3Q15 Earnings Conference Call Supplemental Presentation October 21, 2015 Exhibit 99.2

2 To the extent that statements in this PowerPoint presentation relate to future plans, objectives, financial results or performance of IBERIABANK Corporation, these statements are deemed to be forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements, which are based on management’s current information, estimates and assumptions and the current economic environment, are generally identified by the use of the words “plan”, “believe”, “expect”, “intend”, “anticipate”, “estimate”, “project” or similar expressions. The Company’s actual strategies, results and financial condition in future periods may differ materially from those currently expected due to various risks and uncertainties. Forward-looking statements are subject to numerous assumptions, risks and uncertainties that change over time and could cause actual results or financial condition to differ materially from those expressed in or implied by such statements. Consequently, no forward-looking statement can be guaranteed. Except to the extent required by applicable law or regulation, the Company undertakes no obligation to revise or update publicly any forward-looking statement for any reason. Safe Harbor And Legend

• Reported EPS of $1.03 (up $0.24 from 2Q15) and non-GAAP operating EPS of $1.07 (up $0.02 from 2Q15) • Net interest margin decreased two basis points to 3.50%, consistent with management’s expectations. The cash margin increased two basis points on a linked quarter basis to 3.31% • Tax equivalent net interest income increased $9.6 million, or +7%, from 2Q15, while average earning assets increased $1.0 billion, or +6% • Operating revenues increased $4.5 million, or +2%, while operating expenses increased $4.0 million, or +3%, on a linked quarter basis. Operating expenses were impacted by the inclusion of the Georgia Commerce Bancshares acquisition for the full quarter in 3Q15 as compared to one month included in 2Q15 • Legacy loan growth: • Legacy deposit growth: • On August 5, 2015, sold approximately $80 million of Perpetual Preferred Stock with net proceeds of approximately $77 million Overview Introductory Comments – Third Quarter 2015 ▪ $384 million since June 30, 2015 (+15% annualized), including $210 million of commercial and $174 million of small business and consumer ▪ Energy-related loans down $68 million, or -9%, and indirect loans down $41 million, or -13% ▪ Growth in the legacy loan portfolio was allocated commercial 55%, small business 17%, mortgage 11%, and consumer 17% ▪ $184 million since June 30, 2015 (+5% annualized) ▪ $226 million increase in non-interest bearing deposits (+22% annualized) 3

Credit Non-Performing Assets Trends $ in Millions NPA determination based on regulatory guidance for Acquired portfolios 3Q15 includes $8 million of bank-related properties reclassified to OREO • Continued workout of covered acquired portfolios • Improved asset quality with total legacy NPAs/Assets equal to 0.43%, down 12 basis points on a linked- quarter basis • 3Q15 includes $4.9 million of energy-related loans on non-accrual and an additional $0.5 million that was past due at quarter-end 4

Energy Summary • Total energy-related loans outstanding down $68 million or -9% from 2Q15, equated to 5.1% of total loans at September 30, 2015 • Energy loans at quarter-end: ▪ Non-accrual loans equaled $4.9 million ▪ Loans past due 30 days or more equaled $0.5 million ▪ No loans held in OREO ▪ Criticized loans were 6.1% of total energy-related commitments and equal to 0.4% of the total loans • No energy-related loan losses incurred over the past several years • At October 16, 2015, energy- related loans outstanding were down $7.3 million from quarter- end and were 5.0% of total loans outstanding 5 $ in Millions

Energy Energy Loans Outstanding As % of Total Risk Based Capital 6

7 Midstream E&P Services Energy Update Relative Risk Total Outstanding Loan Balances December 31, 2013 September 30,2015 E n e r g y a s % $ in Millions $25 $41 $36 $37 $122 $336 $90 $33 Portfolio Risk Profile % Of Total Loans Outstanding December 31, 2014

8 Energy Update IBKC Oil Field Services Loans Outstanding * Excludes Non-Drilling Support portion of IBKC outstanding portfolio. “Super Sponsor” is defined as having proven access to capital markets; proven guarantor with meaningful liquidity (50% or more of total direct and contingent debt). Diversification within the portfolio Drilling Support * % Of Total Drilling Support Loans • Limited exposure to drilling related companies • Strong sponsorship behind portfolio companies

