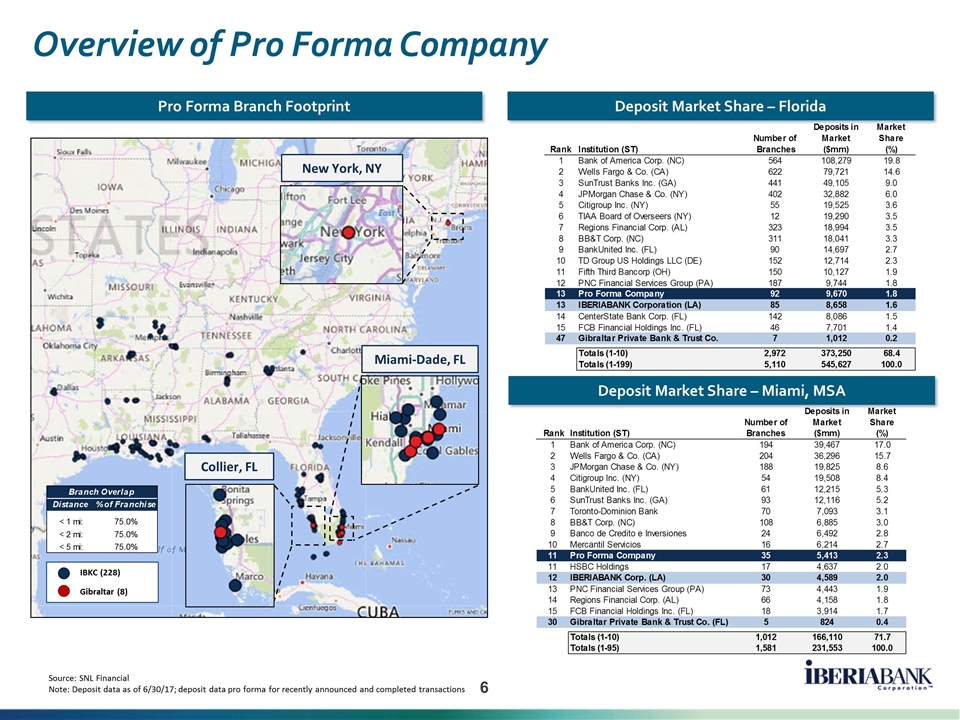

Transaction Rationale Miami is rapidly consolidating from a community bank perspective and dominated by large banks, with over 90% of local share $1.6 billion asset Miami franchise with in-market consolidation opportunities in six of eight locations (five of six branch locations in Florida) Operating leverage driven by significant franchise consolidation Ability to further solidify Miami, MSA presence, moving IBKC to $9.7 billion in total deposits in Florida, with the 11th ranked deposit share in the Miami, MSA and 13th in the state and an opportunity to enter the New York, NY market Private Banking and wealth focus will enable IBERIABANK to increase assets under management by over 30% Compelling Strategic Rationale Financially Attractive Accretive to our GAAP EPS in 2019 and 2020 Minimal dilution to tangible book value per share (“TBVPS”) TBVPS earnback of less than two years (cross-over method1) IRR over 20% - well in excess of our cost of capital Net Present Value of the cost savings is greater than total consideration Low Risk Comprehensive due diligence conducted Gibraltar’s previous regulatory issues have been resolved Strong credit and excellent asset quality IBERIABANK has extensive experience integrating acquisitions and familiarity with the market (1) Crossover method earn-back compares pro forma projected tangible book value per share to standalone projected tangible book value per share.

