Exhibit 99.2 1Q19 Earnings Presentation April 25, 2019

Safe Harbor And Non-GAAP Financial Measures Safe Harbor To the extent that statements in this PowerPoint presentation relate to future plans, objectives, financial results or performance of IBERIABANK Corporation, these statements are deemed to be forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements, which are based on management’s current information, estimates and assumptions and the current economic environment, are generally identified by the use of the words “plan”, “believe”, “expect”, “intend”, “anticipate”, “estimate”, “project” or similar expressions. The Company’s actual strategies, results and financial condition in future periods may differ materially from those currently expected due to various risks and uncertainties. Forward-looking statements are subject to numerous assumptions, risks and uncertainties that change over time and could cause actual results or financial condition to differ materially from those expressed in or implied by such statements. Consequently, no forward-looking statement can be guaranteed. Except to the extent required by applicable law or regulation, the Company undertakes no obligation to revise or update publicly any forward-looking statement for any reason. This PowerPoint presentation supplements information contained in the Company’s earnings release dated April 25, 2019, and should be read in conjunction therewith. The earnings release may be accessed on the Company’s web site, www.iberiabank.com, under “Investor Relations” and then “Financial Information” and then “Press Releases.” Non-GAAP Financial Measures This PowerPoint presentation contains financial information determined by methods other than in accordance with GAAP. The Company’s management uses core non-GAAP financial metrics (“Core”) in their analysis of the Company’s performance to identify core revenues and expenses in a period that directly drive operating net income in that period. These Core measures typically adjust GAAP performance measures to exclude the effects of the amortization of intangibles and include the tax benefits associated with revenue items that are tax-exempt, as well as adjust income available to common shareholders for certain significant activities or transactions that in management’s opinion can distort period-to-period comparisons of the Company’s performance. Reference is made to “Non-GAAP Financial Measures” and “Caution About Forward Looking Statements” in the earnings release which also apply to certain disclosures in this PowerPoint presentation. 2

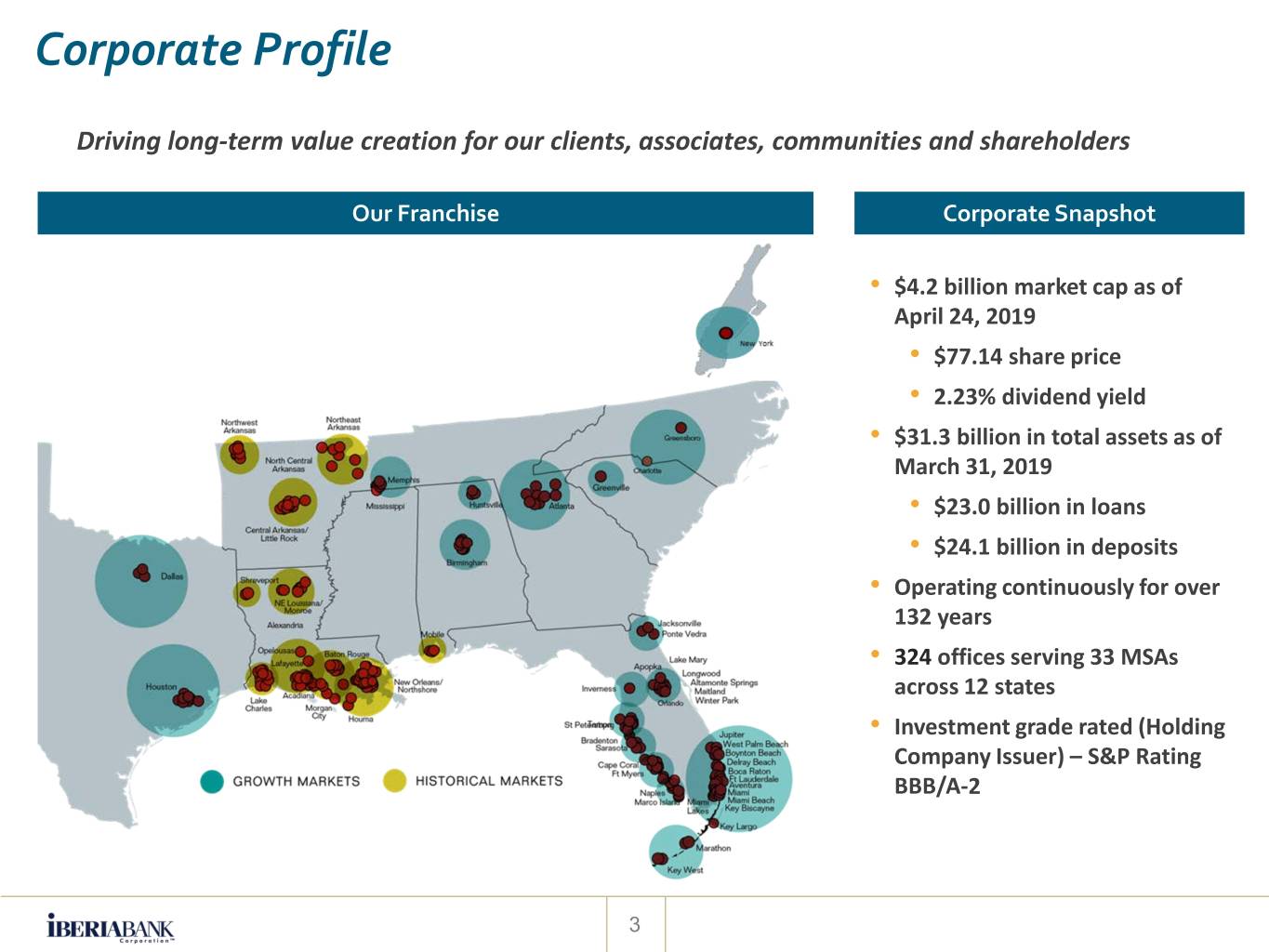

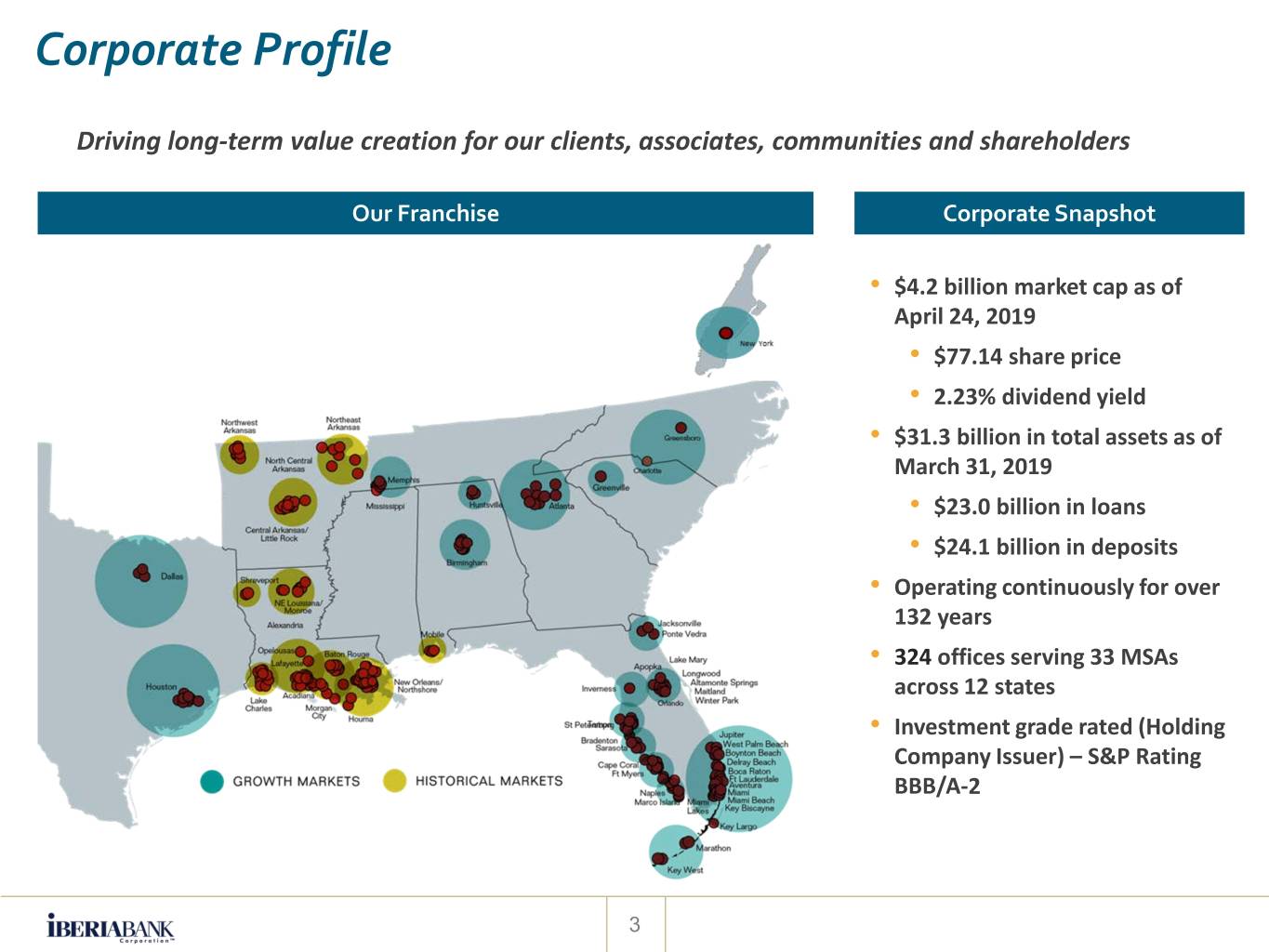

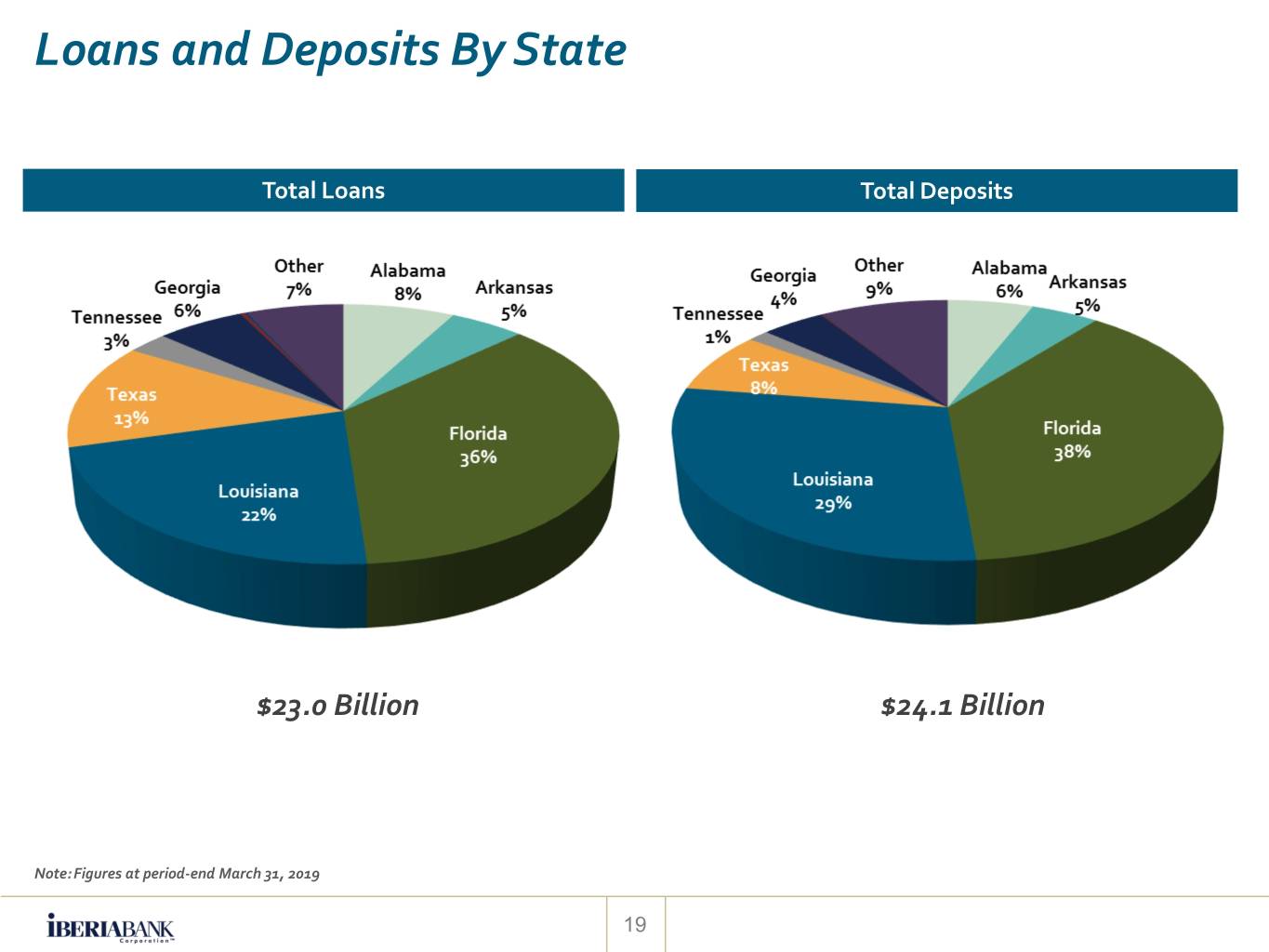

Corporate Profile Driving long-term value creation for our clients, associates, communities and shareholders Our Franchise Corporate Snapshot • $4.2 billion market cap as of April 24, 2019 • $77.14 share price • 2.23% dividend yield • $31.3 billion in total assets as of March 31, 2019 • $23.0 billion in loans • $24.1 billion in deposits • Operating continuously for over 132 years • 324 offices serving 33 MSAs across 12 states • Investment grade rated (Holding Company Issuer) – S&P Rating BBB/A-2 3

Corporate Profile Driving long-term value creation for our clients, associates, communities and shareholders Mission Statement Our Focus • Provide exceptional value-based client • Relationship-driven commercial and services private banking business • Market-centric, people-driven approach in Great place to work • attractive Southeastern markets • Growth that is consistent with high • Building long-term A-list client performance relationships through service and care • “Branch-lite” delivery model with focus on Shareholder-focused • operating efficiency • Strong sense of community • Diversification across asset classes, business lines and geographies 4