9 Energy Update IBKC Oil Field Services Loans Outstanding * Excludes Non-Drilling Support portion of IBKC outstanding portfolio. “Super Sponsor” is defined as having proven access to capital markets; proven guarantor with meaningful liquidity (50% or more of total direct and contingent debt). Diversification within the portfolio Non-Drilling Support * % Of Total Non-Drilling Support Loans • Limited exposure to fabrication and construction • Strong sponsorship behind portfolio companies • Strong geographic diversification

10 Energy Update IBKC Oil Field Services Loans Outstanding Structure of Lending% Of Total Oil Field Services Loans $ in Millions • 62% of outstandings in revolvers with borrowing base or term debt inside of 3 years • 21% of outstandings secured with term debt greater than 3 years and secured by real estate • 12% of outstandings with term debt greater than 3 year non-real estate secured

11 Non-Interest Income 3Q15 Components • Operating non- interest income decreased $5.0 million, or -8%, on a linked quarter basis • Non-operating income of $2.2 million primarily from a $1.9 million gain on the sale / leaseback of a building

12 Non-Interest Income Weekly Locked Mortgage Pipeline Trends • Seasonal rebound commences at the start of each year through spring months into early summer • Increased production due to a combination of favorable rate environment and improved recruiting in key markets and newly acquired markets • Weekly locked pipeline was $289 million at October 16, 2015, up 2% since September 30, 2015

13 • Mortgage non-interest income of $20.7 million is $4.5 million lower than 2Q15 driven by: • Market value adjustments decreased $11.3 million in 3Q15 as compared to 2Q15 • $5.8 million higher gains on higher sales volume (+29%) in 3Q15 • Hedging costs increased $0.8 million in 3Q15 vs 2Q15 • Volumes sold were $726 million (10% higher than in 2Q15) Non-Interest Income Mortgage Income

14 Non-Interest Income Quarterly Production of Recently Added Mortgage Teams* • Total mortgage originations for 3Q15 were $720 million, an increase of 3% from 2Q15 • In 3Q15, $207 million, or 29%, of total origination volume came from new originators across our markets * Volumes represents originations from mortgage teams added since January 1, 2014

15 • Operating non- interest expense increased $4.0 million, or +3%, on a linked-quarter basis • Non-operating expense of $4.5 million includes: • $2.2 million of merger-related expense • $1.7 million in impairment of long-lived assets • $0.3 million of severance Non-Interest Expense 3Q15 Components

16 • In 2013, Achieved More Than $24 Million Annualized Pre-Tax Run-Rate Savings • In 2014, A Second Initiative Achieved An Additional $11 Million In Run-Rate Savings; This Initiative Was Completed In 4Q14 • In 2Q15, Announced A Third Efficiency Initiative Targeting $15 Million In Additional Potential Improvements Efficiency Ratio Quarterly Reported And Operating Efficiency Ratio

17 Capital Preliminary Results • 75% phase-out of trust preferred securities became effective in 1Q15 and is reflected in updated ratios • Impact to capital ratios from remaining phase-out of trust preferred securities in 1Q16 is expected to be -18 bps • Sale of Non-Cumulative Perpetual Preferred Stock with gross proceeds of approximately $80 million (net proceeds of approximately $77 million) in 3Q15 impacted Tier1 Leverage, Risk-Based, and Total Risk-Based Capital Ratios for IBERIABANK Corporation. • Bank ratios were impacted as a result of increases in average assets. Capital ratios at Bank were not affected by Preferred Stock issuance