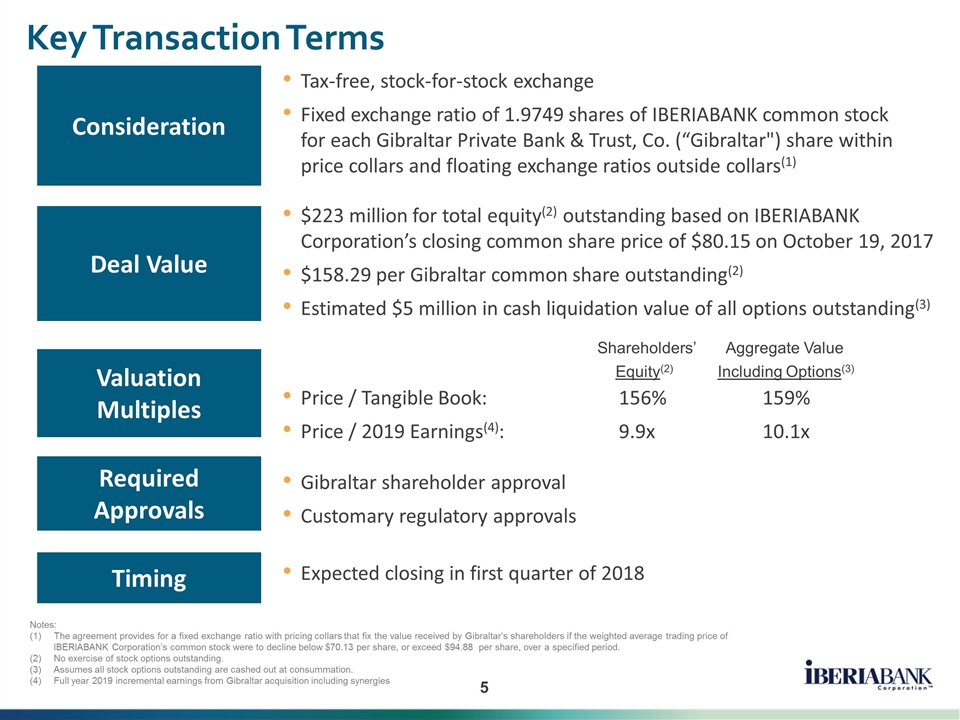

Notes: The agreement provides for a fixed exchange ratio with pricing collars that fix the value received by Gibraltar’s shareholders if the weighted average trading price of IBERIABANK Corporation’s common stock were to decline below $70.13 per share, or exceed $94.88 per share, over a specified period. No exercise of stock options outstanding. Assumes all stock options outstanding are cashed out at consummation. Full year 2019 incremental earnings from Gibraltar acquisition including synergies Tax-free, stock-for-stock exchange Fixed exchange ratio of 1.9749 shares of IBERIABANK common stock for each Gibraltar Private Bank & Trust, Co. (“Gibraltar") share within price collars and floating exchange ratios outside collars(1) Consideration Deal Value Valuation Multiples Required Approvals Timing $223 million for total equity(2) outstanding based on IBERIABANK Corporation’s closing common share price of $80.15 on October 19, 2017 $158.29 per Gibraltar common share outstanding(2) Estimated $5 million in cash liquidation value of all options outstanding(3) Gibraltar shareholder approval Customary regulatory approvals Expected closing in first quarter of 2018 Shareholders’ Aggregate Value Equity(2) Including Options(3) Price / Tangible Book: 156% 159% Price / 2019 Earnings(4): 9.9x 10.1x Key Transaction Terms

Pro Forma Branch Footprint Source: SNL Financial Note: Deposit data as of 6/30/17; deposit data pro forma for recently announced and completed transactions Deposit Market Share – Florida IBKC (228) Gibraltar (8) Collier, FL Miami-Dade, FL Deposit Market Share – Miami, MSA New York, NY Overview of Pro Forma Company