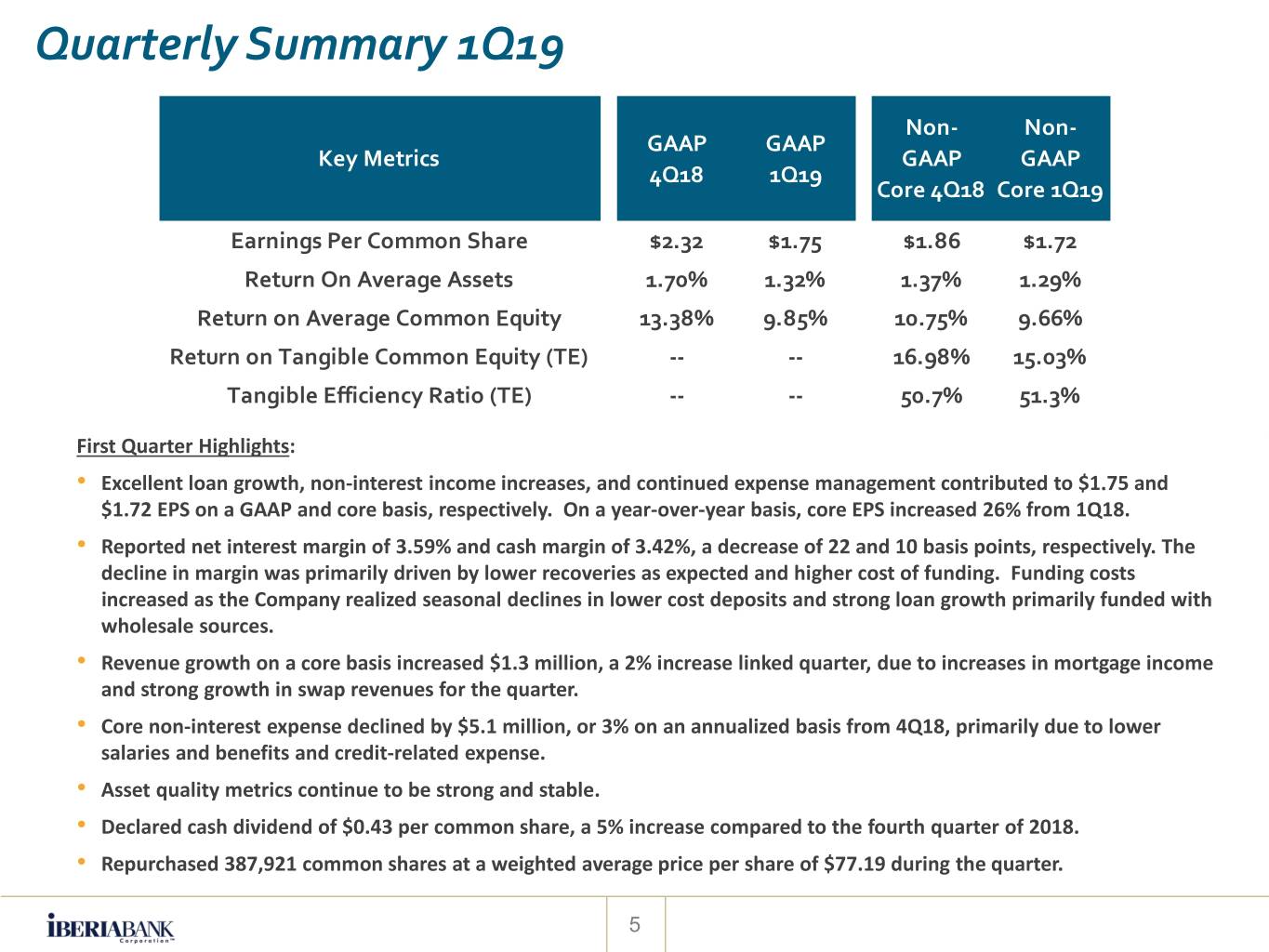

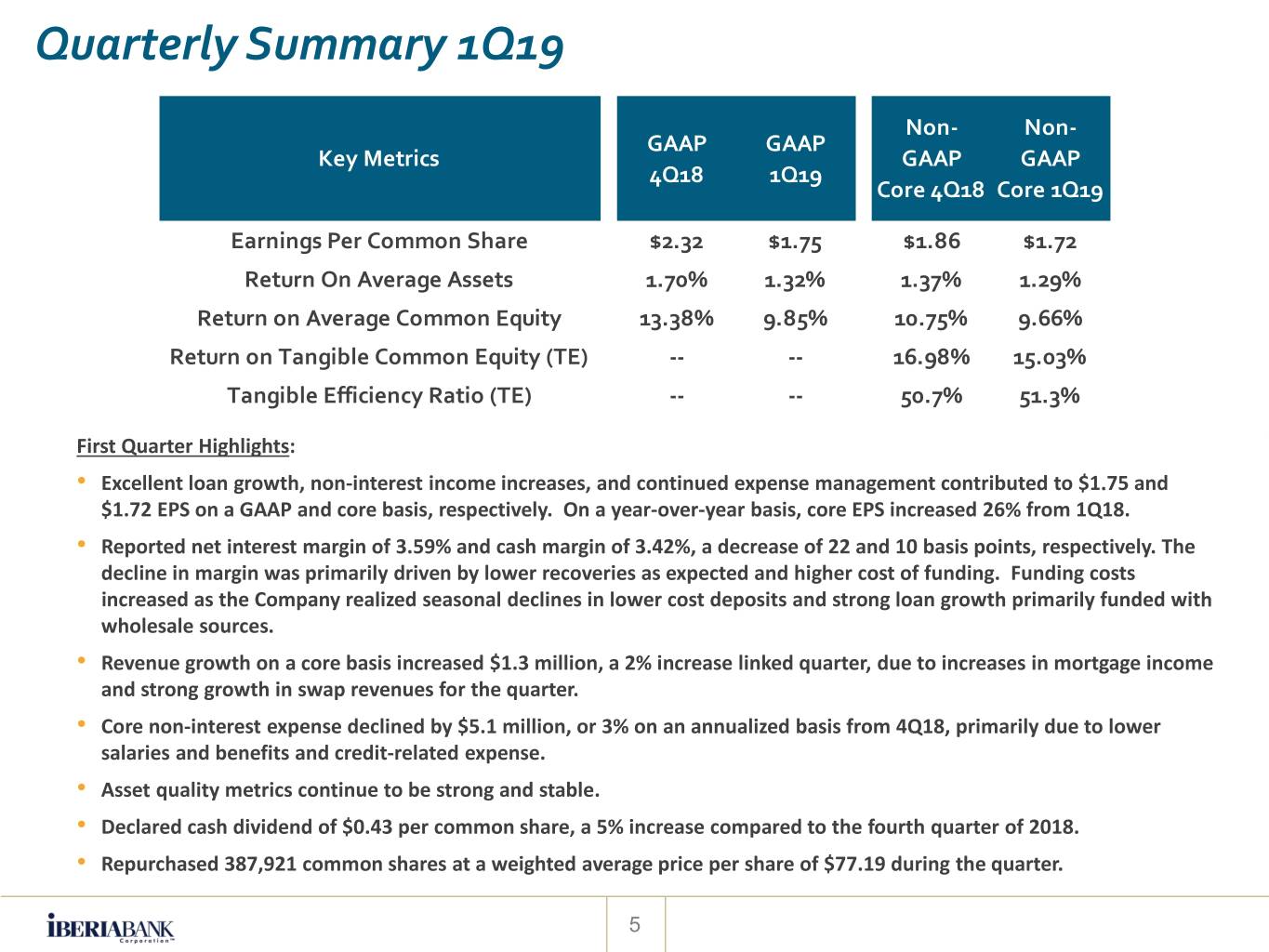

Quarterly Summary 1Q19 Non- Non- GAAP GAAP Key Metrics GAAP GAAP 4Q18 1Q19 Core 4Q18 Core 1Q19 Earnings Per Common Share $2.32 $1.75 $1.86 $1.72 Return On Average Assets 1.70% 1.32% 1.37% 1.29% Return on Average Common Equity 13.38% 9.85% 10.75% 9.66% Return on Tangible Common Equity (TE) -- -- 16.98% 15.03% Tangible Efficiency Ratio (TE) -- -- 50.7% 51.3% First Quarter Highlights: • Excellent loan growth, non-interest income increases, and continued expense management contributed to $1.75 and $1.72 EPS on a GAAP and core basis, respectively. On a year-over-year basis, core EPS increased 26% from 1Q18. • Reported net interest margin of 3.59% and cash margin of 3.42%, a decrease of 22 and 10 basis points, respectively. The decline in margin was primarily driven by lower recoveries as expected and higher cost of funding. Funding costs increased as the Company realized seasonal declines in lower cost deposits and strong loan growth primarily funded with wholesale sources. • Revenue growth on a core basis increased $1.3 million, a 2% increase linked quarter, due to increases in mortgage income and strong growth in swap revenues for the quarter. • Core non-interest expense declined by $5.1 million, or 3% on an annualized basis from 4Q18, primarily due to lower salaries and benefits and credit-related expense. • Asset quality metrics continue to be strong and stable. • Declared cash dividend of $0.43 per common share, a 5% increase compared to the fourth quarter of 2018. • Repurchased 387,921 common shares at a weighted average price per share of $77.19 during the quarter. 5

Preferred Stock Series D • On April 4, 2019, the Company issued and sold 4.0 million depositary shares, each representing 1/400th interest in a share of non-cumulative perpetual preferred stock. The Series D preferred stock has an initial coupon equal to 6.100% for a period of five years, and thereafter floats at a rate of LIBOR plus 385.9 basis points. The Company raised approximately $100 million in gross proceeds from the transaction. Proceeds from the transaction are currently expected to be used for repurchases of common stock. This re-stacking of capital is expected to provide a few incremental pennies of EPS and enhance the Company's ROTCE by approximately 50 basis points in 2020, based on IBKC's current stock price. The impact of this offering will be immaterial on 2019 earnings. 6

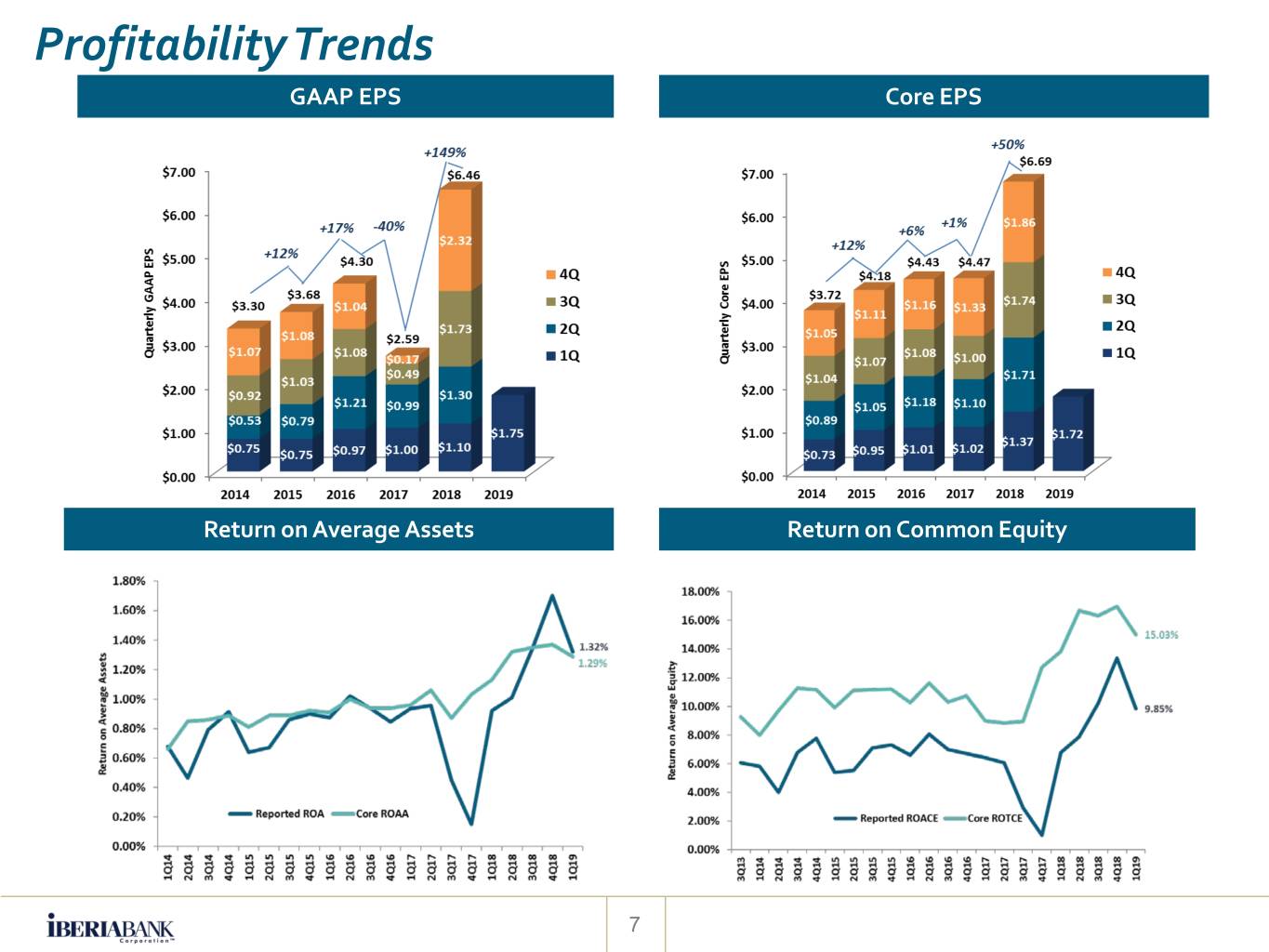

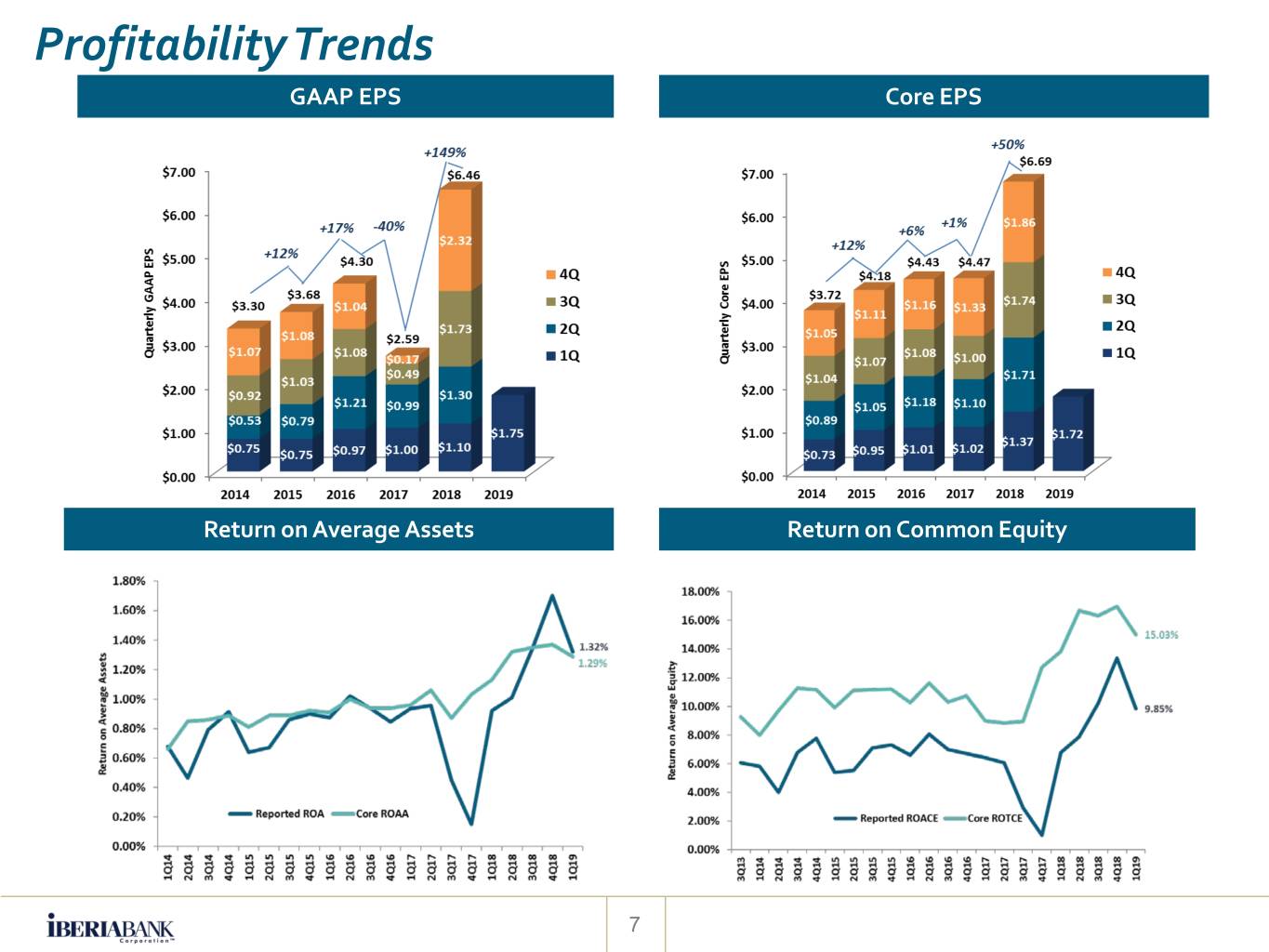

Profitability Trends GAAP EPS Core EPS Return on Average Assets Return on Common Equity 7