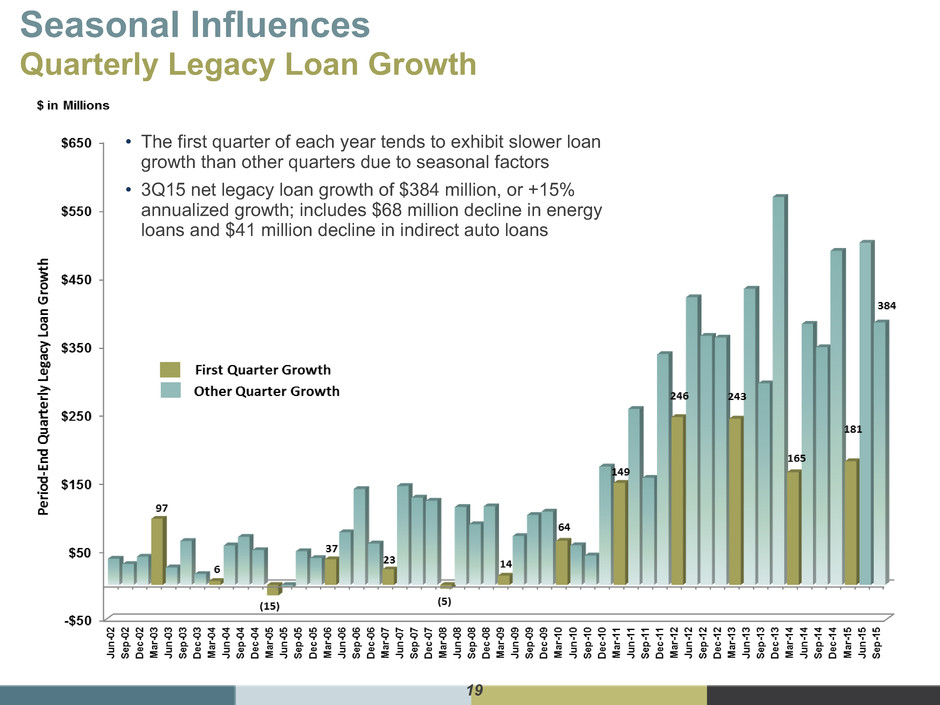

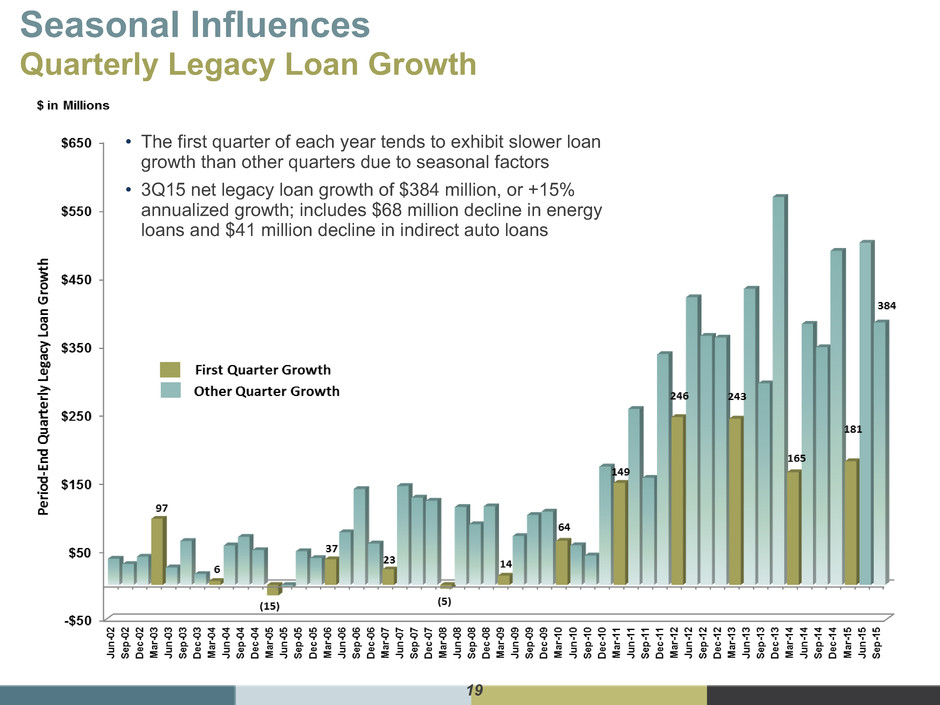

Seasonal Influences

19 Seasonal Influences Quarterly Legacy Loan Growth • The first quarter of each year tends to exhibit slower loan growth than other quarters due to seasonal factors • 3Q15 net legacy loan growth of $384 million, or +15% annualized growth; includes $68 million decline in energy loans and $41 million decline in indirect auto loans

20 Excludes acquired deposits Seasonal Influences Deposit Growth $ in Millions • Increase of $184 million, or +1%, in 3Q15 • $226 million, or +5%,(+22% annualized) growth in total non-interest bearing deposits for 3Q15 Total Deposit Growth