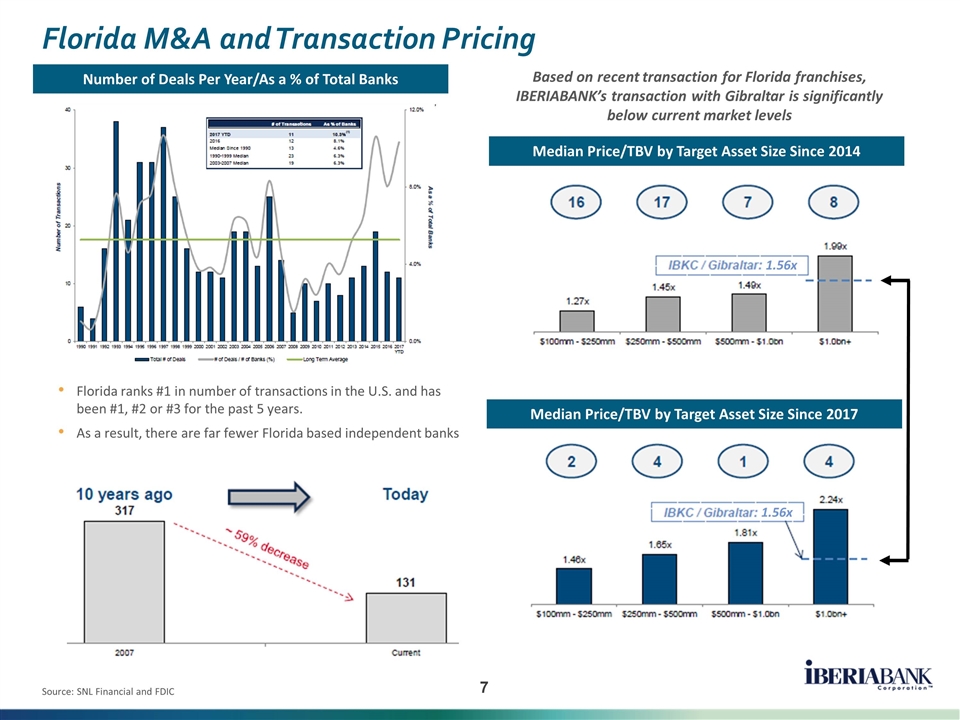

Florida M&A and Transaction Pricing Number of Deals Per Year/As a % of Total Banks Source: SNL Financial and FDIC Florida ranks #1 in number of transactions in the U.S. and has been #1, #2 or #3 for the past 5 years. As a result, there are far fewer Florida based independent banks Median Price/TBV by Target Asset Size Since 2014 Median Price/TBV by Target Asset Size Since 2017 Based on recent transaction for Florida franchises, IBERIABANK’s transaction with Gibraltar is significantly below current market levels 1.56x 1.56x