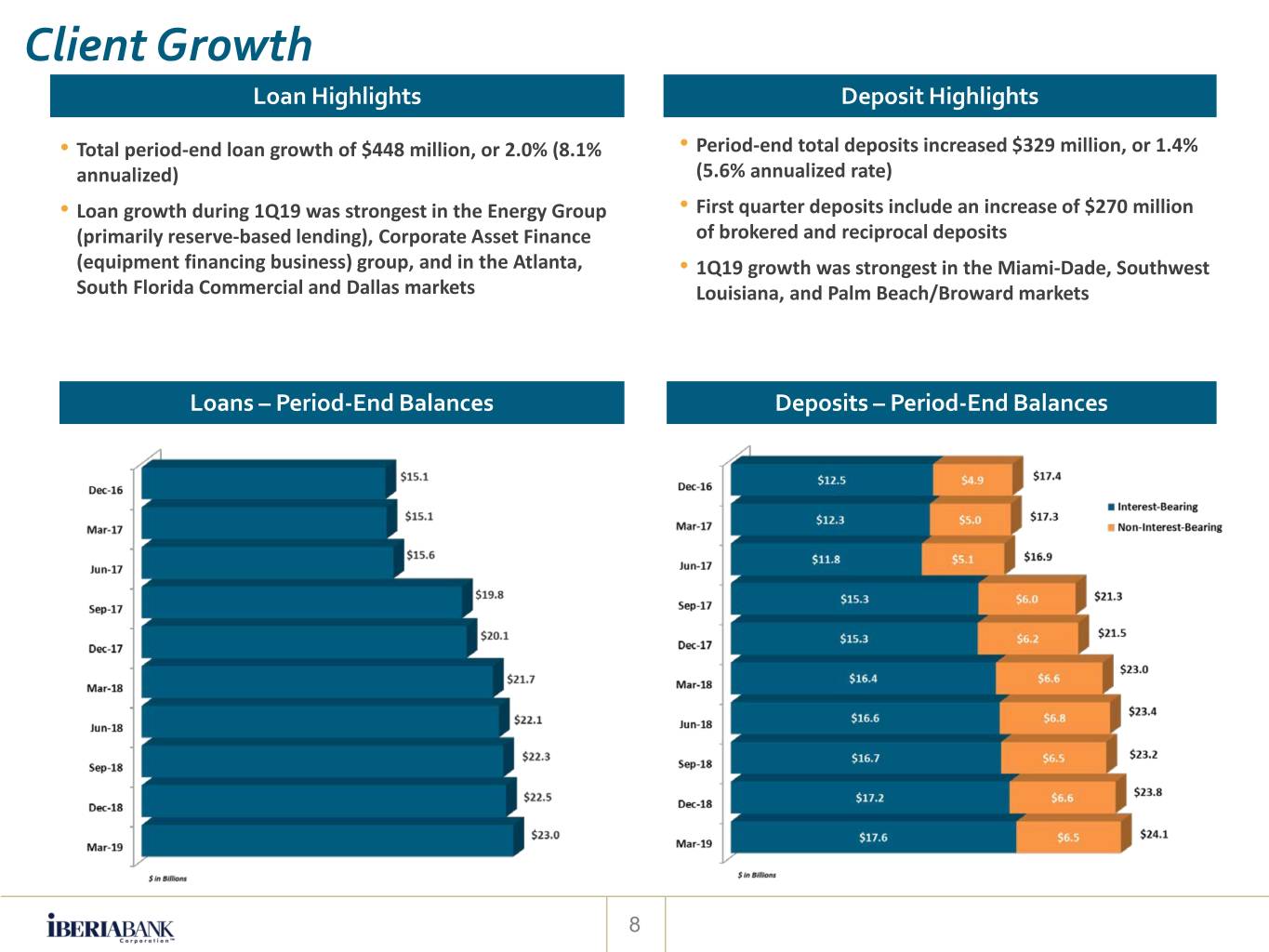

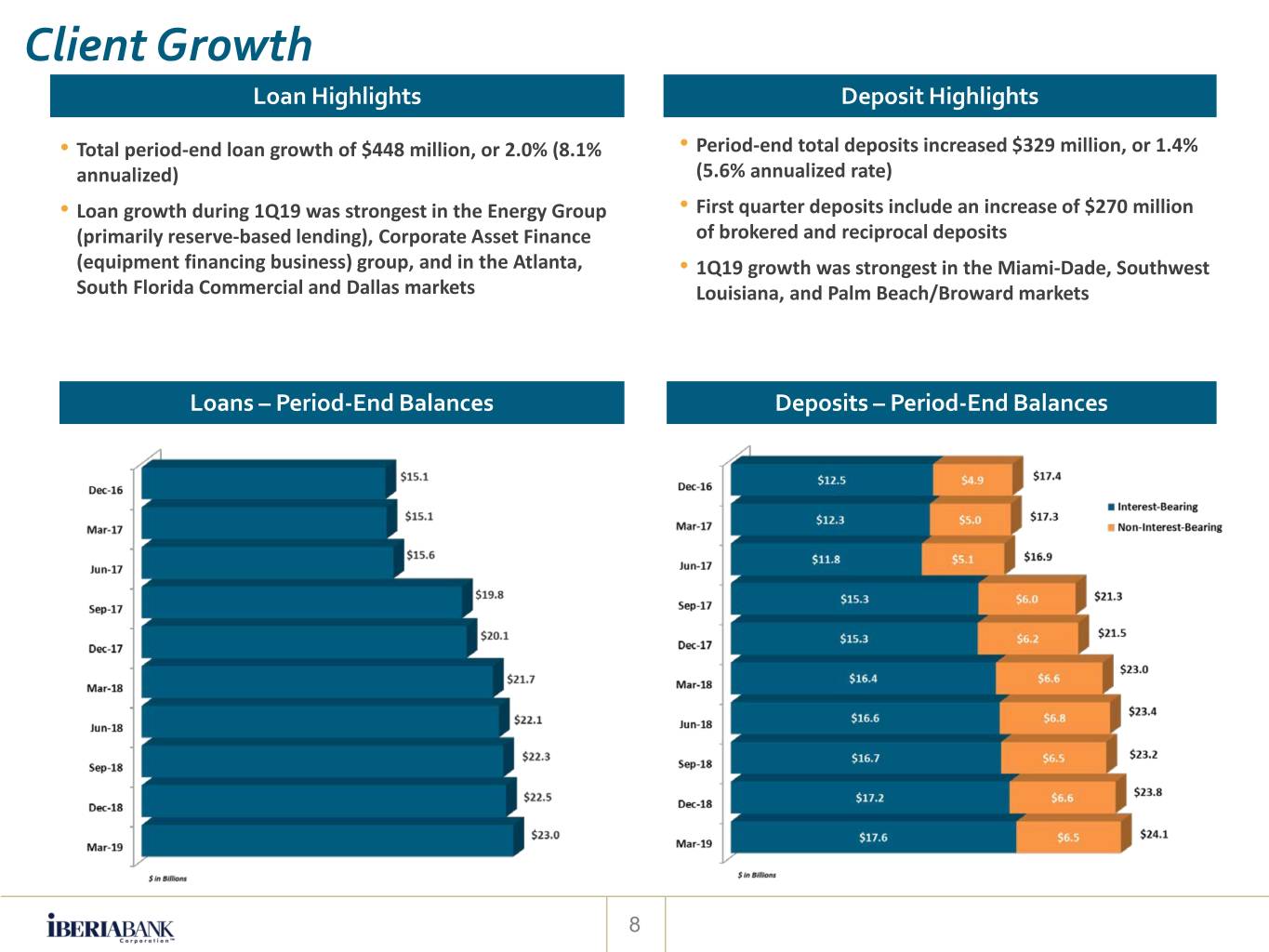

Client Growth Loan Highlights Deposit Highlights • Total period-end loan growth of $448 million, or 2.0% (8.1% • Period-end total deposits increased $329 million, or 1.4% annualized) (5.6% annualized rate) • Loan growth during 1Q19 was strongest in the Energy Group • First quarter deposits include an increase of $270 million (primarily reserve-based lending), Corporate Asset Finance of brokered and reciprocal deposits (equipment financing business) group, and in the Atlanta, • 1Q19 growth was strongest in the Miami-Dade, Southwest South Florida Commercial and Dallas markets Louisiana, and Palm Beach/Broward markets Loans – Period-End Balances Deposits – Period-End Balances 8

Net Interest Margin Changes For 1Q18 Net Interest Primary Reason Net Interest Income ($MM) For Change Margin (%) $265.0 4Q18 3.81% 8.7 Changes in Legacy Loan Portfolios 0.11% (5.2) Runoff of Acquired Loan Balances -0.09% Decrease in Non-Recurring Recovery (8.3) -0.12% Revenue (13.5) Changes in Acquired Loan Portfolios -0.21% 5.6 Improved Securities Portfolio Yield 0.08% (2.7) Increased Borrowings -0.05% Greater Deposit Rates From Repricing (9.4) -0.14% and Wholesale Funding (3.7) Change In Number of Business Days 0.00% 0.5 All Other Factors -0.01% $250.5 1Q19 3.59% • Net interest margin was impacted by repricing of variable rate loans, security portfolio yields, and deposit and funding costs in 1Q19 • Reduction in recovery income on acquired loans negatively impacting margin 12 basis points in 1Q19, partially offset by changes in legacy loans • Increasing funding costs reduced net interest margin by 14 basis points • Variable rate loans represent 61% of total portfolio, with over 86% repricing within the next 12 months 9