21 Seasonal Influences Checking NSF Related Income 1Q15 results include one month operating results from Florida Bank Group acquisition 2Q15 results include one month operating results from Georgia Commerce Bancshares acquisition Influenced by impact of Teche acquisition completed in May 2014

22 Seasonal Influences Payroll Tax Expense 2Q14 results influenced by impact of Teche Holding Company acquisition completed in May 2014 and First Private Holdings, Inc. acquisition completed in June 2014 1Q15 results include one month operating results from Florida Bank Group acquisition 2Q15 results include one month operating results from Georgia Commerce Bancshares acquisition

23 Seasonal Influences Retirement Contribution Expense 1Q15 results include one month operating results from Florida Bank Group acquisition 2Q15 results include one month operating results from Georgia Commerce Bancshares acquisition

Appendix 24

25 Appendix Performance Metrics – Quarterly Trends ▪ Average earning assets up $1.0 billion (+6%) ▪ T/E net interest income up $9.6 million (+7%) ▪ Provision for loan losses of $5 million: Legacy net charge- offs: $2.4 million (annualized 0.09% of average loans) * Covered and acquired net charge- offs: $21 thousand (annualized 0.00% of average loans) * Legacy provision for loan losses: $5.1 million

26 Appendix Performance Metrics – Yields and Costs

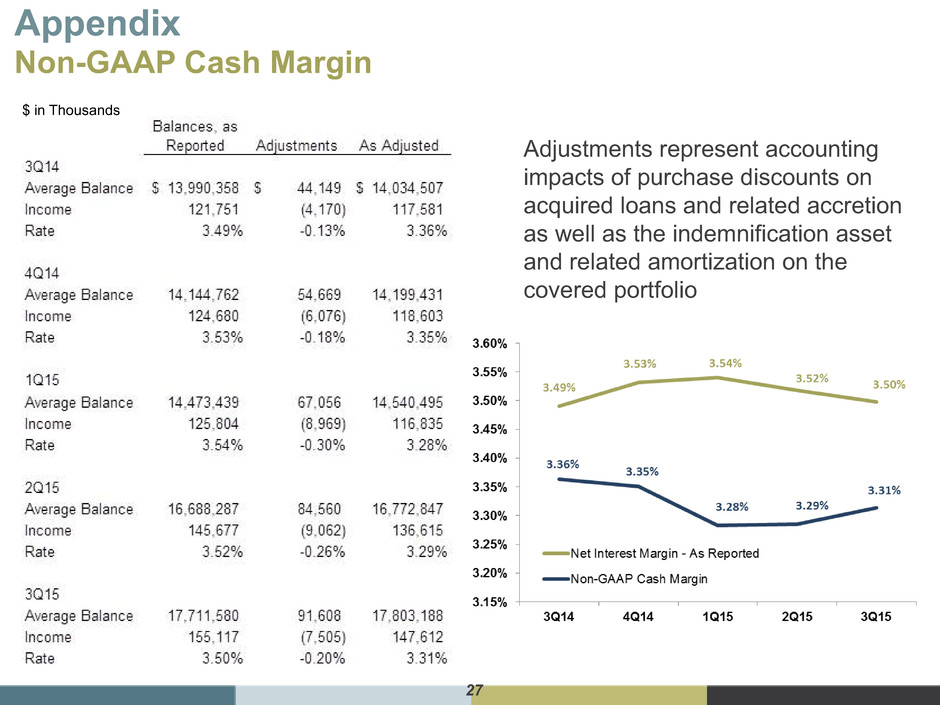

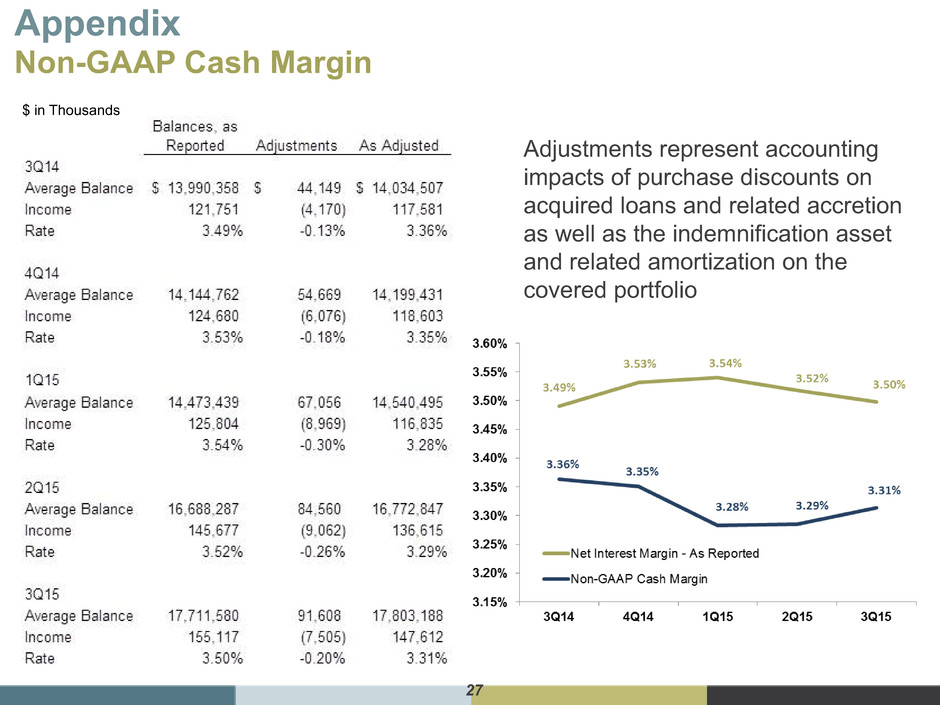

27 Appendix Non-GAAP Cash Margin Adjustments represent accounting impacts of purchase discounts on acquired loans and related accretion as well as the indemnification asset and related amortization on the covered portfolio $ in Thousands