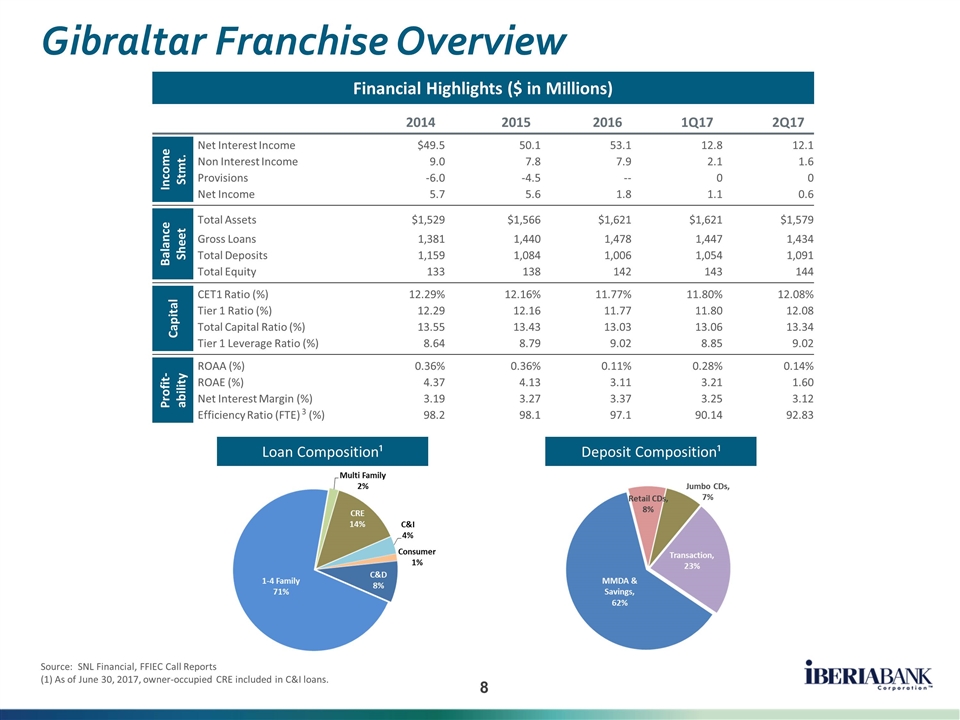

Gibraltar Franchise Overview Financial Highlights ($ in Millions) Loan Composition¹ Deposit Composition¹ Source: SNL Financial, FFIEC Call Reports (1) As of June 30, 2017, owner-occupied CRE included in C&I loans. 2014 2015 2016 1Q17 2Q17 Income Stmt. Net Interest Income $49.5 50.1 53.1 12.8 12.1 Non Interest Income 9.0 7.8 7.9 2.1 1.6 Provisions -6.0 -4.5 -- 0 0 Net Income 5.7 5.6 1.8 1.1 0.6 Balance Sheet Total Assets $1,529 $1,566 $1,621 $1,621 $1,579 Gross Loans 1,381 1,440 1,478 1,447 1,434 Total Deposits 1,159 1,084 1,006 1,054 1,091 Total Equity 133 138 142 143 144 Capital CET1 Ratio (%) 12.29% 12.16% 11.77% 11.80% 12.08% Tier 1 Ratio (%) 12.29 12.16 11.77 11.80 12.08 Total Capital Ratio (%) 13.55 13.43 13.03 13.06 13.34 Tier 1 Leverage Ratio (%) 8.64 8.79 9.02 8.85 9.02 Profit-ability ROAA (%) 0.36% 0.36% 0.11% 0.28% 0.14% ROAE (%) 4.37 4.13 3.11 3.21 1.60 Net Interest Margin (%) 3.19 3.27 3.37 3.25 3.12 Efficiency Ratio (FTE) 3 (%) 98.2 98.1 97.1 90.14 92.83

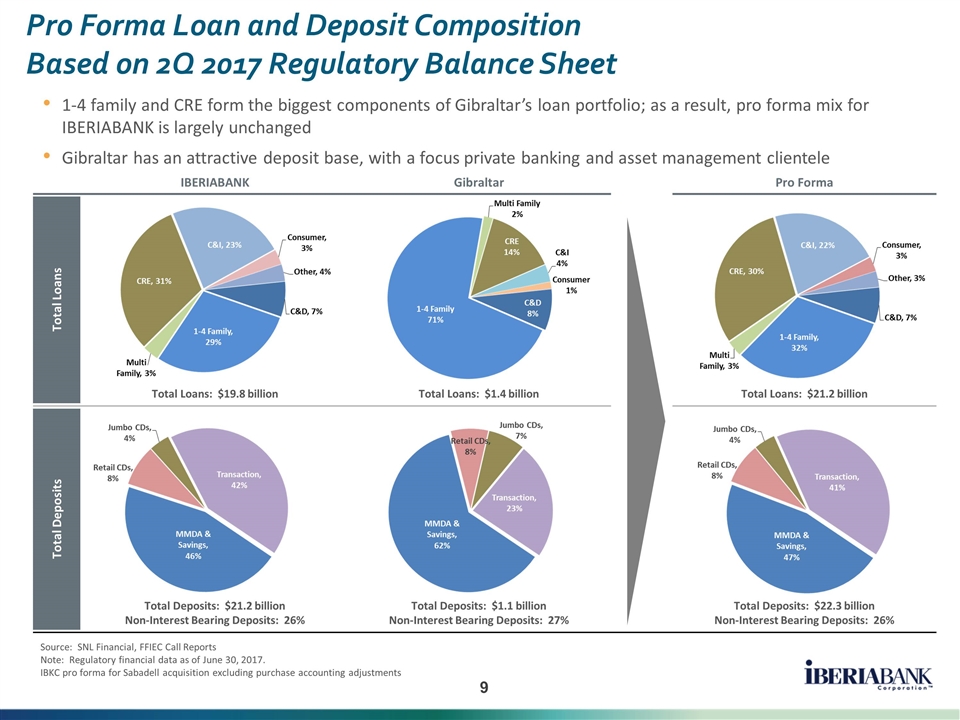

Pro Forma Loan and Deposit Composition Based on 2Q 2017 Regulatory Balance Sheet Source: SNL Financial, FFIEC Call Reports Note: Regulatory financial data as of June 30, 2017. IBKC pro forma for Sabadell acquisition excluding purchase accounting adjustments 1-4 family and CRE form the biggest components of Gibraltar’s loan portfolio; as a result, pro forma mix for IBERIABANK is largely unchanged Gibraltar has an attractive deposit base, with a focus private banking and asset management clientele IBERIABANK Gibraltar Pro Forma Total Loans Total Loans: $19.8 billion Total Loans: $1.4 billion Total Loans: $21.2 billion Total Deposits Total Deposits: $21.2 billion Non-Interest Bearing Deposits: 26% Total Deposits: $1.1 billion Non-Interest Bearing Deposits: 27% Total Deposits: $22.3 billion Non-Interest Bearing Deposits: 26%