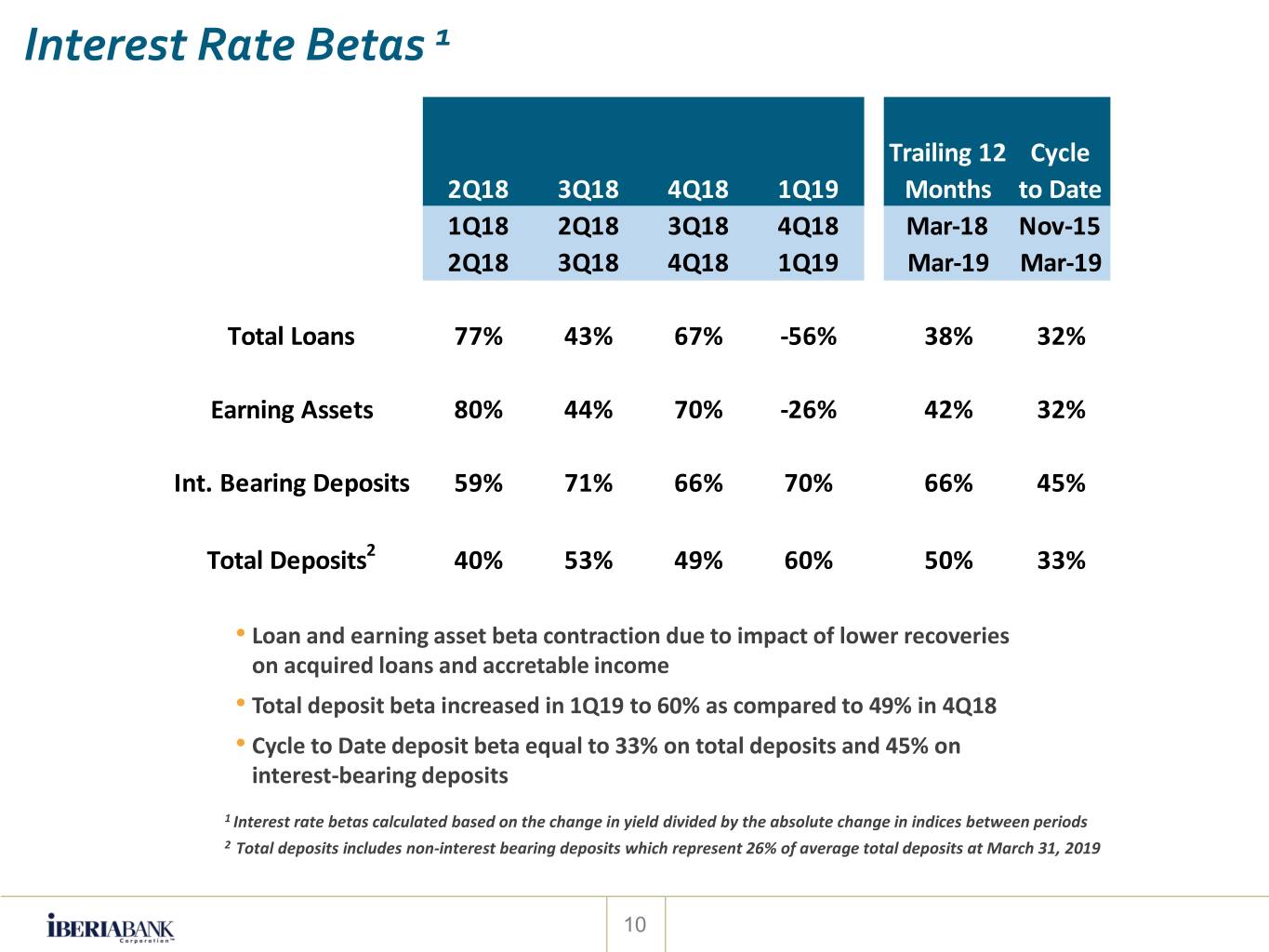

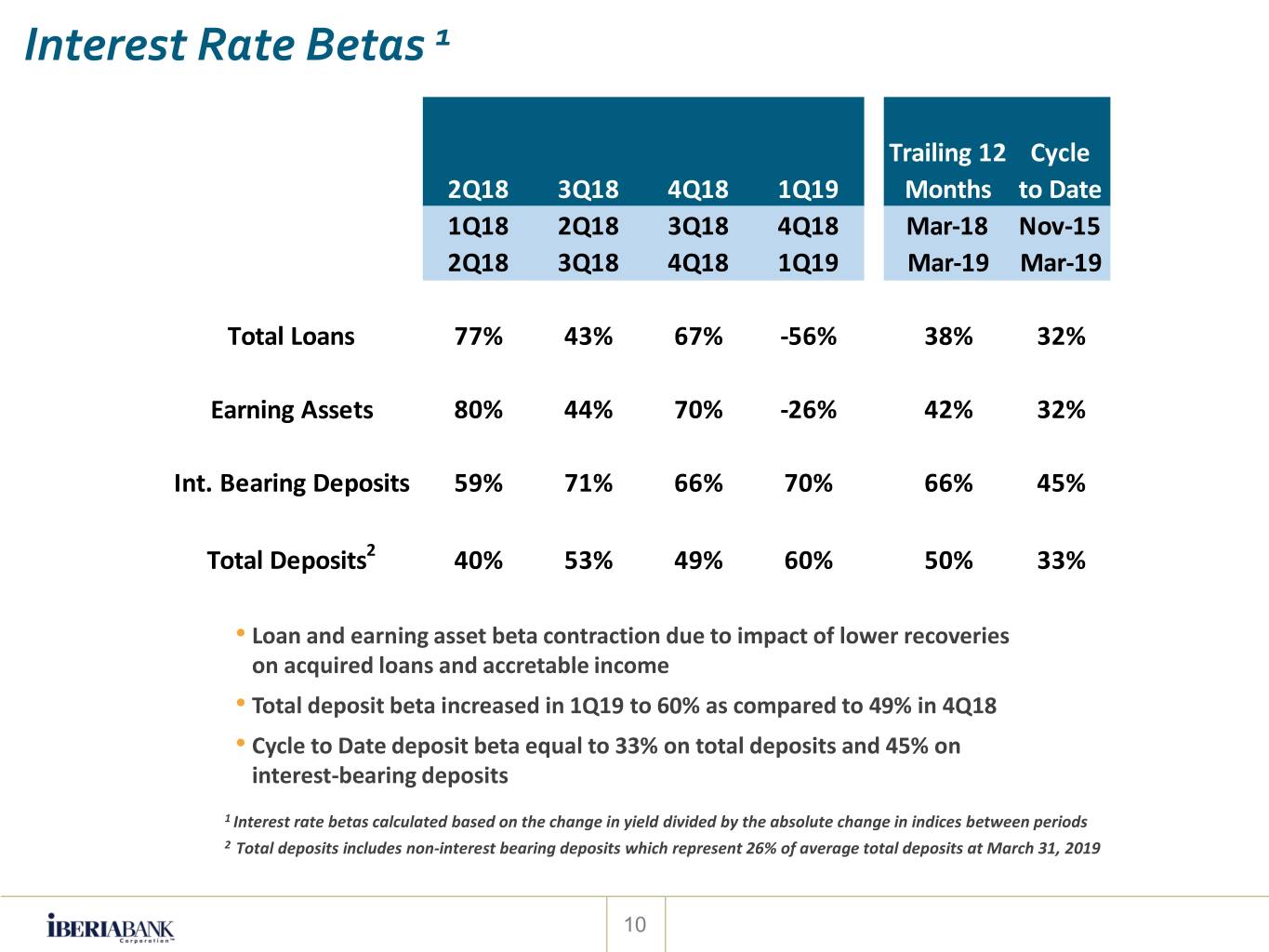

Interest Rate Betas 1 Trailing 12 Cycle 2Q18 3Q18 4Q18 1Q19 Months to Date 1Q18 2Q18 3Q18 4Q18 Mar-18 Nov-15 2Q18 3Q18 4Q18 1Q19 Mar-19 Mar-19 Total Loans 77% 43% 67% -56% 38% 32% Earning Assets 80% 44% 70% -26% 42% 32% Int. Bearing Deposits 59% 71% 66% 70% 66% 45% Total Deposits2 40% 53% 49% 60% 50% 33% • Loan and earning asset beta contraction due to impact of lower recoveries on acquired loans and accretable income • Total deposit beta increased in 1Q19 to 60% as compared to 49% in 4Q18 • Cycle to Date deposit beta equal to 33% on total deposits and 45% on interest-bearing deposits 1 Interest rate betas calculated based on the change in yield divided by the absolute change in indices between periods 2 Total deposits includes non-interest bearing deposits which represent 26% of average total deposits at March 31, 2019 10

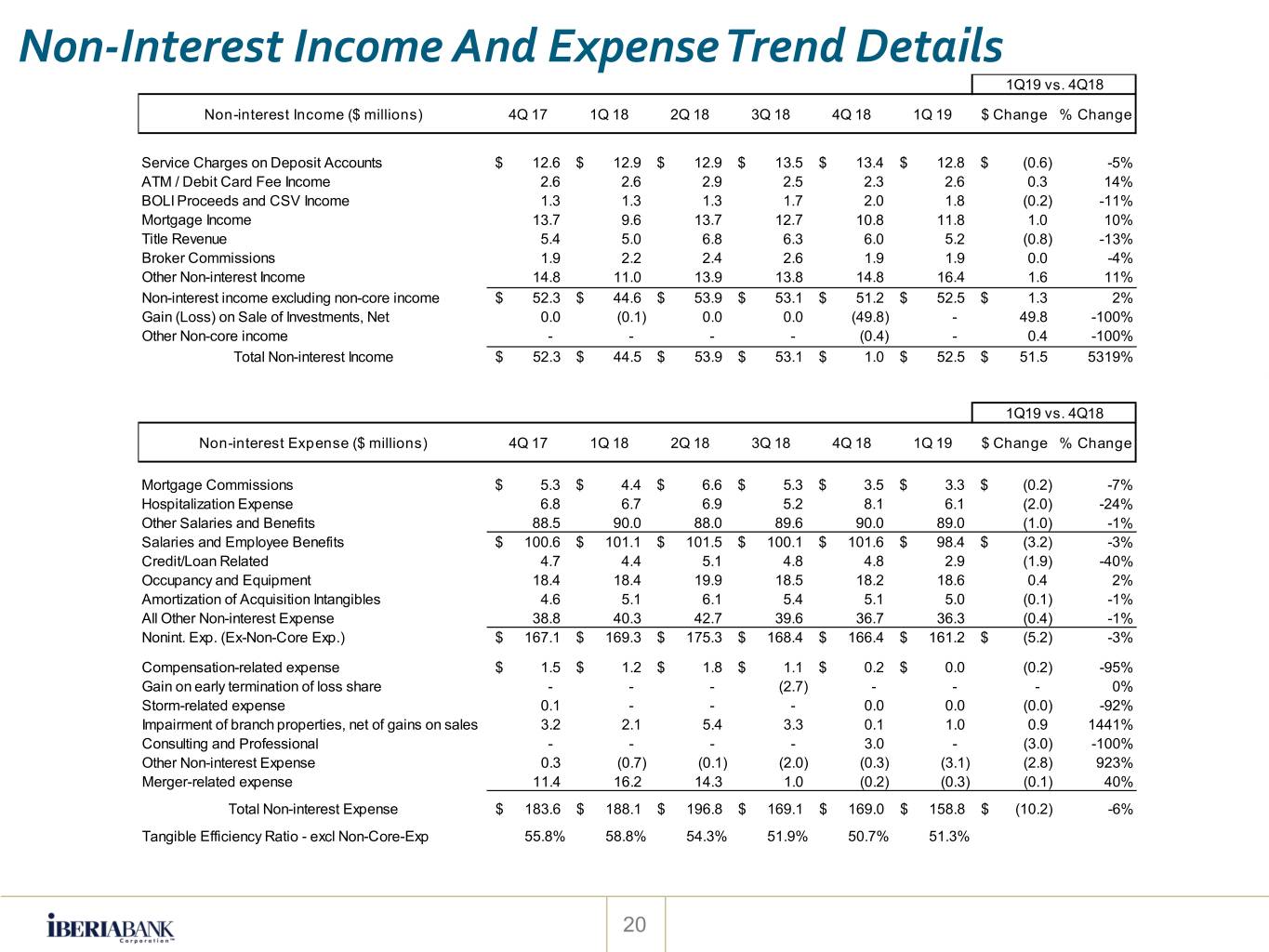

Revenues Net Interest Income and Margins Components of Core Non-Interest Income • GAAP non-interest income increased by $51.5 million primarily as a result of the 4Q18 $49.8 • Reported net interest margin decreased 22 basis million loss on sales of securities as the points and cash margin decreased 10 basis points Company restructured its investment portfolio • Margin decrease a result of increases in loan • Core non-interest income increased by $1.3 originations, slower prepayments and fewer million, or 2%, mainly as result of increases in recoveries leading to non-core wholesale funding mortgage income and customer swap increases commission income Dollars in millions 11