28 Appendix Non-Interest Income Trends ▪ Mortgage income decreased $4.5 million, or -18% ▪ Energy capital markets income and broker commissions decreased $1.6 million, or -30% ▪ Service charges increased $1.2 million, or +12% ▪ Title income increased $0.5 million, or +8% ▪ Other operating non-interest income decreased $0.5 million 3Q15 compared to 2Q15: • Originations were $720 million for the quarter, up 3% • Sale volume increased 10% • Refinancings were 19% of production, down from 22% in 2Q15 • Pipeline of $283 million at quarter-end, down $46 million, or -14% as compared to June 30, 2015. At October 16, 2015, the locked pipeline was $289 million, or up +2%, over September 30, 2015

29 Appendix Non-Interest Expense Trends ▪ Total expenses down $8.2 million, or -5%, in 3Q15▪ Merger-related expense decreased $10.5 million; 3Q15 merger-related expenses primarily attributable to Georgia Commerce transaction ▪ Severance expense down $0.1 million ▪ Impairment of long-lived assets up $0.1 million ▪ Operating expenses up $4.0 million, or +3%, as compared to 2Q15 ▪ Tangible Operating Efficiency Ratio of 64.8%, up from 64.4% in 2Q15 Linked quarter changes in operating expense: • Compensation costs $1.2 mil • Hospitalization expense 0.8 • Occupancy and equipment expense 0.7 • Intangible amortization expense 0.2

30 Appendix Reconciliation Of Non-GAAP Financial Measures Non-operating income equal to $2.2 million pre-tax, or $0.03 EPS after-tax: ▪ Gain on sale/leaseback of building of $1.9 million pre-tax, or $0.03 EPS after-tax ▪ Gain on sale of investment securities of $0.2 million pre-tax, or less than $0.01 EPS after-tax Non-operating expenses equal to $4.5 million pre-tax, or $0.07 EPS after-tax: ▪ 3Q15 Merger-elated expense of $2.2 million pre-tax, or $0.04 EPS after-tax ▪ Net impairment expense of $1.7 million pre-tax, or $0.03, EPS after-tax ▪ Severance expense of $0.3 million pre-tax, or less than $0.01 EPS after-tax ▪ Other non-operating items expense of $0.2 million pre-tax, or less than $0.01 after-tax