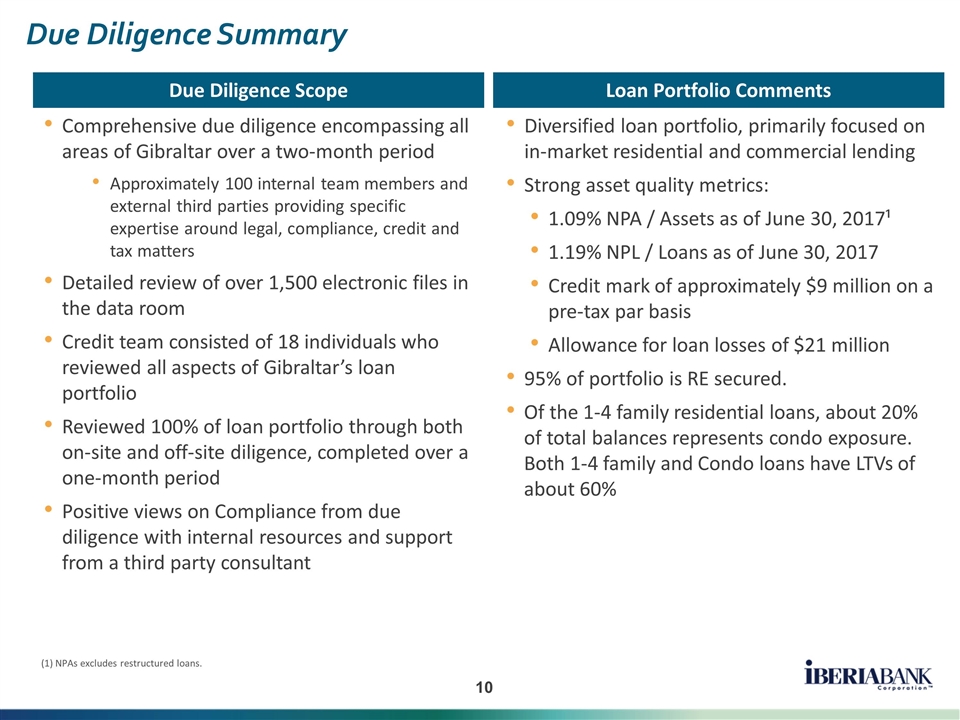

Due Diligence Summary Comprehensive due diligence encompassing all areas of Gibraltar over a two-month period Approximately 100 internal team members and external third parties providing specific expertise around legal, compliance, credit and tax matters Detailed review of over 1,500 electronic files in the data room Credit team consisted of 18 individuals who reviewed all aspects of Gibraltar’s loan portfolio Reviewed 100% of loan portfolio through both on-site and off-site diligence, completed over a one-month period Positive views on Compliance from due diligence with internal resources and support from a third party consultant Diversified loan portfolio, primarily focused on in-market residential and commercial lending Strong asset quality metrics: 1.09% NPA / Assets as of June 30, 2017¹ 1.19% NPL / Loans as of June 30, 2017 Credit mark of approximately $9 million on a pre-tax par basis Allowance for loan losses of $21 million 95% of portfolio is RE secured. Of the 1-4 family residential loans, about 20% of total balances represents condo exposure. Both 1-4 family and Condo loans have LTVs of about 60% Due Diligence Scope Loan Portfolio Comments (1) NPAs excludes restructured loans.