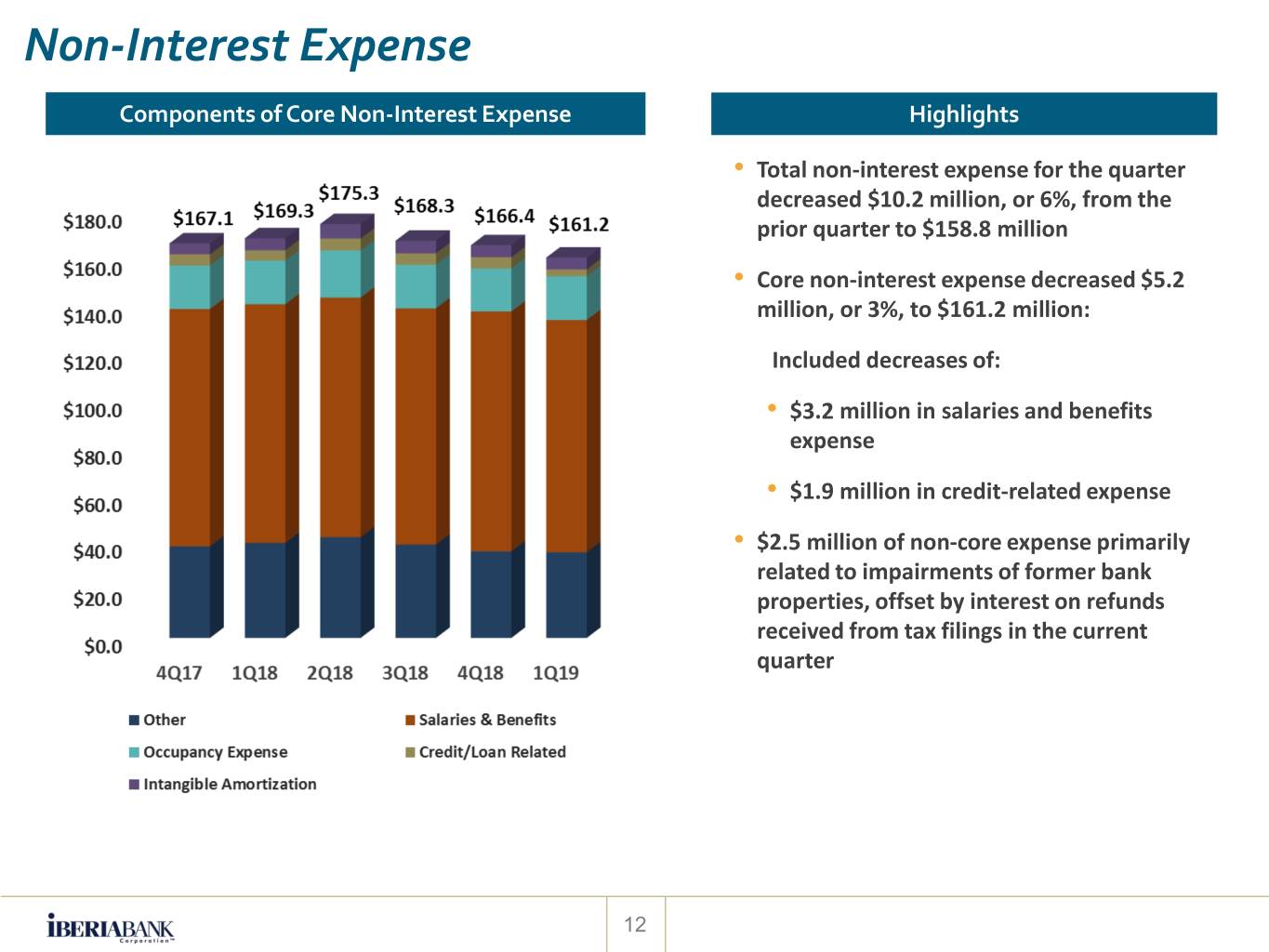

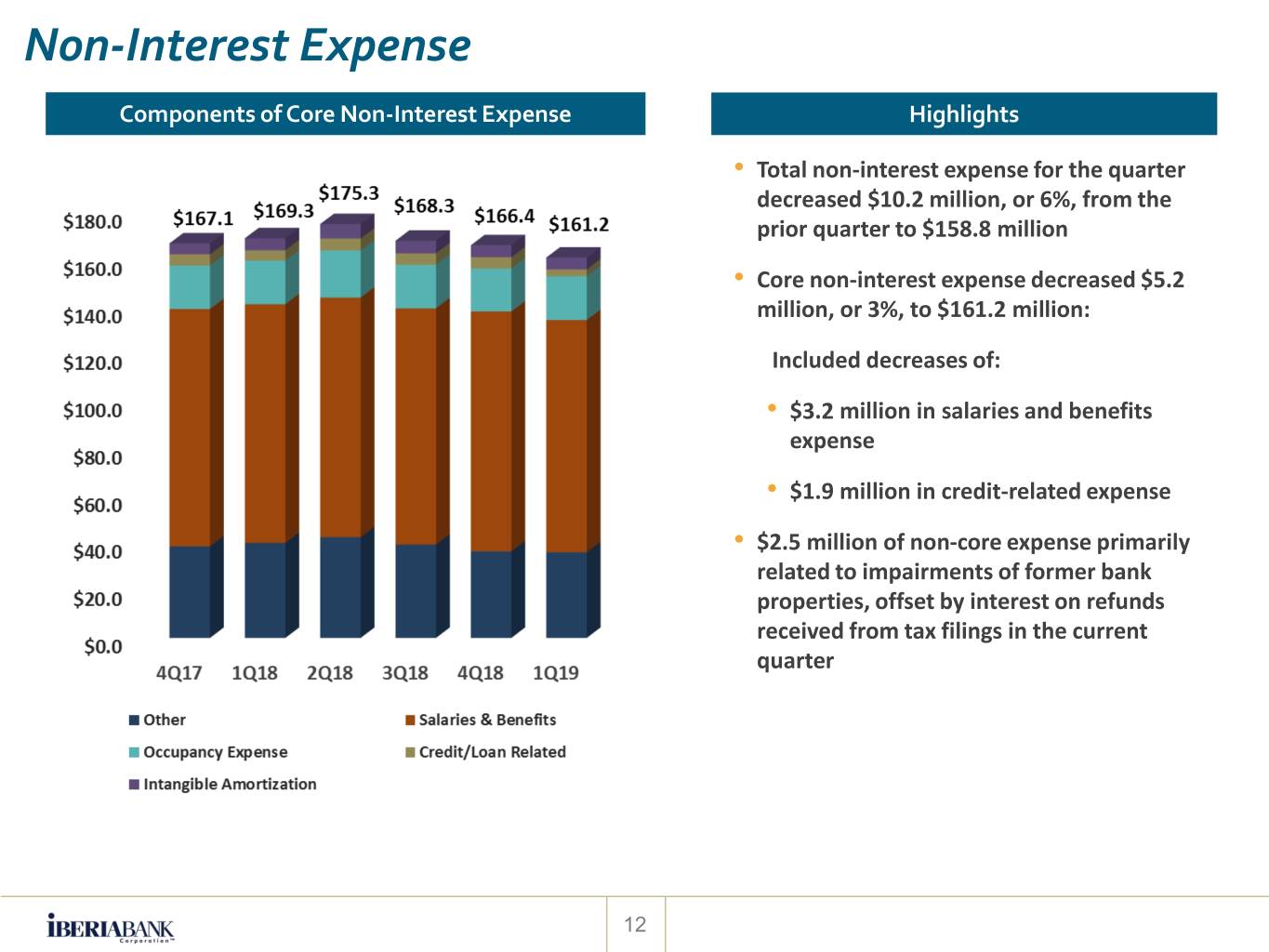

Non-Interest Expense Components of Core Non-Interest Expense Highlights • Total non-interest expense for the quarter decreased $10.2 million, or 6%, from the prior quarter to $158.8 million • Core non-interest expense decreased $5.2 million, or 3%, to $161.2 million: Included decreases of: • $3.2 million in salaries and benefits expense • $1.9 million in credit-related expense • $2.5 million of non-core expense primarily related to impairments of former bank properties, offset by interest on refunds received from tax filings in the current quarter 12

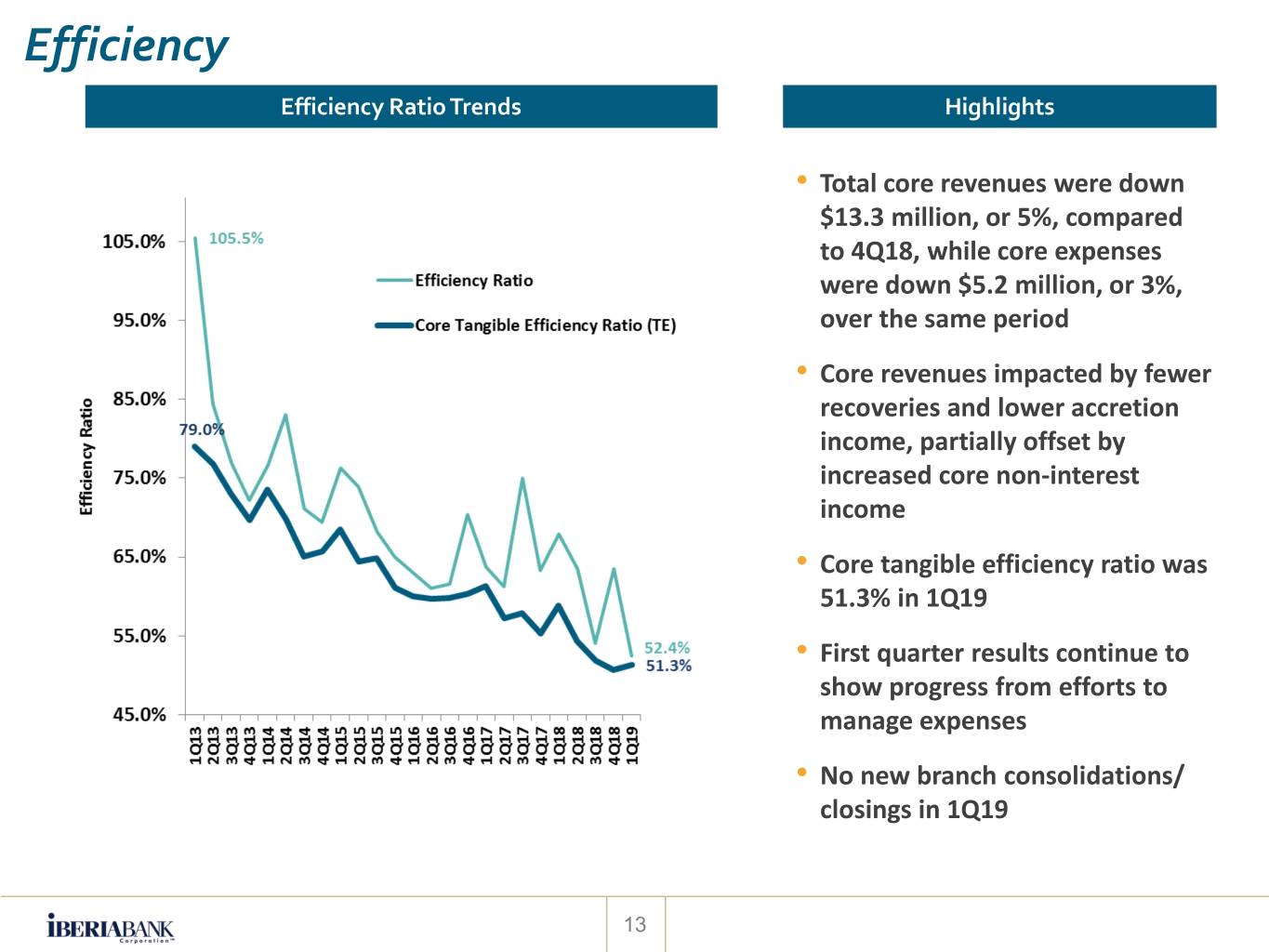

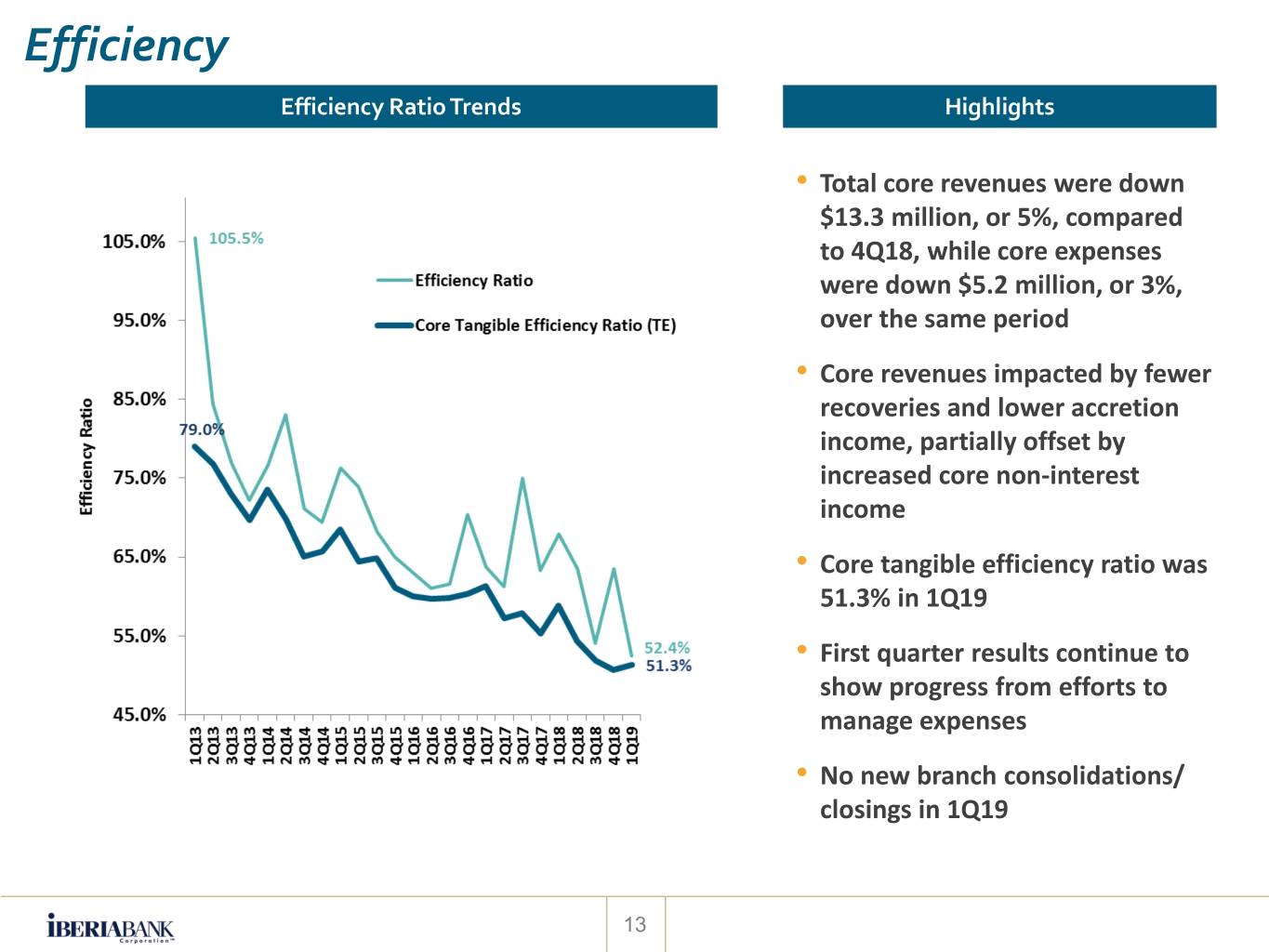

Efficiency Efficiency Ratio Trends Highlights • Total core revenues were down $13.3 million, or 5%, compared to 4Q18, while core expenses were down $5.2 million, or 3%, over the same period • Core revenues impacted by fewer recoveries and lower accretion income, partially offset by increased core non-interest income • Core tangible efficiency ratio was 51.3% in 1Q19 • First quarter results continue to show progress from efforts to manage expenses • No new branch consolidations/ closings in 1Q19 13

Asset Quality Highlights Diversified Loan Portfolio • The Company remains well- positioned with strong and stable asset quality metrics and diversified loan growth • Classified Assets to Total Assets of 1.01% in 1Q19 compared to 0.98% in 4Q18 and 1.49% in 1Q18 • Non-performing assets increased to Non-Performing Assets $183 million at 1Q19. First quarter 2019 NPAs/Assets equal to 0.58% compared to 0.64% in the first quarter of 2018 14

Asset Quality Highlights Provision & Net Charge-Offs NCOs / Avg Loans 2016 0.23% • Net charge-offs remain at historically 2017 0.33% low levels 2018 0.15% • Net charge-offs decreased $0.4 million on a linked quarter basis, to $7.3 million at 1Q19 • Annualized QTD net charge-offs equate to 0.13% of average loans at 1Q19 Allowance for Loan Losses • Provision expense of $13.8 million covered net charge-offs by 188% in 1Q19 15