31 Appendix Market Highlights For 3Q15 • Strong legacy loan growth throughout the franchise with 29% of new originations coming from Louisiana markets and 27% coming from Florida markets • Orlando, Atlanta, Tampa Bay, New Orleans and Sarasota showed strong net loan growth • Total commitments originated during 3Q15 equated to $1.3 billion with 44% fixed and 56% floating rate • Commercial loans originated and funded in 3Q15 totaled $538 million with a mix of 42% fixed and 58% floating ($800 million in commercial loan commitments during the quarter) • Commercial loan and commitment pipeline in excess of $950 million at quarter-end, a record level for the company

32 Overview Small Business and Retail – 3Q15 Progress • Small Business loan growth of $67 million, or +7%, on a linked-quarter basis • Consumer Direct and Mortgage loan growth of $144 million, or +6%, on a linked quarter basis • Credit Card loan growth of $3 million, or +4%, on a linked quarter basis • Checking account growth: • Small Business checking accounts increased 9% year-over-year and an annualized 9% on a linked quarter basis • Consumer checking accounts decreased 2% year-over-year and an annualized 1% on a linked quarter basis, due to a combination of attrition from recent bank acquisitions and expected attrition due to product revisions • Continued focus on productivity and efficiency of the delivery network – consolidated two branches in 3Q15, seven more branch closures scheduled in 4Q15, and three branch openings targeted for 4Q15 • Acceptance and usage of digital delivery continues to increase among our client base

33 Appendix Loan Growth $ in Millions 3rd Quarter 2015: • $384 million legacy loan growth, or +4% (+15% annualized) Since YE 2009: • $6.7 billion legacy loan growth, or +162% (+28% annualized) • The FDIC covered loan portfolio declined 85%, or $1.4 billion (15% annualized rate)

34 Appendix Loan And Deposit Growth In 3Q15 –Top Markets $ in millions $ in millions • $384 million in legacy loan growth for 3Q15 • Top 5 markets represent 75% of legacy growth • $184 million in total deposit growth for 3Q15, a +1% increase from 2Q15 Legacy Loan Growth in 3Q15 Deposit Growth in 3Q15

35 Appendix Loan And Deposit Mix At September 30, 2015 $16.3 Billion$14.1 Billion Loans Deposits

36 Appendix Non-Interest Bearing Deposits % of Total Deposits • $226 million of incremental non- interest-bearing deposit growth, or +5%, in 3Q15 • Top 3Q15 legacy non-interest- bearing deposit growth markets include: • Houston • Lafayette • Naples • New Orleans • Baton Rouge Non-interest-bearing deposits at quarter-end $ in Billions

37 Appendix Deposits Costs • Our deposit costs declined greater than peers • A portion of the lower costs were due to improved mix of deposits • Non-interest- bearing deposits grew from 11% of total deposits in 2010 to 27% of total deposits in 3Q15

38 Appendix Legacy Portfolio Asset Quality Summary (Excludes FDIC covered assets and all acquired loans) • NPAs equated to 0.43% of total assets, down 12 bps compared to 2Q15. Includes $8 million of bank-related properties • $133 million in classified loans (up $2 million compared to 2Q15) • Legacy net charge- offs of $2.4 million, or an annualized rate of 0.09% of average loans

39 Appendix Asset Quality Portfolio Trends

40 Appendix Selected Fee Income Business Revenue Trends • IFS revenues +31% compared to 2Q15 and +21% compared to 3Q14 • IWA revenues -2% compared to 2Q15 and +19% compared to 3Q14 • ICP revenues -77% compared to 2Q15 and -74% compared to 3Q14 • IWA assets under management decreased $16 million (-1%) to $1.4 billion on September 30, 2015 $ in Millions

41 Appendix Expected Quarterly Re-pricing Schedule $ in millions Note: Amounts exclude re-pricing of assets and liabilities from prior quarters Excludes FDIC loans and receivable, non-accrual loans and market value adjustments

42 Appendix Interest Rate Risk Simulation Source: Bancware model, as of September 30, 2015 * Assumes instantaneous and parallel shift in interest rates based on static balance sheet • Asset sensitive from an interest rate risk position • The degree of asset sensitivity is a function of the reaction of competitors to changes in deposit pricing • Forward curve has a positive impact to net interest income over 12 months