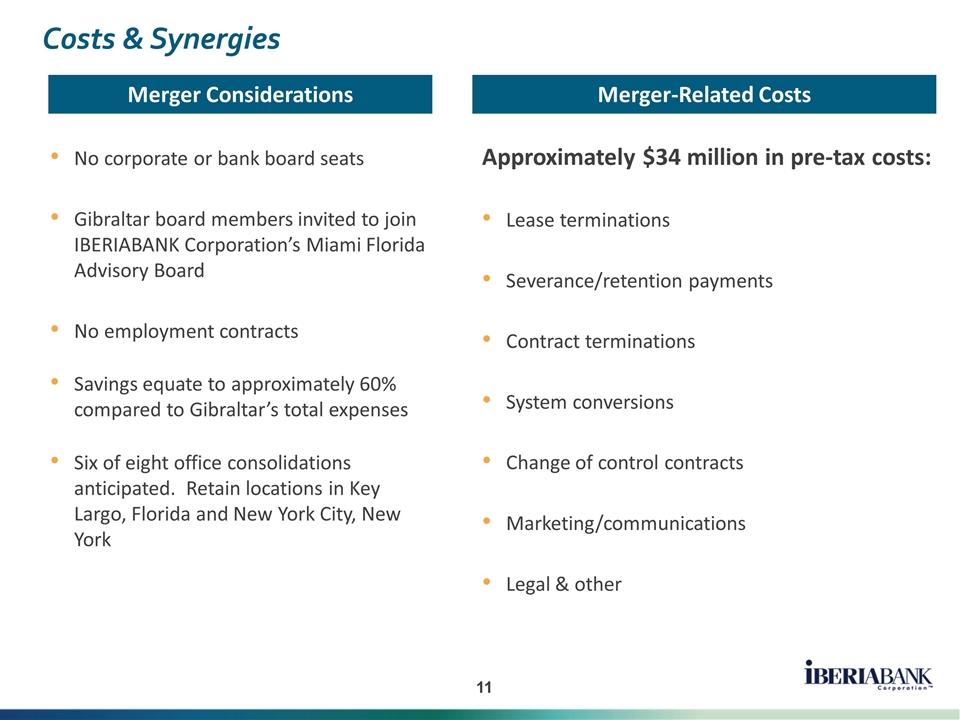

No corporate or bank board seats Gibraltar board members invited to join IBERIABANK Corporation’s Miami Florida Advisory Board No employment contracts Savings equate to approximately 60% compared to Gibraltar’s total expenses Six of eight office consolidations anticipated. Retain locations in Key Largo, Florida and New York City, New York Approximately $34 million in pre-tax costs: Lease terminations Severance/retention payments Contract terminations System conversions Change of control contracts Marketing/communications Legal & other Merger Considerations Costs & Synergies Merger-Related Costs