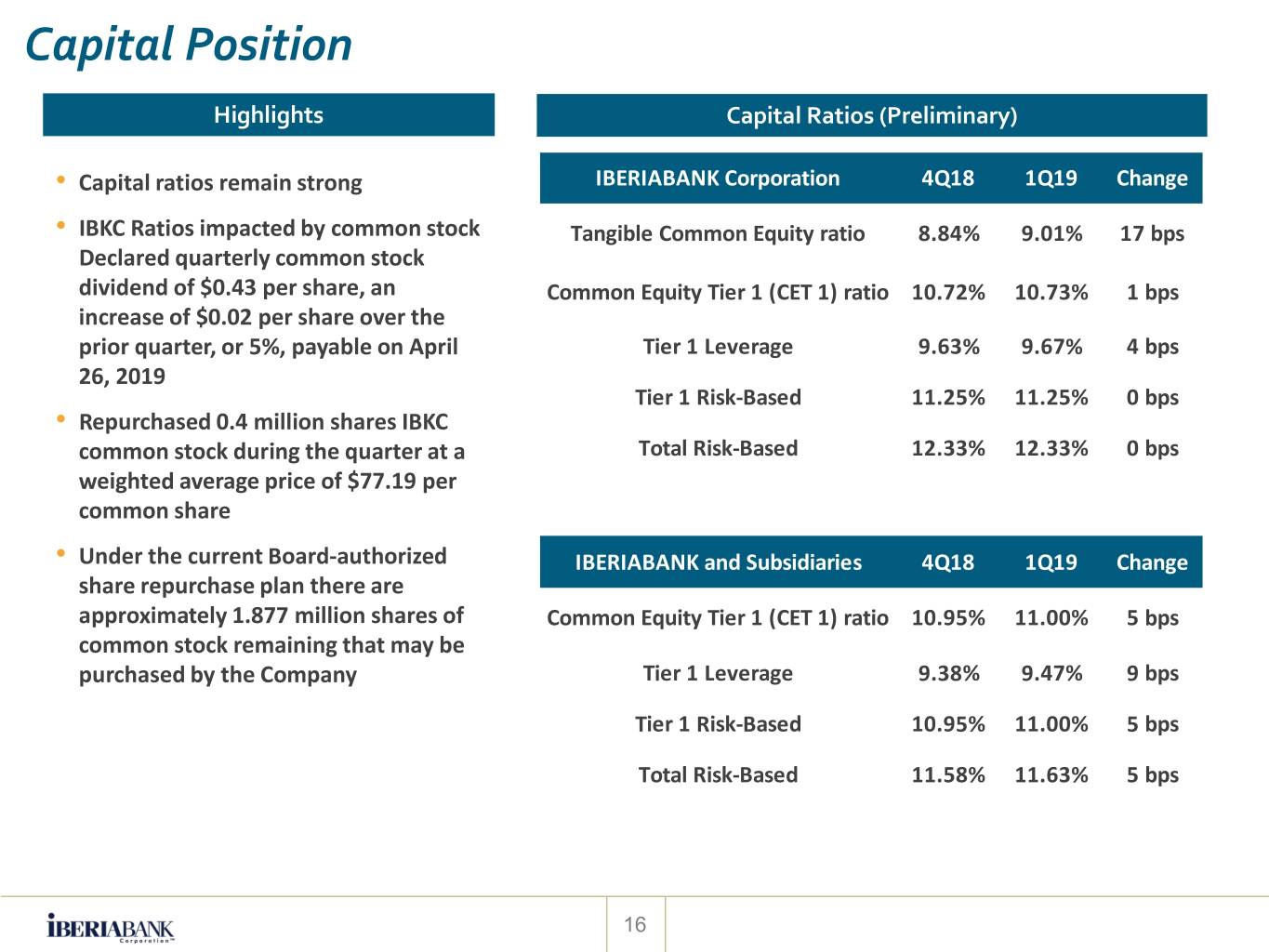

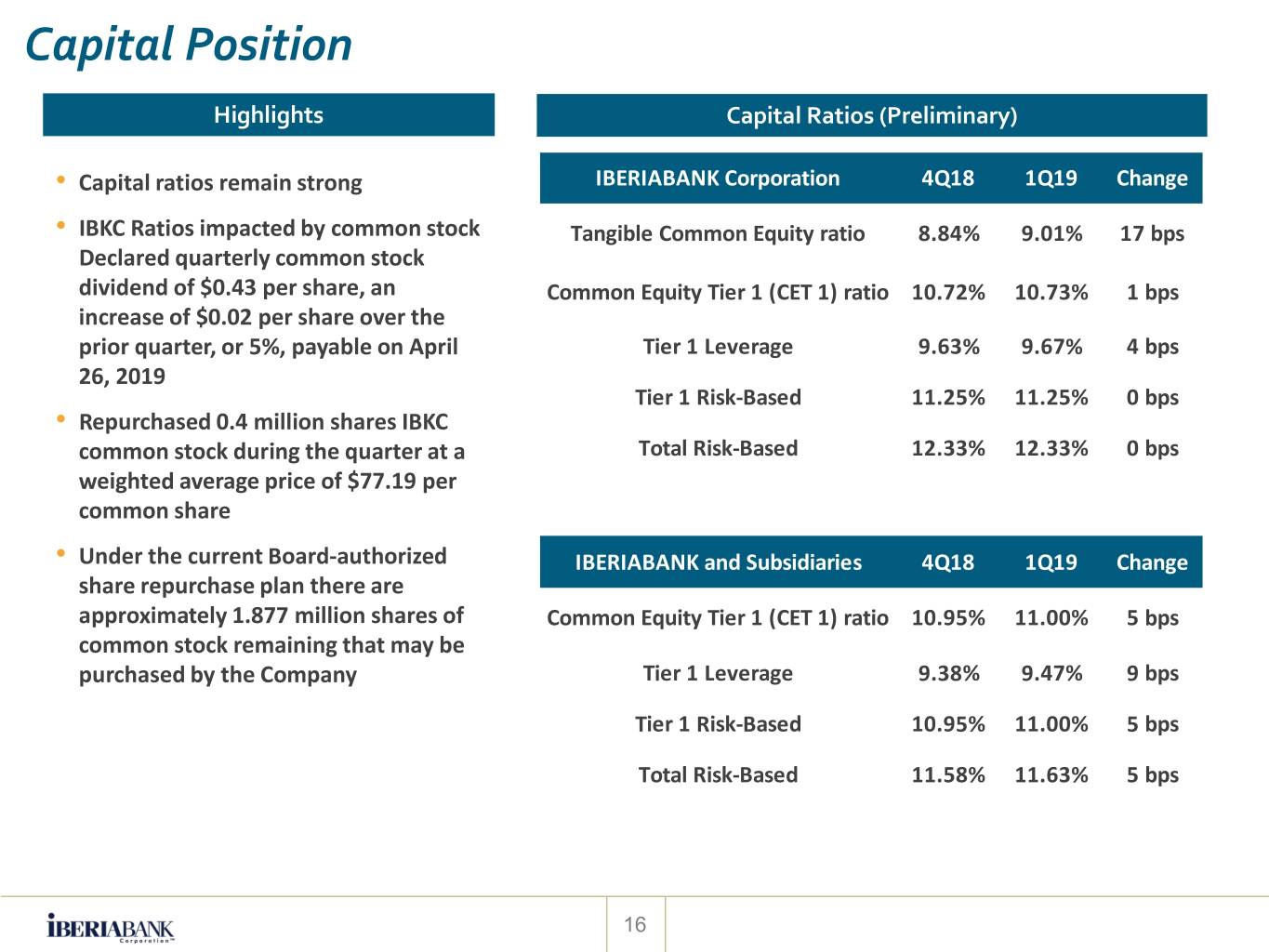

Capital Position Highlights Capital Ratios (Preliminary) • Capital ratios remain strong IBERIABANK Corporation 4Q18 1Q19 Change • IBKC Ratios impacted by common stock Tangible Common Equity ratio 8.84% 9.01% 17 bps Declared quarterly common stock dividend of $0.43 per share, an Common Equity Tier 1 (CET 1) ratio 10.72% 10.73% 1 bps increase of $0.02 per share over the prior quarter, or 5%, payable on April Tier 1 Leverage 9.63% 9.67% 4 bps 26, 2019 Tier 1 Risk-Based 11.25% 11.25% 0 bps • Repurchased 0.4 million shares IBKC common stock during the quarter at a Total Risk-Based 12.33% 12.33% 0 bps weighted average price of $77.19 per common share • Under the current Board-authorized IBERIABANK and Subsidiaries 4Q18 1Q19 Change share repurchase plan there are approximately 1.877 million shares of Common Equity Tier 1 (CET 1) ratio 10.95% 11.00% 5 bps common stock remaining that may be purchased by the Company Tier 1 Leverage 9.38% 9.47% 9 bps Tier 1 Risk-Based 10.95% 11.00% 5 bps Total Risk-Based 11.58% 11.63% 5 bps 16

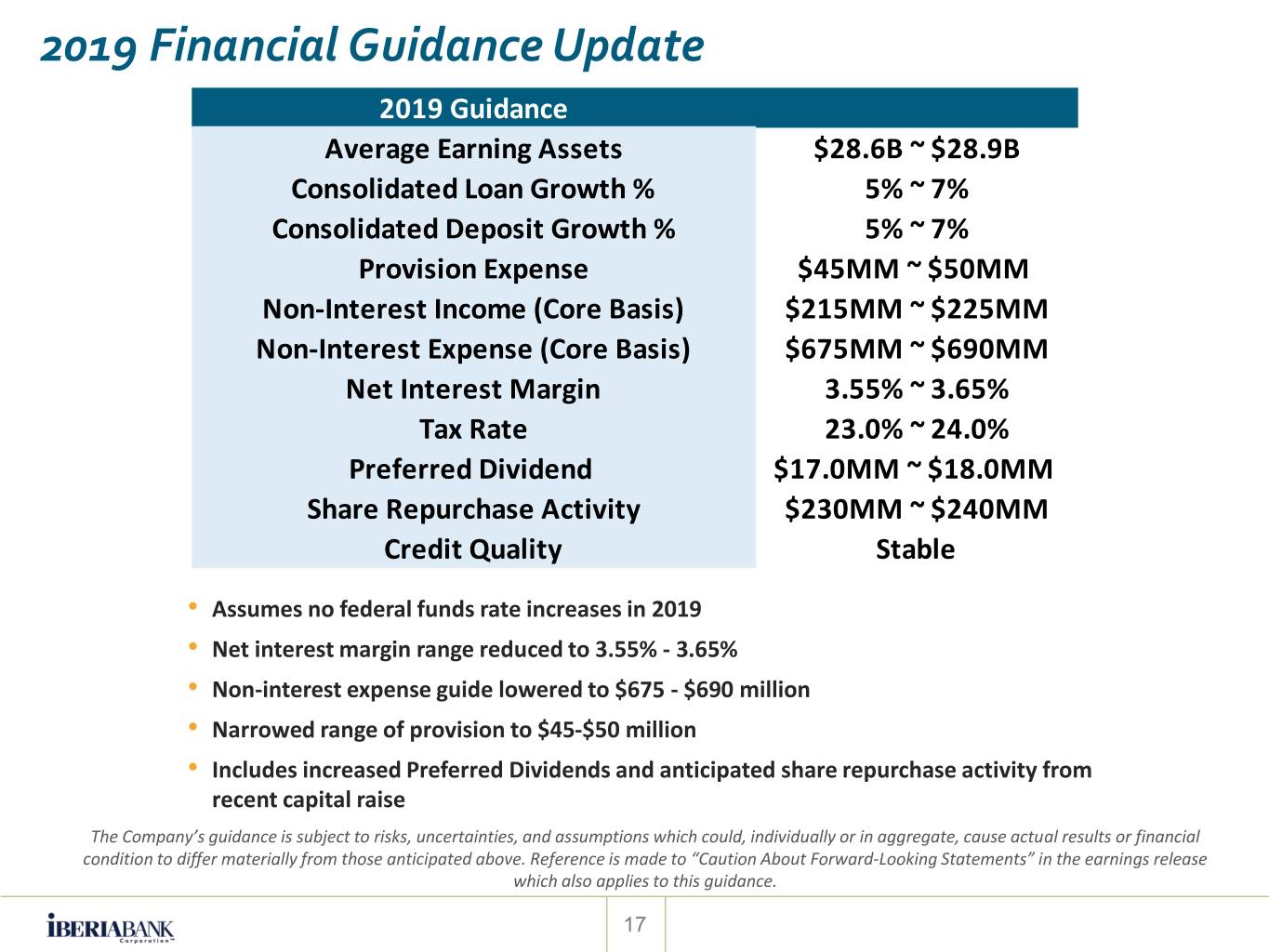

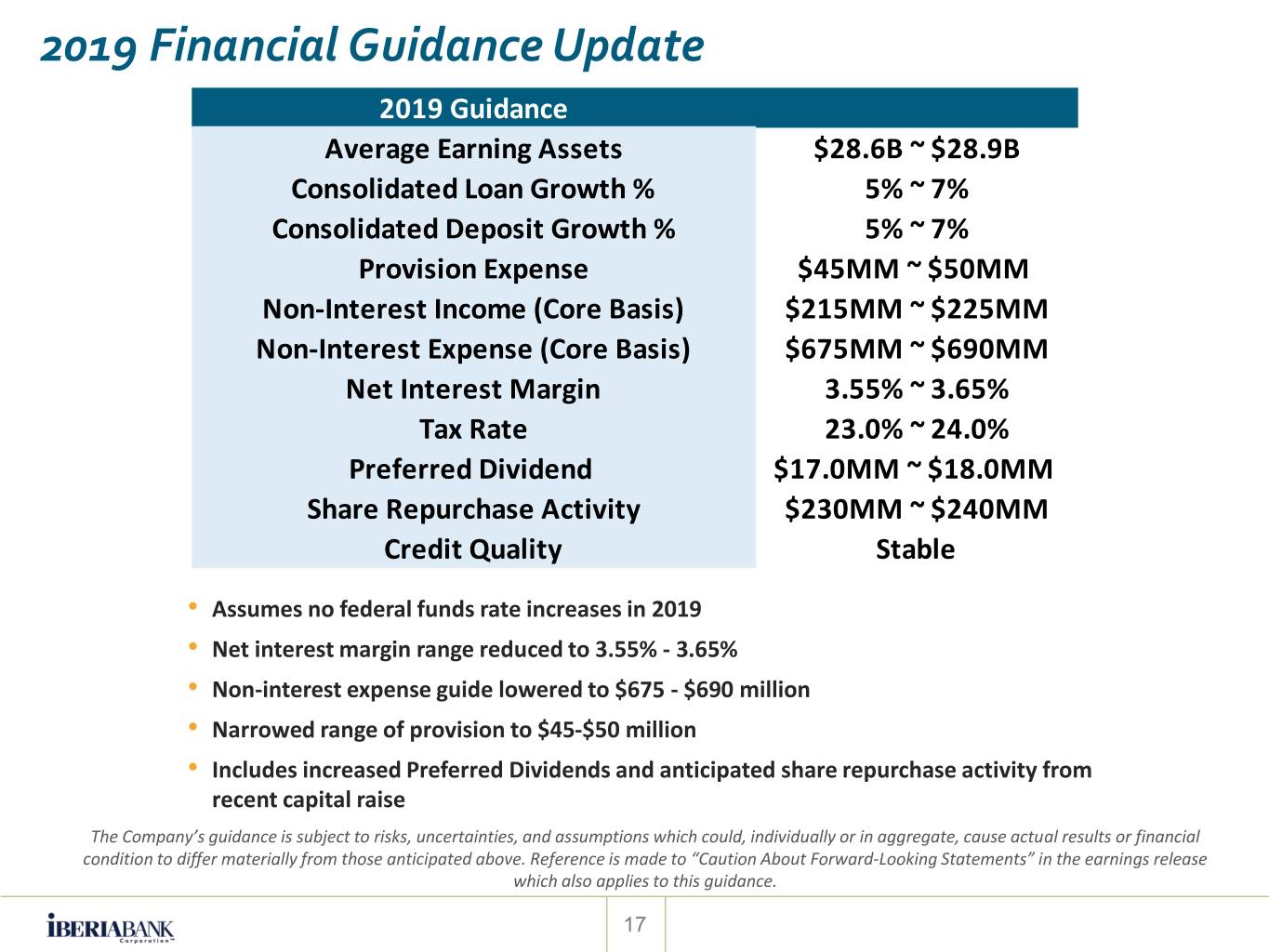

2019 Financial Guidance Update 2019 Guidance Average Earning Assets $28.6B ~ $28.9B Consolidated Loan Growth % 5% ~ 7% Consolidated Deposit Growth % 5% ~ 7% Provision Expense $45MM ~ $50MM Non-Interest Income (Core Basis) $215MM ~ $225MM Non-Interest Expense (Core Basis) $675MM ~ $690MM Net Interest Margin 3.55% ~ 3.65% Tax Rate 23.0% ~ 24.0% Preferred Dividend $17.0MM ~ $18.0MM Share Repurchase Activity $230MM ~ $240MM Credit Quality Stable • Assumes no federal funds rate increases in 2019 • Net interest margin range reduced to 3.55% - 3.65% • Non-interest expense guide lowered to $675 - $690 million • Narrowed range of provision to $45-$50 million • Includes increased Preferred Dividends and anticipated share repurchase activity from recent capital raise The Company’s guidance is subject to risks, uncertainties, and assumptions which could, individually or in aggregate, cause actual results or financial condition to differ materially from those anticipated above. Reference is made to “Caution About Forward-Looking Statements” in the earnings release which also applies to this guidance. 17

APPENDIX 18

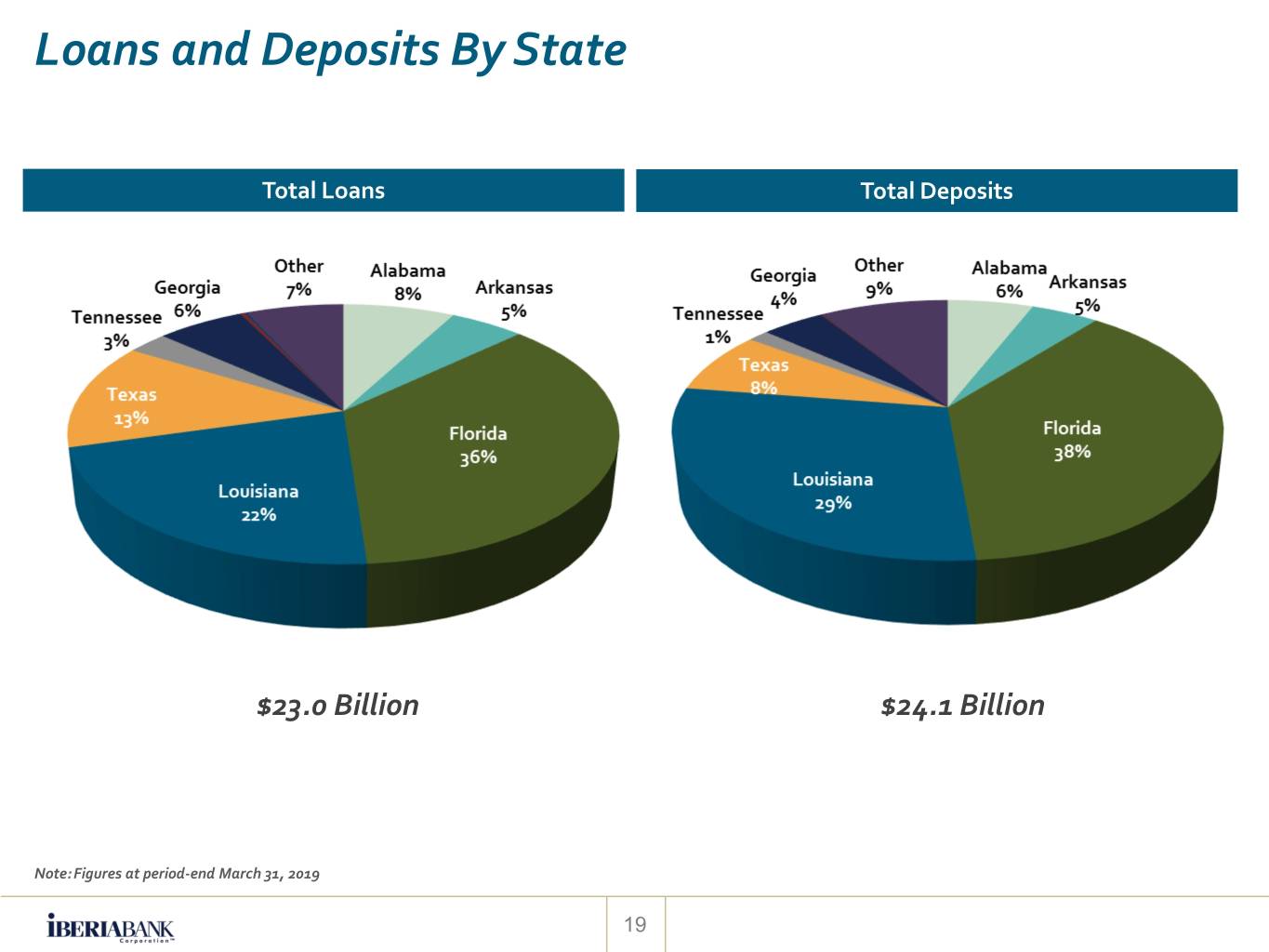

Loans and Deposits By State Total Loans Total Deposits $23.0 Billion $24.1 Billion Note:Figures at period-end March 31, 2019 19

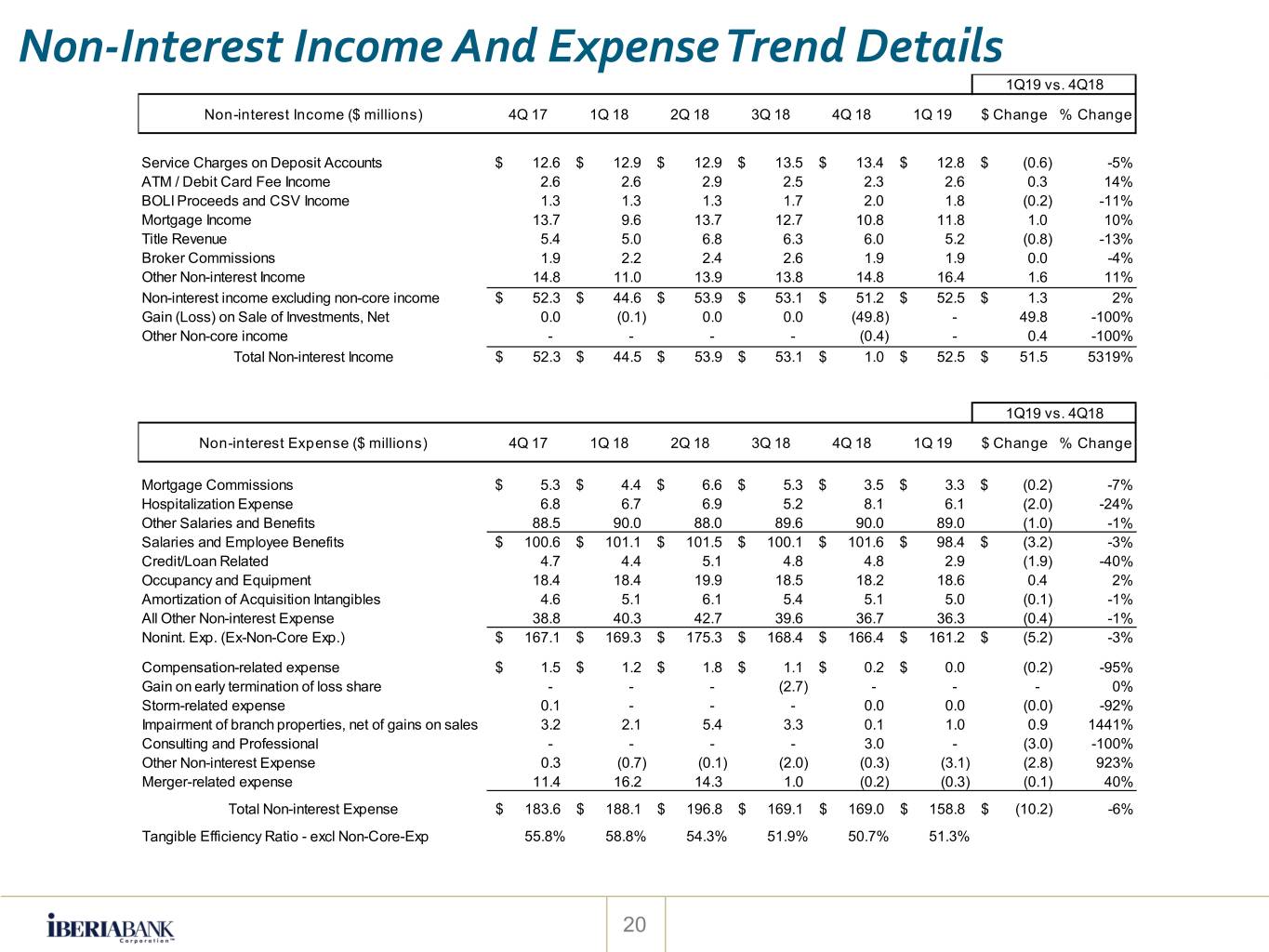

Non-Interest Income And Expense Trend Details 1Q19 vs. 4Q18 Non-interest Income ($ millions) 4Q 17 1Q 18 2Q 18 3Q 18 4Q 18 1Q 19 $ Change % Change Service Charges on Deposit Accounts $ 12.6 $ 12.9 $ 12.9 $ 13.5 $ 13.4 $ 12.8 $ (0.6) -5% ATM / Debit Card Fee Income 2.6 2.6 2.9 2.5 2.3 2.6 0.3 14% BOLI Proceeds and CSV Income 1.3 1.3 1.3 1.7 2.0 1.8 (0.2) -11% Mortgage Income 13.7 9.6 13.7 12.7 10.8 11.8 1.0 10% Title Revenue 5.4 5.0 6.8 6.3 6.0 5.2 (0.8) -13% Broker Commissions 1.9 2.2 2.4 2.6 1.9 1.9 0.0 -4% Other Non-interest Income 14.8 11.0 13.9 13.8 14.8 16.4 1.6 11% Non-interest income excluding non-core income $ 52.3 $ 44.6 $ 53.9 $ 53.1 $ 51.2 $ 52.5 $ 1.3 2% Gain (Loss) on Sale of Investments, Net 0.0 (0.1) 0.0 0.0 (49.8) - 49.8 -100% Other Non-core income - - - - (0.4) - 0.4 -100% Total Non-interest Income $ 52.3 $ 44.5 $ 53.9 $ 53.1 $ 1.0 $ 52.5 $ 51.5 5319% 1Q19 vs. 4Q18 Non-interest Expense ($ millions) 4Q 17 1Q 18 2Q 18 3Q 18 4Q 18 1Q 19 $ Change % Change Mortgage Commissions $ 5.3 $ 4.4 $ 6.6 $ 5.3 $ 3.5 $ 3.3 $ (0.2) -7% Hospitalization Expense 6.8 6.7 6.9 5.2 8.1 6.1 (2.0) -24% Other Salaries and Benefits 88.5 90.0 88.0 89.6 90.0 89.0 (1.0) -1% Salaries and Employee Benefits $ 100.6 $ 101.1 $ 101.5 $ 100.1 $ 101.6 $ 98.4 $ (3.2) -3% Credit/Loan Related 4.7 4.4 5.1 4.8 4.8 2.9 (1.9) -40% Occupancy and Equipment 18.4 18.4 19.9 18.5 18.2 18.6 0.4 2% Amortization of Acquisition Intangibles 4.6 5.1 6.1 5.4 5.1 5.0 (0.1) -1% All Other Non-interest Expense 38.8 40.3 42.7 39.6 36.7 36.3 (0.4) -1% Nonint. Exp. (Ex-Non-Core Exp.) $ 167.1 $ 169.3 $ 175.3 $ 168.4 $ 166.4 $ 161.2 $ (5.2) -3% Compensation-related expense $ 1.5 $ 1.2 $ 1.8 $ 1.1 $ 0.2 $ 0.0 (0.2) -95% Gain on early termination of loss share - - - (2.7) - - - 0% Storm-related expense 0.1 - - - 0.0 0.0 (0.0) -92% Impairment of branch properties, net of gains on sales 3.2 2.1 5.4 3.3 0.1 1.0 0.9 1441% Consulting and Professional - - - - 3.0 - (3.0) -100% Other Non-interest Expense 0.3 (0.7) (0.1) (2.0) (0.3) (3.1) (2.8) 923% Merger-related expense 11.4 16.2 14.3 1.0 (0.2) (0.3) (0.1) 40% Total Non-interest Expense $ 183.6 $ 188.1 $ 196.8 $ 169.1 $ 169.0 $ 158.8 $ (10.2) -6% Tangible Efficiency Ratio - excl Non-Core-Exp 55.8% 58.8% 54.3% 51.9% 50.7% 51.3% 20