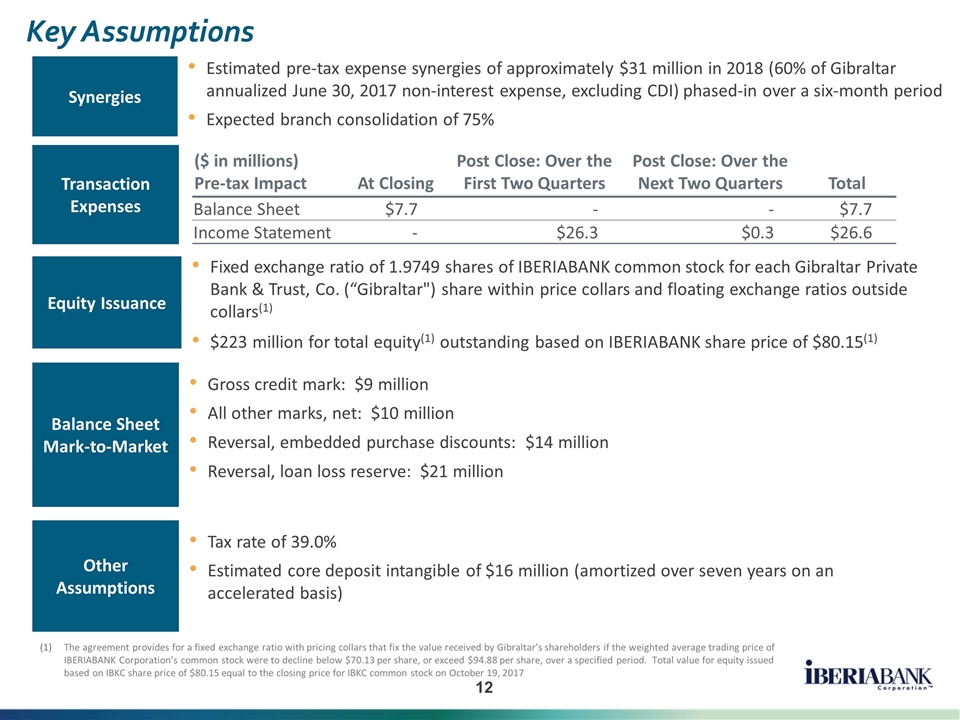

Key Assumptions Estimated pre-tax expense synergies of approximately $31 million in 2018 (60% of Gibraltar annualized June 30, 2017 non-interest expense, excluding CDI) phased-in over a six-month period Expected branch consolidation of 75% Synergies Transaction Expenses Equity Issuance Fixed exchange ratio of 1.9749 shares of IBERIABANK common stock for each Gibraltar Private Bank & Trust, Co. (“Gibraltar") share within price collars and floating exchange ratios outside collars(1) $223 million for total equity(1) outstanding based on IBERIABANK share price of $80.15(1) Gross credit mark: $9 million All other marks, net: $10 million Reversal, embedded purchase discounts: $14 million Reversal, loan loss reserve: $21 million Balance Sheet Mark-to-Market Other Assumptions Tax rate of 39.0% Estimated core deposit intangible of $16 million (amortized over seven years on an accelerated basis) The agreement provides for a fixed exchange ratio with pricing collars that fix the value received by Gibraltar’s shareholders if the weighted average trading price of IBERIABANK Corporation’s common stock were to decline below $70.13 per share, or exceed $94.88 per share, over a specified period. Total value for equity issued based on IBKC share price of $80.15 equal to the closing price for IBKC common stock on October 19, 2017 ($ in millions) Pre-tax Impact At Closing Post Close: Over the First Two Quarters Post Close: Over the Next Two Quarters Total Balance Sheet $7.7 - - $7.7 Income Statement - $26.3 $0.3 $26.6

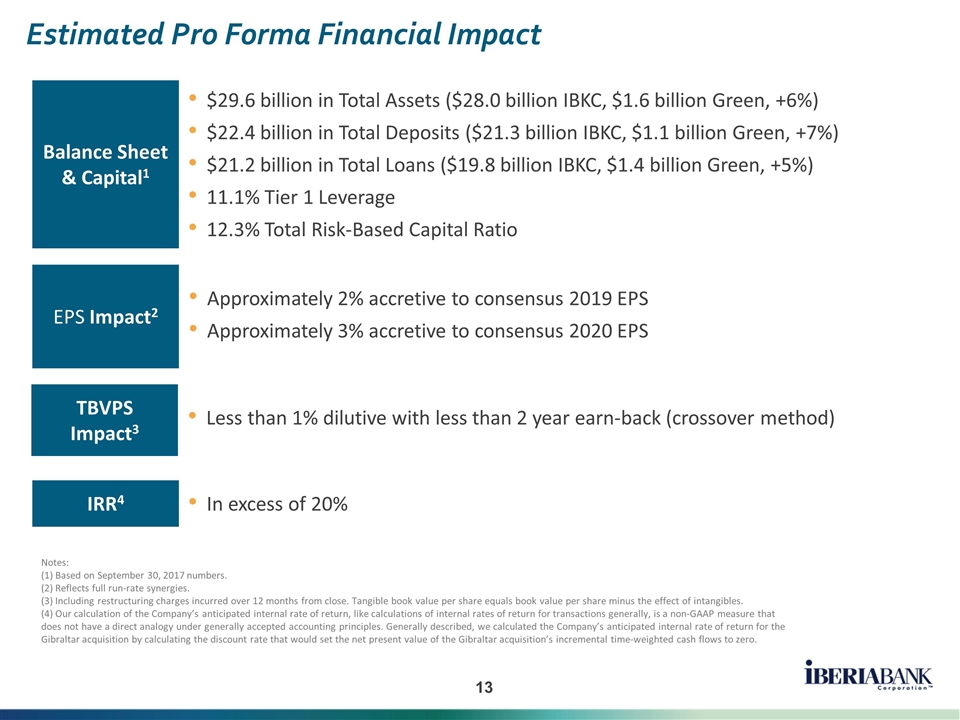

Estimated Pro Forma Financial Impact In excess of 20% IRR4 EPS Impact2 Approximately 2% accretive to consensus 2019 EPS Approximately 3% accretive to consensus 2020 EPS TBVPS Impact3 Less than 1% dilutive with less than 2 year earn-back (crossover method) $29.6 billion in Total Assets ($28.0 billion IBKC, $1.6 billion Green, +6%) $22.4 billion in Total Deposits ($21.3 billion IBKC, $1.1 billion Green, +7%) $21.2 billion in Total Loans ($19.8 billion IBKC, $1.4 billion Green, +5%) 11.1% Tier 1 Leverage 12.3% Total Risk-Based Capital Ratio Balance Sheet & Capital1 Notes: (1) Based on September 30, 2017 numbers. (2) Reflects full run-rate synergies. (3) Including restructuring charges incurred over 12 months from close. Tangible book value per share equals book value per share minus the effect of intangibles. (4) Our calculation of the Company’s anticipated internal rate of return, like calculations of internal rates of return for transactions generally, is a non-GAAP measure that does not have a direct analogy under generally accepted accounting principles. Generally described, we calculated the Company’s anticipated internal rate of return for the Gibraltar acquisition by calculating the discount rate that would set the net present value of the Gibraltar acquisition’s incremental time-weighted cash flows to zero.