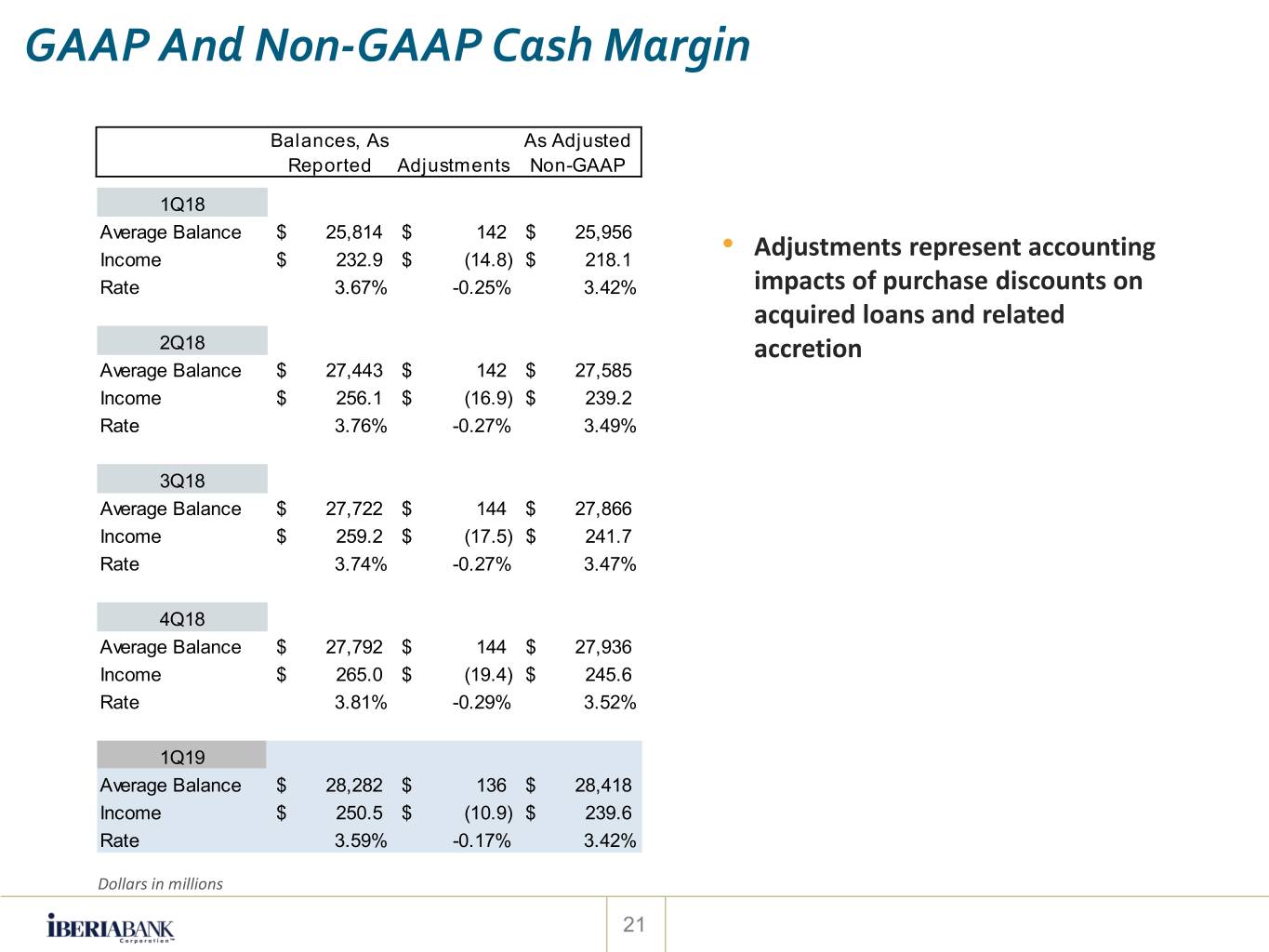

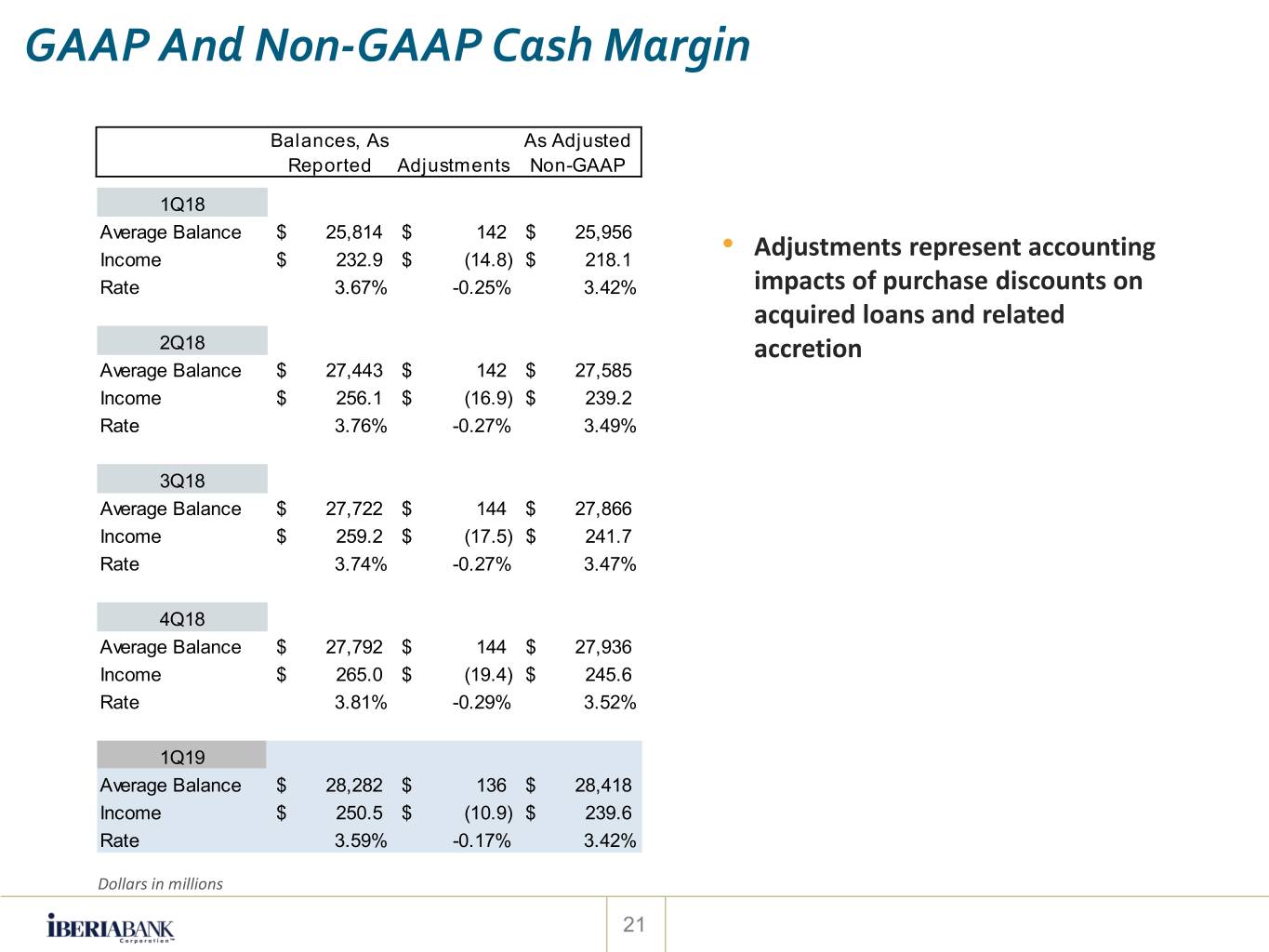

GAAP And Non-GAAP Cash Margin Balances, As As Adjusted Reported Adjustments Non-GAAP 1Q18 Average Balance $ 25,814 $ 142 $ 25,956 Income $ 232.9 $ (14.8) $ 218.1 • Adjustments represent accounting Rate 3.67% -0.25% 3.42% impacts of purchase discounts on acquired loans and related 2Q18 accretion Average Balance $ 27,443 $ 142 $ 27,585 Income $ 256.1 $ (16.9) $ 239.2 Rate 3.76% -0.27% 3.49% 3Q18 Average Balance $ 27,722 $ 144 $ 27,866 Income $ 259.2 $ (17.5) $ 241.7 Rate 3.74% -0.27% 3.47% 4Q18 Average Balance $ 27,792 $ 144 $ 27,936 Income $ 265.0 $ (19.4) $ 245.6 Rate 3.81% -0.29% 3.52% 1Q19 Average Balance $ 28,282 $ 136 $ 28,418 Income $ 250.5 $ (10.9) $ 239.6 Rate 3.59% -0.17% 3.42% Dollars in millions 21

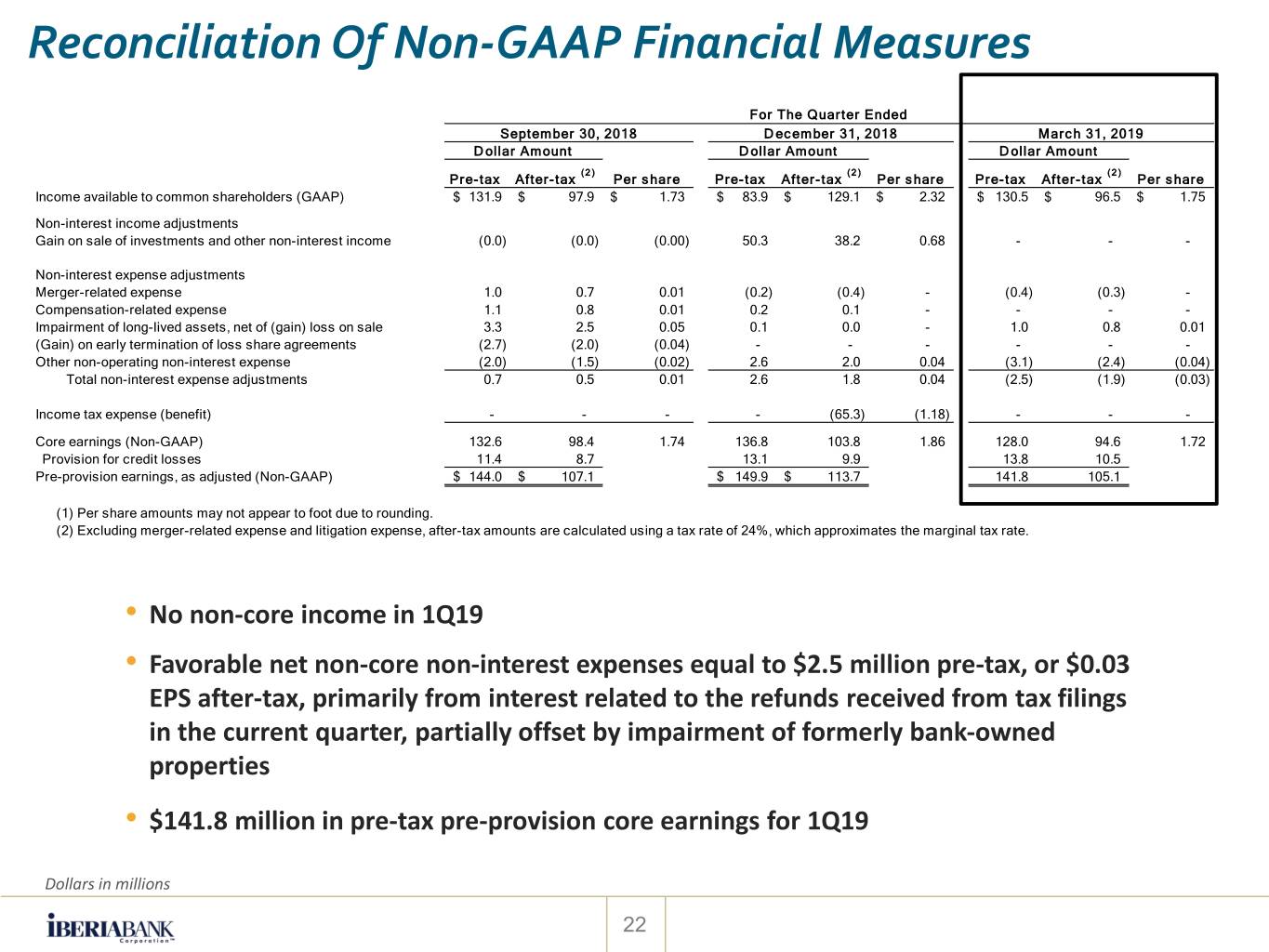

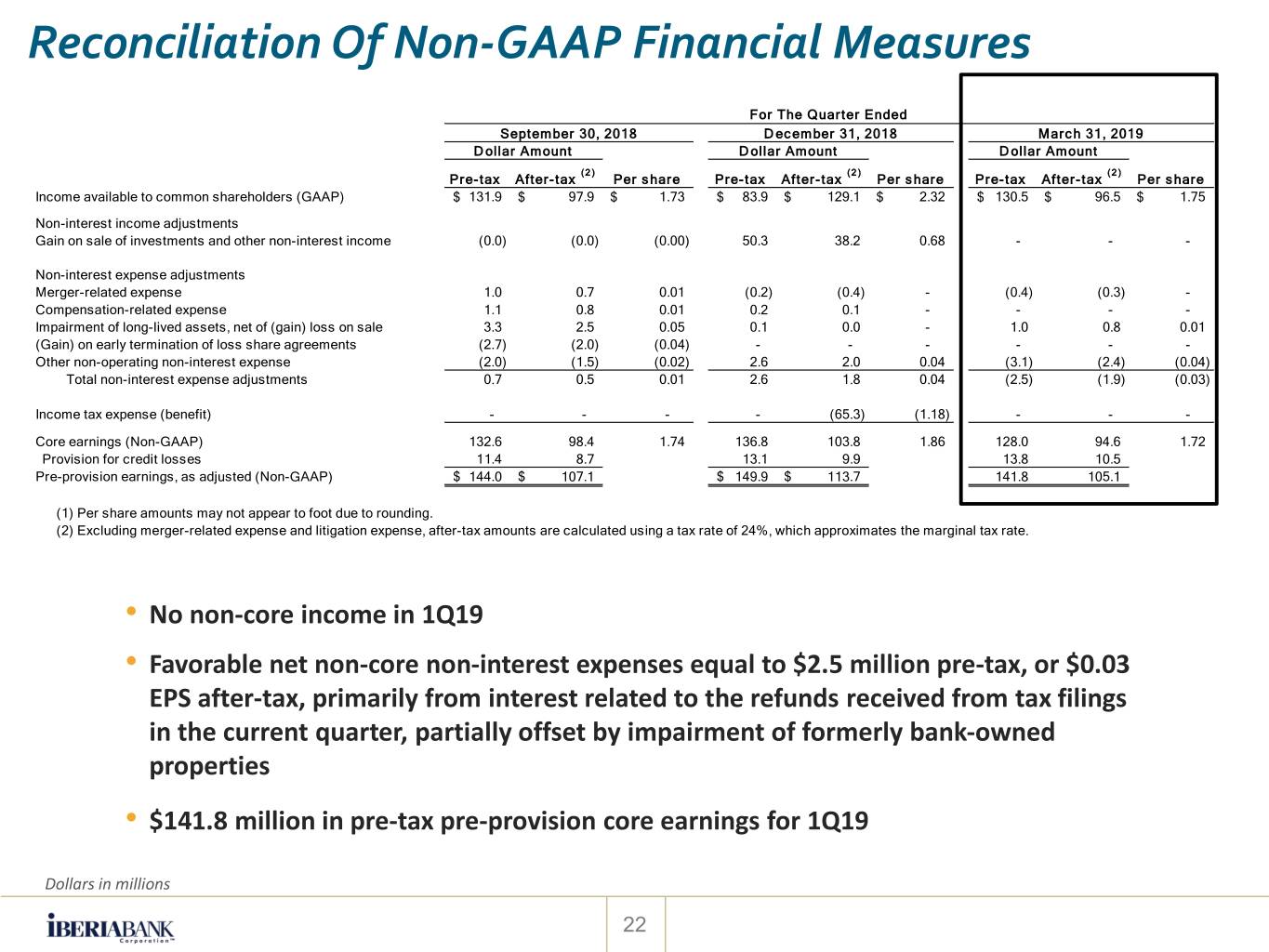

Reconciliation Of Non-GAAP Financial Measures For The Quarter Ended September 30, 2018 December 31, 2018 March 31, 2019 Dollar Amount Dollar Amount Dollar Amount (2) (2) (2) Pre-tax After-tax Per share Pre-tax After-tax Per share Pre-tax After-tax Per share Income available to common shareholders (GAAP) $ 131.9 $ 97.9 $ 1.73 $ 83.9 $ 129.1 $ 2.32 $ 130.5 $ 96.5 $ 1.75 Non-interest income adjustments Gain on sale of investments and other non-interest income (0.0) (0.0) (0.00) 50.3 38.2 0.68 - - - Non-interest expense adjustments Merger-related expense 1.0 0.7 0.01 (0.2) (0.4) - (0.4) (0.3) - Compensation-related expense 1.1 0.8 0.01 0.2 0.1 - - - - Impairment of long-lived assets, net of (gain) loss on sale 3.3 2.5 0.05 0.1 0.0 - 1.0 0.8 0.01 (Gain) on early termination of loss share agreements (2.7) (2.0) (0.04) - - - - - - Other non-operating non-interest expense (2.0) (1.5) (0.02) 2.6 2.0 0.04 (3.1) (2.4) (0.04) Total non-interest expense adjustments 0.7 0.5 0.01 2.6 1.8 0.04 (2.5) (1.9) (0.03) Income tax expense (benefit) - - - - (65.3) (1.18) - - - Core earnings (Non-GAAP) 132.6 98.4 1.74 136.8 103.8 1.86 128.0 94.6 1.72 Provision for credit losses 11.4 8.7 13.1 9.9 13.8 10.5 Pre-provision earnings, as adjusted (Non-GAAP) $ 144.0 $ 107.1 $ 149.9 $ 113.7 141.8 105.1 (1) Per share amounts may not appear to foot due to rounding. (2) Excluding merger-related expense and litigation expense, after-tax amounts are calculated using a tax rate of 24%, which approximates the marginal tax rate. • No non-core income in 1Q19 • Favorable net non-core non-interest expenses equal to $2.5 million pre-tax, or $0.03 EPS after-tax, primarily from interest related to the refunds received from tax filings in the current quarter, partially offset by impairment of formerly bank-owned properties • $141.8 million in pre-tax pre-provision core earnings for 1Q19 Dollars in millions 22